Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hoku Corp | hoku_8k-081611.htm |

| EX-10.2 - EXHIBIT 10.2 - Hoku Corp | ex10-2.htm |

Exhibit 10.1

EXECUTION VERSION

|

NEW YORK BRANCH

|

||

|

CREDIT AGREEEMENT

dated as of

|

||

|

August 16, 2011

|

||

|

By, between and among

|

||

|

HOKU CORPORATION

and

HOKU MATERIALS, INC.

Collectively,

as Borrower

|

||

|

and

|

||

|

BANK OF CHINA, NEW YORK BRANCH

|

||

|

as Lender

|

||

|

US$15,000,000

|

||

TABLE OF CONTENTS

| Page No. | |

|

SECTION 1 DEFINITIONS

|

|

|

1.1 Definitions

|

1

|

|

1.2 Computation of Time Periods

|

7

|

|

1.3 Accounting Terms

|

7

|

|

SECTION 2 THE CREDIT FACILITIES

|

|

|

2.1 Facility

|

7

|

|

2.2 Default Rate

|

8

|

|

2.3 Prepayments

|

8

|

|

2.4 Capital Adequacy

|

9

|

|

2.5 Illegality

|

9

|

|

2.6 Requirements of Law

|

9

|

|

2.7 Taxes

|

10

|

|

2.8 Place and Manner of Payments; Joint and Several Liability

|

11

|

|

2.9 Break Funding Payments

|

12

|

|

2.10 Market Disruption

|

12

|

|

2.11 Right of Setoff

|

12

|

|

SECTION 3 CONDITIONS PRECEDENT

|

|

|

3.1 Conditions to Effectiveness

|

13

|

|

3.2 Conditions to All Loans

|

14

|

|

SECTION 4 REPRESENTATIONS AND WARRANTIES

|

|

|

4.1 Corporate Status

|

15

|

|

4.2 Corporate Authorization

|

15

|

|

4.3 Liens; Indebtedness

|

15

|

|

4.4 Litigation

|

15

|

|

4.5 Governmental and Other Approvals

|

15

|

|

4.6 Use of Loan

|

16

|

|

4.7 ERISA

|

16

|

|

4.8 Environmental Compliance

|

16

|

|

4.9 Foreign Assets Control Regulations, Etc.; OFAC Compliance

|

16

|

|

SECTION 5 COVENANTS

|

|

|

5.1 Corporate Existence

|

17

|

|

5.2 Reports, Certificates and Other Information

|

17

|

|

5.3 Other Reports

|

18

|

|

5.4 Mergers and Consolidations

|

18

|

|

5.5 Taxes

|

18

|

|

5.6 Insurance

|

19

|

|

5.7 Compliance with Laws

|

19

|

|

5.8 Payment of Obligations

|

19

|

|

5.9 Maintenance of Properties. Etc.

|

19

|

|

5.10 Disbursement Account

|

19

|

|

5.11 Independent Verification

|

19

|

|

5.12 Foreign Assets Control Regulations

|

19

|

|

5.13 Disbursement Account

|

20

|

|

5.14 Completion of Project

|

20

|

|

5.15 Independent Verification

|

20

|

i

|

SECTION 6 INTENTIONALLY OMITTED

|

||

|

SECTION 7 EVENTS OF DEFAULT

|

||

|

7.1 Events of Default

|

|

21 |

|

7.2 Rights and Remedies

|

|

21 |

|

SECTION 8 MISCELLANEOUS

|

||

|

8.1 Notices

|

|

22 |

|

8.2 Benefit of Agreement

|

|

22 |

|

8.3 No Waiver; Remedies Cumulative

|

|

23 |

|

8.4 Payment of Expenses, etc.

|

|

23 |

|

8.5 Amendments, Waivers and Consents

|

|

24 |

|

8.6 Counterparts

|

|

24 |

|

8.7 Headings

|

|

24 |

|

8.8 Survival of Indemnification

|

|

24 |

|

8.9 Governing Law; Jurisdiction; Waiver of Jury Trial

|

|

24 |

|

8.10 USA Patriot Act

|

|

25 |

|

8.11 Severability

|

|

25 |

|

8.12 Entirety

|

|

25 |

|

8.13 Survival of Representations and Warranties

|

|

25 |

|

8.14 Fiduciary Relationship

|

|

25 |

|

SCHEDULES:

|

||

|

Schedule 4.3

|

Permitted Liens | |

|

Schedule 4.4

|

Subsidiaries | |

|

Schedule 5.6

|

Insurance | |

|

LIST OF EXHIBITS:

|

||

|

Exhibit A

|

Letter of Credit | |

|

Exhibit B

|

Notice of Borrowing | |

|

Exhibit C

|

Promissory Note |

ii

CREDIT AGREEMENT

THIS CREDIT AGREEMENT (this “Credit Agreement” or “Agreement,” as same may be amended, restated or otherwise modified from time to time), dated as of August 16, 2011 and made effective as of the Effective Date, by, between and among HOKU CORPORATION and HOKU MATERIALS, INC. (each a “Borrower” and collectively, the “Borrower” or “Borrowers” as the context may require) and BANK OF CHINA, NEW YORK BRANCH (the “Lender”).

IN CONSIDERATION of the mutual promises and covenants herein contained, the receipt and sufficiency of which is hereby acknowledged, the parties hereto hereby agree as follows, it being agreed that the representations, warranties, covenants, promises, liabilities and obligations of the Borrowers are joint and several:

SECTION 1. DEFINITIONS

1.1 Definitions.

As used in this Credit Agreement, the following terms shall have the meanings specified below unless the context otherwise requires (terms defined in the singular to have the same meanings when used in the plural, and vice versa). Any capitalized term not otherwise defined in this Agreement shall have the meaning set forth in the other Credit Documents.

“Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Agreement Date” has the meaning defined in the Rider.

"Applicable Permits" shall mean each and every national, autonomic, regional and local license, authorization, certification, filing, recording, permit or other approval with or of any Governmental Authority, including, without limitation, each and every environmental, construction or operating permit and any agreement, consent or approval from or with any other Person that is required by any applicable law or that is otherwise necessary for the development and construction of the Project.

“Approved Plans” means all plans, schematics, drawings and specifications heretofore or hereafter delivered to and approved by all Governmental Authorities relating to the development and construction of the Project.

“Assignment and Acceptance” means an assignment and acceptance entered into by the Lender and an assignee (with the consent of any party whose consent is required by Section 8.2(b)).

“Availability Period” has the meaning described in the Rider.

“Bankruptcy Code” means the Bankruptcy Code in Title 11 of the United States Code, as amended, modified, succeeded or replaced from time to time.

“Base Rate Loan” means any Loan bearing interest at a rate determined by reference to the Prime Rate.

“Borrower” has the meaning defined in the Rider.

“Borrower’s Counsel” has the meaning defined in the Rider.

“Borrowing Date” means the date on which a borrowing is requested as such term is defined in Section 2.1(b)(i).

1

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by law to close; provided that, when used in connection with a LIBOR Loan the term “Business Day” shall also exclude any day on which dealings in foreign currencies and exchanges between banks may not be carried on in London England or New York, New York.

“Capital Lease” means any lease of Property the obligations with respect to which are required to be capitalized on a balance sheet of the lessee in accordance with GAAP.

“Change in Control” means any Person or group of Persons acting in concert (in each case other than the Parent) gaining the Control of the Borrower.

“Closing Date” means the Effective Date.

“Code” means the Internal Revenue Code of 1986, as amended from time to time, and the Treasury regulations promulgated thereunder as in effect from time to time.

“Control” in relation to any Person means either the direct or indirect ownership of more than 50% of the membership interests, share capital, or similar rights of ownership of the Person or the power to direct or cause the direction of the management or policies of a Person, whether through ownership or the ability to exercise voting power or other ownership rights, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto.

