Attached files

| file | filename |

|---|---|

| EX-32.1 - BTHC XV, Inc. | bthc10ka2ex321081911.htm |

| EX-31.1 - BTHC XV, Inc. | bthc10ka2ex311081911.htm |

| EX-32.2 - BTHC XV, Inc. | bthc10ka2ex322081911.htm |

| EX-31.2 - BTHC XV, Inc. | bthc10ka2ex312081911.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 2)

(Mark One)

For the fiscal year ended December 31, 2010

OR

For the transition period from ____________________to____________________

Commission file number: 0-52808

|

BTHC XV, Inc.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Delaware

|

20-5456294

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

c/o Underground Grand Canyon

Linyi City, Yishui County, Shandong Province, China

|

276400

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: +86 539-2553919

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered:

|

|

|

___________________________________________

|

________________________________________

|

|

|

___________________________________________

|

________________________________________

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 Par Value

(Title of class)

____________________________

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation of S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

The aggregate market value of the voting stock on April14, 2011 (consisting of Common Stock, $0.001 par value per share) held by non-affiliates cannot be determined because the registrant currently has no market for its common stock. Non affiliates own 1,058,433 shares of the common stock outstanding.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No o

As of April 14, 2011, there were 18,089,660 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

ANNUAL REPORT ON FORM 10-K

_______________

TABLE OF CONTENTS

|

Forward-Looking Statements

|

iii

|

|

Use of Certain Defined Terms

|

iv

|

|

PART I

|

1 |

|

Item 1.Business.

|

1

|

|

Item 1A.Risk Factors.

|

22

|

|

Item 1B.Unresolved Staff Comments.

|

46

|

|

Item 2.Properties.

|

46

|

|

Item 3.Legal Proceedings.

|

47

|

|

PART II

|

48 |

|

Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

48

|

|

Item 6.Selected Financial Data.

|

50

|

|

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

50 |

|

Item 7A.Quantitative and Qualitative Disclosures about Market Risk.

|

63

|

|

Item 8.Financial Statements and Supplementary Data.

|

64

|

|

Item 9.Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

64 |

|

Item 9A.Controls and Procedures.

|

64

|

|

Item 9B.Other Information.

|

67

|

|

PART III

|

67 |

|

Item 10.Directors, Executive Officers and Corporate Governance.

|

67

|

|

Item 11.Executive Compensation.

|

71

|

|

Item 12.Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

75

|

|

Item 13.Certain Relationships and Related Transactions, and Director Independence

|

76

|

|

Item 14.Principal Accounting Fees and Services.

|

85

|

|

PART IV

|

86 |

|

Item 15.Exhibits, Financial Statement Schedules.

|

86

|

ii

EXPLANATORY NOTE

BTHC XV, Inc. (the “Company”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2010 with the Securities and Exchange Commission (the “SEC”) on April 15, 2011 (the “Original Filing”). On June 29, 2011, the Company filed an amendment to the Original Filing (“Amendment No. 1”) in response to comments it received from the Division of Corporation Finance of the SEC on May 18, 2011. The Company is filing this Annual Report on Form 10-K/A (the “Form 10-K/A”) in response to comments it has received from the Division of Corporation Finance of the SEC on July 22, 2011. Except as described above and for the addition of certain clarifying information, no other changes have been made to Amendment No. 1, and this Form 10-K/A does not modify or update any other information in Amendment No. 1. Information not affected by the changes described above is unchanged and reflects the disclosures made at the time of the Original Filing. Among other things, forward-looking statements made in the Original Filing have not been updated or revised to reflect events, results or developments that have occurred or facts that have become known to the Company after the date of the Original Filing, and such forward-looking statements should be read in their historical context. This Form 10-K/A should be read in conjunction with the Company’s filings made with the SEC subsequent to the Original Filing, including any amendments to those filings.

Forward-Looking Statements

The information contained in this Annual Report, including in the documents incorporated by reference into this Annual Report, includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our and our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Annual Report are based on current expectations and beliefs concerning future developments and the potential effects on our company. There can be no assurance that future developments actually affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following: our ability to increase our revenues and expand our business operations; our ability to successfully implement our acquisition strategy; availability and cost of external financing; our ability to manage our growth; competition for discretionary spending; weather conditions; the length of our operating season; importance of our land use rights to the operation of our business; unanticipated construction delays in completing capital improvements; the effect of any extended shutdown period of our facilities; accidents occurring at our tourist destinations; lack of business interruption or third-party liability insurance; factors that affect tourist destination attendance, such as local conditions, events, natural disasters, disturbances and terrorist activities; dependence on key management personnel; obligations under guarantees; our significant debt load; control by a limited number of principal stockholders; potential conflicts of interest; our ability to increase revenues through price increases; our ability to obtain, maintain and renew necessary safety inspections on the special equipment we operate; failure to maintain an effective system of internal control over financial reporting; lack of experience with and knowledge of U.S. GAAP and SEC rules and regulations by those individuals in charge of and with responsibility over the preparation of our financial statements; our business’ susceptibility to the economic, political and legal policies, developments and conditions in China; uncertain legal environment in China; the degree to which the PRC government influences the conduct of our business; ambiguities in the implementation of the New M&A Rule; our ability to use equity compensation to attract and retain qualified personnel; rapid growth of the PRC economy and inflation as a result thereof; government control of currency conversion; fluctuations in exchange rates; outbreaks of widespread public health problems in the PRC, such as the Swine Flu, SARS or the Avian Flu; lack of deposit insurance for funds held in local banks; our ability to comply with the FCPA and Chinese anti-corruption laws; our ability to pay dividends to our stockholders; the implementation of the new PRC employment contract law; our classification as a “resident enterprise” under the Enterprise Income Tax Law; cultural, political and language differences between China and the United States; adverse changes in the securities markets; development of a public trading market for our securities; and the other factors referenced in this Annual Report, including, without limitation, under the sections entitled “Item 1A. – Risk Factors,” “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Item 1. – Business.”

These risks and uncertainties, along with others, are also described in “Item 1A – Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

-iii-

As used in this Annual Report, unless the context requires or is otherwise indicated, the terms “we,” “us,” “our,” the “Registrant,” the “Company,” “our company” and similar expressions include the following entities, after giving effect to the Share Exchange (as defined below):

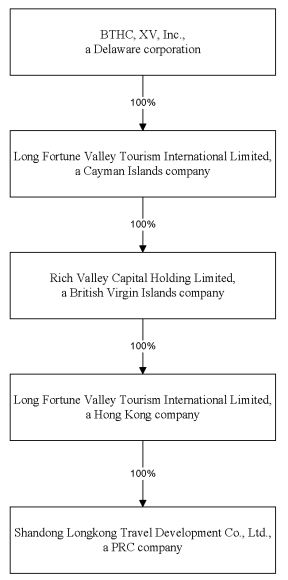

(i) BTHC XV, Inc., a Delaware corporation (“BTHC”), which is a publicly traded company;

(ii) Long Fortune Valley Tourism International Limited, a company organized under the laws of the Cayman Islands and a wholly-owned subsidiary of BTHC (“Long Fortune”);

(iii) Rich Valley Capital Holding Limited, a company organized under the laws of the British Virgin Islands and a wholly-owned subsidiary of Long Fortune (“Rich Valley”);

(iv) Long Fortune Valley Tourism International Limited, a company organized under the laws of Hong Kong and a wholly-owned subsidiary of Rich Valley (“LFHK”); and

(v) Shandong Longkong Travel Management Co., Ltd., a company organized under the laws of China and a wholly-owned subsidiary of LFHK (“Longkong”).

