Attached files

| file | filename |

|---|---|

| EX-5.1 - Tsingda eEDU Corp | c66790_ex5-1.htm |

| EX-23.2 - Tsingda eEDU Corp | c66790_ex23-2.htm |

| EX-23.1 - Tsingda eEDU Corp | c66790_ex23-1.htm |

|

|

|

|

As filed with the Securities and Exchange Commission on August 31, 2011 |

Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

TSINGDA EEDU CORPORATION |

|

|

|

|

|

|

(Exact name of registrant as specified in its charter) |

||

|

|

|

|

|

Cayman Islands |

8200 |

N/A |

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

|

incorporation or organization) |

Classification Code Number) |

Identification Number) |

No. 0620, Yongleyingshiwenhuanan Rd.,

Yongledian Town,

Tongzhou District, Beijing, PR China

86 10-68609290/9301

(Address including zip code, and telephone number of

registrant’s principal executive

offices)

Mr. Kang Chungmai

No. 0620, Yongleyingshiwenhuanan Rd.,

Yongledian Town,

Tongzhou District, Beijing, PR China

86 10-62699290/9301

(

Name, address, including zip code, and

telephone number of Agent for Service

)

with copies to

Ellenoff

Grossman & Schole LLP

150 East 42 nd Street

New York, NY 10017

Tel: (212) 370-1300

Fax: (212) 370-7889

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

Large accelerated filer |

o |

Accelerated filer |

o |

|

|

Non-accelerated filer |

o (Do not check if a smaller reporting company) |

Smaller reporting company |

x |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities to be registered |

|

Amount |

|

Proposed |

|

Proposed |

|

Amount of |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|||||||||||||

|

Ordinary Shares, par value $0.000384 (2) |

|

|

3,000,000 |

|

$ |

4.56 |

|

$ |

13,680,000 |

|

$ |

1,588.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

3,000,000 |

|

|

|

|

$ |

13,680,000 |

|

$ |

1,588.25 |

|

|

|

|

|

(1) |

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457 under the Securities Act of 1933 based on the price of our Ordinary Shares purchased in a private placement of Ordinary Shares which initially closed on July 21, 2011. Currently, there is no trading market for our Ordinary Shares. |

|

(2) |

The shares being registered for resale by certain of the selling stockholder were issued in connection with a private placement and pursuant to the terms of a Securities Purchase Agreement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a) may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDER MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT IS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AND BECOMES EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED AUGUST 31, 2011

PROSPECTUS

TSINGDA EEDU CORPORATION

3,000,000 ORDINARY SHARES

This prospectus relates to 3,000,000 of our ordinary shares, par value $.000384 per share (“Ordinary Shares”), which may be sold from time to time by the selling shareholder named in this prospectus.

The selling shareholder named in this prospectus is offering all of the Ordinary Shares offered through this prospectus. The securities offered for resale hereby were issued to the selling stockholder in a private placement completed prior to the filing of the registration statement of which this prospectus is a part. The selling shareholders named in this prospectus are offering all of the Ordinary Shares offered through this prospectus. All of the shares, when sold, will be sold by the selling stockholder. Unless and until such time as the Company’s ordinary shares are listed on a national securities exchange or quoted on an over-the-counter market, such dispositions by the selling shareholder, if any, will be made only at a price between $5 and $10. Thereafter, dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

We will not receive any of the proceeds from the sale of our Ordinary Shares by the selling shareholder.

Our Ordinary Shares are presently not traded on any market or securities exchange.

The purchase of the securities offered through this prospectus involves a high degree of risk. See Section Entitled “Risk Factors” beginning on page 8.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

No underwriter or person has been engaged to facilitate the sale of Ordinary Shares in this offering. None of the proceeds from the sale of stock by the selling stockholders will be placed in escrow, trust or any similar account.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is ____________, 2011.

1

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

PAGE NO. |

|

|

|

3 |

|

|

|

|

6 |

|

|

|

|

8 |

|

|

|

|

18 |

|

|

|

|

18 |

|

|

|

|

18 |

|

|

|

|

19 |

|

|

|

|

20 |

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

21 |

|

|

|

44 |

|

|

|

|

45 |

|

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES |

|

66 |

|

|

|

68 |

|

|

|

|

69 |

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

71 |

|

|

|

72 |

|

|

|

|

72 |

|

|

|

|

73 |

|

|

|

|

73 |

|

|

|

|

74 |

|

|

|

|

F-1 |

|

2

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “risk factors” section, the financial statements and the notes to the financial statements.

In this prospectus, unless otherwise specified, all monetary amounts are in U.S. dollars. All renminbi, or RMB, amounts have been translated into U.S. dollars at the June 30, 2011 noon buying rate in the City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York, being $1.00 = RMB6.5465.

Except where the context otherwise requires and for the purposes of this prospectus only:

|

|

|

|

|

|

• |

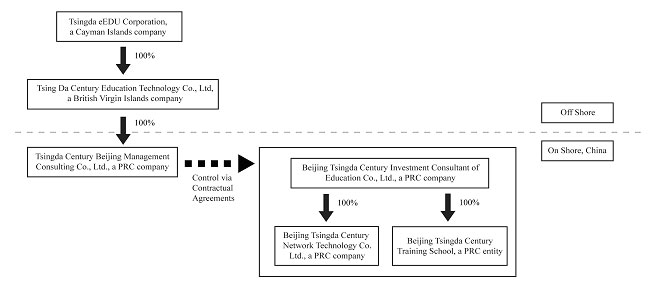

“We,” “us,” “our company,” “our,” and “Compass” refer to the combined business of Tsingda eEDU Corporation and its consolidated subsidiaries and affiliates, but do not include the shareholders of Tsingda eEDU Corporation; |

|

|

|

|

|

|

• |

“Tsingda Technology” refers to Tsing Da Century Education Technology Co. Ltd., a British Virgin Islands business company, which is our direct, wholly-owned subsidiary; |

|

|

|

|

|

|

• |

“Tsingda Management” refers to Beijing Tsingda Century Management Consulting Ltd., a wholly foreign owned enterprise incorporated under the laws of the PRC, which is our indirect, wholly-owned subsidiary; |

|

|

|

|

|

|

• |

“Tsingda Education” refers to Beijing Tsingda Century Investment Consultant of Education Co. Ltd., our contractually controlled affiliate and the PRC operating company; |

