Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHART INDUSTRIES INC | d231241d8k.htm |

CHART INDUSTRIES, INC. CL KING & ASSOCIATES

BEST IDEAS CONFERENCE

September 13, 2011

Exhibit 99.1 |

| Disclosure

1

Forward-Looking Statements: This presentation includes “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of

1995. The use of words such as “may”, “might”, “should”, “will”,

“expect”, “plan”, “anticipate”, “believe”,

“estimate”, “project”, “forecast”, “outlook”, “intend”, “future”, “potential” or

“continue”, and other similar expressions are intended to identify forward-looking

statements. All of these forward-looking statements are based on estimates and

assumptions by our management as of the date of this presentation that, although we believe to

be reasonable, are inherently uncertain. Forward-looking statements involve risks and

uncertainties that could cause the Company’s actual results or circumstances to differ

materially from those expressed or implied by forward-looking statements. These risks and

uncertainties include, among others, the following: the cyclicality of the markets that the

Company serves; a delay, significant reduction in or loss of purchases by large customers;

fluctuations in energy prices; changes in government energy policy or failure of expected

changes in policy to materialize; uncertainties associated with pending legislative initiatives

for the use of natural gas as a transportation fuel; competition; the negative impacts of

downturns in economic and financial conditions on our business; our ability to manage our fixed-

price contract exposure; our reliance on key suppliers and potential supplier failures or defects;

the modification or cancellation of orders in our backlog; changes in government healthcare

regulations and reimbursement policies; general economic, political, business and market risks

associated with the Company’s global operations and transactions; fluctuations in foreign

currency exchange and interest rates; the Company’s ability to successfully manage its

costs and growth, including its ability to successfully manage operational expansions and the

challenges associated with efforts to acquire and integrate new product lines or businesses; the

financial distress of third parties; the loss of key employees and deterioration of employee or

labor relations; the pricing and availability of raw materials; the regulation of our products by the

U.S. Food & Drug Administration and other governmental authorities; potential future

impairment of the Company’s significant goodwill and other intangibles; the cost of

compliance with environmental, health and safety laws; additional liabilities related to taxes;

the impact of severe weather; litigation and disputes involving the Company, including product

liability, contract, warranty, employment and environmental claims; and volatility

and fluctuations in the price of the Company’s stock. For a discussion of these and additional

risks that could cause actual results to differ from those described in the forward-looking

statements, see disclosure under Item 1A. “Risk Factors” in the Company’s most

recent Annual Report on Form 10-K and other recent filings with the Securities and Exchange

Commission, which should be reviewed carefully. Please consider the Company’s

forward-looking statements in light of these risks. Any forward-looking statement speaks only

as of its date. We undertake no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise, except as

required by law.

|

GTLS: GAS TO LIQUID SYSTEMS

Technology leader that provides high-end equipment to the energy industry,

which is the largest end-user of Chart’s products

One of the leading suppliers in all primary markets served

Global footprint for our operations on four continents with approximately 3,345

employees Worldwide earnings with approximately 60% of sales derived from

outside the U.S. Company Overview

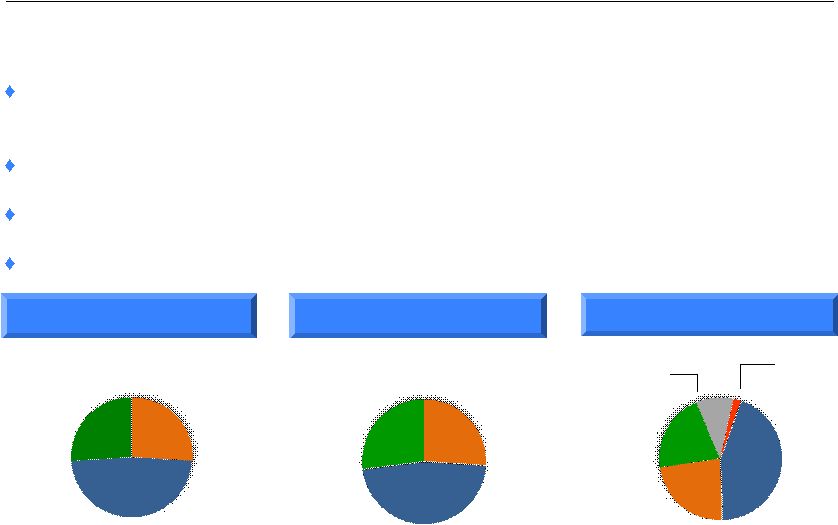

Chart Industries is a leading provider of highly engineered cryogenic equipment

for the hydrocarbon, industrial gas, and biomedical markets

Asia

21%

U.S.

