Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - HECATE EXPLORATION | ex5_1.htm |

| EX-23.1 - EXHIBIT 23.1 - HECATE EXPLORATION | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

HECATE EXPLORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

27-3868559

|

|

(State or other jurisdiction of

|

Primary Standard Industrial

|

IRS Employer

|

|

Incorporation

|

Classification Code Number

|

Identification Number

|

|

or organization)

|

|

Aspen Asset Management Services, LLC

|

|

|

7582 Las Vegas Blvd South,

|

6623 Las Vegas Blvd. South, Suite 255

|

|

Las Vegas, NV 89123

|

Las Vegas, NV 89119

|

|

(702) 516-7156

|

(702) 629-1883

|

|

(Address and telephone number of principal executive

|

(Name, address and telephone number of agent for

|

|

offices)

|

service)

|

Copies to:

David McNay -President

7582 Las Vegas Blvd. South

Las Vegas, NV 89123

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date

of this Registration Statement

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant

to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional common stock for an offering under Rule 462(b) of the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering.

If this Form is a post-effective amendment filed under Rule 462(c) of the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering.

If this Form is a post-effective amendment filed under Rule 462(d) of the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated

filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

|

Non-accelerated Filer o

|

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Securities to be

Registered

|

Amount To Be

Registered

|

Offering

Price

Per

Share

|

Aggregate

Offering Price

|

Registration

Fee

|

|

|

Common Stock:

|

Common

|

9,000,000

|

$0.01

|

90,000

|

$10.45

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price shares were sold to our shareholders in a private placement memorandum. The selling shareholders may sell shares of our common stock at a fixed price of $0.01 per share until our common stock is quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $0.01 has been determined as the selling price based upon the original purchase price paid by the selling shareholders of $0.01. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, Dated October 3, 2011

HECATE EXPLORATION

9,000,000 SHARES OF COMMON STOCK

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON DATES AS THE COMMISSION, ACTING UNDER SAID SECTION 8(a), MAY DETERMINE.

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus.

Our common stock is presently not traded on any market or securities exchange. The 9,000,000 shares of our common stock can be sold by selling security holders at a fixed price of $0.01 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. The fixed price of $0.01 has been determined as the selling price based upon the original purchase price paid by the selling stockholders of $0.01. There can be no assurance that a market maker will agree to file the necessary documents with The Financial Industry Regulatory Authority (“FINRA”), which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 6 to read about factors you should consider before buying shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is: October 3, 2011

Table of Contents

|

PAGE

|

||

|

Summary

|

5

|

|

|

Risk Factors

|

6

|

|

|

Use of Proceeds

|

9

|

|

|

Determination of Offering Price

|

9

|

|

|

Dilution

|

9

|

|

|

Selling Security Holders

|

9

|

|

|

Plan of Distribution

|

11

|

|

|

Description of Securities

|

11

|

|

|

Interest of Named Experts and Counsel

|

12

|

|

|

Description of Business

|

12

|

|

|

Description of Property – Copper Lake Claim

|

13

|

|

|

Description of Property - Other

|

28

|

|

|

Legal Proceedings

|

28

|

|

|

Market for Equity and Related Stockholder Matters

|

28

|

|

|

Financial Statements

|

30

|

|

|

Management Discussion and Analysis and Plan of Operation

|

31

|

|

|

Changes in and Disagreements with Accountants

|

32

|

|

|

Executive Compensation and Management

|

35

|

|

|

Security Ownership of Certain Beneficial Owners and Management

|

35

|

|

|

Certain Relationships and Related Transactions

|

36

|

|

|

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

|

36

|

|

|

Information not Required in Prospectus

|

38

|

|

PROSPECTUS SUMMARY

About our Company

We are a mining exploration and development company. We have an option to acquire a 100% interest in a group of mineral claims known as the Copper Lake Property near Babine Lake, Topely Landing in the Omineca Mining Distrct of British Columbia, Canada. We intend to conduct exploration work on the property in order to ascertain whether it possesses economic quantities of copper. We are a company without revenues or operations and have minimal assets and have incurred losses since inception.

Our principal executive office is located at 7582 Las Vegas Blvd. South, Las Vegas, NV 89123. Our telephone number is (702) 516-7156 and our registered agent for service of process is Aspen Asset Management Services, LLC, located at 6623 Las Vegas Blvd South, Suite 255, Las Vegas, Nevada 89119. Our fiscal year end is December 31.

Terms of the offering

Following is a brief summary of this offering:

|

Securities being offered by selling shareholders

|

9,000,000 shares of common stock,

|

|

Offering price per share

|

$ 0.01

|

|

Net proceeds to us

|

None

|

|

Number of shares outstanding before the offering

|

19,000,000

|

|

Number of shares outstanding after the offering if all of the shares are sold

|

19,000,000

|

Summary financial data

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

|

As of June 30, 2011

|

||||

|

(unaudited)

|

||||

|

Balance Sheet

|

||||

|

Total Assets

|

$ | 47,892 | ||

|

Total Liabilities

|

$ | 6,852 | ||

|

Stockholders Equity

|

$ | 41,040 | ||

|

Period from

|

||||

|

March 1, 2010

|

||||

|

(inception)

|

||||

|

to June 30, 2011

|

||||

|

(unaudited)

|

||||

|

Income Statement

|

||||

|

Revenue

|

$ | -- | ||

|

Total Expenses

|

$ | 56,702 | ||

|

Net Loss

|

$ | 56,702 | ||

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. The following is a discussion of all of the material risks relating to the offering and our business. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Our auditor has expressed substantial doubt as to our ability to continue as a going concern.

Based on our financial history since inception, our auditor has expressed substantial doubt as to our ability to continue as a going concern. We are a development stage company that has never generated any revenue. If we cannot obtain sufficient funding, we may have to delay the implementation of our business strategy.

Because the probability of an individual prospect having economical reserves is remote, any funds spent on exploration may be lost.

The probability of an individual mineral property having additional reserves is remote. In all probability, our Copper Lake Property does not contain any economical reserves. As such, any funds spent on exploration may be lost, which would result in a loss of your investment.

Because we have not yet commenced business operations and have no history of mineral production or mining operations, we face a high risk of business failure.

We have not yet begun the initial stages of exploration of our Copper Lake Property, and thus have no way to evaluate the likelihood that our business will be successful. We were incorporated on March 1, 2010 and to date have been involved primarily in organizational activities and the acquisition of our mineral property interests. We have not earned any revenues as of the date of this prospectus. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

We anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the Copper Lake Property and the production of minerals from the property, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Our net loss from inception to June 30, 2011 was $56,702. The loss was a result of the payment of general and administrative expenses. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

|

·

|

our ability to find mineralized material

|

|

·

|

our ability to extract the mineralized material

|

|

·

|

our ability to generate revenues from the sale of mineralized material

|

6

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the research and exploration of our mineral property. As a result, we may not generate revenues in the future. Failure to generate revenues will cause us to suspend or cease operations.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure against or which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

If we become subject to burdensome government regulation or other legal uncertainties, our business will be negatively affected.

