Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GEORESOURCES INC | d239786d8k.htm |

| EX-99.1 - PRESS RELEASE - GEORESOURCES INC | d239786dex991.htm |

Corporate Profile

October, 2011

Exhibit 99.2 |

Forward-Looking Statements

2

Information included herein contains forward-looking statements that involve

significant risks and uncertainties, including our need to replace production and

acquire or develop additional oil and gas reserves, intense competition in the oil

and gas industry, our dependence on our management, volatile oil and gas

prices and costs, uncertain effects of hedging activities and uncertainties of our

oil and gas estimates of proved reserves and resource potential, all of which

may be substantial. In addition, past performance is no guarantee of future

performance or results. All statements or estimates made by the Company,

other than statements of historical fact, related to matters that may or will occur

in the future are forward-looking statements.

Readers are encouraged to read our December 31, 2010 Annual Report on

Form 10-K and any and all of our other documents filed with the SEC regarding

information about GeoResources for meaningful cautionary language in respect

of the forward-looking statements herein. Interested persons are able to obtain

copies of filings containing information about GeoResources, without charge, at

the SEC’s internet site (http://www.sec.gov). There is no duty to update the

statements herein. |

3

Corporate Highlights

Value Creation

Balanced Portfolio

Long-Term Growth

–

71,000 net acres in two premier U.S. liquids

resource plays

Strong

Current

Cash

Flow/Profitability

–

4,749

Boe/d

of

production in 2Q 2011 (61% oil)

24

Mmboe

proved

reserves;

60%

oil

(1)

Substantial Eagle Ford Position

25,000 net acres (primarily operated)

Successful recent drilling has de-risked acreage and have proved

commerciality of play

Growing to 3 operated rigs in early 2012

Significant Producing Bakken Position

46,000 net acres (33,200 operated)

Continually leasing

2 dedicated rigs currently running on operated position (growing

to 3 in early 2012)

(1)

Does not include interests in affiliated partnerships. Reserves based on SEC

pricing as of 1/1/11. See Additional Disclosures in Appendix. |

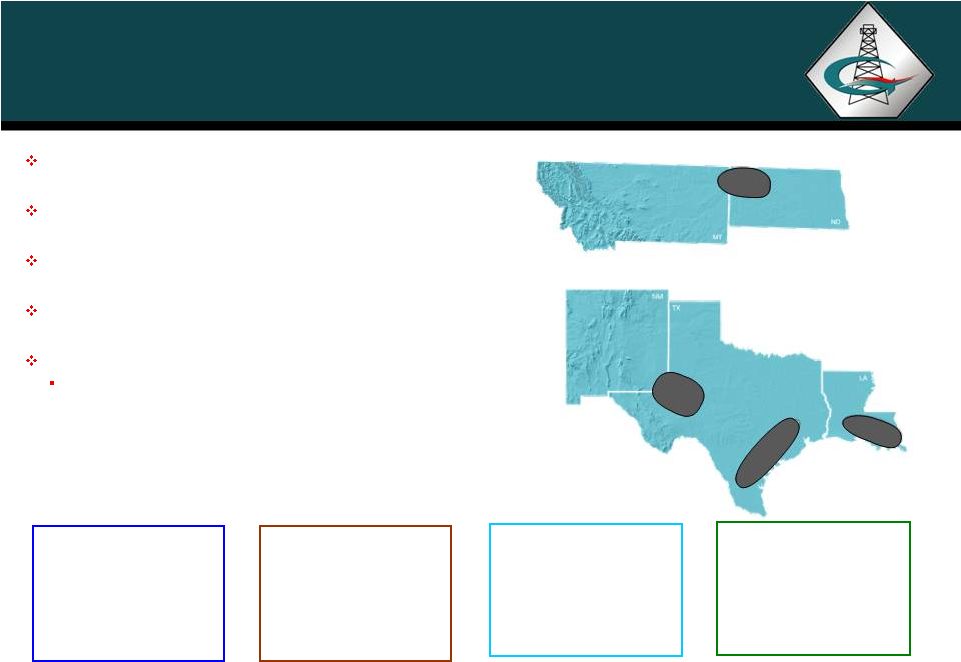

Company Overview

46,000 net acres

Independent oil and natural gas

company focused on operations in the

Southwest, Gulf Coast and Williston

Basin

Significant upside potential through

growing positions in liquids-rich resource

plays:

61% of 2 quarter 2011 production is oil

and expected to increase through near-

term development in the Eagle Ford and

Bakken

Operate approximately 75% of proved

reserves

Generated Adjusted EBITDAX of $71

MM

(2)

during twelve month period ended

June 30, 2011

Eagle Ford

25,000 net acres

4

01/01/11 Proved Reserves (MMBOE)

24.0

Oil % (Reserves)

60%

Proved Developed %

74%

2Q 2011 Production (Boe/d)

4,749

Oil % (Production)

61%

Operated Production

75%

Eagle Ford –

25,000 net acres

Bakken –

46,000 net acres

nd

Bakken

(1)

Reserve data as of January 1, 2011 and production data is for 2Q 2011. Data excludes interests

in two affiliated partnerships. Reserves based on SEC pricing for 2010. See Additional

Disclosures in Appendix. (2)

Adjusted EBITDAX is a non-GAAP financial measure. Please see Appendix for a definition of

Adjusted EBITDAX and a reconciliation to net income.

