Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - HYDROCARB ENERGY CORP | form8k.htm |

| EX-99.1 - PRESS RELEASE DATED SEPTEMBER 21, 2011 - HYDROCARB ENERGY CORP | exhibit99-1.htm |

| PURCHASE AND SALE AGREEMENT |

Among each of:

CW NAVIGATION, INC., KD NAVIGATION, INC.

and KW NAVIGATION, INC.

(as the Seller

Parties)

And:

SPE NAVIGATION I, LLC

(as the

Company)

And:

STRATEGIC AMERICAN OIL CORPORATION

(as the

Buyer)

Strategic American Oil Corporation

800 Gessner

Road, Suite 200, Houston, Texas, U.S.A., 77024

__________

TABLE OF CONTENTS

- i -

- ii -

- iii -

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (the “Agreement”), dated as of September 1, 2011 (the Effective Date herein), and fully executed as of this 20th day of September, 2011, is made by and among CW NAVIGATION, INC., KD NAVIGATION, INC. and KW NAVIGATION, INC., each a Texas corporation (the “Sellers”), SPE NAVIGATION I, LLC, a Nevada limited liability company (the “Company”), and STRATEGIC AMERICAN OIL CORPORATION, a Nevada corporation (“Buyer”). Sellers and the Company are sometimes referred to collectively herein as the “Seller Parties” and individually as a “Seller Party.” The Seller Parties and Buyer are sometimes referred to collectively herein as the “Parties” and individually as a “Party.”

WITNESSETH:

WHEREAS, Seller Parties collectively own 100% of the issued and outstanding membership interests of the Company (the “Interests”), with each Seller holding an equal share in the Interests; and

AND WHEREAS, Seller Parties desire to sell to Buyer, and Buyer desires to purchase from Seller Parties, all of the Interests for the consideration and upon the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the premises and the mutual covenants and agreements hereinafter contained, the Parties hereby agree as follows:

ARTICLE I

DEFINITIONS

1.1 Certain Definitions. For purposes of this Agreement, the following terms shall have the respective meanings specified in this Section 1.1 or in the section, subsections or other subdivisions referred to below:

“AFE’s” has the meaning set forth in Section 3.24.

“Affiliate” means, with respect to any Person, any other Person that, directly or indirectly, through one or more intermediaries, controls, or is controlled by, or is under common control with, such Person. For the purposes of this definition, the term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning set forth in the preamble.

Page 1

“Allocated Value” means, with respect to a particular Oil and Gas Property, the allocated value of such Oil and Gas Property as shown on Exhibit “A”.

“Business Day” means any day other than a Saturday, Sunday or legal holiday on which national banking institutions in Houston, Texas are required or authorized by Law to close.

“Buyer” has the meaning set forth in the preamble.

“Buyer Confidential Information” has the meaning set forth in Section 8.5(b) .

“Buyer Indemnified Parties” has the meaning set forth in Section 10.2(a) .

“Buyer Representative” has the meaning set forth in Section 8.5(a) .

“Casualty Loss” has the meaning set forth in Section 6.3.

“Closing” has the meaning set forth in Section 11.1.

“Closing Date” has the meaning set forth in Section 11.1.

“Code” means the Internal Revenue Code of 1986, or any successor statute thereto, as amended, and any regulations promulgated thereunder by the Treasury Department of the United States.

“Company” has the meaning set forth in the preamble.

“Contract” means any written or oral contract, agreement, agreement regarding indebtedness, indenture, debenture, note, bond, loan, collective bargaining agreement, lease, mortgage, franchise, license agreement, purchase order, binding bid, commitment, letter of credit or any other legally binding arrangement, excluding, however, any Lease or other oil and gas lease, easement, right-of-way, permit or other instrument creating or evidencing the conveyance or transfer of an interest in the Leases or a real or immovable property related to or used in connection with the operations of any Lease or any lands pooled or unitized therewith.

“Decommissioning Obligations” means any and all existing and future claims, costs, charges, expenses, liabilities and obligations associated with, and liability for, abandoning, decommissioning, removing or making safe all Wells and Fixtures, Facilities and Equipment, whether such claims, costs, charges, expenses, liabilities and obligations are incurred under or pursuant to any of the Leases or under statutory, common law, regulation, order, permit, judgment, decree or other obligation, and including any residual liability for anticipated or necessary continuing insurance, maintenance and monitoring costs. Decommissioning Obligations include all of the following:

Page 2

| (a) |

the plugging, replugging and abandonment of all Wells, either active or inactive; | |

| (b) |

the removal, abandonment and disposal of structures, facilities, foundations, wellheads, tanks, pipelines, flowlines, pumps, compressors, separators, heater treaters, valves, fittings and equipment and machinery of any nature and all materials contained therein, located on or used in connection with the Properties; | |

| (c) |

the clearance, restoration and remediation of the lands, groundwater and waterbottoms covered or burdened by the Leases or otherwise affected by the Properties; and | |

| (d) |

the removal, remediation and abatement of any petroleum material, any contamination or pollution (including spilling, leaking, pumping, pouring, emitting, emptying, discharging, leaching, dumping, disposing or other release of any chemical substance, pollutant, contaminant, toxic substance, radioactive material, hazardous substance, NORM, waste, saltwater, cuttings, muds, crude oil, or petroleum product) of surface soils and water, subsurface soils, air, groundwater, or any vessel, piping, equipment, tubing or subsurface structure or strata associated with the Properties. |

“Defensible Title” has the meaning set forth in Section 6.1(a) .

“Effective Date” means September 1, 2011, as of 7:00 a.m. Central Daylight Time.

“Environmental Breach” has the meaning set forth in Section 7.2.

“Environmental Breach Notice Date” has the meaning set forth in Section 7.2.

“Environmental Defect Value” has the meaning set forth in Section 7.2(e) .

“Environmental Due Diligence Period” has the meaning set forth in Section 7.6.

“Environmental Incident Deductible” has the meaning set forth in Section 7.4(a) .

“Environmental Laws” means all national, state, municipal or local laws, rules, regulations, statutes, ordinances or orders of any Governmental Body relating to (a) the use, storage, emission, discharge, cleanup, Release or threatened Release of pollutants, contaminant, chemical or industrial, toxic or hazardous substances or Hazardous Materials on or into the environment (including ambient air, oceans, waterways, wetlands, surface water, ground water (tributary and non-tributary)), and land (surface or subsurface strata); (b) the manufacture, processing, distribution, use, treatment, storage, disposal, transportation or handling of Hazardous Materials; and (c) exposure to hazardous, toxic or other substances alleged to be harmful (including Hazardous Materials), in each case, as in effect on the date of this Agreement. The term “Environmental Laws” shall include the following statutes and the regulations promulgated thereunder: the Clean Air Act, 42 U.S.C. § 7401 et seq., the Clean Water Act, 33 U.S.C. § 1251 et seq., the Resource Conservation and Recovery Act, 42 U.S.C. § 6901 et seq., the Superfund Amendments and Reauthorization Act, 42 U.S.C. § 11011 et seq., the Toxic Substances Control Act, 15 U.S.C. § 2601 et seq., the Safe Drinking Water Act, 42 U.S.C. § 300f et seq., the Comprehensive Environmental Response, Compensation, and Liability Act, 42 U.S.C. § 9601 et seq., the Occupational Safety and Health Act, 29 U.S.C. § 651 et seq., the Hazardous Materials Transportation Act, 49 U.S.C. § 1801 et seq., and any state, county, or local regulations similar thereto.

Page 3

“Environmental Liabilities” means any and all Losses (including any remedial, removal, response, abatement, clean-up, investigation and/or monitoring costs and associated legal costs) incurred or imposed (a) pursuant to any agreement, order, notice of responsibility, directive (including directives embodied in Environmental Laws), injunctions, judgment or similar documents (including settlements) arising out of, in connection with, or under Environmental Laws, or (b) pursuant to any claim by a Governmental Body or any other Person for personal injury, property damage, damage to natural resources, remediation, or payment or reimbursement of response costs incurred or expended by such Governmental Body or other Person pursuant to common law or statute and related to the use or release of Hazardous Materials.

