Attached files

| file | filename |

|---|---|

| 8-K - GENERAC HOLDINGS INC 8-K 10-3-2011 - GENERAC HOLDINGS INC. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - GENERAC HOLDINGS INC. | ex99_1.htm |

1

Acquisition of Magnum Products

Conference Call

Aaron Jagdfeld

President & Chief Executive Officer

York Ragen

Chief Financial Officer

October 4, 2011

2

Forward Looking Statements

Certain statements contained in this presentation, as well as other information provided from time to time by Generac

Holdings Inc. or its employees, may contain forward-looking statements that involve risks and uncertainties that could

cause actual results to differ materially from those in the forward-looking statements.

Holdings Inc. or its employees, may contain forward-looking statements that involve risks and uncertainties that could

cause actual results to differ materially from those in the forward-looking statements.

Forward-looking statements give Generac’s current expectations and projections relating to the Company’s financial

condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking

statements by the fact that they do not relate strictly to historical or current facts. These statements may include words

such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “confident,” “may,” “should,” “can have,”

“likely,” “future” and other words and terms of similar meaning in connection with any discussion of the timing or nature

of future operating or financial performance or other events.

condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking

statements by the fact that they do not relate strictly to historical or current facts. These statements may include words

such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “confident,” “may,” “should,” “can have,”

“likely,” “future” and other words and terms of similar meaning in connection with any discussion of the timing or nature

of future operating or financial performance or other events.

Any such forward-looking statements are not guarantees of performance or results, and involve risks, uncertainties

(some of which are beyond the Company’s control) and assumptions. Although Generac believes any forward-looking

statements are based on reasonable assumptions, you should be aware that many factors could affect Generac’s

actual financial results and cause them to differ materially from those anticipated in any forward-looking statements,

including: demand for Generac products; frequency of major power outages; availability of raw materials and key

components used in producing Generac products; the possibility that the expected synergies, efficiencies and cost

savings of the acquisition of the Magnum Products business will not be realized, or will not be realized within the

expected time period; the risk that the Magnum Products business will not be integrated successfully; competitive

factors in the industry in which Generac operates; Generac’s dependence on the Company’s distribution network;

Generac’s ability to invest in, develop or adapt to changing technologies and manufacturing techniques; Generac’s

ability to adjust to operating as a public company; loss of key management and employees; increase in liability claims;

and changes in environmental, health and safety laws and regulations.

(some of which are beyond the Company’s control) and assumptions. Although Generac believes any forward-looking

statements are based on reasonable assumptions, you should be aware that many factors could affect Generac’s

actual financial results and cause them to differ materially from those anticipated in any forward-looking statements,

including: demand for Generac products; frequency of major power outages; availability of raw materials and key

components used in producing Generac products; the possibility that the expected synergies, efficiencies and cost

savings of the acquisition of the Magnum Products business will not be realized, or will not be realized within the

expected time period; the risk that the Magnum Products business will not be integrated successfully; competitive

factors in the industry in which Generac operates; Generac’s dependence on the Company’s distribution network;

Generac’s ability to invest in, develop or adapt to changing technologies and manufacturing techniques; Generac’s

ability to adjust to operating as a public company; loss of key management and employees; increase in liability claims;

and changes in environmental, health and safety laws and regulations.

Should one or more of these risks or uncertainties materialize, Generac’s actual results may vary in material respects

from those projected in any forward-looking statements. A detailed discussion of these and other factors that may affect

future results is contained in Generac’s filings with the Securities and Exchange Commission. Any forward-looking

statement made by Generac in this presentation speaks only as of the date on which it is made. Generac undertakes

no obligation to update any forward-looking statement, whether as a result of new information, future developments or

otherwise, except as may be required by law.

from those projected in any forward-looking statements. A detailed discussion of these and other factors that may affect

future results is contained in Generac’s filings with the Securities and Exchange Commission. Any forward-looking

statement made by Generac in this presentation speaks only as of the date on which it is made. Generac undertakes

no obligation to update any forward-looking statement, whether as a result of new information, future developments or

otherwise, except as may be required by law.

