Attached files

| file | filename |

|---|---|

| 8-K - Wendy's Co | a8-11x11conferencecallslid.htm |

Second Quarter 2011 Earnings Call

August 11, 2011

August 11, 2011

Opening Comments

John Barker SVP and Chief Communications Officer

John Barker SVP and Chief Communications Officer

Agenda

Forward-Looking Statements and Regulation G

This presentation, and certain information that management may discuss in connection with this presentation, may contain statements that are not historical facts, including, importantly, information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act. Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward-looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our most recent earnings press release and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K and subsequent Form 10-Qs. In addition, this presentation and certain information management may discuss in connection with this presentation reference non-GAAP financial measures, such as earnings before interest, taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measure are in the Appendix to this presentation, and are included in the earnings release and posted on the Investor Relations section of our website.

This presentation, and certain information that management may discuss in connection with this presentation, may contain statements that are not historical facts, including, importantly, information concerning possible or assumed future results of our operations. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). For all our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act. Many important factors could affect our future results and could cause those results to differ materially from those expressed in or implied by our forward-looking statements. Such factors, all of which are difficult or impossible to predict accurately, and many of which are beyond our control, include but are not limited to those identified under the caption “Forward-Looking Statements” in our most recent earnings press release and in the “Special Note Regarding Forward-Looking Statements and Projections” and “Risk Factors” sections of our most recent Form 10-K and subsequent Form 10-Qs. In addition, this presentation and certain information management may discuss in connection with this presentation reference non-GAAP financial measures, such as earnings before interest, taxes, depreciation and amortization, or EBITDA. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measure are in the Appendix to this presentation, and are included in the earnings release and posted on the Investor Relations section of our website.

Business Highlights

Roland Smith President & Chief Executive Officer

Roland Smith President & Chief Executive Officer

A New Day – The Wendy’s Company

Completed sale of Arby’s to Roark Capital Group effective July 4, 2011 Company name changed to The Wendy’s Company Corporate headquarters moving to Dublin, OH Reduced support center and international division in Atlanta, GA

Completed sale of Arby’s to Roark Capital Group effective July 4, 2011 Company name changed to The Wendy’s Company Corporate headquarters moving to Dublin, OH Reduced support center and international division in Atlanta, GA

A New Day – The Wendy’s Company

Launched new corporate website – www.aboutwendys.com

Launched new corporate website – www.aboutwendys.com

Q2 2011 Business Overview

Revenues grew 2.5% to $622 million North America Company-owned same-store sales of +2.3% Positive transactions of +0.9% Adjusted EBITDA* was $89.4 million

* See Appendix

Performance met Company’s expectations

Revenues grew 2.5% to $622 million North America Company-owned same-store sales of +2.3% Positive transactions of +0.9% Adjusted EBITDA* was $89.4 million

