Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE, DATED SEPTEMBER 19, 2011 - American Water Works Company, Inc. | d233829dex991.htm |

| 8-K - FORM 8-K - American Water Works Company, Inc. | d233829d8k.htm |

Institutional Presentation

Bank of America Merrill Lynch

Power and Gas Leaders Conference

September 20, 2011

Exhibit 99.2 |

2

Certain statements in this presentation are forward-looking statements

within the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are predictions based on our current

expectations and assumptions regarding future events and may relate to, among

other things, our future financial performance, including return on

equity performance, our growth and portfolio optimization strategies, our projected capital

expenditures and related funding requirements, our ability to repay debt, our ability

to finance current operations and growth initiatives,

the

impact

of

legal

proceedings

and

potential

fines

and

penalties,

business

process

and

technology

improvement

initiatives, trends in our industry, regulatory or legal developments or rate

adjustments. Actual results could differ materially because of factors such as

decisions of governmental and regulatory bodies, including decisions to raise or lower rates; the

timeliness

of

regulatory

commissions’

actions

concerning

rates;

changes

in

laws,

governmental

regulations

and

policies,

including environmental, health and water quality and public utility regulations and

policies; weather conditions, patterns or events, including drought or

abnormally high rainfall; changes in customer demand for, and patterns of use of, water, such as

may

result

from

conservation

efforts;

significant

changes

to

our

business

processes

and

corresponding

technology;

our

ability to appropriately maintain current infrastructure; our ability to obtain

permits and other approvals for projects; changes in our capital requirements;

our ability to control operating expenses and to achieve efficiencies in our operations; our ability

to obtain adequate and cost-effective supplies of chemicals, electricity, fuel,

water and other raw materials that are needed for our operations; our ability

to successfully acquire and integrate water and wastewater systems that are complementary to our

operations and the growth of our business or dispose of assets or lines of business

that are not complementary to our operations and the growth of our business;

cost overruns relating to improvements or the expansion of our operations;

changes in general economic, business and financial market conditions; access to

sufficient capital on satisfactory terms; fluctuations in interest rates;

restrictive covenants in or changes to the credit ratings on our current or future debt that could

increase our financing costs or affect our ability to borrow, make payments on debt

or pay dividends; fluctuations in the value of benefit plan assets and

liabilities that could increase our cost and funding requirements; our ability to utilize our U.S. and

state net operating loss carryforwards; migration of customers into or out of our

service territories; difficulty in obtaining insurance at acceptable rates and

on acceptable terms and conditions; the incurrence of impairment charges ability to retain

and attract qualified employees; and civil disturbance, or terrorist threats or acts

or public apprehension about future disturbances or terrorist threats or

acts. Any forward-looking statements we make, speak only as of the date of

this presentation. Except as required by law, we specifically disclaim any

undertaking or intention to publicly update or revise any forward-looking statements, whether as a

result

of

new

information,

future

events,

changed

circumstances

or

otherwise.

Cautionary Statement Concerning Forward-Looking

Statements

September 2011 |

September

2011 3

Regulated

Businesses

provide earnings

stability

Solid track record

of Shareholder

Value creation

Continued growth

opportunities

driven by industry

needs

Stable Dividend

Growth

American

Water

NYSE: AWK

American Water’s Value Proposition |

American Water: The Premier Water Services Provider

in North America

Largely residential

customer base promotes

consistent operating

results

Geographic presence

hedges both weather and

regulatory risk

Scale enables multiple

growth opportunities

across service areas

4

September 2011 |

September 2011

0.40

0.45

0.50

0.55

0.60

0.65

AWK Beta

Total Shareholder Return : American Water vs. Indices

(September

13,

2010

–

September

13,

2011)

5

Shareholder Return

LTM

American Water

S&P 500

Dow Jones Utilities

+30.9%

+6.7%

+10.9%

80%

90%

100%

110%

120%

130%

140%

150%

160%

AWK

DJ Util

S&P 500

Source: Thomson Reuters |

The

US Water Industry |

The

U.S. Water Industry 7

Key

Water

Sector

Themes

Aging

Infrastructure

Fragmented

Industry

Increasing

Environmental

Requirements

Capital

Availability

Technology

September 2011 |

September 2011

There is Increasing Public Awareness of Water and

Wastewater Issues

8 |

American Water |

September 2011

American Water’s Regulated Presence

10

States where we recently expanded our Regulated Operations States we are in process of exiting

