Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d8k.htm |

Bank of

America-Merrill Lynch Midwest Investor Meetings

August 9-10, 2011

EXHIBIT 99

PSEG Public Service Enterprise

Group |

2

Forward-Looking Statement

Readers are cautioned that statements contained in this presentation about our and our

subsidiaries' future performance, including future revenues, earnings, strategies,

prospects, consequences and all other statements that are not purely historical, are

forward-looking statements for purposes of the safe harbor provisions under The

Private Securities Litigation Reform Act of 1995. When used herein, the words

“will”, “anticipate”, “intend”, “estimate”, “believe”, “expect”, “plan”, “should”, “hypothetical”,

“potential”, “forecast”, “project”, variations of such

words and similar expressions are intended to identify forward-looking statements. Although we believe that our

expectations are based on reasonable assumptions, they are subject to risks and

uncertainties and we can give no assurance they will be achieved. The results or

developments projected or predicted in these statements may differ materially from what

may actually occur. Factors which could cause results or events to differ from

current expectations include, but are not limited to:

• adverse changes in energy industry law, policies and regulation,

including market structures and a potential shift away from competitive markets toward subsidized market

mechanisms, transmission planning and cost allocation rules, including rules regarding

how transmission is planned and who is permitted to build transmission in the future, and

reliability standards,

• any inability of our transmission and distribution businesses to obtain

adequate and timely rate relief and regulatory approvals from federal and state regulators,

• changes in federal and state environmental regulations that could

increase our costs or limit operations of our generating units,

• changes in nuclear regulation and/or general developments in the nuclear

power industry, including various impacts from any accidents or incidents experienced at our facilities or by

others in the industry that could limit operations of our nuclear generating units,

• actions or activities at one of our nuclear units located on a

multi-unit site that might adversely affect our ability to continue to operate that unit or other units located at the same site,

• any inability to balance our energy obligations, available supply and

trading risks,

• any deterioration in our credit quality, or the credit quality of our

counterparties,

• availability of capital and credit at commercially reasonable terms and

conditions and our ability to meet cash needs,

• any inability to realize anticipated tax benefits or retain tax credits,

• changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units,

•

delays in receipt of necessary permits and approvals for our construction and

development activities,

• delays or unforeseen cost escalations in our construction and development

activities,

• adverse changes in the demand for or price of the capacity and energy

that we sell into wholesale electricity markets,

• increase in competition in energy markets in which we compete,

• challenges associated with recruitment and/or retention of a qualified

workforce,

• adverse performance of our decommissioning and defined benefit plan trust

fund investments and changes in discount rates and funding requirements, and

• changes in technology and customer usage patterns.

For further information, please refer to our Annual Report on Form 10-K, including

Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K

filed with the Securities and Exchange Commission. These documents address in

further detail our business, industry issues and other factors that could cause actual

results to differ materially from those indicated in this presentation. In

addition, any forward-looking statements included herein represent our estimates only as of today

and should not be relied upon as representing our estimates as of any subsequent

date. While we may elect to update forward-looking statements from time to time, we

specifically disclaim any obligation to do so, even if our internal estimates change,

unless otherwise required by applicable securities laws.

|

3

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported in

accordance with accounting principles generally accepted in the United States

(GAAP). Operating Earnings is a non-GAAP financial measure that differs from

Net Income because it excludes gains or losses associated with Nuclear

Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting, and other

material one-time items. PSEG presents Operating Earnings because

management believes that it is appropriate for investors to consider results

excluding these items in addition to the results reported in accordance with

GAAP. PSEG believes that the non-GAAP financial measure of Operating

Earnings provides a consistent and comparable measure of performance of its

businesses

to

help

shareholders

understand

performance

trends.

This

information is not

intended to be viewed as an alternative to GAAP information.

The last two slides in this presentation include a list of items

excluded from

Income from Continuing Operations to reconcile to Operating Earnings, with a

reference to that slide included on each of the slides where the

non-GAAP

information appears. |

Caroline

Dorsa Executive Vice President and Chief Financial Officer

PSEG

–

Defining the Future |

5

PSEG

Advantage:

Right

platform

to

deliver

value to customers and investors…

PSE&G positioned

to meet NJ’s

energy policy and

economic growth

objectives

with a $5.2 billion

investment program

through 2013

Electric & Gas Delivery

and Transmission

PSEG Power’s

low-cost, base load

and load following fleet

is geographically well

positioned and

environmentally

responsible

Regional Wholesale Energy

PSEG Energy Holdings

positioned to pursue

attractive renewable

generation opportunities

Renewable Investments

…with a track record for safeguarding shareholder interests.

|

6

PSEG Advantage: Asset mix, strong

operations…

Reliability One Award

winner for Mid-Atlantic

Region –

9

year in a row

Regulatory agreements

and cost control provide

opportunity for improved

returns

Investment program

focused on growth and

providing customers with

clean, reliable energy

PSEG Power

PSE&G

…with balance sheet to support growth.

Strong platform open to

improvement in the

market

Low-cost generating fleet

combined with fuel

flexibility supports

margins

Hedging strategy

mitigates near-term risk

Major environmental

compliance capital

program completed

Reducing risk

Building a platform for

renewables and investing

through PPA-supported

projects

International lease

investments terminated

Holdings recourse debt

paid down

PSEG Energy Holdings

th |

7

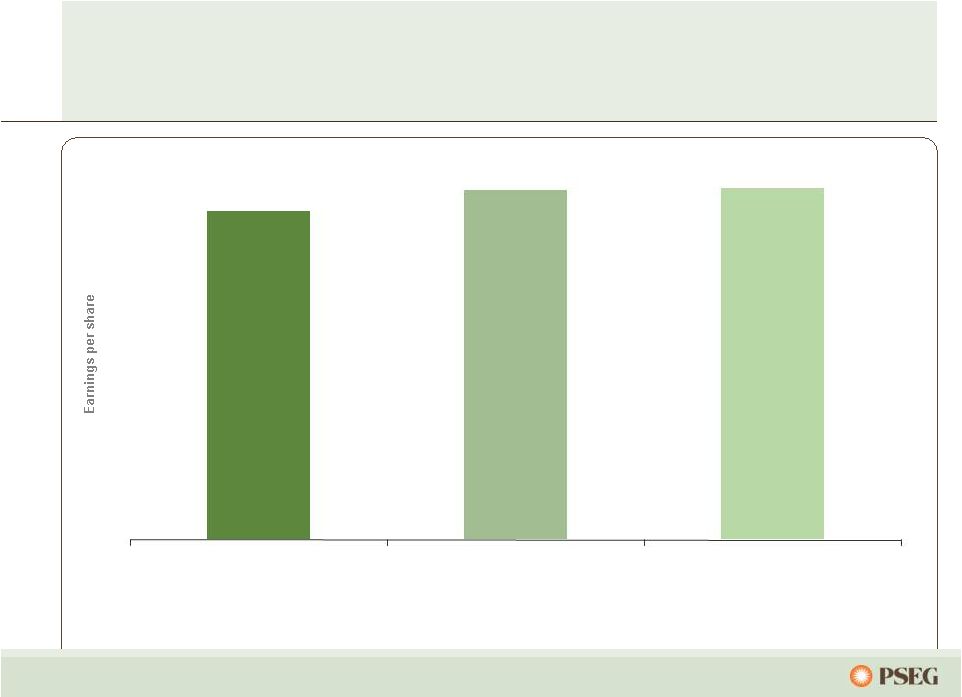

Earnings growth achieved…

…

through increased investment, higher output and lower costs. *

See page 60 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings;

All periods reflect Texas in Discontinued Operations.

$2.91

$3.09

$3.12

2008 Operating Earnings*

2009 Operating Earnings*

2010 Operating Earnings* |

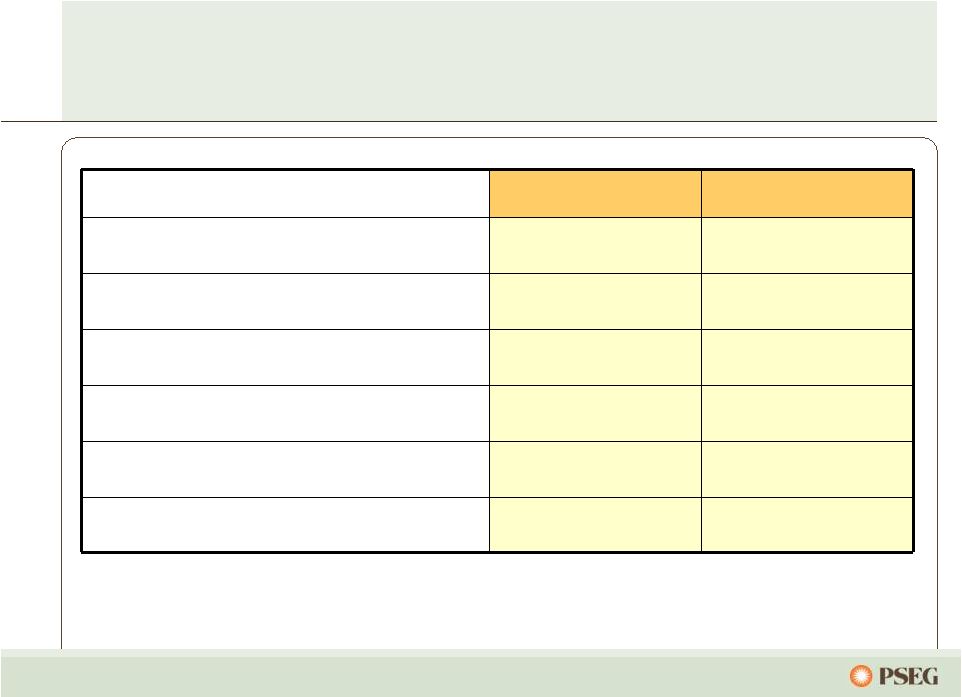

8

First Half Operating Earnings by

Subsidiary

Operating Earnings

Earnings per Share

$ millions (except EPS)

