Attached files

| file | filename |

|---|---|

| 8-K - EASTERN INSURANCE HOLDINGS INC--FORM 8-K - Eastern Insurance Holdings, Inc. | d8k.htm |

Keefe,

Bruyette & Woods 2011 Insurance Conference September 7, 2011

Eastern Insurance Holdings, Inc.

NASDAQ: EIHI

Michael Boguski

President and Chief Executive Officer

and

Kevin Shook

Executive Vice President, Treasurer and Chief Financial Officer

Exhibit 99.1 |

Page

2 Michael

Boguski

President

and

Chief

Executive

Officer |

Page

3 Review of 2010 EIHI Strategic Initiatives

•

EIHI strategic plan focused on driving the organization to a pure specialty

workers’

compensation platform

•

A.M. Best Company financial rating upgrade of workers’

compensation

companies to “A”

(excellent) with a stable outlook in a very difficult

insurance

market

place

(Q2

–

2010)

•

Closed sale of the group benefits insurance subsidiary, Eastern Life and

Health

to

Security

Life

Insurance

Company

of

America

(Q2

–

2010)

$34.0 million transaction value

•

Closed

sale

of

the

run-off

specialty

reinsurance

segment

(Q4

–

2010)

Net loss of $14.5 million

•

Announced CEO succession management plan and implemented an

organizational structure to support the specialty workers’

compensation

platform

(Q3

–

2010) |

Page

4 EAIG Workers’

Compensation Highlights –

Quarter Ended June 30, 2011

•

Direct written premium of $32.9 million for the three months ended June 30, 2011, and

$26.6 million for the three months ended June 30, 2010

•

GAAP Workers’

Compensation Insurance Segment combined ratio –

90.4%

•

Consolidated net income -

$2.0 Million

•

Focused and disciplined state expansion –

regional office combined ratios range from 87.1

percent to 91.6 percent for the quarter ended June 30, 2011

•

Regional/Satellite Office Expansion

–

Lancaster, PA (opened in 1997)

Nashville, TN (opened in 2010)

–

Charlotte, NC (opened in 2008)

Wexford, PA (opened in 2010)

–

Indianapolis, IN (acquisition in

2008)

Richmond, VA (opened in May 2011)

•

Strong Capital Position

–

A.M.

Best

“A”

(Excellent)

for

Eastern

Alliance

Insurance

Group

–

Stable

Outlook

(Upgrade

in

June

2010

and

affirmed in May 2011)

–

A.M.

Best

“A”

(Excellent)

for

Eastern

Re

Ltd.,

SPC

–

Stable

Outlook

(Upgrade

in

June

2011)

