Attached files

| file | filename |

|---|---|

| 8-K - HELIX ENERGY SOLUTIONS GROUP FORM 8-K DATED 8-22-11 - HELIX ENERGY SOLUTIONS GROUP INC | form8k.htm |

| EX-99.1 - PRESS RELEASE DATED 8-22-11 - HELIX ENERGY SOLUTIONS GROUP INC | exb991.htm |

Company Update

August 2011

EXHIBIT 99.2

2

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, any projections of financial items; projections of contracting services activity; future

production volumes, results of exploration, exploitation, development, acquisition and operations expenditures, and

prospective reserve levels of properties or wells; projections of utilization; any statements of the plans, strategies and

objectives of management for future operations; any statements concerning developments; and any statements of

assumptions underlying any of the foregoing. These statements involve certain assumptions we made based on our

experience and perception of historical trends, current conditions, expected future developments and other factors

we believe are reasonable and appropriate under the circumstances. The forward-looking statements are subject to

a number of known and unknown risks, uncertainties and other factors that could cause our actual results to differ

materially. The risks, uncertainties and assumptions referred to above include the performance of contracts by

suppliers, customers and partners; actions by governmental and regulatory authorities; operating hazards and

delays; employee management issues; local, national and worldwide economic conditions; uncertainties inherent in

the exploration for and development of oil and gas and in estimating reserves; complexities of global political and

economic developments; geologic risks, volatility of oil and gas prices and other risks described from time to time in

our reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s most recently filed

Annual Report on Form 10-K and in the Company’s other filings with the SEC. Free copies of the reports can be

found at the SEC’s website, www.SEC.gov. You should not place undue reliance on these forward-looking

statements which speak only as of the date of this presentation and the associated press release. We assume no

obligation or duty and do not intend to update these forward-looking statements except as required by the securities

laws.

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, any projections of financial items; projections of contracting services activity; future

production volumes, results of exploration, exploitation, development, acquisition and operations expenditures, and

prospective reserve levels of properties or wells; projections of utilization; any statements of the plans, strategies and

objectives of management for future operations; any statements concerning developments; and any statements of

assumptions underlying any of the foregoing. These statements involve certain assumptions we made based on our

experience and perception of historical trends, current conditions, expected future developments and other factors

we believe are reasonable and appropriate under the circumstances. The forward-looking statements are subject to

a number of known and unknown risks, uncertainties and other factors that could cause our actual results to differ

materially. The risks, uncertainties and assumptions referred to above include the performance of contracts by

suppliers, customers and partners; actions by governmental and regulatory authorities; operating hazards and

delays; employee management issues; local, national and worldwide economic conditions; uncertainties inherent in

the exploration for and development of oil and gas and in estimating reserves; complexities of global political and

economic developments; geologic risks, volatility of oil and gas prices and other risks described from time to time in

our reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s most recently filed

Annual Report on Form 10-K and in the Company’s other filings with the SEC. Free copies of the reports can be

found at the SEC’s website, www.SEC.gov. You should not place undue reliance on these forward-looking

statements which speak only as of the date of this presentation and the associated press release. We assume no

obligation or duty and do not intend to update these forward-looking statements except as required by the securities

laws.

References to quantities of oil or gas include amounts we believe will ultimately be produced, and may include

“proved reserves” and quantities of oil or gas that are not yet classified as “proved reserves” under SEC definitions.

Statements of oil and gas reserves are estimates based on assumptions and may be imprecise. Investors are urged

to consider closely the disclosure regarding reserves in our most recently filed Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q.

“proved reserves” and quantities of oil or gas that are not yet classified as “proved reserves” under SEC definitions.

Statements of oil and gas reserves are estimates based on assumptions and may be imprecise. Investors are urged

to consider closely the disclosure regarding reserves in our most recently filed Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q.

EXHIBIT 99.2

Services for Each Stage of the Field Life Cycle

3

Drilling

Field Development

Production

Decommissioning

• Seabed Evaluation /

Coring

• Wellbore Drilling

• Wellhead Installation

• Pipeline, Flowline and

Umbilical Installation

• PLET / Manifold Fabrication

and Installation

• Jumper Installation

• Trenching and Burial

• ROV Services

• Coiled Tubing, Wireline,

Slickline, and Drillstring-

based Intervention

• Floating Production

Facilities

• Spill Containment

• Field Decommissioning

• Plug & Abandonment

• Wellhead and Tree Recovery

EXHIBIT 99.2

Offshore

Production Facilities

Helix Producer I

Helix Fast Response System

Marco Polo TLP (50%)