2011

2010

2011

2010

PSEG Power

$ 452

$ 541

$ 0.89

$ 1.07

PSE&G

268

192

0.53

0.38

PSEG Energy Holdings

2

19

-

0.03

Enterprise

10

8

0.02

0.02

Operating Earnings*

$ 732

$ 760

$ 1.44

$ 1.50

Six months ended June 30

* See page 59 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

9

$1.44

(0.03)

0.15

(0.18)

$1.50

0.00

0.25

0.50

0.75

1.00

1.25

1.50

1.75

PSEG EPS Reconciliation –

YTD 2011

versus YTD 2010

YTD 2011

operating

earnings*

YTD 2010

operating

earnings*

Lower Pricing

(0.05)

Lower Volume &

Weather (0.02)

Migration (0.02)

O&M (0.04)

D&A and Interest

(0.05)

PSEG Power

Margins:

Rate Relief 0.04

Transmission 0.02

Renewables

& Cap Stimulus 0.03

O&M 0.07

Weather

& Volume 0.02

D&A (0.02)

Other (0.01)

PSE&G

PSEG Energy

Holdings

Absence of

2010 Tax

Benefits for

Solar & Other

Projects (0.02)

ES&P

Investment

Write-off (0.01)

* See page 59 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. |

10

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

2010

2011E

2012E

2013E

Pension

O&M

PSEG

Consolidated

O&M

(1)

C.A.G.R (’10-’13) = (0.0)%

(1)

Excludes O&M related to PSE&G clauses. E Estimate.

Aggressive

expense

management…

…should result in essentially no O&M growth. |

11

PSEG’s 2011 earnings guidance reflects

continued improvement at PSE&G…

–

Network transmission service revenue increase

= ~ $0.05 per share

–

Full year of E&G Rate Relief = ~ $0.05 per share

–

Each 1% change in Load = ~ $0.02 per share

–

Each 1% change in O&M = ~ $0.01 per share

–

2010 Utility ROE 9.9%; Each 10 bp = $0.01 per share

Revenue/Margin

–

Decline in average Hedge Price/Volume = ~ ($0.25-$0.30)

per share

–

Decline in Capacity revenues = ~ ($0.15-$0.20) per share

–

Improvement in WPT/BGSS = ~ $0.03-$0.05 per share

Other Expense

–

Higher O&M = ~ ($0.03) per share

–

Increase in Depreciation rate = ~ ($0.05) per share

–

Absence of LILO/SILO termination gains = ~ ($0.05) per share

–

Loss of Income from Asset Sales = ~ ($0.05) per share

Guidance

$2.75

$2.50

2011 Drivers

…offset by a decline in margins at Power and Holdings.

Earnings Per Share

* See page 60 for Items excluded from Income from Continuing Operations to reconcile

to Operating Earnings. E Estimate. $3.12

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2010 Operating Earnings*

2011E Earnings Guidance* |

12

Outlook for 2011 Operating Earnings

Maintained

* See page 60 for Items excluded from Income from Continuing Operations to

reconcile to Operating Earnings. $0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2010 Operating Earnings*

2011E Earnings Guidance*

$3.12

$2.75E

$2.50E |

13

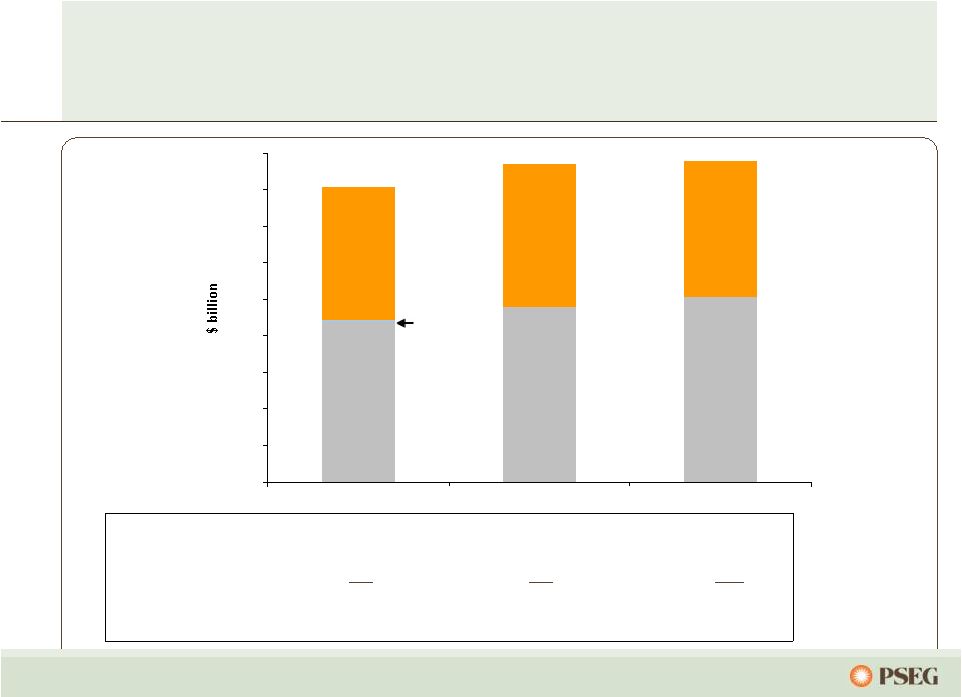

PSEG Consolidated Debt / Capitalization

(1)

Includes debt due within one year and short-term debt; excludes Securitization

Debt and Non-Recourse Debt. $0

$2

$4

$6

$8

$10

$12

$14

$16

$18

2009

2010

6/30/2011

Equity

Debt

(1)

Debt

7,311

7,812

7,453

Preferred Stock

80

0

0

Common Shareholders Equity

8,788

9,633

10,109

Debt plus Equity

16,179

17,445

17,562

Debt Ratio

45.2%

44.8%

42.4%

(in $Millions)

Preferred

Stock |

14

Our capital spending is focused on

growth

PSEG 2011-2013E Capital Spending

$6.85 Billion*

by Subsidiary

PSEG 2011-2013E Capital Spending

$6.85 Billion*

Growth vs. Maintenance Spend

*E: Estimate

.

Growth

$4.72 B

69%

Maintenance

$2.13 B

31%

Parent SC

$0.07 B

1%

Power

$1.50 B

22%

PSE&G

$5.24 B

76%

Holdings

$0.04 B

1% |

15

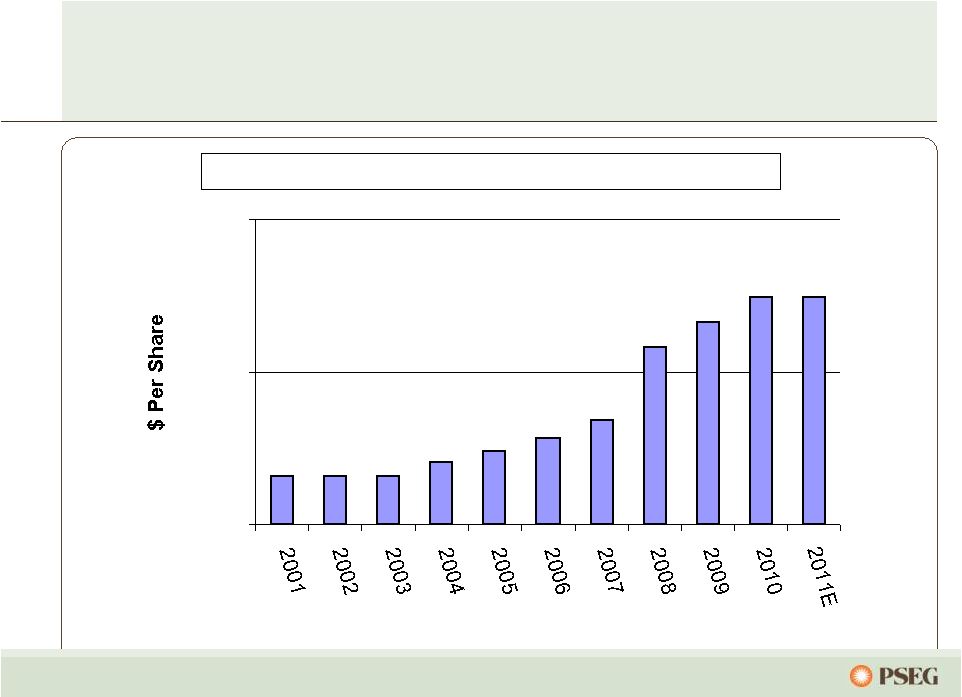

PSEG Dividend –

A 104-year commitment

to returning cash to shareholders

PSEG Annual Common Dividend Per Share 2001-2011E

$1.08

$1.08

$1.08

$1.10

$1.12

$1.14

$1.17

$1.29

$1.33

$1.37

$1.37

$1.00

$1.25

$1.50 |

PSEG Power

– Review and

Outlook |

17

Low-cost portfolio

Fuel flexibility

Regional focus in competitive, liquid

markets

Assets favorably located near

customers/load centers

Many units east of PJM constraints

Southern NEPOOL/ Connecticut

Market knowledge and experience to

maximize the value of our assets

…

with low cost plants, fuel flexibility, good locations and solid markets.

