Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FAUQUIER BANKSHARES, INC. | form8k09022011.htm |

Deeply rooted in our community.

August 2011

NASDAQ: FBSS

Safe Harbor Statement

In addition to the historical information contained herein, this report contains forward-looking statements.

Forward-looking statements are based on certain assumptions and describe future plans, strategies,

and expectations of the Company, and are generally identifiable by use of the words “believe,” “expect,”

“intend,” “anticipate,” “estimate,” “project,” “may,” “will,” or similar expressions. Although we believe our

plans, intentions, and expectations reflected in these forward-looking statements are reasonable, we

can give no assurance that these plans, intentions, or expectations will be achieved. Our ability to

predict results or the actual effect of future plans or strategies is inherently uncertain, and actual results

could differ materially from those contemplated. Factors that could have a material adverse effect on our

operations and future prospects include, but are not limited to, changes in: interest rates, general

economic conditions, the legislative/regulatory climate, monetary and fiscal policies of the U.S.

Government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve

System, the quality or composition of the Bank’s loan or investment portfolios, demand for loan

products, deposit flows, competition, demand for financial services in our market area, and accounting

principles, policies, and guidelines. These risks and uncertainties should be considered in evaluating

forward-looking statements in this report, and you should not place undue reliance on such statements,

which reflect our position as of the date of this report. For additional discussion of risk factors that may

cause our actual future results to differ materially from the results indicated within forward-looking

statements, please refer to "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the year

ended December 31, 2010.

Forward-looking statements are based on certain assumptions and describe future plans, strategies,

and expectations of the Company, and are generally identifiable by use of the words “believe,” “expect,”

“intend,” “anticipate,” “estimate,” “project,” “may,” “will,” or similar expressions. Although we believe our

plans, intentions, and expectations reflected in these forward-looking statements are reasonable, we

can give no assurance that these plans, intentions, or expectations will be achieved. Our ability to

predict results or the actual effect of future plans or strategies is inherently uncertain, and actual results

could differ materially from those contemplated. Factors that could have a material adverse effect on our

operations and future prospects include, but are not limited to, changes in: interest rates, general

economic conditions, the legislative/regulatory climate, monetary and fiscal policies of the U.S.

Government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve

System, the quality or composition of the Bank’s loan or investment portfolios, demand for loan

products, deposit flows, competition, demand for financial services in our market area, and accounting

principles, policies, and guidelines. These risks and uncertainties should be considered in evaluating

forward-looking statements in this report, and you should not place undue reliance on such statements,

which reflect our position as of the date of this report. For additional discussion of risk factors that may

cause our actual future results to differ materially from the results indicated within forward-looking

statements, please refer to "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the year

ended December 31, 2010.

2

FAUQUIER BANKSHARES, INC.

Table of Contents

Ø Who We Are

Ø Market Area

Ø Financial Condition

Ø Financial Performance and Goals

Ø Building Shareholder Value

3

FAUQUIER BANKSHARES, INC.

Who We Are

4

FAUQUIER BANKSHARES, INC.

Purpose

Vision

Core

Values

Making your financial life easier.

Fauquier Bankshares, Inc. is an independent, customer focused,

community resource led by a high performance team. We provide an

above-market return for our shareholders balancing profitability and

prudent growth. Our performance is driven by professional financial

advisors delivering customized investment, credit, fiduciary, insurance,

and banking services in Fauquier County, western Prince William

County, and neighboring markets.

community resource led by a high performance team. We provide an

above-market return for our shareholders balancing profitability and

prudent growth. Our performance is driven by professional financial

advisors delivering customized investment, credit, fiduciary, insurance,

and banking services in Fauquier County, western Prince William

County, and neighboring markets.

Integrity - we do what we say in a respectful and honest manner.

Transparency - we communicate openly and authentically.

Accountability - we own our actions and take responsibility of our results.

Excellence - we continually strive to exceed expectations.

TFB’s Guiding Principles

FAUQUIER BANKSHARES, INC.

5

Summary Statistics

Founded 1902

Headquarters Warrenton, Virginia (50 miles west of Washington, D.C.)

(10 branch locations)

(10 branch locations)

