Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended June 30, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission File Number 1-9728

EPOCH HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 20-1938886 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

640 Fifth Avenue, New York, NY 10019

(Address of Principal Executive Offices), (Zip Code)

(212) 303-7200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 per share par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Table of Contents

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in rule 12b-2 of the Exchange Act. (Check one).

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not Check if a Smaller Reporting Company) |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of December 31, 2010, the last trading day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $233.7 million, computed by reference to the closing price of $15.53 on the NASDAQ Global Select Market on that day. Shares of common stock held by officers, directors and certain holders of more than 1% of the outstanding common stock have been excluded from this calculation because such persons may be deemed to be affiliates.

As of August 31, 2011, there were 23,351,892 shares of the registrant’s common stock, $.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Form 10-K as indicated:

| Document |

Part of Form 10-K into Which Incorporated | |

| Epoch Holding Corporation’s Definitive Proxy Statement for the 2011 Annual Meeting of Shareholders to be held on December 1, 2011 | Part III |

Table of Contents

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2011

| Page No. | ||||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

14 | |||||

| Item 1B. |

22 | |||||

| Item 2. |

23 | |||||

| Item 3. |

23 | |||||

| Item 4. |

23 | |||||

| PART II | ||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 24 | ||||

| Item 6. |

28 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

30 | ||||

| Item 7A. |

52 | |||||

| Item 8. |

55 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

84 | ||||

| Item 9A. |

84 | |||||

| Item 9B. |

84 | |||||

| PART III | ||||||

| Item 10. |

85 | |||||

| Item 11. |

85 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 85 | ||||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

85 | ||||

| Item 14. |

85 | |||||

| PART IV | ||||||

| Item 15. |

86 | |||||

| 89 | ||||||

i

Table of Contents

PART I

| Item 1. | Business. |

Forward-Looking Statements

Certain information included, or incorporated by reference in this Annual Report on Form 10-K and other materials filed or to be filed by Epoch Holding Corporation (“Epoch” or the “Company”) with the United States Securities and Exchange Commission (the “SEC”) contain statements that may be considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about the Company, may include projections of the Company’s future financial performance based on the Company’s anticipated growth strategies and trends in the Company’s business. These statements are only predictions based on the Company’s current expectations and projections about future events. There are important factors that could cause the Company’s actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks and uncertainties outlined in Item 1A. “Risk Factors.”

These risks and uncertainties are not exhaustive. Other sections of this Annual Report on Form 10-K may include additional factors which could adversely impact the Company’s business and financial performance. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for the Company’s management to predict all risks and uncertainties, nor can the Company assess the impact of all factors on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, level of activity, performance or achievements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The Company is under no duty to update any of these forward-looking statements after the date of this Annual Report on Form 10-K, nor to conform the Company’s prior statements to actual results or revised expectations, and the Company does not intend to do so.

Forward-looking statements include, but are not limited to, statements about the Company’s:

| • | business environment, |

| • | expectations with respect to the economy, securities markets, the market for asset management activity and other industry trends, |

| • | competitive position, |

| • | business strategy, |

| • | strategic relationships, |

| • | investment products, |

| • | recruitment and retention of employees, |

| • | possible or assumed future results of operations and operating cash flows, |

| • | potential operating performance, achievements, productivity improvements, technological changes, efficiency and cost reduction efforts, |

| • | expected tax rates, and |

| • | the effect of future legislation and regulation on its business. |

1

Table of Contents

The Company uses a fiscal year, which ends on June 30. References to “FY 2011,” “FY 2010,” and “FY 2009” in this document refer to the fiscal years ended June 30, 2011, June 30, 2010, and June 30, 2009, respectively. This Annual Report on Form 10-K may also include forward-looking statements which refer to fiscal years subsequent to the historical financial positions and results of operations contained herein. References to future fiscal years also apply to the June 30 year-end. When we use the terms the “Company,” “management,” “we,” “us,” and “our,” we mean Epoch Holding Corporation and its consolidated subsidiaries.

Available Information

Reports we file electronically with the SEC via the SEC’s Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) may be accessed through the internet. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at www.sec.gov. In addition, the public may read and copy any material that we file with the SEC at the SEC’s Public Reference Room at 100F Street, N.E., Washington, D.C., 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We maintain a website which contains current information on operations and other matters. The website address is www.eipny.com. Through the Investor Relations section of our website, and the “Financial Information” tab therein, we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website also includes information concerning purchases and sales of our equity securities by our executive officers and directors. The information on our website is not, and shall not be deemed to be a part hereof or incorporated into this or any other filings with the SEC.

Also available free of charge on our website within the Investors Relations section, and the “Corporate Governance” tab therein, is our Code of Ethics and Business Conduct, as well as charters for the Audit, Nominating/Corporate Governance, and the Compensation Committees of our Board of Directors.

Overview

Epoch Holding Corporation, incorporated in Delaware in 2004, is a holding company headquartered in New York, NY whose sole line of business is investment advisory and investment management services. The operations of the Company are conducted through its wholly owned subsidiary, Epoch Investment Partners, Inc. (“EIP”). EIP is a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”).

EIP is an asset management firm with over $17 billion in assets under management (“AUM”) as of June 30, 2011, serving institutional, sub-advisory, and high net worth clients worldwide. For the fiscal year ended June 30, 2011, we generated approximately one-third of our total revenue from clients located outside the U.S.

Our firm’s professional investment staff averages over 20 years of industry experience. Our investment philosophy is focused on achieving superior long-term, risk-adjusted returns by investing in companies that generate free cash flow, appropriately allocate capital to create returns for shareholders, have understandable business models, possess transparent financial statements, and are undervalued relative to our investment team’s value determinations. Security selection and portfolio construction processes are designed to reduce the likelihood of significant capital losses in declining markets while participating in returns from rising markets.

2

Table of Contents

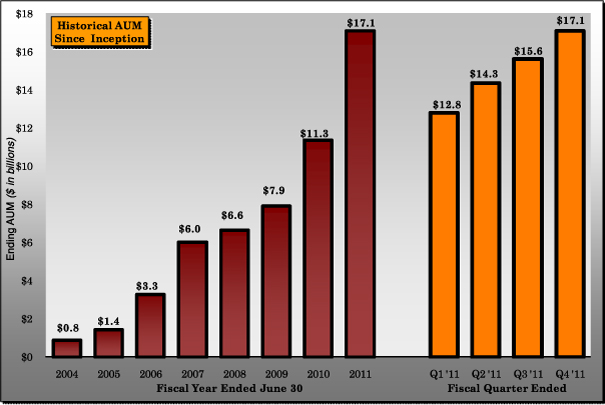

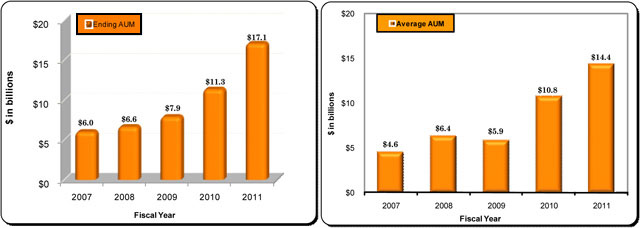

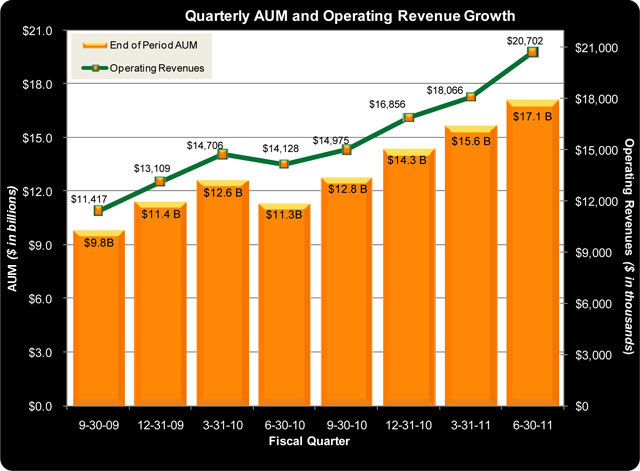

Our operations began in April 2004 with approximately $0.6 billion in AUM and we have grown into a global asset management firm with $17.1 billion in AUM at June 30, 2011. The chart below depicts our annual AUM growth since inception as well as AUM for the last four fiscal quarters:

Our AUM growth reflects favorable long-term investment performance and quality client service, administered across a broad array of investment strategies, distribution channels, and market exposures. We believe these attributes will help us continue to expand and grow our business.