* See Appendix

Performance met Company’s expectations

Wendy’s Q2 2011

June

Berry Almond Chicken Salad & Wild Berry Tea

May

April

Natural-Cut Fries with Sea Salt

Bacon Mushroom

Flavor Dipped Chicken

June

Berry Almond Chicken Salad & Wild Berry Tea

May

April

Natural-Cut Fries with Sea Salt

Bacon Mushroom

Flavor Dipped Chicken

Q2 2011 Results & Full-Year Outlook

Steve Hare Chief Financial Officer

Steve Hare Chief Financial Officer

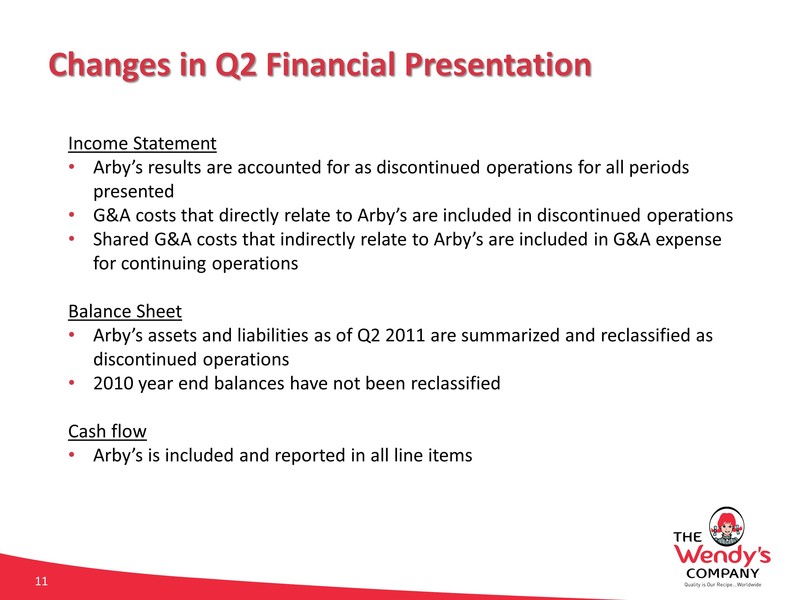

Changes in Q2 Financial Presentation

Income Statement Arby’s results are accounted for as discontinued operations for all periods presented G&A costs that directly relate to Arby’s are included in discontinued operations Shared G&A costs that indirectly relate to Arby’s are included in G&A expense for continuing operations Balance Sheet Arby’s assets and liabilities as of Q2 2011 are summarized and reclassified as discontinued operations 2010 year end balances have not been reclassified Cash flow Arby’s is included and reported in all line items

Income Statement Arby’s results are accounted for as discontinued operations for all periods presented G&A costs that directly relate to Arby’s are included in discontinued operations Shared G&A costs that indirectly relate to Arby’s are included in G&A expense for continuing operations Balance Sheet Arby’s assets and liabilities as of Q2 2011 are summarized and reclassified as discontinued operations 2010 year end balances have not been reclassified Cash flow Arby’s is included and reported in all line items

Q2 2011 Results

*See Appendix.

*See Appendix.

Q2 2011 Special Items Included in Income from Continuing Operations

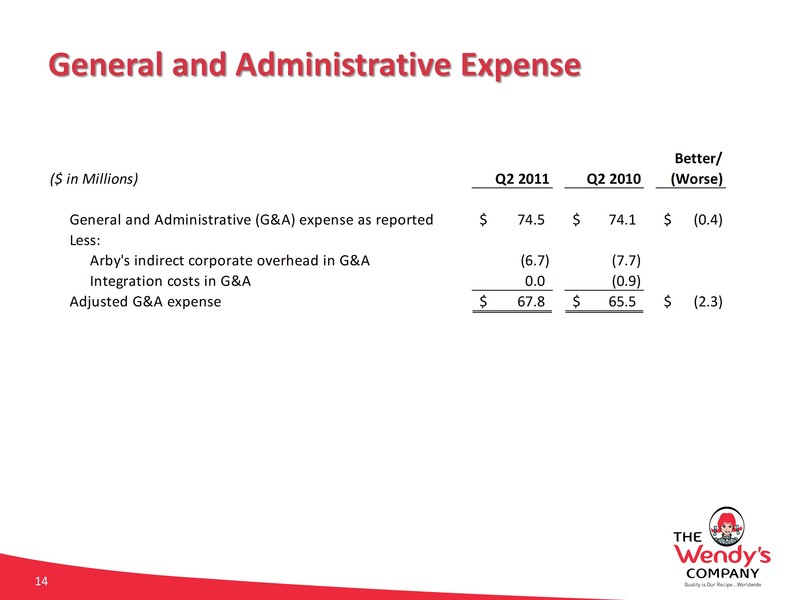

General and Administrative Expense

Cash Flow Q2 YTD 2011

* Includes commissions of $0.1 million and excludes $9.2 million of repurchases that were not settled until after quarter end.

