Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TPC Group Inc. | d239173d8k.htm |

A

market leader in value-added products based on petrochemical raw

materials Exhibit 99.1 |

Forward-Looking Statements & Non-GAAP Financial Measures

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

securities

laws.

These

statements

include

assumptions,

expectations,

predictions,

intentions

or

beliefs

about

future

events,

particularly statements that may relate to future operating results, existing and

expected competition, market factors

that

may

impact

financial

performance,

and

plans

related

to

strategic

alternatives

or

future

expansion activities and capital expenditures. Although TPC Group believes

that such statements are based on reasonable assumptions, no assurance can

be given that such statements will prove to have been

correct.

A

number

of

factors

could

cause

actual

results

to

vary

materially

from

those

expressed

or

implied in any forward-looking statements, including risks and uncertainties

such as volatility in the petrochemicals industry, limitations on the

Company’s access to capital, the effects of competition, leverage and

debt service, general economic conditions, litigation and governmental investigations, and

extensive

environmental,

health

and

safety

laws

and

regulations.

More

information

about

the

risks

and

uncertainties relating to TPC Group and the forward-looking statements are

found in the Company’s SEC filings, including the Transition Report on

Form 10-K, which are available free of charge on the SEC’s website

at http://www.sec.gov . TPC Group

expressly disclaims any obligation to update any forward- looking

statements contained herein to reflect events or circumstances that may arise after the date of this

presentation.

This presentation may also include non-GAAP financial information. A

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP financial measures, as well as additional detail regarding

the utility of such non-GAAP financial information, is included in the

Appendix. 2 |

Overview

3 |

4

Market Leader in

C4 Hydrocarbons

Attractive,

growing end-

user markets

Game-changing

growth

opportunities

Unique logistics

network

Strategically

located

Long-standing

customer/supplier

relationships

Stable, consistent

cash flows

Scalable asset,

infrastructure

platform

Disciplined,

experienced

management team

Overview |

What

We Do 5

TPC Group Inc. is a leader in specialty chemicals, and provides products to

major chemical and petroleum companies worldwide.

Providing building blocks that help make the world’s tires, carpets,

gasoline additives and other essential items for daily lives.

Fuel & Lube Additives

Gasoline & Blendstocks

Nylons

Plastics

Surfactants

Additives

Tires |

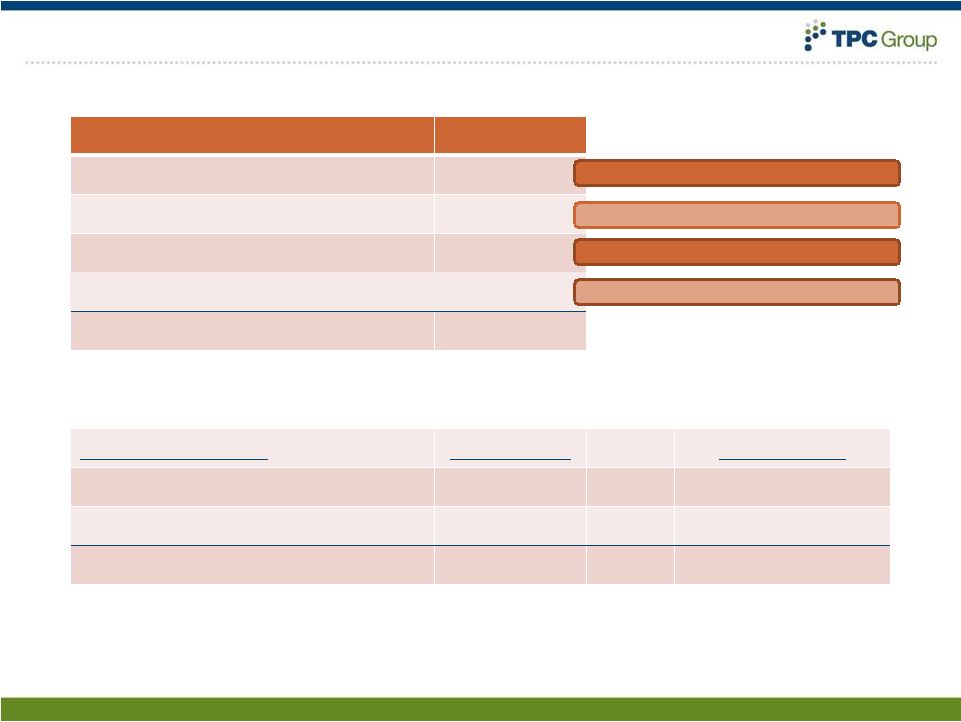

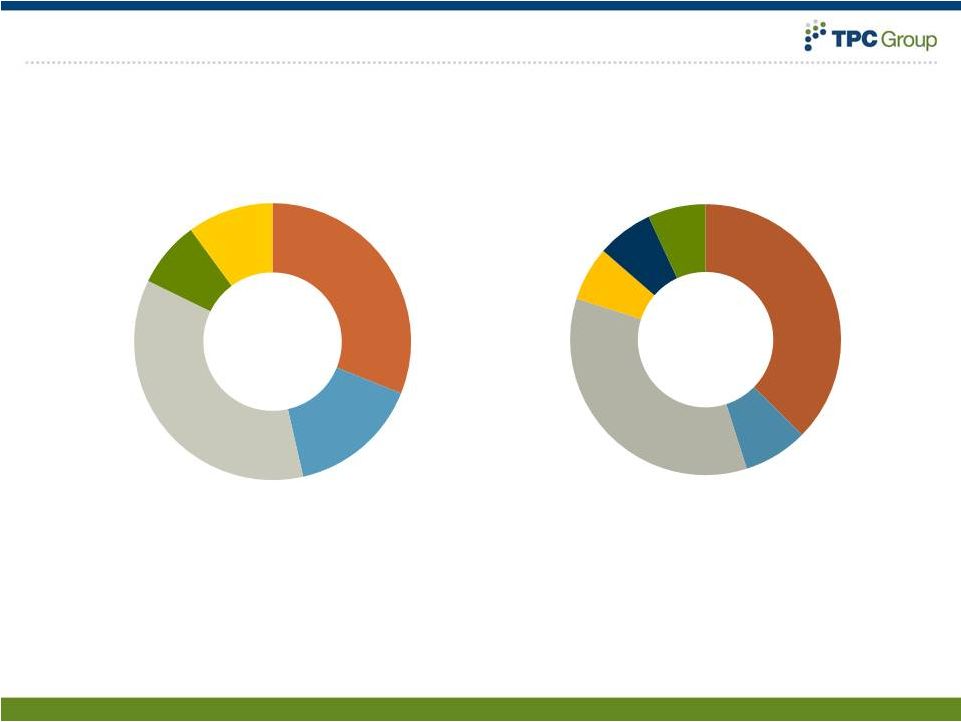

Leading Market Positions

6

C4 Processing Market

Share

Performance Products Market

Share

Butadiene

Butene-1

Isobutylene

Products

Polyisobutylene

(PIB)

