Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - ATLANTIC POWER CORP | a2205789zex-1_1.htm |

| EX-5.1 - EX-5.1 - ATLANTIC POWER CORP | a2205789zex-5_1.htm |

| EX-21.1 - EX-21.1 - ATLANTIC POWER CORP | a2205789zex-21_1.htm |

As filed with the Securities and Exchange Commission on October 11, 2011

Registration No. 333-176257

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ATLANTIC POWER CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| British Columbia, Canada (State or Other Jurisdiction of Incorporation or Organization) |

4900 (Primary Standard Industrial Classification Code Number) |

55-0886410 (I.R.S. Employer Identification Number) |

200 Clarendon St., Floor 25

Boston, Massachusetts 02116

(617) 977-2400

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant's Principal Executive Offices)

Barry E. Welch

President and Chief Executive Officer

Atlantic Power Corporation

200 Clarendon St., Floor 25

Boston, Massachusetts 02116

(617) 977-2400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| Copies to: | ||

Laura Hodges Taylor, Esq. Yoel Kranz, Esq. Goodwin Procter LLP Exchange Place Boston, Massachusetts 02109 Tel: (617) 570-1000 Fax: (617) 523-1231 |

Christopher J. Cummings, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, New York 10019-6064 Tel: (212) 373-3000 Fax: (212) 757-3990 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "larger accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale of such securities is not permitted.

Subject to Completion

Preliminary Prospectus dated October 11, 2011

PROSPECTUS

11,000,000 Shares

Common Shares

We are offering 11,000,000 common shares, no par value per share.

Our common shares are listed on the New York Stock Exchange under the symbol "AT" and on the Toronto Stock Exchange under the symbol "ATP." On October 7, 2011, the last reported sale price of our common shares on the New York Stock Exchange and the Toronto Stock Exchange was $13.81 and C$14.32, respectively, per share.

Investing in our common shares involves a high degree of risk. Before buying any shares you should carefully read the discussion of material risks of investing in our common shares under the heading "Risk factors" beginning on page 20 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

| Public offering price | $ | $ | |||||

| Underwriting discounts and commissions | $ | $ | |||||

| Proceeds, before expenses, to us | $ | $ | |||||

The public offering price for common shares offered in the United States and elsewhere outside of Canada is payable in U.S. dollars, and the public offering price for common shares offered in each of the provinces and territories of Canada other than Québec is payable in Canadian dollars, except as may otherwise be agreed by the underwriters. The public offering price, underwriting discounts and commissions and proceeds, before expenses, to the Company are payable in the currency in which the common shares are sold. For a description of the compensation to be received by the underwriters, see the "Underwriting" section of this prospectus.

This offering is made in contemplation of our acquisition of all the outstanding limited partnership interests in Capital Power Income L.P. pursuant to a plan of arrangement (the "Plan of Arrangement") under the Canada Business Corporations Act, as more fully described herein. We intend to use the net proceeds of this offering to finance a portion of the cash payable by us under the Plan of Arrangement. However, this offering is not conditioned on the completion of the Plan of Arrangement and there can be no assurance that the Plan of Arrangement will be completed. The shares offered hereby will remain outstanding whether or not the Plan of Arrangement is completed.

The underwriters may also purchase up to an additional 1,650,000 common shares from us at the public offering price, less the underwriting discounts and commissions payable by us to cover over-allotments, if any, within 30 days from the date of this prospectus.

The underwriters expect to deliver the common shares on or about , 2011.

Joint Book-Running Managers

| TD Securities | Morgan Stanley |

Co-Managers

| BMO Capital Markets | ||

Desjardins Capital Markets Scotia Capital |

||

Macquarie Capital Markets North America Ltd. |

||

The date of this prospectus is , 2011.

You should rely only on information contained in this document or to which we have referred you. We have not, and our underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. This document may only be used where it is legal to sell these securities.

As used in this prospectus, the terms "Atlantic Power," the "Company," "we," "our" and "us" refer to Atlantic Power Corporation, together with those entities owned or controlled by Atlantic Power Corporation, unless the context indicates otherwise. Unless otherwise noted, all references to "C$" and "Canadian dollars" are to the lawful currency of Canada and all references to "$," "US$" and "U.S. dollars" are to the lawful currency of the United States. This prospectus includes our trademarks and other trade names identified herein. All other trademarks and trade names appearing in this prospectus are the property of their respective holders.

The following summary may not contain all the information that may be important to you or that you should consider before deciding to purchase any common shares and is qualified in its entirety by the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus, especially the risks set forth under the heading "Risk factors" in this prospectus, as well as the financial and other information included or incorporated by reference herein, before making an investment decision.

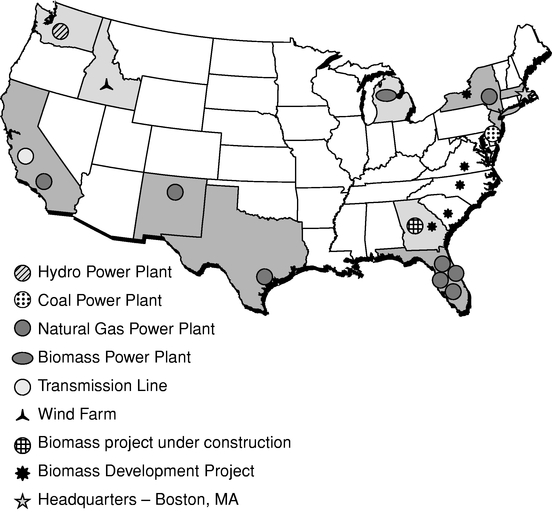

Atlantic Power Corporation owns and operates a diverse fleet of power generation and infrastructure assets in the United States. Our power generation projects sell electricity to utilities and other large commercial customers under long-term power purchase agreements ("PPAs"), which seek to minimize exposure to changes in commodity prices. Our power generation projects in operation have an aggregate gross electric generation capacity of approximately 1,948 megawatts ("MW") in which our ownership interest is approximately 871 MW. Our current portfolio consists of interests in 12 operational power generation projects across nine states, one biomass project under construction in Georgia, and a 500 kilovolt 84-mile electric transmission line located in California. We also own a majority interest in Rollcast Energy, a biomass power plant developer with several projects under development.

The following map shows the location of our currently-owned projects, including joint venture interests, across the United States:

1

We sell the capacity and energy from our power generation projects under PPAs with a variety of utilities and other parties. Under terms of the PPAs, which have expiration dates ranging from 2012 to 2037, we receive payments for electric energy sold to our customers (known as energy payments), in addition to payments for electric generation capacity (known as capacity payments). We also sell steam from a number of our projects under steam sales agreements to industrial purchasers. The transmission system rights ("TSRs") we own in our power transmission project entitle us to payments indirectly from the utilities that make use of the transmission line.

Our power generation projects generally operate pursuant to long-term fuel supply agreements, typically accompanied by fuel transportation arrangements. In most cases, the fuel supply and transportation arrangements correspond to the term of the relevant PPAs and many of the PPAs and steam sales agreements provide for the indexing or pass-through of fuel costs to our customers. In cases where there is no pass-through of fuel costs, we use a financial hedging strategy designed to mitigate the market price risk of fuel purchases.

We partner with recognized leaders in the independent power industry to operate and maintain our projects, including Caithness Energy, LLC ("Caithness"), Power Plant Management Services ("PPMS"), Delta Power Services and the Western Area Power Administration ("Western"). Under these operation, maintenance and management agreements, the operator is typically responsible for operations, maintenance and repair services.

Atlantic Power Corporation is organized under the laws of the Province of British Columbia. Our registered office is located at 355 Burrard Street, Suite 1900, Vancouver, British Columbia, Canada V6C 2G8 and our headquarters are located at 200 Clarendon Street, Floor 25, Boston, Massachusetts, USA 02116, telephone number (617) 977-2400. Our website is www.atlanticpower.com. Information contained on our website is not part of this prospectus.