“Environmental Notice” has the meaning set forth in Section 7.2.

“Environmental Permits” has the meaning set forth in Section 7.1(a)(iv) .

“Financial Statements” has the meaning set forth in Section 3.26.

“GAAP” means generally accepted accounting principles.

“Governmental Body” means any court or tribunal in any jurisdiction (domestic or foreign) or any federal, state, county, municipal, or other public, governmental, quasi-governmental or regulatory body, agency, department, commission, board, bureau, or other authority or instrumentality (domestic or foreign).

“Hazardous Materials” means (a) any “hazardous substance,” as defined by the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended; (b) any “hazardous waste” or “solid waste” in either case as defined by the Resource Conservation and Recovery Act, as amended; (c) any hazardous, dangerous, radioactive or toxic chemical, material, waste or substance, within the meaning of and regulated by any Environmental Law; (d) any asbestos containing materials within the meaning of any Environmental Law; (e) any polychlorinated biphenyls within the meaning of any Environmental Law; (f) petroleum, petroleum hydrocarbons, or any fraction or byproducts thereof within the meaning of any Environmental Law; and (g) any other chemical, pollutant, or contaminant that is regulated under any Environmental Law.

Page 4

“Hedge” means any future derivative, swap, collar, put, call, cap, option or other contract that is intended to benefit from, relate to, or reduce or eliminate the risk of fluctuations in interest rates, basis risk or the price of commodities, including Hydrocarbons or securities, to which the Company is bound.

“Hydrocarbons” means oil, condensate, gas, casinghead gas, distillate, natural gas liquids and other liquid or gaseous hydrocarbons or minerals, or any of them or any combination thereof, and all products and substances extracted, separated, refined, processed and produced therefrom, together with all minerals produced in association with these substances.

“Incident” has the meaning set forth in Section 7.4(a) .

“Indebtedness” means: (a) all obligations of the Company for borrowed money; (b) all obligations of the Company evidenced by bonds, debentures, loans, notes or other similar instruments; (c) all indebtedness of the Company on which interest charges are customarily paid or accrued; (d) the unfunded or unreimbursed portion of all letters of credit issued for the account of the Company; (e) any obligation of the Company representing the deferred purchase price of property or services purchased by the Company other than trade payables incurred in the Ordinary Course of Business and which are not more than 90 days past invoice date; (f) any indebtedness, liability or obligation secured by a Lien on the assets of the Company other than indebtedness relating to obligations which are not delinquent as of the Closing Date, whether or not such indebtedness, liability or obligation is otherwise non-recourse to the Company; (g) the present value of all obligations in respect of leases that are capitalized on the books and records of the Company; (h) liabilities with respect to payments received in consideration of oil, gas or other minerals yet to be acquired or produced at the time of payment (including obligations under “take-or-pay” contracts to deliver gas in return for payments already received and the undischarged balance of any production payment created by the Company or for the creation of which the Company directly or indirectly received payment); and (i) all liability of the Company as a general partner or joint venture for obligations of the nature described in clauses (a) through (h) preceding.

“Indemnification Claim” has the meaning set forth in Section 10.4(a) .

“Indemnified Party” has the meaning set forth in Section 10.4(a) .

“Indemnifying Party” has the meaning set forth in Section 10.4(a) .

“Independent Accounting Firm” has the meaning set forth in Section 8.8(b) .

“Intellectual Property” means all intellectual property and intellectual property rights of the Company, including: (a) all names and marks, including product names, all registered and unregistered trademarks, trade names, service marks and applications therefor and all goodwill associated therewith; (b) all patents, patent applications and inventions, including any provisional, utility, continuation, continuation-in-part or divisional applications filed in the United States or other jurisdiction, and all reissues thereof and all reexamination certificates issuing therefrom; (c) all ownership rights to any copyrightable works, including all related copyright registrations; (d) all confidential and any other proprietary information and techniques, in any form (including paper, electronically-stored data, magnetic media file and microfilm), and all know-how or other trade secrets, whether or not reduced to practice, including geological data, geophysical data, engineering data, maps, interpretations, and other technical information; (e) the right to sue for and recover damages, assert, settle and/or release any claims or demands and obtain all other remedies and relief under applicable Law or equity for any past, present or future infringement or misappropriation of any such intellectual property or intellectual property rights; (f) all licenses, options to license and other contractual rights to use such intellectual property and intellectual property rights; (g) all computer and electronic data processing programs and software programs, including source code, operating systems, application programs, file and utility programs, whether run locally or remotely via a network, including the Internet or an intranet or extranet, and all related documentation, existing research projects, computer software presently under development (including all source code) and all proprietary information, data, processes, formulae and algorithms, used in the development, maintenance, support and delivery of such software; and (h) all corresponding rights throughout other parts of the world.

Page 5

“Interests” has the meaning set forth in the preambles.

“Knowledge” of a specified Person (or similar references to a Person’s knowledge) means the actual knowledge of any of (a) in the case of the Seller Parties, Michael E. Watt, President of the Company, or (b) in the case of Buyer, Jeremy G. Driver, President of the Buyer.

“Law” means any foreign, federal, state, local law, statute, code, ordinance, rule or regulation.

“Leased Real Property” means all leasehold or subleasehold estates and other rights to use or occupy any land, buildings, structures, improvements, fixtures, or other interest in real property held by the Company (other than Oil and Gas Properties).

“Legal Proceeding” means any judicial, administrative or arbitral actions, suits or proceedings (public or private) by or before a Governmental Body.

“Lien” means any lien, encumbrance, pledge, mortgage, deed of trust, security interest, claim, lease, charge, option, right-of-way, right of first refusal, easement, encroachment, servitude, restriction or other encumbrance of every type and description, whether imposed by Law, agreement, understanding, or otherwise.

“Loss(es)” has the meaning set forth in Section 10.2.

Page 6

“Material Adverse Effect” means an occurrence or condition which has a material adverse effect on (a) the business, assets, properties, liabilities, capitalization, results of operations or financial condition of the Company or (b) the ability of the Seller Parties or Buyer, as the case may be, to perform on a timely basis any material obligation under this Agreement or any agreement, instrument, or document entered into or delivered by such Party in connection herewith or to consummate the transactions contemplated by this Agreement; provided, however, that the following shall not be deemed to constitute, create or cause a Material Adverse Effect: any changes, circumstances or effects: (i) that affect generally the U.S. oil and gas industry, such as fluctuations in the price of oil and gas, and that result from (A) international, national, regional, state or local economic conditions, (B) changes in applicable Law or the application or interpretation thereof by any Governmental Body, or (C) other general economic conditions, facts or circumstances that are not subject to the control of such Party; (ii) that result from the effects of conditions or events resulting from an outbreak or escalation of hostilities (whether nationally or internationally), or the occurrence of any other calamity or crisis (whether nationally or internationally), including, the occurrence of one or more terrorist attacks; (iii) that are actions taken by Buyer or its Affiliates with respect to the transactions contemplated hereby or with respect to the Company; (iv) that are attributable to changes in applicable Laws; or (v) that result from the public announcement of this Agreement, Sellers’ compliance with the terms of this Agreement or the consummation of the transactions contemplated by this Agreement.

“Net Revenue Interest” means an interest (expressed as a percentage or decimal fraction) in and to all Hydrocarbons produced and saved from or attributable to an Oil and Gas Property, net of all landowner’s royalties, overriding royalties, production payments or other burdens or other non-operating interests attributable thereto.

“Oil and Gas Property” means all right, title and interest of the Company in and to the Leases, as set forth on Exhibit “A”, and the Wells, including the Wells set forth on Exhibit “B”.

“Order” means any order, injunction, judgment, decree, ruling, writ, assessment or arbitration award of a Governmental Body.

“Ordinary Course of Business” means the ordinary and usual course of normal day-today operations of the Company consistent with past custom and practice.

