Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STRATEGIC HOTELS & RESORTS, INC | d8k.htm |

Exhibit 99.1

STRATEGIC HOTELS & RESORTS, INC. (NYSE: BEE) is an owner and asset manager of world-class hotels and resorts in North America and Europe. We were founded on the principles of disciplined asset management and value creation, employing a life-cycle driven portfolio approach. The company currently owns or has investments in 17 hotels with a total of 7,762 rooms.

CORE STRENGTHS:

| • | Portfolio of premiere hotel properties in high barrier-to-entry markets with no new supply creates a strong inherent underlying real estate valuation, trading well below estimated replacement cost. |

| • | Best in class asset management capabilities backed by operating systems which provide cost controls and revenue enhancement and complement the hotel brand managers’ capabilities and systems. |

| • | A restructured balance sheet with virtually all debt maturities extended to 2013 and beyond, providing liquidity and stability throughout the near term economic volatility. |

| • | Management team with more than 150 years combined hotel and REIT experience with broad industry relationships that enhance operating performance and investment opportunities. |

KEY FINANCIAL DATA:

| Six Months Ended June 30th | ||||

| ($ IN MILLIONS except per share results) |

2011 | 2010 | ||

| Consolidated Revenue |

$380.0 | $332.9 | ||

| Comparable EBITDA |

$71.2 | $60.2 | ||

| Comparable FFO / Share |

$0.03 | ($0.07) | ||

| NORTH AMERICAN HOTELS |

2011 | 2010 | ||

| Occupancy |

69.8% | 64.7% | ||

| ADR |

$231.47 | $223.70 | ||

| RevPAR |

$161.49 | $144.67 | ||

| Total RevPAR |

$304.91 | $274.54 | ||

| Property EBITDA Margin |

20.5% | 17.6% | ||

| Note: | North American Hotel comparisons include 11 properties and are derived from the Company’s hotel portfolio at June 30, 2011, consisting of properties located in North America and held for five or more quarters. |

PORTFOLIO MAP:

TO OUR SHAREHOLDERS:

The United States economy has behaved in unprecedented ways these past few years. The “Great Recession” of 2008-2009 has been followed by a relatively slow and jobless recovery. As we write this letter in late summer of 2011, the markets continue to be very volatile with an uncertain outlook for, at least, the coming year. We are not alone in remaining concerned about the overall economy and the political climate in this country, as well as the attendant linkage with global economic factors. However, our single-minded concentration is on our core business, the circumstances within our control, and ensuring we are able to nimbly and adeptly react to constantly changing and evolving circumstances. We remain cautiously optimistic that the economy will continue a slow recovery and are confident that the high-end business traveler and consumer will be more immune to the volatility inherent in the current environment. The luxury hotel industry has experienced six consecutive quarters of increasing hotel room demand to levels above previous peak room night demand. Corporate earnings and cash held on many corporations’ balance sheets are at record levels, with our portfolio experiencing a strong rebound in corporate group business and positive momentum in future group pace. However, hotel room demand is approximately 80% correlated to GDP and a double dip recession would inevitably have a significant negative impact on the hotel industry.

UNMATCHED ASSET MANAGEMENT CAPABILITIES:

At Strategic Hotels & Resorts, our strategy and mission are crystal clear. We are singularly focused on developing, evolving and applying the best asset management techniques to our unique and irreplaceable properties. We are a premiere owner and operator of luxury and upper upscale hotels and resorts, primarily in North America. The quality of our portfolio is unmatched in the public markets with 17 hotels containing 7,762 rooms, in geographic locations that have both de minimus new supply and very high barriers to entry for additional product in our market niche. Our hotels are managed by world renowned hotel operating brands, including Four Seasons, Ritz-Carlton, Fairmont, InterContinental, Marriott, Westin, Hyatt and Loews. We have outstanding relationships with the hotel operating companies, despite demanding more from them than any other owner in the industry. We continually develop and implement “state of the art” asset management programs including industrial engineered staffing and purchasing, tailored consumer market research, yield management and revenue enhancement. Through these and other initiatives, we are able to achieve the highest relative profitability from our hotels, and our success is widely credited

to our asset management skills and productive relationships with our hotel operators.

We view our hotels as “mixed use” properties where the hotel rooms are the “anchor tenants.” We maximize the revenue and profitability not only through operations, but also through creative utilization of the available square footage in every hotel. We have a consistent history of implementing ROI projects that maximize the use of space and enhance the EBITDA contribution from each property. These projects include room expansions, ballroom and meeting space additions, increasing retail store capacity, high-end spa facilities, and myriad other inventive and profitable uses of space.

