Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED AIRLINES, INC. | d231262d8k.htm |

Deutsche Bank Airline

Equity Conference

United Continental

Holdings, Inc.

September 13, 2011

Exhibit 99.1 |

Jeff

Smisek President & Chief Executive Officer

United Continental Holdings, Inc. |

| Safe

Harbor Statement 3

3

Certain statements included in this presentation are forward-looking and thus reflect our current

expectations and beliefs with respect to certain current and future events and financial

performance. Such forward-looking statements are and will be subject to many risks and

uncertainties relating to our operations and business environment that may cause actual results to differ materially

from any future results expressed or implied in such forward-looking statements. Words such as

“expects,” “will,” “plans,” “anticipates,”

“indicates,” “believes,” “forecast,” “guidance,” “outlook” and similar expressions are intended to identify forward-

looking statements. Additionally, forward-looking statements include statements which do not

relate solely to historical facts, such as statements which identify uncertainties or trends,

discuss the possible future effects of current known trends or uncertainties, or which indicate

that the future effects of known trends or uncertainties cannot be predicted, guaranteed or

assured. All forward-looking statements in this presentation are based upon information available to

us on the date of this presentation. We undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information, future events, changed

circumstances or otherwise, except as required by applicable law. Our actual results could differ

materially from these forward-looking statements due to numerous factors including, without limitation, the following: our

ability to comply with the terms of our various financing arrangements; the costs and availability of

financing; our ability to maintain adequate liquidity; our ability to execute our operational

plans; our ability to control our costs, including realizing benefits from our resource

optimization efforts, cost reduction initiatives and fleet replacement programs; our ability to utilize our

net operating losses; our ability to attract and retain customers; demand for transportation in the

markets in which we operate; an outbreak of a disease that affects travel demand or travel

behavior; demand for travel and the impact that global economic conditions have on customer

travel patterns; excessive taxation and the inability to offset future taxable income; general economic

conditions (including interest rates, foreign currency exchange rates, investment or credit market

conditions, crude oil prices, costs of aviation fuel and energy refining capacity in relevant

markets); our ability to cost-effectively hedge against increases in the price of aviation

fuel; any potential realized or unrealized gains or losses related to fuel or currency hedging programs; the

effects of any hostilities, act of war or terrorist attack; the ability of other air carriers with whom

we have alliances or partnerships to provide the services contemplated by the respective

arrangements with such carriers; the costs and availability of aviation and other insurance; the

costs associated with security measures and practices; industry consolidation or changes in airline alliances;

competitive pressures on pricing and on demand; our capacity decisions and the capacity decisions of our

competitors; U.S. or foreign governmental legislation, regulation and other actions (including

open skies agreements); labor costs; our ability to maintain satisfactory labor relations and the

results of the collective bargaining agreement process with our union groups; any disruptions to

operations due to any potential actions by our labor groups; weather conditions; the possibility that expected

merger synergies will not be realized or will not be realized within the expected time period; and other

risks and uncertainties set forth under Item 1A., Risk Factors of the Company’s Annual

Report on Form 10-K, as well as other risks and uncertainties set forth from time to time in

the reports we file with the SEC. Consequently, forward-looking statements should not be regarded as

