Attached files

| file | filename |

|---|---|

| EX-32.2 - SECTION 906 CERTIFICATION - All American Gold Corp. | exhibit32-2.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - All American Gold Corp. | exhibit32-1.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - All American Gold Corp. | exhibit31-2.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - All American Gold Corp. | exhibit31-1.htm |

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended MAY 31, 2011

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from _______ to _______

Commission file number: 000-54008

ALL AMERICAN GOLD CORP.

(Exact name of small business issuer in its charter)

| Wyoming | 26-0665571 |

| (State or jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 700 North High School Road, Suite 203 | |

| Indianapolis, IN 46214 | _____________________ |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: (317) 926-4653 or (888) 755-9766

Issuer’s Web site: www.allamericangoldcorp.com

Issuer’s email address: allamericangoldcorp@gmail.com or info@allamericangoldcorp.com

Securities Registered Under Section 12(b) of the Exchange Act: None

Securities Registered Under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer as defined by Rule 405 of the Securities Act

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Rule 13 or Section 15(d) of the Act

Yes [

] No [X]

Indicate by check mark whether the issuer (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the past 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate web site, if any, every Interactive

Data File required to be submitted and posted pursuant Rule 405 of Regulation

S-T (s 220.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Check if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer or a smaller reporter.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

Issuer's revenues for its current fiscal year: $0.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter: 40,400,000 common shares at $0.10 = $4,040,000.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

State the number of shares outstanding of each of the Issuer's classes of common stock, as of the latest practicable date. 96,175,000 common shares issued and outstanding as of the date of this report.

Transitional Small Business Disclosure Format (Check one):

Yes [ ] No [X]

2

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K into which the document is incorporated: (1) any annual report to shareholders; (2) Any proxy or information statement and (3) any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933:

S-1 Registration Statement dated September 05, 2008 including audited financial statements to May 31, 2010; Exhibit 3.1 (Articles of Incorporation) dated May 17 2006, filed as an exhibit to All American’s Form S-1; Exhibit 3.2 (Bylaws) dated May 31 2006, filed as an exhibit to All American’s Form S-1; Exhibit 10.1 (Option To Purchase And Royalty Agreement between All American Gold Corp. and Jiujiang Gao Feng Mining Industry Limited Company) dated April 22 2007, filed as an exhibit to All American’s Form S-1; Exhibit 10.2 (Code Of Business Conduct & Ethics and Compliance Program) dated April 22 2007 filed as an exhibit to All American’s Form S-1; Exhibit 10.3 (First Amendment to Option to Purchase and Royalty Agreement) dated May 15 2010 incorporated by reference from our Annual Report on Form 10K filed on August 29, 2010;

Form 14A Information Circular and Proxy dated November 1, 2010 pertaining to the Corporation’s annual general meeting held in Hong Kong on November 26, 2010;

Schedule Def 14C Information Statement dated September 22, 2010, and filed on September 27, 2010, regarding amending our Articles of Incorporation to change the name of Osprey Ventures to “All American Gold Corp.”, amending our Articles of Incorporation to effect a ten (10) new for one (1) old forward stock split of our issued and outstanding common stock and amending our Articles of Incorporation to increase our authorized number of shares of common stock from 200 million shares to 800 million shares of common stock.

3

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Statements

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty.

A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made in this report. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as “may”, “will”, “should”, “plans”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” beginning on page 5, that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. References to common shares refer to common shares in our capital stock.

4

As used in this annual report, the terms “we”, “us”, “our” and “All American” mean All American Gold Corp. unless otherwise indicated.

All American is an exploration stage Corporation. There is no assurance that commercially viable mineral deposits exist on the claims we hold or may have under option. Further exploration and/or drilling will be required before a final evaluation as to the economic and legal feasibility of our projects is determined.

Glossary of Exploration Terms

The following terms, when used in this report, have the respective meanings specified below:

| Development |

Preparation of a mineral deposit for commercial production, including installation of plant and machinery and the construction of all related facilities. The development of a mineral deposit can only be made after a commercially viable mineral deposit, a reserve, has been appropriately evaluated as economically and legally feasible. |

|

| |

| Diamond drill |

A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock, which is recovered in long cylindrical sections an inch or more in diameter. |

|

| |

| Exploration |

Prospecting, trenching, mapping, sampling, geochemistry, geophysics, diamond drilling and other work involved in searching for mineral bodies. |

|

| |

| Geochemistry |

Broadly defined as all parts of geology that involve chemical changes or narrowly defined as the distribution of the elements in the earth’s crust; the distribution and migration of the individual elements in the various parts of the earth. |

|

| |

| Geology |

The science that deals with the history of the earth and its life especially as recorded in the rocks; a chronological account of the events in the earth’s history. |

|

| |

| Geophysics |

The science of the earth with respect to its structure, components and development. |

|

| |

| Mineral |

A naturally occurring inorganic element or compound having an orderly internal structure & characteristic chemical composition, crystal form & physical properties. |

|

| |

| Mineral Reserve |

A mineral reserve is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

|

| |

| Mineralization |

Rock containing an undetermined amount of minerals or metals. |

|

| |

| Oxide |

Mineralized rock in which some of the original minerals, usually sulphide, have been oxidized. Oxidation tends to make the mineral more porous and permits a more complete permeation of cyanide solutions so that minute particles of gold in the interior of the minerals will be more readily dissolved. |

5

PART I

Item 1. Description of Business.

Overview

We were incorporated in the State of Wyoming on May 17, 2006, as Osprey Ventures, Inc. and established a fiscal year end of May 31. On October 15, 2011 we changed our name to All American Gold Corp. and effected an 10:1 forward split of our common stock. Our statutory registered agent's office is located at 1620 Central Avenue, Suite 202, Cheyenne, Wyoming 82001 and our business office is located at 700 North High School Road, Suite 203, Indianapolis, IN 46214. Our telephone number is (317) 926-4653 or (888) 755-9766 and our e-mail addresses are allamericangoldcorp@gmail.com or info@allamericangoldcorp.com.

There have been no material reclassifications, mergers, consolidations or purchases or sales of any significant amount of assets not in the ordinary course of business since the date of incorporation. We are a start-up, exploration stage company engaged in the search for gold and related minerals. There is no assurance that a commercially viable mineral deposit, a reserve, exists in our mineral property(ies) or can be shown to exist until sufficient and appropriate exploration is done and a comprehensive evaluation of such work concludes economic and legal feasibility.

