Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT - WESTERGAARD COM INC | f10q0611ex31i_westergaard.htm |

| EX-32.1 - CERTIFICATION PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT - WESTERGAARD COM INC | f10q0611ex32i_westergaard.htm |

| EX-31.2 - CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT - WESTERGAARD COM INC | f10q0611ex31ii_westergaard.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2011

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 000-29761

WESTERGAARD.COM, INC.

(Name of Registrant as specified in its charter)

| DELAWARE | 52-2002729 | |

| State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification No.) |

Chendai Andou Industry Park, Jinjiang,

Quanzhou, Fujian, China 362211

(Address of principal executive offices)

86-13808527788

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

(Do not check if smaller reporting company)

|

þ

|

Smaller reporting company

|

o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No þ

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. 34,431,262 shares of common stock are issued and outstanding as of August 15, 2011.

WESTERGAARD.COM, INC. AND SUBSIDIARIES

FORM 10-Q

June 30, 2011

TABLE OF CONTENTS

|

Page No.

|

||

|

PART I. - FINANCIAL INFORMATION

|

||

|

Item 1.

|

Financial Statements

|

|

|

Consolidated Balance Sheets as of June 30, 2011 (Unaudited) and December 31, 2010

|

3

|

|

|

Consolidated Statements of Income and Comprehensive Income for the Three and Six Months Ended June 30, 2011 and 2010 (Unaudited)

|

4

|

|

|

Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2011 and 2010 (Unaudited)

|

5

|

|

| Notes to Unaudited Consolidated Financial Statements |

6

|

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

27

|

|

Item 3

|

Quantitative and Qualitative Disclosures About Market Risk.

|

38

|

|

Item 4

|

Controls and Procedures.

|

39

|

|

PART II - OTHER INFORMATION

|

||

|

Item 6.

|

Exhibits.

|

40

|

FORWARD LOOKING STATEMENTS

This report contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this report. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 8-K filed on February 11, 2011, as amended, in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-Q and in other reports that we file with the SEC. You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this quarterly report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

2

PART 1 - FINANCIAL INFORMATION

Item 1. Financial Statements.

WESTERGAARD.COM, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

June 30,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

(Unaudited)

|

||||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$ | 38,508,638 | $ | 15,544,035 | ||||

|

Restricted cash

|

606,300 | - | ||||||

|

Accounts receivable

|

15,653,354 | 17,727,064 | ||||||

|

Advance to suppliers

|

- | 2,260,517 | ||||||

|

Prepaid expenses

|

42,543 | 18,906 | ||||||

|

Inventories

|

4,080,247 | 5,206,012 | ||||||

|

Total Current Assets

|

58,891,082 | 40,756,534 | ||||||

|

Property and equipment, net

|

1,370,857 | 951,816 | ||||||

|

Land use rights, net

|

237,100 | 234,765 | ||||||

|

TOTAL ASSETS

|

$ | 60,499,039 | $ | 41,943,115 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Short-term bank loans

|

$ | 3,635,520 | $ | 3,289,573 | ||||

|

Note payable

|

202,661 | - | ||||||

|

Accounts payable

|

6,588,234 | 2,724,057 | ||||||

|

Other payable and accrued liabilities

|

390,391 | 495,697 | ||||||

|

Due to related parties

|

381,797 | 514 | ||||||

|

Income taxes payable

|

1,887,305 | 693,031 | ||||||

|

Other taxes payable

|

826,694 | 593,046 | ||||||

|

|

||||||||

|

Total Current Liabilities

|

13,912,602 | 7,795,918 | ||||||

|

LONG-TERM LIABILITIES:

|

||||||||

|

Convertible debt, net

|

108,589 | 324,367 | ||||||

|

Total Liabilities

|

14,021,191 | 8,120,285 | ||||||

|

Commitments and contingencies

|

||||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Series B convertible preferred stock ($0.001 par value; 4,000,000 authorized, 866,666

|

||||||||

|

and no shares issued and outstanding at June 30, 2011 and December 31, 2010, respectively,

|

||||||||

|

liquidation preference $1,300,000 at June 30, 2011)

|

867 | - | ||||||

|

Common stock ($0.001 par value; 100,000,000 shares authorized; 34,431,262 and

|

||||||||

|

33,949,212 share issued and outstanding at June 30, 2011 and December 31, 2010, respectively)

|

34,431 | 33,949 | ||||||

|

Additional paid-in capital

|

3,489,804 | 1,677,175 | ||||||

|

Subscription receivable

|

(35,000 | ) | (35,000 | ) | ||||

|

Retained earnings

|

39,474,903 | 29,555,834 | ||||||

|

Statutory reserve

|

837,048 | 837,048 | ||||||

|

Accumulated other comprehensive income

|

2,675,795 | 1,753,824 | ||||||

|

Total Shareholders' Equity

|

46,477,848 | 33,822,830 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 60,499,039 | $ | 41,943,115 | ||||

See notes to the unaudited consolidated financial statements

3

WESTERGAARD.COM, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

|

For the Three Months Ended June 30,

|

For the Six Months Ended June 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

NET SALES

|

$ | 27,779,852 | $ | 19,892,644 | $ | 52,195,438 | $ | 37,545,091 | ||||||||

|

COST OF SALES

|

19,191,669 | 14,192,420 | 35,759,083 | 26,886,869 | ||||||||||||

|

GROSS PROFIT

|

8,588,183 | 5,700,224 | 16,436,355 | 10,658,222 | ||||||||||||

|

OPERATING EXPENSES:

|

||||||||||||||||

|

Selling expenses

|

761,177 | 640,825 | 1,477,078 | 1,286,267 | ||||||||||||

|

Research and development expenses

|

65,642 | 45,421 | 129,134 | 102,865 | ||||||||||||

|

Professional fees

|

60,862 | 62,263 | 373,249 | 62,263 | ||||||||||||

|

General and administrative expenses

|

360,646 | 238,059 | 628,136 | 468,332 | ||||||||||||

|

Total Operating Expenses

|

1,248,327 | 986,568 | 2,607,597 | 1,919,727 | ||||||||||||

|

INCOME FROM OPERATIONS

|

7,339,856 | 4,713,656 | 13,828,758 | 8,738,495 | ||||||||||||

|

OTHER INCOME (EXPENSE):

|

||||||||||||||||

|

Interest income

|

38,572 | 13,098 | 56,447 | 23,961 | ||||||||||||

|

Debt issuance costs

|

- | (15,000 | ) | - | (15,000 | ) | ||||||||||

|

Interest expense

|

(95,302 | ) | (27,613 | ) | (166,872 | ) | (72,458 | ) | ||||||||

|

Total Other Expense

|

(56,730 | ) | (29,515 | ) | (110,425 | ) | (63,497 | ) | ||||||||

|

INCOME BEFORE INCOME TAXES

|

7,283,126 | 4,684,141 | 13,718,333 | 8,674,998 | ||||||||||||

|

INCOME TAXES

|

1,853,110 | 1,184,849 | 3,540,930 | 2,185,636 | ||||||||||||

|

NET INCOME

|

5,430,016 | 3,499,292 | 10,177,403 | 6,489,362 | ||||||||||||

|

DEEMED SERIES B CONVERTIBLE PREFERRED STOCK DIVIDEND

|

(258,334 | ) | - | (258,334 | ) | - | ||||||||||

|

NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

|

$ | 5,171,682 | $ | 3,499,292 | $ | 9,919,069 | $ | 6,489,362 | ||||||||

|

COMPREHENSIVE INCOME:

|

||||||||||||||||

|

NET INCOME

|

$ | 5,430,016 | $ | 3,499,292 | $ | 10,177,403 | $ | 6,489,362 | ||||||||

|

OTHER COMPREHENSIVE INCOME:

|

||||||||||||||||

|

Foreign currency translation adjustment

|

690,493 | 97,468 | 921,971 | 100,313 | ||||||||||||

|

COMPREHENSIVE INCOME

|

$ | 6,120,509 | $ | 3,596,760 | $ | 11,099,374 | $ | 6,589,675 | ||||||||

|

NET INCOME PER COMMON SHARE:

|

||||||||||||||||

|

Basic

|

$ | 0.15 | $ | 0.10 | $ | 0.29 | $ | 0.19 | ||||||||

|

Diluted

|

$ | 0.15 | $ | 0.10 | $ | 0.28 | $ | 0.19 | ||||||||

|

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING:

|

||||||||||||||||

|

Basic

|

34,431,262 | 33,949,212 | 34,319,405 | 33,949,212 | ||||||||||||

|

Diluted

|

35,666,338 | 34,138,212 | 35,149,674 | 34,043,712 | ||||||||||||

See notes to the unaudited consolidated financial statements

4

WESTERGAARD.COM, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

For the Six Months Ended June 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net income

|

$ | 10,177,403 | $ | 6,489,362 | ||||

|

Adjustments to reconcile net income from operations to net cash

|

||||||||

|

provided by operating activities:

|

||||||||

|

Depreciation

|

77,078 | 74,970 | ||||||

|

Amortization of land use rights

|

2,994 | 2,869 | ||||||

|

Amortization of debt discount

|

65,867 | 8,544 | ||||||

|

Stock-based compensation

|

46,500 | - | ||||||

|

Changes in assets and liabilities:

|

||||||||

|

Restricted cash

|

(606,300 | ) | (272,710 | ) | ||||

|

Accounts receivable

|

2,447,172 | (5,362,735 | ) | |||||

|

Advance to suppliers

|

2,282,480 | - | ||||||

|

Prepaid expenses

|

(22,907 | ) | (21,947 | ) | ||||

|

Inventories

|

1,228,797 | (1,046,200 | ) | |||||

|

Note payable

|

202,661 | - | ||||||

|

Accounts payable

|

3,753,022 | 1,741,309 | ||||||

|

Other payable and accrued liabilities

|

(114,604 | ) | 1,332,730 | |||||

|

Income taxes payable

|

1,163,279 | 17,690 | ||||||

|

Other taxes payable

|

217,258 | 137,655 | ||||||

|

NET CASH PROVIDED BY OPERATING ACTIVITIES

|

20,920,700 | 3,101,537 | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Purchase of property and equipment

|

(469,248 | ) | (31,244 | ) | ||||

|

NET CASH USED IN INVESTING ACTIVITIES

|

(469,248 | ) | (31,244 | ) | ||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Proceeds from bank loans

|

1,298,071 | 724,240 | ||||||

|

Repayment of bank loans

|

(1,030,821 | ) | - | |||||

|

Proceeds from convertible debt

|

- | 350,000 | ||||||

|

Net proceeds from sale of Series B convertible preferred stock

|

1,227,499 | - | ||||||

|

Proceeds from related party

|

376,570 | - | ||||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

1,871,319 | 1,074,240 | ||||||

|

EFFECT OF FOREIGN CURRENCY FLUCTUATIONS ON

|

||||||||

|

CASH AND CASH EQUIVALENTS

|

641,832 | 69,640 | ||||||

|

NET INCREASE IN CASH AND CASH EQUIVALENTS

|

22,964,603 | 4,214,173 | ||||||

|

CASH AND CASH EQUILAVENTS - BEGINNING OF YEAR

|

15,544,035 | 12,789,430 | ||||||

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

$ | 38,508,638 | $ | 17,003,603 | ||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

|

||||||||

|

Cash paid for:

|

||||||||

|

Interest

|

$ | 101,005 | $ | 63,914 | ||||

|

Income taxes

|

$ | 2,377,652 | $ | 2,037,667 | ||||

|

NON-CASH INVESTING AND FINANCING ACTIVITIES:

|

||||||||

|

Deemed series B convertible preferred stock dividend

|

$ | 258,334 | $ | - | ||||

See notes to the unaudited consolidated financial statements

5

WESTERGAARD.COM, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2011

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Westergaard.com, Inc. (the “Company” or Westergaard”) was incorporated under the laws of the State of Delaware on August 15, 1996, as "Westergaard Online Systems, Inc." On February 18, 1999, the Company’s corporate name was changed to Westergaard.com, Inc.

On February 9, 2011, prior to the Exchange Agreement, the directors of the Company authorized a 100 for 1 reverse stock split with the record date effective as of February 9, 2011 and FINRA declared the reverse split effective on February 11, 2011. The reverse split was effective immediately prior to the closing of a Share Exchange Agreement (“Exchange Agreement”) and did not have the effect of reducing any of the shares issued in connection with the Exchange Agreement. The reverse split did, however, reduce the 48,200,927 shares outstanding immediately prior to the closing of the Exchange Agreement to 482,050 shares.

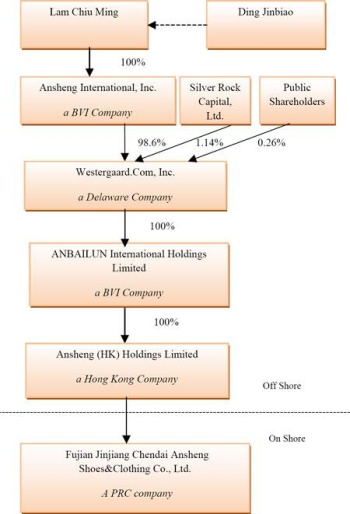

On February 11, 2011, the Company entered into the Exchange Agreement by and among (i) the Company, (ii) the principal stockholders of Westergaard, (iii) Anbailun International Holdings Limited (“Anbailun”), a holding company formed under the laws of the British Virgin Islands on April 12, 2010, and (iv) Ansheng International, Inc., Anbailun’s sole shareholder. Pursuant to the terms of the Exchange Agreement, the Company issued 33,949,212 shares of its common stock, par value US$0.001 per share (the “Common Stock”) representing approximately 98.6 % of the fully diluted outstanding shares of the Company (the “Share Exchange”) for all of the outstanding shares of Anbailun. As a result of the Share Exchange, Anbailun became a wholly-owned subsidiary of the Company.