Independence Hub Semi (20%)

Deepwater

Contracting

Contracting

Pipelay

Intrepid

Express

Intrepid

Express

Caesar

Robotics

39 ROVs

2 ROV Drill Units

5 Trenchers (200 - 2000hp)*

39 ROVs

2 ROV Drill Units

5 Trenchers (200 - 2000hp)*

5 Chartered Vessels (variable)

Well Intervention

Q4000

Seawell

Well Enhancer

Normand Clough (JV)

Mobile VDS/SILs

Oil & Gas Production

GOM shelf and deepwater

PV-10 $1.3 billion @

12/31/2010

12/31/2010

Proved reserves = 376 bcfe

(12/31/2010)

(12/31/2010)

2011 projected production

50 bcfe

50 bcfe

Business Segments

4

* New 1200hp trencher currently under construction with 2012 expected delivery

EXHIBIT 99.2

Strategically Differentiated Fleet

• Helix Producer I is the only DP FPU in the Gulf of

Mexico

Mexico

• Q4000 is the world’s only category B

semisubmersible intervention vessel available to

the open market

semisubmersible intervention vessel available to

the open market

• Saturation diving deployed globally (Seawell, Well

Enhancer, Intrepid, Normand Clough)

Enhancer, Intrepid, Normand Clough)

• Well Enhancer is the North Sea’s only monohull

coiled tubing intervention vessel

coiled tubing intervention vessel

• iTrencher is the world’s largest deepwater

trenching system

trenching system

• The Helix Fast Response System stands ready to

respond to any Gulf of Mexico oil or gas spill

respond to any Gulf of Mexico oil or gas spill

5

Q4000 was one of several Helix ESG vessels whose

versatility and track record played critical roles in the

industry’s response to the BP Macondo oil spill in 2010.

versatility and track record played critical roles in the

industry’s response to the BP Macondo oil spill in 2010.

EXHIBIT 99.2

MODU DP3 Q4000

MSV DP3 Well Enhancer

MSV DP2 Normand Clough

MSV DP2 Seawell

Well Intervention Assets

6

Helix provides well operation and decommissioning services with the flagship Q4000

semisubmersible, the Seawell riserless well intervention vessel, the Well Enhancer coiled tubing /

wireline / slickline intervention vessel, and the Normand Clough (JV) with our Subsea Intervention

Lubricator and Vessel Deployment systems.

semisubmersible, the Seawell riserless well intervention vessel, the Well Enhancer coiled tubing /

wireline / slickline intervention vessel, and the Normand Clough (JV) with our Subsea Intervention

Lubricator and Vessel Deployment systems.

EXHIBIT 99.2

Production Facilities

7

Independence Hub Semi (20%)

• Location: Mississippi Canyon 920

• Depth: 8,000 ft.

• Production capacity:

• 1 BCFD

Marco Polo TLP (50%)

• Location: Green Canyon 608

• Depth: 4,300 ft.

• Production capacity:

• 120,000 BOPD

• 300 MMCFD

Helix Producer I FPU

• Location: Helix’s Phoenix field (GC 237)

• Production capacity:

• 45,000 BOPD

• 55,000 BLPD

• 72 MMCFD

EXHIBIT 99.2

The Helix ROV fleet consists of

40+ vehicles, covering the

spectrum of deepwater

construction services.

40+ vehicles, covering the

spectrum of deepwater

construction services.

The T-1200 jet trencher is

currently under construction (1H

2012 delivery) to support

offshore renewable energy

development projects.

currently under construction (1H

2012 delivery) to support

offshore renewable energy

development projects.

The state of the art I-Trencher

system trenches, lays pipe up to 16”

in diameter, and backfills in a single

operation.

system trenches, lays pipe up to 16”

in diameter, and backfills in a single

operation.

Robotics

8

Helix charters support vessels as needed, which allows us to adjust the size

and capability of our fleet to cost-effectively meet industry demands.

and capability of our fleet to cost-effectively meet industry demands.

EXHIBIT 99.2

DP Reel Lay Vessel

Express

Express

DP S-Lay Vessel

Caesar

Caesar

DP Reel Lay Vessel

Intrepid

Intrepid

Caesar’s onboard pipe welding and testing

capability allows the vessel to lay large diameter

pipe.

capability allows the vessel to lay large diameter

pipe.

Helix’s dual-reel pipelay and subsea construction

vessel has established an extensive track record

of field installation projects around the world.

vessel has established an extensive track record

of field installation projects around the world.

