Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STRATEGIC HOTELS & RESORTS, INC | d235550d8k.htm |

fa

Investor Day Presentation

October 4

th

, 2011

Exhibit 99.1 |

2

I.

BEE’s Unique Value Proposition

II.

Macroeconomic and Industry Update

III.

Company Overview

IV.

Organic Growth and ROI Opportunities

V.

Balance Sheet Recapitalization

VI.

Financial Results and Guidance

Agenda |

3

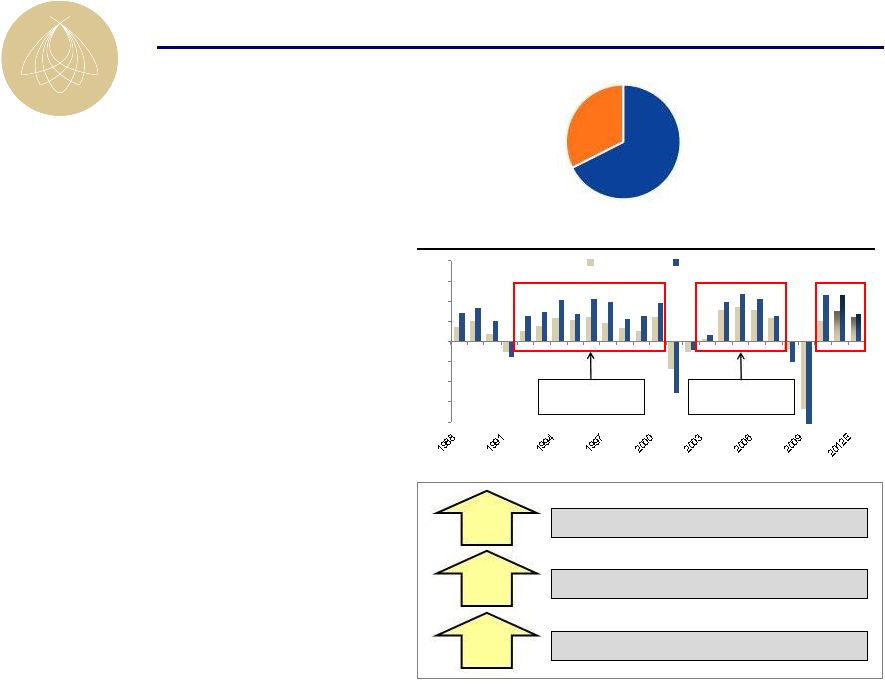

Luxury

68%

Upper-

upscale

32%

BEE’s Unique Value Proposition

2010 RevPAR penetration

Q2 EBITDA Margin Expansion

2010 EBITDA growth / RevPAR Growth

Industry

leading

asset management expertise

The only 100% pure play

high-end lodging REIT

High-end outperforms

the industry in a recovery

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

Total U.S.

Luxury

Luxury vs. Total U.S. Lodging Demand

8.5% Luxury

RevPAR CAGR

8.2% Luxury

RevPAR CAGR

2.6%

309

bps

2.6x |

4

BEE’s Unique Value Proposition

Deferred

CapEx

Assets are in pristine

condition

>$30M of identified

ROI capital projects

Assets offer significant ROI

opportunities

$125

$150

$175

$200

$0

$50

$100

$150

$200

2007

2008

2009

2010

2011F

EBITDA

RevPAR

-27% from peak

EBITDA

Peak-to-Trough RevPAR and EBITDA Decline

EBITDA

RevPAR

Embedded organic growth

limits need for external growth

|

5

BEE’s Unique Value Proposition

Balance sheet well positioned for

growth but prepared for volatility

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

>$400M of liquidity

Debt Maturity Schedule & Liquidity

The best investment proposition in the

lodging space

Historically low supply

growth environment

(4%)

(2%)

0%

2%

4%

6%

8%

10%

12%

14%

YoY % supply growth

Supply Growth in

BEE Markets = 0.2%

Luxury Supply Growth

Replacement cost ~$700,000 per key

(excluding land)

Replacement Cost vs. Trading Value per Key

$700,000

$356,000

$0

$200,000

$400,000

$600,000

$800,000

Replacement Cost

Trading Value

(1)

(1) Reflects stock price as of 9/30/2011 of $4.31 |

6

I.

BEE’s Unique Value Proposition

II.

Macroeconomic and Industry Update

Agenda |

7

European sovereign debt crisis remains a catalyst for market volatility

Unemployment remains stubbornly high but persists primarily within those without a

college education Unemployment rate by education level

Macroeconomic Outlook

Primary BEE

customer

demographic

Unemployment rate for primary BEE customer demographic

only 4.4%; only 2.3% points above historical norm

Source: Bureau of Labor Statistics

2.3 % points |

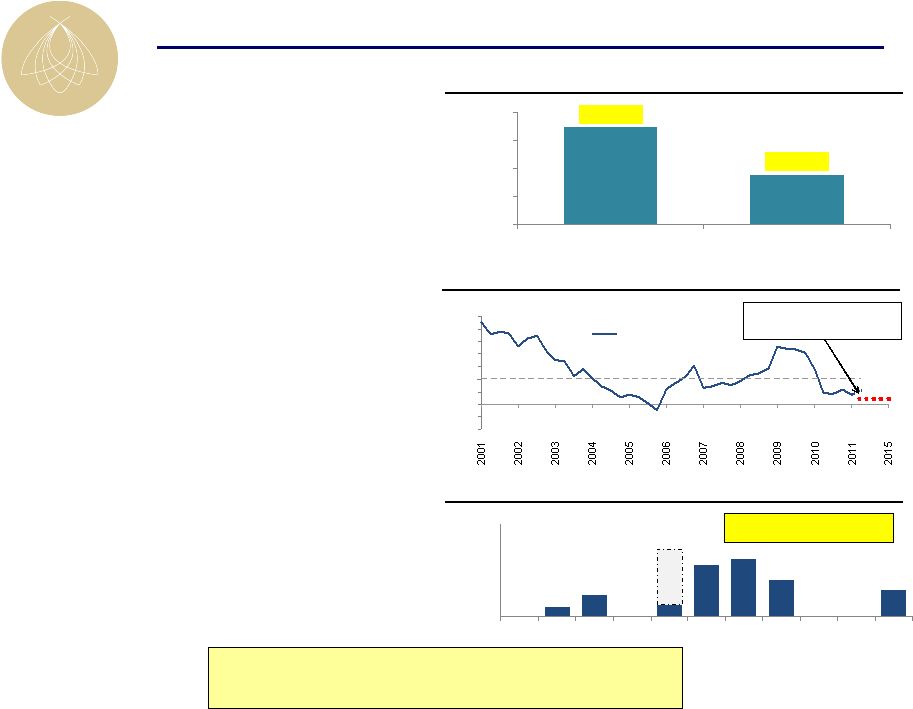

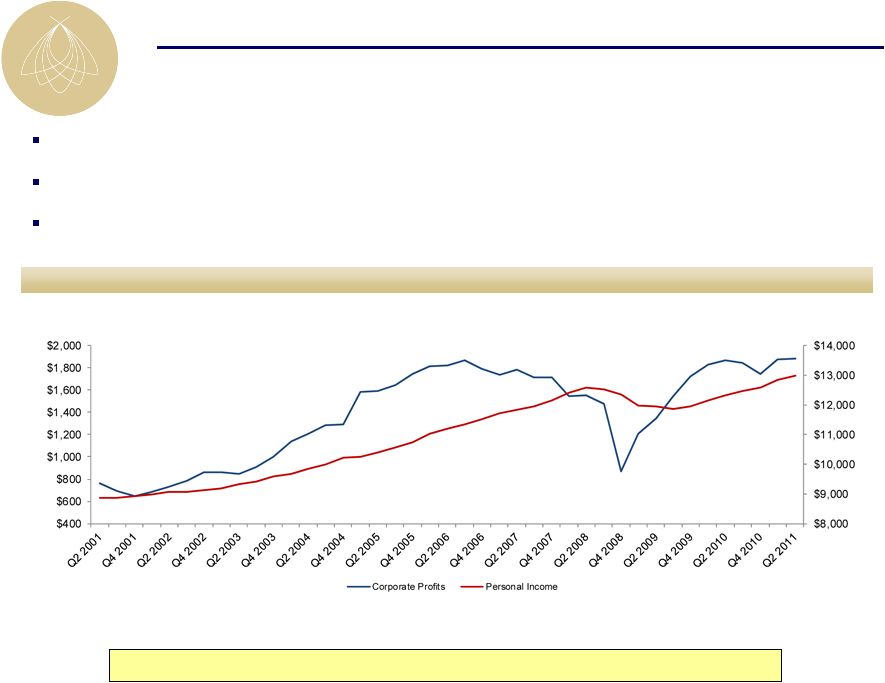

8

Corporate profits and personal income

GDP outlook is uncertain but corporate profits and personal income are at an

all-time high Corporate balance sheets are generally in good

condition Corporate

cash

balances

are

at

the

highest

level

since

1963

(1)