“China” or “PRC” refers to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan. “RMB” or “Renminbi” refers to the legal currency of China and “$” or “U.S. Dollars” refers to the legal currency of the United States. The Company maintains its books and accounting records in Renminbi. Unless otherwise stated, the translations of RMB into U.S. Dollars have been made at the rate of exchange of $1.00 to RMB 6.5920, the approximate average exchange rate for the year ended December 31, 2010. We make no representation that the RMB or U.S. Dollar amounts referred to in this Annual Report could have been or could be converted into U.S. Dollars or RMB, as the case may be, at any particular rate or at all. “GAAP” unless otherwise indicated refers to accounting principles generally accepted in the United States. All U.S. Dollar amounts referenced herein are in thousands, unless the context requires otherwise.

-iv-

PART I

Item 1. Business.

The Share Exchange

On October 6, 2010, BTHC entered into a Share Exchange Agreement with Halter Financial Investments LP, its principal shareholder (“BTHC Principal Shareholder”), Long Fortune and Grand Fountain Capital Holding Limited, a company organized under the laws of the Cayman Islands, Zhang Shanjiu, Zhang Qian, Li Shikun and Yu Xinbo (collectively, the “Long Fortune Shareholders”) (the “Share Exchange Agreement”). Pursuant to the terms of the Share Exchange Agreement, BTHC agreed to acquire all of the issued and outstanding shares of Long Fortune from the Long Fortune Shareholders in exchange for the issuance by BTHC to the Long Fortune Shareholders of an aggregate of 17,185,177 newly-issued shares of BTHC common stock, $0.001 par value per share (the “Share Exchange”). In addition, Long Fortune paid $250,000 to HFG International Limited, a Hong Kong corporation and affiliate of the BTHC Principal Shareholder, for financial advisory services in connection with the Share Exchange and certain post-closing Share Exchange matters and also agreed to pay BTHC’s expenses in connection with the Share Exchange. The execution of the Share Exchange Agreement was previously reported in BTHC’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on October 6, 2010.

On October 18, 2010 (the “Closing Date”), the Share Exchange was consummated and an aggregate of 17,185,177 shares of BTHC common stock were issued to the Long Fortune Shareholders, which constituted 95% of BTHC’s issued and outstanding shares of common stock. Upon the consummation of the Share Exchange, Long Fortune became a wholly-owned subsidiary of BTHC.

The corporate structure of BTHC, after taking into account the Share Exchange, is as follows:

Our shares of common stock are currently listed on the Over the Counter Bulletin Board (“OTCBB”).

1

Description of the Company

Corporate History

BTHC was organized on August 16, 2006 as a Delaware corporation to effect the reincorporation of BTHC XV, LLC, a Texas limited liability company, mandated by the plan of reorganization discussed below. In accordance with the confirmed plan of reorganization, BTHC’s business plan was to seek to identify a privately-held operating company desiring to become a publicly held company by merging with BTHC through a reverse merger or other acquisition transaction. Prior to the Share Exchange, BTHC was considered a “shell” company. From and after the Closing Date of the Share Exchange, BTHC was no longer a “shell” company and its primary operations consist of the business and operations of Long Fortune which are conducted in Linyi City, Yishui County, Shandong Province, China.

In September 1999, Ballantrae Healthcare LLC and affiliated limited liability companies including BTHC XV, LLC (collectively “Ballantrae”) were organized for the purpose of operating nursing homes throughout the United States. Although Ballantrae continued to increase the number of nursing homes it operated and in June 2000 had received a substantial equity investment, it was unable to achieve profitability. During 2001 and 2002, Ballantrae continued to experience severe liquidity problems and did not generate enough revenues to cover its overhead costs. Despite obtaining additional capital and divesting unprofitable nursing homes, by March, 2003, Ballantrae was out of cash and unable to meet its payroll obligations.

2

On March 28, 2003, Ballantrae filed a petition for reorganization under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”). On November 29, 2004, the bankruptcy court approved the First Amended Joint Plan of Reorganization (the “Plan”), as presented by Ballantrae, its affiliates and their creditors. On August 16, 2006, pursuant to the Plan, BTHC XV, LLC was merged into BTHC XV, Inc., a Delaware corporation.

Halter Financial Group, Inc. (“HFG”) participated with Ballantrae and their creditors in structuring the Plan. As part of the Plan, HFG provided $76,500 to be used to pay professional fees associated with the Plan confirmation process. HFG was granted an option to be repaid through the issuance of equity securities in 17 of the reorganized Ballantrae entities, including BTHC. HFG exercised the option, and as provided in the Plan, 70% of BTHC’s outstanding common stock, or 350,000 shares, were issued to HFG, in satisfaction of HFG’s administrative claims. The remaining 30% of BTHC’s outstanding common stock, or 150,000 shares, were issued to 497 holders of administrative and tax claims and unsecured debt. The 500,000 shares (“Plan Shares”) were issued pursuant to Section 1145 of the Bankruptcy Code.

Effective August 16, 2006, HFG transferred its 350,000 Plan Shares to Halter Financial Investments L.P. (“HFI”), a Texas limited partnership controlled by Timothy P. Halter. Mr. Halter also served as BTHC’s sole officer from BTHC’s formation on August 16, 2006 until the Closing Date, when he was replaced by Zhang Shanjiu, and also as our sole director from BTHC’s formation until the effective date of a filing of a Schedule 14F in connection with the Share Exchange.

BTHC remained subject to the jurisdiction of the bankruptcy court until it filed a certificate of compliance with the bankruptcy court that stated that the requirements of the Plan were met as a result of the closing of the transactions contemplated by the Share Exchange Agreement, which resulted in the discharge to be deemed granted. As such, the post discharge injunction provisions set forth in the Plan and the confirmation order have become effective.

Through the Share Exchange, BTHC acquired Long Fortune, a Cayman Islands company that was established on December 9, 2009. Since inception, Long Fortune has not conducted any substantive operations of its own, except to serve as a holding company that owns 100% of the equity of Rich Valley.

Rich Valley is a British Virgin Islands company that was established by Long Fortune on December 9, 2009 as a wholly-owned subsidiary. Since inception, Rich Valley has not conducted any substantive operations of its own, except to serve as a holding company that owns 100% of the equity of LFHK.

LFHK is a Hong Kong company that was established by Rich Valley on December 22, 2009 as a wholly owned subsidiary. Since inception, LFHK has not conducted any substantive operations of its own, except to serve as a holding company that owns 100% of the equity of Longkong. Longkong is a cave tourism development and management company that presently operates the “Underground Grand Canyon” located in Linyi City, Yishui County, Shandong Province, China.