Concurrent with the Share Exchange, Mr. Jinbiao Ding (“Mr. Ding”) was appointed the Chief Executive Officer of the Company and Mr. Lam, Director of Ansheng (HK) Holdings Limited, and Mr. Ding entered into a Share Transfer Agreement (the “Share Transfer Agreement”) dated February 11, 2011 and fully discussed below, pursuant to which Mr. Lam granted to Mr. Ding the option to purchase all of the 30,000 outstanding ordinary shares (the “Option Shares”) of Ansheng International, Inc. held by Mr. Lam at the nominal price of $30,000 or US$1.00 per share.

Anbailun is a holding company formed under the laws of the British Virgin Islands on April 12, 2010. Anbailun is the sole shareholder and incorporator of Ansheng (HK) Holdings Limited (“Ansheng (HK)”). Ansheng (HK) was incorporated under the laws of Hong Kong on June 18, 2010.

Pursuant to a restructuring plan intended to ensure compliance with the PRC rules and regulations (the “Restructuring”) and in order to effectuate a merger with a shell company, on September 15, 2010, Anbailun, through its directly wholly-owned subsidiary Ansheng (HK), signed an agreement to acquire 100% equity interests in Fujian Jinjiang Chendai Ansheng Shoes & Clothing Co., Ltd. (“Fujian Ansheng”), a limited liability company incorporated under the laws of the People’s Republic of China (the “PRC”) on July 25, 1995 and 100% owned and controlled by Mr. Ding for a cash payment to Mr. Ding of RMB 12,580,000 or approximately US$1,900,000, which was paid to Mr. Ding in February 2011 and represents the amount of original registered capital of Fujian Ansheng contributed by Mr. Ding. Also as part of the Restructuring, in February 2011, Ansheng (HK)’s capital was established by way of contributions from Mr. Ding of RMB 12,580,000, which aggregate amount equaled the total transfer price Mr. Ding was entitled to receive pursuant to the Restructuring and which he was paid by Ansheng (HK) for the transfer of his equity interests in Fujian Ansheng.

The acquisition of Ansheng Fujian by Ansheng (HK) was specifically intended to ensure compliance with the PRC M&A rules and regulations and to structure these entities to complete a recapitalization and reverse merger with a public shell. The Company anticipates that pursuant to the Share Transfer Agreement entered into by and between Mr. Lam and Mr. Ding, the ordinary shares of Ansheng International, Inc. will be transferred from Mr. Lam to Mr. Ding. As a result, Mr. Ding has continued to bear the residual risks of the combined entity.

6

The Fujian Ansheng Share Transfer Agreement was approved by the Fujian Provincial Government on December 1, 2010 and such acquisition took effect when Ansheng (HK) was registered as the sole shareholder of Fujian Ansheng with the Fujian Branch Office of the State Administration for Industry and Commerce on December 13, 2010. Although the Fujian Ansheng Share Transfer Agreement took effect on December 13, 2010, the necessary consideration of RMB 12,580,000 or approximately US$1,900,000 was not paid until February 2011. Accordingly, at December 13, 2010, we recorded a contribution receivable of approximately $1,900,000 from Mr. Ding which was offset by the distribution payable to Mr. Ding. Since it was the intent of all parties to complete a reverse merger with a public shell, the consideration was not paid until such a transaction occurred in February 2011, and Mr. Ding and Mr. Lam entered into the Share Transfer Agreement as described above.

Pursuant to ASC 805-10 and 805-40, the Share Exchange has been accounted for as a recapitalization, whereby the Company is deemed to be the accounting acquiree (legal acquirer) and Anbailun is the accounting acquirer (legal acquiree). The financial statements before the date of the Share Exchange are those of Anbailun with the results of the Company being consolidated from the date of the Share Exchange. The equity section and earnings per share has been retroactively restated to reflect the reverse acquisition and no goodwill was recorded.

On July 25, 1995, Fujian Ansheng was incorporated with registered capital of US$274,689 contributed by three owners Mr. Jinbiao Ding (50%), Mr. Choumou Ding (25%) and Ms. Jinfang Ding (25%). The registered capital was increased to US$636,715 by the three owners proportionately on December 20, 2001. In September 2007, Mr. Choumou Ding and Ms. Jinfang Ding transferred their ownership to Mr. Jinbiao Ding, and Mr. Jinbiao Ding contributed additional US$971,054 to Fujian Ansheng which increased its registered capital to US$1,607,769. Until Ansheng (HK)’s acquisition of Fujian Ansheng effective December 13, 2010, Fujian Ansheng was 100% owned by Mr. Ding.

As of June 30, 2011, details of the subsidiaries of the Company are as follows:

|

Subsidiaries’ names

|

Domicile date of incorporation

|

Paid -in capital

|

Effective ownership

|

Principal activities

|

||||

|

Anbailun

|

British Virgin

|

USD$35,000

|

100%

|

Holding company of

|

||||

|

Islands

|

Ansheng (HK)

|

|||||||

|

April 12, 2010

|

||||||||

|

Ansheng (HK)

|

Hong Kong

|

HK$10,000

|

100%

|

Holding company of

|

||||

|

|

June 18, 2010

|

Fujian Ansheng

|

||||||

|

Fujian Ansheng

|

People’s Republic of

|

RMB12,580,000

|

100%

|

Sports footwear

|

||||

|

China (“PRC”)

July 25, 1995

|

designer and

|

|||||||

|

manufacturer in China's domestic market in and rural areas.

|

7

The table below sets forth the proportion of equity interests in all entities and individuals involved before and after the Restructuring based on subscribed registered capital:

|

Ansheng International, Inc.

|

ANBAILUM

|

Ansheng (HK)

|

Fujian Ansheng

|

|||||||||||||||||||||||||||||

|

Before

|

After

|

Before

|

After

|

Before

|

After

|

Before

|

After

|

|||||||||||||||||||||||||

|

%

|

%

|

%

|

%

|

%

|

%

|

%

|

%

|

|||||||||||||||||||||||||

|

Shareholder

|

||||||||||||||||||||||||||||||||

|

Mr. Lam Chiu Ming ("Mr. Lam")

|

100 | 100 | * | — | — | — | — | — | — | |||||||||||||||||||||||

|

Ansheng International, Inc.

|

— | — | 100 | 100 | — | — | — | — | ||||||||||||||||||||||||

|

ANBAILUN

|

— | — | — | — | 100 | 100 | — | — | ||||||||||||||||||||||||

|

Ansheng (HK)

|

— | — | — | — | — | — | — | 100 | ||||||||||||||||||||||||

|

Mr. Ding

|

— | — | — | — | — | — | 100 | — | ||||||||||||||||||||||||

| 100 | 100 | 100 | 100 | 100 | 100 | 100 | — | |||||||||||||||||||||||||

* As part of the Restructuring, Mr. Lam and Mr. Ding entered into a Share Transfer Agreement (the “Share Transfer Agreement”) dated February 11, 2011, pursuant to which Mr. Lam granted to Mr. Ding the option to purchase all of the 30,000 ordinary shares (the “Option Shares”) of Ansheng International, Inc. held by Mr. Lam at the nominal price of US$1.00 per share. The option shares vest and become exercisable upon Fujian Ansheng attaining consolidated net income performance targets for fiscal 2011 of at least 120% of the audited consolidated net income of the year ended December 31, 2010 or alternatively if the performance target has not been met, by the payment of the alternative exercise price of US$30,000. Accordingly, upon exercise of such option, Mr. Ding will directly own and control 33,949,212 shares, or 98.6%, of the Company’s Common Stock.

