Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF MALONE BAILEY LLP - AJ Acquisition Corp. V, Inc. | fs1a2ex23i_chinaaluminum.htm |

As filed with the Securities and Exchange Commission on August 31 , 2011

Registration No. 333-172944

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

China Aluminum Foil, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-3350

|

27-1805188

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

Building No. 35, No. 1 Cui Zhu Street, High-tech Development Area,

Zhengzhou City, Henan Province, China

(86) 371-67539696

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

CSC Services of Nevada, Inc.

2215 B. Renaissance Drive

Las Vegas, NV 89119

(800)927-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

It is respectfully requested that the Securities and Exchange Commission send copies of all notices, orders and communications to:

William N. Haddad

Reed Smith LLP

599 Lexington Avenue

New York, NY 10022

Approximate date of commencement of proposed sale to public: as soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company x

|

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Amount

to be Registered

|

Proposed Maximum Offering

Price per Security(1)

|

Proposed Maximum Aggregate

Offering Price(1)

|

Amount of

Registration

Fee

|

||||||||||

|

Common Stock

|

3,332,973 Shares

|

$ | 2.00 | $ | 6,665,946 | $ | 773.92 | |||||||

|

Total

|

$ | 6,665,946 | $ | 773.92 | ||||||||||

(1) Estimated solely for the purpose of calculating the registration fee.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED , 2011

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

3,332,973 Shares

|

China Aluminum Foil, Inc.

Common Stock

This prospectus relates to the resale, by the selling shareholders identified in this prospectus, of up to 3,332,973 shares of our common stock issued to the selling shareholders.

We will not receive any proceeds from the sale by the selling shareholders of these shares. We are paying the cost of registering the shares covered by this prospectus as well as various related expenses. The selling shareholders are responsible for all discounts, selling commission and other costs related to the offer and sale of their shares. If required, the number of shares to be sold, the public offering price of those shares, the names of any broker-deals and any applicable commission or discount will be included in a supplement to this prospectus, called a prospectus supplement.

The Selling shareholders are offering up to 3,332,973 shares of common stock. The selling shareholders will offer their shares at $2.00 per share until our shares are quoted on the OTC Bulletin Board and, assuming we secure this qualification, thereafter at prevailing market prices or privately negotiated prices. We will pay all expenses of registering the securities, estimated at approximately $ . We will not receive any proceeds of the sale of these securities.

The selling shareholders and any participating broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the Securities Act, in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the share purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

Our common stock is not traded on any exchange. We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board once our shareholders have free trading shares; however, there is no guarantee that we will obtain a listing.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the section entitled “Risk Factors” beginning on page 6 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2011.

|

1

|

|

|

4

|

|

|

4

|

|

|

6

|

|

|

12

|

|

|

12

|

|

|

12

|

|

|

12

|

|

|

13

|

|

|

25

|

|

|

35

|

|

|

38

|

|

|

39

|

|

|

40

|

|

|

41

|

|

|

43

|

|

|

44

|

|

|

45

|

|

|

45

|

|

|

45

|

|

|

45

|

|

|

|

|

|

F-1

|

Unless the context otherwise requires, the terms “we,” “us,” “our,” “China Aluminum,” and “the Company” refer to China Aluminum Foil, Inc., a Nevada corporation, and its consolidated subsidiaries. References to “dollars” and “$” are to United States dollars. Any logos or trademarks mentioned in this prospectus are the property of their respective owners.

You may rely only on the information contained in this prospectus. We have not authorized anyone to provide information or to make representations not contained in this prospectus. This prospectus is neither an offer to sell nor a solicitation of an offer to buy any securities other than those registered by this prospectus, nor is it an offer to sell or a solicitation of an offer to buy securities where an offer or solicitation would be unlawful. Neither the delivery of this prospectus, nor any sale made under this prospectus, means that the information contained in this prospectus is correct as of any time after the date of this prospectus.

This summary provides a brief overview of selected information from this prospectus and the documents incorporated by reference into this prospectus and does not contain all of the information you should consider in making your investment decision. This summary may not contain all of the information that may be important to you. Please carefully read the entire prospectus, including the information under the heading “Risk Factors” and our financial statements and the related notes incorporated by reference into this prospectus, before making an investment decision.

Overview

We were incorporated in the State of Nevada on January 29, 2010 as AJ Acquisition V, Inc. Since inception, we have been engaged in organizational efforts and obtaining initial financing. Our initial business purpose was to seek the acquisition of or merger with, an existing company. On November 8, 2010 we filed an amendment to our articles of incorporation to change our name to China Aluminum Foil, Inc., and on November 8, 2010 we entered into, and closed, a share exchange agreement with Lucky Express, now our wholly owned subsidiary. Prior to the share exchange with Lucky Express, we were a shell company with no business operations.

Current Business

Upon acquiring Lucky Express pursuant to the share exchange, we adopted the business of Lucky Express. We are mainly engaged in the development, production and distribution of various aluminum foils to domestic and overseas markets. Our aluminum foil products can be widely used in multiple industries for different purposes. Currently a majority of our products are used for household daily consumption and container production. However, we intend to expand into other high potential business segments, such as cigarette packaging, pharmaceutical packaging and electronic components.

We have one production line with an annual capacity of approximately 20,000 metric tons. We plan to build or rent another production line to expand our capacity. Due to long-term efforts to streamline production process and reduce wastage and pollution during production, we were recognized as one of the “High Tech New Star Enterprises” in Henan province. We are also recognized for our strong R&D capabilities in the aluminum foil industry in central China.

Principal Products

Aluminum foil is a paper-thin sheet of rolled aluminum that can be torn easily and used to wrap and store food, in art, decoration, insulation and in heat exchangers. Because aluminum foil is paper-thin, the foil is extremely pliable and can be bent or wrapped around objects with ease. In North America, aluminum foil is sometimes alternatively called al-foil or alu-foil.

We develop and manufacture various types of aluminum foils. The production of aluminum foil involves a complex production process and requires advanced technology and equipment. The principal products made by the Company range from 0.005mm to 0.08mm in thickness. We purchase raw aluminum with thickness of 0.3mm and produce different types of aluminum foil by rolling process. Currently our products mainly fall into two product segments: aluminum foil used by households for daily consumption and aluminum foil used for the production of containers such as meal boxes, cake cups, as well as many other applications.

