Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Avantair, Inc | d240911d8k.htm |

Avantair, Inc.

(OTCBB: AAIR)

Steven Santo, CEO

Exhibit 99.1 |

SAFE

HARBOR This

document

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

All

statements,

other

than

statements

of

historical

fact,

including,

without

limitation,

statements

regarding

Avantair’s

financial

position,

business

strategy,

plans,

and

Avantair’s

management’s

objectives

and

its

future

operations,

and

industry

conditions,

are

forward-looking

statements.

Although

Avantair

believes

that

the

expectations

reflected

in

such

forward-looking

statements

are

reasonable,

Avantair

can

give

no

assurance

that

such

expectations

will

prove

to

be

correct.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

Avantair’s

expectations

(“Cautionary

Statements”)

as

described

in

Avantair’s

public

filings

include,

without

limitation,

the

effect

of

existing

and

future

laws

and

governmental

regulations,

the

results

of

future

financing

efforts,

and

the

political

and

economic

climate

of

the

United

States.

All

subsequent

written

and

oral

forward-looking

statements

attributable

to

Avantair,

or

persons

acting

on

Avantair’s

behalf,

are

expressly

qualified

in

their

entirety

by

the

Cautionary

Statements.

2 |

EXCLUSIVE VALUE PROPOSITION

AIRCRAFT

•

Safest, economical and high performance Piaggio Avanti P180

•

57 Piaggio P180 aircraft in fleet

•

Largest and quietest cabin in its category

•

Low operating costs –

innovative aerodynamic design & most fuel efficient

•

Fastest twin turboprop ever built –

light jet speed

COMPETITIVE PRICING

•

Three award winning flight hour programs (fractional shares, leases, cards)

•

40% less

PEOPLE & SERVICE

•

Over 200 highly trained pilots, approx. 100 skilled

maintenance workers in 3 facilities

•

State-of-the-art 24/7 operations center in

Clearwater, FL

•

Entire organization committed to one aircraft type

and industry leading customer service

3 |

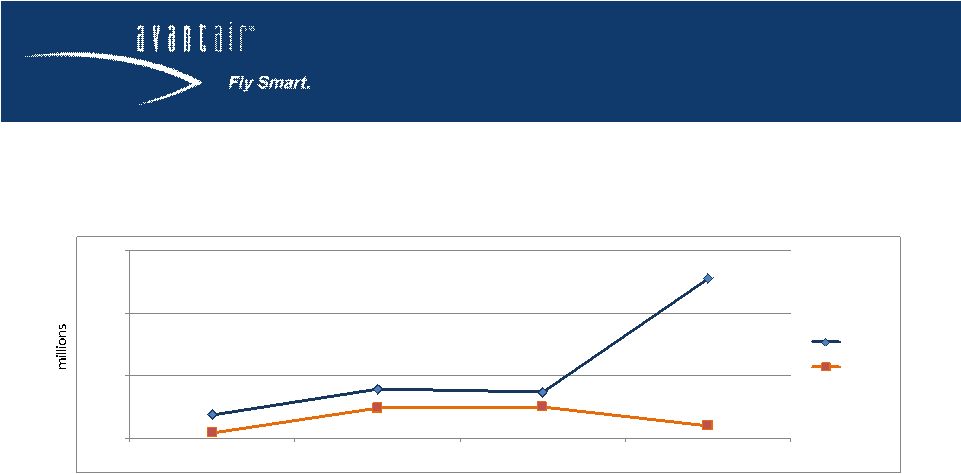

FINANCIALS

•

Consistent revenue growth through challenging economic environment

•

9% CAGR from FY08 -

FY11

•

Revenue generating flight hours reached record level of 43,305 in FY11

•

EBITDA improved in Q4 FY11 vs. Q4 FY10

•

Implementing back office cost reductions targeted between $1 million to

$1.5 million per quarter during FY12

•

FBO, non-core and G&A headcount, leases, third party contracts,

series of other back office initiatives

•

June 30, 2011 balance sheet snapshot

•

$5.6 million in cash, deferred revenue of $94 million and paid down

$8.2 million in net debt

4 |

FY11

REVENUE HIGHLIGHTS 5

•

Total FY11 revenue = $149.0 million

•

Revenue growth of 4.2% from FY10 revenue of $143.0 million

•

FY11 Unit Sales by Program

•

New Fractional Ownership Program = 19 shares (153% increase from

prior year of 7.5 units)

•

Axis Lease Program = 30.5 new sales (program began in March

FY11)

•

Cards sold including Edge Card Program and other cards = 461 (19%

increase from prior year of 388 cards)