Power’s diverse assets drive value in a

dynamic environment…

18%

45%

8%

Fuel Diversity*

Coal

Gas

Oil

Nuclear

Pumped

Storage

1%

Energy Produced*

Total GWh: 56,727

52%

19%

28%

Pumped Storage

& Oil <1%

Nuclear

Coal

Gas

Total MW: 13,538

27%

9%

* Twelve months ended December 31, 2010. |

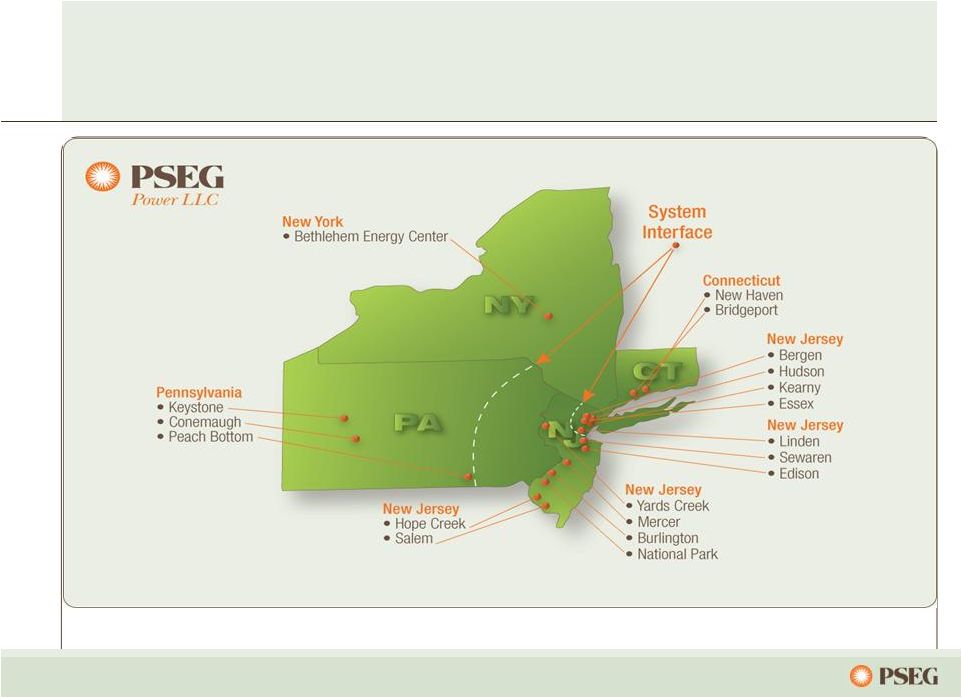

18

Power’s Northeast assets are located in

attractive markets near load centers…

... and the fleet produced record generation in 2010. |

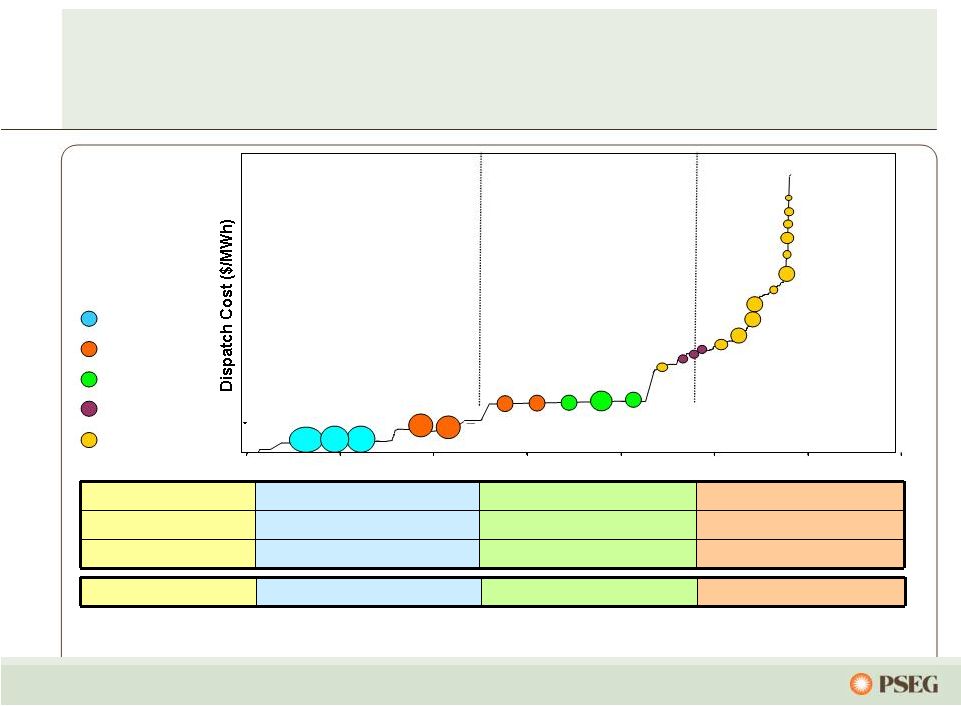

19

…

while maintaining fuel optionality under a variety of conditions.

Power’s PJM assets along the dispatch curve reduce

the risk of serving full requirement load contracts…

Energy Revenue

X

X

X

Capacity Revenue

X

X

X

Ancillary Revenue

X

X

Dual Fuel

X

X

Peaking units

Load following units

Nuclear

Coal

Combined Cycle

Steam

Peaking

Baseload units

Illustrative

Salem

Hope

Creek

Keystone

Conemaugh

Hudson 2

Linden 1,2

Burlington 8-9-11

Edison 1-2-3

Essex 10-11-12

Bergen 1

Sewaren 1-4

Hudson 1

Mercer1, 2

Bergen 2

Sewaren 6

Mercer 3

Kearny 10-11

Linden 5-8 / Essex 9

Burlington 12 / Kearny 12

Peach

Bottom

Yards

Creek

National Park

Salem 3

Bergen 3 |

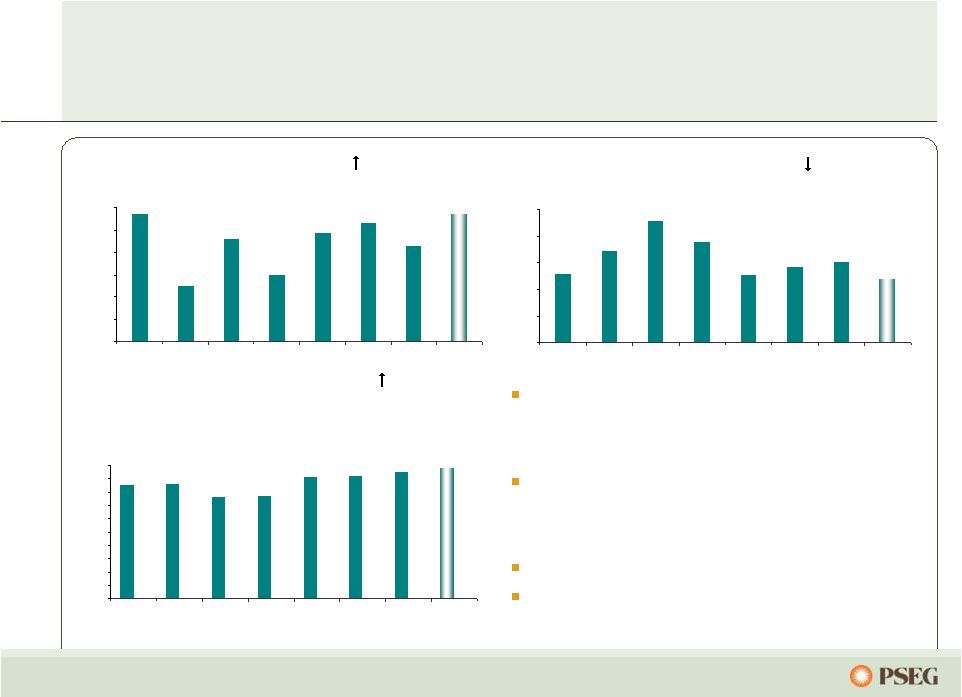

20

Power’s coal fleet has seen significant

efficiency improvements…

14

15

15

13

13

9

11

10

0

2

4

6

8

10

12

14

16

18

2004

2005

2006

2007

2008

2009

2010

2011 E

10.3

11.1

11.3

7.9

8.4

4.8

4.2

3.8

0

2

4

6

8

10

12

2004

2005

2006

2007

2008

2009

2010

2011 E

1.11

1.12

1.01

0.91

0.96

0.83

0.4

0.34

0.34

0.29

0.20

0.21

0.19

0.17

0.13

0.17

0

0.2

0.4

0.6

0.8

1

1.2

2004

2005

2006

2007

2008

2009

2010

2011 E

Market conditions were beneficial to increased

output in 2010

Forced outage rate continues to improve

Environmental footprint upgraded with BET

BET enables coal flexibility

…

as Back-End Technology investment has prepared us for the future.

