Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNB FINANCIAL CORP/PA | d8k.htm |

Financial Highlights

As of and for the six months ended

June 30, 2011

NASDAQ: CCNE

August 30, 2011

Exhibit 99.1 |

Forward-Looking Statements

This

presentation

includes

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

with

respect

to

the

financial

condition,

liquidity,

results

of

operations,

future

performance

and

business

of

CNB

Financial

Corporation.

These

forward-looking

statements

are

intended

to

be

covered

by

the

safe

harbor

for

“forward-looking

statements”

provided

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-

looking

statements

are

those

that

are

not

historical

facts.

Forward-looking

statements

include

statements

with

respect

to

beliefs,

plans,

objectives,

goals,

expectations,

anticipations,

estimates

and

intentions

that

are

subject

to

significant

risks

and

uncertainties

and

are

subject

to

change

based

on

various

factors

(some

of

which

are

beyond

our

control).

Forward-looking

statements

often

include

the

words

“believes,”

“expects,”

“anticipates,”

“estimates,”

“forecasts,”

“intends,”

“plans,”

“targets,”

“potentially,”

“probably,”

“projects,”

“outlook”

or

similar

expressions

or

future

conditional

verbs

such

as

“may,”

“will,”

“should,”

“would”

and

“could.”

Such

known

and

unknown

risks,

uncertainties

and

other

factors

that

could

cause

the

actual

results

to

differ

materially

from

the

statements,

include,

but

are

not

limited

to:

(i)

changes

in

general

business,

industry

or

economic

conditions

or

competition;

(ii)

changes

in

any

applicable

law,

rule,

regulation,

policy,

guideline

or

practice

governing

or

affecting

financial

holding

companies

and

their

subsidiaries

or

with

respect

to

tax

or

accounting

principles

or

otherwise;

(iii)

adverse

changes

or

conditions

in

capital

and

financial

markets;

(iv)

changes

in

interest

rates;

(v)

changes

in

the

quality

or

composition

of

our

loan

and

investment

portfolios;

(vi)

adequacy

of

loan

loss

reserves;

(vii)

increased

competition;

(viii)

loss

of

certain

key

officers;

(ix)

continued

relationships

with

major

customers;

(x)

deposit

attrition;

(xi)

rapidly

changing

technology;

(xii)

unanticipated

regulatory

or

judicial

proceedings

and

liabilities

and

other

costs;

(xiii)

changes

in

the

cost

of

funds,

demand

for

loan

products

or

demand

for

financial

services;

and

(xiv)

other

economic,

competitive,

governmental

or

technological

factors

affecting

our

operations,

markets,

products,

services

and

prices.

Such

developments

could

have

an

adverse

impact

on

our

financial

position

and our results of operations.

The forward-looking statements are based upon management’s beliefs and

assumptions. Any forward- looking

statement

made

herein

speaks

only

as

of

the

date

of

this

presentation.

Factors

or

events

that

could

cause the our actual results to differ may emerge from time to time, and it is not

possible for us to predict all of them. We undertake no obligation to

publicly update any forward-looking statement, whether as a result of

new information, future developments or otherwise, except as may be required by law.

2 |

History of CNB Financial

3

1865

1934

1984

…

2005

2006

2008

2009 2010

1865:

County

National Bank

of Clearfield

established

1934:

Reorganizes

through a stock

offering to existing

depositors

1984:

Forms

CNB

Financial Corporation

holding company

2005:

ERIEBANK is

formed

2005:

Purchases

assets

of Holiday Consumer

Discount Company and

forms Holiday Financial

Services Corporation

2006:

Conversion

to a state banking

charter

2010:

Joseph

Bower

becomes CEO after

retirement of William

Falger

2008-2009:

Receives

approval to raise $21

million via TARP;

CNB chooses not to

participate

2010:

Capital

raise of $34.5

million |

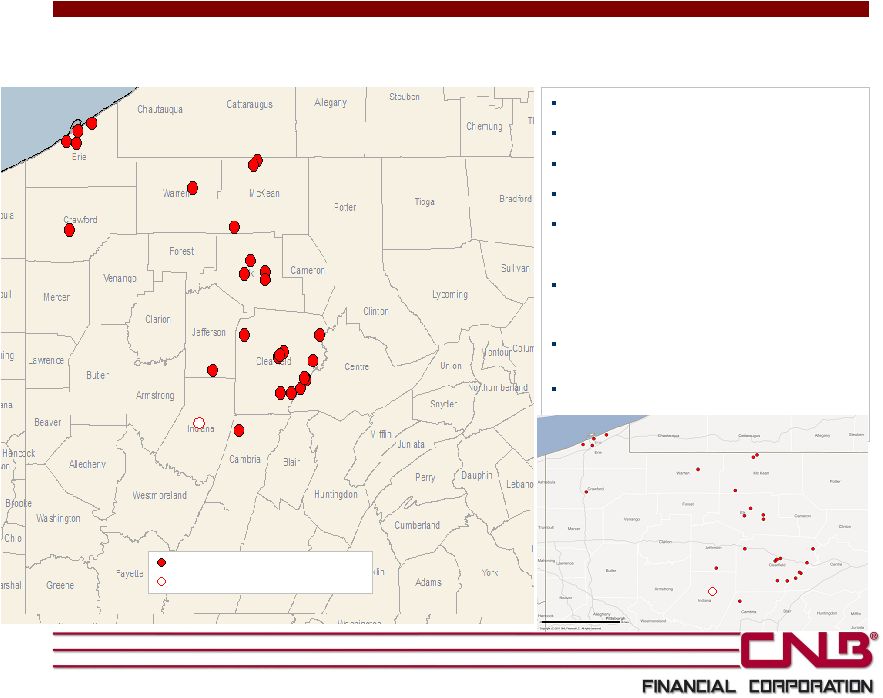

CNB

Financial Overview Headquarters: Clearfield, PA

Branches: 27

Assets: $1.5 billion

Loans: $822 million

Deposits: $1.25 billion

Primary Subsidiaries

CNB

Bank:

22

full-service

branches,

1

loan

production office, telephone & internet banking,

centralized customer service center

ERIEBANK:

Division

of

CNB

Bank

with

five

full-

service branches, headquartered in Erie, PA

Holiday

Financial

Services:

Consumer

loan

company with eight offices

4

Full-service branch

Loan production office

Note: Information and data as of June 30, 2011.

|

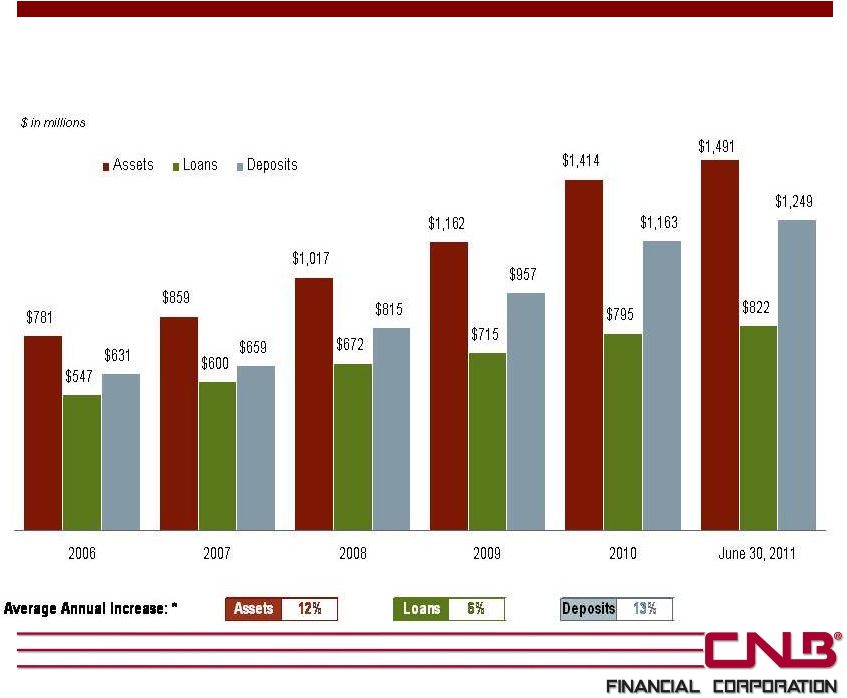

Balance Sheet

•

Deposits of $1.25 billion, growth of 7% over December 31, 2010

–

Transaction, money market and savings deposits equal 75% of total

•

Loans of $822 million, growth of 3% over December 31, 2010

Profitability

•

Net income of $7.2 million, or $0.58 per share

•

Return on assets of 0.98% and return on equity of 12.4%

•

Net interest margin of 3.55%

Asset Quality

•

Nonperforming assets to total assets of 1.23%

•

Net charge-offs to average loans of 0.22%

•

Allowance for loan losses to loans of 1.43%

Capital

•

Tangible common equity to tangible assets of 7.5%*

•

Leverage ratio of 8.5%

•

Tier 1 Risk Based Ratio of 14.0%

•

Total Risk Based Capital Ratio of 15.3%

2011 Highlights

5

Note: Financial data as of or for the six months ended June 30, 2011.

* Please see the Appendix for a reconciliation of non-GAAP financial

information. |

Balance Sheet Growth

* Compound annual growth rate from 2006 –

June 30, 2011.