Our Current Business – Mineral Exploration – Mining Projects

Mineral Property Interests – State of Nevada – U.S.A. (with TAC and Minquest)

On August 23, 2010, we entered into three agreements with TAC Gold Inc. (“TAC”), a Canadian reporting issuer which trades on the Canadian National Stock Exchange (CNSX), in regards to the acquisition of certain property interests. The interests that we have acquired are as follows:

- A 70% interest in a mineral exploration property called the “Belleville” property in Mineral County, Nevada subject to our making certain payments, share issuances and exploration expenditures through 2016. TAC has an underlying option agreement with Minquest Inc. for the acquisition of a 100% interest in the property (under which agreement Minquest has retained a 3% net smelter return royalty);

- A 35% interest in a mineral exploration property called the “Goldfield West” property in Esmeralda County, Nevada subject to our making certain payments, share issuances and exploration expenditures through 2017. TAC has an underlying option agreement with Minquest Inc. for the acquisition of a 100% interest in the property; and

- A right of first refusal on an exploration property called the “Iowa Canyon” property in Lander County, Nevada for period of 12½ months to September 9, 2011, as amended on August 10, 2011.

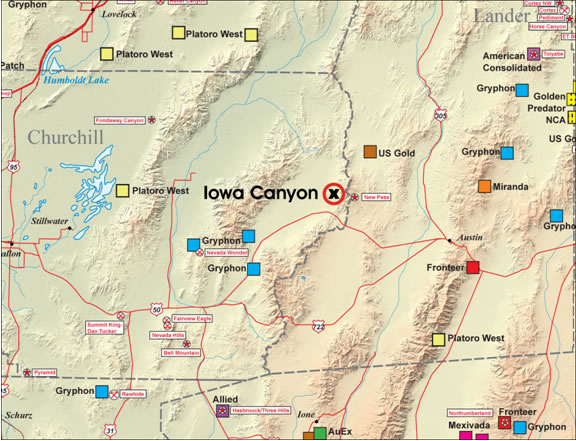

A map of the overall locations of the three properties follows:

6

Belleville Property - Mineral County, Nevada

Pursuant to the terms of the agreement, we have assumed 70% of the obligations of TAC under their agreement with Minquest which consists of All American:

- Making payments in the aggregate amount of $170,000 in annual periodic payments ranging from $20,000 to $50,000, to the sixth anniversary of the underlying option agreement.

- Incurring exploration expenditures in the aggregate amount of $1,320,000 in annual amounts ranging from $120,000 to $400,000, to the seventh anniversary of the underlying option agreement.

In addition, TAC is required to make certain share issuances to Minquest under the terms of the option agreements between them (700,000 shares periodically over the terms of the agreement). We are obligated to reimburse TAC in either cash for the fair market value of the TAC shares that are issued to Minquest or in the issuance of the equivalent value of All American shares as have a market value equal to the amount of the payment then due.

The schedule of payments, stock issuances & required property expenditures to be incurred by All American under the Belleville agreement is as follows

| All American’s Portion | (70% of total) | (70% of total) | |

| Anniversary Date | Payment | Share Issuance | Property Expenditure |

| August 4, 2010 | Paid by TAC | Paid by TAC | Paid by TAC |

| August 4, 2011 | $20,000 | TBD | $120,000 |

| August 4, 2012 | $30,000 | TBD | $150,000 |

| August 4, 2013 | $30,000 | TBD | $200,000 |

| August 4, 2014 | $40,000 | TBD | $200,000 |

| August 4, 2015 | $50,000 | TBD | $250,000 |

| August 4, 2016 | $0 | TBD | $400,000 |

| TOTALS | $170,000 | $1,320,000 |

Technically we are in default of the agreement for not having issued shares to TAC and for not having paid the $120,000 property expenditure. However, TAC has not yet submitted the appropriate documentation for their share issuance to Minquest so we currently do not have a basis upon which to make our share issuance to TAC. We have been informed that TAC will complete their submission by the end of the first full week of September at which time we intend to make our payment to TAC. Further, we are still awaiting a formalized exploration program from TAC, Minquest and their engineers as to the planned exploration program for the current work season; we expect to be in a position to move forward in September, 2011 and will make whatever expenditures are required at that time. In the event that we elected to terminate the agreement, no payment or share issues would be required to be made. Should TAC fail to issue the shares under its agreements with Minquest or fail to make its required property expenditures, All American would either have to negotiate with Minquest and form a new agreement between Minquest and All American or terminate the agreement and lose our interest in the property or make some other mutually agreeable arrangement with the parties involved.

The Belleville Project is approximately 175 miles southeast of Reno, Nevada, and approximately 250 miles northwest of Las Vegas, Nevada, located near recent and historic producing mines including the Candelaria Silver Mine, which is ten miles to the east, and the Marietta Mine, six miles to the west. Both of these past producing mines lie within the Walker Lane structural and mineral belt, as does the Belleville Project, which is comprised of 10 unpatented mining claims spanning 74 acres.

Exposed rocks at Belleville are meta-sediments and meta-volcanics of the Triassic Excelsior formation. Also exposed on the property is a granite intrusion of late Mesozoic age. Several old pits and adits are developed along two semi-parallel shears in the Excelsior package. These shears contain quartz veins, stockworks and varying amounts of iron and copper minerals. Rock chip samples from these workings have revealed as much as 53 parts per million (ppm) gold.

7

To date, exploration efforts at Belleville have consisted of a mapping and sampling program, geophysical surveys, and a limited reverse circulation drilling program completed in 2009. Three potential drill targets have been identified, one of which is the set of gold bearing shear zones described above. The second drill target is a geophysical anomaly indicating the apparent extension of the mineralized shears under pediment. The third target occurs at the intersection of the mineralized structures with a major lithologic contact.

We are reviewing the results of the past drilling and exploration programs Drilling of the first phase is planned for late September, 2011 but a specific date has not, as yet, been determined. We are working with TAC and their JV partner Minquest on the development of a time line for the drilling program.

Goldfields West Property, Esmeralda County, Nevada

In regards to the agreement for the Goldfields West property, the obligations assumed consist of:

- Making payments in the aggregate amount of $398,000 in annual periodic payments ranging from $7,000 to $24,500, to the seventh anniversary of the underlying option agreement and initial payments totalling $307,000 (paid); and

- Incurring exploration expenditures in the aggregate amount of $770,000 in annual amounts ranging from $70,000 to $175,000, to the seventh anniversary of the underlying option agreement.

Upon payment of the $300,000 to TAC (paid as to $200,000 on September 14, 2010 and $100,000 on November 24, 2010 payment of which included a ‘credit’ for the annualized payment due at January 20, 2011), we earned a 35% interest in the Goldfield West Property. In order to maintain this 35% interest, we are required to aggregate cash payments of $98,000 over a seven year period and incur an aggregate of $770,000 in exploration expenditures over a seven year period as described in the table below.

In addition, TAC is required to make certain share issuances to Minquest under the terms of the option agreement between them (1,000,000 shares periodically over the terms of the agreements). We are obligated to reimburse TAC in either cash for the fair market value of the TAC shares that are issued to Minquest or in the issuance of the equivalent value of All American shares as have a market value equal to the amount of the payment then due.