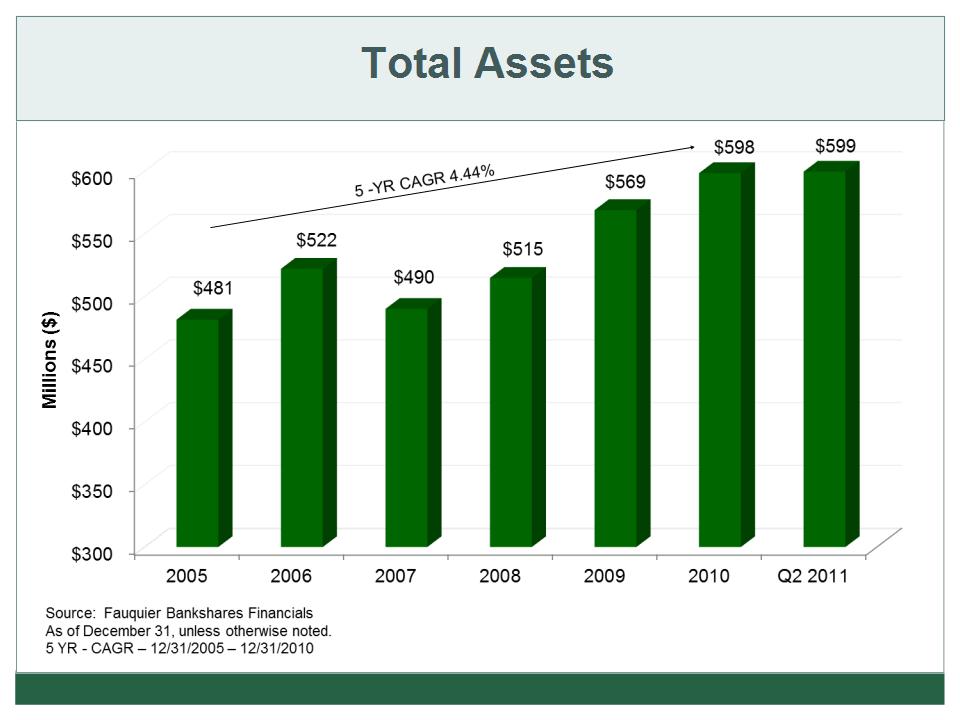

Total Assets $599.2 million

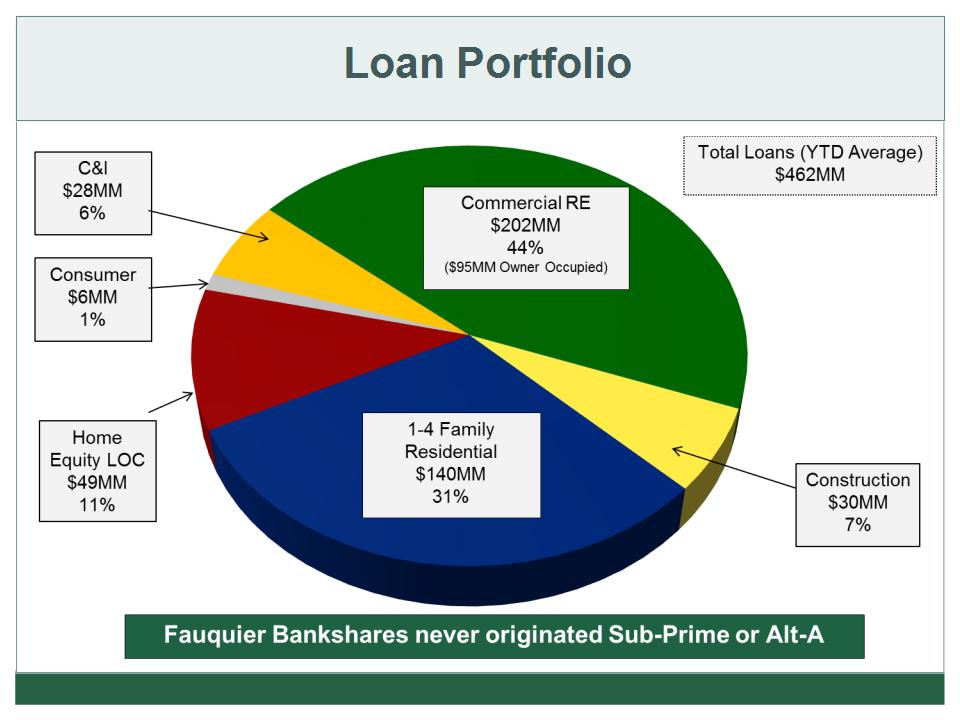

Total Loans, net $447.8 million

Shares Outstanding 3,669,758

Insider Ownership 6.03%

Institutional Ownership 14.09% 1 (8.3% held by Royce & Associates, LLC2)

Shareholders Approx. 400 + “street” (Over 80% in VA)

All data provided as of June 30, 2011, unless otherwise noted.

(1) Source: NASDAQ as of August 8, 2011

(2) A subsidiary of Legg Mason

6

FAUQUIER BANKSHARES, INC.

Industry Recognition

Ø Named #151 of “Top 200 Publicly Traded Community Banks & Thrifts”

in the June 2011 issue of U.S. Banker magazine, based on previous 3

-year average ROE of 1,035 public institutions, placing Fauquier in the

top 15 percent evaluated. This marks the fifth consecutive year that

FBSS was on the “Top 200” listing.

in the June 2011 issue of U.S. Banker magazine, based on previous 3

-year average ROE of 1,035 public institutions, placing Fauquier in the

top 15 percent evaluated. This marks the fifth consecutive year that

FBSS was on the “Top 200” listing.

Ø In November 2010, The Fauquier Bank was named the 2010 Large

Business of the Year by the Fauquier County Chamber of Commerce.

Business of the Year by the Fauquier County Chamber of Commerce.

Ø Ranked #2 in 2009 for Top Community Bank IT projects by Bank

Technology News in their March 2010 issue. In the summer of 2009,

the Bank negotiated and successfully implemented a core conversion

with Fiserv improving efficiency and decreasing expenses.

Technology News in their March 2010 issue. In the summer of 2009,

the Bank negotiated and successfully implemented a core conversion

with Fiserv improving efficiency and decreasing expenses.

7

FAUQUIER BANKSHARES, INC.

Our Success Is a Result of Our Culture

8

Ø Strategic Planning

Ø Teamwork

Ø Disciplined Execution (aka “Blocking and Tackling”)

Ø Consistently Strong Credit Culture

Ø Disciplined Loan and Deposit Pricing Strategy

FAUQUIER BANKSHARES, INC.

Management Focus On Growth

9

FAUQUIER BANKSHARES, INC.

