Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Blox, Inc. | exhibit32-1.htm |

| EX-31.1 - CERTIFICATION - Blox, Inc. | exhibit31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Blox, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________________ to ______________________________.

Commission File Number: 000-53565

NAVA RESOURCES, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation or organization) |

20-8530914

(IRS Employer Identification No.) |

Suite 303 - 11861 88th Avenue

Delta,

B.C., Canada V4C 3C7

(Address of principal executive offices, zip code)

778-218-9638

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the past 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of December 31, 2010 was $367,800.

The number of shares outstanding of the registrant’s common stock as of September 12, 2011 was 12,338,604.

Documents Incorporated By Reference: None

2

TABLE OF CONTENTS

Page

3

PART I.

As used in this Form 10-K, references to the “Company,” the “Registrant,” “we,” “our” or “us” refer to Nava Resources, Inc. unless the context otherwise indicates.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of the Company and other matters. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information in order to encourage companies to provide prospective information about themselves without fear of litigation, so long as that information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission by the Company. You can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. Except as otherwise required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

- strategies, outlook and growth prospects;

- future plans and potential for future growth;

- liquidity, capital resources and capital expenditures;

- growth in demand for our products;

- economic outlook and industry trends;

- developments of our markets;

- the impact of regulatory initiatives; and

- the strength of our competitors

4

Item 1. Business

We are an exploration stage company formed for the purposes of acquiring, exploring and, if warranted and feasible, developing natural resource properties.

Organization

On July 21, 2005, the Company was incorporated under the laws of the State of Nevada for the purpose of conducting mineral exploration activities. We were authorized to issue 400,000,000 shares of common stock, par value $.001 per share, and initially issued 100,000 shares of common stock to each of Jag Sandhu, our President, Chief Executive Officer and a director, and Johnny Astorino, our Chief Financial Officer. Said issuances were paid at a purchase price of the par value per share. Our wholly owned subsidiary, Nava Resources Canada Inc. (“Nava Canada”), was organized under the Federal laws of Canada on August 9, 2005.

On January 4, 2007, the Company obtained written consent from the shareholders to amend our Articles of Incorporation to change the par value of our common stock from $0.001 to $0.00001 per share. On February 28, 2007, the Board of Directors of the Company amended the Articles of Incorporation changing the par value of the Company’s common stock.

In March 2007 we issued 19,900,000 shares to each of Messrs. Sandhu and Astorino in consideration for the payment of par value per share. Mr. Astorino subsequently returned 18,000,000 shares to the Company’s treasury for cancellation.

On March 20, 2007, we accepted subscriptions for 874,104 shares of our common stock from 37 investors. The shares of common stock were sold at a purchase price of $0.15 per share, amounting in the aggregate to $131,116. The offering was made to non-U.S. persons in offshore transactions pursuant to the exemption from registration provided by Regulation S of the Securities Act of 1933, as amended (the “Securities Act”).

On April 18, 2007, Mr. Sandhu returned an aggregate of 10,000,000 shares and Mr. Astorino returned an aggregate of 1,000,000 shares of common stock to the Company’s treasury for cancellation.

On June 1, 2007, we accepted subscriptions for 352,000 units from 10 investors. The units were sold at a purchase price of $0.16 per unit, amounting in the aggregate to $56,320. Each unit was comprised of one share of our common stock and one warrant. Each warrant entitles the warrant holder to purchase one share of common stock at an exercise price of $0.20 per share. Each warrant expires on June 1, 2009. The offering was made to non-U.S. persons in offshore transactions pursuant to the exemption from registration provided by Regulation S of the Securities Act.

Exploratory Activities

In July 2005 we commenced our mineral exploration activities. On October 10, 2006, the Company entered into an agreement with Jag Sandhu, our President, Chief Executive Officer and Director, pursuant to which the Company obtained an option to acquire a 100% interest in and to the mineral claim located in Lillooett Mining Division called the Noel Creek Claim. On October 2, 2007, the option expired due to the Company not making the required payments as per the option agreement.

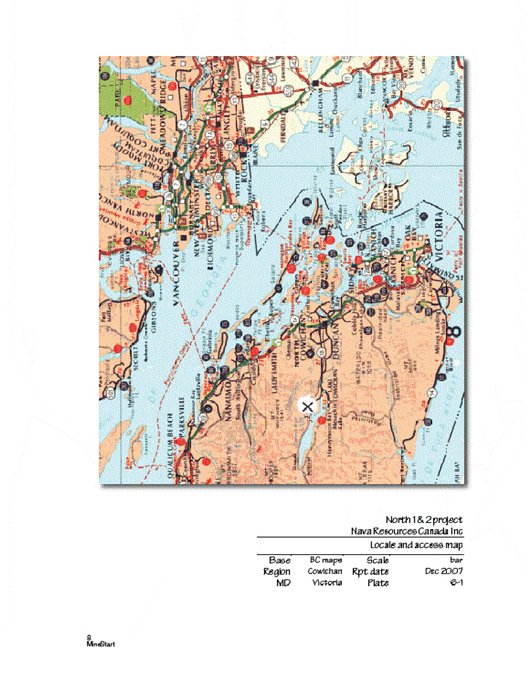

On August 28, 2007, Mr. Jag Sandhu, our President and Chief Executive Officer and a director, acquired two claims for a 637.39 hectare (approximately 1575.03 acres) mineral concession on Vancouver Island, in the Province of British Columbia, Canada through British Columbia’s online staking service. These mineral claims are known as the North 1 and North 2 Claims. On November 22, 2007, Mr. Sandhu transferred the claims to Nava Canada using British Columbia’s Mineral Title Online web site. We intend to conduct exploratory activities with respect to the claims, and if viable mineral deposits are discovered, develop and extract such minerals. In addition, as funding permits, we may acquire additional properties of interest and either abandon our existing properties or enter into agreements to sell all or a portion of those properties.

5

In October 2007, we engaged a professional mining engineering service and consulting firm, MineStart Management Inc. (“MineStart”), to review the geologic premise and information upon which the claim was staked, and to provide a technical report as to its merit as an exploration prospect, including recommendations on appropriate next steps. The report on the claims, entitled “North 1 and 2 Project – A VMS Investigation” and dated December 7, 2007, describes the mineral claim (tenures, location and access) and the regional, local and property geology. It also includes relevant information on targeted deposit types and mineralization, and recommendations with associated budgets, regarding the initial strategy that should be followed in exploring the claim.