Macroeconomic Outlook

Corporate Profits

in billions

Personal Income

in billions

Corporate profits and personal income exceed pre-recession peaks

(1) As of the end of June 2011

Source: Federal Reserve and Bureau of Economic Analysis

|

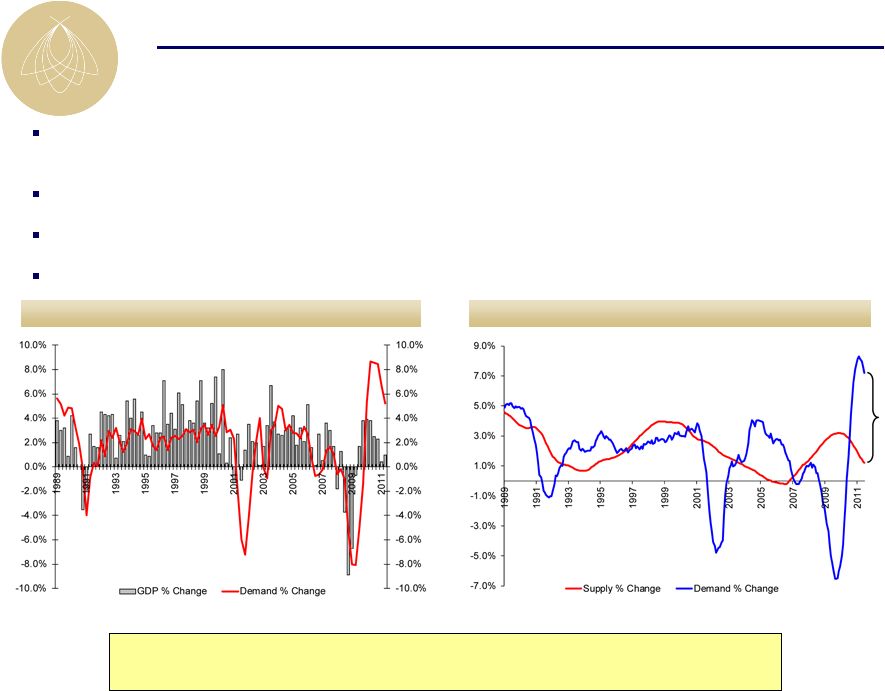

9

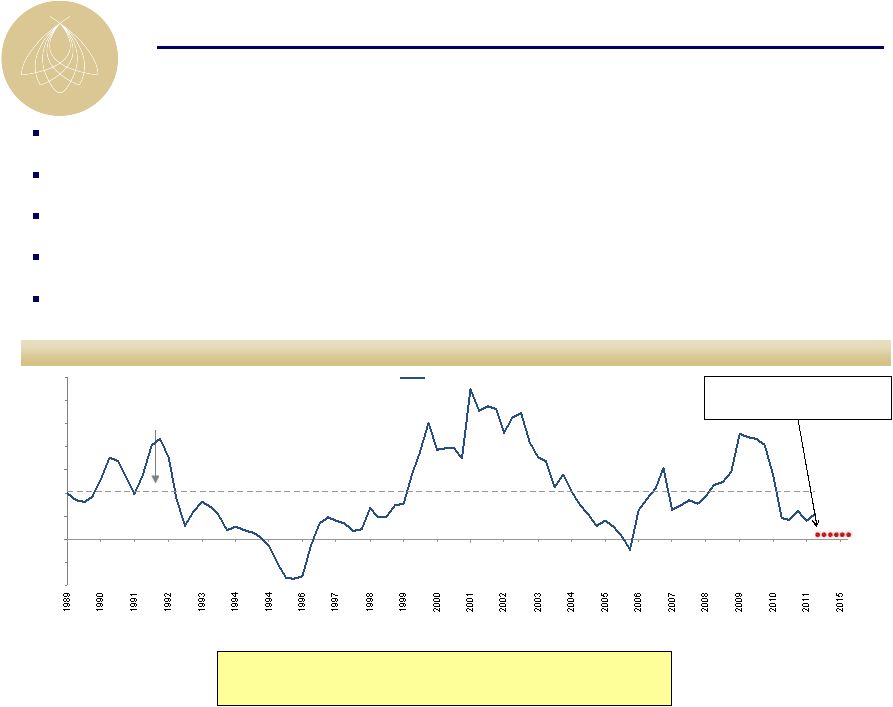

Total U.S. supply and demand change (TTM)

Lodging demand historically correlates with GDP (~80%) but potential exists for

near-term disconnect, particularly at the high-end

To date, little to no indication of a decline in group bookings or an increase in

group cancellations For September, transient demand was up 8% and transient

rate increased 10% Supply growth remains historically low and development

pipeline indicates muted supply going forward GDP and lodging demand change

(TTM) Lodging Outlook

+6.0%

Source: Smith Travel Research

Demand growth exceeds supply growth by 600 bps which could result in

a lower correlation of demand growth to GDP growth in the near-term |

10

Source: Smith Travel Research

Note: Data represents trends within the United States

Luxury supply growth was lower leading into this downturn than past downturns and remains

minimal Projects in planning or under construction have decreased significantly

Only 0.2% new competitive luxury or upper-upscale supply projected in BEE markets

1-2 years estimated time to permit; 3 years estimated time to build a luxury hotel

New hotel construction economic proposition doubtful with replacement cost estimated at approximately

$700,000 per key

Quarterly luxury supply YoY % change

(4%)

(2%)

0%

2%

4%

6%

8%

10%

12%

14%

YoY % supply growth

1988 –

Q2 2011

Average: 4.1%

Favorable Supply Outlook

Supply Growth in

BEE Markets = 0.2%

Benign supply growth environment and no new

supply growth likely until after 2015

|

11

Source: Smith Travel Research and PWC

Annual % change in RevPAR

Quarterly luxury room night demand

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

Total U.S.

Luxury

Luxury

hotels

have

experienced

prolonged

RevPAR

growth

following

past

industry

downturns

–

1992

–

2000:

9

consecutive

years

of

annual

luxury

RevPAR

growth

totaling

109%

or

8.5%

annually

–

2002

–

2007:

5

consecutive

years

of

annual

luxury

RevPAR

growth

totaling

48%

or

8.2%

annually

Overall luxury room nights sold is at an all-time high; 24% higher than

2007 Luxury Hotels Outperform in a Recovery

Most luxury room

nights ever sold

Luxury

Outperformance:

2.2% CAGR

Luxury

Outperformance

: 4.1% CAGR

Luxury outperformed Total U.S. 2.0% -

4.0% in previous two downturns

Source: Smith Travel Research

24%

New luxury supply has been fully absorbed

Luxury room night demand currently at all-

time high |

12

I.

BEE’s Unique Value Proposition

II.

Macroeconomic and Industry Update

III.

Company Overview

Agenda |

13

World-class luxury hotels supported by unique real estate value

Investment acumen and discipline

Industry leading asset management capabilities

Brand leadership experience

Value creating hotel management contract renegotiation expertise

Depth and breadth of long-term relationships throughout the hotel industry

BEE Core Competencies

Fairmont Chicago

Lobby and ENO Wine Bar

Four Seasons Punta Mita

Coral Suite

Hotel del Coronado

Beach Village

Nobody does luxury better |

14

Unique and Irreplaceable Hotel Portfolio

Fairmont Chicago

Marriott Grosvenor Square

Four Seasons Jackson Hole

Ritz-Carlton Laguna Niguel

Ritz-Carlton Half Moon Bay

Four Seasons Washington, D.C.

Four Seasons Silicon Valley

InterContinental Chicago

Nobody owns a portfolio like ours! |

15

Hamburg, Germany

Chicago

Lincolnshire Resort

Chicago

Santa Monica Beach Hotel

Half Moon

Bay

La Jolla

Washington, D.C.

St. Francis

Laguna Niguel

London, England

Scottsdale

17 hotels and resorts with 7,762 rooms

Top-Tier Market Exposure

Jackson Hole

Silicon Valley

Assets located in primary gateway cities and high barrier to entry markets

|

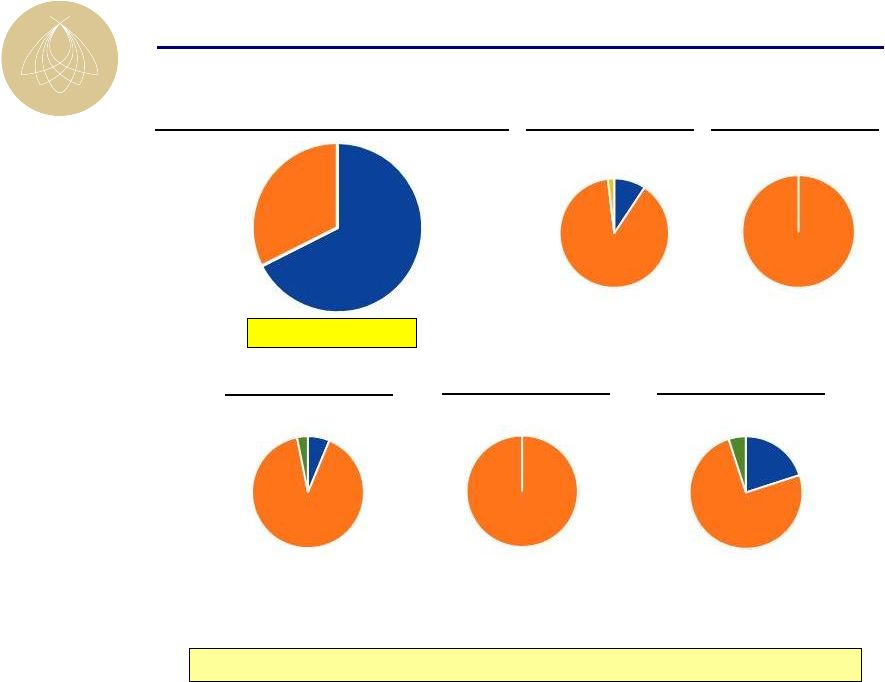

16

High-End Brand Focus

Strategic (BEE)

LaSalle (LHO)

Host (HST)

Sunstone (SHO)

DiamondRock (DRH)

Source: Deutsche Bank

Pebblebrook (PEB)

BEE is the only pure play high-end lodging REIT

*

*BEE’s Upper-Upscale assets per Smith Travel Research include:

Hyatt Regency La Jolla, Marriott Lincolnshire, Westin St. Francis, Marriott Grosvenor Square and

Marriott Hamburg 100% High-End

Chain Scale Mix

Luxury

68%

Upper-

upscale

32%

Upper-

upscale

100%

Luxury

6%

Upper-

upscale

91%

Upscale

3%

Upper-

upscale

100%

Luxury

20%

Upper-

upscale

75%

Upscale

5%

Below

Upscale

2%

Luxury

9%

Upper-

upscale

89% |

17

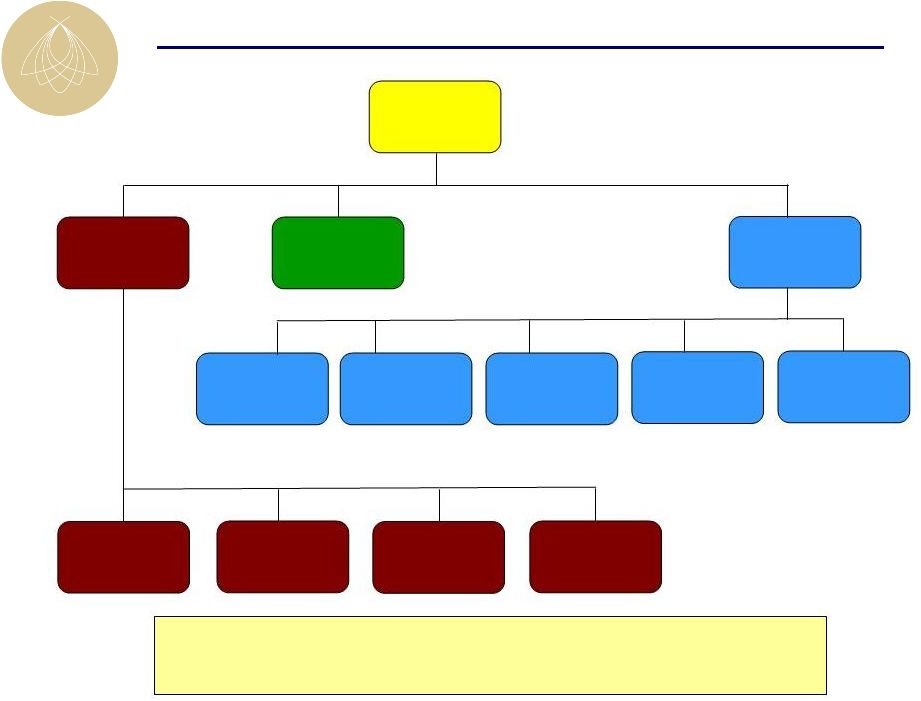

BEE Organizational Chart

Laurence Geller

President & CEO

Richard Moreau

EVP, Chief

Operating Officer

Diane Morefield

EVP, Chief Financial

Officer

Eric Hassberger

VP, Capital Markets

Bob McAllister

SVP, Tax

Jon Stanner

VP, Capital Markets

& Treasurer

Paula Maggio

SVP, General

Counsel

Ken Barrett

VP, Asset

Management

Bob Britt

VP, Asset

Management

Tom Healy

VP, Asset

Management

Dave Hogin

VP, Asset

Management

Cory Warning

VP, Investments

Stephen Briggs

SVP, Chief

Accounting Officer

Experienced hotel brand operators, asset management and investment professionals working tirelessly to maximize profits,

