Attached files

| file | filename |

|---|---|

| EX-10.5 - Westport Energy Holdings Inc. | v229967_ex10-5.htm |

| EX-10.8 - Westport Energy Holdings Inc. | v229967_ex10-8.htm |

| EX-10.7 - Westport Energy Holdings Inc. | v229967_ex10-7.htm |

| EX-99.1 - Westport Energy Holdings Inc. | v229967_ex99-1.htm |

| EX-10.9 - Westport Energy Holdings Inc. | v229967_ex10-9.htm |

| EX-10.4 - Westport Energy Holdings Inc. | v229967_ex10-4.htm |

| EX-10.6 - Westport Energy Holdings Inc. | v229967_ex10-6.htm |

| EX-10.1 - Westport Energy Holdings Inc. | v229967_ex10-1.htm |

| EX-99.2 - Westport Energy Holdings Inc. | v229967_ex99-2.htm |

| EX-10.3 - Westport Energy Holdings Inc. | v229967_ex10-3.htm |

| EX-10.2 - Westport Energy Holdings Inc. | v229967_ex10-2.htm |

| EX-10.10 - Westport Energy Holdings Inc. | v229967_ex10-10.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 10, 2011 (August 17, 2010)

CARBONICS CAPITAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

000-28887

|

22-3328734

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification)

|

100 Overlook Center, 2nd Floor, Princeton, NJ 08540

(Address of Principal Executive Offices)(Zip Code)

Registrant’s telephone number, including area code: 609.498.7029

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

|

Item 2.01 Completion of Acquisition or Disposition of Assets

|

5 |

|

Item 2.03 Creation of a Direct Financial Obligation

|

30 |

|

Item 3.02 Unregistered Sale of Equity Securities

|

30 |

|

Item 5.01 Changes in Control of Registrant

|

31 |

|

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

|

31 |

|

Item 9.01 Financial Statements and Exhibits

|

35 |

|

SIGNATURE

|

INDEX TO EXHIBITS

|

10.1

|

LLC Membership Interest Purchase Agreement dated August 17, 2010 among New Earthshell Corporation, Westport Energy, LLC, Westport Energy Acquisition Inc. and Carbonics Capital Corporation.

|

|

10.2

|

Secured Convertible Debenture dated August 17, 2010 in the principal amount of $27,640,712, with New Earthshell Corporation as the “Holder” thereunder and Carbonics Capital Corporation as the “Company” thereunder.

|

|

10.3

|

Guaranty Agreement in favor of New Earthshell Corporation dated as of August 17, 2010 given by Westport Energy Acquisition Inc., Westport Energy, LLC and each subsidiary and affiliate of the foregoing identified therein or hereinafter joined to this Guaranty.

|

|

10.4

|

Security Agreement in favor of New Earthshell Corporation dated August 17, 2010 by and among Carbonics Capital Corporation, Westport Energy Acquisition Inc., Westport Energy, LLC and any subsidiary and affiliate of the foregoing identified therein or hereinafter joined to this Security Agreement.

|

|

10.5

|

Pledge and Escrow Agreement in Favor of New Earthshell Corporation dated as of August 17, 2010, by 4 Sea-Sons LLC, Carbonics Capital Corporation, Westport Energy Acquisition Inc., and each subsidiary, direct and indirect, of the foregoing identified therein or hereinafter joined to this Pledge and Escrow Agreement.

|

|

10.6

|

Securities Purchase Agreement dated August 17, 2010 between Carbonics Capital Corporation and YA Global Investments, L.P.

|

|

10.7

|

Secured Convertible Debenture dated August 17, 2010 in the principal amount of $650,000, with YA Global Investments, L.P. as the “Holder” thereunder and Carbonics Capital Corporation as the “Company” thereunder.

|

|

10.8

|

Guaranty Agreement in favor of YA Global Investments, L.P. dated as of August 17, 2010 given by Carbonics Capital Corporation, Westport Energy Acquisition Inc. and Westport Energy, LLC.

|

|

10.9

|

Security Agreement in favor of YA Global Investments L.P. dated August 17, 2010 by and among Carbonics Capital Corporation, Westport Energy Acquisition Inc., Westport Energy, LLC.

|

2

|

10.10

|

Pledge and Escrow Agreement in favor of YA Global Investments, L.P. dated as of August 17, 2010, by 4 Sea-Sons LLC, Carbonics Capital Corporation, Westport Energy Acquisition Inc., and each subsidiary, direct and indirect, of the foregoing identified therein or hereinafter joined to this Pledge and Escrow Agreement

|

|

99.1

|

Press Release dated August 18, 2010.

|

|

99.2

|

Audited financial statements of Carbonics Capital Corporation for the years ended December 31, 2008 and December 31, 2009 and pro forma financial information for Carbonics Capital Corporation and Westport Energy LLC as of December 31, 2009.

|

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements, which reflect our views with respect to future events and financial performance. These forward-looking statements are subject to certain uncertainties and other factors that could cause actual results to differ materially from such statements. These forward-looking statements are identified by, among other things, the words “anticipates”, “believes”, “estimates”, “expects”, “will”, “plans”, “projects”, “targets” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that may cause actual results to differ from those projected include the risk factors specified below.

USE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this report to:

“Carbonics” refers to Carbonics Capital Corporation, a Delaware corporation;

“Common Stock” refers to the common stock of Carbonics, par value $0.001.

“CBM” refers to coalbed methane.

“Company,” “we,” “us,” or “our,” refers to the combined business of Carbonics Capital Corporation, and its direct and indirect subsidiaries, Westport Energy Acquisition Inc. and Westport Energy LLC;

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

“NEC” refers to New Earthshell Corporation, a Delaware corporation, wholly-owned by YA Global Investments L.P., and the sole owner of the Westport Membership Interest prior to the closing of the acquisition of Westport Energy by Westport Energy Acquisition;

“Securities Act” refers to the Securities Act of 1933, as amended;

“Series C Preferred Stock” or “Series C Shares” refers to the Series C Preferred Stock of Carbonics, par value $0.001.

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States;

“Westport Energy” refers to Westport Energy LLC, a Delaware limited liability company and our indirect, wholly owned subsidiary;

“Westport Energy Acquisition” refers to Westport Energy Acquisition Inc., a Delaware corporation and our direct subsidiary, and/or its direct and indirect subsidiaries, as the case may be;

“Westport Membership Interest” refers to the 100% membership interest of Westport Energy.

“YA Global” refers to YA Global Investments L.P., a Cayman Islands limited partnership;

4

Item 2.01 - Completion of Acquisition or Disposition of Assets

OUR ACQUISITION OF WESTPORT ENERGY LLC

On August 17, 2010 Carbonics Capital entered into an LLC Membership Interest Purchase Agreement (“LLC Purchase Agreement”) with NEC, Westport Energy (a wholly-owned subsidiary of NEC) and Westport Energy Acquisition (a wholly-owned subsidiary of Carbonics), pursuant to which Westport Energy Acquisition agreed to acquire 100% of the Westport Membership Interest in accordance with the terms of the LLC Purchase Agreement. Westport Energy is an exploration stage company engaged in the exploration for CBM in the Coos Bay region of Oregon. Westport Energy holds leases to approximately 104,000 acres of prospective CBM lands in the Coos Bay Basin.