Ø Quality Growth

Ø Loan Portfolio

Ø Core Transaction Deposits

Ø Non-Interest Fee Income

Ø Wealth Management and Financial Planning

Our Customer Focus

10

To deliver a superior experience for our retail and

commercial customers by enabling them to make the

right choices when selecting financial products and

services that best fit their needs and lifestyles,

thereby empowering our customers to achieve their

financial goals.

commercial customers by enabling them to make the

right choices when selecting financial products and

services that best fit their needs and lifestyles,

thereby empowering our customers to achieve their

financial goals.

FAUQUIER BANKSHARES, INC.

Market Area

11

FAUQUIER BANKSHARES, INC.

Northern Virginia Marketplace

* Includes City of Manassas data

** Includes Fairfax City data

Source: US Census Bureau/CTPP

12

FAUQUIER BANKSHARES, INC.

Fauquier County

16,290

48.02%

Fairfax County**

5,905

18.62%

Prince William County*

6,315

17.41%

Loudoun County

1,805

5.32%

District of Columbia

930

2.74%

Other Places of Work

2,675

7.89%

Total Out-Commuters

17,630

51.98%

Total County Workforce

33,920

100.00%

Places to Which Fauquier County

Residents Commute (2006 - 2008)

Primary Market Area

13

FAUQUIER BANKSHARES, INC.

Northern Virginia Marketplace

Ø Stronger population, economic and employment growth

Ø Stable federal government presence

Ø Exceptional higher education

Ø Diverse industry employment, mostly “clean” industries

Ø High household income

Ø Virginia - “Best State for Business” Forbes (2006 - 2009)

14

FAUQUIER BANKSHARES, INC.

15

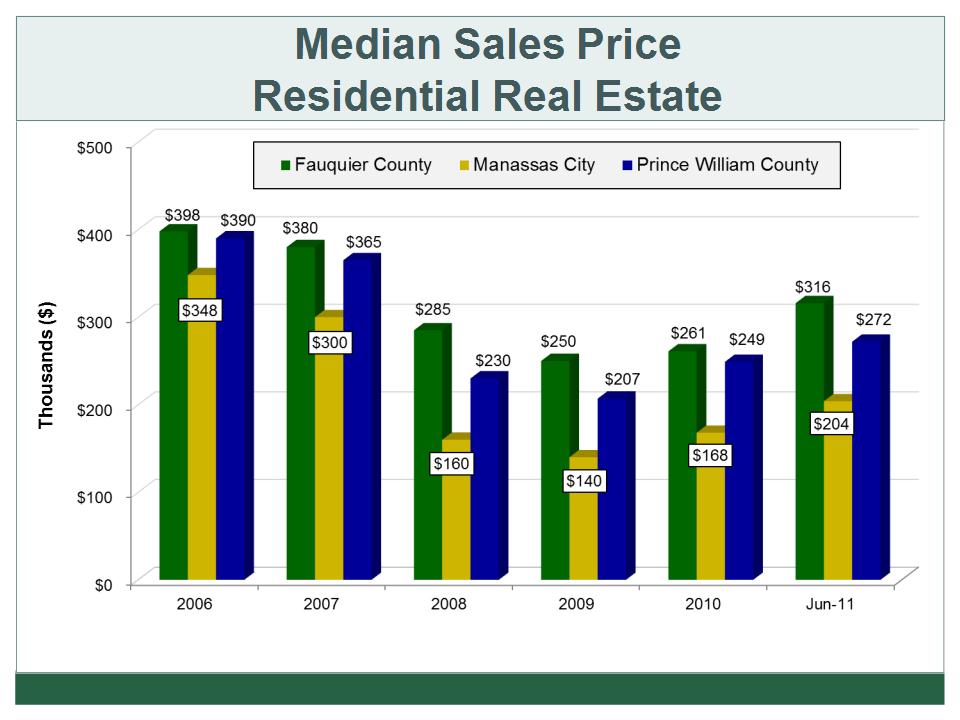

Source: MRIS

FAUQUIER BANKSHARES, INC.

Unemployment Rates

16

FAUQUIER BANKSHARES, INC.

Current Market with Sustainable Growth

17

FAUQUIER BANKSHARES, INC.

|

Market

|

Total

Population 2010 (actual) |

Population

Change 2000 - 2010 (%) |

Projected

Change 2010 - 2015 (%) |

Total

Households 2010 (actual) |

Median

HH Income 2010 ($) |

HH Income

Change 2000 - 2010 (%) |

Projected

HH Income Change 2010 - 2015 (%) |

|

Fauquier, VA

|

68,698

|

24.59

|

5.40

|

24,708

|

81,769

|

31.29

|

14.36

|

|

Manassas, VA

(City) |

36,476

|

3.82

|

(0.77)

|

12,114

|

79,048

|

31.00

|

16.51

|

|

Manassas Park,

VA (City) |

13,364

|

29.87

|

1.26

|

4,217

|

80,759

|

32.65

|

14.56

|

|

Prince William, VA

|

387,988

|

38.17

|

7.32

|

132,702

|

86,208

|

31.59

|

16.48

|

Source: SNL Financial

Financial Condition

FAUQUIER BANKSHARES, INC.

18

18

19

FAUQUIER BANKSHARES, INC.

20

Loans, Net

FAUQUIER BANKSHARES, INC.

Source: Fauquier Bankshares Financials

As of December 31, unless otherwise noted.

5 YR - CAGR - 12/31/2005 - 12/31/2010

21

At June 30, 2011

FAUQUIER BANKSHARES, INC.

