Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Samson Oil & Gas LTD | v234618_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Samson Oil & Gas LTD | v234618_ex99-1.htm |

Exhibit 99.2

ABN 25 009 069 005

FINANCIAL REPORT

30 June 2011

|

|

TABLE OF CONTENTS

|

TABLE OF CONTENTS

|

Corporate Directory

|

1

|

|

Directors’ Report

|

2

|

|

Auditors’ Independence Declaration

|

18

|

|

Corporate Governance Statement

|

19

|

|

Consolidated Statement of Comprehensive Income

|

25

|

|

Consolidated Balance Sheet

|

26

|

|

Consolidated Cash Flow Statement

|

27

|

|

Consolidated Statement of Changes in Equity

|

28

|

|

Notes to the Consolidated Financial Statements

|

29

|

|

Directors’ Declaration

|

76

|

|

Independent Auditor’s Report

|

77

|

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

|

CORPORATE DIRECTORY

|

CORPORATE DIRECTORY

|

Directors

|

Stock Exchange

|

|

V. Rudenno (Chairman)

|

Australian Securities Exchange Limited

|

|

T.M. Barr (Managing Director)

|

Code : SSN

|

|

D. Craig

|

|

|

K. Skipper

|

NYSE Amex

|

|

Code : SSN

|

|

|

Secretary

|

|

|

D.I. Rakich

|

|

|

Registered Office and Business Address

|

Australian Company Number

|

|

Level 36, Exchange Plaza

|

009 069 005

|

|

2 The Esplanade

|

|

|

Perth, Western Australia 6000

|

Australian Business Number

|

|

Telephone: (08) 9220 9830

|

25 009 069 005

|

|

Facsimile: (08) 9220 9820

|

Email

contact@samsonoilandgas.com.au

Web Site

www.samsonoilandgas.com.au

Share Registry

Security Transfer Registrars Pty Ltd

770 Canning Highway

Applecross, Western Australia 6953

Telephone: (08) 9315 2333

Facsimile: (08) 9315 2233

Bankers

Bank of New Zealand Australia

Utility Bay 13.03

100 St Georges Terrace

Perth, Western Australia 6000

Bank of the West

633 17th Street

Denver, Colorado, 80202

Macquarie Bank Limited

No 1. Martin Place

Sydney, New South Wales 2000

Solicitors

Minter Ellison

152 St Georges Terrace

Perth, Western Australia 6000

Davis Graham & Stubbs LLP

1550 Seventeenth Street, Suite 500

Denver, Colorado, 80202

Auditors

PricewaterhouseCoopers

250 St Georges Terrace

Perth, Western Australia 6000

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 1 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

DIRECTORS’ REPORT

In accordance with a resolution of Directors, the Directors submit their report with respect to the results of the operations of Samson Oil & Gas Limited (“the Company”) and its controlled entities (“the Consolidated Entity” or “Group”) for the year ended 30 June 2011 and the state of its affairs at that time.

DIRECTORS

The names and details of the Directors of the Company in office during the whole financial year and until the date of this report, unless noted otherwise, are:

Dr. Victor Rudenno

Chairman – appointed 1 July 2011

Dr. Rudenno was appointed as a Director of the Company in April 2007. In 1984, Dr. Rudenno transitioned to the investment industry as a rated mining and energy analyst working for firms such as James Capel, DBSM and Prudential Bache. In 1995, he moved to the corporate side of investment banking and worked for a number of leading firms including Macintosh Corporate, Deutsche Bank, Hartley Poynton and CIBC. In 2002, Dr. Rudenno co-founded Equity Capital Markets Ltd, an investment bank specialising in corporate advice and capital raising which merged with Interfinancial in 2005 and subsequently was acquired by Tolhurst, an ASX listed broker in 2007. He is currently an Executive Director of Revaluate Pty Limited. He is a Senior Fellow of the Financial Services Institute of Australasia and a Fellow of the Australasian Institute of Mining and Metallurgy. Dr. Rudenno holds a Bachelor of Mining Engineering degree, a Master of Commerce degree and a Doctor of Philosophy for his thesis on Mining Economics. During his earlier academic career, Dr. Rudenno lectured both at the University of New South Wales and part time at University of Sydney, predominantly on mining economics, geostatistics, operations research and thermodynamics. He is the author of the textbook “Mining Valuation Handbook”.

Dr Rudenno is a member of the audit committee.

On 25 August 2010, Dr Rudenno was appointed a non-executive Director of Pilbara Minerals Limited (a publicly listed company.

Dr Rudenno has not held any directorships, other than those disclosed above in the past three years.

Mr Neil Thacker MacLachlan

Chairman – resigned 30 June 2011

Mr MacLachlan has over 30 years’ investment banking experience in Europe, South East Asia and Australia. He was also a former director of Wardley Holdings and James Capel & Co. Limited, investment banking subsidiaries of The Hong Kong and Shanghai Banking Corporation. More recently from 1993 until 1997 he was employed by Barrick Gold Corporation as Executive Vice President, Asia. Mr MacLachlan was also an executive director of Ambrian Partners Ltd (2004-2007) the London based investment bank specialising in natural resources. Mr MacLachlan was appointed a director of the Company on 18 June 1998. Mr MacLachlan was appointed Chairman of the Company effective 19 December 2007. Mr MacLachlan resigned as Director and Chairman of the Board effective 30 June 2011.

Mr MacLachlan was also a member of the Audit Committee.

During the past three years, Mr MacLachlan has also served as a director of the following other listed companies:

|

|

·

|

Kestrel Energy Inc

|

|

|

·

|

Eurogold Ltd*

|

|

|

·

|

Cambridge Mineral Resources plc

|

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 2 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

|

|

·

|

Extract Resources Ltd*

|

|

|

·

|

Oklo Uranium Ltd*

|

|

|

·

|

Kalahari Minerals Plc*

|

|

|

·

|

Brinkley mining plc*

|

|

|

·

|

Ambrian Capital Plc (formerly Golden Prospect Plc)

|

*denotes current directorships

Mr Terence Maxwell Barr

Managing Director

Mr Barr is a petroleum geologist with over 30 years’ experience, including 11 years with Santos. He is credited with the discovery of significant oil and gas reserves during his career. In recent years, Mr Barr has specialised in tight gas exploration, drilling and completion and is considered an expert in this field. This experience and expertise is invaluable given the exposure the Company has to tight gas opportunities in Wyoming and other parts of United States of America. Mr Barr was appointed managing director of the Company on 25 January 2005.

Mr Barr has not held any other directorships in the past three years.

Mr Keith Skipper

Non Executive Director

Mr. Skipper was appointed as director of the Company on 15 September 2008. Mr. Skipper holds a B.Sc (Hons) degree in Geology from Reading University (United Kingdom) and a Master of Science from McMaster University (Canada). He commenced his career with Amoco Canada Petroleum Limited in 1970. Mr. Skipper’s experience includes ten years with Bridge Oil Ltd and several years with Pan Canadian Petroleum Limited (now part of Encana Corporation) and Antrim Energy Inc. in management and senior executive positions. He is a resident of Australia.

Mr Skipper is a member of the audit committee.

During the last three years, Mr. Skipper has been a Director of the following publicly listed companies:

|

|

·

|

Rawson Resources Limited*

|

|

|

·

|

Red Sky Energy Limited

|

|

|

·

|

Circumpacific Energy Corporation

|

* denotes current directorships

Dr DeAnn Craig

Non Executive Director – appointed 11 July 2011

Dr Craig was appointed as a Director of the Company on 11 July 2011. Dr Craig holds an Interdisciplinary PhD with emphasis in Petroleum Engineering and Operations Research from the Colorado School of Mines (USA). She has also earned several degrees from Colorado School of Mines including Masters of International Political Economy of Resources, Masters of Science Mineral Economics and Business and a Bachelor of Science Chemical and Petroleum Refining Engineering. In addition Dr Craig holds an MBA from Regis University in Denver, Colorado. During her career Dr. Craig has been a drilling engineer, a reservoir engineer responsible for reserves determination and property valuation, and progressed to senior management in several companies, including Phillips Petroleum, now ConocoPhillips, and CNX Gas. She is a registered professional engineer in the state of Colorado.