Immediately following the execution of the LLC Purchase Agreement, Westport Energy Acquisition completed the acquisition of Westport Energy (the “Westport Acquisition”) and the parties to the LLC Purchase Agreement also completed various other related transactions in accordance with the terms of the LLC Purchase Agreement and those respective agreements on that same day (the “Closing Transactions”). In addition to the execution and delivery of the LLC Purchase Agreement, the Closing Transactions included:

|

•

|

The issuance by Carbonics to NEC of a senior Secured Convertible Debenture dated August 17, 2010 in the principal amount of $27,640,712, in consideration for the acquisition of the membership interest in Westport Energy by Westport Energy Acquisition (the “NEC Debenture”). The NEC Debenture bears interest at the rate of 9% per annum, payable at maturity. The maturity date for payment of the NEC Debenture is August 31, 2012. The holder of the NEC Debenture is entitled to convert the principal and accrued interest on the NEC Debenture into common stock of Carbonics at a conversion rate initially equal to $0.0003 per share, subject to adjustment and beneficial ownership limitations as provided for in the NEC Debenture.

|

|

•

|

The execution and delivery of a Guaranty Agreement dated as of August 17, 2010 (the “Guaranty”) given by (i) Westport Energy Acquisition, (ii) Westport Energy, and (iii) each subsidiary and affiliate of Westport Energy Acquisition or Westport Energy identified therein or hereinafter joined to this Guaranty in favor of NEC, pursuant to which the Guarantors unconditionally and irrevocably guarantee the full payment and performance of all obligations owed or hereafter owing by Carbonics to NEC.

|

|

•

|

The execution and delivery of a Security Agreement in favor of NEC dated August 17, 2010 by and among (i) Carbonics, (ii) Westport Energy Acquisition, (iii) Westport Energy; and (iv) any subsidiary and affiliate of Carbonics, Westport Energy Acquisition, or Westport Energy identified therein or joined to this agreement in the future (collectively, the “Grantors”), pursuant to which the Grantors granted to NEC security interests in all of the assets and personal property of each Grantor in order to secure the obligations under the NEC Debenture.

|

5

|

•

|

The execution and delivery of a Pledge and Escrow Agreement dated as of August 17, 2010, by 4 Sea-Sons LLC, a Delaware limited liability company (the “Preferred Shareholder”), Westport Energy Acquisition, Carbonics and each subsidiary, direct and indirect, of Carbonics, Westport Energy Acquisition or the Preferred Shareholder identified therein or joined to this agreement in the future (collectively, the “Pledgors”) in favor of NEC, pursuant to which the Pledgors pledged to NEC as security for the NEC Debenture all (i) securities, membership, partnership or other ownership interests or rights to purchase of the Pledgors identified therein and (ii) all securities, membership, partnership or other ownership interests obtained in the future by a Pledgor (collectively, the “Pledged Securities”) and (A) all of the Pledgors’ interests in respect of the Pledged Securities and Pledgors’ interests in all profits and distributions to which the Pledgors shall at any time be entitled in respect of such Pledged Securities and (B) to the extent not otherwise included, all proceeds, dividends, warrants, options, rights, instruments, and other property from time to time received or otherwise distributable in respect of or in exchange of any or all of the foregoing.

|

Immediately following the closing of the Westport Acquisition, Carbonics and YA Global, entered into a securities purchase agreement (“SPA”) pursuant to which Carbonics issued to YA Global a secured convertible debenture dated August 17, 2010 in the principal amount of $650,000.00 (the “YA Debenture”). The YA Debenture bears interest at the rate of 9% per annum, payable at maturity. The maturity date for payment of the YA Debenture is August 31, 2012. The holder of the YA Debenture is entitled to convert the principal and accrued interest on the YA Debenture into common stock of Carbonics at a conversion rate per share initially equal to the lower of $0.0003 or 90% of the lowest VWAP of the common shares for the 20 trading days immediately prior to conversion, subject to adjustment and beneficial ownership limitations as provided for in the YA Debenture. The proceeds from the YA Debenture will be used by Carbonics to fund various short-term administrative and operating expenses.

In connection with the YA Debenture, Carbonics and its subsidiaries also entered into the following agreements:

|

•

|

a Guaranty Agreement in favor of YA Global dated as of August 17, 2010 (the “YA Guaranty”) given by (i) Carbonics, (ii) Westport Energy Acquisition and (iii) Westport Energy (collectively, the “YA Guarantors”), pursuant to which the YA Guarantors unconditionally and irrevocably guarantee the full payment and performance of certain obligations owed or hereafter owing to YA Global in accordance with the terms of the Guaranty Agreement.

|

|

•

|

a Security Agreement in favor of YA Global dated August 17, 2010 (the “YA Security Agreement”) by and among (i) Carbonics, (ii) Westport Energy Acquisition and (iii) Westport Energy (collectively, the “YA Grantors”), pursuant to which the YA Grantors granted to YA Global security interests in certain assets and personal property of each YA Grantor in order to secure certain obligations owed to YA Global in accordance with the terms of the terms of the Security Agreement.

|

6

|

•

|

a Pledge and Escrow Agreement dated as of August 17, 2010 (the “Pledge and Escrow Agreement”), by the Preferred Shareholder, Westport Energy Acquisition, Carbonics and each subsidiary, direct and indirect, of Carbonics, Westport Energy Acquisition or the Preferred Shareholder identified therein or joined to this agreement in the future (collectively, the “YA Pledgors”) in favor of YA Global, pursuant to which the YA Pledgors pledged to YA Global as security for obligations owed to YA Global all (i) securities, membership, partnership or other ownership interests or rights to purchase of the YA Pledgors identified therein and (ii) all securities, membership, partnership or other ownership interests obtained in the future by a YA Pledgor (collectively, the “YA Pledged Securities”) and (A) all of the YA Pledgors’ interests in respect of the YA Pledged Securities and YA Pledgors’ interests in all profits and distributions to which the YA Pledgors shall at any time be entitled in respect of such YA Pledged Securities and (B) to the extent not otherwise included, all proceeds, dividends, warrants, options, rights, instruments, and other property from time to time received or otherwise distributable in respect of or in exchange of any or all of the foregoing, all in accordance with the terms of the Pledge and Escrow Agreement.

|

At the time of the closing of the Westport Acquisition, Viridis Capital LLC, in exchange for $10, transferred to the Preferred Shareholder all of the shares of Series C Preferred Stock issued by Carbonics, which were owned by Viridis Capital LLC. As a result of such transfer and its ownership interest in the Series C Preferred Stock, the Preferred Shareholder now owns the majority of the equity in Carbonics. The Preferred Shareholder is owned and controlled by Stephen J. Schoepfer.

At the closing, Stephen J. Schoepfer, was elected as Chairman of the board of directors of Carbonics. In addition, at the closing, Kevin Kreisler, the former Chairman of the board of directors of Carbonics, and Paul Miller, also a member of the board of directors of Carbonics, submitted their resignations as members of the board, which resignations became effective ten (10) days after the mailing to the shareholders of Carbonics of an applicable 14f-1 Information Statement regarding the change in the board of directors.

Also at the closing, the current officers of Carbonics, Westport Energy Acquisition and Westport Energy resigned from their respective positions and Stephen J. Schoepfer was elected Chief Executive Officer, Chief Financial Officer and Secretary of Carbonics and President of Westport Energy and Westport Energy Acquisition.