The schedule of payments, stock issuances & required property expenditures to be incurred by All American under the Goldfields West agreement is as follows:

| All American’s Portion | (35% of total) | (35% of total) | |

| Anniversary Date | Payment | Share Issuance | Property Expenditure |

| September 14, 2010 | $200,000 (paid) | Nil | Nil |

| November 21, 2010 | $100,000 (paid) | Nil | Nil |

| January 20, 2011 | $7,000 (paid) * | TBD | $70,000 |

| January 20, 2012 | $10,500 | TBD | $70,000 |

| January 20, 2013 | $10,500 | TBD | $87,500 |

| January 20, 2014 | $14,000 | TBD | $105,000 |

| January 20, 2015 | $14,000 | TBD | $122,500 |

| January 20, 2016 | $17,500 | TBD | $140,000 |

| January 20, 2017 | $24,500 | TBD | $175,000 |

| TOTALS | $398,000 | $770,000 |

* included as part of the cost of the acquisition of the agreement and paid by TAC

Technically we are in default of the option agreement for not having issued shares to TAC and for not having made the $70,000 property expenditure. However, TAC has not yet submitted documentation for their share issuance to Minquest so we currently do not have a basis upon which to make our share issuance to TAC. We have been informed that TAC will complete their submission by the end of the first full week of September at which time we intend to make our payment to TAC. Further, we are still awaiting a formalized exploration program from TAC, Minquest and their engineers as to the planned exploration program for the current work season; we expect to be in a position to move forward in mid-September, 2011 and will make whatever expenditures are required at that time. In the event that we elected to terminate the option agreement, no payment or share issues would be required to be made. Should TAC fail to issue the shares under its agreements with Minquest or fail to make its required property expenditures, All American would either have to negotiate with Minquest and form a new option agreement between Minquest and All American or terminate the option and lose our interest in the property or make some other mutually agreeable arrangement with the parties involved.

8

The Goldfield West property is an advanced exploration property with defined targets comprised of 105 unpatented mining claims covering a total of 850 hectares or 2100 acres. It is approximately 3.5 hours northwest of Las Vegas, Nevada, by car; approximately 3 miles west of the town of Goldfield and adjacent to International Minerals (IMZ) Goldfield properties. It is easily accessed via well graded dirt roads.

Geologically, the Goldfield West property encompasses an area of Tertiary volcanic and volcanoclastic rocks. The USGS and several mineral exploration companies hypothesize that the western edge of a caldera rim runs through the property. Historic work conducted by Bear Creek, Placer Amex, U.S. Borax, North Mining and Bonaventure Enterprises has led to the completion of 138 drill holes. The data compiled from drilling results and a wealth of information gathered through geological mapping, geochemical sampling and geophysical surveys have identified three distinct targets over a strike length of 3.5 miles.

We believe that the property has the potential to host a gold resource in these Tertiary age volcanic and volcanoclastic rocks. Surface samples collected from old workings and outcrops have exceeded 15 g/t.

Late in 2010 we completed the drilling of one deep hole into each of the Nevada Eagle (northern) (hole number 1001) site and the South target (hole number 1002) - the first of a permitted 21 hole program on the Goldfield West property. These two holes consisted of RC (reverse circulation) drilling to a depth of approximately 700 feet and then core drilling to a depth of 1,200 to 1,500 feet. Both 1001 and 1002 encountered thick sections of highly anomalous gold with 1001 having 465' of +0.1 g/t gold and 1002 having 385' of the same. The best 5 foot sample was 0.477 g/t gold in 1001 and 1.450 g/t gold in 1002. The mineralization in 1001 is much more associated with permeable host rock than with structure. Hairline quartz-sulfide veinlets are present but rare in 1001. Gold is related to three separate horizons in 1001 which appear to be more permeable hosts. The basal section of the volcanics is one of these anomalous horizons and verifies the theory of a good host at the base of the volcanics. Mr. Richard Kern, the geologist in charge of drilling states, “These results are a verification of the Gemfield model. We have a large cloud of low-grade gold and we need to vector into the higher grade portion of the system. Drilling more deep holes, concentrating on the structures and dikes found with the geophysics is the next step at Nevada Eagle (north target).”

At the South target the gold in 1002 occurs in two separate zones. The first is in permeable tuffaceous sediments with no appreciable structure while the deeper zone is associated with densely welded tuffs that form open-spaced quartz-sulfide veins when fractured. There are numerous veinlets in this lower zone, but each veinlet is very narrow and indicates that the drill hole did not intersect a major structure. No basal volcanic gold anomaly occurs in 1002. The next phase for the South target is to drill a fence (or 2) of angle drill holes (2-3 holes per fence) across the major structure defined by geophysics. The holes should test both mineralized horizons, but don't need to go to the base of the volcanics.

These drill results help to define favourable host stratigraphy as well as further zero in on gold-bearing structures. The technical information in this drill program has been reviewed and approved by Mr. Richard Kern, B.Sc., M.Sc., P. Geo., Registered Geologist - Nevada & California; a ‘qualified person’, as defined by Canadian National Instrument 43-101, “Standards for Disclosure of Mineral Projects”, unless otherwise noted.

Goldfield West has been permitted for a total of 21 holes and drilling will continue in order to further define the overall potential of the property. A work program which is scheduled to begin in mid September is currently being established. Once the results of the above noted drill holes assays have been released and we have further opportunity to study their implications further exploration work will be scheduled for the project in concert with TAC and Minquest.

9

Iowa Canyon Property

We also hold a right of first refusal on an exploration property called the “Iowa Canyon” property in Lander County, Nevada through to August 23, 2011, which is located approximately 30 miles southeast of the Cortez Hills deposit and within 20 miles of the Cove-McCoy mine.

The Iowa Canyon property represents a nearly untested exploration opportunity. Recent exploration efforts have discovered multiple episodes of precious metals mineralization over a district-wide scale. Gold is hosted in a variety of rock types including silicified Tertiary volcanic and volcanoclastic sediments, quartz veins, quartz stockwork zones, carbon-rich Paleozoic sediments, and as jasperoid replacements of lower plate calcareous sediments.

This Project represents a high-quality exploration opportunity. The system correlates well with other nearby mineralizing centers. Gold and silver mineralization is found in upper and lower plate rocks, hypabyssal dikes or sills, and within Tertiary volcanics and volcanoclastics.

Drilling has identified gold and silver jasperoids within upper and lower plate sediments, as well as gold and molybdenum-rich porphyry dikes. A single drill hole on the western side of the property contains up to 800 parts per million (ppm) molybdenum and 0.2 grams per ton gold over ten foot widths. The lower plate Hanson Creek Formation, a favorable host rock for Carlin style mineralization, has been identified in outcrop as well as drilling on the north, east and west portions of the Iowa Canyon Property.