Company

Highlights

(1) |

Proved Reserves

(MMBOE) (2)

Average Daily Production (BOE/d)

Reserves and Production

Current

Proved

Reserves

–

24.0

MMBOE

(1)

(1)

As of January 1, 2011. Excludes partnership interests.

(2)

2006 –

2010 proved reserves based on SEC guidelines.

(3)

2008 reserves reflect lower prices and divestitures. See Additional Disclosures in

Appendix. 5

(3)

Undeveloped,

26%

Developed

Non-

Producing,

14%

Producing,

60%

Gas

40%

Oil

60%

Mid-Con

6%

Permian Basin

9%

Louisiana

16%

Other

3%

Gulf

Coast/ETX/S

TX

34%

Williston

32%

(3)

2.4

0.0

5.0

10.0

15.0

20.0

25.0

15.7

14.6

20.7

24.0

2006

2007

2008

2009

2010

768

1,826

3,388

5,090

4,589

0

1,000

2,000

3,000

4,000

5,000

6,000

2006

2007

2008

2009

2010

30.0 |

Oil

Weighted Development GeoResources Asset Overview

6 |

Eagle

Ford Shale Overview o

Upfront cash payment

o

Will fund 100% of cost of first six

horizontal wells

Note:

Information as of August, 2011.

7

25,000 net acres primarily located in

Southwest Fayette County, TX

Eagle Ford AMI

Leasehold continues to increase

Fayette County: 20,300 net acres

Gonzales County: 2,700 net acres

Atascosa & McMullen counties

combined: 1,800 net acres

Plan to spud 8 -

9 gross wells in 2011 and

21 -

24 gross wells in 2012

2011 drilling program averages ~45% WI

Ramshorn Investments, Inc., an affiliate of

Nabors Industries, Ltd. purchased a 50%

interest

GEOI retains 50% WI and operations |

Eagle

Ford Shale Volatile oil window

On strike with offset operator activity in

Gonzales County

Successful recent drilling results

Completed first three wells in Fayette County

in June/July 2011

o

Flatonia

East

Unit

#1-H:

~3,200’

lateral,

10

stages, 50% WI

o

Flatonia

East

Unit

#2-H:

~4,800’

lateral,

14

stages, 50% WI

o

Black

Jack

Spring

Unit

#1H:

~5,900’

lateral,

16 stages, 43.5% WI

Recently

drilled

Peebles

Unit

#1H:

4,800’

lateral, 39.8% WI –

Awaiting Frac

Multi-year drilling inventory

2nd operated rig coming in Oct. 2011

Planning for 3 operated rigs in early 2012

8

Note:

Third

party

Peak

Month

Avg.

rate

calculated

as

maximum

average

daily

production

rate

of

first

four

calendar

months

of

production.

Source

of

third

party

production

data

is

Drilling

Info

and/or

HPDI.

Source

of

GeoResources’

data

is

internal

figures.

Information

as

of

September

2011.

GEOI Peebles #1H

Awaiting Frac

GEOI Black Jack Springs #1H

30 day Avg. Rate: 369 Boe/d

GEOI Flatonia East #1H

30 day Avg. Rate: 391 Boe/d

GEOI Flatonia East #2H

30 day Avg. Rate: 465 Boe/d

GEOI Arnim “A”

#1H & #2H

Drilling 1 pad Location

MHR Gonzo North #1H

Peak Month Avg.: 471 Boe/d

MHR Gonzo Hunter #1H

Peak Month Avg.: 313 Boe/d

MHR Furrh #1H

Peak Month Avg.: 711 Boe/d

PVA Hawn Holt #4H

Peak Month Avg.: 327 Boe/d

PVA Gardner El Al #1H

Peak Month Avg.: 852 Boe/d

MHR Geo Hunter #1H

Peak Month Avg.: 329 Boe/d

Positive offset operator activity

Magnum Hunter Resources, Penn Virginia and

EOG have had multiple successful wells near

our acreage position in Gonzales County with

single day IPs ranging from 500 to 2,000 bo/d

st |

Eagle

Ford Development Economics Development Economics (~5,000 ft.

Lateral) (1)(2)

(1)

Assumes oil differentials of (5%) and assumes gas shrinkage of (15%). Natural gas

price held constant at $5/Mcf with a +20% gas differential. (2)

EUR refers to management’s internal estimates of reserves potentially

recoverable from successful drilling of wells. See Additional Disclosures in Appendix.

9

9 |

Eagle

Ford Illustrative Resource Potential Resource Potential

(1)

(1)

Data is for illustrative purposes only and is based on management

assumptions. EUR refers to management’s internal estimates of reserves potentially recoverable

from successful drilling of wells. See Additional Disclosures in

Appendix. 10

10

Undeveloped Eagle Ford Acreage Provides Net

Resource Potential of ~60 to ~80 MMboe

Eagle Ford Shale (Fayette Co., Texas)

350 Mboe

500 Mboe

Assumed Spacing Unit Size (Acres)

900

900

# Wells per Spacing Unit

6

6

# Acres per Well (Spacing Unit / # Wells per Unit)

150

150

GeoResources Net Undeveloped Acres

25,000

25,000

Number of Potential Net Drilling Locations

167

167

Estimated EUR per Well (Mboe)

350

500

Unrisked Illustrative Resource Potential (Mboe)

