Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NTELOS HOLDINGS CORP. | d233739d8k.htm |

Investor Presentations

September 2011 |

1

Today’s

presenters

Interim Chief Executive Officer

President

Chief Operating Officer

For Lumos Networks

Jim Hyde

Michael Moneymaker

Frank Berry

President and Chief Executive Officer

Chief Financial Officer

Chief Operating Officer

For nTelos Wireless

Jim Hyde

Steb Chandor

Conrad Hunter |

2

Distribution

Capital

Markets

NTELOS Holdings to complete 1 for 2 reverse split immediately before

separation

Distribution of 1.0 share of Lumos Networks Corp. for every 1.0 share of NTELOS

Holdings, post reverse split

Result of approximately 21mm shares outstanding at each company

$315mm cash dividend to NTELOS Holdings at separation; NTELOS Holdings pays

down debt of $283mm

Pro forma post-separation leverage (06/30/11 PF LTM EBITDA)

NTELOS Holdings: 3.3x; $37mm opening cash

Lumos Networks: 3.5x; $20mm opening cash

Public Listing

NTELOS Holdings: NTLS (NASDAQ)

Lumos Networks: LMOS (NASDAQ)

Dividend payout

Combined dividend expected to be in line with current dividend

Transaction summary |

Investor Presentation

September 2011 |

4

Use of Non-GAAP Financial Measures

Special Note Regarding Forward-Looking Statements

Included in this presentation are certain non-GAAP financial measures that are not

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating activities and exclude the

effects of certain operating, capital and financing costs and may differ from comparable

information provided by other companies, and they should not be considered in

isolation, as an alternative to, or more meaningful than measures of financial performance determined in

accordance with US generally accepted accounting principles. These financial performance

measures are commonly used in the industry and are presented because Lumos Networks

Corp. believes they provide relevant and useful information to investors. The Company utilizes these

financial performance measures to assess its ability to meet future capital expenditure and

working capital requirements, to incur indebtedness if necessary, and to fund continued

growth. Lumos Networks Corp. uses these financial performance measures to evaluate the performance of

its business, for budget planning purposes and as factors in its employee compensation

programs. Any statements contained in this presentation that are not statements of

historical fact, including statements about our beliefs and expectations, are

forward-looking statements and should be evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,”

“targets,” “projects,” “should,” “may,”

“will” and similar words and expressions are intended to identify forward-looking statements. Such forward-

looking statements reflect, among other things, our current expectations, plans and

strategies, and anticipated financial results, all of which are subject to known and

unknown risks, uncertainties and factors that may cause our actual results to differ materially from those expressed or implied

by these forward-looking statements. Many of these risks are beyond our ability to control

or predict. Because of these risks, uncertainties and assumptions, you should not place

undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of

the date they are made. We do not undertake any obligation to update or review any

forward-looking information, whether as a result of new information, future events

or otherwise. Important factors with respect to any such forward-looking statements, including certain risks and

uncertainties that could cause actual results to differ from those contained in the

forward-looking statements, include, but are not limited to: rapid development and

intense competition in the telecommunications industry; our ability to successfully integrate the operations of the FiberNet

business; the failure to realize synergies and cost savings from the acquisition of the

FiberNet business or delay in realization thereof; adverse economic conditions;

operating and financial restrictions imposed by our senior credit facility; our cash and capital requirements; declining prices for

our services; the potential to experience a high rate of customer turnover; federal and state

regulatory fees, requirements and developments; our reliance on certain suppliers and

vendors; failure to complete the business separation of the wireless and wireline operations in an orderly fashion

as currently structured; and other unforeseen difficulties that may occur. These risks and

uncertainties are not intended to represent a complete list of all risks and

uncertainties inherent in our business, and should be read in conjunction with the more detailed cautionary statements and risk

factors included in our SEC filings, including our Form 10 filings and Annual Reports filed on

Forms 10-K. |

5

Investment themes

Unique assets provide operating leverage and competitive advantage,

positioning Lumos Networks as region’s provider of choice

Established platform for growth

Attractive combination of growth and income |

Unique assets

provide operating leverage and competitive advantage, positioning Lumos

Networks as region’s provider of choice |

7

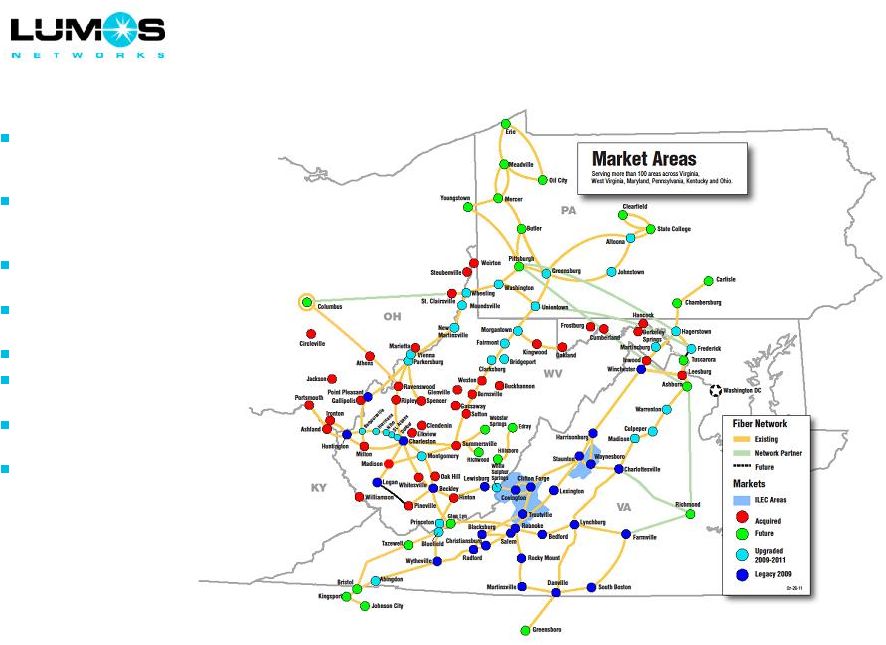

Advanced, dense regional fiber network

Provides service to more than

100 markets in Mid-Atlantic

region

Network footprint includes

approximately 185,000

businesses

Supports IP based and

Ethernet applications

Over 50,000 current customer

relationships

5,800 fiber route miles

State-of-the-art Cisco IP

network

RLEC with 98% 6MB+

broadband coverage

Video and fiber passes

approximately one-third of

the RLEC base

Provider of Choice |

8

57

57

57

63

71

91

109

0

20

40

60

80

100

120

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Fiber-Fed Cell Sites

633

647

687

705

752

830

903

500

600

700

800

900

1000

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

On-Net Buildings ¹

76

86

89

91

143

144

146

0

30

60

90

120

150

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Co-locations

2,511

4,746

4,786

4,940

4,941

5,767

5,788

0

2,000

4,000

6,000

8,000

Q4-09

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Fiber Route Miles

Network positioned for the future

$263 million invested into network in previous 18 months

$ 74 million in capital expenditures; $189 million in acquisitions (network expansion)

Connections to major data centers support exploding Cloud computing demand

Capacity to support significant market opportunity for on-net retail and wholesale

customer expansion 1

On-Net Buildings excludes FiberNet.

