Attached files

Exhibit 99.1

This presentation and any discussion by Management in connection with the presentation include statements regarding expectations, beliefs, strategies, goals, outlook and other non-historical matters. Any such statements are forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include but are not limited to statements about the Company’s expectations, beliefs, strategies, goals, outlook and other non-historical matters. Such statements will include details regarding the Company’s wafer furnaces, the ramp of our factory in China, progress on our wide wafer development plans, expected manufacturing costs and expectations regarding product demand and pricing and the Company’s cash requirements or any projections of future financial performance based on successfully developing a new 500 MW facility in China. Certain risks and uncertainties will cause our actual results to differ from what we expect. These uncertainties arise from the inherent difficulties in predicting the benefits of new technologies, the often volatile market for solar grade silicon, and the difficulty in forecasting customer demand, and our need to restructure our balance sheet and raise additional financing to pursue our business plan. We refer you to our SEC filings for more information regarding forward-looking statements and risks associated with those statements and the Company’s business. Forward-looking statements speak only as of the date they are made.

| Evergreen Solar Confidential | 1 |

|

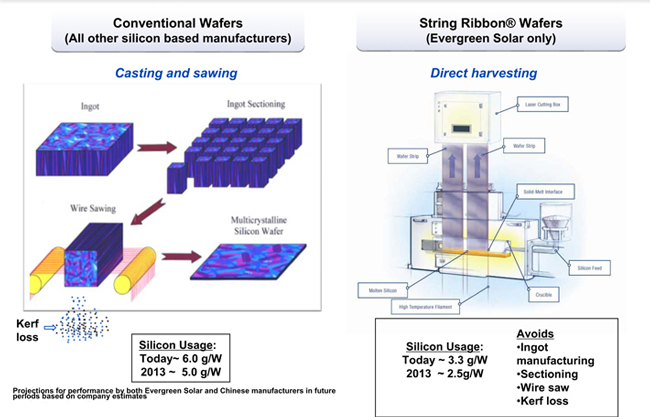

Developed a unique technology – “String Ribbon” – that dramatically lowers the cost of producing wafers for solar cells |

| • | Wafers represent approximately 50% of the total cost of a solar module |

| • | Most of the cost of producing a wafer is materials cost (i.e. polysilicon) |

| • | Our process reduces polysilicon utilization by 50% versus conventional processes, resulting in significant savings |

|

Our original business model was to sell modules using internally produced wafers and cells manufactured in the United States due to our non-standard size wafer |

| • | We expected our cell and module processing costs to be competitive with other global manufacturers while our lower wafer costs would give us an overall advantage at the module level |

|

As Chinese competition scaled their operations rapidly with government subsidies and loans, it became clear that our cell and module operations could not be competitively manufactured in a high cost region |

| • | So much so that our wafer cost advantage was overwhelmed by our cell/module cost disadvantage in the U.S. |

| • | Closed US manufacturing operations in Devens, MA |

|

At the same time, a slowdown in core markets in Europe created intense price pressure |

| Evergreen Solar Confidential | 2 |

|

We shifted our focus to develop an industry standard size wafer, leading to the strategic decision to change our business model to become a merchant supplier of wafers — where our core competency is |

|

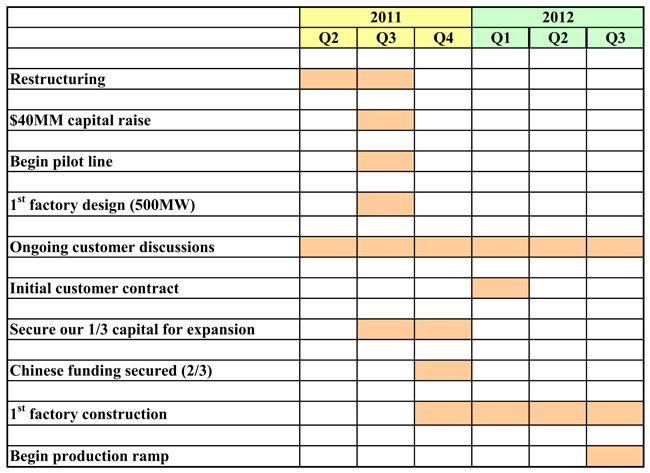

Completing our transition to a merchant wafer supplier requires completing a pilot line so we can (1) ship significant quantities of wafers to prospective customers for large scale testing and (2) prove the efficacy of our new business model to potential Chinese investors who have agreed in principal to fund 2/3 of the cost of building a large scale wafer facility in China |

| • | Several major customers are currently evaluating wafers; quantity is now required |

| • | Some additional development needed to “go commercial” |

| • | We expect we will be required to raise our 1/3 share of expansion capital |

|

Completing the pilot line and providing adequate liquidity requires raising additional capital |

|

We need to address our capital structure to position ourselves for a future capital raise |

| Evergreen Solar Confidential | 3 |

| Evergreen Solar Confidential | 4 |

| Evergreen Solar Confidential | 5 |

|

• Leverage installed 40GW capacity in cell and panel processing

• Implement cell processing best practices more quickly

• Increase business development opportunities

• Provide ~40% cost savings

• Over 125,000 wafers grown

• Wafer characteristics comparable to our current form factor

• 10 new pilot furnaces running

• In discussions today with potential partners and Chinese government for future expansion