44%

Americas

(Non-US)

10%

RoW

2%

Europe

23%

LTM

June 2011 Sales by Segment

Energy

47%

BioMedical

27%

General

Industrial

26%

LTM June 2011 Sales by Region

LTM June 2011 Sales by End-User

Energy &

Chemicals

26%

Distribution

& Storage

48%

BioMedical

26%

2 |

GTLS: GAS TO LIQUID SYSTEMS

Energy & Chemicals (E&C) Segment Overview

Heat Exchanger

Cold Box

Production

Heat

Exchangers

80%

Cold Boxes and

LNG VIP

20%

LTM June 2011 Sales by Product / Region

Highlights

Technology

leader

-

providing

heat

exchangers

and

cold

boxes critical to LNG, Olefin petrochemicals, natural gas

processing and industrial gas markets

–

Separation, liquefaction and purification of hydrocarbon and

industrial gases

Market

leader

–

leading

market

positions

worldwide

Manufacturing

leader

-

one

of

three

global

suppliers

of

mission-critical LNG and LNG liquefaction equipment

Selected Products

Americas

(Non-US)

15%

RoW 4%

Asia

30%

U.S.

49%

Europe

2%

3 |

GTLS: GAS TO LIQUID SYSTEMS

Distribution & Storage (D&S) Segment Overview

LTM June 2011 Sales by Product / Region

Highlights

Balanced

customer

base

-

45%

of

segment

sales

derived

from products used in energy applications

Strategic

footprint

–

manufacturing

located

near

growing

end

markets and lower-cost countries

–

Positioned to capitalize on strong expected growth in Asia and

Eastern

Europe

(supplemented

by

3

Qtr.

acquisition

in

Germany)

–

Continued investment in key global manufacturing facilities

Bulk

MicroBulk

Distribution

Storage

Selected Products

Satellite LNG

Storage

Bulk Storage

Systems

34%

Packaged Gas

Systems

31%

VIP, Systems

and Components

11%

Parts, Repair and On-

Site Service

11%

Beverage Liquid

CO

Systems

7%

LNG Terminals

and Vehicle Fuel

Systems 6%

Americas

(Non-US)

10%

RoW

2%

Asia

21%

U.S.

45%

Europe

22%

4

2

rd |

GTLS: GAS TO LIQUID SYSTEMS

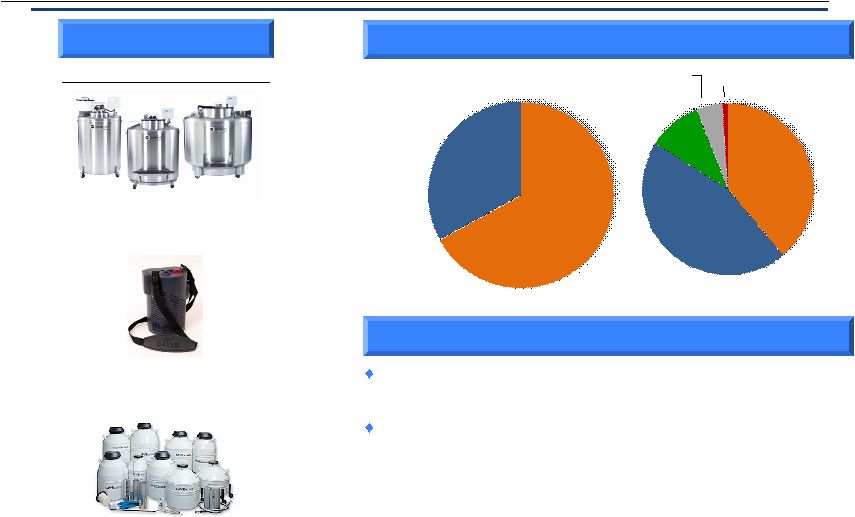

BioMedical Segment Overview

LTM June 2011 Sales by Product / Region

Highlights

Strong

growth

-

increase

in

oxygen

respiratory

therapy

and

biomedical research, led by international markets, expected

Robust end markets include:

–

Home healthcare and nursing homes

–

Hospitals and long-term care

–

Biomedical and pharmaceutical research

–

Animal breeding

Portable Oxygen

Lab Storage

Stainless Steel Freezer

End-Use Consumption

Respiratory

Therapy

Systems

67%

Biological

Storage

Systems

33%

Selected Products

Americas

(Non-US)

5%

U.S.

39%

Europe

45%

Asia

10%

RoW

1%

5 |

GTLS: GAS TO LIQUID SYSTEMS

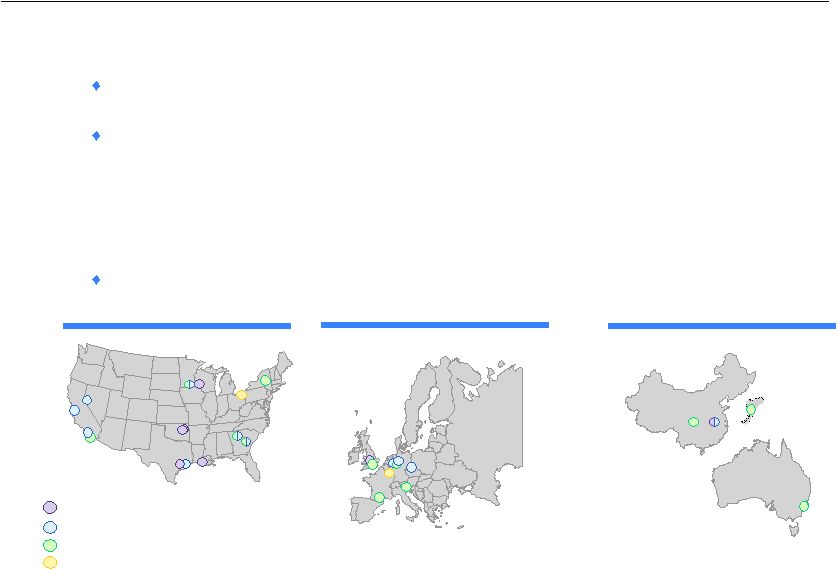

Global Manufacturing and Distribution Platform

Operating

leverage

provides

the

flexibility

to

expand

and

reduce

capacity

as

needed

with minimal capital expenditures

Major manufacturing locations include:

China,

Changzhou (D&S and E&C) and Chengdu (BioMedical)

Czech

Republic,

Decin

(D&S)

Georgia,

Canton and Minnesota, New Prague (D&S and BioMedical)

Wisconsin,

La

Crosse,

Louisiana,

New

Iberia

and

Oklahoma,

Tulsa

(E&C)

