Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPARTON CORP | d8k.htm |

| EX-99.1 - SCRIPT FOR CONFERENCE CALL - SPARTON CORP | dex991.htm |

Fiscal 2011 Fourth Quarter

and Full Year Financial

Results Conference Call

September 8, 2011

EXHIBIT 99.2 |

2

Safe Harbor Statement

Safe Harbor Statement

Certain statements herein constitute forward-looking statements within the meaning of the

Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended.

When used herein, words such as “believe,” “expect,” “anticipate,”

“project,” “plan,” “estimate,” “will” or

“intend” and similar words or expressions as they relate to the Company or its

management constitute forward-looking statements. These forward-looking statements reflect

our current views with respect to future events and are based on currently available financial,

economic and competitive data and our current business plans. The Company is under no

obligation to, and expressly disclaims any obligation to, update or alter its forward-looking

statements whether as a result of such changes, new information, subsequent events or

otherwise. Actual results could vary materially depending on risks and uncertainties that may

affect our operations, markets, prices and other factors. Important factors that could cause actual

results to differ materially from those forward-looking statements include those contained

under the heading of risk factors and in the management’s discussion and analysis

contained from time- to-time in the Company’s filings with the Securities and

Exchange Commission.

Adjusted operating income, adjusted net income and adjusted income per share – basic and

diluted are non-GAAP financial measures that exclude or add the effect of certain gains and

charges, including imputing taxes at a 36% effective rate. Sparton believes that the presentation

of non-GAAP financial information provides useful supplemental information to management

and investors regarding financial and business trends relating to the Company’s financial

results. More detailed information, including period over period segment comparisons,

non-GAAP reconciliation tables and the reasons management believes non-GAAP measures

provide useful information to investors, is included in the Fiscal 2011 Fourth Quarter and Full

Year Results press release and 8-K dated September 7, 2011. |

3

•

Fiscal 2011 Fourth Quarter and Full Year Consolidated Results

•

4

Quarter Segmented Operating Results

•

Liquidity & Capital Resources

•

Medical Financial Results by Location

•

Colorado Financial Comparison

•

Fiscal 2011 Growth Investment Summary

•

Outlook

•

Q & A

Today’s Agenda

Today’s Agenda

th |

4

Consolidated Financial Results

Consolidated Financial Results

Fiscal 2011 Fourth Quarter

Fiscal 2011 Fourth Quarter

($ in 000’s, except per share)

(adjusted removes certain gains and charges, including imputing taxes at 36%

effective rate) (Adjusted)

2011

2010

2011

2010

Net Sales

$ 60,902

$ 40,013

$ 60,902

$ 40,013

$ 20,889

Gross Profit

10,393

5,507

10,393

5,507

4,886

17.1%

13.8%

17.1%

13.8%

Selling and Administrative Expense

5,176

4,188

5,176

4,188

(988)

8.5%

10.5%

8.5%

10.5%

Internal R&D Expense

546

-

546

-

(546)

Restructuring and Impairment Charges

16,814

n/a

n/a

Gain On Acquisition

-

-

n/a

n/a

Gain On PP&E

-

(3,119)

n/a

n/a

Operating Income (Loss)

(12,343)

2,256

4,471

1,092

3,379

-20.3%

5.6%

7.3%

2.7%

Income (Loss) Before Provision For (Benefit From) Income Tax

(12,346)

2,209

4,468

1,045

3,423

Provision For (Benefit From) Income Taxes

(11,619)

111

1,608

376

(1,232)

Net Income

$ (727)

$ 2,098

$ 2,860

$ 669

$ 2,191

-1.2%

5.2%

4.7%

1.7%

Income per Share, Basic and Diluted

$ (0.07)

$ 0.21

$ 0.28

$ 0.07

$ 0.21

Quarter ended June 30,

Quarter ended June 30,

YoY

Variance

(Reported)

(Adjusted)

1,955 |

5

Consolidated Financial Results

Consolidated Financial Results

Fiscal 2011 Year End

Fiscal 2011 Year End

(Adjusted)

2011

2010

2011

2010

Net Sales

$ 203,352

$ 173,977

$ 203,352

$ 173,977

$ 29,375

Gross Profit

33,168

26,583

33,168

26,583

6,585

16.3%

15.3%

16.3%

15.3%

Selling and Administrative Expense

20,842

18,205

20,842

18,205

(2,637)

10.2%

10.5%

10.2%

10.5%

Internal R&D Expense

1,110

-

1,110

-

(1,110)

Restructuring and Impairment Charges

16,891

4,076

n/a

n/a

Gain On Acquisition

(2,550)