“Control Account” means the account or accounts established by the Lender on its books in Borrower’s name. Lender shall credit the Control Account with the amount of each Loan advanced under this Credit Agreement and shall debit the Control Account for (i) payment of unpaid Obligations then due by Borrower to Lender under this Credit Agreement and under other Credit Documents and (ii) to the extent of any remaining credit balance, for transfer to Borrower’s Disbursement Account.

“Credit Documents” means this Credit Agreement, the Promissory Note and, to the extent applicable, the Letter of Credit and any other documents executed and/or delivered or to be executed and/or delivered by or on behalf of the Borrower, including without limitation any consents, modifications, amendments, terminations or waivers relating to this Credit Agreement and the other Credit Documents

“Default” means any event, act or condition which with notice or lapse of time, or both, would constitute an Event of Default.

“Default Increment Percentage” has the meaning set forth in the Rider.

“Disbursement Account” means the depository/transactional account established and maintained by Borrower on the books of the office of the Lender specified in Section 8.1, which account shall be subject to the control of Lender in accordance with the terms and conditions set forth in Section 5.10. The amount of credit balances available in the Control Account during the Availability Period shall be transferred to the Disbursement Account, with all disbursements therefrom subject to the control of Lender in accordance with the terms and conditions set forth in this Agreement.

“Disbursement Date” means the date on which Lender credits any proceeds of a Loan to Borrower’s Disbursement Account.

“Dollars” and “$” means the lawful currency of the United States of America.

“Effective Date” has the meaning set forth in Section 3.1.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, and the regulations promulgated and the rulings issued thereunder.

2

“Event of Default” means such term as defined in Section 7.1.

“Facility Fee” has the meaning defined in the Rider.

“Financial Statement Date” means the date of the Most Recent Borrower Financial Statements.

“Fiscal Year” has the meaning defined in the Rider.

“GAAP” means generally accepted accounting principles in the United States applied on a consistent basis and subject to Section 1.3 hereof.

“Governmental Authority” means any Federal, state, local or foreign court or governmental agency, authority, instrumentality or regulatory body.

“Guaranty Obligations” means, with respect to any Person, without duplication, any obligations of such Person (other than endorsements in the ordinary course of business of negotiable instruments for deposit or collection) guaranteeing or intended to guarantee any Indebtedness of any other Person in any manner, whether direct or indirect, and including without limitation any obligation, whether or not contingent, (i) to purchase any such Indebtedness or any Property constituting security therefor, (ii) to advance or provide funds or other support for the payment or purchase of any such Indebtedness or to maintain working capital, solvency or other balance sheet condition of such other Person (including without limitation keep well agreements, maintenance agreements, comfort letters or similar agreements or arrangements) for the benefit of any holder of Indebtedness of such other Person, (iii) to lease or purchase Property, securities or services primarily for the purpose of assuring the holder of such Indebtedness, or (iv) to otherwise assure or hold harmless the holder of such Indebtedness against loss in respect thereof. The amount of any Guaranty Obligation hereunder shall (subject to any limitations set forth therein) be deemed to be an amount equal to the outstanding principal amount (or maximum principal amount, if larger) of the Indebtedness in respect of which such Guaranty Obligation is made.

“Indebtedness” means, as to any Person, (i) all obligations of such Person for borrowed money, (ii) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments or upon which interest payments are customarily made, (iii) all obligations of such Person under conditional sale or other title retention agreements relating to Property purchased by such Person (other than customary reservations or retentions of title under agreements with suppliers entered into in the ordinary course of business), (iv) all obligations, including without limitation intercompany items, of such Person issued or assumed as the deferred purchase price of Property or services purchased by such Person (other than trade debt incurred in the ordinary course of business and due within six months of the incurrence thereof) which would appear as liabilities on a balance sheet of such Person, (v) all obligations of such Person under take-or-pay or similar arrangements or under commodities agreements, (vi) all Indebtedness of others secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any Lien on, or payable out of the proceeds of production from, Property owned or acquired by such Person, whether or not the obligations secured thereby have been assumed, (vii) all Guaranty Obligations of such Person, (viii) the principal portion of all obligations of such Person under Capital Leases, (ix) all obligations of such Person in respect of interest rate protection agreements, foreign currency exchange agreements, commodity purchase or option agreements or other interest or exchange rate or commodity price hedging agreements and (x) the maximum amount of all letters of credit issued or bankers’ acceptances facilities created for the account of such Person and, without duplication, all drafts drawn thereunder (to the extent unreimbursed). The Indebtedness of any Person shall include the Indebtedness of any partnership in which such Person is a general partner (except for any such Indebtedness with respect to which the holder thereof is limited to the assets of such partnership).

“Interest Payment Date” means, (i) as to any LIBOR Loan, the last day of each Interest Period for such Loan, the date of any prepayment and the Maturity Date and (ii) as to any Base Rate Loan, the last Business Day of each calendar month, the date of any prepayment and the Maturity Date. If an Interest Payment Date falls on a date which is not a Business Day, such Interest Payment Date shall be deemed to be the immediately succeeding Business Day, except that in the case of LIBOR Loans where the immediately succeeding Business Day falls in the immediately succeeding calendar month, then on the immediately preceding Business Day.

3

“Interest Period” means a period of Interest Defined Months duration commencing in each case on the date of the borrowing (including extensions and conversions); provided, however, that (A) if any Interest Period would end on a day which is not a Business Day, such Interest Period shall be extended to the immediately succeeding Business Day (except that in the case of LIBOR Loans where the immediately succeeding Business Day falls in the immediately succeeding calendar month, then on the immediately preceding Business Day), (B) no Interest Period shall extend beyond the Maturity Date and (C) in the case of LIBOR Loans, where an Interest Period begins on a day for which there is no numerically corresponding day in the calendar month in which the Interest Period is to end, such Interest Period shall, subject to clause (A) above, end on the last Business Day of such calendar month.

“Interest Defined Months” has the meaning defined in the Rider.

“Legal Fees” means such fees, costs and disbursements charged to the Borrower and paid by the Borrower directly and separately to the Lender’s legal counsel arising from, in connection with, or otherwise related to the preparation and/or review of legal documents and other services rendered on behalf of the Lender in respect of this Credit Agreement, the Credit Documents and the transactions contemplated herein and therein. Without limiting the foregoing sentence or any other provision of this Agreement, Legal Fees shall include such fees, costs and disbursements charged to the Borrower and paid by the Borrower directly and separately to the Lender’s legal counsel arising from, in connection with, or otherwise related to the preparation and/or review of legal documents and other services rendered on behalf of the Lender subsequent to the Closing Date in respect of this Credit Agreement, the Credit Documents and the transactions contemplated herein and therein.

“Lender” means Bank of China, New York Branch, together with its successors and/or assigns.

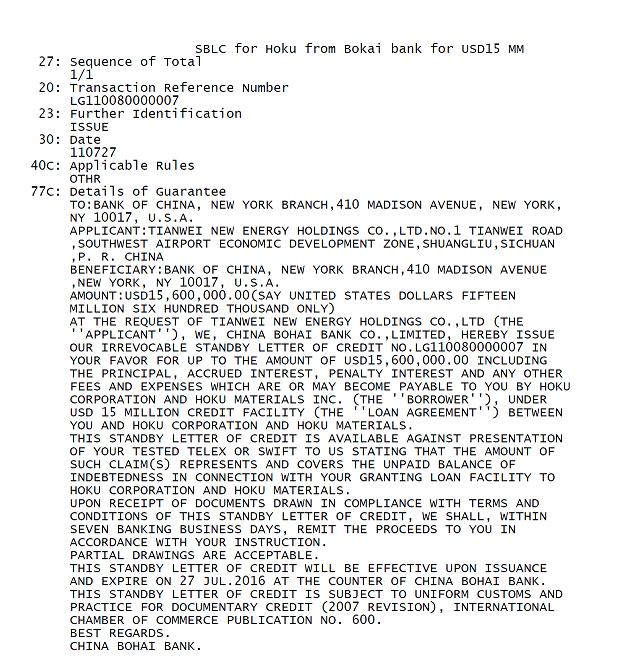

“Letter of Credit” or “Letters of Credit”, as the context requires, means, to the extent applicable, the standby letter(s) of credit issued by the Sichuan Shuangliu Sub-Branch of the Bank of China (“Issuing Bank”), which is procured by the Borrower in favor of the Lender to secure the Borrower’s obligations to the Lender hereunder.