Longkong is a limited liability company that was organized in the PRC on March 15, 2004 as Shandong Underground Grand Canyon Travel Development Co., Ltd. (“Shandong Grand Canyon”) with an initial registered capital of approximately $2.4 million, which was 79.2% owned by Zhang Shanjiu and 20.8% owned by Zhang Qian, Zhang Shanjiu’s daughter. On August 25, 2004, the registered capital of Shandong Grand Canyon was increased to approximately $3.8 million, which resulted in an increase in the number of shareholders from two to fifteen. After the increase in registered capital, Zhang Shanjiu, Zhang Qian, Chen Rongxia, Zhang Shanjiu’s wife, and Yu Xinbo owned 56.60%, 15.72%, 6.92% and 5.66% of Shandong Grand Canyon, respectively, while the remaining eleven shareholders owned 15.10% of Shandong Grand Canyon.

3

Until September 2004, Shandong Grand Canyon invested in Yishui Underground Fluorescent Lake Travel Development Co., Ltd., Shandong Shanjun Bronze Craft Co., Ltd. and Yishui Yimong Mountain Travel Service Co., Ltd., thereby becoming the parent entity of each company and forming a PRC enterprise group of tourism companies. Longkong was then known as Shandong Long Kong Tourism Group Co. Ltd. (“Long Kong Tourism Group”).

In September 2007, the shareholders of Long Kong Tourism Group entered into several equity transfer transactions that resulted in the reduction in the number of shareholders from fifteen to six. After the equity transfers, Zhang Shanjiu, Zhang Qian, Chen Rongxia and Yu Xinbo owned 21.26%, 59.87%, 1.13% and 2.52% of Long Kong Tourism Group, respectively, while the remaining two shareholders owned 15.22% of Long Kong Tourism Group.

On October 10, 2007, the shareholders agreed to a decrease in Long Kong Tourism Group’s registered capital to approximately $3.2 million, which ultimately resulted in Zhang Qian and Li Hongwei being cashed out as shareholders. After the decrease in registered capital, Zhang Shanjiu, Chen Rongxia and Yu Xinbo owned 84.5%, 4.5% and 10% of Long Kong Tourism Group, respectively, while the remaining shareholder owned 1% of Long Kong Tourism Group.

On December 17, 2007, largely in part due to the rarity of a group of companies such as the Long Kong Tourism Group in the PRC, Long Kong Tourism Group’s management decided to sell its majority interest in its three subsidiaries to the minority shareholders in each company in order to focus on its core business. In that process, Long Kong Tourism Group changed its name to Longkong’s present name. Long Kong Tourism Group’s interest in Yishui Underground Fluorescent Lake Travel Development Co. Ltd. was sold to Zhang Qian, Zhang Shanjiu’s daughter, for approximately $1.8 million. Long Kong Tourism Group’s interest in Shandong Shanjun Bronze Craft Co., Ltd. was sold to Li Hongwei, a former shareholder and employee of the predecessor to Long Kong Tourism Group, for approximately $274,000. Long Kong Tourism Group’s interest in Yishui Yimong Mountain Travel Service Co., Ltd. was sold to Zhang Shanshuang, Zhang Shanjiu’s brother, for approximately $27,000.

On March 10, 2008, the four remaining shareholders of Longkong transferred their shares to Longong Travel Limited, a United Kingdom company (“Longong”), for approximately $2.0 million. Longong was a company that was established on behalf of Zhang Shanjiu by a third party trustee in the United Kingdom. The shares of Longong were held in trust for the benefit of Zhang Shanjiu, who beneficially owned the shares of Longong and had the ability to exercise control over Longong.

On November 12, 2008, Longong sold 100% of the equity interests in Longkong to Long Fortune Valley Limited, a company organized under the laws of Gibraltar (“Fortune Valley”), for $1. Both Longong and the trust were dissolved after the sale of Longkong to Fortune Valley. Fortune Valley was a company that was established on behalf of Zhang Shanjiu by a third party trustee in Gibraltar. The shares of Fortune Valley were held in trust for the benefit of Zhang Shanjiu, who beneficially owned the shares of Fortune Valley and had the ability to exercise control over Fortune Valley. On December 29, 2009, Fortune Valley sold 100% of the equity interests in Longkong to LFHK for $1. Both Fortune Valley and the trust were dissolved after the sale of Longkong to LFHK.

4

Longkong owns a less than 1% interest in Yishui Rural Credit Cooperative (“Yishui Credit”), which is a financial institution located in Yishui County, Shandong Province. As of December 31, 2010, Yishui Credit has extended four loans to us with an aggregate balance due of $3.2 million. The interest rates on the loans are between 5.31% and 11.15%, with a weighted average interest rate of 10%. The loans are due between April 20, 2011 and May 20, 2011.

Business Overview

We are a tourism development and management company headquartered in Shandong Province, China. Our business specializes in the development and management of natural, cultural and historic scenic sites and ecotourism projects in China, with particular emphasis on the cave tourism sector of the tourism industry. We currently operate the “Underground Grand Canyon” tourist destination.

By implementing our growth and acquisition strategy, we plan to continue to strengthen our business and our brand by expanding our business, acquiring additional tourist destinations and obtaining the exclusive rights to manage and operate additional tourist destinations within specified geographic regions in China. We aim to become China’s leading tourism development and management company.

The Underground Grand Canyon

The Underground Grand Canyon, located in Linyi City, Yishui County, Shandong Province, has been awarded “AAAA Level Scenic Spot” and “National Geological Park” designations by the National Tourism Administration of the PRC and the Ministry of Land and Resources of the PRC, respectively. The Underground Grand Canyon tourist destination, at 6,100 meters (approximately 3.75 miles), is the longest cave system in northern China and contains several stalactite and stalagmite formations, as well as rivers and streams. To date, approximately 3,100 meters (approximately 2 miles) have been developed into five entertainment attractions, including: (i) the “Underground Water Drifting” attraction; (ii) the “Electric Slide Car” attraction; (iii) the “Battery Vehicle” attraction; (iv) the “Strop Ropeway” attraction; and (v) the “Treasure Hunting Cave” attraction.

In 2004, we entered into a development and management agreement with the Yaodianzi Town Government, Linyi City, Yishui County, Shandong Province to operate and manage the Underground Grand Canyon tourist destination from 2004 through 2062. Since 2004, we have invested approximately $12 million to improve the infrastructure and facilities at the Underground Grand Canyon, including the construction of new facilities, such as the commencement of construction of restaurant facilities for our visitors, an office and accommodation and entertainment facilities for our staff, building the entertainment attractions, repairing roads leading to the Underground Grand Canyon, acquiring new boats or vehicles that are used in our entertainment attractions and repairing electrical lines and water pipes in the Underground Grand Canyon.

In addition, the number of visitors has increased from approximately 150,000 in 2004 to approximately 749,000 in 2009, which is a compounded annual growth rate of 37.9%. In 2010, the number of visitors to the Underground Grand Canyon fell to approximately 672,000 visitors, which represents, from 2004 through 2010, a compounded annual growth rate of 28.5%. The decrease in the number of visitors from 2009 to 2010 was primarily due to a colder than average spring in China and two large, non-recurring tourist events in China, the 16th Asian Games hosted in Guangzhou and the World Exposition hosted in Shanghai, both of which events created additional competition for discretionary spending in 2010. The Asian Games, dating back to 1951, are held every four years and only once prior to 2010 has China been the host country for the Asian Games. The World Exposition, dating back to 1851, is a worldwide exposition held every two to three years and only once prior to 2010 has China been the host country for the World Exposition.