“Organizational Documents” means (a) the articles or certificate of incorporation and the bylaws of a corporation; (b) the limited liability company agreement and the certificate of formation of a limited liability company; (c) any charter or similar document adopted or filed in connection with the creation, formation, or organization of a Person; and (d) any amendment to any of the foregoing.

“Owned Real Property” means all land, together with all buildings, structures, improvements, and fixtures located thereon, and all easements and other rights and interests appurtenant thereto, owned by the Company (other than Oil and Gas Properties) and used in the business of the Company.

“Party” or “Parties” has the meaning set forth in the preamble.

Page 7

“Permits” means any approvals, orders, consents, licenses, permits, franchises, variances, exemptions, certificates, and other authorizations of or from a Governmental Body, including any performance bonds required under the Laws of Texas to be obtained from a reputable financial institution for plugging and abandonment obligations under state Law.

“Person” means any individual, estate, corporation, partnership (general or limited), limited liability company, firm, joint venture, association, joint-stock company, trust, enterprise, unincorporated organization, Governmental Body or other entity.

“Post-Closing Settlement Date” has the meaning set forth in Section 2.4.

“Post-Closing Settlement Payment” has the meaning set forth in Section 2.4.

“Post-Closing Settlement Statement” has the meaning set forth in Section 2.4.

“Properties” means all of the Company’s Owned Real Property, Leased Real Property, and Oil and Gas Properties, including the following:

| (a) |

all of the Company’s rights, titles and interests in and to the oil, gas or mineral leases, leasehold estates, operating rights and other rights authorizing the owner thereof to explore or drill for and produce Hydrocarbons and other minerals, contractual rights to acquire any such of the foregoing interests, which have been earned by performance, and fee mineral, royalty and overriding royalty interests, net profits interests, production payments and other interests payable out of Hydrocarbon production, in each case, in which the Company has an interest (the “Leases”); | |

| (b) |

all of the Company’s rights, titles and interests in and to any wells situated on the land described in the Leases or on land pooled, communitized or unitized therewith, including the wells described in Exhibit “B” or related to the Leases/Fields listed on Exhibit “A” (the “Wells”), together with all of the Company’s interests in and to all of the (i) crude oil, condensate or products in storage and produced after the Effective Date or in pipelines and (ii) materials, supplies, machinery, equipment, personal property, fixtures, improvements and other property, whether real, personal or mixed, now or as of the Effective Date on, appurtenant to or used or obtained by the Company in connection with the Leases or the Wells or with the production, injection, treatment, sale or disposal of Hydrocarbons and all other substances produced therefrom or attributable thereto including all equipment, machinery, fixtures and other tangible personal property and improvements located on the Oil and Gas Properties or used or held for use primarily in connection with the operation of the Oil and Gas Properties, including any Wells, wellhead equipment, tanks, boilers, buildings, fixtures, injection facilities, saltwater disposal facilities, compression facilities, pumping units and engines, flowlines, pipelines, gathering systems, gas and oil treating facilities, machinery, power lines, telephone and telegraph lines, roads, and other appurtenances, improvements and facilities (collectively, the “Fixtures, Facilities and Equipment”); |

Page 8

| (c) |

all of the Company’s rights, titles and interests in royalty interests, overriding royalty interests, net profits interests, operating interests, reversionary interests and other interests or benefits or credits owned by the Company in and to the Leases and Wells or in any other land or leases or in or attributable to production therefrom, and all rights, properties and interests of the Company relating to such interests, including without limitation all oil, gas and other minerals relating to the Leases credited to the account of or owned by the Company and its Subsidiaries for the period prior to the Effective Date pursuant to any balancing agreements relating to the Leases or otherwise arising by virtue of the fact that the Company may not have taken or marketed their full share of oil, gas or other minerals attributable to the Leases; | |

| (d) |

all of the Company’s right, titles and interests in and to, or otherwise derived from (i) all operating agreements and exploration agreements related to the properties described in subsections (a) through (c) above; (ii) pooling, communitization, and unitization agreements, declarations, designations and and/or orders and in and to the properties covered and the units created thereby (including without limitation, all units formed under orders, rules, regulations, or other official acts of any federal, state or other authority having jurisdiction, and voluntary unitization agreements, designations and/or declarations) relating to the properties described in subsections (a) through (c) above; and (iii) farmout agreements, joint venture agreements, product purchase and sale contracts, transportation, processing, treatment or gathering agreements, leases, permits, rights-of-way, easements, rights of surface use, licenses, options, declarations, orders, contracts, agreements, instruments in any way relating to the properties described in subsections (a) through (c) above and other rights and interests used in connection with the exploration, development, operation or maintenance of the properties described in subsections (a) through (c) above (the “Oil and Gas Agreements”); and | |

| (e) |

the Records. |

“Purchase Price” has the meaning set forth in Section 2.2.

“Real Property Leases” has the meaning set forth in Section 3.17(b) .

“Records” has the meaning set forth in Section 5.1.

“Release” means any depositing, spilling, leaking, pumping, pouring, placing, emitting, discarding, abandoning, emptying, discharging, migrating, injecting, escaping, leaching, dumping, or disposing.

“Rules” has the meaning set forth in Section 7.7.

Page 9

“Securities Act” means the United States Securities Act of 1933, as amended, and the rules and regulations thereunder.

“Sellers” has the meaning set forth in the preamble.

“Sellers Confidential Information” has the meaning set forth in Section 8.5(a) .

“Seller Party” or “Seller Parties” has the meaning set forth in the preamble.

“Sellers Representative” has the meaning set forth in Section 8.5(b) .

“Shares” has the meaning set forth in Section 2.2.

“Subsidiary” means any Person of which a majority of the outstanding share capital, voting securities or other voting equity interests is owned, directly or indirectly, by another Person.

“Survival Period” has the meaning set forth in Section 10.1(a) .

“Tangible Personal Property” means the structures, barges, boats, vehicles, and other tangible personal property described on Exhibit “C”.

“Tax” or “Taxes” means (a) any federal, state, local, Indian, or foreign income, gross receipts, gross margin, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental (including taxes under Code Section 59A), customs duties, capital stock, franchise, profits, withholding, social security (or similar excises), unemployment, disability, ad valorem, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not, by any Governmental Body responsible for imposition of any such tax (domestic or foreign), (b) in the case of the Company, liability for the payment of any amount of the type described in clause (a) as a result of being or having been on or before the Closing Date a member of an affiliated, consolidated, combined or unitary group, or a party to any agreement or arrangement, as a result of which liability of the Company to a Governmental Body is determined or taken into account with reference to the liability of any other Person, and (c) liability of the Company for the payment of any amount as a result of being party to any Tax Sharing Agreement or with respect to the payment of any amount of the type described in clause (a) or (b) as a result of any existing express or implied obligation (including an indemnification obligation).

“Tax Return” means any return, declaration, disclosure, election, schedule, estimate, report, claim for refund, estimates or information return or statement relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Tax Sharing Agreement” means all existing agreements or arrangements (whether or not written) binding on the Company that provide for the allocation, apportionment, sharing or assignment of any Tax liability or benefit, or the transfer or assignment of income, revenues, receipts or gains for the principal purpose of determining any Person’s Tax liability.

Page 10

“Termination Date” has the meaning set forth in Section 12.1(b)(i) .

“Title Defect” has the meaning set forth in Section 6.1(a) .

“Title Defect Amount” has the meaning set forth in Section 6.1(c) .

“Title Defect Notice” has the meaning set forth in Section 6.1(b) .

“Title Defect Notice Date” has the meaning set forth in Section 6.1(b) .

“Title Defect Property” has the meaning set forth in Section 6.1(b) .

“Working Interest” means the percentage of costs and expenses attributable to the maintenance, development and operation of an Oil and Gas Property.

ARTICLE II

SALE AND PURCHASE OF

INTERESTS

2.1 Sale and Purchase of Interests. At Closing, subject to the terms and conditions contained herein, Sellers shall sell to Buyer, and Buyer shall purchase from Sellers, the Interests. Such sale of Interests shall be made on the Closing Date, but shall be effective as of the Effective Date.