22

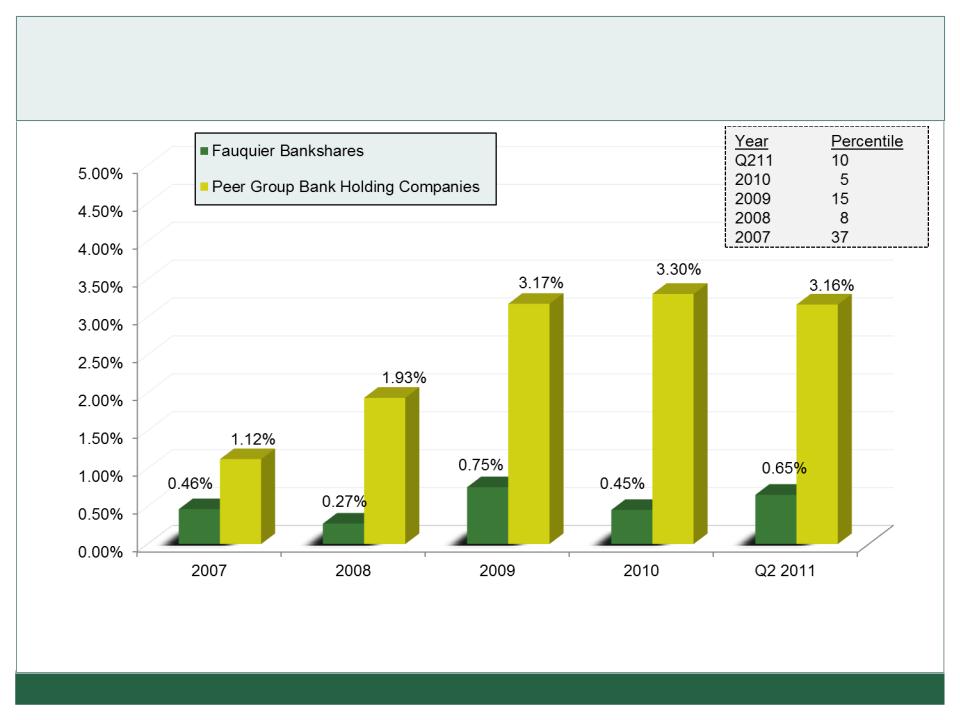

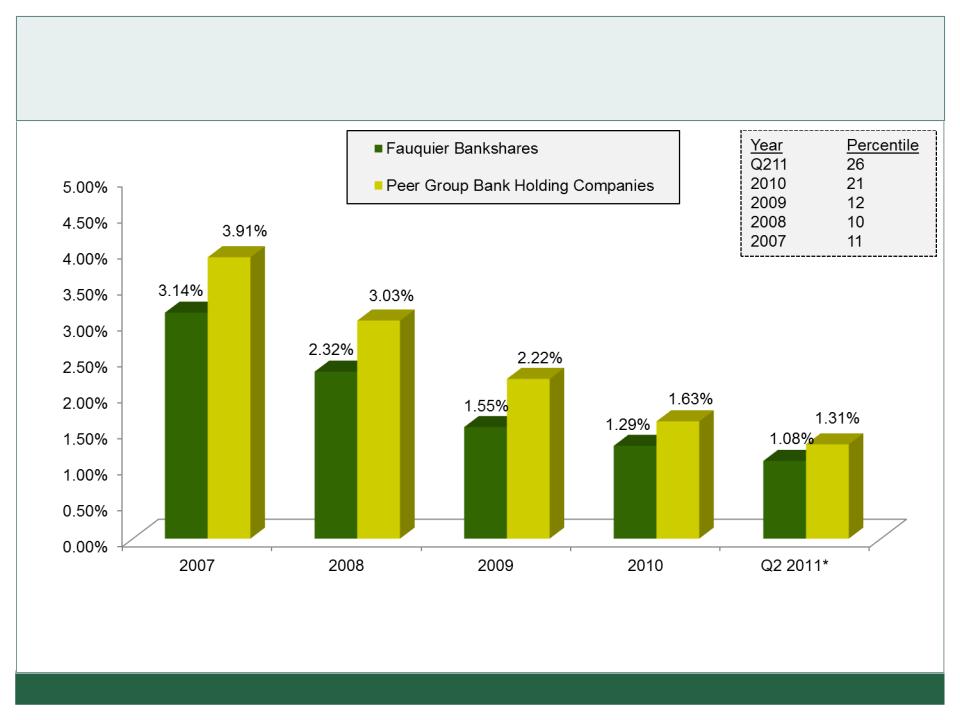

Nonperforming Loans to Period End Loans

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise.

FAUQUIER BANKSHARES, INC.

23

Loan Losses (Net of Recoveries)

As a Percentage of Average Total Loans

FAUQUIER BANKSHARES, INC.

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise. Q2 data is annualized.

24

FAUQUIER BANKSHARES, INC.

Allowance for Loan Loss

As a Percentage of Total Loans

Year Percentile

Q211 31

2010 23

2009 16

2008 28

2007 27

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise.

25

FAUQUIER BANKSHARES, INC.

Allowance for Loan Loss

As a Percentage of 90 Days Past Due & Nonaccrual Loans

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise.

26

FAUQUIER BANKSHARES, INC.