"LIBOR Rate" means, with respect to any LIBOR Loan for the Interest Period applicable thereto, the rate as displayed in the Bloomberg Professional Service page USD-LIBOR-BBA (BBAM) (or as otherwise reasonably determined by Lender) at approximately 11:00 A.M., London time, two Business Days prior to the commencement of such Interest Period, as the rate for dollar deposits with an interest period comparable to the applicable Interest Period. In the event that such rate is not available at such time for any reason, then " LIBOR Rate " shall mean, with respect to any LIBOR Loan for the Interest Period applicable thereto, the arithmetic average, as determined by the Lender, of the rate per annum (rounded upwards, if necessary, to the nearest 1/16 of 1%) quoted by each Reference Bank at approximately 11:00 A.M. New York, New York time (or as soon thereafter as practicable) two Business Days prior to the first day of the Interest Period for such LIBOR Loan for the offering by such Reference Bank to leading banks in the London interbank market of eurodollar deposits having a term comparable to such Interest Period and in an amount comparable to the principal amount of the LIBOR Loan to be made by such Reference Bank for such Interest Period; provided that if any Reference Bank does not furnish such information to the Lender on a timely basis the Lender shall determine such interest rate on the basis of timely information furnished by the remaining Reference Banks.

“LIBOR Loan” means any Loan bearing interest at a rate determined by reference to the LIBOR Rate.

“LIBOR Rate Margin” has the meaning defined in the Rider.

4

“Lien” means any mortgage, pledge, hypothecation, assignment, deposit arrangement, security interest, encumbrance, lien (statutory or otherwise), preference, priority or charge of any kind (including any agreement to give any of the foregoing, any conditional sale or other title retention agreement, any financing or similar statement or notice filed under the Uniform Commercial Code as adopted and in effect in the relevant jurisdiction or other similar recording or notice statute, and any lease in the nature thereof).

“Loan” means, unless otherwise stated in this Credit Agreement, the principal amount of each borrowing under this Credit Agreement or the principal amount outstanding of that borrowing.

“Material Adverse Effect” means a material adverse effect on (i) the condition (financial or otherwise), operations, business, assets or liabilities of the Borrower and its Subsidiaries taken as a whole, (ii) the ability of the Borrower to perform any material obligation under the Credit Documents, (iii) the material rights and remedies of the Lender under the Credit Documents or (iv) any rights, remedies or benefits of or to the Lender under the Letter of Credit.

“Material Subsidiary” means a Subsidiary, including its Subsidiaries, substantially all of whose voting capital stock is owned by the Borrower and/or the Borrower’s other Subsidiaries and which meets all of the following criteria:

(i) the Borrower’s and its other Subsidiaries’ proportionate share of total assets (after intercompany eliminations) of such subsidiary exceeds 10% of the total assets of the Borrower and its Subsidiaries on a consolidated basis as of its most recently completed fiscal year; and

(ii) the Borrower’s and its other Subsidiaries’ proportionate share of or equity in the income from continuing operations before income taxes, extraordinary items and the cumulative effect of a change in accounting principle of such Subsidiary exceeds 10% of such income of the Borrower and its Subsidiaries on a consolidated basis for the most recently completed fiscal year.

“Maturity Date” has the meaning defined in the Rider.

“Maximum Total Amount” has the meaning defined in the Rider.

“Most Recent Borrower Financial Statements” has the meaning defined in the Rider.

“Non-Excluded Taxes” means such term as defined in Section 2.7.

“Notice of Borrowing” means the written notice of borrowing as referenced and defined in Section 2.1(b)(i).

“Obligations” means (i) the unpaid principal of, and the accrued and unpaid interest on, the Loan, all accrued and unpaid fees and expenses payable by the Borrower to the Lender and all other unsatisfied obligations of the Borrower arising under any of the Credit Documents, including without limitation under Sections 2.8, 2.9 and 2.10 hereof; and (ii) all other present and future Indebtedness, obligations and liabilities of the Borrower to the Lender, regardless whether such Indebtedness, obligations and liabilities are direct, indirect, fixed, contingent, joint, several or joint and several.

“Parent” has the meaning defined in the Rider.

“Participant” means such term as defined in Section 8.2(c).

“Permitted Purposes” means such term as defined in Section 4.6.

“Person” means any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, Governmental Authority or other entity.

5

“Plan” means an employee pension benefit plan which is covered by Title IV of ERISA or subject to the minimum funding standards under Section 412 of the Code and is either (i) maintained by the Borrower or any Subsidiary for employees of the Borrower and/or any Subsidiary or (ii) maintained pursuant to a collective bargaining agreement or any other arrangement under which more than one employer makes contributions and to which the Borrower or any Subsidiary is then making or accruing an obligation to make contributions or has within the preceding five plan years made contributions.

“Prime Rate” means the highest “Prime Rate” as published in the “Money Rates” column of the Eastern Edition of the Wall Street Journal (“Wall Street Journal”) from time to time. If the Wall Street Journal should cease or temporarily interrupt publication or if the Prime Rate is no longer reported in the Wall Street Journal or is otherwise unavailable or is limited, regulated or administered by a governmental or quasi governmental body, then the Lender shall select a comparable interest rate which is readily available and verifiable by the Lender at its sole and absolute discretion.

“Prohibited Person” shall have the meaning given to such term in the Trading with the Enemy Act, as amended, or the applicable foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended).

“Project” means the development and construction of a polysilicion production facility having a nominal annual production capacity of four thousand metric tons (4,000mt) as more fully described on Exhibit A annexed hereto, to be located on approximately 67 acres (the “Property”) located in Pocatello, Idaho, which Property is leased by Hoku Materials, Inc., from the City of Pocatello, Idaho pursuant to a lease having a term of ninety-nine (99) years.

“Promissory Note” means the note(s) evidencing the Loan(s), in substantially the form annexed hereto as Exhibit C.

“Property” means any interest in any kind of property or asset, whether real, personal or mixed, or tangible or intangible.

“Reference Banks” means JPMorgan Chase Bank, N.A., Bank of America, N.A. and Citibank, N.A.

“Requirement of Law” means, as to any Person, the certificate of incorporation and by-laws or other organizational or governing documents of such Person, and any law, treaty, rule or regulation or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such Person or any of its material property.

“Reserve Percentage” means the maximum effective percentage in effect on any day as prescribed by the Board of Governors of the Federal Reserve System (or any successor) for determining the reserve requirements (including, without limitation, supplemental, marginal and emergency reserve requirements) with respect to Eurocurrency funding.

“Responsible Officer” means the Chairman of the Board, the President, the Chief Executive Officer, the Chief Operating Officer, the Chief Financial Officer or the Treasurer.

“Revolving Availability Period” has the meaning defined in the Rider.

“Revolving Loans” shall have the meaning assigned to such term in Section 2.1(a).

“Revolving Maturity Date” has the meaning defined in the Rider.

“Rider” means the Rider to Credit Agreement attached to this Credit Agreement

6

“Subsidiary” means, as to any Person, (a) any corporation Controlled by such Person or more than 50% of whose stock of any class or classes having by the terms thereof ordinary voting power to elect a majority of the directors of such corporation (irrespective of whether or not at the time, any class or classes of such corporation shall have or might have voting power by reason of the happening of any contingency) is at the time owned by such Person directly or indirectly through Subsidiaries, and (b) any partnership, limited liability company, association, joint venture or other entity Controlled by such Person or in which such person directly or indirectly through Subsidiaries has more than 50% equity interest at the time. Unless otherwise specified, any reference to a Subsidiary is intended as a reference to a Subsidiary of the Borrower, as identified on Schedule 4.4.