3

Table of Contents

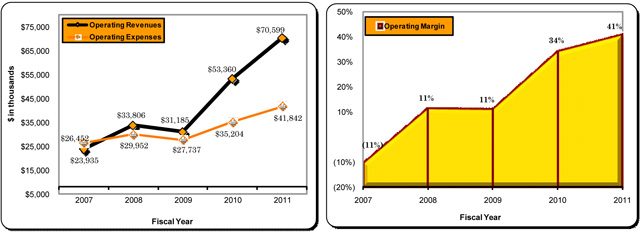

Selected financial operating results for the last five years are as follows:

| For the Fiscal Year Ended June 30, | ||||||||||||||||||||

| (Dollar amounts in millions) |

2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Operating Revenue |

$ | 70,599 | $ | 53,360 | $ | 31,185 | $ | 33,806 | $ | 23,935 | ||||||||||

| Operating Expense |

$ | 41,842 | $ | 35,204 | $ | 27,737 | $ | 29,952 | $ | 26,452 | ||||||||||

| Operating Income |

$ | 28,757 | $ | 18,156 | $ | 3,448 | $ | 3,854 | $ | (2,517 | ) | |||||||||

| Operating Margin (1) |

41 | % | 34 | % | 11 | % | 11 | % | (11 | %) | ||||||||||

| Cash Flows From Operations |

$ | 18,633 | $ | 14,211 | $ | 855 | $ | 11,349 | $ | 2,389 | ||||||||||

| Working Capital (2) |

$ | 41,613 | $ | 43,697 | $ | 41,897 | $ | 36,792 | $ | 32,685 | ||||||||||

| (1) | Operating margin is computed by dividing operating income/(loss) by total operating revenues. |

| (2) | Working capital is computed by subtracting current liabilities from current assets. |

FY 2011 Significant Developments and Highlights*

The following items are corporate highlights and events which transpired during the year ended June 30, 2011:

| (1) | AUM at June 30, 2011 was $17.1 billion, a 51% increase from a year ago. |

| (2) | Net AUM inflows were $1.8 billion. We continued to develop our distribution channels, including the addition of several significant new institutional and sub-advisory relationships. |

| (3) | As of the fiscal year ended June 30, 2011, all of our investment strategies have outperformed their respective benchmarks for the past five-year period, and nearly all investment strategies have outperformed their respective benchmarks since their inception. |

| (4) | Total operating revenues exceeded $70 million, while our operating margin improved to 41%. |

| (5) | We paid a special cash dividend of $0.75 per share in December 2010, in addition to the regular quarterly dividends. In January 2011, the Board approved an increase in the quarterly dividend rate from $0.05 to $0.06 per share. |

| (6) | We repurchased approximately 98,000 shares during the fiscal year ended June 30, 2011. As of June 30, 2011, we have repurchased a cumulative total of 580,016 shares and have 219,984 shares remaining for repurchase under the existing repurchase plan. |

| (7) | Our balance sheet remains strong. At June 30, 2011, liquid assets comprising of cash, cash equivalents, and accounts receivable were $46.3 million, representing 65% of total assets. We continue to operate debt-free. |

* See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for further financial highlights.

4

Table of Contents

Our Business

Investment Management Fees

We earn revenues from managing client accounts under investment advisory and sub-advisory agreements. The fees we earn depend on the type of investment strategy we manage, and are typically negotiated after consultation with the client based upon additional factors such as amount of AUM and servicing requirements. Approximately 48% of our fees are based upon daily average AUM, while 52% of our fees are based upon quarter-end AUM balances. We also have certain agreements which allow us to earn performance fees in the event that investment returns meet or exceed targeted amounts during a measurement period.

Clients

Our client base consists of a large number of geographically diverse clients across many industries. We provide investment management services to a broad range of clients including corporations, mutual funds, retirement plans, public pension funds, endowments, foundations, financial institutions and high net worth individuals. We strive to expand our client base by attracting new clients and earn additional business from our existing clients.

Investment Philosophy

Our investment philosophy is focused on achieving superior long-term, risk-adjusted returns by investing in companies that generate free cash flow, appropriately allocate capital to create returns for shareholders, have understandable business models, possess transparent financial statements, and are undervalued relative to our investment team’s value determinations. Security selection and portfolio construction processes are designed to reduce the likelihood of significant capital losses in declining markets while participating in returns from rising markets.

Investment Process

Our investment strategies are managed by a team of portfolio managers supported by fundamental and quantitative research analysts. Our investment process is centered on the integration of several components: fundamental research analysis, quantitative research, disciplined portfolio construction and management, performance attribution and trading.

Our investment process incorporates the following concepts:

| • | Analyze the Business. Determine the sustainability of the business, earnings drivers, barriers to entry, and competitive advantages. |

| • | Understand the Cash Flow Structure. Focus on companies that generate cash earnings and assess the quality and character of those earnings to determine the net cash flow from the business. |

| • | Relate Cash Flow to Enterprise Value. Examine relevant claims against net cash flow and determine the necessity of these claims to maintain and grow the business. Evaluate how management will use free cash flow. Value the cash flow stream and compare it to enterprise value to determine the attractiveness of the investment. |

| • | Evaluate Management Quality. Identify management with an intention and demonstrated ability to create shareholder value. |

| • | Seek Unrecognized Assets. Uncover, where possible, hidden, undervalued or underutilized assets, especially in under-researched small and mid-cap companies. |

While the security selection and research methodology is the same for all of our investment strategies, the portfolio construction process is adaptable to the specific parameters of each client’s individual mandate.

5

Table of Contents

Our research analysts subject the companies they cover to a detailed fundamental analysis. They focus on a company’s management, business plan, financial statements, industry position and corporate governance. We also require our research analysts to spend a significant amount of time interacting with and visiting company management.

Portfolio Risk Management

Risk management is central to the operation of our investment process. We use both quantitative and qualitative analyses to monitor financial and event risk and manage volatility. We place substantial emphasis on portfolio diversification by asset class, industry sector and geography. The active management of positions in our strategies allows for timely reallocation of capital in response to changes in business, market or economic conditions. Additionally, our portfolio managers meet with our analysts regularly to review inherent risks associated with positions in each strategy.