Plans for the property have not yet been concluded and we will not formulate specific plans until we have had the opportunity to fully review all the available information on the property. Subsequent to the end of the fiscal year, on August 15, 2011, TAC Gold provided an extension of the date of termination of the first right of refusal to allow us to complete a review of the data available on the property and to reach a decision as to how we will proceed. We are currently interested in negotiating a percentage interest in the property and are currently working with TAC to agree to percentages and costs to enter into an option agreement on the property.

Gao Feng Gold Mining Property – Jiangxi, China

On April 22, 2007, as amended on May 15, 2009, we optioned a 25 percent interest in a gold exploration and mining property referred to as the Gao Feng Gold Mining Property located in north-eastern Jiangxi Province, China by entering into an Option To Purchase And Royalty Agreement with Jiujiang Gao Feng Mining Industry Limited Corporation, the beneficial owner of the property. The option allowed us to acquire an interest in the property by making certain expenditures and carrying out certain exploration work. We and Jiujiang retained the services of the Jiujiang Geological Engineering Group Corporation, Gao Fenglin, Senior Engineer, and C. Wong, Senior Engineer, to carry out the first phase of the work program the field work of which was carried out between February 15 and March 3, 2010, to determine if there were commercially exploitable deposits of gold and silver.

On January 31, 2011, the agreement was terminated as a result of insufficient results being obtained from the first phase of exploration and the high costs of a projected second phase as reported and recommended in a geological engineering report dated January 18, 2011. See page 15 for a review of management’s discussion on the reasons for the termination of the project.

No further payments or consideration are required as a result of the termination of the agreement.

We do not claim to have any ores or reserves whatsoever at this time on any of our mineral properties.

Item 1A Risk Factors

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

1. We need to continue as a going concern if our business is to succeed.

Our registered public accounting firm’s report to our audited financial statements for the year ended May 31, 2011, indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are our lack of sufficient working capital, significant operating losses, our failure to attain profitable operations and our dependence upon adequate financing to pay our liabilities.

10

2. Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims.

3. Because we have limited business operations, we face a high risk of business failure.

We are preparing to commence exploration on our Belleville property in the near term. Therefore, we have no way to evaluate the likelihood that our business will be successful. We were incorporated on May 17, 2006, and have been involved primarily in organizational activities, acquisition and exploration of our mineral properties. We have not earned any revenues as of the date of this Annual Report on Form 10-K.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development of the mineral claims and the production of minerals from the claims, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

4. We lack an operating history and we expect to have losses in the future.

We have not realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the following:

- Our ability to locate a profitable mineral property

- Our ability to generate revenues; and

- Our ability to reduce exploration costs.

Based upon current plans, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the exploration of our mineral properties. We cannot guarantee that we will be successful in generating revenues in the future.

5. Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

11

6. If we become subject to onerous government regulation or other legal uncertainties, our business will be negatively affected.

There are several governmental regulations that materially restrict mineral property exploration and development. Under the mining laws of Nevada, we are required to obtain work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. While these current laws do not affect our current exploration plans, if we proceed to commence drilling operations on the mineral claims, we will incur modest regulatory compliance costs.

In addition, the legal and regulatory environment that pertains to the exploration of ore is uncertain and may change. Uncertainty and new regulations could increase our costs of doing business and prevent us from exploring for ore deposits. The growth of demand for ore may also be significantly slowed. This could delay growth in potential demand for and limit our ability to generate revenues. In addition to new laws and regulations being adopted, existing laws may be applied to mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

7. We may not have access to all of the supplies and materials we need to begin exploration that could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

8. Because the SEC imposes additional sales practice requirements on brokers who deal in our shares because they are classed as penny stocks, some brokers may be unwilling to trade them. Thus you may have difficulty in reselling your shares and which may cause the price of the shares to decline.

Our shares qualify as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934, which imposes additional sales practice requirements on broker/dealers who sell our securities in this offering or in the aftermarket. In particular, prior to selling a penny stock, broker/dealers must give the prospective customer a risk disclosure document that contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; contains a description of the broker/dealers' duties to the customer and of the rights and remedies available to the customer with respect to violations of such duties or other requirements of Federal securities laws; contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask prices; contains the toll free telephone number for inquiries on disciplinary actions established pursuant to section 15(A)(i); defines significant terms used in the disclosure document or in the conduct of trading in penny stocks; and contains such other information, and is in such form (including language, type size, and format), as the SEC requires by rule or regulation. Further, for sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement before making a sale to you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the price of the shares to decline.

9. Rain and snow may make the road leading to our property impassable. This will delay our proposed exploration operations and could prevent us from working.

While we do not plan to conduct our exploration year round, it is possible that when we plan to proceed with exploration that snow or rain could cause roads leading to our claims to be impassable. When roads are impassable, we are unable to work.

10. As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

12

11. Trading of our stock may be restricted by the SEC's Penny Stock Regulations which may limit a stockholder's ability to buy and sell our stock.

The SEC has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

12. Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

Our principal office is located at 700 North High School Road, Suite 203, Indianapolis, IN 46214. Our telephone number is (317) 926-4653 or (888) 755-9766. Our principal office is provided by our senior officer and director at no cost. We believe that the condition of our principal office is satisfactory, suitable and adequate for our current needs.

We hold the following property interests:

- A 70% interest in a mineral exploration property called the “Belleville” property in Mineral County, Nevada subject to our making certain payments, share issuances and exploration expenditures through 2016. TAC has an underlying option agreement with Minquest Inc. for the acquisition of a 100% interest in the property (under which agreement Minquest has retained a 3% net smelter return royalty);

- A 35% interest in a mineral exploration property called the “Goldfield West” property in Esmeralda County, Nevada subject to our making certain payments, share issuances and exploration expenditures through 2016. TAC has an underlying option agreement with Minquest Inc. for the acquisition of a 100% interest in the property; and

- A right of first refusal on an additional exploration property called the “Iowa Canyon” property in Ladner County, Nevada for period of 12 months to August 23, 2011.

13

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to All American.

