Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FAIRPOINT COMMUNICATIONS INC | d239475d8k.htm |

FairPoint Communications, Inc.

Investor Presentation

October 2011

Exhibit 99.1 |

Cautionary Notes

2

The information contained herein is current only as of the date hereof. The

business, prospects, financial condition or performance of FairPoint

Communications, Inc. (“FairPoint”) and its subsidiaries described herein may

have changed since that date. FairPoint does not intend to update or

otherwise

revise

the

information

contained

herein.

FairPoint

makes

no

representation

or

warranty,

express

or

implied,

as

to

the

completeness

of

the

information

contained

herein.

If

any

other

information

is

given

or

any

other

representations

are

made,

they

should

not

be

relied

upon

as

having

been

authorized by FairPoint.

Market data used throughout this presentation is based on surveys and studies conducted

by third parties, as well as industry and general publications. FairPoint has no

obligation (express or implied) to update any or all of the information or to advise you of any changes; nor does

FairPoint make any express or implied warranties or representations as to the

completeness or accuracy or to accept responsibility for errors. Some

statements

herein

are

known

as

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

These

forward-looking

statements

include,

but

are

not

limited

to,

statements

about

our plans, objectives, expectations and intentions and other statements contained

herein that are not historical facts. When used herein, the words

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates”

and similar expressions are generally intended to identify forward-

looking statements. Because these forward-looking statements involve known and

unknown risks and uncertainties, there are important factors that could cause

actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements,

including

our

plans,

objectives,

expectations

and

intentions

and

other

factors.

You

should

not

place

undue

reliance

on

such

forward-looking

statements, which are based on the information currently available to us and speak only

as of the date hereof. FairPoint does not undertake any obligation to publicly

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Throughout this presentation, reference is made to Consolidated EBITDAR or EBITDAR and

Adjusted EBITDAR. EBITDAR and Adjusted EBITDAR are non- GAAP financial

measures. Management believes that EBITDAR and Adjusted EBITDAR may be useful in assessing our operating performance and our

ability to meet our debt service requirements. EBITDAR and Adjusted EBITDAR, as

used herein, however, are not necessarily comparable to similarly titled

measures of other companies. Furthermore, EBITDAR and Adjusted EBITDAR have limitations as an analytical tool and should not be considered

in isolation from, or as an alternative to, net income or loss, operating income, cash

flow or other combined income or cash flow data prepared in accordance with

GAAP. Because of these limitations, EBITDAR, Adjusted EBITDAR and related ratios should not be considered as measures of

discretionary

cash

available

to

invest

in

business

growth

or

reduce

indebtedness.

We

compensate

for

these

limitations

by

relying

primarily

on

our

GAAP results using EBITDAR and Adjusted EBITDAR only supplementally. The Securities and

Exchange Commission (“SEC”) has adopted rules to regulate the use in

filings with the SEC and public disclosures and press releases of non-GAAP financial measures, such as EBITDAR and Adjusted

EBITDAR, that are derived on the basis of methodologies other than in accordance with

GAAP. Our presentation of EBITDAR and Adjusted EBITDAR may not comply with these

rules. |

Agenda

I.

Company Overview

II.

Growth Opportunity

III.

Recent Results

3 |

FairPoint is positioned for success

Leveraging core strengths for growth in revenue, EBITDAR and free cash flow

Geographic scope and ubiquitous network in northern New England (ME, NH, VT)

Next generation, IP-based technologies

Organic revenue growth opportunities given low market share

Stable RLEC business in legacy FairPoint markets (“Telecom Group”)

