Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PLAINS EXPLORATION & PRODUCTION CO | d8k.htm |

Barclays

Capital CEO Energy -

Power Conference

September 2011

Exhibit 99.1 |

2

Corporate Headquarters

Contacts

Plains Exploration & Production Company

700 Milam, Suite 3100

Houston, Texas 77002

Forward-Looking Statements

This presentation is not for reproduction or distribution to others without

PXP’s consent. Corporate Information

James C. Flores –

Chairman, President & CEO

Winston M. Talbert –

Exec. Vice President & CFO

Hance V. Myers, III –

Vice President

Corporate Information Director

Joanna Pankey –

Manager, Shareholder Services

Phone: 713-579-6000

Toll Free: 800-934-6083

Email:

investor@pxp.com

Web Site: www.pxp.com

Except for the historical information contained herein, the matters

discussed

in

this

presentation

are

“forward-looking

statements”

as

defined by the Securities and Exchange Commission. These

statements involve certain assumptions PXP made based on its

experience and perception of historical trends, current conditions,

expected future developments and other factors it believes are

appropriate under the circumstances.

The forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors that could cause our

actual results to differ materially. These risks and uncertainties include,

among other things, uncertainties inherent in the exploration for and

development and production of oil and gas and in estimating reserves,

the timing and closing of acquisitions and divestments, unexpected

future capital expenditures, general economic conditions, oil and gas

price volatility, the success of our risk management activities,

competition, regulatory changes and other factors discussed in PXP’s

filings with the SEC.

References to quantities of oil or natural gas may include amounts that

the Company believes will ultimately be produced, but that are not yet

classified as "proved reserves" under SEC definitions.

|

3

PXP Today

•

$9.0

billion

enterprise

value

(1)

•

416 MMBOE proved reserves YE 2010

•

97.7 MBOE per day production for 2Q 2011

•

+2.2 billion BOE resource potential

•

141.0 million shares outstanding

(2)

(1) Reflects stock price and total debt as of June 30, 2011.

(2) As of June 30, 2011. |

4

WTI NYMEX Historical Prices and

Forward Curves

Source: Goldman Sachs, NYMEX, ICE

July 14, 2006

March 7, 2003

October 26, 2004

July 14, 2008

September 3, 2008

October 25, 2010

September 1, 2011

20

30

40

50

60

70

80

90

100

110

120

130

140

150

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014 |

5

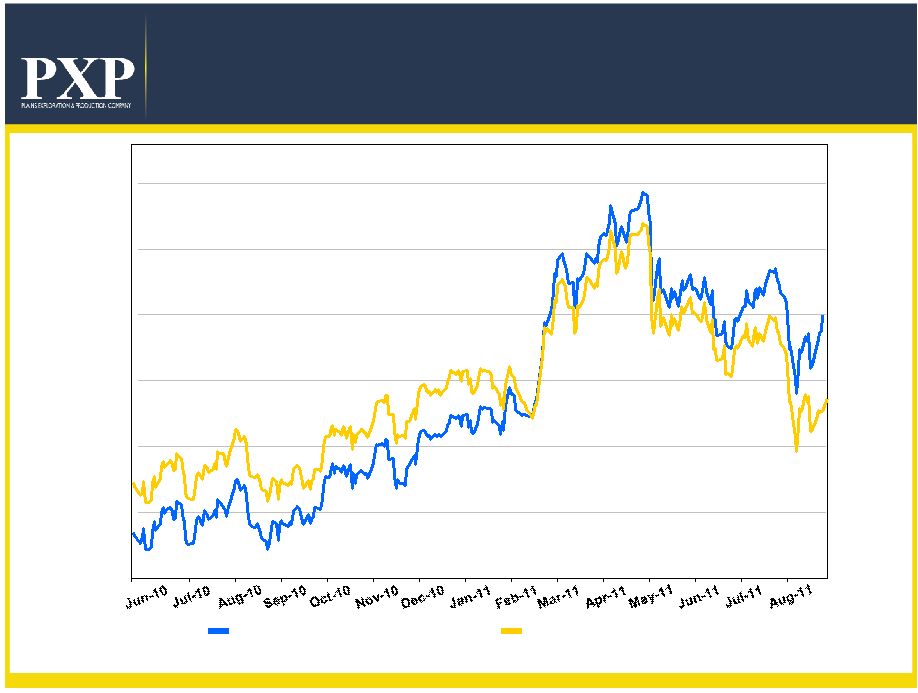

PXP California Spot Crude Index

vs. NYMEX WTI

Source: Morgan Stanley Commodities, NYMEX, Platts, Chevron Corp.

PXP California Spot Crude Index is based on the weighting of the

crudes according to expected 2012 production.

60.00

70.00

80.00

90.00

100.00

110.00

120.00

PXP California Spot Crude Index

NYMEX WTI Rolling Front Month

Units: $/bbl |

6

West Coast Crude Oil Market

Declining Domestic Source Strengthens Local Posted Prices

Declining ANS

Production Midway Sunset % of NYMEX WTI

Source: Barclays Capital and PXP. |

7

PXP Crude Oil Marketing Strategy

•

Crude oil realization moves from ~92% NYMEX to 101%-103%

of NYMEX, which is 85% of total liquids production

(1)

•

Total liquids realization moves from ~89% NYMEX to 93-95%

NYMEX

(1)

, due to NGL’s and condensate discounts

•

Crude slate beginning 2012 will be:

•

Aligned crude realizations with world prices to increase cash

flow in 2012 by over $150 million

(1)

Estimates based on August 2011 price outlook.

(2)

Using August 31, 2011 WTI NYMEX at $88.81.