Provider of Choice

Extensive rural fiber network footprint creates competitive advantages in the market |

9

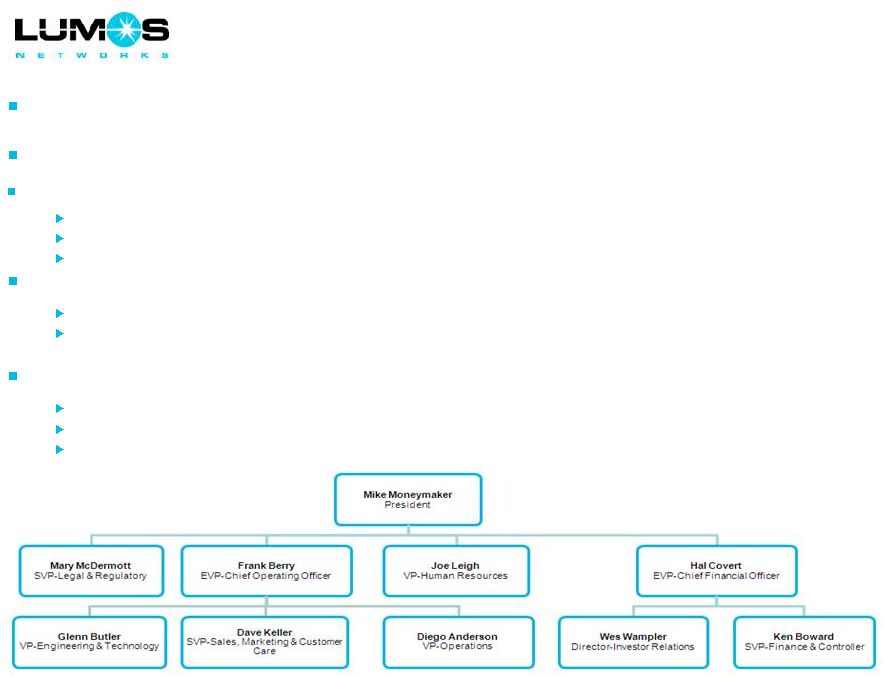

Brand positioning highlights our innovative services and commitment to provide support from

well- trained, dedicated employees

Experienced direct sales and sales engineering teams in-market

Exceptional customer service

93% of calls answered within 10 seconds

91% first-call resolution

Net Promoter scores in top tier across all industries

Strong long-term customer relationships

90% of key vertical account revenues in 2007 are still billing in 2011

75% of revenues in all customer accounts with monthly recurring revenues of $1,000 or greater

in 2007 are still billing in 2011 –

0.6% monthly churn

Experienced management team

Each member of operating management has 10 or more years of experience with wireline

business Key contributors to development of Competitive segment and transition to data

strategy Led execution and integration of recent acquisitions

“Our technology comes with people”

Provider of Choice |

Established

platform for growth |

11

Leverage regional scale

Sell advanced data services to recently-entered Pennsylvania and West Virginia

markets Increase on-net buildings and expand reach in existing markets

Leverage sophisticated sales and sales engineering teams

Up-sell existing enterprise customers to capture growing data demand

Sell advanced services, including managed services and hosting

On-network profile facilitates growth of bandwidth and new applications with minimal

incremental investment

Aggressively pursue fiber-to-the-cell opportunities

Strong early-stage wireless carrier demand in footprint

Positioned for regional 4G deployment expected in 2012 and beyond

Expand footprint through organic edge-out and accretive acquisitions

Opportunities offer attractive returns as revenue density enhances capital

efficiency and on-network sales drive margin growth

Strategies for growth and revenue opportunities

Platform for Growth

109 |

12

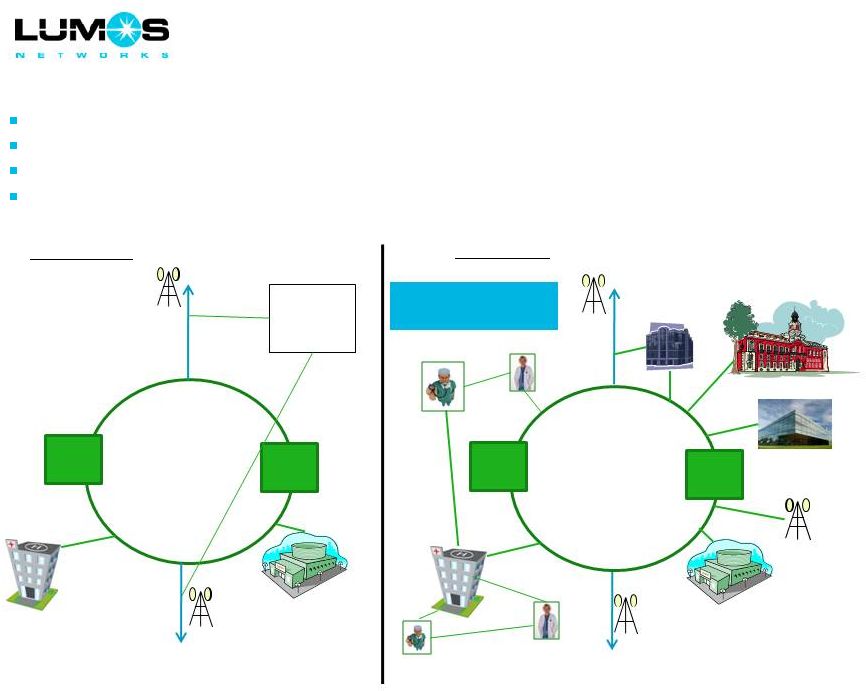

Up-sell existing enterprise customers

•

2

locations

-

Leased

facilities

and

fiber

•

Primarily Voice Service

•

Monthly Recurring Revenue (MRR) = $2K

•

37 locations -

Primarily On-net locations

•

Voice Service + Metro Ethernet Network

•

Increased MRR to $65K

•

Capital investment = $1.0M

•

Payback ~ 18 months

Enterprise Case Study B

Healthcare Customer

Yesterday

Today

Today

Enterprise Case Study A

Education Customer

Yesterday

•

Data circuits

•

Monthly Recurring Revenue (MRR) = $11K

•

Data circuits, Internet bandwidth, IP voice

and connection to major data center

•

Increased MRR to $29K

•

Capital investment = $100K

•

Payback ~ 4 months

Platform for Growth

Advanced Ethernet products meet key vertical customers’ growing broadband needs Dense fiber network in under-served markets differentiates Lumos Networks as the

provider of choice

On-network existing customer up-sell drives incrementally higher margins

|

Natural market

evolution provides opportunity Early-stage markets generate sufficient revenues to

meet initial capital ROI requirements As markets mature, incremental customers, remote

locations and additional rings are added Approximately 75% of addressable in-market

businesses are early-stage Drives

free

cash

flow

growth

from

operating

leverage

and

capital

efficiency

13

Platform for Growth

Early-Stage Enterprise Ready Market

Colo

Colo

A

A

Colo

Colo

B

B

Long haul

Fiber

Haul Fiber

Mid-Stage Enterprise Ready Market

Colo

Colo

A

A

Colo

Colo

B

B

Additional customer

Additional customer

sites + New customers

sites + New customers |

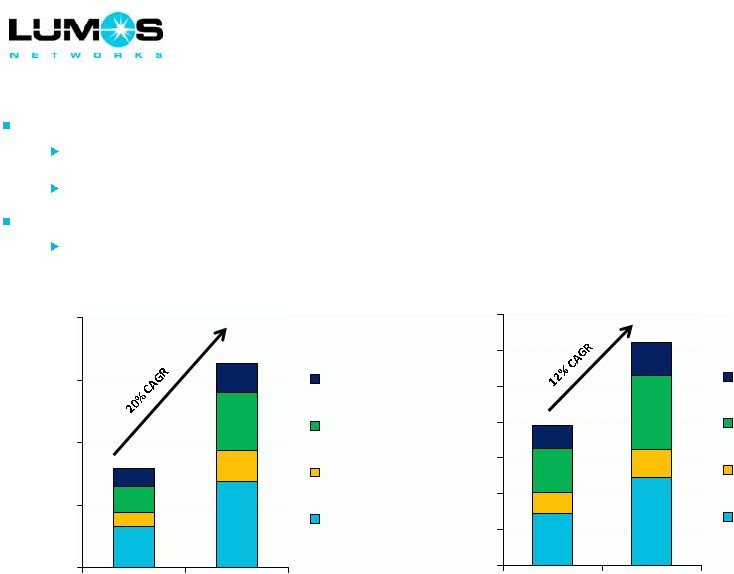

Impressive

enterprise growth trends in key verticals Up-sell existing enterprise

customers Monthly recurring revenue (MRR) in key verticals has grown 20% annually

(CAGR) from 2007 to 2011 and is 45% of large account revenue

Average MRR per customer is growing

Market evolution provides opportunity for new enterprise customers

Number of “Large Customer”

accounts in key verticals has grown 12% annually (CAGR) from 2007 to 2011

14

Note:

Organic

growth,

excluding

recent

acquisitions.