Item 4. Submission of Matters to a Vote of Security Holders

Our last Annual General Meeting (“AGM”) was held on November 26, 2010, at which time stockholders approved the following actions:

| 1. |

received the financial statements of the Corporation for its financial year ended May 31, 2010, together with the report of the independent auditors thereon; |

| 2. |

fixed the number of directors at two for the coming year; |

| 3. |

elected one director, Ma Cheng Ji, to serve until the next Annual General Meeting of Shareholders or until his respective successor(s) is/are elected or appointed; subsequent to the AGM, on December 1, 2010, Mr. Ma, resigned as an officer and Mr. Brent Welke was appointed as a director and became senior officer (president, secretary and treasurer) of the Corporation; |

| 4. |

ratified the appointment of M&K CPAs, PLLC, of Houston, Texas to act as independent certifying accountants and auditors of the Corporation for the financial year ended May 31, 2011. |

14

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Shares of our common stock became available for quotation on the Over-the-Counter Bulletin Board (“the OTC-BB” or “BB”) under the symbol “AAGC” on October 15, 2010 – they previously traded under the symbol OSPR commencing on June 30, 2010. The market for our common shares is limited and can be volatile. The following table sets forth the high and low bid prices relating to our common stock on a quarterly basis for the periods indicated as quoted on the OTC-BB quotation service. These quotations reflect inter-dealer prices without retail mark-up, mark-down or commissions and may not reflect actual transactions.

| Quarter Ended | High Bid | Low Bid |

| September 30, 2010 | $0.095 | $0.095 |

| November 30, 2010 | $0.095 | $0.095 |

| February 29, 2011 | $0.40 | $0.40 |

| May 31, 2011 | $0.50 | $0.40 |

Our common shares are issued in registered form through Madison Stock Transfer, Inc. of 1688 East 16th Avenue, Suite 7, Brooklyn, NY 11229-0145 which is our stock transfer agent. They can be contacted by telephone at (718) 627-4453 and by facsimile at (718) 627-6341.

On May 31, 2011, the shareholders' list of our common shares showed 19 registered shareholders holding 71,550,000 shares with a further 21,350000 shares being held by broker-dealers. There are 92,900,000 shares outstanding.

We have not declared any dividends since incorporation and do not anticipate that we will do so in the foreseeable future. Although there are no restrictions that limit the ability to pay dividends on our common shares, our intention is to retain future earnings for use in our operations and the expansion of our business.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

We were incorporated in the State of Wyoming on May 17, 2006 as Osprey Ventures, Inc. and established a fiscal year end of May 31. On October 15, 2011, we changed our name to All American Gold Corp. and effected a 10:1 forward split of our common stock. Our statutory registered agent's office is located at 1620 Central Avenue, Suite 202, Cheyenne, Wyoming 82001 and our business office is located at 700 North High School Road, Suite 203 Indianapolis, IN 46214. Our telephone number is (317) 926-4653 or (888) 755-9766. We are a start-up, exploration stage company engaged in the search for gold and related minerals. There is no assurance that a commercially viable mineral deposit, a reserve, exists on our mineral properties or can be shown to exist until sufficient and appropriate exploration is done and a comprehensive evaluation of such work concludes economic and legal feasibility.

Mining Property - China

On April 22, 2007, amended on May 15, 2010, we optioned a 25 percent interest in the Gao Feng Mining Property in Jiangxi Province, China, consisting of a mining claim block covering 3.73 sq. km or 921 acres by entering into an Option To Purchase And Royalty Agreement with Jiujiang Gao Feng Mining Industry Limited Company, the beneficial owner of the property. Under the terms of the agreement, Jiujiang granted to All American the right to acquire 25% of the right, title and interest of Jiujiang in the property, subject to its receiving annual payments and a royalty, in accordance with the terms of the agreement, as follows:

a) All American, or its permitted assigns, contributing exploration expenditures on the property of a minimum of US $20,000 on or before May 31, 2011 (paid and field work completed on March 3, 2011); b) All American, or its permitted assigns, contributing exploration expenditures on the property of a further US $40,000 for aggregate minimum contributed exploration expenses of US $60,000 on or before May 31, 2011; c) All American shall allot and issue 1,000,000 shares in the capital of All American to Jiujiang upon completion of a phase I exploration program as recommended by a competent geologist; d) Upon exercise of the option agreement, All American will pay to Jiujiang US $25,000 per annum as pre-payment of the net smelter return, effective May 31, 2012; e) All American will pay to Jiujiang an annual royalty equal to three percent (3%) of NSR; and f) All American has the right to acquire an additional 26% of the right, title and interest in and to the Property by the payment of US $25,000 and by incurring an additional US $100,000 in exploration expenditures on the Property on or before May 31, 2012.

15

We and Jiujiang retained the services of the Jiujiang Geological Engineering Group Corporation, Gao Fenglin, Senior Engineer, and C. Wong, Senior Engineer, to carry out the first phase of the work program the field work of which was carried out between February 15 and March 3, 2010, to determine if there were commercially exploitable deposits of gold and silver.

On January 25, 2011, we received a report entitled “Geological Report of the Phase I Exploration Program on the Gaofeng Gold Property, Dexing City, Jiangxi, China” which is a summary of the work completed in 2010 with recommendations for a proposed second phase of exploration.

The phase I exploration program undertaken between February 16 and March 3, 2010, consisted of the establishment of a full grid of the area with permanent posts for future reference, an airborne electromagnetic and magnetic survey of the Gaofeng property and included an area one kilometre north, south, east and west of the property boundaries with a number of rock, till and geological samples being taken from the area.

All of the work contemplated under the phase I exploration program was completed with the exception of the diamond drilling. The drill rig that had been contracted ran into unexpected mechanical problems shortly after commencing work. As a result, the drill portion of the program was only marginally carried out. The parties verbally agreed to delay further diamond drilling until phase II. This allowed for a significant increase in the base geological work, a widening of the area subject to review and the taking of a greater number of samples for analysis.

The overall evaluations of the previous exploration programs were confirmed. Although few mineral values of interest were determined, vein structures and significant conductors were followed off the property to the east and north. The strongest anomalies were confirmed as being along the north margin of the claim and were continually traced more than one kilometre north of the existing claims boundary.

Phase I Exploration Program

Phase I began by mapping the claims and digitization and Global Information System (GIS) referencing of all existing data on the claims including historical references. The GIS referencing system entailed the production of a database whereby all previous known work on the claims was entered into a computer matrix and correlated based on map coordinates. The results of phase I testing were then entered and correlated to historical data which allowed for certain conclusions as to the best targets and areas to explore in the future.

Mineralization

During the establishment of the grid a new showing was located approximately 400 metres northeast of the area of the originally planned target area.

The phase I exploration program carried out a small drill program prior to the total breakdown of the drilling rig completing five AQ-sized core drill holes in the area of the originally trenched area, in the southeastern part of the property which elongates in a northwesterly direction exposing an oxidized sulphide and quartz zone best developed in interflow metasediments and mafic metavolcanic rocks marginal to their contact with felsic metavolcanic rocks which are flow banded in part showings. The drilling returned no significant mineralization.

The program included stream and till sampling of the drainages crossing the mineralization. The streams sampled were juvenile systems with much non-mineralized till contributing to the transported sediments in the creek beds. The results reflect anomalous gold and silver values that are related to mineralization but are erratic in the downstream decay of values; there may be substantial contributions of unmineralized material due to fines from talus.

