Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUNTINGTON INGALLS INDUSTRIES, INC. | d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - HUNTINGTON INGALLS INDUSTRIES, INC. | dex991.htm |

Q2

2011 Earnings Presentation August 11, 2011

Mike Petters

President and Chief Executive Officer

Barb Niland

Corporate Vice President, Business Management

& Chief Financial Officer

Exhibit 99.2 |

Safe

Harbor 2

Statements in this presentation, other than statements of historical fact, constitute

“forward-looking statements”

within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements involve risks and uncertainties that

could cause our actual results to differ materially from those expressed in these

statements. Factors that may cause such differences include: changes in government

and customer priorities and requirements (including government budgetary restraints,

shifts in defense spending, and changes in customer short-range and long-range

plans); our ability to obtain new contracts, estimate our costs and perform

effectively; risks related to our spin-off from Northrop Grumman (including our

increased costs and debt); our ability to realize the expected benefits from the

consolidation of our Ingalls facilities; natural disasters; adverse economic conditions

in the United States and globally; and other risk factors discussed in our filings with

the Securities and Exchange Commission. There may be other risks

and uncertainties

that we are unable to predict at this time or that we currently do not expect to have

a material adverse effect on our business, and we undertake no obligations to update

any forward-looking statements. Our registration statement on Form 10 and other

filings

with

the

Securities

and

Exchange

Commission

contain

more

information

on

the

types of risks and other factors that could adversely affect these statements.

|

Highlights from the Quarter

3

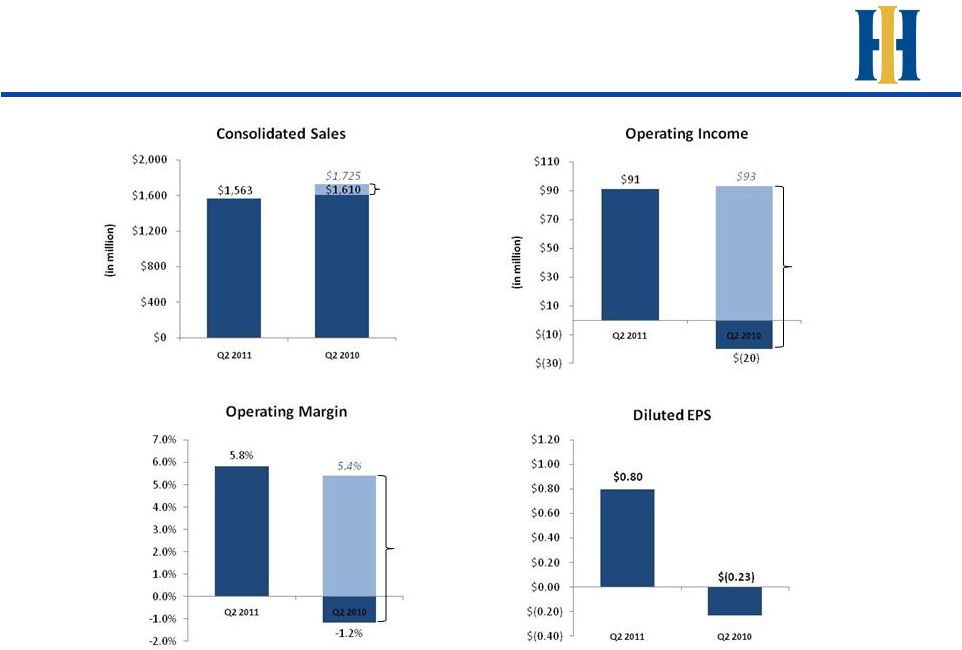

Total operating margin improved to 5.8% from 5.4% last year (after adjusting for

the Avondale charge)* and up sequentially from 5.0%

Newport News operating margin 9.1%, consistent with last year and up sequentially

from 7.1%

Ingalls operating margin improved to 2.7%, up year-over-year from 2.3%

(after adjusting for the Avondale charge)* and sequentially from 2.2%

Operating cash flow was $186 million for the quarter

Strong

liquidity

of

$910

billion,

including

cash

of

$381

million

and

$529

million

under

revolver

Announced contract for DDG-113, first ship in the DDG-51 restart

Delivered SSN-781 California on Aug 7

th

, over eight months ahead of schedule

Completed highly successful Builder’s Trials on NSC-3

Stratton * See Appendix for reconciliation to the operating margin

determined under GAAP |

Second Quarter 2011 Consolidated Results

4

Impact of

Avondale

charge*

Impact of

Avondale charge

($113M)*

Impact of

Avondale charge

($115M)*

* See Appendix for reconciliation to the operating margin determined under

GAAP |

Ingalls Shipbuilding

5

Ingalls sales down due to lower volumes

on DDG-51 program, partially offset by

higher volume on LHA program

Segment operating income increase due

to $113 million charge last year related

to Avondale.