1.2 Computation of Time Periods.

For purposes of computation of periods of time hereunder, the word “from” means “from and including” and the words “to” and “until” each mean “to but excluding.” Time is of the essence with regard to the performance by Borrower of any terms of this Credit Agreement and of the other Credit Documents.

1.3 Accounting Terms.

Except as otherwise expressly provided herein, all accounting terms used herein shall be interpreted, and all financial statements and certificates and reports as to financial matters required to be delivered to the Lender hereunder shall be prepared, in accordance with GAAP applied on a consistent basis. All calculations made for the purposes of determining compliance with this Credit Agreement shall (except as otherwise expressly provided herein) be made by application of GAAP applied on a basis consistent with the most recent annual or quarterly financial statements delivered pursuant to Section 5.2 hereof.

SECTION 2. THE CREDIT FACILITIES

2.1 Facility.

(a) Facility. This Credit Agreement is with respect a Revolving Credit Loan, as set forth in the Rider. Subject to the terms and conditions of this Credit Agreement and the Promissory Note (the terms of which are hereby incorporated by reference), the Lender agrees to make available to the Borrowers during the Revolving Eligibility Period, revolving loans (each, a “Revolving Loan” or “Loan” and collectively the “Revolving Loans” or “Loans”) from time to time in an aggregate principal amount which shall not exceed in the aggregate at any one time the Maximum Total Amount. Within the foregoing limits and subject to the terms and conditions of this Credit Agreement, Lender shall permit Borrowers to borrow, repay and reborrow the Revolving Loans. Notwithstanding anything to the contrary herein, in reliance on the representations, warranties and covenants of each Borrower in this Agreement, the Lender may loan to Borrowers and Borrowers may borrow from the Lender Revolving Loans up to the Maximum Total Amount. Prior to the Revolving Maturity Date, Borrowers may, within the limits of the Maximum Total Amount, borrow, repay and re-borrow sums made available under this Agreement, it being understood that the parties reasonably contemplate that prior to the Revolving Maturity Date, and provided that neither Borrower is in default under any of its obligations to the Lender, payments by Borrowers in reduction of the outstanding principal balance of the Revolving Loans shall become available to be re-advanced to or at the direction of Borrowers as provided under the terms of this Agreement, up to the Maximum Total Amount. Under no circumstances shall the Lender be required to make any future Revolving Loans or advances which will result in an unpaid principal balance in excess of the Maximum Total Amount. Borrowers shall repay the entire unpaid balance due or to become due under this Agreement including any contingent credits, obligations, advances or advices, if not sooner paid, in full on the Maturity Date.

(b) Loan Borrowings.

(i) Notice of Borrowing. The Borrowers shall request each Loan borrowing by written notice (or telephone notice promptly confirmed in writing) to the Lender not later than 11:00 A.M. (New York, New York time) on the third Business Day (or such later day as the Lender may agree in its sole discretion) prior to the date of the requested borrowing. Such request for borrowing shall be irrevocable, shall be made in a notice of borrowing in substantially the form annexed hereto as Exhibit B (a “Notice of Borrowing”), and shall specify (A) that a Loan is requested; (B) the date of the requested borrowing (which shall be a Business Day) (the “Borrowing Date”); (C) the aggregate principal amount to be borrowed; and (D) the purpose for which the proceeds of the Loan shall be applied (which shall meet the requirements set forth in this Credit Agreement). The Notice of Borrowing may not request any Advance if and to the extent it would exceed the Maximum Total Amount.

7

(ii) Minimum Amounts. The initial Revolving Loan shall be in a minimum aggregate amount of $5,000,000 and integral multiples of $100,000 in excess thereof (or the remaining Maximum Total Amount, if less) and each subsequent Revolving Loan borrowing shall be in a minimum aggregate amount of $1,000,000 and integral multiples of $100,000 in excess thereof (or the remaining Maximum Total Amount, if less).

(iii) Advances. Subject to the Lender’s confirmation that (a) the amount of the Revolving Loan plus the outstanding principal balance of any prior Revolving Loans and other Loans (if any) and amounts due thereon are not in excess of the Maximum Total Amount and (b) the Letters of Credit securing the Revolving Loans and all other Loans, if any, remain in full force and effect, as confirmed by the Issuing Bank, the Lender will make the Loan borrowings available to the Borrowers on the Borrowing Date by crediting the Disbursement Account in immediately available funds. The Lender at its option may make the Loans by causing any of its domestic or foreign branches or Affiliates to make such Loans; provided that any exercise of such option shall not affect the obligation of the Borrowers to repay such Loans in accordance with the terms of this Credit Agreement. All Loans made to Borrowers shall be noted on the Schedule to the Promissory Note in the form(s) set forth as Exhibit C.

(c) Repayment. Notwithstanding anything to the contrary or inconsistent contained herein or in the Promissory Note, the Borrowers hereby unconditionally, jointly and severally, promise to repay in full the principal amount of the Loans and the other Obligations outstanding and not previously repaid, on the Maturity Date, subject to the Lender’s right to demand repayment at any time upon occurrence and during the continuation of an Event of Default or as otherwise provided herein. Furthermore, at any time that the principal amount of the Loans outstanding exceed the Maximum Total Amount, Borrower shall repay such excess to Bank within 5 days of such event. A loan history maintained by Lender with respect to each Loan shall be prima facie evidence of the amount and date of the Loan evidenced by such Promissory Note, payments of principal and interest, and the outstanding principal amount and accrued interest on such Promissory Note, and other fees, charges and expenses related thereto and of payments applicable thereto, all of which shall be binding and conclusive upon Borrower absent manifest error.

(d) Interest and Facility Fee. Subject to the provisions of Sections 2.2 and 2.10, the outstanding Loans shall bear interest at a per annum rate equal to the LIBOR Rate for the applicable Interest Period plus the LIBOR Rate Margin. The Borrowers hereby unconditionally, jointly and severally, promise to pay to the Lender accrued interest on the (i) Term Loans in arrears on each Interest Payment Date and the Maturity Date and (ii) Revolving Loans in arrears on each Interest Payment Date and the Revolving Maturity Date. Without limiting the foregoing or any other provision of this Credit Agreement or other Credit Documents, all Loans, Obligations and other Indebtedness of Borrowers to Lender, if not sooner paid, shall be due and payable in full on the Maturity Date.

2.2 Default Rate.

The Borrowers, jointly and severally, hereby unconditionally promise to pay to the Lender interest on demand on all overdue principal and, to the extent permitted by law (after as well as before judgment), overdue interest in respect of each Loan and any other overdue amount payable hereunder or under the other Credit Documents at a Default Increment Percentage per annum greater than the rate which would otherwise be applicable (or if no rate is applicable, then Default Increase Percentage per annum greater than the Prime Rate).

2.3 Prepayments.

(a) Voluntary Prepayments. The Borrower may prepay the Loans, in whole or in part, at any time without any premium or penalty; provided that (i) any such prepayment of the Loan shall include all interest accrued through the date of payment on the portion of the Loan so prepaid and all other moneys then due and payable under this Credit Agreement; (ii) partial prepayments shall be in a minimum principal amount of $100,000 and multiples of $100,000 in excess thereof and (iii) any prepayment shall be made together with all additional amounts, if any, due under Section 2.9.

8

(b) Notice. In the case of voluntary prepayments under subsection (a) hereof, the Borrower will give notice to the Lender of its intent to make such a prepayment by 11:00 A.M. (New York, New York time) fifteen (15) Business Day prior to the date of prepayment.

