Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - Enova International, Inc. | d228493dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 15, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENOVA INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 6141 | 45-3190813 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

200 West Jackson Blvd.

Chicago, Illinois 60606

(312) 568-4200

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Timothy S. Ho

President and Chief Executive Officer

200 West Jackson Blvd.

Chicago, Illinois 60606

(312) 568-4200

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| L. Steven Leshin Douglas M. Berman Hunton & Williams LLP 1445 Ross Avenue, Suite 3700 Dallas, Texas 75202 (214) 979-3000 |

Maurice Blanco Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” or “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||

| Non-accelerated filer (do not check if a smaller reporting company) | x | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Stock, $0.00001 par value per share |

$500,000,000 | $58,050 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we and the selling stockholder are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion | September 15, 2011 |

Shares

Common Stock

This is an initial public offering of the common stock of Enova International, Inc. No public market currently exists for our common stock. We are offering shares of our common stock, and Cash America International, Inc., is offering shares of our common stock. Enova International, Inc. is currently a wholly-owned subsidiary of Cash America International, Inc. We will not receive any proceeds from the common stock sold by Cash America International, Inc. We expect the initial public offering price to be between $ and $ per share.

We intend to apply to list our common stock on the New York Stock Exchange under the symbol “ENVA.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk factors” beginning on page 14 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions | $ | $ | ||||||

| Proceeds, before expenses, to us | $ | $ | ||||||

| Proceeds, before expenses, to Cash America International, Inc. | $ | $ | ||||||

The underwriters may also purchase up to an additional shares of our common stock from Cash America International, Inc. at the public offering price, less the underwriting discounts and commissions payable by us, to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ .

The underwriters are offering the common stock as set forth under “Underwriting.” Delivery of the shares will be made on or about , 2011.

| UBS Investment Bank | Barclays Capital | Jefferies |

| JMP Securities | Raymond James | Wells Fargo Securities | William Blair & Company |

| Keefe, Bruyette & Woods | Roth Capital Partners | Sterne Agee | ||||

Table of Contents

We, the underwriters and Cash America International, Inc. have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us, or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the underwriters and Cash America International, Inc. are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

| 1 | ||||

| 9 | ||||

| 11 | ||||

| 14 | ||||

| 39 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 48 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

54 | |||

| 86 |

| 98 | ||||

| 107 | ||||

| 114 | ||||

| 144 | ||||

| 145 | ||||

| 153 | ||||

| 154 | ||||

| 158 | ||||

| Certain U.S. federal tax considerations for non-U.S. holders |

160 | |||

| 164 | ||||

| 172 | ||||

| 172 | ||||

| 172 | ||||

| F-1 |

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before buying our common stock. You should read the following summary together with the more detailed information appearing in this prospectus, including our consolidated financial statements and related notes, and our risk factors beginning on page 14, before deciding whether to purchase shares of our common stock.

Unless the context otherwise requires, we use the terms the “company,” “we,” “us” and “our” in this prospectus to refer to Enova International, Inc. and its subsidiaries on a consolidated basis. We use the term “Cash America” in this prospectus to refer to Cash America International, Inc., our parent company, and its subsidiaries on a consolidated basis, other than us. In this prospectus, when we refer to a “transaction,” we mean any transaction whereby a customer is provided an advance of credit, whether through direct funding of a loan originated by us, through a loan funded by an unaffiliated lender in connection with our credit services organization programs (which includes our finance brokerage activity in Australia) or through a micro line of credit advance originated by a third-party lender if we acquired a participation interest in such advance, and includes new loans, renewals and each advance on a line of credit. All references to $’s in this prospectus represent U.S. dollars, unless expressly stated otherwise.

OVERVIEW

We are a leading provider of online financial services to alternative credit consumers in the United States, United Kingdom, Australia and Canada, with over 60 million website page views and over $2.0 billion in credit extended in 2010. Our customers include the large and growing number of consumers who have bank accounts but use alternative financial credit services because of their limited access to more traditional consumer credit from banks, thrifts, credit card companies and other lenders. We believe our customers highly value our services as an important component of their personal finances because our services are convenient, quick and often less expensive than other available alternatives. We attribute the success of our business to our advanced and innovative technology systems, the proprietary analytical models we use to predict loan performance, our sophisticated customer acquisition programs and our dedication to customer service. We are currently a wholly-owned subsidiary of Cash America.

We use our flexible and scalable technology platform to process and complete customers’ transactions quickly and efficiently. In the first six months of 2011, we processed over 1.7 million transactions, and we continue to grow our loan portfolio and increase the number of customers we serve. Our highly customizable technology platform allows us to increase the variety and number of products and services we offer and to enter new markets quickly.

We were an early mover into online lending, launching our online business in 2004. We have developed a proprietary underwriting system based on data we have collected over our seven years of experience. This system employs advanced risk analytics to decide whether to approve loan transactions, to structure the amount and terms of the loans we offer and to speed product delivery. Our systems also monitor loan collection and portfolio performance data that we utilize to continually refine the analytical models and statistical measures used in making our credit, marketing and collection decisions.

We provide or arrange multiple types of lending products for consumers in four countries:

| Ø | Short-term consumer loans. We offer single payment unsecured consumer loans in the United States, the United Kingdom, Australia and Canada. Generally, terms are seven to 45 days, loan amounts |

1

Table of Contents

| range from $50 to $2,400, depending on applicable law, and customers promptly receive funds deposited in their bank account in exchange for a pre-authorized debit from their accounts. We also offer lines of credit of up to $1,800 in several U.S. states, depending on applicable law, which allow customers to draw on the line of credit in increments of their choosing, up to their credit limit. |

| Ø | Installment consumer loans. We offer unsecured installment loans in the United Kingdom and in several U.S. states. Generally, terms are between four and 36 months, and loan amounts range from $75 to $2,700, depending on applicable law. |

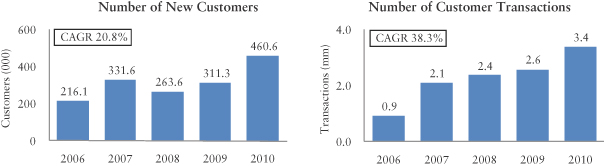

We have achieved significant growth since we began our online business as we have expanded both our product offerings and the geographic markets we serve. We measure our business using several financial and operating metrics. Our key metrics include the number of new customers and total number of customer transactions, in addition to other measures described under “Management’s discussion and analysis of financial condition and results of operations—Measurement of the Business.” The following charts show our growth in the number of new customers and total number of customer transactions completed in each year from 2006 through 2010, excluding the new customers and customer transactions in 2008, 2009 and 2010 related to a micro line of credit, or MLOC, service that ended in October 2010 as described further under “Management’s discussion and analysis of financial condition and results of operations—Our Products.”