•

Select Agency Partnerships

–

113 contracts / 330 locations |

Page

5 EAIG Geographic Footprint

Alabama

Arkansas

District of Columbia

Delaware

Florida

Georgia

Illinois

Indiana

Iowa

Kentucky

Louisiana

Maryland

Michigan

Minnesota

Mississippi

Missouri

New Jersey

New York

North Carolina

Ohio

Oklahoma

Pennsylvania

South Carolina

Tennessee

Texas

Virginia

West Virginia

Wisconsin

•

Direct written premium of

$126.8 million for the year

ended 12.31.10, and $110.1

million for the year ended

12.31.09

•

Direct written premium of

$79.5 million for the six

months ended 6.30.11 and

$65.5 million for the six

months ended 6.30.10

•

Licensed –

28 states

•

2011 Certificates of Authority

received for Minnesota,

Louisiana, Oklahoma and

Texas in Q2

•

Pending state license

applications in New Mexico

and Arizona |

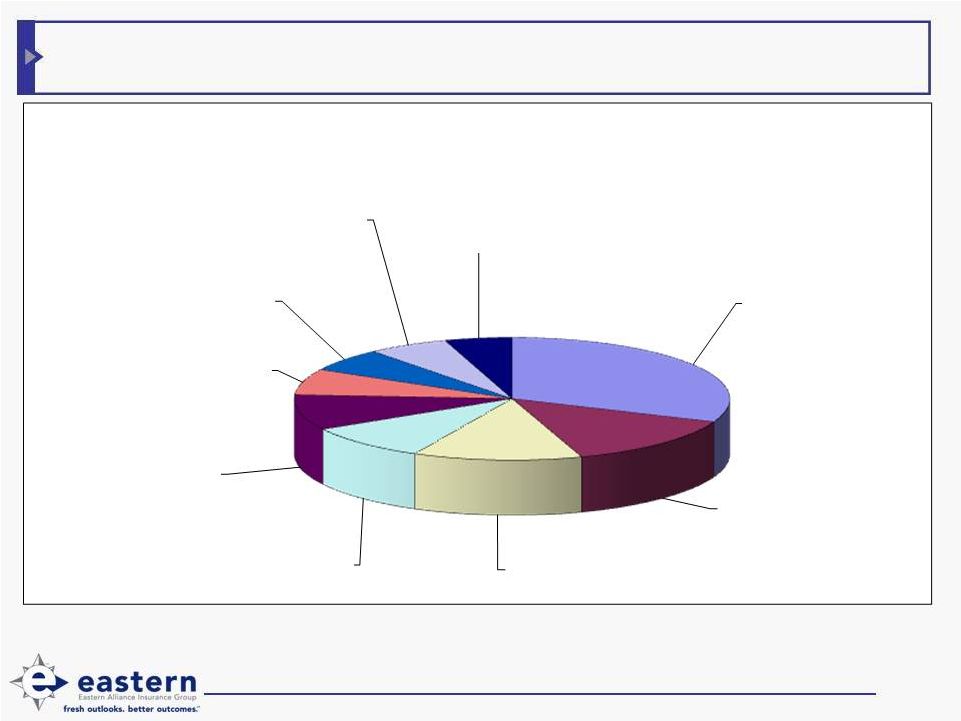

Page

6 EAIG Workers’

Compensation Geography Diversification

•Opened

Southeast

regional

office

(Charlotte,

NC)

–

February

2008

•Acquired

Employers

Security

Insurance

Company

(Indianapolis,

IN)

–

September

2008

to

serve

as

Midwest

regional

office

•Opened

Nashville,

TN

satellite

office

–

April

2010

•Opened

Wexford,

PA

satellite

office

–

June

2010

•Opened

Richmond,

VA

satellite

office

–

May

2011

Percentages as of

June 30, 2006

Percentages as of

June 30, 2011

70.9%

Indiana, 12.5%

North

Carolina, 5.1%

Virginia, 3.5%

Maryland, 2.4%

Delaware, 1.5%

Tennessee, 1.3%

Other, 2.7%

Pennsylvania,

Pennsylvania, 98.9%

Maryland, 0.4%

Delaware, 0.7% |

Payroll Exposure as of June 30, 2011

Clerical / Office 18.7%

Doctors / Dentists

8.2%

Hospital 7.5%

Auto Dealers 5.6%

Colleges/Schools

5.6%

Salesmen -

Outside

4.1%

Nursing Homes

Skilled 3.7%

Restaurant 3.6%

Retirement/Life Care

Community 3.0%

Top 10 Classes (Traditional)

Exposure Base: PA, DE, MD, VA, NC, SC

-

EAIG Workers’

Compensation Risk Diversification

Page 7

•Active Policies = 5,721

•Over 500 Class Codes Actively Written |

Page

8 EAIG Workers’

Compensation Risk Diversification

•Active Policies = 1,584

•Over 300 Class Codes Actively Written

Payroll Exposure as of June 30, 2011

Clerical / Office 16.8%

Auto Dealers 8.2%

Doctors / Dentists

6.6%

Social Rehabiliation

6.1%

6.1%

Nursing Homes -

Skilled 4.0%

3.7%

Ambulance Service -

Non-Volunteer 2.3%

Colleges / Schools

2.0%

Top 10 Classes (Alternative Markets)