We completed our initial public offering on the Toronto Stock Exchange ("TSX") in November 2004. At the time of our initial public offering, or IPO, our publicly traded security was an income participating security ("IPS") comprised of one common share and C$5.767 principal value of 11% subordinated notes due 2016. On November 24, 2009, our shareholders approved a conversion from the IPS structure to a traditional common share structure. Each IPS was exchanged for one new common share and each old common share that did not form part of an IPS was exchanged for approximately 0.44 of a new common share. Our shares trade on the TSX under the symbol "ATP" and began trading on July 23, 2010 on the New York Stock Exchange ("NYSE") under the symbol "AT."

As described in further detail below, on June 20, 2011 we entered into an arrangement agreement, as amended effective July 25, 2011 (the "Arrangement Agreement"), pursuant to which we agreed to acquire all of the issued and outstanding limited partnership units of Capital Power Income L.P., a publicly traded Canadian limited partnership ("CPILP"), in exchange for up to C$506.5 million in cash and up to 31.5 million of our common shares. CPILP's current portfolio consists of 19 wholly-owned power generation assets located in both Canada and the United States, a 50.15% interest in a power generation asset in Washington State, and a 14.3% common equity interest in Primary Energy Recycling Holdings LLC. CPILP's assets have a total net generating capacity of 1,400 MW and more than four million pounds per hour of thermal energy. In addition, pursuant to the Plan of Arrangement, CPILP will sell its Roxboro and Southport facilities located in North Carolina to an affiliate of Capital Power Corporation, a publicly traded Canadian company, for approximately C$121.4 million. We cannot be certain that our acquisition of CPILP will be completed. See "Risk factors—Risks related to the Plan of Arrangement."

2

We believe we distinguish ourselves from other independent power producers through the following competitive strengths:

- •

- Stability of project cash

flow. Many of our power generation projects currently in operation have been in operation for over ten years. Cash flows from each

project are generally supported by PPAs with investment-grade utilities and other creditworthy counterparties. We believe that each project's combination of PPAs, fuel supply agreements and/or

commodity hedges help stabilize operating margins as fuel prices fluctuate.

- •

- Diversified

projects. Our power generation projects have an aggregate gross electric generation capacity of approximately 1,948 MW, and our net

ownership interest in the electric generation capacity of these projects is approximately 871 MW. These projects are diversified by fuel type, electricity and steam customers, and project operators.

Many are located in the deregulated and more liquid electricity markets of California, Mid-Atlantic, New York, and Texas.

Our power transmission project, known as the Path 15 project, is an 84-mile, 500-kilovolt transmission line built in order to alleviate north-south transmission congestion in California. It is a traditional rate-base asset whose revenues are regulated by the Federal Energy Regulatory Commission ("FERC") and is owned and operated by Western, a U.S. Federal power agency. We also have a 53.5 MW biomass project under construction in Georgia.

- •

- Experienced management

team. Our management team has a tremendous depth of experience in project development, asset management, mergers and acquisitions,

finance and accounting. Our network of industry contacts and our reputation allow us to see proprietary acquisition opportunities on a regular basis.

- •

- Access to

capital. Our shares are publicly traded on the NYSE and the TSX. We have a history of successfully raising public equity in Canada and

the U.S. and issuing public convertible debentures in Canada. We have also issued securities by way of private placement in Canada. In addition, we have used non-recourse project-level financing as a

source of capital. Project-level financing can be attractive as it typically has a lower cost than equity, is non-recourse to the Company and amortizes over the term of the project's power purchase

agreement. Having significant experience in accessing all of these markets provides flexibility such that we can pursue transactions in the most cost-effective market at the time capital is needed for

growth opportunities.

- •

- Strong customer

base. Our customers are generally large utilities and other parties with investment-grade credit ratings. The largest customers of our

power generation projects are Progress Energy Florida, Inc. ("PEF"), Tampa Electric Company ("TECO"), and Atlantic City Electric ("ACE"), which purchase approximately 37%, 14% and 10%,

respectively, of the net electric generation capacity of our projects. No other electric customer purchases more than 7% of the net electric generation capacity of our power generation projects.

- •

- Leading third-party operators. Our power generation projects utilize experienced firms for their operation and maintenance, which are recognized leaders in independent power. Affiliates of Caithness, PPMS and Babcock and Wilcox Power Generation Group, Inc. operate projects representing approximately 46%, 19% and 12%, respectively, of the net electric generation capacity of our power generation projects. No other operator is responsible for the operation of projects representing more than 8% of the net electric generation capacity of our power generation projects.

3

Our Objectives and Business Strategies

Our objectives include maintaining the stability and sustainability of dividends to shareholders and maximizing the value of our company. In order to achieve these objectives, we intend to focus on enhancing the operating and financial performance of our current projects and pursuing additional accretive acquisitions primarily in the electric power industry in the United States and Canada.

Organic growth

We intend to enhance the operation and financial performance of our projects through:

- •

- achievement of improved operating efficiencies, output, reliability and operation and maintenance costs through the

upgrade or enhancement of existing equipment or plant configurations;

- •

- optimization of commercial arrangements such as PPAs, fuel supply and transportation contracts, steam sales agreements,

operations and maintenance agreements and hedge agreements; and

- •

- expansion of existing projects.

Extending PPAs following their expiration

PPAs in our portfolio have expiration dates ranging from 2012 to 2037. In each case, we plan for expirations by evaluating various options in the market for maximizing long-term project cash flows and passing through to purchasers as effectively as possible the potential changes in fuel costs. New arrangements may involve responses to utility solicitations for capacity and energy, direct negotiations with the original purchasing utility for PPA extensions, "reverse" request for proposals by the projects to likely bilateral counterparty arrangements with creditworthy energy trading firms for tolling agreements, full service PPAs or the use of derivatives to lock in value. We do not assume that revenues or operating margins under existing PPAs will necessarily be sustained after PPA expirations, since most original PPAs included capacity payments related to return of and return on original capital invested, and counterparties or evolving regional electricity markets may or may not provide similar payments under new or extended PPAs.

Acquisition and investment strategy

We believe that new electricity generation projects will be required in the United States and Canada over the next several years as a result of growth in electricity demand, transmission constraints and the retirement of older generation projects due to obsolescence or environmental concerns. In addition, Renewable Portfolio Standards in over 31 states and the recently extended American Recovery and Reinvestment Act's 1603 grant program have greatly facilitated strong PPAs and financial returns for significant renewable project opportunities. There is also a very active secondary market for existing projects.

We intend to expand our operations by making accretive acquisitions with a focus on power generation, transmission, distribution and related facilities in the United States and Canada. We may also invest in other forms of energy-related projects, utility projects and infrastructure projects, as well as make additional investments in development stage projects or companies where the prospects for creating long-term predictable cash flows are attractive. Since the time of our initial public offering on the TSX in late 2004, we have twice acquired the interest of another partner in one of our existing projects and will continue to look for such opportunities.

4

Our senior management has significant experience in the independent power industry and we believe that their experience, reputation and industry relationships will provide us with enhanced access to future acquisition opportunities on a proprietary basis.

Acquisition guidelines

We use the following general guidelines when reviewing and evaluating possible acquisitions:

- •

- each acquisition or investment should result in an increase in cash available for distribution to shareholders;

- •

- in the case of an acquisition of power generation facilities, facilities with long-term PPAs with investment

grade electrical utilities or other creditworthy customers will be preferred; and, for facilities without such agreements, market electricity price assumptions used in acquisition evaluations will be

obtained from a recognized independent source; and

- •

- the expected useful life of the facility and associated structures will, with regular maintenance, be long enough to conform with our objective of providing stable long-term dividends to shareholders.

Acquisition of Capital Power Income L.P.

The Arrangement Agreement and Plan of Arrangement

On June 20, 2011, we entered into an Arrangement Agreement, as amended effective July 25, 2011, with Capital Power Income L.P. ("CPILP"), a publicly traded Canadian limited partnership, CPILP's general partner and a related entity. The Arrangement Agreement provides that we will acquire, directly or indirectly, all of the issued and outstanding CPILP units pursuant to a plan of arrangement under the Canada Business Corporations Act (the "Plan of Arrangement"). Under the terms of the Plan of Arrangement, CPILP unitholders will be permitted to exchange each of their CPILP units for, at their election, C$19.40 in cash or 1.3 Atlantic Power common shares. All cash elections will be subject to proration if total cash elections exceed approximately C$506.5 million and all share elections will be subject to proration if total share elections exceed approximately 31.5 million Atlantic Power common shares.