“Large

Customers”

are

defined

as

customers

with

$1,000

or

greater

MRR.

($mm)

Platform for Growth

0.0

0.5

1.0

1.5

2.0

2007

2011

Monthly Recurring Revenue

Regional Banking

Local/Regional

Government

Education

Healthcare

0

50

100

150

200

250

300

350

Large Customer Accounts

Regional Banking

Local/Regional

Government

Education

Healthcare

2007

2011 |

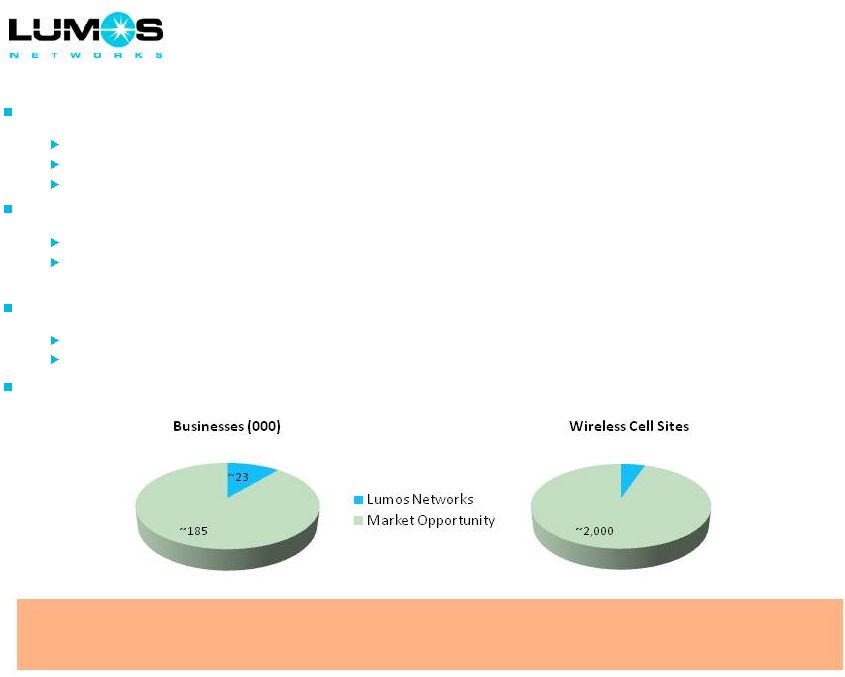

Fiber to the

cell site: A high growth wholesale opportunity Approximately 2,000 sites within three

miles of existing network First customer provides a five-year payback and funds the

site Average of more than two carriers per site

Second and successive customers drive cash flow and margin

Illustrative Wireless Cell Site Economics

Average

Capital

Investment

$80K/site

One Carrier

Annual EBITDA:

$15K to $18K

Payback:

5 years

Two Carriers

Annual EBITDA:

$30K to $36K

Payback:

2 to 3 years

Contracts of 5 to 10 years and multiple carriers per site drive

long-term profitable revenue streams

15

Three to Five

Carriers

Annual EBITDA:

$45K to $90K

Payback:

1 to 2 years

Platform for Growth

Long-term growth in bandwidth demand and additional carriers continue to enhance returns |

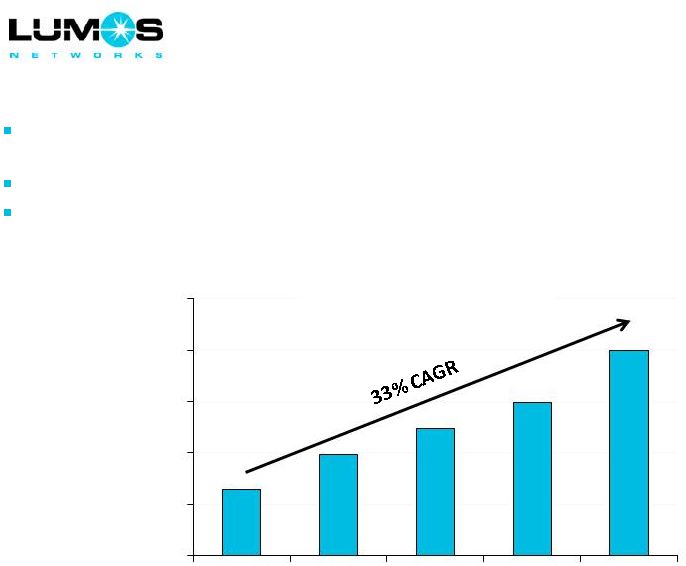

Wholesale

growth: Strong and accelerating with 4G Monthly

Recurring

Revenue

(MRR)

from

Top

6

wireless

carriers

has

grown

33%

annually

(CAGR)

from

2007 to 2011

Early-stage:

Significant

increases

in

demand

will

be

driven

by

future

4G

deployment

4G deployment in Lumos Networks region commenced in the second half of 2011 and is expected

through 2014

16

($mm)

Platform for Growth

0.0

0.5

1.0

1.5

2.0

2.5

2007

2008

2009

2010

2011

Top 6 Wireless Carriers –

MRR |

Attractive

combination of growth and income |

Pro forma

capitalization: Strong balance sheet 18

Available capital to support growth initiatives

Growth and Income

Pro forma as of

June 30, 2011

($mm)

Cash and cash equivalents

$20.5

Restricted cash

8.1

$28.5

Revolver ($60mm total)