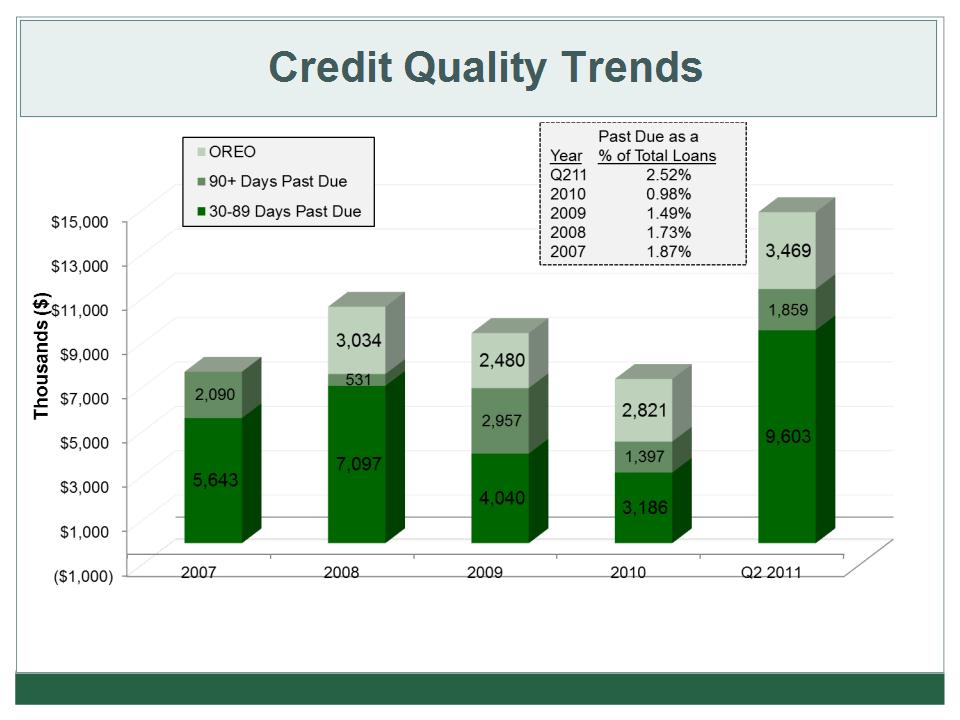

Source: Fauquier Bankshares Financials as of December 31, unless otherwise noted.

27

Total Deposits

FAUQUIER BANKSHARES, INC.

Source: Fauquier Bankshares Financials - as of December 31, unless otherwise noted.

28

Pooled Trust Preferred Securities

FAUQUIER BANKSHARES, INC.

|

Issue

|

X

|

XI

|

XIV

|

XV

|

Total

|

|

Date of purchase

|

6/26/2003

|

9/17/2003

|

6/17/2004

|

9/20/2004

|

|

|

Issue size ($M)

|

$ 581

|

$ 670

|

$ 504

|

$ 625

|

$ 2,380

|

|

Financial institutions (No.)

|

61

|

69

|

65

|

60

|

228*

|

|

States (No.)

|

29

|

28

|

34

|

30

|

30**

|

|

TFB's share of the pool

|

0.17%

|

0.30%

|

0.40%

|

0.16%

|

.029%***

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TFB’s Investment

|

$ 1,000,000

|

$ 2,000,000

|

$ 2,000,000

|

$ 1,000,000

|

$ 6,000,000

|

|

As of June 30, 2011

Cumulative amount of OTTI loss

|

640,706 |

385,564 |

749,336 |

466,388

|

2,241,994

|

|

Cost, net of OTTI loss

|

$ 359,294

|

$ 1,614,436

|

$ 1,250,664

|

$ 533,612

|

$ 3,758,006

|

|

Cumlative other comprehensive

loss, net of tax benefit |

$ 230,632

|

$ 899,884

|

$ 793,692

|

$ 342,510

|

$ 2,266,718

|

|

Fair Value

|

$ 9,852

|

$ 250,975

|

$ 48,100

|

$ 14,658

|

$ 323,585

|

*Unique institutions in each pool.

**Average

***Weighted average

29

Pooled Trust Preferred Securities

Depository Institutions Financials

(Average and Median Totals)

Depository Institutions Financials

(Average and Median Totals)

FAUQUIER BANKSHARES, INC.

Issue X

Issue XI

06/30/11

2003Q2

06/30/11

2003Q3

Avg

Mdn

Avg

Mdn

NPLs to total loans

4.39%

3.08%

4.46%

3.71%

Loan loss reserves to loans

2.27%

1.94%

1.25%

1.21%

2.53%

2.12%

1.31%

1.27%

Tier 1 risk based ratio

13.07%

12.81%

11.48%

10.72%

13.53%

13.23%

12.18%

11.26%

Return on average assets

0.48%

0.64%

1.09%

1.01%

0.29%

0.69%

1.19%

1.14%

Net interest margin

3.98%

3.78%

4.12%

4.01%

3.73%

3.71%

4.10%

4.13%

Texas Ratio*

39.71

26.26

38.96

36.03

No. of banks with Texas Ratio above 100

3

0

4

0

Issue XIV

Issue XV

06/30/11

2004Q2

06/30/11

2004Q3

Avg

Mdn

Avg

Mdn

Avg

Mdn

Avg

Mdn

NPLs to total loans

5.35%

5.08%

0.57%

0.39%

3.99%

2.95%

0.50%

0.32%

Loan loss reserves to loans

2.47%

2.20%

1.96%

1.76%

Tier 1 risk based ratio

12.53%

12.44%

12.16%

11.46%

12.76%

12.43%

12.79%

11.94%

Return on average assets

0.08%

0.65%

0.50%

0.58%

Net interest margin

3.84%

3.81%

4.11%

3.86%

3.85%

3.85%

4.08%

3.92%

Texas Ratio*

56.65

48.28

7.53

5.72

51.17

30.26

6.28

4.95

No. of banks with Texas Ratio above 100

8

0

7

0

|

* Texas Ratio - Nonperforming assets plus 90 day past due loans divided by tangible equity plus loan loss reserve.

|

30

FAUQUIER BANKSHARES, INC.