As part of the Restructuring, Mr. Lam, a resident of Hong Kong and the sole shareholder of Ansheng International, Inc. agreed that without the prior written consent of Mr. Ding, Mr. Lam shall not vote his shares in the Company such that the Company shall (i) issue or create any new shares, equity, registered capital, ownership interest, or equity linked securities, or any options or warrants that are directly convertible into, or exercisable or exchangeable for, shares, equity, registered capital, ownership interest, or equity-linked securities of the Company, or other similar equivalent arrangements, (ii) alter the shareholding structure of the Company, (iii) cancel or otherwise alter the Option Shares, (iv) amend the register of members or the memorandum and articles of association of the Company, (v) liquidate or wind up the Company, or (vi) act or omit to act in such a way that would be detrimental to the interest of Mr. Ding in the Option Shares. Additionally, Mr. Lam agreed that no further directors would be appointed to the board of either Ansheng International, Inc., Anbailun, Ansheng (HK), or Fujian Ansheng without the prior written consent of Mr. Ding. Mr. Ding is able to control and manage the operational, investment and business decisions of these companies, including the ability to control decisions regarding any change in these companies’ capital structure or payment of dividends. Further, Mr. Ding has the ultimate authority to determine the composition of the board of directors for these companies.

The purpose of the Share Transfer Agreement is to enable Mr. Ding to re-acquire the ultimate legal ownership of Fujian Ansheng in compliance with PRC rules and regulations. The arrangement for Mr. Ding to control the holding companies and Fujian Ansheng as well as the Share Transfer Agreement are each an inseparable and indispensable part of the Restructuring which enables Mr. Ding to continue to have residual rewards of the combined entity.

Mr. Ding has retained a financial controlling interest in the combined entity through the above-discussed residual risks and rewards. Furthermore, during and after the Restructuring, there has been no change to Anbailun’s principal managers and Mr. Ding continues to act as the principal managing officer and employee of Anbailun and Fujian Ansheng has remained under common operating, management and financial control. As a result, the Restructuring has been accounted for as a combination of entities under common control and recapitalization of Fujian with no adjustment to the historical basis of the assets and liabilities of Fujian Ansheng, and the operations were consolidated as if the Restructuring occurred as of the beginning of the first accounting period presented in these consolidated financial statements.

8

The Company, through its operating subsidiary, Fujian Ansheng which is located in Fujian, China, is a sports footwear designer and manufacturer in China’s domestic market in Tier 3 cities and towns and rural areas. The Company’s products include skateboard shoes, sneakers, jogging shoes, basketball shoes, tennis shoes, boots, classic shoes and cotton-padded shoes. The Company’s operations include: (1) research and development of sports footwear with original design under its own brand names; (2) manufacturing of sports footwear; (3) manufacturing technologies that support the realization of its designs as well as ensure the quality of shoe products, and (4) a distribution network that covers several small cities and towns in northern and northeastern China.

Basis of presentation

The consolidated interim financial statements include the financial statements of the Company and its subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation.

The consolidated interim financial information as of June 30, 2011 and for the six months ended June 30, 2011 and 2010 have been prepared without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). These consolidated financial statements should be read in conjunction with the summary of significant accounting policies and notes to consolidated financial statements included in the Company’s Form 8-K/A that we filed on April 26, 2011.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s consolidated financial position as of June 30, 2011, its consolidated results of operations and cash flows for the three and six months ended June 30, 2011 and 2010, as applicable, have been made. The interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

Use of estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses, and the related disclosures at the date of the consolidated financial statements and during the reporting period. Actual results could differ from these estimates. Significant estimates include the allowance for doubtful accounts, the allowance for obsolete inventory, the useful life of property and equipment and intangible assets, assumptions used in assessing impairment of long-term assets, and the fair value of embedded beneficial conversion features and warrants.

Cash and cash equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions with maturities of three months or less when purchased. The Company maintains cash and cash equivalents with various financial institutions in the PRC and the balances in banks in the PRC are uninsured.

Fair value of financial instruments

The Company adopted the guidance of Accounting Standards Codification (“ASC”) 820 for fair value measurements which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

|

●

|

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

|

|

●

|

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

|

|

●

|

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

|

9

The carrying amounts reported in the balance sheets for cash, accounts receivable, advances to suppliers, loans payable, accounts payable and accrued expenses, and amounts due to related parties approximate their fair market value based on the short-term maturity of these instruments. The Company did not have any non-financial assets or liabilities that are measured at fair value on a recurring basis as of June 30, 2011 and December 31, 2010.

ASC 825-10 “Financial Instruments”, allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. The Company did not elect to apply the fair value option to any outstanding instruments.

Concentrations of credit risk

The Company’s operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC's economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and trade accounts receivable. Substantially all of the Company’s cash is maintained with state-owned banks within the PRC, and no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts. A significant portion of the Company’s sales are credit sales which are primarily to customers who have the ability to pay; however, concentrations of credit risk with respect to trade accounts receivables is limited due to generally short payment terms. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk.

Accounts receivable

Accounts receivable are presented net of an allowance for doubtful accounts. The Company maintains allowances for doubtful accounts for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, a customer’s historical payment history, its current credit-worthiness and current economic trends. Accounts are written off after exhaustive efforts at collection. The Company recognized the probability of the collection for each customer and believes the amount of the balance as of June 30, 2011 and December 31, 2010 could be collected and accordingly, the Company did not record any allowance for doubtful accounts.

Advance to suppliers

Advance to suppliers represent partial payments or deposits for future inventory purchases. These advances to suppliers are non-interest bearing and unsecured. From time to time, vendors require a certain amount of monies to be deposited with them as a guarantee that the Company will receive their purchases on a timely basis and to secure inventory pricing. As of June 30, 2011 and December 31, 2010, the Company’s advances to suppliers amounted to US$0 and US$2,260,517, respectively.

Inventories

Inventories, consisting of raw materials, work in process and finished goods related to the Company’s products are stated at the lower of cost or market utilizing the weighted average method. An allowance is established when management determines that certain inventories may not be saleable. If inventory costs exceed expected market value due to obsolescence or quantities in excess of expected demand, the Company will record reserves for the difference between the cost and the market value. These reserves are recorded based on estimates. At June 30, 2011 and December 31, 2010, the Company did not record any inventory reserve.