asset values and shareholder value |

18

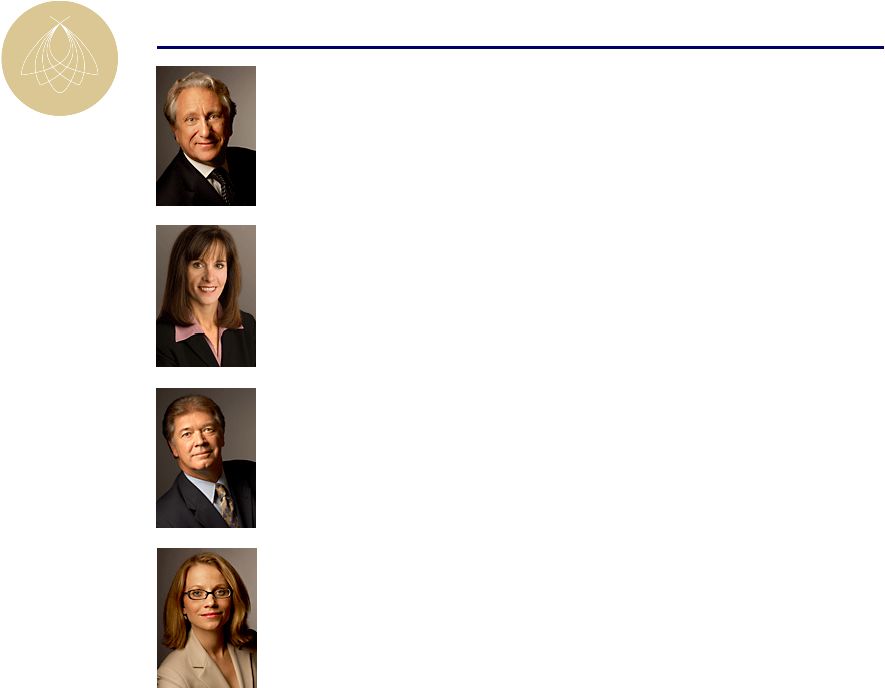

Laurence Geller

President & Chief Executive Officer

Prior

to

founding

Strategic

in

1997,

Mr.

Geller

was

Chairman

and

CEO

of

Geller

&

Co., a

gaming,

tourism

and

lodging

advisory

company

he

founded

in

1989.

Previously,

Mr.

Geller

held positions as EVP and COO of Hyatt Development Corporation, SVP of Holiday Inn

and Director of London’s Grand Metropolitan Hotels. Mr. Geller

has over 40 years of experience in

the

lodging

industry

and

has

received

numerous

awards

for

his

service

to

the

lodging

industry.

Richard Moreau

Executive Vice President, Chief Operating Officer

Mr. Moreau is responsible for the asset management of all Strategic’s

properties. Mr. Moreau has been in the hospitality industry for over

30 years in both property and multi-unit operation positions.

From

1992

until

he

joined

Strategic

in

November

1997,

Mr.

Moreau

was

a

principal

in Gremor Hospitality, a hotel asset management company. From 1988 until 1992, he

was a principal and Executive Vice President at Inn America Corporation, an

independent hotel management company.

Executive Management Team

Paula Maggio

Senior Vice President, Secretary and General Counsel

Ms. Maggio has been responsible for oversight of the company’s legal affairs

since 2004. Ms.

Maggio

played

a

critical

role

in

the

company’s

initial

public

offering

in

2004

and has

subsequently

executed

a

number

of

significant

transactions

for

the

company.

Prior

to

joining

Strategic in 2000, Ms. Maggio practiced law in private practice.

Diane Morefield

Executive Vice President, Chief Financial Officer

Prior to joining Strategic, Ms. Morefield served as chief financial officer of

Equity International, a privately-held investment company focused

exclusively on real estate related businesses operating outside of the

United States. From 1997 to 2006, Ms. Morefield was employed by Equity

Office Properties Trust (NYSE: EOP) (“EOP”), the largest publicly-traded office REIT

and owner of office buildings in the United States. Prior to EOP, Ms.

Morefield held senior positions at Deloitte and Barclays Bank.

|

19

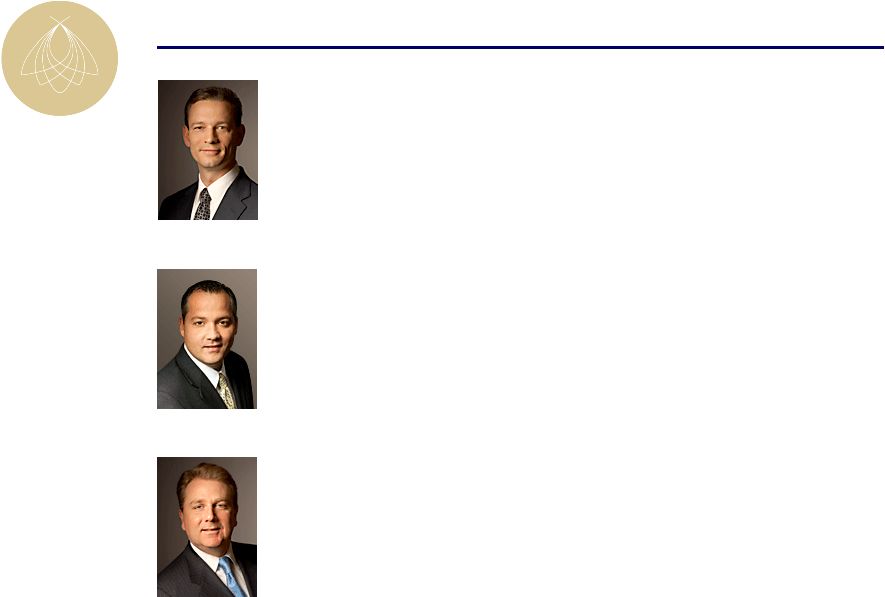

Kenneth Barrett

Vice President, Asset Management

Ken Barrett has held the position of Vice President, Asset Management since 2005.

Mr. Barrett's current and past portfolios have included most major brands:

Fairmont, Four Seasons, Hilton, Hyatt, Loews, Marriott and Embassy Suites.

Prior to joining Strategic, he served in property and corporate financial

roles, including Controller, Regional Controller and Director of Finance

Americas for Interstate Hotels and Resorts and InterContinental Hotels and

Resorts. Thomas Healy

Vice President, Asset Management

Thomas Healy has held the position of Vice President, Asset Management since 2006.

Mr. Healy’s current and past portfolios have included most major

brands: Four Seasons, Fairmont, Marriott, Intercontinental, Hyatt, and

Loews. Prior to joining Strategic, he served in several roles for

Starwood and Hyatt Hotels & Resorts. His most recent prior responsibilities

included

several

roles

for

Starwood

Hotels

as

Senior

Director

of

Development,

General

Manager for Westin Hotels & Resorts and General Manager for Sheraton Hotels.

Asset Management Team

David Hogin

Vice President, Asset Management

David Hogin holds the position of Vice President of Asset Management. Mr.

Hogin's current and past portfolios have included most major brands: Four

Seasons, Ritz-Carlton, Fairmont, Hyatt, InterContinental and Marriott.

Mr. Hogin is backed by eighteen years of hotel management experience,

having risen through the ranks in rooms operations with multiple branded

and independent flags. Prior to joining Strategic, he served in various property

operating roles, including General Manager, Hotel Manager and Director of Six

Sigma. |

20

I.

BEE’s Unique Value Proposition

II.

Macroeconomic and Industry Update

III.

Company Overview

IV.

Organic Growth and ROI Opportunities

Agenda |

21

Market share growth and revenue enhancement through market research based

programs

Exceptional asset management supported by internally developed operating

systems Aggressive and early cost cutting initiatives implemented in advance

of the 2008 / 2009 recession

Proactively maintaining fixed cost reduction at hotels during recovery phase

Rigorous oversight of brand managers to ensure alignment of interests

Evaluation and implementation of value add ROI projects; constant pipeline

Industry Leading Asset Management Capabilities

We are the industry standard for “best in class” asset management |

22

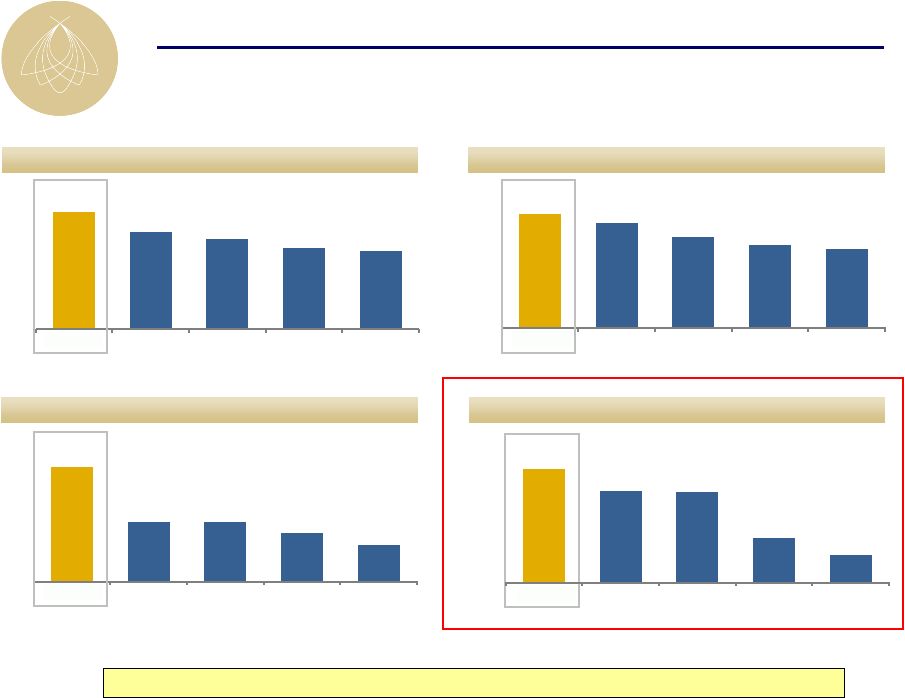

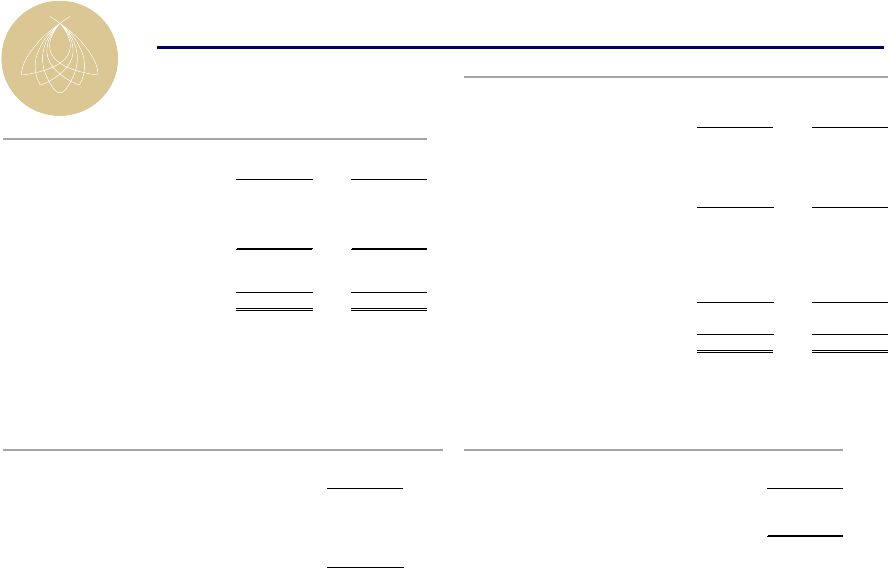

EBITDA Growth to RevPAR Growth Ratio

Non –Rooms Revenue Per Available Room

RevPAR

ADR

Note: All metrics represent full-year 2010 results

BEE portfolio reflects Same Store North American portfolio as of 12/31/2010.