There are several governmental regulations that materially restrict mineral property exploration and development. Under the British Columbia mining laws and regulations, to engage in certain types of exploration will require work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. Also, to operate a working mine, the legislation may require us to undertake an environmental review process.

In addition, existing laws may be applied to mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our exploration and future mining operations, if any, will be subject to risks associated with being able to accurately predict the quantity and quality of mineralized material within the earth using statistical sampling techniques. Estimates of any mineralized material on any of our properties would be made using samples obtained from appropriately placed underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.condition and operating results may be harmed.

Because our directors have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Our President, Mr. David McNay, and our Secretary/ Treasurer, Mr. Andrew Charles McAlpine devote approximately 10% of their time to our affairs. While Mr. McNay, and Mr. McAlpine presently possess adequate time to attend to our interests, it is possible that the demands on Mr. McNay and Mr. McAlpine from their other obligations could increase with the result that they would no longer be able to devote sufficient time to the management of our business.

Our officers and directors each reside outside the United States, which may make it difficult or impossible for the Company or its shareholders to seek legal recovery from either of them in the United States courts.

Our President, CEO and Director, Mr. David McNay, and our Secretary, Treasurer and Director, Mr. Andrew Charles McAlpine, are both residents of the Cayman Islands. Their lack of United States domicile may make it difficult or impossible for the Company or its shareholders to effectively obtain legal redress for actions taken by the Company’s directors or management.

None of the Company’s directors or officers have any mining experience, which may make it difficult or impossible for them to effectively manage the Company and its business.

Neither David McNay, our President, CEO and Director, nor Andrew Charles McAlpine, our Secretary, Treasurer and Director, have any previous mineral exploration or mining experience. This presents the risk that our directors and officers may not effectively manage our Company or its business.

7

If we do not obtain additional financing, our business will fail.

Our current operating funds are less than necessary to complete the potential exploration of the optioned mineral claim, and therefore we will need to obtain additional financing in order to complete our business plan. As of June 30, 2011 we had no cash. We currently do not have any operations and we have no income.

Our business plan calls for significant expenses in connection with the exploration of the Copper Lake Property. We will require additional financing in order to complete the entire recommended exploration program, and pay our administrative costs for the year. We will also require additional financing if the costs of the exploration of the Copper Lake Property are greater than anticipated.

We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, investor acceptance of our property and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be our sale of a partial interest in the Copper Lake Property to a third party in exchange for cash or exploration expenditures, which is not presently contemplated.

Because there is no public trading market for our common stock, you may not be able to resell your stock and as a result your investment is illiquid.

There is currently no public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you do want to resell your shares, you will have to locate a buyer and negotiate your own sale, of which there is no assurance. As a result, your investment is illiquid.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering 9,000,000 shares of our common stock through this prospectus. Our common stock is presently not traded or quoted on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is quoted will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent 47.4% of the common shares outstanding as of the date of this prospectus.

Because there is no public trading market for our common stock, you may not be able to resell your shares.

Our Company plans to have its shares quoted on the OTC Bulletin Board. There are no assurances that we will be successful in listing our shares. There is currently no public trading market for our common stock. Therefore there is no central place, like a stock exchange or electronic trading system, to resell your shares. If you do want to resell your shares, you will have to locate a buyer and negotiate your own sale. Therefore, you may not be able to resell your shares. We intend to engage a market maker to apply to have our common stock listed on the OTC Bulletin Board. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the Securities Exchange Commission or applicable regulatory authority. In order to be eligible to be listed on the OTCBB and to maintain such eligibility, we would be required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 and we would have to remain current in meeting our periodic securities reporting obligations. If for any reason, however, any of our securities are not eligible for initial or continued quotation on the Bulletin Board or an active public trading market does not develop, purchasers of the shares may have difficulty selling their securities should they desire to do so. If we are unable to satisfy the requirements for quotation on the OTCBB, any trading in our common stock would be conducted in the over-the-counter market in what are commonly referred to as the “pink sheets.” As a result, an investor may find it more difficult to dispose of the securities offered hereby.

8

Our common stock is considered a penny stock, which is subject to restrictions on marketability, so you may not be able to sell your shares.

If our common stock becomes tradable in the secondary market, we will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our shareholders to sell their securities.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares of common stock in this offering. All proceeds from the sale of the shares of common stock will be received by the selling shareholders.

DETERMINATION OF OFFERING PRICE

The price of the shares has been determined by our board of directors. We selected the $0.01 price for the sale of our shares of common stock. Currently there is no market for the shares and we wanted to give our shareholders the ability to sell their shares for the price they paid us. If our shares are listed for trading on the Bulletin Board, the price of the shares will be established by the market.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. Although our common stock is not listed on a public exchange, we will be filing to obtain a listing on the Over The Counter Bulletin Board (OTCBB) concurrently with the filing of this prospectus. In order to be quoted on the Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

DILUTION

The common stock to be sold by the selling shareholders is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders.

SELLING SECURITY HOLDERS

The following table sets forth the name of each selling shareholder, the total number of shares owned prior to the offering, the percentage of shares owned prior to the offering, the number of shares offered, and the percentage of shares owned after the offering, assuming the selling shareholder sells all of his shares and we sell the maximum number of shares. The shares being offered hereby are being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are the selling stockholders obligated to sell any shares immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the selling stockholders.