We performed an exploration program on the North 1 and North 2 Claims in August 2008. This program involved a review of property geology based on government compilations, acquisition of relevant air photo coverage and a visit to the property by Jag Sandhu and Don Blackadar. The purpose of this visit was to become familiar with the general layout of the property and related road access, and to prospect and collect rock samples in readily accessible areas. Work was concentrated in the South West corner of the North 2 claim which was accessible just off of the highway, with foot access via an overgrown secondary road leading into the claim.

The North Claim is primarily underlain by felsic to intermediate volcanic and volcaniclastic rocks of the middle to upper Devonian Sicker Group (McLaughlin Ridge Formation), which is prospective for Kuroko-type massive sulphide deposits rich in copper, lead, zinc, gold and silver. Outcrop exposure in the area prospected was minimal due to overburden cover of bolder till with hardpan noted in some rock cuts. A total of 30 rock samples were taken for multi-element geochemical analysis. These samples were primarily float but several samples may have been from small outcrops visible in the road cut. All samples were of intermediate composition (andesite), ranging from fine to medium grained, and relatively massive in texture (weekly foliated in some cases), possibly representing intermediate tuffs with some intrusive equivalents. Samples were sent to Acme Labs in Vancouver, crushed to 200 mesh, and processed by Aqua Regia digestion CCP-MS analysis. Gold was also determined by fire assay fusion by ICP-ES. No significant anomalies were identified in the pathfinder suite. However, the first three samples demonstrate a weakly anomalous Cu-Pb-Zn-Ag-As-Ba signature, which may be of interest.

On October 24, 2010 we allowed our North claim to expire in order to concentrate on our Molly1 claim.

The Molly1 claim was staked by Nava Resources Canada Ltd. on October 20, 2010. The claim comprises 20 contiguous units totaling 424.96 hectares.

The claim is located in the Cowichan Lake area, Vancouver Island, British Columbia, about 30 kilometers west of the city of Duncan and about 5 kilometers northwest of the town of Lake Cowichan. It is accessible via the Meade Lake forestry road from Highway 18, which extends along the north shore of Lake Cowichan from Duncan. The claim is about four kms east and along geologic strike from the North claim.

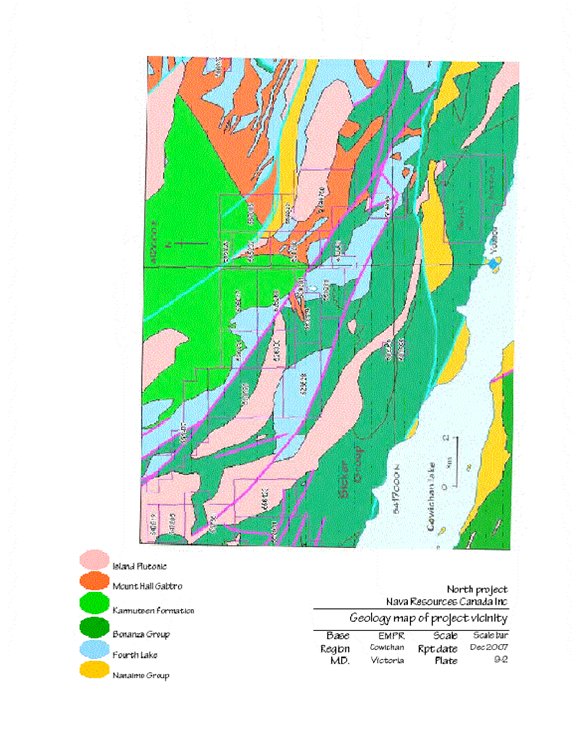

Molly1 is underlain by the McLaughlin Ridge Formation, which is the uppermost member of the Devonian Age Sicker Group. The Sicker assemblage comprises three successive volcanic formations that are believed to represent an oceanic magmatic arc. The lower two members consist predominantly of mafic volcanics. Rocks of the McLaughlin Ridge Formation are more felsic in composition, with some intermediate assemblages and are thought to represent a more advanced stage of arc development. These rocks are related to major magmatic / volcanic centers, one of which is located in the Duncan / Saltspring Island area. The Sicker Group is exposed in four major structural uplifts in the south half of Vancouver Island: 1) the Buttle Lake Uplift west of Courtenay, 2) the Bedingfield Uplift near Tofino, 3) the Nanoose Uplift north of Nanaimo, and 4) the Cowichan Lake Uplift, substantially the largest of the four, which extends in and arcuate belt between Saltspring Island and Port Alberni, a distance of over 100 km.

The Sicker Group is considered to be highly prospective for Volcanogenic Massive Sulphide (VMS) deposits. Definite or potential VMS deposits have been identified within three of the four structural uplifts. Most known occurrences are Kuroko type deposits, which are rich in copper, lead and zinc, with important amounts of gold and silver. These deposits are hosted by felsic volcanic or volcaniclastic rocks of the McLaughlin Ridge Formation or its equivalent, the Myra Formation in the Buttle Lake area. Important Kuroko-type deposits include the Myra Falls mine in the Buttle Lake Uplift, and several deposits (e.g. Mount Sicker, Lara) at the southest end of the Cowichan Lake Uplift near Crofton (northeast of Molly1).

The Myra Falls deposit, located at the southeast end of Buttle Lake, has been in production since 1966. To the end of 2005, the deposit yielded 24 million Tonnes grading 1.8% copper, 5.0% zinc, 2 g/T gold and 52 g/T silver. Mineral reserves at December 31, 2009 were 18.5 million Tonnes grading 6.7% zinc. Deposits in the Crofton area are proximal to a major felsic volcanic center. The Mount Sicker deposits (Tyee, Lenora and Richard III) were mined from 1898 to 1909 and again between 1942 and 1952 as the Twin J. The Lara deposit, discovered in the mid-1980s, remains sub-economic, but has significant demonstrated potential (drill indicated resource of 528,839 Tonnes grading 1.01% copper, 1.22% lead, 5.87% zinc, 100.09 g/T silver and 4.74 g/T gold).