Company Supporting Franchisee Key Initiatives

Dave’s Hot ‘N Juicy Cheeseburger Toasters and Grill enhancements Subsidized franchisee loans Supplemental loan guarantees Breakfast Equipment $20 million loan program for 1,000 stores Royalty abatement to fund advertising New Restaurant Development U.S. reduced development fees and royalties Canada lease guarantees

Toaster

Double Sided Grill

Dave’s Hot ‘N Juicy Cheeseburger Toasters and Grill enhancements Subsidized franchisee loans Supplemental loan guarantees Breakfast Equipment $20 million loan program for 1,000 stores Royalty abatement to fund advertising New Restaurant Development U.S. reduced development fees and royalties Canada lease guarantees

Toaster

Double Sided Grill

Consolidated Debt

* Includes $118 million for sale of Arby's (Purchase price of $130 million less transaction costs)

* Includes $118 million for sale of Arby's (Purchase price of $130 million less transaction costs)

Stock Repurchases and Dividends

Quarterly Cash Dividend $0.02 per share Payable on September 15, 2011 to stockholders of record as of September 1, 2011

Quarterly Cash Dividend $0.02 per share Payable on September 15, 2011 to stockholders of record as of September 1, 2011

2011 Outlook

Expect $330-340 million adjusted EBITDA1 Key Assumptions: Wendy’s same-store sales growth +1% to +3% Wendy’s company-operated restaurant margin2 down 50-100 basis points Capital expenditures of $145 million Restaurant development 20 North America Company-owned 45 North America franchise 40 international franchise

1 Only includes continuing operations. See appendix. 2 Includes incremental new breakfast advertising expense in 2010 and 2011.

Expect $330-340 million adjusted EBITDA1 Key Assumptions: Wendy’s same-store sales growth +1% to +3% Wendy’s company-operated restaurant margin2 down 50-100 basis points Capital expenditures of $145 million Restaurant development 20 North America Company-owned 45 North America franchise 40 international franchise

1 Only includes continuing operations. See appendix. 2 Includes incremental new breakfast advertising expense in 2010 and 2011.

Wendy’s Initiatives & Global Expansion

Roland Smith President & Chief Executive Officer

Roland Smith President & Chief Executive Officer

Value

Chicken

Hamburgers

Salads

Fries

Chicken

Hamburgers

Salads

Fries

Recent Product Introductions

Local Options

Local Options

Upcoming Beverage and Snack Products

Local Options

Local Options

Enhanced Chicken Menu

Local Options

Local Options

Dave’s Hot ’N Juicy Cheeseburgers

October 2011 Launch

October 2011 Launch

Wendy’s Breakfast Opportunity

Customer reaction to new menu is positive Annualized average weekly sales meeting incremental breakfast sales target of $150,000, Represents a 10% sales lift to $1.4 million average unit volumes Maintaining targeted sales levels with reduced couponing

Artisan Egg Sandwich

Fresh Baked Biscuit

Mornin’ Melt Panini

Fresh Cut Fruit

Home-Style Potatoes

Fresh Baked Oatmeal Bar

Customer reaction to new menu is positive Annualized average weekly sales meeting incremental breakfast sales target of $150,000, Represents a 10% sales lift to $1.4 million average unit volumes Maintaining targeted sales levels with reduced couponing