|

|

|

|

|

|

• |

“Tsingda Network” refers to Beijing Tsingda Century Network Technology Co. Ltd., a wholly owned subsidiary of Tsingda Education; |

|

|

|

|

|

|

• |

“China,” “Chinese” and “PRC,” refer to the People’s Republic of China; |

|

|

|

|

|

|

• |

“Renminbi” and “RMB” refer to the legal currency of China; and |

|

|

|

|

|

|

• |

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States. |

Our Company

Business Overview

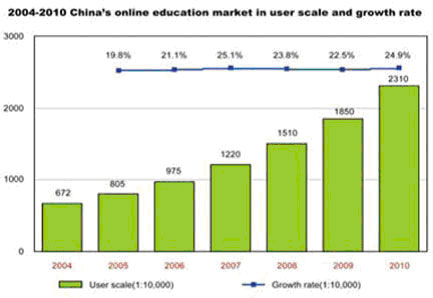

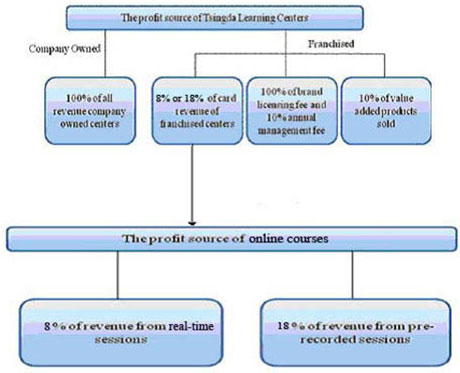

We are an online provider of supplementary educational services in China. All of our courses are broadcast online, and are consumed either in private or at one of our learning centers. As of June 30, 2011, there were 2,496 Tsingda Learning Centers across China, which includes 32 Company-owned learning centers and 2,464 franchised learning centers. Since most of our learning centers are franchised locations, we generate most of our revenues through franchise licensing fees and sales of “e-cards” by franchisees to students, which are pre-paid “credit” cards used by our students to purchase our individual courses. Our franchisees pay an initial franchise licensing fee of between $7,000 and $10,000 per location depending on franchise territory, and thereafter, franchisees pay an annual management fee equal to 10% of their initial franchise licensing fee. A franchisee receives e-cards from the Company with a face value equal to five times the amount of franchise and management fees paid. Our franchisees also have the option to purchase additional e-cards at the same 80% discount. Franchisees earn revenues from the sale of e-cards to students at face value. In other words, for every dollar spent by our students, our franchisees receive eighty cents. With respect to the remaining twenty cents, the Company splits this on a 40%-60% basis with teachers in connection with real-time courses and on a 90%-10% basis with teachers in connection with pre-recorded courses. Factoring in the discount taken by our franchisees and revenue splitting with our teachers, the Company earns 18% of revenues generated from sales of e-cards used for pre-recorded courses and 8% of revenues generated from sales of e-cards used for real-time courses. Each e-card has a specific serial number, and our IT server tracks the opening and usage of these cards in real time. We use this information in order to accurately allocate revenues among teachers.

3

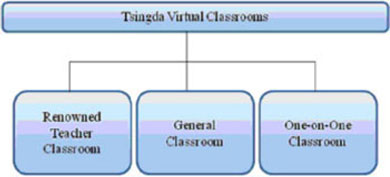

Our online educational services consist of pre-recorded courses and a web based platform called the “Tsingda Virtual Internet Classroom” where students and teachers can interact remotely in either a one-on-one or classroom setting. As of June 30, 2011, we had a total of 7,993,458 “registered” and 1,563,384 “active” students. Of these students 7,466,321 students are registered and 1,461,587 are active through our learning centers, and 527,137 students are registered and 101,797 are active through our Tsingda Virtual Internet Classroom. We classify students who have provided us with their personal information as “registered.” Registered students who have purchased an e-card or are using an e-card to purchase our courses are classified as “active.” Students who have purchased an e-card and have not used an e-card for more than one year are de-classified from active status and classified as registered.

In November 2010 we began offering live courses through our company-owned learning centers which are all located in Beijing. Depending on the initial response to these live courses, we may consider expanding our live course offerings to Company-owned learning centers in other first-tier cities. We do not intend to offer live courses through our franchise-owned learning centers, nor do we intend that any of our Company-owned learning centers will become solely dedicated to live course offerings.

Live courses are taught on either a one-to-one basis or with up to 10 students. As with all of our course offerings, students purchase live courses by purchasing e-cards. Students can choose any combination of live, online or pre-recorded courses for all of their education needs. We charge more for live courses than for online or pre-recorded courses. During the six months ended June 30, 2011, revenue generated from providing live courses was less than 3% of our total revenues.

For the six months ended June 30, 2011, we generated $17,090,536 in gross revenues, which represents an 80.53% increase from gross revenues of $9,467,108 for the comparable period in 2010. Our pre-tax net income for the six month period ended June 30, 2011was $3.41 million, which represents a 52.78% decrease from pre-tax net income of $5.21 million for the comparable period in 2010..

On September 16, 2010, we completed a unit financing with certain accredited investors pursuant to which we received total gross proceeds of $9.6 million. Each unit consisted of one ordinary share and a stock purchase warrant to purchase 35% of the number of Ordinary Shares purchased in the financing. The warrant exercise price is $2.08 per share, subject to adjustment, and the warrant term is five (5) years.

On November 15, 2010, we held a special meeting of our shareholders (“Special Meeting”) at our principal offices in Beijing, China. At the Special Meeting, shareholders approved two proposals (i) to change the corporate name from Compass Acquisition Corporation to Tsingda eEDU Corporation and (ii) to affect a three-for-one (3 to 1) consolidation of the Company’s issued and outstanding Ordinary Shares and to increase the amount of the Company’s authorized Ordinary Shares from 39,062,500 Ordinary Shares to 100,000,000 Ordinary Shares. The name change of the Company to Tsingda eEDU Corporation and the three-for-one consolidation and increase in the Company’s authorized share capital was effective immediately following shareholder approval.