Another of our widely regarded strengths is the success of the critical food and beverage component in each of our hotels. In recent years, we have upgraded dining options in a number of our hotels, including the addition of three Michael Mina Bourbon Steak restaurants, three Richard Sandoval gourmet restaurants and the newly-opened Michael Jordan’s Steak House in the InterContinental Chicago. Our food and beverage strategy is not confined to first class on-site restaurants, but also includes the significant catering and banquet services that win critical acclaim from our group business and other catering customers, including weddings and charity events.

Heading into 2008, our management team anticipated a recession and reacted quickly with appropriate measures that cut costs while preserving the guest experience. Importantly, we have maintained the cost containment discipline at our hotels despite the increase in room night demand and occupancy gains over the past several quarters. We have specific agreements in place for each hotel requiring our approval for any increase in salaried staff as the recovery continues. As an example of the systemic changes we have initiated across our portfolio, the number of hotel level management employees is still 21% lower than peak levels

prior to 2008. We will rigorously maintain this cost discipline through the coming years, regardless of what the economic cycles have in store.

Through our operations and industry leading asset management capabilities, we excel in the total customer experience from the elegant and functional bedrooms, excellent food and beverage offerings, spa facilities and many other amenities we provide in each of our properties. The results are proven through the highest RevPAR among all public hotel companies, top market share among our competitive set in virtually every market in which we operate, and industry leading EBITDA-growth-to-RevPAR-growth ratio, which has been in the 2.5 to 3.5 times range over the trailing five quarters. These metrics clearly demonstrate that our asset management culture provides enhanced profitability and shareholder return.

BALANCE SHEET RESTRUCTURING:

As luxury and high-end hotels were more severely affected during the economic downturn, our company’s leverage became higher than our peers during the recession. The “AIG effect” caused businesses to reject hosting meetings at resorts and luxury hotels, and even wealthy consumers spent money more modestly. As a result, our same store EBITDA declined by nearly 45%, increasing our peak net debt to EBITDA to over 14 times as of year-end 2009. We had always managed the balance sheet to fund acquisitions with roughly 50% debt and 50% equity. The significant decline in EBITDA and later cycle acquisitions resulted in higher leverage than management felt was appropriate. In order to materially reduce this leverage position, we aggressively implemented a series of transactions and capital markets activities to restructure the balance sheet and achieve a better leverage ratio within a truncated time period. Since January 2010, the series of transactions executed by management include:

| • | The sales of the InterContinental Prague and Marriott Paris Champs-Elysees hotels, and our 50% stake in BuyEfficient, raising approximately $70 million in net proceeds, while eliminating approximately $140 million in consolidated, secured debt. |

| • | Raising approximately $545 million in additional common equity through a public secondary offering ($332 million), the issuance of shares to fund the acquisition of two Four Seasons hotels plus a PIPE with The Woodbridge Company Ltd., the sophisticated Canadian investment vehicle for the Thomson family ($145 million), and the purchase of the Government of Singapore’s (GIC) joint venture position in the InterContinental Chicago for stock ($70 million). |

| • | Retiring $180 million in unsecured, fully recourse convertible notes. |

| • | Successfully restructuring and recapitalizing the Hotel del Coronado and the Fairmont Scottsdale Princess loans, and attracting new equity partners including the Blackstone Group and Walton Street Capital, respectively. |

| • | Securing a new $300 million line of credit (plus an accordion feature of $100 million), reducing the number of lenders in the bank syndicate from 21 to 10, and achieving more favorable pricing and financial covenants than the previous line of credit with an ultimate maturity date of 2015. |

| • | Refinancing property level mortgage loans on six individual hotels, extending maturities out through 2021. |

Importantly, management determined in early 2011 that it would be an unnecessary risk to depend on the credit markets remaining liquid in the latter part of 2011 and into 2012, when the bulk of the company’s debt originally matured. We made a very deliberate and strategic decision to de-risk our balance sheet by accelerating the refinancing of all the 2011 and 2012 debt maturities(1) and take advantage of the open credit markets during the first part of the year. In addition, we concluded that the best strategy was to negotiate a new line of credit that would allow the release of the Four Seasons Washington, D.C. hotel from the credit line borrowing base, substituting the Ritz-Carlton Half Moon Bay hotel as the alternate security. We implemented a competitive and timely process to finance four hotels: InterContinental Miami, InterContinental Chicago, Four Seasons Washington, D.C. and Loews Santa Monica. By the end of July, every hotel level maturity and the line of credit had been closed with new loans at very attractive terms. The last loan closed on July 28th, as the credit markets were shutting down in advance of the U.S. debt ceiling deadline of August 2nd.

| (1) | The company chose not to early refinance the mortgage loan on the Hyatt Regency La Jolla, owned in a joint venture with GIC, with the maturity date remaining in September 2012. |

Our proactive debt refinancing strategy has positioned us extremely well and our timing truly could not have been more fortuitous.