Our Strengths:

Superior Quality of Aluminum Foil

The quality of our products has consistently been rated the highest among aluminum foil customers in China. Our product aluminum foil is manufactured using our licensed patented manufacturing technology, which was awarded Scientific Advancement Awards by Zhengzhou Municipal Government in 2007 and obtained official recognition by Henghan Province Scientific Technological Result in 2006.

The licensed patented manufacturing technology enables us to produce aluminum foil of superior quality, in term of strength and price competitiveness, than our competitors. Moreover, we are one of the few manufacturers in China who can manufacture aluminum foil with a thickness of 0.005mm or less.

Large and Diverse Customer Base Across Several Markets and Industries

Our products are in demand in a broad range of markets and industries. We believe this insulates us from any concentration risk or dependence on a certain industry. A downturn in one industry may be made up for by increased demand in another industry which purchases our products. We sell our products to various industries, including, the appliance, manufacturing, telecommunications, food packaging industries.

Our Cost Structure is Lower than the Average Cost Structure of our Competitors

Our location, method of manufacture and our transportation costs allow us to maintain a cost structure that is lower than the average cost structure of our competitors. All of our manufacturing equipment is made in China with close collaboration with the equipment supplier which allows us to manufacture our products at a low cost. In addition, we are located in Zhengzhou, Henan Province, China which has one of the largest bauxite ore reserves in China, allowing us to transport products and supplies cost efficiently. We transport materials and products directly from the production facilities of a nearby company which allows us to limit our transportation costs.

Proven Track Record of Growth

We have had very strong annual growth of 158.8% through our first two years of operation and production of aluminum foil. We have a strategic plan which we believe will allow us to continue this growth by expanding our production capacity and introducing higher margin products.

Superior Technology and a Highly Efficient Manufacturing Process

We have superior technology due to a license agreement which allows us to license 9 patents from an affiliate of ours. We have developed a highly efficient manufacturing process through close collaboration with our equipment supplier pursuant to which we have been able to lower our costs and improve our yields.

An Experienced and Dedicated Management Team

Our management team members have an average of greater than 20 years of experience in the aluminum industry, and our management team has more than 100 years of experience in the aluminum industry.

Growth Strategy:

We intend to pursue the following strategies to achieve our goal:

Continue to Increase Our Production Capacity

We will continue to expand into new production lines and increase our production capacity of ultra-thin aluminum foil which is used in pharmaceutical and electronic industries. We have leased a 1600mm cold-rolling production line, which is being implemented into our production process in phases. We expect this will increase capacity by approximately 15,000 metric tons, or 75% more than our 2010 capacity, by the end of 2011, when the 1600mm cold-rolling production line is scheduled to be operating at full capacity.

We will expand our market share and customer base by expanding and improving our product quality and lowering production and sales cost which will allow us to increasingly capitalize on economies of scale.

Introduce New Products with Higher Margins

We plan to begin production of aluminum foil products used in pharmaceutical packaging and electronic components since such products have much higher margins and offer significant growth opportunities.

Expand our Product Offerings in Emerging Markets

We intend to increase revenues by exporting our products to emerging markets including but not limited to Southeast Asia, Africa and Latin America.

Continue to Enhance Manufacturing Efficiencies

We will focus our research and development on advanced processing techniques to develop more sophisticated products that command higher margins, and we will continue to improve margins through increased efficiencies in our production process.

Our Corporate Information

We were incorporated in the State of Nevada on January 29, 2010 as AJ Acquisition V, Inc. Since inception we have been engaged in organizational efforts and obtaining initial financing. Our business purpose was to seek the acquisition of or merger with, an existing company. On November 8, 2010 we filed an amendment to our articles of incorporation to change our name to China Aluminum Foil, Inc., and on November 8, 2010 we entered into, and closed, a share exchange agreement with Lucky Express, now our wholly owned subsidiary.

Our principal offices are located at Building No.35, No.1 Cui Zhu Street, High-tech Development Area, Zhengzhou City, Henan Province, China. Our telephone number is (86) 371-67539696. Our fiscal year end is June 30.

|

Common stock outstanding before the offering

|

10,201,011 shares as of August 31 , 2011.

|

|

|

Common stock offered by selling shareholders

|

Consists of up to 3,332,973 shares of our common stock issued or issuable to the selling shareholders

|

|

|

Common stock to be outstanding after the offering

|

10,201,011 shares.

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock hereunder. The selling shareholders will offer their shares at $2.00 per share until our shares are quoted on the OTC Bulletin Board and, assuming we secure this qualification, thereafter at prevailing market prices or privately negotiated prices. We will pay all expenses of registering the securities, estimated at approximately $ . We will not receive any proceeds of the sale of these securities. See “Use of Proceeds” for a complete description.

|

|

|

Ticker Symbol

|

Our common stock is not traded on any exchange. We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board once our shareholders have free trading shares; however, there is no guarantee that we will obtain a listing.

|

|

|

Risk Factors

|

Please read the section entitled “Risk Factors” beginning on page 6 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

|

|

The following income statement data for the nine months ended March 31, 2011 and March 31, 2010 and balance sheet data as of March 31, 2011 were derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The income statement data for the years ended June 30, 2010 and June 30, 2009 were derived from our audited consolidated financial statements included elsewhere in this prospectus. These historical results are not necessarily indicative of results to be expected in any future period. You should read the following summary financial information together with the other information contained in this prospectus, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes included elsewhere.

STATEMENT OF INCOME DATA

(In thousands except per share data)

|

Twelve Months Ended

|

Nine Months Ended

|

|||||||||||||

|

June 30, 2010

|

June 30, 2009

|

March 31, 2011

|

March 31, 2010

|

|||||||||||

| (Unaudited) |

(Unaudited)

|

|||||||||||||

|

Sales revenue

|

44,133 | $ | 17,053 | $ | 53,483 | $ | 27,655 | |||||||

|

Cost of goods sold

|

42,001 | 18,002 | 51,908 | 26,378 | ||||||||||

|

Gross Profit

|

2,132 | (949 | ) | 1,575 | 1,277 | |||||||||

|

Operating expenses

|

||||||||||||||

|

Selling expenses

|

397 | 150 | 83 | 288 | ||||||||||

|

General and administrative expenses

|

580 | 330 | 342 | 293 | ||||||||||

|

Total operating expenses

|

977 | 480 | 425 | 581 | ||||||||||

|

Income (loss) from operations

|

1,155 | (1,429 | ) | 1,150 | 696 | |||||||||

|

Interest income

|

1 | 2 | 23 | 1 | ||||||||||

|

Bank Charge

|

(6 | ) | (1 | ) | (1 | ) | (1 | ) | ||||||

|

Income (loss) before income tax

|

1,150 | (1,428 | ) | 1,172 | 696 | |||||||||

|

Current Income Tax Expense

|

- | - | 312 | - | ||||||||||

|

Deferred Income Tax Benefit

|

- | - | (231 | ) | - | |||||||||

|

Net Income (Loss)