Investment Strategies

As of June 30, 2011, we offered the following investment strategies to our clients:

| (1) | U.S. All Cap Value — Comprised of a broad range of U.S. companies with market capitalizations that resemble stocks in the Russell 3000*, a U.S. Equity index which measures the performance of the 3,000 largest U.S. companies based upon total market capitalization. |

| (2) | U.S. Value — Reflects a selection of equities in U.S. companies with market capitalizations generally considered comparable to the Russell 1000*, a U.S. Equity index which measures the performance of the 1,000 largest companies in the Russell 3000 Index*. |

| (3) | U.S. Smid (small/mid) Cap Value — Comprises U.S. companies with market capitalizations generally considered to be comparable to the Russell 2500*, a U.S. Equity index which measures the performance of the 2,500 smallest companies in the Russell 3000 Index*. |

| (4) | U.S. Small Cap Value — Consists of U.S. companies with market capitalizations generally considered to be comparable to the Russell 2000*, a U.S. Equity index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index*. |

| (5) | U.S. Choice — Uses the same security selection process as our other investment strategies but the holdings are limited to 20 – 30 U.S. equity positions and is fully invested. The benchmark for this investment strategy is the Russell 3000 Index*. |

| (6) | International Small Cap — Draws almost all of its holdings from companies outside the U.S., with “small cap” defined as companies with market capitalization in the bottom 25% of the publicly traded companies in each country where the strategy is applied. MSCI World ex USA Small Cap Index** is the benchmark for this investment strategy. |

| (7) | Global Small Cap — Seeks to capitalize upon the continuing globalization of the world economy by investing in small cap companies in the U.S. and throughout the world. The benchmark for this investment strategy is the MSCI World Small Cap Index**. |

| (8) | Global Choice — Uses the same security selection process as our other investment strategies but the holdings are limited to 20 – 35 global equity positions and are fully invested. The MSCI World Index** is the benchmark for this investment strategy. |

| (9) | Global Absolute Return — While this strategy uses the same security selection process as other investment strategies offered by EIP, its holdings are generally limited to fewer than 30 positions. Individual positions can be as high as 15% and cash is used to control loss exposure. The benchmark for this investment strategy is the MSCI World Index**. |

6

Table of Contents

| (10) | Global Equity Shareholder Yield — Seeks to invest in a diversified portfolio of global equity securities with a history of attractive dividend yields and positive growth in free cash flow. The primary objective of this investment strategy is to seek a high level of income, with capital appreciation as a secondary investment objective. The MSCI World Index** is the benchmark for this investment strategy. |

| (11) | Balanced Portfolios — This investment strategy is available primarily to our high net worth investors. The mix of debt and equity securities is tailored to reflect (i) the client’s tolerance for risk and (ii) the client’s marginal tax rate or other preferences. As a result, the mix can vary among individual clients. The equity components of these portfolios typically reflect our U.S. All Cap equity structure and generally contain 40 – 60 positions, almost all of which are held in our other investment strategies. The debt component of the portfolio is largely comprised of high quality bonds. |

| * | Russell indexes are trademarks of Russell Investments, which is not affiliated with Epoch. |

| ** | MSCI World Indexes are trademarks of MSCI Inc., which is not affiliated with Epoch. |

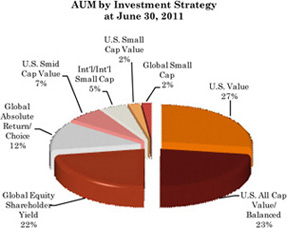

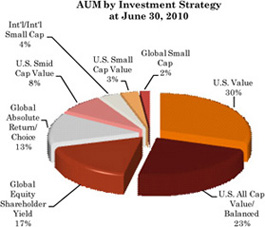

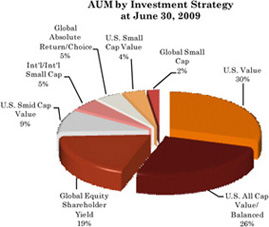

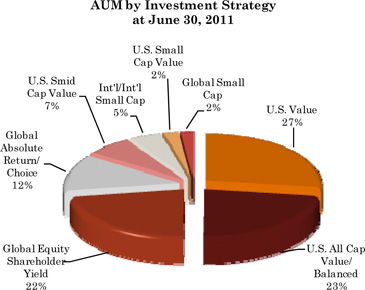

The following chart displays our investment strategies as a percentage of AUM as of June 30, 2011:

The table below depicts our investment strategies’ annual AUM for the past five years, as well as their respective compound annual growth rate for the one, three, and five years ended June 30, 2011 (in millions):

| As of June 30, | Compound Annual Growth Rate | |||||||||||||||||||||||||||||||

| Investment Strategy |

2011 | 2010 | 2009 | 2008 | 2007 | 1 Year | 3 Years | 5 Years | ||||||||||||||||||||||||

| U.S. Value |

$ | 4,661 | $ | 3,403 | $ | 2,340 | $ | 1,499 | $ | 1,155 | 37.0 | % | 46.0 | % | 42.1 | % | ||||||||||||||||

| U.S. All Cap Value/Balanced |

3,900 | 2,646 | 2,016 | 1,601 | 1,395 | 47.4 | % | 34.6 | % | 37.7 | % | |||||||||||||||||||||

| Global Equity Shareholder Yield |

3,811 | 1,959 | 1,515 | 1,538 | 1,323 | 94.5 | % | 35.3 | % | 77.1 | % | |||||||||||||||||||||

| Global Absolute Return/Choice(1) |

2,131 | 1,462 | 375 | 402 | 259 | 45.8 | % | 74.4 | % | 80.6 | % | |||||||||||||||||||||

| U.S. Smid Cap Value |

1,115 | 902 | 749 | 409 | (2) | 13 | 23.6 | % | 39.7 | % | N/A | |||||||||||||||||||||

| International/International Small Cap |

778 | 403 | 396 | 548 | 688 | 93.1 | % | 12.4 | % | 15.8 | % | |||||||||||||||||||||

| U.S. Small Cap Value |

374 | 362 | 325 | 423 | (2) | 995 | 3.3 | % | (4.0 | %) | (10.8 | %) | ||||||||||||||||||||

| Global Small Cap |

316 | 207 | 175 | 214 | 173 | 52.7 | % | 13.9 | % | 1.3 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total AUM |

$ | 17,086 | $ | 11,344 | $ | 7,891 | $ | 6,634 | $ | 6,001 | 50.6 | % | 37.1 | % | 39.3 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

N/A - not applicable

| (1) | Includes U.S. Choice and Global Choice. |

| (2) | In the year ended June 30, 2008, approximately $360 million of AUM transferred from the U.S. Small Cap Value investment strategy to the U.S. Smid Cap Value investment strategy. |

7

Table of Contents

Investment Strategy Development

We have developed several new investment strategies since our inception. Investment strategy development has stemmed from our investment team’s skill and market knowledge, as well as our responsiveness to client and market demands. We will only launch a new investment strategy if we believe that it can add value to a client’s investment portfolio, or may be attractive to our clients in the future. In certain instances we may incubate an investment strategy using our own capital, in order to test and refine our investment strategy and process before introducing the investment strategy to our clients.