Source: Public filings

BEE Positioning Compared to Peers

BEE delivers industry leading results

BEE

BEE

BEE

BEE

$220

$183

$171

$155

$149

$0

$50

$100

$150

$200

$250

LHO

HST

DRH

SHO

$150

$137

$120

$109

$104

$0

$50

$100

$150

LHO

HST

DRH

SHO

$137

$72

$72

$59

$45

$0

$40

$80

$120

$160

LHO

HST

DRH

SHO

2.6x

2.1x

2.0x

1.0x

0.6x

0.0x

0.5x

1.0x

1.5x

2.0x

2.5x

3.0x

DRH

SHO

HST

LHO |

23

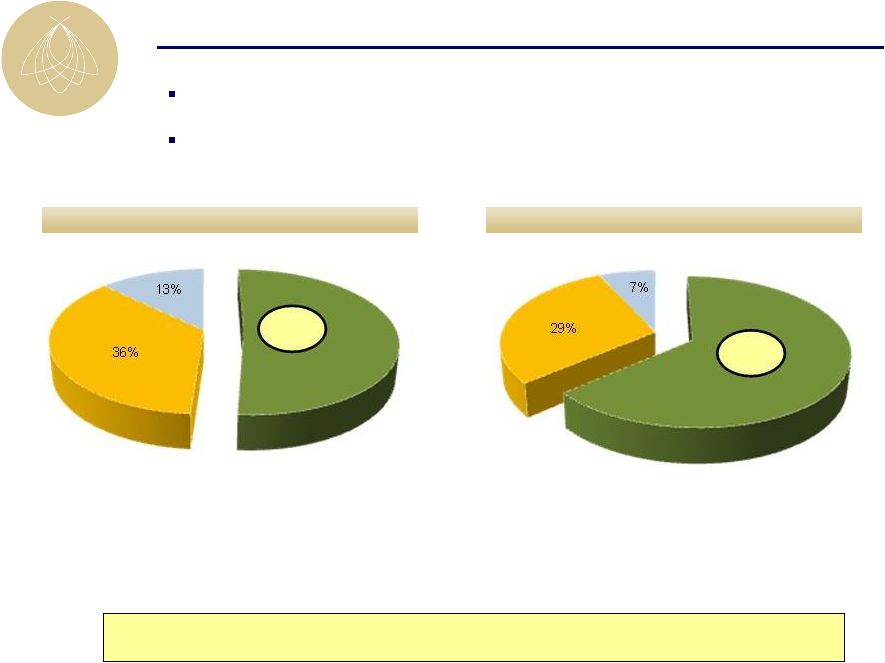

BEE Business Mix Compared to Peers

BEE revenue driven more heavily by non-rooms revenue relative to peers,

maximizing yield per square foot from our hotels

Rooms

64%

Food & Beverage

Other

BEE Total Revenue Mix

Peers Total Revenue Mix

BEE Total RevPAR is key top-line performance metric

BEE focus on maximizing yield per square foot

Rooms

51%

Food & Beverage

Other

Note: All metrics represent full-year 2010 results

Source: Public filings |

24

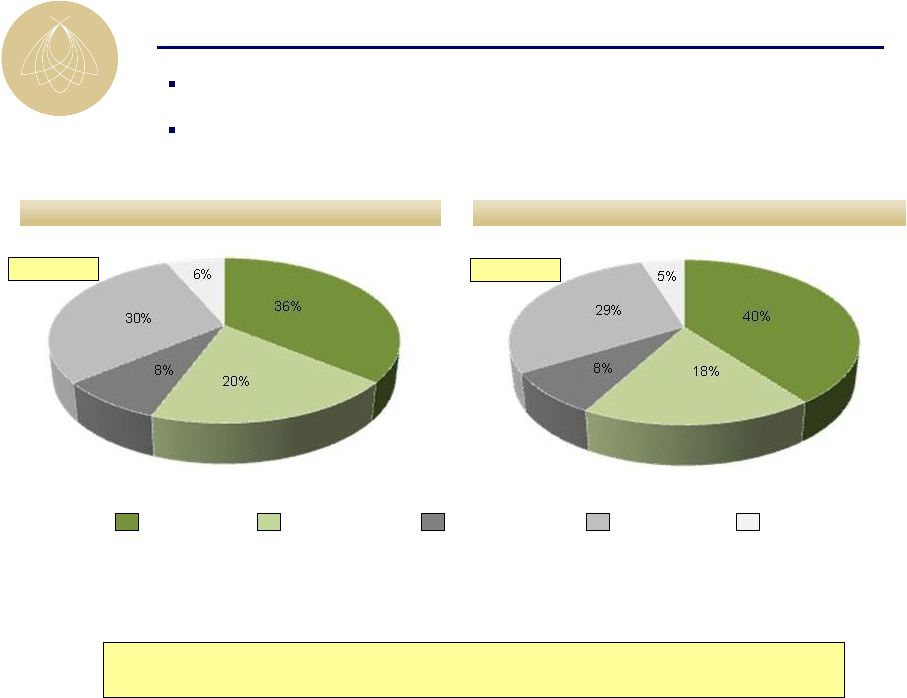

BEE Revenue Mix

Transient - Other

Transient - Negotiated

Group - Association

Group - Corporate

Group - Other

44% Group

42% Group

56% Transient

58% Transient

Note: Statistics are for the full year 2010

BEE Occupied Room Nights Mix

BEE Room Revenue Mix

Targeted mix of business ~50%/50% group/transient

Group business typically yields higher non-rooms revenue than transient

business BEE total revenue driven heavily by group business and ancillary group spend;

still significant capacity to grow group business |

25

Industry Leading Operating Margins

(1) Portfolio includes all North American hotels owned for the full year

2010 Peers include: HST, LHO, SHO, & DRH

Source: Public filings

4% better than peers

BEE

(1)

Peers

Peer margins

@ BEE

Revenue Mix

Average Daily Rate

$230

$167

Revenue

Rooms

51%

64%

51%

Food & Beverage

36%

29%

36%

Other

13%

7%

13%

Total

100%

100%

100%

Departmental Profit Margin

Rooms

71%

73%

73%

Food & Beverage

30%

26%

26%

EBITDA

20%

23%

16%

BEE’s margins significantly outperform when adjusted for same revenue

mix |

26

Group Booking Outlook

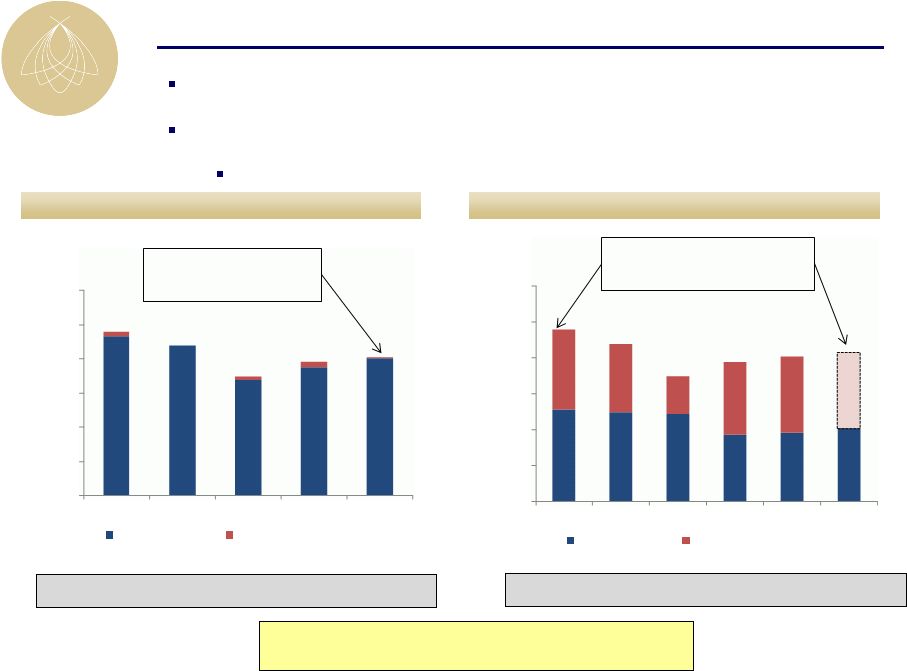

2012 group pace (bookings for the following year)

2011 group pace (bookings for the current year)

Room Nights

99% of 2011 budgeted

group room nights are

on the books

* 2011 room nights represents budget; 2012 room nights booked after 8/31 for

the following year assumes the same production as in 2011 Room Nights

Assuming similar production

as 2011, group room nights

would be down 13% to peak

2012 group pace currently 6% ahead of 2011

2011 group pace currently 7% ahead of 2010

Group pace remains the most reliable forward looking indicator

Booking window has shortened forcing more reliance on room nights booked ITYFTY

(“in-the-year-for-the-year”)