9

|

Percentage

|

||||||||

|

of shares

|

||||||||

|

owned after the

|

||||||||

|

Total number of

|

Percentage of

|

Number of

|

offering assuming

|

|||||

|

shares owned

|

shares owned

|

shares being

|

all of the share are

|

|||||

|

Name

|

prior to offering

|

prior to offering

|

offered

|

sold in the offering

|

||||

|

Raymond Bar nes

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Sandra Beckford

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Darren Campbell

|

600,000

|

3.2%

|

600,000

|

0%

|

||||

|

Richard Campbell

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Capital Venture Group

|

500,000

|

2.6%

|

50,000

|

0%

|

||||

|

Danelee Che

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Neil Clements

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Tim Collins

|

900,000

|

4.7%

|

900,000

|

0%

|

||||

|

Steven Derksen

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Eurasian Enterprises

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Christopher Gourzong

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Mark Hogan

|

100,000

|

0.5%

|

100,000

|

0%

|

||||

|

Gary B. Hughes

|

850,000

|

4.5%

|

850,000

|

0%

|

||||

|

Suzanne Jakeman

|

850,000

|

4.5%

|

850,000

|

0%

|

||||

|

Hugh Keating

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Chad Leslie

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Ben Marler

|

825,000

|

4.3%

|

825,000

|

0%

|

||||

|

Neville Morgan

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Clifford Mothen

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Alvin Nixon

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Charles Edward Pars

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Josh Parsons

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

RH Russell

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Silverstone Capital

|

400,000

|

2.1%

|

400,000

|

0%

|

||||

|

Snow Mass Trust

|

800,000

|

4.2%

|

800,000

|

0%

|

||||

|

Elaine Tapp

|

450,000

|

2.4%

|

450,000

|

0%

|

||||

|

James William Tapp

|

450,000

|

2.4%

|

450,000

|

0%

|

||||

|

Western Homesavers

|

800,000

|

4.2%

|

800,000

|

0%

|

||||

|

Albert Whittaker

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Rupert Whittaker

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Mitt Whitworth

|

100,000

|

0.5%

|

100,000

|

0%

|

||||

|

Colin Wilson

|

900,000

|

4.7%

|

900,000

|

0%

|

||||

|

Jamie Wilson

|

25,000

|

0.01%

|

25,000

|

0%

|

||||

|

Total

|

9,000,000

|

9,000,000

|

||||||

To our knowledge, none of the selling shareholders or their beneficial owners:

- has had a material relationship with us other than as a shareholder at any time within the past three years; or

- has ever been one of our officers or directors or an officer or director of our predecessors or affiliates

- are broker-dealers or affiliated with broker-dealers.

10

PLAN OF DISTRIBUTION

The selling security holders may sell some or all of their shares at a fixed price of $0.01 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Prior to being quoted on the OTCBB, shareholders may sell their shares in private transactions to other individuals. The fixed price of $0.01 has been determined based upon the original purchase price paid by the selling shareholders of $0.01. Although our common stock is not listed on a public exchange, we will attempt to engage a market maker to apply to list our common stock on the Over the Counter Bulletin Board (OTCBB) concurrently with the filing of this prospectus. In order to be quoted on the Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. However, sales by selling security holder must be made at the fixed price of $0.01 until a market develops for the stock.

Once a market has been developed for our common stock, the shares may be sold or distributed from time to time by the selling stockholders directly to one or more purchasers or through brokers or dealers who act solely as agents, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at negotiated prices or at fixed prices, which may be changed. The distribution of the shares may be effected in one or more of the following methods:

|

·

|

ordinary brokers transactions, which may include long or short sales,

|

|

·

|

transactions involving cross or block trades on any securities or market where our common stock is trading,

|

|

·

|

through direct sales to purchasers or sales effected through agents,

|

|

·

|

through transactions in options, swaps or other derivatives (whether exchange listed of otherwise), or exchange listed or otherwise), or

|

|

·

|

any combination of the foregoing.

|

In addition, after a market has developed, the selling stockholders may enter into hedging transactions with broker-dealers who may engage in short sales, if short sales were permitted, of shares in the course of hedging the positions they assume with the selling stockholders. The selling stockholders may also enter into option or other transactions with broker-dealers that require the delivery by such broker-dealers of the shares, which shares may be resold thereafter pursuant to this prospectus.

Brokers, dealers, or agents participating in the distribution of the shares may receive compensation in the form of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agent or to whom they may sell as principal, or both (which compensation as to a particular broker-dealer may be in excess of customary commissions). Neither the selling stockholders nor we can presently estimate the amount of such compensation. We know of no existing arrangements between the selling stockholders and any other stockholder, broker, dealer or agent relating to the sale or distribution of the shares. We will not receive any proceeds from the sale of the shares of the selling security holders pursuant to this prospectus. We have agreed to bear the expenses of the registration of the shares, including legal and accounting fees, and such expenses are estimated to be approximately $22,570.84.

Notwithstanding anything set forth herein, no FINRA member will charge commissions that exceed 8% of the total proceeds of the offering.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Common Stock

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share. Currently we have 19,000,000 shares issued and outstanding.

Each share of common stock shall have one (1) vote per share for all purpose. Our common stock does not provide a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our common stock holders are not entitled to cumulative voting for election of board of directors.

Preferred Stock

We have no preferred shares authorized.

11

Cash dividends

As of the date of this prospectus, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, an interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or prIncipal underwriter, voting trustee, director, officer, or employee.

The financial statements Included in this prospectus and the registration statement have been audited by De Joya Griffith & Company, LLC, CPAs by to the extent and for the periods set forth in their report appearing elsewhere in this document and in the registration statement filed with the SEC, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

DESCRIPTION OF BUSINESS

General

We were incorporated in the State of Nevada on March 1, 2010.

We intend to conduct exploration activities on the Copper Lake Property located in British Columbia, Canada.

We maintain our statutory registered agent's office at Aspen Asset Management Services, LLC Inc. at 6623 Las Vegas Blvd S, Suite 255, Las Vegas, Nevada 89119. Our business office is located at 7582 Las Vegas Blvd South, Las Vegas, NV 89123. Our telephone number is 702-516-7156.

We are an exploration stage company. We are engaged in the acquisition, and exploration of mineral properties with a view to exploiting any mineral deposits we discover that demonstrate economic feasibility. We have an option to acquire a 100% interest in a group of mining claims collectively known as the Copper Lake Property. We have not yet commenced exploration. There is no assurance that commercially viable mineral deposits exist on the property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Economic feasibility refers to a formal evaluation completed by an engineer or geologist which confirms that the property can be successfully operated as a mine. Legal feasibility refers to the completion of a survey of the mineral claims comprising the Copper Lake Property in order to ensure that the mineralization that we intend to exploit is within the claims boundaries.

Our plan of operation is to conduct exploration work on the Copper Lake Property in order to ascertain whether it possesses economic quantities of copper. There can be no assurance that economic mineral deposits or reserves, exist on the Copper Lake Property until appropriate exploration work is done and an economic evaluation based on such work concludes that production of minerals from the property is economically feasible.

Even if we complete our proposed exploration programs on the Copper Lake Property and we are successful in identifying a mineral deposit, we may have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

12

Mineral property exploration is typically conducted in phases. Each subsequent phase of exploration work is recommended by a geologist based on the results from the most recent phase of exploration. Once we complete each phase of exploration, we will make a decision as to whether or not we proceed with each successive phase based upon the analysis of the results of that program. Our directors will make this decision based upon the recommendations of the independent geologist who oversees the program and records the results.