Intrepid has the flexibility to be deployed as a

pipelay, installation or saturation diving vessel.

pipelay, installation or saturation diving vessel.

Subsea Construction Vessels

9

EXHIBIT 99.2

10

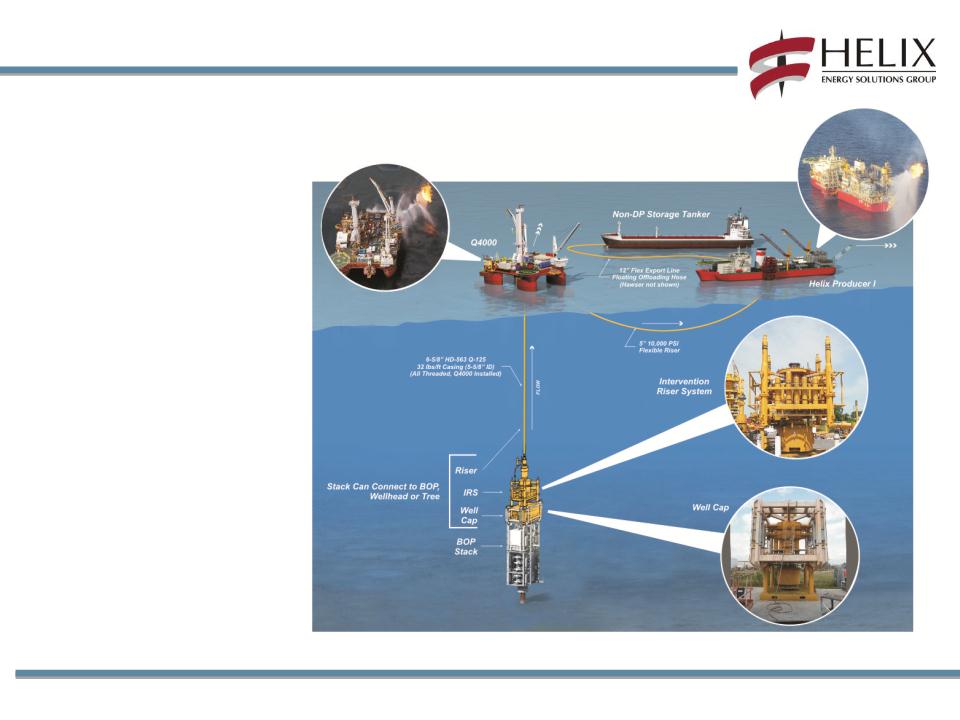

Helix Fast Response System (HFRS)

• Utilizes vessels and subsea

systems proven in Macondo

spill response

systems proven in Macondo

spill response

• Capability to capture and

process up to 55,000 bpd in

water depths to 10,000 feet at

15,000 psi

process up to 55,000 bpd in

water depths to 10,000 feet at

15,000 psi

• 24 independent E&P operators

have signed on to include HFRS

in drilling permit applications

have signed on to include HFRS

in drilling permit applications

• Cited as spill response plan in

at least 14 approved deepwater

permits as of August 22, 2011

at least 14 approved deepwater

permits as of August 22, 2011

EXHIBIT 99.2

Offshore Renewable Energy Support

11

• Generated non-oilfield revenues of $36.5 million on

power cable burial projects in 2010

power cable burial projects in 2010

• Provide trenching, cable burial and ROV support for

offshore wind farm development

offshore wind farm development

• Current focus on export lines (field to shore)

• Future opportunities in-field (inter-array cable

installation)

installation)

• Adding additional capacity to meet short- and long-

term growth opportunities

term growth opportunities

• New chartered vessel, Grand Canyon, under

construction with 2012 delivery

construction with 2012 delivery

• Building new trencher, T-1200, to be paired

with the Grand Canyon

with the Grand Canyon

EXHIBIT 99.2

Helix Oil and Gas

12

12/31/2010 Reserve Profile

• 376 Bcfe

• ≈ 55% Deepwater GOM

• ≈ 40% proved developed

• ≈ 40% Oil

• PV-10 $1.3 billion

Mid-August Average Production Profile

• ≈ 134 mmcfe/d*

• ≈ 70% of production is oil

• ≈ 65% of production is deepwater

• Phoenix ≈ 10,500 boe/d, net*

* August production rates impacted by 3rd party pipeline

disruption at the Phoenix field.

disruption at the Phoenix field.