Operational improvements allow for acceleration of cost reduction initiatives

High-speed data subscriber growth accelerated in 2Q11 to 5.4%

year-over-year Voice access line loss slowed in 2Q11 to 9.3%

year-over-year Recently announced workforce reduction of approximately

400 employees; expected to result in approximately $34 million of annualized

operating savings in 2012 Experienced management team with fresh focus

Aligned to capture revenue growth opportunities and improve operations

Focused on enhanced service and responsiveness

Simplified and right-sized capital structure

Total debt of $1.0 billion, liquidity of $76 million as of June 30, 2011

Listed with NASDAQ: FRP

4 |

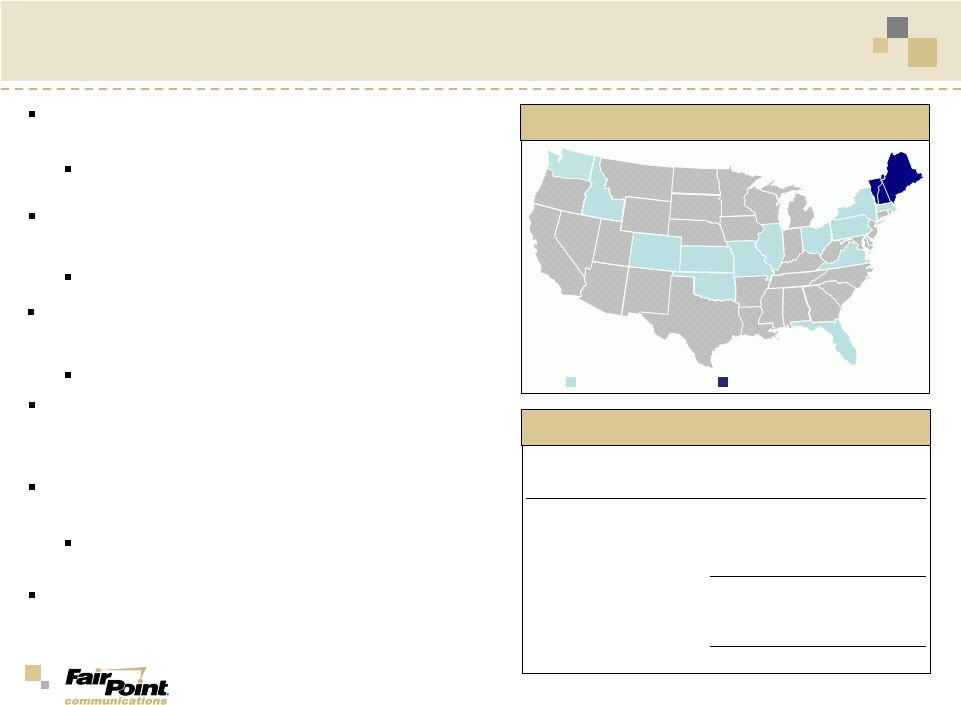

Company

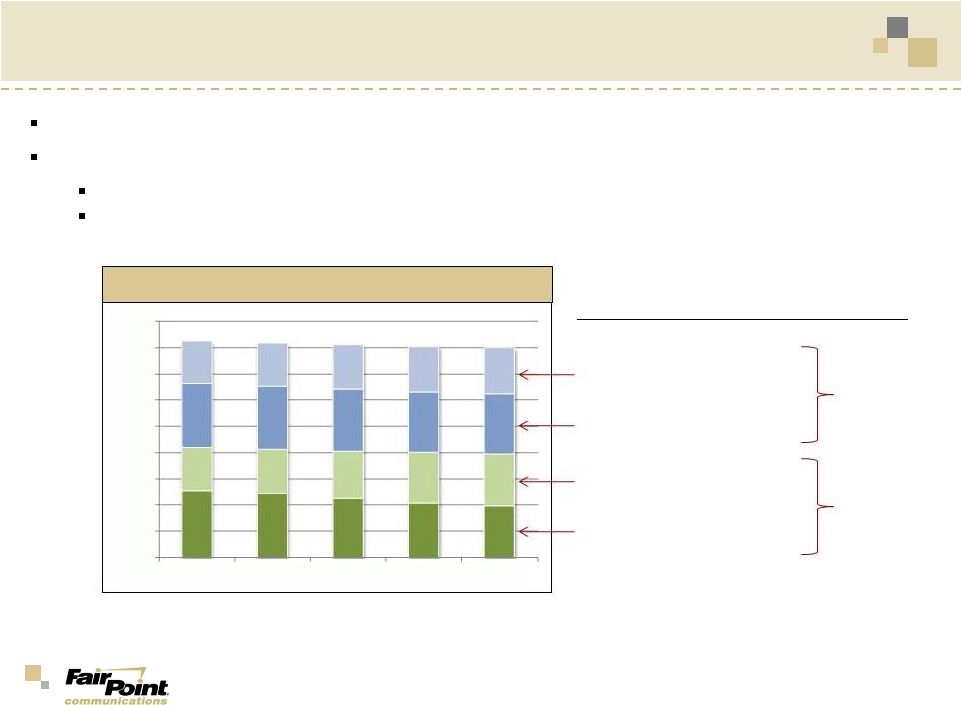

Overview at 2Q11 FairPoint service territory

Telecom Group

Northern New England

Operate in 18 states with approximately

1.4

million

access

line

equivalents

(“ALEs”)¹

~80% of ALEs in northern New England, ~20% in

Telecom Group

NNE averages 25% high-speed data penetration²

TG averages 45% high-speed data penetration²

FairPoint offers an array of services across its

footprint including voice, high-speed data,

video and high-capacity bandwidth products

Extensive capital investment on next

generation network in NNE markets

Broadband available to ~85% of our customers in

NNE, more than 90% in TG

Access line equivalents

5

(1)

Switched access lines plus high-speed data subscribers

(2)

High-speed data subscribers as % of switched access lines

(3)

UNE-P and Resale lines. Excludes UNE-L and Special Access

circuits

(4)

Before Sept 2011 announced workforce reduction. Collective bargaining agreements

with CWA and IBEW cover approximately 2,500

employees including ~230 temporary workers

4

Telecom Group: 30 rural LECs in 18 states

with lower competitive profile

Northern New England: 3-statewide

footprint with ubiquitous network presence

Over $1Bn in annual revenue and

approximately 4,000 employees

as of June 30, 2011

Northern

New

England

Telecom

Group

Total

Switched access lines:

Residential

541,814

138,375

680,189

Business

268,533

49,051

317,584

Wholesale

82,231

NM

82,231

Total switched access lines

892,578

187,426

1,080,004

High-speed data

220,561

84,594

305,155

Total access line equivalents

1,113,139

272,020

1,385,159

3 |

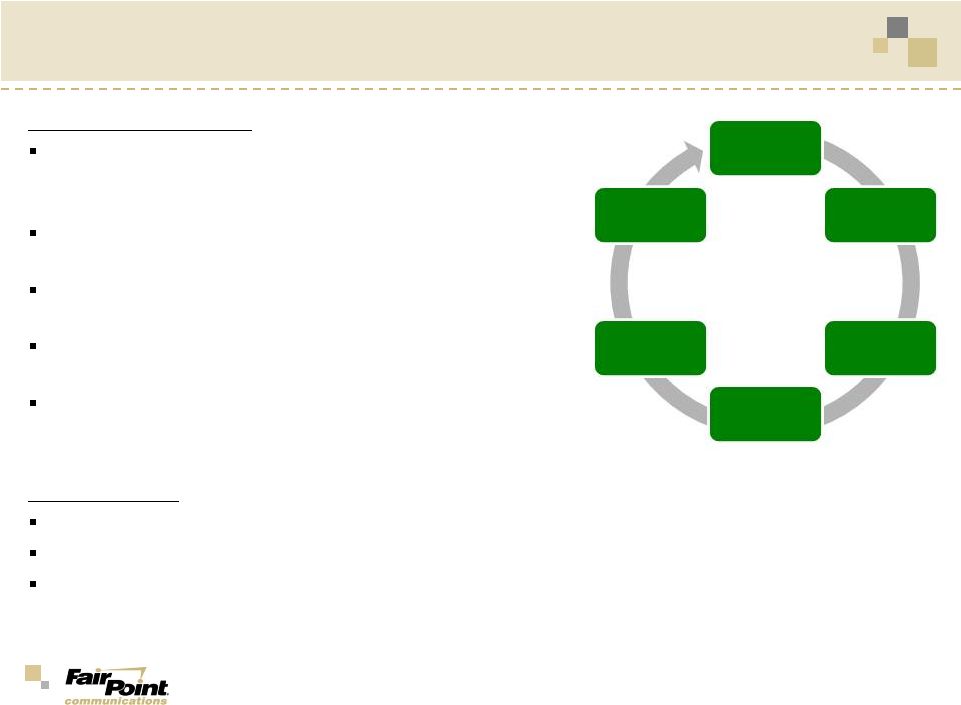

Organic

Revenue Growth Opportunities 6

Northern

New

England: Network + Service

Geographic scope and network ubiquity are

significant advantage, especially to major, enterprise

and wholesale customers

NNE markets offer organic growth and market share

“win-back”

opportunities

Management aligned to unique characteristics of

each customer segment

Quality of Service (“QoS”) and rapid response as

competitive advantages

Next-generation products that speak to SMBs,

enterprise and wholesale customers

Telecom Group: Leverage stable platform

Maintain the market share advantage with attractive bundles and excellent QoS

Hone new products and processes before exporting to NNE markets

Strategic capital investment to enhance the local network and optimize regulated

revenue streams

Product

Development

Geographic

Scope

Network

Ubiquity

Organic

Growth

Opportunity

Management

Alignment

Quality of

Service |

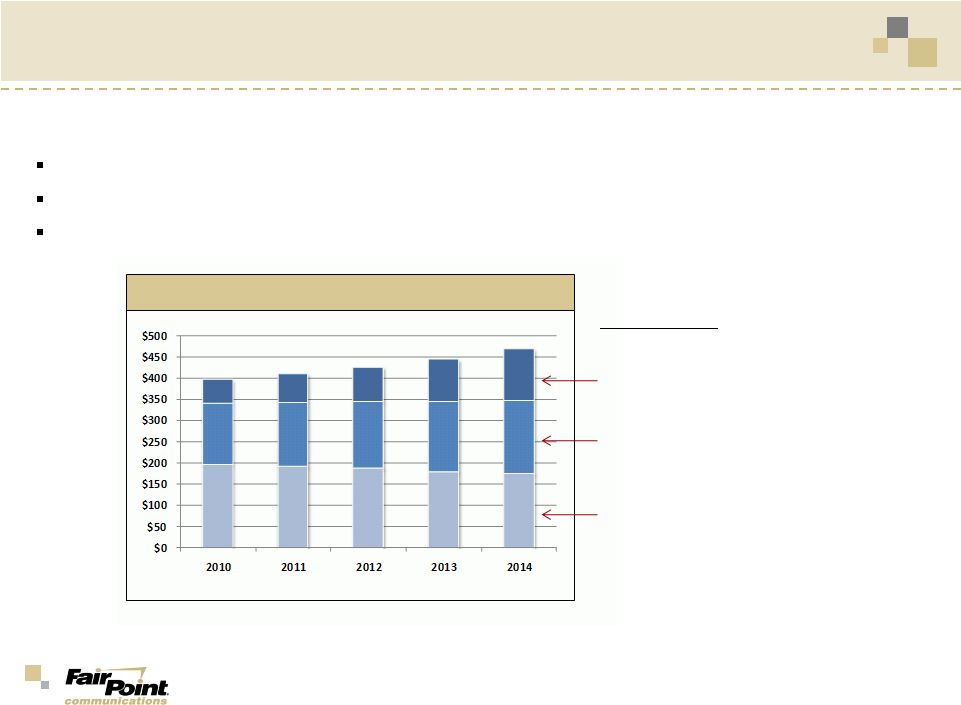

Organic

Revenue Growth in Wholesale 7

Segment / CAGR

Total: 4.3%

Wireless Tower : 21.8%

Wireless Transport3: 4.8%

CLEC Access and Transport: -3.1%

NNE Wholesale Market

1

($ in millions)