$35.0

$37.0

$39.0

$41.0

Quarter 1

Quarter 2

Quarter 3

Quarter 4

FY 2011

FY 2010 |

FLEET

GROWTH AND REVENUE HOURS

6 |

PRODUCT SALES IN HOURS

7 |

REVENUE GROWTH FROM

FLEET MANAGEMENT

8

* Includes

$1.0

million

profit

from

the

sale

of

previously

owned

fractional

aircraft

shares

* |

NON-GAAP MEASURES

9

The

following

table

reflects

the

reconciliation

of

total

revenue

and

net

loss,

both

prepared

in

conformity

with

(GAAP),

to

the

non-GAAP financial measures of total revenue before fractional aircraft sales

revenue and net loss before fractional aircraft sales revenue and

cost. The company believes that these non-GAAP financial measurements are

useful to investors as they highlight results of operations from fleet

management. These measures are supplements to accounting principles generally accepted in the

United States used to prepare the Company’s financial statements and should

not be viewed as a substitute for GAAP measures. In addition, the

Company’s non-GAAP measures may not be the comparable to non-GAAP measures of other

companies.

FY2011 Q1

FY2011 Q2

FY2011 Q3

FY2011 Q4

35,782,116

$

36,584,539

$

36,488,593

$

40,146,729

$

9,197,823

8,778,578

7,720,559

7,631,525

26,584,293

$

27,805,961

$

28,768,034

$

32,515,204

$

Net loss

(4,814,309)

$

(4,066,365)

$

(956,567)

$

(938,681)

$

Add:

Cost of fractional shares sold

8,111,445

7,526,245

6,618,110

6,900,835

Subtract:

Fractional aircraft sales revenue

(9,197,823)

(8,778,578)

(7,720,559)

(7,631,525)

(5,900,687)

$

(5,318,698)

$

(2,059,016)

$

(1,669,371)

$

Total revenue

Fractional aircraft sales revenue

Total revenue before fractional aircraft

sales revenue

Net loss before fractional aircraft sales

revenue and cost |

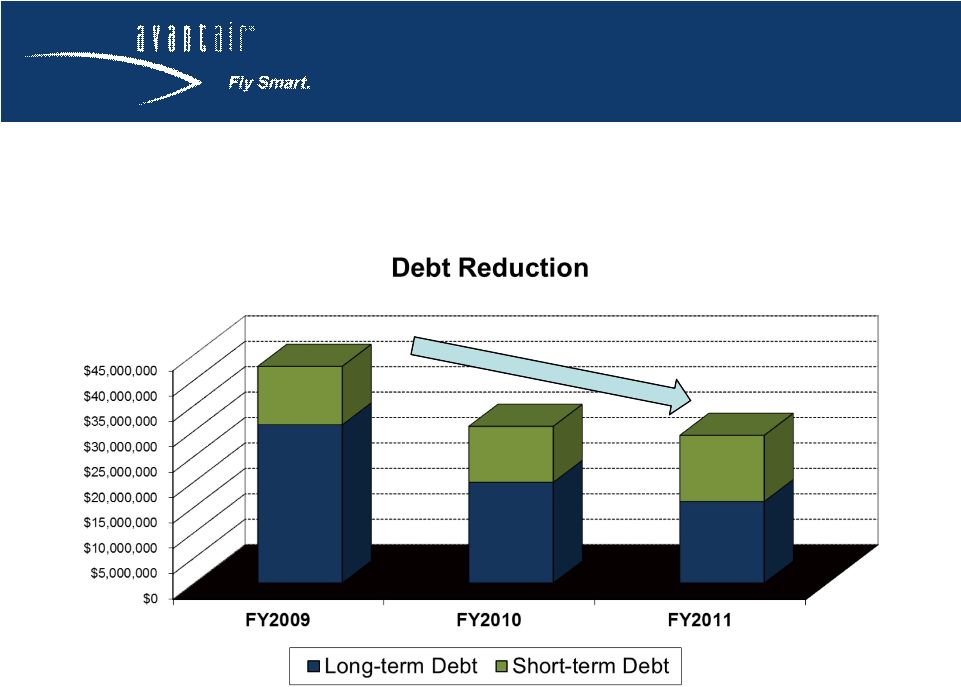

BALANCE SHEET AND CASH FLOW

10

•

Generated $6.9 million in cash from operations during FY11

•

Paid down $8.2 million in net debt in FY11 |

GOING FORWARD PLAN

11

•

Focus on core business objective of marketing, selling and servicing

customers through fractional shares, leases and cards

•

Align and develop personnel to achieve our business objectives

•

Enhancing a metric driven culture toward achieving key performance

goals

•

Optimizing use of technology as a competitive advantage

•

Focus on back office cost efficiencies that do not impact safety,

operations or customer service

•

Strengthening key vendor relationships

•

Exploring the expansion of our operating model to select global

markets through strategic alliances |

RETURN ON INVESTMENT

12

Why is AAIR a solid long-term investment?

•

Growing market share up 4 points since 2010

•

Increased revenue in FY11 4.2% from FY10

•

Exclusivity of the Piaggio P180 aircraft

•

Better positioned to take advantage of challenging economy

•

Adding new aircraft to meet demand

•

Avantair is the “responsible”

choice |

AVANTAIR

(OTCBB: AAIR) |