From 2007 to 2010, our revenue increased from $184.7 million to $378.3 million, which represents a 27% compound annual growth rate, or CAGR. From 2007 to 2010, our Adjusted EBITDA increased from $26.9 million to $62.9 million, which represents a 33% CAGR. See “Adjusted EBITDA” for a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income.

We currently operate in the United States and internationally, and we believe there are significant market opportunities in both. In 2010, we derived 73% of our revenue in the United States and 27% of our revenue internationally. For the six-month period ended June 30, 2011, we derived 56% of our revenue in the United States and 44% of our revenue internationally. We currently operate in the following countries:

| Ø | United States. We began our online business in the United States in May 2004. As of the date of this prospectus, we operate in 32 states under the name CashNetUSA at www.cashnetusa.com. |

| Ø | United Kingdom. We operate in the United Kingdom under the names QuickQuid at www.quickquid.co.uk and Pounds to Pocket at www.poundstopocket.co.uk. We began our QuickQuid short-term consumer loan business in July 2007 and our Pounds to Pocket installment consumer loan business in September 2010. |

| Ø | Australia. We began our operations in Australia in May 2009, where we operate under the name DollarsDirect at www.dollarsdirect.com.au. |

2

Table of Contents

| Ø | Canada. We began our operations in Canada in October 2009. As of the date of this prospectus, we operate in the provinces of Ontario, British Columbia and Alberta under the name DollarsDirect at www.dollarsdirect.ca. |

OUR INDUSTRY

The Internet has transformed how consumers shop for and acquire products and services. According to Frost & Sullivan, global Internet usage increased 75% from 2005 to 2010, and is expected to increase another 40% by the end of 2015. As Internet usage continues to increase, we expect consumer preference for online purchases to increase. In 2001, less than 30% of adults in the United States used the Internet to buy a product; by 2009, that figure had increased to more than 50%, according to Pew Research.

As a number of traditional financial services such as banking, bill payment and investing have become available online, a growing number of consumers are moving online to complete their financial transactions. According to Forrester Research, or Forrester, approximately 59% of U.S. adults banked online in 2010. This level of use highlights consumer acceptance of the Internet for conducting financial transactions and willingness to entrust financial information to online companies. We believe the increased acceptance of online financial services has led to the increased demand for online lending, the benefits of which include customer privacy, easy access, security, 24 hour per day availability, speed of funding and transparency of fees and interest.

We believe that many traditional financial service providers are unwilling or unable to serve our primary customer base due to the higher costs and risks associated with serving these consumers. Our customer base is comprised largely of individuals living in households that earn less than $75,000 or £40,000 annually in the United States and the United Kingdom, respectively. Based on our analysis of industry data, we believe our addressable markets are approximately 43 million and 15 million households in the United States and United Kingdom, respectively.

Demand for products like ours was highlighted by a recent paper from the National Bureau of Economic Research which found that almost half of the Americans surveyed reported that it is unlikely that they would be able to gain access to $2,000 to cover a financial emergency, even if given a month to do so. We believe consumers want access to fast and convenient credit from a reputable and trustworthy source.

OUR COMPETITIVE STRENGTHS

We believe that the following competitive strengths position us well for continued growth:

| Ø | Scalable and flexible technology platform. Our proprietary and custom-designed technology platform is built for scalability and flexibility and is based on proven open source software. The technology platform was designed to be powerful enough to handle the large volumes of data required to evaluate customer applications and flexible enough to capitalize on changing customer preferences, market trends and regulatory changes. The scalability and flexibility of our technology platform allows us to enter new markets and launch new products quickly, often within three to six months from conception to launch. |

| Ø | Proprietary analytics and data. We have developed a fully integrated decision engine that rapidly evaluates and makes credit determinations throughout the customer relationship, including marketing, underwriting, customer service and collections. Our proprietary models are built from 2.75 terabytes of internal data which includes several years of lending history and millions of transactions. We continually refine our underwriting system to manage default risk and to structure loan terms. We |

3

Table of Contents

| believe our system provides more predictive assessments of future loan behavior when compared to traditional credit assessments such as Fair Isaac Corporation, or FICO, scoring models. |

| Ø | Focus on customer experience. We believe that alternative credit consumers are not adequately served by other existing providers. To better serve these consumers, we established customer-focused business practices, including 24/7 customer service by phone, email, fax and web chat. We continuously work to improve customer satisfaction by evaluating information from website analytics, customer surveys, call center feedback and focus groups. |

| Ø | Customer loyalty and brand recognition. We believe we have established strong relationships with our customer base over the previous seven years. We were an early mover into online lending and have continued to invest in our brands to further increase visibility. We believe customers who wish to access credit again may return to us because of our dedication to customer service and our programs that benefit returning customers. In order to develop a comparable database of customers, we believe that competitors would need to incur high marketing and customer acquisition costs, overcome consumer brand loyalties and have sufficient capital to withstand higher early losses associated with unseasoned loan portfolios. |

| Ø | Strong emphasis on regulatory and compliance structure. We conduct our business in a highly regulated industry. We have devoted significant resources to comply with the laws that apply to us while we believe many of our online competitors have not. Consequently, such competitors may face increased regulatory and compliance risks. We have extensive experience in regulatory and legal compliance and have tailored our lending products and services to comply with the specific requirements of each of the jurisdictions in which we operate, including laws and regulations relating to fees, loan durations, loan amounts and disclosures. Our technology platform was designed to allow us to launch new products in compliance with applicable laws and regulations and with a focus on customer protection. |

OUR STRATEGY

Our vision is to be the most trusted online alternative financial resource for hard working people internationally through world-class technology, analytics, operational excellence and customer support. The key elements of our strategy to deliver upon this vision include:

| Ø | Increase penetration in existing markets. We believe that we have only reached a small number of the potential customers for our products and services in the markets in which we currently operate. We will continue to pursue new customer acquisition through channels such as lead generation (sourcing potential customers via third-party lead providers, which use digital, email or other marketing efforts to acquire and provide us with loan applicants), traditional advertising and digital advertising. We also leverage our platform by offering online loans to consumers referred to us by certain bricks and mortar lending companies, including Cash America, further increasing penetration in markets we currently serve. |

| Ø | Expand globally to reach new markets. We intend to build on our global reach by entering new markets, particularly in Latin America and Europe. When pursuing geographic expansion, factors we consider include widespread Internet usage and government policies that promote the extension of credit. Our launch into the United Kingdom in 2007 and Australia and Canada in 2009 demonstrate that we can quickly and efficiently enter new markets. Our revenue from international operations has increased from $1.6 million in 2007, or 1% of our total revenue, to $102.0 million in 2010, or 27% of our total revenue. For the six-month period ended June 30, 2011, our revenue from international |

