Attached files

| file | filename |

|---|---|

| 8-K - ESSEX PROPERTY TRUST 8-K 9-20-2011 - ESSEX PROPERTY TRUST, INC. | form8k.htm |

Exhibit 99.1

ESSEX PROPERTY TRUST

Millennium- Los Angeles, CA (438 units)

Acquired 2011

CREATING OPPORTUNITIES for GROWTH

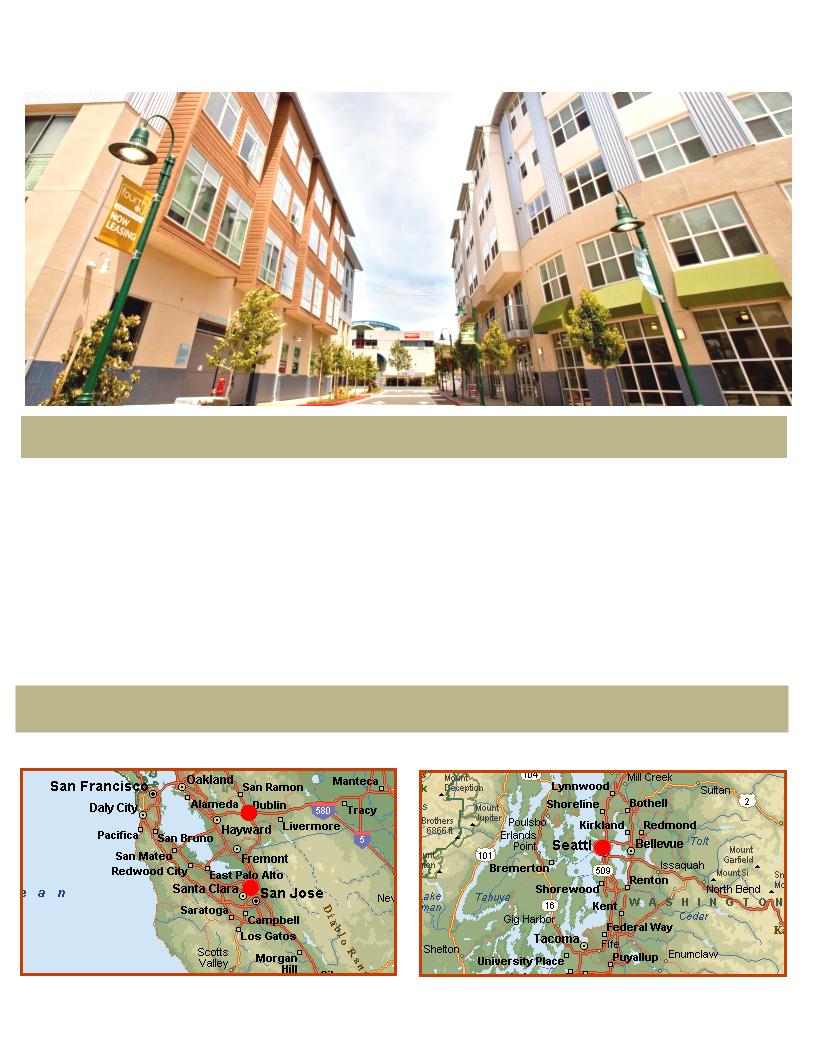

101 San Fernando - San Jose, CA

416 on Broadway - Glendale, CA

Santee Court - Los Angeles, CA

Via - Sunnyvale, CA

Bellerive, Los Angeles, CA

The Bernard - Seattle, WA

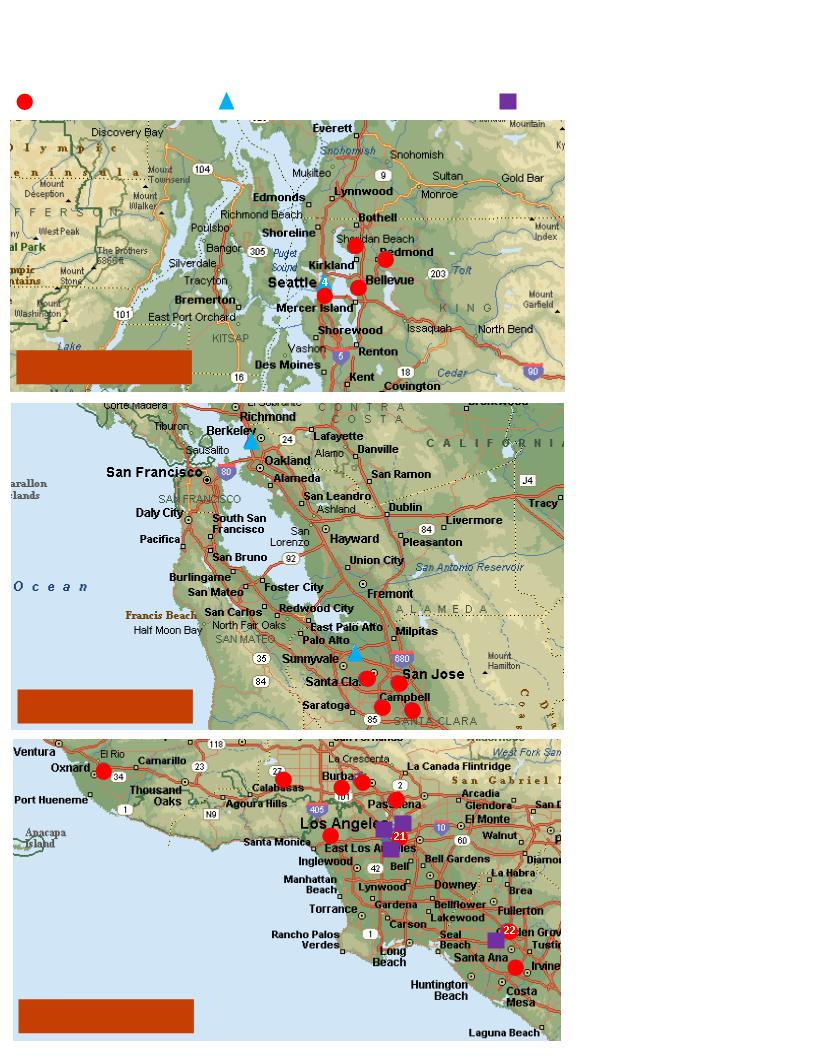

EXTERNAL GROWTH

Since January 2010, Essex has acquired or developed over $1.2 billion in new investments

|

1

|

Corbella (169 units)

|

|

2

|

Elevation (157 units)

|

|

3

|

Courtyard off Main (109 units)

|

|

4

|

Joule (295 units)

|

|

5

|

The Bernard (63 units)

|

|

6

|

Fourth & U (171 units)

|

|

7

|

Via (284 units)

|

|

8

|

Family Tree (121 units)

|

|

9

|

101 San Fernando (323 units)

|

|

10

|

The Commons (264 units)

|

|

11

|

Bella Villagio (231 units)

|

|

12

|

Arbors at Parc Rose (373 units)

|

|

13

|

Millennium (438 units)

|

|

14

|

Bellerive (63 units)

|

|

15

|

Allegro (96 units)

|

|

16

|

Muse (152 units)

|

|

17

|

416 on Broadway (115 units)

|

|

18

|

Orsini I & II (862 units)

|

|

19

|

Piero (225 units)

|

|

20

|

Reserve Lofts (79 units)

|

|

21

|

Santee Court (165 units)

|

|

21

|

Santee Village (73 units)

|

|

22

|

Anavia (250 units)

|

|

23

|

Madison Anaheim (768 units)

|

|

24

|

Skyline (349 units)

|

Seattle Area

Northern California

Southern California

3

6

7

1

2

3

8

9

10

11

12

13

14

16

15

17

24

18

19

20

Acquisitions ($884 mn)

Completed Development ($265 mn)

Preferred Equity Investments ($52 mn)