6 |

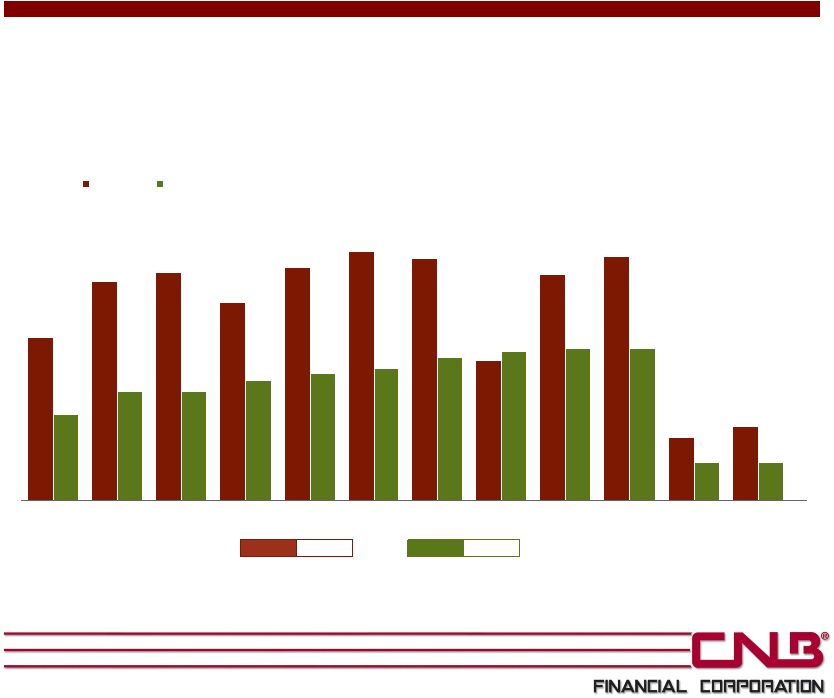

Earnings Per Share & Dividends

* Compound annual growth rate from 2001-2010.

7

Average Annual Increase: *

EPS

4.1%

Div.

6.0%

$0.71

$0.95

$0.99

$0.86

$1.01

$1.08

$1.05

$0.61

$0.98

$1.06

$0.27

$0.32

$0.37

$0.47

$0.47

$0.52

$0.55

$0.57

$0.62

$0.65

$0.66

$0.66

$0.165

$0.165

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Q1 2011

Q2 2011

EPS

Dividends |

7.9%

6.9%

5.1%

5.1%

7.1%

7.5%

9.2%

9.7%

8.4%

7.9%

8.8%

8.5%

11.7%

11.9%

10.8%

10.7%

14.1%

14.0%

12.8%

12.9%

12.0%

12.0%

15.4%

15.3%

2006

2007

2008

2009

2010

June 30, 2011

Tangible Common Equity to Tangible Assets

Leverage Ratio

Tier 1 Risk Based Ratio

Total Risk Based Capital Ratio

Capital Ratios

8

*

* Please see the Appendix for a reconciliation of non-GAAP financial

information. |

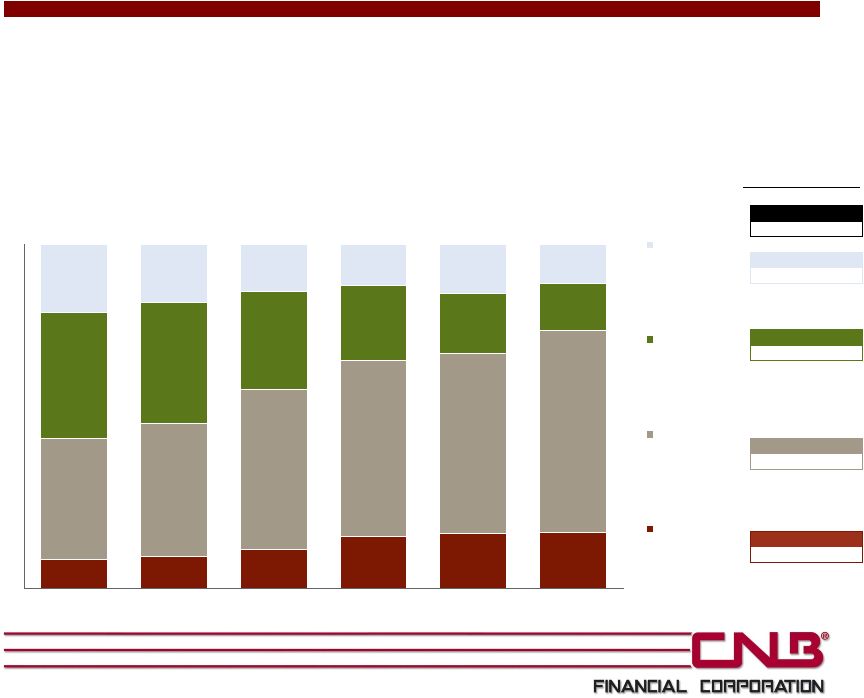

Deposit Composition

9

•

25% annual compound growth from 2006 to June 30, 2011 in transaction, money market

and savings accounts •

Interest-bearing deposit cost of 1.29% (or total deposit cost of 1.11%) for the

six months ended June 30, 2011 * Compound annual growth rate from 2006

– June 30, 2011.