Output

(000’s GWh)

Forced

Outage

Rate

(

)

(% EFORD)

SO

2

and

NO

x

Rates

(

)

(lb/mmbtu)

SO2

NO

x |

21

Power’s combined cycle fleet benefits from

operating enhancements…

5

4

8

10

12

13

15

13

0

2

4

6

8

10

12

14

16

2004

2005

2006

2007

2008

2009

2010

2011 E

3.4

7

3.4

2.5

1.6

1.5

1.2

0.46

0

1

2

3

4

5

6

7

8

2004

2005

2006

2007

2008

2009

2010

2011 E

8079

7847

7928

7768

7810

7691

7533

7514

7200

7300

7400

7500

7600

7700

7800

7900

8000

8100

8200

2004

2005

2006

2007

2008

2009

2010

2011 E

Output

(000’s GWh)

Forced

Outage

Rate

(

)

(% EFORD)

Period

Heat

Rate

(

)

(mmbtu/KWh)

Highest output ever in 2010

Continued improvement in forced outage

rate

Benefiting from heat rate improvement

program

…and continues to react to market dynamics.

All data excludes Texas |

22

Our peaking fleet rounds out a diverse

generation portfolio…

13

17

23

19

13

14

15

12

0

5

10

15

20

25

2004

2005

2006

2007

2008

2009

2010

2011 E

85

86

76

77

91

92

95

98

0

10

20

30

40

50

60

70

80

90

100

2004

2005

2006

2007

2008

2009

2010

2011 E

Peaking’s consistent record of start

success provides opportunities in

ancillary and real time markets

Peaking adds flexibility in serving load

and managing the needs of a diverse

market environment

Approximately 8,400 starts during 2010

HEDD is anticipated to reduce fleet size

…

and provides the ability to follow load during periods of high demand.

Forced

Outage

Rate

(

)

(% EFORD)

Equivalent

Availability

(

)

(%)

99.7

96.5

98.6

97.0

98.9

99.3

98.3

99.7

94

95

96

97

98

99

100

2004

2005

2006

2007

2008

2009

2010

2011 E

%

Start

Success

(

) |

23

Source: MJ Bradley

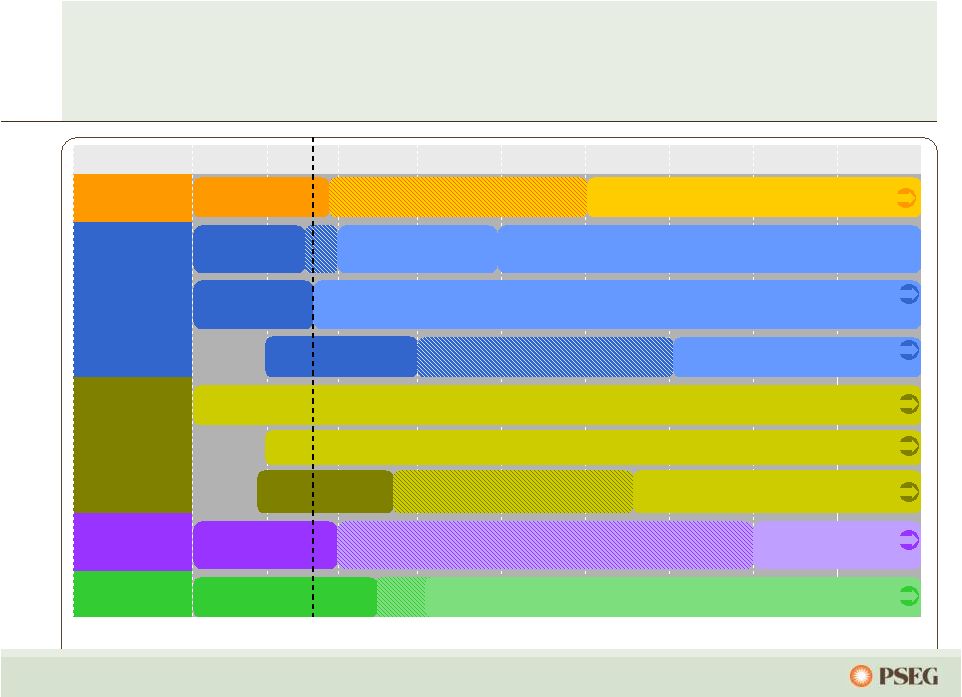

There are numerous upcoming EPA

environmental regulations…

2010

2011

2012

2013

2014

2015

2016

2017

2018

Haz. Air

Pollutants

Criteria

Pollutants

Greenhouse

Gases

Coal

Combustion

By-Products

316(b)

Compliance with Federal GHG Reporting Rule

Compliance with PSD GHG BACT

Compliance with Toxics Rule

Pre-Compliance Period

Develop Toxics

Rule

Develop

Transport

Rule

SIP provisions developed in response to revised NAAQS

Develop

Revised O3

NAAQS

Pre-Compliance Period

Compliance with

Federal CCB

Regulations

Dev. Coal Comb.

By-Products Rule

Develop 316(b)

Regulations

Develop O3

Transport Rule

Estimated

Compliance

w/TR

II

Phase-In of Compliance Period by 2020

Compliance w/GHG NSPS

Pre-Compliance Period

Develop GHG

NSPS

…and Power is well positioned to succeed under numerous outcomes.

Today

Phase I Compliance

Phase II Compliance |

24

The potential impacts to Power vary…

…with Power generally well positioned for the relative near term.

Hazardous Air

Pollutants

(HAPs)

•MACT standard for

Hg and other HAPs establishes emission limits •Uncontrolled coal/oil units to install expensive capital or retire

•Potential for

increased variable O&M cost •Potential for higher electric prices

•Mercer and Hudson

have BET •Bridgeport Harbor has Hg control

•Keystone has

scrubber, ESP and SCR •Conemaugh has scrubber, ESP and planned SCR

Criteria

Pollutants

(CSAPR)

•CSAPR

will

establish

NO

X

and

SO

emission

limits

•Plant by plant,

state and regional basis •Uncontrolled units to install expensive capital or retire

•Potential for

increased variable O&M cost •Potential for higher electric prices

•The generation

fleet as a whole is well positioned for CSAPR Greenhouse

Gases

(GHG)

•Nationally, for

the time being, carbon cap-and-trade not expected

•EPA’s GHG BACT may delay or impede permitting of new

and modified plant

•EPA’s NSPS could potentially lead to emission trading

•RGGI impact

negligible, future uncertain •Power believes it has limited exposure to GHG BACT

requirements

•Power would

potentially benefit by NSPS with trading Coal

Combustion

Byproduct

•Facilities with

wet ash ponds will need to spend capital to close or upgrade ponds

(dam safety, liners, monitoring, etc) •Potential for increased variable O&M cost

•Potential for

higher electric prices •Already utilizes dry ash handling systems and disposal at

Mercer, Hudson and BHS. No cost conversion at Key/Con

•Coal ash scrubber

waste tested as non-hazardous

•Power has

established option for beneficial use of all coal combustion

residuals 316(b)

Cooling Water

Regulations

•Power plants with

once through cooling system are at risk. Plants

located on tidal rivers, estuaries or Great Lakes may face

greater risk

•Invest in

capital, or potentially retire •Potential for higher electric prices

•Lower plant

output

•Power shares

general industry exposure •Prior permits judged that Salem has best technology

available

•Power has over

$150M in estuary enhancement program •Depending on EPA final rule cost/benefit consideration may

limit exposure

Market

Impact

Power

Impact 2 |

25

Power’s investment program to mitigate air

pollutants…

Current Regulations and Compliance Measures

Description

Hudson (NJ)

Mercer (NJ)

Keystone (PA)

Bridgeport (CT)

Conemaugh (PA)*

NO

x

SCR

SCR

SCR

Low NO

x

Burners

SCR

2014

SO

2

Scrubber

Scrubber

Scrubber

Ultra-low

Sulfur Coal

Scrubber

Mercury/

Particulate

Baghouse &

Activated

Carbon

Baghouse

& Activated

Carbon

Scrubber & SCR,

ESP

Baghouse &

Activated Carbon

Scrubber & SCR,

ESP

…places it in good position to meet anticipated regulatory requirements.