Tangible Equity to Assets Ratio

Source: Fauquier Bankshares Financials

As of December 31, unless otherwise noted.

31

FAUQUIER BANKSHARES, INC.

Year Percentile

Q211 38

2010 33

2009 53

2008 67

2007 49

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Source: BHC Performance Report & Fauquier Bankshares Financials - as of December 31

32

FAUQUIER BANKSHARES, INC.

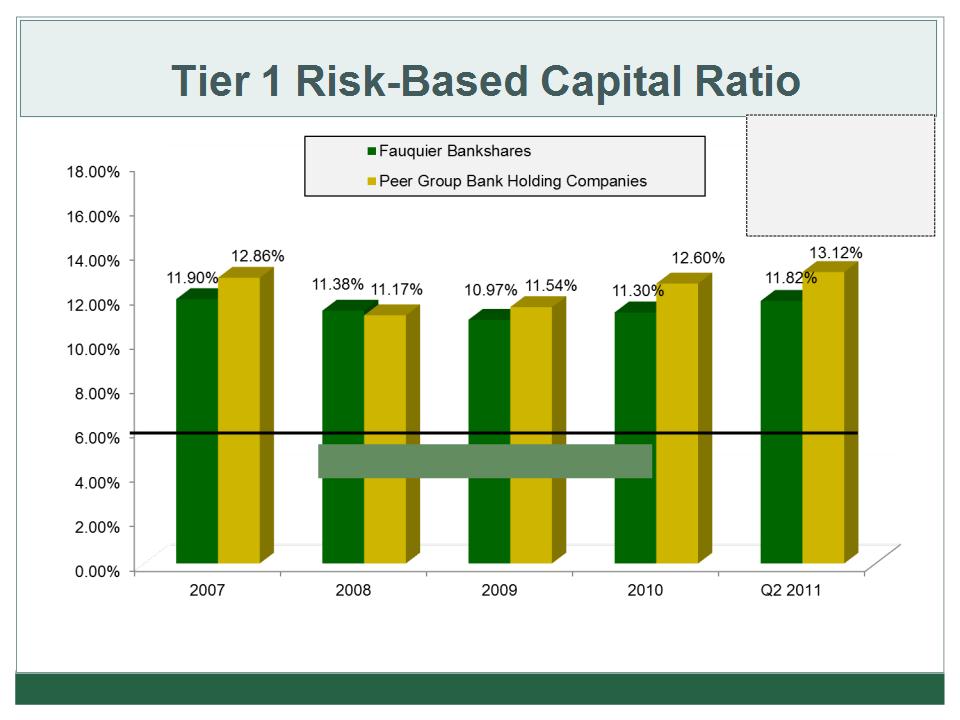

“Well Capitalized” Threshold 6%

Year Percentile

Q211 37

2010 34

2009 43

2008 57

2007 46

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Source: BHC Performance Report & Fauquier Bankshares Financials - as of December 31

33

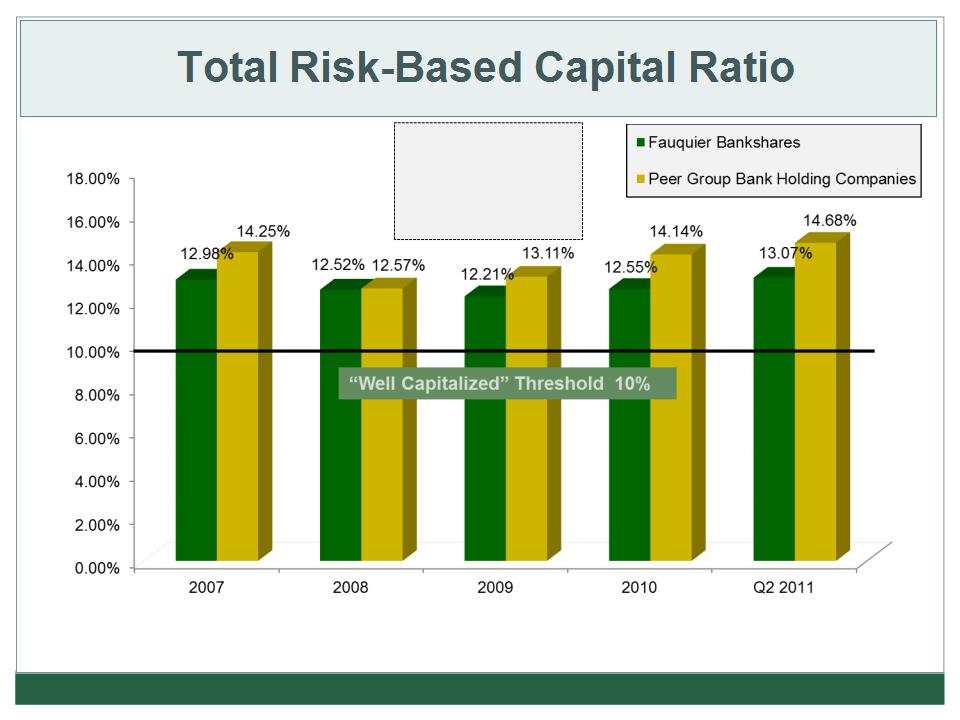

FAUQUIER BANKSHARES, INC.

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Source: BHC Performance Report & Fauquier Bankshares Financials - as of December 31

Year Percentile

Q211 32

2010 29

2009 38

2008 56

2007 42

FAUQUIER BANKSHARES, INC.