16

Geophysical Surveys

The VLF-Ground Magnetic survey was carried out over the showings and the interpretation suggested that there are three linear magnetic lows running roughly parallel to the surface expression of the mineralization. This was interpreted to mean possible magnetite destruction in the volcanics due to alteration that would reflect some vertical conduits of mineralization through the volcanic pile.

The survey identified two electromagnetic conductive zones north and west of the current claims. Two small claim blocks were located for subsequent surface surveys; the first was located immediately east of a small hill located one kilometre north-northeast of the property. VLF-EM surveys were completed over a grid of 100 metre spaced north-south lines with instrument readings taken at intervals of 25 metres along the grid lines. An electromagnetic conductor, partially coincident with higher magnetic readings, was found in the area of the centre of the claims where there are quartz and sulphide showings which are exposed in a number of shallow pits and trenches.

The second area was on the north side of another small hill 3 kilometres west-northwest of the current claims. Here, a strong electromagnetic conductor was found to be coincident with high magnetic response over a width of between 15 and 30 metres and an apparent strike length of 350 metres. The area is outside the current claim boundaries and ownership is unknown.

Surface geophysical surveys were undertaken. The survey grid established for this survey consisted of an east-west baseline (the southern boundary of the claims follows this baseline) and north-south survey lines at 100 metre intervals. This grid extends more than a kilometre north and east of the property and the north-south crosslines throughout the grid area extend several hundred metres to the north.

A Max-Min electromagnetic survey, completed over the entire grid area, involved a coil separation of 200 metres and readings of two frequencies (444Hz and 1777Hz) were recorded at 25 metres intervals along the north-south grid lines. A major, in-phase and out-of-phase cross-over on both frequencies was identified on the easternmost grid line, 1 kilometre east of the eastern boundary of the property. This is coincident with a known exposure of quartz and sulphide mineralization in this area. A weaker in- and out-of-phase crossover was encountered immediately south of an old lakebed adjacent to the current claims western boundary and in another area 600 metres further east. The cause of these is not known. A similar weak EM cross-over was detected immediately west of another known gold zone at the western limits of the grid some 1200 metres west of the current claim western boundary.

Conclusions

Mineralization on the Gaofeng mining property occurs along contacts between mafic metavolcanic rocks and felsic units. Based on the observed distribution of felsic and mafic metavolcanic rocks, a prospective and underexplored horizon is present in the central part of the claims area and may extend for a considerable distance both east and north of the current claims. Evidence for this are three known areas of mineralization east and north of the property plus a similar, parallel belt of similar geology featuring two zones several hundred metres north of the current area.

Two principal styles of disseminated quartz and sulphide mineralization are present in the area. The mineralization exposed in the vein extension areas reviewed was below that which is typical of an exhalative, sulphide iron formation hosted mainly in cherty (sedimentary?) units. By contrast, the mineralization exposed in both the newly discovered trench areas is at least in part typical of contact type mineralization as evidenced by the presence of quartz and sulphides in skarnified limestone, further evidence that the felsic unit at both localities may be intrusive. The chemistry features higher cobalt values and low arsenic samples from the one trench while from the other trenches the characterization was of elevated arsenic values.

The Gaofeng property and surrounding area is considered to be underexplored. In view of the extension of favourable geology well beyond the boundaries of the current claims, plus the presence of several quartz gold bearing and sulphide zones east, west and north of the claims, it would be in order to acquire more ground prior to the initiation of further work on the Gaofeng property. The staking of an additional 50 mining claims extending east, west and north of the current property is recommended. If the staking of additional property is concluded not to be an option, it is recommended that no further work be undertaken and the property abandoned for lack of merit of the claims as presently owned.

17

Recommendations

The property is underlain by sediments and felsic volcanic tuffs along with visibly exposed quartz veining structures which is a favourable setting for gold mineralization. An IP anomaly occurs on the eastern and northern part of the property. A number of other adjacent induced polarization anomalies were outlined which suggest disseminated pyrite zones in bedrock, along with graphitic sediments. The overburden is in the order of 30 feet hence the I. P. responses are moderate. A follow-up diamond drill program is required to test the various anomalies.

A proposed second phase would be comprised of three parts – the staking of additional claims, the continuation of the exploration of the newly acquired claims and diamond drilling on the expanded property grouping:

| Phase 2A |

Stake an additional 50 mining claims to the east, west and north of the existing claims. |

|

| |

| Phase 2B. |

Repeat the phase I general exploration program on the newly acquired claims by establishing a base line with 25-metre stations and cross lines run every 50 metres for 100 metres each side of the baseline; geologically map the grid; conduct an electromagnetic survey over the grid with readings taken every 25 metres along the lines; rock, till and geochemically sample those areas determined by the geological and EM surveys. |

|

| |

| Phase 2C |

Diamond drill a total of 5,000 feet over selected targets determined from phase 2B. It is anticipated that some additional geological mapping, prospecting and some geochemical sampling will take place as the drilling progresses. |

| Phase 2A – Staking & Related | 30,000 | ||

| Phase 2A – Exploration & Geology | 130,000 | ||

| Phase 2C – Diamond Drilling | 220,000 | ||

| Total Costs for Phase 2 | 380,000 |

Although it is recommended that phase 2 be carried out in its entirety, it could be broken up over two years such that phases 2A & 2B be completed in the same year. Phase 2C could be postponed for one year depending on available funds. It is then recommended that a new third phase be undertaken to diamond drill the property to depth and test for continuation of discovered anomalies.

|

Phase 3. |

The third phase of exploration would continue the diamond drill program if results from the phase 2 program remain positive. Cost of the third phase of exploration is estimated to be $350,000. |

SUMMARY

The Board of Directors has reviewed the report, contemplated the costs involved for future exploration of the property as well as considered the risk-reward prospects and had discussions with our Chinese partner Jiujiang Gao Feng Mining Industry Limited Company. The Board has decided that in light of the high cost of proceeding forward to a second phase of exploration given the high risk involved and the relatively lower risks attached to expending the equivalent funds on our Nevada properties, that it is no longer in the best interests of the Corporation to continue with the Gaofeng project given the poor results of the first phase of exploration. We have elected to terminate the Option and Royalty Agreement with Jiujiang Gao Feng Mining effective January 31, 2011, and have so notified Jiujiang of our decision. No further work will be carried out on the Gaofeng project by All American.

DECISION ON PROJECT”S FUTURE

On January 31, 2011, the agreement was terminated as a result of insufficient results being obtained from the first phase of exploration and the high costs of a projected second phase as reported and recommended in a geological engineering report dated January 18, 2011.

18

No further payments, consideration or share issuances are required as a result of the termination of the agreement. The 1,000,000 shares that were contemplated as to be issued upon the conclusion of the phase I exploration program were not issued and will not be issued following the termination of the agreement.