• Technology development in the U.S. with pilot in China

• Continue providing wafers to industry participants for evaluation |

|

| Evergreen Solar Confidential | 6 |

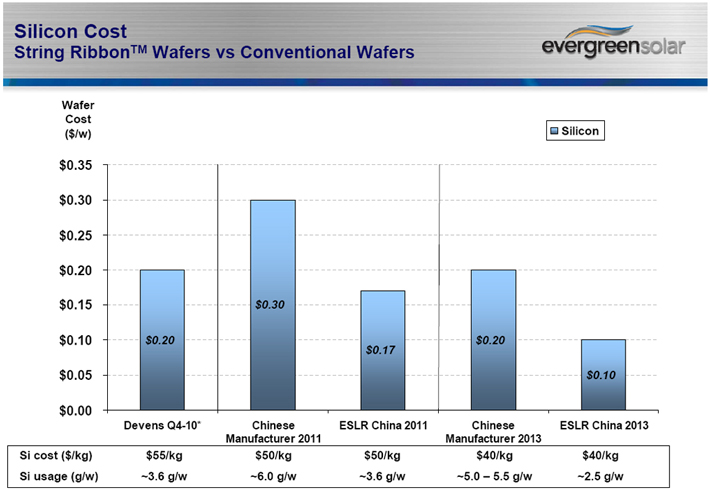

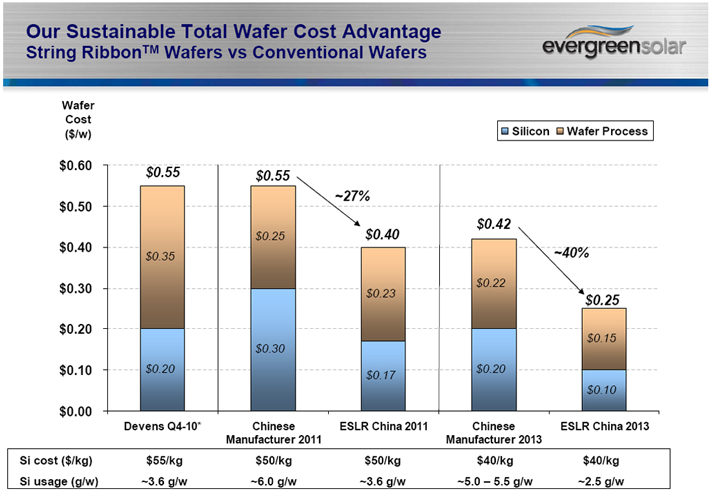

| * | Excludes non-cash amortization charges |

| • | Projections for performance by both Evergreen Solar and Chinese manufacturers in future periods based on company estimates |

| Evergreen Solar Confidential | 7 |

|

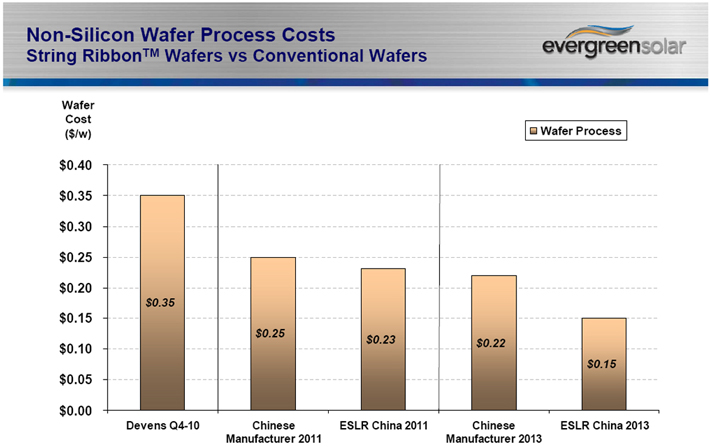

Process cost will be better than the best wafer manufacturers because the “non-silicon” costs used in String Ribbon are lower than those used in ingot growing and wire slicing, including: |

| • | 1 process step vs. 5 process steps |

| • | No slicing costs |

| • | No wires |

| • | No chemicals or abrasives |

| • | No lubricants |

| • | No wafer cleaning costs |

| • | Wafers are ready to process as grown |

| • | Lower power consumption |

| • | Half the energy is used to make one String Ribbon wafer |

Cost savings by both Evergreen Solar and Chinese manufacturers based on company estimates