4

Table of Contents

| operations was $89.0 million, or 44% of our total revenue. We are currently exploring new international opportunities, including a micro line of credit product for consumers in Mexico. |

| Ø | Introduce new products and services. We plan to further penetrate existing markets and attract new categories of consumers not served by traditional lenders through the introduction of new products and services. We have introduced new products to expand our businesses from solely single payment consumer loans to installment and line of credit products, using our analytics expertise and our flexible and scalable technology platform. We will continue to develop additional solutions for our customer base with other innovative products. |

| Ø | Continuous process improvement. Our key areas of continuing focus are: |

| Ø | integrating new data sources to refine our predictive models, which is intended to improve the performance of our portfolio; |

| Ø | increasing loan volumes through efficient and cost effective marketing; |

| Ø | improving customer conversion across the application process; and |

| Ø | improving call center efficiency metrics. |

OUR RELATIONSHIP WITH CASH AMERICA

We are currently a wholly-owned subsidiary of Cash America. In addition to our business, Cash America provides specialty financial services to individuals through retail services locations. Upon completion of this offering, Cash America will own % of our outstanding shares of common stock ( % if the underwriters exercise their over-allotment option in full). Cash America has informed us that its objective is to own between 35% and 49% of our outstanding shares of common stock immediately following the offering to permit it to account for its investment in us using the equity method of accounting, and will not continue to consolidate our results of operations with its consolidated results of operations. Further, Cash America has informed us that it desires to establish a public market for our common stock and, by doing so, establish a market value of our business that is independent from the market value of Cash America’s common stock, and give us the ability to focus singularly on our business strategies while Cash America focuses on its strategy of expanding its storefront business and products in the United States and Latin America. As a result of its anticipated ownership of our common stock following this offering, Cash America will be our largest stockholder following the offering and will have significant influence in all matters submitted to the vote of our stockholders. Cash America has advised us that it has no present intention of selling its remaining shares of our common stock in the near-term following the expiration of the lock-up period described under “Underwriting.” However, Cash America, in its sole discretion, may decide to sell all or any portion of the remaining shares it owns at any time following the expiration or waiver of the lock-up period restrictions described under “Underwriting.”

OUR SEPARATION FROM CASH AMERICA

We were formed on September 7, 2011. On September 13, 2011, Cash America contributed to us all of the capital stock of the subsidiaries owned by it through which Cash America has engaged in its online financial services business prior to the contribution in exchange for 33 million shares of our common stock. We presently depend on Cash America for a number of administrative functions. Immediately prior to the completion of this offering, we also will enter into agreements with Cash America related to certain post-offering matters, including a separation agreement, a transition services agreement, a registration rights agreement, a tax sharing agreement, an employee matters agreement and a marketing and customer referral agreement. These agreements will be in effect as of the completion of this offering and will govern various interim and ongoing relationships between Cash America and us, including the extent and manner of our dependence on Cash America for administrative services following the completion of this offering.

5

Table of Contents

In addition, following completion of this offering, Cash America will continue to offer alternative financial services and other financial services to consumers through its retail services locations in markets served by us. We currently provide to Cash America underwriting and other analytical services for use in its alternative financial services business. Immediately prior to completion of this offering, we will enter into a credit scoring agreement with Cash America pursuant to which we will continue to provide our underwriting and analytical services to Cash America.

For more information regarding the agreements we will enter into with Cash America, see “Our relationship with Cash America.”

SUMMARY RISK FACTORS

Our business is subject to numerous risks and uncertainties that you should understand before making an investment decision. These risks are discussed more fully in the section entitled “Risk factors” beginning on page 14 of this prospectus. These include:

| Ø | Our products and services are subject to extensive regulation and supervision under various federal, state, local and foreign laws, ordinances and regulations. Failure to comply with applicable laws and regulations could subject us to regulatory enforcement action that could result in the assessment against us of civil, monetary or other penalties. The enactment, change or interpretation of applicable laws and regulations could have a material adverse effect on our business activities or effectively eliminate some of our current products and services in certain markets in which we operate. |

| Ø | Adverse decisions in litigation or regulatory proceedings could cause us to change or eliminate our current or future product offerings, could require substantial management time and expenditures and could have a material adverse effect on our business. |

| Ø | Judicial decisions, Consumer Financial Protection Bureau rule-making or amendments to the Federal Arbitration Act could render the arbitration agreements we use illegal or unenforceable. |

| Ø | Media reports and public perception of consumer loans as being predatory or abusive could materially adversely affect our consumer loan business. |

| Ø | We offer or arrange consumer loans over the Internet to customers in the United Kingdom, Australia and Canada. If political, regulatory or economic conditions deteriorate in any of these countries, our ability to continue offering or arranging consumer loans in such countries could be limited and could have a material adverse effect on our foreign operations. In particular, proposed legislation in Australia, if passed, could limit or restrict our ability to offer or arrange loans there and could cause us to exit that market. |

| Ø | The concentration of our revenue in certain products and jurisdictions could adversely affect us. |

| Ø | The failure of lead providers to continue to send us customer leads could have a material adverse effect on our business. |

| Ø | The failure of third-party lenders to offer loans under our credit services organization programs or the failure of third party suppliers to maintain their products, services or support could have a material adverse effect on our revenues and earnings. |

| Ø | Any increased restriction on the use or protection of personal data could affect our underwriting and have a material adverse impact on our business. |

| Ø | A decreased demand for our products and alternative financial services and our failure to adapt to such decrease could adversely affect results of operations and financial condition. |

| Ø | Our U.S. competitors’ use of other business models could have a material adverse effect on our business. |

6

Table of Contents

| Ø | Increased competition from banks, savings and loans, other consumer lenders, and other entities offering similar financial services, as well as retail businesses that offer products and services we offer, could adversely affect our results of operations. |

| Ø | An interruption to, shutdown of or inability to access the facilities in which our Internet operations and other technology infrastructure reside could materially adversely affect our business, prospects, results of operations and financial condition. |

| Ø | A security breach of our computer systems or fraudulent activity could interrupt or damage our operations or harm our reputation and subject us to liability if confidential customer information is misappropriated from our computer systems, which could have a material adverse effect on our business. |

| Ø | Failure to manage our credit risk and allowance and liability for loan losses through our underwriting system may adversely affect our results of operations. |

| Ø | Failure to manage the risk of impairment, the risk of interest rate fluctuation, the fluctuations in currency exchange rates and the operation of our anticipated credit facility could adversely affect our business. |

| Ø | Our failure to maintain our technological edge or to protect our software and other proprietary intellectual property rights could put us at a disadvantage to our competitors and could have a material adverse effect on our business. |

| Ø | The inability to retain our highly-skilled personnel or to hire additional personnel could hinder our ability to develop and successfully market our products and services and our business could be harmed. |

| Ø | Our results as a separate, stand-alone company could be materially different from those portrayed in our historical financial results. |

| Ø | Our separation from Cash America may adversely affect our business, and we may not achieve some or all of the expected benefits of the separation. |

| Ø | Our separation agreement with Cash America requires us to assume the past, present and future liabilities related to our business and may be less favorable to us than if they had been negotiated with unaffiliated third parties. |

CORPORATE INFORMATION

We were incorporated under the laws of the State of Delaware on September 7, 2011. Our principal executive offices are located at 200 West Jackson Blvd., Suite 2400, Chicago, IL 60606. Our telephone number is (312) 568-4200. Our website address is www.enovainternational.com. Information contained on or accessible from our websites is not incorporated by reference into this prospectus, and you should not consider information on our websites as part of this prospectus.