10

Property and equipment

Property and equipment are carried at cost and are depreciated on a straight-line basis (after taking into account their respective estimated residual value) over the estimated useful lives of the assets. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation are removed from the accounts, and any resulting gains or losses are included in income in the year of disposition. The Company examines the possibility of decreases in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

The estimated useful lives are as follows:

|

Years

|

Residual Value

|

|||||||

|

Building

|

20 | 5 | % | |||||

|

Plant and machinery

|

10 | 5 | % | |||||

|

Furniture, fixtures and electronic equipment

|

5 | 5 | % | |||||

Land use rights

All land in the PRC is owned by the PRC government and cannot be sold to any individual or company. The Company has recorded the amounts paid to the PRC government to acquire long-term interests to utilize land underlying the Company’s facilities as land use rights. This type of arrangement is common for the use of land in the PRC. Land use rights are amortized on the straight-line method over the terms of the land use rights, which is 50 years.

Impairment of long-lived assets

In accordance with ASC Topic 360, the Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable, or at least annually. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated fair value and its book value. The Company did not record any impairment charges for the six months ended June 30, 2011 and 2010.

Revenue recognition

Pursuant to the guidance of ASC Topic 605 and ASC Topic 360, the Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the purchase price is fixed or determinable and collectability is reasonably assured.

The Company organizes and attends two product trading fairs each year in May and October. The product trading fairs are attended by more than 100 existing and potential distributors and the Company receives a majority of its product orders from its independent distributors at these trade fairs, with certain amounts of follow-up orders thereafter. Revenue is recognized when products are delivered to its distributors and generally payment is due 60 days from the date of delivery. The Company's sales consist of the invoiced value of goods, net of a value-added tax (VAT).

Provisions for estimated returns and allowances, rebates to customers, and any other adjustments are provided for in the same period the related sales are recorded. Generally, the Company will record a reduction to gross sales based on estimated customer returns and allowances and rebates. These reductions are influenced by historical rates of customer returns and allowances and rebates as well as the specific identification of certain returns and allowances and rebates.

The actual amount of sales returns and allowances realized may differ from our estimates. If we determine that sales returns or allowances should be either increased or decreased, then the adjustment would be made to net sales in the period in which such a determination is made. No product returns allowance is made as products delivered and accepted by customers are normally not returned. Generally, pursuant to the Company’s sales agreements, the customer has seven days to return any damaged product. For the six months ended June 30, 2011 and 2010, the Company did not record any sales return or allowances.

11

The Company offers its customers a sales rebate if the respective customer’s sales of the Company’s products exceed certain levels. If the respective customers sales of product exceed specified sales levels, within one year, the Company shall award the customer between approximately 3% or 4% of the respective customer’s total yearly sales in cash or by writing-down the same amount from the accounts receivable at the end of the period. For the six months ended June 30, 2011 and 2010, sales rebates were netted against gross sales and amounted to US$1,557,685 or 3.0% of gross sales and US$1,492,374 or 3.8% of gross sales, respectively. For the three months ended June 30, 2011 and 2010, sales rebates were netted against gross sales and amounted to US$783,715 or 2.8% of gross sales and US$746,327 or 3.8% of gross sales, respectively.

Income taxes

The Company is governed by the Income Tax Law of the People’s Republic of China, Hong Kong and the British Virgin Islands. The Company accounts for income tax using the liability method prescribed by ASC 740, “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the year in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

The Company applied the provisions of ASC 740-10-50, “Accounting for Uncertainty in Income Taxes”, which provides clarification related to the process associated with accounting for uncertain tax positions recognized in our financial statements. Audit periods remain open for review until the statute of limitations has passed. The completion of review or the expiration of the statute of limitations for a given audit period could result in an adjustment to the Company’s liability for income taxes. Any such adjustment could be material to the Company’s results of operations for any given quarterly or annual period based, in part, upon the results of operations for the given period. As of June 30, 2011 and December 31, 2010, the Company had no uncertain tax positions, and will continue to evaluate for uncertain positions in the future.

Value added tax

The Company is subject to value added tax (“VAT”) for manufacturing products. The applicable VAT rate is 17% for products sold in the PRC. The amount of VAT liability is determined by applying the applicable tax rate to the amount of goods sold (output VAT) less VAT accrued on purchases made with the relevant supporting invoices (input VAT).

Employee benefits

The Company’s operations and employees are all located in the PRC. The Company makes mandatory contributions to the PRC government’s health, retirement benefit and unemployment funds in accordance with the relevant Chinese social security laws. The costs of these payments are charged to income in the same period as the related salary costs and are not material.

Advertising

Advertising is expensed as incurred and is included in selling expenses on the accompanying consolidated statements of income. Advertising expenses amounted to US$1,374,428 and US$1,229,152 for the six months ended June 30, 2011 and 2010, respectively. Advertising expenses amounted to US$691,513 and US$614,622 for the three months ended June 30, 2011 and 2010, respectively.

Research and development

Research and development costs are expensed as incurred. These costs primarily consist of cost of materials used and salaries paid for the development of the Company’s products, and depreciation amount from machinery used. Research and development expenses amounted to US$129,134 and US$102,865 for the six months ended June 30, 2011 and 2010, respectively. Research and development expenses amounted to US$65,642 and US$45,421 for the three months ended June 30, 2011 and 2010, respectively.

12

Shipping costs

Shipping costs, if any, are included in selling expenses and were not material for the six months ended June 30, 2011 and 2010, respectively, since both the Company’s customers and suppliers pay for their respective shipping costs. The Company does not charge its customers for shipping and handling fees.

Related parties

Parties are considered to be related to the Company if the parties that, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. The Company discloses all related party transactions. All transactions shall be recorded at fair value of the goods or services exchanged.

Foreign currency translation

The reporting currency of the Company is the U.S. dollar. The functional currency of the parent company and its subsidiary Anbailun is the U.S. dollar. The functional currency of Ansheng (HK) is the Hong Kong dollar, the functional currency of the Company’s subsidiary, Ansheng Fujian, is the Chinese Renminbi (“RMB”). For the subsidiaries whose functional currencies are the Hong Kong dollar or RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. The foreign currency translation adjustment included in comprehensive income for the six months ended June 30, 2011 and 2010 amounted to US$921,971 and US$100,313, respectively, and for three months ended June 30, 2011 and 2010, amounted to US$690,493 and US$97,468, respectively Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing at the acquisition date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

All of the Company’s revenue transactions are transacted in the functional currency. The Company does not enter any material transaction in foreign currencies and, accordingly, transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company.

Asset and liability accounts at June 30, 2011 and December 31, 2010 were translated at 6.4640 RMB to US$1.00 and 6.61180 RMB to US$1.00, respectively, which were the exchange rates on the balance sheet dates. Equity accounts were stated at their historical rate. The average translation rates applied to the statements of income and comprehensive income for the six months ended June 30, 2011 and 2010 were 6.54818 RMB and 6.83475 RMB to US$1.00, respectively. Cash flows from the Company’s operations are calculated based upon the local currencies using the average translation rate. As a result, amounts related to assets and liabilities reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

Net income per share of common stock

ASC 260 “Earnings Per Share,” requires dual presentation of basic and diluted earnings per share (“EPS”) with a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. Basic EPS excludes dilution. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the entity.

13

Basic net income per share is computed by dividing net income available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted income per share is computed by dividing net income by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive common stock consists of common stock issuable upon the conversion of convertible debt stock and series B convertible preferred stock (using the if-converted method) and common stock purchase warrants (using the treasury stock method).