Our visitors come to the Underground Grand Canyon both on their own, attracted either by advertisements or through word of mouth (“self-drivers”), and through touring with domestic PRC travel agencies. Visitors from travel agencies accounted for approximately 55% of the total number of visitors in 2009, while self-drivers accounted for the remaining 45% of our visitors. Visitors from travel agencies accounted for approximately 48.1%% of the total number of visitors in 2010, while self-drivers accounted for the remaining 51.9% of our visitors. Every year, we enter into cooperation agreements with numerous domestic travel agencies throughout China, through which we anticipate a regular flow of visitors. In addition, we believe we can increase the number of visitors by both entering into cooperation agreements with additional travel agencies, as well as through repeat business from existing travel agencies based on the experience enjoyed by prior visitors from these existing travel agencies. We have built close relationships with many self-driver clubs in China, as well as several Internet travel websites. Self-driver clubs are clubs comprised of individuals with their own vehicles who arrange travel and tourism activities as a group.

5

Our sales revenue decreased approximately $0.4 million, or approximately 4.2%, to approximately $9.1 million in the fiscal year ended December 31, 2010 from approximately $9.5 million in the fiscal year ended December 31, 2009. Our revenue is generated from bundled passes (17.7% of our 2010 sales revenue), admission tickets (48.1% of our 2010 sales revenue), water drifting attraction fees (26.7% of our 2010 sales revenue), rail car fees (5.2% of our 2010 sales revenue) and other fees and services (2.3% of our 2010 sales revenue). Net income decreased approximately $1.0 million, or approximately 20.0%, to approximately $4.0 million in the fiscal year ended December 31, 2010 from approximately $5.0 million in the fiscal year ended December 31, 2009.

Our Growth Strategy

We believe we have the experience and expertise to implement our growth strategy toward our goal of becoming China’s leading tourism development and management company. Further, we believe we are well positioned to capitalize on future industry growth. Our growth strategy is comprised of the following initiatives:

|

·

|

Acquisition and management of additional natural, cultural and historic scenic sites and ecotourism projects in an effort to build a tourism chain operator. We are seeking to locate one or more sites as acquisition and/or management opportunities. No definitive agreements have been executed, nor have there been any preliminary agreements, discussions or negotiations, with respect to any of these opportunities and there can be no assurances that we will execute any such agreements or enter into discussions or negotiations with respect to any potential sites.

|

|

·

|

Enhancement of existing entertainment attractions within the “Underground Grand Canyon” and development of new attractions both in and around the “Underground Grand Canyon” cave. We continue to further improve our existing entertainment attractions within the Underground Grand Canyon and seek to develop new attractions both in and around the Underground Grand Canyon. We plan to develop an additional 1,800 meters (approximately 1.1 miles) of the Underground Grand Canyon to include additional entertainment attractions. In late January 2011, we completed the development of the “Treasure Hunting Cave” entertainment attraction, which consists of eight entertainment attractions suitable for teenagers and young adults encompassing more than 3,000 square meters (approximately 32,300 square feet), including a man-made rock hill for climbing, a maze and amusement park type rides. The total cost to develop the Treasure Hunting Cave was approximately $3.1 million and it took approximately seven to eight months to complete. The Treasure Hunting Cave entertainment attraction first opened to visitors in early February 2011. We believe these new projects will increase the attraction points to the Underground Grand Canyon and ultimately the number of visitors we host, but there can be no assurance that we will be successful in completing these new projects or that, if completed, the new projects will lead to an increase in the number of visitors.

|

|

·

|

Expansion of services and products offered to our visitors. To enhance our visitors’ experience, we recently completed the development of catering facilities, which include restaurant facilities for our visitors, as well as the services to host and cater large-scale events, and gift shop facilities. Our goal is to provide a menu suitable to the largest percentage of our visitors at an affordable price. Our catering and restaurant facilities are outsourced to third party food vendors who pay us a nominal fee to use our facilities, which totaled an aggregate of approximately $18,000 in 2010. In addition, our gift shops contain goods with special features connecting our visitors to the unique scenic images they enjoy while visiting the Underground Grand Canyon. The total cost to develop the catering and gift shop facilities was approximately $1.2 million and it took approximately two years to complete. Although we developed these facilities to enhance our visitors’ experience, there can be no assurance that we will be successful in doing so.

|

6

|

·

|

Promotion of our scenery and brand by effective advertisements. We will continue to build close relationships with domestic PRC travel agencies, self-driver clubs and Internet travel websites. In addition, an effective advertising campaign that promotes our scenery, brand and enterprise culture to new and larger population and income bases, will continue to be an important initiative in our growth strategy.

|

Our Products

As a cave tourism development and management company, we are in the services business and do not produce or manufacture any products. We currently operate the “Underground Grand Canyon” tourist destination located in Linyi City, Yishui County, Shandong Province. The Underground Grand Canyon has been awarded “AAAA Level Scenic Spot” and “National Geological Park” designations by the National Tourism Administration of the PRC and the Ministry of Land and Resources of the PRC, respectively.

The Underground Grand Canyon was discovered in 1974 by a local farmer drilling a well. However, for technical and financial reasons, it was not developed until 2000. In 2003, the Underground Grand Canyon tourist destination officially opened to visitors. In 2004, we entered into a development and management agreement with the Yaodianzi Town Government, Linyi City, Yishui County, Shandong Province to operate and manage the Underground Grand Canyon tourist destination from 2004 through 2062.

The Underground Grand Canyon tourist destination is one of the largest karst caves in China and is currently the longest karst cave in northern China at 6,100 meters (approximately 3.75 miles). The temperature inside the cave stays between 17 and 18 degrees Celsius (62.6 to 64.4 degrees Fahrenheit) year round. The cave is a typical karst topography, the shape of which is gradually formed from large karst fissures occurring 65 million years ago. It is located in the middle of the famous regional geological faults, the Tanlu Faults. Karst is a landscape or terrain that results from the chemical corrosion of carbonate rocks that are soluble in water. Carbonate rocks were made through sedimentation between 230 million and 66 million years ago. Because of the calcium carbonate (CaCO3), which is soluble in water, carbonate rocks dissolve in water and consequently let it through. Permeability is considerable because of chemically induced corrosion causing cracks, which enable the water to run through the rock. The dissolving and corrosion process takes many years.

The cave contains more than 100 landscapes, such as an underground river, stalactite springs, stalactite palaces, stalactite waterfalls and stalactite canyons. To date, approximately 3,100 meters (approximately 2 miles) have been developed, in addition to the natural scenery, into five entertainment attractions, including: (i) the “Underground Water Drifting” attraction; (ii) the “Electric Slide Car” attraction; (iii) the “Battery Vehicle” attraction; (iv) the “Strop Ropeway” attraction; and (v) the “Treasure Hunting Cave” attraction.