FairPoint commissioned a market share and demand study for its NNE markets

FairPoint maintains a majority share in the wholesale market

Organic growth opportunities fueled by mobile broadband demands

We are investing in new products and technologies to capture growth potential

Sources: SNL Kagan, In-Stat, US Census, InfoUSA, Altman Vilandrie &

Company (1)

Wholesale as defined by traditional products and technologies like switched access and

special access circuits (DS1s, DS3s, SONET, etc.) (2)

Wireless tower refers to transport between towers and aggregation sites

(3)

Wireless transport refers to transport between aggregation sites

1

2

3 |

Win-back Opportunities

8

Overall retail wireline market is expected to decline gradually

FairPoint’s non-dominant market share provides significant win-back

opportunities 2010 retail business market share estimated to be 26% (data and

voice) 2010 retail residential market share estimated to be 39% (data and

voice) Segment / CAGR / 2010 FRP Market Share Est.

Total: -0.8% / 33%

Biz Wireline Data: 2.6% / 16%

Biz Wireline Voice: -1.9% / 33%

Res Wireline Data: 4.9% / 17%

Res Wireline Voice: -6.4% / 53%

Sources: SNL Kagan, In-Stat, US Census, InfoUSA, Altman Vilandrie &

Company 39% share

26% share

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2010

2011

2012

2013

2014

NNE Retail Market

($ in millions) |

Aligned

to Capture Revenue Opportunities 9

Revenue

Segment

Telecom

Group

Wholesale

1

Government

&

Education

1

Business

&

Residential

1

Revenue

Contribution

Opportunity

Leverage scale and

scope of enterprise;

Increase attention

Fiber-to-the-tower;

High-capacity and

special access circuits

Increasing bandwidth

needs

Organic growth in

business; targeted

marketing in

residential

Advantages

Dominant presence;

Low competition

Market ubiquity

Market ubiquity

VantagePoint Network

Approach

and Strategy

Local market

knowledge and

presence;

Product development

platform for NNE

Network reliability;

Fiber-to-the-tower

buildout

Maintain market share;

Market FairPoint’s

network ubiquity and

reliability in northern

New England

“Win-back”

business;

“Defend”

residential

and capitalize on

broadband expansion

(1)

Northern New England only |

Combining Network, Service and Products

10

Network reach and IP-based services support organic revenue growth

opportunities Over 1 million fiber strand miles on over 12,000 route miles

Designed

and

deployed

with

400G

dense

wave

division

multiplexing

(“DWDM”)

capabilities; Multiprotocol Label Switching (“MPLS”) design

350 central offices with inter-office fiber capacity

Sales successes enabled by network and service

Maine Schools and Libraries network: 650 locations delivering 21G of bandwidth

capacity averaging 66Mb per location on 16,000 Ethernet ports turned up over a

variety of network elements (fiber, copper, bonded DS1)

Fiber-to-the-tower: announced initial build to over half of 1,600

towers served in NNE. Fiber placed to over 400 towers as of June 30,

2011 Regional businesses: banks and hospitals seeking single source

solution in NNE Expanding broadband network: broadband service available to

approximately 85% of northern New England customers and more than 90% of Telecom

Group customers SMB bundle

Very-high speed data (over fiber)

Carrier Ethernet Service

(1)

FairPoint acquired over 120,000 homes and businesses served with

fiber-to-the-premise during the northern New England

acquisition (former Verizon FiOS territory)