representations or warranties by us that such matters will be realized. |

Building the world’s leading airline

Driving towards sufficient, sustained profitability

4

•

Global network

•

Industry leading financials

•

Capacity discipline

•

Product investment

•

Integration

•

Working together |

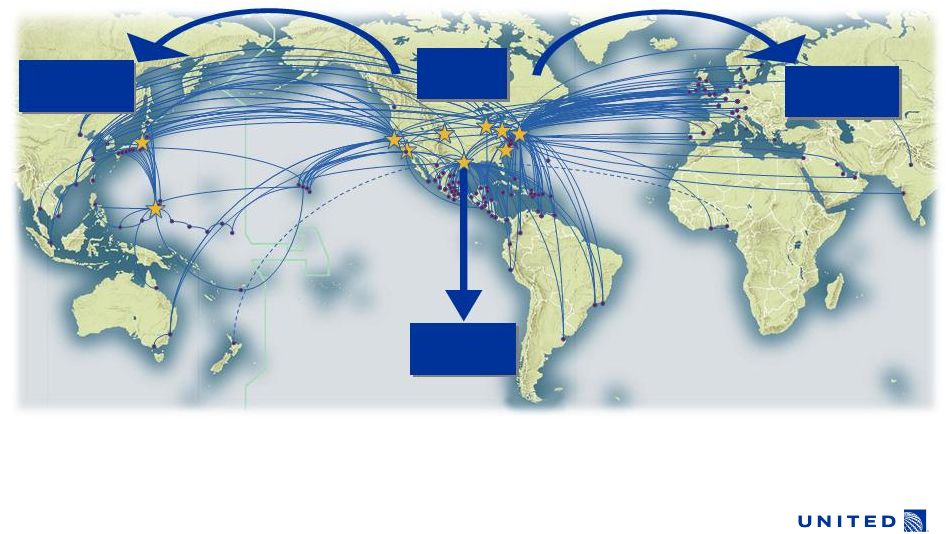

Hubs

in 4 largest U.S. cities Source: U.S. Census Bureau

|

Serving the most destinations in the U.S. |

Merger

created global network with unsurpassed scope |

Merger

created global network with unsurpassed scope |

Serving the right markets, with the right assets

#1 across the

Pacific

#2 to Latin

America

#1 in US /

Canada

Rankings by ASMs as of TME 4Q10

Source: Earnings releases and SEC filings.

#2 across the

Atlantic |

United is generating industry leading results

10

Leads network carriers

Revenue

Leads network carriers

Pre-tax

Margin

Leads network carriers

Liquidity

Exceeded cost of capital

ROIC

Metric

Result

Period: TME 2Q 2011

Industry defined as U.S. global carriers |

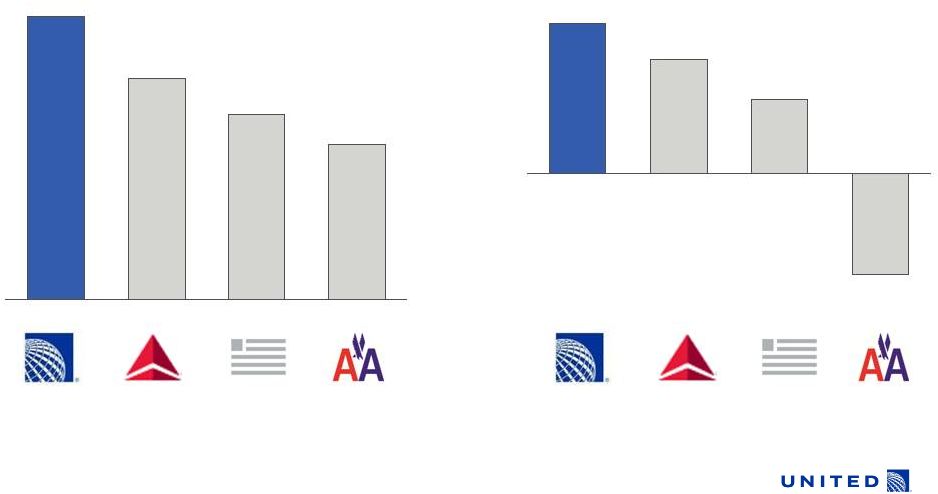

United

leads U.S. network carriers in unit revenue and margin Pre-tax

Margin 2

(TME 2Q 2011)

1. Consolidated PRASM numbers for carriers other than UAL adjusted for length of

haul versus UAL’s length of haul 2. Excludes special, one-time items

and non-cash MTM hedge gains/losses. See non-GAAP reconciliation in Appendix A; UAL results prior

to 4Q 2010 pro forma.

Source: Earnings releases and SEC filings.

-2.8%

2.1%

3.2%

4.2%

Unit Passenger Revenue

1

Growth

(TME 2Q 2011)

9.7%

8.1%

6.8%

12.4%

11 |

Committed to strengthening the balance sheet

1.

Net debt includes capitalized operating leases.