In the previous five years she has served as Senior Vice President, Asset Assessment CNX Gas Corporation, served as an Adjunct Professor in the Petroleum Engineering Department at the Colorado School of Mines and was appointed by the Governor of Colorado to serve on the Colorado Oil and Gas Conservation Commission. Currently she is consulting to the oil and gas industry.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 3 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

Dr Craig is a member of the Audit Committee.

Dr Craig has not held any other directorships in the past three years.

Unless indicated otherwise, all Directors held their positions as Directors throughout the year and up to the date of this report.

COMPANY SECRETARY

Mr Denis Ivan Rakich F.C.P.A

Mr Rakich is an accountant and Company Secretary with extensive corporate experience within the petroleum services, petroleum and mineral production and exploration industries. Mr Rakich is responsible for the corporate management of Samson Oil & Gas Limited and the maintenance of the Company’s ASX listing. He is a member of the Australian Society of Accountants and is currently Company Secretary for another public Company in the resources sector.

DIRECTORS’ SHAREHOLDINGS

At the date of this report, the interests of the Directors in shares and share options in the Company are:

|

Number of Ordinary

Shares

|

Number of Options

over Ordinary

Shares

|

|||||||

|

T.M. Barr

|

10,026,142 | 10,512,960 | ||||||

|

V. Rudenno

|

4,236,502 | 6,800,000 | ||||||

|

K. Skipper

|

736,502 | 6,500,000 | ||||||

|

D. Craig

|

- | - | ||||||

PRINCIPAL ACTIVITIES

The principal activities during the year of entities within the Consolidated Entity were oil and gas exploration, development and production in the United States of America. There have been no significant changes in the nature of these activities during the year.

The Company’s focus in the future will continue to be on oil and gas exploration, development and production in the USA. The Company will look to developing existing acreage, whilst continuing to identify potential project acquisitions.

OPERATING AND FINANCIAL REVIEW

Financial Results

The Consolidated Entity made a gross profit of $2,624,678 (2010: $846,895) from continuing operations, for the financial year ended 30 June 2011 despite several delays experienced in the fracture stimulation of two wells in the North Stockyard Field.

The result for the financial year ended 30 June 2011 from continuing operations, after provision for income tax was a profit attributable to members of the parent of $45,770,082 (2010: $1,197,240). Included in the current year result is exploration expenditure expensed of $403,826 (2010: $1,569,456). This has been expensed in line with the Consolidated Entity’s accounting policy to expense all exploration expenditure until such time as it is expected that the future economic benefit will flow from the expenditure.

In September 2010 the Company sold a portion of interests in acreage in Goshen County, Wyoming. The Company recognised $73,199,687 (2010: $nil) in profit from sale of assets.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 4 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

In March 2011, the Company sold its interests in the Jonah and Lookout Wash Fields for $6,300,000. The Company recognised a $159,196 profit on this sale before tax. This has been recognised in discontinued operations. This sale gave rise to an income tax benefit of $7,911,211 which has also been allocated to discontinued operations.

The Company has also recognised an income tax expense/(benefit) of $13,100,577 (2010: ($6,317,000)), including the benefit allocated to discontinued operations. This relates to the recognition of net operating losses that are likely to be used to offset the income tax payable is a result of the sale of a portion of the Company’s Goshen County acreage.

Discontinued operations

During the current year, the Company sold its interests in its Jonah and Lookout Wash fields. These fields contributed to approximately 65% of gas revenues for the Company and thus the properties have been treated as discontinued operations. The sale of the properties was effective 1 January 2011. For the year ended 30 June 2011, the Company recorded a pre tax loss from discontinued operations of $6,356,108 (2010: $380,007), including $6,678,940 (2010: $1,226,664) in impairment losses. The impairment loss in the current year is primarily as a result of the sale of the properties. No value was given in the sale to the proved undeveloped locations previously carried on the Balance Sheet. This sale gave rise to an income tax benefit of $7,911,211 which has also been allocated to discontinued operations.

Corporate Activities

During the year, the Company incorporate Samson Oil and Gas Montana USA, Inc. This company was incorporated in Colorado and is a 100% owned subsidiary of Samson Oil and Gas USA, Inc.

Development Activities

Bakken Field, Williams County, North Dakota

Gary #1-24H

In May 2010, the Company drilled its third Bakken well, the Gary #1-24H. This well was successfully fracced in September 2010 and has commenced production with an initial production rate of 2,780 barrels of oil equivalent per day (“BOEPD”). This initial production has declined as expected. This well averaged 121 barrels of oil per day (“BOPD”) during July 2011.

Rodney #1-14H

In July 2010, the Company successfully drilled its forth Bakken well, the Rodney #1-14H. This well was successfully fracced and commenced production with an initial production rate of 1,100 BOPD. In July 2011, this well averaged 365 BOPD.

Earl #1 - 13H

This well was drilled in October 2010 and was successfully fracced and commenced production in March 2011 with an initial production rate of 1,300 BOPD. During July 2011, this well averaged 520 BOPD.

Exploration Activities

Niobrara formation, Goshen County, Wyoming

In June 2010, the Company agreed to sell a portion of its acreage in Goshen County, Wyoming to an Chesapeake Energy Corporation for $3,275 per acre. This sale was completed in November 2010 with Samson recognising a net profit from the sale of $73,199,687.

In January 2011, Samson entered into a three way participation agreement with Halliburton Energy Services and its existing private company partner for the evaluation and development of the Niobrara Formation and other conventional targets in the Denver-Julesburg Basin for a working interest in part of the Company’s Hawk Springs project in Goshen County, Wyoming. Under the agreement, Samson and its partner will be free carried through the drilling and completion of two wells. The first of these two wells is the Defender US 33 #2-29H, a 4,300 foot horizontal well at a depth of 7,450 feet, which is currently being drilled. The second well is expected to be drilled in November 2011.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 5 of 78

Production Activities

During the year the Consolidated Entity produced approximately 64,405 (2010: 30,719) barrels of oil and 423,077 (2010: 668,848) Mcf of gas.

Reserves

The Company has determined its hydrocarbon reserves (as defined in the ASX listing rules) at an effective date of 1 July 2011 to be as follows:

|

Oil Mbbls

|

Gas MMcf

|

MBOE

|

NPV10* US$’000’s

|

|||||||||||||

|

Proved

|

505 | 1,349 | 729 | 20,121 | ||||||||||||

|

Probable

|

- | - | - | - | ||||||||||||

|

Total

|

505 | 1,349 | 729 | 20,121 | ||||||||||||

*NPV10 – this is the Net Present Value of the future cash flows, discounted at 10%.

2010 Reserves

|

Oil Mbbls

|

Gas MMcf

|

MBOE

|

NPV10* US$’000’s

|

|||||||||||||

|

Proved

|

465 | 10,445 | 2,205 | 24,812 | ||||||||||||

|

Probable

|

5 | 494 | 87 | 1,443 | ||||||||||||

|

Total

|

470 | 10,939 | 2,293 | 26,255 | ||||||||||||

*NPV10 – this is the Net Present Value of the future cash flows, discounted at 10%.

The increase in the proved oil reserves is as a result of the successful drilling in the Company’s North Stockyard field in North Dakota. The decrease in the proved gas reserves is a result of the sale of the Company’s interest in the Jonah and Lookout Wash fields during the year.