-

n/a

n/a

Gain On PP&E

(139)

(3,119)

n/a

n/a

Operating Income (Loss)

(3,829)

5,722

10,373

6,679

3,694

-1.9%

3.3%

5.1%

3.8%

Income (Loss) Before Provision For (Benefit From) Income Tax

(3,943)

5,524

10,259

6,280

3,979

Provision For (Benefit From) Income Taxes

(11,404)

(1,916)

3,693

2,261

(1,432)

Net Income

$ 7,461

$ 7,440

$ 6,566

$ 4,019

$ 2,547

3.7%

4.3%

3.2%

2.3%

Income per Share, Basic and Diluted

$ 0.73

$ 0.75

$ 0.64

$ 0.40

$ 0.24

($ in 000’s, except per share)

(adjusted removes certain gains and charges, including imputing taxes at 36%

effective rate) Fiscal

YoY

Variance

Fiscal

(Reported)

(Adjusted) |

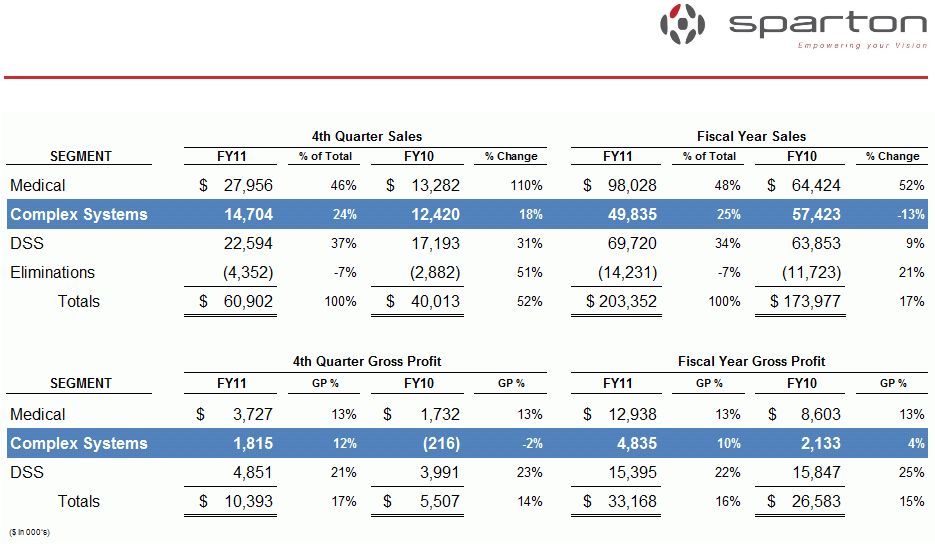

6

Operating Results

Operating Results

Medical

Medical

SEGMENT

FY11

% of Total

FY10

% Change

FY11

% of Total

FY10

% Change

Medical

$ 27,956

46%

$ 13,282

110%

$ 98,028

48%

$ 64,424

52%

Complex Systems

14,704

24%

12,420

18%

49,835

25%

57,423

-13%

DSS

22,594

37%

17,193

31%

69,720

34%

63,853

9%

Eliminations

(4,352)

-7%

(2,882)

51%

(14,231)

-7%

(11,723)

21%

Totals

$ 60,902

100%

$ 40,013

52%

$ 203,352

100%

$ 173,977

17%

SEGMENT

FY11

GP %

FY10

GP %

FY11

GP %

FY10

GP %

Medical

$ 3,727

13%

$ 1,732

13%

$ 12,938

13%

$ 8,603

13%

Complex Systems

1,815

12%

(216)

-2%

4,835

10%

2,133

4%

DSS

4,851

21%

3,991

23%

15,395

22%

15,847

25%

Totals

$ 10,393

17%

$ 5,507

14%

$ 33,168

16%

$ 26,583

15%

($ in 000’s)

4th Quarter Sales

4th Quarter Gross Profit

Fiscal Year Sales

Fiscal Year Gross Profit |

7

Operating Results

Operating Results

Complex Systems

Complex Systems |

8

Operating Results

Operating Results

Defense & Security Systems

Defense & Security Systems

SEGMENT

FY11

% of Total

FY10

% Change

FY11

% of Total

FY10

% Change

Medical

$ 27,956

46%

$ 13,282

110%

$ 98,028

48%

$ 64,424

52%

Complex Systems

14,704

24%

12,420

18%

49,835

25%

57,423

-13%

DSS

22,594

37%

17,193

31%

69,720

34%

63,853

9%

Eliminations

(4,352)

