Attached files

| file | filename |

|---|---|

| EX-31 - EXHIBIT 31.1 - CALIFORNIA FIRST NATIONAL BANCORP | cfnbex311q411.htm |

| EX-32 - EXHIBIT 32 - CALIFORNIA FIRST NATIONAL BANCORP | cfnbex321q411.htm |

| EX-31 - EXHIBIT 31.2 - CALIFORNIA FIRST NATIONAL BANCORP | cfnbex312q411.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| For the fiscal year ended | June 30, 2011 | ||||

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| For the transition period from | to | ||||

Commission File number 0-15641

CALIFORNIA FIRST NATIONAL BANCORP

(Exact name of registrant as specified in its charter)

|

California

|

33-0964185

|

|

(State or other jurisdiction of Incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

18201 Von Karman Avenue, Suite 800, Irvine, CA 92612

(Address of principal executive offices)

|

Registrant's telephone number, including area code:

|

(949) 255-0500

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $.01 par value

|

The NASDAQ Stock Market LLC

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer, large accelerated filer and smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the Common Stock held by non-affiliates of the Registrant as of December 31, 2010 was $33,060,688. Number of shares outstanding as of September 15, 2011: Common Stock 10,417,597.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from Registrant's definitive Proxy Statement to be filed with the Commission within 120 days after the close of the Registrant's fiscal year ended June 30, 2011.

TABLE OF CONTENTS

|

PART I

|

PAGE

|

|

|

Item 1.

|

Business

|

2-11

|

|

Item 1A.

|

Risk Factors

|

11-15

|

|

Item 1B.

|

Unresolved Staff Comments

|

15

|

|

Item 2.

|

Properties

|

15

|

|

Item 3.

|

Legal Proceedings

|

15

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

15

|

|

PART II

|

||

|

Item 5.

|

Market for Company's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

16-17

|

|

Item 6.

|

Selected Financial Data

|

18

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

19-29

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

29-30

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

31-54

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

55

|

|

Item 9A.

|

Controls and Procedures

|

55

|

|

Item 9B.

|

Other Information

|

55

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

56

|

|

Item 11.

|

Executive Compensation

|

56

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

56

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

56

|

|

Item 14.

|

Principal Accountant Fees and Services

|

56

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

56-57

|

|

Signatures

|

|

58

|

1

PART I

ITEM 1. BUSINESS

California First National Bancorp, a California corporation (the “Company”), is a bank holding company headquartered in Orange County, California with a bank subsidiary, California First National Bank (“CalFirst Bank” or the “Bank”) and leasing subsidiary, California First Leasing Corp (“CalFirst Leasing”). The primary business of CalFirst Bank and CalFirst Leasing is leasing and financing capital assets, while CalFirst Bank also participates in the syndicated commercial loans, provides business loans to fund the purchase of assets leased by third parties, including CalFirst Leasing, and offers commercial loans directly to businesses. CalFirst Bank gathers deposits from a centralized location primarily through posting rates on the Internet. All banking and other operations are conducted from one central location.

Forward-Looking Statements

This Form 10-K contains forward-looking statements. Forward-looking statements include, among other things, information concerning our possible future consolidated results of operations, business and growth strategies, financing plans, our competitive position and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by forward-looking words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “plan”, “may”, “should”, “will”, “would”, “project” and similar expressions. These forward-looking statements are based on information currently available to us and are subject to inherent risks and uncertainties, and certain factors could cause actual results to differ materially from those anticipated. Some of the risks and uncertainties that may cause our actual results or performance to differ materially from such forward-looking statements are included in “Item 1A. Risk Factors” of this report. All forward-looking statements are qualified in their entirety by this cautionary statement and the Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances arising after the date on which they were made.

Leasing Activities

At June 30, 2011, leases accounted for 70% of the Company’s net investment in leases and loans. The Company leases and finances most capital assets used by businesses and organizations, with a focus on high technology systems and other mission critical assets. The leases are structured individually and can accommodate a variety of our customers’ objectives. In addition to computer systems and networks, property leased includes automated manufacturing and distribution management systems, production systems, printing presses and warehouse distribution systems. Telecommunications systems include digital private branch equipment and switching equipment as well as voice over Internet protocol (“VoIP”) systems, wireless networks and satellite tracking systems. Retail point-of-sale and inventory tracking systems often integrate computers, scanners and software. Other electronic equipment leased includes ultrasound and medical imaging systems, computer-based patient monitoring systems, testing equipment, and copying equipment. In addition, the Company leases a wide variety of non-high technology property, including oil and gas production equipment, machine tools, school buses, trucks, exercise equipment and office and dormitory furniture. Of the leases booked in fiscal 2011, approximately 36% involved computer equipment and software, 15% manufacturing and distribution equipment, 10% medical equipment, 10% furniture and fixtures, 7% yellow equipment, and 6% oil and gas production equipment.

CalFirst Leasing and CalFirst Bank provide leasing and financing to customers throughout the United States and across a breadth of industries and disciplines, including commercial, industrial and financial companies, as well as government and non-profit entities. The average size of the lease transactions booked during fiscal 2011 was approximately $535,000, compared with $468,000 during fiscal 2010. One customer accounted for 9% of the property cost subject to leases booked during fiscal 2011 and another customer accounted for 27% in fiscal 2010, but historically no lessee has represented more than 5% of leases booked in any one year. Leases primarily are originated directly through a centralized marketing program and direct delivery channels. The marketing program includes a confidential database of current and potential users of business property, a training program to introduce new marketing employees to leasing, and an in-house computer and telecommunication systems. The marketing programs have been augmented through the expanded use of web sites and the Internet to identify and communicate with potential customers. Prospect management software is utilized to enhance the productivity of the sales effort. Specific information about potential customers is entered into a confidential database accessible to sales professionals and their managers that allows them to efficiently focus on the most likely purchaser or lessee of capital assets. The prospect management system and an integrated in-house telecommunications system permit sales management to monitor account executive activity, daily prospect status and pricing information. The ability to monitor account activity and offer immediate assistance in negotiating or pricing a transaction makes it possible to be responsive to customers and prospects.

2

Leases are generally for initial terms ranging from two to five years. Substantially all leases are non-cancelable "net" leases which contain "hell-or-high-water" provisions under which the lessee must make all lease payments regardless of any defects in the property, and which require the lessee to maintain and service the property, insure the property against casualty loss and pay all property, sales and other taxes. CalFirst Leasing or the Bank retain ownership of the property on leases they originate, and in the event of default by the lessee, they may declare the lessee in default, accelerate all lease payments due under the lease and pursue other available remedies, including repossession of the property. Upon the expiration of the leases, the lessee typically has an option, which is dependent upon each lease's defined end of term options, to either purchase the property at a negotiated price, or in the case of a "conditional sales contract," at a predetermined minimum price, or to renew the lease. If the original lessee does not exercise the purchase option, once the leased property is returned, CalFirst Leasing or CalFirst Bank will seek to sell the leased property.