Exposure Base: PA, DE, MD, VA, NC, SC

Grocery Store -

Retail

Salesmen -

Outside |

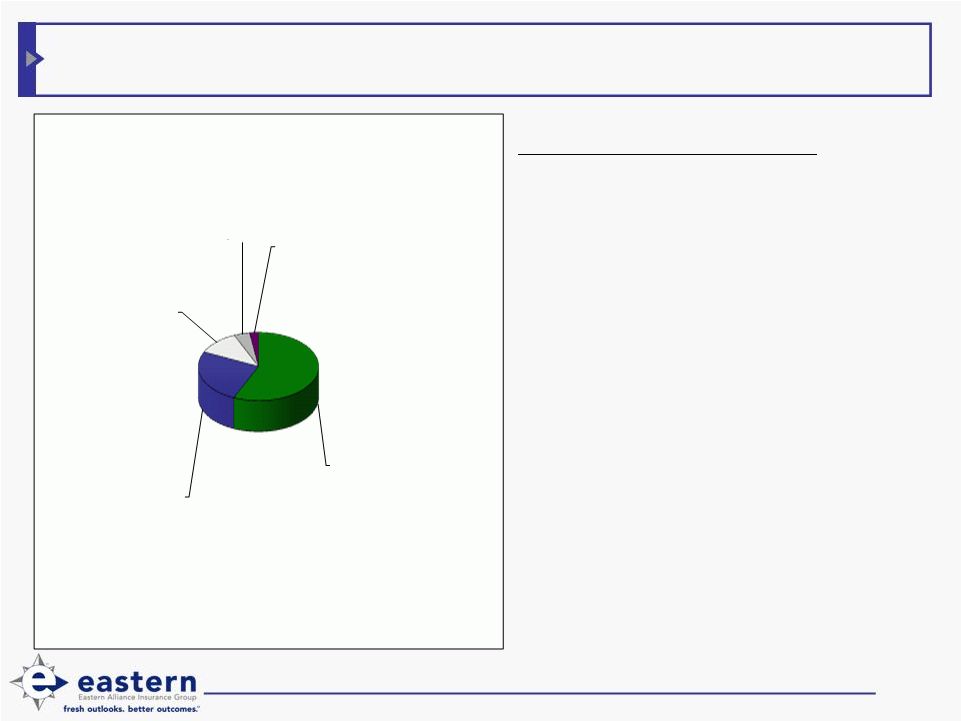

Page

9 Workers’

Compensation Product Line Diversification

Broad Product Spectrum

•

Guaranteed Cost Policies

•

Loss-Sensitive Dividend Plans

•

Large and Medium Deductible

Plans

•

Retrospective Rating Plans

•

ParallelPay®

(Pay As You

Go)

•

Alternative Market Programs

•

TPA Services, including

Claims Administration and

Risk Management

Percentages as of June 30, 2011

Guaranteed

Cost, 56.7%

Alternative

Markets, 25.3%

Policyholder

Dividend, 11.4%

Deductible, 4.2%

Retrospective

Rating, 2.4% |

•

ParallelPay®

program has been very well received by

agents and customers since its release in April of 2009

•

Direct written premium of $32.4 million (908 individual

policies) from the inception of the product to June 30, 2011

•

New business writings represent $12.2 million of the $32.4

million and 391 of the 908 accounts

•

For the six months ended June 30, 2011, recorded direct

written premium of $8.8 million (287 individual policies)

•

New business writings represent $2.5 million of the $8.8

million and 93 of the 287 accounts

Page 10

ParallelPay®

(Pay As You Go) |

Page

11 EAIG Business Model

•

Disciplined individual account underwriting with focus on rate adequacy in rural

territories

•

Broad product spectrum

•

Broad underwriting diversification by class code and market segment

•

Extensive medical cost containment strategies

•

Proactive claims management and strategic use of return-to-work initiatives

•

Value-added risk management services

•

Strategic partnerships with select independent agencies that share

philosophies

on

controlling

workers’

compensation

costs

•

Geographic diversification strategies

–

Opened

Southeast

Regional

Office

(Charlotte,

NC)

–

February

2008

–

Acquired

Employers

Security

Insurance

Company

(Indianapolis,

IN)

–

September

2008

–

Opened

Nashville,

TN

satellite

office

–

April

2010

–

Opened

Western

PA

satellite

office

–

June

2010

–

Opened

Richmond,

VA

satellite

office

–

May

2011 |

Page

12 Workers’

Compensation Key Operating Statistics for the Six Months Ended June 30, 2011

Underwriting

(1)

:

Workers’

Compensation combined ratio

91.3%

Workers’

Compensation calendar year loss ratio

66.4%

Direct written premium

$79.5 million

Direct written premium growth

21.5%

Premium renewal retention

88.1%

New business premium writings

$17.1 million

Select business growth (accounts under $20,000)

9.9%

Large Deductible / Retro premium writings

$7.0 million

Alternative Market premium writings

$21.3 million

High experience modifications premium writings

$13.4 million

ParallelPay premium writings

$8.8 million

Claims

(36

months

average

maturity):

EAIG

Pennsylvania

Variance

Average total cost per claim

$ 4,222

$ 7,935

-46.8%

Average benefit payment per claim

$ 3,612

$ 6,946

-48.0%

Average medical payment per claim

$ 1,934

$ 3,190

-39.4%

Average duration of disability

19.5 weeks

25.3 weeks

-5.8 weeks

Average compromised and release

$ 33,862

$ 59,031

-42.6%

Risk Management

•

Traditional in-force exposure -

$6.2 billion

•

Claims severity –

2 claims over

$300,000

•

No change in lost time claims

frequency on an exposure basis

•

Staffing model –

22 risk

management professionals

(1)

Premium writings include Pennsylvania Employers Assessment

|

Page

13 Pennsylvania Workers’

Compensation Market Share (Top 20)

(dollars in thousands)

2010 Gross Written

Premium

Five Year Average

Loss Ratio

Three Year Average

Loss Ratio

1.