2.2 Purchase Price. In consideration for the sale of the Interests which include the assets described in Exhibits “A”, “B”, “C”, and Schedule 3.21, Buyer shall issue an aggregate of 95,000,000 restricted common shares in the capital of the Buyer (the “Shares”) (the “Purchase Price”) to the Sellers in the following allocation:

| Seller | Shares |

| CW Navigation, Inc. | 31,666,667; |

| KD Navigation, Inc. | 31,666,667; and |

| KW Navigation, Inc. | 31,666,666. |

At the Closing, Buyer will issue the Shares to the Sellers in accordance with each of the Sellers’ direction and registration instructions delivered to the Buyer at the time of Closing.

2.3 Resale Restrictions and Legending of Share Certificates. The Sellers hereby acknowledge and agree that the Buyer makes no representations as to any resale or other restriction affecting the Shares and that it is presently contemplated that the Shares will be issued by the Buyer to the Sellers in reliance upon the registration and prospectus exemptions contained in certain sections of the Securities Act or “Regulation S” promulgated under the Securities Act, which will impose a trading restriction in the United States on the Shares for a period of at least six months from the Closing Date. In addition, the Sellers hereby also acknowledge and agree that the within obligation of the Buyer to issue the Shares pursuant to Section “2.2” hereinabove will be subject to the Buyer being satisfied that an exemption from applicable registration and prospectus requirements is available under the Securities Act, and all applicable securities laws, in respect of each of the Buyer, the Interests and the Shares, and the Buyer shall be relieved of any obligation whatsoever to purchase any Interest of the Sellers and to issue any Shares in respect of the Sellers where the Buyer reasonably determines that a suitable exemption is not available to it. The Sellers hereby also acknowledge and understand that neither the issuance of the Shares which the Sellers are acquiring nor any of the Shares themselves have been registered under the Securities Act, or any state securities laws, and, furthermore, that the Shares must be held indefinitely unless subsequently registered under the Securities Act, or an exemption from such registration is available. The Sellers also acknowledge and understand that the certificates representing the Shares will be stamped with the following legends (or substantially equivalent language) restricting transfer in the following manner if such restriction is required under any applicable securities Laws:

Page 11

|

“The securities represented by this certificate have not been registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or applicable state securities laws. They may not be sold, offered for sale, pledged or otherwise transferred except pursuant to an effective registration statement under the U.S. Securities Act and in accordance with any applicable state securities laws, or pursuant to an exemption or exclusion from registration under the U.S. Securities Act and any applicable state securities laws. The securities represented by the certificate cannot be the subject of hedging transactions unless such transactions are conducted in compliance with the U.S. Securities Act.”. |

and the Sellers hereby consent to the Buyer making a notation on its records or giving instructions to any transfer agent of the Buyer in order to implement the restrictions on transfer set forth and described hereinabove.

|

The Sellers also acknowledge and understand that: | ||

| (a) |

the Shares are restricted securities within the meaning of “Rule 144” promulgated under the Securities Act; | |

| (b) |

the exemption from registration under Rule 144 will not be available in any event for at least six months from the date of issuance of the Shares to the Sellers, and even then will not be available unless (i) a public trading market then exists for the common stock of the Buyer, (ii) adequate information concerning the Buyer is then available to the public and (iii) other terms and conditions of Rule 144 are complied with; and | |

| (c) |

any sale of the Shares may be made by the Sellers only in limited amounts in accordance with such terms and conditions. |

Page 12

2.4 Post-Closing Settlement Statement. As promptly as practicable after the Closing Date, but in any event not later than 90 calendar days thereafter, Buyer shall, or shall cause the Company to, prepare and submit to the Sellers a proposed statement (the “Post-Closing Settlement Statement”), which shall show the revenues earned and the expenses and liabilities incurred by the Company from and including the Effective Date to but excluding the Closing Date with respect to the Interests as described in Exhibits “A”, “B” and “C”. In the event that such expenses and liabilities exceed such revenues, then the Buyer shall pay the Sellers the difference, and in the event that such revenues exceed such expenses and liabilities, then the Sellers shall pay the Buyer the difference, in each case such difference being referred to herein as the “Post-Closing Settlement Payment”, not later than 120 calendar days after the Closing Date (the “Post-Closing Settlement Date”) except as otherwise provided in this Section 2.4.

As soon as possible after receipt of the Post-Closing Settlement Statement, but in any event within 30 calendar days after receipt thereof, Sellers shall deliver to Buyer a written report containing the changes, if any, that the Sellers propose to be made to the Post-Closing Settlement Statement. Buyer covenants and agrees that, from the Closing Date until the Post-Closing Settlement Date, Buyer shall, or shall cause the Company to, make available for Sellers at the Company’s offices such financial and other records and information relating to the Company as are necessary for Sellers to create such report and agree upon the Post-Closing Settlement Statement. In the event no response is made by Sellers within such 30-day period, it shall be conclusively presumed that Sellers concur with the Post-Closing Settlement Statement, and such Post-Closing Settlement Statement shall be the basis for the Post-Closing Settlement Payment, if any. In the event that the Sellers submit a response, the Sellers and Buyer shall exercise all reasonable efforts to agree upon a mutually acceptable Post-Closing Settlement Payment on or before the Post-Closing Settlement Date.

To the extent that Buyer and the Sellers have not agreed with respect to the amounts due pursuant to this Section 2.4 before the Post-Closing Settlement Date, then either the Sellers or Buyer may refer the issues in dispute to a mutually agreed Independent Accounting Firm. The Independent Accounting Firm shall be instructed by the Sellers and Buyer to resolve the issues in dispute as soon as reasonably practicable in light of the circumstances but in no event in excess of 15 calendar days following the submission of such issues in dispute to the Independent Accounting Firm. The resolution of such issues by such firm shall be final and binding on the Sellers and Buyer. The costs of such public accountants shall be borne by the Party referring the issues in dispute unless the resolution of such issues results in adjustments to the Post-Closing Settlement Statement in excess of $15,000 in favor of the Party referring the issues, in which case the other Party shall be responsible for such costs. In this case, payment of the Post-Closing Settlement Payment shall be made within five Business Days of the Post-Closing Settlement Date or the decision by the Independent Accounting Firm by the Party owing the same by confirmed wire transfer to a bank account or accounts to be designated by notice from the receiving Party.

Page 13

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF

SELLERS AND THE COMPANY

Each of the Sellers and the Company, jointly and severally, hereby represents and warrants to Buyer that:

3.1 Authorization of Agreement. Each of the Sellers and the Company have all requisite corporate or limited liability company power, as applicable, and authority to execute, deliver and perform this Agreement and each other agreement, instrument, or document executed or to be executed by it in connection with the transactions contemplated hereby to which it is a party and to consummate the transactions contemplated hereby and thereby. The execution, delivery, and performance by each of the Sellers and the Company of this Agreement and each other agreement, instrument, or document executed or to be executed by it in connection with the transactions contemplated hereby to which it is a party, and the consummation by it of the transactions contemplated hereby and thereby, have been duly authorized by all necessary limited liability company action of such Party. The Company has all requisite limited liability company power and authority to conduct its business in the manner that it is currently being conducted.

3.2 Valid and Binding Agreement. This Agreement has been duly executed and delivered by each of the Sellers and the Company and constitutes, and each other agreement, instrument, or document executed or to be executed by it in connection with the transactions contemplated hereby to which it is a party has been, or when executed will be, duly executed and delivered by such party and constitutes, or when executed and delivered will constitute, a valid and legally binding obligation of such Party, enforceable against it in accordance with their respective terms, except that such enforceability may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium, and similar Laws affecting creditors’ rights generally and (b) equitable principles which may limit the availability of certain equitable remedies (such as specific performance) in certain instances.