DESCRIPTION OF PROPERTY - COPPER LAKE CLAIM

On May 18, 2010, we entered into an agreement with Barry J. Price whereby he agreed to grant us an option to acquire a 100% undivided right, title and interest, subject to a 2% Net Smelter Royalty, in a group of mineral claims, known as the Copper Lake Property, located in the Omineca Mining Division of British Columbia, Canada.

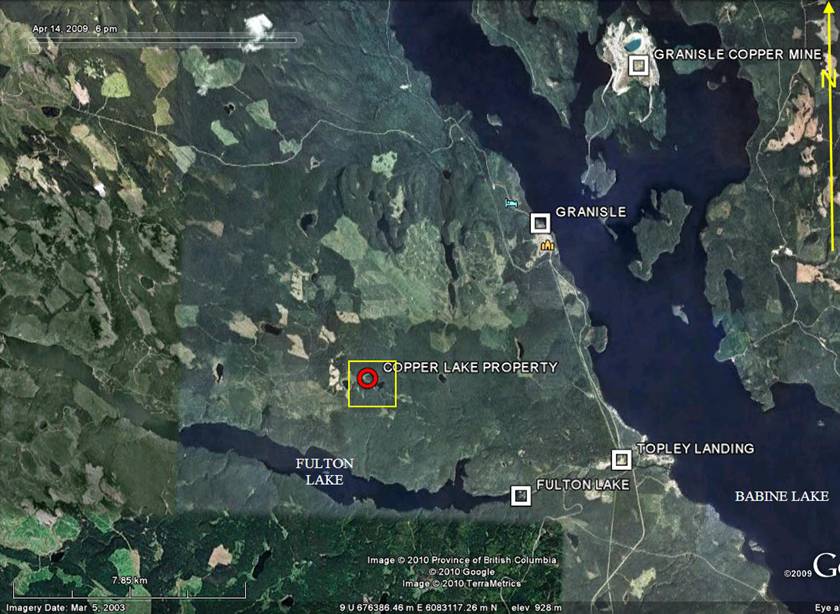

The Copper Lake Property consists of two mineral claims with a total area of approx 2300 acres (931 hectares) and is located near Topley Landing, British Columbia, Canada, about 6 kilometers west of the town site of Granisle and about 12 kilometers southwest of the Granisle Mine itself. Granisle is about 80 kilometers (2 hours) by road from Smithers, British Columbia.

|

Tenure

Number

|

Claim

Name

|

Owner*

|

Map

|

Issue Date

|

Expiry Date

|

Area

(ha)

|

|

775882

|

COPPER LAKE 1

|

121855 (100%)

|

093L

|

2010/may/18

|

2011/may/18

|

465.6774

|

|

779202

|

COPPER LAKE 2

|

121855 (100%)

|

093L

|

2010/may/25

|

2011/may/25

|

465.7196

|

|

2 CLAIMS

|

931.397

|

13

LOCATION MAP OF NORTHERN BC AND BABINE LAKE

14

GOOGLE EARTH IMAGE OF PROPERTY AREA

15

CLAIM MAP

The Copper Lake Property is owned 100% by 121855 BC LTD, (Barry J. Price), who holds record ownership of the mining claim as a Canadian registered free miner. Under the British Columbia Mineral Tenure Act, mining claims may only be transferred to “Free Miners,” who must be Canadian citizens. In the event that the Company decides to exercise its option to acquire the Copper Creek Property, it will also need to form a Canadian subsidiary and have that subsidiary obtain a free miner’s certificate. The current cost of a corporate free miner’s certificate is $510.

Pursuant to the British Columbia Mineral Tenure Act, the claim must be renewed on an annual basis, which requires a filing with British Columbia Mineral Title Online and the performance of assessment work (or payment in lieu thereof) for lode claims of $4.08 per hectare in the first three anniversary years and $8.16 per hectare thereafter and $10.20 per hectare for placer claims. In the event that payment is made in lieu of the performance of assessment work, a submission fee of $0.41 per hectare is also due. If the annual renewal submission and payment is not made by midnight on the expiry date, the claim may be located by another Free Miner on or after 10am the following morning.

16

The Terms of the Option are:

The Optionee shall pay to the Optionor the aggregate sum of Three Thousand Dollars ($3,000) CAD which sum includes the deposit and has been paid on the signing of this agreement, and complete minimum expenditures on the property of at least Three Thousand Dollars ($3,000) CAD by May 18, 2011.

If Hecate has met the terms above in accordance with this agreement, Hecate shall be deemed to have exercised the option and will have acquired an undivided 100% interest in and to the property subject to the royaly interest.

Hecate may elect to purchase from Mr. Price at any time, half the NSR Royalty (being one percent 1%), upon the payment to Mr. Price of One Million Dollars ($1,000,000).

HISTORY

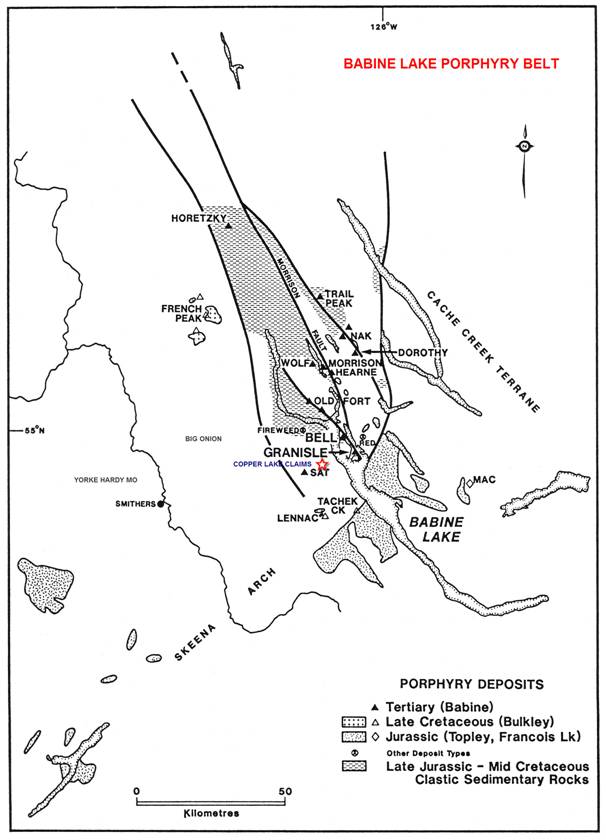

In the 1960’s porphyry copper exploration in the Smithers area led to the discovery of the Bell Copper Mine, developed by Noranda Inc. and the Granisle copper mine near Topley Landing, developed by Granby Mining Ltd. Intense exploration of the area followed the discoveries, and interest remains high in the area long after both mines were depleted. However, significant resources remain at both mines below the existing pits.