TRADEMARKS

CASHNETUSA® , QUICKQUID®, DOLLARSDIRECT, POUNDS TO POCKET and the “e” logo are our key trademarks, and are registered under applicable trademark laws. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate that

7

Table of Contents

we will not assert our rights or the rights of the applicable licensor to these trademarks and trade names to the fullest extent under applicable law. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

8

Table of Contents

| Common stock offered by us |

shares |

| Common stock offered by Cash America |

shares |

| Underwriters’ option to purchase additional common stock from Cash America |

shares |

| Common stock to be held by Cash America immediately after completion of this offering |

shares |

| Common stock outstanding immediately after completion of this offering |

shares |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $ million, assuming an initial offering price of $ , the midpoint of the range of prices set forth on the cover of this prospectus, and after deducting estimated underwriting discounts and commissions relating to the shares to be sold by us and estimated offering expenses. We intend to use the net proceeds that we receive from this offering to repay to Cash America all of our outstanding intercompany indebtedness (totaling approximately $353.2 million), including a $75.0 million dividend paid to Cash America in the form of a promissory note dated September 6, 2011. After repayment of the intercompany indebtedness due to Cash America, we do not expect any additional net proceeds of the offering to be available for use in our business. Additionally, we will not receive any of the proceeds from the sale of shares owned by Cash America to be sold in this offering, including any shares sold by Cash America pursuant to the underwriters’ over-allotment option, although we will bear the costs associated with the sale of these shares, other than underwriting discounts and commissions relating to the shares to be sold by Cash America. |

| Risk factors |

Prior to making an investment decision, you should carefully consider all of the information in this prospectus and, in particular, you should evaluate the risk factors set forth under the caption “Risk factors” beginning on page 14. |

| Exchange listing |

We intend to apply to list our common stock on the New York Stock Exchange under the symbol “ENVA.” |

9

Table of Contents

| Conflicts of interest |

Cash America has informed us that it intends to use a portion of the proceeds it receives from this offering and from our repayment of outstanding intercompany indebtedness owing to Cash America to repay a portion of the amounts outstanding under its domestic line of credit. As a result of these payments, an affiliate of Wells Fargo Securities, LLC may receive a portion of the net proceeds from this offering. Accordingly, this offering will be conducted in compliance with the applicable provisions of Financial Industry Regulatory Authority, or FINRA, Rule 5121. See “Underwriting (Conflicts of interest).” |

Unless we specifically state otherwise, all information in this prospectus regarding our common stock:

| Ø | assumes an offering price of $ per share, the midpoint of the price range reflected on the cover page of this prospectus; |

| Ø | gives effect to the transactions described under “Our relationship with Cash America”; |

| Ø | assumes no exercise by the underwriters of their over-allotment option to purchase additional shares of common stock from Cash America; and |

| Ø | includes shares of common stock to be issued to our executive officers, non-employee directors and other employees in connection with the completion of this offering, but excludes shares of common stock reserved for future issuance under our incentive plan. |

10

Table of Contents

Summary historical consolidated financial data

The following tables present summary historical consolidated financial data for our business. You should read this information together with “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements, related notes and other financial information, each included elsewhere in this prospectus. The summary historical consolidated financial data in this section are not intended to replace the financial statements and are qualified in their entirety by the consolidated financial statements and related notes.

The summary consolidated income statement data for the six months ended June 30, 2011 and 2010 and consolidated balance sheet data as of June 30, 2011 have been derived from our unaudited consolidated financial statements and related notes appearing elsewhere in this prospectus which, in the opinion of our management, have been prepared on the same basis as the audited financial statements and include all adjustments necessary for fair statement of our operating results and financial position as of those dates and for those periods. The summary consolidated other data for the six months ended June 30, 2011 and 2010 was derived from our unaudited financial and operational records. Additional information on these measurements is contained in “Management’s discussion and analysis of financial condition and results of operations.” The summary historical financial information for the six months ended June 30, 2011 is not necessarily indicative of the results that may be expected for the year ending December 31, 2011 and our historical results are not necessarily indicative of our results for any future period.

We derived the summary historical consolidated income statement data for each of the three years in the period ended December 31, 2010 and consolidated balance sheet data as of December 31, 2010 and 2009 from our audited consolidated financial statements and the related notes appearing elsewhere in this prospectus. The summary historical consolidated balance sheet data as of December 31, 2008 was derived from our unaudited financial statements, which are not included in this prospectus. The summary consolidated other data for the years ended December 31, 2010, 2009 and 2008 was derived from our unaudited financial and operational records. Additional information on these measurements is contained in “Management’s discussion and analysis of financial condition and results of operations.”

| Summary consolidated income | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||

| statement data: | 2011 | 2010(1) | 2010(1) | 2009(1) | 2008(1)(2) | |||||||||||||||

| (Unaudited) | (Audited) | |||||||||||||||||||

| (dollars in thousands, except per share data) | ||||||||||||||||||||

| Revenue |

||||||||||||||||||||

| Domestic |

$ | 114,272 | $ | 130,429 | $ | 276,295 | $ | 214,479 | $ | 200,263 | ||||||||||

| Foreign |

89,000 | 40,070 | 102,022 | 40,498 | 23,214 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Revenue |

203,272 | 170,499 | 378,317 | 254,977 | 223,477 | |||||||||||||||

| Cost of Revenue |

76,690 | 70,822 | 164,957 | 109,174 | 107,170 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross Profit |

$ | 126,582 | $ | 99,677 | $ | 213,360 | $ | 145,803 | $ | 116,307 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from Operations |