7

|

·

|

The “Underground Water Drifting” attraction was placed into operation in April 2003 and is the only underground river drifting site in China. Presently, the drift channel is 1,000 meters long (approximately 0.6 miles). Already the longest underground cave drift in China according to Great World DSJJNS, plans are drawn to expand to 2,500 meters (approximately 1.5 miles) in the second phase of development. Visitors take a special rubber boat down the river, enjoying extraordinary views of the valley scenery around both sides and the top of the cave. This attraction has been recognized as a “China Top Ten Rafting Resort” and was named as the major tourist adventure project by the Shandong Provincial Government.

|

|

·

|

The “Electric Slide Car” attraction was placed into operation in February 2006 and is one of the longest natural tourism entertainment projects in China. The slide car has a total length of 2,800 meters (approximately 1.7 miles) (with a drop of more than 50 meters (approximately 165 feet)), which starts at the peak of the mountain and slides along the mountain directly to the access point of the cave in the mountainside. Our visitors are free to control the speed of the car with a designed speed of up to 15 kilometers per hour (approximately 9 mph).

|

|

·

|

The “Battery Vehicle” attraction was placed into operation in February 2005. Visitors can take the battery vehicle for nearly 2 kilometers (approximately 1.2 miles).

|

|

·

|

The “Strop Ropeway” attraction was placed into operation in October 2007 and has a length of 400 meters (approximately 0.25 miles). We built up the ropeway by utilizing the natural topography from the top of the mountain to the entrance of the cave. To ride on the ropeway, visitors are required to wear a harness that attaches to the ropeway and leaves them suspended from the ropeway using the natural topography of the mountain and gravity to slide down the ropeway similar to a zip line.

|

|

·

|

The “Treasure Hunting Cave” attraction was placed into operation in late January 2011. The attraction consists of eight entertainment attractions suitable for teenagers and young adults encompassing more than 3,000 square meters (approximately 32,300 square feet), including a man-made rock hill for climbing, a maze and amusement park type rides. The total cost to develop the Treasure Hunting Cave was approximately $3.1 million and it took approximately seven to eight months to complete. The Treasure Hunting Cave entertainment attraction first opened to visitors in early February 2011.

|

Description of Operations

As a cave tourism development and management company, our daily focus is to provide the best experience possible to our visitors. Toward that end, in addition to the acquisition and development of additional tourist destinations, we aim to improve the existing, and add additional, entertainment attractions within and outside of the Underground Grand Canyon. Our primary focus, however, is the enhancement of our service quality. At the Underground Grand Canyon, we have knowledgeable and friendly tourist guides to provide our visitors with a detailed introduction of our entertainment attractions and provide additional services to our visitors. Our tourist guides are required to follow our strict service process and other requirements to ensure the safety and enhance the experience of our visitors. We plan to have in place the same level of strict service processes and other requirements at any additional sites we acquire, develop and/or manage.

8

Our Competitive Strengths

Our Underground Grand Canyon has been designated an “AAAA Level Scenic Spot” and a “National Geological Park.” Scenic site designations are awarded by the National Tourism Administration of the PRC to tourist destinations based on a combination of factors, including service quality, quality of the tourist destination environment and experience, scenic quality and tourist opinion of the destination. The highest designation awarded is “AAAAA” level scenic site. In awarding the level of designations, the National Tourism Administration performs an annual on-site independent analysis of the tourist destination. Upon the completion of this annual analysis, the National Tourism Administration will either indicate that the level previously awarded remains the same or that the level will be increased or decreased according to whether the tourist destination meets the criteria for the various levels.

We attribute our success to date and potential for future growth to a combination of strengths, including the following:

|

·

|

Our Underground Grand Canyon has achieved national and international merit. The Underground Grand Canyon has attained national and international recognized merits of scenic achievement, such as “AAAA Level Scenic Spot,” “National Geological Park” and “Shandong’s Top Ten Beautiful Scenery.” The achievement of these high degrees of recognition is a testament to our management expertise and our corporate culture.

|

|

·

|

We benefit from favorable geography. Our business is located in Linyi City, Yishui County, which is the southern gateway to Shandong Province and is situated between Beijing and Shanghai, which are two main population centers in China. In addition, Linyi City is accessible by air, ground and water, with easy access to airports, major highways and waterways.

|

|

·

|

We are located in a main population center in China. Linyi City has approximately 10 million residents. In addition, Linyi City is the second largest wholesale market in China, which attracts a high volume of high income people. Within a radius of 200 kilometers (approximately 125 miles) of Linyi City, there are approximately 170 million residents. Further, within a radius of 500 kilometers (approximately 300 miles) of Linyi City, the number of residents is approximately 400 million.

|

|

·

|

Shandong Province is located in a tourism corridor. Linyi City, along with Qingdao, Weihai and Yantai are located along the famed Golden Coast region of Shandong Province. This region, by itself, is a destination for tourists in China. Further, Shandong Province is recognized as the hometown of Confucian and Mencius culture and culture of Taishan Mount. As a result, many tourists from outside of Shandong Province use it as a gathering place.

|

|

·

|

We benefit from favorable government support. We benefit from favorable government support, such as the supply of tourism land. In addition, recent local government initiatives include the improvement of our local tourism environment, including the establishment of a tourism bureau to differentiate the tourism industry from the services industry and mandated regulatory compliance by companies in the tourism industry.

|

|

·

|

We have a proven business model. Our Underground Grand Canyon, judged by the merits achieved, increased number of visitors, visitor satisfaction rates, and significant profit margin, evidences our proven business model. As we seek to acquire new tourist destinations and continue to improve our existing entertainment attractions in and around the Underground Grand Canyon, we will continue to build up and strengthen our business model. We believe our business model is portable to the tourism industry beyond the cave tourism business and seek to operate a national tourism development and management company with a brand recognized for its quality.

|

9

|

·

|

We have a high visitor satisfaction rate. Being in the tourism business, we aim to provide the highest quality experience for our visitors. From the design of our entertainment attractions to the delivery and presentation of our product on a daily basis, we emphasize visitor satisfaction. In recent years, we have initiated an overall quality policy of “Emphasis on tourist travel experience to meet maximum demand” and launched an annual mission for our staff, the most recent of which was “Staff are also attractions,” which was designed to improve our service quality, including an emphasis on the appearance, knowledge and professionalism of our staff. Each of our visitors is asked to complete a visitor satisfaction survey, which includes a variety of questions regarding the visitors’ experience at the Underground Grand Canyon, including, among others, the amount spent by the visitor, whether the visitor is satisfied with the facilities and entertainment attractions, whether the visitor is satisfied with the service provided by our staff and overall visitor satisfaction. More than 99% of our visitors indicate that they are “very satisfied” with their experience at the Underground Grand Canyon. We attribute that rate to our emphasis on visitor service quality.

|

Sales and Marketing

We have established multi-layered and comprehensive marketing channels including travel agencies, self-driver clubs, Internet travel websites, hotel promotion and advertisements.