Immediately following the closing of the Westport Energy Acquisition, Carbonics and YA Global Investments entered into a securities purchase agreement (“SPA”) pursuant to which Carbonics issued to YA Global a secured convertible debenture dated August 17, 2010 in the principal amount of $650,000.00 (the “YA Debenture”). The YA Debenture bears interest at the rate of 9% per annum, payable at maturity. The maturity date for payment of the YA Debenture is August 31, 2012. The holder of the YA Debenture is entitled to convert the principal and accrued interest on the YA Debenture into common stock of Carbonics at a conversion rate per share initially equal to the lower of $0.0003 or 90% of the lowest VWAP of the common shares for the 20 trading days immediately prior to conversion, subject to adjustment and beneficial ownership limitations as provided for in the YA Debenture. The proceeds from the YA Debenture will be used by Carbonics to fund various short-term administrative and operating expenses.

7

OUR CORPORATE HISTORY

Background of Carbonics

Carbonics was organized under the laws of the state of Delaware on June 30, 1994 under the name Telco Technology Inc. (subsequently changed to Telco-Technology Inc.) and engaged in telecommunications and related technology business. On December 27, 2004 our name was changed from “Telco-Technology Inc.” to “GreenWorks Corporation” and our business focus shifted to providing consulting, technical and engineering services to alleviate the environmental problems of our clients.

On April 1, 2005, we acquired majority equity stakes in two OTC Bulletin Board companies, Veridium Corporation and INSEQ Corporation, from affiliates of our former chairman and chief executive officer. We subsequently filed an election on Form N54A pursuant to Section 54 of the 1940 Act to be regulated as a BDC, and we changed our name from "GreenWorks Corporation" to "GreenShift Corporation". Our business model at that time changed to developing and supporting companies and technologies that facilitate the efficient use of natural resources and catalyze transformational environmental gains.

On February 6, 2008 we changed our name from “GreenShift Corporation” to “Carbonics Capital Corporation.” At the time of this change, our business model was adjusted to focus on the development of renewable energy projects that facilitate the more efficient use of carbon in energy supply chains, which would be accomplished by (a) direct development of qualified projects; (b) majority investments in qualified projects; and/or (c) acquisition of qualified distressed or other assets.

On August 17, 2010, we acquired 100% of the membership interest of Westport Energy, which was engaged in the exploration for and development of prospective CBM properties in the Coos Bay region of Oregon. As a result of this acquisition our business plan now focuses solely on CBM exploration and development in the Coos Bay area of Oregon through our Westport Energy subsidiary.

Background of Westport

Prior to its acquisition by Carbonics, Westport Energy was a wholly-owned subsidiary of NEC. Westport Energy was formed in Delaware in October 2008 by NEC to hold title to the CBM assets currently owned by Westport Energy, which were acquired by NEC’s parent company, YA Global, after YA Global, as the senior secured lender to Torrent Energy, foreclosed on, and took title to, those assets from Torrent Energy.

8

OUR BUSINESS

Overview

Following our acquisition of Westport Energy, our primary business now focuses on the exploration for and development of CBM in the Coos Bay area of Oregon. We operate in that market through our Delaware subsidiary, Westport Energy. An overview of our current corporate structure is set forth in the diagram below:

THE COALBED METHANE INDUSTRY

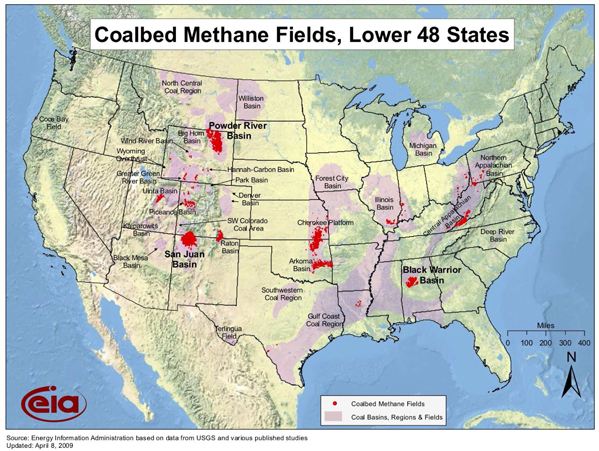

During the past two decades, CBM has emerged as a viable source of natural gas compared to the late 1980s when no significant production outside of the still dominant San Juan Basin in New Mexico, and the Black Warrior Basin in Alabama. According to data from the U.S. Department of Energy’s Energy Information Administration, CBM production totaled 1.914 trillion cubic feet in 2009. This production accounted for nearly 9% of the country’s total dry-gas output of 19.7 trillion cubic feet. CBM production currently comes from fifteen basins located in the Rocky Mountain, Mid-Continent and Appalachian regions. [One of the CBM industry’s leading information specialists estimates that the number of CBM producing wells nationwide (including those close to achieving production) is approaching 35,000. By comparison, more than 493,100 wells produce natural gas nationwide.] However, none of this production of natural gas currently comes from Oregon. All of the natural gas presently consumed in the Pacific Northwest must be delivered by interstate pipelines from Western Canada and Wyoming. The map below from the Energy Information Administration reflects the various CBM fields in the lower 48 states of the U.S.

9

We believe the success of CBM developments has largely been the result of improved drilling and completion techniques (including horizontal/lateral completions), better hydraulic fracture designs and significant cost reductions as a result of highly dependable gas content and coalbed reservoir performance analysis. Also aiding this sector’s growth is the apparent shortage of quality domestic conventional exploration and development projects.

We also believe that a major factor driving the growth in CBM production is its relatively low finding and development costs. CBM fields are often found where deeper conventional oil and gas reservoirs have already been developed. Therefore, considerable exploration-cost reducing geologic information is often readily available. This available geological information, combined with comparatively shallow depths of prospective coalbed reservoirs, reduces finding and development costs.

A number of government agencies and industry organizations use various statistical methodologies to estimate the volume of potentially recoverable CBM using currently available technology and specific economic conditions. The Potential Gas Committee, which provides the most frequent assessments of the country’s natural gas resource base, estimates technically recoverable CBM resources of 158.6 trillion cubic feet for the Lower 48 States as of year-end 2010. It is important to note that technically recoverable gas volumes do not necessarily qualify as proved reserves, and we have not recorded any proved reserves at our CBM properties in Coos Bay, Oregon at this time.

10

COALBED METHANE GAS AND ATTRIBUTES OF COALBED METHANE RESOURCES

CBM gas is a type of natural gas found in coal seams of various types of coal. As coal is formed, large quantities of natural gas are generated and adsorbed on the internal surface area of the coal. CBM exploration and production involves drilling into a known coal deposit and extracting the natural gas that is contained in the coal. A coal seam is often saturated with water, with methane gas being held in the coal by water pressure. To produce CBM from coalbeds, water must first be pumped from the seam in order to reduce the water pressure that holds the gas in the seam. This process is called dewatering. When the water pressure is reduced, the gas adsorbed on the coal is released and diffuses through the fractures, or cleats, contained in the coal seam. Gas flows to the wellbore through the cleat system as well as any of the other cracks, crevices and fractures found in the coalbed. Dewatering volumes decrease as peak CBM production is reached.