|

1,150 | $ | (1,428 | ) | $ | 1,091 | $ | 696 | ||||||

|

Other comprehensive income

|

||||||||||||||

|

Foreign currency translation adjustments

|

15 | 9 | 642 | 278 | ||||||||||

|

Total Comprehensive Income (Loss)

|

1,165 | $ | (1,419 | ) | $ | 1,733 | $ | 974 | ||||||

|

Earnings (loss)per share - basic and diluted

|

11.50 | (14.28 | ) | 0.11 | 6.96 | |||||||||

|

Weighted average shares outstanding - basic and diluted

|

100 | 100 | 10,073 | 100 | ||||||||||

|

At June 30,

|

At December 31,

|

|||||||||||

|

BALANCE SHEET DATA

|

2010

|

2009

|

2010

|

|||||||||

|

(In thousands)

|

(Unaudited)

|

|||||||||||

|

Working capital (deficiency)

|

||||||||||||

|

Total assets

|

$

|

16,134

|

$

|

7,877

|

$

|

13,495

|

||||||

|

Short-term debt

|

-

|

-

|

-

|

|||||||||

|

Long-term debt (including current portion)

|

-

|

-

|

-

|

|||||||||

|

Total deferred credits and other liabilities

|

8,581

|

1,653

|

4,228

|

|||||||||

|

Stockholders' equity

|

7,553

|

6,224

|

9,267

|

|||||||||

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our common stock. If any of the following events were to occur, our business, financial condition or results of operations could be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you could lose some or all of your investment.

We expect to incur costs related to our planned acquisitions and expansion into new plants and ventures, which may not prove to be profitable. Moreover, any delays in our expansion plans could cause our profits to decline and jeopardize our business.

We anticipate that our proposed expansion of our production facilities may include the acquisition and construction of new or additional facilities. Our cost estimates and projected completion dates for construction of new production facilities may change significantly as the projects progress. In addition, our projects will entail significant construction risks, including shortages of materials or skilled labor, unforeseen environmental or engineering problems, weather interferences and unanticipated cost increases, any of which could have a material adverse effect on the projects and could delay their scheduled openings. A delay in scheduled openings of production facilities will delay our receipt of sales revenues from such facilities, which, when coupled with the increased costs and expenses of our expansion, could cause a decline in our profits.

Our plans to finance, develop, and expand our production facilities will be subject to many risks inherent in the rapid expansion of a high growth business enterprise, including unanticipated design, construction, regulatory and operating problems, and the significant risks commonly associated with implementing a marketing strategy in changing and expanding markets. These projects may not become operational within their estimated time frames and budgets as projected at the time we enter into a particular agreement, or at all. In addition, we may develop projects as joint ventures in an effort to reduce our financial commitment to individual projects. The significant expenditures required to expand our production plants may not ultimately result in increased profits.

When our future expansion projects become operational, we will be required to add and train personnel, expand our management information systems and control expenses. If we do not successfully address our increased management needs or are otherwise unable to manage our growth effectively, our operating results could be materially and adversely affected.

Our products may not achieve market acceptance.

We are currently selling our products principally in Eastern, Central and Southern China. Achieving market acceptance for our products, particularly in new markets, will require substantial marketing efforts and the expenditure of significant funds. There is substantial risk that any new markets may not accept or be as receptive to our products. In addition, we intend to market our products as premium and super-premium quality products and to adopt a corresponding pricing model, which may not be accepted in new or existing markets. Market acceptance of our current and proposed products will depend, in large part, upon our ability to inform potential customers that the distinctive characteristics of our products make them superior to competitive products and justify their pricing. Our current and proposed products may not be accepted by consumers or able to compete effectively against other premium or non-premium products. Lack of market acceptance would limit our revenues and profitability.

The recent global economic and financial market crisis could significantly impact our financial condition.

Current global economic conditions could have a negative effect on our business and results of operations. Economic activity in China, United States and throughout much of the world has undergone a sudden, sharp economic downturn following the recent housing downturn and subprime lending collapse in both the United States and Europe. Market disruptions have included extreme volatility in securities prices, as well as severely diminished liquidity and credit availability. The economic crisis may adversely affect us in a variety of ways. Access to lines of credit or the capital markets may be severely restricted, which may preclude us from raising funds required for operations and to fund continued expansion. It may be more difficult for us to complete strategic transactions with third parties. The financial and credit market turmoil could also negatively impact our suppliers and customers, which could decrease our ability to source, produce and distribute our products and could decrease demand for our products. While it is not possible to predict with certainty the duration or severity of the current disruption in financial and credit markets, if economic conditions continue to worsen, it is possible these factors could significantly impact our financial condition.

Our results of operations may be affected by fluctuations in availability and price of raw materials.

The raw materials we use are subject to price fluctuations due to various factors beyond our control, including, among other pertinent factors:

|

·

|

increasing market demand;

|

|

·

|

inflation;

|

|

·

|

severe climatic and environmental conditions;

|

|

·

|

commodity price fluctuations;

|

|

·

|

currency fluctuations; and

|

|

·

|

changes in governmental and agricultural regulations and programs.

|

We are subject to public company reporting and other requirements for which we will incur substantial costs and our accounting and other management systems and resources may not be adequately prepared.

We incur significant legal, accounting, insurance and other expenses as a result of being a public company. For example, laws and regulations affecting public companies, including the provisions of the Sarbanes-Oxley Act of 2002, or SOX, and rules related to corporate governance and other matters subsequently adopted by the U.S. Securities and Exchange Commission, or the SEC, result in substantial costs to us, including legal and accounting costs, and may divert our management’s attention from other matters that are important to our business. Compliance with Section 404 of SOX requires that our management annually assess the effectiveness of our internal control over financial reporting.