On July 12, 2011, we entered into a securities purchase agreement with AMI Corporation, as the investor, in connection with a private placement of 3,000,000 Ordinary Shares at a price of $4.56 per share. On July 21, 2011, we closed an initial $5,000,000 tranche and on August 23, 2011, we received the balance of $8,680,000, for total proceeds of $13,680,000. Under the terms of our agreement with AMI we are obligated, by July 12, 2012, to have our Ordinary Shares listed for trading on the NASDAQ Global Select Market, NASDAQ Global Market or New York Stock Exchange. Subject to our obtaining such listing, AMI has agreed not to sell any of the 3,000,000 shares for six months and limit to 600,000, the number of shares it will sell during the next succeeding six months. Under the securities purchase agreement with AMI, the Company agreed to file an initial registration statement to register the Ordinary Shares for resale in a registration statement with the Securities and Exchange Commission within 45 days from the initial closing, and to make such registration statement effective within 180 days from the initial closing. The filing of the registration statement of which this prospectus is a part is intended to satisfy our obligations under the securities purchase agreement.

On August 21, 2011, our Board of Directors approved a stock repurchase transaction in the amount of $6,187,500 to repurchase 1,875,000 of the Company’s issued and outstanding ordinary shares from Zhong Hui Rong (Fujian) Fund Ltd. The repurchase occured in a privately negotiated transaction, as there currently is no public trading market for the Company’s ordinary shares. In connection with the repurchase of such shares, Zhong Hui Rong (Fujian) Fund Ltd. agreed to cancel 656,250 warrants held by Zhong Hui Rong (Fujian) Fund Ltd.

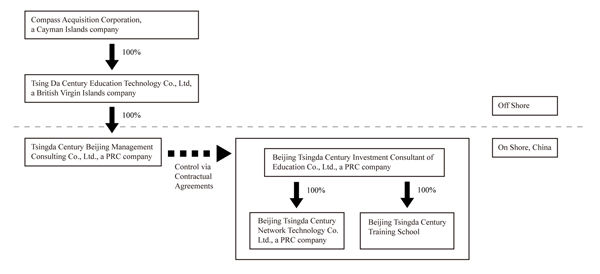

The Industry

The People’s Republic of China (PRC) represents approximately one quarter of the global population. According to information published by the PRC government, our target population market as of June 30, 2011 is approximately 360 million individuals. The group is comprised of: infants and children below school age (6) - 160 million; primary school students - 110 million; junior high school students - 60 million; and senior high school students 30 million.

Organizational History

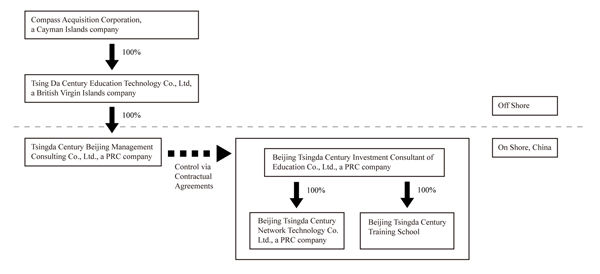

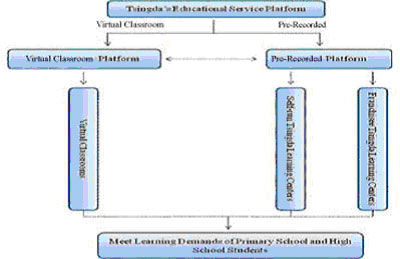

We were organized under the laws of the Cayman Islands on September 27, 2006. Tsingda Technology was organized under the laws of British Virgin Islands on December 11, 2009. Tsingda Management was organized under the laws of the PRC on November 26, 2007. Tsingda Education was organized under the laws of the PRC on October 23, 2003. Tsingda Network was organized under the laws of the PRC on February 14, 2004.

4

On April 22, 2010, Tsingda Century Training School (“Tsingda School”) was incorporated in Beijing, as a wholly owned subsidiary of Tsingda Education. The Company, through its subsidiary Tsingda School, acquired a license from the PRC government to issue course completion certificates to students. These certificates are not equivalency degrees, but rather these certificates acknowledge that a student has passed a particular course offered by Tsingda.

On May 24, 2010, we acquired Tsingda Technology. The transaction was treated for accounting purposes as a capital transaction and recapitalization by Tsingda Technology, the accounting acquirer, and as a re-organization by Compass, the accounting acquiree. Compass (now Tsingda eEdu Corporation) is the legal acquirer and Tsingda Technology the legal acquiree.

Tsingda Technology owns 100% of the issued and outstanding capital stock of Tsingda Management. On April 26, 2010, Tsingda Management entered into a series of contractual agreements with Tsingda Education, and its shareholders, in which Tsingda Management assumed management of the business activities of Tsingda Education. Namely, these contractual agreements consist of: (i) a consulting services agreement, (ii) an operating agreement, (iii) an equity pledge agreement, (iv) a voting rights proxy agreement, and (v) an option agreement. We rely on these agreements to, among other things, generate all our revenues, control the business activities of Tsingda Education, appoint all of its executives, senior management and the members of its board of directors, and at our option, purchase all the outstanding equity of Tsingda Education. If one or more of these contractual agreements are terminated or ruled unenforcable, we could lose control of Tsingda Education, which will materially and adversely affect our revenues and future growth prospects. See “Risk Factors” beginning on Page 8.

The Wholly-Foreign Owned Enterprise Law (1986), as amended, and The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of the PRC (2006), contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, such companies are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC central government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the Company’s profits.

Furthermore, if our subsidiaries or affiliates in China incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our Ordinary Shares.

The risks described above and other risks in connection with an investment in our securities are found in the “Risk Factors” section beginning on page 8. You should carefully read and consider the information in the “Risk Factors” section before making an investment in our securities.

Corporate Structure

Our organization structure is depicted below:

5

This prospectus relates to the resale by the selling stockholder identified in this prospectus of up to 3,000,000 Ordinary Shares. The securities offered for resale hereby were issued to the selling stockholder in a private placement completed prior to the filing of the registration statement of which this prospectus is a part. The selling shareholders named in this prospectus are offering all of the Ordinary Shares offered through this prospectus. All of the shares, when sold, will be sold by the selling stockholder. Unless and until such time as the Company’s ordinary shares are listed on a national securities exchange or quoted on an over-the-counter market, such dispositions by the selling shareholder, if any, will be made only at a price between $5.00 and $10.00. Thereafter, dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. We will not receive any proceeds from the sale of the Ordinary Shares by the selling stockholder.