| Evergreen Solar Confidential | 8 |

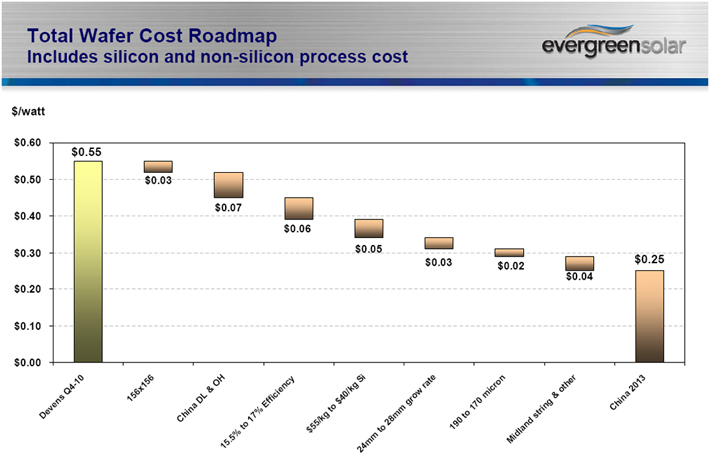

Note: Process costs include labor, manufacturing overhead, electricity, depreciation and consumable materials

Projections for performance by both Evergreen Solar and Chinese manufacturers in future periods based on company estimates

| Evergreen Solar Confidential | 9 |

| * | Excludes non-cash amortization charges |

| • | Projections for performance by both Evergreen Solar and Chinese manufacturers in future periods based on company estimates |

| Evergreen Solar Confidential | 10 |

Devens Q4-10 excludes non-cash amortization charges

| • | Projections for performance by both Evergreen Solar and Chinese manufacturers in future periods based on company estimates |

| Evergreen Solar Confidential | 11 |

|

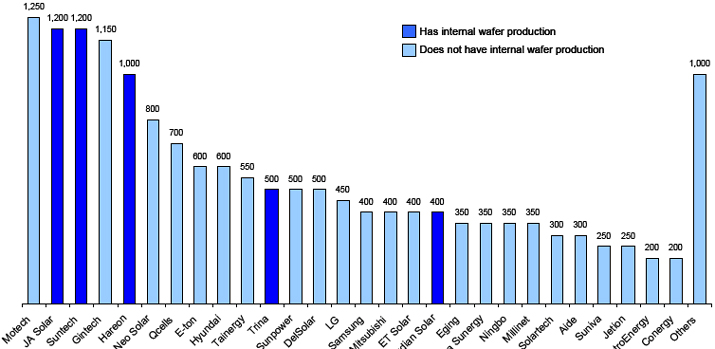

Almost 60% of the wafers used in silicon-based PV modules are produced internally by companies that also make cells and modules. Not all companies have “balanced” production between wafer-cell-module, and some companies both make and buy wafers. |

|

The merchant wafer market is serviced by companies who specialize in wafer production only (GCL, MEMC, etc.), or by companies who consume some, but not all, of their wafer production in captive cell/module production (REC, LDK, etc.). Levels of vertical integration within the wafer supplier base are expected to fluctuate, depending on market conditions or changes in company strategy. |

|

The chart below shows the major customers for merchant wafers in 2012, by anticipated volumes. About 90% of the current solar PV market is for modules using crystalline silicon technology. |

2012 Merchant Wafer Customer Base

MW

Sources: Photon International, PV News, competitor statements, company estimates

| Evergreen Solar Confidential | 12 |

|

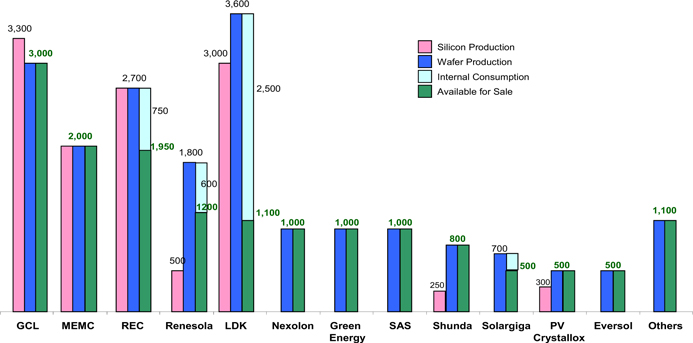

The wafer supplier base is more concentrated than the wafer customer base, with the top 12 vendors supplying the majority of the market, as well as more geographically dispersed, with large vendors based in the U.S. and Europe, although these companies have significant Asian operations. |

|

The largest of the merchant wafer vendors are shown below. |

2012 Merchant Wafer Supply Base

Total = 15,650 MW

12 large companies

Sources: Photon International, PV News, competitor statements, company estimates

| Evergreen Solar Confidential | 13 |

|

Product |

| • | Progress is good and we continue to reduce differences with cast wafers |

| • | Major “breakthroughs” made recently such as reduced bowing |

| • | Working issues from multiple ends, but must rely on potential customers and vendors for specific feedback |