During the course of auditing our consolidated financial statements for the years ended June 30, 2009 and 2010, we and our independent registered public accounting firm identified one material weakness in our internal control over financial reporting, as defined in AU 325, Communicating Internal Control Related Matters Identified in an Audit, of the AICPA Professional Standards. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the registrant’s annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls. A “significant deficiency” is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the registrant’s financial reporting. A “deficiency” in internal control over financial reporting exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent or detect misstatements on a timely basis.

The material weakness identified relates to a lack of sufficient accounting personnel to review the outputs from our finance function on a timely basis due to the additional demands of producing financial information to fulfill our public reporting requirements and lack of sufficient accounting personnel with appropriate technical expertise in U.S. GAAP.

We are taking steps to improve our internal control over financial reporting and disclosure controls, including (1) increasing resources so we have the appropriate levels of experience and technical expertise in U.S. GAAP, (2) providing additional accounting and financial reporting trainings for our existing personnel and (3) standardizing our accounting systems by introducing additional monitoring programs and control procedures.

However, the implementation of these initiatives may not fully address the material weakness in our internal control over financial reporting. Our failure to cure the material weakness and significant deficiency or our failure to discover and address any other weaknesses or deficiencies may result in inaccuracies in our financial statements in accordance with U.S. GAAP or delay in preparing our financial statements.

Currently, none of our employees, including our Chief Financial Officer, who is responsible for preparing and supervising the preparation of our financial statements, have any formal training in U.S. GAAP and SEC rules and regulations. Therefore, there is a risk that our current or future financial statements may not be properly prepared in accordance with U.S. GAAP or that our current or future disclosures are not in compliance with SEC rules and regulations. We are planning to hire the financial experts with US GAAP knowledge in the near future.

We significantly depend on our management team.

Chuanhong Xie, our executive officer, who holds multiple executive positions is responsible for an important aspect of our operations. In addition, we rely on management and senior personnel to ensure that our sourcing, production, sales, distribution and other business functions are effective. Losing the services of our executive officer or key personnel could be detrimental to our operations. We do not have key-man life insurance for our executive officer or any other employees.

Investors may not be able to enforce judgments entered by United States courts against certain of our officers and directors.

We are incorporated in the State of Nevada. However, a majority of our directors and executive officers, and certain of our principal shareholders, live outside of the U.S., principally in China. As a result, you may not be able to effect service of process upon those persons within the U.S. or enforce against those persons judgments obtained in U.S. courts.

We face substantial competition in connection with the marketing and sale of our products.

Our products compete with other premium quality brands as well as less expensive, non-premium brands. Our products face competition from non-premium producers distributing in our marketing area and other producers packaging their products in our marketing area. Many of our competitors are well established, have greater financial, marketing, personnel and other resources, have more established distribution channels into major markets, and have products that have gained wide customer acceptance in the marketplace. Our largest competitors are multinational companies and companies owned by the government of China. The greater financial resources of such competitors will permit them to procure a large amount of raw material at a volume discount and to implement extensive marketing and promotional programs, both generally and in direct response to advertising efforts by us. The aluminum foil industry in China is also characterized by the introduction of new products, accompanied by substantial promotional campaigns. We may be unable to compete successfully or our competitors may develop products that have superior qualities or gain wider market acceptance than ours.

Doing business in China involves various political and economic risks.

We conduct substantially all of our operations and generate significant amount of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including:

|

·

|

the higher level of government involvement and regulation;

|

|

·

|

the early stage of development of the market-oriented sector of the economy;

|

|

·

|

the rapid growth rate;

|

|

·

|

the higher level of control over foreign exchange; and

|

|

·

|

government control over the allocation of many resources.

|

Although the government of China has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways. Any adverse change in the economic conditions or government conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of consumer spending in China, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our business and prospects.

Extensive regulation of our industry in China could increase our expenses resulting in reduced profits.

We are subject to extensive regulation by China’s National Development and Reform Committee Ministry, and by other provincial and local authorities in jurisdictions in which our products are processed or sold, regarding the processing, packaging, storage, distribution and labeling of our products. Other applicable laws and regulations governing our products may include nutritional labeling and serving size requirements. Our processing facilities and products are subject to periodic inspection by national, provincial and local authorities. We believe that we are currently in substantial compliance with all material governmental laws and regulations and maintain all material permits and licenses relating to our operations. Nevertheless, we may fall out of substantial compliance with current laws and regulations or may be unable to comply with any future laws and regulations. To the extent that new regulations are adopted, we will be required, possibly at considerable expense, to adjust our activities in order to comply with such regulations. Our failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, operations and finances.

Regulations affecting acquisitions of PRC companies by foreign entities may make it more difficult for us to complete acquisitions and grow our business.

In 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued a public notice, known as “Circular 75,” concerning the application of foreign exchange regulations to mergers and acquisitions involving foreign investment in China. Among other things, the public notice provides that if an offshore company controlled by PRC residents intends to acquire a PRC company, such acquisition will be subject to strict examination by the relevant foreign exchange authorities. Under Circular 75, if an acquisition of a PRC company by an offshore company controlled by PRC residents occurred prior to the issuance of Circular 75, certain PRC residents were required to submit a registration form to the local SAFE branch to register their ownership interests in the offshore company before March 31, 2006. Such PRC residents must also amend the registration form if there is a material event affecting the offshore company, such as, among other things, a change to the company’s share capital, a transfer of shares, or if the company is involved in a merger, an acquisition or a spin-off transaction or uses its assets in China to guarantee offshore obligations.

As there is still significant uncertainty in China regarding the interpretation and implementation of Circular 75, we cannot predict how these regulations will affect our future acquisition strategy and business operations. For example, if we decide to acquire additional PRC companies, we or the owners of such companies may not be able to complete the filings and registrations, if any, required by the SAFE notices. This may restrict our ability to implement our acquisition strategy and could adversely affect our business and prospects.

In addition, in 2006 six PRC regulatory authorities, including the PRC Ministry of Commerce and the PRC Securities Regulatory Commission, jointly promulgated a rule entitled “Provisions regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors,” or the New M&A Rules. The New M&A Rules establish additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex, including, in some circumstances, advance notice to the Ministry of Commerce of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise. Compliance with the New M&A Rules, and any related approval processes, including obtaining approval from the Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

The PRC government’s recent measures to curb inflation rates could adversely affect future results of operations.