CPILP's primary business is the ownership and operation of power plants in Canada and the United States, which generate electricity and steam, from which it derives its earnings and cash flows. The power plants generate electricity and steam from a combination of natural gas, waste heat, wood waste, water flow, coal and tire-derived fuel. CPILP's generation projects sell electricity to utilities and other large commercial customers under long-term PPAs, which seek to minimize exposure to changes in commodity prices. At present, CPILP's portfolio consists of 19 wholly-owned power generation assets located in both Canada (in the provinces of British Columbia and Ontario) and the United States (in the states of California, Colorado, Illinois, New Jersey, New York and North Carolina), a 50.15% interest in a power generation asset in Washington State, and a 14.3% common equity interest in Primary Energy Recycling Holdings LLC. CPILP's assets have a total net generating capacity of 1,400 MW and more than four million pounds per hour of thermal energy. The CPILP units trade on the TSX under the symbol "CPA.UN."

Pursuant to the Plan of Arrangement, CPILP will sell its Roxboro and Southport facilities located in North Carolina to an affiliate of Capital Power Corporation, a publicly traded Canadian company, for approximately C$121.4 million. Additionally, in connection with the Plan of Arrangement, the management agreements between certain subsidiaries of Capital Power Corporation and CPILP and certain of its subsidiaries will be terminated (or assigned) in consideration of a payment of C$10.0 million. Atlantic Power or its subsidiaries will assume the management of CPILP and intends to enter into a transitional services agreement with Capital Power Corporation for a term of up to

5

12 months following the completion of the Plan of Arrangement, which will facilitate the integration of CPILP into Atlantic Power. In addition, upon completion of the Plan of Arrangement, Atlantic Power will fully and unconditionally guarantee the cumulative redeemable preferred shares, Series 1, cumulative rate reset preferred shares, Series 2 and cumulative floating rate preferred shares, Series 3 issued by CPI Preferred Equity Ltd., a subsidiary of CPILP, on a subordinated basis as to: (i) payment of dividends, as and when declared; (ii) payment of amounts due on redemption; and (iii) payment of amounts due on liquidation, dissolution or winding up of CPI Preferred Equity Ltd.

The Arrangement Agreement contains customary representations, warranties and covenants. Among these covenants, CPILP and its affiliates have each agreed not to solicit alternative transactions, except that CPILP may respond to an alternative transaction proposal that constitutes, or would reasonably be expected to lead to, a superior proposal. In addition, we or CPILP may be required to pay a C$35.0 million fee if the Arrangement Agreement is terminated in certain circumstances.

We currently expect to complete the Plan of Arrangement in the fourth quarter of 2011, subject to receipt of required shareholder/unitholder, court and regulatory approvals and the satisfaction or waiver of the financing and other conditions contained in the Arrangement Agreement. However, we cannot be certain that the Plan of Arrangement will be completed. The shares offered hereby will remain outstanding whether or not the Plan of Arrangement is completed. See "Risk factors—Risks related to the Plan of Arrangement."

A copy of the Arrangement Agreement, including the Plan of Arrangement, is included as an exhibit to our Current Report on Form 8-K filed with the Securities and Exchange Commission on June 24, 2011, which is incorporated by reference into this prospectus. The foregoing description of the proposed transaction and the Arrangement Agreement does not purport to be complete and is qualified in its entirety by reference to such exhibit.

Reasons for the Arrangement Agreement and Plan of Arrangement

Our board of directors believes that the combination of Atlantic Power and CPILP, if completed, will result in significant strategic benefits to the combined company. These strategic benefits include:

- •

- Atlantic Power will become a leading publicly traded power generation and infrastructure company, with a larger and more

diversified portfolio of contracted power generation assets in the United States and Canada;

- •

- the transaction will combine Atlantic Power's proven management team with CPILP's highly qualified operations,

maintenance, commercial management, accounting, human resources, legal and other personnel;

- •

- Atlantic Power's market capitalization and enterprise value are expected to increase significantly, which is expected to

add liquidity and enhance access to capital to fuel the long term growth of Atlantic Power's asset base throughout North America;

- •

- the combination will expand and diversify Atlantic Power's asset portfolio to include projects in Canada and regions of

the United States where we do not currently have a presence; and

- •

- the transaction will further diversify the fuel types used by Atlantic Power's projects to include additional hydro, biomass and natural gas.

6

Our board of directors also believes that the combination of Atlantic Power and CPILP, if completed, will result in significant financial benefits to Atlantic Power's shareholders. These financial benefits include:

- •

- upon completion of the Plan of Arrangement, our board of directors anticipates being able to increase dividends by 5%,

from C$1.094 to C$1.15 per share on an annual basis;

- •

- the transaction is expected to strengthen Atlantic Power's dividend sustainability for the foreseeable future with

immediate accretion to cash available for distribution;

- •

- the transaction is expected to result in a significant improvement in Atlantic Power's dividend payout ratio starting in

2012;

- •

- the transaction extends Atlantic Power's average PPA term from 8.8 to 9.1 years and enhances the credit quality of

Atlantic Power's power offtakers; and

- •

- following completion of the Plan of Arrangement, we expect to benefit from cost savings attributable to synergies from combining the two entities and eliminating the public company reporting costs for CPILP.

Financing transactions

We intend to use the net proceeds from this offering to pay a portion of the cash consideration required under the Plan of Arrangement and related fees and expenses. We plan to fund the remainder of the cash consideration payable by us under the Plan of Arrangement, including related fees and expenses, with the net proceeds from a senior unsecured notes offering and/or drawings under a $625 million senior secured credit facility, for which we have obtained a conditional written commitment, each as described below.

Under a separate offering memorandum or otherwise, we may offer senior unsecured notes to fund a portion of the cash consideration payable by us under the Plan of Arrangement, pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the "Securities Act"). The completion of this offering of common shares is not subject to the completion of an offering of senior unsecured notes and the completion of an offering of senior unsecured notes will not be subject to the completion of this offering. No assurance can be given that a notes offering will be commenced or completed or, if completed, as to the final terms of the notes offering.

We do not intend to register any notes under the Securities Act or the securities laws of any other jurisdiction, and notes may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Any such notes will be offered only to qualified institutional buyers in the United States pursuant to Rule 144A under the Securities Act and outside the United States pursuant to Regulation S under the Securities Act. This description and other information regarding a possible notes offering is included in this prospectus solely for information purposes. Nothing in this prospectus should be construed as an offer to sell, or the solicitation of an offer to buy, any notes.

We have received the written commitment of a Canadian chartered bank and another financial institution to structure, arrange, underwrite and syndicate a senior secured credit facility in the amount of $625 million in order to finance the cash consideration payable by us under the Plan of Arrangement. The credit facility, if funded, will mature in seven years and bear an interest rate based on U.S. base rate or LIBOR at the Company's option. Funding under this facility is subject to certain conditions, including, without limitation, that there shall not have occurred a material adverse effect with respect to Atlantic Power, CPILP, CPI Income Services Ltd. and CPI Investments Inc. taken as a whole. Such facility will be guaranteed by us and each of our existing and subsequently acquired or organized direct or indirect subsidiaries (subject to certain exceptions), and will contain covenants

7

restricting certain actions by us and our subsidiaries (including CPILP and its subsidiaries), including financial, affirmative and negative covenants, which may include limitations on the ability to incur indebtedness, create liens and merge and consolidate with other companies, in each case, subject to exceptions and baskets that may be mutually agreed upon by us and the lender parties thereto.