Expansion of facilities in China, Changzhou and Louisiana are currently in

process Manufacturing facilities are strategically located in lower-cost

countries and near centers of demand

Corporate

Energy & Chemicals

Distribution & Storage

BioMedical

Asia-Pacific

North America

Europe

6 |

GTLS: GAS TO LIQUID SYSTEMS

BioMedical

•Aging demographics

•

Product expansion

•

Increasing biological

research

Growth Opportunities

7

D&S

•Global LNG opportunity

•

Strong relationships with

Industrial Gas customers

•

Demand for Industrial Gas

projected to increase 8%

per year

E&C

•Global base load LNG

projects

•

Growth in natural gas

processing

•

Emerging market

opportunities |

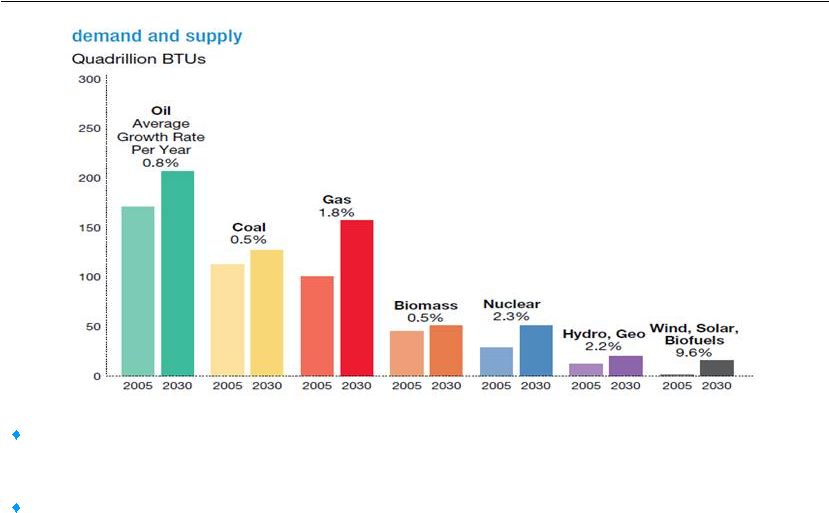

GTLS: GAS TO LIQUID SYSTEMS

Natural

gas

expansion

-

Natural

gas

demand

is

expected

to

continue

to

grow

at

a

pace

faster

than

coal

and oil, and will be heavily weighted towards emerging economies, which is expected

to drive demand for Chart’s products

LNG

growth

leader

–

The

natural

gas

industry

is

expected

to

invest

approximately

$720

billion

in

LNG

facilities from 2009 to 2035, with LNG reaching 25% of world demand in 2035 (Source: International Energy

Agency –

World Energy Outlook 2011, Golden Age of Gas Scenario)

Natural Gas Expected To Grow Globally

8

Source: ExxonMobil – Outlook for Energy, A View to 2030 |

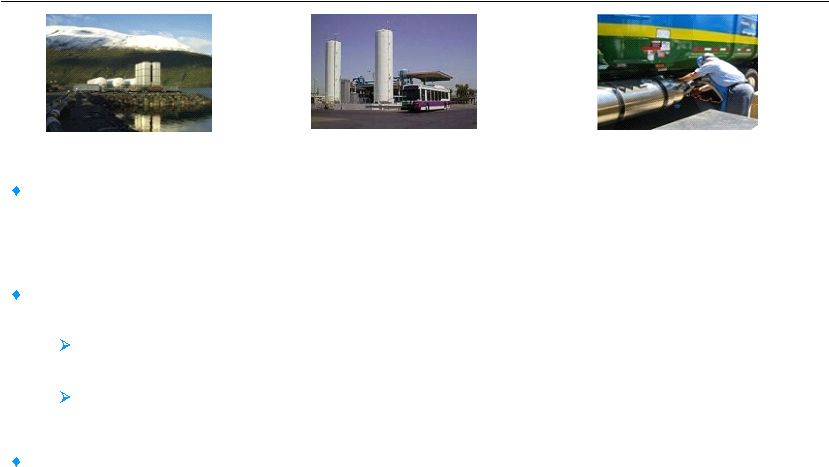

GTLS: GAS TO LIQUID SYSTEMS

Increasing

natural

gas

penetration

as

a

viable

energy

source

and

transportation

fuel

due

to

its

high

energy density, lower costs, cleaner emissions profile, and plentiful supply due to

improved drilling technologies

(e.g.

shale

gas).

U.S.

trucking

fleets

beginning

to

convert

to

natural

gas

as

a

fuel.