China has faced rising inflation in recent years. The government of China undertook various measures to alleviate the effects of inflation, especially with respect to key commodities. In January 2008, the PRC National Development and Reform Commission announced national price controls on various products. Similarly, the government of China may conclude that the prices of our products are too high and may institute price controls that would limit our ability to set prices for our products as we might wish. The government of China has also encouraged local governments to institute price controls on similar products. Such price controls could adversely affect our future results of operations and, accordingly, the price of our common stock.

The PRC currency is not a freely convertible currency, which could limit our ability to obtain sufficient foreign currency to support our business operations in the future.

The PRC currency, the “Renminbi” or “RMB,” is not freely convertible into other foreign currencies, and we receive substantially all of our revenues in Renminbi. We rely on the PRC government’s foreign currency conversion policies, which may change at any time, in regard to our currency exchange needs. In China, the government has control over Renminbi reserves through, among other things, direct regulation of the conversion of Renminbi into other foreign currencies and restrictions on foreign imports. Although foreign currencies that are required for current account transactions can be bought freely at authorized PRC banks, the proper procedural requirements prescribed by PRC law must be met. At the same time, PRC companies are also required to sell their foreign exchange earnings to authorized PRC banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the PRC government. This substantial regulation by the PRC government of foreign currency exchange may restrict our business operations and a change in any of these government policies could negatively impact our operations, which could result in a loss of profits.

In order for our China subsidiaries to pay dividends to us, a conversion of Renminbi into U.S. dollars or USD is required, which, if not permitted by the PRC government, would interrupt our cash flows. Under current PRC law, the conversion of Renminbi into foreign currency for capital account transactions generally requires approval from SAFE and, in some cases, other government agencies. Government authorities may impose restrictions that could have a negative impact in the future on the conversion process and upon our ability to meet our cash needs and to pay dividends to our shareholders. Although our subsidiaries’ classification as wholly foreign-owned enterprises, or WFOEs, under PRC law permits them to declare dividends and repatriate their funds to us in the United States, any change in this status or the regulations permitting such repatriation could prevent them from doing so. Any inability to repatriate funds to us would in turn prevent us from utilizing our PRC cash to pay creditors in U.S. dollars or other currencies or to pay dividends to our shareholders.

Fluctuations in the exchange rate between the PRC currency and the U.S. dollar could adversely affect our operating results.

The functional currency of our operations in China is the Renminbi. However, results of our operations are translated at average exchange rates into U.S. dollars for purposes of reporting results. As a result, fluctuations in exchange rates may adversely affect our expenses and results of operations as well as the value of our assets and liabilities. Fluctuations may adversely affect the comparability of period-to-period results. We do not currently use hedging techniques, and any hedging techniques we may use in the future may not eliminate, and may exacerbate, the effects of currency fluctuations. Thus, exchange rate fluctuations could cause our profits, and therefore our stock prices, to decline.

Under the New EIT Law, we may be classified as a “resident enterprise” of China, which would likely result in unfavorable tax consequences to us and our non-PRC shareholders.

Under China’s Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, which became effective in 2008, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. Under the implementing rules of the New EIT Law, de facto management means substantial and overall management and control over the production and operations, personnel, accounting, and properties of the enterprise. Because the New EIT Law and its implementing rules are new, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that China Aluminum Foil, Inc. is a “resident enterprise” for PRC enterprise income tax purposes, unfavorable PRC tax consequences could follow. First, we may be subject to enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income,” such dividends may be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC shareholders and with respect to gains derived by our non-PRC shareholders from transferring our shares. Although we are monitoring the possibility of “resident enterprise” treatment for the 2008 and 2009 tax years and evaluating appropriate organizational changes to avoid this treatment, our efforts and evaluation may prove unsuccessful and incorrect.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to tax in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

Certain judgments obtained against us by our shareholders may not be enforceable.

The majority of our assets and business operations are located in China. In addition, all of our directors and executive officers, some of the experts named in this prospectus and the selling shareholders reside in jurisdictions outside of the United States and substantially all of the assets of these persons are located in jurisdictions outside of the United States. As a result, it may not be possible to effect service of process within the United States or elsewhere upon these directors, executive officers and experts, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. For example, China does not have a treaty with the United States and many other countries providing for the reciprocal recognition and enforcement of judgments of courts. As a result, it may be difficult or impossible for you to bring an original action against us or against these individuals in Chinese court in the event that you believe that your rights have been infringed under the U.S. federal securities laws or otherwise.

We do not intend to pay and may be restricted from paying dividends on our common stock.

We have never declared or paid dividends on our capital stock and we do not intend to declare dividends in the foreseeable future. We currently intend to retain future earnings to fund our continued growth. Furthermore, if we decide to pay dividends, foreign exchange and other regulations in China may restrict our ability to distribute retained earnings from China or convert those payments from Renminbi into foreign currencies.

Lack of bank deposit insurance puts our funds at risk of loss from bank foreclosures or insolvencies.

We maintain certain bank accounts in China that are not protected by any insurance. As of June 30, 2010, Shensheng held approximately RMB 839 thousand in bank accounts in China. As of December 30, 2010, Shensheng held approximately RMB 14.6 million in bank accounts in China. If a PRC bank holding our funds experienced insolvency, it may not permit us to withdraw our funds, which would result in a loss of such funds and reduction of our net assets.

Limited and uncertain trademark protection in China makes the ownership and use of our trademark uncertain.

We have obtained trademark registrations for the use of our trade name “中园,” Chinese, which have been registered with the PRC Trademark Bureau of the State Administration for Industry and Commerce with respect to our products. We are able to use this trademark pursuant to a license agreement with Zhengzhou Aluminum Co. Ltd. We believe our trademark is important to the establishment of consumer recognition of our products. However, due to uncertainties in PRC trademark law, the protection afforded by our trademark may be less than we currently expect and may, in fact, be insufficient. Moreover, even if it is sufficient, in the event it is challenged or infringed, we may not have the financial resources to defend it against any challenge or infringement and such defense could in any event be unsuccessful. Moreover, any events or conditions that negatively impact our trademark could have a material adverse effect on our business, operations and finances.

Our lack of patent protection could permit our competitors to copy our trade secrets and formula and thus gain a competitive advantage.