3.3 No Conflicts. The execution and delivery by Sellers or the Company of this Agreement, the consummation of the transactions contemplated hereby, or compliance by the Sellers or the Company with any of the provisions hereof do not and will not conflict with, or result in any violation of or default (with or without notice or lapse of time or both) under, give rise to a right of termination, cancellation or acceleration of any material obligation or to the loss of a material benefit under, or result in the creation of any Lien on any of the Interests or any of the properties or assets of the Company under any provision of (a) the Organizational Documents of Sellers or the Company; (b) any Contract or Permit to which Sellers or the Company is a party or by which any of the properties or assets of the Company are bound; (c) any Order of any Governmental Body applicable to Seller or the Company or by which any of the properties or assets of the Company are bound; or (d) any applicable Law binding upon Sellers or the Company or applicable to Sellers or the Company or by which any of the properties or assets of the Company are bound.

3.4 Approvals. No consent, approval, order, or authorization of, or declaration, filing, or registration with, any Governmental Body or of any third party is required to be obtained or made by either Sellers or the Company in connection with the execution, delivery, or performance by it of this Agreement, each other agreement, instrument, or document executed or to be executed by such Party in connection with the transactions contemplated hereby to which it is a party or the consummation by such Party of the transactions contemplated hereby and thereby.

Page 14

3.5 Ownership and Transfer of Interests. All of the Interests are owned by Sellers, of record and beneficially, free and clear of any and all Liens, other than (a) Liens that arise out of any actions taken by or on behalf of Buyer or its Affiliates; or (b) Liens that will be released at or before Closing; or (c) restrictions on transfer that may be imposed by federal or state securities Laws. Sellers’ delivery of such Interests as provided in this Agreement will convey to Buyer legal and beneficial title to such Interests, free and clear of any and all Liens, other than (a) Liens that arise out of any actions taken by or on behalf of Buyer or its Affiliates or (b) restrictions on transfer that may be imposed by federal or state securities Laws.

3.6 Litigation. Except as set forth in Schedule 3.6, (a) there are no Legal Proceedings pending or, to the Knowledge of the Seller Parties, threatened against or affecting, the Company or any its Properties or affecting the execution and delivery of this Agreement by Sellers or the Company or the consummation of the transactions contemplated herein and (b) there are no outstanding Orders, awards or decrees of any Governmental Body against or naming the Company. Schedule 3.6 contains a complete and correct list of all Legal Proceedings pending or, to the Knowledge of the Seller Parties, threatened against the Company or relating to the Properties. The Company has not received any notice of any pending or, to the Knowledge of the Seller Parties, threatened condemnation, taking or similar proceeding affecting any of the Properties.

3.7 Financial Advisors. No broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission for which Buyer may be liable in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Sellers or the Company.

3.8 Organization and Good Standing. Each of the Sellers is a corporation and the Company is a limited liability company; and each of the Sellers and the Company is duly organized, validly existing and in good standing under the Laws of, in the case of the Sellers, the State of Texas, and in the case of the Company, the State of Nevada, and has all requisite corporate or limited liability company power, as applicable, and authority to own, lease and operate its properties and to carry on its business as now conducted. The Company does not conduct any business or activity outside the State of Nevada and the State of Texas.

3.9 Capitalization. The Interests constitute all of the issued and outstanding interests of the Company. All of the Interests have been duly authorized, validly issued and are fully paid and non-assessable, and none of the Interests are subject to, or have any been issued in violation of, preemptive or similar rights. No authorization or consent of any Person is required in order to consummate the transactions contemplated by this Agreement by virtue of any such Person having an equitable or beneficial interest in the Company or the Interests. Except for the Interests and the rights created by this Agreement, there are outstanding or in existence (a) no membership interests or other equity or debt securities of the Company, (ii) no securities or obligations of the Company convertible into or exchangeable for membership interests or other equity or debt securities of the Company, (iii) no options, warrants, calls, commitments or other rights or Contracts to acquire from the Company, and no obligation or plan of the Company to issue or sell, any membership interests or other equity or debt securities of the Company or any securities of the Company convertible into or exchangeable for such membership interests or equity or debt securities, and (iv) no equity equivalents, interests in the ownership or earnings, or other similar rights of or with respect to the Company. There are no outstanding obligations or plans of the Sellers or the Company to repurchase, redeem, or otherwise acquire any of the foregoing membership interests (including the Interests), securities, options, equity equivalents, interests, or rights. Except for this Agreement, neither Sellers nor the Company is a party to any voting trust or other Contract with respect to the voting, sale, transfer or other disposition of the Interests.

Page 15

3.10 Subsidiaries. The Company has no Subsidiaries.

3.11 Governing Documents. Sellers have provided to Buyer accurate and complete copies of the Organizational Documents of the Company, as currently in effect and the minutes of all meetings of the Company’s board of managers (or similar governing body), any committees of such board, and the Company’s members (and all consents in lieu of such meetings). Such records, minutes, and consents accurately reflect the ownership of the Company and in all material respects all actions taken by the Company’s board, any committees of such board, and the Company’s members.

3.12 Compliance with Law.

| (a) |

To the Knowledge of Seller Parties, the Company is in compliance in all material respects with all applicable Laws. The Company has not received any notice from any Governmental Body, or any other Person, alleging that the Company is in violation of, or has violated, any applicable Law in any material respect and to the Knowledge of the Seller Parties, no such allegation has been filed, commenced or threatened against the Company. | |

| (b) |

Notwithstanding the foregoing, this Section 3.12 does not relate to Environmental Laws, Environmental Liabilities, Environmental Permits or matters that would or could constitute Environmental Breaches, which are addressed solely in Section 7.1. |

3.13 Taxes.

| (a) |

To the Knowledge of Seller Parties: (i) the Company has timely filed (taking into account any properly granted extensions of time to file) all Tax Returns with the appropriate taxing authorities required to have been filed, and each such Tax Return is correct and complete in all material respects; (ii) all material Taxes due and owed by the Company, whether or not shown on any Tax Return, have been timely paid; (iii) the Company and its officers, directors or employees responsible for Tax matters have complied with all rules and regulations relating to the withholding of Taxes and the remittance of withheld Taxes in connection with any amounts paid or owing to any employee, independent contractor, creditor, stockholder or other third party; (iv) the Company has not waived any statute of limitations in respect of its Taxes or agreed to any extension of time with respect to a Tax assessment of deficiency, which waiver or extension is currently in effect; (v) there are no liens for Taxes (other than Taxes not yet due and payable) upon any of the assets of the Company; (vi) the Company has not received any written notice from any Tax authority that such Tax authority currently plans to assess any additional Taxes for any period for which Tax Returns have been filed; (vii) no tax audits or administrative or judicial Tax proceedings are pending or being conducted with respect to the Company; (viii) the Company has not received from any taxing authority (including jurisdictions in which the Company has not filed Tax Returns) any currently unresolved (A) written notice indicating an intent to open an audit or other review, (B) written or oral request for information related to Tax matters or (C) notice of deficiency or proposed adjustment for any amount of Tax, proposed, asserted or assessed by any taxing authority against the Company; and (ix) the Company has never been treated as an S-corporation as defined in Section 1361 under the Code. |

Page 16

| (b) |

The Company has delivered to Buyer (i) complete copies of all Tax Returns of the Company requested by Buyer, and of all examination reports and statements of deficiencies assessed against or agreed to by the Company for all taxable periods for which the applicable statute of limitations has not yet expired, and (ii) complete copies of all private letter rulings, revenue agent reports, information documents requests, notices of proposed deficiencies, deficiency notices, protests, petitions, closing agreements, settlement agreements, pending ruling requests, and any similar documents, submitted by, received by, agreed to by or on behalf of or otherwise relating to the Company with respect to a taxable period for which the statute of limitations has not yet expired. | |

| (c) |

The Company does not own any interest or has not owned an interest in any Person treated as a partnership for Tax purposes. |