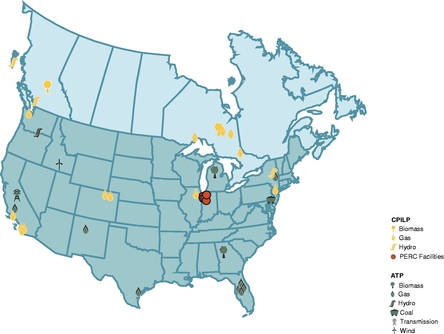

The combined company

As a result of the Plan of Arrangement, if completed, we will emerge as a leading publicly traded, power generation and infrastructure company with a well diversified portfolio of assets in the United States and Canada. The transaction will increase the net generating capacity of our projects by 143% from 871 MW to approximately 2,116 MW. The combined portfolio of assets will consist of interests in 30 operational power generation projects across 11 states and two provinces, one 53.5 MW biomass project under construction in Georgia, and an 84-mile, 500 kilovolt electric transmission line located in California. We will remain headquartered in Boston and will add offices in Chicago, Toronto, Ontario and Richmond, B.C. We expect to add personnel from Capital Power Corporation who have a strong track record of managing, operating and maintaining CPILP's assets, allowing us to have direct control across the vast majority of the CPILP portfolio by taking advantage of the valuable expertise of this new personnel.

The following map is a pro forma company structure showing the location of our projects following the Plan of Arrangement, if completed:

8

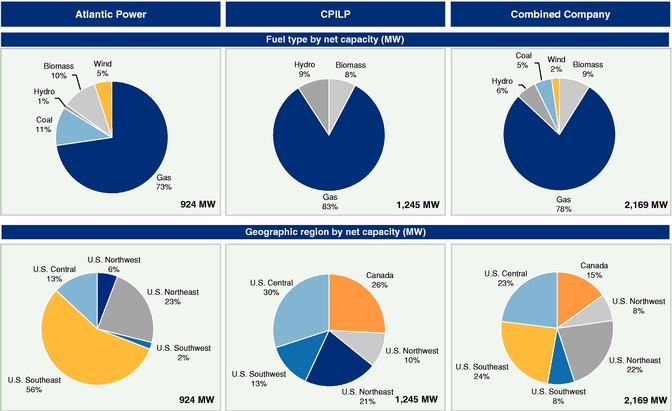

The following charts show the fuel type and geographic diversity of Atlantic Power and CPILP and the pro forma fuel type and geographic diversity of the combined company following the Plan of Arrangement, if completed:

- (1)

- Includes 53.5MW Piedmont project that is currently under construction.

- (2)

- Excludes North Carolina assets.

9

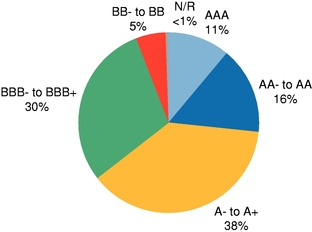

The following chart shows the Standard & Poor's credit rating of the electricity purchasers, or "off takers," of the combined company following the Plan of Arrangement, if completed:

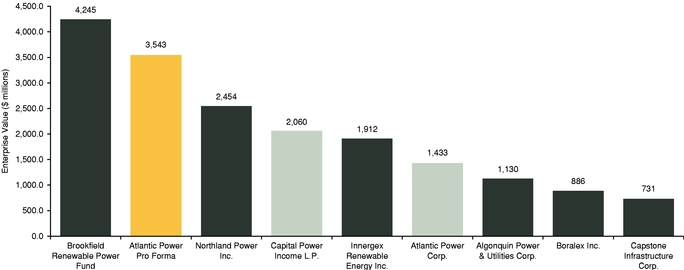

As a result of the Plan of Arrangement, if completed, we believe our larger size and broader-based ownership will improve our access to capital and facilitate the pursuit of sustained growth initiatives. Following the Plan of Arrangement, if completed, Atlantic Power will be the second largest publicly traded power generation and infrastructure company on the TSX by enterprise value.

- *

- Source: Bloomberg as of October 7, 2011

Historically, the North American electricity industry was characterized by vertically-integrated monopolies. The trend towards restructuring the electric power industry and the introduction of competition in electricity generation began with the passage and implementation of the Public Utility Regulatory Policies Act of 1978. During the late 1980s, several jurisdictions began a process of restructuring by moving away from vertically integrated monopolies toward more competitive market models. Rapid growth in electricity demand, environmental concerns, increasing electricity rates, technological advances and other concerns prompted government policies to encourage the supply of electricity from independent power producers.

In the independent power generation sector, electricity is generated from a number of energy sources, including natural gas, coal, water, waste products such as biomass (e.g., wood, wood waste,

10

agricultural waste), landfill gas, geothermal, solar and wind. According to the North American Electric Reliability Corporation's Long-Term Reliability Assessment, published in October 2010, summer peak demand within the United States in the ten-year period from 2010 through 2019 is projected to increase 1.3%, while winter peak demand in Canada is projected to increase 0.9%.

The non-utility power generation industry in the U.S.

Our 12 power generation projects are non-utility electric generating facilities that operate in the U.S. electric power generation industry. The electric power industry is one of the largest industries in the United States, generating retail electricity sales of approximately $353 billion in 2009, based on information published by the Energy Information Administration. A growing portion of the power produced in the United States is generated by non-utility generators. According to the Energy Information Administration, there were approximately 8,448 non-utility generators representing approximately 475 gigawatts of capacity (equal to 47% of total generating plants and 42% of nameplate capacity) in 2009, the most recent year for which data is available. Non-utility generators sell the electricity that they generate to electric utilities and other load-serving entities (such as municipalities and electric cooperatives) by way of bilateral contracts or open power exchanges. The electric utilities and other load-serving entities, in turn, generally sell this electricity to industrial, commercial and residential customers.

The power generation industry in Canada

In its 2009 outlook of Canada's energy supply, the National Energy Board of Canada ("NEB") forecast Canadian electricity production to grow at a compound average annual rate of over 1% between 2011 and 2020. The combined effect of demand growth and facility retirements is expected to result in a need for new generation in the coming years. The British Columbia and Ontario markets remain price regulated, and provincial regulatory bodies have continued to issue requests for proposals or other procurements for the development of new generation.

A major trend identified by the NEB is a push towards reducing greenhouse gas emissions. This includes energy efficiency initiatives, as well as emphasizing clean energy alternatives such as natural gas, hydro, biomass, wind, solar, nuclear and coal with carbon capture and storage technologies. Natural gas will continue to be relied upon to meet increased electricity demand. Natural gas-fired generation capacity is forecast to increase by 8,146 MW by 2020 in Canada, particularly in Ontario where 3,917 MW of combined-cycle gas and 1,337 MW of combustion turbine/cogeneration facilities will be relied on to help meet demand following the phase-out of coal-fired generation by 2014. Hydroelectric capacity is also expected to continue to be the major source of electricity with hydroelectric-based capacity projected to increase from 72,853 MW in 2008 to 80,604 MW by 2020. Extensive development of new hydro projects is expected in British Columbia, Quebec, Newfoundland and Labrador.

In addition, installed unconventional emerging technology generation continues to remain small however is expected to become a major source of generation capacity in the future. The NEB's outlook incorporates increased provincial renewable targets reflecting both increased public interest in clean sources of electricity and greater confidence on the part of system operators with their ability to integrate wind power into electric systems. Wind power is experiencing exceptionally strong growth with generation capacity projected to grow from 2,369 MW in 2008 to 16,400 MW by 2020. While wind power generation is expected to contribute the most, other generation technologies such as biomass, landfill gas, waste heat, solar and tidal are expected to contribute 3,750 MW by 2020.

11

The following table outlines our portfolio of power generating and transmission assets in operation and under construction as of October 7, 2011, including our interest in each facility. Management believes the portfolio is well diversified in terms of electricity and steam buyers, fuel type, regulatory jurisdictions and regional power pools, thereby partially mitigating exposure to market, regulatory or environmental conditions specific to any single region.