EXHIBIT 99.2

13

Key Balance

Sheet Metrics

Sheet Metrics

EXHIBIT 99.2

14

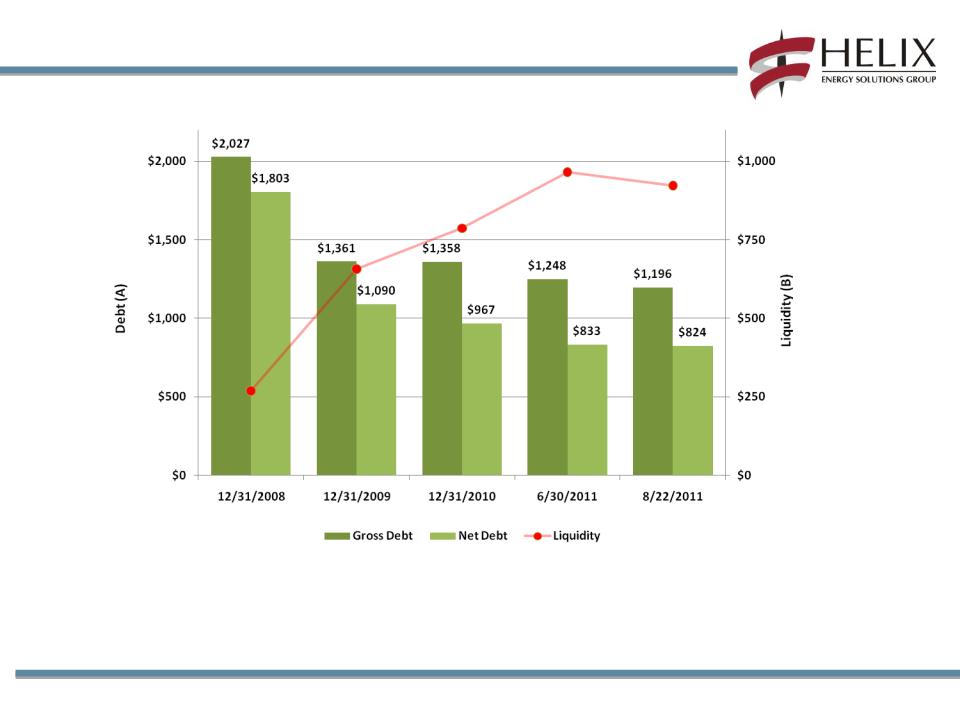

Debt and Liquidity Profile

Liquidity of approximately $923 million at 8/22/2011

(A) Includes impact of unamortized debt discount under our Convertible Senior Notes.

(B) Liquidity, as we define it, is equal to cash and cash equivalents ($372 million), plus available

capacity under our revolving credit facility ($551 million).

capacity under our revolving credit facility ($551 million).

($ amounts in millions)

EXHIBIT 99.2

Debt Profile

Credit Facilities, Commitments and Amortization

December 2012 (Potential Put by Holders, Actual Maturity December 2025):

•$300 Million Convertible Notes - Interest only until put by noteholders or called by Helix.

First put/call date is December 2012, although noteholders have the right to convert prior to

that date if certain stock price triggers are met ($38.56).

First put/call date is December 2012, although noteholders have the right to convert prior to

that date if certain stock price triggers are met ($38.56).

July 2015:

•$600 Million Revolving Credit Facility - UNDRAWN.

• Facility extended to July 2015 (or January 2016 if certain unsecured debt is

refinanced of paid in full by July 1, 2015).

refinanced of paid in full by July 1, 2015).

• $49 million of LCs in place.

July 2015:

•$299 Million Term Loan B

• Committed facility through July 2015 (or July 2016 if certain unsecured debt is

refinanced or repaid in full by July 1, 2015).

refinanced or repaid in full by July 1, 2015).

• $3.0 million principal payments annually.

15

EXHIBIT 99.2

Debt Profile (continued)

Credit Facilities, Commitments and Amortization

January 2016:

•$500 Million High Yield Notes ($550 million at June 30, 2011)

• Interest only until maturity (January 2016) or called by Helix. First Helix call

date is January 2012 (first call price of 104.75).

date is January 2012 (first call price of 104.75).

• Helix has repurchased $50 million in Q3 at an average price of 103.54 ahead of

first call date as permitted in the credit facility.

first call date as permitted in the credit facility.

February 2027:

•$110 Million MARAD - Original 25 year term; matures February 2027. $4.8 million principal

payments annually.

payments annually.