|

|

|

|

Ordinary Shares Offered: |

3,000,000 Ordinary Shares. |

|

|

|

|

Ordinary Shares Outstanding prior to Offering: |

35,754,862 |

|

|

|

|

|

|

|

Ordinary Shares Outstanding after Offering |

35,754,862 |

|

|

|

|

Use of Proceeds: |

We will not receive any proceeds from the sale of the 3,000,000 Ordinary Shares subject to sale by the selling stockholder under this prospectus. |

6

Summary Consolidated Financial Information

The following table summarizes selected historical financial data regarding our business and should be read in conjunction with our consolidated financial statements and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary consolidated statement of income for the fiscal years ended December 31, 2010 and 2009 respectively and the summary balance sheet data as of December 31, 2010 and 2009 are derived from the audited consolidated financial statements of Tsingda Technology included elsewhere in this prospectus. Tsingda Technology conducts all our business operations and became our wholly-owned subsidiary on May 24, 2010. We derived our summary consolidated financial data for the six months ended June 30, 2011 and 2010 respectively from our unaudited consolidated financial statements included elsewhere in this prospectus, which include all adjustments, consisting of normal recurring adjustments, that our management considers necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented. The results of operations for past accounting periods are not necessarily indicative of the results to be expected for any future accounting period.

Balance Sheet

|

|

|

|

|

|

|

|

|

|

|

|

December |

|

December |

|

||

|

|

|

|

|

|

|

||

|

|

|

(Audited) |

|

(Audited) |

|

||

|

|

|

|

|

|

|

||

|

Cash |

|

$ |

4,086,214 |

|

$ |

458,645 |

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

|

43,453,932 |

|

|

17,243,696 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

9,792,960 |

|

|

3,732,244 |

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity |

|

|

33,660,972 |

|

|

13,511,452 |

|

Statement of Operations

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

Year Ended |

|

||

|

|

|

|

|

|

|

||

|

Revenues |

|

$ |

27,447,545 |

|

$ |

14,650,863 |

|

|

|

|

|

|

|

|

|

|

|

Pre-Tax Net Income |

|

|

12,135,737 |

|

|

7,120,130 |

|

Balance Sheet

|

|

|

|

|

|

|

|

|

|

June 30, 2011 |

|

December 31, 2010 |

|

||

|

|

|

|

||||

Cash |

|

$ |

1,945,964 |

|

$ |

4,086,214 |

|

|

|

|

|

|

|

|

|

Total Assets |

|

|

49,315,992 |

|

|

43,453,952 |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

10,892,275 |

|

|

9,792,960 |

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity |

|

|

38,423,717 |

|

|

33,660,972 |

|

Statement of Operations

|

|

|

|

|

|

|

|

|

|

|

|

Six Month |

|

Six Month |

|

||

|

|

|

|

|

|

|

||

|

Revenue |

|

$ |

17,090,536 |

|

$ |

9,467,108 |

|

|

|

|

|

|

|

|

|

|

|

Pre-Tax Net Income |

|

|

3,413,197 |

|

|

5,214,682 |

|

7

An investment in our Ordinary Shares is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this prospectus, including the consolidated financial statements and notes thereto of our Company, before deciding to invest in our Ordinary Shares. The risks described below are not the only ones facing our Company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our Company. If any of the following risks occur, our business, financial condition and results of operations and the value of our Ordinary Shares could be materially and adversely affected.

Risks Relating to Our Business

We have a limited operating history and we may not be able to sustain the growth in our business.

Our limited operating history and the early stage of development of the online education industry in which we operate makes it difficult to evaluate our business and future prospects. Although our annual growth rate of sales revenue from the six month period ended June 30, 2011 to the comparable period in 2010 was approximately 80.53%, there is no assurance that we will be able to sustain such growth in the future. We may have negative growth, which in turn may impair our business operations and profitability.

Furthermore, our largest shareholder, Tsing Da Century Education Technology Co., Ltd., a Belize corporation controlled by Zhang Hui, our chairman and CEO, has entered into a securities escrow agreement with respect to the 6,000,000 Ordinary Shares (the “Escrowed Shares”) owned by it. If the Company’s net income for the fiscal year 2011 is less than $13,500,000, the escrow agent shall transfer to the investors in our 2010 private placement, on a pro-rata basis, an amount of Escrow Shares equal to the percentage of variation from the 2011 performance threshold times the total number of Escrow Shares. Any Escrow Shares not distributed to such investors following the release of fiscal year 2011 information will be returned to Tsing Da Century Education Technology Co., Ltd. Therefore, if we cannot meet these performance targets, there may be a significant change in the ownership of our outstanding shares.

The market for the services that we provide is still emerging and evolving rapidly, and we may not be able to adapt our business.

The market for educational services is still evolving in the PRC. Our success will depend to a large extent on the perceived benefit that our services provide to our customers, who are mainly students. Therefore we will need to increase awareness of our products, protect our reputation and develop customer loyalty among our customers, anticipate and adapt to changing conditions in the markets in which we operate.

Increased funding of educational programs by the local or national government may negatively impact our business.

It is possible that increased funding of educational programs would result in either greater competition or reduced demand for our products and services. For example, increased funding of educational programs may lead to nationwide student access to online educational courses and services, as well as publicly available state-sponsored learning centers. Increased online access could dramatically increase the demand for online supplemental education, which could be expected to lead to an increase in the number of private competitors we face. The government may also determine to compete with us directly by offering supplemental education services, and would be able to undercut our prices and adversely affect the demand for our products and services.

Additional funding of education may also reduce the overall demand for supplemental education in the event such funds are used to better educate students in the primary and secondary schools. To the extent the quality of education in schools increases, the need for supplemental education may decrease. In any of such events, we would expect our results of operations and future growth prospects to be harmed.

We may have difficulty executing our plan to expand our business, which may negatively impact our operations.

In order to expand our business operations we will need to (i) increase the number of our learning centers, (ii) scale and adapt our existing network infrastructure to accommodate increased systems traffic and (iii) increase our marketing efforts. Through 2011, we expect to open approximately 600 additional franchised locations. We plan on a broad scale brand promotion campaign, and we will need significantly more computing power as traffic within our system increases and our learning center locations expand. We will be required to spend significant capital and resources to manage our additional franchises, execute our promotional campaign and to purchase equipment, and upgrade our technology and network infrastructure to handle increased Internet traffic. In this regard, we have budgeted approximately $1.2 million for our marketing campaign, approximately $1.4 million for IT expenditures, and approximately $1.8 million to add and improve our course content. We expect to generate the funds necessary for our expansion through our existing cash flow. If we fail to expend sufficient capital to execute our growth strategy, our operating results will be harmed.

