Attached files

| file | filename |

|---|---|

| EX-23.1 - China Industrial Steel Inc. | ex23-1.htm |

As filed with the Securities and Exchange Commission on September 22, 2011

Registration No. 333-172135

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA INDUSTRIAL STEEL INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

3310

|

27-1847645

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

110 Wall Street, 11th Floor

New York, NY 10005

(646) 328 1502

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

HIQ Maryland Corp.

715 St. Paul Street

Baltimore, MD 21202

(410) 752-8030

(Name, address, including zip code, and telephone number, including area code, of agent for service)Copies to:

Gregory Sichenzia, Esq.

Benjamin Tan, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-accelerated Filer x

|

Smaller Reporting Company o

|

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Amount to be

Registered(1)

|

Proposed maximum

offering price per share

|

Proposed maximum

aggregate offering price

|

Amount of

registration fee

|

||||||||||||

|

Common stock, par value $0.0001 per share (3)

|

2,580,022 | $ | 4.50 | (2) | $ | 11,610,099 | $ | 1,347.93 | (3) | |||||||

____________

|

(1)

|

Pursuant to Rule 416 under the Securities Act, the shares of common stock offered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of anti-dilution provisions, stock splits, stock dividends, recapitalizations or other similar transactions.

|

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee. Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price the shares were sold to our shareholders in a private placement transaction which closed in February 2011. The price of $4.50 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, Inc. (“FINRA”), which operates the OTC Electronic Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

|

|

(3)

|

Registrant has previously paid the registration fee.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer and sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION, DATED SEPTEMBER [*], 2011

|

CHINA INDUSTRIAL STEEL INC.

2,580,022 Shares of Common Stock

Offered by Selling Stockholders

This prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 2,580,022 shares of our common stock, par value $.0001 per share. The common stock has already been issued to the selling stockholders in private placement transactions which closed in January 2011 and February 2011, that were exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended.

The selling stockholders may be deemed underwriters of the shares of common stock, which they are offering.

We have set an offering price for these securities at $4.50 per share of common stock offered through this prospectus. The $4.50 per share offering price of our common stock was determined based on the price per share of our common stock in our most recent private placement transaction, which was consummated in February 2011. Under the February 2011 private placement, we sold 1,000 units at a price of $4.50 per unit, with each unit consisting of: (i) one share of our common stock, (ii) one three-year warrant to purchase one share of our common stock at an exercise price of $2.00 per share, and (iii) one three-year warrant to purchase one share of our common stock at an exercise price of $4.50 per share. Accordingly, the $4.50 price was based on negotiations between the Company and the investors.

Similarly, under the January 2011 private placement, we sold we sold an aggregate of 2,579,022 units at $1.50 per unit with each unit consisting of: (i) one share of our common stock, and (ii) a three-year warrant to purchase one share of our common stock at an exercise price of $4.50 per share.

We are registering the shares contained in the units sold in the January 2011 and February 2011 private placement transactions on behalf of the selling stockholders. The selling stockholders will sell their shares of our common stock at a price of $4.50 per share until shares of our common stock are quoted on the Over-The-Counter (OTC) Bulletin Board, or listed for trading or quoted on any other public market, and thereafter, from time to time, at prevailing market prices or privately negotiated prices. We will not receive any of the proceeds from the sale of the shares by the selling stockholders. We will pay all of the registration expenses incurred in connection with this offering (estimated to be approximately $35,348), but the selling stockholders will pay all of their selling commissions, brokerage fees and related expenses.

Our common stock is not currently quoted on any exchange or inter-dealer market. We cannot give you any assurance that an active trading market in our common stock will develop, or if an active market does develop, that it will continue.

The shares are being offered by the selling stockholders in anticipation of the development of a secondary trading market in our common stock.

Investing in our common stock involves a high degree of risk. You may lose your entire investment. See “Risk Factors” beginning on page 7 for a discussion of certain risk factors that you should consider. You should read the entire prospectus before making an investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________, 2011

TABLE OF CONTENTS

|

PART I

|

Page | |

|

1

|

||

|

2

|

||

|

2

|

||

|

7

|

||

|

24

|

||

|

24

|

||

|

25

|

||

|

26

|

||

|

47

|

||

|

50

|

||

|

51

|

||

|

54

|

||

|

70

|

||

|

70

|

||

|

71

|

||

|

72

|

||

|

76

|

||

|

78

|

||

|

83

|

||

|

84

|

||

|

84

|

||

|

84

|

||

|

84

|

||

|

85

|

||

|

86

|

||

|

86

|

||

Until _____________, 2011 all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information other than that contained in this prospectus. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. The prospectus will be updated and updated prospectuses will be made available for delivery to the extent required by the federal securities laws.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us or any selling stockholder. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses will be made available for delivery to the extent required by the federal securities laws.

When used in this prospectus, the terms:

|

●

|

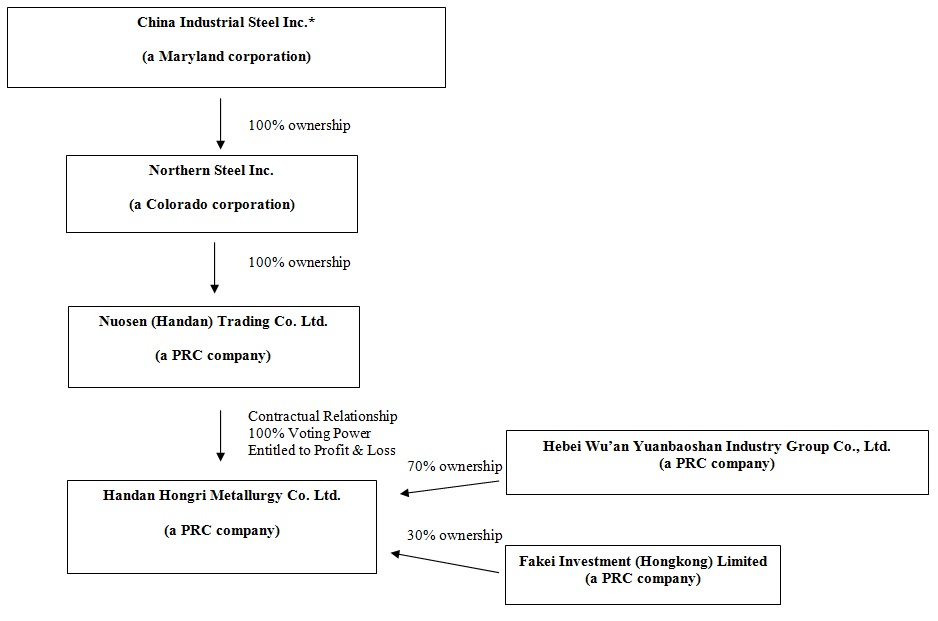

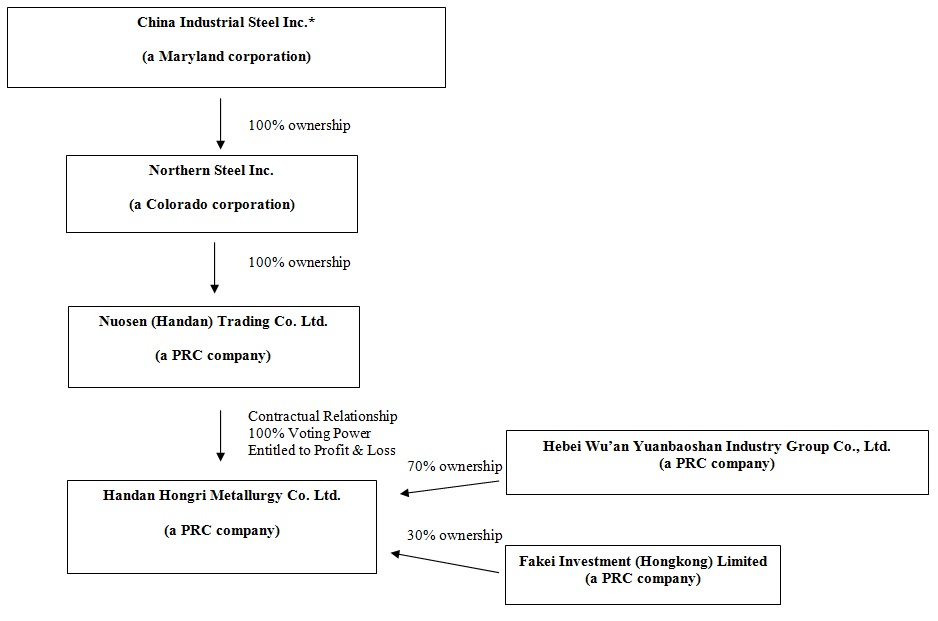

“China Industrial Steel,” the "Company," "we," "our" and "us" refers to China Industrial Steel Inc., a Maryland company.

|

|

|

●

|

“Northern Steel” refers to our wholly-owned subsidiary, Northern Steel Inc., a Colorado corporation.

|

|

●

|

"Nuosen" refers to Northern Steel’s wholly owned subsidiary, Nuosen (Handan) Trading Co. Ltd., a wholly foreign-owned enterprise (“WFOE”) organized under the laws of the People’s Republic of China.

|

|

●

|

"Hongri Metallurgy" refers to our variable interest entity, Handan Hongri Metallurgy Co., Ltd., a Chinese company that together with the shareholders of Hongri Metallurgy, has entered into a series of agreements with Nuosen that:

|

|

●

|

give Nuosen control over the board of directors, officers, operations and finances of Hongri Metallurgy (see “Description of Business - Corporate History” beginning on page 52 of this prospectus).

|

|

●

|

allow us to consolidate Hongri Metallurgy’s financial statements under GAAP (see “Description of Business - Corporate History” beginning on page 52 of this prospectus).

|

|

●

|

“Hongri Metallurgy Shareholders” refers to the shareholders of Hongri Metallurgy.

|

|

●

|

"Yuan" or "RMB" refer to the Chinese Yuan (also known as the Renminbi). According to the currency website xe.com, as of February 6, 2011, $1 = 6.557 Yuan.

|

|

●

|

"PRC" or "China" refers to the People's Republic of China.

|

|

●

|

"OTC Bulletin Board" or the "OTCBB" refers to the Over-the-Counter Bulletin Board, an electronic quotation system for equity securities overseen by the Financial Industry Regulatory Authority ("FINRA") (formerly the National Association of Securities Dealers), which is accessible through its website at www.otcbb.com.

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER

INFORMATION CONTAINED IN THIS PROSPECTUS

This prospectus contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) projected sales, profitability, and cash flows, (b) growth strategies, (c) anticipated trends, (d) future financing plans and (e) anticipated needs for working capital. They are generally identifiable by use of the words "may," "will," "should," "anticipate," "estimate," "plans," "potential," "projects," "continuing," "ongoing," "expects," "management believes," "we believe," "we intend" or the negative of these words or other variations on these words or comparable terminology. These statements may be found under "Management's Discussion and Analysis of Financial Condition and Plan of Operation" and "Business," as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of the forward-looking statements in this report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under "Risk Factors" and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus, including “Risk Factors” and the consolidated financial statements and the related notes before making an investment decision. Contents from our website, www.chinaindustrialsteel.com,are not part of this prospectus.