Regulated Operations |

September 2011

11

Recovery Received*

Rate Cases Filed

Infrastructure Charges

Rate Cases

$180.1

$313.9

$158.9

$206.2

(in millions of dollars)

(in millions of dollars)

$107.5

$312.7

$33.1

$222.9

Continuing Effort to Earn an Appropriate Rate of Return on

Prudent Investments

•

2010 Recovery Received includes $1.5 million of additional annualized revenues in

California associated with its Motion for reconsideration and rate base addition for cases

finalized in 2009

•

Recovery Received reflects final orders issued, and does not include Interim rate

increases. $277.2

$129.3

•

As of August 26, 2011: $314.6 million in annualized revenue

requests from 9 outstanding rate cases

•

In 2011 American Water received average ROE of 10.1% |

September 2011

Regulated Operations Growth: Investing in Needed

Infrastructure

(1)

Net

capex

defined

as

gross

capex

less

advances

and

contributions

in aid of construction.

Capital Expenditure Framework

Net Capex

(1)

by category

Ongoing Capital Expenditure program

of $800 million to $1 billion per year

Capital program focused on

Infrastructure replacement

Capacity projects

Source of supply needs

Acquisitions

Major projects

Pittsburgh, PA

Short Hills, NJ

Warsaw, IN

Hopewell, VA

Peoria, IL

12

Quality of

Service, 19%

Other, 6%

Asset Renewal,

40%

Capacity

Expansion, 20%

Regulatory

Compliance, 15% |

13

American Water is Actively Addressing Regulatory

Lag that Impact Returns on Investments

= Recognition of regulatory lag in rate cases requested, but not

yet obtained

•

= Recognition of regulatory lag in rate cases that exist today

Note: Each of these tools is designed and applied differently in

each state and subject to regulatory change

Pending Rate

Cases

Declining

Usage

Decoupling

Distribution

Surcharges

Balancing/

Trackers

Adjustment

Clauses

California

Iowa

New York

Pennsylvania

Indiana

Missouri

Ohio

New Jersey

September 2011 |

American Water’s Portfolio Optimization Initiatives

•

Balanced Portfolio Analysis

•

Focus Achieving Authorized Rates

of Return

•

Monetize Non-Producing Assets

•

Focused Capital Resources

•

Selective Acquisition Opportunities

•

Leverage Internal Growth

14

Focus on

Value Drivers

Drive Profitability and

Returns

Explore Opportunities for

Long-Term Success

Optimizing

Long-term Value

Through

Proactive

Management

Redeploy Value Into Core

Growth Markets

Continue to Lower Costs

September 2011 |

AZ

$265M

(2)

(1)An approximation of rate base as of December 30, 2010 , which includes Net

Utility Plant not yet included in rate base pending rate case filings/outcomes

(2)Rate base approved in rate cases by respective commissions

(3)Most recent transactions (AZ, NM, OH and NY) subject to closing risk and

regulatory approval 15

TX

$5.5M

(2)

NM

$34M

(2)

NY

$42M

(3)

MO

$3M

(2)

OH

$70M

(3)

Rate Base

(1)

= $8.3 Bn

Portfolio Optimization: Rate Base Inflows and

Outflows

Proceeds of $470 mm from New Mexico and Arizona transactions

will be used to lower debt or finance Capital Expenditures

September 2011 |

16

American Water’s Market-Based Operations Continue

to Generate Opportunities for Growth

(1)

Includes 137 AWM and 48 EMC projects

(2)

Includes 16 AWM projects

Contract Operations

Military Bases Privatization

•

Over $2 Billion in Revenues Backlog

Contract Operations

•

Over 200 contracts

(1)

•

Serving 3.1 Million people

•

25 industrial contracts

Design, Build,Operate

•

20 current projects

(2)