Artisan Egg Sandwich

Fresh Baked Biscuit

Mornin’ Melt Panini

Fresh Cut Fruit

Home-Style Potatoes

Fresh Baked Oatmeal Bar

Breakfast Menu Test – Premium Coffee

2011 Breakfast Expansion Timeline

Q4 2011

Q2 2011

Q3 2011

Q1 2011

2010

1,000 STORES

YE 2011

CONVERT 300 STORES FROM OLD TO NEW MENU

NEW MENU LAUNCH

LOUISVILLE & SAN ANTONIO

ADDITIONAL MARKETS

Kansas City Phoenix Pittsburgh Shreveport

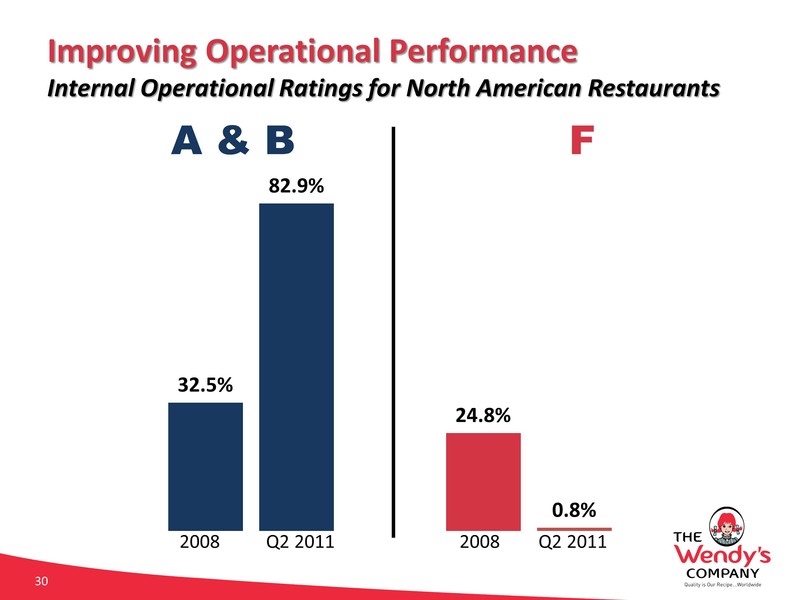

Improving Operational Performance Internal Operational Ratings for North American Restaurants

A & B

F

Q2 2011

2008

Q2 2011

2008

A & B

F

Q2 2011

2008

Q2 2011

2008

Highest Rated QSR Hamburger Chain

Source: American Customer Satisfaction Index, June 2011

Source: American Customer Satisfaction Index, June 2011

Remodel Designs to be Tested

Modern

Contemporary

Urban

Traditional

Modern

Contemporary

Urban

Traditional

First Modern Design Opens in Columbus, Ohio

Digital Signage

Casual Seating

Digital Signage

Casual Seating

Wendy’s International Division

Long-term development agreements signed since Q4 2008 Joint venture agreement with Higa Industries Target countries – Brazil and China

Brazil

China

Potential for 8,000 international restaurants Currently 333 international locations (all franchised) +700 future commitments for restaurants

Wendy’s Enters the Russian Market

First Moscow location celebrated grand opening on June 23 Part of development agreement with Wenrus Restaurant Group, LTD., a Wendy’s franchisee Wenrus plans to develop 180 restaurants over the next 10 years.

First Moscow location celebrated grand opening on June 23 Part of development agreement with Wenrus Restaurant Group, LTD., a Wendy’s franchisee Wenrus plans to develop 180 restaurants over the next 10 years.

Average annual EBITDA growth of 10-15%, beginning in 2012

Q&A

Appendix

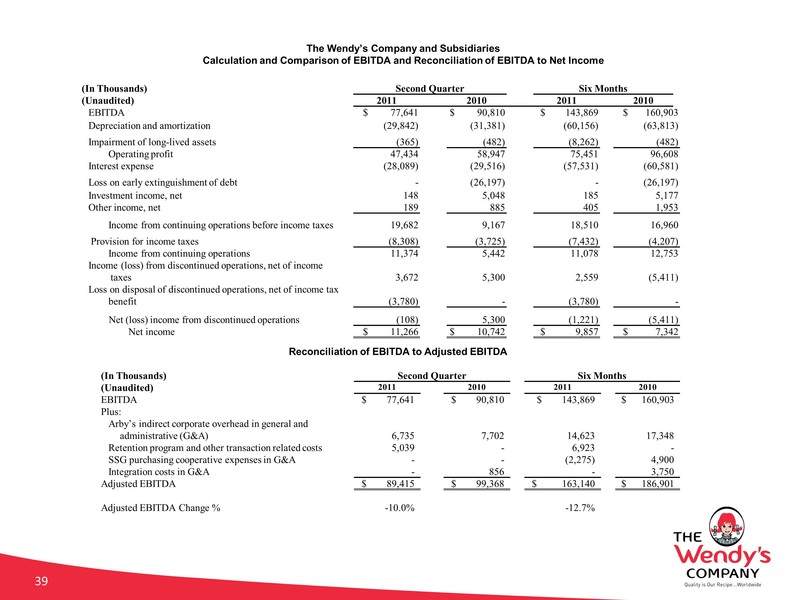

Reconciliation of EBITDA to Adjusted EBITDA

The Wendy’s Company and Subsidiaries Calculation and Comparison of EBITDA and Reconciliation of EBITDA to Net Income

The Wendy’s Company and Subsidiaries Calculation and Comparison of EBITDA and Reconciliation of EBITDA to Net Income