Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GENTIVA HEALTH SERVICES INC | d8k.htm |

Investor Presentation

September 2011

Exhibit 99.1 |

Forward-Looking Statements

2

This presentation should be considered forward-looking and is subject to various risk factors and

uncertainties. For more information on those risk factors, please refer to Gentiva's various

filings with the Securities and Exchange Commission (SEC), including the Company’s annual

report on Form 10-K. This presentation is also produced in compliance with the SEC's

Regulation FD, which provides guidelines on all disclosures by publicly traded companies.

The viewer or listener should not place undue reliance on forward-looking statements, which speak

only as of the date indicated in this presentation. The Company is not obligated to publicly

release any revisions to forward-looking statements to reflect unforeseen or other events

after such date. |

Agenda

Company Overview

Legislative & Reimbursement Environment

Current Business Priorities

Financial Update

3 |

Company Overview

Leading U.S. provider of home healthcare

and hospice services

Revenue Mix*

* Revenue mix calculated based on Q211 results.

Average patient age

Average daily census

Locations:

Home Health

Hospice

States

FT employees

79

85K

478

312

166

42

15K

43%

57%

4 |

Growth in U.S. Population of 65+

10,000 U.S. citizens become eligible for Medicare each day.

This trend is expected to continue for the next 20 years.

5

Sources: 2010 - U.S. Census Bureau. 2030 estimate - Administration on Aging, Dept. of

Health & Human Services. |

6

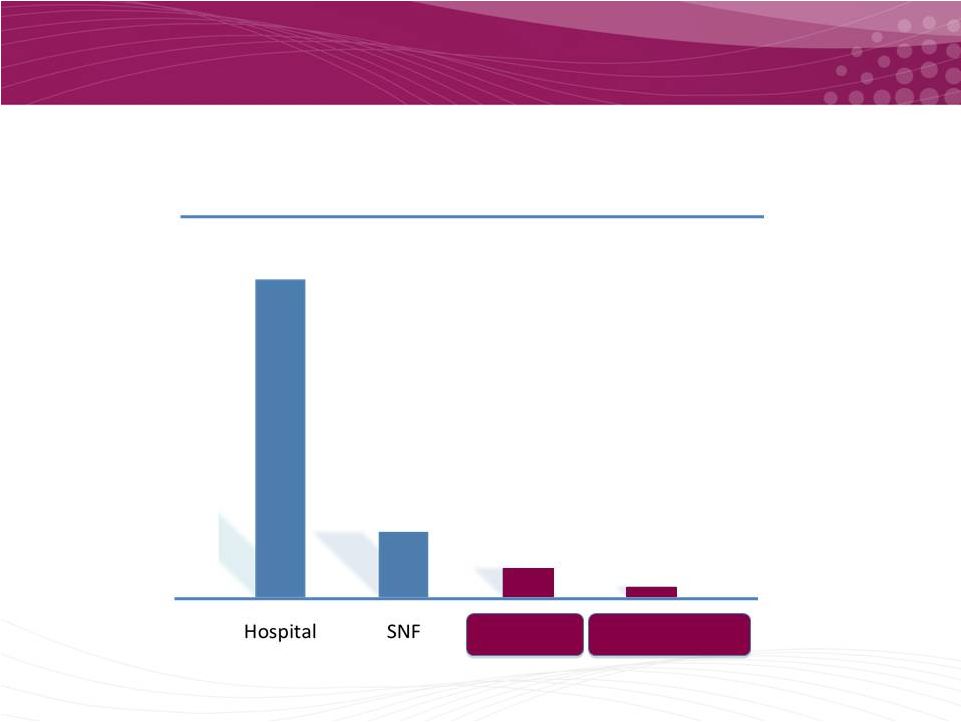

Benefits of Home Healthcare

Medicare Part A & Part B Average Payment Per Day

(2)

(1)

Source: U.S. Census Bureau projections.

(2)

Source: CMS HCIS data files for 2006. Hospital data includes inpatient PPS and

non-PPS. Home Health day calculated based on 60-day episode. Lower

cost per day vs. hospitals and SNFs $1,479

$135

$303

$50

Hospice

Home Health |

7

•

Partnership for Quality Home

Health active in Washington

•

Meetings with CMS to discuss

changes to new Face-to-Face

requirements

•

Drafting new legislation targeting

industry fraud as substitute for

other approaches

Legislative Update |

8

Proposed rule issued July 2011

•

3.35% decrease including

market basket/wage index

updates and case-mix

reduction

•

Removes two hypertension

codes and lowers payments

for high-

therapy episodes

Effective January 1, 2012

Home Health

2012 Medicare Reimbursement Update

Final rule issued July 2011

•

2.5% net increase

approved for 2012

Effective October 1, 2011

Potential 2012 Impact

Combined 2012 EBITDA impact estimated to be $40-45M,

excluding any revisions to current proposed rule

Hospice |

Current Business Priorities

Actions to mitigate potential 2012 Medicare rate cut

Grow volumes

Reduce non-essential costs

Divest non-core assets

Seek legislative change

9 |

Financial Update

10 |

11

Asset Sale Update

•

Announced sale of CareCentrix Holdings Inc.

on August 26, 2011

•

Sold remaining equity stake

•

Continue to hold $25M note receivable with

10% interest

Net cash flow of $65-70M expected

Net cash flow of $65-70M expected |

12

Cost Reduction Update

•

Business reviews underway focused on the following:

–

Limiting discretionary spending

–

Right-sizing business to reflect near-term growth trends

–

Achieving operating efficiencies at branch and support levels

•

Will provide a more detailed update in Q4 when

assessment is complete |

13

Debt & Leverage Update

(in millions, except leverage ratio)

As of:

June 30, 2011

December 31, 2010

Debt

Total Debt

$1,028.1

$1,051.6

Cash & Equivalents

$98.1

$104.8

Net Debt

$930.0

$946.8

Leverage

Ratio

Reported

3.93x

Maximum Allowed

4.75x |

14

•

In compliance today

–

Q211 leverage ratio of 3.93x

vs. 4.75x requirement

•

Expect to be in compliance through

year-end

–

Asset sales, cost reductions,

and strong cash position offset

potential Q411 impact of home

health rate cut

Q2

Q4

4.75x

4.5x

Debt Update

Covenant Waiver Considerations

•

Considerations

–

Final Medicare home health

rules

–

Mitigating actions taken by GTIV

–

Growth environment

•

Working closely with banks should

need arise for waiver

2012

2011

Q1

4.5x

Q4

3.75x |

15

Investment Summary

Significant long-term growth opportunities

Strong financial track record

Diversified revenue mix

Positioned to play consolidator role

Experienced management team |

|