$ | 38,621 | $ | 28,188 | $ | 54,369 | $ | 39,722 | $ | 42,212 | ||||||||||

| Net Income |

19,157 | 13,317 | 24,821 | 17,703 | 21,951 | |||||||||||||||

| Earnings per share |

||||||||||||||||||||

| Basic |

$ | 0.58 | $ | 0.40 | $ | 0.75 | $ | 0.54 | $ | 0.67 | ||||||||||

| Diluted |

$ | 0.58 | $ | 0.40 | $ | 0.75 | $ | 0.54 | $ | 0.67 | ||||||||||

footnotes on following page

11

Table of Contents

| (1) | Results of operations for the years ended 2010, 2009 and 2008 and the six-month period ended June 30, 2010 include revenues and results of operations of our MLOC services business that ended in October 2010. See “Management’s discussion and analysis of financial information and results of operations” for further information concerning our former MLOC services business. |

| (2) | See Note 4 in the Notes to Consolidated Financial Statements for discussion of our acquisitions in 2008. |

| As of June 30, | As of December 31, | |||||||||||||||||||

| Summary consolidated balance sheet data: | 2011 | 2010 | 2010 | 2009 | 2008(1) | |||||||||||||||

| (Unaudited) | (Audited) | (Unaudited) | ||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Cash |

$ | 33,252 | $ | 32,911 | $ | 19,187 | $ | 27,261 | $ | 16,496 | ||||||||||

| Consumer loans, net |

108,648 | 74,559 | 90,355 | 60,787 | 43,320 | |||||||||||||||

| Total assets |

454,204 | 426,631 | 421,767 | 375,736 | 316,924 | |||||||||||||||

| Affiliate notes payable |

278,238 | 272,117 | 270,269 | 255,799 | 204,626 | |||||||||||||||

| Long-term liabilities |

312,032 | 295,205 | 293,309 | 274,086 | 213,682 | |||||||||||||||

| (1) | See Note 4 in the Notes to Consolidated Financial Statements for discussion of our acquisition in 2008. |

| Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||

| Summary consolidated other data: | 2011 | 2010(2) | 2010(2) | 2009(2) | 2008(1)(2) | |||||||||||||||

| (dollars in thousands) (unaudited) | ||||||||||||||||||||

| Number of customer transactions |

||||||||||||||||||||

| Domestic(2) |

1,062,534 | 1,981,990 | 3,905,696 | 2,947,204 | 2,314,421 | |||||||||||||||

| Foreign |

702,071 | 378,518 | 923,474 | 413,929 | 192,691 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

1,764,605 | 2,360,508 | 4,829,170 | 3,361,133 | 2,507,112 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Volume of customer transactions |

||||||||||||||||||||

| Domestic(2) |

$ | 529,136 | $ | 759,816 | $ | 1,554,285 | $ | 1,230,885 | $ | 1,099,559 | ||||||||||

| Foreign |

383,216 | 178,312 | 458,811 | 174,188 | 97,436 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 912,352 | $ | 938,128 | $ | 2,013,096 | $ | 1,405,073 | $ | 1,196,995 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA(3) |

$ | 44,343 | $ | 32,249 | $ | 62,928 | $ | 47,019 | $ | 47,446 | ||||||||||

| (1) | See Note 4 in the Notes to Consolidated Financial Statements for discussion of our acquisition in 2008. |

| (2) | Includes number of domestic transactions and dollar amounts of domestic customer transactions associated with our MLOC services business which ended in October 2010. See “Management’s discussion and analysis of financial information and results of operations” for further information concerning our former MLOC services business. |

footnotes continued on following page

12

Table of Contents

| (3) | The following table presents a reconciliation of net income, the most comparable generally accepted accounting principles, or GAAP, measure to Adjusted EBITDA for each of the periods presented. See “Management’s discussion and analysis of financial condition and results of operations” for a definition of Adjusted EBITDA. |

| Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| Net Income |

$ | 19,157 | $ | 13,317 | $ | 24,821 | $ | 17,703 | $ | 21,951 | ||||||||||

| Adjustments: |

||||||||||||||||||||

| Depreciation and amortization expenses |

5,722 | 4,061 | 8,559 | 7,297 | 5,234 | |||||||||||||||

| Interest expense, net |

8,034 | 7,309 | 15,209 | 11,852 | 7,099 | |||||||||||||||

| Foreign currency transaction loss (gain) |

94 | 28 | 156 | (38 | ) | 79 | ||||||||||||||

| Provision for income taxes |

11,336 | 7,534 | 14,183 | 10,205 | 13,083 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 44,343 | $ | 32,249 | $ | 62,928 | $ | 47,019 | $ | 47,446 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

13

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to purchase shares of our common stock. The occurrence of any of the events described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the trading price of our common stock may decline and you may lose part or all of your investment.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Adverse changes in laws or regulations affecting our consumer loan business could negatively impact our operations.

Our products and services are subject to extensive regulation and supervision under various federal, state, local and foreign laws, ordinances and regulations. In addition, as we develop new products and services, we will become subject to additional federal, state, local and foreign laws, ordinances and regulations. Future legislation or regulations may restrict our ability to continue our current methods of operation or to expand our operations and may have a negative effect on our business, results of operations and financial condition. Governments at the national, state and local levels, as well as foreign governments, may seek to impose new regulatory restrictions or licensing requirements or interpret or enforce existing requirements in new ways. Changes in laws or regulations, or our failure to comply with applicable laws and regulations, could subject us to regulatory enforcement action that could result in the assessment against us of civil, monetary or other penalties. We face the risk that restrictions or limitations resulting from the enactment, change or interpretation of laws and regulations could negatively affect our business activities or effectively eliminate our ability to offer current or future loan products or services.

In particular, the regulatory environment surrounding consumer loans such as we offer has, in recent years, been active in many jurisdictions in which we operate. Legislative or regulatory activities in certain jurisdictions aimed at consumer loan products such as ours have limited, and may in the future limit, the amount of interest and fees allowed on such consumer loans, the number of such consumer loans that customers may receive or have outstanding, or other terms, conditions or features of such consumer loans. As discussed below under “—Consumer loans are highly regulated under state, local and provincial laws and regulations, which can adversely affect our business,” such actions have caused us to cease or modify our offerings in certain jurisdictions and may make the offering of some or all of our products less profitable or could eliminate our ability to offer some or all of our products in the future.

Certain consumer advocacy groups and legislators at the federal and state levels and at comparable levels in foreign governments have also asserted that laws and regulations should be tightened so as to severely limit, if not eliminate, the availability of loan products such as ours. In particular, both the executive and legislative branches of the U.S. federal government continue to receive significant pressure from consumer advocates and other industry opposition groups, and those governmental branches have recently exhibited an increased interest in debating legislation that could further regulate consumer loan products, such as those we provide. The U.S. Congress, as well as similar state and local bodies and similar foreign authorities, have debated, and may in the future adopt, proposed legislation that could, among other things, place a cap on the effective annual percentage rate on consumer loans, place a cap on the dollar amount of fees that may be charged for consumer loans, ban renewals (payment of a fee to extend the term of a consumer loan), require lenders to offer extended payment plans, allow only

14

Table of Contents

Risk factors

minimal origination fees for loans, limit renewals and the rates to be charged for renewals, require lenders to be bonded, or require lenders to report consumer loan activity to databases designed to monitor or restrict consumer borrowing activity.