6

Molly1 lies in a panel of Sicker Group rocks, which is parallel to but separate from the assemblage that contains the Sicker and Lara deposits. While no VMS deposits have been discovered in this panel in the Cowichan Lake area and vicinity of the claim, the area is dominated by Sicker volcanics and contains a significant number of documented mineral showings. Many of these showings are in structurally-controlled epigenetic vein systems and some include significant gold and silver values. Significantly, in terms of VMS potential, some showings have a polymetallic signature that is representative of Kuroko-type deposits.

McLaughlin Ridge rocks in the Cowichan Lake area are described on government geological maps as thickly-bedded tuffite and lithic tuffite, feldspar-crystal tuff, lapilli tuff, rhyolite, dacite, laminated tuff and chert. On the Molly1 claim, the assemblage is well-exposed in a logging road cut over a distance of about 1 km. This assemblage consists predominantly of bedded tuffites, which are locally siliceous and cherty. A total of 46 grab samples have been taken across strike in this area and will be analyzed geochemically for a multi-element suite (37 elements) in order to accrue a foundation of geochemical data, and to test for the presence of copper, lead, zinc, silver, gold, barium and arsenic values which are potential indications of Kuroko-type environments.

Nava continued with its program of prospecting and lithogeochemical sampling of Sicker Group rocks in the Lake Cowichan area, Vancouver Island. The Sicker Group is prospective for polymetallic ‘Kuroko-type’ massive sulphide deposits rich in copper, lead, zinc, silver and gold and is exposed in a number of structural uplifts on Vancouver Island. Two of these uplifts host economically significant Kuroko deposits, including the Myra Falls mine in the Buttle Lake Uplift, and the Mount Sicker (intermittent producer up to 1952) and Lara deposits in the Cowichan Lake Uplift.

Nava’s exploration is focused in the southeast end of the Cowichan Lake uplift, which extends in an arcuate, northwest-trending belt over approximately 100 km between Saltspring Island (in the southeast) and Horne Lake in the north.

The Molly1 claim, comprising 20 units (424.96 hectares) was staked in October 2010 to cover outcroppings of the prospective McLaughlin Ridge formation (within the Sicker), approximately 4.5 kilometers along geological strike to the east of the North claim, which was prospected by Nava in 2008; this claim was allowed to lapse in 2010. The Molly1 claim is bounded to the east by the Meade Creek valley, and is accessible via logging roads extending north from the main highway along the steep western slope of the valley.

Exploration on Molly1 during 2010 comprised reconnaissance traverse of roads in the area in late October 2010. Outcroppings of Sicker Group and other rocks are exposed in road cuts over a distance of perhaps 2 kilometers along the main access road. The McLaughlin Ridge Formation is well exposed over a distance of about one kilometer in this area and comprises a relatively uniform section of steeply dipping, banded, medium grey fine grained tuffites and cherty tuffites with occasional quartz veining and local finely disseminated pyrite. Exposures of siltstone and grit representing the much younger Nanaimo Group (Benson Formation) occur at the north end of this section, which is bounded to the south by outcroppings of the Mount Hall Gabbro and intermediate intrusive rocks of the Nitnat Formation.

This section of rocks was prospected over a distance of about one kilometer within the claim boundary, focusing on the McLaughlin Ridge Formation. No visible mineralization, other than occasional minor disseminated pyrite was noted. A total of 46 grab samples were taken at intervals across the section and sent for multi-element geochemical analysis (36 element suite), which included the Kuroko indicator elements copper, lead, zinc, silver, gold, barium, and arsenic. No significant anomalies were indicated in this analysis, though three samples (tuffite) demonstrated weakly anomalous barium concentrations.

History and Geological Setting

Vancouver Island is dominated by rocks of the Wrangellia Terrane, which is interpreted to represent a Paleozoic Island Arc assemblage, accreted to the North American content about 100 million years ago. Mid-Devonian volcanic rocks of the Sicker Group, representing the basement of this complex, are the oldest rocks on Vancouver Island and are exposed in four major structural uplifts – Buttle Lake, Beddington, Nanoose, and Cowichan Lake. The Molly1 Claim lies toward the southeast end of the Cowichan Lake Uplift, along the north shore of the east end of Cowichan Lake. In the Cowichan Lake Uplift, the Sicker comprises three distinct volcanic / volcaniclastic assemblages – the Duck Lake Formation as the oldest member and overlain by the Nitnat Formation, which in turn is overlain, possibly unconformably, by the McLaughlin Ridge Formation.

7

Volcanic rocks of the Sicker Group are highly prospective for economically viable volcanogenic massive sulphide (VMS) deposits, which are the primary exploration target on the Molly1 Claim. As a group, these deposits are rich in copper and zinc and also carry significant gold and silver values.

The most significant mineral deposit in the Sicker Group is the Myra Falls mine, a world class deposit located in the Buttle Lake Uplift. Other significant deposits, notably the Lara and Mount Sicker deposits, are located in the southeast part of the Cowichan Lake uplift, several kilometers northeast of the Molly1 Claim and separated from the property by a major geologic fault.

Massive sulphide mineralization was first discovered in the Sicker Group with the Mount Sicker discoveries in the late 1800s. Production was from one main ore body via three separate underground mines (Tyee, Lenora and Richard III), which operated for several years. These mines were subsequently amalgamated and re-operated as the Twin J mine from 1942 to 1952. Production from the Tyee mine (1901 – 09) totaled 5,840,593 kilograms copper and 13,725,069 grams silver, and 762,553 grams gold from 152,668 tonnes mined. The Buttle Lake mine, which has been in operation since 1966, currently produces approximately 1 millioncqui of ore per year. Over the 39 years to 2005, the mine yielded 24 million cqui with an average grade of 1.8% copper, 5.0% zinc, 2g/T gold and 52g/T silver. The Lara deposit, discovered in the mid-1980s, contains a drill indicated resource of 528,839 tonnes grading 1.01% copper, 1.22% lead, 5.87% zinc, 100.09 g/T sliver and 4.73 g/T gold.