Percentage of

NYMEX

(2)

Approx. Quality and

Transportation Discount

Net Price

(2)

74% California Spot

118%

($2.00)/Bbl

$103/Bbl

18% Louisiana Light

Sweet

130%

($8.00)/Bbl

$107/Bbl

8% NYMEX

100%

($1.00)/Bbl

$ 88/Bbl |

8

Cash Flow Sensitivities

(1)

Excludes impact of derivatives. |

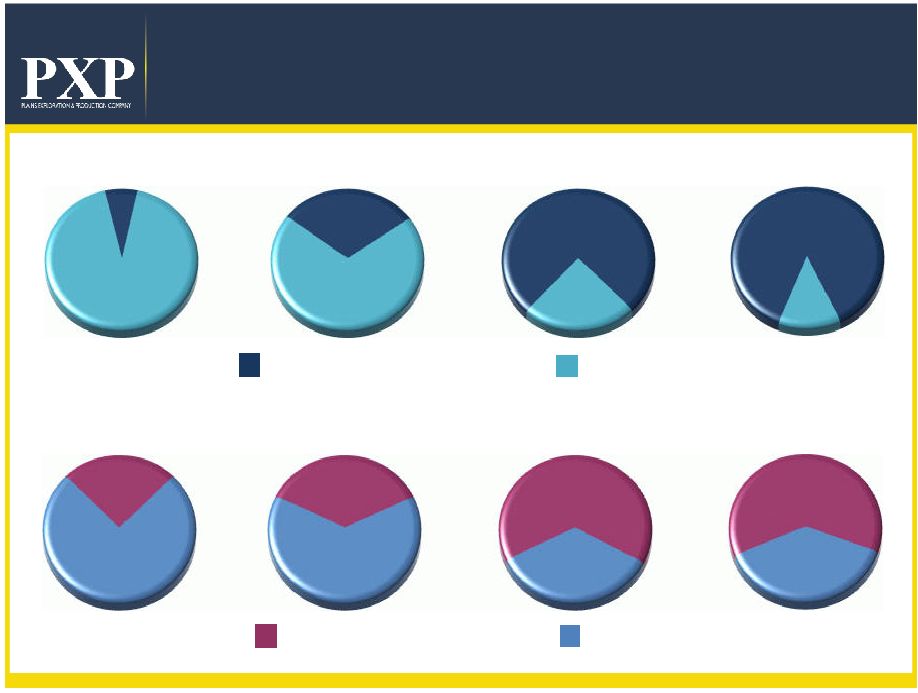

Operated

CapEx Transition Profile

2009

2011E

2010

Oil vs. Gas

Operated vs. Non-Operated

2009

2011E

2010

Includes Eagle Ford acquisition and excludes Gulf of Mexico shallow water assets as of

12/30/2010 . 2012E

2012E

Oil + Liquids

9

7%

93%

30%

70%

76%

24%

87%

13%

25%

75%

36%

64%

65%

35%

62%

38%

Gas + Exploration

Non-operated |

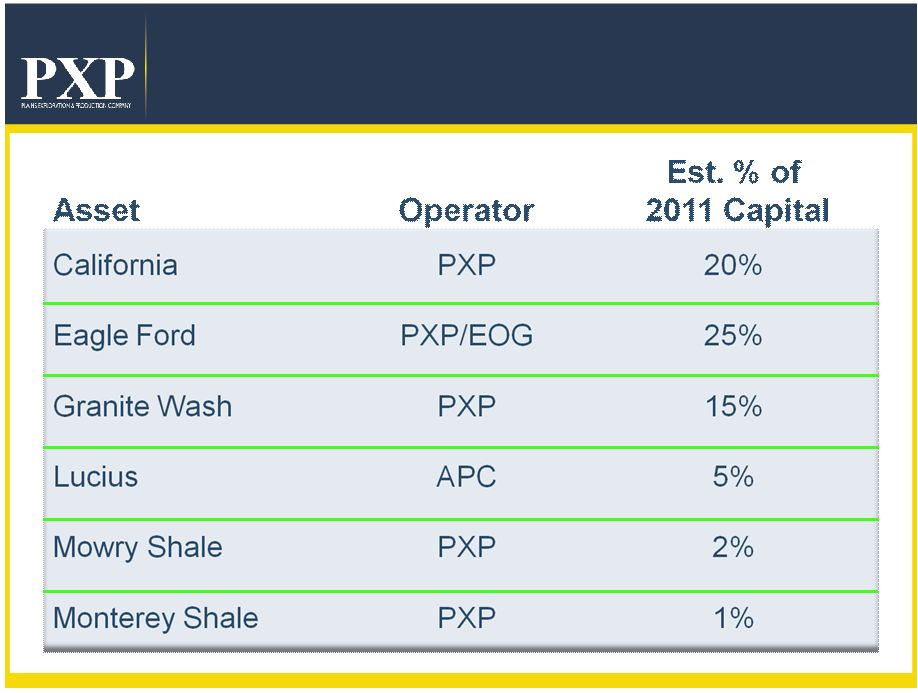

10

2011 Capital Allocation

Capital Program

(1)

Includes development, exploitation, real estate, capitalized interest and G&A

costs but does not include additional capital for exploratory

successes. Haynesville

California

Cap G&A, Interest

and Other

(1)