8

Problems with content delivery services, bandwidth providers, data centers or other third parties could harm our business, financial condition or results of operations.

Our business relies significantly on third-party vendors, such as data centers, content delivery services and bandwidth providers. While no single vendor is material to our operations, if any third-party vendor fails to provide their services or if their services are no longer available to us for any reason and we are not immediately able to find replacement providers, our business, financial conditions or results of operations could be materially adversely affected.

Additionally, any disruption in network access or related services provided by these third-party providers or any failure of these third-party providers to handle current or higher volumes of use could significantly harm our business operations. If our service is disrupted, we may lose revenues due to our inability to provide services to our franchised learning centers and we may be obligated to compensate these franchisees for their loss. Our reputation also may suffer in the event of a disruption. Any financial or other difficulties our providers face may negatively impact our business and we are unable to predict the nature and extent of any such impact. We exercise very little control over these third-party vendors, which increases our vulnerability to problems with the services they provide. Any errors, failures, interruptions or delays experienced in connection with these third-party technologies and information services could negatively impact our relationships with our franchisees and materially adversely affect our brand reputation and our business, financial condition or results of operations and expose us to liabilities to third parties.

Our data centers are vulnerable to natural disasters, terrorism and system failures that could significantly harm our business operations and lead to client dissatisfaction.

In delivering our solutions, we are dependent on the operation of our data centers and bandwidth providers, which are vulnerable to damage or interruption from earthquakes, terrorist attacks, war, floods, fires, power loss, telecommunications failures, computer viruses, computer denial of service attacks or other attempts to harm our system, and similar events. We do not have insurance to cover any losses. Some of our systems are not fully redundant, and our disaster recovery planning cannot account for all eventualities. The occurrence of a natural disaster, a terrorist attack, a provider’s decision to close a facility we are using without adequate notice or other unanticipated problems at our data centers could result in lengthy interruptions in our service. Interruptions in our service could reduce our revenues and profits, and our brand reputation could be damaged if customers believe our system is unreliable, which could have a material adverse affect on our business, financial condition and results of operations.

Our business may be adversely affected by malicious third-party software applications that interfere with the function of our technology.

Our business may be adversely affected by malicious software applications that make changes to operating computers and interfere with our technology. These applications may attempt to change users’ experience in using our virtual classrooms or teaching modules at our learning centers, including changing configurations of our user interface, or otherwise interfering with our ability to connect with users. The interference may occur without disclosure to or consent from users, resulting in a negative experience that users may associate with our solutions. These software applications may be difficult or impossible to uninstall or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. If our efforts to combat these malicious software applications are unsuccessful, our reputation may be harmed, and users may be reluctant to use our services. This could result in a decline in usage of our educational services and corresponding revenues, which would have a material adverse effect on our business, financial condition and results of operations.

If we fail to manage our growth effectively, our business, financial condition and results of operations could be materially adversely affected.

We have experienced, and continue to experience, rapid growth in our operations and headcount, which has placed, and will continue to place, significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our solutions and services could suffer, which could negatively affect our brand and operating results. To effectively manage this growth, we will need to continue to improve, among other things:

|

|

|

|

|

|

• |

our information and communication systems to ensure that our operations are well coordinated and that we can effectively communicate with our growing base of franchisees and users; |

|

|

|

|

|

|

• |

our systems of internal controls to ensure timely and accurate reporting of all of our operations; and |

|

|

|

|

|

|

• |

our information technology infrastructure to maintain the effectiveness of our systems. |

9

In order to enhance and improve these systems we will be required to make significant capital expenditures and allocation of valuable management resources. If the improvements are not implemented successfully, our ability to manage our growth will be impaired and we may have to make additional expenditures to address these issues, which could materially adversely affect our business, financial condition and results of operations.

If we do not reach certain business milestones, our largest shareholder would suffer contractual penalties which would cause a significant change in the ownership of our outstanding shares.

Our largest shareholder, Tsing Da Century Education Technology Co., Ltd., a Belize corporation controlled by Zhang Hui, our chairman and CEO, has entered into a securities escrow agreement with respect to the Escrowed Shares. If the Company’s net income for fiscal year 2011 is less than $13,500,000, the escrow agent shall transfer to the investors in our September 2010 private placement, on a pro-rata basis, an amount of Escrow Shares equal to the percentage of variation from the 2011 performance threshold times the total number of Escrow Shares. Any Escrow Shares not distributed to such investors following the release of fiscal year 2011 information will be returned to Tsing Da Century Education Technology Co., Ltd. Therefore, if we cannot meet these performance targets, there may be a significant change in the ownership of our outstanding shares.

We may incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, and other rules implemented by the Securities and Exchange Commission. We expect all of the applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. We currently estimate our annual costs for such compliance to be approximately $280,000, however we cannot predict the amount of future compliance costs or other additional costs we may incur or the timing of such costs.

We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

We are dependent upon key personnel and the loss of key personnel, or the inability to hire or retain qualified personnel, could have an adverse effect on our business and operations.

Our success is heavily dependent on the continued active participation of our current executive officers listed under “Management.” Loss of the services of one or more of our officers could have a material adverse effect upon our business, financial condition or results of operations. Further, our success and achievement of our growth plans depend on our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in the PRC is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect on us. The inability on our part to attract and retain the necessary personnel and consultants and advisors could have a material adverse effect on our business, financial condition or results of operations.

As of June 30, 2011, we had a total of approximately 356 employees in our offices in the PRC. However, there can be no assurance that we will be able to maintain a prolonged good relationship with our existing or ex-employees and that no labor disruptions will occur in the future. Should any industrial action or labor unrest occur, our business operations could be adversely affected.

Potential claims alleging infringement of third party’s intellectual property by us could harm our ability to compete and result in significant expense to us and loss of significant rights.