Discovery of the Lara deposit and ongoing interest in the nearby Mount Sicker deposits, all of which are hosted in felsic volcanic rocks of the McLaughlin Ridge formation, stimulated significant interest and exploration activity in the Cowichan uplift during the mid-to late 1980s. During this period the Striker Property, comprising 31 contiguous mineral claims (528 units) and extending along virtually the entire north shore of Cowichan Lake, was explored by Utah Mines. This property is underlain predominantly by the Sicker Group, with Nitnat rocks dominant in the western part of the property and McLaughlin Ridge sediments and volcanics dominant in the east. Work on this property is documented in a number of BC government assessment reports, from which the following descriptions are derived. McLaughlin Ridge rocks, as mapped, divide grossly into 3 units, dominated by diverse sedimentary lithologies with volcanic members, particularly lower in the sequence. Volcanic rocks are described as interbedded lithic and crystal tuff, cherty dust tuff, chert and minor lapilli tuff. The lower unit consists of fine-grained andesitic lithic crystal tuffs and cherty tuffs with local coarse lapilli beds and dacitic tuff units.

Exploration on the Striker property included airborne geophysics, with ground follow-ups and grid work in selected areas in the eastern part of the property because of the distribution of geophysical and geochemical targets. While massive sulphides were not encountered, encouraging mineralization of various types was noted, including exhalative horizons, which occasionally contain anomalous molybdenum, copper and silver. Significant barium, silver, molybdenum and zinc values are also associated with syndepositional pyrite in argillite units and significant gold-silver-copper-zinc values are associated with several structures. Anomalous silt and heavy metal values (copper-lead-zinc-silver-gold) were also identified. The latest assessment report on the Striker property recommended further, more detailed work in the eastern part of the property including detailed mapping, sampling, trenching and limited drilling.

The Cowichan Lake area generally, has been the subject of mineral exploration since the late 1800s and a large number and variety of mineral showings in the area are documented in B.C. government Minfile records. Massey and Friday (1986) grouped Cowichan area mineral showings into five categories:

1. Volcanogenic gold-bearing massive sulphides (Sicker Group Kuroko deposits).

2. Gold-bearing, pyrite-chalcopyrite-quart-carbonate veins along shears, which are quite common cutting Sicker Group and Karmutsen Formation sills north of Cowichan Lake.

3. Epithermal gold-silver deposits within Bonanza Group volcanics.

4. Copper skarns developed in limy sediments apparently interbedded with basalts of the Karmutsen formation.

5. Copper-molybdenum quarts veins in granodiorite and adjacent country rock on several properties. Chalcopyrite and pyrite, with or without molybdenite are the principle sulphides and minor sphalerite, galena and arsenopyrite are also reported.

8

Property and Claim Position

The Molly1 claim was staked by Nava Resources Canada Ltd. on October 20, 2010. The claim comprises 20 contiguous units totaling 424.96 hectares. The Molly1 property is in the Victoria mining division of British Columbia and lies on the north shore of Cowhichan lake in southern Vancouver Island about 30km west of the town of Duncan and 10km west of the town of Lake Cowichan. (See location map below.)

9

Geology North of Cowichan Lake Including Molly1 Property

10

Conditions to Retain Title to the Claims

The mineral titles are subject to annual renewal and government permits for specific field work. The claims are valid until their next anniversary date of October 20, 2011. They can be renewed indefinitely by performance and recording of assessment work as defined in the Mineral Act (B.C.) or by payment of cash in lieu of work. Work or cash payment of the equivalent of CAN$4.00 per hectare or approximately CAN$1,700 for each of the first, second and third anniversary years, and the equivalent of CAN$8.00 per hectare for each subsequent anniversary year is required. Contiguous claims may be grouped for purposes of applying the value of work from the site of work to other claims. Failure to perform and record valid exploration work or pay the equivalent sum to the Province of British Columbia on the anniversary dates will result in forfeiture of title to the claim.

Present Condition of the Claims

The Claim was staked on October 20, 2010 by Nava Resources Canada Ltd.. The Claim was staked to acquire a position in the Sicker Group, a sequence of volcanic rocks known to be very prospective for the occurrence of polymetallic volcanogenic massive sulphide deposits (VMS), commonly referred to as Kuroko type deposits.

Our objective is to conduct exploration activities on the Molly1 Claim to assess whether they possess evidence of mineralization sufficient to merit further exploration activities. The Molly1 Claim is without known reserves.

Competitive Conditions

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.

Government Approvals and Recommendations

We will be required to comply with all regulations defined in the British Columbia Mineral Tenure Act for the Province of British Columbia (the “Act”). The Act sets forth rules for:

- locating claims

- posting claims

- working claims

- reporting work performed

We also have to comply with the British Columbia Mineral Exploration Code which dictates how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations. In order to explore for minerals on our mineral claim we must submit our exploration plan for review. We believe that our exploration plan as described below will be accepted and an exploration permit will be issued to our agent or us. The exploration permit is the only permit or license we will need to explore for precious and base minerals on the mineral claim.

11

We will be required to obtain additional work permits from the British Columbia Ministry of Energy and Mines for any exploration work that results in a physical disturbance to the land. Accordingly, we may be required to obtain a work permit depending on the complexity and affect on the environment if we proceed beyond the exploration work contemplated by our proposed exploration programs. The time required to obtain a work permit is approximately four weeks. We will incur the expense of our consultants to prepare the required submissions to the Ministry of Energy and Mines. We will be required by the Mining Act to undertake remediation work on any work that results in physical disturbance to the land. The cost of remediation work will vary according to the degree of physical disturbance. No remediation work is anticipated as a result of completion of Stage One and Stage Two of our exploration program.

As mentioned above, we will have to sustain the cost of reclamation and environmental remediation for all exploration and other work undertaken. The amount of reclamation and environmental remediation costs are not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended exploration program. Because there is no information on the size, tenor, or quality of any mineral resource at this time, it is impossible to assess the impact of any capital expenditures on earnings or our competitive position in the event a potential mineral deposit is discovered.

If we enter into substantial exploration, the cost of complying with permit and regulatory environment laws will be greater than in Stages One and Two because the impact on the project area is greater. Permits and regulations will control all aspects of any program if the project continues to that stage because of the potential impact on the environment. We may be required to conduct an environmental review process under the British Columbia Environmental Assessment Act if we determine to proceed with a substantial project. An environmental review is not required under the Environmental Assessment Act to proceed with the recommended Stage One and Two exploration programs on our Molly1 Claim.