Project Name

|

Location (State) |

Type | Total MW |

Economic Interest(1) |

Net MW(2) |

Primary Electricity Purchaser |

Power Contract Expiry |

Customer S&P Credit Rating |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Auburndale |

Florida | Natural Gas | 155 | 100.00% | 155 | Progress Energy Florida | 2013 | BBB+ | ||||||||

Lake |

Florida | Natural Gas | 121 | 100.00% | 121 | Progress Energy Florida | 2013 | BBB+ | ||||||||

Pasco |

Florida | Natural Gas | 121 | 100.00% | 121 | Tampa Electric Co. | 2018 | BBB+ | ||||||||

Chambers |

New Jersey | Coal | 262 | 40.00% | 89 | ACE(3) | 2024 | BBB+ | ||||||||

|

16 | DuPont | 2024 | A | ||||||||||||

Path 15 |

California | Transmission | N/A | 100.00% | N/A | California utilities via CAISO(4) |

N/A(5) | BBB+ to A(6) | ||||||||

Orlando |

Florida | Natural Gas | 129 | 50.00% | 46 | Progress Energy Florida | 2023 | BBB+ | ||||||||

|

19 | Reedy Creek Improvement District | 2013(7) | AA-(8) | ||||||||||||

Selkirk |

New York | Natural Gas | 345 | 17.70%(9) | 15 | Merchant | N/A | N/R | ||||||||

|

49 | Consolidated Edison | 2014 | A- | ||||||||||||

Gregory |

Texas | Natural Gas | 400 | 17.10% | 59 | Fortis Energy Marketing and Trading | 2013 | AA(10) | ||||||||

|

9 | Sherwin Alumina | 2020 | NR | ||||||||||||

Badger Creek |

California | Natural Gas | 46 | 50.00% | 23 | Pacific Gas & Electric | 2012(11) | BBB+ | ||||||||

Koma Kulshan |

Washington | Hydro | 13 | 49.80% | 6 | Puget Sound Energy | 2037 | BBB | ||||||||

Delta-Person |

New Mexico | Natural Gas | 132 | 40.00% | 53 | Public Service Company of New Mexico | 2020 | BB | ||||||||

Cadillac |

Michigan | Biomass | 40 | 100.00% | 40 | Consumers Energy | 2028 | BBB- | ||||||||

Idaho Wind |

Idaho | Wind | 183 | 27.56% | 50 | Idaho Power Co. | 2030 | BBB | ||||||||

Piedmont(12) |

Georgia | Biomass | 54 | 98.00% | 53 | Georgia Power | 2032 | A |

- (1)

- Except

as otherwise noted, economic interest represents the percentage ownership interest in the project held indirectly by Atlantic Power.

- (2)

- Represents

our interest in each project's electric generation capacity based on our economic interest.

- (3)

- Includes

a separate power sales agreement in which the project and Atlantic City Electric ("ACE") share profits on spot sales of energy and capacity not

purchased by ACE under the base PPA.

- (4)

- California

utilities pay transmission access charges to the California Independent System Operator ("CAISO"), who then pays owners of TSRs, such as Path

15, in accordance with its annual revenue requirement approved every three years by the Federal Energy Regulatory Commission ("FERC").

- (5)

- Path

15 is a FERC regulated asset with a FERC-approved regulatory life of 30 years: through 2034.

- (6)

- Largest

payers of transmission access charges supporting Path 15's annual revenue requirement are Pacific Gas & Electric (BBB+), Southern California

Edison (BBB+) and San Diego Gas & Electric (A). The CAISO imposes minimum credit quality requirements for any participants rated A or better unless collateral is posted per the CAISO imposed

schedule.

- (7)

- Upon

the expiry of the Reedy Creek Improvement District PPA, the associated capacity and energy will be sold to Progress Energy Florida under the terms of

the current agreement.

- (8)

- Fitch

rating on Reedy Creek Improvement District bonds.

- (9)

- Represents

our residual interest in the project after all priority distributions are paid to us and the other partners, which is estimated to occur in

2012.

- (10)

- The

guarantor under the Fortis Energy Marketing and Trading PPA is Fortis Bank S.A./N.V., which is rated AA.

- (11)

- Entered

into a one-year interim agreement in April 2011.

- (12)

- Project currently under construction and is expected to be completed in late 2012.

12

CPILP's power projects generate electricity and steam from a combination of natural gas, waste heat, wood waste, water flow, coal and tire-derived fuel. CPILP's Canadian operations consist of:

- •

- four natural gas-fired plants with a combined generating capacity of 163 MW;

- •

- two biomass, wood waste plants with a combined generating capacity of 101 MW; and

- •

- two hydroelectric facilities with a combined generating capacity of 56 MW.

CPILP's United States operations consist of:

- •

- one simple-cycle natural gas-fired power plant with a generating capacity of 300 MW;

- •

- one combined-cycle natural gas-fired power plant with a generating capacity of 125 MW;

- •

- seven natural gas-fired combined heat and power ("CHP") plants, three of which can also use distillate fuel,

with a combined generating capacity of 440 MW and steam generating capacity of 2,537 mlbs/hr; and

- •

- a hydroelectric plant with a total generating capacity of 60 MW.

Pursuant to the Plan of Arrangement, CPILP will sell its Roxboro and Southport facilities located in North Carolina to an affiliate of Capital Power Corporation, a publicly traded Canadian company, for approximately C$121.4 million.

The following table summarizes each of CPILP's power plants in each of Canada and the United States, and their respective operating characteristics (other than the Roxboro and Southport facilities):

Project Name

|

Location | Type | Net MW |

Economic Interest |

Primary Electric Purchaser | Power Contract Expiry |

Customer S&P Credit Rating |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Calstock |

Ontario | Biomass | 35 | 100% | Ontario Electricity Financial Corporation | 2020 | AA- | ||||||||||

Kapuskasing |

Ontario | Natural Gas | 40 | 100% | Ontario Electricity Financial Corporation | 2017 | AA- | ||||||||||

Nipigon |

Ontario | Natural Gas | 40 | 100% | Ontario Electricity Financial Corporation | 2012 | (1) | AA- | |||||||||

North Bay |

Ontario | Natural Gas | 40 | 100% | Ontario Electricity Financial Corporation | 2017 | AA- | ||||||||||

Tunis |

Ontario | Natural Gas | 43 | 100% | Ontario Electricity Financial Corporation | 2014 | AA- | ||||||||||

Mamquam |

British Columbia | Hydro | 50 | 100% | British Columbia Hydro and Power Authority | 2027 | (2) | AAA | |||||||||

Moresby Lake |

British Columbia | Hydro | 6 | 100% | British Columbia Hydro and Power Authority | 2022 | AAA | ||||||||||

Williams Lake |

British Columbia | Biomass | 66 | 100% | British Columbia Hydro and Power Authority | 2018 | (3) | AAA | |||||||||

Frederickson |

Washington | Natural Gas | 125 | (4) | 50.15% | (5) | 3 Public Utility Districts(6) | 2022 | A to A+ | ||||||||

Greeley |

Colorado | Natural Gas | 72 | 100% | Public Service Company of Colorado | 2013 | A- | ||||||||||

Manchief |

Colorado | Natural Gas | 300 | 100% | Public Service Company of Colorado | 2022 | (7) | A- | |||||||||

Naval Station |

California | Natural Gas | 47 | 100% | San Diego Gas & Electric | 2019 | A | ||||||||||

Naval Training Centre |

California | Natural Gas | 25 | 100% | San Diego Gas & Electric | 2019 | A | ||||||||||

North Island |

California | Natural Gas | 40 | 100% | San Diego Gas & Electric | 2019 | A | ||||||||||

Oxnard |

California | Natural Gas | 49 | 100% | Southern California Edison | 2020 | BBB+ | ||||||||||

Curtis Palmer |

New York | Hydro | 60 | 100% | Niagara Mohawk Power Corp. | 2027 | A- | ||||||||||

Kenilworth |

New Jersey | Natural Gas | 30 | 100% | Schering-Plough Corporation | 2012 | (8) | AA | |||||||||

Morris |

Illinois | Natural Gas | 177 | 100% | Equistar Chemicals, LP(9) | 2023 | (10) | BB- | |||||||||

- (1)

- CPILP

has the option to extend the PPA for ten years at existing terms.