THE COMPANY

Business Overview

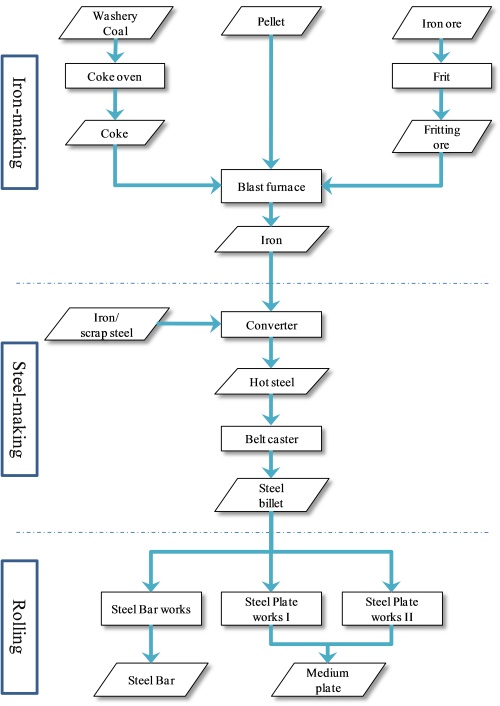

We are a holding company that, through our wholly-owned subsidiary Nuosen and our variable interest entity (“VIE”) Hongri Metallurgy, produces and sells steel plate, bar and billet in China. The Company currently operates four production lines with an aggregate production capacity of 2.3 million metric tons of steel per year from its headquarters on approximately 1,000 acres in Handan City in Hebei Province, PRC.

We have a strategic relationship with Wu’an Yuanbaoshan Industrial Group Co., Ltd. (“YBS Group”), a multi-industrial conglomerate, which, among other things, is engaged in the production of pig iron, cement, and the operation of a gas power plant. Under the laws of the PRC, certain restrictions are placed on round trip investments through an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents as well as on foreign investment in iron and steel industry. To comply with these restrictions, on August 1, 2010, Northern Steel, through Nuosen, entered into a Entrusted Management Agreement, Exclusive Option Agreement, and a Covenant Letter (collectively, the “Entrusted Agreements”) with Hongri Metallurgy and the shareholders of Hongri Metallurgy, Fakei Investment (Hongkong) Limited (“Fakei”) and YBS Group, (Fakei and YBS Group are collectively referred to as the “Hongri Metallurgy Shareholders”). We issued 44,083,529 restricted shares of our common stock to Karen Prudente, a U.S. resident who entered into call option agreements (collectively, the “Call Option Agreements”) respectively with the shareholders of YBS Group, for YBS Group entering into the Entrusted Agreements. In addition, we issued 17,493,463 restricted shares of our common stock to Fakei, for Fakei entering into the Entrusted Agreements. According to the Call Option Agreements, Karen Prudente would transfer all restricted shares of our common stock that she received to the shareholders of YBS Group subject to the terms and conditions thereunder and entrust the shareholders of YBS Group with her voting rights in the Company. These restricted shares issued to Karen Prudente and Fakei were issued in reliance upon the exemptions set forth in Section 4(2) of the Securities Act of 1933, as amended, on the basis that they were issued under circumstances not involving a public offering. As a result of the aforementioned transaction, the shareholders of YBS Group and Fakei obtained control of the Company.

We serve various industries and produce a variety of steel products, including billet, steel plate and steel bar. While the vast majority of our sales are made to distributors and traders, our products are typically used in ship building, construction, industrial manufacturing and infrastructure projects. Steel billet is also occasionally sold to end users to develop into plates and bars.

Our principal executive offices are located at 110 Wall Street – 11th Floor, New York, NY, 10005 and our U.S. telephone number is (646) 328-1502 and the telephone number at our production facility in the PRC is (86)-310-5919498.

Corporate History

We were incorporated in the State of Maryland on January 27, 2010.

On February 5, 2010, we formed Northern Steel Inc., a Colorado corporation as our wholly-owned subsidiary. On July 15, 2010, Northern Steel formed Nuosen (Handan) Trading Co. Ltd. (“Nuosen”), a limited liability company organized under the laws of the PRC, as its wholly-owned subsidiary (commonly termed as “WOFE” under PRC law).

Under the laws of the PRC, certain restrictions are placed on round trip investments through an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents as well as on foreign investment in iron and steel industry. To comply with these restrictions, on August 1, 2010, Northern Steel, through Nuosen, entered into a Entrusted Management Agreement, Exclusive Option Agreement, and a Covenant Letter (collectively, the “Entrusted Agreements”) with Hongri Metallurgy and the shareholders of Hongri Metallurgy, Fakei Investment (Hongkong) Limited (“Fakei”) and Hebei Wu’an Yuanbaoshan Industry Group Co., Ltd. (“YBS Group”), (Fakei and YBS Group are collectively referred to as the “Hongri Metallurgy Shareholders”). We issued 44,083,529 restricted shares of our common stock to Karen Prudente, a U.S. resident who entered into call option agreements (collectively, the “Call Option Agreements”) respectively with the shareholders of YBS Group, for YBS Group entering into the Entrusted Agreements. In addition, we issued 17,493,463 restricted shares of our common stock to Fakei, for Fakei entering into the Entrusted Agreements. According to the Call Option Agreements, Karen Prudente would transfer all restricted shares of our common stock that she received to the shareholders of YBS Group subject to the terms and conditions thereunder and entrust the shareholders of YBS Group with her voting rights in the Company. Karen Prudente’s role with respect to the restricted shares held by the shareholders of YBS Group is to manage the trust of the shareholders of YBS Group. While Ms. Prudente exercises sole voting power with respect to the shares held in the name of the shareholders of YBS Group, she disclaims beneficial ownership of such shares. These restricted shares issued to Karen Prudente and Fakei were issued in reliance upon the exemptions set forth in Section 4(2) of the Securities Act of 1933, as amended, on the basis that they were issued under circumstances not involving a public offering. As a result of the aforementioned transaction, the shareholders of YBS Group and Fakei obtained control of the Company.