Homeowner Services

Over 870,000 contracts

17 States

Emerging Technologies

Desalination plant

•

Tampa Bay Seawater, FL

Water Reuse; 22 Projects; 7 States

•

Gillette Stadium, MA

•

Battery Park, NY

•

Butterball Turkey, NC

Regulated-Like

Complementary

Value-Added

Services

For 2010, American Water reported $311.8 million of

Market-Based Operations revenues

September 2011 |

September 2011

17

2011 Guidance: Solid Growth Powers Increased

Earnings Guidance, as Adjusted, to $1.75 -

$1.82

Note: Changes in events, or circumstances beyond the Company’s control or that

it cannot anticipate could materially impact the EPS guidance and could result in actual results being significantly above

or

below

this

outlook.

In

addition

to

the

cautionary

statements

herein,

Investors

are

advised

to

review

the

risk

factors

in

the

Company’s

10-K

and

other

filed

financial

documents

when

making

investment

decisions

Previous Guidance

$1.65 -

$1.75

Key Drivers

New Guidance

$1.75 -

$1.82

•

Cost efficiencies

•

Continued low interest rate

environment

•

Favorable early summer

weather

in

Northeast

•

Favorable summer weather

in Midwest states

The 2011 EPS Guidance, as adjusted, does not recognize the benefit to net income and

earnings per share of the cessation of depreciation for discontinued

operations in Arizona, New Mexico, Texas and Ohio, which is estimated to be

approximately $0.09 for 2011 |

September 2011

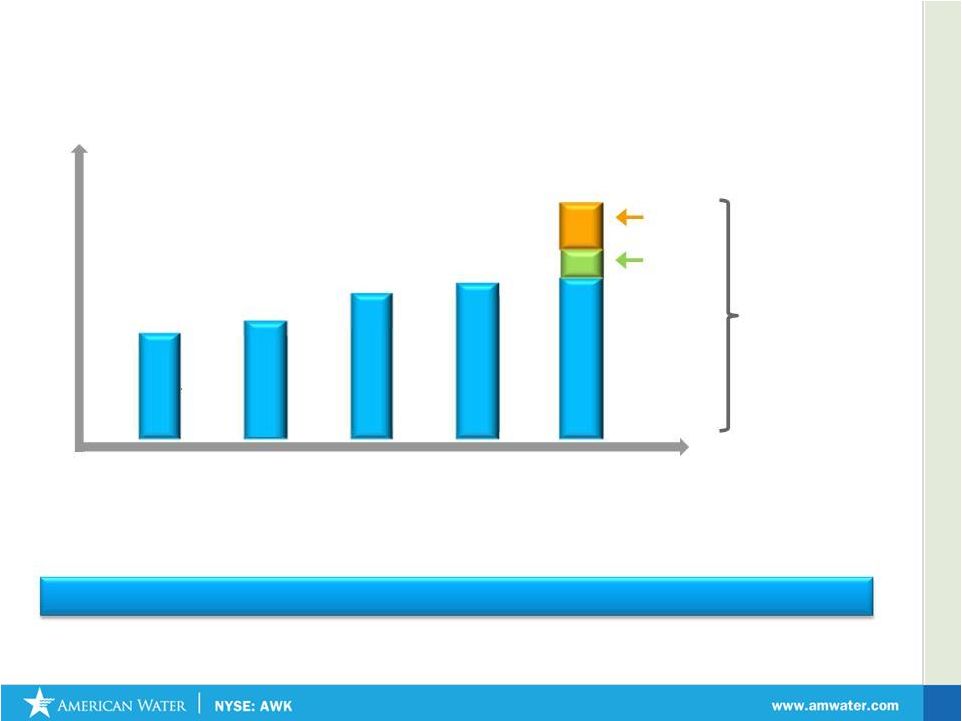

Investment Thesis: Sustained 7-10% EPS Growth

Future Growth

New Services

Regulated Investments

Acquisitions

Operational Excellence/

Efficiencies

ROE improvement

Long Term Growth

Conceptual Representation

18

September 2011 |

Financial Update |

September 2011

American Water: Solid 2011 Results

Cash Flow From Operations

(in millions)