The productivity potential of a well depends on many reservoir and geological characteristics, including permeability, thickness and depth of the coalbed, the coal ranking of the coalbed, gas content and other factors. We consider these factors, as well as isotherm tests conducted on core samples, the amount of dewatering required of a well and a number of other factors, when choosing where to develop any CBM present in our CBM acreage.

Permeability. CBM gas production requires that the coal have sufficient permeability. Permeability is the ability of a substance to allow another substance to pass through it. In the case of our CBM properties, permeability is the ability of the coal to allow water and/or gas to pass through it. Permeability in coal is primarily created by naturally occurring fractures, which are commonly referred to as cleats. Permeability is largely based upon how many cleats the coal has and how close they are to each other. The more cleats the coal has, the better the coal's permeability and the greater opportunity to retrieve the adsorbed CBM. Tectonic fracturing can also contribute greatly to permeability. Reservoirs with high permeability have a higher propensity for strong gas production than less permeable reservoirs. The same permeability that can contribute to strong gas production also initially allows more water to flow through the coal. Thus, coal seams with higher permeability often take significantly longer time to dewater than lower permeability coal seams. Once sufficient water is produced, higher permeability normally allows wells to maintain higher production rates for longer periods and enables higher gas recoveries with fewer wells.

Thickness. The thickness of the coal seam is crucial to CBM production. A coal seam with otherwise unacceptably low permeability could produce commercial quantities of gas if the coal seam has sufficient thickness. In this case, the gas would flow out slowly, but because the coal seam is thick, more of the gas would be produced since there is a large area from which to collect the CBM.

Depth. The depth of the coal seam is also a significant factor in the productivity potential of a well. Where the coal, and thus the methane gas, lies at shallow depths, wells are generally easier to drill and less expensive to complete. With greater depth, increased pressure closes cleats in the coal, which reduces permeability and the ability of the CBM to move through and out of the coal. On the other hand, if a coal seam is not buried deep enough, there may not have been sufficient water pressure to hold the gas in place and through geologic time the gas may have escaped from the coal.

Coal Ranking. Methane gas is contained in all ranks of coal. Most CBM is contained in the highest rank coal, which is called anthracite. Unfortunately, anthracite has very low permeability. Semi-anthracite coal typically has lower quantities of CBM than anthracite coal, but may contain significant cleats as well, making it more permeable. The next lesser coal rank is bituminous coal that contains less CBM per ton than the anthracite and semi-anthracite coal but usually has a good cleat structure, allowing for better permeability.

11

Dewatering. Water must be removed from the coal seams to decrease reservoir pressure and release the gas to produce methane gas from coalbeds. After the detachment of gas molecules from the coal surface, or desorption, occurs, the gas diffuses through the coalbed's cleats and fractures toward the wellbore. Substantial dewatering of the coalbed is required initially. Water production declines as methane gas production increases. Dewatering of a well may generally range in length from a few weeks to as many as three years or more depending on the attributes of the coal seam.

THE COOS BAY BASIN

The Coos Bay Basin is located along the Pacific coast in southwest Oregon, approximately 200 miles south of the Columbia River and 80 miles north of the Oregon/California border. The onshore portion of the Coos Bay Basin is elliptical in outline, elongated in a north-south direction and covers over 250 square miles. More than 150,000 acres in the Coos Bay Basin are underlain by the Coos Bay coal field and appears prospective for CBM gas production. The current leasehold position owned by Westport Energy covers most of the lands believed to be prospective for CBM production in the Coos Bay Basin. Most areas in Coos County are accessible year-round via logging and fire control roads maintained by the county or by timber companies. In addition, numerous timber recovery staging areas are present and in many cases can be modified for drill-site locations.

The Coos Bay Basin is basically a structural basin formed by folding and faulting and contains a thick section of coal-bearing sediments. Coal-bearing rocks contained within the Coos Bay Basin form the Coos Bay Coal field. Coal mining from the Coos Bay field began in 1854 and continued through the mid 1950’s. Much of the coal was shipped to San Francisco. Since mining activity ended several companies such as Sumitomo, Shell and American Coal Company have done exploratory work and feasibility studies on the Coos Bay Coal Field but no mining operations were conducted. In addition, approximately 20 exploratory oil and/or gas wells have been drilled in the Coos Bay basin during the years 1914 to 1993. Many of these wells encountered gas shows in the coal seams that were penetrated during drilling.

Coalbeds are contained in both the Lower and Upper Member of the Middle Eocene Coaledo Formation. The coal-bearing sandstones and siltstones of the Middle Eocene Coaledo formation are estimated to form a section up to 6,400 feet thick. Total net coal thickness for the Lower Coaledo Member can range up to 70 feet and over 30 feet for the Upper Coaledo Member. Coos Bay coal rank ranges from sub bituminous to high-volatile bituminous, with a heating value of 8,300 to 14,000 British Thermal Units per pound (“BTU/LB.”), low sulphur content, and a moderate percentage of ash.

NATURAL GAS MARKET IN THE COOS BAY AREA

Until 2005, the Port of Coos Bay was one of the largest population centers on the west coast not served by natural gas. A project to bring natural gas into the region via a 52-mile, 12-inch pipeline was approved, funded by Coos County and the State of Oregon, and completed in late 2004 with gas sales beginning in early 2005. While the line is owned by Coos County, the local gas distribution company, Northwest Natural Gas, operates the line. Northwest Natural Gas serves Coos County and most of western Oregon. The pipeline and its associated distribution system represent the most likely market option for delivery of gas, if produced by Westport Energy in the future. Estimates of current local Coos County market requirements are less than 1 million cubic feet of gas per day initially, which represents less than 1% of ultimate pipeline capacity. Excess capacity is available for additional gas input.

12

Coos County is also likely to benefit from new industrial, commercial and residential development as natural gas is now available. Expansion of the market is likely to bring greater demand for and value to natural gas. Because of its west coast location, Coos Bay market prices would be subject to pricing standards of the New York Mercantile Exchange for most of the year. Regional gas pricing hubs are located at Malin and Stanfield, Oregon. The closest pricing point, however, would be the Coos Bay City Gate, where Northwest Natural Gas’s retail rates are set and regulated by Oregon’s Public Utilities Commission. Seasonal or critical gas demand fluctuations could cause prices to exceed or fall below posted prices on a regular basis.

OUR GAS PROPERTIES IN COOS BAY

Coos Bay Leases

Through our subsidiary, Westport Energy, we have under lease approximately 104,000 undeveloped acres in the Coos Bay Basin in the state of Oregon as of December 31, 2010. In March 2008, Methane Energy Corp., Westport Energy’s predecessor in interest, elected to drop the lease with the Oregon Department of State Lands, which consisted of approximately 11,000 acres under the waterways in the Coos Bay Basin. In addition, in January 2010, we determined that the cost to continue exploration of various leases that we had in the Chehalis Basin in the state of Washington outweighed the projected benefits from such leases. Accordingly, these leases were not renewed with their owners. Following our decision to abandon these Washington leases we performed certain reclamation work on the one well that was drilled in the Chehalis Basin, as required pursuant to the applicable lease and as requested in a notice from the state of Washington. While we believe we have satisfied all of our obligation under the applicable Washington leases we have not received any confirmation from the state of Washington to that effect and therefore any potential liability in connection with any remaining obligations under the Washington leases cannot be ascertained at this time.