Generally, we provide Hongri Metallurgy with management services pursuant to the Entrusted Agreements, the material terms which are as follows:

|

·

|

Entrusted Management Agreement – pursuant to this agreement entered into by and among the Hongri Metallurgy Shareholders, Hongri Metallurgy, and Nuosen, the Hongri Metallurgy Shareholders and Hongri Metallurgy entrust the management of Hongri Metallurgy to Nuosen until (a) the winding up of Hongri Metallurgy, or (b) the date on which Nuosen acquires Hongri Metallurgy. During the term, Nuosen is fully and exclusively responsible for the management of Hongri Metallurgy. In consideration of such services, the Hongri Metallurgy Shareholders and Hongri Metallurgy will pay a fee to Nuosen as set forth in the agreement. The fee payable to Nuosen by Hongri Metallurgy shall be equal to the before-tax profit of Hongri Metallurgy since August 1, 2010, when such agreement became effective. However, the Company currently intends to either reinvest or retain all of the income granted by Hongri Metallurgy for strategic expansion purposes into the foreseeable future. |

|

·

|

Exclusive Option Agreement – pursuant to this agreement entered into by and among Nuosen, the Hongri Metallurgy Shareholders, and Hongri Metallurgy, the Hongri Metallurgy Shareholders grant Nuosen an irrevocable exclusive purchase option to purchase all or part of the shares of Hongri Metallurgy, currently owned by any of the Hongri Metallurgy Shareholders. Further, Hongri Metallurgy grants Nuosen an irrevocable exclusive purchase option to purchase all or part of the assets and business of Hongri Metallurgy. Nuosen and the Hongri Metallurgy Shareholders will enter into relevant agreements regarding the price of acquisition based on the circumstances of the exercise of the option, and the consideration shall be refunded to Nuosen or Hongri Metallurgy at no consideration in an appropriate manner decided by Nuosen. Upon the exercise of the option, Nuosen will be subject to non-competition restrictions as set forth in the agreement.

|

|

·

|

Covenant Letter – pursuant to this letter, the Hongri Metallurgy Shareholders irrevocably covenant that without the prior written consent of Nuosen, the Hongri Metallurgy Shareholders would not transfer, pledge, or create any encumbrance in other way on all or part of the contribution and share equity of Hongri Metallurgy, or increase or decrease the registered capital of Hongri Metallurgy, or divide or merge the Company or conduct any other activity which would change the registered capital or shareholding structure of Hongri Metallurgy.

|

Through the Entrusted Agreements, we have the ability to substantially influence Hongri Metallurgy’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result of the Entrusted Agreements, which enable us to control Hongri Metallurgy and operate our business in the PRC through Hongri Metallurgy, we are considered the primary beneficiary of Hongri Metallurgy.

Although we have no equity ownership interest in Hongri Metallurgy, we are entitled to receive all the profits of Hongri Metallurgy, and we are obligated to pay its debts to the extent that Hongri Metallurgy does not have enough funds to repay such debts.

As a result of the foregoing, we are required to consolidate the financial statements of Hongri Metallurgy under GAAP.

Call Option Agreement

Liu Shenghong, our Chairman of Board of Directors and one of the shareholders of YBS Group and other several the shareholders of YBS Group (each of them, a “Purchaser”) have entered into call option agreements, dated as of August 10, 2010 (collectively, the “Call Option Agreements”), with Karen Prudente, the nominee and trustee of YBS Group, pursuant to which they are entitled to purchase up to 100% of the issued and outstanding shares of Karen Prudente at a price of $0.0001 per 100 shares for a period of five years as outlined in the Call Option Agreements: the Option may be exercised, in whole or in part, in accordance with the following schedule: 34% of the Option Shares subject to the Option shall vest and become exercisable on January 1, 2012; 33% of the Option Shares subject to the Option shall vest and become exercisable on January 1, 2013 and 33% of the Option Shares subject to the Option shall vest and become exercisable on January 1, 2014.

Corporate Structure

The following diagram sets forth the current corporate structure of the Company:

* Hebei Wu’an Yuanbaoshan Industry Group Co., Ltd. and Fakei Investment (Hongkong) Limited own 44,083,529 and 17,493,463, respectively, of our shares.

Summary Financial Information

Total sales for the year ended December 31, 2010 were $573,666,684, an increase of $16,911,724, or 3%, compared to $556,754,960 in 2009. Among the increased revenues, approximately $108 million increase was due to the increase in sales price; $26 million increase was attributable to new products – steel bars; offset by lower selling quantity due to various market conditions of approximately $115 million and a reduction of $2 million from sale of byproducts. Net income totaled $25,770,440 in 2010, a decrease of $32,390,537, or (56)%, compared to the net income of $58,160,977 in 2009. The decrease of net income was attributable primarily to the restriction of production due to “energy-saving and emission-reduction” control initiatives implemented by the PRC government and its related impact on sales volume together with the increased prices of raw materials which had a significant negative impact on the Company’s gross profit rate and net income.

THE OFFERING

Offering By Selling Stockholders

This prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 2,580,022 shares of our common stock.

