Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILYSYS INC | d231303d8k.htm |

September 2011

1

Company Overview

Company Overview

Exhibit 99.1 |

Forward-looking statements & non-GAAP financial

information

Forward-looking statements & non-GAAP financial

information

2

Forward-Looking Language

This Quarterly Report contains certain management expectations, which may

constitute forward-looking information within the meaning of Section

27A of the Securities Act of 1933, Section 21E of the Securities and Exchange Act of 1934, and the Private Securities Reform Act of

1995.

Forward-looking

information

speaks

only

as

to

the

date

of

this

Quarterly

Report

and

may

be

identified

by

use

of

words

such

as

“may,”

“will,”

“believes,”

“anticipates,”

“plans,”

“expects,”

“estimates,”

“projects,”

“targets,”

“forecasts,”

“continues,”

“seeks,”

or the negative of those

terms

or

similar

expressions.

Many

important

factors

could

cause

actual

results

to

be

materially

different

from

those

in

forward-looking

information,

including,

without

limitation,

competitive

factors,

disruption

of

supplies,

changes

in

market

conditions,

pending

or

future

claims

or

litigation, or technology advances. No assurances can be provided as to the

outcome of cost reductions, expected benefits and outcomes from our recent

ERP implementation, business strategies, future financial results, unanticipated downturns to our relationships with

customers

and

macroeconomic

demand

for

IT

products

and

services,

unanticipated

difficulties

integrating

acquisitions,

new

laws

and

government regulations, interest rate changes, consequences related to the

concentrated ownership of our outstanding shares by MAK Capital,

unanticipated deterioration in economic and financial conditions in the United States and around the world or the consequences

associated with the sale of the Company’s TSG business, and uncertainties

regarding restructuring actions and the relocation of the Company’s

corporate headquarters. The Company does not undertake to update or revise any forward-looking information, even if events

make it clear that any projected results, actions, or impact, express or implied,

will not be realized. Other potential risks and uncertainties that may cause

actual results to be materially different from those in forward-looking information are

described in “Risk Factors,”

which is included in Part I, Item 1A of the Company’s Annual Report for the

fiscal year ended March 31, 2011. Use of Non-GAAP Financial

Information To supplement the unaudited condensed consolidated financial

statements presented in accordance with U.S. GAAP in this presentation,

certain non-GAAP financial measures as defined by the SEC rules are

used. Management

believes

that

such

information

can

enhance

investors'

understanding

of

the

Company's

ongoing

operations.

The

non-GAAP

measures included in this presentation have been reconciled to the comparable GAAP

measures within an accompanying table, shown on the last page of this

presentation. |

Agilysys: overview

Agilysys: overview

Agilysys: overview

Quick Facts

Summary

•

Leading developer and marketer of proprietary enterprise software, services and

solutions to the hospitality and retail industries

•

Two

reportable

businesses:

Hospitality

Solutions

Group

(“HSG”)

develops

and

markets

proprietary

software

for

hospitality

markets

and

Retail

Solutions

Group

(“RSG”)

is a system integrator of store front technology for retailers

Formed:

1963

Ticker symbol:

AGYS (NASDAQ)

Market capitalization:

~$200 million

Capital structure as of 6/30/11:

Debt-free

Fiscal 2011 sales

1

:

$201 million

Markets served as % of revenue:

94% North America

6% Asia and Europe

Employees:

800

Corporate HQ:

Solon, Ohio (relocating to Alpharetta, GA)

(1) March 31

st

fiscal year: excludes TSG which was divested 7/31/11

3 |

Vision and Mission

Vision and Mission

•

Extend customer brand through effective business system

design, implementation and support

•

End-to-end guest centric business system

•

Win guest recruitment against competition

•

Maximize guest experience and revenue opportunity

•

Extend on-premise experience to pre/post stay

4 |

We

Are An Exciting Company We Are An Exciting Company

•

Big enough to be a relevant, credible competitor

•

Small enough to make quick decisions, execute and disrupt the market to

our

advantage

and

in

the

customers’

favor

•

Intriguing partner for our customers

•

Board and management team commitment to business and product strategy

•

Operating plan, business strategy and use of capital

•

Personnel have deep understanding of technology in hospitality and retail

verticals

•

Keen understanding of how our markets use technology in their businesses

•

Our personnel are tops in their field, we are investing behind this

expertise 5 |

Focused Strategy

Focused Strategy

•

Closed divestiture of Technology Solutions Group (TSG) business to OnX

Enterprise Solutions on August 1st

•

Net proceeds expected to be $55.7M

•

Net proceeds remain subject to downward working capital adjustment

•

Strategic emphasis focuses on improving business performance, making

select investments and returning capital to shareholders

•

Streamlining operations and reducing corporate expenses, including

facilities’ footprint

•

Relocating corporate headquarters to Alpharetta, Georgia

•

Reduce corporate costs and reposition support closer to key revenue-producing

locations

•

Executing

plan

to

reduce

annual

“run-rate”