Note: Change in Debt, Capital Leases for the period 10/1/2010 through 6/30/2011;

Debt and Capital Lease prepayments for the period 10/1/2010 through

7/21/2011. Source: Earnings releases and SEC filings.

Liquidity as % of Revenue

(TME 2Q 2011)

16.7%

17.9%

22.4%

24.0%

Since closing the merger on Oct. 1, 2010:

•

Made $2.4B of debt and capital lease

payments

•

Prepaid more than $480M of debt

12

•

$1.8B of unencumbered assets, half

of which are §1110 aircraft •

$1.5B of scheduled debt payments

in 2012

|

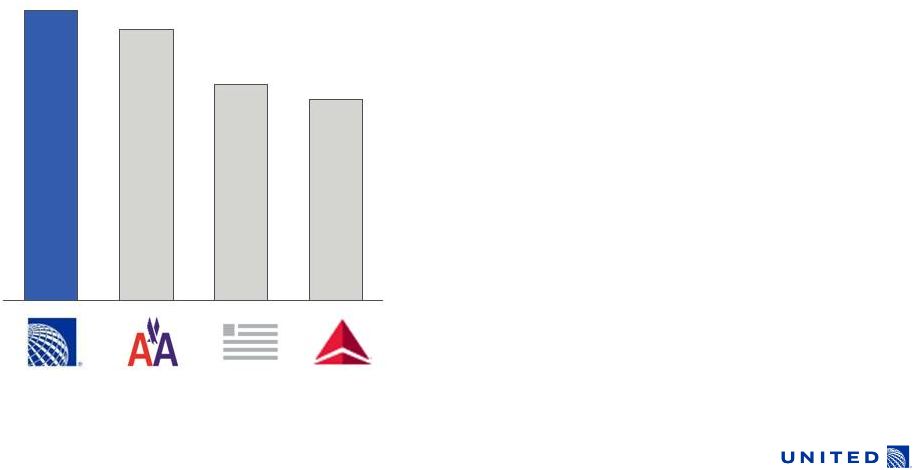

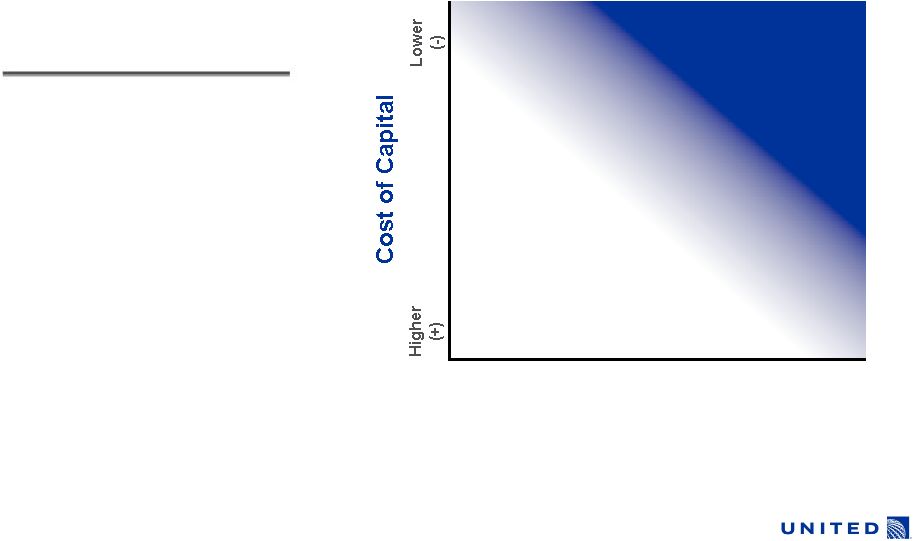

Focused on generating returns that exceed our cost of

capital over the business cycle

Return on Invested Capital

Lower

(-)

Higher

(+)