The common stock has already been issued to the selling stockholders through a series of private placement transactions which closed in February 2011 that were exempt from the registration and prospectus delivery requirements of the Securities Act of 1933, as amended. No shares are being offered for sale by the Company.

|

The Company

|

China Industrial Steel Inc.

|

|

|

Selling stockholders

|

The selling stockholders named in this prospectus are existing stockholders of our Company who purchased shares of our Common Stock from us in the private placement transactions which closed in January 2011 and February 2011. The issuance of the shares by us to the selling stockholders was exempt from the registration requirements of the Securities Act of 1933, as amended, or the Securities Act. See “Selling Stockholders.”

|

|

|

Capitalization

|

Common Stock, par value $0.0001 per share

980,000,000 authorized

73,542,058 issued and outstanding as of February 7, 2011

10,000,000 shares of Series A Preferred Stock, $0.0001 par value, authorized, none of which are issued and outstanding as of February 7, 2011

10,000,000 shares of Blank Check Preferred Stock, $0.0001 par value, authorized, none of which are issued and outstanding as of February 7, 2011

|

|

|

Common stock outstanding prior to offering

|

73,542,058

|

|

|

Common stock offered by the Company

|

0

|

|

|

Common Stock to be outstanding after the offering

|

73,542,058

|

|

|

Total shares of common stock offered by selling stockholders

|

2,580,022

|

|

|

Common stock to be outstanding after the offering

|

73,542,058

|

|

|

Use of Proceeds

|

We will not receive any of the proceeds from the sales of the shares by the selling stockholders.

|

|

|

Risk Factors

|

See "Risk Factors" and other information included in this prospectus for a discussion of factors you should consider before deciding to invest in shares of our common stock.

|

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

RISKS RELATED TO OUR BUSINESS

Steel consumption is cyclical and worldwide overcapacity in the steel industry and the availability of alternative products has resulted in intense competition, which may have an adverse effect on our profitability and cash flow.

Steel consumption is highly cyclical and generally follows general economic and industrial conditions both worldwide and in various smaller geographic areas. The steel industry has historically been characterized by excess world supply. This has led to substantial price decreases during periods of economic weakness, which have not been offset by commensurate price increases during periods of economic strength. Substitute materials are increasingly available for many steel products, which may further reduce demand for steel. Additional overcapacity or the use of alternative products could have a material adverse effect upon our results of operations.

Rapidly growing demand and supply in China and other developing economies may result in additional excess worldwide capacity and falling steel prices, which could adversely impact our results.

Over the last several years steel consumption in China and other developing economies such as India has increased at a rapid pace. Steel companies have responded by developing plans to rapidly increase steel production capability in these countries and entered into long-term contracts with iron ore suppliers in Australia and Brazil. Steel production, especially in China, has been expanding rapidly and could be in excess of Chinese demand depending on continuing growth rates. Because China is now the largest worldwide steel producer, any significant excess in Chinese capacity could have a major impact on domestic and international steel trade and prices.

Our subsidiary Hongri Metallurgy's business will suffer if it cannot obtain, maintain or renew necessary filings, approvals, permits or licenses.

All PRC enterprises in the iron and steel industry are required to obtain from various PRC governmental authorities certain permits and licenses, including, without limitation, a business license, a pollution emission license and a National Industrial Product Manufacture License and filing and approval for the production capacity of fixed

asset investments.

These filings, approvals, permits and licenses are subject to periodic renewal and/or reassessment by the relevant PRC government authorities, and the standards of compliance required in relation thereto may from time to time be subject to change. Hongri Metallurgy intends to obtain and apply for renewal and/or reassessment of such filings, approvals, permits and licenses when required by applicable laws. However, we cannot assure you that Hongri Metallurgy can obtain, maintain or renew the filings, approvals, permits and licenses or accomplish the reassessment of such permits and licenses in a timely manner. Any changes in compliance standards, or any new laws or regulations that may prohibit or render it more restrictive for us to conduct Hongri Metallurgy's business or increase its compliance costs may adversely affect our operations or profitability. Any failure by Hongri Metallurgy to obtain, maintain or renew the filings, licenses, permits and approvals may have an adverse effect on the operation of Hongri Metallurgy's business.

Hongri Metallurgy is also required to conduct an environmental impact assessment and file such assessment with the local government, as well as to obtain the approval of construction project environment protection completion acceptance from Environmental Protection Bureau of Hebei Province for the production lines. Hongri Metallurgy intends to obtain and apply for the environmental impact assessment and application for construction project environment protection completion acceptance for its production lines. We cannot assure you that Hongri Metallurgy can obtain the requisite approval for the environmental impact assessment and construction project environment protection completion acceptance in a timely manner. Any failure by Hongri Metallurgy to make the filing and obtain the approval for environmental impact assessment may subject Hongri Metallurgy to a fine of approximately RMB 50,000 to RMB 200,000 and any failure by Hongri Metallurgy to obtain the approval of construction project environment protection completion acceptance may subject Hongri Metallurgy to halt the operation or production and a fine up to RMB 100,000, and as a result may have a material adverse effect on Hongri Metallurgy's production and business.

Environmental compliance and remediation could result in substantially increased capital requirements and operating costs.

Our operating subsidiary, Hongri Metallurgy, is subject to numerous Chinese provincial and local laws and regulations relating to the protection of the environment. These laws continue to evolve and are becoming increasingly stringent. The ultimate impact of complying with such laws and regulations is not always clearly known or determinable because regulations under some of these laws have not yet been promulgated or are undergoing revision. Our consolidated business and operating results could be materially and adversely affected if our operating subsidiaries were required to increase expenditures to comply with any new environmental regulations affecting its operations.

We may require additional capital in the future and we cannot assure that capital will be available on reasonable terms, if at all, or on terms that would not cause substantial dilution to stockholdings.

The development of high quality precision steel requires substantial funds. Sourcing external capital funds for product development and requisite capital expenditures are key factors that have and may in the future constrain our growth, production capability and profitability. To achieve the next phase of our corporate growth, increased production capacity, successful product development and additional external capital will be necessary. There can be no assurance that such capital will be available in sufficient amounts or on terms acceptable to us, if at all. Any sale of a substantial number of additional shares of common stock or securities convertible into common stock will cause dilution to the holders of our common stock and could also cause the market price of our common stock to decline.