1

Product development will drive future sales |

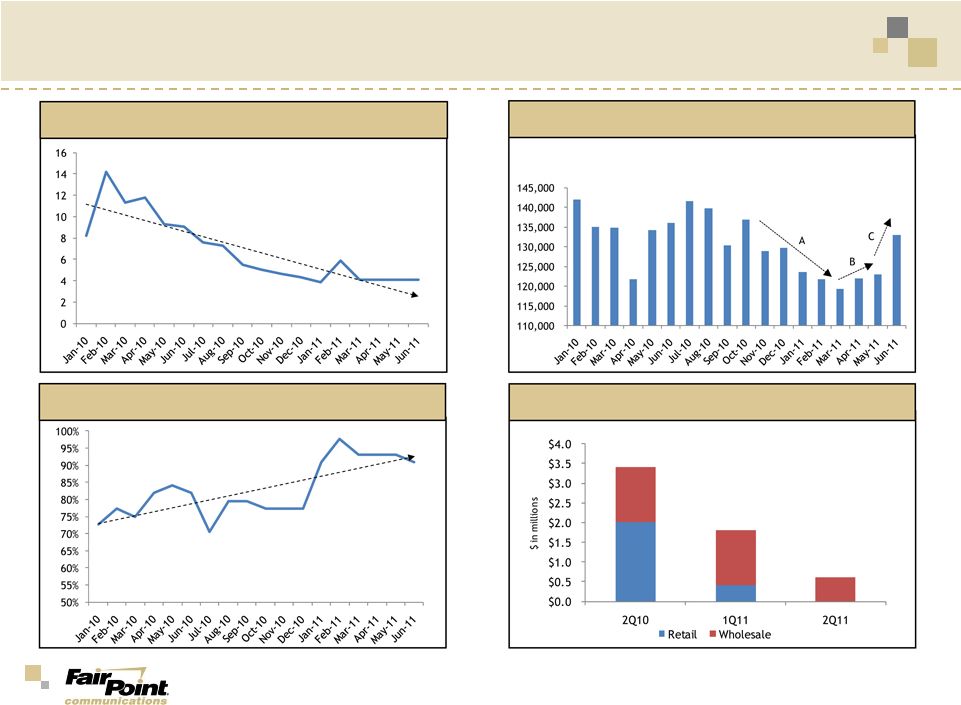

Operational and Quality Metrics are Improving

11

Retail

Service

Quality

Metrics

Met

3

Call

Center

Volume

2

Mean-time-to-repair

(hours)

1

Service

Quality

Penalties

4

(1)

For a select major customer in northern New England

(2)

Northern New England consumer, small business and repair call centers

(3)

Number of retail service quality metrics achieved as a percentage of total

penalty-bearing metrics in northern New England (4)

Excludes benefit from service quality penalty reversals related to regulatory

settlements, legislative changes and true-ups (A) Operational

improvement (B) Promotional activity

(C) Seasonal storm activity |

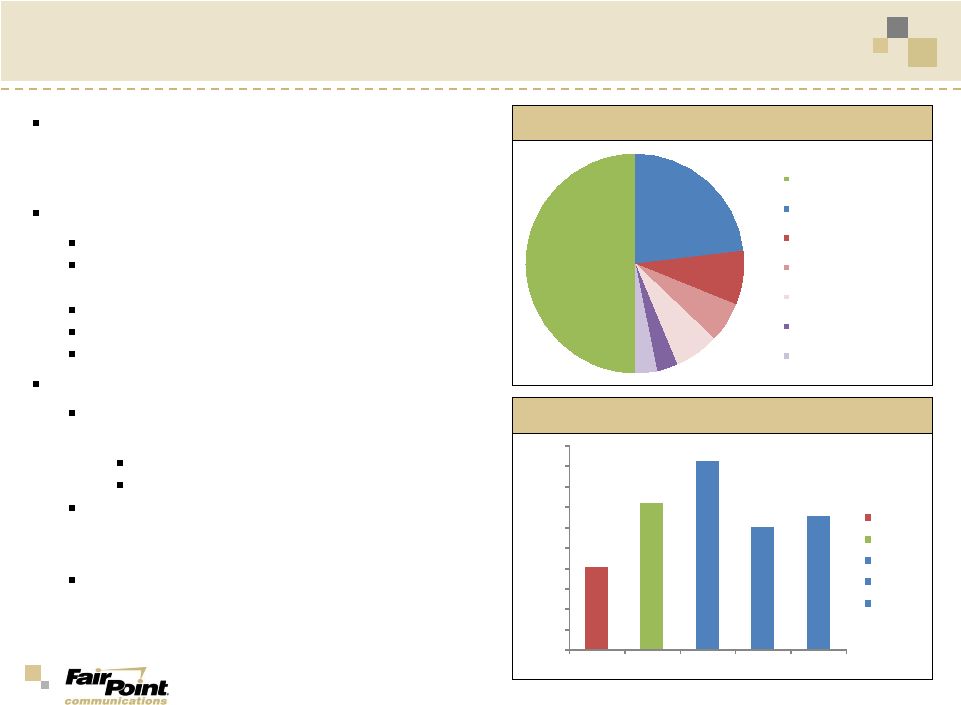

Cost

Reduction Opportunities 12

Operational improvements in late 2010

and early 2011 allow FairPoint to

accelerate cost reduction initiatives

Areas of focus:

Cost of goods sold (access circuits)

Facilities and fleet (power, fuel, real

estate)

Contracted services

Bad debt

Employee costs

Recent Announcement:

Workforce reduction of approximately 400

employees

~100 management

~300 union

4

Annualized employee cost savings of

approximately $34 million expected, with

full benefit in 2012

Severance and incentive payments cost

range of $7 million to $13 million

5

Voice access lines per employee

~$800Mn Cost Structure

1

3

50%

23%

8%

6%

7%

3%

3%

Employee

Circuits, network and

backoffice

Facilities and fleet

Contracted services

Operating taxes, legal,

insurance and other

Marketing, customer service

and billing

Bad debt

282

344

385

320

331

200

220

240

260

280

300

320

340

360

380

400

FRP

Average

FTR

CTL

WIN

FRP

Average

FTR

CTL

WIN

2

(1)

1H11 annualized. Excludes restructuring and vacation accrual

(2)

As of December 31, 2010

(3)

Weighted average of FTR, CTL and WIN

(4)

FairPoint is following prescribed steps in the collective bargaining agreement

(5)

Credit agreement allows for severance add-back of $12 million per calendar year

and $30 million aggregate for Consolidated EBITDAR purposes |

Capital

Structure 13

Capital Structure Summary

As of June 30, 2011:

Generated $3 million of FCF in 157

days post-emergence

Liquidity of $76 million

$13 million unrestricted cash

$63 million revolver (net of LCs)

Leverage of 3.87x vs. 4.75x covenant

Interest Coverage of 4.49x vs. 3.25x

covenant

Capex covenant:

2011 = $200 million

2012 = $190 million

2013 = $170 million

2014 = $150 million

2015 = $150 million

(1)

Excludes letters of credit of $12 million and capital lease obligations of $5

million (2)

Before applying letters of credit of $12 million, which reduces revolver

availability (3)

Includes management restricted stock and ~0.6 million of common stock held in reserve

for certain pre-petition claims (4)

Generally vest 25% at emergence, 25% on each anniversary for three years

thereafter. All restricted stock included in common stock outstanding

(5)

Generally vest 25% at emergence, 25% on each anniversary for three years

thereafter. Options struck at $24.29 as of June 30, 2011

(in millions)

Cash and cash equivalents (unrestricted)

$13

Gross debt

$1,000

Revolver

$75

Amortization schedule:

2011

$0

2012

$10

2013

$10

2014

$25

2015

$38

January 24, 2016

$918

L+450, with LIBOR floor of 200

No dividends if leverage > 2.0x

Interest coverage and leverage covenants

Common stock outstanding

26.2

Warrants

(7

yr,

$48.81

strike

)

3.6

Management long-term incentive

Restricted stock

4

0.5

Options

5

1.0

1

3

2 |

Recent

Operating and Financial Results 14

2Q11 highlights

Data

and

Internet

services

revenue

up

3.1%

YoY

on

5.4%

growth

in

high-speed

data

subs

Revenue

of

$255-260

million

for

last

3

quarters

on

adjusted

basis

5

Consolidated EBITDAR

1

$70.5 million in 2Q11: Adjusted EBITDA up sequentially and YoY

($ in millions)

2Q11

1Q11

2Q10

2Q11 vs.

1Q11

2Q11 vs.