Granite Wash

Eagle Ford

2011 Budget

$1.5 Billion

Lucius |

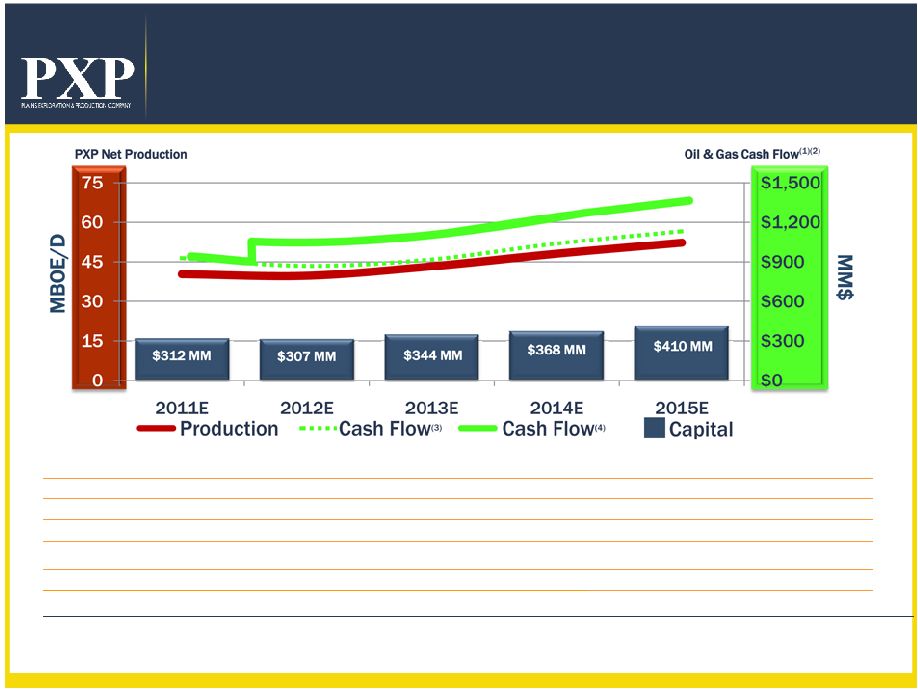

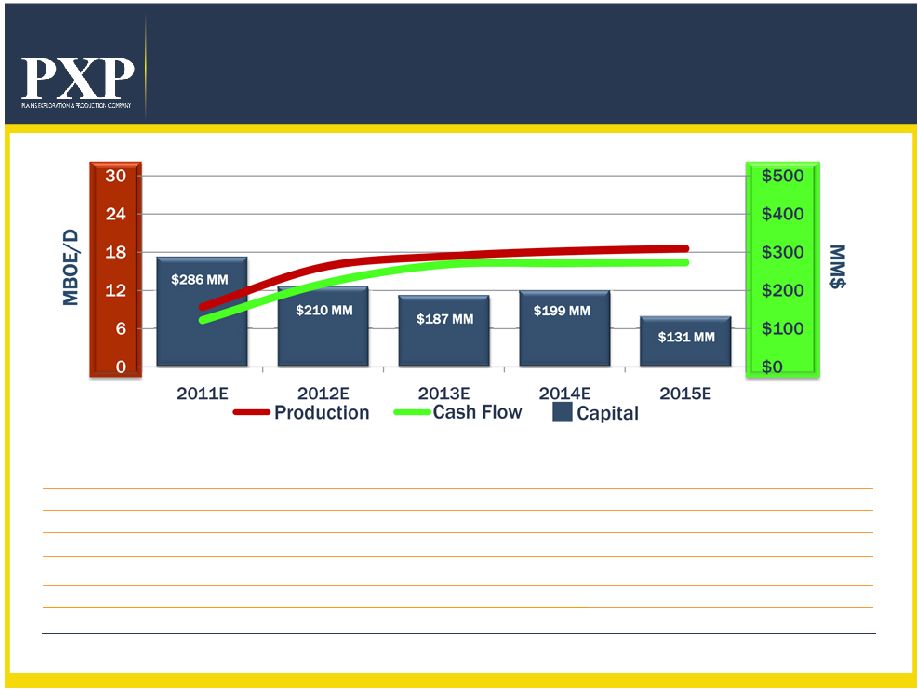

PXP

Operational Plan at $100 Oil

PXP Net Production

Oil & Gas Cash Flow

(1)(2)

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $100/Bbl of oil and natural gas pricing of $4.50/MMBtu in 2011, $100/Bbl of

oil and natural gas pricing of $5.00/MMBtu in 2012, and $100/Bbl of oil and

natural gas pricing of $6.00/MMBtu 2013 and beyond. (3) Represents cash flow at

forecasted 2011 differentials. (4) Includes impact of recently announced crude

oil marketing contracts for California and Eagle Ford volumes. Oil & Gas

Capital Cash Flow

(4)

Cash Flow

(3)

Production

GOM Oil Production

Starts 2014

Reduce Haynesville

Spending 2012

11

200

175

150

125

100

75

50

25

0

$1500 MM

$1700 MM

$1700 MM

$1700 MM

$1500 MM

2011E

2012E

2013E

2014E

2015E

$4,000

$3,500

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$0 |

12

Oil/Liquids Operational Strategy

Focused Oil/Liquids Growth Strategy

•

Increase total company oil/liquids volumes

at a 17% CAGR through 2016 with current

development portfolio

•

Approximately 87% of 2012 CapEx

directed toward oil/liquids assets |

13

Oil/Liquids Assets |

14

California Oil

Onshore/Offshore

Los

Angeles

Basin

San Joaquin

Valley

Arroyo

Grande

Pt Pedernales

Pt Arguello

•

211 MMBOE Net Proved Reserves

•

272 MMBOE Net Development

Resource Potential

•

70% Proved Developed

•

14 yr R/P

•

2,000+ future well locations

The shaded areas are for illustrative purposes only and do not reflect actual

leasehold acreage. |

15

California Oil

Operational Plan

January 1, 2010 Project Cost Forward F&D:

$9.87/BOE

(2)

PXP

Interest:

98% WI / 86%

NRI Potential Net Locations:

2,000+

Proved Net

Reserves:

211 MMBOE

Net Development Resource

Potential:

272 MMBOE

Average Gross Well Cost:

$1.2 MM

Average Gross EUR per Well:

135 MBOE

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $100/Bbl of oil and natural gas pricing of $4.50/MMBtu in 2011,

$100/Bbl of oil and natural gas pricing of $5.00/MMBtu in 2012, and $100/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

(3) Represents cash flow at forecasted 2011 differentials.