The end results from our recently executed debt strategy include:

| • | Raising net proceeds of $64 million. |

| • | Reducing exposure to CMBS debt from 57% to 31% of total mortgage debt, and having a roughly equal balance of CMBS, bank and insurance company mortgage debt. |

| • | Currently having zero outstanding on our $300 million line of credit and approximately $100 million in unrestricted cash, providing ample liquidity. |

| • | Maintaining the Four Seasons Jackson Hole and Four Seasons Silicon Valley as unencumbered assets representing additional liquidity. |

| • | Reducing our net debt to EBITDA ratio from 14.3 times at year-end 2009, to approximately 7 times, pro forma for year-end 2011. |

| • | Extending and staggering debt maturity dates over a 10 year period, with no more than 22% of debt maturing in a single calendar year. |

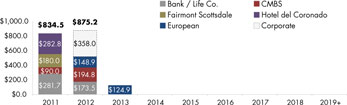

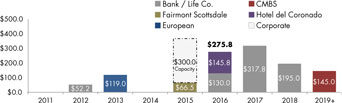

The success of our balance sheet restructuring and overall debt financing strategy is illustrated in the following tables which highlight the debt maturities at January 1, 2010, as compared to July 31, 2011.

DEBT MATURITY SCHEDULE (in millions)

January 1, 2010

July 31, 2011(1)

| (1) | Note: Assumes all extension options exercised. |

As of the date of this letter, the company has approximately $77 million in accrued preferred dividends, representing 10 quarters of accrual through June 30, 2011, since the suspension of the preferred dividend payments at the end of 2008. The board of directors and management will review the appropriate time to pay the accrued dividends, and reinstate the quarterly preferred dividend payments, based on the overall economic environment. The company has structured its liquidity position and debt maturity schedule to fund the preferred dividends when the board deems it appropriate to declare the dividend payments.

THE FUTURE:

The hotel industry is in the sixth consecutive quarter of increasing room demand. Our portfolio operates in a stabilized environment with roughly 50% group demand and 50% transient room nights. Group pace is significantly improving with an 11.5% increase in group room revenue for the first half of 2011, as compared to the prior year. Regarding group pace, 2007 is often referred to as the peak year for group business and in the second quarter of that year our same store portfolio booked approximately 65,000 group room nights in the year for the year (“ITYFTY”). For the same period in 2011, we booked 82,000 ITYFTY group room nights. Although this is merely a snapshot in time, it indicates a significant trend in the healthy pace of recovery for group bookings. Transient travel, from both the corporate and leisure customer, has also been consistently increasing. The combined result has been an increase in total occupancy from 66.4% at year-end 2009 to 74.8% at the end of the second quarter of 2011, a strong indication of increasing demand.

Our optimism regarding the continued strengthening of our financial results is tied to several factors. First, there is no new competitive supply of luxury or high-end hotels and resorts in our markets. To recreate a hotel of our quality would reasonably take a four to six year development period, from the permitting to grand opening stage. This lack of new supply, which has not existed in any previous recovery cycle, bodes well for future RevPAR growth. In the past two recovery cycles, for example, luxury RevPAR growth totaled 8% on a compound annual growth basis. We could realistically experience even higher RevPAR growth, heavily weighted towards rate increases given the dearth of new construction.

In addition, the cost containment discipline we have instituted, along with higher flow-through from ADR increases, should lead to higher margins. During peak performance, our EBITDA margins were 26%. In 2010, our same store EBITDA margin was 20%. Our goal is to achieve margins in excess of our peak range as the market fully recovers and our fixed

cost reductions remain permanent. These enhanced margins will further prove the uniqueness of our asset management.

While the past does not always guarantee future performance, several key financial metrics remain well below our peak performance in our same store portfolio. Group demand is 18% below peak, RevPAR is 14% lower than peak, and EBITDA is 27% below the peak same store performance. This indicates significant embedded growth in our existing portfolio, without the acquisition of any new assets.

Our hotel properties are in impeccable condition as we continued to invest in each hotel through the annual FF&E reserves and owner funded capital throughout the downturn. We have no deferred capital expenditure needs. However, we do have a significant inventory of ROI driven capital expenditure projects which will enhance the return of each hotel and contribute towards maximizing our earnings.