Our operations are technology driven, and we have sought patent and copyright protection for our key software packages. However, we may confront, from time to time, third parties that may assert patent, copyright, and other intellectual property rights to these and other software packages which are important to our business. Any claims that our products or processes infringe the intellectual property rights of others, regardless of the merit or resolution of such claims, could cause us to incur significant costs in responding to, defending, and resolving such claims, and may divert the efforts and attention of our management and technical personnel away from the business. As a result of such intellectual property infringement claims, we could be required or otherwise decide it is appropriate to pay third-party infringement claims; discontinue using the technology or processes subject to infringement claims which would include the software relating to our learning centers and virtual classrooms; develop other technology not subject to infringement claims, which could be time-consuming and costly or may not be possible; and/or license technology from the third-party claiming infringement, which license may not be available on commercially reasonable terms. The occurrence of any of the foregoing could result in unexpected expenses or require us to recognize an impairment of our assets, which would reduce the value of the assets and increase expenses. In addition, if we are required to discontinue the use of existing software, our revenue could be negatively impacted.

10

Risks Related to our Corporate Structure

Our principal shareholder is able to control substantially all matters requiring a vote of our shareholders and its interests may differ from the interests of our other shareholders.

Tsing Da Century Education Technology Co., Ltd., a Belize corporation (not to be confused with Tsingda Technology, a BVI corporation, which is our direct-wholly-owned subsidiary), is our majority shareholder and beneficially owns approximately 33.8% of our issued and outstanding Ordinary Shares. Mr. Zhang Hui, our Chairman and President, is an officer and majority owner of this company. Therefore, Mr. Zhang is able to exert substantial control on all matters requiring approval by our shareholders, including the election of our directors and officers. This concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our shares.

The contractual agreements with Tsingda Education are not as effective as direct ownership. Because we rely on Tsingda Education for our revenue, any termination of, or disruption to, these contractual arrangements could detrimentally affect our business.

Presently all of our business operations are carried out by Tsingda Education, and its wholly owned subsidiary, Tsingda Network. We do not own any equity interests in Tsingda Education, but control and receive the economic benefits of its business operations through various contractual arrangements. Through these contractual arrangements, we have the ability to substantially control the daily operations and financial affairs of Tsingda Education, as we are able to appoint its senior executives and approve all matters requiring shareholder approval. Accordingly, we consolidate Tsingda Education results, assets and liabilities in our financial statements.

However, these contractual agreements may be terminated under certain circumstances. Generally the PRC has substantially less experience related to the enforcement of contractual rights through its judiciary or the arbitration process as compared to the United States or the Cayman Islands. This inexperience presents the risk that the judiciary or arbitrators in the PRC may be reluctant to enforce contractual rights, interpret these rights and remedies differently than what was intended by the parties to the agreements, or find that such contractual agreements do not comply with restrictions in current PRC laws. A PRC court may also set aside an arbitration award by reason of any defect the court considers to be present in the arbitration proceeding, remedies at law may not be adequate and a PRC court may not order specific performance. In addition, any legal proceeding may result in substantial costs, disruptions to our business, damage to our reputation and diversion of our resources.

If Tsingda Education or its shareholders fail to perform their obligations under the contractual arrangements, we may have to rely on legal remedies under PRC laws, including seeking specific performance or injunctive relief, and claiming damages, and there is a risk that we may be unable to obtain these remedies. Therefore our contractual arrangements may not be as effective in providing control over Tsingda Education as direct ownership. Because we rely on Tsingda Education for our revenue, any termination of or disruption to these contractual arrangements could detrimentally affect our business.

If the PRC government determines that our agreements with these companies are not in compliance with applicable regulations, our business in the PRC could be adversely affected.

The Chinese government restricts foreign investment in education and Internet-related businesses, including distribution of content over the Internet. We cannot be sure that the PRC government would view our operating arrangements to be in compliance with PRC licensing, registration, restrictions on foreign investment or other regulatory requirements, including without limitation the requirements described in the “Government Regulations” section of this prospectus. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, block our website, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business. We may also encounter difficulties in obtaining performance under or enforcement of related contracts.

In addition, our agreements are governed by the PRC laws and regulations. PRC laws and regulations concerning the validity of the contractual arrangements are uncertain, as many of these laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement by the PRC government may involve substantial uncertainty.

We may not be able to consolidate the financial results of some of our affiliated companies or such consolidation could materially adversely affect our operating results and financial condition.

All of our business is conducted through Tsingda Education which currently is considered for accounting purposes a variable interest entity (“VIE”), and we are considered the primary beneficiary, enabling us to consolidate our financial results in our consolidated financial statements. We have also received a legal opinion from our PRC legal counsel that the VIE Agreements are valid and enforceable under PRC Laws. In the event that in the future a company we hold as a VIE would no longer meet the definition of a VIE, or we are deemed not to be the primary beneficiary, we would not be able to consolidate line by line that entity’s financial results in our consolidated financial statements for PRC purposes. Also, if in the future an affiliate company becomes a VIE and we become the primary beneficiary, we would be required to consolidate that entity’s financial results in our consolidated financial statements for PRC purposes. If such entity’s financial results were negative, this could have a corresponding negative impact on our operating results for PRC purposes. However, any material variations in the accounting principles, practices and methods used in preparing financial statements for PRC purposes from the principles, practices and methods generally accepted in the United States and in the SEC accounting regulations must be discussed, quantified and reconciled in financial statements for United States and SEC purposes.

11

We rely on certain contractual agreements between Tsingda Management and Tsingda Education, and if any of these agreements are terminated or unenforceable, our business and operations will be materially and adversely affected. In the event of termination or unenforceability of any of these agreements, our financial condition, results of operations and future growth prospects may be materially harmed.

We rely on the VIE Agreements between our wholly-owned subsidiary, Tsingda Management, and our variable interest entity, Tsingda Education to control Tsingda Education.

Under the terms of the exclusive consulting services agreement, Tsingda Management has the exclusive right to provide business consulting and related services to Tsingda Education in connection with its business operations. Under this agreement, Tsingda Management owns the intellectual property rights arising from the performance of these services, including, but not limited to, any trade secrets, copyrights, patents, know-how, unpatented methods and processes and otherwise, whether developed by Tsingda Management or Tsingda Education based on Tsingda Management’s provision of such services under the agreement. Tsingda Education pays quarterly consulting service fees to Tsingda Management that are equal 100% of Tsingda Education’s total net profit for such quarter. The consulting services agreement is in effect from April 26, 2010 and continues indefinitely unless terminated by (a) Tsingda Management upon a material breach by Tsingda Education; (b) bankruptcy by either Tsingda Management or Tsingda Education; (c) by either Tsingda Management or Tsingda Education in the event Tsingda Management ceases operations or (d) by either Tsingda Management or Tsingda Education in the event circumstances arise which materially adversely affects the performance of either party under the consulting agreement. Because 100% of our revenues are generated from Tsingda Education pursuant to this agreement, if this agreement is terminated or not enforceable, we will not be able to generate any revenues.