The estimate has used the NYMEX forward curve as at 30 June 2011 less an appropriate differential to take into account the difference between the NYMEX pricing and the price received by the Company at its various sales points.

DIVIDENDS

No dividend was paid or recommended for payment during the year (2010: $Nil).

SHARE OPTIONS

As at the date of this report, there were 320,665,565 (2010: 347,940,277) unissued ordinary shares under option. All option exercise prices are denominated in Australian Dollars unless noted otherwise.

5,500,000 options were granted on 22 May 2006 to Directors. These options had an exercise price of 45 cents and expired unexercised on 31 May 2011.

3,000,000 options were granted on 7 June 2006 to employees and other parties. These options had an exercise price of 45 cents and expired unexercised on 31 May 2011. 2,000,000 of these options with an exercise price of 45 cents were issued to an executive who left the Company’s employment. These options expired on 3 November 2007, unexercised.

4,000,000 options were granted on 11 October 2007 to key management personnel. These options have an exercise price of 30 cents per share, an expiry date of 10 October 2012 and vested immediately.

2,000,000 options were granted on 12 May 2008 to key management personnel. These options have an exercise price of 25 cents per share and an expiry date of 11 May 2013. 600,000 options vested immediately, 600,000 vested following twelve months of service by the employee on 1 April 2009, and the remainder vested on 1 April 2010, following 24 months of employment service.

3,379,077 options were granted on 10 October 2007 to participants of a capital raising, completed at the same time. These options have an exercise price of 30 cents per share, an expiry date of 10 October 2012 and vested immediately.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 6 of 78

344,431,144 options were granted on 6 November 2009, in conjunction with the rights offering completed at that time. An additional 12,500,007 options with the same terms and conditions were issued in January 2010. The options have an exercise price of 1.5 cents per share, an expiry date of 31 December 2012 and vested immediately. 109,144,663 of these options have been exercised to the date of this report.

29,000,000 options were granted on 18 November 2010 to the Directors of the Company. These options have an exercise price of 8 cents per share and an expiry date of 31 October 2014. They vested immediately.

32,000,000 options were granted on 17 December 2010 to employees of the Company. These options have an exercise price of 8 cents per share and an expiry date of 31 December 2014. One third of these options vested upon grant, another third will vest on 31 January 2012, with the remainder vesting on 31 January 2013, provided the employee is still employed with the Company on the vesting dates. 500,000 of the vested options were exercised in April 2011.

4,000,000 options were granted on 1 July 2011 to an employee of the Company. These options have an exercise price 16.4 cents and an expiry date of 31 December 2014. One third of these options vested on 31 July 2011, another third will vest on 31 July 2012 with the remainder vesting on 31 July 2013, provided the employee is still employed with the Company on the vesting dates.

Option holders do not have any right, by virtue of the option, to participate in any share issue of the Company.

Shares issued as a result of the exercise of options

86,819,821 1.5 cent options have been exercised from 1 July 2010 to the date of this report.

500,000 8 cent options have been exercised from 1 July 2010 to the date of this report.

Remuneration Report

The remuneration report is set out under the following headings:

A Principles used to determine the nature and amount of remuneration

B Details of remuneration

C Service agreements

D Company performance

The information provided in this remuneration report has been audited as required by section 308 (3C) of the Corporations Act 2001.

A Principles used to determine the nature and amount of remuneration

The objective of the Consolidated Entity’s executive reward framework is to ensure reward for performance is competitive and appropriate for the results delivered. The performance of the Company depends upon the quality of its Directors and executives. To be successful and maximise shareholder wealth, the Company must attract, motivate and retain highly skilled Directors and executives.

Remuneration packages applicable to the executive Directors, senior executives and non-executive Directors are established with due regard to:

|

|

·

|

Performance against set goals

|

|

|

·

|

Ability to attract and retain qualified and experienced Directors and senior executives.

|

Due to the size and nature of the Company’s operations, the Directors do not believe the establishment of a remuneration committee is warranted. The Board of Directors is responsible for determining and reviewing compensation arrangements for Directors and executives. The Board assesses the appropriateness of the nature and amount of remuneration of Directors and executives on a periodic basis by reference to relevant employment market conditions with the overall objective of ensuring maximum stakeholder benefit from the retention of a high quality Board and executive team.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 7 of 78

Non-executive Directors

Fees and payments to non-executive Directors reflect the demands which are made on, and the responsibilities of, the Directors. Non-executive Directors’ fees and payments are reviewed annually by the board. The Chair’s fees are determined independently of the other non-executive Directors. The Chair is not present at any discussions relating to determination of his own remuneration.

The ASX Listing Rules specify that the aggregate remuneration of non-executive Directors shall be determined from time to time by a general meeting. An amount not exceeding the amount determined is then divided between Directors as agreed. The latest determination was at the Annual General Meeting held on 18 November 2010 when shareholders approved an aggregate remuneration of A$500,000 per annum. The amount of aggregate remuneration sought to be approved by shareholders and the manner in which it is apportioned amongst Directors is reviewed annually.

Non-executive Directors are encouraged by the Board to hold shares in the Company (purchased by Directors on market). It is considered good governance for Directors to have a stake in the Company on whose Board they sit.

Remuneration Incentives

The Company does not have a policy in place limiting the Directors exposure to risk in relation to the Company’s options.

The remuneration of non-executive Directors for the period ending 30 June 2011 and 2010 is detailed in Table 1 and Table 2.

Executive Pay

The Company aims to reward executives with a level and mix of remuneration commensurate with their position and responsibilities within the Company and so as to:

|

|

·

|

Align the interests of executives with those of shareholders;

|

|

|

·

|

Link reward with strategic goals and performance of the Company; and

|

|

|

·

|

Ensure total remuneration is competitive by market standards.

|

Base pay for executives is reviewed on the contract renewal date to ensure the base pay is set to reflect the market for a comparable role. There are no guaranteed base pay increases included in any executives’ contracts.

Remuneration consists of fixed remuneration and remuneration incentives in the form of options issued in the Company.

The level of fixed remuneration is reviewed annually by the Board having due regard to performance against goals set for the year and relevant comparative information. The Board has access to external advice independent of management if required.

Remuneration Incentives

Directors’ remuneration is not linked to either long term or short term incentives. The Board feels that the expiry date and exercise price of the options issued to the Directors in the current and prior years are sufficient to align the goals of the Directors and executives with those of the shareholders to maximise shareholder wealth. There are no performance criteria or service conditions attached to options issued to Directors.

During the prior year, the Board agreed that vesting conditions should be included in relation to the options issued to new executives. Previously, similar to the Directors incentives detailed above, no conditions were placed on options issued to executives.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 8 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

A bonus structure is in place for the calendar year 2011 for all employees. The bonus is payable dependent on the movement in the volume weighted average share price (from trades on the Australian Securities Exchange and NYSE Amex, adjusted for the impact of foreign exchange) from December 2010 compared to December 2011. No bonus is payable if the share price decreases from December 2010 or does not increase above 25%. The maximum bonus is payable if the share price increases by 100% from December 2010 to December 2011. A total bonus of $1,353,170 may be paid if the combined volume weighted average share price during December 2011, as calculated on individual trades across both exchanges is greater than 100% of 6.3 cents (AUD). This was the volume weighted average price calculated in December 2010 based on individual trades on the ASX and NYSE Amex. The value of trades on the NYSE Amex were translated to AUD based on the exchange rate on each trading day in December from the Reserve Bank of Australia website.

No bonuses were paid by the Company for the year ended 30 June 2010.

B Details of Remuneration

Amounts of remuneration

Details of remuneration of the Directors and executives of the Company and Consolidated Entity in accordance with the requirements of the Corporations Act 2001 and its Regulations are set out in the following tables.