-7%

(2,882)

51%

(14,231)

-7%

(11,723)

21%

Totals

$ 60,902

100%

$ 40,013

52%

$ 203,352

100%

$ 173,977

17%

SEGMENT

FY11

GP %

FY10

GP %

FY11

GP %

FY10

GP %

Medical

$ 3,727

13%

$ 1,732

13%

$ 12,938

13%

$ 8,603

13%

Complex Systems

1,815

12%

(216)

-2%

4,835

10%

2,133

4%

DSS

4,851

21%

3,991

23%

15,395

22%

15,847

25%

Totals

$ 10,393

17%

$ 5,507

14%

$ 33,168

16%

$ 26,583

15%

($ in 000’s)

4th Quarter Sales

4th Quarter Gross Profit

Fiscal Year Sales

Fiscal Year Gross Profit |

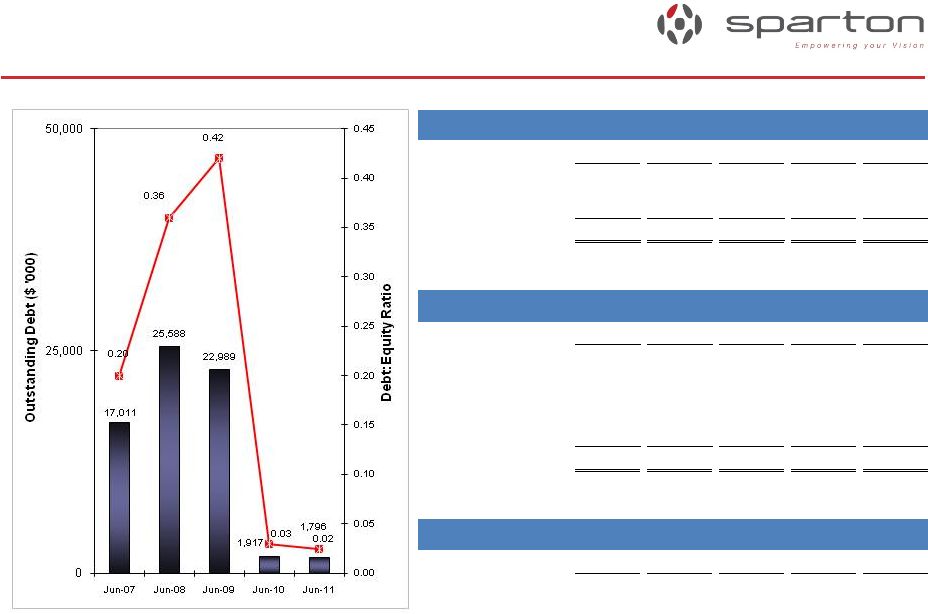

9

Liquidity & Capital Resources

Liquidity & Capital Resources

($ in '000)

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Cash and equivalents

30,589

27,281

29,941

26,119

24,550

LOC Availability

16,897

17,769

17,389

17,497

17,541

Total

47,486

45,050

47,330

43,616

42,091

($ in '000)

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Credit Revolver

-

-

-

-

-

Long Bank Term Debt

-

-

-

-

-

Former Astro Owners

-

-

-

-

-

IRB (Ohio)

1,917

1,887

1,856

1,826

1,796

Total

1,917

1,887

1,856

1,826

1,796

($ in '000)

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Net Inventory

26,514

36,629

35,076

40,282

38,752

Cash Availability

Debt

Inventory |

10

Medical

Medical

Financial Results by Location

Financial Results by Location

($ in 000’s)

Total Medical

Colorado

Strongsville

Total Medical

Colorado

Strongsville

Net Sales

$ 27,956

$ 14,229

$ 13,727

$ 98,028

$ 42,320

$ 55,708

Gross Profit

3,727

2,059

1,668

12,938

6,082

6,856

Gross Margin

13.3%

14.5%

12.2%

13.2%

14.4%

12.3%

1,994

1,110

884

6,362

3,235

3,127

Adjusted Operating Margin

7.1%

7.8%

6.4%

6.5%

7.6%

5.6%

*Adjusted for the exclusion of restructuring charges, gain on sale of acquisition

and impairments of goodwill and intangible assets. 3 months ending June 30,

2011 Fiscal 2011

Adjusted Operating Income |

11

Colorado Financial Comparison

Colorado Financial Comparison

($ in 000’s)

2011

2010

2011

2010

Colorado

Colorado Pro

Forma

Colorado Pro

Forma

Colorado Pro

Forma

Net Sales

$ 14,229

$ 9,360

$ 52,384

$ 39,046

Gross Profit

2,059

510

6,957

1,364

Gross Margin

14.5%

5.4%

13.3%

3.5%

Gain on Acquisition

-

-

2,550

-

Operating Income (Loss)

1,080

(111)

5,490

(1,450)

Operating Margin

7.6%

-1.2%

10.5%

-3.7%

3 months ending June 30,

Fiscal year

Note:

manufacturing businesses of Delphi Medical and Byers Peak as though the acquisitions had occurred as

of July 1, 2009.