Capital Spend Planned

No Additional Capital Spend Planned

*Activated carbon under consideration. |

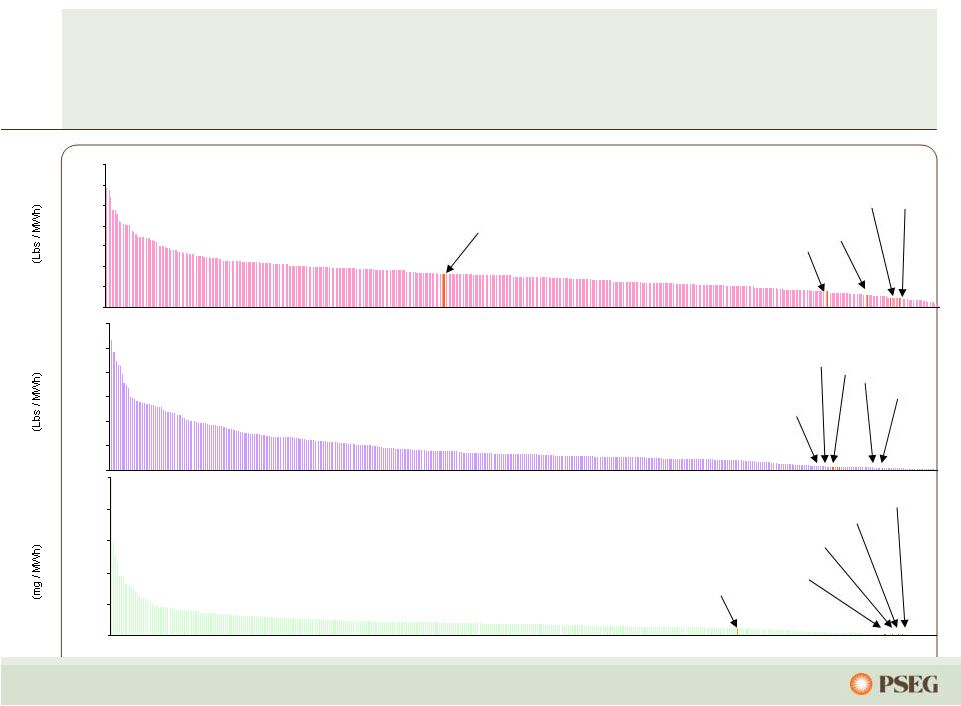

26

PSEG Projected NOx Emission Rate for 2011

versus 2009 400 U.S. Coal Plants

Conemaugh

Hudson

Bridgeport

Mercer Keystone

NOx

Keystone

Bridgeport

Conemaugh

Hudson Mercer

SO

2

PSEG Projected SO2

Emission Rate for 2011

versus 2009 400 U.S. Coal Plants

Keystone

Conemaugh

Bridgeport

Mercer

Mercury

PSEG Projected HG Emission Rate for 2011

versus 2009 400 U.S. Coal Plants

Hudson

PSEG Power’s environmental program has

resulted in dramatically lower emissions…

…leaving Power’s coal fleet among the cleanest in the country.

0

50

100

150

200

250

0

2

4

6

8

10

12

14

0

10

20

30

40

50

60

Source: EPA (2009), EIA (2009), and PSEG Projections

|

27

…through a balanced portfolio hedging strategy.

Pricing in 2010 was impacted by low economic demand and low gas prices, offset by

warmer summer and colder winter weather

Power’s hedging strategy combined with strong operations enabled solid

results

2011 forwards imply continued market challenges, but entities with the right assets in

the right locations are best positioned

Power will continue to utilize a hedging strategy that incorporates full requirement

load contracts and contracting using other products to secure pricing

over a 2-3 year forward

horizon

BGS continues to be an important part of our hedging strategy

Balanced generation portfolio in ideal position to serve BGS

Three year nature of BGS provides reduced volatility for customers and

providers

Power’s fleet is economically optimized…

|

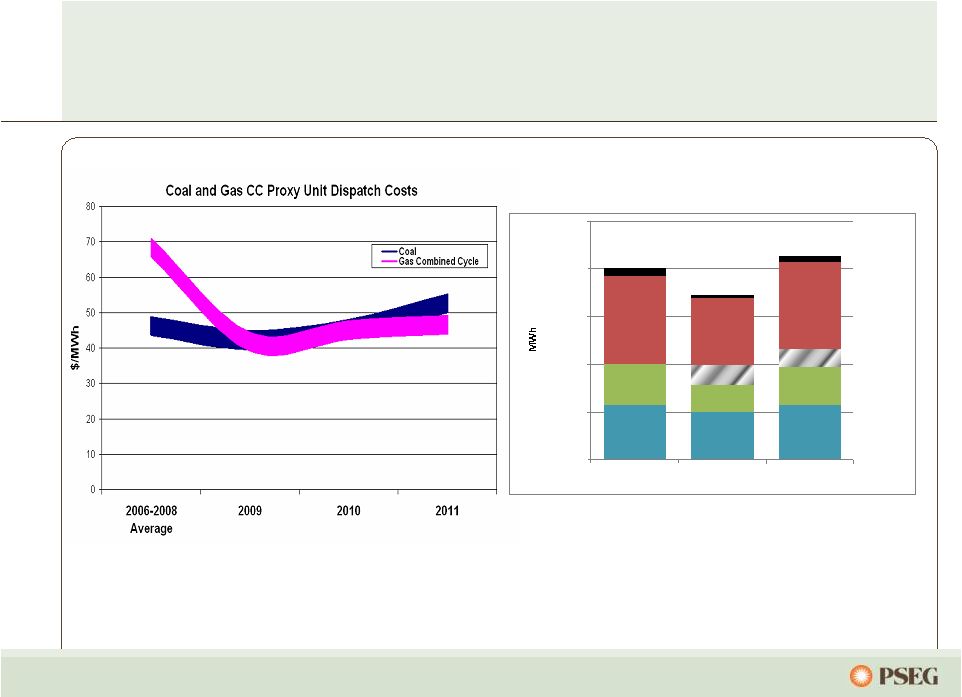

28

Gas competed favorably with coal in 2010,

with operational flexibility favoring gas…

…

and Power’s diverse fleet is positioned to compete under various

market conditions.

PJM Fleet Flexibility

Base Coal

Base Coal

Base Coal

CC/Coal

CC/Coal

CC

PK

PK

PK

Int Coal

Int Coal

Int Coal

CC

CC

-

5,000

10,000

15,000

20,000

25,000

2008

2009

2010

Note: Forward prices as of February 2011 |

29

Full Requirements Component

Increase in Capacity Markets/RPM

Growing Renewable Energy Requirements

Component for Market Risk

Through Power’s participation in each of the

BGS auctions…

Market Perspective –

BGS Auction Results

…

we have developed an expertise in serving full-requirements contracts.

3 Year Average

Round the Clock

PJM West Forward

Energy Price

Capacity

Load shape

Transmission

Congestion

Ancillary services

Risk premium

Green

Note: BGS prices reflect PSE&G Zone

2003

2004

2005

2006

2007

2008

2009

2010

2011

$55.59

$33 -

$34

$36 -

$37

$44 -

$46

$67 -

$70

$58 -

$60

$68 -

$71

$56 -

$58

$48 -

$50

~ $21

$55.05

~ $18

$65.41

~ $21

$102.51

~ $32

$98.88

~ $41

$111.50

~ $43

$103.72

~ $47

$95.77

~ $47

$45 -

$47

~ $48

$94.30 |

30

Migration and headroom are a function of

market and BGS price differentials…

…with impact on Power’s margin in 2010-2011 limited by warm

weather.

•

Migration has grown steadily from 2009 – 2011

–

Market prices have been below BGS prices

–

Retail penetration has expanded beyond C&I to include residential customers

–

Approximate average migration of ~10% in 2009; ~24% in 2010; and

forecasted to be ~34% in 2011, assuming 37% to 39% at year-end

•

Power margin is a direct function of headroom

•

Headroom has varied by year

–

2009 headroom was high, as mild weather resulted in low market prices

–

2010 headroom was low, as extreme weather resulted in high market prices

–

2011 headroom affected by higher market pricing

–

Retail providers are more likely to promote switching if headroom is seen as

sustainable

|

31

Hedging Update…

…

our strategy is to hedge our base load generation long term.

Contracted Energy*

2011

2012

2013

Aug - Dec

Volume TWh

14

36

36

Base Load

% Hedged

100%

75%-80%

35%-40%

(Nuclear and Base Load Coal)

Price $/MWh

$68

$64

$63

Volume TWh

9

20

21

Intermediate Coal, Combined

% Hedged

30%-35%

Cycle, Peaking

Price $/MWh

$68

Volume TWh

23

56

57

Total

% Hedged

70%-75%

45%-50%

20%-25%

Price $/MWh

$68

$64

$63

*Hedge percentages and prices as of July 2011 for the August 2011 and forward time frame.

Revenues of full requirement load deals based on contract price, including renewable energy

credits, ancillary, and transmission components but excluding capacity. Hedges include positions with MTM accounting

treatment and options.

|

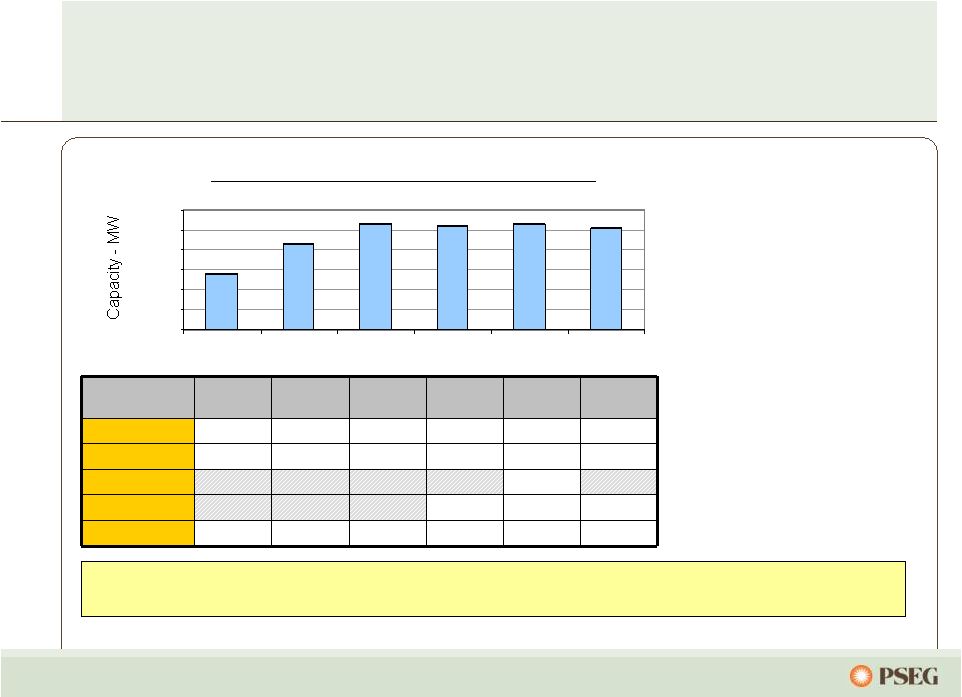

32

…

with sites in the eastern part of PJM.