(4) Includes impact of recently announced crude oil marketing contracts for

California volumes. |

16

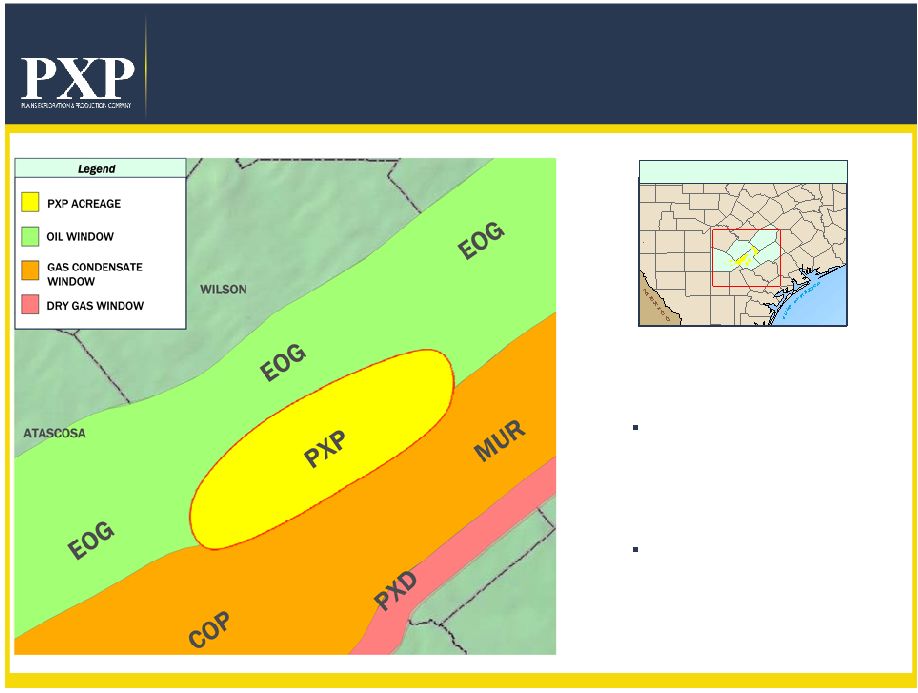

Eagle Ford Horizontal Oil Play

•

PXP acreage position

~58,700 net acres

•

4 to 6 rigs running in 2011

•

Depth to Eagle Ford Top

~9,500' -

11,500' TVD

TEXAS

Walker

Kimble

Lee

Travis

Milam

Llano

Burnet

Mason

Gillespie

Grimes

Matagorda

Williamson

Fort Bend

Brazos

Waller

Burleson

Webb

Duval

Frio

Kerr

Edwards

Bee

Uvalde

Bexar

Zavala

Medina

Dimmit

La Salle

Real

Maverick

Lavaca

Goliad

Atascosa

Hays

Fayette

Wharton

De Witt

Live Oak

Wilson

Victoria

McMullen

Bastrop

Gonzales

Nueces

Colorado

Karnes

Kleberg

Blanco

Bandera

Austin

Jackson

Refugio

Comal

Jim Wells

Kendall

Guadalupe

Caldwell

San Patricio

Washington

Calhoun

Aransas

Location Map

The shaded area is for illustrative purposes only and does not reflect actual

leasehold acreage. |

17

Eagle Ford Horizontal Oil Play

Operational Plan

September 1, 2010 Project Cost Forward F&D:

$18.81/BOE

(2)

PXP

Interest:

73% WI/ 56%

NRI Potential Net Locations:

487

Net Development Resource

Potential:

170 MMBOE

Average Gross Well Cost:

$7.0 MM

Average Gross Resource Potential per Well:

483 MBOE

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $100/Bbl of oil and natural gas pricing of $4.50/MMBtu in 2011,

$100/Bbl of oil and natural gas pricing of $5.00/MMBtu in 2012, and $100/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

(3) Represents cash flow at forecasted 2011 differentials.

(4) Includes impact of recently announced crude oil marketing contract for Eagle

Ford volumes. |

18

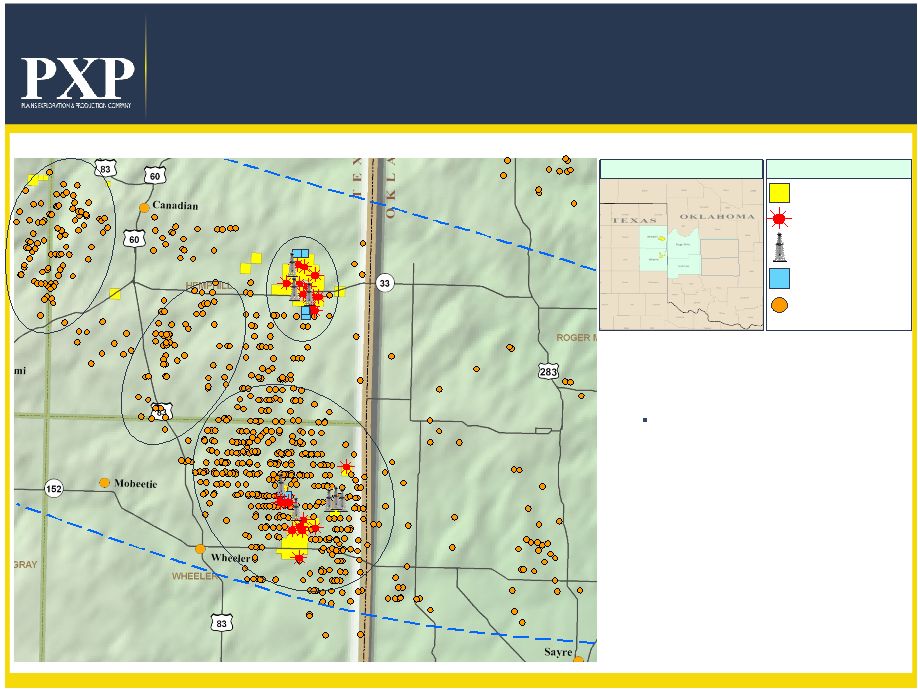

Panhandle Horizontal Liquids Play

Activity Map

•

PXP acreage position

21,400 net acres

•

Five rigs currently operating

•

152 Granite Wash Locations

(PXP WI 93%)