Because we have entered into a significant number of related party transactions through the course of our routine business operations, there is a risk that we may not be able to control the valuation of such transactions, which could then adversely impact our profitability.

Hongri Metallurgy is 70% owned by YBS Group, who is a major shareholder of some other steel production related companies, mainly Hongrong Iron and Steel Co. Ltd., Wu'an Baoye Coke Industrial Co. Ltd., Wu'an Yuanbaoshan Cement Plant, Wu'an Yuanbaoshan Ore Treatment Plant, Wu'an Yuanbaoshan Industrial Group Go. Ltd - Gas Station and Wu’an Yeijin Iron Co. Ltd. In the course of our normal business operations, Hongri Metallurgy has purchased raw materials and supplies from these companies and made advances to or owed cash to these companies in respect of these purchases. Hongri Metallurgy has also engaged in sales of its products to the YBS Group. Because such related party transactions may not always be completed at arm’s-length due to their nature, we may not be able to control the valuation of such transactions and as a result, there is a risk that the value of such related party transactions exceeds market value, which could ultimately impact our profitability.

We face significant competition from competitors who have greater resources than we do, and we may not have the resources necessary to successfully compete with them.

There are many manufacturers of steel products in China. Our business is in an industry that is becoming increasingly competitive and capital intensive, and competition comes from manufacturers located in China as well as from international competition. Our competitors may have financial resources, staff and facilities substantially greater than ours and we may be at a competitive disadvantage compared with larger companies.

We are dependent on our Chinese manufacturing operations to generate our income and profits, and the deterioration of any current favorable local conditions may make it difficult or prohibitive to continue to operate or expand in China.

Our manufacturing operations are located in China and could be affected by, among other things:

|

·

|

economic and political instability in China, including problems related to labor unrest;

|

|

|

·

|

lack of developed infrastructure;

|

|

|

·

|

variances in payment cycles;

|

|

|

·

|

currency fluctuations;

|

|

|

·

|

employment and severance taxes;

|

|

|

·

|

compliance with local laws and regulatory requirements;

|

Moreover, inadequate development or maintenance of infrastructure in China, including adequate power and water supplies, transportation, raw materials availability or the deterioration in the general political, economic or social environment could make it difficult, more expensive and possibly prohibitive to continue to operate or expand our facilities in China.

We may not be able to pass on to customers the increases in the costs of our raw materials, particularly crude steel.

We require substantial amounts of raw materials in our business, principally iron ore. Any substantial increases in the cost of iron ore could adversely affect our financial condition and results of operations. The availability and price of iron ore depends on a number of factors outside our control, including general economic conditions, domestic and international supply and tariffs. Increased domestic and worldwide demand for iron ore has had and will continue to have the effect of increasing the prices that we pay for these raw materials, thereby increasing our cost of goods sold. Generally, there is a potential time lag between changes in prices under our purchase contracts and the point when we can implement a corresponding change under our sales contracts with our customers. As a result, we can be exposed to fluctuations in the price of raw materials, since, during the time lag period, we may have to temporarily bear the additional cost of the change under our purchase contracts, which could have a material adverse effect on our profitability. If raw material prices were to increase significantly without a commensurate increase in the market value of our products, our financial condition and results of operations would be adversely affected.

Although we are dependent on a steady flow of raw materials for our operations, we do not have in place long-term supply agreements for all of our material requirements.

As a substantial portion of our raw material requirements is met by Wu'an Yuanbaoshan Industrial Group Co., Ltd. through a strategic relationship. However, we do not currently have long-term supply contracts with any particular supplier, including Wu'an Yuanbaoshan Industrial Group Co., Ltd., to assure a continued supply of the raw materials we need in our operations. While we maintain good relationships with our suppliers, the supply of raw materials may nevertheless be interrupted on account of events outside our control, which will negatively impact our operations.

The loss of any key executive or our failure to attract and retain key personnel could adversely affect our future performance, strategic plans and other objectives.

The loss or failure to attract and retain key personnel could significantly impede our future performance, including product development, strategic plans, marketing and other objectives. Our success depends to a substantial extent not only on the ability and experience of our senior management, but particularly upon our Chairman, Mr. Liu Shenghong, our Chief Engineer and Plant Manager, Mr. Pan Rutai, and our Chief Financial Officer, Mr. Xiaolong Zhou. We do not currently have in place key man life insurance for these executive officers. To the extent that the services of these officers would be unavailable to us, we would be required to recruit other persons to perform the duties performed by them. We may be unable to employ other qualified persons with the appropriate background and expertise to replace these officers and directors on terms suitable to us.

We may not be able to retain, recruit and train adequate management and production personnel. We rely heavily on those personnel to help develop and execute our business plans and strategies, and if we lose such personnel, it would reduce our ability to operate effectively.

Our continued operations are dependent upon our ability to identify and recruit adequate management and production personnel in China. We require trained graduates of varying levels and experience and a flexible work force of semi-skilled operators. Many of our current employees come from the more remote regions of China as they are attracted by the wage differential and prospects afforded by our operations. With the economic growth currently being experienced in China, competition for qualified personnel is substantial, and there can be no guarantee that a favorable employment climate will continue and that wage rates we must offer to attract qualified personnel will enable us to remain competitive internationally. The inability to attract such personnel or the increased cost of doing so could reduce our competitive advantage relative to other precision steel producers, reducing or eliminating our growth in revenues and profits.

We are subject to risks associated with changing technology and manufacturing techniques, which could place us at a competitive disadvantage.