Of the acreage Westport Energy has under lease, approximately 16,000 acres are leased from Menasha Development Corporation, 29,000 acres from Coos County, 3,000 acres from the State of Oregon Department of Transportation, and approximately 56,000 acres from various companies and individual landowners. The total annual lease payments related to the 104,000 acres are approximately $81,000. These leases typically have a five-year term with an option for an additional five years with renewal conditioned on continued payment of annual lease rentals. In addition, we have granted the landowners royalties, typically averaging 12.5% on gross sales resulting from the leases. The first of our lease renewal payments began in September 2008 and the majority of our Coos Bay Basin leases were renewed in 2009 and 2010 at rates varying from $2-$5 per net acre.

Drilling History on Our Coos Bay Properties

On October 6, 2004, Methane Energy Corp., a predecessor in interest to Westport Energy, commenced a multi-hole coring program in connection with the Coos Bay leases. Coring was needed to collect coal samples so that accurate gas content data could be measured. Cores were collected, desorption work was done on the coals and evaluation was completed by mid 2005. This data, as well as other geologic information, was provided to Sproule Associates, Inc., an international reservoir engineering firm, for an independent evaluation. To date, natural gas analyses performed on samples from Methane Energy Corp. coal samples and wells indicate that the gas is pipeline quality and that the coals are fully saturated with gas. It is important to note that technically recoverable gas volumes do not necessarily qualify as proved reserves, and we have not recorded any proven reserves at any of our projects at this time.

Drilling and testing programs were then initiated at three pilot sites—Beaver Hill, Radio Hill and Westport. A total of eleven exploratory wells have been drilled.

13

OUR STRATEGY

Exploration & Production Objectives

The Coos Bay Basin is the southernmost of a series of sedimentary basins that are present in western Oregon and Washington west of the Cascade Range. The region containing this series of basins is generally referred to as the Puget-Willamette Trough. These basins contain thick sequences of predominantly non-marine, coal-bearing sedimentary rock sequences that are correlative in age, closely related in genesis, and very similar in many other characteristics. Westport Energy is primarily targeting natural gas from coal seams of the Coaledo Formation in the Coos Bay Basin. Secondary objectives may include natural gas, and possibly oil, trapped in conventional sandstone reservoirs.

Our short-term strategy involves evaluating whether to proceed with production and flow testing at five pilot wells that have already been drilled on our Coos Bay properties and which we have identified as the best opportunities for such production-testing. We currently do not have the funding available to perform the production testing at these pilot wells and would, therefore, need to raise additional funding if, and when, we move forward with production testing. In addition, we are seeking out potential partners to potentially facilitate our short-term strategy and subsequent development efforts.

Regulation

The production and sale of oil and gas are subject to various federal, state and local governmental regulations, which may be changed from time to time in response to economic or political conditions and can have a significant impact upon overall operations. Matters subject to regulation include discharge permits for drilling operations, drilling bonds, reports concerning operations, the spacing of wells, unitization and pooling of properties, taxation, abandonment and restoration and environmental protection. These laws and regulations are under constant review for amendment or expansion. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our future business operations.

Regulation of Oil & Gas Production

Our future oil and natural gas exploration, production and related operations will be subject to extensive rules and regulations promulgated by federal, state and local authorities and agencies. Failure to comply with such rules and regulations can result in substantial penalties. The regulatory burden on the oil and natural gas industry increases our cost of doing business and affects our profitability. Although we believe we are in substantial compliance with all applicable laws and regulations, because such rules and regulations are frequently amended or reinterpreted, we are unable to predict the future cost or impact of complying with such laws.

Many states require permits for drilling operations, drilling bonds and reports concerning operations and impose other requirements relating to the exploration and production of oil and natural gas. Such states also have statutes or regulations addressing conservation matters, including provisions for the unitization or pooling of oil and natural gas properties, the establishment of maximum rates of production from wells, and the regulation of spacing, plugging and abandonment of such wells.

14

Federal Regulation of Natural Gas

The Federal Energy Regulatory Commission ("FERC") regulates interstate natural gas transportation rates and service conditions, which affect the marketing of natural gas produced by us, as well as the revenues received by us for sales of such production. Since the mid-1980's, FERC has issued a series of orders that have significantly altered the marketing and transportation of natural gas. These orders mandated a fundamental restructuring of interstate pipeline sales and transportation service, including the unbundling by interstate pipelines of the sale, transportation, storage and other components of the city- gate sales services such pipelines previously performed. One of FERC's purposes in issuing the orders was to increase competition within all phases of the natural gas industry. Certain aspects of these orders may be modified as a result of various appeals and related proceedings and it is difficult to predict the ultimate impact of the orders on us and others. Generally, the orders eliminated or substantially reduced the interstate pipelines' traditional role as wholesalers of natural gas in favor of providing only storage and transportation service, and have substantially increased competition and volatility in natural gas markets.

The price, which we may receive for the sale of oil, natural gas and natural gas liquids, would be affected by the cost of transporting products to markets. FERC has implemented regulations establishing an indexing system for transportation rates for oil pipelines, which, generally, would index such rates to inflation, subject to certain conditions and limitations. We are not able to predict with certainty the effect, if any, of these regulations on any future operations. However, the regulations may increase transportation costs or reduce wellhead prices for oil and natural gas liquids.

Environmental Matters

Our operations and properties will be subject to extensive and changing federal, state and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. The recent trend in environmental legislation and regulation generally is toward stricter standards, and this trend will likely continue. These laws and regulations may (i) require the acquisition of a permit or other authorization before construction or drilling commences and for certain other activities; (ii) limit or prohibit construction, drilling and other activities on certain lands lying within wilderness and other protected areas; and (iii) impose substantial liabilities for pollution resulting from our operations. Governmental authorities have the power to enforce their regulations, and violations are subject to fines or injunctions, or both. In the opinion of management, we are in substantial compliance with current applicable environmental law and regulations, and we have no material commitments for capital expenditures to comply with existing environmental requirements. Nevertheless, changes in existing environmental laws and regulations or in interpretations thereof could have a significant impact on our business operations, as well as the oil and natural gas industry in general.

The Comprehensive Environmental, Response, Compensation, and Liability Act ("CERCLA") and comparable state statutes impose strict, joint and several liability on owners and operators of sites and on persons who disposed of or arranged for the disposal of "hazardous substances" found at such sites. It is not uncommon for the neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act ("RCRA") and comparable state statutes govern the disposal of "solid waste" and "hazardous waste" and authorize the imposition of substantial fines and penalties for noncompliance. Although CERCLA currently excludes petroleum from its definition of "hazardous substance," state laws affecting our operations impose clean-up liability relating to petroleum and petroleum related products. In addition, although RCRA classifies certain oil field wastes as "non-hazardous," such exploration and production wastes could be reclassified as hazardous wastes, thereby making such wastes subject to more stringent handling and disposal requirements.

15

We may acquire leasehold interests in properties that for many years have produced oil and natural gas. Although the previous owners of these interests may have used operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed of or released on or under the properties. In addition, some of our properties may be operated in the future by third parties over which we have no control. Notwithstanding our lack of control over properties operated by others, the failure of the operator to comply with applicable environmental regulations may, in certain circumstances, adversely impact our business operations.