- (2)

- British

Columbia Hydro and Power Authority ("BC Hydro") has an option exercisable in 2021 and every five years thereafter to buy the Mamquam facility or

extend the contract.

- (3)

- BC

Hydro has an option to extend the agreement by up to 10 years, on the basis of two five-year term extensions.

- (4)

- In

addition, there is 10 MW duct firing.

- (5)

- Represents

CPILP's 50.15% ownership interest in Frederickson. Puget Sound Energy, Inc. owns the remaining 49.85% ownership interest.

- (6)

- Public

Utility Districts ("PUDs") are: Benton (A+), Franklin (A) and Grays Harbor (A).

- (7)

- Public

Service Company of Colorado has an option during the latter part of the extension term to purchase the Manchief facility.

- (8)

- Pursuant

to the ESA, Schering-Plough Corporation has the option to purchase the Kenilworth facility. The ESA can be extended automatically for successive

five year periods.

- (9)

- 100

MW is sold forward through April 2014 into the Pennsylvania, New Jersey, and Maryland market.

- (10)

- Equistar Chemicals, LP has a right to purchase the Morris facility at fair market value at the end of 2013, 2018 and 2023.

13

| Issuer | Atlantic Power Corporation, a British Columbia corporation. | |

Common shares to be offered by us |

11,000,000 shares. |

|

Common shares to cover over-allotments |

We have granted the underwriters an option to purchase up to 1,650,000 additional common shares to cover over-allotments. |

|

Common shares to be outstanding after this offering |

79,997,122 shares (or 81,647,122 shares if the underwriters exercise their over-allotment option in full). If our acquisition of CPILP is completed, there would be approximately 111.5 million shares outstanding (or 113.1 million shares if the underwriters exercise their over-allotment option in full), including the approximately 31.5 million common shares we expect to issue in exchange for CPILP units in connection with the Plan of Arrangement. |

|

Risk factors |

Prospective purchasers should carefully review and evaluate certain risk factors relating to an investment in the common shares and risks related to the Plan of Arrangement. See "Risk factors." |

|

United States and Canadian federal income tax considerations |

You should consult your tax advisor with respect to the U.S. and Canadian federal income tax consequences of owning the common shares in light of your own particular situation and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. See "Certain United States federal income tax considerations" and "Certain Canadian federal income tax considerations." |

|

Use of proceeds |

We expect to receive net proceeds from this offering of approximately $144.2 million after deducting the underwriting discount and our estimated expenses (or approximately $165.9 million if the underwriters exercise their over-allotment option to purchase additional shares in full). We intend to use the net proceeds from this offering to fund a portion of the cash consideration payable by us under the Plan of Arrangement and, to the extent that any proceeds remain thereafter, or the Plan of Arrangement is not completed, to fund additional growth opportunities and for general corporate purposes. This offering is not conditioned on the completion of the Plan of Arrangement and there can be no assurance that the Plan of Arrangement will be completed. The shares offered hereby will remain outstanding whether or not the Plan of Arrangement is completed. See "Use of proceeds." |

|

Listing |

Our outstanding common shares are listed on the TSX under the symbol "ATP" and on the NYSE under the symbol "AT." |

14

The number of common shares to be outstanding after this offering is based upon 68,997,122 shares outstanding as of October 7, 2011. Unless otherwise stated, the number of common shares to be outstanding after this offering does not include:

- •

- approximately 31.5 million common shares we expect to issue in exchange for CPILP units in connection with the Plan of

Arrangement;

- •

- 416,830 unvested notional units granted under the terms of our Long Term Incentive Plan; and

- •

- 13,632,715 shares issuable upon conversion, redemption, purchase for cancellation or maturity of our outstanding convertible debentures.

15

Summary Historical Consolidated Financial Data of Atlantic Power

The following table presents summary consolidated financial information for Atlantic Power. The annual historical information as of December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and 2008 has been derived from the audited consolidated financial statements appearing in Atlantic Power's Annual Report on Form 10-K for the year ended December 31, 2010, incorporated by reference into this prospectus. The annual historical information as of December 31, 2008, 2007 and 2006 and for the years ended December 31, 2007 and 2006 has been derived from historical financial statements not incorporated by reference into this prospectus. The historical information as of, and for the six-month periods ended June 30, 2011 and 2010 has been derived from the unaudited consolidated financial statements appearing in Atlantic Power's Quarterly Report on Form 10-Q for the quarter ended June 30, 2011, incorporated by reference into this prospectus. Data for all periods have been prepared under U.S. GAAP. You should read the following selected consolidated financial information together with Atlantic Power's consolidated financial statements and the notes thereto and the discussion under "Management's Discussion and Analysis of Financial Condition and Results of Operations" included as part of Atlantic Power's Annual Report on Form 10-K for the year ended December 31, 2010 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2011, each of which is incorporated by reference into this prospectus. See "Where you can find more information" beginning on page 86 of this prospectus.

| |

|

|

|

|

|

Six Months Ended June 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year Ended December 31, | |||||||||||||||||||||

| (in thousands of US dollars, except per share/subordinated note data and as otherwise stated) |

||||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006(a) | 2011(a) | 2010(a) | ||||||||||||||||

Project revenue |

$ | 195,256 | $ | 179,517 | $ | 173,812 | $ | 113,257 | $ | 69,374 | $ | 106,923 | $ | 95,125 | ||||||||

Project income |

41,879 | 48,415 | 41,006 | 70,118 | 57,247 | 27,900 | 19,405 | |||||||||||||||

Net (loss) income attributable to Atlantic Power Corporation |

(3,752 | ) | (38,486 | ) | 48,101 | (30,596 | ) | (2,408 | ) | 19,322 | (4,618 | ) | ||||||||||

Basic earnings (loss) per share |

$ | (0.06 | ) | $ | (0.63 | ) | $ | 0.78 | $ | (0.50 | ) | $ | (0.05 | ) | $ | 0.28 | $ | (0.08 | ) | |||

Basic earnings (loss) per share, C$(b) |

$ | (0.06 | ) | $ | (0.72 | ) | $ | 0.84 | $ | (0.53 | ) | $ | (0.06 | ) | $ | 0.28 | $ | (0.08 | ) | |||

Diluted earnings (loss) per share(c) |

$ | (0.06 | ) | $ | (0.63 | ) | $ | 0.73 | $ | (0.50 | ) | $ | (0.05 | ) | $ | 0.28 | $ | (0.08 | ) | |||

Diluted earnings (loss) per share, C$(b)(c) |

$ | (0.06 | ) | $ | (0.72 | ) | $ | 0.78 | $ | (0.53 | ) | $ | (0.06 | ) | $ | 0.28 | $ | (0.08 | ) | |||

Distribution per subordinated note(d) |

$ | — | $ | 0.51 | $ | 0.60 | $ | 0.59 | $ | 0.57 | $ | — | $ | — | ||||||||

Dividend declared per common share |

$ | 1.06 | $ | 0.46 | $ | 0.40 | $ | 0.40 | $ | 0.37 | $ | 0.57 | $ | 0.52 | ||||||||

Total assets |

$ | 1,013,012 | $ | 869,576 | $ | 907,995 | $ | 880,751 | $ | 965,121 | $ | 1,008,980 | $ | 862,525 | ||||||||

Total long-term liabilities |

$ | 518,273 | $ | 402,212 | $ | 654,499 | $ | 715,923 | $ | 613,423 | $ | 523,351 | $ | 407,413 | ||||||||

- (a)

- Unaudited.

- (b)

- The

C$ amounts were converted using the average exchange rates for the applicable reporting periods.

- (c)

- Diluted

earnings (loss) per share is computed including dilutive potential shares, which include those issuable upon conversion of convertible debentures

and under our long term incentive plan. Because we reported a loss during the years ended December 31, 2010, 2009, 2007 and 2006, and for the six-month period ended June 30, 2010, the

effect of including potentially dilutive shares in the calculation during those periods is anti-dilutive. Please see the notes to our historical consolidated financial statements

incorporated by reference into this prospectus for information relating to the number of shares used in calculating basic and diluted earnings per share for the periods presented.