3.14 Employee Related Matters. The Company has no employees.

3.15 Contracts.

| (a) |

Schedule 3.15 lists all material Contracts to which the Company is a party or by which it or its assets or Properties may be bound. | |

| (b) |

To the Knowledge of Seller Parties, each material Contract is a valid and binding, in full force and effect and enforceable against the Company and, to the Knowledge of Seller Parties, the other parties thereto in accordance with their respective terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, moratorium or other similar laws affecting or relating to the enforcement of creditors’ rights generally and the application of general principles of equity (regardless of whether that enforceability is considered in a proceeding at law or in equity). To the Knowledge of Seller Parties: i) neither the Company nor any other party thereto is in default thereunder and ii) no condition exists with respect to any such Contract, which, with the passage of time or the giving of notice or both, could reasonably be expected to have a Material Adverse Effect. Neither the Company nor Sellers have received notice of any claim of breach or default under any Contract, except for such breaches or defaults which would not, individually or in the aggregate, have a Material Adverse Effect. The consummation of the transactions contemplated by this Agreement would not give any party to any Contract the right to terminate or alter the terms of such Contract or to declare a breach or default thereunder except for such terminations or alterations which would not, individually or in the aggregate, have a Material Adverse Effect. Each Contract in the possession of Company or Sellers has been provided to Buyer. The right, title and interest of Company in each Contract is free and clear of all Liens (other than Liens specified in such Contract). Except as disclosed in Schedule 3.15, (i) no material Contract will be terminated by the Company or Sellers prior to Closing and (ii) neither the Company, Sellers nor any other party to any Contract, have given or, to the Knowledge of the Seller Parties, threatened to give notice of any action to terminate, cancel, rescind or procure a judicial reformation of any material Contract or any provisions thereof. |

Page 17

3.16 Oil and Gas Properties.

| (a) |

Sellers and the Company specially warrant by, through or under Sellers or the Company, but not otherwise that: | ||

| (i) |

the Oil and Gas Properties are free and clear of all Liens; and | ||

| (ii) |

with respect to each of the Wells set forth on Exhibit “B” the ownership by the Company entitles the Company to receive a decimal share of the oil, gas and other hydrocarbons produced from such Well not less than the decimal share set forth in Exhibit “A” as the “Net Revenue Interest” for such Well and causes the Company to be obligated to bear a decimal share of the cost of operation of such Well not greater than the decimal share set forth in Exhibit “A” as the “Working Interest” for such Well, and such shares of production which the Company is entitled to receive, and shares of expenses which the Company is obligated to bear, are not subject to change (unless the Net Revenue Interest for such asset is greater than the Net Revenue Interest set forth on Exhibit “A” in the same proportion as any increase in such Working Interest). | ||

| (b) |

Except as set forth in Schedule 3.24, the Company has not entered into any commitment to incur any individual capital expenditure in excess of $100,000 or any two or more commitments which in the aggregate exceed $250,000 in connection with the ownership or operation of the Oil and Gas Properties, other than routine expenses incurred in the normal and ordinary operation of the Oil and Gas Properties in accordance with generally accepted practices in the oil and gas industry. Further, the Company has not abandoned, or, agreed to abandon, any Wells (or removed any material items of equipment, except those replaced by items of substantially equivalent suitability and value) on the Oil and Gas Properties since the Effective Date. | ||

Page 18

| (c) |

All expenses (including all bills for labor, materials and supplies used or furnished for use by the Company in connection with the Oil and Gas Properties, and all severance, production, ad valorem, windfall profit and other similar Taxes) relating to the ownership or operation of the Oil and Gas Properties by the Company, have been, and are being paid (timely, and before the same become delinquent) by the Company, except such expenses and Taxes as are disputed in good faith by the Company and except for such expense or Tax, the non-payment of which, either individually or in the aggregate, would not reasonably be expected to result in a Material Adverse Effect. With respect to the Oil and Gas Properties operated by the Company, the Company is not delinquent in any material respect, and with respect to the Oil and Gas Properties operated by third parties, to the Knowledge of the Seller Parties, such third party is not delinquent in any material respect, with respect to its obligations to bear costs and expenses relating to the development and operation of such Oil and Gas Properties. The Company is not delinquent with respect to its obligations to pay any material royalties, overriding royalties, compensatory royalties and other payments due from or in respect of production, with respect to the Oil and Gas Properties it operates. | |

| (d) |

All proceeds from the sale of Hydrocarbons produced from the Oil and Gas Properties are being received by the Company in a timely manner. | |

| (e) |

No Person has any call upon, option to purchase, preferential right to purchase or similar rights with respect to the Oil and Gas Properties or to the production therefrom. |

3.17 Real Property.

| (a) |

Other than the Oil and Gas Properties, Schedule 3.17(a) sets forth the legal description of each parcel of Owned Real Property. With respect to each parcel of Owned Real Property, and except as specified in Schedule 3.17(a): | ||

| (i) |

the Company has good and marketable title, free and clear of all Liens; | ||

| (ii) |

the Company has not leased or otherwise granted to any Person the right to use or occupy such Owned Real Property or any portion thereof; | ||

| (iii) |

there are no outstanding options, rights of first offer or rights of first refusal to purchase such Owned Real Property or any portion thereof or interest therein; | ||

| (iv) |

other than the Company, there are no parties in possession of the parcel of Owned Real Property; and | ||

Page 19

| (v) |

all facilities located on the parcels of Owned Real Property are supplied with utilities and other services necessary for the operation of such facilities, including electricity and water all of which services are adequate and are provided via public roads or via appurtenant easements benefiting the parcels of Owned Real Property. | ||

| (b) |

Other than the Oil and Gas Properties, Schedule 3.17(b) sets forth the address of each parcel of Leased Real Property which is material to the business of the Company (“Real Property Leases”), and a true and complete list of all Real Property Leases for each such parcel of Leased Real Property. The Company has made available to Buyer a true and complete copy of each Real Property Lease. With respect to each of the Real Property Leases: | ||

| (i) |

each such Real Property Lease is legal, valid, binding, enforceable, and in full force and effect; | ||

| (ii) |

each such Real Property Lease will continue to be legal, valid, binding, enforceable, and in full force and effect on identical terms following the consummation of the transactions contemplated by this Agreement; | ||

| (iii) |

the Company has not received notice of, and to the Knowledge of Seller Parties is not in, breach or default under such Real Property Lease, and to the Knowledge of Seller Parties no event has occurred which, with notice or lapse of time, would constitute a breach or default or permit termination, modification, or acceleration thereunder; | ||

| (iv) |

no other party to such Real Property Lease has repudiated or breached any provision thereof; | ||

| (v) |

all facilities leased or subleased under such Real Property Lease have received all approvals of Governmental Bodies (including Permits) required in connection with the operation thereof and, to the extent operated by Company, have been operated and maintained in accordance with applicable Laws; and | ||

| (vi) |

except as set forth on Schedule 3.17(b), all facilities leased or subleased under such Real Property Lease are supplied with utilities and other services necessary for the operation of such facilities, including electricity and water all of which services are adequate and are provided via public roads or via appurtenant easements benefiting the parcel of Leased Real Property. | ||

3.18 Expense Accounts. The Company has no expense accounts.

3.19 Intellectual Property. The Company has no Intellectual Property other than as may be contained in the Records.

Page 20

3.20 Insurance; Bonds, Letters of Credit and Guaranties. Schedule 3.20 lists all bonds, letters of credit, guaranties and other similar instruments outstanding and issued by the Company.

3.21 Activities of the Company. The Company has engaged in no business other than owning and operating the Properties, disposing of Hydrocarbons from the Oil and Gas Properties, performing its obligations under the Contracts and matters incident to the foregoing. Except as set forth on Schedule 3.21, the Company does not own any material assets other than the Properties and investments in cash or cash equivalents.

3.22 Bank Accounts; Power of Attorney. Except as set out in Schedule 3.22, the Company has no bank accounts and has granted no powers of attorney.

3.23 Records. The books of account and other financial records of the Company that have been previously furnished to Buyer are substantially complete and correct in all material respects and have been in all material respects maintained in accordance with good business practice and all Laws. Sellers make no warranty whatsoever as to any documents or records created by any party other than Sellers or Company.