China’s

twelfth

5-year

plan

(2011

-

2015)

mandates

an

increase

of

gas

as

a

percentage

of

energy

consumption from less than 4% to over 8%

Dramatic

increase

in

imported

LNG

in

China

has

already

begun

and

is

expected

to

accelerate,

with aggressive investment in infrastructure, including LNG transportation and

storage equipment Lack

of

pipeline

infrastructure

in

China

requires

“virtual

pipeline”

with

LNG

Chart provides a broad offering of products and solutions for the full LNG value

chain: LNG liquefiers, transportation

equipment,

terminal

storage

equipment

and

vehicle

tanks

for

both

on-road

and

off-road

heavy duty vehicles and marine applications

LNG Value Chain Opportunities

9 |

GTLS: GAS TO LIQUID SYSTEMS

Core Competencies

Proprietary Technology

Global Platform

Financial Strength

New Products

New Segments

New Geographies

Current Platforms

E&C

D&S

BioMedical

New Platform

Business Differentiators

Growth Enablers

Value Added Acquisitions

Acquisitions Enhancing Shareholder Value

Continue investment in current platforms

-10 acquisitions since 2005

Actively seeking new business platform

10 |

GTLS: GAS TO LIQUID SYSTEMS

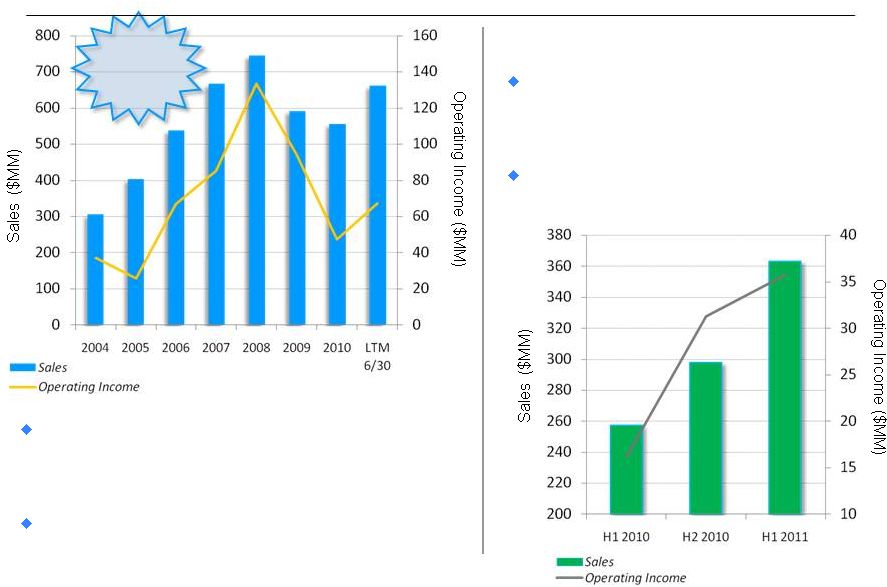

Strong Track Record of Successful Execution

¹Included in 2005 are non-recurring costs of $26.5 million for the

acquisition of Chart Industries by First Reserve

¹

During last growth cycle Company leveraged its flexible

manufacturing platform resulting in operating income

growth that outpaced sales

Flexible cost structure and good execution allowed for

aggressive response to economic downturn resulting in

higher operating income level than last cycle low point

11

Similar or higher growth, leveraged by

acquisitions, expected to occur again during the

current growth cycle

First half 2011 sales of $363.6 million continue

to ramp up significantly

Last Growth

Cycle CAGR

(2004-2008)

Sales 25%

Oper. Inc. 38%

GTLS: GAS TO LIQUID SYSTEMS |

GTLS: GAS TO LIQUID SYSTEMS

Historical Orders and Backlog

Backlog

12

Orders |

GTLS: GAS TO LIQUID SYSTEMS

Very Stable Business Model

•Attractive industry with long-term

customer relationships

•

Solid platform with worldwide

presence and leading market

positions in all segments

Summary of Investment Highlights

13

Strong Balance Sheet

•

Strong organic earnings should provide

substantial free cash flow and liquidity

•

Permit continued accretive organic /

inorganic growth

Positioned for Significant Growth

•Exploit LNG and NG growth

•

Opportunities with global

infrastructure build-out

•

New product development and

innovation

•Expanded new business and

inorganic pipeline

Chart continues to represent a unique investment opportunity to capitalize on global

energy demand, growth in natural gas use, and biomedical opportunities

Flexible / Low Cost Capital Structure

•

7 year, $250 million convertible, hedged

financing with 2% cash interest cost

•

Actively monitor financing opportunities

with a view toward cost efficiency and

financial flexibility |