Performance Highlights

We measure relative investment performance by comparing our investment returns to competing investment strategies, industry benchmarks and client investment objectives. As long-term fundamental investors, we believe that our investment strategies yield the most benefits, and are best evaluated, over a long-term time horizon. The following table shows each investment strategy’s composite returns, net of management fees, for the one, three and five year periods ended June 30, 2011 and from the investment strategy’s inception, compared to their applicable benchmarks:

| Inception Date(1) |

Returns* (%)(2) | ||||||||||||

| Strategy |

1 Year |

3 Years |

5 Years |

Since Inception | |||||||||

| U.S. Value |

7/31/01 | 32.7 | 2.9 | 5.6 | 6.0 | ||||||||

| Russell 1000 |

31.9 | 3.7 | 3.3 | 3.4 | |||||||||

| Russell 1000 Value |

28.9 | 2.3 | 1.2 | 4.0 | |||||||||

| U.S. All Cap Value |

7/31/94 | 36.6 | 2.7 | 5.0 | 11.0 | ||||||||

| Russell 3000 |

32.4 | 4.0 | 3.4 | 8.7 | |||||||||

| Russell 3000 Value |

29.1 | 2.7 | 1.2 | 9.1 | |||||||||

| Global Equity Shareholder Yield |

12/31/05 | 32.8 | 5.7 | 6.2 | 6.9 | ||||||||

| MSCI World (Net) |

30.5 | 0.5 | 2.3 | 3.2 | |||||||||

| Global Absolute Return |

12/31/01 | 24.6 | 3.8 | 4.8 | 9.9 | ||||||||

| MSCI World (Net) |

30.5 | 0.5 | 2.3 | 5.0 | |||||||||

| Global Choice |

9/30/05 | 26.4 | 2.1 | 6.4 | 8.2 | ||||||||

| MSCI World (Net) |

30.5 | 0.5 | 2.3 | 3.6 | |||||||||

| U.S. Choice |

4/30/05 | 35.5 | 6.3 | 5.5 | 6.8 | ||||||||

| Russell 3000 |

32.4 | 4.0 | 3.4 | 5.0 | |||||||||

| U.S. Smid Cap Value |

8/31/06 | 37.7 | 6.8 | N/A | 5.6 | ||||||||

| Russell 2500 |

39.3 | 8.2 | N/A | 5.5 | |||||||||

| Russell 2500 Value |

34.5 | 7.9 | N/A | 3.4 | |||||||||

| International Small Cap |

1/31/05 | 40.2 | 3.0 | 6.0 | 10.6 | ||||||||

| MSCI World ex USA Small Cap (Net) |

37.0 | 3.7 | 3.1 | 6.8 | |||||||||

| U.S. Small Cap Value |

12/31/02 | 39.4 | 6.7 | 5.6 | 9.9 | ||||||||

| Russell 2000 |

37.4 | 7.8 | 4.1 | 10.9 | |||||||||

| Russell 2000 Value |

31.4 | 7.1 | 2.2 | 10.3 | |||||||||

| Global Small Cap |

12/31/02 | 40.4 | 6.9 | 7.4 | 13.1 | ||||||||

| MSCI World Small Cap (Net) |

38.4 | 7.0 | 4.4 | 13.8 | |||||||||

* – Index and investment strategy returns assume dividend reinvestment. Investment strategy returns are net of management fees.

8

Table of Contents

N/A – not applicable.

| (1) | Epoch Investment Partners, Inc. became a registered investment adviser under the Investment Advisers Act of 1940 in June 2004. Performance from April 2001 through May 2004 is for our investment team and accounts while at Steinberg Priest Sloane Capital Management, LLC. For the period July 1994 through March 2001, Chief Investment Officer William W. Priest managed the accounts while at Credit Suisse Asset Management, LLC. and was the only individual responsible for selecting the securities to buy and sell. |

| (2) | Past performance is not indicative of future results. |

Distribution Channels

Our AUM is distributed through multiple channels. Our institutional sales efforts include building strong relationships with institutional consultants and also establishing direct relationships with institutional clients.

We manage certain sub-advisory mandates that provide access to market segments that we would not otherwise serve. For example, we currently serve as sub-advisor to mutual funds offered by major financial institutions in retail channels. These mandates are attractive to us because we have chosen not to build the large team of sales professionals typically required to service those channels. We typically approach the servicing of those relationships in a manner similar to our approach with other large institutional account clients.

We service the high net worth channel both directly and through third-party intermediaries, such as wealth advisers who utilize our investment strategies in investment programs they construct for their clients. We maintain a limited direct sales effort in the high net worth channel, and previously raised the minimum account size for this channel.

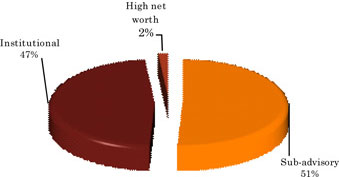

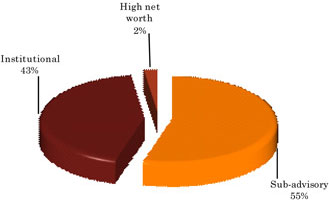

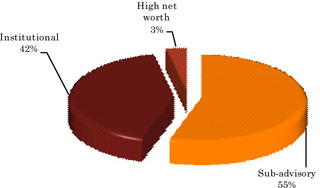

The following table provides information regarding the composition of our AUM by distribution channel for the past five years, as well as its respective compound annual growth rate for the one, three, and five years ended June 30, 2011 (in millions):

| As of June 30 | Compound Annual Growth Rate | |||||||||||||||||||||||||||||||

| Distribution Channel |

2011 | 2010 | 2009 | 2008 | 2007 | 1 Year | 3 Years | 5 Years | ||||||||||||||||||||||||

| Sub-advisory |

$ | 8,680 | $ | 6,183 | (1) | $ | 4,332 | $ | 3,080 | $ | 2,876 | 40.4 | % | 41.3 | % | 38.3 | % | |||||||||||||||

| Institutional |

8,140 | 4,915 | (1) | 3,309 | 3,263 | (2) | 2,765 | 65.6 | % | 35.6 | % | 45.6 | % | |||||||||||||||||||

| High Net Worth |

266 | 246 | 250 | 291 | (2) | 360 | 8.1 | % | (3.0 | %) | (1.9 | %) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total AUM |

$ | 17,086 | $ | 11,344 | $ | 7,891 | $ | 6,634 | $ | 6,001 | 50.6 | % | 37.1 | % | 39.3 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | During the three months ended December 31, 2009, approximately $820 million of AUM previously classified as Institutional was reclassified to Sub-advisory in conjunction with the adoption of the Epoch Funds by New York Life Investment Management. |

| (2) | During the fiscal year ended June 30, 2008, approximately $28 million of AUM in separate accounts within the high net worth distribution channel transferred to the Epoch Global Absolute Return Fund, LLC, and approximately $8 million transferred to the Epoch U.S. All Cap Equity Fund, both of which are included within the Institutional distribution channel above. |

Strategic Relationship

In July 2009, we entered into a strategic relationship with New York Life Investments, whereby the MainStay Group of Funds adopted our family of mutual funds (the “Epoch Funds”). The adoption was completed in November 2009. We are responsible for the day-to-day investment management of the funds through a sub-advisory relationship, while MainStay Investments (“MainStay”), the retail distribution arm of New York Life Investments, is responsible for the distribution and administration of the funds. Each former Epoch Fund is now co-branded as a “MainStay Epoch” Fund.

In addition to an existing sub-advisory relationship with New York Life Investments for certain funds, and the adoption of the Epoch Funds indicated above, EIP and New York Life Investments have entered into an arrangement wherein, among other things, EIP and an affiliate of New York Life Investments have established a distribution and administration relationship with respect to certain separately managed account and unified managed account products, and for a period of three years New York Life Investments agrees to pay certain additional base fees and meet minimum distribution targets. For the fiscal year ended June 30, 2011, New York Life Investment Management, through the MainStay Epoch Funds and other funds sub-advised by EIP, accounted for approximately 19% of consolidated operating revenues. Our services and relationship with New York Life Investment Management is considered important to our ongoing growth strategy.