Net Income*

(in millions)

Operating Revenues

(in millions)

$634.9

$1,192.9

$674.2

$1,276.1

$0.0

$500.0

$1,000.0

$1,500.0

2nd Quarter

YTD

2010

2011

$100.9

$262.4

$121.5

$297.9

$0.0

$200.0

$400.0

2nd Quarter

YTD

Earnings Per Share*

$72.8

$103.6

$84.6

$131.9

$0.0

$50.0

$100.0

$150.0

2nd Quarter

YTD

2010

2011

$0.42

$0.59

$0.48

$0.75

$0.00

$0.20

$0.40

$0.60

$0.80

2nd Quarter

YTD

2010

2011

*Net Income and EPS include the cessation of depreciation that favorably affected

net income by $3.2 million after tax, or $0.02 per share and $7.9 million after tax and $0.04 per share for

the three and six months ended June 30, 2011, respectively, on assets under

agreement for sale .

2010

2011

20

Regulated O&M Efficiency Ratio improved 220 bps

for the six months ended June 30, 2011* |

September 2011

21

American Water Continues to Improve Return on

Equity

(1)

to Shareholders

10 % -

10.5 %

ROE

(5)

1.

ROE calculation excludes impairment , SOX, divestiture and other

2.

2008, 2009 and 2010 reflect net income as there was no discontinued operations in

these periods 3.

2011 is adjusted for cessation of depreciation associated with assets of

discontinued operations 4.

Parent company debt as of June 30, 2011

5.

Range of allowed ROE

1.1%

Parent Co.

Debt

(4)

Opportunity

(2)

(2)

(2)

(3)

4.73%

5.28%

6.49%

6.95%

2008

2009

2010

LTM

6/30/11

Allowed

ROE

American Water continues to close ROE Gap |

September 2011

1)

Water Companies Include: AWR, CTWS, CWT, MSEX, SJW,

WTR, YORW.

2)

Gas Companies include ATO, LG, GAS, NWN, PNY, SJI, SWX,

WGL.

3)

Regulated Electric Companies include HE, NU, TE, LNT, XEL,

SO, CNP, PCG, SCG, POR, DUK, UIL, PGN, AEP.

4)

Average

monthly

dividend

yield

for

2008

–

2010

period.

5)

Non GAAP: American Water EPS adjusted to exclude impairment

charges.

American Water’s Past Performance and Future Growth

Expectations Compare Very Favorably vs Water, Electric

and Gas Peers

Source: Thomson Reuters

* For AWK represents 7-10% Long Term EPS CAGR market guidance .

All other data from First Call Consensus Estimates

** as of 9/13/11

Note: Consensus Estimates are calculated by First Call based on the earnings

projections made by the analysts

who

cover

companies

noted

(other

than

AWK).

Please

note

that

any

opinions,

estimates

or

forecasts regarding performance made by these analysts (and therefore the

Consensus estimate numbers) are theirs alone and do not represent opinions,

forecasts or predictions of American Water or its management.

2008 –

2010

EPS CAGR + Average Dividend Yield

(4)

Total Shareholder Return

(Long Term Expected EPS Growth* and

Dividend Yield**)

22 |

September 2011

P/E Compared with Total Return

Source: Thomson Reuters

* PE data as of September 2011

American Water’s Higher Growth Expectations are not

Fully Reflected in its PE Multiple

Forward P/E

Expected Total Return

23 |

September 2011

Recent Dividend History

•

Key component of American

Water’s total shareholder return

proposition

•

Dividend Growth –

Board of

Directors increased dividend 5%

to $0.23 or $0.92 annualized

•

Dividend Yield –

3.19% at

9/13/11

•

Growth in Dividend reflects

growth in Net Income

24

Quarterly Dividend Rate Increases |

25

Regulated

Businesses

provide earnings

stability

Solid track record

of Shareholder

Value creation

Continued growth

opportunities

driven by industry

needs

Stable Dividend

Growth

American Water’s Value Proposition

American

Water

NYSE: AWK

September 2011 |

September 2011

Investor

Relations

Contacts:

Ed Vallejo

Vice President –

Investor Relations

Edward.vallejo@amwater.com

Muriel Lange

Manager –

Investor Relations

Muriel.lange@amwater.com

Tel: 856-566-4005

Fax: 856-782-2782

26 |

Appendix |

September 2011

Water Utility Expenditures

28

Water vs Other Utility Expenditures

Water Use in the Home |

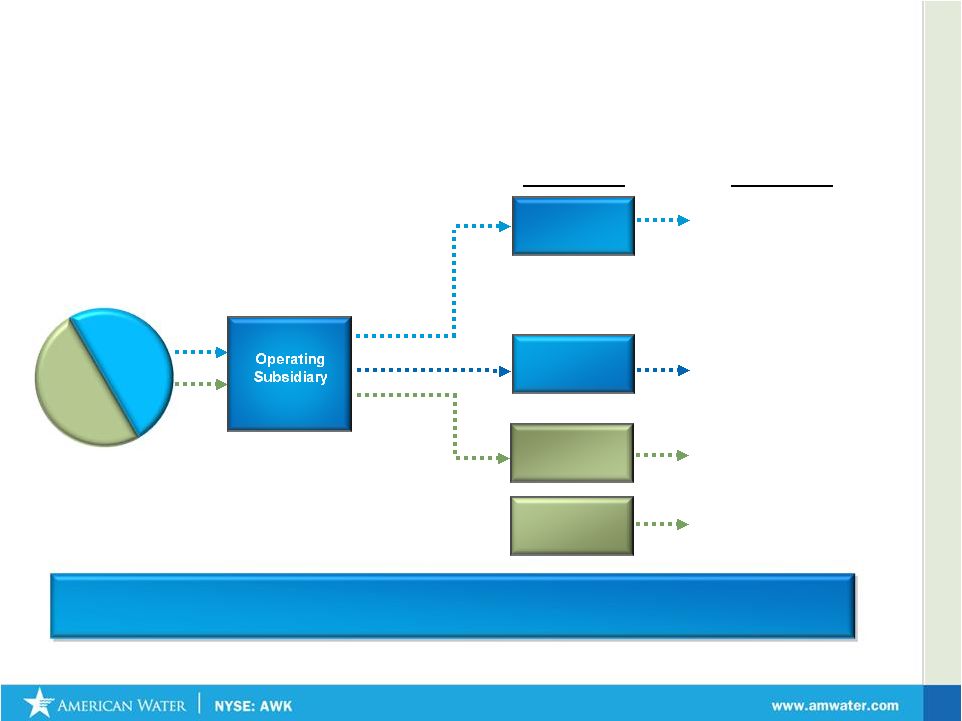

September 2011

Rate of Return Regulation in the United States

Prudent Investment Drives Need for Rate Cases

Operating

Expenses

Taxes, Depr &

Amortization

WACC

Establish

Rate

Base

Allowed

Return

Allowed

Return

Revenue

Requirement

Step 2

Step 1

+

+

x

=

=

29

American Water has experience in securing appropriate rates of

return and promoting constructive regulatory frameworks

|

September 2011

AW Parent

Company

Equity

Debt

Equity (Capex)

Operating Expenses

Debt

Regulatory

Treatment

Net Income

Impact

•

Neutral, if interest costs

are deemed prudent

and fair to the

consumer by regulator

How is Net Income Generated in Rate of Return Regulation?

Pass Through

1:1

Pass Through

1:1

Return of

(Depreciation)

Return on Equity

(ROE)

Debt

Equity

•

Neutral, if all operating

expenses are deemed

prudent and fair to the

consumer by regulator

•

Depreciation is neutral

if all depreciable assets

are in rate base

•

Rate Base x Earned

ROE + Gross Up for

Taxes is Added

Revenue

* Assuming no regulatory lag between rate cases

30

If all assets are included in the Company’s Rate Base and all operating

expenses are deemed prudent and recoverable by regulator, Company earns

allowed ROE* |

September 2011

31

Rate Cases Awaiting Final Order

Docket /

Annualized Revenue

ROE

Rate Base

Filing

Case Number

Date Filed

Increase Filed

Requested

(Filed)