$30.0

Term Loan A

110.0

Term Loan B

200.0

340.0

Capital leases

2.3

Total Debt

$342.3

PF Total Debt / LTM Adjusted EBITDA

3.5x

PF Net Debt / LTM Adjusted EBITDA

3.2x |

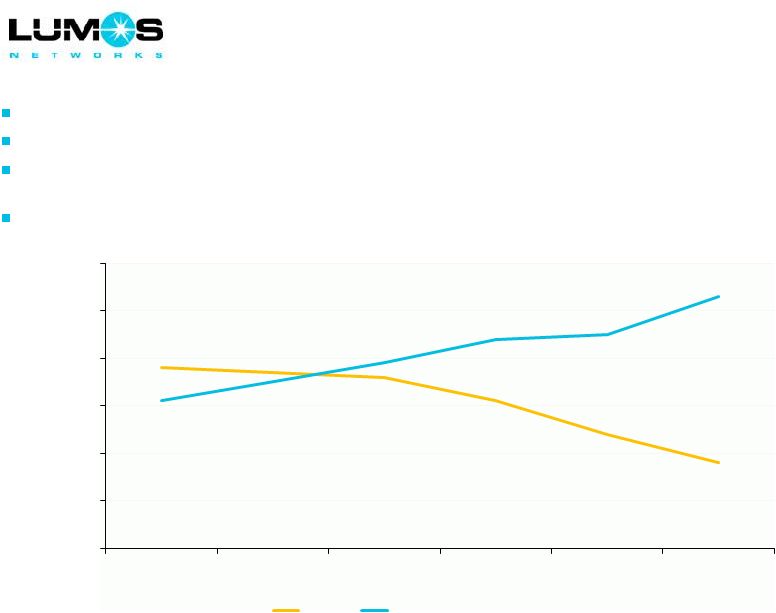

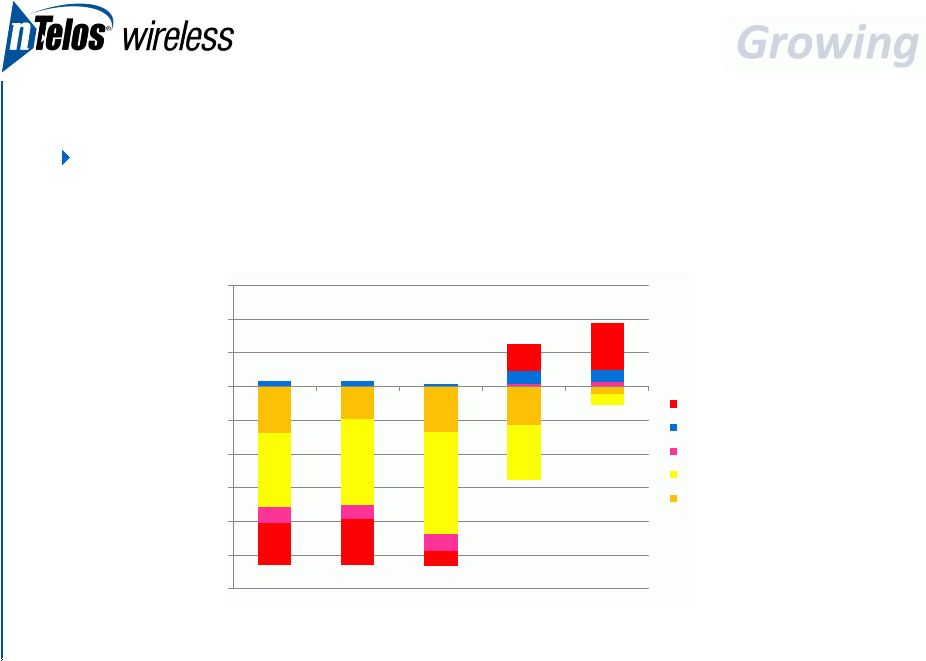

Competitive

segment revenue composition: Transition to data Competitive

segment now accounts for 74% of company revenues Strong data growth offsetting voice

declines Wholesale and enterprise data revenues are up 15% year over year; now about 45%

of segment revenues

Significance of voice revenues declining; now only about one-third of segment

revenues 19

($mm)

Note: 2010 revenue is Pro Forma for FiberNet.

Growth and Income

$15.8

$15.7

$15.6

$15.1

$14.4

$13.8

$15.1

$15.5

$15.9

$16.4

$16.5

$17.3

12

13

14

15

16

17

18

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Voice

Wholesale / Enterprise Data |

20

Addressable market significantly increased

Recent network investments made to generate increasing returns in 2012 and beyond

Metro Ethernet products have been launched into 24 new markets in 2011; 7 more planned

by year-end, totaling an increase of 79% for the year

Metro fiber ring reach in 18 markets; planned to be 29 by year-end

As markets mature, revenues grow with increased penetration and data demand

Early stages of revenue growth potential from recent acquisitions

2%

35%

45%

52%

Growth and Income

($ mm)

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

2007

2010

Competitive

Revenues

-

Virginia

Enterprise Data

SMB Data

Wholesale

Voice |

21

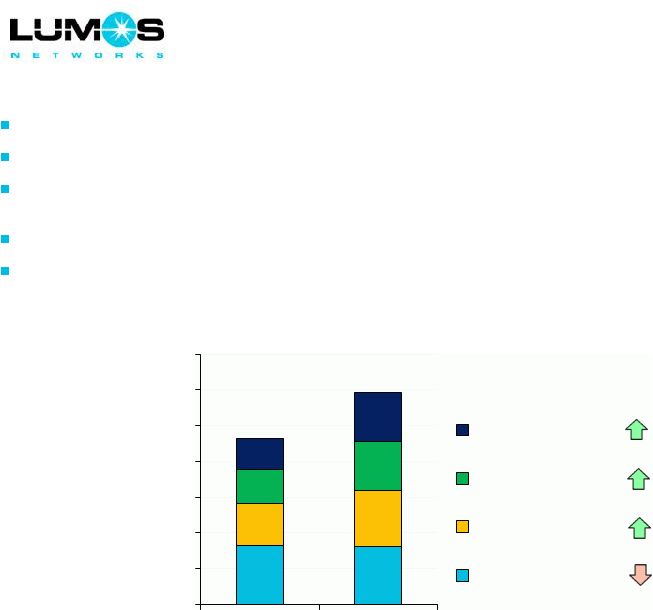

Adjusted EBITDA

(1)

Revenue

(1)

Operating strategy and acquisitions successfully shifting business mix

Competitive

RLEC

Data focus drives growth in the Competitive segment

RLEC provides high-margin and attractive cash flows

Competitive Data

RLEC

($ mm)

($ mm)