For the purposes of this report, Key Management Personnel (KMP) of the Consolidated Entity are defined as those persons having authority and responsibility for planning, directing and controlling the major activities of the Company and the Consolidated Entity, directly or indirectly, including any director (whether executive or otherwise) of the Parent Company, and includes the four executives in the Parent and Consolidated Entity receiving the highest remuneration.

For the purposes of this report, the term “executive” encompasses the Chief Executive Officer, Company Secretary, Chief Financial Officer, Vice President – Exploration and Vice President - Engineering. There are no further employees employed by either the Company or its subsidiaries who meet the definition of executive, therefore only the five executives detailed above are included in this report. These five employees constitute the Top 5 highest paid executives for the purposes of this report. During the year and as at the date of this report, unless stated otherwise, the key management personnel were:

|

Neil MacLachlan

|

Chairman (resigned effective 30 June 2011)

|

|

Terry Barr

|

Managing Director

|

|

Victor Rudenno

|

Non-executive Director (appointed Chairman effective 1 July 2011)

|

|

Keith Skipper

|

Non-executive Director

|

|

Denis Rakich

|

Company Secretary

|

|

Robyn Lamont

|

Chief Financial Officer

|

|

David Ninke

|

Vice President – Exploration

|

|

Dan Gralla

|

Vice President – Engineering (appointed 1 January 2011)

|

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 9 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

Table 1: Key Management Personnel compensation for the year ended 30 June 2011

|

Short Term

|

|

Share-based Payments

|

|

|

||||||||||||||||||||||||||||||||

|

Salary &

Fees

$

|

Bonus

$

|

Non-monetary

Benefits

$

|

Accrual for

possible

bonus*

$

|

Post

Employment

Super -annuation$

|

Options

$

|

Ordinary

Shares

$

|

Total

$ |

Total

Performance

Related

% |

||||||||||||||||||||||||||||

|

Directors

|

||||||||||||||||||||||||||||||||||||

|

T.Barr

|

333,169 | 262,500 | 3,826 | 132,000 | 14,752 | 360,000 | 54,439 | 1,160,686 | 42.3 | % | ||||||||||||||||||||||||||

|

N. MacLachlan

|

71,630 | - | - | - | - | 252,000 | 19,403 | 343,033 | 73.5 | % | ||||||||||||||||||||||||||

|

K. Skipper

|

23,070 | - | - | - | 26,330 | 216,000 | 6,314 | 271,714 | 79.5 | % | ||||||||||||||||||||||||||

|

V. Rudenno

|

49,400 | - | - | - | - | 216,000 | 6,314 | 271,714 | 79.5 | % | ||||||||||||||||||||||||||

|

Executives

|

||||||||||||||||||||||||||||||||||||

|

D. Rakich1

|

108,261 | 16,796 | - | 28,800 | 10,826 | 91,900 | 15,784 | 272,367 | 44.3 | % | ||||||||||||||||||||||||||

|

R. Lamont1

|

211,477 | 30,000 | 1,986 | 55,920 | 15,621 | 128,660 | 24,386 | 468,050 | 39.4 | % | ||||||||||||||||||||||||||

|

D. Ninke1

|

241,479 | 135,000 | - | 72,480 | 15,125 | 128,660 | 23,378 | 616,122 | 32.6 | % | ||||||||||||||||||||||||||

|

D. Gralla1, 2

|

132,648 | - | - | 67,200 | 7,350 | 128,660 | - | 335,858 | 58.3 | % | ||||||||||||||||||||||||||

|

Total

|

1,171,134 | 444,296 | 5,812 | 356,400 | 90,004 | 1,521,880 | 150,018 | 3,739,544 | ||||||||||||||||||||||||||||

* This expense relates to the current year expense associated with the calendar year 2011 bonus plan. Based on probability analysis, using Monte Carlo simulation, 60% of the total bonus is expected to be paid out. This expense represents the accrual from 1 January 2011 to 30 June 2011. No cash has been paid in relation to this bonus.

1 These options were issued during the year ended 30 June 2011; however are subject to a vesting schedule dependent on each employee’s continued employment with the Company. This value represents the portion of the expense recognised during the current year.

2 Mr Gralla was appointed Vice President – Engineering, effective 1 January 2011. Prior to that he was working for the Company on a contract basis. Whitehall Engineering (an entity he controlled) was paid $158,952 for his services, including a bonus of $42,500.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 10 of 78

|

DIRECTORS’ REPORT

|

|

30 June 2011

|

Table 2: Key Management Personnel compensation for the years ended 30 June 2010

|

Short Term

|

|

Share-based

Payments

|

|

|

||||||||||||||||||||||||||||

|

Salary &

Fees

$

|

Bonus

$

|

Non-monetary

Benefits

$

|

Post

Employment

Superannuation$

|

Options

$

|

Ordinary

Shares

|

Total

$ |

Total Performance

Related

% |

|||||||||||||||||||||||||

|

Directors

|

||||||||||||||||||||||||||||||||

|

T.Barr

|

212,644 | - | - | 10,966 | - | 38,735 | 262,345 | 0 | % | |||||||||||||||||||||||

|

N. MacLachlan

|

68,371 | - | - | - | - | 6,015 | 74,386 | 0 | % | |||||||||||||||||||||||

|

K. Skipper

|

25,089 | - | - | 2,259 | 2,755 | 4,010 | 34,113 | 8.07 | % | |||||||||||||||||||||||

|

V. Rudenno

|

27,348 | - | - | - | 2,755 | 4,010 | 34,113 | 8.07 | % | |||||||||||||||||||||||

|

Executives

|

||||||||||||||||||||||||||||||||

|

D. Rakich

|

84,541 | - | - | 6,837 | - | 10,025 | 101,403 | 0 | % | |||||||||||||||||||||||

|

R. Lamont

|

134,728 | - | 6,307 | 10,419 | - | 17,351 | 168,805 | 0 | % | |||||||||||||||||||||||

|

D. Ninke*

|

168,860 | - | 3,873 | 12,818 | 14,218 | 16,634 | 216,403 | 7.69 | % | |||||||||||||||||||||||

|

Total

|

721,581 | - | 10,180 | 43,299 | 19,728 | 96,780 | 891,568 | |||||||||||||||||||||||||

*These options were issued during the year ended 30 June 2008, however a portion vested during the current year, therefore the expense has been recognised in line with the vesting of these options.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 11 of 78

|

DIRECTORS’ REPORT

|

|

for the year ended 30 June 2011

|

Table 3 Compensation options: Granted and vested during the year (Consolidated) – in Australian Dollars