PXP Leases

PXP Producing Wells

Active Drilling

Waiting on Completion

Non PXP

Horizontal Wells

Custer

Washita

Legend

Location Map

Buffalo

Wallow Area

Marvin

Lake

Area

Wheeler

Area

NW. Mendota Area |

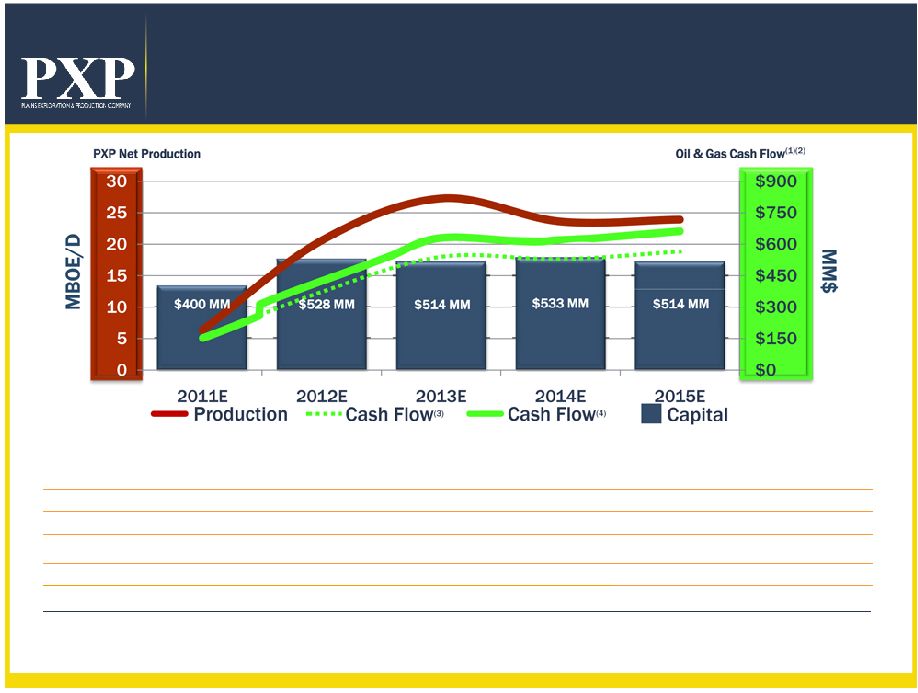

19

Oil & Gas Cash Flow

(1)(2)

Panhandle Horizontal Liquids Play

Operational Plan

January 1, 2010 Project Cost Forward F&D:

$9.79/BOE or $1.62/Mcfe

(2)

PXP

Interest:

93% WI / 74%

NRI Net Acreage:

21,400

Potential

Locations:

152

Net Resource

Potential:

119.5 MMBOE

Average Gross Well Cost:

$8.2 MM

Average Gross EUR per Well:

1.1 MMBOE

PXP Net Production

(1) Oil and Gas revenues minus lease expenses.

(2) Assumes $100/Bbl of oil and natural gas pricing of $4.50/MMBtu in 2011,

$100/Bbl of oil and natural gas pricing of $5.00/MMBtu in 2012, and $100/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

|

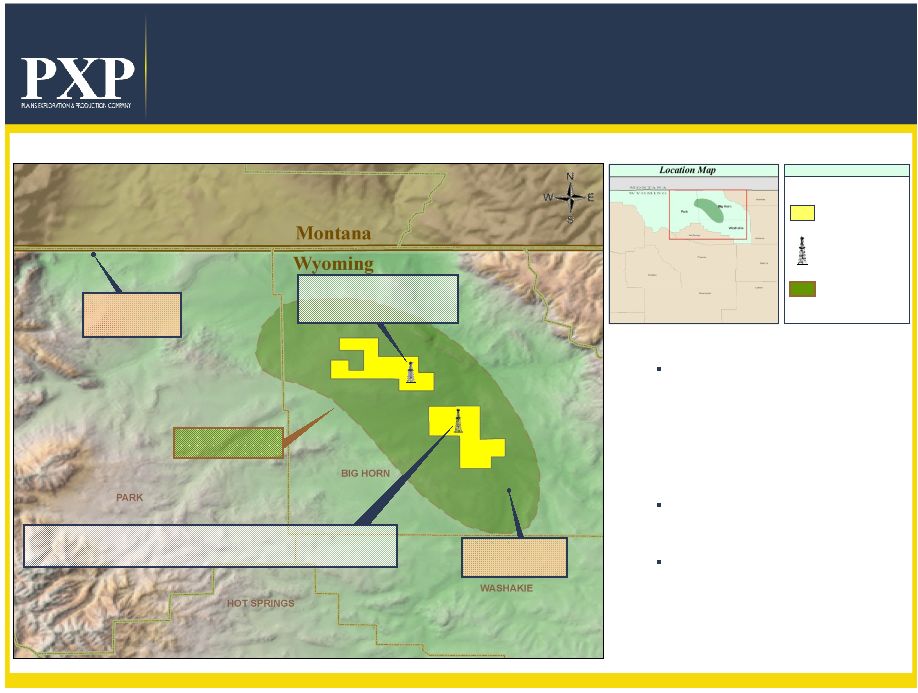

20

Mowry Shale Horizontal Oil Play

Big Horn Basin, Wyoming

•

PXP acreage position

106,300 net acres

•

Proven source rock

•

Petrophysical characteristics

of successful oil shale plays

•

Depth Range

~6,000' to 10,000'

•

Shale Thickness Range

~250' to 400'