Avg Annual Increase*

Total Deposits

13%

Jumbo CDs

2%

Retail CDs

-5%

MMDA & Savings

24%

Trans Accts

27%

9%

9%

11%

15%

16%

16%

35%

39%

47%

51%

52%

59%

37%

35%

29%

22%

18%

14%

20%

17%

14%

12%

14%

11%

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

2010

June 30, 2011

Jumbo CDs

Retail CDs

MMDA &

Savings

Trans Accts

$631

$659

$815

$957

$1,163

$1,249

$ in millions |

Deposit Demographics

Source: SNL Financial 6/30/10

County

CNB Market

Rank

Number

of

Branches

CNB

Deposits

in Market

($000)

CNB

Market

Share

(%)

Total

Deposits

in Market

($000)

Total

Population

2010

(Actual)

Clearfield

1

11

405,489

29.65

1,367,426

83,248

Erie

6

4

271,572

7.25

3,745,173

279,906

Elk

4

4

105,820

16.16

654,902

32,583

McKean

3

3

87,717

11.77

745,411

43,660

Centre

10

1

65,370

2.93

2,333,913

146,264

Warren

4

1

43,613

4.72

923,841

40,631

Cambria

11

1

42,380

1.59

2,673,207

145,348

Crawford

8

1

41,277

3.68

1,120,484

89,185

Jefferson

6

1

35,155

3.96

888,499

45,343

Total

27

1,098,393

14,452,856

906,168

10 |

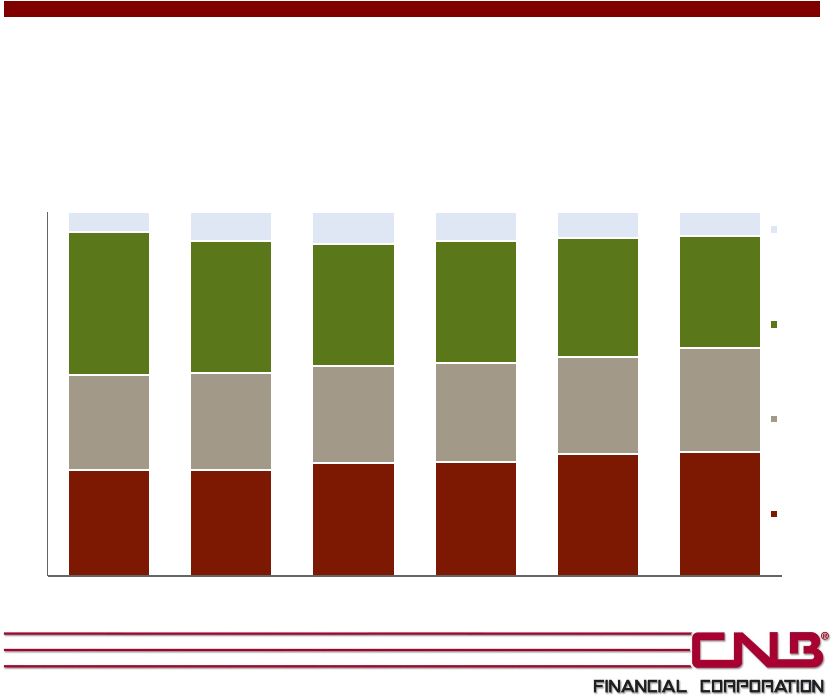

Loan Portfolio Overview

11

$ in millions

29%

29%

31%

31%

34%

34%

26%

27%

27%

27%

27%

29%

39%

36%

34%

33%

33%

31%

5%

8%

9%

8%

7%

7%

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

2010

June 30, 2011

Consumer and

other

Commercial,

industrial, and

agricultural

Commercial

mortgage

Residential

mortgage

$547

$600

$672

$715

$795

$822 |

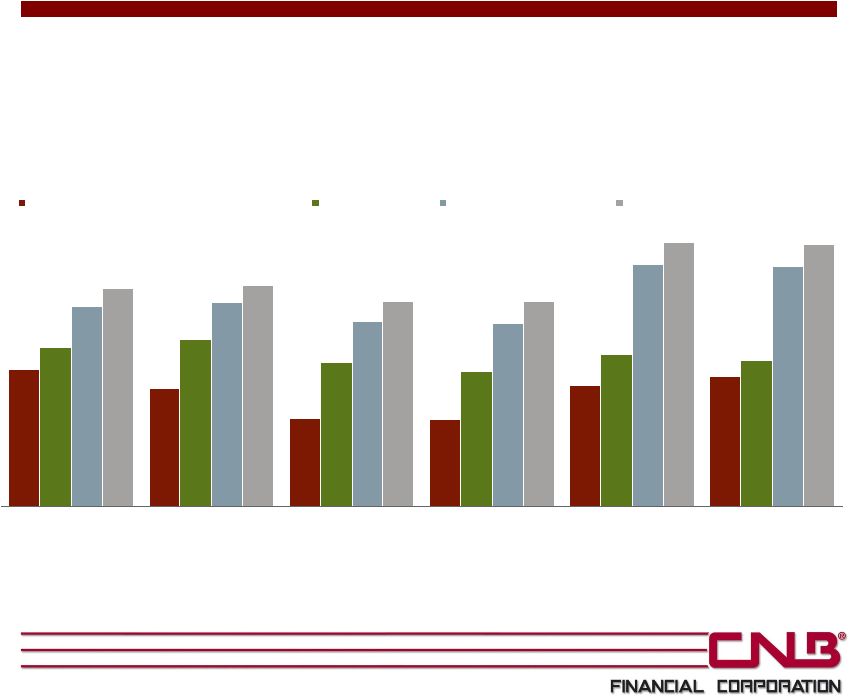