During the exploration of the area, several junior mining companies completed exploration on several small properties including the subject claims.

Only limited exploration is known for the subject property mainly that done by Gerry Noel for El Paso Mining in 1970, after claims were staked in 1967, also by El Paso. Minor additional work was done later in the area by Rip Van Mining Co., a junior company.

GENERAL GEOLOGY

The Babine Lake area is underlain by sedimentary and volcanic rocks of the Hazelton group of Triassic - Jurassic age. These rocks include andesite, latite and rhyolite flows and related tuffs and breccias.

On the east side of Babine Lake, at the Granisle Copper mine and on Newman Peninsula, the Hazelton rocks are intruded by small granitic plugs with associated copper mineralization.

The only outcrops seen on the property occur along the south edge of the small lake and include quartz latite porphyry, amygdaloidal andesite and tuff-agglomerate. All of these rocks are considered members of· the Hazelton volcanic group. A few specks of bornite, chalcocite and malachite were seen in the amygdaloidal andesite.

In the area are a variety of small to large mineral deposits, including vein gold-silver deposits, porphyry copper-molybdenum-gold-silver deposits, volcanics red-bed hosted copper silver deposits and coal deposits.

17

The area is host to two major copper gold porphyry deposits, Bell Copper and Granisle, with past production and three unmined mineral deposits, Morrison, Hearne Hill and Big Onion.

GENERAL GEOLOGY

18

MINERAL DEPOSITS IN THE BABINE LAKE AREA

19

MINERAL SHOWINGS

The Copper Lake property is host to two separate copper showings that have been explored in the past:

|

|

1.

|

The “O” showings of disseminated copper in volcanic rocks

|

|

|

2.

|

The “Badge” showing, also of disseminated copper

|

Other showings are held under claim by other companies and individuals in the area.

The Badge showing

The property is located on the north side of Fulton Lake, 7.5 miles west of Topley Landing.

The Badge 1-14 claims were held in 1969 by The Granby Mining Company Limited. Soil geochemical and magnetometer surveys were carried out over the entire property. In 1970 the property was reduced to the Badge 5-12 claims. Diamond drilling was done in 2 holes totaling 749 feet on Badge 5 and 9 claims. The results of drilling were not published and are unknown. It is possible the core may remain on the property. There are no Assessment reports available.

The O Showing (Copper Lake)

Also called Hal and Pas, The claims are underlain by Triassic Takla Group volcanics comprised mainly of augite porphyry flows, breccia and tuff with occurrences of dark grey shale and minor conglomerate. The porphyry flows and tuff host minor occurrences of bornite, chalcocite and malachite. Chalcopyrite occurs in fine epidote filled fractures in the volcanic flows. One main assessment report cover the work done, but the property is mentioned briefly in other reports.

GEOCHEMISTRY

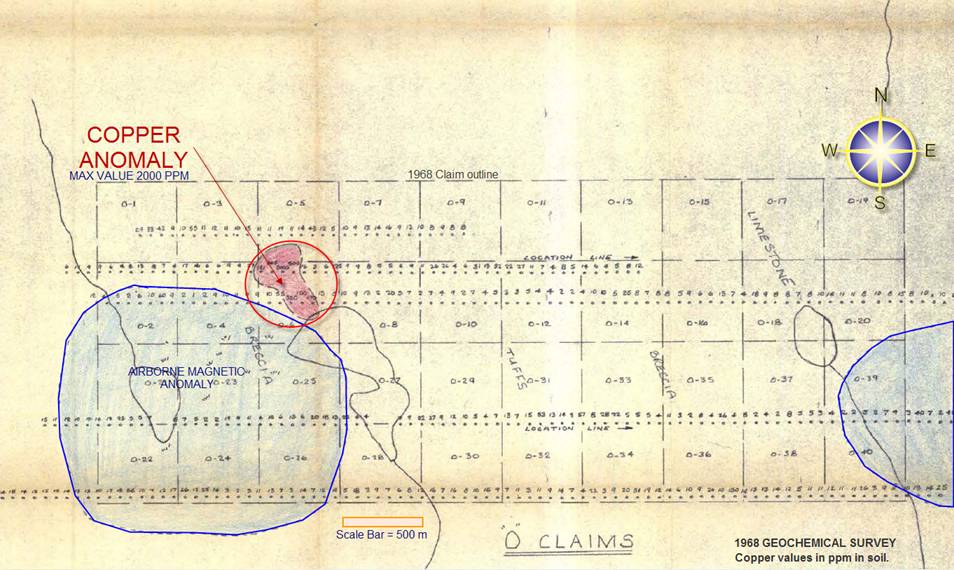

1967-68 Geochemical Surveys

Brief soil sampling surveys were conducted by El Paso Mining in 1967, which results are not public, but the survey lines are shown on the 1970 map. The 1967 survey may have outlined the initial anomaly and a small copper anomaly was found north of the 2 lakes in 1968.

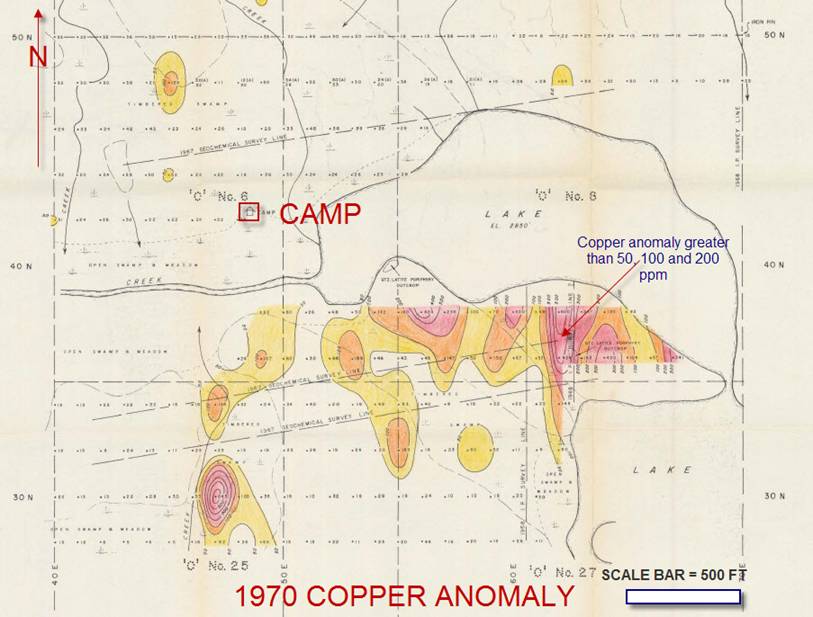

1970 Geochemical Survey

A geochemical soil survey was conducted over the seven "O" Claims held by El Paso Mining and Milling Company from April 29 to May 15, 1970. The claims are underlain by volcanics and pyroclastics of the Hazelton group of Triassic - Jurassic age. One main copper anomaly was outlined.