Propylene

Derivatives

35%

35%

60%

25%

25%

U.S. Market Share:

#1

#1

#1

#1, #3

#3 |

Commitment to Technology, Development

•

Opening of new multi-million dollar TPC Technical Center in Houston

•

Exploring new opportunities for proprietary product and process

technologies

–

Highly reactive PIB (patented)

–

Multiple processing technologies (e.g. TPC Group Oxo-D

TM

process)

–

Catalyst development and testing

•

Recent appointment of Senior Vice President -

Corporate Development

7 |

Our

Competitive Advantages 8

Strategic

Location

(US “Petrochemical Corridor”)

Depth of

Expertise

Established, Integrated

Relationships

Unique, Valuable

Infrastructure

Strong,

Sustainable

Earnings

Growth |

Established, Integrated Relationships

9

Customers

Feedstock Suppliers

Playing a Profitable Central Role in the Ethylene Value Chain

•

Crude C4 processor for every non-integrated North American ethylene

producer •

Deeply integrated into respective customer/supplier supply chains

•

Premier processing reliability record |

Strategically Located in the “Petrochemical Corridor”

10 |

Michael T. McDonnell

President and Chief Executive Officer

Miguel A. Desdin

Senior Vice President & Chief Financial Officer

Luis E. Batiz

Senior Vice President of Operations

Russell T. Crockett

Senior Vice President, Commercial

Management Expertise

11

Gene Allspach

Senior

Vice

President

–

Corporate

Development

Driving Transformation at TPC Group |

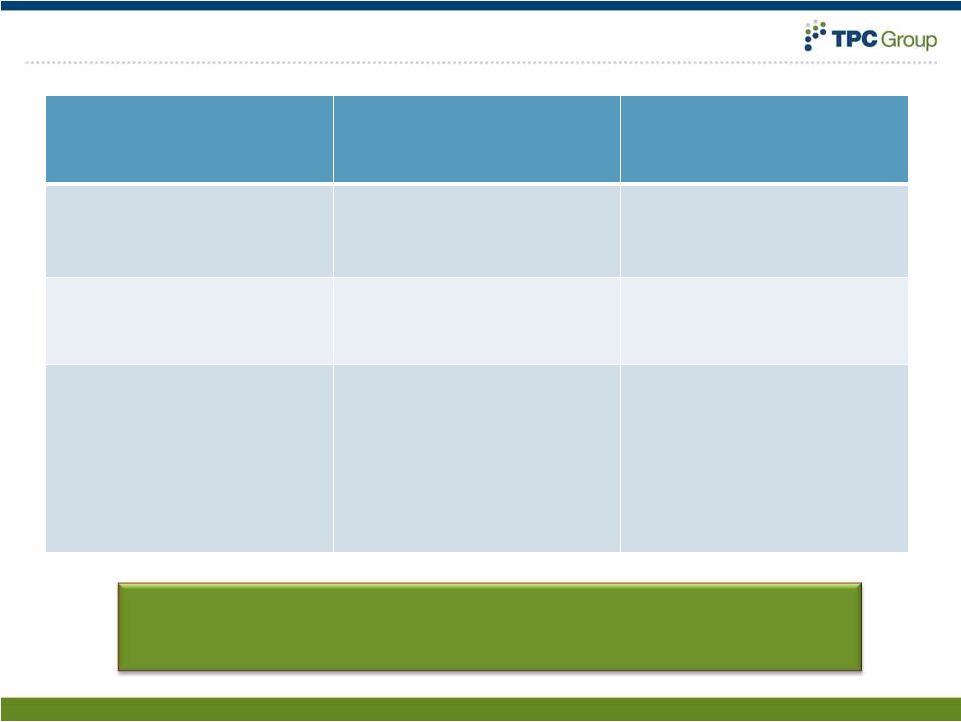

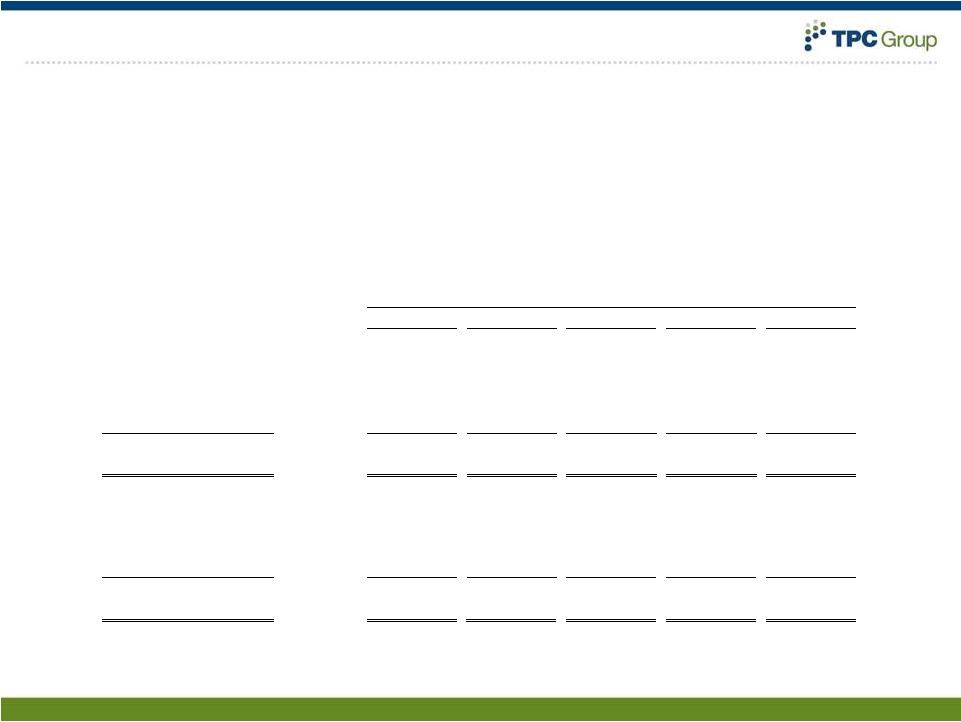

Past

(4

yr

avg.)