|

·

|

We enter into cooperation agreements with numerous domestic travel agencies throughout China, through which we anticipate a regular flow of visitors. As of December 31, 2010, we have entered into cooperation agreements with approximately 1,100 travel agencies. Terms of these agreements generally include a discounted admission ticket price to the Underground Grand Canyon, as well as discounted prices to our entertainment attractions in and around the Underground Grand Canyon so long as the travel agency brings more than a set number of visitors, generally 10 or more, at any one time. In addition to the discounted prices offered to the visitors from a travel agency, commencing on January 1, 2010, we also began to offer a return to the travel agency based on the number of total tourists the travel agency brings to the Underground Grand Canyon over the term of the agreement (generally one year). The return is accumulated over the term of the agreement and paid to the travel agencies at the end of the term. Of the 1,100 travel agencies with which we enter into cooperation agreements, we expect that only approximately 14 travel agencies will bring enough tourists to the Underground Grand Canyon to qualify for a return under the cooperation agreement. The travel agents do not guarantee to us a certain number of visitors per year nor a certain amount of revenue to be generated from their visitors. Similarly, we do not guarantee a certain amount of return to the travel agencies. The cooperation agreements typically have a one-year term and are renewed annually. A cooperation agreement with a one-year term will run from January 1 through December 31 regardless of when in the year the agreement is entered into or renewed. As of December 31, 2010, approximately $0.2 million in return was due the approximately 14 travel agencies that qualified for a return under the cooperation agreements, which amount was paid to the travel agencies by the end of February 2011. We believe we can increase the number of visitors by both entering into cooperation agreements with additional travel agencies, as well as through repeat business from existing travel agencies based on the experience enjoyed by prior visitors from these existing travel agencies. We plan to continue to expand the number of travel agencies we cooperate with, particularly in the major cities of developed provinces in China, such as Zhejiang, Jiangsu and Shanghai, which we believe have a higher percentage of higher net income residents. Relationships with travel agencies are managed by our sales team and we plan to rely on our sales team to continue to cultivate our existing relationships and to foster new relationships with travel agencies.

|

10

|

·

|

We promote the Underground Grand Canyon and the entertainment attractions, as well as our brand, through traditional media outlets, including television, radio and print media. Print media, such as newspapers, magazines, express advertisements, outdoor advertisements, scenery signposts and advertisements on buses, continues to be the main focus of our advertising campaign. We have implemented an effective plan for our advertising campaign, while maintaining a relatively high degree of exposure and increasing consumer awareness within our target markets, such as Shandong Province.

|

|

·

|

We have built close relationships with many self-driver clubs in China, which organize tourism activities to the Underground Grand Canyon. Self-driver clubs are clubs comprised of individuals with their own vehicles who arrange travel and tourism activities as a group.

|

|

·

|

We have built close relationships with several Internet travel websites, which advertise and promote the Underground Grand Canyon and our brand.

|

|

·

|

We cooperate with the Shandong provincial government and tourism association to sponsor public activities in order to promote the Underground Grand Canyon and our brand. For example, we have twice sponsored the China (Yishui) Festival of Underground Drifting.

|

|

·

|

The Underground Grand Canyon also is promoted through the attainment of national and international recognized merits of scenic achievement, such as “AAAA Level Scenic Spot,” “National Geological Park” and “Shandong’s Top Ten Beautiful Scenery.” By achieving these high degrees of recognition, the Underground Grand Canyon becomes visible on a grander scale, which we believe draws more visitors to our tourist destination.

|

Our Visitors

The number of visitors to the Underground Grand Canyon grew from approximately 150,000 visitors in 2004 to approximately 749,000 visitors in 2009, which is a compounded annual growth rate of 37.9%. In 2010, the number of visitors to the Underground Grand Canyon fell to approximately 672,000 visitors, which represents, from 2004 through 2010, a compounded annual growth rate of 28.5%. The decrease in the number of visitors from 2009 to 2010 was primarily due to a colder than average spring in China and two large, non-recurring tourist events in China, the 16th Asian Games hosted in Guangzhou and the World Exposition hosted in Shanghai, both of which events created additional competition for discretionary spending in 2010. The Asian Games, dating back to 1951, are held every four years and only once prior to 2010 has China been the host country for the Asian Games. The World Exposition, dating back to 1851, is a worldwide exposition held every two to three years and only once prior to 2010 has China been the host country for the World Exposition.

Visitors from travel agencies amounted to approximately 323,000 in 2010 and approximately 408,000 in 2009, which represented 48.1% and 54.5% of our total visitors in 2010 and 2009, respectively. Due to the lower prices offered to visitors from travel agencies, revenue from these visitors accounted for approximately 36.9%and approximately 43.0% of our total revenue in the fiscal year ended December 31, 2010 and 2009, respectively.

Self-driver visitors amounted to approximately 349,000 in 2010 and approximately 341,000 in 2009, which represented 51.9% and 45.5% of our total visitors in 2010 and 2009, respectively. Revenue from these visitors accounted for approximately 63.1% and approximately 57.0% of our total revenue in the fiscal year ended December 31, 2010 and 2009, respectively.

11

Pricing

We charge an initial admission ticket price to our Underground Grand Canyon and an additional fee for each of our entertainment attractions in and around the Underground Grand Canyon. We do not offer weekly, monthly or other annual or season type passes to the Underground Grand Canyon, but discounted admission ticket prices and fees are available to visitors from travel agencies with which we enter into cooperation agreements.

According to PRC regulations, price increases must be approved by the local Administration for Commodity Prices. In order to obtain this approval, we must prepare and submit a written application for review. The Administration’s review of the application generally takes one to two months, including a public hearing to discuss the suggested price increase, after which a formal approval or denial document will be provided. Any price increase that is approved, which can occur once every 3 years, is limited to a specified increase based on the unadjusted admission ticket price. For example, if the unadjusted admission ticket price is between RMB 50 (approximately $7.30) and RMB 100 (approximately $14.60) the increase may not exceed 30% of the former price. Further, the adjusted admission ticket price may not take effect until after 6 months’ notice has been provided to the public. The last time a price increase was approved was in April 2008. See “Government Regulation” below for additional information regarding the regulations and procedures governing price increases.

Admission ticket prices and entertainment attraction fees are set, pending Administration approval, based on the following factors:

|

·

|

Prices charged by tourism companies offering similar attractions;

|

|

·

|

China’s economic growth and the growth of per capita disposable income;

|

|

·

|

China’s consumer price index (“CPI”) level and growth rate, which indicates overall price movement for commodities;

|

|

·

|

Enhancements to our existing entertainment attractions and the development of new attractions in and around the Underground Grand Canyon;

|

|

·

|

Our overall service quality and visitor satisfaction rates; and

|

|

·

|

Feedback received from our visitors regarding whether it is suitable to increase our prices.

|

Research and Development

As a cave tourism development and management company, we do not have significant research and development activities. In the past two fiscal years, in addition to focusing on development of additional entertainment attractions for our Underground Grand Canyon and services to enhance our visitors’ experience, such as the catering and restaurant facilities and souvenir shops, our research and development activities have focused on analyzing market trends and developing methods of increasing our number of visitors.

Intellectual Property

We have obtained from the Trademark Office of the State Administration for Industry and Commerce of the PRC trademarks and the exclusive use permission of trademarks including “沂蒙地下奇観” (English translation – Yimeng Underground Wonder), “红嫂” (English translation – Hong Sao) and “地下大峡谷” (English translation – Underground Ground Canyon). These trademarks and exclusive use permissions offer protection within the PRC and do not cover any other geographic areas. We are currently applying for trademarks and the exclusive use permission of trademarks for “LONGON”, “地下河漂流” (English translation – Underground Water Drifting), “溶洞第一漂” (English translation – No 1 Cave Drifting), “龙岗” (English translation – Long Gang) and “LONGONTOUR”.

12

With respect to the Underground Grand Canyon trademark, the trademark is owned by Shandong Shanjun Bronze Craft Co., Ltd. (“Bronze Craft”), an entity in which siblings of Zhang Shanjiu, our Chairman, President and Chief Executive Officer, own an aggregate 21.3% interest. Pursuant to the Trademark Agreement, dated September 28, 2010, between Longkong and Bronze Craft, Longkong is authorized to use the trademark. No payment was required for the authorization.