Through its lease purchase operations, CalFirst Bank purchases lease receivables on a non-recourse basis from other intermediaries. All banks or lessors from whom the Bank purchases lease receivables are subject to an individual credit review and investigation by the Bank and must be approved by the Bank’s board of directors prior to establishing a discounting relationship. The Bank generally does not assume any obligations as lessor for these transactions, and the original lessor retains ownership of any underlying asset, with the Bank taking a priority first lien position. Periodically, the Bank will purchase a whole lease and assume the role as lessor and take a residual interest in the property subject to such lease. The Bank verifies the completeness of all lease documentation prior to purchase, to confirm that all documentation is correct and secure, that liens have been perfected, and legal documentation has been filed as appropriate. Leases purchased from unaffiliated third parties during fiscal 2011 aggregated to $43.4 million, with $6.3 million, or 15%, including a residual interest in the transaction.

CalFirst Leasing and CalFirst Bank conduct their leasing business in a manner designed to minimize risk, however, they are subject to risks through their investment in lease receivables held in their own portfolio, lease transactions-in-process, and residual investments. CalFirst Leasing and CalFirst Bank do not purchase leased property until they have received a binding non-cancelable lease from the customer. A portion of CalFirst Leasing’s lease originations are discounted to banks or finance companies, including CalFirst Bank, on a non-recourse basis at fixed interest rates that reflect the customers' financial condition. The lender to which a lease has been assigned has no recourse against CalFirst Leasing, unless CalFirst Leasing is in default under the terms of the agreement by which the lease was assigned. The institution to which a lease has been assigned may take title to the leased property, but only in the event the lessee fails to make lease payments or otherwise defaults under the terms of the lease. If this occurs, CalFirst Leasing may not realize their residual investment in the leased property.

Lease Portfolio

During the fiscal years ended June 30, 2011, 2010 and 2009, 99%, 85% and 87%, respectively, of the total dollar amount of new leases completed by the Company were retained in the Company’s portfolios, with 1%, 14% and 12% for fiscal years 2011, 2010 and 2009, respectively, of such leases discounted to unaffiliated financial institutions. Approximately 50% and 34% of the new leases booked by CalFirst Leasing were assigned to CalFirst Bank in fiscal 2011 and 2010, respectively. Pursuant to bank regulations, CalFirst Bank can purchase no more than 50% of the extensions of credit originated by CalFirst Leasing during the preceding 12 calendar months..

CalFirst Leasing applies a portfolio management system intended to develop portfolios with different risk/reward profiles. Each lease transaction held by CalFirst Leasing must meet or exceed certain credit or profitability requirements established, on a case-by-case basis, by the credit committee for the portfolio. Through the use of non-recourse financing, CalFirst Leasing avoids risks that do not meet their risk/reward requirements. Certain portfolios hold leases where the credit profile of the lessee or the value of the underlying leased property is not acceptable to other financial institutions.

3

The Bank’s strategy is to develop a conservative, diversified portfolio of leases with high credit quality lessees. The Bank’s credit committee has established underwriting standards and criteria for the lease portfolio and monitors the portfolio on an ongoing basis. The Bank performs an independent credit analysis and due diligence on each lease transaction originated or purchased. The committee applies the same underwriting standards to all leases, regardless of how they are sourced.

The table below present the discounted minimum lease payments receivable (“Net Lease Receivable") related to leases retained in the Company’s portfolios at June 30, 2011, 2010 and 2009, respectively. Of the Bank’s Net Lease Receivable, approximately 46%, 66% and 65%, respectively, represented leases originated directly by the Bank, with 23% of the Bank’s Net Lease Receivables at June 30, 2011 related to purchased leases.

|

(dollars in thousands)

|

Years ended June 30,

|

|||||||||||||||||||||||

|

2011

|

2010

|

2009

|

||||||||||||||||||||||

|

Net Lease

|

Percent of

|

Net Lease

|

Percent of

|

Net Lease

|

Percent of

|

|||||||||||||||||||

|

Receivable

|

Total

|

Receivable

|

Total

|

Receivable

|

Total

|

|||||||||||||||||||

|

California First National Bank

|

$ | 160,847 | 77% | $ | 115,971 | 65% | $ | 128,447 | 63% | |||||||||||||||

|

California First Leasing

|

$ | 47,218 | 23% | $ | 63,153 | 35% | $ | 75,454 | 37% | |||||||||||||||

CalFirst Leasing and the Bank often make payments to purchase leased property prior to the commencement of the lease. The disbursements for such lease transactions-in-process are generally made to facilitate the property implementation schedule of the lessees. The lessee generally is contractually obligated to make rental payments during the period that the transaction is in process, and obligated to reimburse CalFirst Leasing or the Bank for all disbursements under certain circumstances. Income is not recognized while a transaction is in process and prior to the commencement of the lease. At June 30, 2011, 2010, and 2009, the Company’s total investment in property acquired for transactions-in-process amounted to $29.2 million, $26.8 million and $12.4 million, respectively. Of such amounts, approximately 56%, 86% and 53%, respectively, for each year related to CalFirst Leasing, with the balance held by CalFirst Bank.

Commercial Loans

Commercial loans accounted for 30% of the Company’s net investment in leases and loans at June 30, 2011. The commercial loan portfolio consists primarily of participations in syndicated transactions originated by other financial institutions, with approximately 13% of the loan portfolio the result of a direct origination effort. Direct loan origination is targeted primarily to existing Bank and CalFirst Leasing relationships. These commercial loans are a complementary product leveraging existing relationships and extending customer longevity. Commercial loan products originated directly include lines of credit, term loans and commercial mortgages, and generally will be secured by a first priority filing on the customer’s assets, including accounts receivable and inventory, capital equipment or commercial real estate, but unsecured loans or lines of credit will be considered, depending on the nature of the credit. Commercial loans originated directly have terms from five to ten years, and priced with both fixed or floating rates. Commercial loan commitments directly originated as of June 30, 2011 ranged in amount from approximately $1.0 million to $6.2 million.

Syndicated bank loans have structures ranging from working capital loans secured by accounts receivable and inventories, term loans secured by all assets to leveraged loans supported by operating cash flow and enterprise valuation. Loans are priced at variable rates, and generally are made to larger corporations with debt ratings of BB or Ba, or higher, as rated by Standard & Poors or Moody’s Investors Service, respectively, however, $13.1 million, or approximately 14% of the syndicated loan portfolio, relates to companies that are unrated. Credits that the Company characterizes as highly leveraged account for approximately 27% of the syndicated loan portfolio. All syndicated loan transactions have been purchased from major money-center banking institutions and are diversified across industries, with the loans ranging in size from $2.0 million to $7.0 million. At June 30, 2011, the average principal outstanding was $3.6 million, and the remaining terms were from three to six years.

The Bank’s underwriting standards for commercial loans have been maintained in accordance with its existing credit policies. The commercial lending policy requires each loan, regardless of whether it is directly originated or purchased through syndication, to have viable repayment sources. The risks associated with loans in which the Bank participates as part of a syndicate of financial institutions are similar to those of directly originated commercial loans; however, additional risks may arise from the Bank’s limited ability to control actions of the syndicate. Existing staff administer loan operations including documentation, lien perfection, funding, payments and collections. The Bank’s current computer systems are capable of fully processing loans and have the requisite connectivity to the Company’s accounting, customer service and collections processes.