Present

(June

LTM)

Future

EBITDA ($MM)

$75

$158

2x-3x

EBITDA margin %

4.3%

6.8%

2x-3x

Total Assets

$819

$1,083

Shareholder Equity

$278

$305

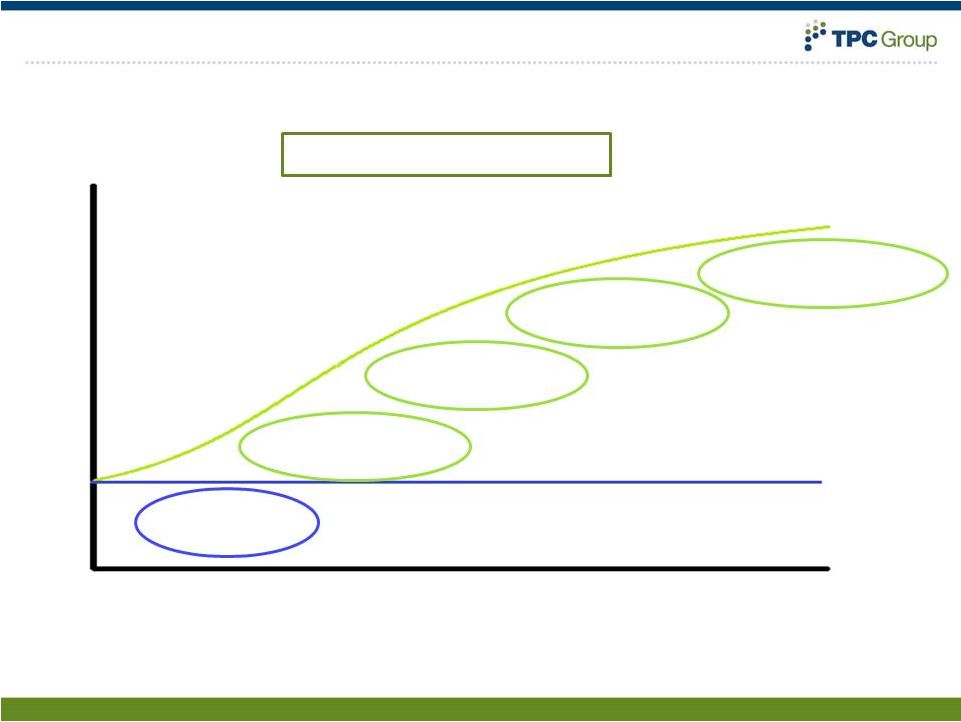

TPC Group Transformation

12

Tactically-driven

“Me-to”

player

Narrow product slate

Toll-processing business

model

Strategically-driven

Market Leader

Broadened product slate

Services & Processing business

model

Driving a performance-based

culture

Operational excellence focus

Multiple revenue streams

Diverse business models

Full margin capture

Strong performance culture

-

ownership mentality

-

results driven

Fully utilized asset base

Past

Present

Future |

Unique, Valuable Infrastructure

13

13

Crude C4: non-core “by-product”

processed for a range of critical

“building blocks”

for diverse market use

Logistics & Infrastructure

TPC

Logistics

Operations

TPC Purity

Products

Propylene

Producers

Ethylene/Mixed

C4

Producers

Propylene

Derivative

7%

Raffinates

and Fuels

35%

Butadiene

37%

Polyisobutylene

6%

Butene-1

8%

DIB and HPIB

7% |

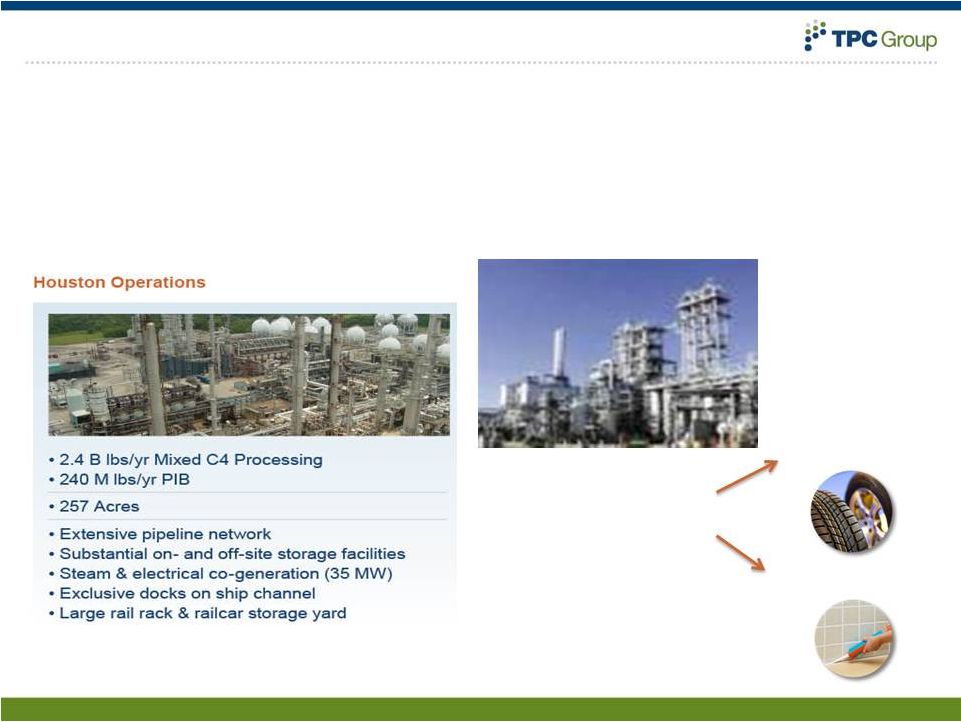

Unique, Valuable Infrastructure

14

Houston

Baytown

Port Neches

Facility

Capacity:

Footprint:

Key

Attributes:

2.4B

lbs/yr

-

Mixed

C4

240M

lbs/yr

-

PIB

85

M

lb/yr

-

Nonene

50M

lbs/yr

-

Tetramer

1.8B lbs/yr Mixed C4

257 Acres

133 Acres

154 Acres

Estimated replacement cost >$1.9B + value of idled assets

•

Extensive

pipeline

network

•

Substantial

storage

facilities

•

World-class

docking

and

rail

facilities

•

Terminaling

services |

Near

Term Drivers of Performance 15

•

Margin expansion in C4 processing

•

Volume growth and margin expansion in Performance Products

•

High return/low risk capital projects

•

Operational Excellence |

Market cap (6/30/11):