9

Table of Contents

Client Service

Our client service team plays a critical role in maintaining client relations and ensuring quality client service. A dedicated client relationship manager serves as a single point of contact. Some of the key roles and responsibilities of our client service team are as follows:

| • | regular portfolio updates and on-going monitoring of client satisfaction; |

| • | maintaining a comprehensive website including video and whitepaper perspectives on investment issues; and |

| • | hosting quarterly client webcasts with presentations and insights from our senior investment professionals. |

Business Continuity, Technology and Information Security

Business continuity and information security are high priorities for us. Our business continuity plans have been developed to provide reasonable assurance of business continuity in the event of disruptions of our facilities and to comply with regulatory requirements. The key elements of the plans are crisis management and back-up recovery facilities. In the area of information security, we have developed and implemented policies and technology to protect information assets of our firm and our clients.

Our business and operations rely on the secure processing, storage and transmission of confidential and other information. We have made substantial investments in our technology, and are committed to the continued development and use of technology throughout our firm. Our technology initiatives are designed to enhance client service, improve our trading and execution capabilities, support risk management and increase our overall efficiency, productivity and control.

Competition

The investment advisory and investment management industry is highly competitive. There are few barriers to entry for new firms and consolidation within the industry continues to alter the competitive landscape. We continuously encounter competitors in the marketplace who offer similar investment strategies and services. No single or small group of competitors is dominant in the industry. We compete in the U.S. and international markets with a large number of global and U.S. investment advisors, commercial banks, broker/dealers, insurance companies and other financial institutions. According to Pensions & Investments, a publication covering the money management industry, we ranked 228th worldwide out of 711 asset management firms as of December 31, 2010, based on our AUM level of $14.3 billion at that time. When comparing only the equity portion of AUM of all asset management firms, we ranked 134th out of 514 firms who had all or a portion of their AUM invested in equities.

We compete primarily on the basis of investment philosophy, investment performance, range of investment strategies and features, reputation, and quality of client service. We believe that our investment style, investment strategies, and distribution channels enable us to compete effectively in our industry. We also believe that being an independent asset management firm is a competitive advantage, enabling our business model to avoid conflicts that are often inherent within larger institutions that offer a wide range of services. While we believe we will continue to be successful in growing our AUM, it may be necessary to expend additional resources to compete effectively. Our competitive success will depend upon our ability to develop and market investment strategies, adopt or develop new technologies, and continue to expand our relationships with existing clients and attract new ones. Our ability to compete also depends on our ability to attract and retain key employees while managing our compensation and other costs.

10

Table of Contents

Competitive Strengths

We are a global asset management firm with accomplished and experienced professionals that combines in-house research and insight. Our team of senior managers, including our investment professionals, marketing and sales directors, and client service personnel, averages over 20 years of industry experience. We pride ourselves on being able to offer a high level of attention from senior personnel to our clients. We have many highly skilled professionals who have chosen to be part of a smaller firm that has flexibility and preserves an entrepreneurial environment. All of our employees are shareholders. Accordingly our employees’ interests are aligned with those of our clients and shareholders.

Our overall investment philosophy is focused on achieving superior risk-adjusted returns by investing in companies that generate free cash flow and are undervalued relative to our investment team’s value determinations. We have a track record of achieving superior risk-adjusted investment returns over the longer term across our key investment strategies. As of the fiscal year ended June 30, 2011, all of our investment strategies have outperformed their respective benchmarks for the past five-year period, and nearly all investment strategies have outperformed their respective benchmarks since their inception.

We foster an open, collaborative culture that encourages the sharing of ideas and insights. We believe that sharing ideas and analyses across investment teams allows us to leverage our knowledge of markets and industries worldwide. Additionally, this collaboration enables us to readily implement ideas across our range of investment strategies.

We are a global firm in both investment strategy set and in distribution. We offer a set of investment strategies that allows our clients to access investment opportunities worldwide. Our AUM is distributed through multiple channels, including intermediaries such as investment consultants and through sub-advisory relationships. Our distribution model has allowed us to achieve significant leverage from our focused sales force and client service infrastructure.

Our balance sheet is also a source of competitive strength. We maintain liquidity levels sufficient to weather adverse market conditions and to enable us to take advantage of growth opportunities.

Growth Strategy

As we enter our eighth full year of operations, our growth strategy will remain focused on generating superior risk-adjusted investment returns, providing the highest level of client service and continuing to generate operating margins consistent with seasoned, mature firms within our industry. We will also continue to be focused on the development of distribution channels to enable us to offer our various investment strategies to a broad array of clients. These efforts will continue to include developing relationships with investment advisory consultants, initiating managed accounts with third-party institutions, and maintaining strong advisory and sub-advisory relationships. We are also looking to continue to expand internationally through our established distribution partners.

We routinely evaluate our strategic position and maintain a disciplined acquisition and alliance effort that seeks complementary investment strategies or new investment strategies which could benefit clients. While we continue to actively seek such opportunities, we will only act on opportunities that we believe are accretive to our long-term business strategy.

Regulation

Our business is subject to various federal, state and foreign laws and regulations. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of participants in those markets, including investment advisory clients and shareholders of investment funds. Under these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event the adviser fails to comply with such laws and regulations. Possible sanctions that may be imposed include civil and criminal liability, the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines.

11

Table of Contents

Epoch Investment Partners, Inc. (“EIP”), our sole operating subsidiary, is registered as an investment adviser with the SEC. As a registered investment adviser, EIP is subject to the requirements of the Investment Advisers Act, the SEC’s regulations thereunder, and examination by the SEC. Requirements relate to, among other things, fiduciary duties to clients, engaging in transactions with clients, disclosure obligations, record keeping and reporting obligations, and general anti-fraud prohibitions. Moreover, in our capacity as a sub-advisor to mutual funds, we are subject to the Investment Company Act of 1940 (the “Investment Company Act”) and its rules and regulations. The Investment Company Act regulates the relationship between a mutual fund and its investment adviser and imposes additional obligations, including detailed operational requirements for both the funds and their advisers. Additionally, an investment adviser’s agreement with a registered fund may be terminated by the fund on not more than 60 days notice, and is subject to renewal by the fund’s board after an initial two-year term. Under the Investment Advisers Act, our investment management agreements may not be assigned without the client’s consent. Under the Investment Company Act, advisory agreements with registered funds, such as the funds we subadvise, terminate automatically upon assignment. The term “assignment” is broadly defined and includes direct assignment as well as assignments that may be deemed to occur, under certain circumstances, upon the transfer, directly or indirectly, of a controlling interest in us. The SEC is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act and the Investment Company Act, ranging from fines and censures to termination of an investment adviser’s registration. The failure of EIP, or the registered funds for which EIP serves as sub-advisor, to comply with the requirements of the SEC could have a material adverse effect on us.

To the extent that EIP is a “fiduciary” under the Employment Retirement Act of 1974 (“ERISA”) with respect to benefit plan clients, it is subject to ERISA, and to regulations promulgated thereunder. ERISA and applicable provisions of the Internal Revenue Code impose certain duties on persons who are fiduciaries under ERISA, prohibit certain transactions involving ERISA plan clients, and provide monetary penalties for violations of these prohibitions. Failure to comply with these requirements could have a material adverse effect on our business.

Our trading activities for client accounts are regulated under the Securities Exchange Act of 1934, as amended (“Exchange Act”), as well as the rules of various U.S. and non-U.S. securities exchanges and self-regulatory organizations, including laws governing trading on inside information, market manipulation and a broad number of trading requirements (e.g., volume limitations, reporting obligations) and market regulation policies in the United States and abroad.