58,333

83,333 |

11

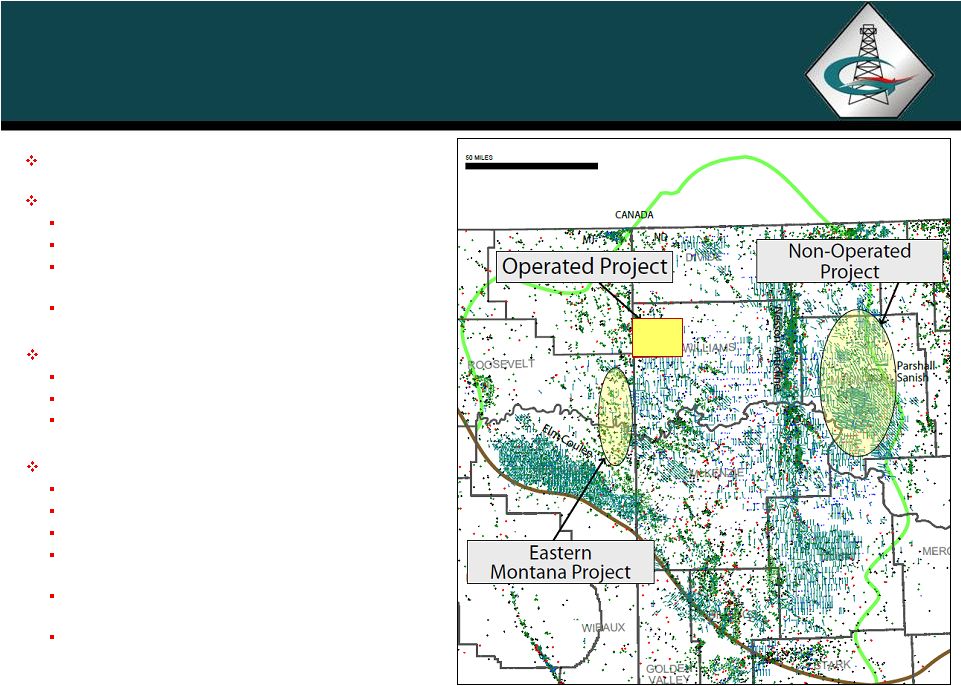

Bakken Shale Overview

25,000 net acres in Williams County, ND

6 wells drilled and completed

Continuous drilling with 2 dedicated rigs currently

running

Interests in 100 spacing units (1,280 acres)

Partnered with Slawson Exploration Company

11,000 net acres primarily Mountrail County, ND

4-5 rigs currently running

10,000 net acres in Roosevelt/Richland County, MT

8,200 operated / 1,800 non-operated acres

17 operated 1,280 acre units

Recently

completed

drilling

1

operated

Bakken

well,

Olson #1-21-16H with a 31.4% WI (awaiting Frac)

Participated with Slawson in the Renegade 1-10H,

Battalion 1-3H & Squadron 1-15-14H

Participated with Brigham in the Swindle 16-9 #1H

11

Information as of August 2011. Symbols on map depict permitted or drilled Bakken

locations.

Note:

46,000 total net acres in three project areas

Williams County Project (Operated)

Mountrail County Project (Non-Op)

Eastern Montana Project (Primarily Operated)

st |

Williams County Project

25,000 net acres in NW Williams Co., ND

First 4 wells have de-risked acreage

Positive offset activity

12

Note:

Information

as

of

August

2011.

30

Day

Avg.

rate

calculated

as

maximum

average

daily

production

rate

of

first

four

calendar

months

of

production

and

excludes

months

with

less

than

20

days

of

production.

Source

of

third

party

production

data

is

NDIC

website.

Plan

to

spud

10

-

11

gross

wells

in

2011

and

23 –

26 gross wells in 2012

2011 drilling program averages ~30% WI

Partnered with Resolute Energy in March ‘10

Retained 47.5% WI in project

Carlson

1-11H

(640

acre):

236

Bo/d

30

Day

Avg. (47.5% W.I.)

Siirtola

1-28-33H

(1,280

acre):

246

Bo/d

30

Day Avg. (41.4% W.I.)

Anderson

1-24-13H

(1,280

acre):

372

Bo/d

30

Day Avg. (35.0% W.I.)

Muller

1-21-16H

(1,280

acre):

250

Boe/d

first

30 Day Avg. (31.1% W.I.)

2 dedicated rigs currently running

Planning for 3 operated rigs in 2012

4-5 rigs drilling in and around our AMI

Bakken AMI

Multi-year drilling inventory |

Williams County Project Activity

13

13

GEOI Anderson 1-24-13H

Peak Month Avg.: 372 Bo/d

NFX Christensen 159-102-17-

20-1H

Peak Month Avg.: 326 Bo/d

OAS Sandaker 5602 11-13H

Peak Month Avg.: 440 Bo/d

OAS NJOS Federal 5602 11-

13H

Peak Month Avg.: 375 Bo/d

GEOI Muller 1-21-16H

30 Day Avg.: 250 Boe/d

GEOI Carlson 1-11H

Peak Month Avg.: 236 Bo/d

(640 ac. unit -

short lateral)