4

The volume of commercial loan transactions funded during fiscal 2011 was $76.9 million, all of which were purchased under syndication, compared to $18.0 funded during fiscal 2010, of which $17.3 million were purchased under syndication. Yields earned on commercial loans tend to be lower than yields earned on lease transactions, but the average life or duration of the investment is expected to be longer and such yields will vary more with changes in market interest rates.

Credit Risk Management

The Company’s strategy for credit risk management includes stringent credit authority centered at the most senior levels of management. The strategy also emphasizes diversification on both a geographic and customer level, and spreading risk across a breadth of leases and loans while minimizing the risk to any one area. The credit process primarily focuses on a customer’s ability to repay the lease or loan through their cash flow, and generally, collateral securing a transaction represents a secondary source of repayment. The credit process includes a policy of classifying all leases and loans in accordance with a risk rating classification system, monitoring changes in the risk ratings of lessees and borrowers, identification of problem leases and loans and special procedures for the collection of problem leases and loans. The lease and loan classification system is consistent with regulatory models under which leases and loans may be rated as “pass”, “special mention”, “substandard”, “doubtful” or “loss”.

An Asset Management (“AM”) group handles the day-to-day management and oversight of the CalFirst Leasing and CalFirst Bank lease portfolios. The AM group monitors the performance of all leases held in the portfolios, transactions-in-process as well as lease transactions assigned to lenders, if CalFirst Leasing retains a residual investment in the leased property subject to the lease. The AM group conducts an ongoing review of all leases 10 or more days delinquent. The AM group contacts the lessee directly and generally sends the lessee a notice of non-payment within 15 days after the due date. In the event that payment is not then received, senior management becomes involved. Delinquent leases are coded in the AM tracking system in order to provide management visibility, periodic reporting, and appropriate reserves. Legal recourse is considered and promptly undertaken if alternative resolutions are not obtained. To date, the Company has had no delinquent loans. At 90 days past due, leases and loans will be placed on non-accrual status such that interest income no longer accretes into income, unless the Company believes the amounts due are otherwise recoverable.

Allowance for Credit Losses

The allowance for credit losses is an estimate of probable and assessable losses in the Company’s lease and loan portfolios applying the principles of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 450, “Contingencies,” and ASC Topic 310-35, “Loan Impairment.” The allowance recorded is based on a quarterly review of all leases and loans outstanding and transactions-in-process. The determination of the appropriate amount of any provision is based on management’s judgment at that time and takes into consideration all known relevant internal and external factors that may affect the lease and loan portfolios. The primary responsibility for setting reserves resides with executive management at the Bank and the Company who report quarterly to the Company’s Audit Committee and Board of Directors regarding overall asset quality, problem leases and loans and the adequacy of valuation allowances. The Bank's classification of its assets and the amount of its valuation allowances are subject to review by regulators who can order the establishment of additional loss allowances.

The Company individually analyzes the net book value of each non-performing or problem lease and loan to determine whether the carrying value is less than or equal to the expected recovery anticipated to be derived from lease or loan payments, additional collateral or residual realization. The amount estimated as unrecoverable is recognized as a reserve specifically identified for the lease or impaired loan. An analysis of the remaining portfolios is conducted, taking into account recent loss experience, known and inherent risks in the portfolio, levels of delinquencies, adverse situations that may affect the customer’s ability to repay, trends in volume and other factors, including regulatory guidance and current and anticipated economic conditions in the market. This portfolio analysis includes a stratification of the lease and loan portfolio by risk classification and segments, and estimation of potential losses based on risk classification or segment. The composition of the portfolio based on risk ratings is monitored, and changes in the overall risk profile of the portfolio also is factored into the evaluation of inherent risks in the portfolios. Regardless of the extent of the Company's analysis of customer performance or portfolio evaluation, certain inherent but undetected losses are probable within the lease and loan portfolios. This is due to several factors including inherent delays in obtaining information regarding a customer’s financial condition or change in business conditions; the judgmental nature of individual credit evaluations and classification, and the interpretation of economic trends; volatility of economic or customer-specific conditions affecting the identification and estimation of losses and the sensitivity of assumptions utilized to establish allowances for losses, among other factors. Therefore, an estimated inherent loss not based directly on the specific problem assets is recorded as an unallocated allowance. The level of such unallocated allowance is determined based on a review of prior years’ loss experience, and may vary depending on general market conditions. The aggregate allowance in any one period is apportioned between allowance for doubtful accounts and allowance for valuation of residual value.

5

Banking Operations

The Bank is focused on gathering deposits from depositors nationwide for the primary purpose of funding its investment in leases and loans. The Bank’s strategy is to be a low cost producer through marketing its products and services directly to end-users. The Bank believes that its operating costs generally will be lower than those of traditional "bricks and mortar" banks because it does not have the expense of a traditional branch network to generate deposits and conduct operations.

Deposit Products

The Bank’s deposits have been gathered primarily through the Internet. Other strategies to identify depositors are through direct mail, telephone campaigns, purchase of leads from private sources and more extensive print advertisements. The Bank offers two types of interest-bearing checking accounts, savings accounts and three (3) month to three (3) year certificates of deposit (“CDs”) to taxable and IRA depositors. CDs are offered with varying maturities in order to achieve a fair approximation or match of the average life of the Bank’s lease and loan portfolio. With leases generally providing for fixed rental rates, a matching fixed rate CD book is intended to allow the Bank to minimize interest rate fluctuation risk. Most of the Bank’s commercial loans are floating rate.

To open a new account, a customer can complete an on-line enrollment form on the Bank’s web site, or can call the Bank’s toll-free customer service number and open an account telephonically. Signature cards and deposits are then mailed to the Bank. Customers can make deposits by wire transfer, via direct deposit programs, or by mail. No teller line is maintained. The Bank’s customers have 24-hour access to account information. Customers can view their banking records and current balances, and transfer funds between accounts through the use of personal computers. They can also pay bills on-line. Each customer automatically receives a free ATM card upon opening an account. In order to obtain cash, the Bank’s customers use other banks’ automated teller machines that are affiliated with the Plusä system. The Bank generally will reimburse customers for some portion of any ATM fees charged by other financial institutions. The Bank believes that any inconvenience resulting from the Bank not maintaining automated teller machines or a local branch office will be offset by the Bank’s higher investment yields and lower banking fees.

As part of the Bank’s entry into broader services for commercial customers, CalFirst Bank can provide on-line cash management services for its commercial customers. Leveraging on its existing Internet banking platform, through the Bank’s remote deposit capture system customers provided with a desktop scanner can scan items for deposit and electronically send images of the items securely to the Bank’s electronic banking system. These systems are attractive to commercial customers who are able to perform more banking functions on-site, avoid courier and other costs and enhance cash flow through faster access to payments received.