We are also subject to investment advisory rules and regulations internationally. EIP is registered with the Ontario Securities Commission and several other provinces in Canada, and also operates in various other foreign jurisdictions without registration in reliance upon applicable exemptions under the laws of those jurisdictions.

The preceding descriptions of the regulatory and statutory provisions applicable to us are not complete and are qualified in their entirety by reference to their respective statutory or regulatory provisions.

Regulatory Reform

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “DFA”) was signed into law in the United States. The DFA is expansive in scope and requires the adoption of extensive regulations and numerous regulatory decisions in order to be implemented. The ultimate adoption of these regulations and decisions will determine the impact of the DFA on us. It is difficult to predict the ultimate effects that the DFA, or subsequent implementing regulations and decisions, will have upon our business and results of operations. Other jurisdictions outside the United States in which we operate are also in the process of devising or considering more pervasive regulation of many elements of the financial services industry, which could have an impact on us. The DFA and its regulations, other new laws or regulations, changes in rules promulgated by either the SEC or other international, federal and state regulatory authorities or self-regulatory bodies, or changes in the interpretation or enforcement of existing laws and rules could materially and adversely impact the scope or profitability or our business.

Geographic Information

We have clients located worldwide. One of our key priorities is to continue to expand our global distribution network and partnerships. We are building our distribution network through both direct sales to clients and sales through intermediaries, such as investment consultants, private banks, and third party distributors.

12

Table of Contents

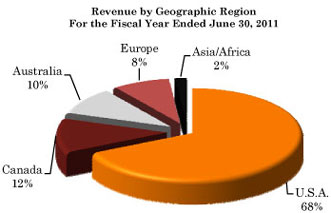

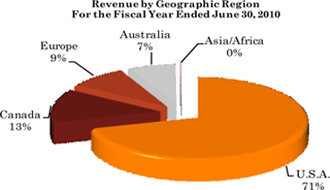

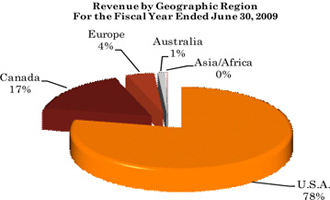

For the fiscal years ended June 30, 2011, 2010, and 2009, approximately 32%, 29%, and 22%, respectively, of our total operating revenues were generated from clients domiciled outside the United States. Information relating to revenues by geographic region is contained in Note 19 in the Notes to our Consolidated Financial Statements in Item 8 of Part II of this Form 10-K, which is incorporated herein by reference.

Employees

We believe that a major strength and principal reason for our success is the quality and dedication of our employees and the shared sense of being a part of a team. We strive to maintain a work environment that fosters professionalism, excellence, diversity, cooperation among our employees, and high standards of business ethics.

As of June 30, 2011, we employed 57 full-time employees, including 22 investment management, research and trading professionals, 15 marketing and client service professionals and 20 operations and business management professionals. None of our employees are subject to any collective bargaining agreements. Our portfolio managers and analysts average over 20 years of experience. Since our founding seven years ago, we have had a very low turnover rate among our portfolio managers and analysts. The majority of our portfolio managers have devoted most of their professional careers to the analysis, selection and surveillance of the types of securities held in the funds or accounts they manage.

13

Table of Contents

| Item 1A. | Risk Factors. |

As an investment management firm, risk is an inherent part of our business. Capital markets, by their nature, are prone to uncertainty and expose participants to a variety of risks. While we devote significant resources across all of our operations to identify, measure, monitor, manage and analyze market and operating risk, our business, prospects, financial condition, results of operations, cash flow, or share price could be materially adversely affected by any of the following risks. Additionally, other risks and uncertainties that we do not presently consider to be material or of which we are not presently aware may become important factors that affect us in the future.

Risks Related to Our Business

Difficult market conditions can adversely affect our business in many ways, including reducing the value of our AUM and/or causing clients to withdraw funds, each of which could materially reduce our revenues and adversely affect our results of operations and our financial condition.

We derive all of our revenues from investment management services. The investment management fees paid to us are typically based on the market value of AUM. Accordingly, a general or prolonged decline in securities markets, and equity markets in particular, may cause our revenues and net income to decline due to (i) the value of our AUM decreasing, and/or (ii) clients withdrawing funds in favor of investments they perceive as offering greater opportunity or lower risk. The securities markets have recently been and may continue to be highly volatile and securities prices may decrease for many reasons beyond our control, including a general economic downturn, deterioration in the credit of sovereign nations, political uncertainty or acts of terrorism. In addition, any such decline in the equity markets, failure of these markets to sustain their prior levels of growth, or continued short-term volatility in these markets could result in clients withdrawing funds from our investment strategies in full or in part, or decreased demand for our investment services, which would adversely affect us. Our operating margin may also be adversely affected if we are unable to reduce fixed costs and other expenses within a time frame sufficient to match any decrease in revenue relating to changes in our AUM.

Our investment style in the asset management business may underperform other investment approaches, which may result in significant client or asset departures or a reduction in AUM.

Even when securities prices are rising, performance can be affected by investment style. Many of the equity investment strategies in our asset management business share a common investment orientation towards fundamental security selection. Our overall investment philosophy is focused on achieving a superior risk-adjusted return by investing in companies that generate free cash flow. We believe this style tends to outperform the market in some market environments and underperform it in others. In particular, a prolonged “growth” environment (i.e., a prolonged period whereby growth stocks outperform value stocks) may cause our investment strategy to be out of favor with some clients, consultants or third-party intermediaries.

If our investment strategies perform poorly, our results of operations, financial condition and our prospects for future growth may be materially adversely affected.

The relative performance of our investment strategies is critical in retaining existing clients as well as attracting new clients. If our investment strategies perform poorly, our earnings could be reduced because:

| • | existing clients may withdraw funds from our asset management business in favor of better performing investment strategies, which could cause the revenues that we generate from our investment advisory fees to decline; |

| • | third-party financial intermediaries, advisers or consultants may rate our investment strategies poorly, which may result in client withdrawals and reduced asset flows from these third parties or their clients; |

| • | the investment funds which we sub-advise may decide not to renew or decide to terminate the agreements pursuant to which we sub-advise them and we may not be able to replace these relationships; or |

| • | firms with which we have strategic alliances may terminate such relationships with us, and future strategic alliances may be unavailable. |

14

Table of Contents

Because our clients can remove the assets we manage on short notice, we may experience unexpected declines in revenue and profitability.

Our investment advisory and sub-advisory agreements can generally be terminated upon very short notice. Institutional and individual clients, and firms with which we have strategic alliances, can terminate their relationships with us, reduce the aggregate amount of AUM or shift their funds to other types of accounts with different rate structures for a number of reasons, including investment performance, changes in prevailing interest rates, changes in investment preferences, changes in their management or control, loss of our key investment management or other personnel, and financial market performance. Further, the ability to terminate relationships may allow clients to renegotiate for lower fees paid for asset management services. The decrease in revenues that results from any such significant terminations, withdrawals or reductions in fees could have a material adverse effect on our business.