The following table presents a reconciliation of basic and diluted net income per share:

|

Three Months Ended

|

Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Net income available to common stockholders for basic and diluted net income per share of common stock

|

$ | 5,171,682 | $ | 3,499,292 | $ | 9,919,069 | $ | 6,489,362 | ||||||||

|

Weighted average common stock outstanding - basic

|

34,431,262 | 33,949,212 | 34,319,405 | 33,949,212 | ||||||||||||

|

Effect of dilutive securities:

|

||||||||||||||||

|

Convertible debt

|

384,615 | 189,000 | 376,654 | 94,500 | ||||||||||||

|

Series B convertible preferred stock

|

745,333 | - | 372,666 | - | ||||||||||||

|

Warrants

|

105,128 | - | 80,949 | - | ||||||||||||

|

Weighted average common stock outstanding - diluted

|

35,666,338 | 34,138,212 | 35,149,674 | 34,043,712 | ||||||||||||

|

Net income per common share - basic and diluted

|

$ | 0.15 | $ | 0.10 | $ | 0.29 | $ | 0.19 | ||||||||

|

Net income per common share - basic and diluted

|

$ | 0.15 | $ | 0.10 | $ | 0.28 | $ | 0.19 | ||||||||

Accumulated other comprehensive income

Comprehensive income is comprised of net income and all changes to the statements of stockholders' equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. For the Company, comprehensive income for the three and six months ended June 30, 2011 and 2010 included net income and unrealized gains from foreign currency translation adjustments.

Recent accounting pronouncements

In May 2011, the FASB issued ASU No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs”, which is not expected to have a material impact on the consolidated financial statements upon adoption.

In June 2011, the FASB issued ASU No. 2011-05, “Presentation of Comprehensive Income”. Under the amendments in this ASU, an entity has two options for presenting its total comprehensive income: to present total comprehensive income and its components along with the components of net income in a single continuous statement, or in two separate but consecutive statements. The amendments in this ASU are required to be applied retrospectively and are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011, with early adoption permitted. The Company intends to conform to the new presentation required in this ASU beginning with its Form 10-Q for the three months ended March 31, 2012.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

14

NOTE 2 – ACCOUNTS RECEIVABLE

Accounts receivable at June 30, 2011 and December 31, 2010 consisted of the following:

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

||||||||

|

Accounts receivable

|

$ | 15,653,354 | $ | 17,727,064 | ||||

|

Less: allowance for doubtful accounts

|

- | - | ||||||

|

Total

|

$ | 15,653,354 | $ | 17,727,064 | ||||

Management recognizes allowance for doubtful accounts by specific identification method. No allowance for doubtful accounts was recorded as of June 30, 2011 and December 31, 2010 as management believes no accounts are uncollectible as of June 30, 2011 and December 31, 2010. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, a customer’s historical payment history, its current credit-worthiness and current economic trends. Accounts are written off after exhaustive efforts at collection.

NOTE 3 – INVENTORIES

At June 30, 2011 and December 31, 2010, inventories consisted of the following:

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

||||||||

|

Raw materials

|

$ | 789,580 | $ | 764,016 | ||||

|

Work in process

|

2,427,221 | 3,681,100 | ||||||

|

Finished goods

|

863,446 | 760,896 | ||||||

| $ | 4,080,247 | $ | 5,206,012 | |||||

NOTE 4 – PROPERTY AND EQUIPMENT

At June 30, 2011 and December 31, 2010, property and equipment consist of the following:

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

||||||||

|

Building and building improvements

|

$ | 1,942,760 | $ | 1,451,950 | ||||

|

Manufacturing equipment

|

771,880 | 805,973 | ||||||

|

Office equipment and furniture

|

65,874 | 67,723 | ||||||

| 2,780,514 | 2,325,646 | |||||||

|

Less: accumulated depreciation

|

(1,409,657 | ) | (1,373,830 | ) | ||||

|

Total

|

$ | 1,370,857 | $ | 951,816 | ||||

For the six months ended June 30, 2011 and 2010, depreciation expense amounted to US$77,078 and US$74,970, of which US$51,805 and US$51,087 was included in cost of sales, respectively. For the three months ended June 30, 2011 and 2010, depreciation expense amounted to US$37,811 and US$39,423, of which US$26,142 and US$26,224 was included in the cost of sales, respectively.

As of June 30, 2011, the buildings with net value of US$573,948 were collateralized for short-term bank loans of US$773,515 from Industrial and Commercial Bank of China Ltd. (“ICBC”) Jinjiang Branch. As of December 31, 2010, the buildings with net value of US$526,634 were collateralized for short-term bank loans of US$756,224 from ICBC Jinjiang Branch.

15

NOTE 5 – LAND USE RIGHTS

At June 30, 2011 and December 31, 2010, land use rights consist of the following:

|

Useful Life

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

|||||||||

|

Land use rights

|

50 Years

|

$ | 303,326 | $ | 296,545 | ||||

|

Less: accumulated amortization

|

(66,226 | ) | (61,780 | ) | |||||

|

Total

|

$ | 237,100 | $ | 234,765 | |||||

Amortization expense for the six months ended June 30, 2011 and 2010 amounted to US$2,994 and US$2,869 and amortization expense for three months ended June 30, 2011 and 2010 amounted to US$1,506 and US$1,435, respectively.

As of June 30, 2011, land use right with net value of US$237,100 was collateralized for short-term bank loans of US$773,515 from ICBC Jinjiang Branch. As of December 31, 2010, land use right with net value of US$234,765 was collateralized for short-term bank loans from ICBC Jinjiang Branch.

Amortization of land use rights attributable to future periods is as follows:

|

Amount

|

||

|

The periods ending December 31:

|

(Unaudited)

|

|

|

2011

|

$

|

3,034

|

|

2012

|

6,067

|

|

|

2013

|

6,067

|

|

|

2014

|

6,067

|

|

|

2015

|

6,067

|

|

|

2016 and thereafter

|

209,798

|

|

|

Total

|

$

|

237,100

|

NOTE 6 – SHORT-TERM BANK LOANS

At June 30, 2011 and December 31, 2010, short-term bank loan consisted of the following:

|

June 30, 2011

|

December 31, 2010

|

|||

|

(Unaudited)

|

||||

|

Loan payable to Industrial and Commercial Bank of China, due on February 1, 2011 and bears annual interest based on the benchmark interest rate multiplied by 1.05 (6.1005% as of December 31, 2010), collateralized by accounts receivables and repaid on due date.

|

$

|

-

|

$

|

264,678

|

|

Loan payable to Industrial and Commercial Bank of China, due on July 15, 2011 with an annual interest rate based on the benchmark interest rate multiplied by 1.05 (6.6255% as of June 30, 2011) and collateralized by accounts receivables and guaranteed by Jinjiang Qiuzhi East Asia Shoes and Clothing Ltd and repaid on due date

|

495,050

|

483,983

|

||

|

Loan payable to Industrial and Commercial Bank of China, due on August 2, 2011 with an annual interest rate based on the benchmark interest rate multiplied by 1.05 (6.6255% as of June 30, 2011) and guaranteed by Jinjiang Qiuzhi East Asia Shoes and Clothing Ltd and repaid on due date

|

464,109

|

453,734

|

16

|

Loan payable to Industrial and Commercial Bank of China, due on June 2, 2011 with an annual interest rate based on the benchmark interest rate multiplied by 1.15 (7.2565% as of June 30, 2011) and repaid on due date.