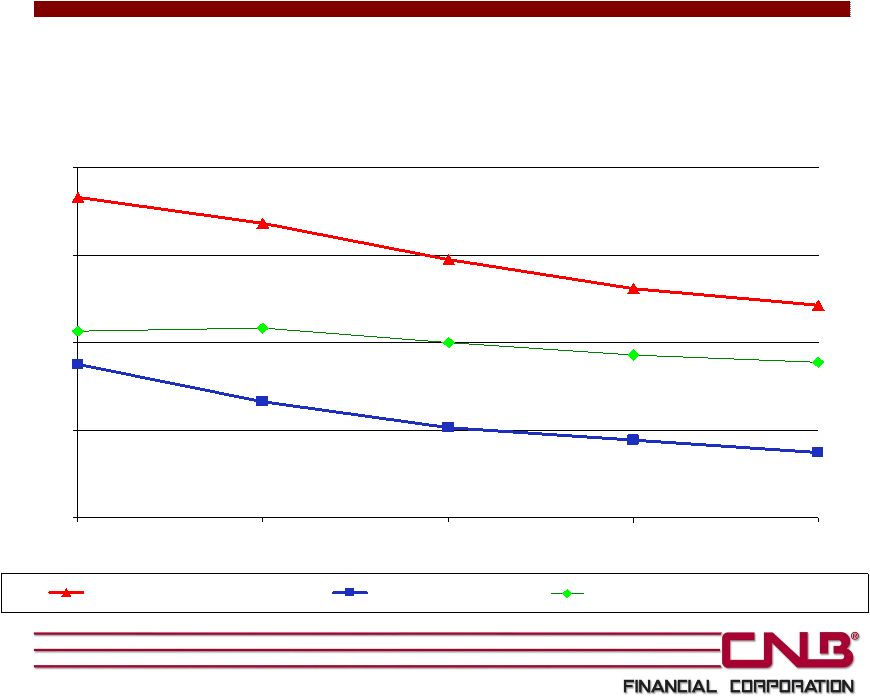

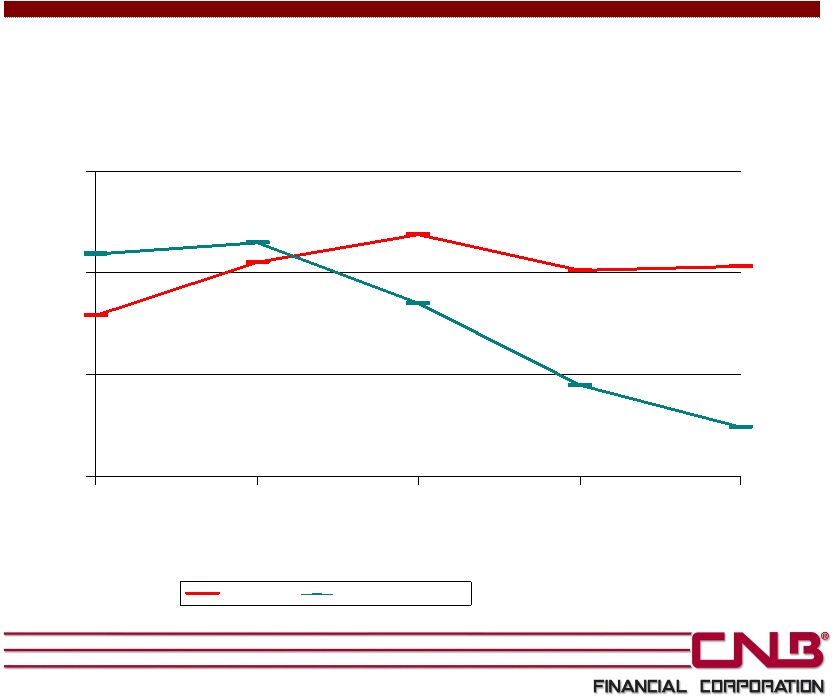

Yield on earning assets, cost of funds and

net interest margin

6.72%

7.11%

5.23%

5.89%

4.86%

2.64%

3.51%

1.78%

2.07%

1.50%

4.27%

4.33%

4.00%

3.71%

3.55%

0%

2%

4%

6%

8%

2007

2008

2009

2010

June 30, 2011

Yield on earning assets

Cost of funds

Net interest margin (tax equivalent)

12 |

Asset Quality Summary

13 |

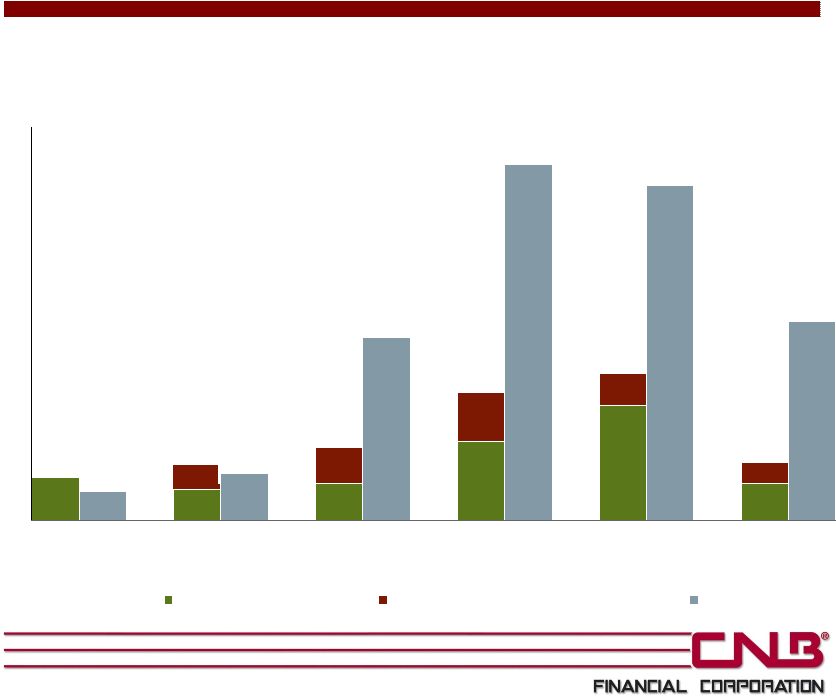

NCOs / Average Loans

Peers include U.S. bank holding companies with assets between $1 and $3 billion for

2011, 2010, 2009, and 2008, and U.S. bank holding companies with assets

between $500 million and $1 billion for 2007 and 2006. (Source: Bank Holding

Company Performance Report – www.ffiec.gov)