In addition, in the U.S., as required by the Investment Company Act, each of our investment advisory agreements with the mutual funds we advise or sub-advise automatically terminates upon its “assignment,” or transfer of our responsibility for fund management. Each of our other investment advisory agreements subject to the provisions of the Investment Advisers Act provides that the agreement may not be “assigned” without the consent of the client. A sale of a sufficiently large block of shares of our voting securities or other transactions could be deemed an “assignment” in certain circumstances. An assignment, actual or constructive, will trigger these termination provisions and could adversely affect our ability to continue managing these client accounts. To the extent that a technical “assignment” of investment advisory agreements arises, we will take the necessary steps to provide clients an opportunity to consent to the continuation of their advisory agreements. Such new agreements may need approval by the stockholders of the respective funds. In the event that any of these clients do not consent to a renewal of their agreement, our revenue and profitability may be materially adversely impacted.

Our business and financial condition may be materially adversely impacted by the highly variable nature of our revenues, results of operations and cash flows. Additionally, because of market fluctuations, there may not be a consistent pattern in our financial results from period to period.

Because our revenues are based on the value of our AUM, fluctuations in the equity markets and our AUM affect our revenues. A reduction in the equity markets generally has a negative impact on the level of our AUM and consequently our revenues. Additionally, asset flows, whether inflows or outflows, can be highly variable from month-to-month and quarter-to-quarter. Accordingly, our revenues, results of operations and cash flows are all highly variable. We may also experience fluctuations in our results from quarter to quarter due to a number of other factors, including changes in our operating expenses and unexpected business developments and initiatives. Such variability and unpredictability may lead to volatility or declines in the price of our common stock and cause our results for a particular period not to be indicative of our performance in a future period or particularly meaningful as a basis of comparison against results for a prior period.

Access to clients through intermediaries is important to our asset management business, and reductions in referrals from such intermediaries or poor reviews of our investment strategies or our organization by such intermediaries could materially reduce our revenue and impair our ability to attract new clients.

Our ability to grow our business relies, in large part, on receiving mandates from the client base of investment consultants, insurance companies, defined contribution plan administrators, international and regional securities firms, mutual fund providers, third party distributors and other intermediaries. These intermediaries review and evaluate our investment strategies and our organization. Poor reviews or evaluations of either the particular investment strategies or of our organization may result in client withdrawals or an inability to attract new assets through such intermediaries. The inability to have this access could materially adversely affect our business.

We depend on the continued services of our key personnel, and the loss of key personnel could have a material adverse effect on our business.

We depend upon the skills, expertise and continued contributions of our key personnel and our management team. The loss of any such personnel, without adequate replacement, could have a material adverse effect on our business, results of operations or financial condition. Loss of key personnel may occur due to perceived opportunity for promotion, increased compensation, work environment or other individual reasons, some of which may be beyond our control.

15

Table of Contents

Except for our CEO, there are no employment agreements with any other key employees. The loss of services of one or more key employees, or failure to attract, retain and motivate qualified personnel could limit our ability to successfully execute our business strategy and may prevent us from sustaining the performance of our investment strategies or adversely affect our ability to retain existing clients and attract new clients. We do not carry any “key man” insurance that would provide us with proceeds in the event of the death or disability of any key members of senior management, our investment team, or senior marketing personnel.

The market for experienced asset management professionals is extremely competitive and is increasingly characterized by the movement of employees among different firms. Compensation levels in the investment management industry are highly competitive and can fluctuate significantly from year to year. Due to the competitive market for asset management professionals and the success achieved by some of our key personnel, the costs to retain key personnel are significant and will likely increase over time. We also anticipate that it will be necessary for us to hire additional key personnel as we further develop our business. Consequently, in our efforts to attract and retain highly skilled individuals, our compensation expense could increase at a level that could adversely affect our profitability.

Additionally, we utilize share-based awards as part of our compensation program and as a means for recruiting and retaining highly skilled talent. A decline in our share price could lessen the effectiveness of retaining employees through share-based awards. There can be no assurance that we will continue to successfully attract and retain key personnel.

If our techniques for managing risk are ineffective, we may be exposed to material unanticipated losses.

To manage the significant risks inherent in our business, we must maintain effective policies, procedures and systems that enable us to identify, assess and manage the full spectrum of our risks including market, fiduciary, operational, legal, regulatory and reputational risks. While we believe that our approach to risk management helps us to manage the risks in our business, our risk management methods may prove to be ineffective due to their design or implementation, or as a result of the lack of adequate, accurate or timely information or otherwise. If our risk management efforts are ineffective, we could suffer losses that could have a material adverse effect on our financial condition or results of operations. Additionally, we could be subject to litigation and sanctions or fines from regulators.

Our techniques for managing risks in client portfolios may not fully mitigate the risk exposure in all economic or market environments, or against all types of risk, including risks that we might fail to identify or anticipate. Any failures in our risk management techniques and strategies to accurately quantify such risk exposure could limit our ability to manage risks in those portfolios or to achieve positive, risk-adjusted returns. In addition, any risk management failures could cause portfolio losses to be significantly greater than historical measures predict. If approaches to managing those risks prove insufficient, it may expose us to material unanticipated losses in the value of client portfolios, a reduction in our revenues, and a material adverse impact on our business.

Our reputation is critical to our success.

As a financial services firm, we depend on our reputation of integrity and high-caliber professional services. Any damage to our reputation could impede our ability to attract and retain clients and key personnel, and lead to a reduction in the amount of our AUM.

In recent years, there have been a number of highly publicized cases involving fraud, conflicts of interest or other misconduct by individuals in the financial services industry, and there is the risk that our employees could engage in misconduct that adversely affects our business. For example, if an employee were to engage – or be accused of engaging – in illegal or suspicious activities (such as improper trading, disclosure of confidential information or breach of fiduciary duties), we could be subject to regulatory sanctions and serious reputational or financial harm. We are subject to a number of obligations and standards arising from our business and our authority over the assets we manage as well as our status as a public company listed on the Nasdaq Global Select Market. Accordingly, we have adopted and implemented a code of ethics and other related policies and procedures to address such obligations and standards. However, it is not always possible to deter employee misconduct, and the precautions we take to detect and prevent this activity may not be effective in all cases. Misconduct by our employees, or even unsubstantiated allegations, could result in a material adverse effect on our reputation and our business.

16

Table of Contents

Failure to comply with client requirements and/or guidelines could result in losses, damage awards against us and loss of revenues due to client terminations.

The investment management agreements under which we provide investment advisory services specify certain guidelines or requirements that we are required to observe in the provision of our services. While we maintain various compliance procedures and controls to monitor such guidelines and prevent related errors, a failure to comply with these guidelines or requirements could result in losses to a client or investors in a fund which, depending on the circumstances, could result in our making clients or fund investors whole for such losses. If we believed that the circumstances did not justify a reimbursement, or clients and investors believed the reimbursement offered was insufficient, they could seek to recover damages from us or could withdraw assets from our management or terminate the investment management agreement. Any of these events could harm our reputation and adversely affect our results of operations.

Fluctuations in foreign currency exchange rates could lower our net income or negatively impact the portfolios of our clients and may affect the levels of our AUM.

Certain client portfolios include securities denominated in foreign currencies. Accordingly, foreign currency fluctuations may affect the levels of our AUM. For securities denominated in currencies other than U.S. dollars, an increase in the value of the U.S. dollar relative to those non-U.S. currencies may result in a decrease in the dollar value of our AUM, which, in turn, would result in lower U.S. dollar denominated revenues.

Additionally, a limited portion of our clients are billed for management and performance fees in currencies other than U.S. dollars, and the amounts due to us are subject to foreign currency fluctuation. If the currency in which our fees are paid depreciates against the U.S. dollar, our net income could decline.

While these risks could be limited by foreign currency hedging, some risks cannot be hedged and there is no guarantee that our hedging activity would be successful. Additionally, hedging would result in additional costs to us.