We will evaluate acquisitions and dispositions as opportunities arise, while maintaining a rigid discipline and criteria for capital allocation. We will not dilute the quality of our portfolio and will remain consistent with our well-defined qualitative and quantitative investment criteria. We have proven that our stock is an attractive currency, when appropriately valued, to be utilized for acquisitions as an effective way to fund future external growth. The good news is that we don’t have to buy anything. We can grow organically, while managing costs and maximizing margins.

Our balance sheet restructuring is complete, allowing us to be opportunistic in considering new transactions. We succeeded in this deliberate restructuring, which we typically refer to as Strategic 2.0; a full 12 to 18 months ahead of our original timetable, and with excellent timing given the reversal in the capital markets in August 2011.

We believe we have the most pristine and clearly defined portfolio and targeted strategy of any hotel REIT. No company or management team knows and operates luxury and high-end hotels and resorts better than we do. We say this not

out of hubris, but rather to highlight that we recognize our strengths, and we will not stray from our core competencies. In our opinion (biased that it naturally is), there is not a better single, pure play investment in the hotel sector.

While we remain concerned about the global and U.S. economies, we continue to manage and lead from a position of strength and focus on the areas within our control. We are nimble, flexible and have a proven and highly experienced management team. We have the highest quality public company hotel portfolio, a well-capitalized and restructured balance sheet, an outstanding board of directors, and significant runway for earnings growth. With an irreplaceable portfolio of high-end hotel assets trading well below replacement cost, we look forward to continuing to create significant shareholder value through our ongoing operations, capital allocation and creative thinking that are the hallmarks of Strategic Hotels & Resorts.

Sincerely,

Laurence S. Geller

President and Chief Executive Officer

Diane M. Morefield

Executive Vice President and

Chief Financial Officer

BOARD OF DIRECTORS:

Raymond L. Gellein, Jr., Chairman

Robert P. Bowen

Kenneth Fisher

Laurence S. Geller

James A. Jeffs

Richard D. Kincaid

Sir David M.C. Michels

William Prezant

Eugene F. Reilly

EXECUTIVE OFFICERS:

Laurence S. Geller, President and

Chief Executive Officer

Diane M. Morefield, Executive Vice President and

Chief Financial Officer

Richard J. Moreau, Executive Vice President,

Asset Management

Stephen M. Briggs, Senior Vice President,

Chief Accounting Officer

Paula C. Maggio, Senior Vice President, Secretary

and General Counsel

ANALYST COVERAGE:

Bank of America Merrill Lynch

Andrew Didora

Deutsche Bank

Carlo Santarelli

Green Street Advisors, Inc.

Enrique Torres

JMP Securities

Will Marks

JP Morgan

Joseph Greff

Keefe, Bruyette & Woods

Smedes Rose

Raymond James & Associates

William Crow

Robert W. Baird & Co.

David Loeb

Wells Fargo

Jeffrey Donnelly

CORPORATE HEADQUARTERS:

200 West Madison Street, Suite 1700

Chicago, IL 60606

(312) 658-5000

INVESTOR CONTACT:

Jonathan P. Stanner

Vice President, Capital Markets and Treasurer

(312) 658-5000

info@strategichotels.com

www.strategichotels.com

LISTED SECURITIES:

NEW YORK STOCK EXCHANGE

BEE - Common Stock

BEE.A - Series A Preferred Stock

BEE.B - Series B Preferred Stock

BEE.C - Series C Preferred Stock

Property Images (in order shown)

Hotel del Coronado — Coronado, CA

Michael Jordan’s Steak House, Intercontinental Hotel - Chicago, IL

Fairmont Scottsdale Princess — Scottsdale, AZ

Four Seasons Resort — Jackson Hole, WY

Ritz-Carlton Half Moon Bay - Half Moon Bay, CA

Four Seasons Hotel — Washington D.C.

Four Seasons Hotel — Washington D.C.

This document contains forward-looking statements concerning the current economic climate, hotel performance, future demand, hotel property values and new competition that are subject to risk and uncertainty. Reference is made to “Risk Factors” in the company’s Form 10-K annual report for the year ended December 31, 2010, and subsequent quarterly reports on Form 10-Q, for discussion of certain factors, including conditions in the hotel industry, the economic climate and the financial markets, that might cause actual results to differ materially from those set forth in the forward-looking statements. We undertake no obligation to update any forward-looking statements to reflect future events. Reconciliation for non-GAAP measures can be found in the Supplemental Financial Information contained in the company’s Form 8-K filed August 3, 2011.