2.4 Capital Adequacy.

If, after the Closing Date, the Lender has determined that the adoption or effectiveness of any applicable law, rule or regulation regarding capital adequacy, or any change therein, or any change in the interpretation or administration thereof by any Governmental Authority, central bank or comparable agency charged with the interpretation or administration thereof, or compliance by the Lender (including its foreign banking organization) or its holding company with any request or directive regarding capital adequacy (whether or not having the force of law) of any such Governmental Authority, central bank or comparable agency, has or would have the effect of reducing the rate of return on the Lender’s (including its foreign banking organization’s) or its holding company’s capital as a consequence of its commitments or obligations hereunder to a level below that which the Lender (including its foreign banking organization) or its holding company could have achieved but for such adoption, effectiveness, change or compliance (taking into consideration the Lender’s (including its foreign banking organization’s) or its holding company’s policies with respect to capital adequacy), then, upon notice from the Lender, the Borrower shall pay to the Lender such additional amount or amounts as will compensate the Lender (including its foreign banking organization) or its holding company for such reduction. Each determination by the Lender of amounts owing under this Section shall, absent manifest error, be conclusive and binding on the Borrower. Notwithstanding anything contained herein to the contrary, the Borrower shall not be under any obligation to pay to the Lender amounts otherwise owing under this Section 2.4 if the Lender shall not have delivered such written notice to the Borrower within ninety (90) days following the later of (i) the date of occurrence of the event which forms the basis for such notice and request for compensation and (ii) the date the Lender becomes aware of such event. Notwithstanding the foregoing, the Lender agrees that, before giving any notice seeking a payment under this Section 2.4, it will use reasonable efforts (consistent with its internal policy and legal and regulatory restrictions) to designate a different office, branch or Affiliate of the Lender as the office, branch or Affiliate of the Lender having the commitments and obligations of the Lender hereunder if making such designation would avoid or reduce the amount of such reduction in its rate of return on its capital or assets and would not, in the reasonable judgment of the Lender, be otherwise disadvantageous to the Lender.

2.5 Illegality.

Notwithstanding any other provision herein, if the adoption of or any change in any Requirement of Law or in the interpretation or application thereof occurring after the Closing Date shall make it unlawful for the Lender to maintain a LIBOR Loan as contemplated by this Credit Agreement, (a) the Lender shall promptly give written notice of such circumstances to the Borrower, (b) the commitment of the Lender hereunder, if any, to continue a LIBOR Loan as such and shall forthwith be canceled and, until such time as it shall no longer be unlawful for the Lender to maintain a LIBOR Loan, the Lender may then maintain a Base Rate Loan when the continuation of a LIBOR Loan is supposed to occur hereunder and (c) the Lender’s Loan then outstanding as a LIBOR Loan, if any, shall be converted automatically to Base Rate Loan on the respective last days of the then current Interest Periods with respect to such Loan or within such earlier period as required by law. If any such conversion of a LIBOR Loan occurs on a day which is not the last day of the then current Interest Period with respect thereto, the Borrower shall pay to the Lender such amounts, if any, as may be required pursuant to Section 2.9.

2.6 Requirements of Law.

If the adoption of or any change in any Requirement of Law or in the interpretation or application thereof applicable to the Lender, or compliance by the Lender with any request or directive (whether or not having the force of law) from any central bank or other Governmental Authority, in each case made subsequent to the Closing Date (or, if later, the date on which such Lender becomes a Lender) (it being understood and agreed that matters set forth in the Consultation Paper issued by the Basle Committee on Banking Supervision of June 1999, including any subsequent revisions or updates thereto, shall not be treated as having been adopted or applied prior to the Closing Date):

9

(i) shall subject the Lender to any tax of any kind whatsoever with respect to the Loan made by it or change the basis of taxation of payments to the Lender in respect thereof (except for Non-Excluded Taxes covered by Section 2.7 (including Non-Excluded Taxes imposed solely by reason of any failure of the Lender to comply with its obligations under Section 2.7(b)) and changes in taxes measured by or imposed upon the overall net income, or franchise tax (imposed in lieu of such net income tax), of the Lender or its applicable lending office, branch, or any affiliate thereof);

(ii) shall impose, modify or hold applicable any reserve, special deposit, compulsory loan or similar requirement against assets held by, deposits or other liabilities in or for the account of, advances, loans or other extensions of credit by, or any other acquisition of funds by, any office of the Lender; or

(iii) shall impose on the Lender any other condition (excluding any tax of any kind whatsoever);

and the result of any of the foregoing is to increase the cost to the Lender, by an amount which such Lender deems to be material, of making, continuing or maintaining the Loan or to reduce any amount receivable hereunder in respect thereof, then, in any such case, upon notice to the Borrower from the Lender, in accordance herewith, the Borrower shall promptly pay the Lender, upon its demand, any additional amounts necessary to compensate the Lender for such increased cost or reduced amount receivable; provided that the Borrower shall not be under any obligation to pay to the Lender amounts otherwise owing under this Section 2.6 if the Lender shall not have delivered such written notice to the Borrower, within ninety (90) days following the later of (A) the date of occurrence of the event which forms the basis for such notice and request for compensation and (B) the date the Lender becomes aware of such event. If the Lender becomes entitled to claim any additional amounts pursuant to this Section, it shall provide prompt notice thereof to the Borrower certifying (x) that one of the events described in this Section has occurred and describing in reasonable detail the nature of such event, (y) as to the increased cost or reduced amount resulting from such event and (z) as to the additional amount demanded by the Lender and a reasonably detailed explanation of the calculation thereof. Such a certificate as to any additional amounts payable pursuant to this Section submitted by the Lender to the Borrower shall be conclusive in the absence of manifest error. This covenant shall survive the termination of this Credit Agreement and the payment of the Loan and all other amounts payable hereunder. Notwithstanding the foregoing, the Lender agrees that, before giving any notice seeking a payment of additional amounts under this Section 2.6, the Lender will use reasonable efforts (consistent with its internal policy and legal and regulatory restrictions) to designate a different office, branch or Affiliate as the office, branch or Affiliate of the Lender making, continuing or maintaining the Loan hereunder or having the commitments and obligations hereunder resulting in such increased cost to the Lender or reduction in the amount receivable by the Lender hereunder if making such designation would avoid the need for, or reduce the amount of, such increased cost or would avoid or decrease the reduction in the amount receivable hereunder and would not, in the reasonable judgment of such Lender, be otherwise disadvantageous to the Lender.

2.7 Taxes.

(a) Except as provided below in this subsection, all payments made by the Borrower under this Credit Agreement shall be made free and clear of, and without deduction or withholding for or on account of, any present or future income, stamp or other taxes, levies, imposts, duties, charges, fees, deductions or withholdings, now or hereafter imposed, levied, collected, withheld or assessed by any Governmental Authority (excluding net income taxes and franchise taxes imposed in lieu of net income taxes imposed on the Lender as a result of a present or former connection between the jurisdiction of the Governmental Authority imposing such tax and the Lender (except a connection arising solely from the Lender having executed, delivered or performed its obligations or received a payment under, or enforced, this Credit Agreement)) (all such non-excluded taxes, levies, imposts, duties, charges, fees, deductions and withholdings being hereinafter called “Non-Excluded Taxes”). If any Non-Excluded Taxes are required to be withheld from any amounts payable to the Lender hereunder, the amounts so payable to the Lender shall be increased to the extent necessary to yield to the Lender (after payment of all Non-Excluded Taxes) interest or any such other amounts payable hereunder at the rates or in the amounts specified in this Credit Agreement, provided, however, that the Borrower shall be entitled to deduct and withhold any Non-Excluded Taxes and shall not be required to increase any such amounts payable to the Lender that is not organized under the laws of the United States of America or a state thereof if the Lender fails to comply with the requirements of Section 2.8(b). Whenever any Non-Excluded Taxes are payable by the Borrower, as promptly as possible thereafter the Borrower shall send to the Lender a certified copy of an original official receipt received by the Borrower showing payment thereof. If the Borrower fails to pay any Non-Excluded Taxes when due to the appropriate taxing authority or fails to remit to the Lender the required receipts or other required documentary evidence, the Borrower shall indemnify the Lender for any taxes, interest or penalties that may become payable by the Lender as a result of any such failure. Notwithstanding anything contained herein to the contrary, the Borrower shall not be under any obligation to pay to the Lender amounts otherwise owing under this Section 2.8(a) if the Lender shall not have delivered such written notice to the Borrower within ninety (90) days following the later of (i) the date of occurrence of the event which forms the basis for such notice and request for indemnity and (ii) the date the Lender becomes aware of such event. The agreements in this subsection shall survive the termination of this Credit Agreement and the payment of the Loan and all other amounts payable hereunder.