GEOI Siirtola 1-28-33H

Peak Month Avg.: 246 Bo/d

OAS Grimstvedt 5703 42-34H

Peak Month Avg.: 262 Bo/d

GEOI WI = 2.6%

OAS Bean 5703 42-34H

Peak Month Avg.: 298 Bo/d

OAS Horne 5603 44-9H

Peak Month Avg.: 550 Bo/d

OAS Somerset 5602 12-17H

Peak Month Avg.: 352 Bo/d

OAS Ellis 5602 12-17H

Peak Month Avg.: 421 Bo/d

Petro-Hunt NJOS 157-100-

28A-33-1H

Peak Month Avg.: 215 Bo/d

Petro-Hunt NJOS 157-100-

26B-35-1H

Peak Month Avg.: 344 Bo/d

Petro-Hunt Forseth 157-100-

25B-1H

Peak Month Avg.: 325 Bo/d

NFX Christensen 159-102-8-5-

1H

Drilling (GEOI WI 2.2%)

BEXP BCD Farms 16-21

Peak Month Avg.: 485 Bo/d

GEOI Rasmussen 1-21-16H

24 Hr. IP: 835 Boe/d

Note:

Information as of September 2011. Peak Month Avg. rate calculated as maximum average daily

production rate of first four calendar months of production and excludes months with less than

20 days of production. Source of all production data is HPDI website, except for Muller and Rasmussen well data which is based on GeoResources’ internal figures.

|

Williams County Completion Comparison

14

14

GeoResources Completions

Offset

Completions

Siirtola/Anderson

(Avg.)

Muller and

Rasmussen Wells

Future Completions

(Estimated Avg.)

30 Day Avg. Oil Rate (bbl/d)

309

-

-

500

60 Day Cumulative Oil (bbls)

15,000

-

-

27,000

Days On Pump (1

60 Days)

0

-

-

22

Lateral Length (feet)

9,800

~ 9,800

~ 9,800

9,500

Number of Frac Stages

30

38

34

34

Stage Length (Feet)

327

~250

~290

290

Frac Method

Sleeve & PnP

Plug 'n Perf

Plug 'n Perf

Plug 'n Perf

Sand Volume (MM lbs)

2.8

4.0

3.6

3.7

Sand Type

Sand & Resin-coated

Sand & Ceramic

Sand & Resin-coated

Sand & Ceramic

Current Water Cut (%)

54%

-

-

56%

Gas-Oil Ratio (cf/bbl)

589

-

-

675

Note:

Comparison limited to 1280 acre unit completions in Williams County (T154-157,

R100-104) occurring after June 2009. Water cut and GOR for offset completions are based

on

average

of

most

recent

monthly

data

from

the

wells

in

the

area

and

will

vary

by

well.

Water

cut

and

GOR

for

GeoResources

are

based

on

Carlson,

Siirtola

&

Anderson

wells

current month averages. Source of offset completion data is NDIC

website st |

15

Mountrail County Project

11,000 net acres primarily in Mountrail County,

ND

W.I. ranges from 1% to 18%

Average WI of ~8%

Partnered

with

experienced

operator

-

Slawson

Exploration

Slawson has 4-5 rigs currently running

Currently have dedicated frac crews under contract

Drilled over 100 wells to date; 100% success

Additional opportunities:

Slawson and others evaluating appropriate Bakken

spacing and infill drilling with several drilling units

containing second wells and proposals for third wells

in the unit

Slawson evaluating Three Forks potential with two

producers

Encouraging offset Three Forks results from EOG

and Whiting where GEOI has minor working

interests

15

Information, except for map, as of August 2011. Yellow-highlighted areas on map represent

GEOI’s acreage position.

Note: |

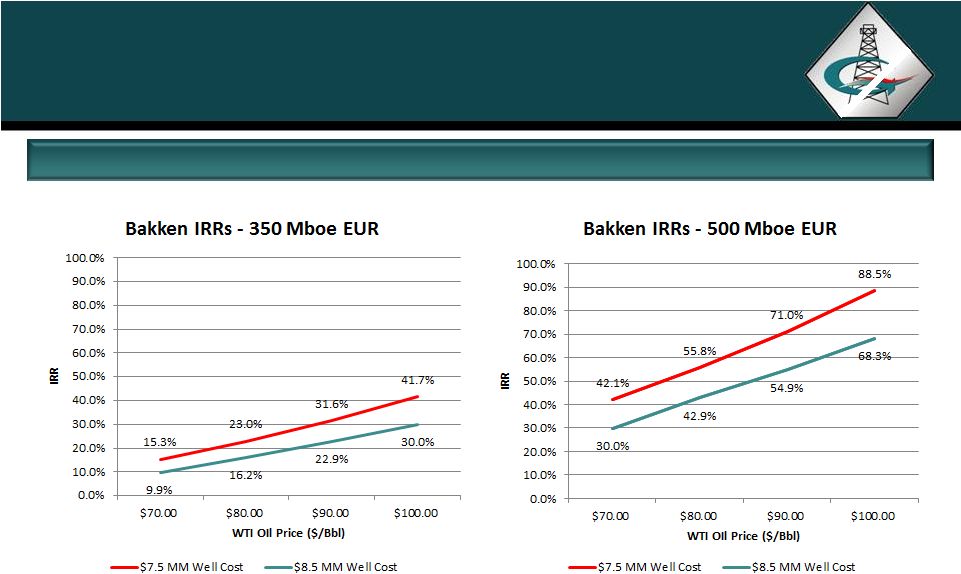

Williams County Development Economics

Development Economics (1,280 Acre Unit)

(1)(2)

(1)

Assumes oil differential of (15%) and assumes gas shrinkage of (10%). Natural gas

price held constant at $5/Mcf with no gas differential.. (2)

EUR refers to management’s internal estimates of reserves potentially

recoverable from successful drilling of wells. See Additional Disclosures in Appendix.