Copper

The arithmetic mean of all the copper analyses is 39 ppm. From the statistical frequency curve for copper the norm or background value is about 25 ppm. The possibly anomalous "copper" range is taken as two to four times background, or 50 to 100 ppm. "Probably anomalous" values range from four to eight times background, or 100 to 200 ppm. "Definitely anomalous" values are shown as those above 200 ppm copper. The area of "possibly anomalous" copper values in the soil is approximately 2000 feet by 500 feet on the south shore of the small lake.

20

|

COPPER LAKE GEOCHEMICAL LINES

1970

|

||

|

NORTH

|

EAST

|

COPPER PPM

|

|

Strong Anomaly

|

||

|

3800

|

6200

|

600

|

|

3600

|

6200

|

424

|

|

3800

|

5600

|

424

|

|

3600

|

6400

|

400

|

|

3600

|

6700

|

341

|

|

3800

|

6000

|

300

|

|

3800

|

6300

|

242

|

|

3800

|

5700

|

236

|

|

Moderate anomaly

|

||

|

3600

|

5300

|

189

|

|

3600

|

6300

|

183

|

|

3800

|

5500

|

160

|

|

3600

|

5900

|

150

|

|

3600

|

5700

|

147

|

|

3800

|

5400

|

122

|

|

3800

|

6400

|

120

|

|

3600

|

4900

|

107

|

|

3600

|

6500

|

104

|

|

3800

|

5800

|

100

|

|

Background

|

||

|

3800

|

5000

|

80

|

|

3800

|

5900

|

70

|

|

3800

|

6100

|

69

|

|

3600

|

6000

|

67

|

|

3600

|

5200

|

64

|

|

3800

|

4900

|

62

|

|

3600

|

5000

|

60

|

|

3600

|

6600

|

57

|

|

3600

|

6100

|

52

|

|

3600

|

5800

|

50

|

|

3800

|

5200

|

48

|

|

3600

|

5400

|

46

|

|

3600

|

5600

|

46

|

|

3600

|

5500

|

43

|

|

3600

|

5100

|

30

|

|

3800

|

5300

|

30

|

|

3800

|

5100

|

26

|

|

3600

|

4800

|

24

|

|

Mean

|

146

|

|

|

Geometric Mean

|

100

|

|

21

SKETCH OF COPPER GEOCHEM ANOMALIES IN 1968 AND MAGNETIC ANOMALIES

22

1970 COPPER ANOMALY IN SOIL SAMPLES

23

SOIL GEOCHEMICAL PROFILES IN PPM COPPER

24

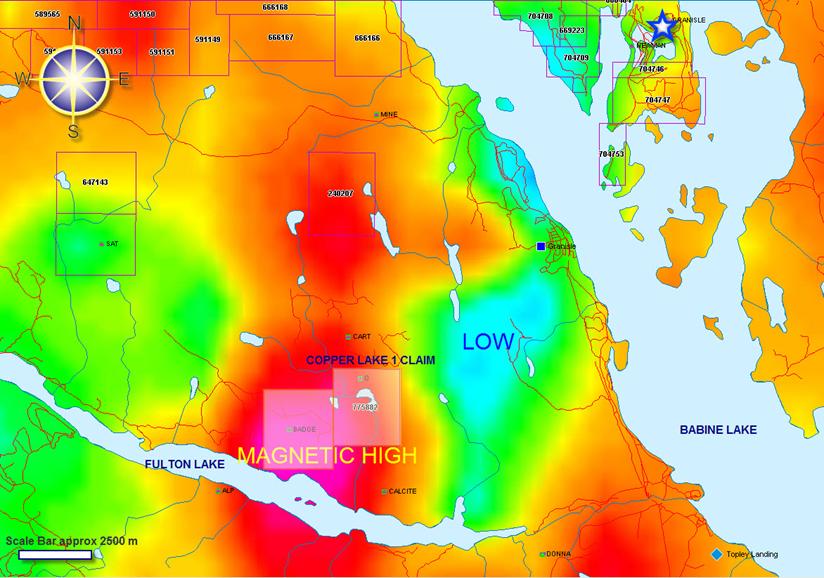

REGIONAL MAGNETIC SURVEY AND COPPER LAKE CLAIMS

25

DISCUSSION

The claims lie within a generally covered area with little outcrop. Two past productive copper –gold porphyries were mined by Noranda Inc. and Granby Mining, and are indicative of the potential for other porphyry copper deposits in the same area. At both the O (Copper Lake) and Badge showings, disseminations of copper occur in volcanics. At the Copper Lake showing, geochemistry has provided a target for further exploration. Little is known at this stage about the Badge copper showing.

Supplies

Supplies and manpower are readily available for exploration of the property.

Other

Other than our interest in the Copper Lake Property, we own no business or other property.

Proposed Budget

Approximate costs for the recommended two phase program are as follows. Amounts payable in Canadian Dollars have been translated to United States Dollars at an exchange rate of USD$1.02 = CAD$1.00:

|

Phase One:

|

||||

|

Prospecting, Mapping and Sampling

|

$ | 8,160.00 | ||

|

Phase Two:

|

||||

|

Magnetometer and IP Surveys, Geological and Geophysical Reports

|

30,600.00 | |||

|

Total Estimated Cost

|

$ | 38,760.00 | ||

26

The laws of British Columbia govern work on the claim. Title to mineral claims are issued and administered by the Land Title Office and any work on the property must comply with all provisions under the Mineral Tenure Act (British Columbia). A mineral claim acquires the right to the minerals, which were available at the time of location and as defined in the Mineral Tenure Act (British Columbia). There are no surface rights included, but the title holder has the right to use the surface of the claim for mining proposes only. All work carried out on a claim that disturbs the surface by mechanical means requires a Notice of Work and must receive written approval from the District Inspector of Mines prior to commencement.

Competitive Factors

The mining industry is fragmented, that is there are many, many mineral prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the property. We will either find copper on the property or not. If we do not, we will cease or suspend operations. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the mining market.

Location, Access, Utilities and Infrastructure

There is no road access to the claims but logging access roads lead to within a kilometer of the property. Other than this normal occurance in exploring mining properties, we do not expect any major challenges in accessing the property during the initial exploration stages. Electric and water service is presently available in Granisle and nearby subdivisions. However, these utilities are not presently available to the Company’s property line. The Company’s initial need for power will be met by diesel generator and water will be hauled by truck from Granisle. Depending on the cost to interconnect with the water company, the Company may decide to attempt to drill its own wells on the property.