|

-

|

756,224

|

||

|

Loan payable to Industrial and Commercial Bank of China, due on December 1, 2011 with annual interest rate based on the benchmark interest rate multiplied by 1.05 (6.6255% as of June 30, 2011) and collateralized by its accounts receivables and guaranteed by Jinjiang Qiuzhi East Asia Shoes and Clothing Ltd.

|

1,361,386

|

1,330,954

|

||

|

Loan payable to Industrial and Commercial Bank of China, due on November 11, 2011 with annual interest rate based on the benchmark interest rate multiplied by 1.05 (6.6255% as of June 30, 2011) and collateralized by the buildings and land use rights. See Note 5.

|

773,515

|

-

|

||

|

Loan payable to Industrial and Commercial Bank of China, due on March 10, 2012 with annual interest rate based on the benchmark interest rate multiplied by 1.05 (6.6255% as of June 30, 2011) and collateralized by its accounts receivables and guaranteed by Jinjiang Qiuzhi East Asia Shoes and Clothing Ltd.

|

541,460

|

-

|

||

|

Total

|

$

|

3,635,520

|

$

|

3,289,573

|

For the six months ended June 30, 2011 and 2010, interest expense related to loans amounted to US$101,005 and US$63,914 and for three months ended June 30, 2011 and 2010 amounted to US$57,841 and US$19,069, respectively. Weighted average annual interest rate for the six months ended June 30, 2011 and 2010 are 5.58% and 7.18% respectively.

NOTES 7 – NOTES PAYABLE

At June 30, 2011, notes payable amounting to $202,661 were issued by the Company to creditors with the banker’s acceptance payable at the maturity date for the purpose of raw materials for production. The Company has to repay the notes within six months from date of issuance and 5% service fees will be charged by banks for the issuance of the notes. The notes payable were collateralized by restricted cash of $202,661 as reflected on the accompanying consolidated balance sheets.

NOTE 8 – OTHER PAYABLE AND ACCRUED LIABILITIES

At June 30, 2011 and December 31, 2010, other payables and accrued liabilities consist of the following:

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

||||||||

|

Accrued payroll payable

|

$ | 360,075 | $ | 411,193 | ||||

|

Other liabilities

|

30,316 | 84,504 | ||||||

| $ | 390,391 | $ | 495,697 | |||||

17

NOTE 9 – RELATED PARTY TRANSACTIONS

From time to time, Mr. Jinbiao Ding and Mrs. Shunmei Ding advanced funds to company for working capital purposes. These advances are non-interest bearing, unsecured and payable on demand. At June 30, 2011 and December 31, 2010, due to related parties was as follows:

|

Name

|

June 30, 2011

|

December 31, 2010

|

||||||

|

(Unaudited)

|

||||||||

|

Mr. Jinbiao Ding

|

$ | 15,151 | $ | 514 | ||||

|

Mrs. Shunmei Ding

|

366,646 | - | ||||||

|

Total

|

$ | 381,797 | $ | 514 | ||||

NOTE 10 – CONVERTIBLE DEBT

On May 12, 2010, Anbailun and Silver Rock Capital Limited (“Silver Rock Capital”) entered into a series of agreements (a securities purchase agreement and other related agreements (the “Bridge Loan Agreement)). Pursuant to the Bridge Loan Agreement, Silver Rock Capital provided capital in the form of a senior secured convertible note to Anbailun in the principal amount up to US$350,000 to be solely used for the fees and expenses incurred in preparation of the Offering in the U.S. capital market. In connection with the loan, Silver Rock Capital received a senior secured convertible note (the “Note”) in the aggregate principal amount of US$350,000. Pursuant to the original May 12, 2010 secured convertible note, the Note will mature on May 12, 2011, and carry no interest. Pursuant to the convertible note agreement, commencing at such time Anbailun becomes a publicly traded entity in the U.S. the holders of the Note have the right to convert the Note to the common stock of Anbailun with an initial conversion price (the “Conversion Price”) of (i) US$1.00 assuming that 35,000,000 shares of Anbailun's common or ordinary stock is issued and outstanding subject to adjustment for future share splits or (ii) eighty percent (80%) of the price of any securities sold in any financing of Anbailun. The convertible note included common stock warrants (the "Warrants") exercisable for a period of 5 years from issuance to purchase common stock of Anbailun up to the same amount of shares of the common stock issuable upon conversion of the Notes. Each warrant was exercisable with an initial exercise price equal to 120% of the Conversion Price of the Notes. On the agreement date, Anbailun was an inactive company with no assets or operations and was formed in contemplation of setting an offshore structure to eventually acquire the Company’s current operating subsidiary Fujian Ansheng which became effective on December 13, 2010 upon the approval of the applicable Chinese administrative agency.

On May 12, 2010, the Company evaluated whether or not the convertible debt contained embedded conversion options, which meet the definition of a derivatives under ASC Topic 815 - “Derivatives and Hedging” and related interpretations. The Company concluded that the convertible debt did not contain any embedded conversion options and was not a derivative. Since Anbailun was a private company, the common shares underlying the convertible debt could not be converted into cash and there was no net settlement.

In accordance with ASC Topic 470-20 – “Debt with Conversion and Other Options”, the convertible notes were considered not to have an embedded beneficial conversion feature because the convertible note was not fully convertible at the issuance date due to the contingency.

Pursuant to the terms of the initial Warrant, Silver Rock Capital was entitled to initially purchase 350,000 shares of common stock of Anbailun at an initial exercise price of US$1.20 per share. The Warrants had a term of 5 years after the issuance date. The warrant was treated as a discount to the convertible debt and was valued at US$68,355 and is being amortized over the one year initial note term. The fair market value of the stock warrant was estimated on the date of grant using the Black-Scholes option-pricing model using the following weighted-average assumptions: stock price of $0.75; expected dividend yield 0%; risk-free interest rate of 2.29%; volatility of 50% and an expected term of five years. For the six months ended June 30, 2011 and 2010, amortization of the debt discount into interest expense amounted US$65,867 and US$8,544, respectively. For the three months ended June 30, 2011 and 2010, amortization of the debt discount into interest expense amounted US$37,461 and US$8,544, respectively.

18

On February 11, 2011, the Company amended the convertible note agreement and the related warrants. Simultaneously with the Exchange Agreement with Anbailun, the Company amended its Bridge Loan Agreement dated May 12, 2010 with Silver Rock Capital, whereby (i) the note due date was extended to the mature on the earlier to occur of: (a) two (2) years from the closing of a reverse merger with a US Public Company; or (b) February 15, 2013, and (ii) the note became convertible into shares of common stock of the Company at a fixed conversion price of US$0.91 per share to replace the Conversion Price. Additionally, pursuant to the amended Bridge Loan Agreement, in replacement of the Warrants, Silver Rock Capital received a five (5) year warrant (“Amended Warrant”) to purchase 384,615 shares of the Company’s common stock at an initial fixed exercise price of US$1.09 per share. The fixed conversion price for the note and fixed exercise price for the warrants replaced any down-round provisions in the amendment.