Costs and Effects of Compliance with Environmental Laws

We currently have no costs to comply with environmental laws concerning our exploration program.

We will have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended phases. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

Employees

We currently have no employees other than our officers and directors. We intend to retain the services of geologists, prospectors and consultants on a contract basis to conduct the exploration programs on our mineral claims and to assist with regulatory compliance and preparation of financial statements.

Item 1A. Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this Annual Report and in our Registration Statement on Form S-1, as filed with the Securities and Exchange Commission on May 1, 2008 (Registration No. 333-150582), in evaluating our Company and its business, before purchasing shares of our Company’s common stock. The following risks are in addition to numerous other risks that are typical of exploration stage resource companies. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

12

Risks Relating to Our Company

1. Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements for the year ended June 30, 2011 were prepared assuming that we will continue our operations as a going concern. We were incorporated on July 21, 2005 and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

2. We may require additional funds which we plan to raise through the sale of our common stock, which requires favorable market conditions and interest in our activities by investors. We may not be able to sell our common stock and funding may not be available for continued operations.

We anticipate that our current assets of $62,303 as of June 30, 2011 will be sufficient to complete the first phase of our planned exploration program on the Molly1 Claim. Subsequent exploration activities will require additional funding. Our only present means of funding is through the sale of our common stock. The sale of common stock requires favorable market conditions for junior exploration companies like ours, as well as specific interest in our stock, neither of which may exist if and when additional funding is required by us. If we are unable to raise additional funds in the future, we may have to cease our operations.

3. We have a very limited history of operations and accordingly there is no track record that would provide a basis for assessing our ability to conduct successful mineral exploration activities. We may not be successful in carrying out our business objectives.

We were incorporated on July 21, 2005, and to date have been involved primarily in organizational activities, obtaining financing, acquiring an interest in the claims and conducting exploration work on the claims. Accordingly we have no track record of successful exploration activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a junior resource exploration company. Junior exploration companies often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

4. Our failure to perform exploratory activities with respect to the claims, or our failure to make required payments or expenditures, could cause us to lose title to the mineral claim.

The Molly1 Claim has an expiration date of October 20, 2011. In order to maintain the tenure of our ownership of the claims in good standing, it will be necessary for us to coordinate an agent to perform and record valid exploration work with value of approximately $1,700 Canadian dollars, or pay the equivalent sum to the Province of British Columbia in lieu of the exploratory work. Failure to perform and record valid exploration work or pay the equivalent sum to the Province of British Columbia on October 20, 2011, will result in the forfeiture of our title to the claim.

5. Due to the speculative nature of mineral property exploration, there is substantial risk that no commercially viable mineral deposits will be found on our Molly1 Claim or other mineral properties that we acquire.

In order for us to even commence mining operations we face a number of challenges which include finding qualified professionals to conduct our exploration program, obtaining adequate financing to continue our exploration program, locating a viable mineral body, partnering with a senior mining company, obtaining mining permits, and ultimately selling minerals in order to generate revenue. Moreover, exploration for commercially viable mineral deposits is highly speculative in nature and involves substantial risk that no viable mineral deposits will be located on any of our present or future mineral properties. There is a substantial risk that the exploration program that we will conduct on the Claims may not result in the discovery of any significant mineralization, and therefore no commercial viable mineral deposit. There are numerous geological features that we may encounter that would limit our ability to locate mineralization or that could interfere with our exploration programs as planned, resulting in unsuccessful exploration efforts. In such a case, we may incur significant costs associated with an exploration program, without any benefit. This would likely result in a decrease in the value of our common stock.

13

6. Due to the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or may elect not to insure. We currently have no such insurance nor do we expect to obtain such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets and cease operations, resulting in the loss of your entire investment.

7. Access to the Molly1 Claim is seasonally restricted by inclement weather, which may delay our exploration and any future mining efforts.

Access to the claims could potentially be restricted to the period between October and May of each year due to snowfall in the area. This presents both a short and long term risk to us in that poor weather could delay our exploration program and prevent us from exploring the Claims as planned. Attempts to visit, test, or explore the property may be limited to the few months of the year when weather permits such activities. These limitations can result in significant delays in exploration efforts, as well as mining and production in the event that commercial amounts of minerals are found. Such delays can result in our inability to meet deadlines for exploration expenditures required to be made in order to retain title to our claims under provincial mineral property laws.

8. The market price for precious metals is based on numerous factors outside of our control. There is a risk that the market price for precious metals will significantly decrease, which will make it difficult for us to fund further mineral exploration activities, and would decrease the probability that any significant mineralization that we locate can be economically extracted.

Numerous factors beyond our control may affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital and you may lose your entire investment in the Company.

9. Changes in the exchange rates between the United States dollar and foreign currencies may be volatile and may negatively impact our costs, which in turn could adversely affect our operating results.

When operating in foreign countries, such as Canada, we expect to incur a certain amount of our expenses from our operations in foreign currency and translate these amounts into United States dollars for purposes of reporting operating results. As a result, fluctuations in foreign currency exchange rates may adversely affect our expenses and results of operations, as well as the value of our assets and liabilities. Fluctuations may adversely affect the comparability of period-to-period results. In addition, we anticipate holding foreign currency balances, which will create foreign exchange gains or losses, depending upon the relative values of the foreign currency at the beginning and end of the reporting period, which may affect our net income and earnings per share. Although we may use hedging techniques in the future (which we currently do not use), we may not be able to eliminate the effects of currency fluctuations. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock price.

10. Since the majority of our shares of common stock are owned by our President, Chief Executive Officer and director, our other stockholders may not be able to influence control of the Company or decision making by management of the Company.

Mr. Jag Sandhu, our President, Chief Executive Officer and a director, beneficially owns 81% of our outstanding common stock. The interests of Mr. Sandhu may not be, at all times, the same as that of our other shareholders. Since Mr. Sandhu is not simply a passive investor but is also an executive officer and director of the Company, his interests as an executive may, at times be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon Mr. Sandhu exercising, in a manner fair to all of our shareholders, his fiduciary duties as an officer or as a member of the Company’s Board of Directors. Also, Mr. Sandhu will have the ability to significantly influence the outcome of most corporate actions requiring shareholder approval, including the merger of Nava with or into another company, the sale of all or substantially all of our assets and amendments to our articles of incorporation. This concentration of ownership with Mr. Sandhu may also have the effect of delaying, deferring or preventing a change of control of Nava, which may be disadvantageous to minority shareholders.