We cannot currently assess the likelihood of the proposal or enactment of any future unfavorable U.S. federal, state or local or comparable foreign legislation or regulations. There can be no assurance that additional legislative or regulatory initiatives will not be enacted that could restrict, prohibit or eliminate our ability to offer some or a significant part of our consumer loan products. Any legislative or regulatory action that restricts, by imposing interest rate or annual percentage rate limits on consumer loans such as ours or otherwise prohibits, or places restrictions on, such consumer loans and similar services, if enacted, could have a material adverse impact on our business, prospects, results of operations and financial condition and could impair our ability to continue current operations.

Consumer loans are highly regulated under applicable U.S. and foreign federal laws and regulations.

Consumer loans, such as those we provide, are highly regulated under federal laws. Federal legislation affecting consumer lending, such as that engaged in by us, including interest rate cap bills that would effectively prohibit such lending, have been introduced in the U.S. Congress in the past. Earlier federal efforts culminated in federal legislation effective in October 2007 that limits the interest rate and fees charged on certain consumer loans to members of the U.S. military, active duty reservists, members of the National Guard and their immediate families to 36% per annum, which effectively prohibits us from offering certain of our consumer loan products to members of the military or their families.

In addition, the U.S. Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act. Title X of the Dodd-Frank Act created the Consumer Financial Protection Bureau, or the CFPB. The CFPB became operational in July 2011, although it may not currently have the ability to oversee non-depository institutions and write rules until a permanent director is installed. Once fully operational, the CFPB will have regulatory, supervisory and enforcement powers over providers of consumer financial products and services, including explicit supervisory authority to examine and require registration of consumer loan providers such as us. Included in the powers afforded the CFPB is the authority to adopt rules describing specified acts and practices as being “unfair”, “deceptive” or “abusive”, and hence unlawful. Some consumer advocacy groups have suggested that short-term consumer lending should be a regulatory priority for the CFPB. Since the director of the CFPB will have significant influence in establishing the CFPB’s priorities and the direction of the CFPB’s rulemaking activities, the timeframe on which the CFPB considers rules applicable to consumer loan products and services such as ours, and the nature and extent of such rules, will depend in large part on who ultimately becomes the director of the CFPB. Accordingly, it is possible that at some time in the near future the CFPB could propose and adopt rules making such lending products and services materially less profitable or even impractical to offer, forcing us to modify or terminate certain product offerings. The CFPB could also adopt rules imposing new and potentially burdensome requirements and limitations with respect to our other consumer loan products and services. Any such rules could have a material adverse effect on our business, results of operations and financial condition or could make the continuance of our current business impractical or unprofitable.

In addition to the Dodd-Frank Act’s grant of regulatory and supervisory powers to the CFPB, the Dodd-Frank Act gives the CFPB authority to pursue administrative proceedings or litigation for violations of federal consumer financial laws (including the CFPB’s own rules). In these proceedings, the CFPB can obtain cease and desist orders (which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief) and monetary penalties ranging from $5,000 per day for ordinary

15

Table of Contents

Risk factors

violations of federal consumer financial laws to $25,000 per day for reckless violations and $1 million per day for knowing violations. Also, where a company has violated Title X of Dodd-Frank or CFPB regulations under Title X, Dodd-Frank empowers state attorneys general and state regulators to bring civil actions for the kind of cease and desist orders available to the CFPB. If the CFPB or one or more state officials believe we have violated the foregoing laws or regulations, they could exercise their enforcement powers in ways that would have a material adverse effect on us.

Certain other U.S. federal laws also affect our business. For example, because short-term and installment consumer loans, such as those we provide, are viewed as extensions of credit, we must comply with the federal Truth-in-Lending Act and Regulation Z adopted under that Act. Additionally, we are subject to the Equal Credit Opportunity Act, the Fair Credit Reporting Act, the Electronic Funds Transfer Act, and the Gramm-Leach-Bliley Act, among other laws, and with respect to our Credit Services Organization, or CSO, programs, the Fair Debt Collection Practices Act. A failure to comply with any applicable federal law or regulation could have a material adverse effect on our business, prospects, results of operations and financial condition. In addition, our marketing efforts and the representations we make about our products and services are subject to federal and state unfair and deceptive practice statutes. The Federal Trade Commission enforces the Federal Trade Commission Act, and state attorneys general and private plaintiffs may bring legal actions under analogous state statutes. If we are found to have violated any of these statutes, it could have a material adverse effect on our business, prospects, results of operations and financial condition.

In the United Kingdom, our consumer lending activities must comply with the Consumer Credit Act of 1974, which was amended by the Consumer Credit Act of 2006, or CCA, and related rules and regulations, including certain provisions of the European Union Consumer Credit Directive, or the EU CCD, which, among other things, require us to obtain governmental licenses and prescribe the presentation, form and content of loan agreements, including statutory warnings and the layout of financial information. We must also follow the Irresponsible Lending Guidance of the Office of Fair Trade, or OFT, which provides greater clarity for lenders as to business practices that the OFT believes constitute irresponsible lending under the CCA. We are subject to the requirements of the Data Protection Act 1988, or the DPA, and are fully registered as a data-controller under the DPA as required. Finally, we are certified under the EU Safe Harbor provisions, which allows us to pass European Union, or EU, data to non-EU countries. Changes in these laws or regulations, or changes to the laws or regulations of the EU, or our failure to comply with these laws or regulations, could have a material adverse effect on our business, prospects, results of operations and financial condition.

In Australia, we act as a finance broker, offering the lending products of unaffiliated third-party lenders, which is similar to our CSO programs in the United States. We follow the responsible lending guidelines under the National Consumer Credit Protection Act (2010), or the NCCPA. However, a draft bill covering amendments to the NCCPA was proposed on August 25, 2011 and includes limitations on the interest rate charged on certain consumer loans, such as those arranged by us, and prohibits loan extensions and refinancings. See “—We may need to exit Australia if proposed consumer loan legislation passes.”

In Canada, the Canadian Parliament amended the federal usury law to transfer jurisdiction and the development of laws for and regulation of our industry to the respective provinces, so all regulation of the consumer lending industry is conducted at the provincial level. Changes in Canadian laws and regulations in the future could have an adverse impact on our Canadian business operations.

16

Table of Contents

Risk factors

Consumer loans are highly regulated under state, local and provincial laws and regulations, which can adversely affect our business.

As of the date of this prospectus, we operate in 32 states in the United States. Currently, we do not conduct business in the remaining states or in the District of Columbia due to, among other reasons, specific legislative restrictions, such as interest rate ceilings and loan amount restrictions. Moreover, the product offerings in the states in which we operate may be limited by future legislative or regulatory restrictions. In addition, regulations adopted by some states require that all borrowers of certain loan products, such as those we provide, be listed in a database and limit the number of such loans a borrower may have outstanding.