The fair market value of the Amended Warrant was estimated to be $0.78 using the Black-Scholes option-pricing model using the following weighted-average assumptions: stock price of $1.50; expected dividend yield 0%; risk-free interest rate of 2.38%; volatility of 50% and an expected term of 4.25 years.

Pursuant to ASC Topic 470-20-35-1 to 35-3, since the initial terms of a contingent conversion option did not permit the Company to compute the number of shares that the Silver Rock Capital would receive if the contingent event occurred and the conversion price was adjusted, the Company waited until the contingent event occurred and then computed the resulting number of shares that would be received pursuant to the new conversion price. The number of shares that would be received upon conversion based on the adjusted conversion price would was compared with the number that would have been received before the occurrence of the contingent event. The excess number of shares multiplied by the commitment date stock price equals the incremental intrinsic value that resulted from the resolution of the contingency and the corresponding adjustment to the conversion price. That incremental amount shall be recognized when the triggering event occurs.

Accordingly, the Company recorded an Amended Warrant and additional beneficial conversion feature of US$281,645, the difference between the total debt (US$350,000) and the warrant value previously recorded (US$68,355).

The convertible debt liability is as follows at June 30, 2011 and December 31, 2010:

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

$ | |||||||

|

Convertible debt

|

$ | 350,000 | 350,000 | |||||

|

Less: unamortized discount on convertible debt

|

(241,411 | ) | (25,633 | ) | ||||

|

Convertible debt, net

|

$ | 108,589 | $ | 324,367 | ||||

NOTE 11 – INCOME TAXES

The Company accounts for income tax pursuant to the accounting standards that requires the recognition of deferred tax assets and liabilities for both the expected impact of differences between the financial statements and the tax basis of assets and liabilities, and for the expected future tax benefit to be derived from tax losses and tax credit carryforwards. Additionally, the accounting standards require the establishment of a valuation allowance to reflect the likelihood of realization of deferred tax assets. Realization of deferred tax assets, including those related to the U.S. net operating loss carryforwards, are dependent upon future earnings, if any, of which the timing and amount are uncertain. The Company recognized no deferred tax asset or liability as of June 30, 2011 and December 31, 2010 since there was no difference between the financial statements and the tax basis of assets and liabilities, nor the expected future tax benefit to be derived from tax losses and tax credit carryforwards.

The Company and its subsidiaries file separate income tax returns.

United States

Westergaard was incorporated in Delaware. Westergaard did not earn any income that was derived in the United States for the three and six months ended June 30, 2011 and 2010 and therefore was not subject to income taxes. No deferred US taxes were reported as of June 30, 2011 and 2010 as all earnings in the PRC are intended to be permanently reinvested in the PRC operation.

19

British Virgin Islands

Anbailun was incorporated in the British Virgin Islands. Under the current laws of the British Virgin Islands, Anbailun is not subject to tax on income or capital gains. In addition, upon payments of dividends by Anbailun, no British Virgin Islands withholding tax is imposed.

Hong Kong

Ansheng (HK) was incorporated in Hong Kong. Ansheng (HK) did not earn any income that was derived in Hong Kong for the three and six months ended June 30, 2011 and 2010 and therefore was not subject to Hong Kong Profits Tax. The payments of dividends by Hong Kong companies are not subject to any Hong Kong withholding tax.

PRC

Fujian Ansheng is governed by the Income Tax Law of the People’s Republic of China. In the six months ended June 30, 2011 and 2010, under the Income Tax Laws of PRC, Chinese companies are generally subject to an income tax at an effective rate of 25%, on income reported in the statutory financial statements after appropriate tax adjustments. The tables below summarize the differences between the PRC statutory rate and the Company’s effective tax rate and are as follows for the six months ended June 30, 2011 and 2010:

|

Six months ended June 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Statutory tax rates

|

25.00

|

% |

25.00

|

% | ||||

|

Non-deductible expenses (non-taxable income)

|

0.06 | % | 0.06 | % | ||||

|

Total provision for income taxes

|

25.06 | % | 25.06 | % | ||||

The Company and its subsidiaries did not have any unrecognized tax benefit as of June 30, 2011 and December 31, 2010.

NOTE 12 – OTHER TAXES PAYABLE

The following table reflects other taxes payable as of June 30, 2011 and December 31, 2010:

|

June 30, 2011

|

December 31, 2010

|

|||||||

|

(Unaudited)

|

||||||||

|

Value added taxes

|

$ | 758,435 | $ | 544,079 | ||||

|

Other taxes

|

68,259 | 48,967 | ||||||

|

Total

|

$ | 826,694 | $ | 593,046 | ||||

NOTE 13 – SHAREHOLDERS’ EQUITY

Preferred stock

Pursuant the Company’s articles of incorporation, the Company is authorized to issue 10,000,000 shares of preferred stock with a par value of $0.001, and that the Board of Directors have the authority to attach such terms as they deem fit with respect to the preferred stock. On April 13, 2011, the Company’s Board of Directors, adopted a resolution providing for the designation, rights, powers and preferences and the qualifications, limitations and restrictions of 4,000,000 shares of Series B Convertible Preferred Stock (the “Series B Preferred Stock”).

20

The Series B Preferred Stock has the following rights, preferences and limitations:

|

●

|

There are 4,000,000 authorized shares of series B preferred stock.

|

|

●

|

The holders of shares of Series B Preferred Stock shall not be entitled to dividends.

|

|

●

|

The Series B Preferred Stock shall have the following class voting rights (in addition to the voting rights set forth in Section 3(b) hereof). So long as any shares of the Series B Preferred Stock remain outstanding, the Company shall not, without the affirmative vote or consent of the holders of a majority of the shares of the Series B Preferred Stock outstanding at the time (the “Majority Holders”), given in person or by proxy, either in writing or at a meeting in which the holders of the Series B Preferred Stock vote separately as a class:

(i) authorize, create, issue or increase the authorized or issued amount of any class or series of Preferred Stock, which class or series, in any such case, ranks pari passu or senior to the Series B Preferred Stock, with respect to the distribution of assets on Liquidation (as defined below);

(ii) amend, alter or repeal the provisions of the Series B Preferred Stock, whether by merger, consolidation or otherwise, so as to adversely affect any right, preference, privilege or voting power of the Series B Preferred Stock; provided, however, that any creation and issuance of another series of Junior Stock shall not be deemed to adversely affect such rights, preferences, privileges or voting powers;

(iii) issue any shares of Series B Preferred Stock (or any securities convertible into or exercisable for, directly or indirectly, any shares of Series B Preferred Stock or other security, other than Junior Stock) other than pursuant to the Securities Purchase Agreement;