16

EXHIBIT 99.2

17

2011 Outlook

EXHIBIT 99.2

18

2011 Outlook

We expect to continue to improve our liquidity position in 2011.

|

Broad Metrics

|

2011 Forecast

(revised)

|

2011 Forecast

(original)

|

2010 Actual

|

|

Oil and Gas

Production |

50 Bcfe

|

49 Bcfe

|

47 Bcfe

|

|

EBITDAX

|

$575+ million

|

$475 million

|

$430 million

|

|

CAPEX

|

$275 million

|

$225 million

|

$179 million

|

|

Commodity Price

Deck |

2011 Forecast

(revised)

|

2011 Forecast

(original)

|

2010 Actual

|

|

|

Hedged

|

Oil

|

$92.79 / bbl

|

$87.11 / bbl

|

$75.27 / bbl

|

|

Gas

|

$5.46/ mcf

|

$4.80/ mcf

|

$6.01 / mcf

|

|

EXHIBIT 99.2

19

2011 Outlook

• Contracting Services

o Strong backlog for the Q4000, Well Enhancer and Seawell in 2011

o Continued robotics utilization recovery in second half of 2011, driven primarily by activity outside the GOM

o Backlog for Express and Intrepid improved, although some backlog subject to customer permitting

o Express scheduled to work in the North Sea in the second half of 2012

o Well Enhancer to work in West Africa this winter

o Continued focus on trenching and cable burial business with non-oilfield projects growing

• Production Facilities

o Production Facilities business consists of:

§ HP I

§ Investments in Marco Polo TLP and Independence Hub platform

§ HFRS and related retainer fee

o Provides relatively stable level of EBITDA

§ 2011 forecast of approximately $69 million

o Forecasted 2011 overall production of 50 Bcfe

§ 66% oil and 63% deepwater

§ Assumes no significant storm disruptions

EXHIBIT 99.2

20

2011 Outlook

• Capital Expenditures

o Contracting Services ($115 million)

§ No major vessel projects planned for 2011

§ Caesar thruster upgrade continues through Q3

§ Incremental investment in robotics business

o Oil and Gas ($160 million)

§ Focus capital investment on oil development with relatively fast payback

§ Two major planned well projects in the 2nd half of the year

§ Kathleen (development drill)

§ Nancy (completion)

§ Shelf platform construction and opportunistic workovers

EXHIBIT 99.2

21

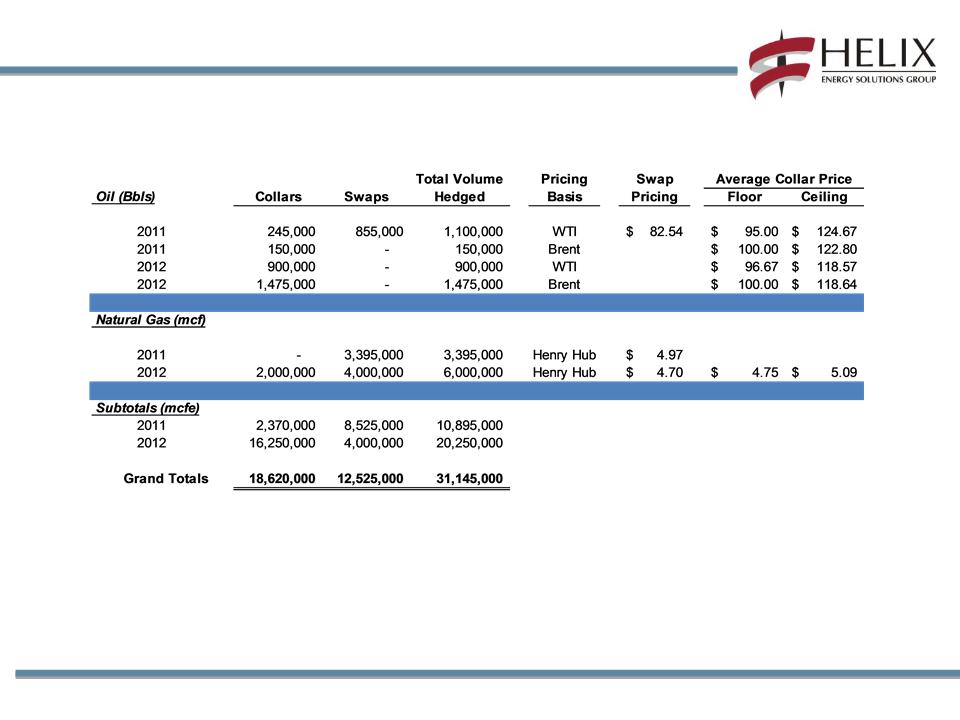

Summary of Aug 2011 - Dec 2012 Hedging Positions *

* As of August 22, 2011.

EXHIBIT 99.2

22

EXHIBIT 99.2