$626 million

Total cash:

$66 million

Net debt:

$282 million

Fully diluted shares:

16.2 million

Operating revenues:

$2,334 million

Net income:

$58 million

Earnings per fully diluted share:

$3.56

Adjusted EBITDA:

$158 million

ROIC

14%

Trailing 12m

(as of 6/30/11)

As of 6/30/11

EBITDA is a non-GAAP measure. See appendix for reconciliation of EBITDA to net

income. A Financial Platform for Growth

16 |

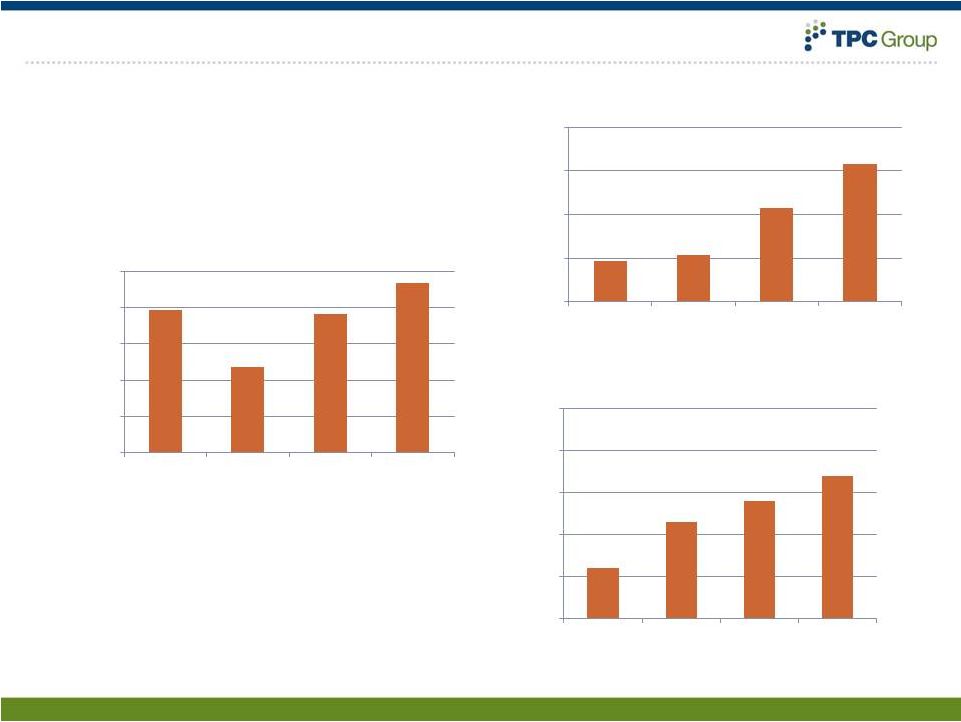

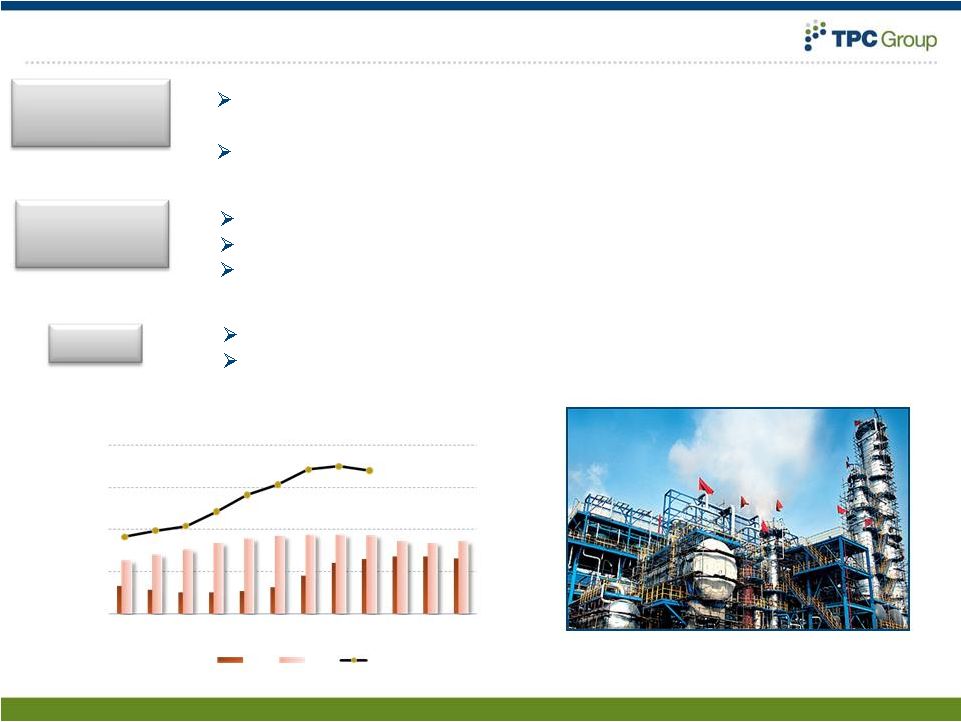

Financial Performance

17

1,973

1,179

1,918

2,334

0

500

1,000

1,500

2,000

2,500

2008

2009

2010

TTM

as of 6/30/11

Sales Revenue ($m)

47

54

108

158

0

50

100

150

200

2008

2009

2010

TTM

as of 6/30/11

Adjusted EBITDA ($m)