Growth and Income

Competitive Voice & Other

(1) Reported results; not pro forma for acquisitions

$15

$14

$15

$14

$14

$14

$14

$14

$15

$17

$21

$22

$6

$6

$6

$10

$18

$16

$35

$34

$36

$41

$53

$52

$0

$10

$20

$30

$40

$50

$60

1Q '10

2Q '10

3Q '10

4Q '10

1Q '11

2Q '11

$10

$10

$10

$10

$10

$10

$8

$9

$9

$11

$14

$15

$18

$19

$19

$21

$24

$25

$0

$10

$20

$30

1Q'10

2Q'10

3Q'10

4Q'10

1Q'11

2Q'11 |

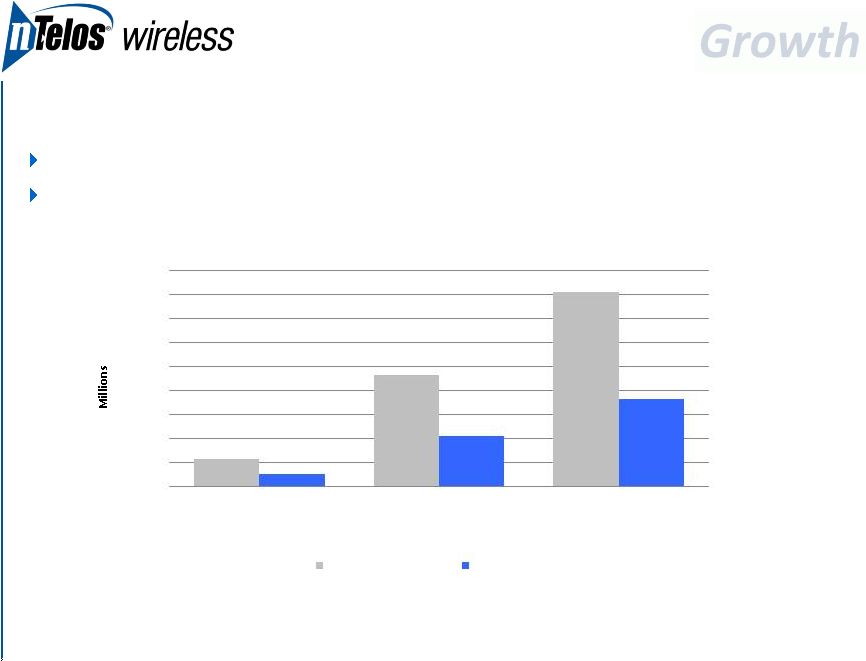

22

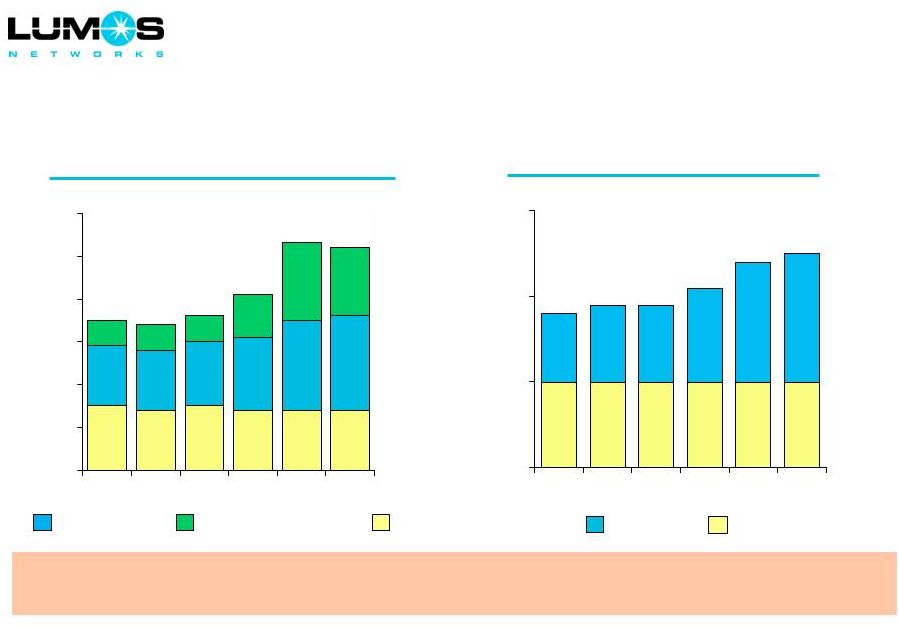

Strong margins and recurring free cash flow

($ in millions)

Free Cash Flow

(2)

Total Revenue

Adj. EBITDA/Margin %

Capital Expenditures

Historical

Pro forma for FiberNet

Pro forma

(1)

Pro forma

(1)

Pro forma

(1)(3)

Pro forma

(1)(3)

LTM reflects post acquisition network capital investments to support

market expansion and service offerings

Growth and Income

Recurring cash flow stream to support dividend:

Unique among Competitive providers

Expected annualized dividend of $12 million ($0.56 per share)

$126

$129

$131

$146

$213

$211

$0

$100

2007

2008

2009

2010

2010

LTM

$64

$68

$70

$77

$96

$98

51%

52%

54%

53%

45%

46%

$0

$50

2007

2008

2009

2010

2010

LTM

$25

$35

$37

$40

$45

$54

$0

$30

$60

2007

2008

2009

2010

2010

LTM

$39

$33

$33

$37

$51

$44

$0

$30

$60

2007

2008

2009

2010

2010

LTM

$200

$100

(1)

Pro forma 2010 includes FiberNet results from January 1, 2010. LTM pro forma for the

twelve months ended June 30, 2011, reflects results of FiberNet from July 1, 2010.

(2)

Throughout this presentation, Free Cash Flow is defined as consolidated adjusted EBITDA less

CAPEX, exclusive of assets acquired from Allegheny Energy, Inc. on December 31, 2009

and FiberNet on December 1, 2010.

(3)

LTM includes approximately $5 million of one-time capital expenditures related to the

integration of FiberNet. |

23

Investment themes

Unique assets provide operating leverage and competitive advantage,

positioning Lumos Networks as region’s provider of choice

Established platform for growth

Attractive combination of growth and income |

Appendix |

25

Adjusted EBITDA Reconciliation

($ in millions)

3/31/10

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

Operating Income

$10

$10

$11

$10

$12

$14

Depreciation and Amortization

7

9

7

9

11

11

Equity Based Compensation

1

-

1

-

1

Voluntary Early Retirement and Workforce Reduction Plans

-

-

-

2

-

-

Adjusted EBITDA

$18

$19

$19

$21

$24

$25

Three Months Ended

-

2006

2007

2008

2009

2010

Operating Income

$36

$36

$39

$41

$41

Depreciation and Amortization

26

27

27

29

31

Equity Based Compensation

2

1

1

-

2

Voluntary Early Retirement and Workforce Reduction Plans

-

-

1

-

3

Adjusted EBITDA

$64

$64

$68

$70

$77

Year Ended |

Growing

Profitably Investor Presentation

September, 2011 |

Included in

this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial

performance measures are not indicative of cash provided or used by operating activities and

exclude the effects of certain operating, capital and financing costs and may differ from

comparable information provided by other companies, and they should not be considered in

isolation, as an alternative to, or more meaningful than measures of financial performance

determined in accordance with US generally accepted accounting principles. These

financial performance measures are commonly used in the industry and are presented because NTELOS

believes they provide relevant and useful information to investors. NTELOS utilizes

these financial performance measures to assess its ability to meet future capital expenditure and

working capital requirements, to incur indebtedness if necessary, and to fund continued

growth. NTELOS also uses these financial performance measures to evaluate the performance of

its business, for budget planning purposes and as factors in its employee compensation

programs. Use of Non-GAAP Financial Measures

Special Note Regarding Forward-Looking Statements

Presentation of Financial and Other Important Information

2

Any statements contained in this presentation that are not statements of historical fact,

including statements about our beliefs and expectations, are forward-looking statements and

should be evaluated as such. The words “anticipates,” “believes,”

“expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,” “may,” “will” and similar words and expression

are intended to identify forward-looking statements. Such forward-looking statements

reflect, among other things, our current expectations, plans and strategies, and anticipated financial

results, all of which are subject to known and unknown risks, uncertainties and factors that

may cause our actual results to differ materially from those expressed or implied by these

forward-looking statements. Many of these risks are beyond our ability to control or

predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on

these forward-looking statements. Furthermore, forward-looking statements speak only

as of the date they are made. We do not undertake any obligation to update or review any

forward-looking information, whether as a result of new information, future events or

otherwise. Important factors with respect to any such forward-looking statements, including certain

risks and uncertainties that could cause actual results to differ from those contained in the

forward-looking statements, include, but are not limited to: rapid development and intense

competition in the telecommunications industry; adverse economic conditions; operating and

financial restrictions imposed by our senior credit facility; our cash and capital requirements;

declining prices for our services; the potential to experience a high rate of customer

turnover; our dependence on our affiliation with Sprint Nextel (“Sprint”); a potential increase in our

roaming rates and wireless handset subsidy costs; the potential for Sprint to build networks

in our markets; federal and state regulatory fees, requirements and developments; loss of our

cell sites; the rates of penetration in the wireless telecommunications industry; our reliance

on certain suppliers and vendors; failure to complete the business separation of the wireless

and wireline operations in an orderly fashion as currently structured and other unforeseen

difficulties that may occur. These risks and uncertainties are not intended to represent a

complete list of all risks and uncertainties inherent in our business, and should be read in

conjunction with the more detailed cautionary statements and risk factors included in our SEC

filings, including our Annual Reports filed on Forms 10-K. |

Today’s

Presenters Jim Hyde, CEO, President and Director

Former T-Mobile USA / Western Wireless / VoiceStream Sr. Exec

Former CEO, T-Mobile UK

17 years industry experience

Steb Chandor, EVP, CFO and Treasurer

Former CFO, iPCS Wireless

Former CFO, Metro One

16 years industry experience

Conrad Hunter, EVP, COO

Former COO, iPCS Wireless

Former VP of Midwest Operations, U.S. Cellular Corporation

32 years industry experience

3 |

Leading

“pure-play” regional wireless company

Platform for organic and strategic growth

Unique growth and income investment opportunity

Wholesale revenue at an all time high and growing

NTELOS intends to pay $0.42/share initial dividend post separation

Strong Free Cash Flow characteristics

27%

FCF margin

Attractive strategic asset set

Exclusive network provider to Sprint in region

Unique network footprint in Mid-Atlantic region

Experienced senior management team

Investment Rationale

(1) Adjusted for proposed one for two reverse stock split

(2) Results as of YE 2010

(3) Throughout presentation, Free Cash Flow is defined as Adjusted EBITDA less Capital