Reliability Pricing Model –

locational value

of Power’s generating fleet recognized…

With nearly 1/3 of its capacity in PS North and nearly 2/3 of its capacity in EMAAC, Power’s

assets in congested locations received higher pricing.

•

Locational value of Power’s

fleet recognized.

•

Bid for 89 MW of new

capacity accepted for

2013/2014 auction;

in-service June 2012.

•

On schedule to complete

178 MW of previously

cleared peaking capacity

by June 2012.

•

Latest auction influenced

by updated demand

forecast and transfer

capabilities.

$/MW-day

PJM Zones

2009 / 2010

2010 / 2011

2011 / 2012

2012 / 2013

2013/2014

2014/2015

Eastern MAAC

$191.32

$174.29

$110.00

$139.73

$245.00

$136.50

MAAC

$191.32

$174.29

$110.00

$133.37

$226.15

$136.50

PSEG

$245.00

PSEG North Zone

$185.00

$245.00

$225.00

Rest of Pool

$102.04

$174.29

$110.00

$16.46

$27.73

$125.99

0

2,000

4,000

6,000

8,000

10,000

12,000

09/10

10/11

11/12

12/13

13/14

14/15

PJM Capacity Available to Receive Auction Pricing |

PSE&G

– Review and Outlook |

34

PSE&G is the largest utility in New Jersey providing

electric, gas and transmission services…

…and delivering renewable and energy efficiency solutions for customers.

*

Actual

** Weather

normalized = estimated annual growth per year over forecast period

*** Energy Efficiency Annualized Savings (75% Electric/25% Gas Equivalent)

Electric

Gas

Customers

Growth

(2005 –

2010)

2.2 Million

4.0%

1.8 Million

4.0%

Electric Sales and Gas Sold and Transported

43,645 GWh

3,465 M Therms

Historical

Annual

Load

Growth

Distribution

(2006

-

2010)

(0.5%)*

(1.0%)*

Historical

Annual

Peak

Load

Growth

Transmission

(2006

–

2010)

(0.1%)

Projected

Annual

Load

Growth

(2011

–

2013)

1.3%**

0.8%**

Projected Annual Load

Growth

Transmission

(2011

–

2013)

1.4%

Sales Mix

Residential

33%

61%

Commercial

57%

36%

Industrial

10%

3%

Transmission

Electric

Gas

Approved Rate of Return

11.68% ROE

10.3% ROE

10.3% ROE

Renewables and Energy Efficiency

2009-2010

Total Program

Plan

Solar Loan

19 MW

81 MW

Solar 4 All

28 MW

80 MW

Energy Efficiency Initiative (lifetime equivalent)***

389 GWh

604 GWh |

35

Oyster

Creek

New Jersey’s energy future requires

continued investment to ensure reliability …

Susquehanna-Roseland

Bergen O66

…

while adapting to changes in resources.

Transmission Capacity Growth

Transmission Capacity Reductions

Susquehanna-Roseland ~1,500 MW

Northeast Grid (formerly BRH alternative) ~200 MW

Bergen O66 -

Bergen to ConEd's West 49th Street

~(670 MW*)

Lakewood V3-206 -

Lakewood to New York ~550 MW

Werner X1-078 -

Werner to New York ~525MW

Other Impacts to NJ

Long-term Capacity Agreement Pilot Program (LCAPP)

~2,000 MW

Exelon has entered into an agreement with the state of New

Jersey to close Oyster Creek in 2019 ~(700 MW)

2010-2020 Demand growth of ~1% based on 2011 PJM

Load Forecast report ~1,125 MW

* Project has firm contract for 320MW

*** PSE&G has announced a 2-year delay of the in-service date for the

S-R Transmission line Sources: Imports: PSE&G Estimates; Exports:

PJM 2009 RTEP; Load Growth: PJM 2011 Load Forecast Report Arrows are

general indicators and not intended to represent actual route Net impact to New

Jersey is ~130MW by 2020 |

36

Transmission investment recovery is supported by

formula rate treatment…

($ Millions)

Phase

In-Service

Spending

Up To

Susquehanna-Roseland

Engineering / Licensing

2014 East

2015 West

$750

North East Grid

Preliminary Design

2015

$880

Burlington –

Camden 230kV

Conversion

Engineering / Licensing

2014

$381

North Central Reliability

Engineering / Licensing

2014

$336

Mickleton –

Gloucester -

Camden

Preliminary Design

2015

$435

…

and CWIP in rate base* for certain projects.

* CWIP in Rate Base and 1.25% ROE incentive treatment approved for the Susquehanna-Roseland

project. Transmission Projects

Future Projects

Future Transmission project spending will be influenced by PJM

evaluation, potentially adding additional projects over 2011 – 2015 and

revising required in-service dates.

|

37

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2010

2011

2012

2013

Susquehanna-Roseland *

RTEP 230 kV Conversions

Other RTEP

69kV Transmission

Other Transmission

FERC’s Transmission formula rate order grants

PSE&G an 11.68% ROE and a fully-forecasted

cost of service

Transmission represents approximately 56% of planned investment over the

2011-2013

plan

and

is

expected

to

comprise

~33%

of

PSE&G

rate

base

by

2013

Supportive

regulatory

treatment

with

contemporaneous

recovery

is

key

to

align

earnings growth with investment

Execution of the Transmission plan is critical to achieving PSE&G’s

future growth.

Transmission Investment by Major Category

* Susquehanna-Roseland approved for 12.93% ROE. |

38

Our 2011 –

2013 capital plan calls for investing

$5.2 billion…

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2010

2011E

2012E

2013E

NJ Infrastructure

Stimulus

Solar

Energy Efficiency

Transmission

Core Investment

…with contemporaneous recovery mechanisms approved

for ~$3.1 billion.

PSE&G Capital Expenditures

E -

Estimated. |

39

PSE&G’s investment program provides opportunity

for ~11%* annualized growth in rate base

PSE&G Projected Rate Base

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

2010

2011

2012

2013

Gas Distribution

Electric Distribution

Electric Transmission

Energy Master Plan

*Starting from 2010 Rate Base of $7.8 billion. |

40

Success in meeting State’s energy

and economic development goals…

…with reasonable contemporaneous returns.

($ Millions)

Approval

Date

Total

Amount

Spending

Thru

6/2011

Remaining

Spending

Thru 2013

Solar Loan I & II

April 2008/

November 2009

$248

$93

151

Carbon Abatement

December 2008

46

30

16

NJ Capital Infrastructure Stimulus I

April 2009

694

701

-

Solar 4 All *

July 2009

465

278

187

Energy Efficiency Economic Stimulus

July 2009

166

118

48

Demand Response

July 2009

65

10

35

Energy Efficiency Economic Stimulus

Extension

July 2011

95

-

95

NJ Capital Infrastructure Stimulus II

July 2011

273

-

273

Total

$2,052

$1,230

$805

* Filing amount based on installation of 80MW, total forecasted spend is lower due

to a lower cost per watt to install. |

PSEG

Energy Holdings - Review & Outlook

|

42

PSEG Energy Holdings has made significant

reductions in size and risks

International Energy:

Global has disposed of all but one

international asset

Domestic Generation:

Only 176 MW of Global domestic generation

remain

LILO/SILO:

Resources terminated all 18 LILO/SILO leases

Traditional Leases:

Resources continues to carefully manage the

remaining traditional leases and other investments.

As of June 30, PSEG had a gross equity investment at risk of

$264 million in two indirect subsidiaries of Dynegy and Dynegy

Holdings Inc. |

PSEG

– Financial Review and

Outlook |

44

PSEG’s long-term outlook is influenced by

Power’s hedge position…

2012

2013

Each $1/mcf Change in Natural Gas

Each $2/Mwh Change in Spark Spread

Each $2/Mwh Change in Dark Spread

Each 1% Change in Nuclear Capacity Factor

Each 1% Change in Depreciation Rate

$0.06 -

$0.08

$0.03

$0.02

$0.01

$0.01

$0.15 -

$0.20

$0.03

$0.03

$0.01

$0.01

Segment EPS Drivers

Each $100 Million of Incremental Investment

Each 1% Change in Sales:

Electric

Gas

Each 1% Change in O&M

Each 10 bp Change in ROE

$0.01

$0.01

$0.01

$0.01

$0.01

$0.02

$0.01

$0.01

$0.01

$0.01

…and increased investment at PSE&G. |

45

PSE&G’s capital program is directed at

improving reliability…

…through investment in transmission and distribution.

*E: Estimate.

2011-2013E Utility Capital Spending

$5.2 Billion*

Renewables/EMP

$0.7 B

13%

Gas Utility

$0.6 B

11%

Electric Distribution

$1.0 B

20%

Transmission

$2.9 B

56% |

46

PSEG’s internally generated cash flow

over 2011 –

2013 …

…

supports capital investment and the shareholder dividend without

the need for equity.