The National Environmental Policy Act ("NEPA") is applicable to many of our planned activities and operations. NEPA is a broad procedural statute intended to ensure that federal agencies consider the environmental impact of their actions by requiring such agencies to prepare environmental impact statements ("EIS") in connection with all federal activities that significantly affect the environment. Although NEPA is a procedural statute only applicable to the federal government, a portion of our properties may be acreage located on federal land. The Bureau of Land Management's issuance of drilling permits and the Secretary of the Interior's approval of plans of operation and lease agreements all constitute federal action within the scope of NEPA. Consequently, unless the responsible agency determines that our drilling activities will not materially impact the environment, the responsible agency will be required to prepare an EIS in conjunction with the issuance of any permit or approval.

The Endangered Species Act ("ESA") seeks to ensure that activities do not jeopardize endangered or threatened animals, fish and plant species, nor destroy or modify the critical habitat of such species. Under ESA, exploration and production operation, as well as actions by federal agencies, may not significantly impair or jeopardize the species or their habitat. ESA provides for criminal penalties for willful violations of the Act. Other statutes that provide protection to animal and plant species and that may apply to our operations include, but are not necessarily limited to, the Fish and Wildlife Coordination Act, the Fishery Conservation and Management Act, the Migratory Bird Treaty Act and the National Historic Preservation Act. Although we believe that our operations are in substantial compliance with such statutes, any change in these statutes or any reclassification of a species as endangered could subject us to significant expense to modify our operations or could force us to discontinue certain operations altogether.

Management believes that we are in substantial compliance with current applicable environmental laws and regulations.

Competition

CBM in the United States is produced by several major exploration and production companies and by numerous independents. The majors include BP American and ConocoPhillips in the San Juan Basin and, to a lesser extent, Chevron USA in the Black Warrior Basin. A number of large and mid-size independents, including Anadarko Petroleum Corporation, CMS Energy Corporation, CNX Gas Corporation, Devon Energy Corporation, Dominion Resources, Inc., El Paso Corporation, EnCana Corporation, Energen Corporation, Equitable Resources, Inc., Fidelity Exploration & Production Company, GeoMet Inc., J.M. Huber Corporation, Lance Oil & Gas Corporation, Penn Virginia Corporation, Pennaco Energy Inc., Pioneer Natural Resources Company, The Williams Companies, Inc., XTO Energy Inc. and Yates Petroleum Corporation, have established production in one or more basins. Dozens of smaller independents, many of whom originally began with conventional oil and gas production and operating a small number of wells, have found profitable niches in CBM. Other new entrants to CBM continue to acquire prospective acreage and to conduct test drilling. By virtue of their strategic property holdings, affiliates of several of the country’s largest coal mining companies also have become active in CBM, such as Consol Energy Inc., Jim Walter Resources, Inc., Peabody Energy Corporation, USX Corporation and Westmoreland Coal Company.

16

LEGAL PROCEEDINGS

NONE

RISK FACTORS

Risks Related to Our Business

The global financial crisis has had, and may continue to have, an impact on our business and financial condition.

The ongoing global financial crisis may limit our ability to access the capital markets at a time when we would like, or need, to raise capital, which could have an impact on our ability to react to changing economic and business conditions. Accordingly, if the global financial crisis and current economic downturn continue or worsen, our business, results of operations and financial condition could be materially and adversely affected.

We have not earned any revenues in our Westport Energy business unit since its incorporation and only have a limited operating history in its current business, which raise doubt about our ability to continue as a going concern.

Our Westport Energy business unit has a limited operating history in its current business and must be considered in the development stage. It has not generated any revenues since its inception and we will, in all likelihood, continue to incur operating expenses without significant revenues until we complete development of our certain drilled wells. The primary source of funds for our Westport Energy business unit has been the sale of common stock and convertible debt financing. We cannot assure that we will be able to generate any significant revenues or income. These circumstances make us dependent on additional financial support until profitability is achieved. There is no assurance that we will ever be profitable and we have not yet achieved profitable operations. These factors raise substantial doubt that we will be able to continue as a going concern.

Our auditor’s report reflects the fact that without realization of additional capital, it would be unlikely for us to continue as a going concern.

As a result of our deficiency in working capital at December 31, 2010 and other factors, our auditors have included an explanatory paragraph in their audit report regarding substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments as a result of this uncertainty. The going concern qualification may adversely impact our ability to raise the capital necessary for the expansion and continuation of operations.

17

We need to raise additional financing to support the development of our business but we cannot be sure that we will be able to obtain additional financing on terms favorable to us when needed. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated.

Our ability to develop and commercialize our CBM properties is dependent upon our ability to raise significant additional financing when needed. If we are unable to obtain such financing, we will not be able to develop and commercialize our gas properties. Our future capital requirements will depend upon many factors, including:

• test results from pilot wells;

• the number of wells included in any future development plans;

• our ability to establish collaborative relationships; and

• pipeline and transportation availability.

We have limited financial resources and to date, no cash flow from the operations of our Westport Energy business unit and we are dependent for funds on our ability to sell our common stock, primarily on a private placement basis, or issue convertible debt securityj. There can be no assurance that we will be able to obtain financing on that basis in light of factors such as the market demand for our securities, the state of financial markets generally and other relevant factors. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any future indebtedness or that we will not default on our future debts, jeopardizing our business viability. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders would be reduced, and these newly issued securities might have rights, preferences or privileges senior to those of existing stockholders. Finally, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to continue the development of our gas properties, which might result in the loss of some or all of your investment in our common stock.

The requirements of being a public company may strain our resources and distract our management

As a public company, we are subject to the reporting requirements of the Exchange Act and the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). These requirements place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls for financial reporting. Management has identified the following material weaknesses in our internal controls over financial reporting: (1) lack of documented policies and procedures; (2) lack of resources to account for complex and unusual transactions; and, (3) there is no effective segregation of duties, which includes monitoring controls, between the members of management.

We are also required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of our internal controls over financial reporting. We may not be able to remediate these weaknesses in time to meet the deadlines imposed by the Sarbanes-Oxley Act. If we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with the Sarbanes-Oxley Act.

18

In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight will be required. This may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge, and we cannot assure you that we will be able to do so in a timely fashion.

Because we face uncertainties in estimating proven recoverable natural gas reserves, you should not place undue reliance on such reserve information.

Although we do not currently have any proven gas reserves, there are nevertheless various risks associated with estimating proven recoverable gas reserves, which should be considered. There are numerous uncertainties inherent in estimating quantities of proved reserves and cash flows from such reserves, including factors beyond our control and the control of our independent petroleum and geological engineers. Reserve engineering is a subjective process of estimating underground accumulations of natural gas and oil that cannot be measured in an exact manner. The accuracy of an estimate of quantities of reserves, or of cash flows attributable to these reserves, is a function of the available data; assumptions regarding future natural gas and oil prices; expenditures for future development and exploitation activities; and engineering and geological interpretation and judgment. Reserves and future cash flows may also be subject to material downward or upward revisions based upon production history, development and exploitation activities and natural gas and oil prices. Actual future production, revenue, taxes, development expenditures, operating expenses, quantities of recoverable reserves and value of cash flows from those reserves may vary significantly from any assumptions and estimates in this Form 10-K. Any significant variance from these assumptions to actual figures could greatly affect our estimates of reserves, the economically recoverable quantities of natural gas attributable to any particular group of properties, the classification of reserves based on risk of recovery, and estimates of the future net cash flows. In addition, reserve engineers may make different estimates of reserves and cash flows based on the same available data. The estimated quantities of proved reserves and the discounted present value of future net cash flows attributable to those reserves are not intended to represent the fair market value of such reserves.