2.4%

4.6%

5.6%

6.8%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

2008

2009

2010

TTM

as of 6/30/11

Adjusted EBITDA % |

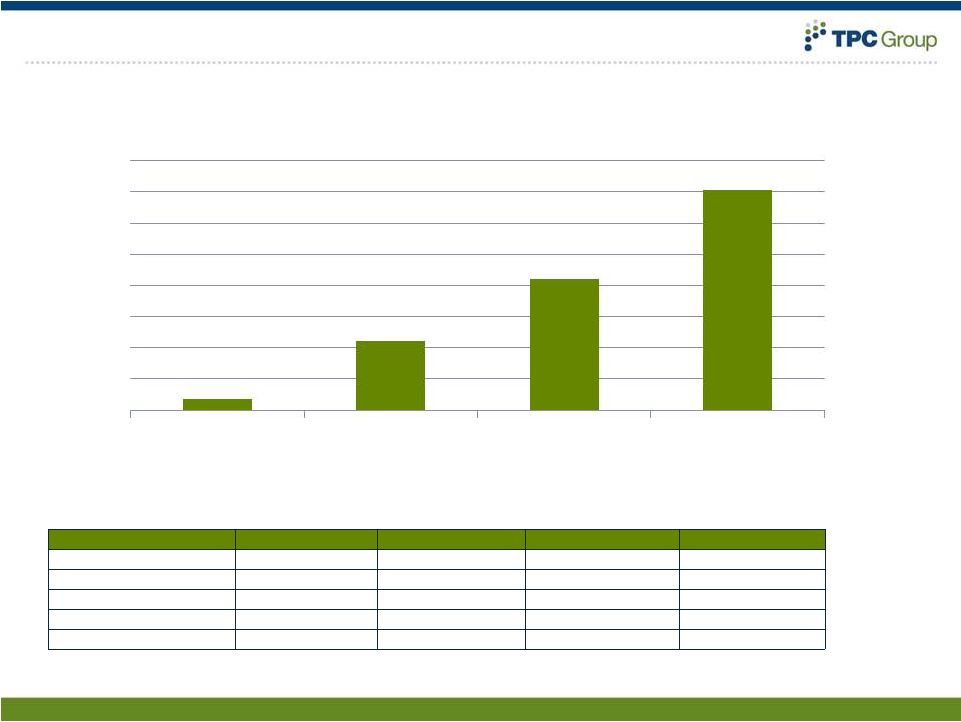

With

Improving Returns on Invested Capital 18

0.7%

4.4%

8.4%

14.1%

2008

2009

2010

LTM 6/2011

EBIT

6,436

38,194

68,206

116,597

Ave. Shareholders' Equity

286,900

279,859

298,492

295,936

Ave. Long-term Debt

299,875

290,000

280,597

314,753

Ave. Cash

3,136

1,614

52,293

72,469

ROIC

0.7%

4.4%

8.4%

14.1%

Components of ROIC:

2008

2009

2010

LTM Jun-11 |

Business Model

19 |

How

We Make Money 20

2008

2009

2010

2011 (first six months)

2.7

2.9

3.7

4.5

7.5

3.4

3.2

3.3

TOTAL MARGIN

Operational

excellence

Growth &

margin expansion

Core/Stable

Margins

BD price

changes

Fuel value in

price formulas

Margin

Cents

per

pound |

With

a Business Model Based on Stable Core Margins 21

Feedstock

Supplies

TPC Processing

& Logistics

Services

Crude C4s from

Suppliers

Purchased Raw

Materials

Isobutylene

(IBL)

Propylene

Mixed

C4

End Products

Margin Structure

Butadiene (BD)

Stable: processing

margin & service fees

Butylenes:

•

Butene-1

(B-1)

•

Fuel Components

Contained Isobutylene

Stable: prices &

costs tied to

gasoline

High Purity

Isobutylene &

Derivatives

Stable: indexed

pricing based on

butane

(“formula pricing”)

Stable: costs tied to

gasoline

Propylene

Derivatives

Stable: indexed, pricing

based on propylene

(“formula pricing”) |

Attractive, Stable Margin Model—Illustrative Example

22

Butadiene (45%)

Supplier Price

-

Monthly Contract Price

$ (1.00/lb)

+

Extraction Fee

$ 0.04

+

Energy Fee

85%

Selling Price

-

Monthly Contract Price

$ 1.00/lb

+

Service Fee

$ 0.05

TPCG Value

+

Extraction Fee

$ 0.04

+

Energy Fee

85%

+

Service Fee

$ 0.05

Butylene (55%)

Supplier Price

% of Unleaded Regular Gasoline

Selling Price

% + of Unleaded Regular Gasoline

TPCG Value

+ of Unleaded Regular Gasoline

Performance Products

Supplier Price

% of Butane

Selling Price

% + of Butane

TPCG Value

+ of Butane

Key Takeaway:

Relatively stable unit margins

Cash flow generation throughout the cycle |

Key

Variable Sensitivities Key Variable

Key Indicators

Directional

Significance

Operating leverage

•

Cracker rates

•

Cracker feedslates

•

Enabled by significant,

underutilized capacity

Fuel values

•

Unleaded gasoline

•

Gasoline-to-butane

spread

•

Margins positively

correlated to fuel values

BD price level

•

End-market demand

•

Continued tightness in

supply

•

Driven by timing between

crude purchase and finished

BD sale

•

One-time impact: profits

retained once prices

stabilize

•

Core margin unaffected by

BD price changes

23

Inherently Stable “Core”

Margins

•

Autos, fuel demand |

Strategy for Growth

24 |

Fundamental Anchors of Our Strategy

25

Excellent Long-

Term Market

Fundamentals

Idled Assets and

Scalable

Infrastructure

Able to

Be Deployed

Mixed

C4

Key Products in

Structural Short

Supply

Cost-Advantaged

Raw Materials

(NGLs) in

Plentiful Supply |

Excellent Long-term Market Fundamentals

26

Global Mobility

Rising Living

Standards

Environmental

Regulations

Tires:

-

Performance

-

Fuel economy

Fuels & Lubricants:

-

Engine life

-

Engine performance

-

Industrial Products:

-

Surfactants

-

Adhesives

Demand Drivers

TPC Products

Representative

Macro Trends

Source: Lanxess

Source: Michelin

People Entering Middle Class

26

0

200

400

600

800

1000

1200

1400

1600

0

100

200

300

400

500

600

700

800

900

Cars per 1K people

0

200

400

600

800

1000

1200

1400

1600

1800

Brazil

India

China

BRIC

2000

2010e

(m people)