26% increase in second quarter ITYFTY rooms compared to second quarter 2007

Significant

capacity

to

grow

group

business

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

2007

2008

2009

2010

2011*

Definite as of 8/31

Production after 8/31

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

2007

2008

2009

2010

2011*

2012*

Definite as of 8/31

Production after 8/31 |

27

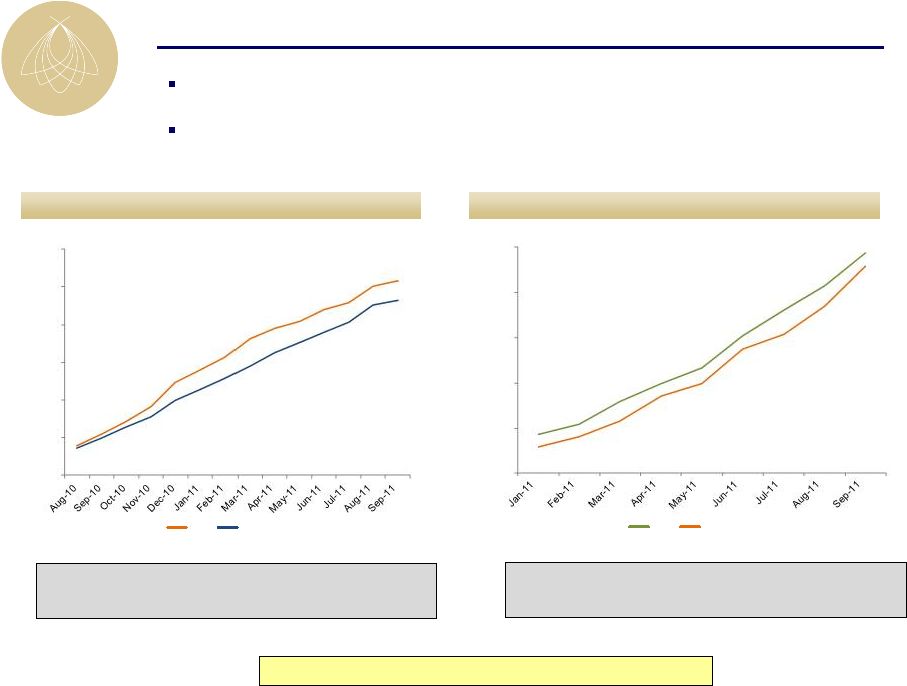

Group Booking Outlook

2012 group booking production

2011 group booking production

YTD group booking production for 2012 is 6%

above 2011

TTM group booking production for 2011 is 8%

above 2010

Group production is monitored to identify any signs of a slowdown

Current production levels are trending higher than comparable periods in

2007 No evidence of a slowdown

300,000

400,000

500,000

600,000

700,000

800,000

900,000

2011

2010

200,000

250,000

300,000

350,000

400,000

450,000

2012

2011 |

28

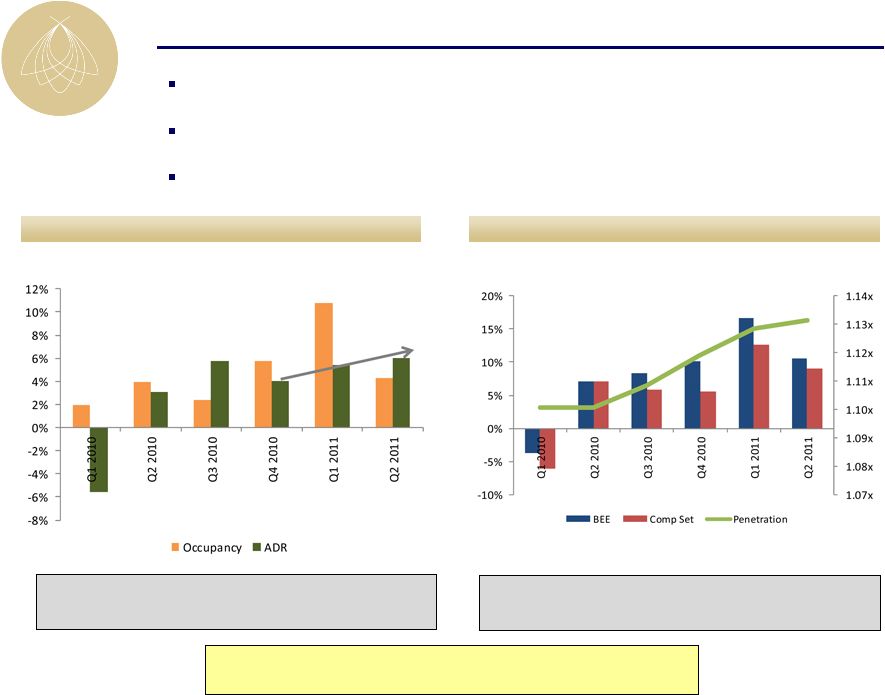

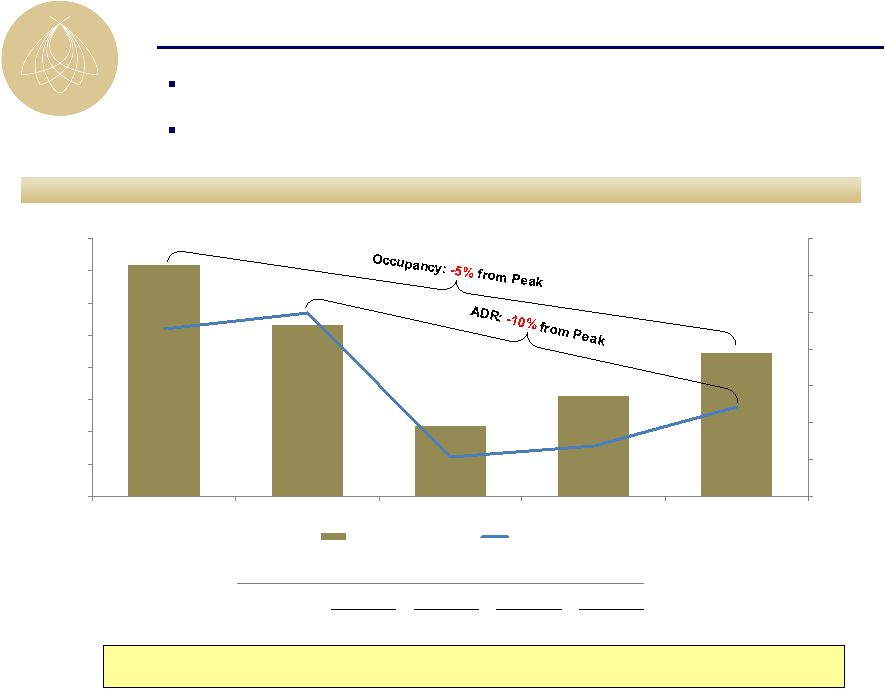

Focus on ADR Growth Drives Margin Outperformance

RevPAR

growth

RevPAR

penetration

RevPAR growth and penetration

BEE Occupancy and ADR

Occupancy growth typically leads a recovery

BEE ADR growth drives higher margins

BEE RevPAR penetration is best measurement of market share capture

Occupancy led the recovery; ADR growth

continues to improve

BEE has improved market share at all points

in the cycle

BEE hotels consistently outperform in market share

|

29

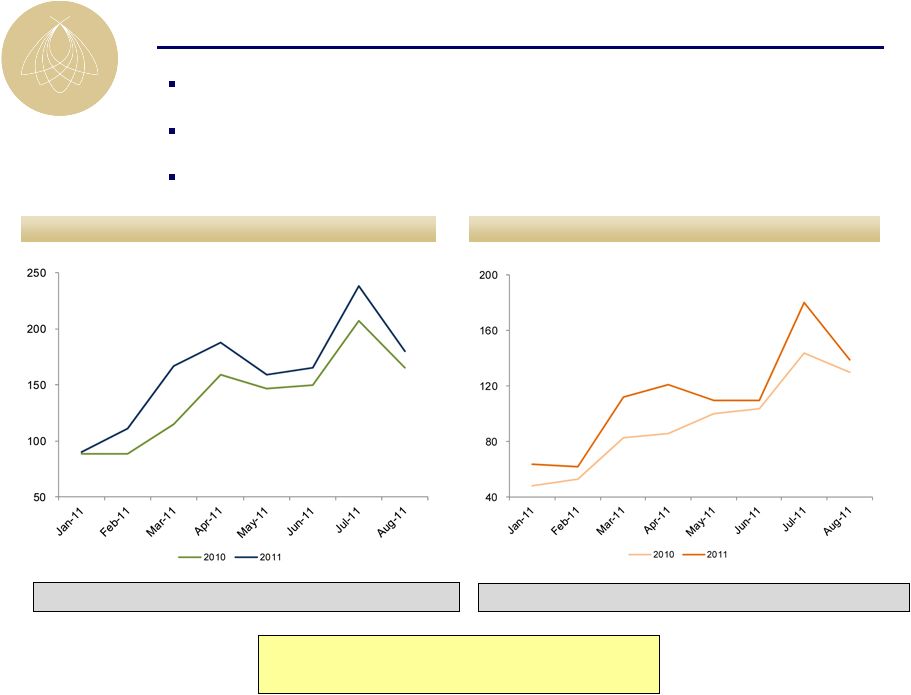

Compression Room Nights

90% compression room nights

80% compression room nights

Compression nights (occupancy 80%/90% or higher) drive higher rates

Average rate on 80% compression nights is up 7% year-to-date

Average rate on 90% compression nights is up 13% year-to-date

YTD 80% compression nights are up 16% in 2011 vs. 2010

YTD 90% compression nights are up 20% in 2011 vs. 2010

BEE ideally positioned for rate growth |

30

$210

$220

$230

$240

$250

$260

$270

$280

62.0%

64.0%

66.0%

68.0%

70.0%

72.0%

74.0%

76.0%

78.0%

2007

2008

2009

2010

2011F

Occupancy

ADR

Embedded Portfolio Growth

ADR will be a bigger driver of RevPAR growth going forward and will likely

exceed peak in the future

Occupancy and ADR

Occupancy

Note: portfolio excludes: Hotel del Coronado, Fairmont Scottsdale Princess, Four

Seasons Jackson Hole, Four Seasons Silicon Valley ADR

Peak-to-trough ADR dropped 15% and is still 10% below peak

Peak-to-trough occupancy dropped 10 percentage points and is still 5

percentage points below peak

CAGR to Reach Peak by:

2012

2013

2014

2015

ADR

11.0%

5.4%

3.5%

3.5% |

31

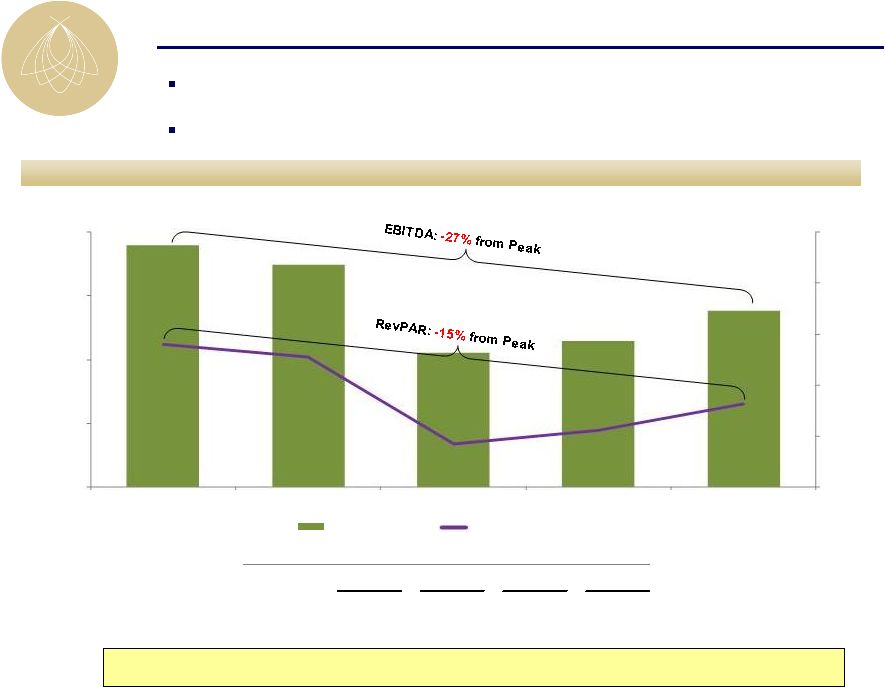

Embedded Portfolio Growth

Significant organic growth opportunity in existing portfolio

Note: portfolio excludes: Hotel del Coronado, Fairmont Scottsdale Princess, Four

Seasons Jackson Hole, Four Seasons Silicon Valley Property-level EBITDA and

RevPAR EBITDA (MM)