In 2010 and 2011, more than 200 bills were introduced in U.S. state legislatures, including bills in virtually every state in which we are doing business, with the intent of addressing various aspects of consumer lending activity, such as that engaged in by us. Laws prohibiting consumer loans and similar products or services, such as those we provide, or making them less profitable or unprofitable, could be passed in states where we currently lend and existing enabling laws for the short-term consumer loans we offer could expire or be amended at any time. For instance, since 2006 legislation enacted in Colorado, Illinois, Maryland, Minnesota, Montana, New Hampshire, Ohio, Oregon, Washington and Wisconsin has impacted the consumer loan products and services we had historically offered in those states. Due to those legislative changes, we ceased offering consumer loans to residents in the states of Colorado, Montana and New Hampshire and discontinued the CSO program that we offered in Maryland. In addition, these changes have altered the terms upon which we offer loans to consumers in other states, such as Illinois, Minnesota, Ohio, Oregon, Washington and Wisconsin, in some instances reducing the profitability and the volume of the loans we offer to customers. In addition, Mississippi, a state in which we operate, has a sunset provision in its short-term consumer loan law that requires renewal of the law by the state legislature, and there is no guarantee that Mississippi will renew this law prior to sunset in 2016. In 2010, Arizona’s short-term consumer loan law under which we operated expired, or sunset, without being renewed, which caused us to discontinue offering consumer loan products in that state. The exits in whole or part from certain states in the past have had a material negative impact on our revenue in the periods in which they occurred.

Statutes authorizing consumer loans and similar products and services, such as those we provide, typically provide the state agencies that regulate banks and financial institutions or similar state agencies with significant regulatory powers to administer and enforce the law. In most jurisdictions, we are required to apply for a license, file periodic written reports regarding business operations, and undergo comprehensive examinations or audits from time to time to assess our compliance with applicable laws and regulations. Under statutory authority, state regulators have broad discretionary power and may impose new licensing requirements, interpret or enforce existing regulatory requirements in different ways or issue new administrative rules, even if not contained in state statutes, that affect the way we do business and may force us to terminate or modify our operations in particular states or affect our ability to renew licenses we hold. Regulators may also impose rules that are generally adverse to our industry. Any new licensing requirements or rules, or new interpretations of existing licensing requirements or rules, or our failure to follow licensing requirements or rules could have a material adverse effect on our business, prospects, results of operations and financial condition.

In some cases, we rely on the interpretations of the staff of state regulatory bodies with respect to the laws and regulations of their respective jurisdictions, which may change as the staff of state regulatory bodies change. If staff interpretations on which we rely change, any such changes could have a negative impact on our business. For example, an adverse change in a staff interpretation by the Pennsylvania Department of Banking caused us to suspend our operations in Pennsylvania in July 2009 following our

17

Table of Contents

Risk factors

unsuccessful challenge to that interpretive change. Further, any misinterpretations by us of existing laws or regulations could have a material adverse effect on our business, results of operations and financial condition.

State attorneys general and financial services regulators scrutinize our products and services and could take actions that may require us to modify, suspend, or cease operations in their respective states. We regularly receive, as part of comprehensive state examinations or audits or otherwise, comments from state attorneys general and financial services regulators about our business operations and compliance with state laws and regulations. These comments sometimes allege violations of, or deficiencies in complying with, applicable laws and regulations. While we have resolved most such allegations promptly and without penalty, we operate in a large number of jurisdictions with varying requirements and we cannot anticipate how state attorneys general and financial services regulators will scrutinize our products and services or the products and services of our industry in the future. If we fail to resolve future allegations satisfactorily, there is a risk that we could be subject to significant penalties, including material fines, or that we may lose our licenses to operate in certain jurisdictions.

In addition, state laws can be changed by ballot initiative or referendum in certain states. A 2010 ballot initiative in Montana adversely affected our short-term consumer loan product in that state, causing us to discontinue our consumer loan product offering in that state. In 2008 a ballot initiative in Arizona and a ballot referendum in Ohio, both of which were intended to protect short-term consumer loan products in those states, failed. Subsequent to the failures of the ballot initiatives in Arizona and Ohio, we ceased providing our consumer loan product in Arizona in 2010, and in 2008 we significantly altered our product offering in Ohio. Ballot initiatives can be expensive to support or oppose, as the case may be, and may be more susceptible to emotion than deliberations in the normal legislative process. Recently, a ballot initiative in Missouri was proposed and if it is placed on the ballot and passed by voters, we may need to exit the state.

In states in which we are licensed to operate, we must comply with all applicable license requirements, including those concerning direct or indirect changes in control of the licensed entities. Most states in which we conduct licensed operations impose requirements related to changes in control of licensed entities or changes of officers of licensed entities or of controlling entities of licensed entities. There is a risk that state agencies responsible for licensing our operations may, as a result of this Offering, impose unexpected requirements related to the change of control of the Company or its subsidiaries. Any such unexpected requirements in any state, if imposed, could result in delays or limitations on our operations in that state.

In addition to state and federal laws and regulations, we may be subject to various local rules and regulations such as local ordinances or local business conduct or licensing requirements applicable to companies lending in that jurisdiction. Local jurisdictions’ efforts to restrict short-term consumer lending have been increasing. Typically, these local ordinances apply to storefront operations, however, local jurisdictions could attempt to enforce certain business conduct and registration requirements on online lenders lending to residents of that jurisdiction, even though no such attempt has been made previously. Actions taken in the future by local governing bodies to impose other restrictions on consumer loan lenders such as us could have a material adverse effect on our business, prospects, results of operations and financial condition and could impair our ability to continue current operations.

In Australia, several states have interest rate caps in place. However, the draft bill covering amendments to the NCCPA, proposed on August 25, 2011, includes limitations on the interest rate charged on consumer loans, such as those arranged by us, and prohibits loan extensions and refinancings. If passed, the amendments to the NCCPA would supersede any state interest rate caps. See “—We may need to exit Australia if proposed consumer loan legislation passes.”

18

Table of Contents

Risk factors

In Canada, after transfer of jurisdiction over our industry to the provinces by the Canadian Parliament, five provinces have adopted a regulatory framework to allow for online short-term consumer lending to date, and we currently offer our lending product in three of those provinces. In general, the regulations require lenders to be licensed, set maximum fees and regulate collection practices. Any changes in Canadian provincial laws or regulations in the future could alter or materially impact our ability to offer our products and services in Canada.

Current and future litigation or regulatory proceedings could have a material adverse effect on our business, prospects, results of operations and financial condition.