~800 Million people

Emissions reductions

2020e |

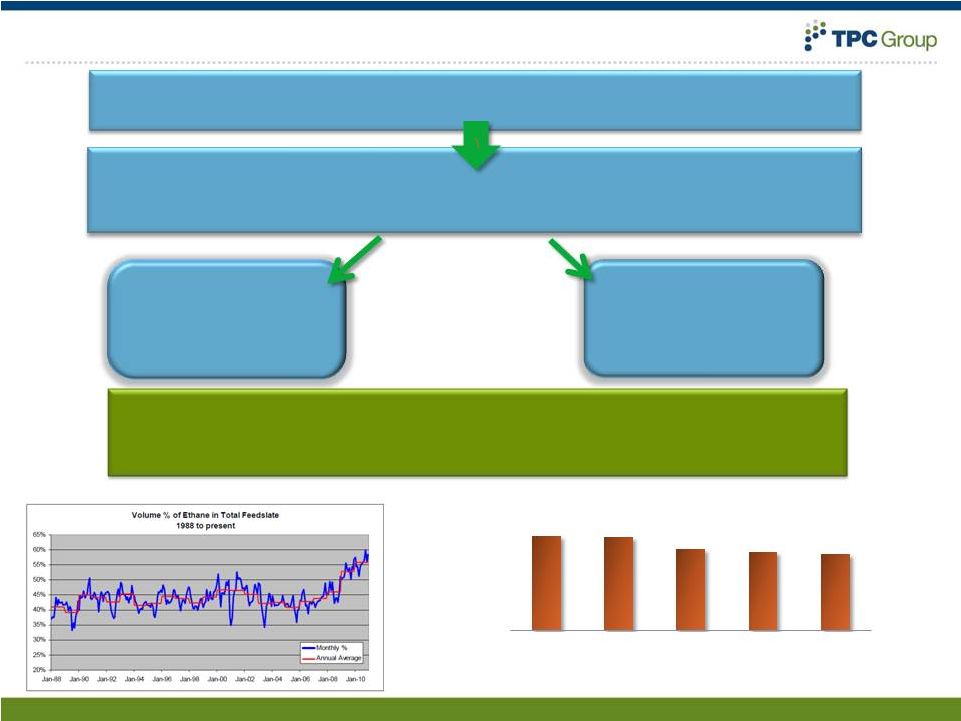

Key

Products in Structurally Short Supply 27

Causing shift from heavier (e.g. Naptha) to lighter (e.g. Ethane)

Ethylene Cracker Feedstocks

NA Ethylene Industry

now Globally

Competitive

Ethylene Production

now generates less Co-

Products, particularly

Butadiene

Structural shift in cracker feed stocks causing

critical product shortages in face of rising demand

% Ethane in Cracker Feedslate

B/E Ratio

Pounds of Butadiene for every 100 lbs of ethylene

Source: Hodson Report

Source: Hodson Report

Low-cost Ethane from NGLs resulting from Shale Drilling

7.8%

7.7%

6.7%

6.5%

6.2%

2007

2008

2009

2010

2011 ytd |

Plentiful Natural Gas Liquids Create Feedstock Advantage

28

‘wet-gas’

plays are favored by drillers

NGL

prices

are

de-coupling

from

crude

oil

Forecast

NGL Market Dynamics:

•

U.S. chemical producers will

maximize favorable NGL’s

•

NGL stream is yielding higher

ethane, butane and propane

•

Butane: a key feedstock for

TPC’s products

Source: Platts, OPIS

22.2

23.6

26.3

28.1

32.7

34.1

36.1

2008

2009

2015

2020

2025

2030

2035

U.S. Natural Gas Plant Liquids

Production

(Million MMcf)

Source: EIA

0.00

50.00

100.00

150.00

200.00

250.00

NGL vs. Crude Oil

¢

/ gal

$ / Barrel |

Idled

TPC Dehydro Assets: A Perfect Fit 29

Dehydrogenation

Butadiene

Isobutylene

•

Dehydro assets located within TPC’s Houston plant

•

Can convert NGLs into valuable C4 products: butadiene and isobutylene

•

Utilizing

existing

dehydro

assets

greatly

reduces

capital

costs

vs.