The successful implementation of our business strategy requires our products and services meet customers’ needs. Our designs and products are characterized by stringent performance and specification requirements that mandate a high degree of manufacturing and engineering expertise. We believe that our customers rigorously evaluate our services and products on the basis of a number of factors, including, but not limited to:

|

·

|

quality;

|

|

|

·

|

price competitiveness;

|

|

|

·

|

technical expertise and development capability;

|

|

|

·

|

innovation;

|

|

|

·

|

reliability and timeliness of delivery;

|

|

|

·

|

product design capability;

|

|

|

·

|

operational flexibility;

|

|

|

·

|

customer service; and

|

|

|

·

|

overall management.

|

Our success depends on our ability to continue to meet our customers’ changing requirements and specifications with respect to these and other criteria. There can be no assurance that we will be able to address technological advances or introduce new designs or products that may be necessary to remain competitive within the precision steel industry.

We depend upon independent distributors for a significant portion of our sales revenue, and we cannot be certain that sales to these distributors will continue. If sales to these distributors do not continue, then our sales may decline and our business may be negatively impacted.

We currently supply our steel products in the Chinese domestic market. For the year ended December 31, 2010, there were ten (10) major customers that accounted for approximately 63.05% of the Company's total sales. Two customers accounted for 18% and 10% of sales, respectively. We do not enter into long-term contracts with our customers and therefore cannot be certain that sales to these customers will continue. The loss of any of our largest customers would likely have a material negative impact on our sales revenues and business.

Defects in our products could impair our ability to sell products or could result in litigation and other significant costs.

Detection of any significant defects in our precision steel products may result in, among other things, delay in time-to-market, loss of market acceptance and sales of its products, diversion of development resources, injury to our reputation, litigation or fines, or increased costs to correct such defects. Defects could harm our reputation, which could result in significant costs and could impair our ability to sell our products. The costs we may incur in correcting any product defects may be substantial and could decrease our profit margins.

Failure to optimize our manufacturing potential and cost structure could materially increase our overhead, causing a decline in our margins and profitability.

We strive to utilize the manufacturing capacity of our facilities fully but may not do so on a consistent basis. Our factory utilization is dependent on our success in, among other things:

|

·

|

accurately forecasting demand;

|

|

|

·

|

predicting volatility;

|

|

|

·

|

timing volume sales to our customers;

|

|

|

·

|

balancing our productive resources with product mix; and

|

|

|

·

|

planning manufacturing services for new or other products that we intend to produce.

|

Demand for contract manufacturing of these products may not be as high as we expect, and we may fail to realize the expected benefit from our investment in our manufacturing facilities. Our profitability and operating results are also dependent upon a variety of other factors, including, but not limited to:

|

·

|

utilization rates of manufacturing lines;

|

|

|

·

|

downtime due to product changeover;

|

|

|

·

|

impurities in raw materials causing shutdowns; and

|

|

|

·

|

maintenance of contaminant-free operations.

|

Failure to optimize our manufacturing potential and cost structure could materially and adversely affect our business and operating results.

Moreover, our cost structure is subject to fluctuations from inflationary pressures in China and specific geographic regions where we conduct business. China is currently experiencing dramatic growth in its economy. This growth may lead to continued pressure on wages and salaries that may exceed our budget and adversely affect our operating results.

Our production facilities are subject to risks of power shortages and risks of halts in production due to government action, which may adversely affect our ability to meet our customers’ needs and reduce our revenues.

Many cities and provinces in China have suffered serious power shortages since 2004. Many of the regional grids do not have sufficient power generating capacity to fully satisfy the increased demand for electricity driven by continual economic growth and persistent hot weather. Local governments have occasionally required local factories to temporarily shut down their operations or reduce their daily operational hours in order to reduce local power consumption levels.

In September 2010, the Company was forced to stop production with all other local steel manufacturers in order to fulfill the quota of “energy-saving and emission-production” by the local government. There is a risk that our operations may be affected by those administrative measures at another time in the future, thereby causing material production disruption and delay in delivery schedule. In such event, our business, results of operation and financial conditions could be materially adversely affected.

We do have a back-up power generation system in the event natural power outages should occur.

Unexpected equipment failures may lead to production curtailments or shutdowns.

Interruptions in our production capabilities will adversely affect our production costs, products available for sales and earnings for the affected period. In addition to equipment failures, our facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions or violent weather conditions. Our manufacturing processes are dependent upon critical pieces of equipment, such as our various cold-rolling mills, as well as electrical equipment, such as transformers, and this equipment may, on occasion, be out of service as a result of unanticipated failures. We have experienced and may in the future experience material plant shutdowns or periods of reduced production as a result of such equipment failures.

We do not currently maintain property damage or business interruption insurance. If our production facilities were destroyed or significantly damaged as a result of fire or some other natural disaster, it could have a material impact on our operations.

All of our products are currently manufactured at our existing facilities located in Handan City in Hebei Province. Firefighting and disaster relief or assistance in China may not be as developed as in Western countries. We do not maintain property damage insurance covering our inventories and equipment. We do not maintain business interruption insurance. Material damage to, or the loss of, our production facilities due to fire, severe weather, flood or other act of God or cause, even if insured, could have a material adverse effect on our financial condition, results of operations, business and prospects.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiary. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiary and/or other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after tax profits according to Chinese accounting standards and regulations to fund certain reserve funds. Currently, our subsidiaries in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fund certain reserve funds as required by Chinese accounting standards, we will be unable to pay any dividends.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our company, because these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. Also, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

RISKS RELATED TO DOING BUSINESS IN CHINA

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We currently conduct substantially all of our operations and generate all of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

|

·

|

a higher level of government involvement;

|

|

|

·

|

an early stage of development of the market-oriented sector of the economy;

|

|

|

·

|

a rapid growth rate;

|

|

|

·

|

a higher level of control over foreign exchange; and

|

|

|

·

|

the allocation of resources.

|

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in economic conditions or government policies in China could have a material adverse effect on the overall economic growth in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and all of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

If we are found to have failed to comply with applicable laws, we may incur additional expenditures or be subject to significant fines and penalties.