14

0.16%

0.12%

0.14%

0.30%

0.44%

0.14%

0.19%

0.12%

0.08%

0.11%

0.18%

0.70%

1.36%

1.28%

0.76%

0.02%

0.14%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

2006

2007

2008

2009

2010

June

30,

2011

CCNE - CNB Bank

CCNE - Holiday Financial Services

Peers |

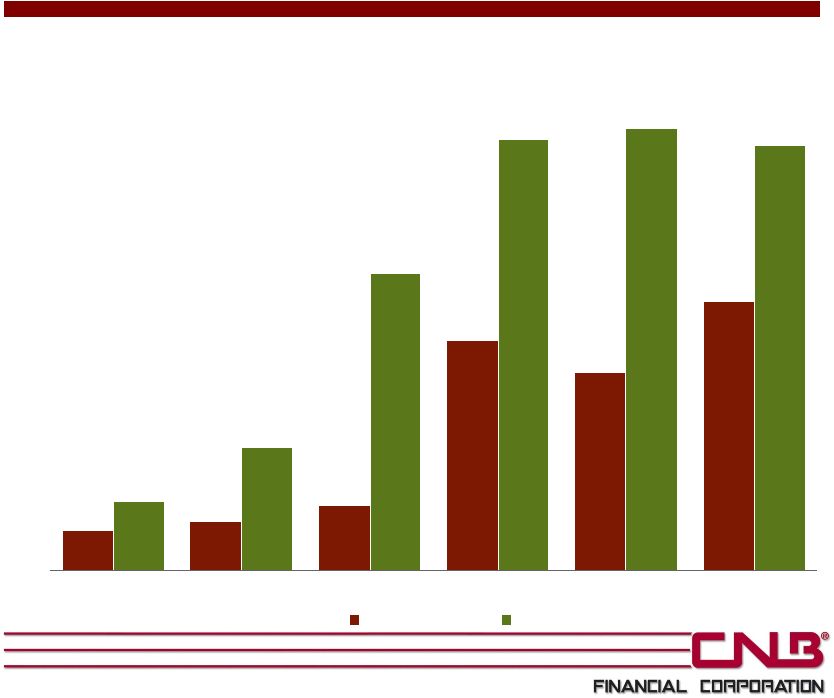

Nonperforming Loans / Loans

15

Peers include U.S. bank holding companies with assets between $1 and $3 billion for

2011, 2010, 2009 and 2008, and U.S. bank holding companies with assets

between $500 million and $1 billion for 2007 and 2006. (Source: Bank Holding

Company Performance Report – www.ffiec.gov)

0.32%

0.40%

0.53%

1.87%

1.61%

2.19%

0.56%

1.00%

2.41%

3.50%

3.59%

3.45%

2006

2007

2008

2009

2010

June 30, 2011

CCNE

Peers |

Delinquent Loans/Total Loans

Peers include U.S. bank holding companies with assets between $1 and $3 billion for

2011, 2010, 2009, and 2008, and U.S. bank holding companies with assets

between $500 million and $1 billion for 2007 and 2006. (Source: Bank Holding

Company Performance Report – www.ffiec.gov)

16 |

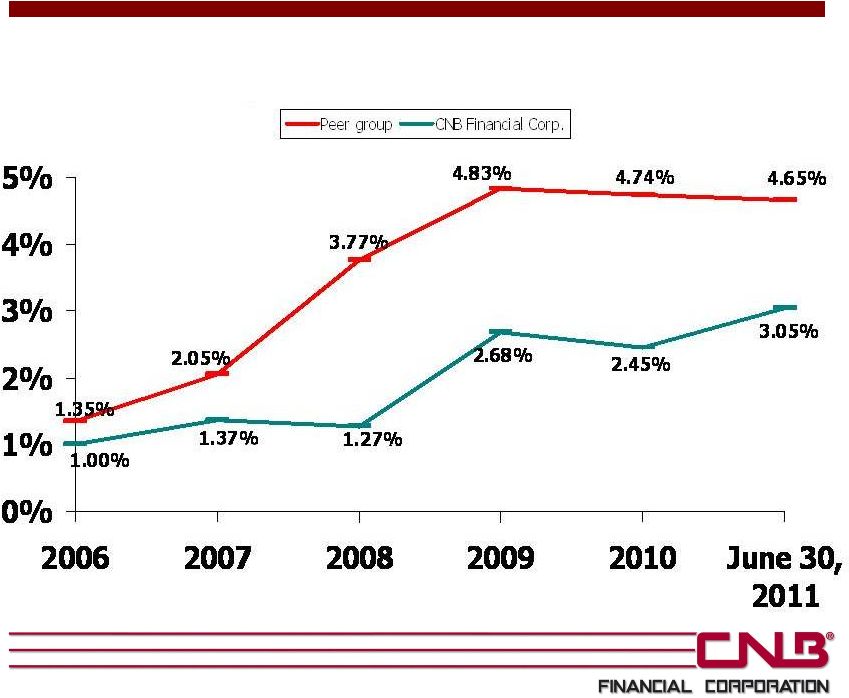

Non-interest expense ratio

{Non-interest expenses divided by average assets}

Peers include U.S. bank holding companies with assets between $1 and $3 billion for

2011, 2010, 2009, and 2008, and U.S. bank holding companies with assets

between $500 million and $1 billion for 2007. (Source: Bank Holding Company

Performance Report – www.ffiec.gov)

3.03%

3.19%

3.01%

2.79%

3.05%

2.24%

2.45%

2.85%

3.15%

3.09%

2.0%

2.5%

3.0%

3.5%

2007

2008

2009

2010

June 30,

2011

Peer group

CNB Financial Corp.