Operations

The Bank’s operations have been developed by outsourcing certain principal functions to leading bank industry service providers and by sharing established systems utilized by CalFirst Leasing or the Company. Outsourced systems include the Bank’s core processing and electronic banking system, electronic bill payment systems and depositary services, including item processing. The Bank believes it benefits from the service provider's expertise and investments in developing technology. A critical element to the Bank’s success is the ability to provide secure transmission of confidential information over the Internet. The Bank’s service providers utilize sophisticated technology to provide maximum security. All banking transactions are encrypted and all transactions are routed from the Internet server through a "firewall" that limits access to the Bank’s and service provider’s systems. Systems are in place to detect attempts by third parties to access other users' accounts and feature a high degree of physical security, secure modem access, service continuity and transaction monitoring. The Bank has implemented the two-factor authentication security to its Internet banking procedures and platform.

6

CalFirst Leasing provides certain services to the Bank pursuant to formal agreements, including servicing the Bank’s lease portfolio on the Bank’s behalf.

Investments

In addition to leases and loans, the Company had total cash and cash equivalents and investment securities of $163.6 million at June 30, 2011 compared to $146.0 million at June 30, 2010. This investment portfolio consists of interest-earning deposits with banks and short-term money market securities, as well as corporate bonds, Federal Reserve Bank and Federal Home Loan Bank stock and other investments. The Company is authorized to invest in high-quality United States agency obligations, mortgage backed securities, investment grade corporate bonds and municipal securities and selected preferred and equity securities. The investment portfolio may increase or decrease depending upon the comparative returns on investments in relation to leases and loans.

Customers

Leasing and loan customers include major corporations and middle-market companies, subsidiaries and divisions of Fortune 1000 companies, private and state-related educational institutions, municipalities and other not-for-profit organizations and institutions located throughout the United States. The Company does not believe the loss of any one customer would have a material adverse effect on its operations taken as a whole.

The Bank’s deposit customers are individuals from across the nation who place a substantial portion of their savings in safe, government-insured deposits and businesses that spread their liquid investments among a breadth of banks in order to ensure that they are government insured. Such depositors are seeking to maximize their interest income and, therefore, are more inclined to move their investments to a bank that offers the highest yield regardless of the geographic location of the depository.

Competition

The Company competes for the lease and loan financing of capital assets with other banks, commercial finance companies, and other financial institutions, independent leasing companies, credit companies affiliated with equipment manufacturers, and equipment brokers and dealers. Many of the Company's competitors have substantially greater resources, capital, and more extensive and diversified operations than the Company. The Company believes that the principal competitive factors are rate, responsiveness to customer needs, flexibility in structuring lease financing and loans, financial technical proficiency and the offering of a broad range of financing options. The level of competition varies depending upon market and economic conditions, the interest rate environment, and availability of capital.

The Bank competes with other banks and financial institutions to attract deposits. The Bank faces competition from established local and regional banks and savings and loan institutions. Many of them have larger customer bases, greater name recognition and brand awareness, greater financial and other resources, broader product offerings and longer operating histories. The market for Internet banking has seen increased competition over the past several years as large national banks have deployed and aggressively promoted their own on-line banking platforms. Additionally, new competitors and competitive factors are likely to emerge with the continued development of Internet banking.

Supervision and Regulation

The Company is a bank holding company within the meaning of the Bank Holding Company Act of 1956, as amended, and is registered with, regulated and examined by the Board of Governors of the Federal Reserve System (the “FRB”). In addition to the regulation of the Company by the FRB, the Bank is subject to extensive regulation and periodic examination, principally by the Office of the Comptroller of the Currency (“OCC”). The Federal Deposit Insurance Corporation (“FDIC”) insures the Bank’s deposits up to certain prescribed limits and the Bank is a member bank within the San Francisco Federal Reserve district. The Company is also subject to jurisdiction of the Securities and Exchange Commission ("SEC") and to the disclosure and regulatory requirements of the Securities Act of 1933 and the Securities Exchange Act of 1934, and through the listing of the common stock on the NASDAQ Global Select Market is subject to the rules of NASDAQ.

7

The Bank Holding Company Act, the Federal Reserve Act, and the Federal Deposit Insurance Act subject the Company and the Bank to a number of laws and regulations. The primary concern of banking regulation is “Safety and Soundness” with an emphasis on asset quality and capital adequacy. These laws and regulations also encompasses a broad range of other regulatory concerns including insider transactions, the adequacy of the allowance for credit losses, inter-company transactions, regulatory reporting, adequacy of systems of internal controls and limitations on permissible activities. The federal banking agencies possess broad powers to take corrective action as deemed appropriate for an insured depository institution and its holding company. The FRB routinely examines the Company, which exam includes CalFirst Leasing. The OCC, which has primary supervisory authority over the Bank, regularly examines banks in such areas as reserves, loans, investments, management practices, and other aspects of operations. These examinations are designed for the protection of the Bank’s depositors rather than the Company’s shareholders. The Bank must furnish annual and quarterly reports to the OCC, which has the authority under the Financial Institutions Supervisory Act to prevent a national bank from engaging in an unsafe or unsound practice in conducting its business. The OCC may impose restrictions or new requirements on the Bank, including, but not limited to, growth limitations, dividend restrictions, individual increased regulatory capital requirements, lease and loan loss reserve requirements, increased supervisory assessments, activity limitations or other restrictions that could have an adverse effect on the Bank, the Company or holders of our common stock. Many banking laws and regulations have undergone significant change in recent years and, given the recent financial crisis in the United States, regulators have increased their oversight of financial institutions and taken a more active role in imposing restrictions on bank operations, the classification of assets and determination of the allowance for credit losses. Future changes to these laws and regulations, and other new financial services laws and regulations are likely, and cannot be predicted with certainty.

Under FRB policy, the Company is expected to serve as a source of financial and managerial strength to the Bank and, under appropriate circumstances, to commit resources to support the Bank. Certain loans by the Company to the Bank would be subordinate in right of payment to deposits in, and certain other indebtedness of, the Bank.

Among the regulations that affect the Company and the Bank are provisions of Section 23A of the Federal Reserve Act. Section 23A places limits on the amount of loans or extensions of credit the Bank may make to affiliates and the amount of assets purchased from affiliates, except for transactions exempted by the FRB. The aggregate of all of the above transactions is limited in amount, as to any one affiliate, to 10% of a bank’s capital and surplus and, as to all affiliates combined, to 20% of a bank's capital and surplus. The Bank and the Company must also comply with certain provisions designed to avoid the Bank buying low-quality assets. The Company and the Bank are also subject to the provisions of Section 23B of the Federal Reserve Act which, among other things, prohibits an institution from engaging in transactions with affiliates unless the transactions are on terms substantially the same, or at least as favorable to the institution as those prevailing at the time for comparable transactions with non-affiliated companies. All services provided by the Company or CalFirst Leasing to the Bank are in accordance with this provision.

In December 2002, the FRB approved Regulation W (“Reg. W”), which implements, interprets and applies statutory provision in sections 23A and 23B, and became effective April 1, 2003. Under Reg. W, a bank does not have to comply with the quantitative limits of Section 23A when making a loan or extension of credit to an affiliate if 1) the extension of credit was originated by the affiliate; 2) the bank makes an independent evaluation of the creditworthiness of the borrower and commits to purchase the extension of credit before the affiliate makes or commits to make the extension of credit; 3) the bank does not make a blanket advance commitment to purchase loans from the affiliate and 4) the dollar amount of all purchases over any 12 month period by the bank from an affiliate does not represent more than 50% of that affiliate’s credit extensions during such period. The Company believes the Bank’s purchase of lease receivables from CalFirst Leasing conforms to the requirements of Reg. W. In addition, the Company has agreed with the FRB that the Bank’s purchase of leases from CalFirst Leasing will not exceed 50% of the Bank’s lease portfolio.