- (d)

- At the time of our initial public offering, our publicly traded security was an income participating security, or an "IPS," each of which was comprised of one common share and C$5.767 principal amount of 11% subordinated notes due 2016. On November 27, 2009,we converted from the IPS structure to a traditional common share structure. In connection with the conversion, each IPS was exchanged for one new common share.

16

Summary Historical Consolidated Financial Information of CPILP

The following table presents summary consolidated financial information for CPILP. The selected historical financial data as of, and for the years ended, December 31, 2010, 2009 and 2008 has been derived from CPILP's audited consolidated financial statements for those periods prepared under Canadian generally accepted accounting principles and appearing elsewhere in this prospectus. Data as of, and for the years ended, December 31, 2010 and 2009 has been reconciled to U.S. generally accepted accounting principles as noted below. The selected historical financial data as of, and for the years ended, December 31, 2007 and 2006 has been derived from the audited consolidated financial statements of CPILP prepared under Canadian generally accepted accounting principles not appearing in this prospectus. The selected historical financial data as of, and for the six-month periods ended June 30, 2011 and 2010 has been derived from CPILP's unaudited consolidated financial statements for those periods prepared using International Financial Reporting Standards and appearing elsewhere in this prospectus.

Data for all periods presented below is reported in Canadian dollars. You should read the following selected consolidated financial data together with CPILP's consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| |

Year Ended December 31, | Six Months Ended June 30, |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands of Canadian dollars, except per unit data) |

2010 | 2009 | 2008 | 2007 | 2006 | 2011(a)(b) | 2010(a)(b) | |||||||||||||||

Revenue |

$ | 532,377 | $ | 586,491 | $ | 499,267 | $ | 549,872 | $ | 326,900 | $ | 261,524 | $ | 241,453 | ||||||||

Depreciation, amortization and accretion |

$ | 98,227 | $ | 93,249 | $ | 88,313 | $ | 85,553 | $ | 65,200 | $ | 45,461 | $ | 47,826 | ||||||||

Financial charges and other, net |

$ | 40,179 | $ | 46,462 | $ | 94,836 | $ | 8,574 | $ | 42,200 | $ | 21,457 | $ | 21,384 | (d) | |||||||

Net income before tax and preferred share dividends |

$ | 35,224 | $ | 56,812 | $ | (91,918 | ) | $ | 108,953 | $ | 67,400 | $ | 18,741 | $ | 4,705 | |||||||

Net income (loss) attributable to equity holders of CPILP |

$ | 30,500 | $ | 57,553 | $ | (67,893 | ) | $ | 30,816 | $ | 62,121 | $ | 10,529 | $ | 8,410 | |||||||

Basic and diluted net income (loss) per unit, C$ |

$ | 0.55 | $ | 1.07 | $ | (1.26 | ) | $ | 0.59 | $ | 1.28 | $ | 0.19 | $ | 0.15 | |||||||

Distributions declared per unit, C$ |

$ | 1.76 | $ | 1.95 | $ | 2.52 | $ | 2.52 | $ | 2.52 | $ | 0.88 | $ | 0.88 | ||||||||

Total assets |

$ | 1,583,910 | $ | 1,668,057 | $ | 1,809,225 | $ | 1,852,573 | $ | 1,883,400 | $ | 1,471,772 | $ | 1,667,775 | ||||||||

Total long-term liabilities |

$ | 874,190 | $ | 853,314 | $ | 935,248 | $ | 730,940 | $ | 757,800 | $ | 821,382 | $ | 900,995 | ||||||||

Operating margin(c) |

$ | 187,567 | $ | 211,680 | $ | 111,446 | $ | 216,188 | $ | 185,900 | $ | 99,675 | $ | 77,753 | ||||||||

- (a)

- Unaudited.

- (b)

- Results

have been prepared using International Financial Reporting Standards.

- (c)

- Operating

margin is a non-GAAP financial measure. CPILP uses operating margin as a performance measure. Operating margin is not a defined financial measure

according to Canadian generally accepted accounting principles or International Financial Reporting Standards and does not have a standardized meaning prescribed by Canadian generally accepted

accounting principles or International Financial Reporting Standards. Therefore, operating margin may not be comparable to similar measures presented by other enterprises.

- (d)

- Under International Financial Reporting Standards, finance income of $1.8 million is reported separately and not netted against finance costs as reported under previous Canadian generally accepted accounting principles.

Under U.S. GAAP, the following differences are noted for the years indicated below:

| |

Years Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| (in thousands of Canadian dollars, except per unit data) |

2010 | 2009 | |||||

Revenue |

$ | 532,377 | $ | 586,491 | |||

Depreciation, amortization and accretion |

$ | 98,277 | $ | 93,249 | |||

Financial charges and other, net |

$ | 40,129 | $ | 46,462 | |||

Net income before tax and preferred share dividends |

$ | 39,179 | $ | 54,753 | |||

Net income (loss) attributable to equity holders of CPILP |

$ | 34,455 | $ | 55,529 | |||

Basic and diluted net income (loss) per unit, C$ |

$ | 0.63 | $ | 1.03 | |||

Distributions declared per unit, C$ |

$ | 1.76 | $ | 1.95 | |||

Total assets |

$ | 1,588,352 | $ | 1,673,059 | |||

Total long-term liabilities |

$ | 878,632 | $ | 858,317 | |||

Operating margin |

$ | 191,530 | $ | 209,621 | |||

17

Summary Unaudited Pro Forma Condensed Combined Consolidated Financial Information

The following table sets forth selected information about the pro forma financial condition and results of operations, including per share data, of Atlantic Power after giving effect to the completion of the Plan of Arrangement with CPILP. The table sets forth selected unaudited pro forma condensed combined consolidated statements of operations data for the six months ended June 30, 2011 and the year ended December 31, 2010, as if the Plan of Arrangement had been completed on January 1, 2010, and the selected unaudited pro forma condensed combined consolidated balance sheet data as of June 30, 2011, as if the Plan of Arrangement had been completed on that date. The information presented below was derived from Atlantic Power's and CPILP's consolidated historical financial statements, and should be read in conjunction with these financial statements and the notes thereto, included elsewhere or incorporated by reference into this prospectus and the other unaudited pro forma financial data, including related notes, included elsewhere in this prospectus. CPILP's historical consolidated financial statements have been prepared in accordance with Canadian GAAP (or, in the case of the six months ended June 30, 2011, International Financial Reporting Standards) and include a discussion of the significant differences between Canadian GAAP and U.S. GAAP in Note 27 to the CPILP audited consolidated financial statements for the year ended December 31, 2010. For purposes of the unaudited pro forma condensed combined consolidated financial data, CPILP's balance sheet financial data has been translated from Canadian dollars into U.S. dollars using a C$/$ exchange rate of C$0.9643 to $1.00 and is presented in accordance with U.S. GAAP. CPILP's statement of operations financial data has been translated from Canadian dollars into U.S. dollars using an average C$/$ exchange rate of C$0.9766 to $1.00 and C$1.0295 to $1.00 for the six months ended June 30, 2011 and the year ended December 31, 2010, respectively, and is presented in accordance with U.S. GAAP.

The unaudited pro forma financial data is based on estimates and assumptions that are preliminary and does not purport to represent the financial position or results of operations that would actually have occurred had the Plan of Arrangement been completed as of the dates or at the beginning of the periods presented or what the combined company's results will be for any future date or any future period. See the sections entitled "Cautionary statements regarding forward-looking statements" and "Risk factors."