We own no patents covering our products or production processes, and we expect to rely principally on know-how and the confidentiality of our formula and production processes for our products in producing competitive product lines. We are licensed to use nine patents pursuant to a license agreement with Zhengzhou Aluminum Co., Ltd.. Any breach of confidentiality by our executives or employees having access to our formula and production processes could result in our competitors gaining access to such formula or production processes. The ensuing competitive disadvantage could reduce our revenues and our profits.

Congfu Li, our Chairman, beneficially owned approximately 32% of our common stock as of August 31 , 2011. Our executive officers and directors as a group beneficially owned approximately 53% of our common stock as of August 31 , 2011. Consequently, these individuals will likely be able to determine the composition of our board of directors, retain the voting power to approve certain matters requiring shareholder approval and continue to have significant influence over our operations. The interests of these shareholders may be different than the interests of other shareholders on these matters. This concentration of ownership could also have the effect of delaying or preventing a change in our control or otherwise discouraging a potential acquirer from attempting to obtain control of us, which in turn could reduce the price of our common stock.

Failure to comply with the U.S. Foreign Corrupt Practices Act and Chinese anti-corruption laws could subject us to penalties and other adverse consequences.

Our executive officers, employees and other agents may violate applicable law in connection with the marketing or sale of our products, including China’s anti-corruption laws and the U.S. Foreign Corrupt Practices Act, or the FCPA, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. The PRC also strictly prohibits bribery of government officials. However, corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC.

While we intend to implement measures to ensure compliance with the FCPA and China’s anti-corruption laws by all individuals involved with our company, our employees or other agents may engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations. In addition, our brand and reputation, our sales activities or our stock price could be adversely affected if we become the target of any negative publicity as a result of actions taken by our employees or other agents.

RISKS RELATED TO THE VIE AGREEMENTS

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

Shentong Investment manages and operates our aluminum foil production business through Shensheng pursuant to the rights it holds under the VIE Agreements. Almost all economic benefits and risks arising from Shensheng’s operations are transferred to Shentong Investment under these agreements. Details of the VIE Agreements are set out in “BUSINESS — Organization”.

There are risks involved with the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. Our PRC counsel has provided a legal opinion that the VIE Agreements are binding and enforceable under PRC law, but has further advised that if the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

|

•

|

imposing economic penalties;

|

|

•

|

discontinuing or restricting the operations of Shensheng or Shentong Investment;

|

|

|

•

|

imposing conditions or requirements in respect of the VIE Agreements with which Shensheng or Shentong Investment may not be able to comply;

|

|

•

|

requiring our company to restructure the relevant ownership structure or operations;

|

|

•

|

taking other regulatory or enforcement actions that could adversely affect our company’s business; and

|

|

•

|

revoking the business licenses and/or the licenses or certificates of Shentong Investment, and/or voiding the VIE Agreements.

|

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Shensheng, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to manage and operate Shensheng under the VIE Agreements may not be as effective as direct ownership.

We conduct our aluminum foil production business in the PRC and generate virtually all of our revenues through the VIE Agreements. Our plans for future growth are based substantially on growing the operations of Shensheng. However, the VIE Agreements may not be as effective in providing us with control over Shensheng as direct ownership. Under the current VIE arrangements, as a legal matter, if Shensheng fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) reply on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control Shensheng, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.

As the VIE Agreements are governed by PRC law, we would be required to rely on PRC law to enforce our rights and remedies under them; PRC law may not provide us with the same rights and remedies as are available in contractual disputes governed by the law of other jurisdictions.

The VIE Agreements are governed by the PRC law and provide for the resolution of disputes through arbitral proceedings pursuant to PRC law. If Shensheng or its shareholder fail to perform the obligations under the VIE Agreements, we would be required to resort to legal remedies available under PRC law, including seeking specific performance or injunctive relief, or claiming damages. We cannot be sure that such remedies would provide us with effective means of causing Shensheng to meet its obligations, or recovering any losses or damages as a result of non-performance. Further, the legal environment in China is not as developed as in other jurisdictions. Uncertainties in the application of various laws, rules, regulations or policies in the PRC legal system could limit our liability to enforce the VIE Agreements and protect our interests.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

Pursuant to our VIE agreements, all net profits of Shensheng shall be used to pay management fees to Shentong Investment. Adverse tax consequences may arise if the PRC tax authorities determine that these payment arrangements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes, which could result in us being subject to higher tax liability or cause other adverse financial consequences. Furthermore, the actual payment of the management fees to Shentong Investment may give rise to further PRC business tax and income tax obligations on the part of Shentong Investment.

The controlling shareholder of Shensheng may have potential conflicts of interest with our company that may adversely affect our business.

Congfu Li is our chairman of the board, and is also the largest shareholder of Zhengzhou Aluminum Co., Ltd, the sole shareholder of Shensheng. Conflicts could arise from time to time between our interests and the interests of Mr. Li. Conflicts could also arise between us and Shensheng that would require our shareholders and Shensheng’s shareholders to vote on corporate actions necessary to resolve the conflict. There can be no assurance in any such circumstances that Mr. Li will vote his shares in our best interest or otherwise act in the best interests of our company. If Mr. Li fails to act in our best interests, our operating performance and future growth could be adversely affected.

We rely on the approval certificates and business license held by Shensheng and any deterioration of the relationship between Shentong Investment and Shensheng could materially and adversely affect our business operations.

We operate our aluminum foil production business in China on the basis of the approval certificates, business license and other requisite licenses held by Shentong Investment and Shensheng. There is no assurance that Shentong Investment and Shensheng will be able to renew their licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold.

Further, our relationship with Shensheng is governed by the VIE Agreements, which are intended to provide us with effective control over the business operations of Shensheng. However, the VIE Agreements may not be effective in providing control over the application for and maintenance of the licenses required for our business operations. Shensheng could violate the VIE Agreements, become insolvent, suffer from difficulties in its business or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputations and business could be materially harmed.

Many statements made in this prospectus contain forward-looking statements that reflect our current expectations and views of future events. These statements include, but are not limited to, statements about our plans, objectives, expectations, strategies, intentions or other characterizations of future events or circumstances and are generally identified by the words “may,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “could,” “would,” and similar expressions. Because these forward-looking statements are subject to a number of risks and uncertainties, our actual results could differ materially from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the heading “Risk Factors” and in other documents we file from time to time with the Securities and Exchange Commission, or the SEC. All forward-looking statements included in this prospectus are based on information available to us on the date hereof. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

We will not receive any proceeds from the sale of the shares by the selling shareholders. All net proceeds from the sale of the common stock covered by this prospectus will go to the selling shareholders.