In connection with its approval of the Company’s purchase of the stock of the Bank, the FRB and the OCC required the Company and the Bank to make certain commitments with respect to the operation of the Bank. During fiscal 2006, in light of the Bank’s achievement of profitability, the commitments were modified to include the following on an on-going basis: (i) the Bank and the Company entered into a binding written agreement setting forth the Company’s obligations to provide capital maintenance and liquidity support to the Bank, if and when necessary; (ii) the Bank must obtain prior approval from the OCC before implementing any significant deviation or change from its original operating plan; and (iii) the Company must comply with Reg. W.

8

In September 2006, the OCC approved a change in the Bank’s original operating plan that provided for the Bank to begin originating commercial loans. In October 2010, the OCC advised the Bank that the scope and volume of its commercial loan business exceeded the forecast provided in July 2006 and therefore is a deviation from the Bank's business plan approved in September 2006. While the Bank does not agree that it deviated significantly from forecasts and documents submitted to the OCC in 2008 and 2009, the Bank submitted an updated plan and request for no objection to its continued development of the commercial loan portfolio. The OCC has not provided a written determination of no objection to the Bank's continued expansion of its commercial loan portfolio and the Bank is currently precluded from expanding its commercial loan commitments. As a result, the Company currently expects that it will be restricted from meaningful loan growth during fiscal 2012.

Bank holding companies are subject to risk-based capital guidelines adopted by the FRB. The Company currently is required to maintain (i) Tier 1 capital equal to at least six percent of its risk-weighted assets and (ii) total capital (the sum of Tier 1 and Tier 2 capital) equal to ten percent of risk-weighted assets. The FRB also requires the Company to maintain a minimum Tier 1 "leverage ratio" (measuring Tier 1 capital as a percentage of adjusted total assets) of at least five percent. At June 30, 2011 and 2010, the Company exceeded all these requirements. The Company is not subject to capital adequacy regulations and standards based on an accord of the Basel Committee on Banking Supervision (“BIS II/BIS III”) as they currently stand.

The Bank is also subject to risk-based and leverage capital requirements mandated by the OCC. In general, banks are required to maintain a minimum ratio of qualifying total capital to risk-adjusted assets of 8% and a minimum ratio of Tier 1 capital to risk-adjusted assets of 4%. In addition to the risk-based guidelines, banks are generally required to maintain a minimum ratio of Tier 1 capital to adjusted total assets, referred to as the leverage ratio, of 4%. At June 30, 2011 and 2010, the Bank had capital in excess of all minimum risk-based and leverage capital requirements.

Under the Community Reinvestment Act (“CRA”), the Bank has a continuing and affirmative obligation, consistent with safe and sound operation, to help meet the credit needs of their entire communities, including low- and moderate-income neighborhoods. CalFirst Bank is designated as a wholesale institution for CRA purposes. To evaluate the CRA performance of banks with this designation, regulatory agencies use the community development test. This includes an assessment of the level and nature of the Bank’s community development lending, investments and services. The CRA requires the OCC, in connection with its examination of the Bank, to assess and assign one of four ratings to the Bank’s record of meeting the credit needs of its community. The CRA also requires that the Bank publicly disclose their CRA ratings. During fiscal 2008, CalFirst Bank was subjected to a CRA examination and received a “satisfactory” rating on the CRA performance evaluation. There was no CRA examination for fiscal 2011.

The Bank is a member of the Deposit Insurance Fund (“DIF”) maintained by the FDIC. Through the DIF, the FDIC insures the deposits of the Bank up to prescribed limits for each depositor. As a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “2010 Financial Reform Act”), the maximum deposit insurance amount has been increased permanently from $100,000 to $250,000. The FDIC utilizes a risk-based assessment system that imposes insurance premiums based upon a risk matrix that takes into account a bank’s capital level and supervisory rating. As of January 1, 2009, there are four risk categories, which are distinguished by capital levels and supervisory ratings. The three capital categories are “well capitalized,” “adequately capitalized,” and “undercapitalized.” Under the regulations, assessment rates for calendar 2009 ranged from 12 to 16 basis points per $100 of deposits for banks in Risk Category I, to 45 basis points for banks assigned to Risk Category IV. On May 22, 2009, the FDIC adopted a final rule imposing a 5 basis point special assessment on each insured depository institution’s assets minus Tier 1 capital as of June 30, 2009. The special assessment was collected on September 30, 2009. In lieu of further special assessments, on November 12, 2009, the FDIC approved a final rule to require all insured depository institutions to prepay their estimated risk-based assessments for the fourth quarter of 2009, and for all of 2010, 2011, and 2012 on December 30, 2009. The Bank prepaid $722,526 of such premium on December 30, 2009 and $389,088 remains as a prepaid balance at June 30, 2011. The expense related to this prepayment is anticipated to be recognized over the next 18 months based on actual calculations of quarterly premiums. The actual assessment would be applied against the prepaid assessment until exhausted. Any funds remaining after June 30, 2013 will be returned to the institution. The FDIC may still increase or decrease the assessment rate in the future, and any such increase could have an adverse impact on the earnings of insured institutions, including the Bank.

9

In November 2008, the FDIC implemented the Temporary Liquidity Guarantee Program (TLGP), which applies to U.S. depository institutions insured by the FDIC and U.S. bank holding companies. The Bank elected to participate in the deposit account guarantee component of the TLGP (the “Transaction Account Guarantee”), pursuant to which the FDIC guaranteed all noninterest-bearing transaction accounts in full until December 31, 2010, regardless of the existing deposit insurance limit of $250,000. As a result of the 2010 Financial Reform Act, beginning December 31, 2010 through December 31, 2012, all non-interest bearing transaction accounts are fully insured, regardless of the balance of the account at all FDIC-insured institutions. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities. This unlimited insurance coverage is separate from, and in addition to, the insurance coverage provided to a depositor’s other deposit accounts held at an FDIC-insured institution.

The Bank also is required to make payments for the servicing of obligations of the Financing Corporation (“FICO”) issued in connection with the resolution of savings and loan associations, so long as such obligations remain outstanding. The FICO annual assessment rate for 2011 is 1.04 cents per $100 of deposits.

The FDIC can terminate insurance of the Bank’s deposits upon a finding that the Bank has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations, or has violated any applicable law, regulation, rule, order, or condition imposed by the OCC. The termination of deposit insurance could have a material adverse effect on the Company’s earnings.

The principal source of cash flow to the Company, including cash flow to pay dividends on its common shares, is dividends from its subsidiaries and fees for services rendered to its subsidiaries. Various statutory and regulatory provisions limit the amount of dividends or fees that may be paid to the Company by the Bank. In general, the Bank may not declare or pay a dividend to the Company in excess of 100% of its net retained earnings for the current year combined with its net retained earnings for the preceding two calendar years without prior approval of the OCC. The Company has not received any dividends from the Bank to date, and believes CalFirst Leasing and CalFirst Bank have sufficient resources to meet the Company’s requirements.