|

Name

|

Grant

Number

|

Grant

Date

|

Fair

value

per

option

at grant

date

$

|

Exercise

price per

option

$

|

Expiry

date

|

First

Exercise

Date

|

Last

exercise

date

|

Vested

No.*

|

Vested

%

|

|||||||||||||||||

|

Directors

|

||||||||||||||||||||||||||

|

T. Barr

|

10,000,000 |

18 Nov 2010

|

0.036 | 0.08 |

31 Oct 2014

|

19 Nov 2010

|

31 Oct 2014

|

10,000,000 | 100 | |||||||||||||||||

|

N. MacLachlan

|

7,000,000 |

18 Nov 2010

|

0.036 | 0.08 |

31 Oct 2014

|

19 Nov 2010

|

31 Oct 2014

|

7,000,000 | 100 | |||||||||||||||||

|

V. Rudenno

|

6,000,000 |

18 Nov 2010

|

0.036 | 0.08 |

31 Oct 2014

|

19 Nov 2010

|

31 Oct 2014

|

6,000,000 | 100 | |||||||||||||||||

|

K. Skipper

|

6,000,000 |

18 Nov 2010

|

0.036 | 0.08 |

31 Oct 2014

|

19 Nov 2010

|

31 Oct 2014

|

6,000,000 | 100 | |||||||||||||||||

|

Executives

|

||||||||||||||||||||||||||

|

D. Rakich*

|

5,000,000 |

17 Dec 2010

|

0.031 | 0.08 |

31 Dec 2014

|

31 Jan 2011

|

31 Dec 2014

|

1,666,666 | 33 | |||||||||||||||||

|

R. Lamont*

|

7,000,000 |

17 Dec 2010

|

0.031 | 0.08 |

31 Dec 2014

|

31 Jan 2011

|

31 Dec 2014

|

2,333,333 | 33 | |||||||||||||||||

|

D. Ninke*

|

7,000,000 |

17 Dec 2010

|

0.031 | 0.08 |

31 Dec 2014

|

31 Jan 2011

|

31 Dec 2014

|

2,333,333 | 33 | |||||||||||||||||

|

D. Gralla*

|

7,000,000 |

17 Dec 2010

|

0.031 | 0.08 |

31 Dec 2014

|

31 Jan 2011

|

31 Dec 2014

|

2,333,333 | 33 | |||||||||||||||||

|

Total

|

55,000,000 |

-

|

- | - |

-

|

37,666,665 | - | |||||||||||||||||||

* These options have the following vesting schedule, assuming the employee is still employed by the Company – one third vested on 31 January 2011, one third will vest on 31 January 2012 with the remaining third vesting on 31 January 2013.

Table 4 Compensation options: Granted and vested during the prior year (Consolidated) – in Australian Dollars

|

Name

|

Grant

Number

|

Grant

Date

|

Fair

value

per

option

at grant

date

(cents)

|

Exercise

price per

option

$

|

Expiry

date

|

First

Exercise

Date

|

Last

exercise

date

|

Vested

No.*

|

Vested

%

|

|||||||||||||||||||||||||||

|

Directors

|

||||||||||||||||||||||||||||||||||||

|

T. Barr

|

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

|

N. MacLachlan

|

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

|

V. Rudenno

|

500,000 |

18 Nov 2009

|

0.006 | 0.20 |

30 Nov 2013

|

19 Nov 2009

|

30 Nov 2013

|

500,000 | 100 | |||||||||||||||||||||||||||

|

K. Skipper

|

500,000 |

18 Nov 2009

|

0.006 | 0.20 |

30 Nov 2013

|

19 Nov 2009

|

30 Nov 2013

|

500,000 | 100 | |||||||||||||||||||||||||||

|

Executives

|

||||||||||||||||||||||||||||||||||||

|

D. Rakich

|

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

|

R. Lamont

|

- | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

|

D. Ninke*

|

- | - | - | 0.25 | - | - | - | 800,000 | 40 | |||||||||||||||||||||||||||

|

Total

|

1,000,000 | - | - | - | - | 1,800,000 | - | |||||||||||||||||||||||||||||

* 600,000 options vested at grant date, 600,000 options vested following the completion of twelve months employment by Mr Ninke on 1 April 2009. The remaining 800,000 options vested following the completion of twenty four months employment by Mr Ninke on 1 April 2010.

500,000 remuneration options were exercised during the year. The company received cash of A$40,000/US$42,216 in relation to this exercise.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 12 of 78

|

DIRECTORS’ REPORT

|

|

for the year ended 30 June 2011

|

C Service Agreements

It is the Board’s policy that employment contracts are only entered into with the managing director and senior executives. As such contracts have been entered into for Mr. Barr, Mr. Gralla, Mr. Ninke and Ms Lamont. Details of these contracts are included below.

Mr. Barr – Chief Executive Officer

Effective 1 January 2011, Mr Barr has been retained by the Company to act as the Company’s President, Managing Director and Chief Executive officer for a period of three years with an option to extend the contract for an additional three years. The contract allows for total compensation of $440,000 (cash and non cash benefits) with a bonus payable of up to $440,000 for the calendar year 31 December 2011, based on the Company’s share price performance from December 2010 to December 2011. The bonus structure for the remaining years of the contract has not yet been set but provision has been made in the contract for a bonus to be payable.

Mr. Ninke – Vice President Exploration

Effective 1 January 2011, Mr Ninke has been retained by the Company to act as Vice President - Exploration for a period of three years with an option to extend the contract for an additional three years. The contract allows for total compensation of $302,000 (cash and non cash benefits) with a bonus payable of up to $241,600 for the calendar year 31 December 2011, based on the Company’s share price performance from December 2010 to December 2011. The bonus structure for the remaining years of the contract has not yet been set but provision has been made in the contract for a bonus to be payable. Mr Ninke also retains the right to receive a 1% revenue royalty from production from prospects identified and recommended prior to 31 March 2011, being the Diamondback prospect. This prospect has yet to be drilled.

Ms Lamont – Chief Financial Officer

Effective 1 January 2011, Ms Lamont has been retained by the Company to act as the Vice President – Finance and Chief Financial Officer for a period of three years with an option to extend the contract for an additional three years. The contract allows for total compensation of $233,009 (cash and non cash benefits) with a bonus payable of up to $186,407 for the calendar year 31 December 2011, based on the Company’s share price performance from December 2010 to December 2011. The bonus structure for the remaining years of the contract has not yet been set but provision has been made in the contract for a bonus to be payable.

Mr Gralla – Vice President Engineering

Effective 1 January 2011, Mr Gralla has been retained by the Company to act as the Vice President – Engineering for a period of three years with an option to extend the contract for an additional three years. The contract allows for total compensation of $280,000 (cash and non cash benefits) with a bonus payable of up to $224,000 for the calendar year 31 December 2011, based on the Company’s share price performance from December 2010 to December 2011. The bonus structure for the remaining years of the contract has not yet been set but provision has been made in the contract for a bonus to be payable.

D Company Performance

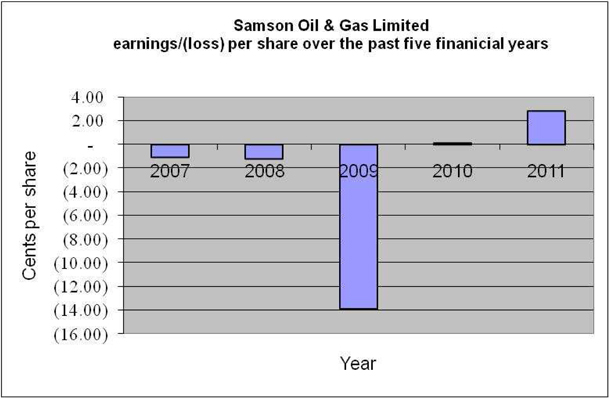

The Company’s performance is reflected in the movement in the Company’s earnings/(loss) per share (EPS) over time. The graph below shows Samson Oil & Gas Limited’s basic EPS history for the past five years, including the current period.

EPS for the years ended 30 June 2011, 2010, 2009, 2008 and 2007 has been measured based on the net loss as calculated by the application of Australian Accounting Standards.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 13 of 78

|

DIRECTORS’ REPORT

|

|

for the year ended 30 June 2011

|

CORPORATE STRUCTURE

Samson Oil & Gas Limited is a Company limited by shares that is incorporated and domiciled in Australia.

EMPLOYEES

The Consolidated Entity employed 8 employees at 30 June 2011 (2010: 7 employees).

LIKELY DEVELOPMENTS AND EXPECTED RESULTS

The likely developments of the Consolidated Entity during the next financial year involve the ongoing principal activities of oil and gas exploration, development and production in the United States of America.