3.24 Current Commitments. Schedule 3.24 sets forth as of the date of this Agreement all authorities for expenditures (“AFE’s”) relating to the Company’s interest in the Leases to drill or rework Wells or for other capital expenditures pursuant to any of the Contracts or any applicable joint operating agreement for which all of the activities anticipated in such AFE’s or commitments have not been completed by the date of this Agreement.

3.25 Permits.

| (a) |

The Company or the operators of the Oil and Gas Properties, hold all Permits required under applicable Law and necessary to carry on operations connected with the Oil and Gas Properties as currently conducted, except where the failure to obtain such permits or licenses would not have a Material Adverse Effect. | |

| (b) |

The Company or such operator is in compliance with the terms, provisions and conditions of each of its Permits, except where the failure to be in compliance would not have a Material Adverse Effect. | |

| (c) |

Sellers have made available to Buyer in the offices of the Company true and complete copies of (i) all material Permits of the Company and (ii) any and all pending applications of additional material Permits that have been submitted to any Governmental Body by or on behalf of the Company. |

3.26 Financial Statements; Accounts Receivable; Undisclosed Liabilities.

| (a) |

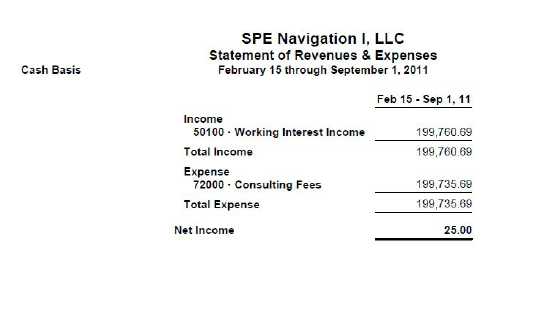

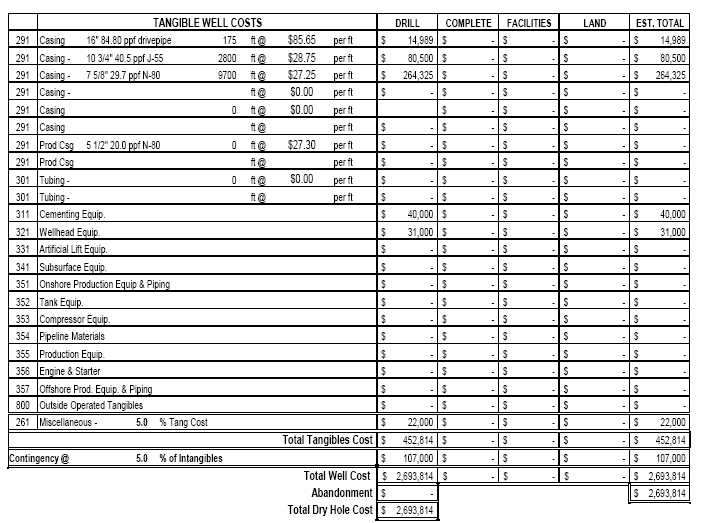

Buyer has been provided copies or access to balance sheets and statements of operations, income and cash flows of the Company for the period ended August 31, 2011 (the “Financial Statements”), which are attached hereto as Exhibit “D”. Such financial statements and notes fairly present the financial condition and the results of operations and changes in cash flow at the respective dates of and for the periods referred to in such financial statements. |

Page 21

| (b) |

Any accounts receivable as of August 31, 2011 will be retained by the Sellers. | |

| (c) |

Except as set forth in this Agreement or on the Financial Statements and any related footnotes thereto, the Company has no liabilities or obligations, including off balance sheet arrangements of any nature (whether accrued, absolute, fixed, contingent or otherwise and whether due or become due) except for (a) liabilities and obligations incurred since the date of the Financial Statements in the Ordinary Course of Business or operations, (b) liabilities and obligations incurred since the date of the Financial Statements pursuant to this Agreement, (c) liabilities and obligations disclosed in this Agreement (or its schedules) or (d) liabilities or obligations that would not reasonably be expected to have a Material Adverse Effect. |

3.27 Absence of Certain Changes Except as may be contemplated by this Agreement, (a) the Company has conducted its business in the Ordinary Course of Business consistent with past practice (including with respect to the collection of accounts receivable and payment of accounts payable) (b) there has not been a Material Adverse Effect, and (c) the Company has not:

| (i) |

borrowed any amount or incurred or become subject to any liabilities (other than liabilities specifically indicated in the balance sheet of the Financial Statements attached as Exhibit “D”); | |

| (ii) |

mortgaged, pledged or subjected to any Lien, charge or other encumbrance, any material portion of its assets; | |

| (iii) |

sold, assigned or transferred any portion of its tangible assets outside the ordinary course of business; | |

| (iv) |

issued, sold or transferred any of its capital stock or other equity securities, securities convertible into its capital stock or other equity securities or warrants, options or other rights to acquire its capital stock or other equity securities, or any bonds or debt securities; | |

| (v) |

made any loan to any other Person; | |

| (vi) |

Other than as specified in Sections 3.16(b) or 3.24 made any capital expenditures or commitments therefor in excess of $100,000 individually or in excess of $250,000 in the aggregate; | |

| (vii) |

made any loan to, or entered into any other transaction with, any of its directors, officers, and employees outside the ordinary course of business; | |

| (viii) |

amended its Organizational Documents; |

Page 22

| (ix) |

made any material change in any method of accounting or accounting principles or practice or made any change in revenue recognition practice; | |

| (x) |

terminated or otherwise amended any material Contracts other than in the Ordinary Course of Business; | |

| (xi) |

incurred any loss, destruction or casualty affecting the Company not covered by insurance; | |

| (xii) |

(A) made or revoked any election relating to Taxes, (B) settled or compromised any claim, action, suit, litigation, proceeding, arbitration, investigation, audit or controversy relating to Taxes, (C) filed any amended Tax Return, or (D) changed any methods of reporting income or deductions for federal income tax purposes; or | |

| (xiii) |

committed or agreed in writing, orally or otherwise to do any of the foregoing. |

3.28 Leases and Contracts.

| (a) |

All royalties and other payments due as of the Effective Date under the Leases have been or will be properly and timely paid in accordance with applicable Lease provisions and federal, state or tribal regulations, and all conditions within the control of the Company necessary to keep the Leases in force have been fully performed. | |

| (b) |

The material Oil and Gas Agreements are in full force and effect and constitute binding obligations of the parties thereto. (i) the Company is not in breach or default (and no situation exists that with the passage of time or giving of notice would create such a breach or default) of its obligations under the material Oil and Gas Agreements and (ii) no breach or default by any third party (or situation that with the passage or time or giving of notice would create such a breach or default) exists. |

3.29 Seismic Data. The Company does not own any seismic data.

3.30 Disclaimers. Sellers make all of the following disclaimers:

| (a) |

Except as specifically stated in this Agreement, SELLER PARTIES MAKE NO REPRESENTATION OR WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, WITH RESPECT TO ANY MATTER OR THING AND DISCLAIM ALL LIABILITY AND RESPONSIBILITY FOR ANY REPRESENTATION, WARRANTY, COLLATERAL CONTRACT, STATEMENT, ASSURANCE, OPINION OR INFORMATION MADE OR COMMUNICATED (ORALLY OR IN WRITING) TO BUYER (INCLUDING THOSE BY ANY OFFICER, DIRECTOR, EMPLOYEE, AGENT, ADVISER, CONSULTANT OR REPRESENTATIVE OF SELLERS, COMPANY OR ANY AFFILIATE THEREOF). |

Page 23

| (b) |

The Parties agree that, to the extent required by applicable Law to be effective, the disclaimers of certain representations and warranties contained in this Section 3.30 are “conspicuous” disclaimers for the purpose of any applicable Laws. |

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF

BUYER

Buyer hereby represents and warrants to Sellers and the Company that:

4.1 Organization and Good Standing. Buyer is a corporation duly organized, validly existing and in good standing under the Laws of the State of Nevada and has all requisite corporate power and authority to own, lease and operate its properties and to carry on its business as now conducted.