10

(b) The Lender agrees that it shall:

(X)(i) so long as it is a “bank” within the meaning of Section 881(c)(3)(A) of the Code, on or before the date of any payment by the Borrower under this Credit Agreement to the Lender, deliver to the Borrower two duly completed copies of United States Internal Revenue Service Form W-8BEN or W-8ECI, or successor applicable form, as the case may be, certifying that it is entitled to receive payments under this Credit Agreement without deduction or withholding of any United States federal income taxes;

(ii) deliver to the Borrower two further copies of any such form or certification on or before the date that any such form or certification expires or becomes obsolete and after the occurrence of any event requiring a change in the most recent form previously delivered by it to the Borrower; and

(iii) obtain such extensions of time for filing and complete such forms or certifications as may reasonably be requested by the Borrower; or

(Y) if the Lender is not a “bank” within the meaning of Section 881(c)(3)(A) of the Code, (i) agree to furnish to the Borrower on or before the date of any payment by the Borrower two accurate and complete original signed copies of Internal Revenue Service Form W-8BEN, or successor applicable form certifying to the Lender’s legal entitlement at the date of such certificate to an exemption from U.S. withholding tax under the provisions of Section 881(c) of the Code with respect to payments to be made under this Credit Agreement (and to deliver to the Borrower two further copies of such form on or before the date it expires or becomes obsolete and after the occurrence of any event requiring a change in the most recently provided form and, if necessary, obtain any extensions of time reasonably requested by the Borrower for filing and completing such forms), and (ii) agree, to the extent legally entitled to do so, upon reasonable request by the Borrower, to provide to the Borrower such other forms as may be reasonably required in order to establish the legal entitlement of the Lender to an exemption from withholding with respect to payments under this Credit Agreement;

unless in any such case any change in treaty, law or regulation has occurred after the date such Person (or, in the case of a Person that shall become a Lender or a Participant pursuant to Section 8.2, its transferor) becomes the Lender hereunder which renders all such forms inapplicable or which would prevent the Lender from duly completing and delivering any such form with respect to it and the Lender so advises the Borrower. Each Person that shall become the Lender shall, upon the effectiveness of the related transfer, be required to provide all of the forms, certifications and statements required pursuant to this subsection; provided that in the case of a Participant the obligations of such Participant pursuant to this subsection (b) shall be determined as if the Participant were a Lender except that such Participant shall furnish all such required forms, certifications and statements to the Lender..

11

2.8 Place and Manner of Payments; Joint and Several Liability

Except as otherwise specifically provided herein, all payments hereunder shall be made to the Lender in Dollars in immediately available funds, without offset, deduction, counterclaim or withholding of any kind, at its offices specified in Section 8.1 not later than 2:00 P.M. (New York, New York time) on the date when due. Payments received after such time shall be deemed to have been received on the immediately succeeding Business Day. The Lender may (but shall not be obligated to) debit the amount of any such payment which is not made by such time to any ordinary deposit account of the Borrowers maintained with the Lender (with notice to the Borrower). The Borrowers shall, at the time they make any payment under this Credit Agreement, specify to the Lender the principal, interest, fees or other amounts payable by the Borrowers hereunder to which such payment is to be applied (and in the event that it fails so to specify, or if such application would be inconsistent with the terms hereof, the Lender shall apply the payment in such manner as the Lender may determine to be appropriate in respect of obligations owing by the Borrower hereunder). Whenever any payment hereunder shall be stated to be due on a day which is not a Business Day, the due date thereof shall be extended to the immediately succeeding Business Day (subject to accrual of interest at non-default rates and fees for the period of such extension (but not any default interest on amounts as to which such due date shall have been extended)), except that in the case of LIBOR Loan, if the extension would cause the payment to be made in the next following calendar month, then such payment shall instead be made on the immediately preceding Business Day. Except as expressly provided otherwise herein, all computations of interest shall be made on the basis of actual number of days elapsed over a year of 360 days. Interest shall accrue from and include the date of borrowing, but exclude the date of payment. Notwithstanding anything to the contrary herein, express or implied, the obligations of the Borrowers under this Agreement shall be joint and several.

2.9 Break Funding Payments.

In the event of (a) the payment of any principal of any LIBOR Loan other than on the last day of an Interest Period applicable thereto (including as a result of an Event of Default), or (b) the failure to borrow or prepay any LIBOR Loan on the date specified in any notice delivered pursuant hereto, then, in any such event, the Borrower shall compensate the Lender for the loss, cost and expense attributable to such event. In the case of a LIBOR Loan, such loss, cost or expense to the Lender shall be deemed to include an amount determined by the Lender to be the excess, if any, of (i) the amount of interest which would have accrued on the principal amount of such Loan had such event not occurred, at the interest that would have been applicable to such Loan, for the period from the date of such event to the last day of the then current Interest Period therefor (or, in the case of a failure to borrow, for the period that would have been the Interest Period for such Loan), over (ii) the amount of interest which would accrue on such principal amount for such period at the then applicable LIBOR Rate for a period available in the London interbank market closest in length to such remaining period. A certificate of the Lender setting forth any amount or amounts that the Lender is entitled to receive pursuant to this Section shall be delivered to the Borrower and shall be conclusive absent manifest error. The Borrower shall pay the Lender the amount shown as due on any such certificate within 10 days after receipt thereof.

2.10 Market Disruption

If in relation to any Interest Period the Lender determines (which determination shall be conclusive and binding) that by reason of circumstances affecting the London interbank market generally, adequate and fair means do not exist for ascertaining LIBOR for that Interest Period or that the quoted LIBOR for that Interest Period does not accurately or reliably reflect the cost of funding to Lender for making the Loan or to lenders, generally, for making loans similar to the Loan (a “Market Disruption”), the Lender shall promptly notify the Borrower accordingly. Immediately following such notification, the Lender and Borrower shall negotiate in good faith with a view to agreeing upon an alternative basis for determining the applicable interest rate. If an alternative basis is agreed in writing within a period of thirty (30) days after such notification or such longer period for discussion as the parties may agree, the alternative basis shall take effect in accordance with its terms. If the parties are unable to reach agreement as to an alternative basis for determining the applicable interest rate for the relevant Interest Period, then each Loan shall automatically convert to a Base Rate Loan and shall continue as a Base Rate Loan until Lender determines, in the exercise of its sole discretion, that the circumstances causing or contributing to the Market Disruption no longer exist.

12

2.11 Right of Setoff

If an Event of Default shall have occurred and be continuing, Lender (including Lender’s home office and other Branches thereof) is hereby authorized at any time and from time to time, to the fullest extent permitted by law, to set off and apply any and all deposits (general or special, time or demand, provisional or final) at any time held and other indebtedness at any time owing by Lender to or for the credit or account of the Borrower against any and all the Loans and other Obligations of the Borrower now or hereafter existing under this Credit Agreement and the other Credit Documents held by the Lender, irrespective of whether or not the Lender shall have made any demand under this Credit Agreement or such other Credit Documents and although such Loans and other Obligations may be unmatured. The rights of the Lender under this Section 2.11 are in addition to other rights and remedies (including other set off rights) which Lender may have.