Under the terms of the operating agreement by and among Tsingda Management, Tsingda Education and the shareholders of Tsingda Education, Tsingda Management has the right to direct the corporate policies regarding Tsingda Education’s daily operations and financial management, including the power to appoint the members of Tsingda Education’s board of directors as well as its executive officers. The operating agreement is effective for an indefinite term under the laws of the PRC, and may only be terminated by Tsingda Management. Because we rely on the operating agreement to control the business operations of Tsingda Education, if this agreement is terminated or not enforceable, we may lose the ability to control the management and operations of Tsingda Education.

Under the terms of the equity pledge agreement, Tsingda Education pledged all of its assets to Tsingda Management for a term of two years following Tsingda Education meeting all of its obligations under the consulting services agreement. If this agreement is terminated or not enforceable, we may not have any adequate security or remedy against Tsingda Education should Tsingda Education breach its obligations under the consulting services agreement.

Under the terms of the voting rights agreement by and among Tsingda Management, Tsingda Education and the shareholders of Tsingda Education, the shareholders of Tsingda Education irrevocably grant and entrust Tsingda Management, for the maximum period of time permitted by PRC law, all voting rights in Tsingda Education. Because we rely on the voting rights agreement to vote on all matters submitted to Tsingda Education’s shareholders for their approval, if this agreement is terminated or not enforceable, shareholders of Tsingda Education may take shareholder initiatives that may not be in our best interests.

Under the terms of the option agreement by and among Tsingda Management, Tsingda Education and the shareholders of Tsingda Education, Tsingda Management has the option to purchase from the shareholders of Tsingda Education, all the outstanding shares of Tsingda Education. The option agreement is effective for the maximum period allowable under the laws of the PRC, and may only be terminated by Tsingda Management. In the event we are not able to control Tsingda Education through our other contractual arrangement, we would need to rely on the option agreement to purchase all the outstanding shares of Tsingda Education. In such an event, if the option agreement is terminated or not enforceable, then we may lose control of Tsingda Education.

Risks Related to Doing Business in China

PRC economic, political and social conditions, as well as changes in any government policies, laws and regulations, could adversely affect the overall economy in China or the prospects of the education market, which in turn could adversely affect our business.

Substantially all of our operations are conducted in China, and substantially all of our revenues are derived from China. Accordingly, our business, financial condition, results of operations, prospects and certain transactions we may undertake are subject, to a significant extent, to economic, political and legal developments in China.

The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past two to three decades, growth has been uneven, both geographically and among various sectors of the economy. Demand for our services may depend, in large part, on economic conditions in China. Any slowdown in China’s economic growth may cause families to reduce the use of our services for their children, which in turn could reduce our net revenues.

12

Although the PRC economy has been transitioning from a planned economy to a more market-oriented economy since the late 1970s, the PRC government continues to play a significant role in regulating industry development by imposing ongoing policies. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling the incurrence and payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Changes in any of these policies, laws and regulations could adversely affect the overall economy in China or the prospects of the education market, which could harm our business.

The PRC government has implemented various measures to encourage foreign investment and sustainable economic growth and to guide the allocation of financial and other resources, which have for the most part had a positive effect on our business and growth. However, we cannot assure you that the PRC government will not repeal or alter these measures or introduce new measures that will have a negative effect on us.

China’s social and political conditions are also not as stable as those of the United States and other developed countries. Any sudden changes to China’s political system or the occurrence of widespread social unrest could have negative effects on our business and results of operations. In addition, China has tumultuous relations with some of its neighbors and a significant further deterioration in such relations could have negative effects on the PRC economy and lead to changes in governmental policies that would be adverse to our business interests

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. To date, we have taken no steps to prevent violations of the FCPA other than the adoption of a code of ethics. Although we intend to adopt a code of ethics to ensure compliance with the FCPA and Chinese anti-corruption laws by all individuals involved with our company, our employees or other agents may engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

PRC regulations regarding offshore financing activities by PRC residents have undertaken continuous changes which may increase the administrative burden we face and create regulatory uncertainties that could adversely affect our business.

On August 8, 2006, the PRC Ministry of Commerce (“MOFCOM”), joined by the China Securities Regulatory Commission (“CSRC”), the State Administration of Foreign Exchange (“SAFE”) as well as other government agencies, released a Provisions for Foreign Investors to Merge with or Acquire Domestic Enterprises (“M&A Regulation”), which took effect September 8, 2006 and was amended in 2009. These new rules significantly revised China’s regulatory framework governing onshore-to-offshore restructurings and foreign acquisitions of domestic enterprises. These new rules reflect greater PRC government attention to cross-border merger, acquisition and other investment activities, by confirming MOFCOM as a key regulator for issues related to mergers and acquisitions in China and requiring MOFCOM approval of a broad range of merger, acquisition and investment transactions. According to the new M&A Regulation, a related-party acquisition in which an offshore Company-owned or controlled by a PRC resident acquires a domestic company controlled by the same PRC resident shall be subject to the approval of MOFCOM.

Among other things, the M&A Regulation also included new provisions to require that the overseas listing of an offshore company which is directly or indirectly controlled by a PRC resident for the purpose of overseas listing of such PRC resident’s interests in a domestic company, known as a “special purpose company”, must obtain the approval of CSRC prior to the listing.

We believe that our current VIE structure avoids the acquisition transaction which is directly the target under scrutiny of the M&A Regulation, including the requirement of CSRC approval. No PRC regulatory authority has stated that this type of structure is subject to the M&A Regulations and we know of no similar VIE structure that has been reviewed under the M&A Regulations. Thus, in its current practice, it appears the M&A Regulation does not apply to our corporate structure.

However, the application of this M&A Regulation remains uncertain since neither MOFCOM nor CSRC has approved any Chinese company’s foreign listing. There is no consensus currently existing among the leading PRC law firms regarding the scope and applicability of the MOFCOM or CSRC approval requirements. If the MOFCOM, CSRC or other PRC regulatory body subsequently determines that the new M&A Regulation applies to our situation and CSRC’s approval was required for this offering, we may face sanctions by the MOFCOM, CSRC or other PRC regulatory agencies. In such event, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of funds to our offshore companies, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our securities.