14

11. Since our officers and directors have the ability to be employed by or consult for other companies, their other activities could slow down our operations.

Mr. Jag Sandhu, our President, Chief Executive Officer and a director, works with other mineral exploration companies. Our officers and directors are not required to work exclusively for us and do not devote all of their time to our operations. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment by other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that each of our directors will devote between 10 and 20 hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of Mr. Sandhu, or any of our other officers or directors.

Risks Relating to Our Common Stock

12. Since public trading in our common stock is limited and sporadic, there can be no assurance that our stockholders will be able to liquidate their holdings of our common stock.

Our common stock price is currently quoted on the OTC Bulletin Board under the symbol “NAVA”. However, trading has been limited and sporadic and we can provide no assurance that the market for our common stock will be sustained. We cannot guarantee that any stockholder will find a willing buyer for our common stock at any price, much less a price that will result in realizing a profit on an investment in our shares. There may be limited opportunity for stockholders to liquidate any of their holdings in common stock of the Company. Trading volume may be insignificant and stockholders may be forced to hold their investment in Company shares for an extended period of time. The lack of liquidity may also cause stockholders to lose part or all of their investment in our common stock.

13. Since public trading in our common stock is limited and sporadic, the market price of our common stock may be subject to wide fluctuations.

There is currently a limited public market for our common stock and we can provide no assurance that the market for our common stock will be sustained. If a market is sustained, however, we anticipate that the market price of our common stock will be subject to wide fluctuations in response to several factors, including:

(1) actual or anticipated variations in our results of operations;

(2) our ability or inability to generate new revenues;

(3) increased competition; and

(4) conditions and trends in the mining industry.

Further, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations, may adversely affect the market price of our common stock.

14. Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure

15

schedule prepared by the Securities and Exchange Commission relating to the penny stock market, which, in highlight form, sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

15. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 400,000,000 shares of common stock. As of September 12, 2011, the Company had 12,338,604 shares of common stock outstanding. Accordingly, we may issue up to an additional 387,661,396 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

16. State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell shares of our common stock.

Secondary trading in our common stock will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

17. Re-sale restrictions for British Columbia residents and other Canadian residents may limit the ability of our shareholders to sell their securities.

Shareholders who are residents of British Columbia have to rely on an exemption from prospectus and registration requirements of B.C. securities laws to sell their shares. Shareholders have to comply with B.C. Securities Commission’s BC Instrument 72-502 “Trade In Securities of U.S. Registered Issuers” to resell their shares. BC Instrument 72-502 requires, among other conditions, that B.C. residents hold the shares for four months and limit the volume of shares sold in a 12-month period. These restrictions will limit the ability of B.C. resident shareholders to resell our common stock in the United States, and therefore may materially affect the market value of your shares. Residents of other Canadian provinces have to rely on available prospectus exemptions to re-sell their securities, and if no exemptions can be relied upon then the shareholders may have to hold the securities for an indefinite period of time. Shareholders of other Canadian provinces should consult with independent legal counsel to determine the availability and use of prospectus exemptions to re-sell their securities.

18. Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

Item 1B. Unresolved staff comments

None.

Item 2. Properties

16

Our executive offices are located at Suite 303 - 11861 88th Avenue, Delta, British Columbia, Canada, V4C 3C7. The space is being provided to us without charge. This space may not be available to us free of charge in the future.

We do not have any ownership or lease interests in any property other than our interest in the Molly1 Claim.

Item 3. Legal Proceedings

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, or any owner of record or beneficially of more than 5% of any class of voting securities of the Company is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

Item 4. Removed and Reserved

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Quotation of our shares of common stock on the OTC Bulletin Board was approved on July 18, 2008 under the symbol “NAVA”. Prior to that date there was no active market for our common stock, and since that date there have only been limited or sporadic quotations and only a very limited public trading market for our common stock.

Transfer Agent

The transfer agent and registrar for our common shares Nevada Agency and Trust Company. 50 West Liberty Street, Suite 880, Reno, NV 89501, Tel: 775-322-0626, Fax: 775-322-5623.

Holders

As of September 12, 2011, the Company had 12,338,604 shares of our common stock issued and outstanding held by 50 holders of record.

Dividend Policy

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends.

Securities Authorized Under Equity Compensation Plans

We have adopted a stock option plan.

Item 6. Selected Financial Data

Not applicable.

17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Certain statements contained in this prospectus, including statements regarding the anticipated development and expansion of our business, our intent, belief or current expectations, primarily with respect to the future operating performance of the Company and the products we expect to offer, and other statements contained herein regarding matters that are not historical facts, are “forward-looking” statements. Future filings with the Securities and Exchange Commission, future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may contain forward-looking statements. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

Plan of Operation

Our plan of operation for the next twelve months is to complete the following objectives within the time periods specified, subject to our obtaining any additional funding necessary for the continued exploration of our mineral claims. We have enough funds to complete our Phase One exploration program and possibly Phase Two depending on scope and costs.

1. Since the next anniversary date of the Claims is October 20, 2011 we will need to arrange some exploration work worth approximately $1,700 or pay the Province of British Columbia $1,700 in lieu of filing exploration expenses in order to keep the Claims in good standing.

2. We conducted a phase one program of prospecting and lithogeochemical sampling of Sicker Group rocks in the Lake Cowichan area, Vancouver Island in 2010. The Sicker Group is prospective for polymetallic ‘Kuroko-type’ massive sulphide deposits rich in copper, lead, zinc, silver and gold and is exposed in a number of structural uplifts on Vancouver Island. Two of these uplifts host economically significant Kuroko deposits, including the Myra Falls mine in the Buttle Lake Uplift, and the Mount Sicker (intermittent producer up to 1952) and Lara deposits in the Cowichan Lake Uplift.