Status

California

A 10-07-007

07/01/10

37.3

10.20%

409.6

3

Arizona

W-01303A-10-0448

11/03/10

20.4

11.50%

149.2

2

Hawaii

2010-0313

02/22/11

1.8

11.85%

25.2

3

Pennsylvania

R-2011-2232243

04/29/11

70.7

11.50%

2,096.2

2

New York

11-W-0200

04/29/11

9.6

11.50%

126.9

2

Iowa

RPU-2011-0001

04/29/11

5.1

11.35%

88.9

5

Indiana

44022

05/02/11

20.4

11.50%

733.4

2

New Mexico

11-00196-UT

05/18/11

2.6

11.75%

33.6

2

Missouri

WR-2011-0037

06/30/11

42.9

11.50%

849.1

2

Ohio

11-4161-WS-AIR

07/01/11

8.3

11.50%

92.3

1

New Jersey

WR11070460

07/29/11

95.5

11.50%

2,059.7

1

Total

314.6

$

6,664.1

$

Note: Above excludes rate case file in 2007 for Hawaii for which interim

rates have been in effect since October 2008 Index of Rate Case Status

1 -

Case Filed

2 -

Discovery (Data Requests, Investigation)

3 -

Negotiations / Evidentiary Hearings / Briefings

4 -

Recommended order issued / settlement reached, without interim rates

5 -

Interim rates in effect, awaiting final order

General Rate Cases Awaiting Final Order (as of September 2011)

|

September 2011

Rate Cases and Infrastructure Charges Awarded That Will Have an

Impact

on

2011

Results

(As

of

September

2011)

32

Annualized

($ in millions)

Effective Date

ROE

Increase to

for new rates

Granted

Revenue

General Rate Cases:

Illinois

4/23/2010

10.38%

41.4

$

New Mexico (Edgewood) **

5/10/2010

10.00%

0.5

Indiana

5/3/2010

10.00%

31.5

Virginia (Eastern)

5/8/2010

10.50%

0.6

Ohio **

5/19/2010

9.34%

2.6

Missouri

7/1/2010

10.00%

28.0

California (Sac, LA, Lark)

7/1/2010

10.20%

14.6

Michigan

7/1/2010

10.50%

0.2

Kentucky

10/1/2010

9.70%

18.8

New Jersey

1/1/2011

10.30%

39.9

Pennsylvania Wastewater

1/1/2011

10.60%

8.4

Arizona **

1/1/2011

9.50%

14.7

Tennessee

4/5/2011

10.00%

5.6

West Virginia

4/19/2011

9.75%

5.1

Virginia

4/6/2011*

10.20%

4.8

*

Subtotal -

General Rate Cases

216.7

$

Infrastructure Charges:

Pennsylvania

19.3

Indiana

5.4

Missouri

6.3

Illinois

1.7

Other

1.6

Subtotal -

Infrastructure Charges

34.3

$

Total

251.0

$

* Includes non-jurisdictional components of approximately $0.5 million. The

effective dates the

specific

customers

and

were

either

August

2010

or

January

1,

2011.

** In process of being sold |

September 2011

American Water Continues to Educate Consumers

about Needed Infrastructure Investments

•

Open houses/tours

•

Speaking forums

•

News releases/op-eds

•

Media pitching

•

Bill inserts

•

Flyers

•

Advertising

•

Community events

•

Public official meetings

•

White papers

33 |

Infrastructure Surcharges: A Viable Mechanism to

Address Regulatory Lag

•

Infrastructure Surcharges allow companies to recover

infrastructure replacement costs without necessity of filing

full rate proceeding

•

States that currently allow use of infrastructure surcharges

Pennsylvania

Indiana

Illinois

Ohio

•

Surcharges are typically reset to zero when new base rates

become effective and incorporate the costs of the previous

surcharge investments

Delaware

New York

Missouri (St Louis County)