Liberty Mutual Insurance Company

$

193,142 76.97%

72.11%

2.

American International Group

153,488

86.78%

95.29%

3.

Old Republic Insurance Group

135,420

74.32%

75.69%

4.

Zurich Financial Services NA Group

130,565

80.09%

73.81%

5.

Travelers Group

129,971

73.41%

66.63%

6.

Erie Insurance Group

101,610

47.68%

41.15%

7.

Hartford Insurance Group

100,236

73.15%

62.75%

8.

Eastern Alliance Insurance Group

93,964

45.14%

46.82%

9.

Lackawanna Insurance Group

68,500

51.72%

53.96%

10.

ACE INA Group

50,250

37.90%

45.50%

11.

Highmark Casualty Group

49,830

55.01%

54.30%

12.

Companion Property and Casualty Group

48,289

59.76%

67.38%

13.

Selective Insurance Group

47,801

75.76%

78.55%

14.

Cincinnati Insurance Companies

45,475

82.32%

87.45%

15.

Penn National Insurance

42,834

57.36%

54.25%

16.

Chubb Group of Insurance Companies

38,157

41.42%

39.44%

17.

W. R. Berkley Group

35,329

68.64%

70.50%

18.

Fairfax Financial (USA) Group

32,230

54.74%

56.96%

19.

Argo Group

31,573

49.40%

49.32%

20.

CNA Insurance Companies

30,634

102.09%

92.87%

Source: 2010 Best’s State/Line (P/C Lines). |

Page

14 Indiana Workers’

Compensation Market Share (Top 20)

(dollars in thousands)

2010 Gross Written

Premium

Five Year Average

Loss Ratio

Three Year Average

Loss Ratio

1.

Liberty Mutual Insurance Company

$

91,671 62.02%

68.05%

2.

Travelers Group

44,298

56.46%

54.85%

3.

American International Group

35,861

70.10%

79.04%

4.

Accident Fund Group

31,171

76.39%

87.31%

5.

Zurich Financial Services NA Group

27,173

74.54%

89.45%

6.

Auto-Owners Insurance Group

25,054

93.14%

109.33%

7.

Cincinnati Insurance Group

23,835

77.89%

85.80%

8.

Hartford Insurance Group

21,794

66.21%

53.93%

9.

Amerisure Companies

19,591

55.94%

59.43%

10.

QBE Americas Group

15,520

50.58%

38.94%

11.

Old Republic Insurance Group

14,561

72.97%

72.40%

12.

W. R. Berkley Group

13,352

69.67%

73.22%

13.

ACE INA Group

11,766

21.77%

20.66%

14.

Eastern Alliance Insurance Group

11,186

50.58%

57.92%

15.

FCCI Insurance Group

10,421

82.35%

91.54%

16.

United Farm Bureau of Indiana Group

9,710

71.35%

84.89%

17.

ACUITY A Mutual Insurance Company

9,708

75.45%

94.30%

18.

Selective Insurance Group

9,493

57.52%

62.73%

19.

Westfield Group

9,306

64.01%

70.82%

20.

CNA Insurance Companies

9,292

74.90%

57.60%

Source: 2010 Best’s State/Line (P/C Lines). |

Page

15 North Carolina Workers’

Compensation Market Share (Top 20)

Source: 2010 Best’s State/Line (P/C Lines).

(dollars in thousands)

2010 Gross Written

Premium

Five Year Average

Loss Ratio

Three Year Average

Loss Ratio

1.

Liberty Mutual Insurance Company

$

126,752 76.26%

75.70%

2.

Hartford Insurance Group

92,343

66.88%

65.69%

3.

Travelers Group

77,119

63.28%

57.21%

4.

American International Group

74,148

83.11%

101.81%

5.

W. R. Berkley Group

70,859

67.83%

65.87%

6.

Zurich Financial Services NA Group

56,937

79.78%

79.01%

7.