SG&A

by

$14M

to

$16M,

expected

to

be realized beginning in FY13

•

Estimated

restructuring

costs

are

$16M

to

$18M

—

expect

to

be

primarily

recognized in FY12

•

Announced repurchase up to 1.6 million (approximately 7%) of outstanding

shares 6

Shareholder value to be driven by improved operating performance while focusing on

the market opportunities in the hospitality and retail industries

|

Agilysys Hospitality Solutions

Agilysys Hospitality Solutions

•

Hospitality customers can rely

on HSG to deliver:

•

Enterprise applications

•

Hardware enabling our complete

array of enterprise applications

•

Recurring services such as

software maintenance and

hosting or SaaS offerings

•

Implementation and training

services as well as help desk

support

7 |

Document

Management Central Reservation

Mobility

•

G360 capabilities

•

Acquisition

•

POS (IG Roam)

•

PMS (iPad enabled)

•

RSG (mPOS)

Titles We Own

Titles We Own

Property Management

Inventory & Procurement

Point of Sale

8 |

Product challenges

Product challenges

•

Current state

•

Complete business system composed of discrete products from single

or multiple vendors, integration is interface dependent

•

Customer data housed in disparate data sources, integrated via

reporting, limited actionable outcomes

•

Future state —

opportunity for convergence of point products

to an enterprise solution including:

•

Application featuring CRS/PMS/POS/IP/Sales & Catering/Spa/Golf

•

Platform with common elements used by all applications

•

Mobility

becomes

part

of

the

platform,

with

capability

to

extend

guest

reach beyond the property

9 |

HSG

Markets Served HSG Markets Served

Gaming

Hotels & Resorts

Restaurants

Cruise Lines

Food Service

Stadiums & Arenas

10 |

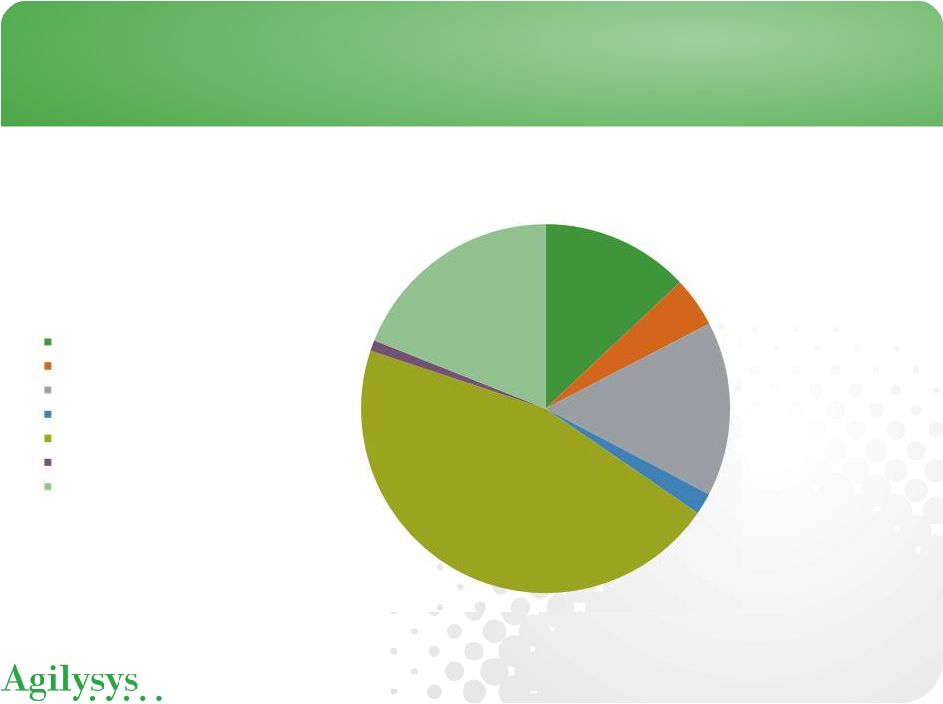

HSG

Revenue Profile HSG Revenue Profile

11

13%

4%

15%

2%

46%

1%

19%

HSG Revenue Mix

Software

-

Proprietary

Software

-

Remarketed

Services

-

Proprietary

Services

-

Remarketed

Support

-

Proprietary

Support

-

Remarketed

Hardware |

Agilysys Retail Solutions

Agilysys Retail Solutions

•

Agilysys Retail Solutions provides:

•

Integration of end-to-end in-store technology solutions

•

Unparalleled expertise in POS and Mobility solutions

•

Personnel with an average of 18 years experience in the retail market

•

Agilysys Retail Solutions is:

•

Solution partner for IBM Retail Store Solutions receiving the IBM RSS

Excellence Award for 16 consecutive years (since the award’s

inception)

•

Large Motorola Enterprise Mobility Solutions Partner and also one of

Motorola’s largest Enterprise Mobility Wireless (WLAN) Partners

•

Verifone Premier Partner

12 |

Agilysys Retail Solutions

Agilysys Retail Solutions

•

Lifecycle management of

store-centric business

systems

•

Higher ROI and lower TCO

•

Servicing the needs of

smart consumers

•

Point-of-Sale

•

Customer Self-Service

•

Mobile Point-of-Service

•

Mobile Store Managers

•

Mobile Store Associates

13 |

RSG

Markets Served RSG Markets Served

Grocery

Chain Drug Stores

General and Specialty Retail

Quick Serve Restaurants

Convenience Stores

14 |

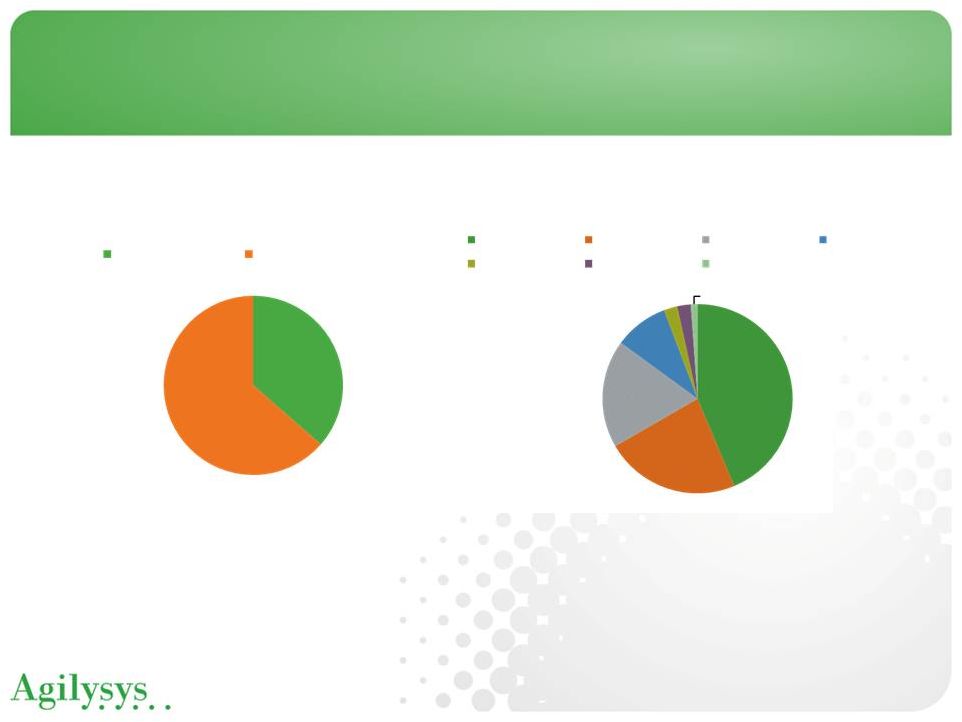

RSG

Revenue Profile RSG Revenue Profile

15

44%

23%

19%

9%

2%

2%

1%

Proprietary Services Revenue Mix

Dedicated Support

System Integration

Managed Services

Contracted R&D

Depot Support

Help desk

Consulting

36%

64%

RSG Revenue Mix

Proprietary services

Re

-

market HW/SW/Services

The percentages represented on this chart are approximate values based on TTM revenue. |

Strategic Opportunity

Strategic Opportunity

•

Hoteliers and retailers demand lower operating costs, while enhancing

guest experience, driven by their investments in business systems

•

Deliver deeper value through “personalization”

of guest experience

•

No clear end-to-end hospitality solution exists

•

Hotels and resorts desire to be hub of guest travel experience

•

Retailers seeking mobility solutions to drive richer guest experience

•

Key strategic initiatives

•

Product integration

•

Capability development

•

Investment prioritization

•

Partner expansion

16 |

Appendix

Appendix

17 |

FY

2011 & 2010 Segment Financial Information FY 2011 & 2010 Segment

Financial Information 18

Corporate/

Corporate/

(In thousands)

HSG

RSG

TSG

Other

Consolidated

HSG

RSG

TSG

Other

Consolidated

Total revenue

$24,814

$22,015

$ 97,145

$ -

$ 143,974

$92,839

$109,147

$474,052

$ -

$ 676,038

Elimination of intersegment revenue

(26)