RevPAR

Peak-to-trough RevPAR dropped 22% and is still 15% below peak

Peak-to-trough property-level EBITDA dropped 39% and is still 27%

below peak CAGR to Reach Peak by:

2012

2013

2014

2015

RevPAR

17.5%

8.4%

5.5%

4.1%

EBITDA

36.9%

17.0%

11.0%

8.2%

$125

$150

$175

$200

$225

$250

$50

$100

$150

$200

2007

2008

2009

2010

2011F

EBITDA

RevPAR

$0 |

32

Completed ROI Projects Enhance Future Growth |

33

Notable 2008

capital

projects

Notable 2009

capital

projects

InterContinental

Miami

–

Guestroom

renovation

InterContinental

Chicago

–

Michael

Jordan’s

Steak

House

Four Seasons

Washington,

D.C

–

Retail

outlet

renovation

Marriott

Lincolnshire

–

Lobby

renovation

Westin

St.

Francis

–

Michael

Mina

Steakhouse

conversion

Four Seasons

Washington,

D.C.

–

Lobby

renovation,

11-room

expansion, new restaurant, 63-room and suite renovation

Westin

St.

Francis

–

Clock

Bar

Fairmont

Chicago

–

ENO

wine

tasting

room,

lobby

renovation,

guestroom renovation, new spa and fitness center

Four Seasons

Punta

Mita

–

New

lobby

bar

Ritz-Carlton

Half

Moon

Bay

–

ENO

wine

tasting

room,

restaurant and lounge renovation, suite renovation

Completed ROI Projects Enhance Future Growth

Notable 2010

capital

projects

2011 Projects

In progress

Fairmont Chicago Lobby

Four Seasons Washington, D.C.

Lobby

Westin St. Francis Michael Mina

Bourbon Steak

InterContinental Miami Guestroom

Proven track record of successful ROI projects |

34

Four Seasons D.C.

ROI Capital Project Examples

ROI projects produce very attractive returns and maximize earnings

contribution from existing space

InterContinental Chicago

Hotel del Coronado

(1)

(1)

(1)

Represents 100% ownership

(1)

(1)

Description:

Bourbon Steakhouse

and 11-room expansion

ENO Wine Room &

Starbucks

North Beach

Development

Year of Project:

2008 - 2009

2006 - 2007

2007

Investment ($mm):

$8.4

$2.9

$68.4

2010 EBITDA Yield (%):

15%

28%

$113 million in unit sales revenue

~$45 million in unit sales profit

$6.6 million in 2010 EBITDA |

35

$18 million guestroom renovation

Re-concept of guestrooms and corridors

New soft goods and case goods

Upgrade of bathroom

Integration of technology

Design based on in-depth consumer research

and meeting planner feedback

Project phased over 2011 and 2012;

approximately two-thirds complete

Long-term plan to incorporate a revitalization of

the hotel’s lobby and public space

2011 Capital Projects

Guestroom after

InterContinental Miami Guestroom Renovation

Guestroom before

Successful repositioning will regain market share penetration against significantly increased competition |

36

$3.8 million restaurant revitalization

–

Replaced former Zest restaurant

–

Enhanced existing lobby bar

Licensing agreement with Cornerstone

Restaurant Group

Official grand opening was September 22

Estimated $9 million annual revenue

–

Approximately $30,000 revenue per night

during first weekend of operations

Target mid-teens cash yield on investment

2011 Capital Projects

Dining Area

Bar and lounge

InterContinental Chicago –

Michael Jordan’s Steak House

nd

Michael Jordan’s Steak House has significantly enhanced the public space of

the hotel and is expected to generate a significant return on investment |

37

Four Seasons Washington, D.C.

ENO Wine Room

Retail space optimization

Four Seasons Silicon Valley

Quattro patio renovation

Meeting room renovation

Four Seasons Jackson Hole

Restaurant re-concept

InterContinental Chicago

North tower guestroom renovation

Meeting space expansion

Michigan Ave. frontage optimization

Potential Capital Projects in the Pipeline

Ritz-Carlton Laguna Niguel

35-room fire pit addition

Pool deck upgrades

InterContinental Miami

Public space revitalization

Meeting space renovation

Pool deck refurbishment

Fairmont Chicago

Meeting space renovation

Westin St. Francis

ENO wine room

Significant ROI capital investment opportunities within existing portfolio;

rigorous analysis and approval process for each project |

38

I.

BEE’s Unique Value Proposition

II.

Macroeconomic and Industry Update

III.

Company Overview

IV.

Organic Growth and ROI Opportunities

V.

Balance Sheet Recapitalization

Agenda |

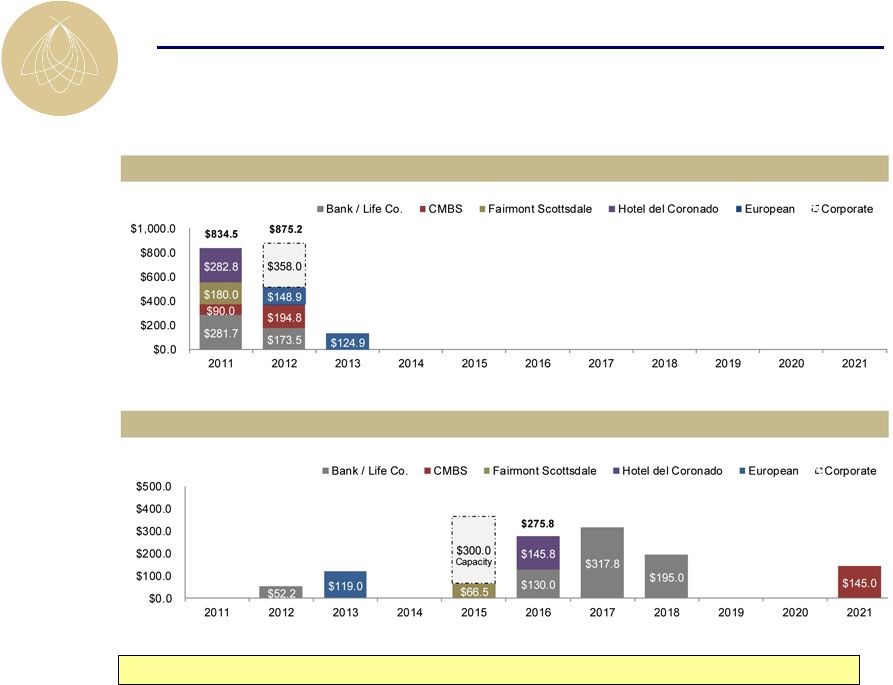

39

2011 Debt Refinancing Strategy Objectives

Simultaneous negotiation of a new syndicated line of credit; substituting the

Ritz-Carlton Half Moon Bay for the Four Seasons Washington, D.C. in the

borrowing base Execute a competitive loan marketing process with goal to

close all loans in the first half of 2011

Stagger new loan maturities over a 10 year period; no more than 25% debt maturing

in a single year

Manage fixed versus floating rate debt mix in conjunction with existing swap

portfolio Reduce reliance on CMBS loans

Position company for payment of preferred dividends

Mission 100% Accomplished!

(1)

The decision was made not to early refinance the mortgage loan on the Hyatt

Regency La Jolla, owned in a joint venture with GIC, with the maturity date

remaining in September 2012 Deliberate, focused decision made in January 2011

to accelerate the refinancing of all 2011

/

2012

debt

maturities

(1) |

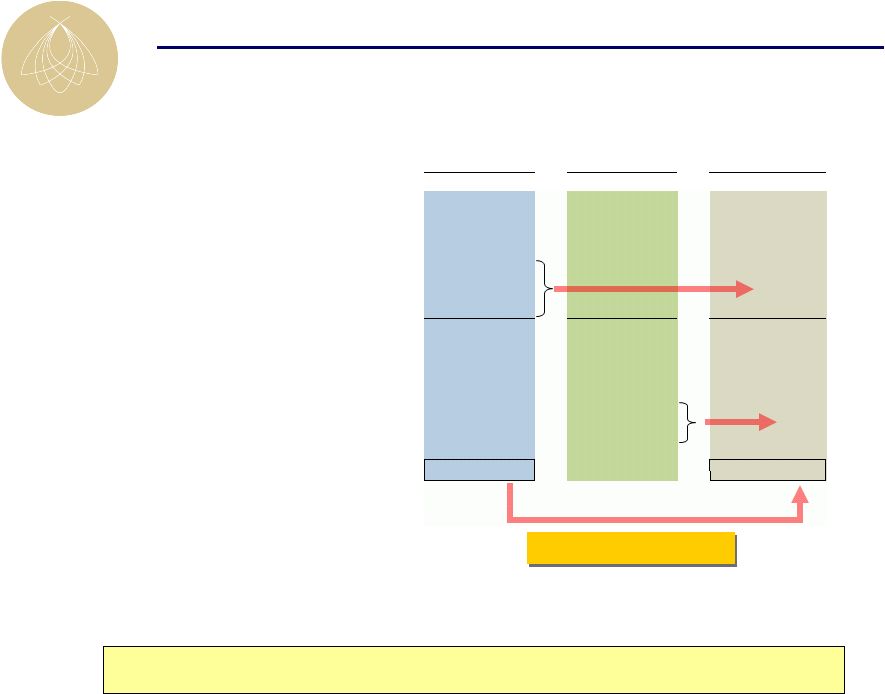

40

($ in millions)

Note: Assumes full extension periods for all loans.

BEE’s balance sheet structured for growth, yet prepared for volatility

Strong Recapitalized Balance Sheet

Current

January 1, 2010 |

41

January 1, 2010

(1)

Data reflects second quarter 2011 balances updated for property refinancing

activity. (2)

EBITDA assumed at mid-point of current guidance range.

(3)

Current TEV based on stock price as of close September 30, 2011 of $4.31.