There are numerous laws, regulations and policies affecting financial services businesses currently in effect and they are continually under review by Congress and state legislatures and federal and state regulatory agencies. The Gramm-Leach-Bliley Act (“Gramm-Leach”) established requirements for financial institutions to provide privacy protections to consumers and notices to customers about its privacy policies and practices. The USA Patriot Act imposes obligations to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing and to verify the identity of customers. The 2010 Financial Reform Act provides for sweeping financial regulatory reform and may have the effect of increasing the cost of doing business, limiting or expanding permissible activities and affect the competitive balance between banks and other financial intermediaries. While many of the provisions of the 2010 Financial Reform Act do not impact the existing business of the Bank, the extension of FDIC insurance to all non-interest bearing deposit accounts and the repeal of prohibitions on the payment of interest on demand deposits, thereby permitting depository institutions to pay interest on business transaction and other accounts, will likely increase deposit rates to be paid by the Bank in order to retain or grow deposits. Changes in the laws, regulations or policies that impact the Company cannot necessarily be predicted, and they may have a material effect on the business and earnings of the Company.

The commercial banking business is also influenced by the monetary and fiscal policies of the federal government and the policies of the FRB. The FRB implements national monetary policies through its management of the discount rate, the money supply, and reserve requirements on bank deposits. Indirectly, such policies and actions may impact the ability of non-bank financial institutions to compete with the Bank. Monetary policies of the FRB have had, and will continue to have, a significant effect on the operating results of financial institutions. The nature and impact of any future changes in monetary or other policies of the FRB cannot be predicted.

Employees

At June 30, 2011, the Company and its subsidiaries had 154 employees, none of whom are represented by a labor union. The Company believes that its relations with its employees are satisfactory.

10

Available Information

Our Internet address is www.calfirstbancorp.com. There we make available, by link to the SEC, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC. Our SEC reports can be accessed through the Investor Information section of our Internet site. Our Corporate Governance Guidelines and our Code of Ethics for Senior Financial Management are available for viewing and printing under the Corporate Governance section of our Internet site. The information found on our Internet site is not part of this or any other report we file with or furnish to the SEC and is not incorporated herein by reference.

ITEM 1A. RISK FACTORS

There are a number of factors, including those specified below, that may adversely affect the Company’s business, financial results or stock price. Additional risks that the Company currently does not know about or currently views as immaterial may also affect the Company’s business or adversely impact its financial results or stock price.

Industry Risk Factors

The Company’s business and financial results are subject to general business and economic conditions. The Company’s business activities and earnings are affected by general business conditions in the United States. The recent economic downturn resulted in a deterioration of credit quality of certain lessees and reduced demand for financing capital assets. Continued weakness in the financial performance and condition of customers could negatively affect the repayment of their obligations. In addition, changes in securities markets and monetary fluctuations adversely affect the availability and terms of funding necessary to meet the Company’s liquidity needs.

Changes in the domestic interest rate environment could reduce the Company’s net direct finance and interest income. The Company’s net direct finance and interest income, which is the difference between income earned on leases, loans and investments and interest expense paid on deposits, is affected by market rates of interest, which in turn are affected by prevailing economic conditions, by the fiscal and monetary policies of the Federal government and by the policies of various regulatory agencies.

Disruptions in the domestic credit markets and interest rate environment, including changes in interest spreads and the yield curve, could reduce net interest income. Low prevailing interest rates have reduced the income earned on the Company’s available cash balances. Higher interest rates and the inability to access capital markets could negatively affect certain customers and result in increased lease and loan losses.

Changes in the laws, regulations and policies governing financial services companies could alter the Company’s business environment and adversely affect operations. The Board of Governors of the Federal Reserve System regulates the supply of money and credit in the United States. Its fiscal and monetary policies determine in a large part the Company’s cost of funds and the return that can be earned on leases, loans and investments, which affect the Company’s net direct finance, loan and interest income.

The Company and the Bank are regulated by governmental entities. This regulation is to protect depositors, federal deposit insurance funds and the banking system as a whole. Bank regulators can impose restrictions on the ability of the Company to undertake certain business. Following the recent financial crisis, regulators have increased their oversight of banks and taken a more active role in imposing restrictions on bank operations, the classification of assets and determination of the allowance for credit losses. The 2010 Financial Reform Act provides for sweeping financial regulatory reform, much of which does not impact the existing business of the Bank, however, the extension of FDIC insurance to all non-interest bearing deposit accounts and the repeal of prohibitions on the payment of interest on demand deposits will likely increase deposit rates to be paid by the Bank in order to retain or grow deposits. These changes in regulations or policies could affect the Company in substantial and unpredictable ways. The Company cannot predict whether any additional legislation will be enacted, and if enacted, the effect that it or any regulations would have on the Company’s financial condition or results of operations.

11

The financial services industry is highly competitive, and competitive pressures could intensify and adversely affect the Company’s financial results. The Company operates in a highly competitive industry that could become even more competitive as a result of legislative, regulatory and technological changes. The Company competes with other commercial banks, savings and lease associations, mutual savings banks, finance companies, credit unions and investment companies, many of which have greater resources than the Company.

Acts or threats of terrorism and political or military actions taken by the United States or other governments could adversely affect general economic or industry conditions.

Company Risk Factors

The Company’s allowance for credit losses may not be adequate to cover actual losses. The Company’s subsidiaries retain approximately 90% of lease transactions and all loans in their own portfolios, which expose the Company to credit risk. The Company maintains an allowance for credit losses to provide for probable and estimatable losses in the portfolio. The Company’s allowance for credit losses is based on its historical experience as well industry data, an evaluation of the risks associated with its portfolio, including the size and composition of the lease and loan portfolio, current economic conditions and concentrations within the portfolio. The allowance for credit losses may not be adequate to cover losses resulting from unanticipated adverse changes in the economy or the financial markets. If the credit quality of the customer base materially decreases, or if the reserve for credit losses is not adequate, future provisions for credit losses could materially and adversely affect financial results.

The Company may suffer losses in its lease and loan portfolio despite its underwriting practices. The Company seeks to mitigate the risks inherent in its lease and loan portfolio by adhering to specific credit practices. Although the Company believes that its criteria are appropriate for the various kinds of leases and loans it makes, the Company may incur losses on leases and loans that meet these criteria.

The Bank’s commercial loan initiative may increase the Company’s risk of losses. The commercial loan portfolio contains a number of commercial loans with relatively larger balances than its historical lease portfolio. Almost 25% of the commercial loan portfolio is comprised of highly leveraged loans, with 12% of the portfolio rated substandard. The deterioration of one or a few of these loans could cause a significant increase in non-performing loans. An increase in non-performing loans could result in an increase in the provision for credit losses and an increase in charge-offs, all of which could have a material adverse effect on the Company’s results of operations.