•

Currently completing second

well

•

Two additional wells planned

for 2012

Legend

PXP LEASES

PXP DRILLING

OIL FAIRWAY

Oil Fairway

Mowry Oil

Production

Mowry Gas

Production

Drilled

but not completed

Drilled and completed in June 2011. This test produced

high-quality oil in small quantities. |

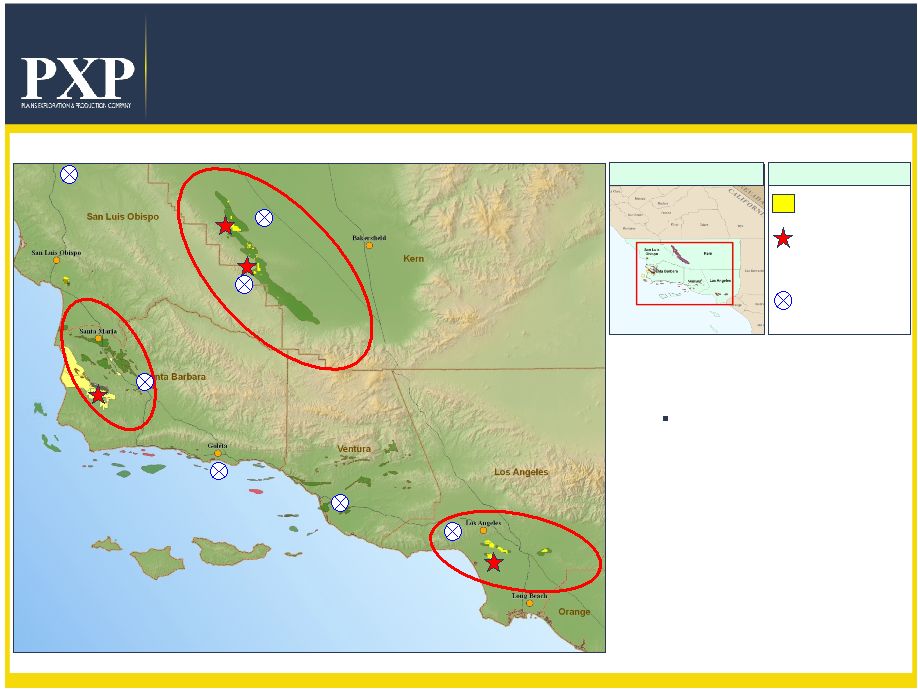

21

Legend

PXP ACREAGE

PXP

MONTEREY

PRODUCTION

OXY DISCOVERY

VENOCO

ACTIVITY

*

•

PXP acreage position

86,000 net acres

•

Acquiring 3D seismic data

over key assets

•

Potential exploratory wells

planned in 2011

Monterey Shale Oil Play

Location Map

Los Angeles Basin

Los Angeles Basin

Point Pedernales

Point Arguello

Rocky Point

Arroyo Grande

Lompoc

Cymric

Belridge

McKittrick

Midway Sunset

Urban Area

Las Cienegas

Inglewood

Montebello

Pescado

Hondo

San Joaquin Basin

San Joaquin Basin

Santa Maria Basin

Santa Maria Basin

*

Jesus Maria |

22

Lucius Oil Development

•

Lucius

Oil

Development,

Deepwater

Gulf

of

Mexico

-

project

financing efforts ongoing

•

Coordinating with official Lucius oil project commercial

sanction targeted for year end 2011

•

“Gross resource potential in the Lucius field is approximately

300+ MMBOE”

(1)

•

The Hadrian 5 (KC 919-3) well, that is part of the Lucius

unitization agreement, initially “encountered 475 feet of net oil

pay”

and “drilling ahead to deeper objectives, encountered an

additional 250 feet of net oil pay”

(2)

•

600+ MMBOE net resource potential from Phobos and

additional Pliocene, Miocene and Lower Tertiary prospects

(1)

Source: Anadarko Petroleum Corporation (APC)

(2)

Exxon Mobil Corporation (XOM) Q2 2011 Earnings Call Transcript

|

23

ExxonMobil / Hadrian 2

KC 964 OCSG-21451 #1

Source: Wood Mackenzie,

Plains Offshore estimates,

ExxonMobil and BOEMRE

ExxonMobil / Hadrian 1

KC 919 OCSG-21447 #1

LUCIUS Discovery

PHOBOS Prospect

Lucius 1

Lucius 1ST

Lucius 2

Hadrian 3

Hadrian 1

Hadrian 2

Hadrian 4

Phobos 1

•Potential 2012 drill

•25,000 acres higher than oil pay at

Hadrian 2

•Pliocene, Miocene and Wilcox potential

•Structure mapped on seismic

Hadrian 2

•Over 1,000 feet of net sand with

over 400 feet of net oil and gas

pay

Hadrian 1

•Over 900 feet of net sand with over

100 feet of net oil and gas pay

•Kicked off additional delineation

drilling in the complex

Lucius 2

•Over 600 feet of net oil pay in three primary

oil pays

•Deeper targets remaining to be drilled

Lucius 1

•Over 600 feet of net high-

quality oil pay with further

gas condensate pay

•Successful flow test

complete

Hadrian 3

•Over 500 feet of net oil pay

Hadrian 5 (KC 919-3)

•Over 700 feet of net oil pay

Hadrian 4

•Discovery

Hadrian 5

HADRIAN Discovery

Lucius / Hadrian / Phobos Oil Complex

500 MMBOE of Discovered Resource;

1+ BBOE Exploration Upside |

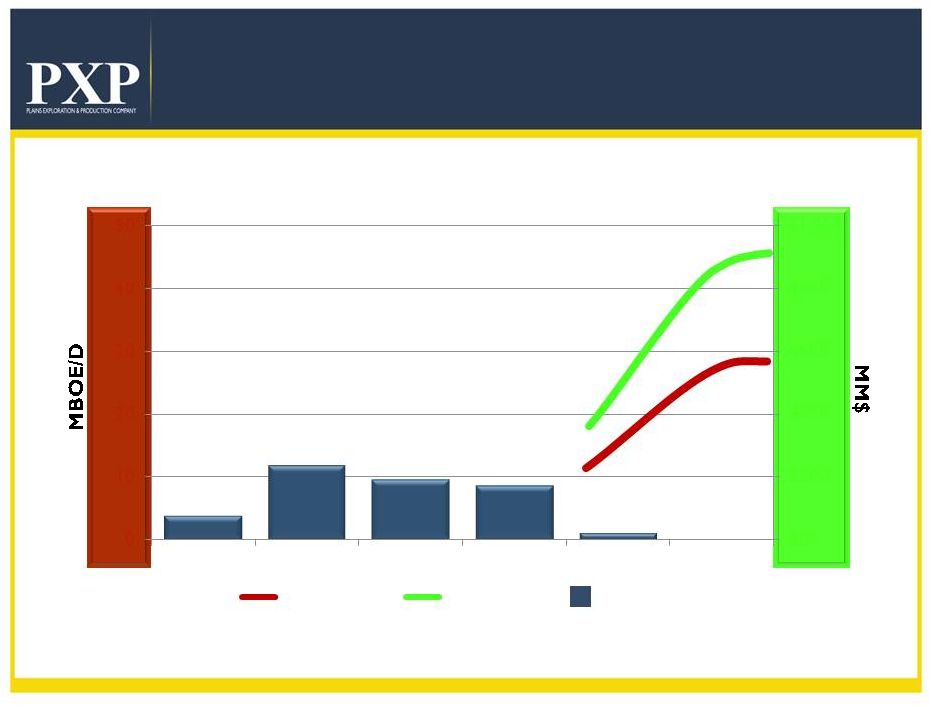

Net

Production Oil & Gas Cash Flow

(1)

Gulf of Mexico Operational Plan

(1) Oil and Gas revenues minus lease expenses.