Note: For Non-GAAP to GAAP reconciliations please see final slide of

presentation Significantly Improved Leverage Metrics

Successful balance sheet restructuring resulted in reduction of Net Debt /

EBITDA by over 7 turns

(2)

(3)

Current

(1)

Key Stats

Net Debt/EBITDA

14.3x

7.2x

Net Debt/TEV

76.9%

47.9%

Avg. Maturity (yrs)

3.4

5.2

Unencumbered assets

0

2

Liquidity (MM)

$105.0

$400.0

Fixed rate debt

86%

98%

Mix of Debt

Bank Debt

17.8%

38.0%

Life Insurance Co.

25.6%

31.5%

CMBS

56.6%

30.5% |

42

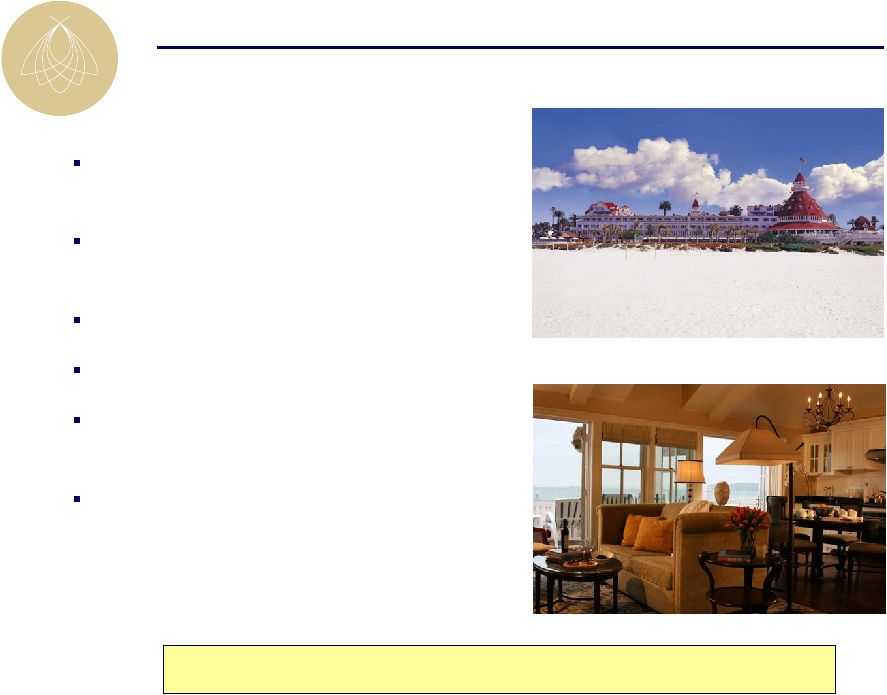

Partial debt retirement through purchase at a

discount

Recapitalized as joint venture with Blackstone

and KSL

Retained 34.3% ownership

Reduced debt from $630 million to $425 million

Refinanced debt with first major CMBS floater;

5-year term @ LIBOR + 480 bps

Retained asset management fees and return-

based promote

Hotel del Coronado

Hotel del Coronado

Beach Village Guest Room

$630 million recapitalization / restructuring

Invested approximately $57 million at very attractive projected returns;

added Blackstone as a joint venture partner |

43

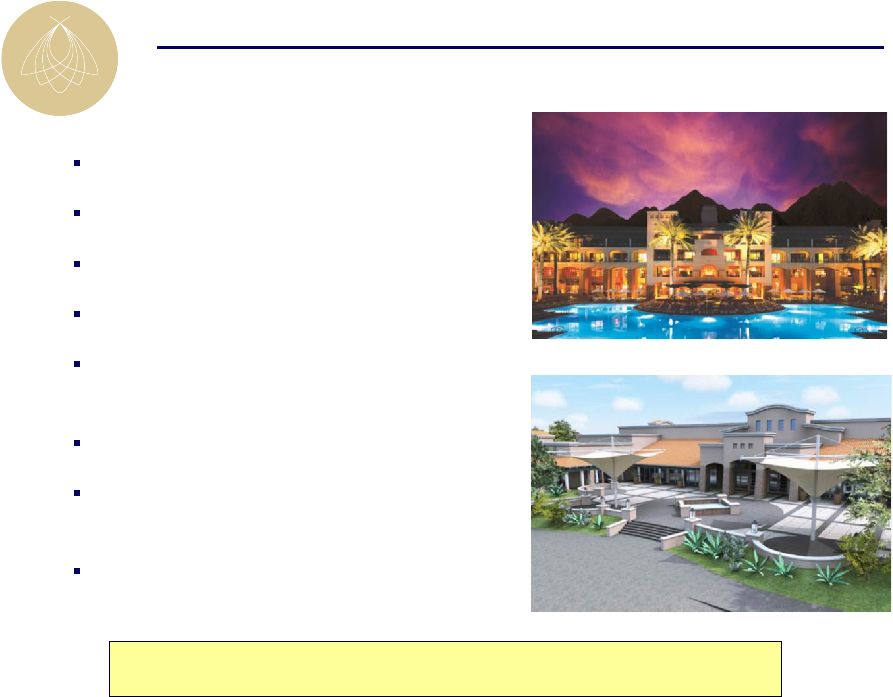

Restructured existing CMBS loan

Recapitalized joint venture with Walton Street

Retained 50% ownership interest

Reduced debt from $180 million to $133 million

Maintained below market interest rate of

LIBOR + 36 bps

Extended debt maturity through April 2015

Restructured hotel management agreement and

ground lease

Committed to a $20 million, 23,000 sq. ft.

ballroom / conference center expansion

Fairmont Scottsdale Princess

Fairmont Princess pool at dusk

Rendering of ballroom expansion

$203 million recapitalization / restructuring

Invested approximately $35 million on very attractive terms with below

market debt and high growth profile of the Fairmont Scottsdale Princess |

44

Disposed of leasehold position

Generated approximately $60 million disposition

proceeds

–

~18x 2010 EBITDA contribution

(1)

Effectively matched proceeds for investment in

Hotel del Coronado restructuring

Eliminated approximately $500,000 corporate

overhead related to the asset

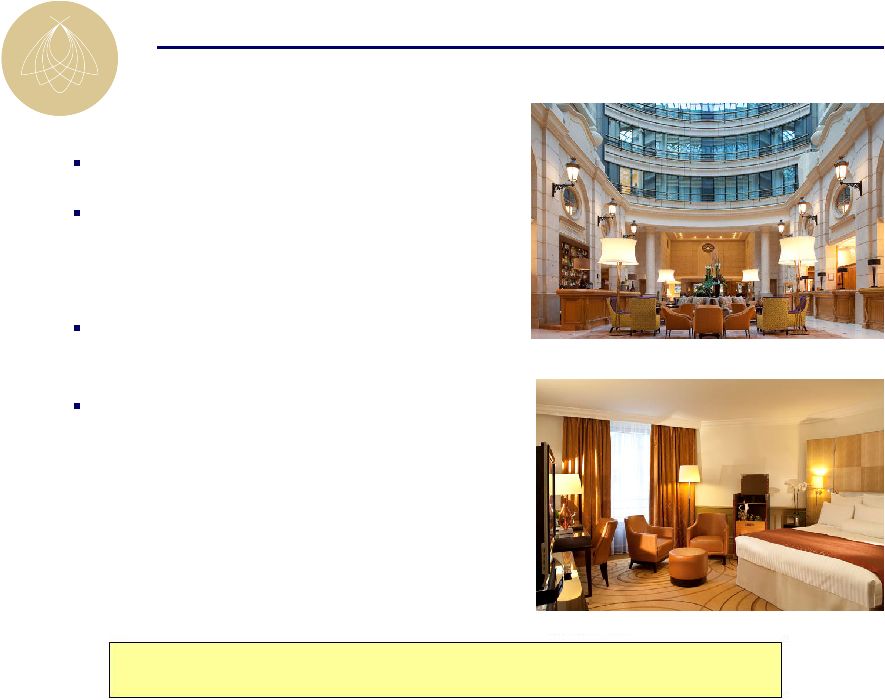

Marriott Paris Champs Elysees

Lobby

Guestroom

$60 million disposition proceeds

(1) 2010 EBITDA contribution of $3.3 million.

Generated approximately $60 million from an asset that was generally

valued at less than $5 million |

45

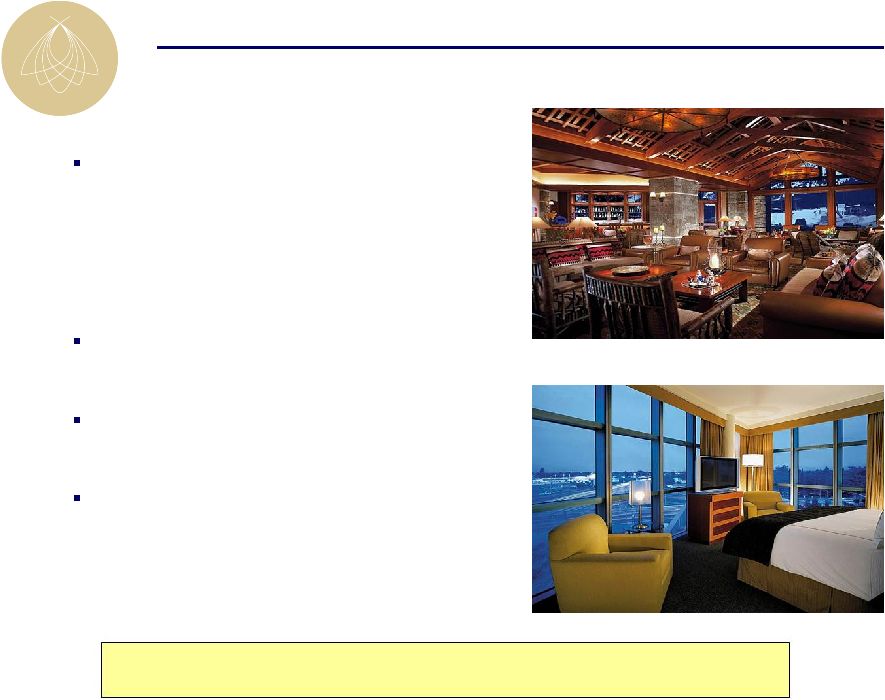

Acquired Four Seasons Jackson Hole & Four

Seasons Silicon Valley

–

Implied valuation of $95 million

($293,000 per key)

–

11x

2011

EBITDA

(1)

multiple

Issued 23.2 million shares of common stock at

$6.25 share price

$50 million in additional proceeds through PIPE

transaction with Woodbridge

Both assets are unencumbered

Four Seasons / Woodbridge Transaction

Four Seasons Jackson Hole

Four Seasons Silicon Valley

$145 million acquisition and equity issuance

(1) For Non-GAAP to GAAP reconciliations please see final slide of

presentation Accretive acquisition which deleveraged the company and added another significant, strategic long-term shareholder |