SECTION 3. CONDITIONS PRECEDENT

3.1 Conditions to Effectiveness.

This Credit Agreement shall not become effective until the date (the “Effective Date”) on which each of the following conditions is satisfied or provided for in form and substance as satisfactory to the Lender, as determined by Lender, in its sole discretion, or duly waived in writing by the Lender in accordance with Section 8.5:

(a) Executed Credit Documents. Receipt by the Lender of duly executed originals of this Credit Agreement, the other Credit Documents and the initial Letter of Credit, issuance of which Letter of Credit shall have been confirmed by the issuer. In order to increase the Maximum Total Amount above an initial Maximum Total Amount of $15,000,000, the Borrower shall provide additional Letters of Credit at any time and from time to time within the six (6) month period following the Effective Date. The Borrower shall not have the right to provide additional Letters of Credit or to otherwise increase the then effective Maximum Total Amount after such date.

(b) No Default; Representations and Warranties. As of the Effective Date (i) there shall exist no Default or Event of Default and (ii) all representations and warranties contained herein and in the other Credit Documents shall be true and correct in all material respects.

(c) Corporate Documents. Receipt by the Lender of the following:

(i) Charter Documents. A copy of the articles of incorporation of each Borrower certified to be true and complete as of a recent date by the appropriate Governmental Authority of the state of its incorporation and certified by an officer of each Borrower to be true and correct as of the Closing Date.

(ii) By-laws. A copy of the by-laws of the Borrower certified by an officer of the Borrower to be true and correct as of the Effective Date.

(iii) Resolutions. A copy of the resolution of the board of directors of each Borrower approving and adopting the Credit Documents to which it is a party, the transactions contemplated thereby and authorizing execution and delivery thereof, certified by the Secretary of the Board of Directors of Borrower to be true and correct and in force and effect as of the date hereof and the Effective Date.

(iv) Good Standing. A copy of (A) the certificate of good standing, with respect to the Borrower, certified as of a date that is within 5 business days of the Effective Date (or such other recent date as is acceptable to Lender, in its sole discretion) by the appropriate Governmental Authorities of the state of incorporation and each other jurisdiction in which the failure to so qualify and be in good standing would have a Material Adverse Effect on the business or operations of the Borrower in such jurisdiction and (B) to the extent available, a certificate indicating payment of all corporate franchise taxes certified as of a recent date by the appropriate governmental taxing authorities.

13

(v) Incumbency. An incumbency certificate, including specimen signatures, of the authorized signatories of the Borrower authorized to execute the Credit Documents to which it is a party on behalf of the Borrower.

(vi) Financial Statements. The Most Recent Borrower Financial Statements.

(d) Financial Information. The Most Recent Borrower Financial Statements (i) present fairly in all material respects the financial position of the Borrower as of the dates thereof and the results of operations of the Borrower for the periods covered thereby; (ii) are consistent in all material respects with the books and records of the Borrower; and (iii) have been prepared in accordance with GAAP throughout the periods indicated (except as may be indicated therein). Since the Financial Statement Date, there shall not have occurred, nor otherwise exist, an event or condition which has a Material Adverse Effect on the Borrower.

(e) Opinion of Borrower’s Counsel. Lender shall have received a legal opinion addressed to the Lender and dated the Closing Date from Borrower’s Counsel, in the form and substance acceptable to Lender.

(f) Public Records Searches. Lender shall have received UCC, liens, judgments and Bankruptcy searches, each of which shall in all respects be satisfactory to Lender.

(g) Payment of Lender’s Legal Fees. The Legal Fees shall be paid on or prior to the date of this Credit Agreement to the extent invoices for such Legal Fees have been presented to Borrower for payment.

(h) Other. Receipt by the Lender of such other documents, agreements or information which it may reasonably request.

3.2 Conditions to All Loans

The obligation of the Lender to make any Loan hereunder is subject to the satisfaction prior to or concurrently with the making of such Loan of the following conditions precedent in form and substance satisfactory to Lender as determined by the Lender in its sole discretion, or duly waived in writing by the Lender in accordance with Section 8.5:

(a) The Lender shall receive from the Borrower (A) a duly executed and completed Promissory Note, specifying or reflecting (by recordation or other notation by Lender from time to time on the Note and/or in books and records maintained for such purpose, whether manually, electronically or digitally) the principal amount of the requested Loan and dated the date of the requested Disbursement Date; (B) a duly executed and completed Notice of Borrowing in accordance with Section 2.1(b); and (C) such other Credit Documents as may be required by Lender, to the extent not previously executed and delivered in connection with the original closing and such requirement to deliver the relevant Credit Documents is covered herein.

(b) If the Borrower elects to increase the Maximum Total Amount above an initial Maximum Total Amount of $15,000,000, the Borrower shall provide additional Letters of Credit at any time and from time to time within the six (6) month period following the Effective Date.

(c) The representations and warranties made by the Borrower regarding the Borrower herein or which are contained in any certificate, document or financial or other Credit Document furnished at any time under or in connection herewith, shall be true and correct on and as of each the Borrowing Date and the Disbursement Date for such Loan as if made on and as of such date (unless the representation or warranty expressly relates to an earlier date, in which case such representation or warranty shall have been true and correct in all material respects as of such earlier date.

(d) No default or Event of Default shall have occurred and be continuing on such date or after giving effect to the Loan to be made on such Disbursement Date.

14

(e) After giving effect to the requested Loan the aggregate amount of all Loans shall not exceed the Maximum Total Amount.

(f) (i) No litigation, investigation or proceeding before or by any arbitrator or Governmental Authority shall be continuing or threatened against Borrower or against the officers or directors of Borrower (A) in connection with the Credit Documents or any of the transactions contemplated thereby and which, in the reasonable opinion of Lender, is deemed material or (B) which is likely to, in the reasonable opinion of Lender, have a Material Adverse Effect; and (ii) no injunction, writ, restraining order or other order of any nature materially adverse to Borrower or the conduct of its business or inconsistent with the due consummation of the transactions contemplated by this Credit Agreement shall have been issued by any Governmental Authority.

(g) (i) since the date of the Most Recent Borrower Financial Statements, there shall not have occurred any event, condition or state of facts which could reasonably be expected to have a Material Adverse Effect with respect to the condition, financial or otherwise, or the results and business prospects of Borrower and (ii) no representations made or information supplied to Lender shall have been proven to be inaccurate or misleading in any material respect.

SECTION 4. REPRESENTATIONS AND WARRANTIES

The Borrower represents and warrants to the Lender as of the date of this Credit Agreement and on each Disbursement Date, as follows:

4.1 Corporate Status.

Each Borrower is a corporation duly formed and organized and validly existing in good standing in its jurisdiction of incorporation, is duly qualified and in good standing as a foreign corporation and authorized to do business in and to own its assets in all other jurisdictions wherein the nature of its business or property makes such qualification necessary, except where its failure so to qualify would not have a Material Adverse Effect, and has full power to own its real properties and its material personal properties and to carry on its business as now conducted.

4.2 Corporate Authorization.

The execution, delivery and performance of the Credit Documents by the Borrower are within the powers and authority of the Borrower, have been duly authorized by proper corporate proceedings and do not and will not contravene any provision of applicable law or of its articles of incorporation, as amended to date, or the by-laws, as amended to date, or any instrument binding on the Borrower or any of its material properties or assets, or result in the creation or imposition of any Lien upon any of its property or assets pursuant to any agreement or any instrument to which it is a party or by which it is bound. Each of this Credit Agreement and other Credit Documents to which it is a party has been duly executed and delivered by the Borrower and constitutes the legal, valid and binding obligation of the Borrower enforceable against the Borrower in accordance with its terms, subject to the effect of (a) applicable bankruptcy, moratorium, insolvency, reorganization or other similar law affecting the enforceability of creditors’ rights generally and (b) general principles of equity (whether in a proceeding at law or in equity)..

4.3 Liens; Indebtedness.

Neither the Borrower nor any of its Subsidiaries has outstanding any Lien except as identified on Schedule 4.3.

4.4 Litigation.

There are no actions, suits or proceedings pending or, to the best knowledge of the Borrower, threatened against or affecting the Borrower or any Subsidiary in any court or arbitration or before or by any governmental department, agency or instrumentality, domestic or foreign, which reasonably could be expected to have a Material Adverse Effect; and none of the Borrower or any Subsidiary is in violation of any judgment, order, writ, injunction, decree or award or in violation of any rule or regulation of any Governmental Authority, domestic or foreign, the violation of which would have a Material Adverse Effect.