16

16 |

Bakken Illustrative Resource Potential

Resource Potential

(1)

(1)

Data is for illustrative purposes only and is based on management

assumptions. EUR refers to management’s internal estimates of reserves potentially recoverable

from successful drilling of wells. See Additional Disclosures in

Appendix. 17

17

Undeveloped Bakken Acreage Provides Net Resource

Potential of ~35 to ~50 MMboe

Bakken (Williams Co. & Montana)

Bakken (Mountrail County)

350 Mboe

500 Mboe

400 MBOE

600 MBOE

Assumed Spacing Unit Size (Acres)

1,280

1,280

1,280

1,280

Estimated Remaining # Wells per Spacing Unit (Bakken Only)

3.0

3.0

1.5

1.5

# Acres per Well (Spacing Unit / # Wells per Unit)

427

427

853

853

GeoResources Net Acres

35,000

35,000

11,000

11,000

Number of Potential Net Drilling Locations

82

82

13

13

Estimated EUR per Well (Mboe)

350

500

400

600

Unrisked Illustrative Resource Potential (Mboe)

28,711

41,016

5,156

7,734 |

Additional Assets |

19

Giddings Field –

Austin Chalk

17 wells drilled

–

100% success

19 additional drilling locations

WI ranges from 37%

-

53%

Operating control

Majority of acreage held-by-production

Eastern acreage in Grimes and

Montgomery Counties is dry gas

Western acreage is liquids-rich gas and

condensate

Eagle Ford, Georgetown and Yegua

potential

Rate increase potential from slick water

fracture stimulations

1,035 boe/d avg. for first 31 days

67% oil

APACHE

APACHE

APACHE

APACHE

APACHE

CWEI

CWEI

MAGNUM-HUNTER

Lee

Washington

Waller

Fayette

Austin

Colorado

Milam

Brazos

Grimes

Burleson

Giddings Field Acreage

Eagle Ford AMI

19

29,000 net acres

Eastern Giddings development area

Additional upside includes:

Recently completed drilling W.

Cannon Unit in northwest Grimes

County (43.4% WI) |

Louisiana -

Louisiana -

St. Martinville & Quarantine Bay

St. Martinville & Quarantine Bay

2,585 net acres of HBP or leased (yellow), 534

net acres of owned minerals (green)

Average WI of 97% and NRI of 91%

2010 cash flow exceeded $3,000,000

Multiple exploration and development

objectives

from

3,000’

–

10,000’

Cumulative shallow production of 15.2 MMBO and

16.6 BCFG

Cumulative production over 125 Bcfe at 10,000’

LOUISIANA

Quarantine Bay Field

St. Martinville Field

126

1

1

1

2

3

4

5

3-1

2

1

1

2

1

1

2

1

2

3

3

3ST1

2

1

1

2

1

1

1

1

1

2

1

1

1

2

31

1

51

3

4

1

4111

211

1

1

131

221

1

1

1

1B

6A

1211

3

3

21

4

1

1

4

1

51

31

2

¹

1

1

9A

14A

15A

11A32A

10A

13A4A

12A17A24A46A

3A1A37A

5A

16A37A

7A

21

4C

1

2

1

3

1

2

2

1

1

1

5

7D

6D

8A

6

1

2

1

3

7

5

4

1C

1

1D

11²

¹

1

2A

18A31A

19A

1

20A

21A

22A

1

1

2

23A

1

8

9

3

2

10

11

1

3

¹1²

12

13

1

1

25A

1

2

3

1

14

4

15

16

1

1

2

17

6

1

6

2

18

1

234

3

19

¹

1E

20

4

26A39A

2

27A

¹234

28A

1

5E

21

2

1

29A

8D

1

1

2

30A

1

1D

²

²34

9D

33A

6

22

1

34A

35A

7

8

1

10D

4

38A

41A

36A

40A

1

5

7

42A

43A

1

1

7

8

9

2E

44A

1

1

45A

5

1

1

1

47A(2)

¹

6

48A52A

49A

50A

54

1

51A

1

²

7

53

1

A-53

20

20

14,000

gross

acres

(13,000

HBP)

33%

WI

below

major

field

plays

Cumulative

production

of

180

MMBO

and

285

BCF

105’

of

net

pay

encountered

22.0%

WI

Currently

producing

1,211

boe/d

(83%

oil)

Significant

deep

exploration

potential

(11,000

-

25,000’);

plus

sub-salt

potential

Prospect

DN:

16.0

MMBO

+

40

BCFG

at

~16,500’

Additional

deeper

prospects

Recent Exploratory Success |

Financial Overview |

Capital Plan and Production Guidance

2012 Capital Budget

2011 capital plan of approximately $120 MM

2012 capital plan of $188 MM to $223 MM

Current project allocations favor lower-risk, high

cash flow oil-weighted projects primarily in

Bakken and Eagle Ford

Capital Allocation

22

22

Production Guidance

Year Ending December 31, 2011

5,000 to 5,500 boe/d estimated daily rate

61% to 65% oil

Year Ending December 31, 2012

6,500 to 7,500 boe/d estimated daily rate

70% to 75% oil

($ in millions)

Low

(1)

High

(2)

Notes

Bakken Operated (Williams County and Montana)

$61

$73

23 to 26 gross wells (~31% W.I.)