Expenditures (2)

(1)

(3)

4 |

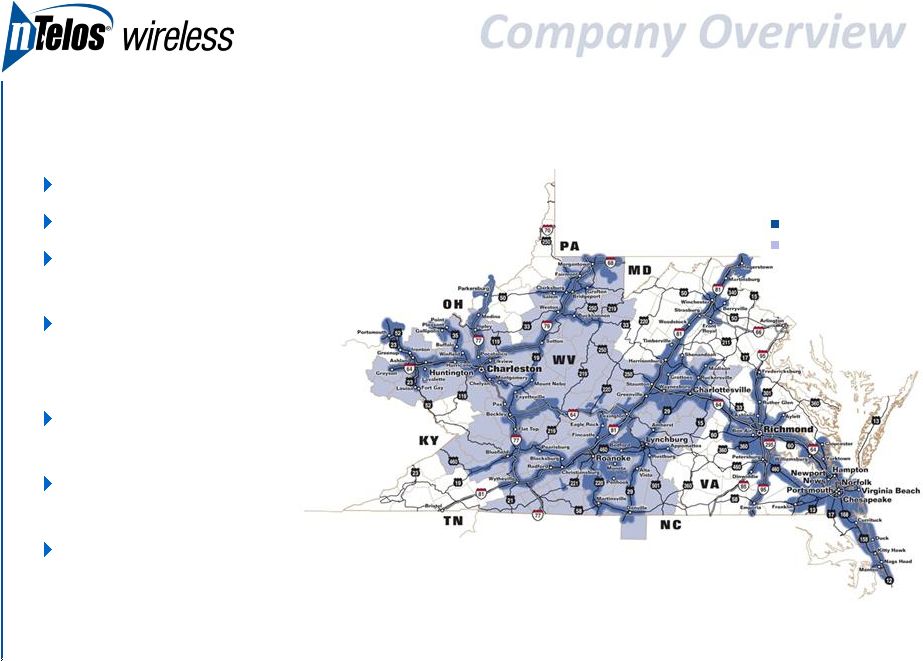

Growing.

Profitable. Stable. Strategic. 8.0M licensed POPs

5.9M covered POPs

425K retail (post and

prepaid) subscribers

Exclusive network provider

to Sprint over more than

50% of NTELOS footprint

Wholesale revenues of $120

million LTM and growing

$144M EBITDA and $104M

FCF LTM

36% Adjusted EBITDA

margin

Note: Results as of 6/30/11

NTELOS Covered Network

Sprint Wholesale Markets

Strategic Network Assets

5 |

Growing

Sprint wholesale revenue up 32% YOY

Data ARPU up 34% YOY

Profitable

5 years of minimum 35% EBITDA margin

21% 5 year FCF margin

Stable

Diverse revenue stream from postpaid, prepaid and wholesale customers

Market share stabilizing while other regional competitors shed customers

Strategic

Exclusive relationship with Sprint through July 2015

Unique network footprint in Mid-Atlantic region

Growing. Profitable. Stable. Strategic.