California -

Trial basis

34

September 2011 |

September 2011

Case in Point: Increased Investment in Pennsylvania’s

Infrastructure

35 |

September 2011

36

Marcellus Shale: Possible Opportunities for

Growth

•

Marcellus Shale formation covers 2/3

of Pennsylvania

•

363 trillion cubic feet of natural gas is

estimated to be captured in

Pennsylvania’s shale formation

•

Many of the 390 communities that we

serve are in areas where drilling is

taking place

•

PAW is currently selling water to gas

drillers at 29 distribution points in

Pennsylvania, primarily in Western PA

and some in Northeast PA

•

PAW sold 115.3 million gallons of

water to gas drillers from January

through June of 2011, producing

$702,000 in revenues

•

3,792 Marcellus Shale wells drilled

from 2008 to July 2011

Pennsylvania American Water Service Areas with DEP Bureau oil

and gas Marcellus Shale wells drilled between 2008-2011

Realizing additional revenues from water sales to drilling

companies while remaining vigilant in protecting our water sources

|

September 2011

Debt

Maturities

(as

of

6/30/2011)

37

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2011 -

2015

2016 -

2020

2021 -

2025

2026 -

2030

2031 -

2035

2036 -

2040

* Excludes Preferred Stock with Mandatory Redemptions and Capital Leases

Weighted Average Interest Rates

Parent Company Debt

5.3%

5.9%

5.9%

6.4%

6.3%

6.0%

$100

million

of

Parent

Company

debt

swapped

from

6.085%

to

6

month

LIBOR

+

3.422% |

September 2011

Financial

Tables:

GAAP

and

Non-GAAP

Measures,

Rate

Base

Rate Base as of June 30, 2011

(1)

($ in Thousands)

Net Utility Plant

$10,463,211

Less

Advances for Construction

396,440

CIAC –

Contributions in Aid of Construction

940,819

Deferred income taxes

1,163,854

Deferred investment tax credits

30,198

Sub Total

$2,531,311

Rate Base

TOTAL

$7,931,900

(1) An approximation of rate base, which includes Net Utility Plant not yet

included in rate base pending rate case filings/outcomes 38

Net

Income

(Loss)

–

Earnings

per

Share

Excluding Impairment Charge

(A Non-GAAP Unaudited Number)*

Historical

For the Year Ended December 31,

($ in thousands, except per share data)

2008

2009

2010

Net income (Loss)

($562,421)

($233,083)

$267,827

Add: Impairment

750,000

450,000

0

Net income excluding impairment charge before associated

tax benefit

187,579

216,917

267,827

Less: Income tax benefit relating to impairment charge

11,525

6,976

0

Net income excluding impairment charge

$176,054

$209,941

$267,827

Basic earnings per common share excluding impairment

charge:

Net income excluding impairment charge

$1.10

$1.25

$1.53

Diluted earnings per common share excluding impairment

charge:

Net income excluding impairment charge

$1.10

$1.25

$1.53

*A Non-GAAP number, excluding net impairment charges for 2009 and 2008 of

$(443,024) and $(738,475), respectively. |

Income Statement

Three Months Ended

June

30,

Six Months Ended

June

30,

2011

2010

2011

2010

Operating revenues

$

674,248

$

634,910

$

1,276,070

$

1,192,930

Operating expenses

Operation and maintenance

332,310

314,016

647,677

614,599

Depreciation and amortization

87,654

81,695

174,603

162,754

General taxes

53,096

50,889

108,815

103,743

Loss (gain) on sale of assets

28

26

296

(45)

Total operating expenses, net

473,088

446,626

931,391

881,051

Operating income

201,160

188,284

344,679

311,879

Other income (expenses)

Interest, net

(78,504)

(78,444)

(154,724)

(156,888)

Allowance for other funds used during construction

2,535

2,305

5,363

4,414

Allowance for borrowed funds used during construction

1,198

1,194

2,402

2,547

Amortization of debt expense

(1,255)

(735)

(2,547)

(1,927)

Other, net

679

1,987

(475)

2,059

Total other income (expenses)

(75,347)

(73,693)

(149,981)

(149,795)

Income from continuing operations before income taxes

125,813

114,591

194,698

162,084

Provision for income taxes

51,160

46,570

79,315

64,880

Income from continuing operations

74,653

68,021

115,383

97,204

Income from discontinued operations, net of tax

9,913

4,730

16,515

6,355

Net income

$

84,566

$

72,751

$

131,898

$

103,559

Basic earnings per common share: (a)