Mineral Properties – United States of America

We hold interests in the Belleville property and the Goldfield West property subject our making certain payments, share issuances and exploration expenditures through 2016 and 2017 respectively and hold a right of first refusal on a property known as the “Iowa Canyon” property. For a description of the agreements, please see the section entitled “Our Current Business” on pages 5 to 8 above.

Belleville Property

Location and Access

The Belleville project lies about equidistant from the towns of Hawthorne and Tonopah (approximately 60 miles to either). It is situated in T4N, R34E, Mineral County, Nevada, about 175 miles south-southeast of Reno and approximately 250 miles northwest of Las Vegas (see Figure 1, Location Map). Labor force, drill water and supplies would be available from Tonopah or Hawthorne, Nevada. Access is from Nevada SR 360, which junctions with US 95 about 12 miles north of the old abandoned mining and milling site of Belleville. From just south of Belleville, an unimproved gravel road heads westward across an alluvial fan and accesses the eastern part of the claims. The remainder of the claim block is not accessible by vehicle.

Elevations range from 5,600 feet at the range front to over 6,200 feet on the ridges to the west. Vegetation is sparse; range front is relatively steep and drainages are typically steep and rocky. The climate is typical high desert, western Nevada, with hot summers, cool evenings and some snow in the winter, especially at higher elevations. Exploration or mining could be conducted year round. The project is comprised of ten, unpatented mining claims (approximately 75 acres) on land administered by the US Bureau of Land Management (BLM).

Figure 1 – General Location of Belleville Property – Esmeralda County, Nevada

19

Description of Agreement

In order to maintain the 70% interest in the Belleville property, we are required to make aggregate cash payments of $170,000 over a six year period and incur an aggregate of $1,320,000 in exploration expenditures over a seven year period.

Pursuant to the underlying option agreement between TAC and Minquest, TAC is required to issue an aggregate of 700,000 shares of its common stock to Minquest over the term of the underlying agreement. Pursuant to our agreement with TAC, we are obligated to reimburse TAC in either cash or restricted shares of our common stock for the fair market value of the TAC shares that are issued to Minquest.

Below is a detailed schedule of the payments, exploration expenditures and stock issuances that are required under the agreement for the Belleville property between our company and TAC.

| All American’s Portion | (70% of total) | (70% of total) | |

| Anniversary Date | Payment | Share Issuance | Property Expenditure |

| August 4, 2010 | Paid by TAC | Paid by TAC | Paid by TAC |

| August 4, 2011 | $20,000 | TBD | $120,000 |

| August 4, 2012 | $30,000 | TBD | $150,000 |

| August 4, 2013 | $30,000 | TBD | $200,000 |

| August 4, 2014 | $40,000 | TBD | $200,000 |

| August 4, 2015 | $50,000 | TBD | $250,000 |

| August 4, 2016 | $0 | TBD | $400,000 |

| TOTALS | $170,000 | $1,320,000 |

Technically we are in default of the agreement for not having issued shares to TAC and for not having paid the $120,000 property expenditure. However, TAC has not yet submitted documentation for their share issuance to Minquest so we currently do not have a basis upon which to make our share issuance to TAC. We have been informed that TAC will complete their submission by the end of the first full week of September at which time we intend to make our payment to TAC. Further, we are still awaiting a formalized exploration program from TAC, Minquest and their engineers as to the planned exploration program for the current work season; we expect to be in a position to move forward in September, 2010 and will make whatever expenditures are required at that time. In the event that we elected to terminate the agreement, no payment or share issues would be required to be made. Should TAC fail to issue the shares under its agreements with Minquest or fail to make its required property expenditures, All American would either have to negotiate with Minquest and form a new agreement between Minquest and All American or terminate the agreement and lose our interest in the property or make some other mutually agreeable arrangement with the parties involved.

History and Plan of Operation

To date, exploration efforts at Belleville have consisted of a mapping and sampling program, geophysical surveys, and a limited reverse circulation program completed in 2009. Three potential drilling targets have been identified, one of which is a set of gold bearing shear zones. The second drill target is a geophysical anomaly indicating the apparent extension of the mineralized shears under pediment. Belleville's third target occurs at the intersection of the mineralized structures with a major lithologic contact. Drilling is planned for a later in 2011 but a specific date has not, as yet, been determined. We are working with TAC and their JV partner Minquest on the development of a time line for the drilling program and expect to see the program started in mid to late September, 2011.

Mineralization

Exposed rocks at Belleville are meta-sediments and meta-volcanics of the Triassic Excelsior formation. Also exposed on the property is a granite intrusion of late Mesozoic age. Several old pits and adits are developed along two semi-parallel shears in the Excelsior package. These shears contain quartz veins, stockworks and varying amounts of iron and copper minerals. Rock chip samples from these workings have revealed as much as 53 parts per million (ppm) gold.

20

Significant gold and silver mineralization has so far been detected only within the NESW trending shear/vein systems described above. Although these shears are rarely more than a few feet wide, they persist for at least 1000 feet along strike. Surface samples were mainly grab samples from prospect pits and dumps. Sampling of the many short adits that occur on the property consisted of chip channel sampling across the ceilings (backs) which gives information on width as well as grade. All adit samples were across the veins using a 2.0 foot width (0.6 meters).

Adit sampling shows the northern vein zone to be the strongest. Within this zone adit BA-3 shows the best values with a high of 7.29 ppm gold. This part of the vein appears to be bending to the left which is consistent with dilation of a left lateral fault. This area is considered the best portion of a drilling target that extends from above the range front approximately 1,200 feet to the southwest. At the range front the structure is present but appears to be only weakly altered. This is the second drilling target defined at Belleville.

Examination of the surface geology within the Belleville project reveals a disconformable contact between a meta-andesite/basalt unit and underlying lithologies. This unit appears to sit unconformably not only on the slightly older meta-sediments and meta-volcanics, but also upon the gold-bearing shears. This scenario could produce a ‘pooling’ of mineralization underneath the meta-andesite, with the meta-andesite acting as a physical barrier to ascending mineral fluids. This is the third drilling target defined at Belleville.

Goldfield West Property

Location and Access

The Goldfield West Property is an advanced exploration property with defined targets comprised of 105 unpatented mining claims covering a total of 850 hectares, or 2100 acres. The property is located approximately 3.5 hours northwest of Las Vegas, Nevada, by car, and approximately 3 miles west of the town of Goldfield. The Goldfield West property is accessible by well-graded dirt roads.