(171)

-

-

(197)

(92)

(476)

-

-

(568)

Revenue from external customers

$24,788

$21,844

$ 97,145

$ -

$ 143,777

$92,747

$108,671

$474,052

$ -

$ 675,470

Gross margin

$15,821

$ 3,958

$ 16,546

$ -

$ 36,325

$54,669

$ 20,970

$ 82,052

$ -

$ 157,691

Gross margin percentage

63.8%

18.1%

17.0%

25.3%

58.9%

19.3%

17.3%

23.3%

Operating income (loss)

$ 1,622

$ (520)

$(41,288)

$ (6,763)

$ (46,949)

$ 6,030

$ 3,369

$(31,736)

$(32,099)

$ (54,436)

Other income, net

-

-

-

(43)

(43)

-

-

-

(2,320)

(2,320)

Interest expense, net

-

-

-

352

352

-

-

-

1,171

1,171

Income (loss) from continuing operations before income taxes

$ 1,622

$ (520)

$(41,288)

$ (7,072)

$ (47,258)

$ 6,030

$ 3,369

$(31,736)

$(30,950)

$ (53,287)

Other information:

Capital expenditures

$ 1,249

$ 1

$ 45

$ 26

$ 1,321

$ 3,760

$ 623

$ 914

$ 1,694

$ 6,991

Other charges:

Depreciation and amortization - non-cash (1)

$ 1,091

$ 203

$ 329

$ 1,771

$ 3,394

$ 4,297

$ 449

$ 2,881

$ 5,987

$ 13,614

Asset impairment charges - non-cash

900

-

36,762

-

37,662

959

-

36,762

-

37,721

Restructuring charges

-

-

790

(1)

789

-

-

790

405

1,195

Total

$ 1,991

$ 203

$ 37,881

$ 1,770

$ 41,845

$ 5,256

$ 449

$ 40,433

$ 6,392

$ 52,530

Corporate/

Corporate/

HSG

RSG

TSG

Other

Consolidated

HSG

RSG

TSG

Other

Consolidated

Total revenue

$21,313

$25,373

$ 89,295

$ -

$ 135,981

$83,361

$110,506

$440,887

$ -

$ 634,754

Elimination of intersegment revenue

(33)

(91)

(9)

-

(133)

(206)

(155)

(73)

-

(434)

Revenue from external customers

$21,280

$25,282

$ 89,286

$ -

$ 135,848

$83,155

$110,351

$440,814

$ -

$ 634,320

Gross margin

$13,374

$ 5,840

$ 16,613

$ -

$ 35,827

$51,463

$ 23,326

$ 87,501

$ (763)

$ 161,527

Gross margin percentage

62.8%

23.1%

18.6%

26.4%

61.9%

21.1%

19.8%

25.5%

Operating income (loss)

$ 2,220

$ 737

$ (1,531)

$ (7,639)

$ (6,213)

$ 7,666

$ 5,759

$ 9,407

$(29,669)

$ (6,837)

Other income, net

-

-

-

(213)

(213)

-

-

-

(6,176)

(6,176)

Interest expense, net

-

-

-

278

278

-

-

-

939

939

Income (loss) from continuing operations before income taxes

$ 2,220

$ 737

$ (1,531)

$ (7,704)

$ (6,278)

$ 7,666

$ 5,759

$ 9,407

$(24,432)

$ (1,600)

Other information:

Capital expenditures

$ 1,041

$ -

$ 41

$ 2,552

$ 3,634

$ 4,694

$ 31

$ 103

$ 8,478

$ 13,306

Non-cash charges:

Depreciation and amortization (1)

$ 1,029

$ 55

$ 839

$ 1,266

$ 3,189

$ 4,337

$ 198

$ 6,418

$ 4,876

$ 15,829

Asset impairment charges

-

-

55

-

55

90

-

55

148

293

Restructuring charges

-

-

-

78

78

-

-

-

823

823

Total

$ 1,029

$ 55

$ 894

$ 1,344

$ 3,322

$ 4,427

$ 198

$ 6,473

$ 5,847

$ 16,945

(1) Does not include the amortization of deferred financing fees totaling $131 and $139 for the three

months ended March 31, 2011 and 2010, respectively, and $524 and $485 for the year

ended March 31, 2011 and 2010, respectively.

Year Ended March 31, 2011 (Unaudited)

Reportable Segments

Year Ended March 31, 2010

Reportable Segments

Reportable Segments

Reportable Segments

Three Months Ended March 31, 2011 (Unaudited)

Three Months Ended March 31, 2010 (Unaudited) |