Income from continuing operations

$ 0.43

$ 0. 39

$ 0.66

$ 0.56

Income from discontinued operations, net of tax

$ 0.06

0.03

$ 0.09

0.04

Net income

$ 0.48

$ 0.42

$ 0.75

$ 0.59

Diluted earnings per common share: (a)

Income from continuing operations

$ 0.42

$ 0. 39

$ 0.65

$ 0.56

Income from discontinued operations, net of tax

$ 0.06

$ 0.03

$ 0.09

$ 0.04

Net income

$ 0.48

$ 0.42

$ 0.75

$ 0.59

Average common shares outstanding during the period:

Basic

175,469

174,774

175,364

174,747

Diluted

176,436

174,850

176,273

174,820

Dividends per common share

$

0.45

$

0.21

$

0.67

$

0.42

(a) Amounts may not sum due to rounding

39

September 2011 |

September 2011

Reconciliation Tables

In thousands

2011

2010

2011

2010

Total Regulated Operation and Maintenance Expenses

271,383

$

261,711

$

536,336

$

512,964

$

Less: Regulated Purchased Water Expenses

25,565

26,063

46,380

46,421

Adjusted Regulated Operation and Maintenance Expenses (a)

245,818

$

235,648

$

489,956

$

466,543

$

Total Regulated Operating Revenues

594,441

$

566,002

$

1,122,722

$

1,055,457

$

Less: Regulated Purchased Water Revenues*

25,565

26,063

46,380

46,421

Adjusted Regulated Operating Revenues (b)

568,876

$

539,939

$

1,076,342

$

1,009,036

$

Regulated Operations and Maintenance Efficiency Ratio = (a)/(b)

43.2%

43.6%

45.5%

46.2%

*As revenues not tracked in this manner, calculation assumes that purchased water revenues approximate

purchased water expenses Six Months Ended

June 30,

Regulated Operations and Maintenance Efficiency Ratio (A Non-GAAP, unaudited measure)*

Three Months Ended

June 30,

40

*

O&M Efficiency Ratio (A Non-GAAP, unaudited measure) = operating and

maintenance expenses / revenues, adjusted to eliminate revenues and expenses

related to purchased water . * Quarterly data reflects the effect of

discontinued operations. |

September 2011

Reconciliation Tables

41

* Net

Income

and

EPS

include

the

cessation

of

depreciation

worth

$3.2

million

after

tax,

or

$0.02

per

share

and

$7.9

million

after

tax

and

$0.04

per

share

for

the three and six months ended June 30, 2011, respectively, on assets under

agreement for sale . In thousands

Three Months Ended

Six Months Ended

June 30,

June 30,

2011

2011

Net income

84,566

$

131,898

$

Less: Cessation of depreciation, net of tax

3,159

7,888

Net income, exclusive of the cessation of depreciation associated with assets

of discontinued operations

81,407

$

124,010

$

Basic earnings per common share:

GAAP net income

$0.48

$0.75

Diluted earnings per common share:

GAAP net income

$0.48

$0.75

Basic earnings per common share:

Adjusted net income

$0.46

$0.71

Diluted earnings per common share:

Adjusted net income

$0.46

$0.70

Net income, exclusive of the cessation of depreciation associated with assets

of discontinued operations (a Non-GAAP, unaudited measure)*

|

September 2011

Balance Sheet Reconciliation for ROE

Return on Equity*

In thousands

LTM

Ended

6/30/11

Total LTM Net income

$ 296,166

Less: Cessation of depreciation, net of tax

7,888

LTM net income, exclusive of the cessation of depreciation associated with assets

of discontinued operations (a) $ 288,278

Common Stockholders equity

$ 4,157,920

Cessation adjustment

7,888

Common Stockholders equity, adjusted (b)

$ 4,150,032

LTM Adjusted ROE % = (a)/(b)

6.95%

* 2011 net income is adjusted for cessation of depreciation associated with assets of

discontinued operations; there were no discontinued operations in prior

periods. 42 |