The significant growth we have experienced in recent years may not be indicative of future growth.

Our AUM increased from approximately $7.9 billion at June 30, 2009 to approximately $17.1 billion at June 30, 2011, and it represents a significant rate of growth that may be difficult to sustain. The growth of our business depends on, among other things, our success in producing attractive returns in our investment strategies, our ability to expand our distribution capabilities, the overall performance of the equity markets, and our ability to deal with changing market conditions.

Our continued growth places significant demands on our legal, compliance, accounting, risk management, administrative and operational resources.

Rapid growth in our AUM imposes substantial demands on our legal, compliance, accounting, risk management, administrative and operational infrastructures. We must maintain adequate infrastructure, including technological capacity, backup facilities and sufficient space for expanding staff levels. Furthermore, our future growth will depend on, among other things, our ability to maintain highly reliable operating platforms, management systems and financial reporting and compliance infrastructures that are also sufficiently flexible to promptly and appropriately address our business needs, applicable legal and regulatory requirements and relevant market and operating conditions, all of which change rapidly. Addressing these matters may require us to incur significant additional expenses and to commit additional senior management and operational resources, even during periods when we are experiencing declines in AUM. There can be no assurance that we will be able to manage our operations efficiently without incurring substantial additional expense or that we will be able to effectively grow our business and AUM, and any failure to do so could materially adversely affect our business.

17

Table of Contents

We derive more than 10% of our operating revenue from one client.

Pursuant to a strategic relationship with New York Life Investment Management, EIP is the sub-advisor to several mutual funds within New York Life Investment Management’s MainStay group of funds. As such, New York Life Investment Management accounted for approximately 19% of revenues for FY 2011. There can be no assurance that our relationship with New York Life will remain in place. A loss of this client would significantly impact our operating revenues and net income, and we may not be able to establish relationships with other clients in order to replace the lost revenues and net income.

Changes in fee levels or asset mix could reduce revenues and margins.

Our profit margins and net income are dependent, in significant part, on our ability to maintain current fee levels for the investment strategies that we offer. In recent years, however, in response to market pressures, there has been a trend towards lower fees in the asset management industry and no assurances can be given that we will be able to maintain our current fee structure. Although our investment management fees vary from investment strategy to investment strategy, we compete primarily on the basis of our investment performance and not on the level of our investment management fees relative to those of our competitors. In order to maintain our fee structure in a competitive environment, we must be able to continue to provide clients with investment returns and client service that incentivize our clients to pay our fees. We cannot be assured that we will succeed in providing investment returns and service that will allow us to maintain our current fee structure. Additionally, a shift in the mix in our AUM from higher revenue-generating AUM to lower revenue-generating AUM may result in a decrease in revenues even if our aggregate level of AUM remains unchanged or increases.

Our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation.

Our expenses are subject to fluctuation and may increase for various reasons, including: variations in compensation due to changes in employee staffing levels, mix, or incentive compensation, expenses incurred to support the distribution of our investment strategies, and changes in expenses and capital costs incurred to maintain and enhance our administrative and operating services infrastructure.

We may not be able to adjust our expenses quickly enough to match a significant deterioration in revenues.

If we are unable to implement appropriate expense reductions in a timely manner in response to declines in our revenues, or if we are otherwise unable to adapt to rapid changes in the global marketplace, our profitability, results of operations and financial condition may be adversely affected.

We may enter into more performance-based fee arrangements with our clients in the future, which could cause greater fluctuations in our revenues.

A small portion of our investment advisory revenues is currently derived from performance fees. We earn performance fees under certain client agreements if the investment performance in the portfolio meets or exceeds a specified benchmark. In these instances, we charge a base advisory fee and are eligible to earn an additional performance-based fee or incentive allocation that is calculated as either a percentage of absolute investment results or a percentage of investment results in excess of a stated benchmark over a specified period of time. In addition, some performance-based fee arrangements include a high-watermark provision, which generally provide that if a client account underperforms relative to its performance target (whether absolute or relative to a specified benchmark), it must gain back such underperformance before we can collect future performance-based fees. Therefore, if we fail to achieve the performance target for a particular period, we will not earn a performance fee for that period and, for accounts with a high-watermark provision, our ability to earn future performance fees may be impaired. We earned $1.8 million, $0.8 million, and $0.6 million in performance fees during fiscal years 2011, 2010, and 2009, respectively. Performance fees may become more common in our industry. An increase in performance fees, or in performance-based fee arrangements with clients, could create greater fluctuations in our revenues.

18

Table of Contents

Expansion into international markets may increase operational, regulatory and other risks.

We offer investment management services in many different regulatory jurisdictions globally and intend to continue to expand our operations. As we increase our international business activities and expand our investment strategy offerings, we will face increased operational, regulatory, compliance, reputational and other risks. Additionally, we will likely incur additional costs and expenses. A failure of our compliance and internal control systems to properly mitigate such risks, or of our operating infrastructure to support such international expansion, could result in a loss of clients or inability to attract new clients, regulatory fines or sanctions, damage to our reputation, or other material adverse impacts on our business.

We are subject to numerous operational risks which may disrupt our business, result in regulatory action against us, or limit our growth.

We face numerous operational risks related to our business on a day-to-day basis. Among other things, we must be able to consistently and reliably obtain securities pricing information, process investment transactions and provide reports and other customer service to our clients. Any failure to keep current and accurate books and records can render us liable to disciplinary action by governmental and self-regulatory authorities, as well as to claims by our clients. If any of our financial, portfolio accounting or other data processing systems, or the systems of third parties on whom we rely for information or communication, do not operate properly or are disabled or if there are other shortcomings or failures in our internal processes, people or systems, or those of third parties on whom we rely, we could suffer a financial loss, a disruption of our businesses, liability to clients, regulatory problems or damage to our reputation. These systems may fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control, including a disruption of electrical or communications services.

Our operations rely on the secure processing, storage and transmission of confidential and other information in our computer systems and networks. Although we take protective measures and endeavors to modify them as circumstances warrant, our computer systems, software and networks may be vulnerable to unauthorized access, computer viruses or other malicious code, and other events that have a security impact. If one or more of such events occur, it potentially could jeopardize our or our clients’ or counterparties’ confidential and other information processed and stored in, and transmitted through, our computer systems and networks, or otherwise cause interruptions or malfunctions in our clients’, our counterparties’ or third parties’ operations. We may be required to spend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures, and we may be subject to litigation and financial losses that are either not insured against fully or not fully covered through any insurance that we maintain.

Lastly, we depend on our headquarters, which is located in New York City, for the continued operation of our business. A disaster or a disruption in the infrastructure that supports our headquarters, or an event disrupting the ability of our employees to perform their job functions there, including terrorist attacks or a disruption involving electrical communications, transportation or other services used by us or third parties with whom we conduct business, directly affecting our headquarters, may have a material adverse impact on our ability to continue to operate our business without interruption. Although we have disaster recovery programs in place, there can be no assurance that these will be sufficient to mitigate the harm that may result from such a disaster or disruption. In addition, insurance and other safeguards might only partially reimburse us for our losses.

Insurance coverage may not protect us from all of the liabilities that could arise from the risks inherent in our business.

We maintain insurance coverage focused on reducing risks related to our operations, in amounts that we consider appropriate. There can be no assurance, however, that a claim or claims will be completely covered by insurance or, if covered, will not exceed the limits of our existing insurance coverage. If a loss occurs that is partially or completely uninsured, we could be exposed to substantial liability.