greenfield

investment |

Strategic Initiatives

30 |

Strategy Going Forward

Excellent Long-

Term Market

Fundamentals

Idled Assets

and Scalable

Infrastructure

Able to

Be Deployed

Key Products in

Structural Short

Supply

Cost-

Advantaged

Raw Materials

(NGLs) in

Plentiful

Supply

Solve long-term N.A. shortage of

butadiene utilizing idled

dehydro asset, proprietary

technology for on-purpose

production

Restart other idled dehydro

asset to provide lower-cost,

isobutylene feedstock for

Performance Products

Capitalize on cost-advantaged

NGL feedstocks to integrate

upstream and improve margins

Meet the Growing Demand for

On-Purpose Butadiene and Isobutylene

31 |

On-Purpose Butadiene Project

32

Restarting idled dehydro unit

Produce on-purpose butadiene from NGLs, capturing full margins

Ensure long-term security of supply of mission-critical product

Detailed engineering study to be completed by Q1 2012

Expected production of 600 million pounds of butadiene

Critical shortage of on-purpose BD facing relative to growing world

demand

Price decoupling between BD and crude oil = unique opportunity

-

50

100

150

200

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2009

2010

2011

U.S. Butadiene Price

Market

Opportunity

Project

Description

Status |

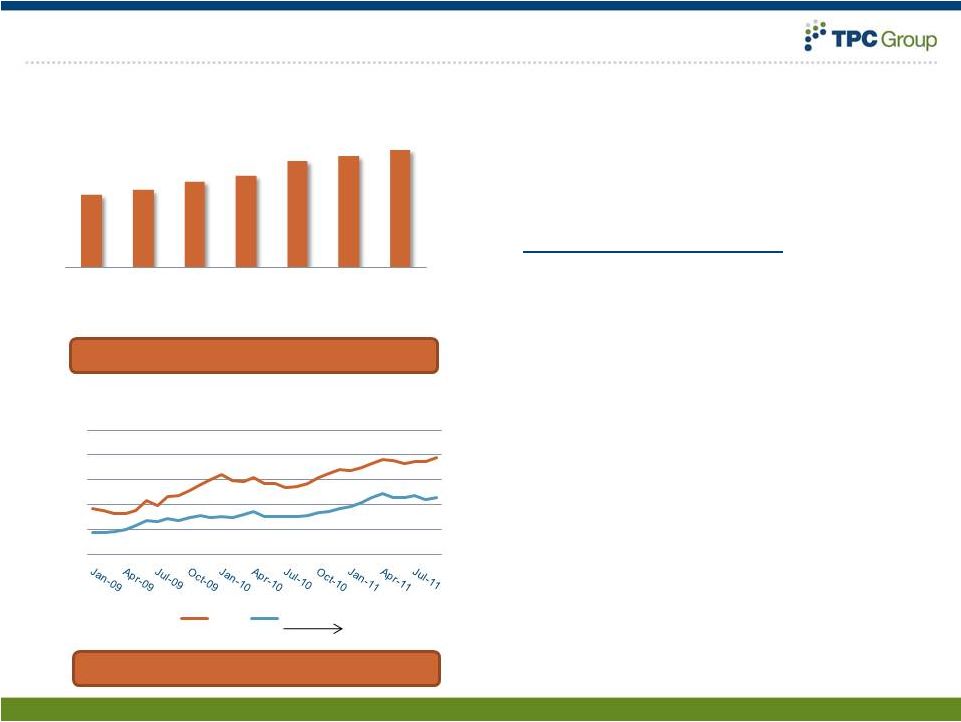

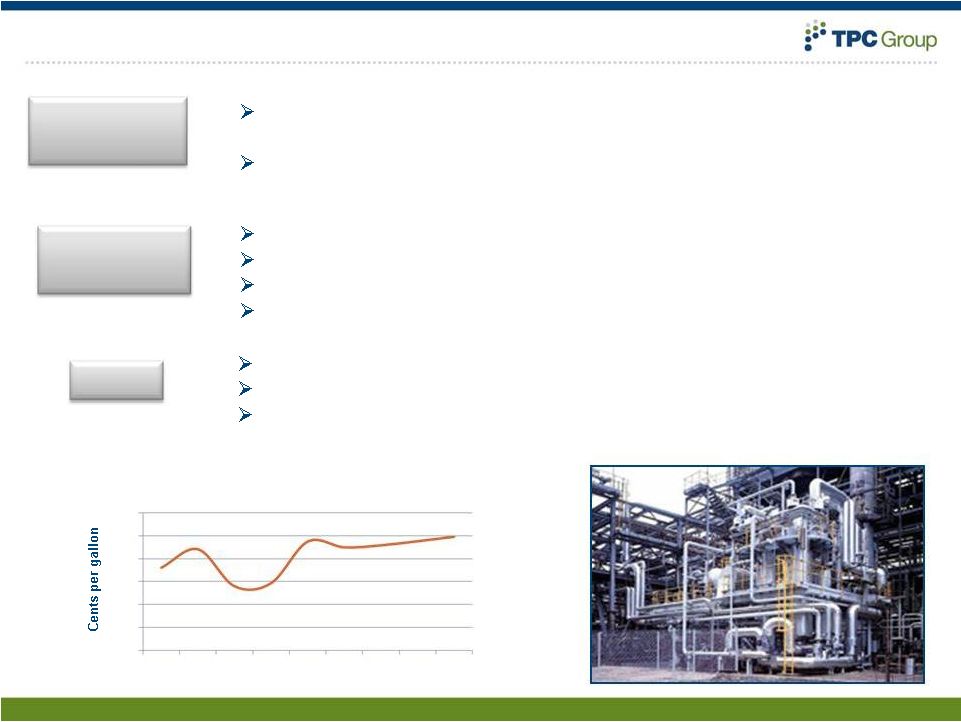

On-Purpose Isobutylene Project

33

Received operating permit

Completed primary engineering study

Proceeding with detailed engineering and initial

construction/refurbishment

Restart other idled dehydro unit

Produce isobutylene from NGLs

Ensure feedstock security for growth

Expand margins through upstream integration

Critical feedstock for Performance Products and Fuels Products

businesses

Currently outsourcing majority of requirements, unable to

capitalize on NGL economics

Source: CDI

0

20

40

60

80

100

120

2007

2008

2009

2010

2011

2012

2013

2014

2015

Unleaded Premium minus i-Butane Spread

Market

Opportunity

Project

Description

Status |

TPC

Group: Offering Strong Sustainable Earnings Growth 34

68 years of C4 expertise and experience

Unique

position

in

C4

industry

–

assets,

infrastructure,

location

Focus on operational excellence, performance culture

Well-positioned to capitalize on “game-changing”

growth

opportunities to enhance shareholder value

Experienced, disciplined management team |

Financials

35

Appendix |

2011

Capex Guidance (in millions)

2011 Base maintenance

$ 15

2011 New Lab

7

2011 Discretionary ROI

8

Engineering for Dehydro 1

5

2011 Capex Plan

$ 35

Potential Projects

Low Range

High Range

Dehydro 1 add’t spend

0

-

10

Dehydro 2 engineering

0

-

5

Total

$ 35

-

$ 50

Consistent through next few years

Improving infrastructure

Execute and replenish

Take advantage of NGL economics

36 |

SEC

Disclosure Information ADJUSTED

EBITDA

–

REVISION

OF

PREVIOUSLY

REPORTED

AMOUNTS

37

6/30/2011

3/31/2011

12/31/2010

9/30/2010

6/30/2010

Adjusted EBITDA - as previously reported ($mm)

C4 Processing

15.7

$

23.8

$

26.1

$

Performance Products

9.2

14.6

17.2

Corporate

(5.9)

(5.3)

(7.8)

Total

19.0

$

33.1

$

35.5

$

Adjusted EBITDA - current definition ($mm)

C4 Processing

66.9

$

30.6

$

15.7

$

23.8

$

26.1

$

Performance Products

12.0

11.6

9.2

14.6

17.2

Corporate

(7.9)

(6.7)

(6.2)

(5.6)

(7.2)

Total

71.0

$

35.5

$

18.7

$

32.8

$

36.1

$

(Unaudited, in millions)

Quarter Ended

We calculate Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization

(EBITDA), which is then adjusted to remove or add back certain items. These items are

identified below in the reconciliation of Adjusted EBITDA to Net Income (Loss) on Slide 39. Net Income (Loss) is the GAAP measure most

directly comparable to Adjusted EBITDA. As indicated in the table below, during the first quarter of