15

4.5 Governmental and Other Approvals.

No approval, consent or authorization of, or any other action by, or filing or registration with, any governmental department, agency or instrumentality, domestic or foreign, is necessary for the execution or delivery by the Borrower of the Credit Documents or for the performance by the Borrower of any of the terms or conditions hereof.

4.6 Use of Loan.

Proceeds of the Loan will be used and applied solely for purposes of completing the development and construction of the Project (“Permitted Purposes”). Notwithstanding any conflicting or inconsistent provision of this Agreement, Lender may, in its sole discretion, require as a condition to making any advances or disbursements of proceeds of the Loan, require Borrower to furnish for review by Lender, any reports, information, material or data which shall be satisfactory to Lender in all respects, to enable Lender to determine (which determination shall be conclusive and binding) whether the intended purpose(s) set forth in any applicable Notice of Borrowing qualifies as a Permitted Purpose(s). Without limiting any other provision of this Agreement or under applicable law, the making of any Loan or disbursement of any proceeds thereof shall not be deemed an approval or acceptance by the Lender of any work performed or to be performed on the Project, it being understood and agreed that (i) any determination by Lender as to whether the intended purpose set forth in any applicable Notice of Borrowing qualifies as a Permitted Purpose(s) shall be for Lender’s sole benefit and (ii) Lender shall have no obligation to monitor or determine Borrower’s use or application of any advance or disbursement of Loan proceeds.

4.7 ERISA.

Each of the Borrowers and each Subsidiary have fulfilled its obligations, if any, under the minimum funding standards of ERISA with respect to each Plan maintained by it and is otherwise in compliance in all material respects with the applicable provisions of ERISA.

4.8 Environmental Compliance.

Each of the Borrower and its Subsidiaries is in substantial compliance with all applicable federal, state and local environmental laws, regulations and ordinances governing its business, properties or assets with respect to discharges into the ground and surface water, emissions into the ambient air and generation, storage, transportation and disposal of waste materials or process by-products, except such noncompliances as are not likely to have a Material Adverse Effect.

4.9 Foreign Assets Control Regulations, Etc.; OFAC Compliance.

Neither the execution and delivery of this Credit Agreement or the other Credit Documents by Borrower nor the use of the proceeds of the Loan, will violate the Trading with the Enemy Act, as amended, or any of the foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) of the Anti-Terrorism Order or any enabling legislation or Executive Order relating to any of the same. Without limiting the generality of the foregoing, neither the Borrower nor any of their respective Subsidiaries (a) is or will become a blocked person described in Section 1 of the Anti-Terrorism Order or (b) engages or will engage in any dealings or transactions or be otherwise associated with any such blocked person. None of the Borrower or any Subsidiary thereof or any principal of Borrower or any Person who controls Borrower is listed on the Specially Designated Nationals and Blocked Persons List maintained by the Office of Foreign Asset Control, Department of the Treasury (“OFAC”) pursuant to Executive Order No. 13224, 66 Fed. Reg. 49079 (Sept. 25, 2001), and/or any other list maintained pursuant to any of the rules and regulations of OFAC or pursuant to any other applicable Executive Orders or otherwise subject to any sanction imposed pursuant to an OFAC implemented regulation.

16

SECTION 5. COVENANTS

So long as this Agreement, or any renewal, extension or modification hereof, remains in effect, and, in any event, until indefeasible payment in full and discharge of all Loans and other Obligations of Borrower to the Lender, including payment of all principal of and interest on the Loans, the Borrower shall comply, and shall cause each Subsidiary, to the extent applicable, to comply, with the following covenants:

5.1 Corporate Existence.

The Borrower will, and will cause each of its Subsidiaries to, do or cause to be done all things necessary to preserve, renew and keep in full force and effect its legal existence and the rights, licenses, permits, privileges, franchises, patents, copyrights, trademarks and trade names that are material to the conduct of the business of the Borrower and its Subsidiaries as a whole.

5.2 Reports, Certificates and Other Information.

The Borrower shall furnish to the Lender:

(A) as soon as available and in any event within 120 days after the end of each Fiscal Year of the Borrower, the audited consolidated balance sheet of the Borrower and its consolidated Subsidiaries as at the end of such Fiscal Year and the consolidated statements of income, cash flows and common shareholders’ equity of the Borrower and its consolidated Subsidiaries for such fiscal year, setting forth in each case in comparative form the corresponding figures for the preceding Fiscal Year, all in reasonable detail and accompanied by a report or opinion (which shall not be qualified by reason of any limitations imposed by the Borrower) of an independent public accounting firm of recognized national standing selected by the Borrower, which shall be prepared in accordance with generally accepted auditing standards relating to reporting, to the effect that such financial statements present fairly, in accordance with GAAP consistently applied (except for changes in which such accountants concur), the consolidated financial condition of the Borrower and its consolidated Subsidiaries as at the end of such Fiscal Year and their consolidated results of operations and the consolidated cash flows for such Fiscal Year;

(B) as soon as available and in any event within 45 days after the end of each fiscal quarter period (other than the last quarterly period) of each Fiscal Year of the Borrower, the consolidated balance sheet of the Borrower and its consolidated Subsidiaries as at the end of such quarterly period and the consolidated statements of income and cash flows of the Borrower and its consolidated Subsidiaries for that part of the Fiscal Year ended with such quarterly period, setting forth in each case in comparative form the corresponding figures for the corresponding period of the preceding Fiscal Year, all in reasonable detail and certified by the senior officer in the Borrower’s finance department, subject to normal year-end adjustments;

(C) as soon as available and in any event within 30 days after the Borrower knows or has reason to know that any circumstances exist that constitute grounds entitling the Pension Benefit Guaranty Corporation (“PBGC”) to institute proceedings to terminate a Plan subject to ERISA with respect to the Borrower or any commonly controlled entity, and promptly but in any event within two (2) business days of receipt by the Borrower or any commonly controlled entity of notice that the PBGC intends to terminate a plan or appoint a trustee to administer the same, and promptly but in any event within five (5) business days of the receipt of notice concerning the imposition of withdrawal liability with respect to the Borrower or any commonly controlled entity, the Borrower will deliver to the Lender a certificate of the chief financial officer of the Borrower setting forth all relevant details and the action which the Borrower proposes to take with respect thereto;

(D) immediately upon a senior officer in the Borrower’s finance department becoming aware of (i) the existence of a Default or an Event of Default; and (ii) any matter that has resulted or could reasonably be expected to result in a Material Adverse Effect, including, without limitation, (a) any dispute, litigation, investigation, proceeding or suspension between the Borrower or any of its Subsidiaries and any Governmental Authority; (b) the commencement of, or any material development in, any litigation or proceeding affecting the Borrower or any of its Subsidiaries, including pursuant to any applicable environmental law; and (c) any litigation, investigation or proceeding affecting the Borrower in which the amount involved exceeds $500,000, or in which injunctive relief or similar relief is sought, in the cases of subclauses (ii) (a) through (c) which could reasonably be expected to have a Material Adverse Effect, a written notice specifying the nature and period of existence thereof and what action the Borrower is taking or proposes to take with respect thereto;

17

(E) promptly after the sending or filing thereof, copies of all reports which the Borrower may from time to time furnish its stockholders;

(F) within five (5) business days following the close of each calendar month with respect to the month just ended: (i) reports on the progress of the development and construction of the Project and (ii) reports on the business operations of Borrower (including, without limitation, reports on production volume, customer lists, sales volume, unit pricing and such other information required by Lender); each of the foregoing reports and information required under this Section 5.2 (F) shall be in such form, substance and detail as required by Lender, in its sole discretion, and each of which shall be duly certified by a duly authorized officer(s) of Borrower having knowledge of the respective contents, as shall be reasonably determined by Lender.