We regard our intellectual property, particularly our trademarks, to be of considerable value and importance to our business and our success. For trademarks in Chinese, the English translation of the Chinese language trademark is not included in the official certificate filed with, and approved by, the Trademark Office of the State Administration for Industry and Commerce of the PRC. The English translation of the Chinese trademarks may not be used as trademarks in China unless the English translation is registered as a trademark in China. Further, unless our trademarks are determined by the Trademark Office of the State Administration of Industry and Commerce of the PRC to be “well-known trademarks,” it may be possible for a third party to trademark the English translation of our Chinese language trademarks and we may not have any injunctive relief against such use. We currently do not own any patents.

We rely on a combination of trademark, trade secrecy laws and contractual provisions to protect our intellectual property rights. There can be no assurance that the steps taken by us to protect these proprietary rights will be adequate or that third parties will not infringe or misappropriate our trademarks, trade secrets or similar proprietary rights. In addition, there can be no assurance that other parties will not assert infringement claims against us, and we may have to pursue litigation against other parties to assert our rights. Any such claim or litigation could be costly and we may lack the resources required to defend against such claims. In addition, any event that would jeopardize our proprietary rights or any claims of infringement by third parties could have a material adverse affect on our ability to market or sell our brand, and profitably exploit our services.

Our Employees

As of December 31, 2010, we employed a total of 145 full-time employees in the following functions:

|

Department

|

Number of Employees

|

|

Senior Management

|

4

|

|

Human Resources

|

3

|

|

Administration

|

43

|

|

Public Relations

|

5

|

|

Finance and Investment

|

21

|

|

Purchasing

|

4

|

|

Infrastructure Construction

|

14

|

|

Sales & Marketing

|

12

|

|

Operations Management

|

39

|

|

TOTAL

|

145

|

13

From time to time, we hire part-time, seasonal staff, which typically work for short periods of time, such as one week. At any given point in time, the number of seasonal staff varies, however, as of December 31, 2010, we had 250 part-time, seasonal staff.

Our employees have established a labor union in accordance with PRC law, but are not covered by a collective bargaining agreement. We have not experienced any work stoppages.

We are required under PRC law to make contributions to employee benefit plans of 1.2% of our after-tax profit. In addition, we are required by PRC law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC employment laws.

For a discussion of our executive officers and employment agreements we have entered into with our executive officers, see “Item 10. – Directors, Executive Officers and Corporate Governance.” and “Item 11. – Executive Compensation.”

In compliance with the Employment Contract Law of the PRC, Longkong has written contracts with all of its employees for a term of 3 to 5 years. The employment agreements include the positions, responsibilities and salaries of the respective employees, as well as the circumstances under which employment may be terminated in compliance with the Employment Contract Law of the PRC. Longkong considers its relationship with its employees to be good.

Under the Employment Contract Law of the PRC, upon the termination of an employment agreement by Longkong without cause or expiration of an employment agreement without an offer to renew, Longkong is obligated to pay the applicable employee compensation equal to one month’s salary for each year the employee has been employed by Longkong, up to a maximum of twelve years (“Compensation”), except where (1) the employee has committed a crime or the employee’s actions or inactions have resulted in a material adverse effect on Longkong; (2) the employee receives pension payments; (3) the employee dies or is declared dead or missing; or (4) Longkong offers to renew the employment agreement with equal or higher consideration and the employee does not accept it. In these cases, Longkong is not required to pay any Compensation and may terminate an employment agreement without prior notice. If the employee’s salary is greater than three times the average salary for the last year in Linyi City, the Compensation will be calculated by multiplying such average salary by three, and then multiplying the product obtained by the number of years the employee was employed by Longkong, up to a maximum of twelve years.

Longkong may terminate an employment agreement upon 30 days’ prior written notice or without prior notice upon an extra payment of one month salary and with Compensation payable to such employee, for any of the following reasons: (1) sickness or non-working injury and after medical treatment an employee is not able to do the original work or other assignments designated by Longkong; (2) an employee is unable to perform his job after training or position adjustment and is still unable to perform his job at a suitable level; and (3) the employment cannot be performed due to a fundamental change of circumstances and the employer and employee fail to reach an agreement to change the original employment contract.

14

If Longkong terminates an employment agreement prior to its expiration for any reason other than as described above, the employee has the right to either enforce the agreement or to terminate the agreement and require Longkong to pay an amount equal to twice the Compensation.

An employee may at any time terminate the employee’s employment agreement upon 30 days’ prior written notice.

Seasonality

Tourism, particularly cave tourism, is a seasonal business, with peak months occurring during periods of warmer weather, when students are on summer vacation and during our National Holiday. Our peak months are April, May, July, August and October, which collectively accounted for 66.6% of our total visitors in 2010. As recently as 2007, however, our peak months collectively accounted for 70% of our total visitors. In April and May, the weather is favorable as compared to our winter months and people are beginning their vacation schedules. During the hottest months of July and August, the constant temperature in the Underground Grand Canyon of between 17 and 18 degrees Celsius (62.6 to 64.4 degrees Fahrenheit) is appealing to many visitors. In addition, students are on summer vacation in July and August and therefore family vacations are at their peak. The National Holiday, which occurs in early October annually, is one of the two long-term holidays of 7 days in length in China.

Historically, the volume of visitors to the Underground Grand Canyon is lowest during the coldest months of the year, January, February, November and December. These months collectively accounted for 8.6% of our total visitors in 2010. The remaining months of March, June and September collectively accounted for 24.8% of our total visitors in 2010.

As a result of seasonality, our personnel, revenue, and cash flow vary throughout the year.

An element of our growth strategy is to acquire additional tourist destinations throughout China and in various climate zones. As we begin to manage and operate additional tourist destinations, the extent to which our business is affected by seasonality should initially decrease and eventually level off.

Government Regulation

The principal regulation governing our business in the PRC is the Foreign Investment Industrial Guidance Catalogue, which became effective as of December 1, 2007. Under this regulation, the tourism industry belongs to the category of permitted foreign investment industries. As a result, there is no restriction on foreign investment in this line of business in China, except for the regular business license and other permits that must be possessed by every company conducting the same line of business in China. Our industry in China is also subject to a number of other laws and regulations, including laws and regulations relating specifically to tourism operations. In addition, certain laws and regulations of the PRC also affect the rights of our stockholders to receive dividends and other distributions from us.

Tourism Specific Regulations

The PRC Pricing Law, effective on May 1, 1998, provides that the government shall issue government-set or guided prices for the following merchandise and services if necessary: (i) merchandise that is considered to be of great importance to development of the national economy and people’s livelihood; (ii) merchandise for which there is shortage; (iii) merchandise that is monopolistic in nature; (iv) certain public utilities that are deemed to be important; and (v) certain public welfare services. In fixing government-set and guided prices, the relevant government price department convenes public hearings to solicit views from consumers, business operators and others to explore the necessity for a government-set and guided price and the feasibility of the suggested price. The scope and level of the government-set and guided prices are adjusted in light of the operation of the national economy and the recommendations of consumers and business operators, as well as the feedback received at the public hearings. After the government-set and guided prices are determined, the relevant government price departments announce the prices publicly.