Builders Mutual Insurance Group

47,187

41.13%

39.55%

8.

Franklin Holdings Group

31,148

52.21%

53.65%

9.

Old Republic Insurance Group

27,659

84.13%

84.42%

10.

Accident Fund Group

25,446

65.15%

62.71%

11.

ACE INA Group

24,858

55.25%

60.36%

12.

Cincinnati Insurance Companies

20,536

78.93%

81.34%

13.

Auto-Owners Insurance Group

17,948

80.06%

88.64%

14.

Chubb Group of Insurance Companies

17,278

52.64%

58.41%

15.

Erie Insurance Group

16,873

40.02%

50.34%

16.

Amerisafe Insurance Group

16,672

68.76%

84.59%

17.

North Carolina FB Insurance Group

16,012

66.50%

67.76%

18.

AmTrust Financial Group

15,864

53.10%

54.38%

19.

Great American P & C Insurance Group

14,402

79.05%

79.11%

20.

Companion Property and Casualty Group

11,769

72.14%

56.88%

33

Eastern Alliance Insurance Group

6,487

48.19%

48.23% |

Page

16 Kevin Shook

Executive Vice President, Treasurer

and Chief Financial Officer |

Page

17 Eastern Insurance Holdings, Inc. Financial Model

•

Active Capital

Management

–

Geographic expansion

–

Stock repurchases

–

Shareholder dividends

–

M&A opportunities

•

Underwriting Profit

–

Underwriting, risk

management and claims

philosophy

–

Financial underwriting

–

Low expense ratio

•

Investment Results

•

Strong Balance Sheet

–

Asset quality

–

Credit risk management

–

Reserves |

Page

18 EAIG Balance Sheet Strength

•

67.4% of June 30, 2011 assets are in cash and invested

assets

•

Excellent collection history on premiums receivable

•

Strong reinsurer security

•

Unpaid loss and loss adjustment expense

–

Reserves recorded near high end of actuarial range

–

History of favorable workers’

compensation loss reserve

development

–

Strong base case reserves |

Page

19 Investment Portfolio Mix

Total Cash and Invested Assets: $227.4 Million

as of June 30, 2011

•Conservative investment

strategy (76% fixed income and cash) •Preservation of capital strategy

•High quality

securities 21%

5%

11%

8%

Fixed Income Securities

Convertible Bonds

Equity Securities

Other Long-Term Investments

Cash and Cash Equivalents

55% |

Page

20 EIHI Fully Diluted Book Value Performance |

Page

21 EAIG Workers’

Compensation Combined Ratio History

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

100.0%

2006

2007

2008

2009

2010

Q1 2011

Q2 2011

79.1%

65.6%

80.2%

87.7%

96.0%

92.2%

90.4%

•2010 A.M. Best composite

projected combined ratio 121.5 percent |

Page

22 EAIG Direct Written Premium Growth Rates

•United States workers’ compensation industry

direct written premium writings decreased from $55

billion in 2005 to $36 billion in 2009

•Projected 2010 = $32

billion $-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

10.4%

7.7%

8.9%

13.6%

20.6%

8.0%

15.2%

19.8%

23.7%

Percentages as of June 30, 2011 |

Page

23 EAIG Workers’

Compensation Claim Closing Patterns

Results as of June 30, 2011 |

Page

24 Eastern Insurance Holdings, Inc. Capital Position

Reported

Implied

Target

Implied Capital

6/30/2011

Book Value

Book Value

Unallocated

Tangible BV

NPW

(1)

NPW/ Surplus

Requirement

GAAP Equity

Per Share

Per Share

Capital

Per Share

Workers' compensation insurance

101,582

$

1.25

81,266

$

91,717

$

11.14

$

9.87

$

1.27

$

11.14

$

Specialty reinsurance

6,000

9,987

1.21

0.73

0.48

1.21

Total required capital

87,266

101,704

12.35

10.60

1.75

12.35

Goodwill and other

14,428

14,428

1.75

1.75

-

-

Total allocated capital

101,693

116,132

14.11

12.35

1.75

12.35

Holding company tangible equity

-

13,403

1.63

-

1.63

1.63

Total shareholders' equity

129,534

129,534

15.73

$

12.35

$

3.38

$

13.98

$

Stock option dilution

(0.22)

(0.06)

Diluted earnings per share

15.51

$

13.93

$

Total unallocated capital

27,841

$

3.38

$

(1)

Net written premium represents a rolling twelve months. |

|