Bakken Non-Operated (Primarily Mountrail County)

23

23

42 gross wells with Slawson (8% W.I.); 12 with others (1% W.I.)

Eagle Ford (Fayette and Gonzales Counties)

74

86

21 to 24 gross wells (~40% W.I.)

Other Drilling

11

11

Williston basin conventional, St. Martinville and Chalk drilling

Acreage and Seismic

15

25

Primarily Eagle Ford and Bakken

Infrastructure and Other

4

6

Saltwater disposal and other infrastructure and equipment

Total Expected 2012 Capital Expenditures

$188

$223

(1) Assumes GEOI grows to 3 drilling rigs in both the Bakken and Eagle Ford in 2012 with gross well

costs of $8.0 million on GEOI operated Bakken wells and $8.5 million on GEOI operated Eagle

Ford wells. (2) Assumes GEOI grows to 4 drilling rigs in both the Bakken and Eagle Ford by late

2012 with gross well costs of $8.5 million on GEOI operated Bakken wells and $9.0 million on

GEOI operated Eagle Ford wells. |

23

EBITDAX

(1)

Debt / EBITDAX

(1)

$145 MM borrowing base

Last twelve months EBITDAX

(1)

= $71.0 MM

Cash balance of $48.3 MM as of June 30, 2011

Strong Financial Position

($ in millions)

(1)

EBITDAX is a non-GAAP financial measure. See reconciliation of net income

to EBITDAX following in Appendix. 23

Ability to fund current capital budget with cash flow and undrawn debt

capacity Conservative use of leverage to maintain strong balance sheet

No debt currently outstanding |

Investment Highlights

Value Creation

Eagle

Ford

Shale

-

25,000

net

acres

Bakken

Shale

-

46,000

net

acres

Ongoing

leasing

program

to

further

expand

acreage

24

MMBOE

of

proved

reserves

(1)

with

bias

towards

liquids

High

level

of

operating

control

Additional

upside

identified

in

conventional

assets

Significant

free

cash

flow

from

existing

assets

to

invest

in

shale

development

Unlevered

balance

sheet

Successful

track

record

of

creating

value

and

liquidity

for

shareholders

Cost

effective

operator

with

significant

operating

experience

in

unconventional

resource

plays

Board

and

management

own

approximately

19%

of

the

company

(1)

Does not include interests in affiliated partnerships. Reserves based on SEC

pricing as of 1/1/11. See Additional Disclosures in Appendix. 24

Significant

upside

from

Eagle

Ford

and

Bakken

positions

Solid

proved

reserve

and

production

base

Strong

financial

position

to

execute

development

plans

Experienced

management

and

technical

team

with

large

ownership

stake |

Appendix |

Development Economics Table

Development Economics

(2)

(1)

Assumes Bakken and Eagle Ford oil differentials of (15%) and (5%), respectively.

Assumes Bakken and Eagle Ford gas shrinkage of (10%) and (15%), respectively.

Natural gas price held constant at $5/Mcf with an assumed differential of +20% in

the Eagle Ford and no differential in the Bakken. (2)

EUR refers to management’s internal estimates of reserves potentially

recoverable from successful drilling of wells. These estimates do not necessarily represent reserves

as defined under SEC rules and by their nature and accordingly are more speculative

and substantially less certain of recovery and no discount or risk adjustment is

included in the presentation. Actual locations drilled and quantities that may be

ultimately recovered from the Company’s interests could differ substantially.

26

Bakken Shale (Williams Co., North Dakota)

Eagle Ford Shale (Fayette Co., Texas)

350 Mboe

500 Mboe

350 Mboe

500 Mboe

Well Assumptions

Drilling & Completion Cost ($M)

$8,500

$8,500

$9,000

$9,000

Lateral Length (feet)

10,000

10,000

5,000

5,000

WI

100%

100%

100%

100%

NRI

80.0%

80.0%

82.5%

82.5%

First 30 Day Average Oil IP (Bopd)

441

689

448

847

GOR (Scf/bbl)

600

600

1,000

1,000

Economics @ $80/bbl and $5/Mcf

(1)

NPV @ 10%

$1,335

$5,715

$2,979

$7,847

IRR

16.2%

42.9%

25.1%

66.4%

Payout (Yrs)

4.0

1.9

2.7

1.3

ROI

1.7

2.4

1.8

2.5

Price Sensivity (IRR)

(1)

$100/Bbl (WTI)

30.0%

68.3%

44.4%

109.1%

$90/Bbl (WTI)

22.9%

54.9%

34.7%

85.6%

$80/Bbl (WTI)

16.2%

42.9%

25.1%

66.4%

$70/Bbl (WTI)

9.9%

30.0%

17.2%

48.5% |

27

Management History

2004-

2007

Southern Bay Energy, LLC

Gulf Coast, Permian Basin

REVERSE MERGED INTO

GEORESOURCES, INC.

1992-1996

Hampton Resources Corp

Gulf Coast

SOLD TO BELLWETHER

EXPLORATION

Preferred investors –

30% IRR

Initial investors –

7x return

1997-2001

Texoil Inc.