3

Magnum Business Overview

Magnum MMG55FH Flip Hood 52 kW

Mobile Diesel Generator

Mobile Diesel Generator

Magnum MMG55 49 kW Mobile

Diesel Generator

Diesel Generator

Magnum MLG20 Diesel Generator

MTP 4000D Dry Prime Pump

Magnum Family of Light Towers

4

Access to Incremental Distribution and End Markets

5

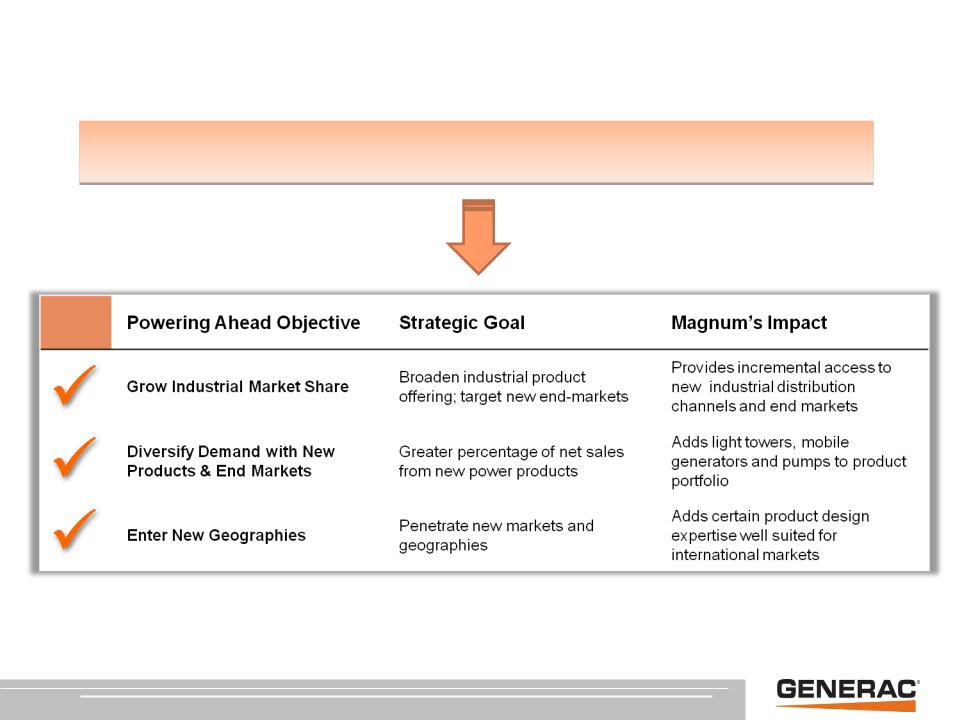

Supporting the “Powering Ahead” Strategy

Acquisition of Magnum Products supports three of the four key objectives

from our “Powering Ahead” strategic plan

from our “Powering Ahead” strategic plan

6

Strategic Rationale for Acquiring Magnum

§ Broadens Generac’s Industrial product offering and strengthens

position in power equipment markets

position in power equipment markets

– Incremental product offering for Generac’s distribution

§ Adds new sales channels and end markets including industrial

rental yards, road and commercial construction, energy, and

government / military end markets (GSA)

rental yards, road and commercial construction, energy, and

government / military end markets (GSA)

§ Leverages Generac’s global sourcing & vertical manufacturing

capabilities

capabilities

§ Adds “prime” equipment expertise - design, manufacture & service

– Supports potential domestic & international growth in non-standby

applications

applications

§ Attractive ROI and strong utilization of current cash position

7

Balances Sales Mix between Residential and C&I

Generac Sales by Product Class

Generac (Stand Alone) LTM 6/30/11

Pro Forma LTM 6/30/11

8

Integration & Key Opportunities

§ Magnum will continue to operate its existing manufacturing facility in Berlin, Wisconsin

§ Will maintain Magnum’s brands and sales force given company’s strong reputation in its markets

§ Experienced integration team consisting of members of both companies created and focused on

execution of detailed integration plan for first twelve months

execution of detailed integration plan for first twelve months

INTEGRATION

OPPORTUNITIES

§ Revenue synergies as a result of significant opportunities to leverage each companies’ respective

sales channels and cross-sell products

sales channels and cross-sell products

§ Cost synergies will be phased in beginning in fiscal 2012 with future cost synergies expected to be

approximately $2 million annually on a run-rate basis, starting 2013

approximately $2 million annually on a run-rate basis, starting 2013

– Primarily based on material synergies from leveraging Generac’s global supply chain and vertical

manufacturing capabilities

manufacturing capabilities

– Overlap of major cost components between Magnum and Generac industrial products

9

Transaction Overview

§ Approximately $80 million; subject to customary, post-close working capital

adjustment

adjustment

§ Modest earn-out based on future performance of a certain product line

currently in development

currently in development

TRANSACTION VALUE

FINANCING

STRUCTURE

§ Cash on hand

§ Transaction structured as an asset purchase

§ Expected to create additional tax shield

10

Financial Impact

11

Non-GAAP Financial Measures

Adjusted EBITDA

The computation of Adjusted EBITDA is based on the definition of EBITDA contained in Generac's credit

agreement, dated as of November 10, 2006. Included in Generac’s earnings releases, to supplement the

Company's financial results presented in accordance with US GAAP, Generac provides a reconciliation

to show the computation of Adjusted EBITDA, taking into account certain charges and gains that were

taken during the periods presented. Transaction costs, amortization of definite-lived intangible assets

and the write-up of inventory basis all related to the Magnum Products transaction will be included in the

Adjusted EBITDA reconciliation and added back for Adjusted EBITDA purposes.

agreement, dated as of November 10, 2006. Included in Generac’s earnings releases, to supplement the

Company's financial results presented in accordance with US GAAP, Generac provides a reconciliation

to show the computation of Adjusted EBITDA, taking into account certain charges and gains that were

taken during the periods presented. Transaction costs, amortization of definite-lived intangible assets

and the write-up of inventory basis all related to the Magnum Products transaction will be included in the

Adjusted EBITDA reconciliation and added back for Adjusted EBITDA purposes.

Adjusted Earnings Per Share

To further supplement Generac's financial results presented in accordance with US GAAP, the Company

provides a reconciliation to show the computation of Adjusted Net Income and Adjusted Earnings Per

Share in its earnings releases. Adjusted net income is defined as Net income before provision (benefit)

for income taxes adjusted for the following items: cash income tax (expense) benefit, amortization of

intangible assets, amortization of deferred loan costs related to the Company's debt, intangible

impairment charges, and certain non-cash gains. Transaction costs, amortization of definite-lived

intangible assets and the write-up of inventory basis all related to the Magnum Products transaction will

be included in the Adjusted Net Income reconciliation and added back for Adjusted Net Income purposes.

provides a reconciliation to show the computation of Adjusted Net Income and Adjusted Earnings Per

Share in its earnings releases. Adjusted net income is defined as Net income before provision (benefit)

for income taxes adjusted for the following items: cash income tax (expense) benefit, amortization of

intangible assets, amortization of deferred loan costs related to the Company's debt, intangible

impairment charges, and certain non-cash gains. Transaction costs, amortization of definite-lived

intangible assets and the write-up of inventory basis all related to the Magnum Products transaction will

be included in the Adjusted Net Income reconciliation and added back for Adjusted Net Income purposes.