4.2 Authorization of Agreement. Buyer has all requisite power and authority to execute, deliver and perform this Agreement and each other agreement, instrument, or document executed or to be executed by it in connection with the transactions contemplated hereby to which it is a party and to consummate the transactions contemplated hereby and thereby. The execution, delivery, and performance by Buyer of this Agreement and each other agreement, instrument, or document executed or to be executed by it in connection with the transactions contemplated hereby to which it is a party, and the consummation by it of the transactions contemplated hereby and thereby, have been duly authorized by all necessary corporate action of Buyer.

4.3 Valid and Binding Agreement. This Agreement has been duly executed and delivered by Buyer and constitutes, and each other agreement, instrument, or document executed or to be executed by Buyer in connection with the transactions contemplated hereby to which it is a party has been, or when executed will be, duly executed and delivered by Buyer and constitutes, or when executed and delivered will constitute, a valid and legally binding obligation of Buyer, enforceable against it in accordance with their respective terms, except that such enforceability may be limited by (a) applicable bankruptcy, insolvency, reorganization, moratorium, and similar laws affecting creditors’ rights generally and (b) equitable principles which may limit the availability of certain equitable remedies (such as specific performance) in certain instances.

4.4 No Conflicts. None of the execution and delivery by Buyer of this Agreement, the consummation of the transactions contemplated hereby, or the compliance by Buyer with any of the provisions hereof will conflict with, or result in any violation of or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation or acceleration of any material obligation or to the loss of a material benefit under any provision of (a) the certificate of incorporation or bylaws of Buyer; (b) any Contract or Permit to which Buyer is a party or by which Buyer or its properties or assets are bound; (c) any Order of any Governmental Body applicable to Buyer or by which any of the properties or assets of Buyer are bound; or (d) any applicable Law binding upon or applicable to Buyer or by which any of the properties or assets of Buyer are bound.

4.5 Approvals. No consent, approval, order, or authorization of, or declaration, filing, or registration with, any Governmental Body or of any third party is required to be obtained or made by Buyer in connection with the execution, delivery, or performance by it of this Agreement, each other agreement, instrument, or document executed or to be executed by Buyer in connection with the transactions contemplated hereby to which it is a party or the consummation by it of the transactions contemplated hereby and thereby.

Page 24

4.6 Bankruptcy. No proceedings are pending for, and the Buyer is unaware of, any basis for the institution of any proceedings leading to the dissolution or winding up of the Buyer or the placing of the Buyer in bankruptcy or subject to any other laws governing the affairs of an insolvent company.

4.7 Title to Assets. The Buyer owns and possesses and has good and marketable title to and possession of all of its business assets free and clear of all actual or threatened liens, charges, options, encumbrances, voting agreements, voting trusts, demands, limitations and restrictions of any nature whatsoever, save and except for those actual or threatened liens, charges, encumbrances, demands, limitations and restrictions which are listed in Schedule 4.7.

4.8 Licenses and Permits. Save and except as set forth in the Schedule 4.8, the Buyer holds all licenses and permits required for the conduct in the ordinary course of the operations of its business and for the uses to which its business assets have been put and are in good standing, and such conduct and uses are in compliance with all laws, zoning and other by-laws, building and other restrictions, rules, regulations and ordinances applicable to the Buyer and its business and assets, and neither the execution and delivery of this Agreement nor the completion of the transactions contemplated hereby will give any person the right to terminate or cancel any said license or permit or affect such compliance.

4.9 Litigation. There are no Legal Proceedings pending or, to the Knowledge of Buyer, threatened, in which it is or may be a party affecting the execution and delivery of this Agreement by Buyer or the consummation of the transactions contemplated herein by Buyer.

4.10 No Material Adverse Effect. Save and except as set forth in Schedule 4.11, the Buyer has not experienced, nor is the Buyer aware of, any occurrence or event which has had, or might reasonably be expected to have, a materially adverse affect on its business or on the results of its operations.

4.11 Permits. Save and except as set forth in Schedule 4.12, the Buyer holds or has applied for all permits, licenses, consents and authorities issuable by any federal, state, regional or municipal government or agency thereof which are necessary or desirable in connection with its operations.

4.12 Tax. There is not now, and there will not be by the Closing Date, any proceeding, claim or, to the best of the knowledge, information and belief of the Buyer, after making due inquiry, any investigation by any federal, state or municipal taxation authority, or any matters under discussion or dispute with such taxation authorities, in respect of taxes, governmental charges, assessments or reassessments in connection with the Buyer, and the Buyer is not aware of any contingent tax liabilities or any grounds that could result in an assessment, reassessment, charge or potentially adverse determination by any federal, state or municipal taxation authority as against the Buyer.

Page 25

4.13 No Breach. The Buyer is not in breach of any provision or condition of, nor have they done or omitted anything that, with or without the giving of notice or lapse or both, would constitute a breach of any provision or condition of, or give rise to any right to terminate or cancel or accelerate the maturity of any payment under, any deed of trust, contract, certificate, consent, permit, license or other instrument to which it is a party, by which it is bound or from which it derives benefit, any judgment, decree, order, rule or regulation of any court or governmental authority to which it is subject, or any statute or regulation applicable to it, to an extent that, in the aggregate, has a Material Adverse Effect on it.

4.14 Activities of the Company. Until the Closing Date the Buyer will:

| (i) |

maintain its assets in a manner consistent with and in compliance with applicable law; and | |

| (ii) |

not enter into any material transaction or assume or incur any material liability outside the normal course of its business. |

4.15 Corporate Changes. The Buyer has not committed to making and until the Closing Date will not make or commit itself, without the written consent of each of the Sellers and the Company, to:

| (i) |

declare or pay any dividend, or make any distribution of its properties or assets to its shareholders, or purchase or retire any of its shares; | |

| (ii) |

sell all or any part of its assets or agree to do or perform any act or enter into any transaction or negotiation which could reasonably be expected to interfere with this Agreement or which would render inaccurate any of the representations, warranties and covenants set forth in this Agreement; or | |

| (iii) |

merge, amalgamate or consolidate into or with any entity, or enter into any other corporate reorganization; |

provided, however, that the provisions hereof shall not preclude the Buyer pending the Closing or the termination of this Agreement, whichever shall first occur, from carrying on its business in the normal course thereof.

4.16 No Cease Trades. Save and except for those matters which are listed in Schedule 4.17 which is attached hereto, the shares in the capital of the Buyer are not subject to or affected by any actual or, to the knowledge of the Buyer, pending or threatened cease trading, compliance or denial of use of exemptions orders of, or action, investigation or proceeding by or before, any securities regulatory authority, Court, administrative agency or other tribunal.

4.17 Investment Intention. Buyer is acquiring the Interests for its own account for investment purposes only and not with a view to the distribution (as such term is used in Section 2(11) of the Securities Act), except in compliance with applicable federal and state securities Laws. Buyer understands that the Interests have not been registered under the Securities Act and cannot be sold unless subsequently registered under the Securities Act or an exemption from such registration is available.

Page 26

4.18 Financial Advisors. No broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission for which Sellers may be liable in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

4.19 Financial Capability. Buyer (a) has sufficient funds available to pay any expenses incurred by Buyer in connection with the transactions contemplated by this Agreement and (b) has the resources and capabilities (financial or otherwise) to perform its obligations hereunder.

4.20 Sophisticated Buyer. Buyer is a knowledgeable purchaser, owner and operator of oil and gas properties, has the ability to evaluate oil and gas properties, and in fact has evaluated the Properties for purchase, and is acquiring the Properties based upon its own evaluation.

4.21 Buyer Acknowledgements, Waivers and Agreements.

| (a) |

Buyer acknowledges and agrees that at Closing, it shall accept all Properties in its then “AS IS, WHERE IS” condition and with all faults, with an expressed acceptance and understanding of the disclaimers contained in this Agreement. | ||

| (b) |

Buyer further acknowledges each of the following: | ||

| (i) |