Regulations

Our mineral exploration program will comply with the British Columbia Mineral Tenure Act. This act sets forth rules for:

|

*

|

locating claims

|

|

*

|

posting claims

|

|

*

|

working claims

|

|

*

|

reporting work performed

|

We also have to comply with the British Columbia Mineral Exploration Code which tells us how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations.

In order to explore for minerals on our mineral claim we must submit the plan contained in this prospectus for review. We believe that the plan as contained in this prospectus will be accepted and an exploration permit will be issued to our agent or us. The exploration permit is the only permit or license we will need to explore for precious and base minerals on the mineral claim.

We will be required to obtain additional work permits from the British Columbia Ministry of Energy and Mines for any exploration work that result in a physical disturbance to the land. Accordingly, we may be required to obtain a work permit depending on the complexity and affect on the environment if we proceed beyond the exploration work contemplated by our proposed exploration programs. The time required to obtain a work permit is approximately four weeks. We will incur the expense of our consultants to prepare the required submissions to the Ministry of Energy and Mines. We will be required by the Mining Act to undertake remediation work on any work that results in physical disturbance to the land. The cost of remediation work will vary according to the degree of physical disturbance.

We have budgeted for regulatory compliance costs in the proposed exploration program recommended by the summary report. As mentioned above, we will have to sustain the cost of reclamation and environmental remediation for all exploration and other work undertaken. The amount of reclamation and environmental remediation costs are not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended exploration program. Because there is presently no information on the size, tenor, or quality of any mineral resource at this time, it is impossible to assess the impact of any capital expenditures on earnings or our competitive position in the event a potential mineral deposit is discovered.

27

If we enter into substantial exploration, the cost of complying with permit and regulatory environment laws will be greater than in Phases 1 and 2 because the impact on the project area is greater. Permits and regulations will control all aspects of any program if the project continues to that stage because of the potential impact on the environment. We may be required to conduct an environmental review process under the British Columbia Environmental Assessment Act if we determine to proceed with a substantial project. An environmental review is not required under the Environmental Assessment Act to proceed with the recommended Phase 1 or 2 exploration programs on our Copper Lake Property.

Environmental Factors

We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described above. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

Employees

We are a development stage company and we intend to use the services of outside contractors and consultants for exploration work on our property. At present, we have no paid employees.

DESCRIPTION OF PROPERTY - OTHER

Our offices are currently located at 7582 Las Vegas Blvd South, Las Vegas, NV 89123. Our telephone number is 702-516-7156.

LEGAL PROCEEDINGS

We are not a party to any pending litigation and none is contemplated or threatened.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

There is presently no public market for our shares of common stock. We anticipate applying for trading of our common stock on the Over the Counter Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms apart. However, we can provide no assurance that our shares of common stock will be traded on the Bulletin Board or, if traded, that a public market will materialize.

Holders of Our Common Stock

As of the date of this registration statement, we had 37 shareholders of our common stock.

Rule 144 Shares

As of the date of this registration statement, we do not have any shares of our common stock that are currently available for sale to the public in accordance with the volume and trading limitations of Rule 144.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

28

AVAILABLE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the common stock offered hereby. This prospectus, which constitutes part of the registration statement, does not contain all of the information set forth in the registration statement and the exhibits and schedule thereto, certain parts of which are omitted in accordance with the rules and regulations of the SEC. For further information regarding our common stock and our Company, please review the registration statement, including exhibits, schedules and reports filed as a part thereof. Statements in this prospectus as to the contents of any contract or other document filed as an exhibit to the registration statement, set forth the material terms of such contract or other document but are not necessarily complete, and in each instance reference is made to the copy of such document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

We will also be subject to the informational requirements of the Exchange Act which requires us to file reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information along with the registration statement, including the exhibits and schedules thereto, may be inspected at public reference facilities of the SEC at 100 F Street N.E , Washington D.C. 20549. Copies of such material can be obtained from the Public Reference Section of the SEC at prescribed rates. You may call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because we file documents electronically with the SEC, you may also obtain this information by visiting the SEC’s Internet website at http://www.sec.gov .

29

Index to Financial Statements

Hecate Exploration

(A Exploration Stage Company)

1. Audited financial statements for the period from March 1, 2010 (inception) to December 31, 2010:

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

Balance Sheet as of December 31, 2010

|

F-2

|

|

Statement of Operations for the period from March 1, 2010 (inception) to December 31, 2010

|

F-3

|

|

Statement of Changes in Stockholders’ Equity for the period from March 1, 2010 (inception) to

|

|

|

December 31, 2010

|

F-4

|

|

Statement of Cash Flows for the period from March 1, 2010 (inception) to December 31, 2010

|

F-5

|

|

Notes to Financial Statements

|

F-6

|

2. Unaudited financial statements for the period from March 1, 2010 (inception) to June 30, 2011:

|

Balance Sheet as of June 30, 2011

|

F-10

|

|

Statement of Operations for the period from March 1, 2010 (inception) to June 30, 2011

|

F-11

|

|

Statement of Changes in Stockholders’ Equity for the period from March 1, 2010 (inception) to

|

|

|

June 30, 2011

|

F-12

|

|

Statement of Cash Flows for the period from March 1, 2010 (inception) to June 30, 2011

|

F-13

|

|

Notes to Financial Statements

|

F-14

|

30

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Hecate Exploration,

We have audited the accompanying balance sheets of Hecate Exploration, (A Exploration Stage Company) as of December, 2010 and the related statements of operations, stockholders’ equity, and cash flows from inception (March 01, 2010) to December 31, 2010. Hecate Exploration, management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over the financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Hecate Exploration. (A Exploration Stage Company) as of December 31, 2010 , and the results of its operations and its cash flows from inception (March 01, 2010) to December 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has suffered recurring losses from operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

De Joya Griffith & Company, LLC

/s/ De Joya Griffith & Company, LLC

Henderson, Nevada

May 11, 2011

F-1

|

Hecate Exploration

|

||||

|

(An Exploration Stage Company)

|

||||

|

Balance Sheet

|

||||

|

December 31, 2010

|

||||

|

Assets

|

||||

|

Current assets

|

||||

|

Cash

|

$ | 985 | ||

|

Deferred offering costs

|

90,000 | |||

|

Deposits

|

2,892 | |||

|

Total current assets

|

93,877 | |||

|

Total assets

|

$ | 93,877 | ||

|

Liabilities and Stockholders' Equity

|

||||

|

Current liabilities

|

||||

|

Accounts payable and accrued liabilities

|

$ | 985 | ||

|

Total current liabilities

|

985 | |||

|

Total liabilities

|

985 | |||

|

Stockholders' equity

|

||||

|

Common stock; $0.001 par value; 75,000,000 shares

|

||||

|

authorized, 19,000,000 shares issued and outstanding

|

19,000 | |||

|

Additional paid-in capital

|

81,000 | |||

|

Subscriptions receivable

|

(6,108 | ) | ||

|

Accumulated deficit during the development stage

|

(1,000 | ) | ||

|

Total stockholders' equity

|

92,892 | |||

|

Total liabilities and stockholders' equity

|

$ | 93,877 | ||

The accompanying notes are an integral part of these financial statements.