* Cash from Operations adjusts for securitization principal repayments ~$0.7B.

** 2011-2012 include bonus depreciation of ~$0.9B offset by ~$0.1B in 2013.

Sources

Uses

Power

Cash

from Ops

Debt

Issued

PSE&G

Investment

Debt

Redeemed

Shareholder

Dividend

PSE&G

Cash from

Ops*

Power

Investment

Texas Net

Proceeds

Includes:

Bonus Depreciation = ~$0.8B**

Pension Contribution = ~($0.5B)

Other Net

Cash Flow

PSEG

Consolidated

2011 – 2013 Sources and

Uses |

47

25%

30%

35%

40%

45%

50%

2008

2009

2010

2011-2013

Average

PSEG Power

Funds from Operations / Total Debt

Power’s credit metrics remain strong during

challenging markets ...

Power free cash flow

produces strong

credit measures

providing sufficient

cushion for potential

gas price volatility

Free Cash Flow

(1)

~750

~950

~750

Average: ~725

Dividends to Parent

500

850

550

Average: ~475

(in $Millions)

(1)

Free Cash Flow represents cash from operations less cash used for investing.

…

providing opportunities for growth investments. |

48

PSEG is responding to investors’

questions

Investors’

Questions

PSEG Position

How is PSEG affected

by policy changes?

Commercial operation of Back-End Technology puts us in good position

on potential Clean Air rules

What’s the impact of

commodity volatility?

Multi-year hedging

Asset balance dampens relative fuel price volatility

Capacity markets provide stability

How are you responding

to State incursion into

markets?

Recent decision by FERC has upheld competitive market mechanisms

We are also challenging the constitutionality of NJ’s actions

Do you need equity?

Strong cash flow enables us to execute our strategy, with room for additional

investment, without the need to issue equity

How is management

incented to deliver value to

shareholders?

Management’s long-term incentives are based on a combination of return

on invested capital and total shareholder return relative to peers over a

multi-year period of time |

Appendix |

50

PJM has adequate reserves to meet near

term demand…

…but over the longer term, many influences will dictate sources of market

sufficiency. Unforecasted influences that could increase capacity:

=>Government

interventions

–

for

example

LCAPP

=>Load/demand rate of change

=> Demand response / Economic recovery

Unforecasted influences that could decrease capacity:

=>Government

regulations

–

for

example

coal

retirements

(20-45

GW’s),

HEDD

=>Load/demand rate of change

=>Demand response / Economic recovery

PJM Forecasted Capacity Reserves -

January 2011

PJM

•

Reserve margins to tighten going forward

due to:

–

Load growth

–

Anticipated unit retirements driven

by new EPA regulations (not

reflected in PJM’s forecast)

EMAAC

•

Most of Power’s assets located in EMAAC

•

Anticipated retirements driven by HEDD

rule

•

Transmission projects expected to

increase net imports into EMAAC,

offsetting retirements

•

Local legislation (NJ LCAPP) could initially

increase reserve margins but would

discourage long-term merchant investment

0%

10%

20%

30%

40%

2011/2012

2012/2013

2013/2014

2014/2015

2015/2016 |

51

Power’s coal hedging reflects 2011 supply

matched with 2011 sales…

…

while maintaining flexibility on supply post BET installation.

0%

20%

40%

60%

80%

100%

2011

2012

2013

$0

$10

$20

$30

$40

$50

Contracted Coal

Station

Coal Type

Pricing

($/MWh)*

Comments

Bridgeport

Harbor

Adaro

High $40’s

Higher price,

lower BTU,

enviro coal

Hudson

CAPP

Mid $40’s

Flexibility

after BET in

2010

Mercer

Metallurgical

NAPP/CAPP

Mid $40’s

More limited

segment of

coal market

Keystone

NAPP

Mid $20’s

To

High $20’s

Prices

moderating

Conemaugh

NAPP

Mid $20’s

To

High $20’s

Prices

moderating

% Hedged

(left scale)

$/MWh

(right

scale)

*Commodity plus transportation. |

52

$0

$5

$10

2011

2012

2013

Anticipated Nuclear Fuel Cost

Power

has

fully

hedged

its

nuclear

fuel

needs

through 2013…

…

with increased costs over that time horizon.

Hedged |

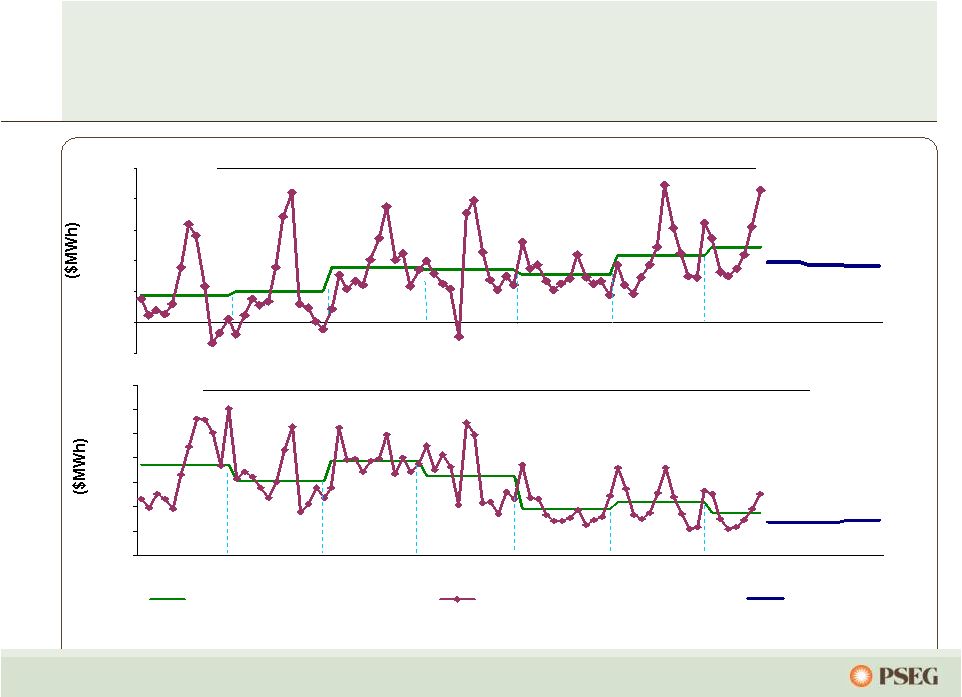

53

53

-$10

$0

$10

$20

$30

$40

$50

2005

2006

2007

2008

2009

2010

2011

2012

2013

$0

$10

$20

$30

$40

$50

$60

$70

2005

2006

2007

2008

2009

2010

2011

2012

2013

Annual Average

Historical Monthly

Forecast

Note: Forward prices as of July 2011.

Forward spark spreads indicate moderation to 2009

levels and dark spreads continue to be challenged…

PJM Western Hub Spark Spread (On-Peak –

Henry Hub x 7.5 Heat Rate)

PJM Western Hub Dark Spread (RTC –

Central Appalachian Coal x 10 Heat Rate)

…

and both are expected to remain highly influenced by gas prices.

|

54

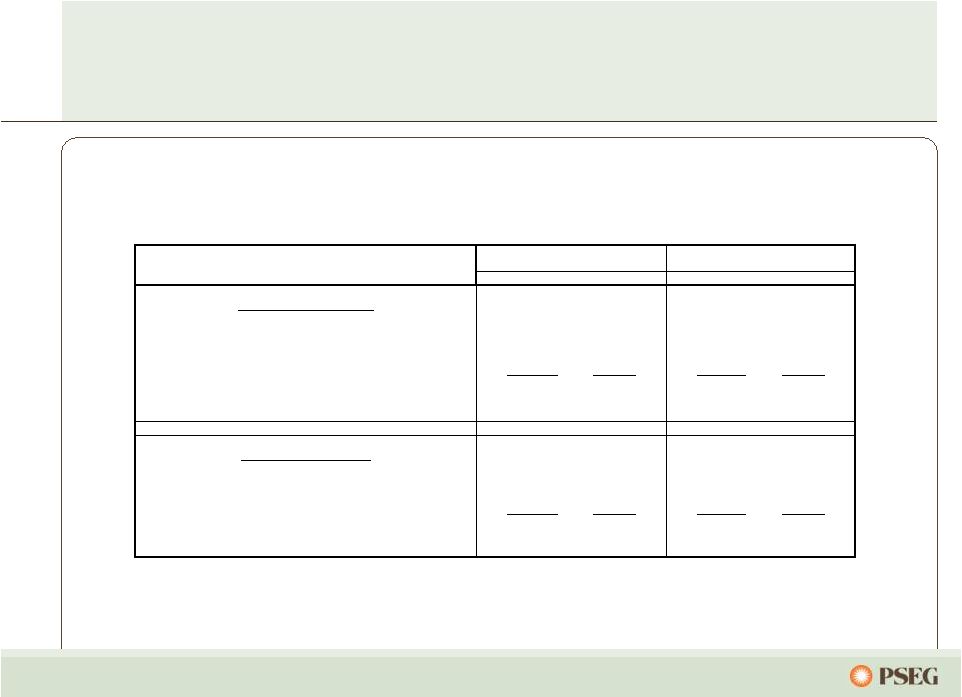

PSEG 2011 Operating Earnings Guidance

-

by Subsidiary

$ millions (except EPS)