Our common stock is not traded on any exchange. We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board once our shareholders have free trading shares; however, there is no guarantee that we will obtain a listing.

There is currently no trading market for our common stock and there is no assurance that a regular trading market will ever develop. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

To have our common stock listed on any of the public trading markets, including the OTC Bulletin Board, we will require a market maker to sponsor our securities. We have not yet engaged any market maker to sponsor our securities and there is no guarantee that our securities will meet the requirements for quotation or that our securities will be accepted for listing on the OTC Bulletin Board. This could prevent us from developing a trading market for our common stock.

On August 31 , 2011, there were 10,201,011 shares of our common stock issued and outstanding that were held by approximately 41 shareholders of record.

We have not declared or paid any dividends on our common stock and presently do not expect to declare or pay any such dividends in the foreseeable future. Payment of dividends to our shareholders would require payment of dividends by our PRC subsidiaries to us. This, in turn, would require a conversion of Renminbi into US dollars and repatriation of funds to the US. Under current PRC law, the conversion of Renminbi into foreign currency for capital account transactions generally requires approval from SAFE and, in some cases, other government agencies. Government authorities may impose restrictions that could have a negative impact in the future on the conversion process and upon our ability to meet our cash needs, and to pay dividends to our shareholders. Although our subsidiaries’ classification as WFOEs under PRC law permits them to declare dividends and repatriate their funds to us in the United States, any change in this status or the regulations permitting such repatriation could prevent them from doing so. Any inability to repatriate funds to us would in turn prevent payments of dividends to our shareholders.

Overview

Zhengzhou Shensheng Aluminum Foil Co., Ltd. or Shensheng or the VIE was originally formed on Feb 4, 2008. We are a manufacturer of aluminum foil products in central China. Demand for our aluminum foil is driven primarily by spending in the consumer products and electrical manufacturing industries. We have benefited from continued improvement of living standard among Chinese consumers and strong growth of aluminum foil usage as the PRC has rapidly urbanized.

Our principal business is the production of aluminum foil ranging from 0.005mm to 0.08mm in thickness. We operate one aluminum production line, which has an annual capacity of approximately 20,000 MT. Our products are tailor-made to customers’ individual requirements. China Aluminum Foil’s products are further processed by downstream manufacturers and incorporated into a wide variety of end products including, among others, home appliances, kitchen supplies, packaging, and specialized construction materials. Our facilities and head office are located in Zhengzhou of Henan Province.

On September 2, 2010, Congfu Li acquired a total of 99,000 shares of AJ Acquisition Corp. V, Inc., from Gregg Jaclin and Richard Anslow, in a private transaction for total consideration of $40,000. After the acquisition, Mr. Li owned 99% of the issued and outstanding stock of the AJ Acquisition Corp. V, Inc .

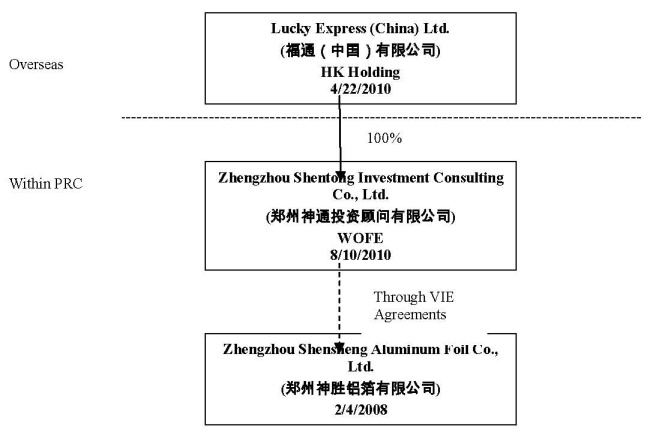

On November 8, 2010, we completed a reverse acquisition transaction through a share exchange with Lucky Express Limited or Lucky Express, a Hong Kong entity established on April 22, 2010, and its shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Lucky Express in exchange for 10,000,000 shares of our Common Stock which constituted 99% of our issued and outstanding common stock immediately after the consummation of the reverse acquisition.

As a result of the reverse acquisition, Lucky Express became our wholly-owned subsidiary and the former stockholders of Lucky Express became our controlling stockholders. The share exchange transaction with Lucky Express and the shareholders was treated as a reverse acquisition for accounting and financial reporting purposes, with Lucky Express as the acquirer and us as the acquired party. After the reverse acquisition, we changed our name to China Aluminum Foil, Inc. By virtue of our ownership of Lucky Express, we also own Zhengzhou Shentong Investment Consulting Co., Ltd. or Shentong Investment , which is a wholly owned foreign subsidiary of Lucky Express that effectively and substantially controls Shensheng, through a series of captive agreements known as variable interest agreements or the VIE Agreements with Shentong Investment .

Holding Company Structure

We are a holding company with no material operations of our own. We conduct our operations in China primarily through our wholly owned subsidiary Shentong Investment and Shensheng which is controlled by us through a series of contractual arrangements between Shentong Investment and Shensheng and Zhengzhou Aluminum Co., Ltd., the sole shareholder of Shensheng or the Shensheng Shareholder. For a description of these contractual arrangements, see “Business-Organization".

However, this management control over Shensheng through contracts may not be as effective in providing operational control as direct ownership. If Shensheng or Zhengzhou Aluminum Foil Co. fails to perform its respective obligations under these contractual arrangements, we may incur substantial costs and resources to enforce such arrangements, and rely on legal remedies under PRC law, including seeking specific performance, injunctive relief or and claiming damages, which may not be effective.

Pursuant to the contractual arrangements between Shentong Investment, Shensheng and Zhengzhou Aluminum Co., Ltd., Shensheng’s earnings and cash are used to pay consulting service fees in RMB to Shentong Investment in the manner and amount set forth in these agreements. After deducting the withholding taxes applicable to Shentong Investment ‘s revenue and earnings, making appropriations for its statutory reserve requirement (see ‘Liquidity and Capital Resources’) and retaining any profits from accumulated profits, the remaining net profits of Shentong Investment would be available for distribution to its sole shareholder, Lucky Express (China) Ltd. and from Lucky Express to us.