Economic

Value Added

UAL

2010

UAL

2007

UAL

2006-2010

UAL

TME 2Q11

Fleet

Strategy

Network / Route

Analysis

ROIC imbedded in

business decisions

Product

Investment

13 |

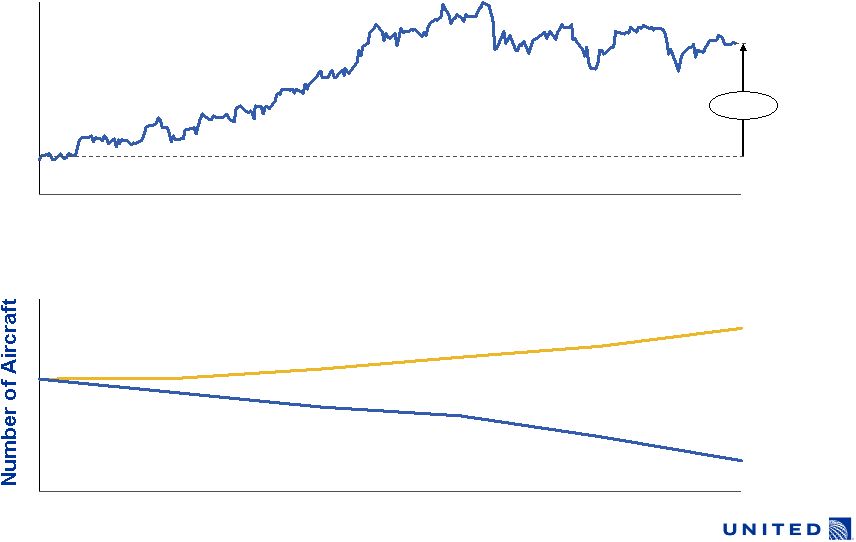

Flexible fleet permits adjustments for fuel prices

14

Mainline Fleet Flexibility

Maximum

Retirements

Maximum

Options

2010

2015E

Jet-A Fuel Prices LTM

~45%

Sept.

2010

Sept.

2011 |

Expect 2012 consolidated capacity to be flat

Reduce domestic capacity while growing international with delivery of 6

B787 Dreamliners

Expect to take delivery of 25 new, fuel efficient aircraft in 2012

19 B737-900ER & 6 B787

15

Installing EconomyPlus on Continental

Aircraft in 2012

Up to 5 more inches of space in coach |

Refreshing aircraft interiors…

Boeing Sky Interior

Nearly doubling capacity of Airbus

overhead bins

16 |

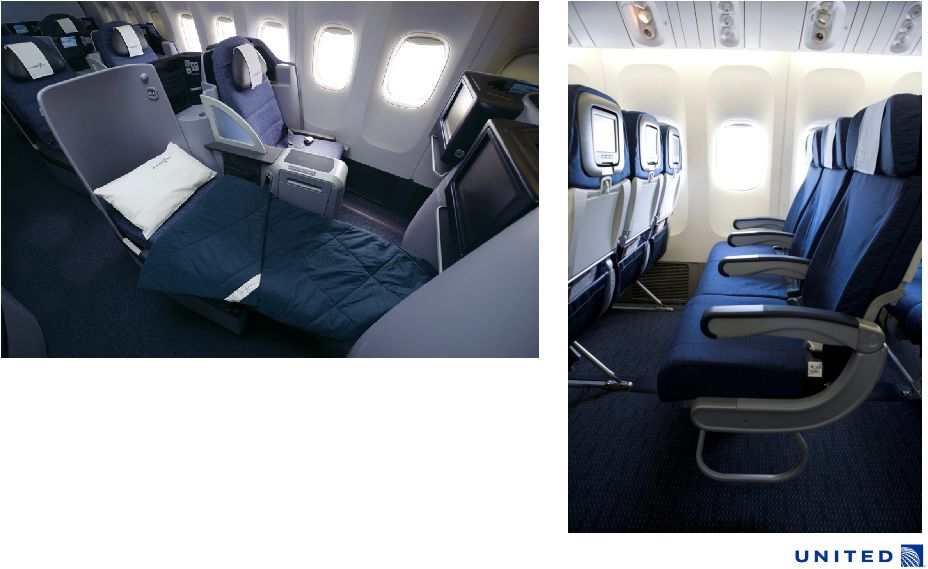

…investing in better seats…

17

•

Flat bed seats in international premium cabins

•

Full refresh of p.s. transcontinental fleet

•

Expanding EconomyPlus to Continental fleet |

…redefining United’s inflight entertainment experience.