17 |

Holiday Financial Services Corporation

18

Six months ended

2009

2010

June 30, 2011

Net income

$225

$576

$402

Net chargeoffs

$1,332

$889

$338

Year ended December 31,

(in thousands)

(in thousands) |

Summary Financial Highlights

19

* Please see the Appendix for a reconciliation of non-GAAP financial

information. ($ in millions, except per share data)

Quarter Ended

2006

2007

2008

2009

2010

3/31/2011

6/30/2011

BALANCE SHEET

Assets

$781

$859

$1,017

$1,162

$1,414

$1,484

$1,491

Loans

$547

$600

$672

$715

$795

$793

$822

Deposits

$631

$659

$815

$957

$1,163

$1,226

$1,249

Shareholders' Equity

$72

$69

$62

$69

$110

$113

$122

PROFITABILITY

Net Income

$9.6

$9.1

$5.2

$8.5

$11.3

$3.3

$3.9

EPS

$1.08

$1.05

$0.61

$0.98

$1.06

$0.27

$0.32

Return on Average Assets

1.26%

1.12%

0.55%

0.79%

0.87%

0.91%

1.04%

Return on Average Equity

13.5%

12.8%

7.9%

12.9%

11.6%

11.8%

13.0%

Net Interest Margin

4.17%

4.27%

4.33%

4.00%

3.71%

3.53%

3.56%

Efficiency Ratio

57.7%

61.8%

65.1%

59.9%

57.9%

57.7%

55.6%

Noninterest Expense/ Avg Assets

2.87%

3.09%

3.03%

2.73%

2.43%

2.30%

2.19%

CAPITAL

Tang. Common Equity / Tang. Assets *

7.9%

6.9%

5.1%

5.1%

7.1%

6.9%

7.5%

Leverage Ratio

9.2%

9.7%

8.4%

7.9%

8.8%

8.6%

8.5%

Tier 1 Risk Based Ratio

11.7%

11.9%

10.8%

10.7%

14.1%

14.1%

14.0%

Total Risk Based Capital Ratio

12.8%

12.9%

12.0%

12.0%

15.4%

15.3%

15.3%

ASSET QUALITY

NPAs/ Assets

0.25%

0.34%

0.42%

1.17%

0.93%

1.09%

1.23%

NPAs/ Loans+OREO

0.35%

0.48%

0.63%

1.90%

1.66%

2.03%

2.23%

NCOs / Average Loans

0.17%

0.14%

0.28%

0.49%

0.56%

0.19%

0.24%

Reserves/ Loans

1.11%

1.13%

1.30%

1.37%

1.36%

1.42%

1.43% |

Appendix

Non-GAAP Financial Reconciliation

Tangible

common

equity

to

tangible

assets

is

a

non-GAAP

financial

measure

calculated

using

GAAP

amounts.

Tangible

common

equity

is

calculated

by

excluding

the

balance

of

goodwill

and

other

intangible

assets

from

the

calculation

of

shareholders’

equity.

Tangible

assets

is

calculated

by

excluding

the

balance

of

goodwill

and

other

intangible

assets

from

the

calculation

of

total

assets.

CNB

believes

that

this

non-GAAP

financial

measure

provides

information

to

investors

that

is

useful

in

understanding

our

financial

condition.

Because

not

all

companies

use

the

same

calculations

of

tangible

common

equity

and

tangible

assets,

this

presentation

may

not

be

comparable

to

other

similarly

titled

measures

calculated

by

other

companies.

A

reconciliation

of

this

non-GAAP

financial

measure

is

provided

below.

20

Quarter Ended

($ in thousands)

2006

2007

2008

2009

2010

3/31/2011

6/30/2011

Total Shareholders' Equity

$72,279

$69,283

$62,467

$69,409

$109,645

$112,870

$122,230

Less Goodwill

10,821

10,821

10,821

10,821

10,821

10,821

10,821

Less Other Intangible Assets

385

285

185

85

-

-

-

Tangible Common Equity

$61,073

$58,177

$51,461

$58,503

$98,824

$102,049

$111,409

Total Assets

$780,850

$858,700

$1,016,518

$1,161,591

$1,413,511

$1,484,135

$1,491,194

Less Goodwill

10,821

10,821

10,821

10,821

10,821

10,821

10,821

Less Other Intangible Assets

385

285

185

85

-

-

-

Tangible Assets

$769,644

$847,594

$1,005,512

$1,150,685

$1,402,690

$1,473,314

$1,480,373

Total Shareholders' Equity / Total Assets

9.26%

8.07%

6.15%

5.98%

7.76%

7.61%

8.20%

Tangible Common Equity / Tangible Assets

7.94%

6.86%

5.12%

5.08%

7.05%

6.93%

7.53% |

Financial Highlights

As of and for the six months ended

June 30, 2011

NASDAQ: CCNE

August 30, 2011 |