Certain shareholders of ours are also directors and executive officers of our VIE. PRC laws provide that a director or certain members of senior management owes a fiduciary duty to the company he directs or manages. These individuals must therefore act in good faith and in the best interests of the relevant VIE and must not use their respective positions for personal gain. These laws do not require them to consider our best interests when making decisions as a director or member of management of the relevant VIE. Conflict may arise between these individuals’ fiduciary duties as director and officer of the VIE and our company.

We cannot assure you that when conflicts of interest arise, these individuals will act in the best interests of our company or that conflicts of interest will be resolved in our favor. Currently, we do not have arrangements to address potential conflicts of interest between these individuals and our company and a conflict could result in these individuals as directors and officers of our company violating fiduciary duties to us. In addition, these individuals may breach or cause our VIE to breach or refuse to renew the existing contractual arrangements that allow us to effectively control our VIE and receive economic benefits from them. If we cannot resolve any conflicts of interest or disputes between us and the shareholders of our VIE, we would have to rely on legal proceedings, which could result in disruption of our business, and there would be substantial uncertainty as to the outcome of any such legal proceedings.

Critical Accounting Policies

The consolidated financial statements include the financial statements of the Company, its wholly owned subsidiaries and its VIE, Shensheng. All significant inter-company transactions and balances have been eliminated in consolidation.

Through the contractual arrangements as described in Business-Organization, the Company’s wholly owned subsidiary, Shentong Investment, controls the critical and significant transactions of Shensheng, including operating activities, investing activities, financing activities and equity changes of Shensheng and is deemed the primary beneficiary of the VIE-Shensheng. Accordingly, the results of Shensheng have been included in the accompanying consolidated financial statements for the years ended June 30, 2010 and 2009. The Company does not control Zhengzhou Aluminum Co., Ltd. either by equity interest or through any contractual arrangements, therefore the financial statements of Zhengzhou Aluminum Co., Ltd. is not included in the Company's consolidated financial statements.

Basis of preparation

The accompanying consolidated financial statements reflect the financial position, results of operations and cash flows of the Company and all of its wholly owned subsidiary and its VIE as of June 30, 2010 and 2009, and for the years ended June 30, 2010 and 2009, and have been prepared in accordance with U.S. Generally Accepted Accounting Principles or US GAAP.

Basis of consolidation

The consolidated financial statements include the financial statements of the Company, its wholly owned subsidiaries and its VIE, Shensheng. All significant inter-company transactions and balances have been eliminated in consolidation.

Because of the contractual arrangements as described in Business-Organization, which assigned all of Shensheng ‘s equity owners’ rights and obligations to Shentong Investment, resulting in the equity owners lacking the ability to make decisions that have a significant effect on Shensheng’s operations and because of the Shentong Investment’s ability to extract the profits from the operation of Shensheng and assume Shensheng’s residual benefits, Shentong Investment becomes the primary beneficiary of Shensheng. Accordingly, the results of Shensheng have been included in the accompanying consolidated financial statements for the years ended June 30, 2010 and 2009.

Use of Estimates

In preparing financial statements in conformity with US GAAP , management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those estimates.

Fair Value of Financial Instruments

ASC 820 “Fair Value Measurements and Disclosures”, adopted January 1, 2008, defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosure requirements for fair value measures. The carrying amounts reported in the balance sheets for current receivables and payables qualify as financial instruments. Management concluded the carrying values are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and if applicable, their stated interest rate approximates current rates available. The three levels are defined as follows:

|

·

|

Level 1 - inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

|

|

·

|

Level 2 - inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

|

|

·

|

Level 3 - inputs to the valuation methodology are unobservable and significant to the fair value. It is management’s opinion that as of June 30, 2010 and 2009, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheet. This is attributed to the short maturities of the instruments and that interest rates on the borrowings approximate those that would have been available for loans of similar remaining maturity and risk profile at respective balance sheet dates.

|

We derived revenues from sales of aluminum foils products, aluminum ingots and providing processing services. We recognize sales in accordance with the SEC Staff Accounting Bulletin or SAB No. 101, “Revenue Recognition in Financial Statements” and SAB No. 104, “Revenue Recognition.” We recognize revenue when the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred or services were rendered, (iii) the price to the customer is fixed or determinable and (iv) collection of the resulting receivable is reasonably assured.

Principal Factors Affecting Our Financial Performance

Our operating results are primarily affected by the following factors:

|

·

|

Growth in the Chinese Economy — We operate our facilities in China and derive significant portion of our revenues from sales to customers in China. Economic conditions in China, therefore, affect virtually all aspects of our operations, including the demand for our products, the availability and prices of our raw materials and our other expenses. China has experienced significant economic growth, achieving a compound annual growth rate of approximately 10% in real gross domestic product from 1996 through 2009. (World Economic Outlook (April 2010) through International Monetary Fund Data Mapper). China is expected to experience continued growth in all areas of investment and consumption, even in the face of a global economic recession. However, China has not been entirely immune to the global economic slowdown and is experiencing a slowing of its growth rate.

|

|

·

|

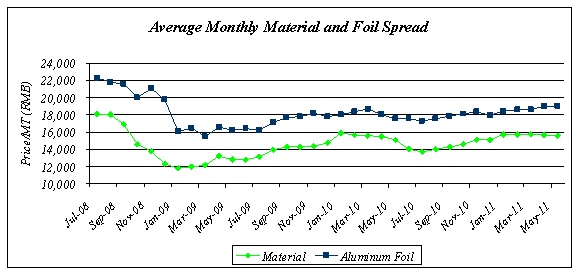

Supply and Demand in the Aluminum Market — We are subject to macroeconomic factors dictating the supply and demand of aluminum and aluminum foil in the PRC. Bauxite and aluminum prices have been volatile in the past, and while they have stabilized since the first quarter of 2009, our revenues and earnings could be dramatically affected by increases and decreases in bauxite and aluminum costs.

|

|

·

|

Production Capacity — In order to capture the market share and take advantage of the demand for our products, we have expanded, and wish to continue to expand our production capacity. Increased capacity has had a significant impact on our ability to increase revenues and net income through increased product sales. We have signed an operating lease for a newly constructed 15,000MT aluminum foil plant adjacent to our current facilities. If we successfully expand our production capacity, we should be able to gain new customers in new markets.

|

|

·

|