The present value of future net cash flows from any proved reserves is not necessarily the same as the current market value of estimated natural gas reserves. We intend to base the estimated discounted future net cash flows from any proved reserves on prices and costs. However, actual future net cash flows from our natural gas and oil properties also will be affected by factors such as:

|

Ÿ

|

geological conditions;

|

|

Ÿ

|

changes in governmental regulations and taxation;

|

|

Ÿ

|

assumptions governing future prices;

|

|

Ÿ

|

the amount and timing of actual production;

|

|

Ÿ

|

availability of funds;

|

19

|

Ÿ

|

future operating and development costs; and

|

|

Ÿ

|

capital costs of drilling new wells.

|

The timing of both our production and our incurrence of expenses in connection with the development and production of natural gas properties will affect the timing of actual future net cash flows from any proved reserves, and thus their actual present value.

The SEC permits natural gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC’s guidelines strictly prohibit us from including “probable reserves” and “possible reserves” in filings with the SEC. We also caution you that the SEC views such “probable” and “possible” reserve estimates as inherently unreliable and these estimates may be seen as misleading to investors unless the reader is an expert in the natural gas industry. Unless you have such expertise, you should not place undo reliance on any such estimates. Potential investors should also be aware that such “probable” and “possible” reserve estimates will not be contained in any “resale” or other registration statement filed by us that offers or sells shares on behalf of purchasers of our common stock and may have an impact on the valuation of the resale of the shares.

We are implementing new business plans, which make the results of our business uncertain.

Our limited operating history makes it difficult for potential investors to evaluate our business. Therefore, our proposed operations are subject to all of the risks inherent in the initial expenses, challenges, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to early-stage technology development companies in general. Investors should evaluate an investment in our company in light of the problems and uncertainties frequently encountered by companies attempting to develop markets for new products, services and technologies. Despite best efforts, we may never overcome these obstacles to achieve financial success. Our business is speculative and dependent upon the implementation of our business plan, as well as our ability to enter into agreements with third parties for necessary financing. There can be no assurance that our efforts will be successful or result in revenue or profit. There is no assurance that we will earn significant revenues or that our investors will not lose their entire investment.

We currently employ only one executive officer and rely heavily upon the technical expertise of a small group of experienced engineers, geoscientists and other technical and professional personnel. The loss of this officer, or of any such experienced engineers, geoscientists and other technical and professional personnel, whose knowledge and expertise upon which we rely, may harm our ability to execute our business plan.

Our success depends heavily upon the continued contributions of our sole executive officer, whose knowledge and expertise may be difficult to replace, and on our ability to retain and attract a small group of experienced engineers, geoscientists and other technical and professional personnel. If we were to lose his services, or experience difficulties retaining and attracting such experienced engineers, geoscientists and other technical and professional personnel, our ability to execute our business plan may be harmed and we may be forced to cease or limit our operations until such time as we could hire a suitable replacement for this officer or replace such engineers, geoscientists and other technical and professional personnel.

20

We are in the exploration and development phase and have substantial capital requirements that, if not met, will hinder our ability to continue as a going concern.

We face significant challenges, expenses and difficulties as a development stage company seeking to explore, develop and produce CBM gas. The development of our projects in the Coos Bay Basin will require that we obtain funding to satisfy very significant expenditures for exploration and development of these projects, if they are successful. We will also require resources to fund significant capital expenditures for exploration and development activities in future periods. Our success will depend on our ability to secure additional capital to fund our capital expenditures until such time as revenues are sufficient to fund our activities. If we cannot obtain adequate capital, or do not have sufficient revenue to fund our activities, and we cannot obtain extensions of our gas leases, we will not be able to successfully complete our exploration and development activities, and we may lose rights under our gas leases. This would materially and adversely affect our business, financial condition and results of operations.

The development of CBM properties involves substantial risks, and we cannot assure that our exploration and drilling efforts will be successful.

The business of exploring for and, to a lesser extent, developing and operating CBM properties involves a high degree of business and financial risk that even a combination of experience, knowledge and careful evaluation may not be able to overcome. The selection of prospects for CBM gas drilling, the drilling, ownership and operation of CBM wells and the ownership of interests in CBM properties are highly speculative. We cannot always predict whether any of our wells will produce commercial quantities of CBM.

Drilling for CBM gas may involve unprofitable efforts from, among other things, wells that are productive but do not produce CBM in sufficient quantities or quality to realize enough net revenues to return a profit after drilling, operating and other costs. The cost of drilling, completing and operating wells is often uncertain, and cost overruns are common. Our drilling operations may be curtailed, delayed or canceled as a result of numerous factors, many of which are beyond our control, including but not limited to uncooperative inhabitants, title problems, weather conditions, compliance with governmental requirements and shortages or delays in the delivery of equipment and services. In addition, other factors such as permeability, structural characteristics of the coal, or the quality or quantity of water that must be produced, may hinder, restrict or even make production impractical or impossible.

Drilling and completion decisions generally are based on subjective judgments and assumptions that are speculative. We may drill wells that, although productive, do not produce CBM in economic quantities. It is impossible to predict with certainty the production potential of a particular property or well. Furthermore, the successful completion of a well does not ensure a profitable return on the investment. A variety of geological, operational, or market-related factors, including, but not limited to, unusual or unexpected geological formations, pressures, equipment failures or accidents, fires, explosions, blowouts, cratering, pollution and other environmental risks, shortages or delays in the availability of drilling rigs and the delivery of equipment, loss of circulation of drilling fluids or other conditions may substantially delay or prevent completion of any well, or otherwise prevent a property or well from being profitable. We intend to contract with drilling companies to drill certain of our wells in Coos Bay, and we face the risk that the other party may not perform, which may delay our drilling program. A productive well may also become uneconomic in the event excessive water or other deleterious substances are encountered, which impair or prevent the production of natural gas from the well. In addition, production from any well may be unmarketable if it is contaminated with water or other deleterious substances. We cannot assure that wells drilled by us will be productive or, even if productive, will produce CBM in economic quantities so that we will recover all or any portion of our investment. In the event we are not successful, we may be required to write off some or all of the capitalized well costs on our financial statements.

21

Currently our gas properties are located solely in the Coos Bay Basin of Oregon, making us vulnerable to risks associated with having our production concentrated in one area.

Our gas properties are currently geographically concentrated solely in the Coos Bay Basin of Oregon. As a result of this concentration, we may be disproportionately exposed to the impact of delays or interruptions of production from these wells caused by significant governmental regulation, transportation capacity constraints, curtailment of production, natural disasters, adverse weather conditions or interruption of transportation of natural gas produced from the wells in this basin or other events which impact this area.

Our lease ownership may be diluted due to financing strategies we may employ in the future due to our lack of capital or due to our focus on producing leases.