F-2

|

Hecate Exploration

|

||||

|

(An Exploration Stage Company)

|

||||

|

Statement of Operations

|

||||

|

For the Period from

|

||||

|

March 1, 2010 (inception) to

|

||||

|

December 31, 2010

|

||||

|

Expenses

|

||||

|

General and administrative

|

$ | 1,000 | ||

|

Total expenses

|

1,000 | |||

|

Net loss

|

$ | (1,000 | ) | |

|

Net loss per common share - basic

|

$ | (0.00 | ) | |

|

Weighted average common

|

||||

|

shares outstanding - basic

|

4,711,475 | |||

The accompanying notes are an integral part of these financial statements.

F-3

|

Hecate Exploration

|

||||||||||||||||||||||||

|

(An Exploration Stage Company)

|

||||||||||||||||||||||||

|

Statement of Stockholders' Equity

|

||||||||||||||||||||||||

| From March 1, 2010 (inception) to December 31, 2010 | ||||||||||||||||||||||||

|

|

Stock

|

Total

|

||||||||||||||||||||||

|

Common Stock

|

Additional

|

Subscription

|

Accumulated

|

Stockholders'

|

||||||||||||||||||||

|

Shares

|

Amount

|

Paid-in Capital

|

Receivable

|

Deficit

|

Equity

|

|||||||||||||||||||

|

Balance, March 1, 2010 (Inception)

|

- | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||

|

Issuance of stock to founders for cash

|

||||||||||||||||||||||||

|

$0.001 per share

|

10,000,000 | 10,000 | - | (6,108 | ) | - | 3,892 | |||||||||||||||||

|

Issuance of stock pursuant to private placement

|

||||||||||||||||||||||||

|

$0.01 per share

|

9,000,000 | 9,000 | 81,000 | - | - | 90,000 | ||||||||||||||||||

|

Net loss for the year ended December 31, 2010

|

- | - | - | - | (1,000 | ) | (1,000 | ) | ||||||||||||||||

|

Balance, December 31, 2010

|

19,000,000 | $ | 19,000 | $ | 81,000 | $ | (6,108 | ) | $ | (1,000 | ) | $ | 92,892 | |||||||||||

The accompanying notes are an integral part of these financial statements.

F-4

|

Hecate Exploration

|

||||

|

(An Exploration Stage Company)

|

||||

|

Statement of Cash Flows

|

||||

|

For the Period from

|

||||

|

March 1, 2010 (inception) to

|

||||

|

December 31, 2010

|

||||

|

Cash flows from operating activities:

|

||||

|

Net loss

|

$ | (1,000 | ) | |

|

Changes in operating assets and liabilities:

|

||||

|

Deferred offering costs

|

(90,000 | ) | ||

|

Accounts payable and accrued liabilities

|

985 | |||

|

Net cash used by operating activities

|

(90,015 | ) | ||

|

Cash flows from investing activities:

|

||||

|

Deposits

|

(2,892 | ) | ||

|

Net cash used by investing activities

|

(2,892 | ) | ||

|

Cash flows from financing activities:

|

||||

|

Proceeds from sale of common stock

|

93,892 | |||

|

Net cash provided by financing activities

|

93,892 | |||

|

Net change in cash

|

985 | |||

|

Cash, beginning of period

|

- | |||

|

Cash, end of period

|

$ | 985 | ||

|

Supplemental disclosure of cash flow information:

|

||||

|

Interest paid

|

$ | - | ||

|

Taxes paid

|

$ | - | ||

The accompanying notes are an integral part of these financial statements.

F-5

Hecate Exploration

(An Exploration Stage Company)

Notes to Financial Statements

December 30, 2010

1. DESCRIPTION OF BUSINESS

Hecate Exploration (the “Company”) was incorporated in the state of Nevada on March 1, 2010. The Company has exercised an exclusive option becoming the beneficial owner of an undivided 100% interest in a group of mineral claims known as the Copper Lake Claims in the Omineca Mining District of British Columbia, Canada. The Company intends to conduct mineral exploration on the optioned mining claims in an effort to find economically developable deposits of precious metals.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting - The basis is United States generally accepted accounting principles.

Year-End - The Company has selected December 31 as its year-end.

Exploration Stage Company - The Company’s financial statements are presented as a company in the exploration stage of business. Activities during the exploration stage primarily include implementation of the business plan and obtaining debt and/or equity related financing. The Company has not commenced significant operations and, in accordance with ASC Topic 915, the Company is considered an exploration stage company.

Use of Estimates - The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents - Cash and cash equivalents consist primarily of cash on deposit, certificates of deposit, money market accounts, and investment grade commercial paper that are readily convertible into cash and purchased with original maturities of three months or less.

Prepaid Expenses - The Company prepaid its legal fees with regards to the preparation and filing of its Registration Statement on Form S-1.

Revenue Recognition Policy - We recognize revenue when all of the following conditions are satisfied: (1) there is persuasive evidence of an arrangement; (2) the product or service has been provided to the customer; (3) the amount of fees to be paid by the customer is fixed or determinable; and (4) the collection of our fees is probable.

The Company did not realize any revenues from inception on March 1, 2010 till December 31, 2010.

Dividends - The Company has not yet adopted any policy regarding payment of dividends. No dividends have been paid during the period shown.

Income Taxes - The Company accounts for its income taxes in accordance with FASB ASC 740, which requires recognition of deferred tax assets and liabilities for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in operations in the period that includes the enactment date.

F-6

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial statement purposes and the amounts used for income tax purposes.

Fair Value of Financial Instruments - FASB ASC 825, “Disclosure About Fair Value of Financial Instruments,” requires the Company to disclose, when reasonably attainable, the fair market values of its assets and liabilities which are deemed to be financial instruments. As of December 31, 2010 the carrying amounts and estimated fair values of the Company’s financial instruments approximate their fair value due to the short-term nature of such financial instruments.