Note: Results as of 6/30/11

6 |

NTELOS

Wireless Strategy Mission

Mission

Vision

Vision

Strategic

Strategic

Differentiators

Differentiators

We

We

Inspire

Inspire

Loyalty

Loyalty

Highest in revenue

Highest in revenue

and subscriber

and subscriber

market share growth

market share growth

of all carriers in our

of all carriers in our

markets

markets

through 2016

through 2016

Value

Value

Unlimited nationwide

Unlimited nationwide

plans always less

plans always less

expensive than AT&T and

expensive than AT&T and

Verizon Wireless

Verizon Wireless

Simplicity

Simplicity

Cutting through the

Cutting through the

complexity with simple,

complexity with simple,

customer friendly

customer friendly

products and plans

products and plans

Service

Service

Creating

“raving

fans”,

leveraging local retail and

customer service

presence

7 |

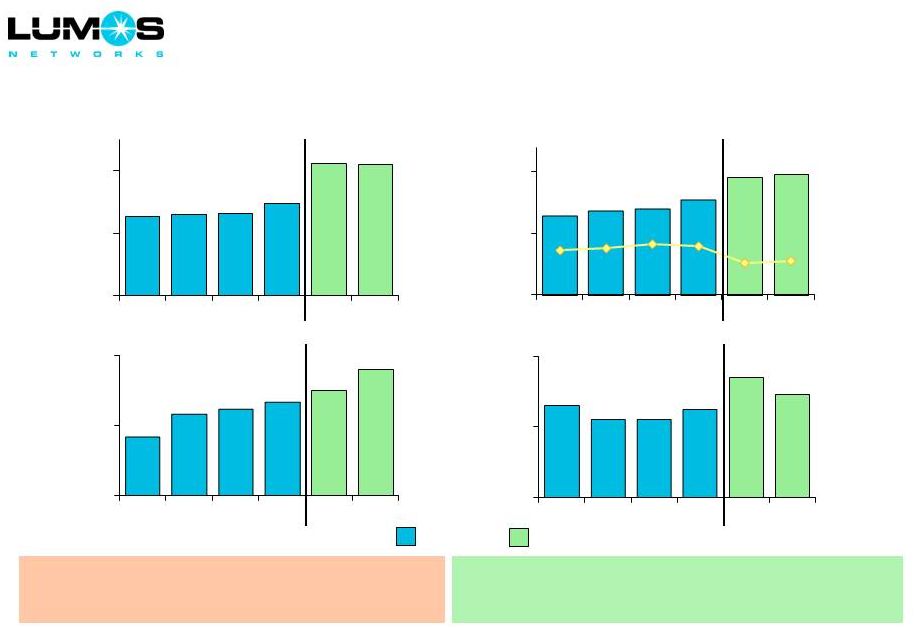

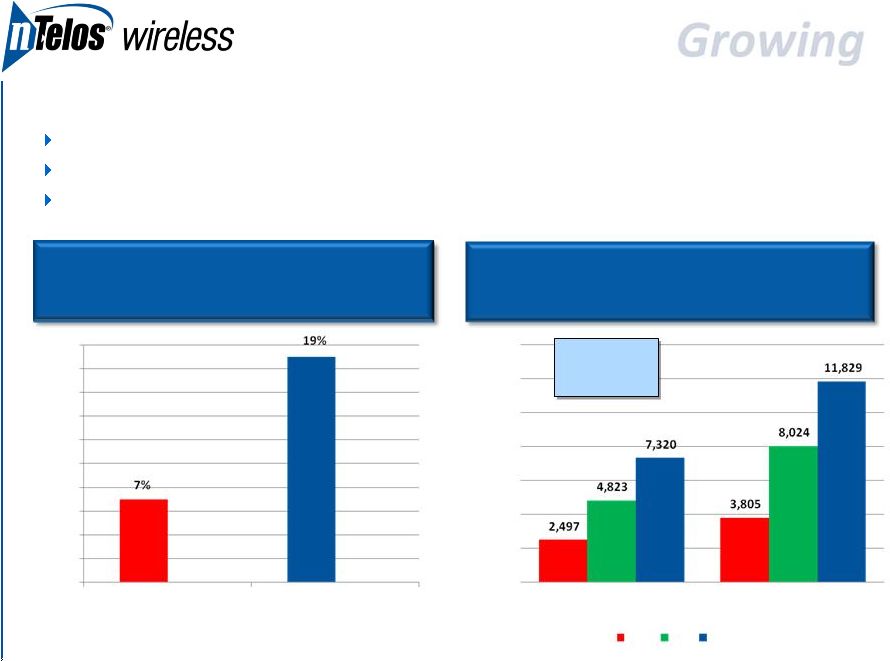

Platform for

Organic Growth – Distribution Strategy

YOY Postpaid Sales up 19% at

Remodeled Retail Locations

Indirect Sales Up 62% YOY

(1)

35% of retail locations are remodeled

(2)

Results compare Q210 vs. Q211

(1)

Redefined distribution strategy in 2010

System wide redesign = higher sell-through rates on postpaid

Indirect channel expansion = increased sales productivity

(2)

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

Existing

Remodeled

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Q210

Q211

Post

Pre

Total

Gross adds per

indirect door

up 21% YOY

8 |

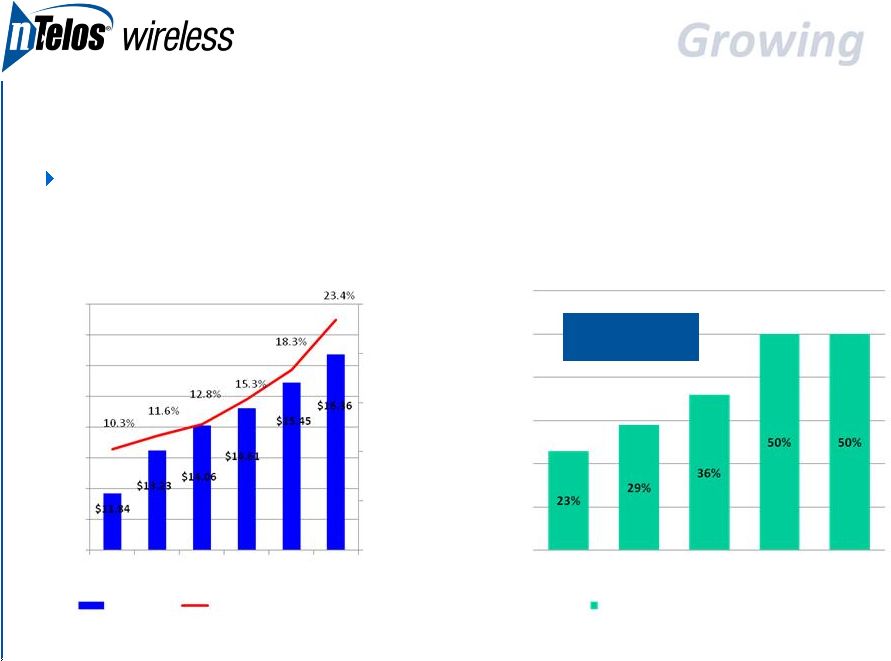

Increased

smartphone penetration drives ARPU and lowers churn Platform for Organic Growth

– Smartphone Explosion

Smartphone ARPU on

average $18 greater than

non-smartphone

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

$10

$11

$12

$13

$14

$15

$16

$17

$18

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

Postpaid Data ARPU and Device Penetration of

Postpaid Base

Data ARPU

Smartphone Penetration of Base

0%

10%

20%

30%

40%

50%

60%

NTELOS

T-

Mobile

Verizon

Sprint

AT&T

Smartphones as a % of Postpaid Base

Smartphone as a % of Postpaid Base

9 |

Platform for

Organic Growth – Wholesale Revenues

Network investments driving wholesale revenue growth

Sprint wholesale revenue up 32% YOY

*

Reflects Sprint Minimum

Wholesale Revenue

Cell Sites

$15

$20

$25

$30

$35

$40

1,000

1,050

1,100

1,150

1,200

1,250

1,300

1,350

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

* Excluding support from the contracted minimums in the prior year, revenues from Sprint

wholesale were up 32% in second quarter 2011, from $24.5 million of calculated revenue

underlying the minimums for second quarter 2010.

10 |

Unaided Brand

Awareness Cell Phone

Provider

Q2 vs. Q1

% Change

T-Mobile

42%

NTELOS

38%

Sprint

11%

Verizon

6%

AT&T

(4%)

U.S. Cellular

(15%)

Alltel

(29%)

Leading Indicators Support Strategy and Execution

Brand Awareness up 38% QOQ

Leading NPS scores in largest

markets

* Based on Internal Brand Awareness and Image Tracking Survey (Charleston, Roanoke,

Richmond, Hampton Roads) 36%

37%

27%

22%

4%

44%

43%

25%

20%

6%

10%

0%

10%

20%

30%

40%

50%

NTELOS

U.S. Cellular

Verizon

AT&T

Sprint

Net Promoter Scores

1Q11

2Q11

-

-

11 |

Leading

Indicators Support Strategy and Execution Subscriber ports now net positive for first

time since July 2007 Wireless Number Porting

(3,000)

(2,500)

(2,000)

(1,500)

(1,000)

(500)

0

500

1,000

1,500

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011 QTD

Verizon

USCC

T-Mobile

Sprint

AT&T

12 |

Leading

Indicators Support Strategy and Execution Market Share erosion stabilizing

Subscriber Market Share

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Market A

Market B

Market C

Market D

Market F

Market G

Market H

Market I

Market J

Market K

13 |

$24

$93

$163

$11

$42

$73

$-

$20

$40

$60

$80

$100

$120

$140

$160

$180

8.0%

10.0%

12.0%

Penetration of Covered POPs

Revenue and EBITDA Impact of Increased Penetration

Annual Revenue Impact

Annual EBITDA Impact

Moderate increases in penetration provide substantial retail revenue and EBITDA growth

1% increase in market share = 58k incremental subs

“Size of the Prize”

* Assumes current subscriber base mix at higher penetration and applies operating financial

metrics to illustrate subscriber base * Assumes 45% incremental EBITDA

margin * Current NTELOS combined share in all markets is 7.3%

14 |

Growth

opportunities exist if Big 4 become Big 3 Platform for Strategic Growth

Will evaluate AT&T/T-Mobile divestiture scenarios

Opportunistic in M&A activities

Attractive balance sheet / capital structure

Access to incremental capital

Spectrum

(Hampton, VA)