To accelerate our development efforts we plan to take on working interest partners that will contribute to the costs of drilling and completion and then share in revenues derived from production. In addition, we may in the future, due to a lack of capital or other strategic reasons, establish joint venture partnerships or farm out all or part of our development efforts. These economic strategies may have a dilutive effect on our lease ownership and will more than likely reduce our operating revenues.

In addition, our lease ownership is subject to forfeiture in the event we are unwilling or unable to continue making lease payments. Our leases vary in price per acre and on the term period of the lease. Each lease requires payment to maintain an active lease. In the event we are unable or unwilling to make our lease payments or renew expiring leases, then we will forfeit our rights to such leases. Such forfeiture would prevent us from pursuing development activity on the leased property and could have a substantial impact on our gross leased acreage.

Risks Related to Our Industry

The volatility of natural gas and oil prices could harm our business.

Our future revenues, profitability and growth as well as the carrying value of our gas properties depend to a large degree on prevailing gas prices. Commercial lending sources are not currently available to us because of our lack of operating history and income. Our ability to borrow and to obtain additional equity funding on attractive terms also substantially depends upon gas prices. Prices for gas are subject to large fluctuations in response to relatively minor changes in the supply and demand for gas, uncertainties within the market and a variety of other factors beyond our control. These factors include weather conditions in the Coos Bay area, the condition of the U.S. economy, the foreign supply of gas, the price of foreign imports and the availability of alternative fuel sources. Prices for natural gas have been and are likely to remain extremely unstable.

22

We may not be able to successfully compete with rival companies.

The energy industry is highly competitive in all its phases. Competition is particularly intense with respect to the acquisition of CBM prospects suitable for enhanced production efforts, and the hiring of experienced personnel. Our competitors in CBM acquisition, development, and production include major integrated oil and gas companies in addition to substantial independent energy companies. Many of these competitors possess and employ financial and personnel resources substantially greater than those that are available to us and may be able to pay more for desirable producing properties and prospects and to define, evaluate, bid for, and purchase a greater number of producing properties and prospects than we can. Our financial or personnel resources to generate revenues in the future will depend on our ability to select and acquire suitable producing properties and prospects in competition with these companies.

The production and producing life of wells is uncertain and production will decline.

If any well becomes commercially productive, it will not be possible to predict the life and production of that well. The actual producing lives could differ from those anticipated. Sufficient CBM may not be produced for us to receive a profit or even to recover our initial investment. In addition, production from our CBM gas wells will decline over time, and does not indicate any consistent level of future production.

We are Dependent Upon Transportation and Storage Services Provided by Third Parties.

We will be dependent on the transportation and storage services offered by various interstate and intrastate pipeline companies for the delivery and sale of our gas supplies. Both the performance of transportation and storage services by interstate pipelines and the rates charged for such services are subject to the jurisdiction of the Federal Energy Regulatory Commission or state regulatory agencies. An inability to obtain transportation and/or storage services at competitive rates could hinder our processing and marketing operations and/or affect our sales margins.

We may suffer losses or incur liability for events as the operator of a property or as to which we have chosen not to obtain insurance.

Our operations are subject to hazards and risks inherent in producing and transporting oil and natural gas, such as fires, natural disasters, explosions, pipeline ruptures, spills, and acts of terrorism, all of which can result in the loss of hydrocarbons, environmental pollution, personal injury claims and other damage to our properties and others. The occurrence of any of these events could result in the following:

|

Ÿ

|

Substantial losses due to injury and loss of life;

|

|

Ÿ

|

Severe damage to and destruction of property, natural resources and equipment;

|

|

Ÿ

|

Pollution and other environmental damage;

|

|

Ÿ

|

Clean-up responsibilities; and

|

|

Ÿ

|

Regulatory investigation and penalties and suspension of operations.

|

As protection against operating hazards, we maintain insurance coverage against some, but not all, potential losses. The occurrence of an event that is not covered, or not fully covered, by insurance could have a material adverse effect on our business, financial condition and results of operations.

23

Environmental hazards and liabilities may adversely affect us and result in liability.

There are numerous natural hazards involved in the drilling of CBM wells, including unexpected or unusual formations, pressures, and blowouts and involving possible damages to property and third parties, surface damages, bodily injuries, damage to and loss of equipment, reservoir damage and loss of reserves. We could also be liable for environmental damages caused by previous property owners. As a result, substantial liabilities to third parties or governmental entities may be incurred which could have a material adverse effect on our financial condition and results of operations.

We maintain insurance coverage for our operations in amounts we deem appropriate, but we do not believe that insurance coverage for environmental damages that occur over time, or complete coverage for sudden and accidental environmental damages, is available at a reasonable cost. Accordingly, we may be subject to liability or may lose the privilege to continue exploration or production activities upon substantial portions of our properties if certain environmental damages occur. The insurance coverage we do maintain may also be insufficient. In that event, our assets would be utilized to pay personal injury and property damage claims and the costs of controlling blowouts or replacing destroyed equipment rather than for additional drilling activities.

We face substantial governmental regulation.

Our business is subject to various laws and regulations that may be changed from time to time in response to economic or political conditions. Matters subject to regulation include the following:

|

Ÿ

|

Discharge permits for drilling operations;

|

|

Ÿ

|

Drilling bonds;

|

|

Ÿ

|

Reports concerning operations;

|

|

Ÿ

|

The spacing of wells;

|

|

Ÿ

|

Unitization and pooling of properties;

|

|

Ÿ

|

Taxation; and

|

|

Ÿ

|

Environmental protection.

|

The unavailability or high cost of drilling rigs, equipment, supplies, personnel and gas field services could adversely affect our ability to execute our exploration and exploitation plans on a timely basis and within our budget.

The demand for qualified and experienced field personnel to drill wells and conduct field operations, geologists, geophysicists, engineers and other professionals in the oil and natural gas industry, as well as drilling rigs and other equipment, can fluctuate significantly, often in correlation with oil and natural gas prices, causing periodic shortages. Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts with providers of drilling rigs and we cannot assure you that drilling rigs will be readily available when we need them. Drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

24

Risks Related to Our Debt Financing

We have substantial indebtedness to NEC and its affiliate, YA Global (collectively, the “YA Affiliates”), which is secured by all of our assets. If an event of default occurs under the secured debentures issued to the YA Affiliates, the YA Affiliates may foreclose on all of our assets and we may be forced to curtail our operations or sell some or all of our assets to repay the notes.

Events of default include, without limitation:

Ÿ Failure to pay interest and principal when due;

Ÿ An uncured breach by us of any material covenant, term or condition in any of the notes or related agreements;

Ÿ A breach by us of any material representation or warranty made in any of the notes or in any related agreement;

Ÿ Any money judgment or similar final process is filed against us for more than $50,000;

Ÿ Any form of bankruptcy or insolvency proceeding is instituted by or against us;

Ÿ A change in control of our stock ownership or a majority change in control in our board of directors; and

Ÿ Suspension of our common stock from our principal trading market for five consecutive days or five days during any ten consecutive days.

In the event of a future default under our agreements with the YA Affiliates, the YA Affiliates may enforce its rights as a secured party and we may lose all or a portion of our assets or be forced to materially reduce our business activities.

The issuance of shares to YA Affiliates upon conversion of the convertible debentures and exercise of YA Global’s warrants may cause immediate and substantial dilution to our existing stockholders.