2011 we revised previously reported Adjusted EBITDA to no longer remove the effect of

non-cash stock-based compensation and unrealized gains and losses on derivative financial instruments, because they are recurring in

nature. Our calculation of Adjusted EBITDA may be different from the calculation used by other

companies; therefore, it may not be comparable to other companies. |

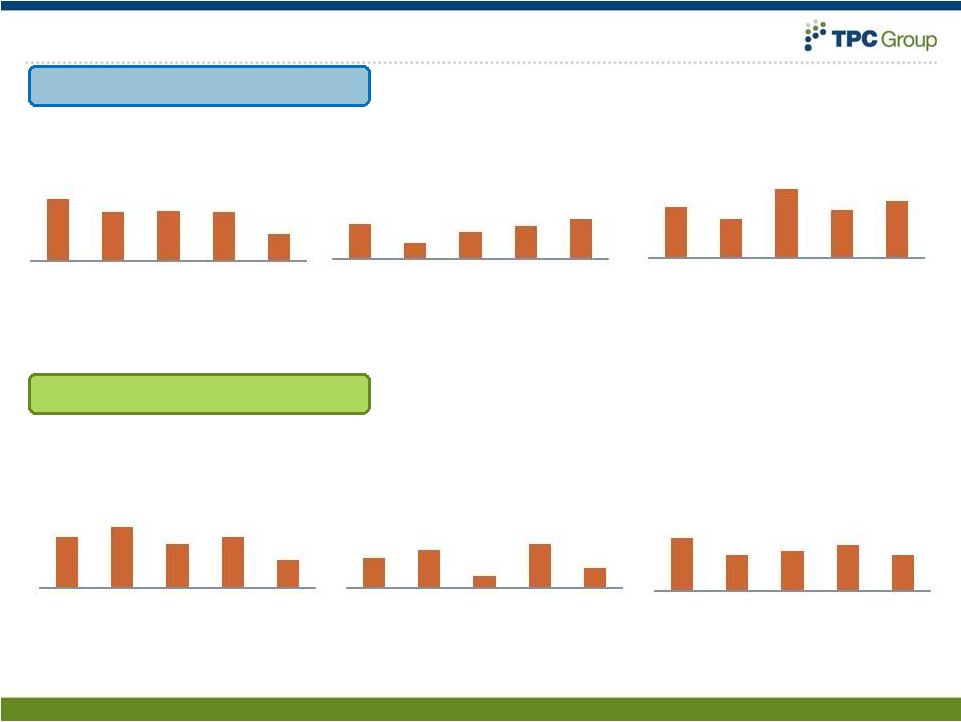

Financial Historical Trends

38

Volume, in thousands

Op. Margin, in thousands

Gross Profit %

Crude C4 Processing

Volume, in thousands

Op. Margin, in thousands

Gross Profit %

Performance Products

12.3%

9.3%

16.8%

11.7%

13.8%

2007

2008

2009

2010

2011 YTD

as of

6/30/11

25.5%

17.2%

19.3%

22.4%

17.4%

2007

2008

2009

2010

2011 YTD

as of

6/30/11

85

37

64

80

97

2007

2008

2009

2010

2011 YTD

as of

6/30/11

36

46

13

52

24

2007

2008

2009

2010

2011 YTD

as of

6/30/11

2,990

2,367

2,440

2,360

1,272

2007

2008

2009

2010

2011 YTD

as of

6/30/11

620

734

526

614

338

2007

2008

2009

2010

2011 YTD

as of

6/30/11 |

BD

37%

B-1

8%

Raffinates and

Fuels

35%

PIB

6%

DIB and HPIB

7%

Propylene

Derivatives

7%

TPC Sales by End-Market and Product

39

Sales by End Market

Sales by Product

Source: TPCG internal est

Synthetic Rubber

31%

Plastics

15%

Fuels

36%

Lube & Fuel

Additives

8%

Other

10% |

40

Selected Market Data

6/30/2011

3/31/2011

12/31/2010

9/30/2010

6/30/2010

End of Qtr BD Contract Price ($/lb) (1)

1.53

1.04

0.86

0.93

0.92

Unleaded

Gasoline

Qtr

Avg

-

USGC

($/gal) (2)

3.07

2.61

2.18

2.00

2.11

US Ethylene Industry Capacity Utilization (%) (3)

89.1

92.5

88.0

92.3

87.6

US BD Production (mm lbs) (3)

795

833

813

838

820

(1) Source: CMAI

(2) Source: Platts

(3) Source: Hodson

Quarter Ended |

41

Selected Financial Data

6/30/2011

3/31/2011

12/31/2010

9/30/2010

6/30/2010

Sales Volumes (mm lbs) (1)

859.8

750.7

738.2

748.7

802.7

Sales Revenue ($mm)

792.9

555.6

486.1

499.4

531.8

Adjusted EBITDA ($mm)

C4 Processing

66.9

30.6

15.7

23.8

26.2

Performance Products

12.0

11.6

9.2

14.6

17.2

Corporate

(7.9)

(6.7)

(6.2)

(5.6)

(7.3)

Adjusted EBITDA (2)

71.0

35.5

18.7

32.8

36.1

Adjusted EBITDA per pound

0.08

0.05

0.03

0.04

0.04

Operating Segment Adjusted EBITDA per pound (3)

0.09

0.06

0.03

0.05

0.05

Quarter Ended

(Unaudited)

(1) Does not include tolling volume.

(2) Adjusted EBITDA as set by current definition.

(3) Adjusted EBITDA for the C4 Processing and Performance

Products operating segments - i.e. total Adjusted EBITDA less Corporate. |

42

6/30/2011

3/31/2011

12/31/2010

9/30/2010

6/30/2010

Net income (loss)

34.3

$

11.4

$

(0.7)

$

12.8

$

14.4

$

Income tax expense (benefit)

17.7

5.7

(1.6)

6.9

7.9

Interest expense, net

8.6

8.4

11.1

3.2

4.0

Depreciation and amortization

10.4

10.0

9.9

9.9

9.8

Adjusted EBITDA

71.0

$

35.5

$

18.7

$

32.8

$

36.1

$

Quarter Ended

(Unaudited, in millions)

Reconciliation of Adjusted EBITDA to Net Income

(*) Adjusted EBITDA is presented and discussed herein because management believes it enhances

understanding by investors and lenders of the Company’s financial performance.

Adjusted EBITDA is not a measure computed in accordance with GAAP. Accordingly it does not

represent cash flow from operations, nor is it intended to be presented herein as a substitute

for operating income or net income as indicators of the Company’s operating performance. Adjusted EBITDA is the primary performance measurement used by senior

management and our Board of Directors to evaluate operating results of, and to allocate capital

resources between, our business segments. We calculate Adjusted EBITDA as earnings

before interest, taxes, depreciation and amortization (EBITDA), which is then adjusted to remove or add back certain items. The items removed or added back have

historically consisted of items we consider to be non-recurring in nature and which we believe

distort comparability between periods. There were no such items identified in the

Reconciliations of Adjusted EBITDA to Net Income for the periods presented above. Our calculation of

Adjusted EBITDA may be different from calculations used by other companies; therefore, it may

not be comparable to other companies. |