The Bank’s expanded lease purchase operations may increase the Company’s risk of losses. CalFirst Bank has implemented a program to grow its lease portfolio through the purchase of lease receivables on a non-recourse basis from other banks and finance companies. The Company seeks to mitigate the risks inherent in this third-party business by adhering to specific underwriting practices, but many of these relationships are new and untested, and the Bank could be exposed to risks not inherent with the lease transactions originated directly or acquired from its affiliates, including unfamiliar documentation and reliance on sales and funding professionals not subject to the Bank’s policies and practices.

Customer concentration may increase the risk of loss in the event of the deterioration of one of these customers or industries. At June 30, 2011, approximately 27% of the Company’s net investment in leases and 19% of the total investment in leases and loans was with public and private colleges, universities, elementary and secondary schools located throughout the United States. Hospitals, nursing homes and related medical facilities represented 11% of the total investment in leases and loans while 7% was related to the oil and gas industry. One customer in the consumer products industry accounted for 6% of the investment in capital leases and 4% of investment in leases and loans.

The Company’s diversification into broader investment alternatives may increase the Company’s risk of losses. The Company’s investment portfolio may include U.S. Treasury and Agency Securities, corporate bonds and closed-end mutual funds, in addition to interest-earning deposits, short-term money market securities and federal funds previously held. These securities subject the Company to increased risk of volatility in the valuation of the investment, as well as greater interest and market risks. The deterioration of one or a few of these investments on a permanent basis could result in an determination that the investment has been permanently impaired and require a write-down of such investment, all of which could have a material adverse effect on the Company’s results of operations.

12

The Company may be adversely affected by significant changes in the bank deposit market and interest rates. CalFirst Bank has grown to represent 73% of the Company’s assets, and bank deposits now exceed $275 million. As a result, the Company’s sensitivity to changes in interest rates and demand for bank deposits has increased from historical levels. Time deposits due within one year of June 30, 2011 totaled $143 million. If these maturing deposits do not roll over, CalFirst Bank may be required to seek other sources of funds, including other time deposits and borrowings. Depending on market conditions, rates paid on deposits and borrowings may be higher than currently paid or no longer available. Although the Bank employs a funding strategy designed to correlate the repricing characteristics of assets with liabilities, the impact of interest rate movements and customer demand is not always consistent during different market cycles, and changes in the costs for deposits and yields on assets may not coincide.

The change in residual value of leased assets may have an adverse impact on the Company’s financial results. A portion of the Company’s leases is subject to the risk that the residual value of the property under lease will be less than the Company’s recorded value. Adverse changes in the residual value of leased assets can have a negative impact on the Company’s financial results. The risk of changes in the realized value of the leased assets compared to recorded residual values depends on many factors outside of the Company’s control.

The financial services business involves significant operational risks. Operational risk is the risk of loss resulting from the Company’s operations, including, but not limited to, the risk of fraud by employees or persons outside of the Company, the execution of unauthorized transactions by employees, errors relating to transaction processing and technology, breaches of the internal control system and compliance requirements, and failure of business continuation and disaster recovery plans. This risk of loss also includes the potential legal actions that could arise as a result of an operational deficiency or as a result of noncompliance with applicable regulatory standards, adverse business decisions or their implementation, and customer attrition due to potential negative publicity. In the event of a breakdown in the internal control system, improper operation of systems or improper employee actions, the Company could suffer financial loss, face regulatory action and suffer damage to its reputation.

Bank regulators can impose restrictions on the Company’s ability to execute its strategic plan. In October 2010, the OCC advised the Bank that the scope and volume of its commercial loan business deviated from the Bank's approved business plan. The Bank submitted a strategic plan to the OCC that provided for the continued development of the commercial loan portfolio but the OCC has not provided a written determination of no objection to the Bank's continued expansion of its commercial loan portfolio. The Bank expects that it will be restricted from meaningful loan growth during the fiscal year ending June 30, 2012.

Quarterly operating results may fluctuate significantly. Operating results may differ from quarter to quarter due to a variety of factors, including the volume and profitability of leased property being remarketed, the size and credit quality of the lease and loan portfolio, the interest rate environment, the volume of new lease and loan originations, including variations in the property mix and funding of such originations and economic conditions in general. The results of any quarter may not be indicative of results in the future.

Negative publicity could damage the Company’s reputation and adversely impact its business and financial results. Reputation risk, or the risk to the Company’s business from negative publicity, is inherent in the Company’s business. Negative publicity can result from the Company’s actual or alleged conduct in any number of activities, including leasing practices, corporate governance, and actions taken by government regulators in response to those activities. Negative publicity can adversely affect the Company’s ability to keep and attract customers and can expose the Company to litigation and regulatory action.

The Company’s reported financial results are subject to certain assumptions and estimates and management’s selection of accounting method. The Company’s management must exercise judgment in selecting and applying many accounting policies and methods so they comply with generally accepted accounting principles and reflect management’s judgment of the most appropriate manner to report the Company’s financial condition and results. In some cases, management may select an accounting policy which might be reasonable under the circumstances yet might result in the Company’s reporting different results than would have been reported under a different alternative.

13

Certain accounting policies are critical to presenting the Company’s financial condition and results. They require management to make difficult, subjective or complex judgments about matters that are uncertain. Materially different amounts could be reported under different conditions or using different assumptions or estimates. These critical accounting policies include the estimate of residual values, the allowance for credit losses, and income taxes. For more information, refer to “Critical Accounting Policies and Estimates”.

Changes in accounting standards could materially impact the Company’s financial statements. The Financial Accounting Standards Board (FASB) may change the financial accounting and reporting standards that govern the preparation of the Company’s financial statements. These changes can be hard to predict and can materially impact how the Company records and reports its financial condition and results of operations. Recently, FASB has proposed new accounting standards related to fair value accounting and accounting for leases that could materially change the Company’s financial statements in the future. In some cases, the Company could be required to apply a new or revised standard retroactively, resulting in the Company’s restating prior period financial statements.

Loss of certain key officers would adversely affect the Company’s business. The Company‘s business and operating results are substantially dependent on the certain key employees, including the Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, the President and Chief Credit Officer of the Bank and certain key sales managers. The loss of the services of these individuals, particularly the Chief Executive Officer, would have a negative impact on the business because of their expertise and years of industry experience.

The Company’s business could suffer if the Company fails to attract and retain qualified people. The Company’s success depends, in large part, on its ability to attract and retain key people. Competition for personnel in most activities the Company engages in can be intense. The Company may not be able to hire the best people or to keep them.

The Company relies on other companies to provide components of the Company’s business infrastructure. Third party vendors provide certain components of the Company’s business infrastructure, such as the Bank’s core processing and electronic banking systems, item processing, and Internet connections. While the Company has selected these third party vendors carefully, it does not control their actions. Any problems caused by these third parties not providing the Company their services for any reason or their performing their services poorly, could adversely affect the Company’s ability to deliver products and services to the Company’s customers and otherwise to conduct its business. Replacing these third party vendors could also entail significant delay and expense.

A natural disaster could harm the Company’s business. Natural disasters could harm the Company’s operations directly through interference with communications, including the interruption or loss of the Company’s websites, which would prevent the Company from gathering deposits, originating leases and loans and processing and controlling its flow of business, as well as through the destruction of facilities and the Company’s operational, financial and management information systems.