Nava’s exploration was focused in the southeast end of the Cowichan Lake uplift, which extends in an arcuate, northwest-trending belt over approximately 100 km between Saltspring Island (in the southeast) and Horne Lake in the north.

The Molly1 claim, comprising 20 units (424.96 hectares) was staked in October 2010 to cover outcroppings of the prospective McLaughlin Ridge formation (within the Sicker), approximately 4.5 kilometers along geological strike to the east of the North claim, which was prospected by Nava in 2008; this claim was allowed to lapse in 2010. The Molly1 claim is bounded to the east by the Meade Creek valley, and is accessible via logging roads extending north from the main highway along the steep western slope of the valley.

Exploration on Molly1 during 2010 comprised reconnaissance traverse of roads in the area in late October 2010. Outcroppings of Sicker Group and other rocks are exposed in road cuts over a distance of perhaps 2 kilometers along the main access road. The McLaughlin Ridge Formation is well exposed over a distance of about one kilometer in this area and comprises a relatively uniform section of steeply dipping, banded, medium grey fine grained tuffites and cherty tuffites with occasional quartz veining and local finely disseminated pyrite. Exposures of siltstone and grit representing the much younger Nanaimo Group (Benson Formation) occur at the north end of this section, which is bounded to the south by outcroppings of the Mount Hall Gabbro and intermediate intrusive rocks of the Nitnat Formation.

This section of rocks was prospected over a distance of about one kilometer within the claim boundary, focusing on the McLaughlin Ridge Formation. No visible mineralization, other than occasional minor disseminated pyrite was noted. A total of 46 grab samples were taken at intervals across the section and sent for multi-element geochemical analysis (36 element suite), which included the Kuroko indicator elements copper, lead, zinc, silver, gold, barium, and arsenic. No significant anomalies were indicated in this analysis, though three samples (tuffite) demonstrated weakly anomalous barium concentrations.

3. We will be further analyzing the data received and if warranted conducting further work on the property in spring of 2012. Depending on scope, may include geological mapping, a geochemical survey, trenching, sampling and analysis.

4. In the case that the Phase Two exploration program takes place, we will review its results in May 2012. Further work on the property may be undertaken if justified by the results of Phase Two. A joint venture relationship may be explored at some future point as justified to offset the costs of continued exploration and drilling if warranted.

We may consider entering into a joint venture partnership by linking with a major resource company to provide the required funding to complete exploration beyond Phase Two. We have not undertaken any efforts to locate a joint venture partner at this point. If we enter into a joint venture arrangement, we will assign a percentage of our interest in our mineral claims to the joint venture partner.

18

5. We will also be evaluating other opportunities that might be brought to our attention.

Accounting and Audit Plan

We have engaged T&L Group Chartered Accountants LLP to prepare our quarterly and annual financial statements and have these financial statements reviewed or audited by our independent auditor. Our independent auditor is expected to charge us approximately $1,300 to review our quarterly financial statements and approximately $6,000 to $8,000 to audit our annual financial statements. In the next twelve months, we anticipate spending approximately $11,000 to pay for our accounting and audit requirements.

Results of Operations

We have had no operating revenues since our inception on July 21, 2005. Our activities have been financed from the proceeds of share subscriptions. From our inception on July 21, 2005 to June 30, 2011 we have raised a total of $188,870 from private offerings of our common stock.

For the year ended June 30, 2011 we incurred expenses in the amount of $79,099, a increase of approximately 211% as compared to expenses of $25,376 in the year ended June 30, 2010. Professional fees increased from $21,680 in the year ended June 30, 2010 to $27,466 in the year ended June 30, 2011. In addition, in the year ended June 30, 2011 we incurred $4,598 exploration costs, as compared to nil exploration costs in the year ended June 30, 2010, as a result of exploration work on our Molly1 claim.

In the year ended June 30, 2011 we incurred a net loss of $78,066, as compared to a net loss of $25,286 in the year ended June 30, 2010. For the period from July 21, 2005 (inception) to June 30, 2011, we have an accumulated loss of $193,874.

Liquidity and Capital resources

At June 30, 2011, we had cash and cash equivalents in the amount of $62,180, a decrease of approximately 31% as compared to cash and cash equivalents in the amount of $89,581 on June 30, 2010. We believe that we have enough cash on hand to complete our Phase One exploration program and commence a fairly basic Phase Two program. If the results of the Phase One are particularly encouraging, we may wish to raise additional funds for a more in depth Phase Two program starting in February 2012. Additional funds will need to be raised to support work that may be undertaken subsequent to Phase Two.

If additional funds are required, the additional funding will likely come from equity financing from the sale of our common stock or sale of part of our interest in our mineral claims. If we are successful in completing an equity financing, existing shareholders will experience dilution of their interest in our Company. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our exploration activities. In the absence of such financing, our business will likely fail.

There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our exploration of the Claims and our business will fail.

Going Concern Consideration

We have not generated any revenues since inception. As of June 30, 2011, the Company had accumulated losses of $193,874. Our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors. Our financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

Off Balance Sheet Arrangements.

We have no off-balance sheet arrangements including arrangements that would affect our liquidity, capital resources, market risk support and credit risk support or other benefits.

19

Summary of Critical Accounting Estimates

Recently issued accounting pronouncements

| In January 2010, the FASB issued Accounting Standards Update No. 2010-06, “Fair Value Measurements and Disclosures” (“ASU 2010-06”). This update provides amendments to ASC Topic 820, “Fair Value Measurements and Disclosure”, that requires new disclosure for transfers in and out of Levels 1 and 2 and activity in Level 3 fair value measurements. The update also provides amendments that clarify existing disclosures surrounding levels of disaggregation and inputs and valuation techniques. ASU 2010-06 is effective for reporting periods beginning after December 15, 2009 with the exception of Level 3 activity fair value measurements which is effective for reporting periods beginning after December 15, 2010. The adoption of the accounting standards is not expected to have an impact on the Company’s consolidated financial statements. | |

| In April 2010, the FASB issued Accounting Standards Update No. 2010-13 “Compensation – Stock Compensation” (“ASU 2010-13”). This update addresses whether an employee stock option should be classified as a liability or as an equity instrument if the exercise price is denominated in the currency in which a substantial portion of the entity’s equity securities trades. That currency may differ from the entity’s functional currency and from the payroll currency of the employee receiving the option. This update provides amendments to ASC 718, “Compensation – Stock Compensation” to clarify that an employee share-based payment award that has an exercise price denominated in the currency of the market in which a substantial portion of the entity’s equity shares trades should not be considered to contain a condition that is not a market, performance, or service condition. Therefore, an entity should not classify such an award as a liability if it otherwise qualifies as equity. ASU 2010-13 is effective for reporting periods beginning after December 15, 2010. The adoption of the accounting standards is not expected to have an impact on the Company’s consolidated financial statements. |