2011E

2010A

PSEG Power

$ 765 –

$ 855

$ 1,091

PSE&G

$ 495 –

$ 520

$ 430

PSEG Energy Holdings

$ 0 –

$ 5

$ 49

Enterprise

$ 5 –

$ 15

$ 14

Operating

Earnings*

$ 1,265 –

$ 1,395

$ 1,584

Earnings

per

Share

$ 2.50 –

$ 2.75

$ 3.12

* See Page 60 for Items excluded from Income from Continuing Operations to reconcile to Operating

Earnings. |

55

PSEG Consolidated Debt / Capitalization

(1)

Long-Term Debt includes Debt due within one year; excludes Securitization Debt

and Non-Recourse Debt. PSEG Consolidated ($Millions)

December 31, 2009

December 31, 2010

June 30, 2011

PSE&G Short-Term Debt

-

$

-

$

298

$

PSEG Money Pool Short-Term Debt

530

64

-

Total Short-term Debt

530

64

298

Long-Term Debt

(1)

:

Power

3,121

3,455

2,851

PSE&G

3,571

4,283

4,284

Holdings

127

-

-

Parent / Services

(38)

10

20

Total Long-Term Debt

6,781

7,748

7,155

Preferred

Stock 80

-

-

Total Common Stockholders' Equity

8,788

9,633

10,109

TOTAL

CAPITALIZATION 16,179

$

17,445

$

17,562

$

December 31, 2009

December 31, 2010

June 30, 2011

Debt

7,311

7,812

7,453

Preferred Stock

80

-

-

Total Common Stockholders' Equity

8,788

9,633

10,109

Debt Plus Equity

16,179

$

17,445

$

17,562

$

Debt Ratio

45.2%

44.8%

42.4% |

56

Operated by PSEG Nuclear

PSEG Ownership: 100%

Technology: Boiling Water Reactor

Total Capacity: 1,197MW

Owned Capacity: 1,197MW

License Expiration: 2046

License renewal approved

July 2011

Next Refueling 2012

Operated by PSEG Nuclear

Ownership: PSEG –

57%

Exelon

–

43%

Technology:

Pressurized

Water

Reactor

Total Capacity: 2,337MW

Owned Capacity: 1,342MW

License Expiration: 2036 and 2040

License renewal approved

June 2011

Next Refueling

Unit 1 –

Fall 2011

Unit 2 –

Fall 2012

Operated by Exelon

PSEG Ownership: 50%

Technology: Boiling Water Reactor

Total Capacity: 2,245MW

Owned Capacity: 1,122MW

License Expiration: 2033 and 2034

Next Refueling

Unit 2 –

2012

Unit 3 –

Fall 2011

Hope

Creek

Salem

Units

1

and

2

Peach

Bottom

Units

2

and

3

Our five unit nuclear fleet…

…

is a critical element of Power’s success. |

57

0%

25%

50%

75%

100%

2011

2012

2013

$0

$50

$100

$150

$200

$250

0%

25%

50%

75%

100%

2011

2012

2013

$0

$10

$20

$30

$40

$50

$60

$70

$80

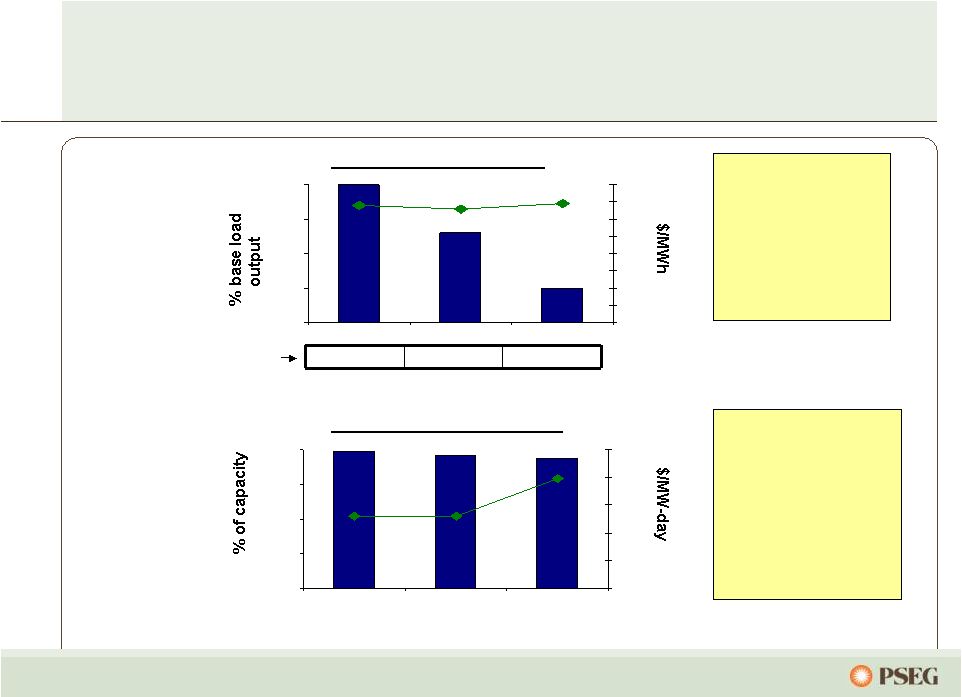

Power’s hedging program provides near-

term stability from market volatility…

…

while remaining open to long-term market forces.

Estimated EPS impact of $5/MWh

PJM West around the clock price

change* (~$1/mmbtu gas change)

Contracted Capacity

Price

(right

scale)

* As of May 2011, assuming normal market commodity correlation and demand.

Power has

contracted for a

considerable

percentage of its

future output

over the next two

years.

The pricing for

most of Power’s

capacity has been

fixed through May

2014, with the

completion of

auctions in PJM

and NE.

% sold

(left

scale)

Contracted Energy

Price

(right

scale)

% sold

(left

scale)

*

$0.03 -

$0.12

$0.15 -

$0.30

$0.25 -

$0.45 |

58

PSEG Resources Leveraged Lease Portfolio

Lessee

Equipment

6/30/11

Invested

($millions)

S&P

Credit

Rating*

REMA (GenOn)

Keystone, Conemaugh & Shawville (PA)

3 coal fired plants (1,162

equity MW)

329

B

Dynegy Holdings

Danskammer & Roseton Generating Station (NY) 370

MW coal fired and 1,200 MW oil/gas fired

264

CC

Edison Mission

Energy (EME)

Powerton & Joliet Generating Stations (IL)

2 coal-fired generating facilities (1,640 equity MW)

219

B-

Merrill Creek –

(PECO, MetEd,

Delmarva P& L)

Reservoir in NJ

128

BBB, BBB-,

BBB+

Grand Gulf

Nuclear station in Mississippi (154 equity MW)

99

A+

US West/Qwest**

Qwest headquarters located in Denver, CO

115

BB

Renaissance Ctr.

GM headquarters located in Detroit, MI

40

BB-

Wal-Mart

Portfolio of 17 Wal-Mart stores

29

AA

E-D Centers

Portfolio of 8 shopping centers

30

NR

Total Leases

$1,253

*Indicative recent rating reflecting either Lessee, additional equity collateral

support or parent company unsecured debt rating. ** Qwest was acquired by

CenturyLink |

59

Items Excluded from Income from Continuing

Operations to Reconcile to Operating Earnings

Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a

non-GAAP financial measure and how it differs from Net Income. Pro-forma Adjustments, net

of tax 2011

2010

2011

2010

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

15

$

10

$

42

$

20

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

4

(37)

8

12

Market Transition Charge Refund (PSE&G)

-

(72)

-

(72)

Total Pro-forma adjustments

19

$

(99)

$

50

$

(40)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

507

507

Per Share Impact (Diluted)

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.03

$

0.02

$

0.08

$

0.04

$

Gain (Loss) on MTM (PSEG Power)

0.01

(0.07)

0.02

0.02

Market Transition Charge Refund (PSE&G)

-

(0.14)

-

(0.14)

Total Pro-forma adjustments

0.04

$

(0.19)

$

0.10

$

(0.08)

$

For the Three Months Ended

For the Six Months Ended

June 30,

June 30,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings

(Unaudited) |

60

Pro-forma Adjustments, net of tax

2010

2009

2008

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

46

$

9

$

(71)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

(1)

(11)

14

Market Transition Charge Refund (PSE&G)

(72)

-

-

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

29

-

Lease Transaction Reserves (Energy Holdings)

-

-

(490)

Asset Impairments

-

-

(13)

Premium on Bond Redemption

-

-

(1)

Total Pro-forma adjustments

(27)

$

27

$

(561)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

507

508

Per Share Impact (Diluted)

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

0.09

$

0.02

$

(0.14)

$

Gain (Loss) on Mark-to-Market (MTM) (PSEG Power)

-

(0.02)

0.03

Market Transition Charge Refund (PSE&G)

(0.14)

-

-

Net Reversal of Lease Transaction Reserves (Energy Holdings)

-

0.05

-

Lease Transaction Reserves (Energy Holdings)

-

-

(0.96)

Asset Impairments

-

-

(0.03)

Premium on Bond Redemption

-

-

-

Total Pro-forma adjustments

(0.05)

$

0.05

$

(1.10)

$

December 31,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings

(Unaudited)

For the Twelve Months Ended

Items Excluded from Income from Continuing

Operations to Reconcile to Operating Earnings

Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP

financial measure and how it differs from Net Income. |