Unaudited Pro Forma Condensed Combined Consolidated Financial Information

(in thousands of U.S. dollars, except per share data)

|

Six Months Ended June 30, 2011 |

Year Ended December 31, 2010 |

||||||

|---|---|---|---|---|---|---|---|---|

Combined consolidated statement of operations information |

||||||||

Project revenues |

$ | 346,015 | $ | 669,985 | ||||

Project income |

60,937 | 91,687 | ||||||

Net income |

19,817 | 11,135 | ||||||

Net income attributable to noncontrolling interest |

6,952 | 13,597 | ||||||

Net income (loss) attributable to Atlantic Power Corporation/CPILP |

12,865 | (2,462) | (1) | |||||

Earnings (loss) per share |

||||||||

Basic |

$ | 0.11 | $ | (0.02 | ) | |||

Diluted |

$ | 0.11 | $ | (0.02 | ) | |||

Weighted average shares outstanding |

||||||||

Basic |

112,757 | 106,347 | ||||||

Diluted |

113,184 | 106,347 | ||||||

18

(in thousands of U.S. dollars)

|

As of June 30, 2011 |

|||

|---|---|---|---|---|

Balance sheet information |

||||

Cash and cash equivalents |

$ | 145,409 | ||

Total assets |

3,456,478 | |||

Long-term debt and convertible debentures |

1,602,699 | |||

Total liabilities |

2,096,958 | |||

Total Atlantic Power Corporation shareholders' equity |

1,128,671 | |||

Noncontrolling interest |

230,849 | |||

Total equity |

$ | 1,359,520 | ||

- (1)

- Net

income (loss) attributable to Atlantic Power/CPILP on a pro forma basis reflects:

- a.

- a

significant increase in amortization expense as a result of the estimated increase in fair value associated with CPILP PPAs (see Note 5(e) in the

notes to the unaudited pro forma condensed combined consolidated financial statements included elsewhere in this prospectus);

- b.

- timing

differences in Atlantic Power's deferred tax expense; and

- c.

- timing differences in CPILP's deferred tax benefit.

19

Investing in our common shares involves a high degree of risk. In addition to other information contained in this prospectus you should carefully consider the risks described below in evaluating our company and our business before making a decision to invest in our common shares. These risks are not the only ones faced by us. Additional risks not presently known or that we currently deem immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects. The trading price of our common shares could decline due to any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus. Please refer to the section entitled "Cautionary statements regarding forward-looking statements" in this prospectus.

Risks Related to Our Business and Our Projects

Our revenue may be reduced upon the expiration or termination of our power purchase agreements.

Power generated by our projects, in most cases, is sold under PPAs that expire at various times. For example, the PPA at our Badger Creek project expires in 2012 and represents 23 MWs of our net generating capacity. PPAs at our Auburndale, Lake and Gregory projects expire by the end of 2013 and represent 335 MWs of our net generating capacity. The table on page 12 contains details about our projects' PPAs. In addition, these PPAs may be subject to termination in certain circumstances, including default by the project. When a PPA expires or is terminated, it is possible that the price received by the project for power under subsequent arrangements may be reduced significantly. It is possible that subsequent PPAs may not be available at prices that permit the operation of the project on a profitable basis. If this occurs, the affected project may temporarily or permanently cease operations.

Our projects depend on their electricity, thermal energy and transmission services customers.

Each of our projects rely on one or more PPAs, steam sales agreements or other agreements with one or more utilities or other customers for a substantial portion of its revenue. The largest customers of our power generation projects, including projects recorded under the equity method of accounting, are Progress Energy Florida, Inc. ("PEF"), Tampa Electric Company ("TECO"), and Atlantic City Electric ("ACE"), which purchase approximately 37%, 14% and 10%, respectively, of the net electric generation capacity of our projects. The amount of cash available to pay dividends to shareholders is highly dependent upon customers under such agreements fulfilling their contractual obligations. There is no assurance that these customers will perform their obligations or make required payments.

Certain of our projects are exposed to fluctuations in the price of electricity.

Those of our projects with no PPA or PPAs based on spot market pricing will be exposed to fluctuations in the wholesale price of electricity. In addition, should any of the long-term PPAs expire or terminate, the relevant project will be required to either negotiate a new PPA or sell into the electricity wholesale market, in which case the prices for electricity will depend on market conditions at the time.

Our most significant exposure to market power prices is at the Selkirk and Chambers projects. At Chambers, the project has the right to sell a portion of the plant's output to our utility customer at spot market prices if it is economical to do so and the Chambers project shares in the profits from these sales. In addition, during periods of low spot electricity prices the customer takes less generation, which negatively affects the project's profitability. At Selkirk, approximately 23% of the capacity of the

20

facility is not contracted and is sold at market prices or not sold at all if market prices do not support the profitable operation of that portion of the facility.

Our projects may not operate as planned.

The revenue generated by our power generation projects is dependent, in whole or in part, on their availability, performance and the amount of electric energy and steam generated by them. The ability of our projects to meet availability requirements and generate the required amount of power to be sold to customers under the PPAs are primary determinants of the amount of cash that will be distributed from the projects to us, and that will in turn be available for dividends paid to our shareholders. There is a risk of equipment failure due to wear and tear, latent defect, design error or operator error, or force majeure events among other things, which could adversely affect revenues and cash flow. To the extent that our projects' equipment requires more frequent and/or longer than forecasted down times for maintenance and repair, or suffers disruptions of plant availability and power generation for other reasons, the amount of cash available for dividends may be adversely affected.

In general, our power generation projects transmit electric power to the transmission grid for purchase under the PPAs through a single step up transformer. As a result, the transformer represents a single point of vulnerability and may exhibit no abnormal behavior in advance of a catastrophic failure that could cause a temporary shutdown of the facility until a replacement transformer can be found or manufactured.

If the reason for a shutdown is outside of the control of the operator, a power generation project may be able to make a force majeure claim for temporary relief of its obligations under the project contracts such as the PPA, fuel supply, steam sales agreement, or otherwise mitigate impacts through business interruption insurance policies maintenance and debt service reserves. If successful, such insurance claims may prevent a default or reduce monetary losses under such contracts. However, a force majeure claim may be challenged by the contract counterparty and, to the extent the challenge is successful, the outage may still have a materially adverse effect on the project.

We provide letters of credit under our senior credit facility for contractual credit support at some of our projects. If the projects fail to perform under the related project-level agreements, the letters of credit could be drawn and the Company would be required to reimburse our senior lenders for the amounts drawn.

Our projects depend on suppliers under fuel supply agreements and increases in fuel costs may adversely affect the profitability of the projects.

Revenues earned by our projects may be affected by the availability, or lack of availability, of a stable supply of fuel at reasonable or predictable prices. To the extent possible, the projects attempt to match fuel cost setting mechanisms in supply agreements to energy payment formulas in the PPA. To the extent that fuel costs are not matched well to PPA energy payments, increases in fuel costs may adversely affect the profitability of the projects.

The amount of energy generated at the projects is highly dependent on suppliers under certain fuel supply agreements fulfilling their contractual obligations. The loss of significant fuel supply agreements or an inability or failure by any supplier to meet its contractual commitments may adversely affect our results.

Upon the expiration or termination of existing fuel supply agreements, we or our project operators will have to renegotiate these agreements or may need to source fuel from other suppliers. Our project operators may not be able to renegotiate these agreements or enter into new agreements on similar terms. Furthermore, there can be no assurance as to availability of the supply or pricing of fuel under new arrangements and it can be very difficult to accurately predict the future prices of fuel.

21

For example, a portion of the required natural gas at our Auburndale project and all of the natural gas required at our Lake project is purchased at market prices, but the projects' PPAs that expire in 2013 do not effectively pass through changes in natural gas prices.

The amount of energy generated at the projects is dependent upon the availability of natural gas, coal, oil or biomass. The long-term availability of such resources could change in the future.

Generation from windpower projects may be less than anticipated.

We now own an interest in a windpower project, which is exposed to the risk of its wind resource having unfavorable characteristics, which could result in unfavorable financial impacts to its generation and revenues.

Our operations are subject to the provisions of various energy laws and regulations.

Generally, in the United States, our projects are subject to regulation by the Federal Energy Regulatory Commission, or "FERC," regarding the terms and conditions of wholesale service and rates, as well as by state agencies regarding PPAs entered into by qualifying facility projects and the siting of the generation facilities. The majority of our generation is sold by qualifying facility projects under PPAs that required approval by state authorities.