23

5

1971 George Marcus forms Essex Property Corporation

1988 Essex delivers 8 development communities under the name Summerhill Development

1994 Prices IPO at $19.50 per share (6.3 million shares). Essex has ownership in 16 apartment

communities in the West Coast

communities in the West Coast

1997 Increases portfolio by 60%, acquiring 27 communities. Reaches $1 billion market

capitalization

capitalization

2001 Creates Essex Apartment Value Fund L.P. with approximately $700 million in investment

capability

capability

2002 Acquires John M. Sachs, Inc. through a merger and adds 18 communities to portfolio

2004 Sells remaining Essex Fund I assets for $756 million, generating a 41% gross partnership IRR

and forms Essex Apartment Value Fund II with $750 million investment capacity

and forms Essex Apartment Value Fund II with $750 million investment capacity

2010 Michael Schall appointed new CEO. Company acquires 12 communities for $584 million

and achieves 42% one-year total shareholder return

and achieves 42% one-year total shareholder return

CELEBRATING 40 YEARS of EXCELLENCE

ACCOMPLISHMENTS

§ Highest total return of any REIT since IPO - 1,899% (Source: SNL Financial)

§ Cumulative Dividend paid in excess of $50 per share since IPO

§ At IPO, Essex owned 16 multifamily properties (4,410 units); currently, Essex has ownership in

151 apartment communities (31,058 units)

§ Total capitalization at IPO was $250 million; as of June 30, 2011, total capitalization was $7.1

billion

§ IPO stock price was $19.50 a share, today the stock trades around $140 per share

4

2011 Guidance (updated August 5, 2011)

|

FFO Per Share Guidance

|

|

|

|

|

|

|

|

$5.58- $5.73

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Same Property NOI Growth (Midpoint)

|

|

|

|

|||

|

6.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Expectations

|

2011

|

|

2011

|

|

2011

|

|

|

|

|

Market

|

|

Market

|

|

Market

|

|

|

|

Job Growth

|

|

Rent Growth

|

|

Occupancy

|

|

Southern California

|

0.9%

|

|

5.0%

|

|

95.2%

|

|

|

Northern California

|

1.3%

|

|

8.7%

|

|

96.3%

|

|

|

Seattle Metro

|

2.0%

|

|

9.0%

|

|

95.5%

|

|

|

|

Weighted Average

|

1.1%

|

|

7.5%

|

|

95.7%

|

|

|

|

|

|

|

|

|

|

US Economic Assumptions

|

|

|

|

|

|

|

|

GDP Growth of 2.0%

|

|

|

|

|

|

|

|

Job Growth of 1.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Targeted Acquisitions

|

|

|

|

|

|

|

|

$300 million - $500 million

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Targeted Development

Investment |

|

|

|

|

|

|

|

$150 million related to finishing Via, starting Queen Anne and the Cadence Campus

|

||||||

5

ESSEX MARKET DYNAMICS

6

Source - National Association of Realtors, DataQuick, Essex

Anavia - Anaheim, CA

7

DEVELOPMENT TRACK RECORD

Over the past 25-years, we have delivered over 8,500 units through our development program

|

RECENT DEVELOPMENT AWARDS

|

||

|

2011

|

Fourth and U, Berkeley, CA

|

Gold Nugget, Award of Merit - Best Mixed-Use Project

|

|

2010

|

Eastlake 2851, Seattle, WA

|

Pillars of the Industry, Finalist - Best Garden Apartment Community

|

|

2010

|

The Grand, Oakland, CA

|

Pillars of the Industry, Finalist - Best High Rise Apartments (9+) stories

|

|

2010

|

Eastlake 2851, Seattle, WA

|

Gold Nugget, Award of Merit - Rental Apartments

|

|

2010

|

Joule, Seattle, WA

|

Gold Nugget, Award of Merit - Best Multifamily Project (4-6 stories)

|

|

2010

|

Belmont Station, Los Angeles, CA

|

Gold Nugget, Award of Merit - Best Multifamily Project over 6 stories

|

|

2010

|

Via, Sunnyvale, CA

|

Gold Nugget, Award of Merit - Best on the Boards Multifamily Projects (Best Plan)

|

|

2010

|

Belmont Station, Los Angeles, CA

|

Gold Nugget, Award of Merit - Best Affordable Project

|

ACTIVE DEVELOPMENT COMMUNITIES (Starting in 2011)

Fourth & U - Berkeley, CA

8

Northern California

Seattle

2

3

1) West Dublin - 309 units ($94.5 million)