The Consolidated Entity plans to pursue three objectives.

|

|

1)

|

The appraisal and development of the retained acreage in the Hawks Springs Project, Goshen County, Wyoming

|

|

|

2)

|

The appraisal and development of newly acquired acreage in the Roosevelt Project, Roosevelt County, Montana and

|

|

|

3)

|

The continued production of the Company’s North Stockyard Bakken Formation project.

|

SIGNIFICANT CHANGES IN THE STATE OF AFFAIRS

Since the Company’s listing on the NYSE Amex in January 2008, it has been classified as a Foreign Private Issuer by the Securities Exchange Commission (“SEC”) in the United States. This classification granted the Company relief from some reporting obligations in the US, in particular the Company did not have to comply with US Generally Accepted Accounting Principles (“US GAAP”) or to file a 10-K Annual Report or 10-Q quarterly reports with the SEC.

Following the migration of greater than 50% of the outstanding share ownership to US holders as at 31 December 2010 (the SEC’s annual test date), the Company changed its Foreign Private Issuer status with the SEC, effective 1 July 2011 and became a US Domestic issuer. This has a number of implications for the Company as the SEC now views Samson Oil & Gas Limited as a US Domestic issuer despite the Company’s home exchange being the ASX. The Company is now required to file with the SEC its 10-K Annual Report for the year ended 30 June 2011 within 75 days of the end of the fiscal year. The10-K utilises US GAAP rather than IFRS will be filed simultaneously with this report in the United States. This change in status is expected to increase compliance and regulatory costs for the Company but is expected to provide greater comparability and transparency in reporting amongst its US peers.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 14 of 78

|

DIRECTORS’ REPORT

|

|

for the year ended 30 June 2011

|

Other than the changes mentioned above in the operating review or below in significant events after balance date that have occurred during the year, there has not been any matter or circumstance that has occurred during the year or that has arisen since the end of the financial year that has significantly affected, or may significantly affect:

|

|

·

|

the operations;

|

|

|

·

|

the results of those operations;

|

|

|

·

|

or the state of affairs of the Consolidated Entity in subsequent financial years.

|

ENVIRONMENTAL REGULATIONS AND PERFORMANCE

The Consolidated Entity has various permits and licenses to operate in different states within the United States of America.

There have been no significant known breaches of the Consolidated Entity’s licence or permit conditions during the year ended 30 June 2011.

DIRECTORS’ MEETINGS

The numbers of meetings of the Company’s board of Directors and of the audit committee held during the year ended 30 June 2011, and the numbers of meetings attended by each director were:

|

Full meetings of Directors

|

Audit Committee Meetings

|

|||||||||||||||

|

No. of Meetings

held while in office

|

Meetings

attended

|

No. of Meetings

held while in office

|

Meetings

attended

|

|||||||||||||

|

T.M. Barr

|

18 | 18 | *** | *** | ||||||||||||

|

N.T. MacLachlan

|

18 | 18 | 3 | 3 | ||||||||||||

|

K. Skipper

|

18 | 18 | 3 | 3 | ||||||||||||

|

V. Rudenno

|

18 | 18 | 3 | 3 | ||||||||||||

*** Not a member of the audit committee

INDEMNIFICATION AND INSURANCE OF DIRECTORS

During the financial year, the Consolidated Entity incurred a premium of $85,000 (2010: $65,000) to insure Directors and officers of the Consolidated Entity.

The liabilities insured include costs and expenses that may be incurred in defending civil or criminal proceedings that may be brought against the officers in their capacity as officers of the Consolidated Entity, and any other payments arising from liabilities incurred by the officers in connection with such proceedings. This does not include such liabilities that arise from conduct involving a wilful breach of duty by the officers or the improper use by the officers of their position or of any information to gain advantage for themselves or someone else or to cause detriment to the Company. It is not possible to apportion the premium between amounts relating to insurance against legal costs and those relating to other liabilities.

CORPORATE GOVERNANCE

The Directors of Samson Oil & Gas Limited aspire to maintain the standards of corporate governance appropriate to the size of the Company. The Company’s corporate governance statement is contained within the next section of this report.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 15 of 78

|

DIRECTORS’ REPORT

|

|

for the year ended 30 June 2011

|

AUDIT COMMITTEE

The members of the audit committee during the year were Dr Victor Rudenno, Mr Neil MacLachlan and Mr Keith Skipper. Mr MacLachlan resigned as a member of the Board of Directors and therefore of the audit committee effective 30 June 2011. He was replaced by Dr DeAnn Craig on the Audit Committee, when she was appointed on 10 July 2011.

See detail under Directors Meetings for details of Audit Committee meetings attended by the Directors.

SIGNIFICANT EVENTS AFTER THE BALANCE DATE

Acquisition of acreage in Roosevelt County, Montana

In July 2011, the Consolidated Entity closed on the purchase of 20,028 acres of oil and gas leases in the Fort Peck Indian Reservation in Roosevelt County, Montana from the Fort Peck Energy Company. This acquisition was the first tranche of a three tranche purchase of the Roosevelt Project for the Company. The first tranche includes a two well drilling commitment. Once the two wells have been drilled, Samson has the option to acquire 100% working interest in an additional 20,000 acres from Fort Peck Energy Company. Following the drilling of the two appraisal wells in Tranche 1, FPEC will have the right to back into a 33.34% position in both tranches by reimbursing Samson’s acreage and drilling costs to the extent of that equity. In such an event, Samson will have a 66.66% working interest and a 53.34% net revenue interest. Tranche 3 is a 50,000 acre area covered by an Area of Mutual Interest where Samson and FPEC have agreed to jointly acquire additional leases, with Samson holding a 66.66% working interest (53.34% net revenue interest) and FPEC a 33.34% working interest. The first of these wells will be Australia II and is expected to be drilled in October 2011.

Defender US33 #2-29

In August 2011, the Consolidated Entity commenced drilling operations on its first appraisal well in the Hawk Springs project. Samson has a 37.5% working interest in this well, though is being carried on all costs by Halliburton Energy Services.

Acquisition of additional Hawk Springs acreage, Wyoming

In August 2011, Samson was advised that has been awarded, on a conditional basis, approximately 956 net acres of leasehold offered by competitive tender from the University of Wyoming. This land is part of the University’s agricultural research facility. The Consolidated Entity has also been successful in acquiring additional acreage in the State of Wyoming’s lease sales as well as leasing acreage from fee owners. Accordingly, the Consolidated Entity has now increased its holding to 17,489 net acres in the Hawk Springs area. This holding assumes that Samson’s farminee exercises its full right to earn a 25% interest within the farmin area.

NON-AUDIT SERVICES

The Company may decide to employ the auditor on assignments additional to their statutory audit duties where the auditor’s expertise and experience with the Company are important.

The Directors when considering the auditor for non audit services, will ensure that they are satisfied the provision of non-audit services is compatible with the general standard of independence for auditors imposed by the Corporations Act 2001. The nature and scope of each type of non-audit service provided did not compromise auditor independence.

The board of Directors has considered the position and, in accordance with advice received from the Audit Committee, is satisfied that the provision of non-audit services is not incompatible with the general standard of independence for auditors imposed by the Corporations Act 2001. The Directors are satisfied that the provision of non-audit services by the auditor, as set out below, did not compromise the auditor independence requirements of the Corporations Act 2001 for the following reasons:

|

|

·

|

all non-audit services have been reviewed by the Audit Committee to ensure they do not impact the impartiality and objectivity of the auditor

|

|

|

·

|

none of the services undermine the general principles relating to auditor independence as set out in APES 110 Code of Ethics for Professional Accountants

|

For the year ended 30 June 2011, PricewaterhouseCoopers received or were due to receive the following amounts for the provision of non-audit services:

Advisory services $nil (2010: $33,930)

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 16 of 78

|

DIRECTORS’ REPORT

|

|

for the year ended 30 June 2011

|

AUDITOR INDEPENDENCE

A copy of the auditor’s independence declaration as required under section 307C of the Corporations Act 2001 is set out on page 18.