Capital

Cash Flow

Production

24

50

40

30

20

10

0

$1,000

$800

$600

$400

$200

$0

$75 MM

$235 MM

$190 MM

$170 MM

$10 MM

2011E

2012E

2013E

2014E

2015E |

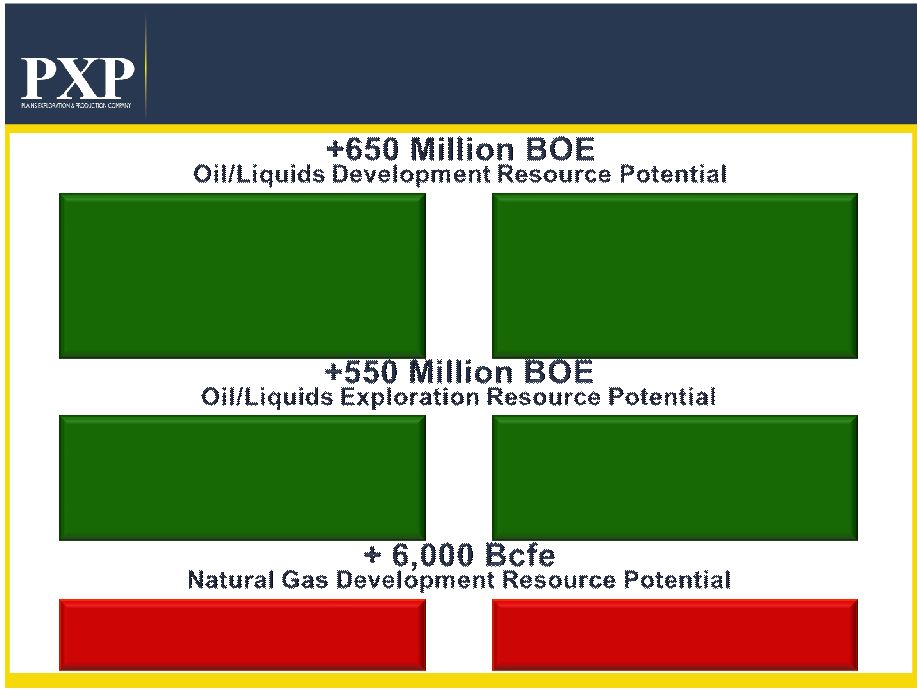

25

+2.2 Billion BOE Resource Potential

Potential Reserves

272 MMBOE

170 MMBOE

120 MMBOE

106 MMBOE

Region

California

Eagle Ford

Granite Wash

Gulf of Mexico

Potential Reserves

156 MMBOE

30 MMBOE

409 MMBOE

Region

Mowry Shale

Monterey Shale

Gulf of Mexico

6,000 Bcfe

60 Bcfe

Haynesville/Bossier

Rockies |

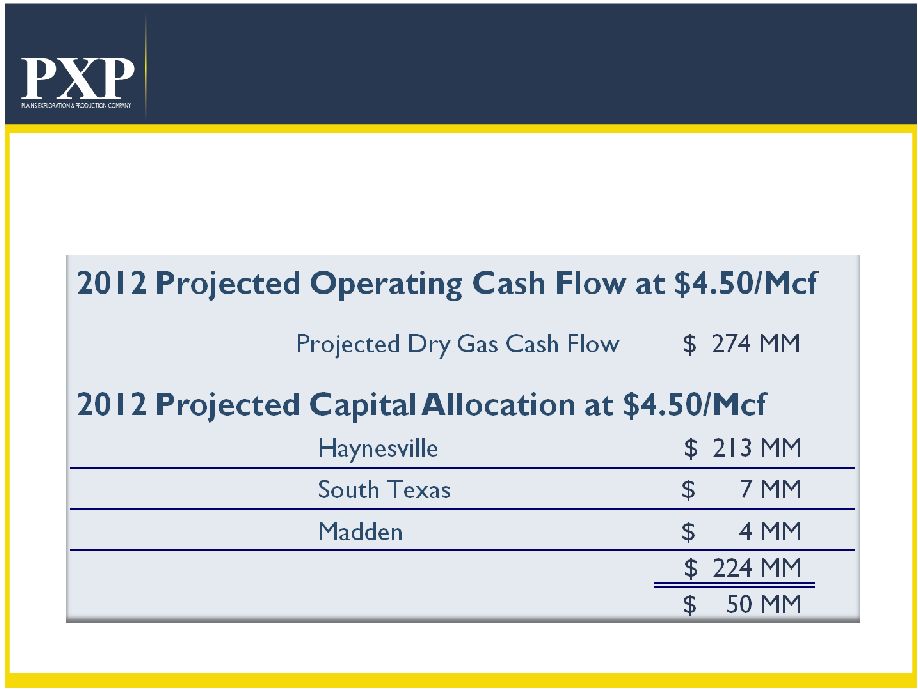

Projected Dry Gas Scenario at $4.50 Mcf

•

Closely align Natural Gas focused CapEx with Natural

Gas generated operating cash flow at $4.50/Mcf

26 |

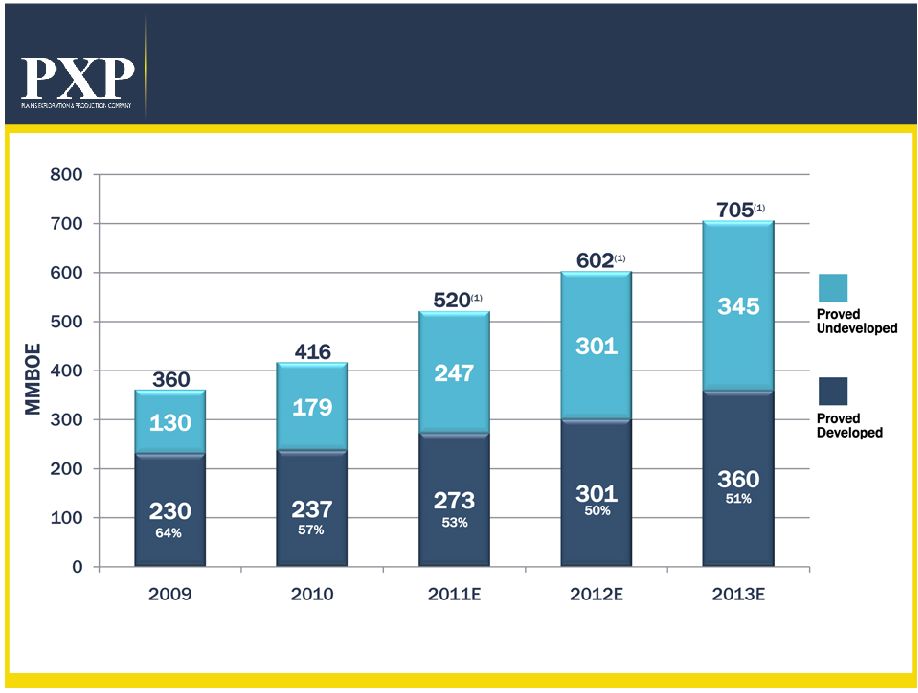

27

Proved Reserves Target Growth

(1)

Illustrates estimated reserves using NYMEX pricing.

Excludes deepwater Gulf of Mexico. |

28

PXP Targets Over Next 3 Years

•

Grow

reserves

15%

to

20%

per

year

over

the

next 3 years

•

Grow

production

10%

to

15%

per

year

over

the

next 3 years

•

Efficiently

manage

business

focusing

on

cost

reduction

and

profitability

•

Maintain

active

hedging

program

for

secure

cash

flow

•

Focus drilling on high liquid development projects

to increase total percentage of oil production |

29

Addendum |

30

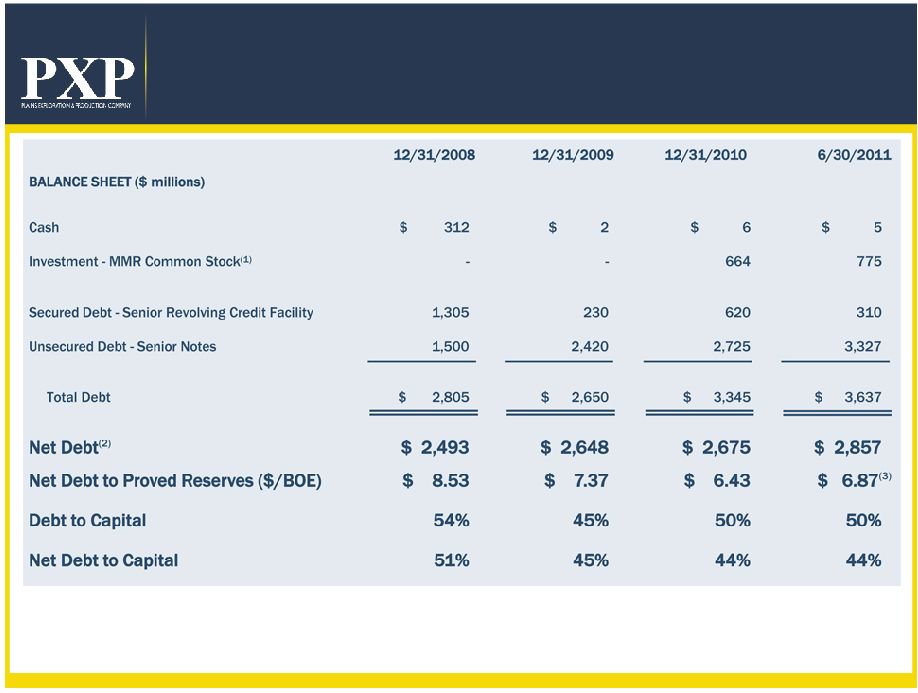

Stronger Financial Position