2) Cadence Phase 1 - 280 units ($98.6 million)

3) Queen Anne - 275 units ($79.1 million)

1

REDEVELOPMENT

28 units added at Foothill Commons - Bellevue, WA

Before/After at Highridge - Rancho Palos Verdes, CA

Before/After at The Pointe - Cupertino, CA

SAN JOSE

Via - Sunnyvale, CA

Family Tree - Santa Clara, CA

The Commons, Campbell, CA

Cadence Campus - San Jose, CA

10

Bella Villagio - San Jose, CA

|

SJ MSA

|

U.S.

|

|||

|

Average

Wage |

% of

Total Jobs |

Average

Wage |

% of

Total Jobs |

|

|

$73,144

|

4%

|

$50,268

|

4%

|

|

|

$145,811

|

17%*

|

$68,393

|

9%

|

|

|

$68,868

|

15%

|

$45,227

|

19%

|

|

|

$183,894

|

5%

|

$86,949

|

2%

|

|

|

$37,193

|

4%

|

$48,585

|

6%

|

|

|

$92,283

|

19%

|

$57,552

|

13%

|

|

|

$52,873

|

25%

|

$36,955

|

29%

|

|

|

$84,500

|

11%

|

$62,914

|

18%

|

|

|

$89,752

|

|

$50,784

|

|

|

|

|

|

|||

Gap = 3% of

current rents

current rents

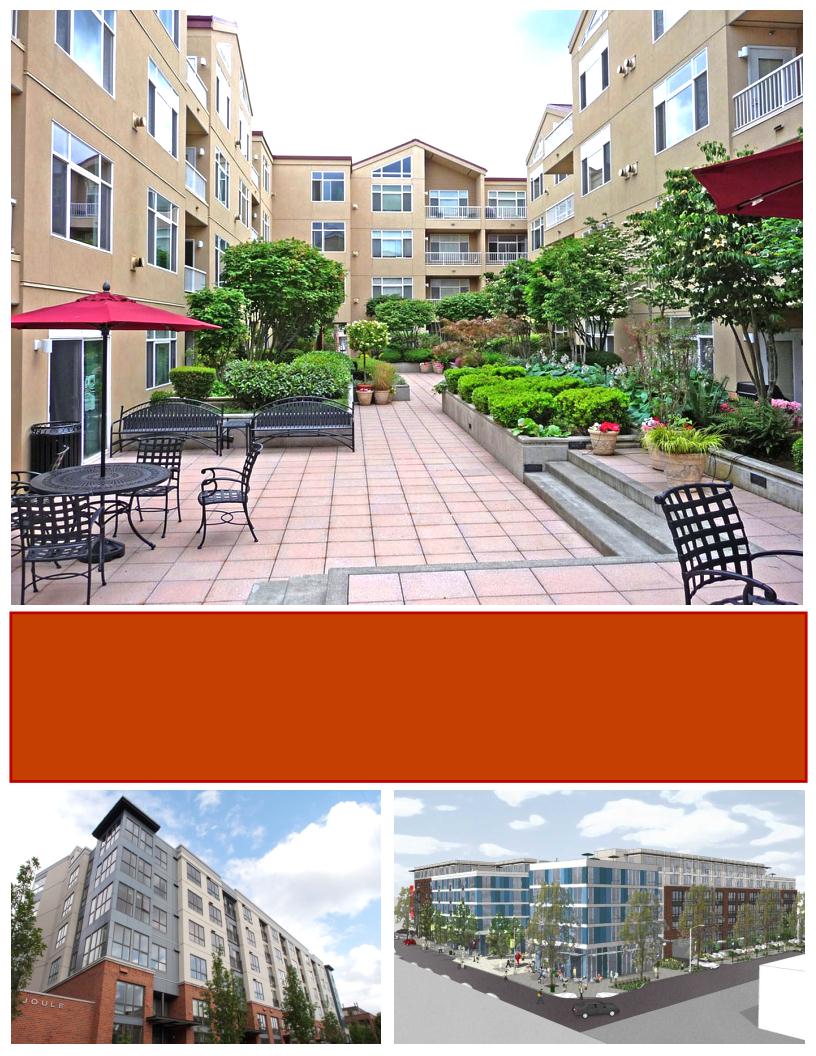

SEATTLE

Joule - Seattle, WA

Queen Anne - Seattle, WA

Courtyard off Main - Bellevue, WA

|

% of

Total Jobs |

||||

|

4%

|

||||

|

9%

|

||||

|

19%

|

||||

|

2%

|

||||

|

6%

|

||||

|

13%

|

||||

|

29%

|

||||

|

18%

|

||||

|

|

||||

Gap = 6% of

current rents

current rents

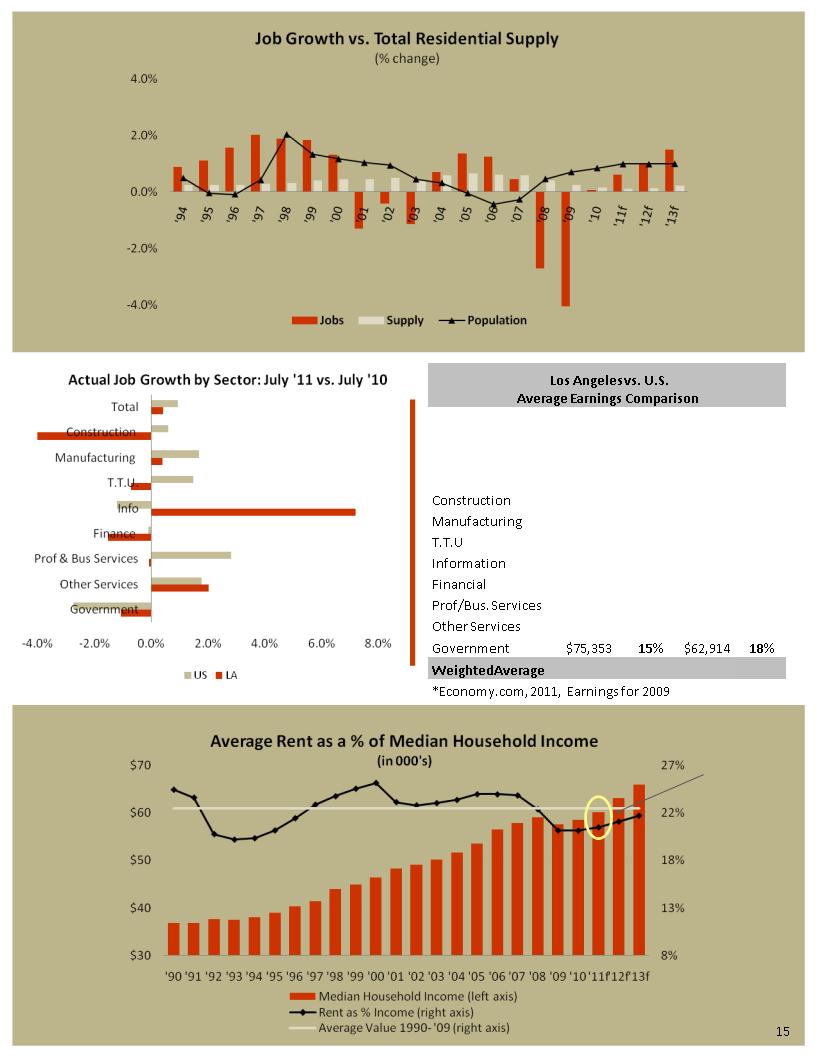

LOS ANGELES

416 on Broadway - Glendale, CA

Millennium, Los Angeles, CA

Bellerive, Los Angeles, CA

|

LA MSA

|

U.S.