Our operations are subject to PRC laws and regulations applicable to us. However, many PRC laws and regulations are uncertain in their scope, and the implementation of such laws and regulations in different localities could have significant differences. In certain instances, local implementation rules and/or the actual implementation are not necessarily consistent with the regulations at the national level. Although we strive to comply with all the applicable PRC laws and regulations, we cannot assure you that the relevant PRC government authorities will not later determine that we have not been in compliance with certain laws or regulations.

In addition, our facilities and products are subject to many laws and regulations. Our failure to comply with these and other applicable laws and regulations in China could subject us to administrative penalties and injunctive relief, as well as civil remedies, including fines, injunctions and recalls of our products. It is possible that changes to such laws or more rigorous enforcement of such laws or with respect to our current or past practices could have a material adverse effect on our business, operating results and financial condition. Further, additional environmental, health or safety issues relating to matters that are not currently known to management may result in unanticipated liabilities and expenditures.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

The majority of our revenues will be settled in RMB and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between the U.S. dollar and RMB and between those currencies and other currencies in which our revenues may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Currently, some of our raw materials and equipment are imported. In the event that the U.S. dollars appreciate against RMB, our costs will increase. If we cannot pass the resulting increased cost to our customers, our profitability and operating results will suffer.

Restrictions under PRC law on our PRC subsidiaries’ ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

Substantially all of our revenues are earned by our PRC subsidiary. However, PRC regulations restrict the ability of our PRC subsidiary to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiary only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of its annual after-tax profits determined in accordance with PRC generally accepted accounting principles to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

You may have difficulty enforcing judgments against us.

We are a Maryland holding company and most of our assets are located outside of the United States. Almost all of our operations are conducted in the PRC. In addition, most of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Although the recognition and enforcement of foreign judgments are generally provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

PRC State Administration of Foreign Exchange ("SAFE") regulations regarding offshore financing activities by PRC residents which may increase the administrative burden we face. The failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident shareholders to liability under PRC law.

SAFE, issued a public notice ("SAFE #75") effective from November 1, 2005, which requires registration with SAFE by the PRC resident shareholders of any offshore special purpose company. Without registration, the PRC subsidiary entity cannot remit any of its profits out of the PRC as dividends or otherwise.

In October 2005, SAFE issued a public notice, the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, or the SAFE notice, which requires PRC residents, including both legal persons and natural persons, to register with the competent local SAFE branch before establishing or controlling any company outside of China, referred to as an "offshore special purpose company," for the purpose of overseas equity financing involving onshore assets or equity interests held by them. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to amend its SAFE registration with the local SAFE branch with respect to that offshore special purpose company in connection with any increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China. Moreover, if the offshore special purpose company was established and owned the onshore assets or equity interests before the implementation date of the SAFE notice, a retroactive SAFE registration is required to have been completed before March 31, 2006. If any PRC shareholder of any offshore special purpose company fails to make the required SAFE registration and amendment, the PRC subsidiaries of that offshore special purpose company may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the offshore special purpose company. Moreover, failure to comply with the SAFE registration and amendment requirements described above could result in liability under PRC laws for evasion of applicable foreign exchange restrictions.

Our current beneficial owners and/or prospective shareholders may fall within the ambit of the SAFE notice and be required to register with the local SAFE branch as required under the SAFE notice. If so required, and if such beneficial owners fail to timely register their SAFE registrations pursuant to the SAFE notice, or if future shareholders and/or beneficial owners of our company who are PRC residents fail to comply with the registration procedures set forth in the SAFE notice, this may subject such shareholders, beneficial owners and/or our PRC subsidiaries to fines and legal sanctions and even criminal liabilities under the PRC Foreign Exchange Administrative Regulations promulgated January 29, 1996, as amended, and may also limit our ability to contribute additional capitals, limit our PRC subsidiaries’ ability to distribute dividends to our company, or otherwise adversely affect our business.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

On March 16, 2007, the National People’s Congress of China passed the EIT Law and on November 28, 2007, the State Council of China passed its implementing rules, both of which took effect on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.

On April 22, 2009, the State Administration of Taxation issued the Notice Concerning Relevant Issues Regarding Cognizance of Chinese Investment Controlled Enterprises Incorporated Offshore as Resident Enterprises pursuant to Criteria of de facto Management Bodies, or the Notice, further interpreting the application of the EIT Law and its implementation against non-Chinese enterprise or group controlled offshore entities. Pursuant to the Notice, an enterprise incorporated in an offshore jurisdiction and controlled by a Chinese enterprise or group will be classified as a “domestically incorporated resident enterprise” if (i) its senior management in charge of daily operations reside or perform their duties mainly in China; (ii) its financial or personnel decisions are made or approved by bodies or persons in China; (iii) its substantial assets and properties, accounting books, corporate chops, board and shareholder minutes are kept in China; and (iv) at least half of its directors with voting rights or senior management often resident in China. A resident enterprise would be subject to an enterprise income tax rate of 25% on its worldwide income and its non-PRC stockholders would be subject to a withholding tax at a rate of 10% when dividends are paid to such non-PRC stockholders. However, it remains unclear as to whether the Notice is applicable to an offshore enterprise incorporated by a Chinese natural person. Nor are detailed measures on enforcement of PRC tax against non-domestically incorporated resident enterprises are available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

We may be deemed to be a resident enterprise by Chinese tax authorities. If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on financing proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiary would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2010 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

We face uncertainty from China’s Circular on Strengthening the Administration of Enterprise Income Tax on Non-Resident Enterprises' Share Transfer, or Circular 698, that was released in December 2009 with retroactive effect from January 1, 2008.