Average Daily Balances for Six Months Ended June 30, 2011

|

Transaction Account Growth

Average Daily Balances for Six Months Ended June 30

|

|||

|

2011

|

2010

|

% Change

|

|

|

DDA

|

$73,807 |

$66,077 |

11.70%

|

|

NOW

|

$140,087 |

$98,932 |

41.60%

|

|

Totals

|

$213,894 |

$165,009 |

29.63%

|

Source: Fauquier Bankshares Financials

ØCDARS are large-dollar investments of local depositors

in FDIC insured CDs.

in FDIC insured CDs.

ØBrokered CDs are used to offset interest rate risk.

34

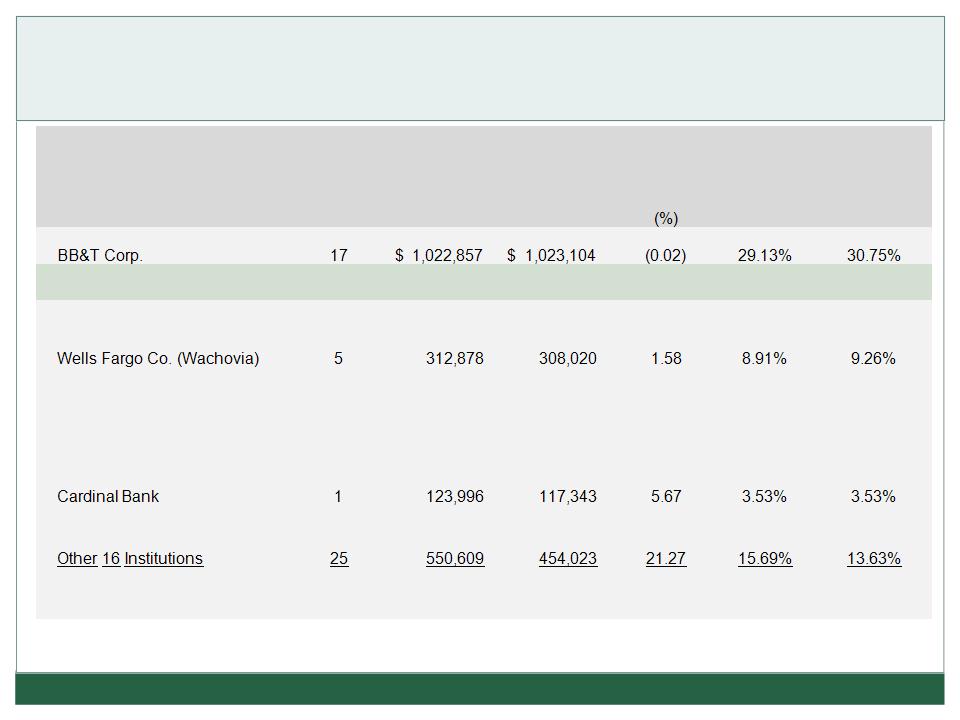

Fauquier County, Western Prince William County and

Manassas City Deposit Market Share

Manassas City Deposit Market Share

35

|

|

Financial Institution

|

Current

Number of Branches |

Total Deposits

2010 ($000) |

Total Deposits

2009 ($000)

|

Year to Year

Deposit Change 2010

|

Market

Share 2010

|

Market

Share 2009

|

|

|

|||||||

|

|

Fauquier Bankshares

|

10

|

493,053

|

412,892

|

19.41

|

14.04%

|

12.41%

|

|

|

Suntrust Bank

|

7

|

428,557

|

417,666

|

2.61

|

12.20%

|

12.55%

|

|

|

|||||||

|

|

Bank of America Corp.

|

4

|

192,607

|

184,549

|

4.37

|

5.48%

|

5.55%

|

|

|

Capital One Financial Corp

|

8

|

139,108

|

154,882

|

(10.18)

|

3.96%

|

4.66%

|

|

|

PNC Financial Services Group

|

7

|

129,330

|

151,671

|

(14.73)

|

3.68%

|

4.56%

|

|

|

|||||||

|

|

Virginia Commerce Bank

|

2

|

118,727

|

102,985

|

15.29

|

3.38%

|

3.10%

|

|

|

|||||||

|

|

|||||||

|

|

Total

|

86

|

$3,511,722

|

$3,327,135

|

5.55%

|

100%

|

100%

|

|

|

Source: FDIC - Deposit Market Share Report

Data as of June 30, 2010 |

|

|||||

FAUQUIER BANKSHARES, INC.

Financial Performance

and Goals

and Goals

FAUQUIER BANKSHARES, INC.

36

Return on Average Equity (ROAE)

FAUQUIER BANKSHARES, INC.

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise. - Q211 annualized

Earnings Per Share, Diluted

FAUQUIER BANKSHARES, INC.

38

Net Income

$3.4MM

Net Income

$3.7MM

Net Income

$3.7MM

Source: Fauquier Bankshares Financials

As of December 31, unless otherwise noted.

2Q 2011 data is annualized based on $.56 per share and net income of $2.1 million as of June 30, 2011.

39

Net Income (ROAA)

(As a Percent of Average Assets)

(As a Percent of Average Assets)

FAUQUIER BANKSHARES, INC.

Year Percentile

Q211 58

2010 60

2009 69

2008 65

2007 59

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise - Q211 annualized

Net Interest Margin*

40

FAUQUIER BANKSHARES, INC.

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Source: BHC Performance Report and Fauquier Bankshares Financials - as of December 31 - Q211 - YTD

Cost of Funds

41

FAUQUIER BANKSHARES, INC.