15

On September 19, 2006, the State Council promulgated Regulations on Scenic Spots to strengthen the administration of scenic spots, such as the Underground Grand Canyon tourist destination, and to effectively protect and explore the resources thereof. The price of the admission ticket to scenic spots must comply with relevant laws and regulations regarding pricing. In accordance with the regulations, violations of the regulations may be subject to various administrative or monetary penalties, and potentially criminal liability.

On January 29, 2007, the National Development and Reform Commission (“NDRC”) issued a Notice on Further Improving Administration of Scenic Spots’ Admission Price (No. FaGaiJiaGe (2007)227). In accordance with the notice, prices may not be increased more than once every three years. The range of the price adjustment depends upon the unadjusted admission ticket price. For example, if the unadjusted admission ticket price is below RMB 50 (approximately $7.30), an increase may not exceed 35% of the former price; if the unadjusted admission ticket price is between RMB 50 (approximately $7.30) and RMB 100 (approximately $14.60), an increase may not exceed 30% of the former price; if the unadjusted admission ticket price is between RMB 100 (approximately $14.60) and RMB 200 (approximately $29.20), an increase may not exceed 25% of the former price; and if the unadjusted admission ticket price is over RMB 200 (approximately $29.20), an increase may not exceed 15% of the former price.

On April 9, 2008, the NDRC, the Ministry of Finance, the State Land and Resource Ministry and the State Administration of Tourism jointly promulgated a Notice on Regulating the Ticket Price of Scenic Spots (No. FaGaiJiaGe (2008)905). The notice provides that the admission ticket price of a scenic spot that is based upon a state natural resource or historic resources must apply government-set or guided prices. As discussed above, the use of or adjustments to government-set or guided prices require a public hearing. Further, the admission ticket price of well-known scenic spots must be administrated by a provincial-level price department.

On December 1, 2009, the State Council promulgated Opinions on Accelerating the Development of Tourism Industry (No. 41 (2009) of the State Council). In accordance with the opinions, the government is to actively develop the domestic tourism industry and push forward the development of the tourism industry with local characteristics at all places. In response to expected growth in the tourism industry, the opinions encourage investment (including through acquisitions and reorganizations) in the tourism industry and actively encourage qualified tourism enterprises to obtain capital financing. In addition, the opinions require that if there is any adjustment to the price of a scenic spot’s admission ticket, 6 months’ advance notice must be provided to the public.

Shandong Provincial Rules on Tourism, which was passed on May 27, 2005 by the 10th Standing Committee of Shandong Provincial People’s Congress and revised on July 30, 2010 by the 11th Standing Committee of Shandong Provincial People’s Congress, require tourism operators to publish their services or products and prices thereof and establish safety responsibility systems with respect to such services or products. Tourism operators are required to report any accidents involving their visitors to the local tourism administration. The rules encompass the PRC government level rules discussed above, that is: (i) that the admission ticket price of a scenic spot that is based upon a state natural resource or historic resources must be determined or guided by the government; (ii) adjustments to the admission ticket price must comply with relevant procedures, such as the public hearing process; (iii) an adjustment to the admission ticket price requires 6 months’ advance notice to the public; (iv) adjustments to the admission ticket price may not exceed the limit allowed by law; and (v) an adjustment to the admission ticket price may not occur more than once every 3 years. Any violation of the rules by the tourism operators may be subject to various actions of the local governmental agencies, including warning and confiscation of income received by violating the rules and payment of fines of one to five times the income received by violating the rules; if there is no such income, there will be imposed a fine of up to approximately $750.

16

On August 31, 2009, the Ministry of Culture and the State Administration of Tourism issued Guidelines on Promoting the Development of the Combination of Culture and Tourism, encouraging companies to take active measures to strengthen the combination of culture and tourism and build a series of brands and cultural tours.

Regulations of Special Equipment

Regulations on Safety Supervision over Special Equipment, which was promulgated by the State Council on March 11, 2003, provide that before special equipment, such as a passenger cableway or a large entertainment facility, is placed into operation or within 30 days after it has been placed into operation, the operator of the special equipment must file for registration with the department of safety supervision of the municipality directly under the central government or the city where such special equipment is to be used. Upon registration, the special equipment undergoes periodic safety inspections, which in practice last for one year. One month prior to the expiration of the safety inspection, the operator of the equipment must file for another inspection with the special equipment inspection and testing institution. Special equipment that either fails an inspection or is not inspected prior to the expiration date of the safety inspection may no longer be used. In addition to the registration and inspections, the operator of the special equipment and its relevant management personnel must obtain a certificate for operating or managing the special equipment. If an operator uses special equipment in violation of these regulations, it could be subject to a monetary fine of up to approximately $3,000 or an administrative penalty by the department of safety supervision, including an order to cease operations of the business.

Environmental Regulation

The most significant environmental regulations applicable to us include the Environmental Protection Law of the PRC, the Law of the PRC on the Prevention and Control of Water Pollution, Implementation Rules of the Law of the PRC on the Prevention and Control of Water Pollution, the Law of the PRC on the Prevention and Control of Air Pollution, the Law of the PRC on the Prevention and Control of Solid Waste Pollution, and the Law of the PRC on the Prevention and Control of Noise Pollution. Since 2004, we have incurred approximately $0.8 million in compliance costs in connection with these environmental regulations. No significant environmental compliance costs are anticipated during the next 12 months. Compliance activities include primarily the planting of trees on the mountain that houses the Underground Grand Canyon, protecting the plants and soil on the mountain that houses the Underground Grand Canyon, managing polluted waters and waste management.

Regulations on Intellectual Property Rights

China has adopted comprehensive legislation governing intellectual property rights, including trademarks, patents and copyrights. The National People’s Congress adopted the Patent Law of the PRC in 1984, and amended it in 1992, 2000 and 2008, respectively. The Copyright Law of the PRC was adopted in 1990 and amended in 2001 and 2010, respectively. The Trademark Law of the PRC was adopted in 1982 and amended in 1993 and 2001, respectively. The Implementation Rules for the Law of the PRC on Trademarks were adopted in 2002. Infringement of a patent, copyright or trademark’s exclusive right may be subject to administrative penalties, and civil or criminal liabilities, as applicable.

17

Regulations on Labor

China adopted the Labor Contract Law and its implementation rules effective on January 1, 2008 and September 18, 2008, respectively. The labor contract law and its implementation rules impose more stringent requirements on employers with regard to, among other things, minimum wages, severance payments and non-fixed term employment contracts, time limits for probation periods as well as the duration of and the times that an employee can be placed on a fixed term employment contract. Due to the lack of clarity with respect to the implementation and potential penalties and fines of the labor contract law and its implementation rules, it is uncertain how they will impact our current employment policies and practices. Our employment policies and practices may violate the labor contract law or its implementation rules and we may be subject to related penalties, fines or legal fees.

Regulations on Foreign Exchange Control and Administration

Foreign exchange in China is primarily regulated by:

|

·

|

The Foreign Currency Administration Regulations (1996), as amended on January 14, 1997 and August 5, 2008, respectively; and

|

|

·

|

The Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996) (the “Administration Rules”).

|

Under the Foreign Currency Administration Regulations, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments and trade and service-related foreign exchange transactions. Conversion of Renminbi into foreign currency for capital account items, such as direct investment, loans, investment in securities and repatriation of investment, however, remains subject to the approval of the State Administration for Foreign Exchange (“SAFE”) or its local counterpart as required by law.