We are currently subject to lawsuits (including purported class actions) and other legal proceedings that could cause us to incur substantial expenditures and generate negative publicity, and could significantly impair our business, force us to cease doing business in one or more jurisdictions or cause us to cease offering one or more products. We are also likely to be subject to future litigation, and regulatory proceedings and government investigations. The consequences of an adverse ruling in any current or future litigation, regulatory proceeding or government investigation could cause us to have to refund fees and/or interest collected, refund the principal amount of loans, pay treble or other multiple damages, pay monetary penalties and/or modify or terminate our operations in particular states or jurisdictions.

Defense of any lawsuit, regulatory proceeding or government investigation, even if successful, could require substantial time and attention of our management and could require significant expenditures for legal fees and other related costs. Settlement of lawsuits may also result in significant payments and modifications to our operations. Because we and our competitors may become subject to regulatory proceedings or governmental investigations, we could also suffer losses from interpretations of laws or regulations in those proceedings or investigations, even as a result of proceedings or investigations to which we are not a party. For example, we discontinued our CSO program in Florida in 2008 subsequent to a ruling of the Florida regulator against another company that offered a similar CSO program. Similar or additional actions in the future could have a material adverse effect on our business, prospects, results of operations and financial condition.

Furthermore, our lead providers are subject to federal, state, local and foreign laws and regulations. State legislators and regulators have recently shown an increased interest in oversight and licensing of lead providers in the consumer lending industry in which we operate and could propose or support additional legislation or regulation, or enforce current laws or regulations or new interpretations thereof, governing the business of lead providers or our relationship with them. For example, some states have proposed, or instructed us, that lead providers be licensed under consumer lending laws or have proposed restrictions on lead providers’ sale of leads to unlicensed lenders. Our lead providers’ failure to comply with applicable laws or regulations, or any changes in these laws or in the interpretation thereof, could have a detrimental effect on our consumer lending business or subject us to direct liability or regulatory action, for which we may not be indemnified. See “—The failure of lead providers to continue to send us customers could disrupt our operations or result in a loss of revenue.” Any of these events could have a material adverse effect on our business, prospects, results of operations and financial condition and could impair our ability to continue current operations.

Judicial decisions, CFPB rule-making or amendments to the Federal Arbitration Act could render the arbitration agreements we use illegal or unenforceable.

We include arbitration provisions in our consumer loan agreements. These provisions are designed to allow us to resolve any customer disputes through individual arbitration rather than in court and explicitly provide that all arbitrations will be conducted on an individual and not on a class basis. Our arbitration agreements do not generally have any impact on regulatory enforcement proceedings.

19

Table of Contents

Risk factors

We take the position that the Federal Arbitration Act requires the enforcement of our arbitration agreements and their class action waivers in accordance with their terms. We believe the U.S. Supreme Court’s decision in the AT&T Mobility v. Concepcion case, holding that consumer arbitration agreements meeting certain specifications are enforceable, will now reduce the possibility that lower courts will rule that our arbitration agreements with class action waivers are unenforceable. The AT&T Mobility v. Concepcion decision was rendered on April 27, 2011. Notwithstanding two recent rulings from a Pennsylvania federal district court enforcing our arbitration agreements with class action waivers in reliance on the AT&T Mobility v. Concepcion decision, further challenges to the enforceability of arbitration agreements with class action waivers will likely continue to be brought in an effort to limit the precedential effect of the AT&T Mobility v. Concepcion decision. If those challenges are successful, our arbitration agreements could be unenforceable.

In addition, the U.S. Congress has considered legislation that would generally limit or prohibit mandatory arbitration agreements in consumer contracts and has adopted such a prohibition with respect to certain mortgage loan agreements and also certain consumer loan agreements to members of the military on active duty and their dependents. Further, the Dodd-Frank Act directs the CFPB to study consumer arbitration and report to the U.S. Congress, and it authorizes the CFPB to adopt rules limiting or prohibiting consumer arbitration, consistent with the results of its study. Any such rule would apply to arbitration agreements entered into more than six months after the final rule becomes effective (and not to prior arbitration agreements).

Any judicial decisions, legislation or other rules or regulations that impair our ability to enter into and enforce consumer arbitration agreements and class action waivers could significantly increase our exposure to class action litigation as well as litigation in plaintiff-friendly jurisdictions. Such litigation could have a material adverse effect on our business, results of operations and financial condition.

Media reports and public perception of short-term or “high-cost” consumer loans as being predatory or abusive could materially adversely affect our business.

In recent years, consumer advocacy groups and some media reports have advocated governmental action to prohibit or place severe restrictions on short-term or “high-cost” consumer loans. Such consumer advocacy groups and media reports generally focus on the Annual Percentage Rate, or APR, to a consumer for this type of loan, which is compared unfavorably to the interest typically charged by banks to consumers with top-tier credit histories. If the negative characterization of these types of loans becomes increasingly accepted by consumers, demand for our consumer loan products could significantly decrease. If the negative characterization of these types of loans is accepted by legislators and regulators, we could also become subject to more restrictive laws and regulations. Further, media coverage and public statements that assert some form of inappropriateness in our products and services can lower employee morale, make it more difficult for us to attract and retain qualified employees, management and directors, divert management attention and increase expense. Our financial condition and results of operations could be materially adversely affected if any of these circumstances were to occur.

We may need to exit Australia if proposed consumer loan legislation passes.

In Australia, a draft bill covering amendments to the NCCPA was proposed on August 25, 2011. The proposed legislation would limit the interest charged on consumer loans, such as those arranged by us, and prohibit loan extensions and refinancings. Should the proposed legislation pass, the effective date will likely be in mid-2012. Depending upon the provisions contained in any legislation that is enacted, we may need to exit the Australian market.

20

Table of Contents

Risk factors

The legislative and regulatory environment in the United Kingdom could become more hostile to the consumer loan business.

The coalition government in the United Kingdom has recently agreed to research the effects upon consumers of a cap on the total charge for credit. The Minister of Treasury and the Minister for Employment Relations, Consumer and Postal Affairs have agreed to the investigation request, which will now involve the commission of research on the market for consumer credit. In addition, the coalition government is exploring whether the current principles-based regulations governing unsecured short-term credit should be replaced with prescriptive-based regulations. Prescriptive-based regulations, as contrasted with principles-based regulations, define what a lender may and may not do, similar to U.S. law. If prescriptive-based regulations are adopted, our compliance costs will be significantly increased. Additionally, the coalition government has recently formed the Financial Conduct Authority, or FCA, and it appears that the FCA may take over regulatory responsibility for consumer credit from the OFT in 2014. The FCA may regulate consumer credit pursuant to the guidance of the Financial Services and Markets Act, or FSMA, which are prescriptive regulations that currently govern the secured credit market, and could possibly call for the repeal of the CCA or enabling legislation in the United Kingdom. Any of these changes could have a material adverse effect on our business, prospects, results of operations and financial conditions and could impair our ability to continue current operations.