Subs

Share

90MHz

1.3M

24%

60MHz

150MHz

112MHz

44MHz

20MHz

.5M

1.8M

2.1M

1.1M

.1M

9%

33%

38%

20%

6%

15 |

Investment in

EVDO driving strong retail and wholesale data revenue growth

9

8

8

9

7

16

9

19

14

16

18

25

15

16

17

35

47

9

378

412

425

407

412

$300

$320

$340

$360

$380

$400

$420

$440

$0

$10

$20

$40

$50

$60

$70

$80

$90

$100

2007

2008

2009

CAPEX Summary vs. Total Revenue 2007-2010

EVDO

Growth

Capacity

Maintenance

Total Revenue

78

88

39

40

$30

2010

LTM

51

16 |

Fast follower

with LTE Well positioned with Sprint for technology upgrade

LightSquared

Clearwire

Stand alone

LTE field trials completed

Industry Milestones

NTELOS Milestones

VZ launch in 30

cities

First LTE Device

Introduced

4G Roadmap

EVDO Build

Completion

Metro PCS

initial Launch

AT&T launch in 10

cities

Sprint WiMAX in

Baltimore

LTE Field Trials

Completed

2010

2011

2012

2009

17 |

Financial

Summary |

19

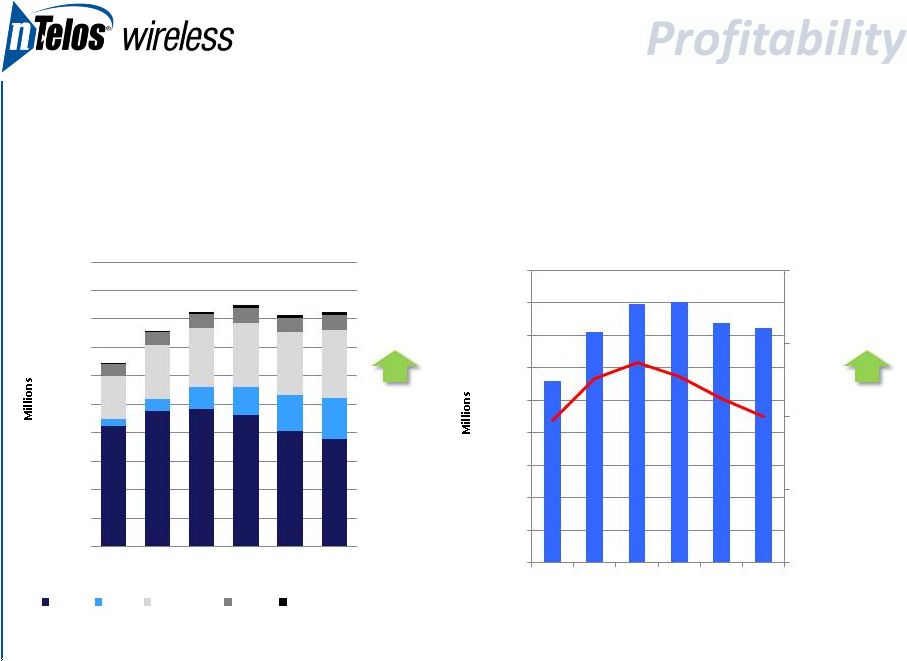

Solid Revenue and EBITDA Growth

Revenue

reflects

6% CAGR

EBITDA

reflects

7% CAGR

212

238

242

232

203

189

11

22

38

49

63

72

77

95

104

113

110

120

21

22

25

26

25

25

1

1

4

5

5

6

$-

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

2006

2007

2008

2009

2010

LTM

Revenue

Voice

Data

Wholesale

Other

Roaming

323

378

412

425

407

412

112

142

159

160

147

144

35%

38%

39%

38%

36%

35%

25%

30%

35%

40%

45%

$-

$20

$40

$60

$80

$100

$120

$140

$160

$180

2006

2007

2008

2009

2010

LTM

EBITDA and EBITDA Margin |

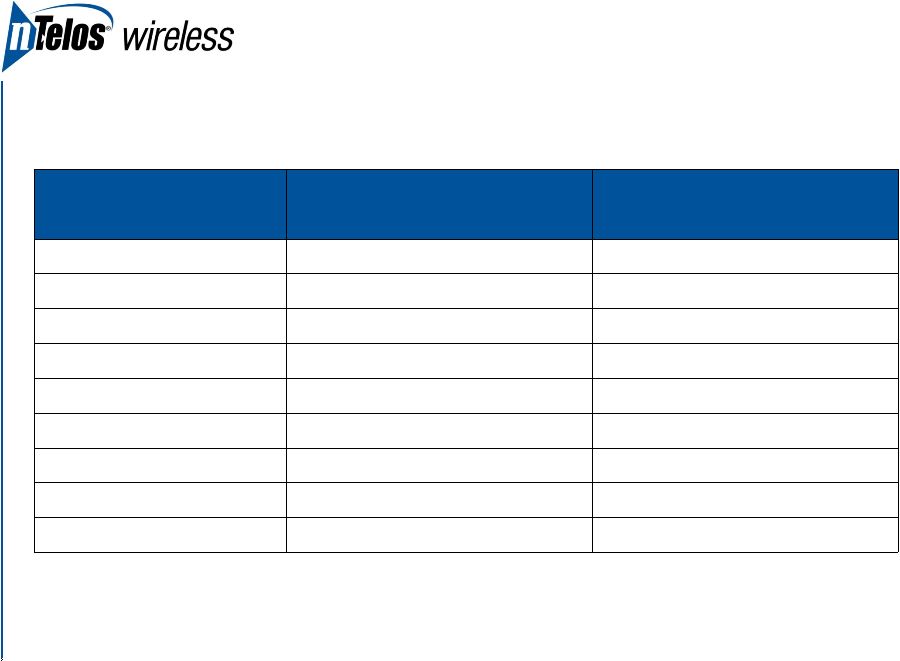

Financial

Overview – Capitalization

Pro Forma as of

June 30, 2011

Cash & Cash Equivalents

$44.3

Restricted Investments

1.1

Total Cash

$45.4

Revolver ($35mm total)

$ -

Term Loan B

460.2

Total Funded Debt

460.2

Capital Leases

1.0

Total Debt

$461.2

PF Total Debt/LTM Adjusted EBITDA

3.3x

PF Net Debt/LTM Adjusted EBITDA

3.0x

(1)

(1) Reflects impact of cash dividend upon spin-off of Lumos Networks and restructured debt

repayment Available Capital to Support Growth Initiatives

20 |

Financial

Overview (1)

Reflects impact of cash dividend upon spin-off of Lumos Networks and restructured debt

repayment (2)

Expected annualized dividend of $1.68 per share to be paid by wireless

(3)

Wireless Revenue and Expenses before Intercompany eliminations

(1)

(1)

(3)

(mm, except Operating Data)

Consolidated

Wireless Only

2Q11

LTM

2Q11

LTM

Revenue ($)

154.5

585.9

104.4

412.1

Adjusted EBITDA ($)

60.1

230.6

35.9

144.2

Margin %

38.9%

39.4%

34.4%

35.0%

CAPEX ($)

34.5

103.7

13.3

40.3

% of Revenue

22.3%

17.7%

12.7%

9.8%

Op FCF ($)

25.7

126.9

22.7

103.9

Margin %

16.6%

21.7%

21.7%

25.2%

Total Debt ($)

746.5

746.5

461.2

461.2

Total Dividend Payout ($)

11.8

47.0

8.8

35.3

(2)

(1)

(1)

(3)

(2)

21 |

Leading

“pure-play” regional wireless company

Platform for organic and strategic growth

Unique growth and income investment opportunity

Wholesale revenue at an all time high and growing

NTELOS intends to pay $0.42/share initial dividend post separation

Strong Free Cash Flow characteristics

27%

FCF margin

Attractive strategic asset set

Exclusive network provider to Sprint in region

Unique network footprint in Mid-Atlantic region

Experienced senior management team

Investment Rationale

(1) Adjusted for proposed one for two reverse stock split

(2) Results as of YE 2010

(3) Throughout presentation, Free Cash Flow is defined as Adjusted EBITDA less Capital

Expenditures (2)

(1)

(3)

22 |

Growing

Profitably Investor Presentation

September, 2011 |