Segment operating margin increased

even after adjusting for charge last year

Impact of

Avondale charge

($115M)*

Impact of

Avondale

charge*

Impact of

Avondale charge

($113M)*

* See Appendix for reconciliation to the operating margin determined under

GAAP |

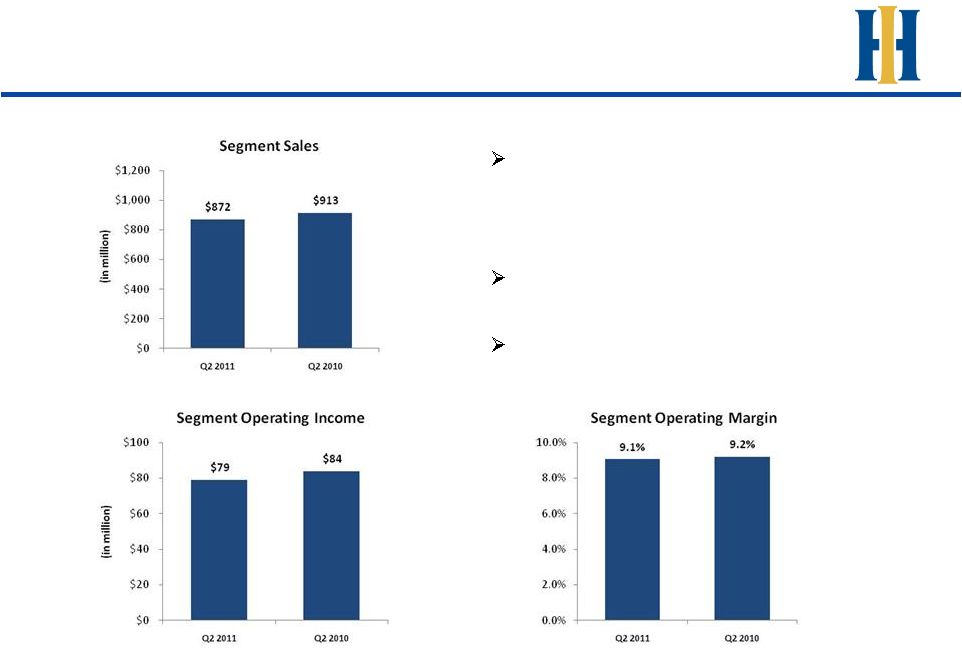

Newport News Shipbuilding

6

Newport News sales down YoY due to

lower volumes on Ford

& Roosevelt

RCOH, partially offset by Lincoln RCOH

planning effort

Segment operating income down due to

volume

Operating margin consistent with last year |

Capital Structure & Liquidity

7

Cash

on

hand

was

$381

million,

plus

$529

million

available

under

revolving

credit

facility, for $910 million total liquidity

Total debt was $1.87 billion at quarter-end

Interest expense was $30 million, up sequentially due to new capital

structure 2011 capital expenditures expected to be slightly over 3% of

sales As of

($ in millions)

June 30, 2011

Cash

381

$

Revolving credit facility*

-

$

Term loan due March 2016

568

Senior Notes due March 2018

600

Senior Notes due March 2021

600

Other debt

105

Total debt

1,873

$

* $650 million facility, $529 million available after standby

letters of credit of $121 million |

Appendix |

Reconciliations

9

We make reference to “segment operating income,”

“adjusted segment operating

income,”

“adjusted operating income”

and “adjusted sales and service revenues.”

Segment operating income is defined as operating income before net pension and

post-retirement benefits adjustment and deferred state income taxes. Adjusted

segment operating income is defined as segment operating income as adjusted for

the impact of the Avondale wind down. Adjusted operating income is defined as

operating income adjusted for the impact of the Avondale wind down. Adjusted sales

and service revenues is defined as sales and service revenues adjusted for the impact

of the Avondale wind down.

Segment operating income is one of the key metrics we use to evaluate operating

performance because it excludes items which do not affect segment performance. We

believe adjusted segment operating income, adjust operating income and adjusted

sales and service revenues are useful because they exclude certain non-recurring

items that we do not consider indicative of our core operating performance.

Therefore, we believe it is appropriate to disclose these measures to help investors

analyze our operating performance. However, these measures are not measures of

financial performance under GAAP and may not be defined or calculated by other

companies in the same manner. |

Reconciliation of Non-GAAP Measure –

Segment Operating Income

10

Three Months Ended

June 30

$ in millions

2011

2010

Sales and Service Revenues

Ingalls

708

$

714

$

Newport News

872

913

$

Intersegment eliminations

(17)

(17)

Total sales and service revenues

1,563

$

1,610

$

Operating Income (Loss)

Ingalls

19

$

(94)

$

Newport News

79

84

Total Segment Operating Income (Loss)

98

(10)

As a percentage of sales

6.3%

-0.6%

Non-segment factors affecting operating income

Net pension and post-retirement benefits adjustment

(4)

(14)

Deferred state income taxes

(3)

4

Total operating income (loss)

91

$

(20)

$ |

Reconciliation of Non-GAAP Measure –

Adjusted Operating Margin

11

Three Months Ended

June 30

$ in millions

2011

2010

Adjusted Sales and Service Revenues

Ingalls

708

$

714

$

Adjustment for Avondale wind down

-

115

Adjusted Ingalls

708

829

Newport News

872

913

$

Intersegment eliminations

(17)

(17)

Total adjusted sales and service revenues

1,563

$

1,725

$

Adjusted Operating Income (Loss)

Ingalls

19

$

(94)

$

Adjustment for Avondale wind down

-

113

Adjusted Ingalls

19

19

As a % of sales

2.7%

2.3%

Newport News

79

84

Total Adjusted Segment Operating Income (Loss)

98

103

As a % of sales

6.3%

6.0%

Non-segment factors affecting adjusted operating income

Net pension and post-retirement benefits adjustment

(4)

(14)

Deferred state income taxes

(3)

4

Total adjusted operating income (loss)

91

$

93

$

As a % of sales

5.8%

5.4% |