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise. Q211 - YTD

Total Non-Interest Income

As a Percent of Adjusted Operating Income (TE)

As a Percent of Adjusted Operating Income (TE)

FAUQUIER BANKSHARES, INC.

42

Peer Group - Bank Holding Companies with Consolidated Assets of $500MM - $1B (2011/2010/2009/2008)

Peer Group - Bank Holding Companies with Consolidated Assets less than $500MM (2007)

Sources: BHC Performance Report and Fauquier Bankshares Financials as of December 31, unless noted otherwise.

43

Assets Under Management

(At Market Value)

(At Market Value)

FAUQUIER BANKSHARES, INC.

Q2 2011 as of June 30, 2011

S&P 500 Index

Keys to Building Shareholder Value

Ø Maintain strong credit quality

- Past due loans as a percent of total loans consistently under 2.6%

- Past due loans as a percent of total loans consistently under 2.6%

Ø Build transaction account deposit base

Ø Disciplined loan and deposit pricing

Ø Continue to improve and implement technology

FAUQUIER BANKSHARES, INC.

44

Stock Total Return Performance

Source: SNL Financial as of 8/03/2011 - SNL indices are weighted by the market capitalization of the company.

FAUQUIER BANKSHARES, INC.

45

|

Index

|

Over Last

Year |

Over Last Two

Years |

Over Last

Three Years |

Since Going

Public (1997) |

|

FBSS

|

(18.83%)

|

(1.80%)

|

(12.55%)

|

189.18%

|

|

SNL Banks

$500M - $1B

|

3.65%

|

(6.96%)

|

(22.05%)

|

64.63%

|

|

SNL Banks

$250M - $500M

|

(2.05%)

|

2.79%

|

(28.26%)

|

49.60%

|

|

SNL Banks

|

(9.61%)

|

2.08%

|

(33.35%)

|

(4.60%)

|

46

Stock Total Return Performance

(September 1, 1997 - August 5, 2011)

(September 1, 1997 - August 5, 2011)

FAUQUIER BANKSHARES, INC.

Source: SNL Financial - August 8, 2011

(4.39)

FAUQUIER BANKSHARES, INC.

Source: SNL Financial - As of August 5, 2011

Stock Chart - Price/Tangible Book

(September 1, 1997- August 5, 2011)

(September 1, 1997- August 5, 2011)

47

FBSS 97.6

SNL 97.5

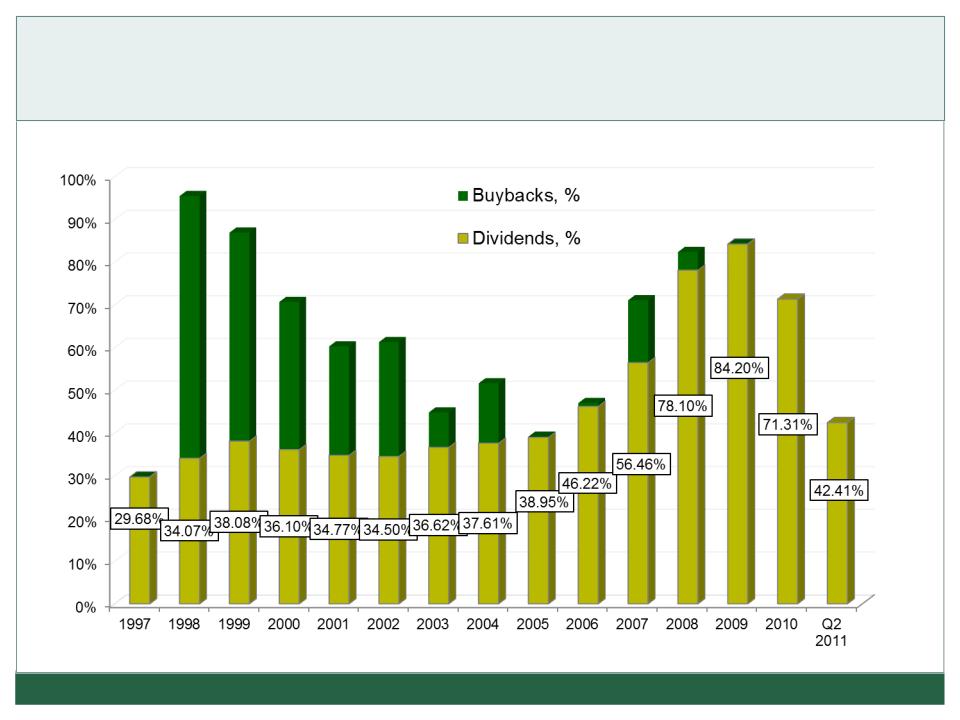

Buybacks and Dividends

as a Percentage of Net Income

as a Percentage of Net Income

48

FAUQUIER BANKSHARES, INC.

Contact Information

Investor Relations Contacts

Randy K. Ferrell

President & Chief Executive Officer

randy.ferrell@fauquierbank.com

randy.ferrell@fauquierbank.com

Eric P. Graap

Executive Vice President

& Chief Financial Officer

eric.graap@fauquierbank.com

Valerie Barlowe

Investor Relations Coordinator

valerie.barlowe@fauquierbank.com

www.fauquierbank.com

MAIN OFFICE

THE PLAINS

VIEW TREE

BEALETON

OLD TOWN MANASSAS

SUDLEY ROAD

NEW BALTIMORE

CATLETT

FAUQUIER BANKSHARES, INC.

BRISTOW

49

HAYMARKET