The Company faces systems failure risks as well as security risks, including “hacking” and “identity theft.” The computer systems and network infrastructure the Company and others use could be vulnerable to unforeseen problems. These problems may arise in both our internally developed systems and the systems of our third-party service providers. Our operations are dependent upon our ability to protect computer equipment against damage from fire, power loss or telecommunication failure. Any damage or failure that causes an interruption in our operations could adversely affect our business and financial results. In addition, our computer systems and network infrastructure present security risks, and could be susceptible to hacking or identity theft.

The Company relies on dividends from its subsidiaries for its liquidity needs. The Company is a separate and distinct legal entity from CalFirst Leasing and the Bank. The principal source of funds to pay dividends on the Company’s stock is from distributions from the subsidiaries. Various regulations limit the amount of dividends that the Bank may pay to the Company.

The Company’s stock price can be volatile. The Company’s stock price can fluctuate widely in response to a variety of factors, including: actual or anticipated variations in the Company’s quarterly operating results; operating and stock price performance of other companies that investors deem comparable to the Company; news reports relating to trends, concerns and other issues in the financial services industry, and changes in government regulations. General market fluctuations, industry factors and general economic and political conditions and events, including terrorist attacks, economic slowdowns or recessions, interest rate changes, credit loss trends or currency fluctuations, could also cause the Company’s stock price to decrease regardless of the Company’s operating results. In addition, the volume of trading in the Company’s stock is very limited and can result in fluctuations in prices between trades.

14

The Company is a “controlled company” as defined by NASDAQ, with over 64% of the stock held by the Chief Executive Officer, over 77% held by two senior executives and fewer than 100 shareholders of record. As a result, senior management has the ability to exercise significant influence over the Company’s policies and business, and determine the outcome of corporate actions requiring stockholder approval. These actions may include, for example, the election of directors, the adoption of amendments to corporate documents, the approval of mergers, sales of assets and the continuation of the Company as a registered company with obligations to file periodic reports and other filings with the SEC.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

At June 30, 2011 the Company and its subsidiaries occupied approximately 43,000 square feet of office space in Irvine, California leased from an unaffiliated party. The lease provides for monthly rental payments that average $106,926 from July 2011 through August 2013.

ITEM 3. LEGAL PROCEEDINGS

The Company is sometimes named as a defendant in litigation relating to its business operations. Management does not expect the outcome of any existing suit to have a material adverse effect on the Company's financial condition or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

15

PART II

ITEM 5. MARKET FOR COMPANY'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of California First National Bancorp trades on the NASDAQ Global Market System under the symbol CFNB. The following high and low closing sale prices for the periods shown reflect inter-dealer prices without retail markup, markdown or commissions and may not necessarily reflect actual transactions.

|

For the years ended

|

||||||||||||||||

|

June 30, 2011

|

June 30, 2010

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

First Quarter

|

$ | 13.90 | $ | 11.85 | $ | 12.88 | $ | 11.01 | ||||||||

|

Second Quarter

|

15.21 | 12.40 | 13.21 | 10.76 | ||||||||||||

|

Third Quarter

|

15.09 | 13.56 | 13.47 | 12.31 | ||||||||||||

|

Fourth Quarter

|

$ | 15.19 | $ | 14.52 | $ | 13.76 | $ | 11.73 | ||||||||

The Company had approximately 28 stockholders of record and in excess of 400 beneficial owners as of September 15, 2011.

For the fiscal years 2007 to 2009 and through the first quarter of fiscal 2010, the Company had a policy of paying regular quarterly cash dividends. In October 2009, the Board of Directors of the Company approved a change in the Company’s dividend policy to provide one annual dividend payment in lieu of quarterly dividends. The Board of Directors paid a second annual dividend in the amount of $1.00 dividend on December 17, 2010. The Board of Directors will continue to review the dividend policy on an ongoing basis, and the decision to pay dividends in fiscal 2012 and beyond has not been made. For the fiscal years ended June 30, 2011, 2010, and 2009, the Company declared cash dividends totaling $1.00, $.60 and $.48, respectively, per common share.

In August 2008, the Company completed the purchase of 1,300,000 shares of its common stock at a purchase price of $13.00 per share pursuant to a modified “Dutch Auction” tender offer. In April 2001, the Board of Directors authorized management, at its discretion, to repurchase up to 1,000,000 shares of common stock. This authorization has no termination date, but the Board of Directors reviews the authorization to repurchase common stock from time to time. The Company repurchased no shares of common stock under this authorization during the year ended June 30, 2011, 25,654 during fiscal 2010 and 35,328 during fiscal 2009. As of September 15, 2011, 368,354 shares remain available under this authorization.

16

The following table summarizes share repurchase activity for the quarter ended June 30, 2011:

|

Total number

|

Maximum number of

|

|||||

|

of shares

|

Average price

|

shares that may yet be

|

||||

|

Period

|

Purchased

|

Paid per share

|

Purchased under the plan

|

|||

|

April 1, 2011 - April 30, 2011

|

-

|

$ -

|

368,354

|

|||

|

May 1, 2011 – May 31, 2011

|

-

|

$ -

|

368,354

|

|||

|

June 1, 2011 – June 30, 2011

|

-

|

$ -

|

368,354

|

|||

|

-

|

$ -

|

Common Stock Performance Graph

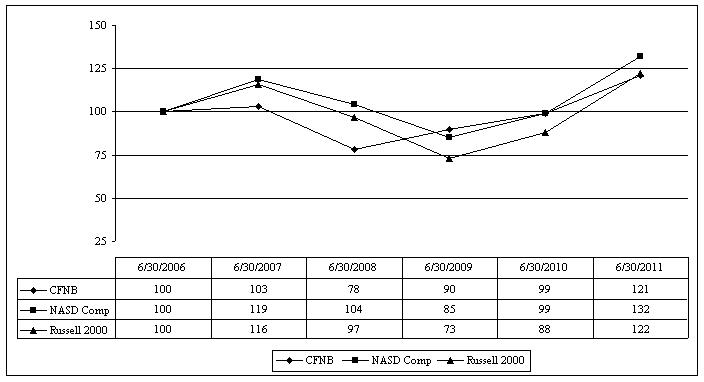

The graph below shows a comparison of the five-year cumulative return among the Company, the NASDAQ Composite Index and the Russell 2000. As required by Securities and Exchange Commission rules, total return in each case assumes the reinvestment of dividends paid.

Equity Compensation Plan Information

The following table provides information about shares of the Company’s Common Stock that may be issued upon the exercise of options under our existing equity compensation plans as of June 30, 2011.

|

Plan category

|

Number of shares of common

stock to be issued upon exercise

of outstanding options (1)

|

Weighted average

exercise price of

outstanding options

|

Number of shares of common stock remaining available

for future issuance under equity compensation plans

(excluding shares in first column)

|

||

|

Equity compensation plans

approved by shareholders

|

42,327

|

$12.17

|

1,707,662

|

||

|

Equity compensation plans

not approved by shareholders

|

None

|

N/A

|

N/A

|

||

|

Total

|

42,327

|

$12.17

|

1,707,662 (1)

|

||

|

(1)

|