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company, as defined by Rule 229.10(f)(1), is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

The financial statements are set forth immediately following the signature page and are incorporated herein by reference.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

EVALUATION OF DISCLOSURE CONTROLS

Under the supervision and with the participation of the Company's management, including the Company's principal executive officer and principal financial officer, the Company has evaluated the effectiveness of the design and operation of its disclosure controls and procedures pursuant to Exchange Act Rule 13a- 15(e) and Rule 15d-15(e) as of the end of the fiscal year covered by this annual report. Based on that evaluation, the principal executive officer and principal financial officer have identified that the lack of segregation of accounting duties as a result of limited personnel resources is a material weakness of its financial procedures. Other than for this exception, the principal executive officer and principal financial officer believe the disclosure controls and procedures are effective to ensure that information required to be disclosed by us in the reports we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Commission's rules and forms and that our disclosure and controls are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive officer and principal financial officer, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. There were no significant changes in the Company's internal controls or in other factors that could significantly affect internal controls subsequent to the date of their evaluation and there were no corrective actions with regard to significant deficiencies and material weaknesses.

20

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Rules 13a-15(f) under the Securities Exchange Act of 1934, internal control over financial reporting is a process designed by, or under the supervision of, the Company’s principal executive, principal operating and principal financial officers, or persons performing similar functions, and effected by the Company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

The Company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records, that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Company’s assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of the Company’s management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Company’s management, including the Company’s Chief Executive Officer and Principal Financial Officer assessed the effectiveness of the Company’s internal control over financial reporting as of June 30, 2011. In making this assessment, management used the framework in “Internal Control - Integrated Framework” promulgated by the Committee of Sponsoring Organizations of the Treadway Commission, commonly referred to as the “COSO” criteria.

In performing the assessment, management noted that our board of directors is performing the duties of the audit committee, there is only one independent director, and none of the members is considered a financial expert. Our management believes that the lack of a financial expert on our board of directors means that no member of our board of directors has the financial expertise to review our financial statements for potential errors and provide the necessary oversight over our management's activities in the event of a management override of our internal control policies. Our management believes that this lack of a financial expert on our board of directors raises a reasonable possibility that a material misstatement of our annual or interim financial statements may not be timely prevented or detected and that it should therefore be considered a material weakness in our internal control over financial reporting. Because of this material weakness, our management believes that as of June 30, 2011, our company's internal controls over financial reporting were not effective. We do not currently have any plans to replace any existing member of our board of directors, nor do we have any current plans to add any additional directors.

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the SEC that permit the Company to provide only management’s report in this annual report.

CHANGES IN INTERNAL CONTOLS

During the year ended June 30, 2011, there was no change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect our internal control over financial reporting.

The Company’s management, including the chief executive officer and principal financial officer, do not expect that its disclosure controls or internal controls will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake.

21

Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people or by management’s override of the control. The design of any systems of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of these inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected. Individual persons perform multiple tasks which normally would be allocated to separate persons and therefore extra diligence must be exercised during the period these tasks are combined. Management is aware of the risks associated with the lack of segregation of duties at the Company due to the small number of employees currently dealing with general administrative and financial matters. Although management will periodically reevaluate this situation, at this point it considers the risks associated with such lack of segregation of duties and that the potential benefits of adding employees to segregate such duties do not justify the substantial expense associated with such increases. It is also recognized the Company has not designated an audit committee and no member of the board of directors has been designated or qualifies as a financial expert. The Company should address these concerns at the earliest possible opportunity.

Item 9B. Other Information

None.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The Directors and Officers currently serving our Company is as follows:

| Name | Age | Positions and Offices |

| Jag Sandhu | 43 | President, Chief Executive Officer, Chief Financial Officer and Director |

| Don Blackadar | 58 | Director |

The business address of each our officers and directors is c/o Nava Resources, Inc., Suite 303 - 11861 88th Avenue, Delta, B.C., Canada V4C 3C7.

The directors named above will serve until the next annual meeting of the stockholders. Thereafter, directors will be elected for one-year terms at the annual stockholders’ meeting. Officers will hold their positions at the pleasure of the Board of Directors, absent any employment agreement, of which none currently exists or is contemplated.

Mr. Jag Sandhu

Mr. Jag Sandhu has been our President and Director since our inception on July 21, 2005 and has acted as our Chief Executive Officer since July 22, 2006. From January 2007 to present, Mr. Sandhu has been the president of JNS Capital Corp., a company engaged in providing Corporate Finance/Development and Investor Relations services to publicly traded junior exploration companies. From November 2004 to January 2007, Mr. Sandhu was Vice President of Corporate Finance for Pacific North West Capital Corp., a public company trading on the TSX Exchange and the OTCBB. From March 2002 to October 2004 Mr. Sandhu was Vice President of Corporate Development and Director of Nicer Canada Corp, a public company trading on the TSX Venture Exchange. From February 2000 to November 2001 Mr. Sandhu was the Chief Financial Officer and Director of Network Technology Professionals Inc., which was a public company trading on the TSX Venture Exchange. From September 1998 to January 2000, Mr. Sandhu was Vice President of Corporate Development of Group West Systems Ltd. which traded on the Toronto Stock Exchange.

22

Mr. Don Blackadar

Mr. Don Blackadar has acted as a Director of Nava Resources, Inc., since June 1, 2007. Mr. Blackadar is a non-practicing geologist with an MSc in Geology from the University of Alberta. Mr. Blackadar has operated his own small consulting company for the past 10 years, offering services as a senior business analyst. He is also a partner in a small software development company specializing in software for the healthcare industry.

Significant Employees and Consultants