|

|||

|

Average

Wage |

% of

Total Jobs |

Average

Wage |

% of

Total Jobs |

|

|

$58,565

|

3%

|

$50,268

|

4%

|

|

|

$73,593

|

10%

|

$68,393

|

9%

|

|

|

$50,381

|

20%

|

$45,227

|

19%

|

|

|

$111,157

|

5%

|

$86,949

|

2%

|

|

|

$42,135

|

5%

|

$48,585

|

6%

|

|

|

$64,705

|

14%

|

$57,552

|

13%

|

|

|

$44,148

|

28%

|

$36,955

|

29%

|

|

|

$75,353

|

15%

|

$62,914

|

18%

|

|

|

$59,645

|

|

$50,784

|

|

|

|

|

|

|||

Gap = 10% of

current rents

current rents

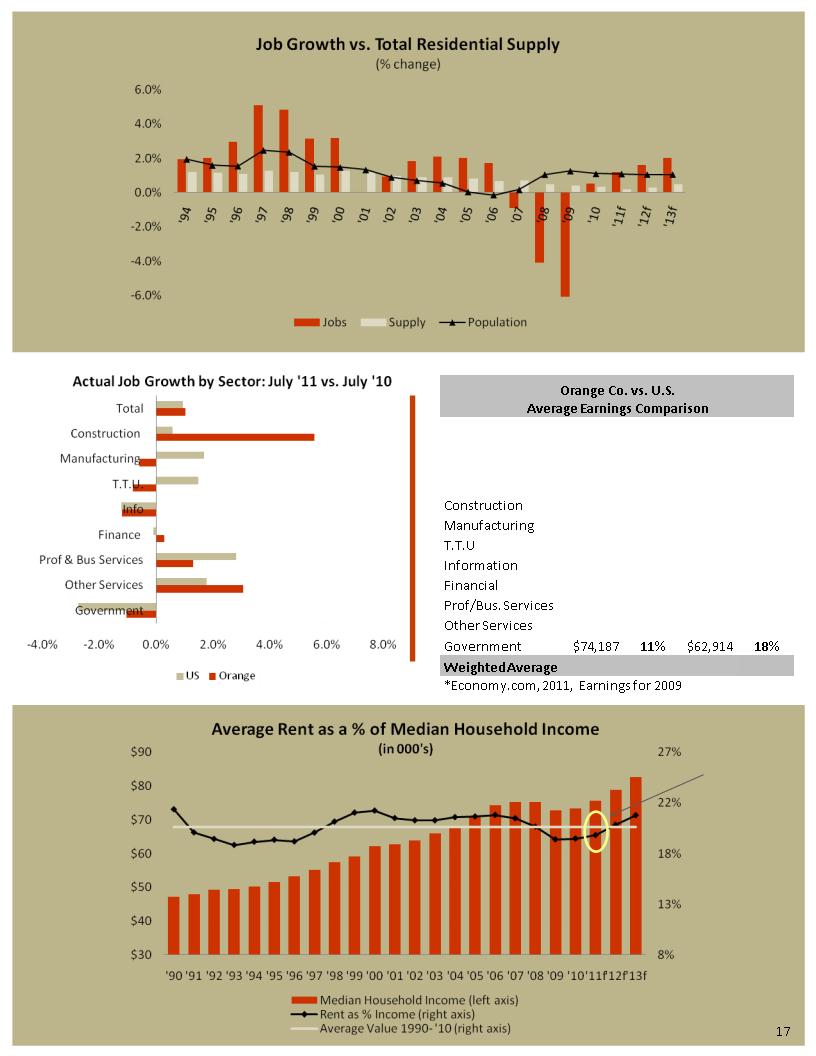

ORANGE COUNTY

Axis 2300 - Irvine, CA

Essex Skyline - Santa Ana, CA

Anavia - Anaheim, CA

|

ORG MSA

|

U.S.

|

|||

|

Average

Wage |

% of

Total Jobs |

Average

Wage |

% of

Total Jobs |

|

|

$81,817

|

5%

|

$50,268

|

4%

|

|

|

$80,612

|

11%

|

$68,393

|

9%

|

|

|

$59,061

|

18%

|

$45,227

|

19%

|

|

|

$81,716

|

2%

|

$86,949

|

2%

|

|

|

$50,573

|

8%

|

$48,585

|

6%

|

|

|

$64,251

|

18%

|

$57,552

|

13%

|

|

|

$40,692

|

27%

|

$36,955

|

29%

|

|

|

$74,187

|

11%

|

$62,914

|

18%

|

|

|

$60,005

|

|

$50,784

|

|

|

Gap = 6% of

current rents

current rents

NOTES

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

18