Gulf

Coast,

Permian

Basin

SOLD

TO

OCEAN

ENERGY

Preferred investors –

2.5x return

Follow-on investors

–

3x return

Initial investors

–

10x return

2001-2004

AROC Inc.

Gulf Coast, Permian Basin, Mid-Con.

DISTRESSED ENTITY TURNED

AROUND AND MONETIZED

Preferred investors –

17% IRR

Initial investors

–

4x return

Track record of profitability and liquidity

Extensive industry and financial relationships

Significant technical and financial experience

Long-term repeat shareholders

Team has been together for up to 23 years through

multiple entities

27

Cohesive management and technical staff |

28

Proved Reserves

(1)

PV-10% is a non-GAAP financial measure. See reconciliation of SEC PV

10% to standardized measure in Appendix. (2)

Utilizing five year NYMEX forward prices at 1/1/11. See Additional

Disclosures in Appendix. MMBO

BCF

MMBOE

Total

PV-10

PDP

8.9

33.0

14.4

60.0%

$239.6

PDNP

2.3

6.1

3.4

14.2%

68.5

PUD

3.2

18.4

6.2

25.8%

70.2

Total Proved Corporate Interests

14.4

57.6

24.0

100.0%

378.3

Partnership Interests

0.1

8.0

1.4

12.0

Total Proved Corporate and Partnerships

14.5

65.6

25.4

$390.3

28

Proved Reserves –

SEC Pricing at 1/1/11

Proved Reserves –

Forward Strip Pricing at 1/1/11

MMBO

BCF

MMBOE

Total

PV-10

PDP

9.2

35.2

15.1

60.2%

$303.6

PDNP

2.4

6.3

3.4

13.5%

83.7

PUD

3.3

19.6

6.6

26.3%

98.5

Total Proved Corporate Interests

14.9

61.1

25.1

100.0%

485.8

Partnership Interests

0.1

8.3

1.4

15.9

Total Proved Corporate and Partnerships

15.0

69.4

26.5

$501.7

(1)

(2)

Corporate Interests

Corporate Interests

Oil

Gas

Total

% of

Oil

Gas

Total

% of

($ in millions)

($ in millions) |

Hedge

Portfolio Oil Hedges

GEOI uses commodity price risk management in order to execute its business plan

throughout commodity price cycles

Natural Gas Hedges

29

Weighted Average Gas Hedge Price

2011

2012

2013

$6.76

$5.48

$4.85

Collar

Swap

Note:

2011

hedge

volume

and

weighted

average

price

data

is

as

of

7/1/2011.

Weighted Average Oil Hedge Price

2011

2012

2013

$85.11

$90.76

$101.85 |

Operating Performance

Historical Operating Data

(1)

Adjusted Net Income and Adjusted EBITDAX are non-GAAP financial

measures. See reconciliation of net income to Adjusted Net Income and Adjusted EBITDAX in Appendix.

6 Mos Ended

Years Ended December 31,

6/30/2011

2010

2009

2008

Key Data:

Average realized oil price ($/Bbl)

88.12

$

70.33

$

61.09

$

82.42

$

Avg. realized natural gas price ($/Mcf)

5.22

$

5.30

$

3.97

$

8.12

$

Oil production (MBbl)

515

1,060

851

743

Natural gas production (MMcf)

2,015

4,789

4,944

2,962

% Oil

61%

57%

51%

60%

($ in millions except per share data)

Total revenue

59.5

$

107.0

$

81.0

$

94.6

$

Reported net income

15.2

$

23.3

$

9.8

$

13.5

$

Adjusted net income

15.1

$

23.9

$

10.9

$

16.3

$

Adjusted earnings

per share (diluted)

0.60

$

1.19

$

0.66

$

1.03

$

Adjusted EBITDAX

38.4

$

66.7

$

45.8

$

49.0

$

30

(1)

(1)

(1) |

31

Reconciliation of non-GAAP Measures

31

Adjusted EBITDAX Reconciliation

6 Mos Ended

Years Ended December 31,

6/30/2011

2010

2009

2008

($ in millions)

Net Income Attributable to GeoResources

15.2

$

23.3

$

9.8

$

13.5

$

Adjustments:

(Gain) on sale of property and equipment

(0.7)

$

(1.0)

$

(1.4)

$

(4.4)

$

Interest and other income

(0.4)

$

(1.5)

$

(1.0)

$

(0.8)

$

Interest Expense

1.0

$

4.7

$

5.0

$

4.8

$

Income Taxes

9.6

$

12.1

$

5.1

$

7.9

$

Depreciation, depletion and amortization

11.9

$

24.7

$

22.4

$

16.0

$

Unrealized (gain) / loss on hedge and derivatives

0.6

$

(0.9)

$

0.3

$

0.4

$

Non-cash Compensation

0.8

$

1.1

$

1.4

$

0.7

$

Exploration

0.4

$

1.5

$

1.4

$

2.6

$

Impairments

-

$

2.7

$

2.8

$

8.3

$

Adjusted EBITDAX

(1)

38.4

$

66.7

$

45.8

$

49.0

$

(1) As used herein, Adjusted EBITDAX is calculated as net income attributable to GeoResources, Inc.

before interest, income taxes, depreciation, depletion and amortization, and exploration

expense and further excludes non-cash compensation, impairments, hedge ineffectiveness and income

or loss on derivative contracts. Adjusted EBITDAX should not be considered as an

alternative to net income (as an indicator of operating performance) or as an alternative to cash flow