We may be subject to PRC penalties and may be required to forfeit $100,000 if our PRC resident shareholders including Zhang Hui, our chairman and CEO, and Liu Juntao, our Executive Vice President do not obtain SAFE Circular 75 approval of their ownership of our shares.

13

Under PRC law, a PRC resident is required to obtain approval from SAFE when such PRC resident acquires securities of a foreign company. In that respect, all nineteen of our PRC resident shareholders including Zhang Hui, our chairman and CEO, and Liu Juntao, our Executive Vice President, are required to obtain SAFE approval of the shares indirectly held by them. If they fail to obtain SAFE approval, we may be subject to penalties under PRC law. Failure to obtain the approval may result in restrictions on the Company, including prohibitions on the payment of dividends and other distributions to its offshore affiliates and capital inflow from the offshore entities.

We have requested our shareholders and beneficial owners who may be subject to SAFE rules to make the necessary applications, filings and amendments as required under SAFE rules. We have advised these shareholders and beneficial owners to comply with the relevant requirements. To date, the required filings are underway for all of our PRC resident shareholders. However, we cannot provide any assurance that all of our shareholders and beneficial owners who may be PRC residents will comply with our request to make or obtain any applicable registrations or comply with other requirements required by SAFE rules. Under the terms of our Holdback Escrow Agreement, the failure or inability of Zhang Hui or Liu Juntao (but not our other PRC resident shareholders) to make any required registrations or comply with other requirements may result in the forfeiture of $100,000 currently held in escrow for our benefit, may subject such shareholders or beneficial owners to fines and legal sanctions and may also limit our ability to contribute additional capital into or provide loans to our PRC subsidiaries, limit the ability of our PRC subsidiaries to pay dividends or otherwise distribute profits to us, or otherwise adversely affect us.

Under the EIT Law, we may be classified as a “resident enterprise” of the PRC. Such classification could result in unfavorable tax consequences to us and our non-PRC shareholders.

Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes, although the dividends paid to one resident enterprise from another may qualify as “tax-exempt income.” The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. The EIT Law and its implementing rules are relatively new and ambiguous in terms of some definitions, requirements and detailed procedures, and currently no official interpretation or application of this new “resident enterprise” classification is available; therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

We have been advised by our PRC legal counsel that we are, under the EIT Law, likely to be classified as a resident enterprise and that we are exempt from PRC income taxes because income from equity investments (such as dividends and bonuses) between resident enterprises is tax exempt.

If any PRC taxes apply to our non-PRC shareholders, a non-PRC shareholder may be entitled to a reduced rate of PRC taxes under an applicable income tax treaty and/or a foreign tax credit against such shareholder’s domestic income tax liability (subject to applicable conditions and limitations). You should consult with your own tax advisors regarding the applicability of any such taxes, the effects of any applicable income tax treaties, and any available foreign tax credits. In the event we become subject to the EIT Laws, our tax obligations can be expected to increase, which would adversely affect our net income, results of operations and future growth prospects.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC operating companies, we may not be able to pay dividends to our shareholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended and The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, such companies are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. Tsingda Education and Tsingda Network are regulated by the laws governing foreign-invested enterprises in the PRC. Accordingly, Tsingda Education and Tsingda Network are required to allocate 10% of their after-tax profits based on PRC accounting standards each year to their general reserves until the accumulated amount of such reserves has exceeded 50% of their registered capital, after which no further allocation is required to be made. If a company’s legal accumulations fund is not sufficient to make up for the losses of the company from the previous year, the current year’s profits are first used for making up the losses before the legal accumulations funds is drawn. As of December 31, 2009, the registered capitals of Tsingda Education and Tsingda Network are $4,421,156 and $588,235, respectively, and both companies have made the required allocations to the general reserves. These reserve funds, however, may not be distributed to equity owners except in accordance with PRC laws and regulations. We cannot assure you that the PRC government authorities will not request our subsidiaries to use their after-tax profits for their own development and restrict our subsidiaries’ ability to distribute their after-tax profits to us as dividends.

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the Company’s profits.

14

Furthermore, if our subsidiaries or affiliates in China incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our Ordinary Shares.

Changes in PRC regulations relating to tuitions may adversely affect our business.

Currently, we are not regulated by the Ministry of Education of the PRC due to the fact that we are a non-accredited learning center and do not offer certification programs. The types and amounts of fees charged by private schools offering certification programs must be approved by the relevant governmental authority and be publicly disclosed, and the types and amounts of fees charged by private schools that do not offer certification programs need only be filed with the relevant governmental authority and be publicly disclosed. If the PRC government decides to regulate private schools which do not offer certification programs similar to their regulations of certification programs, set limits on fees chargeable by us, or impose a special tax on our business, such events could significantly affect our operations.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us, our management or the experts named in this current report.

We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, all of our senior executive officers reside within China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside of China upon our senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, our PRC counsel has advised us that the PRC does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in RMB. Under our current structure, our income is primarily derived from Tsingda Education. Shortages in the availability of foreign currency may restrict the ability of our PRC subsidiaries and our affiliated entity to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate government authorities is required where RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies. The PRC government may also, at its discretion, restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our shareholders.

Fluctuation in the value of RMB may have a material adverse effect on your investment.

The value of RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. Our revenues and costs are mostly denominated in RMB, while a significant portion of our financial assets are denominated in U.S. dollars. Our revenue is based entirely on that generated by our affiliated entity in China. Any significant fluctuation in value of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payable on, our stock in U.S. dollars. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditures more costly to us, to the extent that we need to convert U.S. dollars into RMB for such purposes. An appreciation of RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our U.S. dollar denominated financial assets into RMB, as RMB is our reporting currency.

We face risks related to health epidemics and other outbreaks.

Our business could be adversely affected by the effects of an epidemic or outbreak that will cause social and economic disruptions in China, such as SARS or H1N1 flu. Any prolonged recurrence of SARS, H1N1 or other adverse public health developments in China may have a material adverse effect on our business operations as schools may be closed for an extended period of time. For instance, health or other government regulations adopted in response may require temporary closure of our production facilities or of our offices. Such closures would severely disrupt our business operations and adversely affect our results of operations. We have not adopted any written preventive measures or contingency plans to combat any future outbreak of SARS, H1N1 or any other epidemic.

15

Risks Related to an Investment in Our Securities

We are not listed or quoted on any exchange and we may never obtain such a listing or quotation.