18

WiFi & Wireless Streaming Video

In seat entertainment |

Working Together

19 |

20

Working Together

Work

Group

Flight

Attendants

Mechanics

Passenger

Service Agents

Determine Union

Representation

Bargaining

Pilots

Ramp Agents

In joint negotiations

Election not yet

requested by IAM

S-CO: No bargaining required

S-UA: In negotiations

S-CO: Agreement

S-UA: In negotiations

S-CO: Agreement

S-UA: In negotiations

S-CO: Agreement

S-UA: In negotiations

Joint negotiations upcoming

Joint negotiations upcoming

Joint negotiations upcoming |

21

Merger progressing

On track to achieve 25% of synergies in 2011

Co-branded Credit Card

Management Team

New Livery

Airport Co-location & Branding |

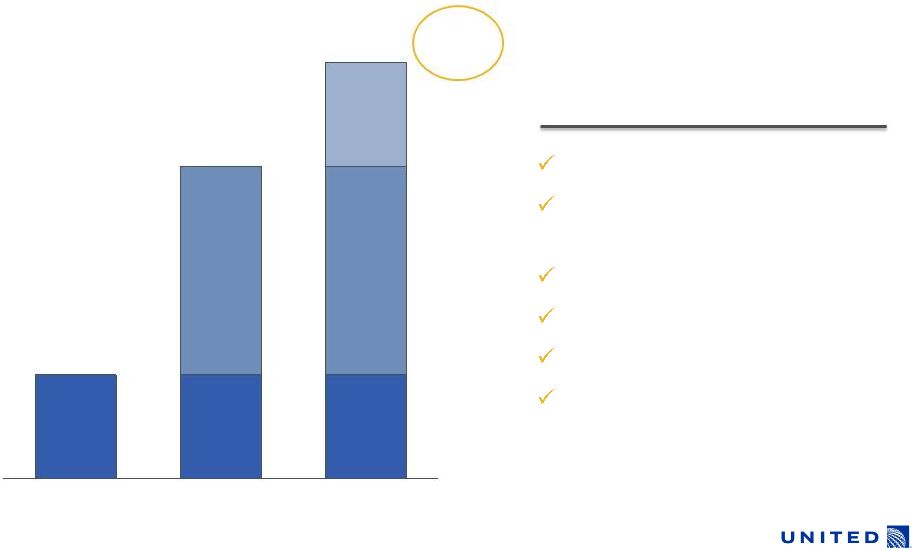

Have

captured more than $130M in synergies year-to-date On

track

to

achieve

25%

of

$1.0

–

1.2B

run

rate

synergies

in

2011

2011 Integration Success

$1.0B -

1.2B

Cross-fleeting

Completed 1/3 of airport co-

locations system-wide

Insurance

Prescription benefits

In-flight magazine

Rebranded hubs: ORD, SFO,

CLE, DEN

75%

100%

2011

2012

2013

25%

22 |

23

2012 synergy capture enabled by integration and technology

FAA Certification:

Single Operating Certificate

Technology:

Passenger Service System

Expected by year-end 2011

Expected first quarter 2012

Enables:

Enables:

•

Marketing and selling all flights

with single code

•

Joint operations once JCBAs

in place

•

Common check-in process •

Aircraft and gate optimization •

Selling ancillary products •

Single loyalty

program |

United –

the world’s leading airline

24

Fly to Win

Make Reliability a Reality

Working Together

Fund the Future |

United Continental Holdings, Inc. |

26

Appendix A

Non-GAAP Financial Reconciliation

Note: UAL 3Q 2010 results pro forma.

Twelve Months Ended

(In $M)

6/30/2011

Pre-tax Margin

Earnings / (Loss) before income taxes

$857

Add: Special items

645

Adjusted pre-tax Income (Loss)

$1,502

Total operating revenue

$35,829

Less: Special Items

(107)

Adjusted total operating revenue

$35,722

Adjusted pre-tax margin

4.2% |