The above table summarizes, on a pro forma basis, the results of the operations of the acquired

contract |

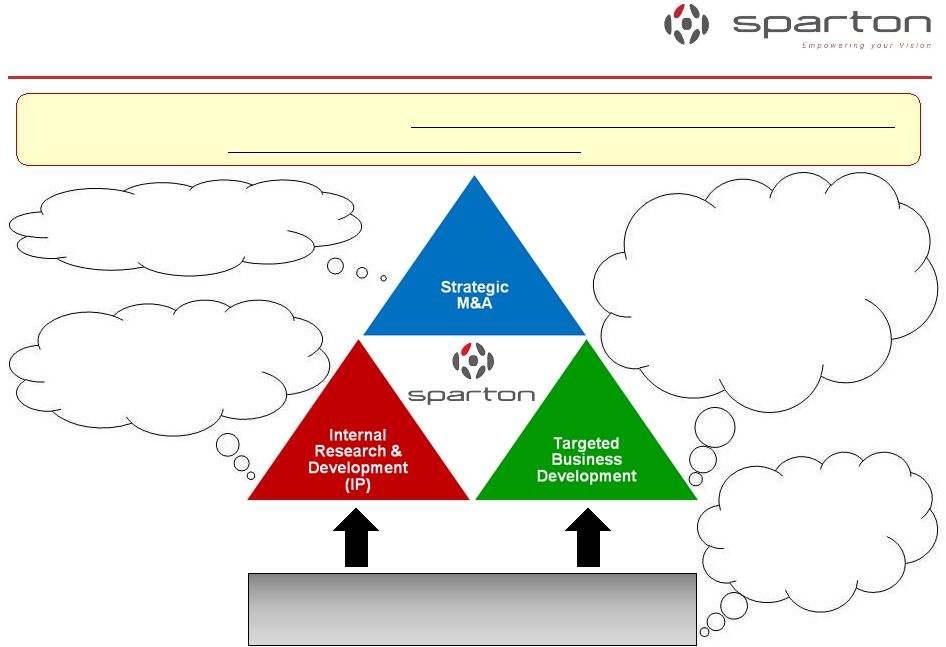

12

Growth Investments

Growth Investments

Fiscal 2011 Summary

Fiscal 2011 Summary

Focus:

Use

growth

investments

to

achieve

sustainable

year-over-year

revenue

and

profit

increases

and

to

further

place

protective

barriers

around

Sparton.

Supported by market research &

go-to-market programs

•

Delphi Medical Systems on August 6, 2010

•

Byers Peak on March 4, 2011

•

Added 7 business development managers

and ancillary support staff

•

Implemented a new business development

process

•

Won 26 new programs that were

4.5% of FY11 sales (will be 9.1%

of the FY12 sales plan)

•

11 brand new customers

•

Developed the new gyro-enhanced digital

compass (GEDC-6) for a FY12 launch

•

Repackaged the hydrophone as

the PHOD-1 for a FY12 launch

•

New logo, font, and tagline

•

Rebuilt website & micro-sites

•

New marketing collateral

•

New trade show booth |

13

•

Focus on sustained profitability

–

Continue margin improvements in Complex Systems

•

Targeted gross margin range adjusted up to 7%-10%

–

Backfill Strongsville revenue losses with new business

–

Offset reduced U.S. Navy sonobuoy contracts with foreign sonobuoy sales

–

Continue improvements in operating performance through lean and quality

efforts •

Implementation of the strategic growth plan

–

Continue refining the new business development process to increase the new

business opportunity funnel and win more new business

–

Continue to target the right trade show venues

–

Continue to invest in internal R&D for new product introductions

–

Challenge the technical staff to develop new & innovative ideas

–

Continue to look at complementary and compatible acquisitions

•

Continue

to

attend

Investor

Conferences

and

maintain

an

Investor

Relations

road

show schedule to visit new and existing investors on a regular basis

Fiscal 2012 Outlook

Fiscal 2012 Outlook |

14

Q & A |