46

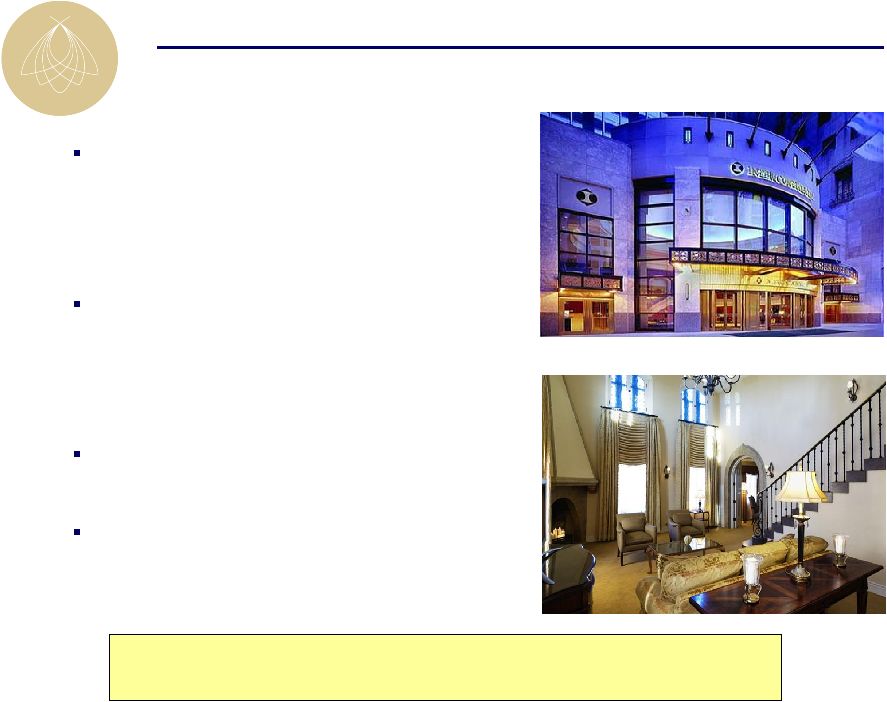

Purchased 49% GIC interest for all-in price of

$288 million

–

~14.1x

forecasted

2011

EBITDA

(1)

–

~$364,000 per key

Funded $82 million investment with:

–

10.8 million shares of common stock at

$6.50 per share

–

$11.8 million cash

Completed the Michael Jordan’s Steak House in

September 2011

Subsequently refinanced with a 10-year fixed

rate loan

InterContinental Chicago / Government of Singapore

InterContinental entrance on Michigan Ave.

Presidential Suite

$288

million

acquisition

with

$70.2

million

private

placement

of

equity

(1) For Non-GAAP to GAAP reconciliations please see final slide of

presentation Acquired at attractive metrics and added another significant, strategic

long-term shareholder |

47

$300 million revolving credit facility ($400 million

with accordion feature)

Secured by:

–

Four Seasons Punta Mita

–

Marriott Lincolnshire

–

Ritz-Carlton Laguna Niguel

–

Ritz-Carlton Half Moon Bay

Leveraged-based pricing currently at LIBOR +

300 bps

Favorable covenants

Reduced line banks from 21 to 10

Currently undrawn

Line of Credit Refinancing

$300 million credit facility

Improved pricing and

terms

Extended

maturity

Provides ample liquidity and

flexibility Ritz-Carlton Laguna Niguel

Ritz-Carlton Half Moon Bay

Marriott Lincolnshire

Four Seasons Punta Mita |

48

Four Seasons Washington, D.C.

$130 million, 5-year bank syndicated loan

Interest Rate: LIBOR + 315 basis points

InterContinental Chicago

$145 million, 10-year CMBS

Interest rate: 5.61% fixed rate

InterContinental Miami

$85 million, 7-year bank loan

Interest rate: LIBOR + 350 basis points

Loews Santa Monica

$110 million, 7-year bank loan

Interest rate: LIBOR + 385 basis points

Property Level Debt Financings

Four Seasons Washington, D.C.

Loews Santa Monica

$470 million financing proceeds

Eliminated near-term maturity

risk

Generated approximately $70 million of net proceeds

|

49

Summary

of

Results

–

Debt

Refinancing

Strategy

Completed accelerated refinancing of all 2011 and 2012 maturities

Executed highly complicated CMBS restructurings for the Hotel del Coronado

and Fairmont Scottsdale Princess

Effectively staggered debt maturities; managed fixed rate vs. floating rate

mix Competitive process provided best market terms and optimal mix of

lenders Estimated refinancing gap at the beginning of 2010 for 2011 / 2012

maturities was approximately $100 million

Raised ~$70 million in net proceeds through holistic approach

100% execution and prescient timing of overall debt refinancing strategy |

50

Accrued preferred dividend approximately $93 million by year-end 2011

Approximately $400 million corporate liquidity at year-end 2011 (excluding

financeable unencumbered assets)

Currently able to pay accrued preferred dividend under line of credit

covenants Payment of accrued dividend likely accompanied by reinstatement of

current preferred dividend

Management to monitor 2012 outlook and determine appropriate timing of payment;

critical to cover quarterly dividends out of operating cash flow

Payment of preferred dividend positions company to reinstate a common

dividend in the future

Preferred Equity Dividend

Ample liquidity and no current covenant restrictions on payment of accrued

preferred dividend; management is closely monitoring 2012 outlook |

51

I.

BEE’s Unique Value Proposition

II.

Macroeconomic and Industry Update

III.

Company Overview

IV.

Organic Growth and ROI Opportunities

V.

Balance Sheet Recapitalization

VI.

Financial Results and Guidance

Agenda |

(EBITDA in

millions) (a)

Excludes Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four Seasons Silicon Valley, and

Hotel del Coronado Operations

Corporate

Results

(a)

Strong First Half 2011 Results

Comparable

EBITDA

$60.2

18.3%

$71.2

Comparable

FFO

/

share

$(0.07)

N/A

$0.03

(Same Store U.S. Portfolio)

1

st

Half

2010

ADR

$210

5.7%

$222

RevPAR

$136

14.7%

$156

Total RevPAR

EBITDA Margins

$260

15.9%

13.4%

410 bps

$295

20.0%

52

1

st

Half

2011 |

53

EBITDA

$132

10%-17%

$145-$155

FFO / share

$0.05

60%-180%

$0.08-$0.14

2011 Guidance

(EBITDA in millions)

(b)

2010 results exclude $4.9 mm of real estate tax refunds and no adjustments for cancellation

fees (c)

2010 excludes $12.6 mm of VCP expense; 2011 VCP expense excluded

Operations

(a)

Corporate

Results

(c)

(b)

(a)

Portfolio excludes Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four Seasons Silicon

Valley, and Hotel del Coronado 2010

2011

Guidance

RevPAR

$153

8%-9.5%

$165-$167

Total RevPAR

$286

8%-9%

$309-$312

EBITDA Margins

19.0%

200

-

300bps

21%-22% |

54

The only pure play high-end lodging REIT

High-end outperforms the industry in a recovery

Industry leading asset management expertise

Assets are in pristine condition and offer significant ROI opportunities

Embedded organic growth limits need for external growth

Replacement cost, excluding land, approximately $700,000 per key

Historically

low

supply

growth

environment,

particularly

in

BEE

markets

Balance sheet positioned for growth, yet prepared for volatility

BEE’s Unique Value Proposition

The best investment proposition in the lodging space |

55

Q&A

Q&A |

56

Disclaimer

Except for historical information, the matters discussed in this press release are

forward-looking statements subject to certain risks and uncertainties. Actual results

could differ materially from the Company's projections and forward-looking statements are

not guarantees of future performance. These forward looking statements are identified by looking their use

of terms and phrases such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,”

“should,” “will,” “continue” and other similar terms and phrases,

including references to assumptions and forecasts of future results. Factors that

may contribute to these differences include, but are not limited to the following: ability to obtain,

refinance or restructure debt or comply with covenants contained in our debt facilities; volatility

in equity or debt markets; availability of capital; rising interest rates and operating costs;

rising insurance premiums; cash available for capital expenditures; competition; demand for

hotel rooms in our current and proposed market areas; economic conditions generally and in the

real estate market specifically, including deterioration of economic conditions and the extent of its

effect on business and leisure travel and the lodging industry; ability to dispose of existing

properties in a manner consistent with our disposition strategy; delays in construction and

development; the failure of closing conditions to be satisfied; risks related to natural

disasters; the effect of threats of terrorism and increased security precautions on travel

patterns and hotel bookings; the outbreak of hostilities and international political instability;

legislative or regulatory changes, including changes to laws governing the taxation of REITs;

and changes in generally accepted accounting principles, policies and guidelines applicable to

REITs. Certain of these risks and uncertainties are described in greater detail in our

filings with the Securities and Exchange Commission. Although we believe our current expectations to be

based upon reasonable assumptions, we can give no assurance that our expectations will be attained or

that actual results will not differ materially. We undertake no obligation to update any

forward-looking statement to conform the statement to actual results or changes in our

expectations.

|

57

Non-GAAP to GAAP Reconciliations

Reconciliation of Net Debt / EBITDA

($ in 000s)

YE 2009

(a)

July 2011

(b)

Consolidated Debt

$1,658,745

$1,004,284

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(45,548)

Cash and cash equivalents

(116,310)

(85,000)

Net Debt

$1,718,195

$1,086,011

Comparable EBITDA

$119,953

$150,000

Net Debt / EBITDA

14.3x

7.2x

(a) All figures taken from year-end 2009 financial statements.

(b) Balance sheet metrics updated to reflect closing of debt refinancings

Comparable EBITDA reflects mid-point of guidance range as of

Q2 2011. Reconciliation of Net Debt / TEV

($ in 000s)

YE 2009

(a)

Current

(b)

Consolidated Debt

$1,658,745

$1,004,284

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(45,548)

Cash and cash equivalents

(116,310)

(85,000)

Net Debt

$1,718,195

$1,086,011

Market Capitalization

$144,966

$811,530

Total Debt

1,834,505

1,171,011

Preferred Equity

370,236

370,236

Cash and cash equivalents

(116,310)

(85,000)

Total Enterprise Value

$2,233,397

$2,267,777

Net Debt / EBITDA

76.9%

47.9%

(a) All figures taken from year-end 2009 financial statements.

(b) Balance sheet metrics updated to reflect closing of debt refinancings

Comparable EBITDA reflects mid-point of guidance range as of

Q2 2011. Reconciliation of Woodbridge Transaction EBITDA Multiple

($ in 000s)

2011

Net Income Attributable to Common Shareholders

$5,203

Depreciation & Amortization

3,417

Comparable EBITDA

$8,620

Implied Purchase Price

$95,000

2011 EBITDA Multiple

11.0x

Note: Depreciation and amortization estimate based on preliminary

purchase price allocation at the

time of closing. Reconciliation of InterContinental Chicago EBITDA Multiple

($ in 000s)

2011

Net Income Attributable to Common Shareholders

$5,934

Depreciation & Amortization

7,980

Interest Expense

5,413

Income Tax Expense

1,070

Comparable EBITDA

$20,397

Implied Purchase Price

$288,250

2011 EBITDA Multiple

14.1x

Note: Interest Expense estimate based on the LIBOR curve and refinancing

estimates at time of closing.

All figures represent 100% ownership

|

|