Signed in accordance with a resolution of the Board of Directors.

Terence M. Barr

Director

Denver, Colorado

14 September 2011

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 17 of 78

|

AUDITORS INDEPENDENCE DECLARATION

|

|

for the year ended 30 June 2011

|

AUDITORS INDEPENDENCE DECLARATION

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 18 of 78

|

CORPORATE GOVERNANCE STATEMENT

|

|

for the year ended 30 June 2011

|

CORPORATE GOVERNANCE STANDARD

Samson Oil & Gas Limited (“the Company”) and the board are committed to achieving and demonstrating the highest standards of Corporate Governance. The Board continues to review the framework and practices to ensure they meet the interests of shareholders. The Company and its controlled entity together are referred to as the Consolidated Entity in this statement.

A description of the Consolidated Entity’s main corporate governance practice is set out below. All these practices, unless stated otherwise, were in place for the entire year. They comply with the August 2007 ASX Principles of Good Corporate Governance and Best Practice Recommendations.

Principle 1 – Lay solid foundations for management and oversight.

The relationship between the board and senior management is critical to the Consolidated Entity’s long term success. The Directors are responsible to the shareholders for the performance of the Consolidated Entity in both the short and longer term and seek to balance often competing objectives in the best interests of the Consolidated Entity as a whole. Their focus is to enhance the interests of the shareholders and other key stakeholders and to ensure the Consolidated Entity is properly managed.

The responsibilities of the Board include:

|

·

|

contributing to developing and approving the corporate strategy;

|

|

·

|

reviewing and approving business plans, the annual budget and financial plans including available resources and major capital expenditure initiatives;

|

|

·

|

overseeing and monitoring

|

|

|

·

|

organisational performance and the achievement of the Consolidated Entity’s strategic goals and objectives

|

|

|

·

|

compliance with Company’s code of conduct

|

|

|

·

|

progress of major capital expenditures and other significant corporate projects including acquisitions and divestitures

|

|

·

|

ensuring there are effective management processes in place and approving major corporate initiatives

|

|

·

|

overseeing the operation of the Company’s system for compliance and risk management

|

|

·

|

monitoring financial performance including the approval of the annual and half year financial reports and liaison with the Company’s auditors

|

|

·

|

appointment, performance assessment and, if necessary, removal of the Managing Director

|

|

·

|

ensuring appropriate resources are available to senior management.

|

Day to day management of the Company’s affairs and the implementation of the corporate strategy and policy initiatives are formally delegated by the Board to the Managing Director and senior executives.

Principle 2 – Structure the Board to add value

The board operates in accordance with the broad principles set out in its charter which is available from the corporate governance information section of the company’s website at www.samsonoilandgas.com. The charter details the board’s composition and responsibilities.

Board composition

The charter states:

|

·

|

the board is to be comprised of both executive and non-executive Directors with a majority of non-executive Directors. Non-executive Directors bring a fresh perspective to the board’s consideration to strategic, risk and performance matters

|

|

·

|

in recognition of the importance of independent views and the board’s role in supervising the activities of management, the Chair must be independent of management and all Directors are required to exercise independent judgement and review and constructively challenge the performance of management

|

|

·

|

the Chair is elected by the full board and is required to meet regularly with the Managing Director

|

|

·

|

the Company is to maintain a mix of Directors on the board from different backgrounds with complementary skills and experience.

|

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 19 of 78

|

CORPORATE GOVERNANCE STATEMENT

|

|

for the year ended 30 June 2011

|

The board seeks to ensure that:

|

·

|

at any point in time, its membership represents an appropriate balance between Directors with experience and knowledge of the Consolidated Entity and Directors with an external or fresh perspective

|

|

·

|

the size of the board is conducive to effective discussion and efficient decision-making.

|

Directors’ Independence

The board has adopted specific principles in relation to Directors’ independence. These state that when determining independence, a director must be a non-executive and the board should consider whether the director:

|

·

|

is a substantial shareholder of the Company or an officer or, or otherwise associated directly with, a substantial shareholder of the Company

|

|

·

|

is or has been employed in an executive capacity by the Company or any other Consolidated Entity member within three years before commencing to serve on the board

|

|

·

|

within the last year has been a principal of a material professional adviser or material consultant to the Company or any other Consolidated Entity member, or an employee materially associated with the service provided

|

|

·

|

is a material supplier or customer of the Company or any other Consolidated Entity member, or an officer or otherwise associated directly or indirectly with a material supplier or customer

|

|

·

|

has a material contractual relationship with the Company or a controlled entity other than as director of the Consolidated Entity

|

|

·

|

is free from any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director’s independent exercise of their judgement.

|

“Materiality” for these purposes is determined on a qualitative basis. A transaction of any amount or a relationship is deemed material if knowledge of it may impact the shareholders’ understanding of the director’s performance.

Recent thinking on corporate governance has introduced the view that a director’s independence may be perceived to be impacted by lengthy service on the board. To avoid any potential concerns, the board has determined that a director will not be deemed independent if he or she has served on the board of the Company for more than ten years. The board continues to monitor developments on this issue.

The board assess independence each year. To enable this process, the Directors must provide all information to the Chief Financial Officer that may be relevant to the assessment.

Board members

Details of the members of the board, their experience, expertise, qualifications, term of office and their independent status are set out in the Directors report under the heading “Directors”. At the date of signing the Directors’ report, there is one executive director and three non-executive Directors. All non-executive Directors are deemed to be independent.

Term of office

The Company’s Constitution specifies that all non-executive Directors appointed during the year, automatically retire at the next annual general meeting (“AGM”) and are eligible for re-election at that general meeting. Any director that has been appointed during the year and is subject to automatic retirement at the AGM is not taken into account in the automatic retirement of one third of the Directors as detail below.

At each annual general meeting:

(a) one third (or if that is not a whole number, the whole number nearest to one third) of the Directors who are not:

(i) appointed, and required to retire, as detailed above; or

(ii) the Managing Director; or

(iii) Directors only because they are Alternates; and

(b) any Director who would, if that Director remained in office until the nextannual general meeting, have held that office for more than 3 years must retire from office and is eligible for re-election.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 20 of 78

|

CORPORATE GOVERNANCE STATEMENT

|

|

for the year ended 30 June 2011

|

Chair and Chief Executive Officer

The Chair is responsible for leading the board, ensuring Directors are properly briefed in all matters relevant to their role and responsibilities, facilitating board discussions and managing the board’s relationship with the Company’s senior executives. In accepting the position, the Chair has acknowledged that it will require a significant time commitment and has confirmed that other positions would not hinder his effective performance in the role of Chair.

The CEO is responsible for implementing the Consolidated Entity’s strategies and policies. The board charter specifies that these are separate roles to be undertaken by separate people. The CEO role is performed by the Managing Director.

Commitment

The board held 18 meetings (including those held by circulating resolution) during the year. The number of meetings of the Company’s board of Directors and of each board committee held during the year ended 30 June 2011, and the number of meetings attended by each director is disclosed on page 15.

It is the Company’s practice to allow its executive Directors to accept appointments outside the Company with prior written approval of the board. No appointments of this nature were requested during the year.

Prior to appointment or being submitted for re-election, each non-executive director is required to specifically acknowledge that they will have and continue to have the time available to discharge their responsibilities to the Company.

Independent professional advice

Directors and board committees have the right, in connection with their duties and responsibilities, to seek independent professional advice at the Company’s expense. Prior written approval of the Chair is required, but this will not be unreasonably withheld.

Performance assessment

In order to ensure that the board continues to discharge its responsibilities in an appropriate manner, the performance of all Directors is reviewed annually by the Chair. Directors whose performance is unsatisfactory are asked to retire. The board has not formally documented the results of performance evaluations to date.