(as a measure of liquidity or ability to service debt obligations) and is not in accordance with,

nor superior to, generally accepted accounting principles, but provides additional information for

evaluation of our operating performance.

|

32

Reconciliation of non-GAAP Measures

32

6 Mos Ended

Years Ended December 31,

6/30/2011

2010

2009

2008

($ in millions)

Net Income Attributable to GeoResources

15.2

$

23.3

$

9.8

$

13.5

$

Adjustments:

Unrealized (gain) / loss on hedge and derivatives

0.6

$

(0.9)

$

0.3

$

0.4

$

Impairments

-

$

2.7

$

2.8

$

8.3

$

(Gain) on sale of property and equipment

(0.7)

$

(1.0)

$

(1.4)

$

(4.4)

$

Tax impact

-

$

(0.3)

$

(0.7)

$

(1.7)

$

Adjusted Net Income

15.1

$

23.9

$

10.9

$

16.3

$

Adjusted Net Income Reconciliation

(1)

(2)

(1) Tax impact is estimated as 37.6% of the pre-tax adjustment amounts. (2) As used

herein, adjusted net income is calculated as net income attributable to GeoResources, Inc. excluding (gains) and losses on property sales, impairment of proved and

unproved properties and an unrealized (gains) and losses related to hedge ineffectiveness and income

or loss on derivative contracts. Adjusted net income should not be considered as an

alternative to net income (as an indicator of operating performance) or as an alternative to cash flow (as a measure of liquidity or ability to service debt obligations) and is not in

accordance with, nor superior to, generally accepted accounting principles, but provides additional

information for evaluation of our operating performance. |

Standardized Measure

SEC PV-10 Reconciliation to Standardized Measure

(1)

(1)

PV-10% is not a measure of financial or operating performance under

GAAP, nor should it be considered in isolation or as a substitute for the

standardized measure of discounted

future

net

cash

flows

as

defined

under

GAAP.

Our

calculations

of

PV-10%

and

standardized

measure

of

discounted

future

net

cash

flows

at

July

1,

2010

are

based on our internal reserve estimates, which have not been reviewed or audited by

our independent reserve engineers. (2)

Through two affiliated partnerships.

33

($ in millions)

1/1/2011

Direct interest in oil and gas reserves:

Present value of estimated future net revenues (PV-10%)

$378.3

Future income taxes at 10%

(101.3)

Standardized measure of discounted future net cash flows

$277.0

Indirect

interest

in

oil

and

gas

reserves:

(2)

Present value of estimated future net reserves (PV-10%)

$12.0

Future income taxes at 10%

(4.0)

Standardized measure of discounted future net cash flows

$8.0 |

The disclosures below apply to the contents of this presentation:

34

Additional Disclosures

34

In April 2007, GeoResources, Inc. (“GEOI” or the “Company”) merged with Southern

Bay Oil & Gas, L.P. (“Southern Bay”) and a subsidiary of Chandler Energy, LLC and

acquired certain oil and gas properties (collectively, the “Merger”). The Merger was

accounted for as a reverse acquisition of GEOI by Southern Bay. Therefore, any information prior

to 2007 relates solely to Southern Bay.

Cautionary Statement – The SEC has established specific guidelines related to reserve

disclosures, including prices used in calculating PV 10% and the standardized measure of

discounted future net cash flows. PV 10% is not a measure of financial or operating

performance under General Accepted Accounting Principles (GAAP), nor should it be considered in isolation or as a

substitute for the standardized measure of discounted future net cash flows as defined under

GAAP. In addition, alternate pricing methodologies, such as the NYMEX forward strip price

curve, are not provided for under SEC guidelines and therefore do represent GAAP.

PV-10% is not a measure of financial or operating performance under GAAP, nor should it be

considered in isolation or as a substitute for the standardized measure of discounted future

net cash flows as defined under GAAP. PV-10 % for SEC price calculations are based on

the 12-month unweighted average prices at year-end 2010 of $79.43 per Bbl for oil and $4.37 per Mmbtu

for natural gas. These prices were adjusted for transportation, quality, geographical

differentials, marketing bonuses or deductions and other factors affecting wellhead

prices received. For the Strip Price reserve case, five year NYMEX strip pricing at 12/30/10 was

utilized for 2011 – 2015. NYMEX oil strip ranged from $93.85 per Bbl to $92.48 per

Bbl and then constant thereafter. NYMEX gas strip ranged from $4.59 per Mmbtu to $5.64

per Mmbtu and then held constant thereafter. These prices were adjusted for transportation,

quality, geographical differentials, marketing bonuses or deductions and other factors affecting wellhead prices

received. Actual realized prices will likely vary materially from the NYMEX strip. The

Company’s independent engineers are Cawley, Gillespie & Associates, Inc. BOE

is defined as barrel of oil equivalent, determined using a ratio of six MCF of natural gas equal to one barrel of oil equivalent.

IP (BO/d or BOE/d) (24 hour rate) is defined as the peak oil volume produced on a daily basis through

permanent production facilities that occur within the first few days of initial production from

the well.

EUR estimates do not necessarily represent reserves as defined under SEC rules and by their nature and

accordingly are more speculative and substantially less certain of recovery and no discount or

risk adjustment is included in the presentation. Actual locations drilled and quantities that

may be ultimately recovered from the Company’s interests could differ substantially. |