Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARRIS GROUP INC | d242112d8k.htm |

| EX-99.3 - EX-99.3 - ARRIS GROUP INC | d242112dex993.htm |

| EX-99.1 - EX-99.1 - ARRIS GROUP INC | d242112dex991.htm |

ARRIS Announces

Acquisition of BigBand

Networks

Building Leadership in Video Networking

October 11, 2011

Exhibit 99.2 |

Safe

Harbor October 11, 2011

2

ARRIS Acquires BigBand Networks Conference Call

This

presentation

contains

forward

looking

statements.

These

statements

include,

among

others, accelerating time to market, increasing opportunities for ARRIS, plans to

optimize BigBand Networks’

performance, the transaction being neutral to accretive by mid-2012 and

offering upside potential thereafter, being optimistic about the

acquisition, the acquisition

offering new opportunities to expand the customer base, generate

broader opportunities,

continued innovation, and the time frame during which the acquisition is expected

to close. Statements

regarding

future

events

are

based

on

the

parties’

current

expectations.

The

statements

in

this

press

release

and

presentation

that

use

such

words

as

“believe,”

“expect,”

“intend,”

“anticipate,”

“contemplate,”

“estimate,”

or “plan,”

or similar expressions are also

forward looking-statements. Actual results may differ materially from

those contained in any forward-looking statement. Specific factors

that could cause material differences include, among other things,

shareholder approval of the acquisition, regulatory approval of the

acquisition, the potential impact on the business of BigBand Networks due to

uncertainty about the acquisition, the retention of employees of BigBand

Networks, the ability of ARRIS to successfully integrate BigBand

Networks’ opportunities, technology, personnel and

operations,

and

the

customer

demand

for

our

products.

The

above

listing

of

factors

is

representative and is not intended as an all-encompassing list of

factors. For additional factors please see our respective Form

10-Qs for the quarter ended June 30, 2011. We disclaim any

obligation to update forward-looking statements, whether as a result of new

information, future events or otherwise. |

Important Information

The planned tender offer referred to in these materials has not yet commenced. This

description is not an offer to buy or the solicitation of an offer to sell

any securities. At the time the planned tender offer is commenced, the

Company will file a Tender Offer Statement on Schedule TO with the

Securities and Exchange Commission (“SEC”), and BigBand Networks

will file a Solicitation/Recommendation Statement on Schedule 14D-9 with

respect to the tender offer. The Tender Offer Statement (including an

offer to purchase, a related letter of

transmittal and other tender offer documents) and the Solicitation/Recommendation

Statement will contain important information that should be read

carefully before making any decision to

tender securities in the planned tender offer. All of those materials (and

all other tender offer documents filed with the SEC) will be made available

at no charge on the SEC’s website, www.sec.gov. In addition, the Tender Offer Statement on Schedule TO and related offering

materials may be obtained for free (when they become available) from

the Company. October 11, 2011

3

ARRIS Acquires BigBand Networks Conference Call |

Transaction Summary…

$2.24 in Cash per BigBand share or ~$172 million

~$53

million

net

of

cash

on

hand

Tender Offer

Unanimous BigBand Board Recommendation

Voting Agreement with two largest BigBand

shareholders (~32% ownership)

Majority shareholder acceptance in tender offer period

Customary Regulatory Approval

Late 2011

Neutral/Accretive (non-GAAP) by mid-2012

Estimated $18M transaction and transition costs

~$20M in cash tax benefit from NOLs over time

Offer Price:

Form:

Support Agreements:

Closing Conditions:

Target Closing:

Key Metrics:

4

ARRIS Acquires BigBand Networks Conference Call

October 11, 2011

1. BigBand cash on hand estimated to be $119 M

1 |

Strategic Rationale…

October 11, 2011

5

ARRIS Acquires BigBand Networks Conference Call |

Acquisition Builds on ARRIS Strategy…

Maintain a strong capital structure, mindful of our 2013 debt maturity,

share repurchase opportunities and other capital needs

including M&A Grow our current

businesses into a more complete portfolio including a

strong

video

product

suite.

Continue

to

invest

in

the

evolution

toward

enabling true network convergence onto an all IP platform (Convergence

Enabled.)

Continue

to

expand

our

product/service

portfolio

through

internal

developments, partnerships and

acquisitions Expand our international

business and begin to consider opportunities in

markets other than cable

Continue to invest in and evolve the ARRIS talent pool to implement the

above…

6

Convergence Enabled. A World Where Broadband Communication and

Entertainment Services can be Consumed Anywhere, Anytime

October 11, 2011

ARRIS Acquires BigBand Networks Conference Call |

BigBand

Company Overview -

Innovator and Market Leader

Founded in 1998

-

Headquarters: Redwood City, CA

-

Research & Development: Tel Aviv, Israel;

Shenzhen, China; Westborough, MA

Leader in Digital Video Networking

-

Advanced Advertising

•

AT&T Local Advertising

•

1 Billion+ transactions /year

-

Switched Digital Video (SDV)