Figure 2, General Location of Goldfield West Property –

Nevada

21

Description of Agreement

In order to maintain the 35% interest in the Goldfield West property, we are required to make the following payments:

| 1. |

to pay TAC $200,000 on the date of execution of the agreement (paid on September 14, 2010) and $100,000 by November 21, 2010 (paid on November 24, 2010); | |

| 2. |

aggregate cash payments of $98,000 over a seven year period; and; | |

| 3. |

incur an aggregate of $770,000 in exploration expenditures over a seven year period. |

Upon payment of the $300,000 to TAC (paid as to $200,000 on September 14, 2010 and $100,000 on November 24, 2010), we earned a 35% interest in the Goldfield West Property. In order to maintain this 35% interest, we are required to aggregate cash payments of $98,000 over a seven year period and incur an aggregate of $770,000 in exploration expenditures over a seven year period.

Pursuant to the underlying option agreement between TAC and Minquest, TAC is required to issue an aggregate of 1,100,000 shares of its common stock to Minquest over the term of the underlying option agreement. Pursuant to our agreement with TAC, we are obligated to reimburse TAC in either cash or restricted shares of our common stock for the fair market value of the TAC shares that are issued to Minquest.

Below is a detailed schedule of the payments, exploration expenditures and stock issuances that are required under the agreement for the Goldfield West property between our company and TAC.

| All American’s Portion | (35% of total) | (35% of total) | |

| Anniversary Date | Payment | Share Issuance | Property Expenditure |

| September 14, 2010 | $200,000 (paid) | Nil | Nil |

| November 21, 2010 | $100,000 (paid) | Nil | Nil |

| January 20, 2011 | $7,000 (paid) * | TBD | $70,000 |

| January 20, 2012 | $10,500 | TBD | $70,000 |

| January 20, 2013 | $10,500 | TBD | $87,500 |

| January 20, 2014 | $14,000 | TBD | $105,000 |

| January 20, 2015 | $14,000 | TBD | $122,500 |

| January 20, 2016 | $17,500 | TBD | $140,000 |

| January 20, 2017 | $24,500 | TBD | $175,000 |

| TOTALS | $398,000 | $770,000 |

* included as part of the cost of the acquisition of the agreement and paid by TAC

Technically we are in default of the option agreement for not having issued shares to TAC and for not having paid the $70,000 property expenditure. However, TAC has not yet submitted the documentation for their share issuance to Minquest so we currently do not have a basis upon which to make our share issuance to TAC. We have been informed that TAC will complete their submission by the end of the first full week of September at which time we intend to make our payment to TAC. Further, we are still awaiting a formalized exploration program from TAC, Minquest and their engineers as to the planned exploration program for the current work season; we expect to be in a position to move forward in mid-September, 2010 and will make whatever expenditures are required at that time. In the event that we elected to terminate the option agreement, no payment or share issues would be required to be made. Should TAC fail to issue the shares under its agreements with Minquest or fail to make its required property expenditures, All American would either have to negotiate with Minquest and form a new option agreement between Minquest and All American or terminate the option and lose our interest in the property or make some other mutually agreeable arrangement with the parties involved.

Plan of Operation

Goldfield West has been permitted for a total of 21 holes and drilling will continue in order to further define the overall potential of the property. Once the results of the drill hole assays have been released and we have further opportunity to study their implications further exploration work will be scheduled for the project in concert with TAC, the operator, and Minquest.

22

Mineralization

Geologically, the Goldfield West property encompasses an area of Tertiary volcanic and volcanoclastic rocks. The USGS (US Geological Survey) and several mineral exploration companies hypothesize that the western edge of a caldera rim runs through the property. Historic work conducted has led to the completion of 138 drill holes. Combined geophysical surveys, geochemical sampling and 23 reverse circulation drill holes within the Nevada Eagle and South targets have tended to confirm the existence of a gold-bearing hydrothermal system associated with the argillization and silification of host rocks proximal to feeder structures.

Iowa Canyon Property

We hold a right of first refusal on an additional exploration property called the “Iowa Canyon” property in Lander County, Nevada through to September 8, 2011. The Iowa Canyon property represents a nearly untested exploration opportunity. Recent exploration efforts have discovered multiple episodes of precious metals mineralization over a district-wide scale. Gold is hosted in a variety of rock types including silicified Tertiary volcanic and volcanoclastic sediments, quartz veins, quartz stockwork zones, carbon-rich Paleozoic sediments, and as jasperoid replacements of lower plate calcareous sediments.

This project represents a high-quality exploration opportunity. The system correlates well with other nearby mineralizing centers. Gold and silver mineralization is found in upper and lower plate rocks, hypabyssal dikes or sills, and within Tertiary volcanics and volcanoclastics.

Drilling has identified gold and silver jasperoids within upper and lower plate sediments, as well as gold and molybdenum-rich porphyry dikes. A single drill hole on the western side of the property contains up to 800 parts per million (ppm) molybdenum and 0.2 grams per ton gold over ten foot widths. The lower plate Hanson Creek Formation, a favorable host rock for Carlin style mineralization, has been identified in outcrop as well as drilling on the north, east and west portions of the Iowa Canyon Property.

Plans for the property have not yet been concluded and we will not formulate specific plans until we have had the opportunity to fully review all the available information on the property.

23

Figure 3 - General Location of Iowa Canyon Property – Lander

County, Nevada

RESULTS OF OPERATIONS

| Year Ended May 31 |

||||

| 2011 | 2010 | |||

| Revenue | $ | Nil | $ | Nil |

| Operating Expenses | $ | 407,884 | $ | 77,051 |

| Net Profit (Loss) | $ | (407,884) | $ | (77,051) |

COMMON SHARES: Since inception we have used common stock, notes payable, a convertible debenture and an advance from a related party to raise money for our optioned mineral acquisitions and corporate expenses. Net cash provided by financing activities in the current fiscal year ended May 31, 2011 was $375,500 of which $355,500 was provided by a convertible debenture and a $20,000 advance from a related party. Net cash provided by financing activities from inception on May 17, 2006, was $514,500 ($119,000 as proceeds received from sales of our common stock $355,000 through a convertible debenture plus a net borrowing of $40,000.

Revenue

We have not earned any revenues since our inception.

24

Expenses

Our operating expenses for the year ended May 31, 2011 and 2010 are outlined in the table below:

| Year Ended May 31 | |||

| 2011 | 2010 | ||

| Exploration of mining property – China | $ 0 | $ 20,000 | |

| Exploration of mining property – U.S.A. | 303,807 | 0 | |

| Banking and related charges | 753 | 337 | |

| Loss on currency exchange | (48) | (3) | |

| Interest expense – promissory note & advances | 1,000 | 868 | |

| Interest expense – convertible debenture | 10,301 | 0 | |

| Consulting | 4,500 | 15,000 | |

| Professional Fees | 36,065 | 13,952 | |

| Office Expenses | 8,457 | 8,334 | |

| Management Fees | 18,500 | 4,752 | |

| Registration and Filing Fees | 15,260 | 2,895 | |

| Transfer Agent | 3,229 | 5,975 | |