|

Potential customers |

| • | Solid interest from variety of industry players (Tier 1 to Tier 3) |

| • | Challenge is to make running String Ribbon wafers easier |

| • | Close collaboration needed with vendors and potential customers |

|

Funding |

| • | Good progress with Chinese sources |

| Evergreen Solar Confidential | 14 |

|

Our potential Chinese partners for transitioning to our wafer only strategy in China include the Hubei Science and Technology Investment Corporation (HSTIC) and the East Lake Hi-Tech Development Zone (East Lake) |

|

HSTIC and East Lake are helping to promote our business plan to large Chinese banks and Asian investment groups |

|

Plan presented to HSTIC / East Lake anticipates phased approach of approximately 500 MW to 600 MW per factory |

|

Major focus has been on first 500 MW facility. Estimated cost about $200 million (plus additional $30-$50MM for land and infrastructure to support 4GW campus) |

|

We will be expected to fund 1/3 of the cost of each phase |

|

Phase 1 funding (2/3) expected to be provided by a large Chinese bank |

| Evergreen Solar Confidential | 15 |

|

Progress has been steady |

|

Key concerns & gating items: |

| • | What is the status of our technology? |

| • | When will we get firm customer commitments? |

| • | When will we get funding for our share of the project cost? |

|

HSTIC, East Lake and banks continuing with their due diligence |

| • | Most due diligence procedures have already been performed |

| • | Initial feedback has been positive - banks have requested that we move forward with submitting our loan commitment application letter |

|

Interest and attention to project at very high levels in China |

| • | Banking and government officials routinely visit our Wuhan facility |

| Evergreen Solar Confidential | 16 |

|

Uncertainties in European subsidies resulted in slow sales within industry |

| • | Entire industry experienced slow activity and continued rapid decline in selling prices |

| • | Shipped ~18MW @ $1.86/w resulting in ~43MW of inventory at end of Q1 |

| • | Selling prices are widely expected to continue to decline rapidly throughout 2011 |

|

Major cash uses Q4-10 to Q1-11 |

| • Opening cash December 2010 |

$68MM (includes $6.8M restricted cash) | |

| • Cash for operations & working capital |

($22MM) | |

| • CapEx |

($3MM) | |

| • Interest payment |

($5MM) | |

| • Cash at April 2, 2011 |

$38MM | |

| • (Cash at April 26, 2011 was $33M; reflects $10.75MM interest payment made on April 15, 2011) | ||

|

We expect to realize lower selling prices than expected for 2011 |

| • | Average selling price expected to be below $1.40/w |

| • | Results in lower than expected cash from liquidating Devens working capital of ~$17MM |

| • | Production in China will be adjusted to respond to market conditions |

| Evergreen Solar Confidential | 17 |

|

Estimated major cash sources and uses 2011 and 2012 |

| 2011 | 2012 | |||||||

| Opening cash |

$ | 68,384 | $ | 76,736 | ||||

| Sale of LBIE claim & Devens assets |

40,000 | — | ||||||

| U.S. Financing |

40,000 | 25,000 | ||||||

| China debt financing |

— | 90,667 | ||||||

| Cash flow provided by working capital |

43,612 | 16,609 | ||||||

| Interest payments |

(14,885 | ) | — | |||||

| One-time charges relating to Devens & startup |

(28,849 | ) | (10,000 | ) | ||||

| Cash flow used in ongoing operations |

(61,526 | ) | (34,064 | ) | ||||

| Capex for wide wafer development |

(10,000 | ) | (500 | ) | ||||

| Capex for expansion |

— | (136,000 | ) | |||||

|

|

|

|

|

|||||

| Ending cash |

$ | 76,736 | $ | 28,447 | ||||

|

|

|

|

|

|||||

| Evergreen Solar Confidential | 18 |

| $000 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||

| Revenue |

113,007 | 78,400 | 175,000 | 209,250 | 207,506 | |||||||||||||||

| EBITDA |

(99,508 | ) | (37,971 | ) | 29,075 | 52,077 | 53,441 | |||||||||||||

| Capital Expenditures |

(10,000 | ) | (136,500 | ) | (56,000 | ) | (9,250 | ) | (500 | ) | ||||||||||

| New Money |

40,000 | 25,000 | — | — | — | |||||||||||||||

| New China Debt |

— | 90,667 | 37,000 | 5,833 | — | |||||||||||||||

Projected financial performance assumes the Company successfully develops a new 500 MW facility in China that becomes operational at the end of 2012, with 2/3 of the cost financed by external debt and 1/3 funded by equity contribution from the Company funded from new financing

| Evergreen Solar Confidential | 19 |