•

39 million homes passed

•

Cox Expansion Q2 2011

-

Universal EdgeQAMs

•

900K channels shipped

•

Beijing Gehua VoD launch Q2 2011

-

Broadcast Video

•

5000 chassis deployed

•

Verizon FiOS TV

North America: Top 2 Telcos, 9 of top 10 Cable Operators

200+ global customers, 50+ million subscribers

North America: Top 2 Telcos, 9 of top 10 Cable Operators

200+ global customers, 50+ million subscribers

October 11, 2011 |

Broadcast

Video

Broadband

Media Router

(BMR)

Broadcast Video

+ Zoned

Advertising

BigBand Networks Product Strategy:

Transition from Broadcast to Personal Video

Broadcast

1:1 Personalization

Personal

Video

Broadcast

Video

Switched

Digital

Video

Switched Video

(Multicast)

Converged Video

Exchange

(CVEx™)

SDV/vIP

Universal Edge

QAM (BEQ™)

MSP

QAM

High

Performance

IPTV

Addressable

Ads/Personal

Services

1:1 Personalized

Video (Unicast)

Media

Services

Platform

(MSP)

ARRIS Acquires BigBand Networks Conference Call

8

October 11, 2011 |

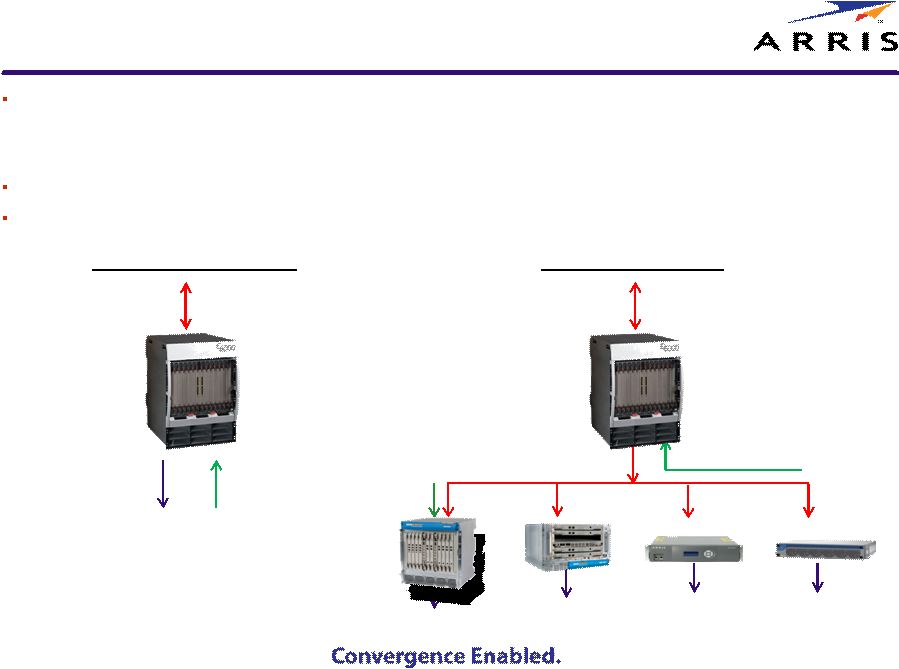

ARRIS

and BigBand… Early CCAP Readiness and Market Share

Demand for ultra-dense EdgeQAM platforms is beginning now

-

BigBand MSP deployable now

-

Graceful migration to full IP when used in combination with the E6000™ Support a

wider variety of network architecture and deployment options Opportunity to

include innovative video processing capabilities on the same platform

Downstream

Upstream

CCAP -

Integrated

Data

Voice

IP Video

Upstream

CCAP -

Modular

Data

Voice

IP Video

MPEG Video

MSP2800

BEQ

D5

MSP1200

40+ chan / port

8 chan / port

E6000™

9

October 11, 2011

ARRIS Acquires BigBand Networks Conference Call

E6000™

|

ARRIS

+ BigBand Improved Market Position

Edge Access

•

Accelerate Modular CCAP time to market

•

Leverage MSP and BEQ footprint for future E6000 sales

•

Increases current EdgeQAM market share

Video Processing

•

Multiplexing, Rate Shaping, Bandwidth Clamping, and Video

Grooming

•

Promote BMR footprint expansion with MSP

•

MSP video processing capabilities complementary to ARRIS VIPr

transcoding product line

Advertising

•

Expand Telco IP Video Targeted Ad Insertion and Broadcast

Video to additional markets

•

Exploit synergies with ARRIS Ad Insertion offering

SDV

•

Expand base of BigBand’s market leading CVEx SDV Solutions

•

SDV Growth creates demand for EdgeQAM (MSP, BEQ, D5)

10

ARRIS Acquires BigBand Networks Conference Call

October 11, 2011 |

Operating Plan…

Ready to Implement at Closing

October 11, 2011

11

ARRIS Acquires BigBand Networks Conference Call |

Financial Metrics Going Forward…

12

October 11, 2011

ARRIS Acquires BigBand Networks Conference Call |

Benefits of Transaction to ARRIS…

October 11, 2011

13

ARRIS Acquires BigBand Networks Conference Call |

THANK YOU

ARRIS Acquires BigBand Networks Conference Call

14

October 11, 2011 |

Questions and Answers

ARRIS Acquires BigBand Networks Conference Call

15

October 11, 2011 |