2Q10

Consolidated EBITDAR (1)

70.5

$

49.1

$

72.3

$

43.6%

-2.5%

One-time penalty reversal (2)

(4.0)

-

-

Restatement items (3)

-

-

(8.3)

Vacation accrual impact (4)

(3.2)

10.8

(3.1)

Adjusted EBITDA

63.3

$

59.8

$

60.9

$

5.7%

3.8%

margin

24.5%

23.5%

22.4%

High-speed data subscribers (000s)

305.2

297.5

289.6

2.6%

5.4%

Residential access lines (000s)

680.2

695.9

758.0

-2.3%

-10.3%

Business access lines

317.6

322.1

341.0

-1.4%

-6.9%

Wholesale access lines

82.2

84.7

91.1

-2.9%

-9.8%

Total switched access lines

1,080.0

1,102.7

1,190.1

-2.1%

-9.3%

Access line equivalents (000s)

1,385.2

1,400.2

1,479.7

-1.1%

-6.4%

(1)

As defined in FairPoint’s credit facility. For a reconciliation of Net

Income (Loss) to Consolidated EBITDAR, see our year end 2010, first quarter and

second quarter 2011 earnings releases furnished by FairPoint on April 5, 2011, May 16,

2011 and August 8, 2011, respectively, on Form 8-K (2)

Reversal of penalties related to Maine legislation and other

true-ups (3)

Though added back under new credit facility, the impact of the financial restatement

does belong in 2Q10 for comparative purposes (4)

FairPoint accrues a full year of vacation expense each

January (5)

Adjusted for one-time service quality penalty reversals in 2Q11 and 4Q10 of $4

million and $13 million, respectively 1

st

, which is then reversed throughout the year |

FairPoint Management Team

15

Experienced

management

team

with

fresh

focus:

FairPoint

strengthened

its

senior

management team in key areas, while maintaining institutional knowledge

Name

Position

Experience

Paul Sunu

Chief Executive Officer

31 years corporate and operating experience; CEO since August

2010; Former CFO of Hargray Communications and Hawaiian

Telecom; Co-founder and former CFO of Madison River

Communications

Ajay Sabherwal

Executive Vice President, Chief

Financial Officer

23 years of experience with 18 years in telecom; Joined FairPoint

in July 2010; Former CFO of Choice One Communications, Aventine

Renewable Energy and Mendel Biotechnology

Kathleen McLean

Executive Vice President and Chief

Revenue Officer

28 years of telecom and information technology experience; Joined

FairPoint in 2010 from Verizon Partner Solutions

Ken Amburn

Executive Vice President, Operations

and Engineering

42 years of telecommunications experience. Prior to joining

FairPoint, served as COO of Madison River Communications

Peter Nixon

Executive Vice President, External

Affairs and Operational Support

33 years experience; Former COO and SVP of Corporate

Development and President of Telecom Group; Former President of

C&E Telephone Corp.

Shirley Linn

Executive Vice President, General

Counsel and Secretary

35 years business and securities law experience; Joined FairPoint in

2000

Greg Castle

Senior Vice President, Human

Resources

Over 25 years of experience managing employee and labor

relations, including VP of labor relations at Ameritech

Rose Hauser

Senior Vice President, Chief

Information Officer

20 years experience in the telecom and IT; Joined FairPoint in May

2011; Prior to FairPoint, most recently served as CIO of Hawaiian

Telcom. Held leadership roles at MCI, XO Comm. and Bell Atlantic

Lee Newitt

Director, Investor Relations and

Corporate Development

Joined FairPoint in 2003; has held leadership roles in M&A,

corporate finance and investor relations

|

Conclusion: FairPoint is positioned for success

16

Leveraging core strengths for growth in revenue, EBITDAR and free cash flow

Network: geographic scope, network ubiquity, next-generation platform

Service: enhanced service and responsiveness as competitive advantage

Organic revenue growth opportunities: business and wholesale

Stable RLEC business: steady cash flow, platform for product development

Recent achievements accelerate cost reduction opportunities

Operational

improvements:

service

quality,

data

growth,

slowing

voice

loss

Margin expansion: revenue growth plus cost reduction

Aligned to capture growth and improve operations

Experienced management team |