(1)

At

December

31,

2010

and

June

30,

2011

the

McMoRan

("MMR")

shareswere

valued

at

approximately

$664.3

million,

and

$774.9

million

respectively

based

on

MMR's

closing

stock

price

of

$17.14

on

December

31,

2010

and

$18.48

on

June

30,

2011

discounted

to

reflect

certain

restrictions

on

the

marketability

of

the

MMR

shares.

Under

the

terms

of

the

stockholder

agreement

with

MMR,

we

are

generally

prohibited

from

transferring

any

of

our

shares

of

MMR

until

December

30,

2011.

In

addition,

the

market

price

of

MMR

common

stock

may

decline

substantially

before

we

sell

them.

(2)

Net

of

Cash

and

Investment

in

MMR

common

stock.

(3)

Calculated

utilizing

December

31,

2010

proved

reserves. |

31

(Millions, except for share data)

Quarter

Ended

6/30/2011

Quarter

Ended

6/30/2010

Revenues

$ 514.8

$ 364.6

Production Costs

(143.1)

(100.7)

General & Administrative

(30.8)

(30.3)

DD&A & Accretion Expense

(155.1)

(128.2)

Impairment of Oil & Gas Properties

-

(59.5)

Other Operating Income

0.3

3.9

Income From Operations

$ 186.1

$ 49.8

Income Before Income Taxes

$ 212.1

$ 91.0

Net Income

$ 124.9

$ 45.4

Earnings Per Share –

Diluted

$ 0.87

$ 0.32

Income Statement Summary |

“People building value together to find and produce

energy resources safely, reliably and efficiently”

|