Board committees

The board has established an audit committee to assist in the execution of the supervision of the audit by the Board. Effective 28 July 2011, the Board also formed a Compensation Committee

Audit Committee

The audit committee consists entirely of independent Directors, including DeAnn Craig, Keith Skipper and Victor Rudenno. Neil MacLachlan was a member of this committee until his resignation on 30 June 2011. The Audit Committee operates in accordance with a formal written charter, a copy of which is available on the Company’s website. This committee oversees, reviews and acts on reports to the board on various auditing and accounting matters, selects the independent auditors and oversees the scope of annual audits, fees to be paid to the independent auditors, the performance of the independent auditors and our accounting practices. In addition, the Audit Committee oversees the Company’s compliance programs relating to legal and regulatory requirements.

It is the board’s responsibility to ensure that an effective internal control framework exists within the entity. This includes internal controls to deal with both the effectiveness and efficiency of significant business processes. This also includes the safeguarding of assets, the maintenance of proper accounting records, and the reliability of financial information.

Nomination Committee

The Company does not have a formally appointed nomination committee, as the Directors believe the size of the Company’s operations does not warrant the establishment of such a committee.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 21 of 78

|

CORPORATE GOVERNANCE STATEMENT

|

|

for the year ended 30 June 2011

|

Principle 3 – Promote ethical and responsible decision making

Code of Conduct

The Company has developed a Code of Conduct (“the Code”) which has been fully endorsed by the board and applies to all Directors and employees. The Code is regularly reviewed and updated as necessary to ensure it reflects the highest standards of behaviour and professionalism and the practices necessary to maintain confidence in the Consolidated Entity’s integrity and to take into account legal obligations and reasonable expectations of the Company’s stakeholders.

In summary, the Code requires that at all times all Company personnel act with the utmost integrity, objectivity and in compliance with the letter and the spirit of the law and Company policies.

The purchase and sale of Company securities by Directors and employees is only permitted during non-black out periods. Black out periods are defined in the Company’s Insider Trading Policy. Any transactions undertaken must be notified to the CEO or CFO prior to being entered into.

The Code and the Company’s trading policy is discussed with each new employee. Further training is periodically provided and all employees are asked to sign an annual declaration confirming their compliance with the Code and trading policy.

The Code requires employees who are aware of unethical practices with the Consolidated Entity or breaches of the Company’s trading policy to report these using the Company’s whistleblower program.

The Directors are satisfied that the Consolidated Entity has complied with its policies on ethical standards, including trading in securities.

A copy of the Code and the Insider Trading Policy are available on the Company’s website.

Principle 4 – Safeguard integrity in financial reporting

Audit committee

The Audit Committee consists of the following non-executive Directors:

D. Craig

K. Skipper

V. Rudenno

N. MacLachlan (resigned 30 June 2011)

Details of these Directors’ qualifications and attendance at Audit Committee meetings are set out in the Directors report on pages 2, 3 and 15.

All members of the Audit Committee are financially literate and have an appropriate understanding of the oil and gas industry. Dr Rudenno and Dr Craig are both deemed to be financial experts.

The Audit Committee operates in accordance with a charter which is available on the Company’s website. The main responsibilities of the committee are to:

|

|

·

|

review, assess and approve the annual report, Form 10K, the half-year financial report and all other financial information published by the Company or released to the market

|

|

|

·

|

assist the board in reviewing the effectiveness of the organisation’s internal control environment covering:

|

|

|

·

|

effectiveness and efficiency of operations

|

|

|

·

|

reliability of financial reporting

|

|

|

·

|

compliance with applicable laws and regulations

|

|

|

·

|

oversee the effective operation of the risk management framework

|

|

|

·

|

recommend to the board the appointment, removal and remuneration of the external auditors and review the terms of their engagement, the scope and quality of the audit and assess performance

|

|

|

·

|

consider the independence and competence of the external auditor on an on-going basis

|

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 22 of 78

|

CORPORATE GOVERNANCE STATEMENT

|

|

for the year ended 30 June 2011

|

|

|

·

|

review and approve the level of non-audit services provided by the external auditors and ensure it does not adversely impact on auditor independence

|

|

|

·

|

review and monitor related party transactions and assess their propriety

|

|

|

·

|

report to the board on matters relevant to the committee’s role and responsibilities.

|

In fulfilling its responsibilities, the Audit Committee:

|

|

·

|

receives regular reports from management and the external auditors

|

|

|

·

|

meets with external auditors at least twice a year, or more frequently if necessary

|

|

|

·

|

reviews the processes the CEO and CFO have in place to support their certifications to the board

|

|

|

·

|

reviews any significant disagreements between the auditors and management, irrespective of whether they have been resolved

|

|

|

·

|

is given the opportunity to meet with external auditors without the presence of management if required

|

|

|

·

|

provides the external auditors with a clear line of communication at any time to the either the audit committee or the Chair of the board.

|

The Audit Committee has authority, within the scope of its responsibilities, to seek any information it requires from any employee or external party.

External auditors

The Company’s and Audit Committee’s policy is to appoint external auditors who clearly demonstrate quality and independence. The performance of the external auditor is reviewed annually and applications for tender of external audit services are requested as deemed appropriate, taking into consideration assessment of performance, existing value and tender costs. The external audit was put to tender in 2008 with PricewaterhouseCoopers being appointed external auditors in October 2008. It is PricewaterhouseCoopers policy to rotate audit engagement partners on listed companies at least every five years.

An analysis of fees paid to the external auditors, including a break-down of fees for non-audit services, is provided in the Directors’ report and in note 25 to the financial statements. It is the policy of the external auditors to provide an annual declaration of their independence to the Audit Committee.

The external auditor will attend the annual general meeting and be available to answer shareholder questions about the conduct of the audit and the preparation and content of the audit report.

Principle 5 and 6 – Make timely and balanced disclosures and respect the rights of shareholders

The Company recognises the importance of ensuring its continuous disclosure requirements are met, and has procedures in place to ensure this happens, however has not formally documented them.

The Company Secretary has been nominated as the person responsible for communications with the Australian Stock Exchange (“ASX”). This role includes responsibility for ensuring compliance with the continuous disclosure requirements in the ASX Listing Rules and overseeing and co-ordinating information disclosure to the ASX, analysts, brokers, shareholders, the media and the public.

All information disclosed to the ASX is posted on the Company’s website as soon as it is disclosed to the ASX. When analysts are briefed on aspects of the Consolidated Entity’s operations, the material used in the presentation is released to the ASX and posted on the Company’s website. Procedures have also been established for reviewing whether any price sensitive information has been inadvertently disclosed and, if so, this information is also immediately released to the market.

From 30 June 2009, shareholders could elect whether or not they wished to receive a hard copy of the Annual Report. A copy of the Annual Report is sent to all shareholders who elected to receive one. All shareholders receive the Notice of Meeting for the Company’s Annual General Meeting.

The Company actively promotes communication with shareholders through a variety of measures, including the use of the Company’s website and email. The Company’s reports and ASX announcements may be viewed and downloaded from its website: www.samsonoilandgas.com or the ASX website: asx.com.au under ASX code “SSN”. The Company also maintains an email list for the distribution of the Company’s announcements via email in a timelier manner.

|

Samson Oil & Gas Limited

|

Annual Report – 30 June 2011

|

Page 23 of 78

|

CORPORATE GOVERNANCE STATEMENT

|

|

for the year ended 30 June 2011

|

Principle 7- Recognise and manage risk

The board, through the Audit Committee, is responsible for ensuring there are adequate policies in relation to risk management, compliance and internal control systems. In summary, the Company policies are designed to ensure strategic, operational, legal, reputational and financial risks are identified, assessed, effectively and efficiently managed and monitored to enable achievement of the Consolidated Entity’s business objectives.