Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDMENT NO. 1 TO FORM 8-K - MOSAIC CO | d8ka.htm |

The Mosaic Company

August 2011

Exhibit 99.1 |

Safe Harbor Statement

2

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about future financial and operating results. Such statements are based upon the current

beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks

and uncertainties include but are not limited to the predictability and volatility of, and customer

expectations about, agriculture, fertilizer, raw material, energy and transportation markets

that are subject to competitive and other pressures and the effects of the current economic and

financial turmoil; the level of inventories in the distribution channels for crop nutrients; changes

in foreign currency and exchange rates; international trade risks; changes in government

policy; changes in environmental and other governmental regulation, including greenhouse gas

regulation and implementation of the U.S. Environmental Protection Agency’s numeric water quality standards for the discharge of

nutrients into Florida lakes and streams; further developments in the lawsuit involving the federal

wetlands permit for the extension of the Company’s South Fort Meade, Florida, mine into

Hardee County, including orders, rulings, injunctions or other actions by the court or actions

by the plaintiffs, the Army Corps of Engineers or others in relation to the lawsuit, or any actions

the Company may identify and implement in an effort to mitigate the effects of the lawsuit;

other difficulties or delays in receiving, or increased costs of, necessary governmental permits

or approvals; further developments in the lawsuit involving the tolling agreement at the Company's

Esterhazy, Saskatchewan, potash mine, including settlement or orders, rulings, injunctions or

other actions by the court, the plaintiff or others in relation to the lawsuit; the

effectiveness of our processes for managing our strategic priorities; adverse weather conditions

affecting operations in Central Florida or the Gulf Coast of the United States, including

potential hurricanes or excess rainfall; actual costs of asset retirement, environmental remediation,

reclamation or other environmental regulation differing from management’s current estimates;

accidents and other disruptions involving Mosaic’s operations, including brine inflows at

its Esterhazy, Saskatchewan potash mine and other potential mine fires, floods, explosions,

seismic events or releases of hazardous or volatile chemicals, as well as other risks and

uncertainties reported from time to time in The Mosaic Company’s reports filed with the

Securities and Exchange Commission. Actual results may differ from those set forth in the forward-

looking statements. |

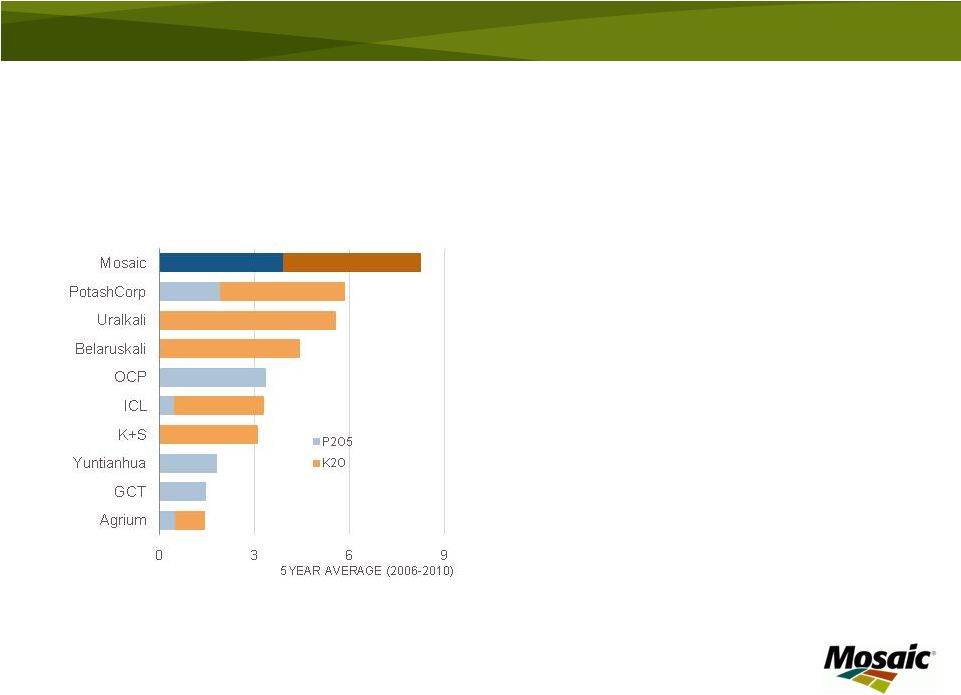

Mosaic is well positioned to capitalize on attractive

near and long-term opportunities:

3

High quality production and distribution

assets

•

Largest combined P&K producer

•

Global presence

Experienced and talented management team

focused on operational excellence and

execution

•

$5 billion potash expansion, on time, on budget

•

Operational excellence driving maintenance,

energy, and other savings

•

Productivity enhancements increasing operating

rates

Strong balance sheet reflecting store of value

and flexibility to capitalize on investment

opportunities

•

Over $3.9 billion in cash

•

Significant debt capacity

•

Fiscal

2011

ROIC

of

22.3

percent

(c)

(a)

Mosaic K2O production includes the POT / MOS tolling agreement

production, mined, milled and shipped by MOS. This production

is excluded from PotashCorp production statistics

(b)

Reflects combined Uralkali and Silvinit production over the period

(c)

See appendix 2 for ROIC calculation

Source: IFA, company reports and Mosaic estimate

WORLD’S LARGEST P&K COMPANIES

MILLION TONNES PRODUCTION |

Market Overview

4

Attractive near and long term industry fundamentals will

drive crop nutrient demand growth |

Crop Nutrients Required to Meet Global

Demand for Food, Fuel, Feed and Fiber

Crop nutrients are a key component required to meet the food security

challenge

Key demand drivers suggest strong nutrient demand

Global population growth

Growing affluence leading to higher protein usage

Biofuel production

Farm economics

Planted area

Application rates

5 |

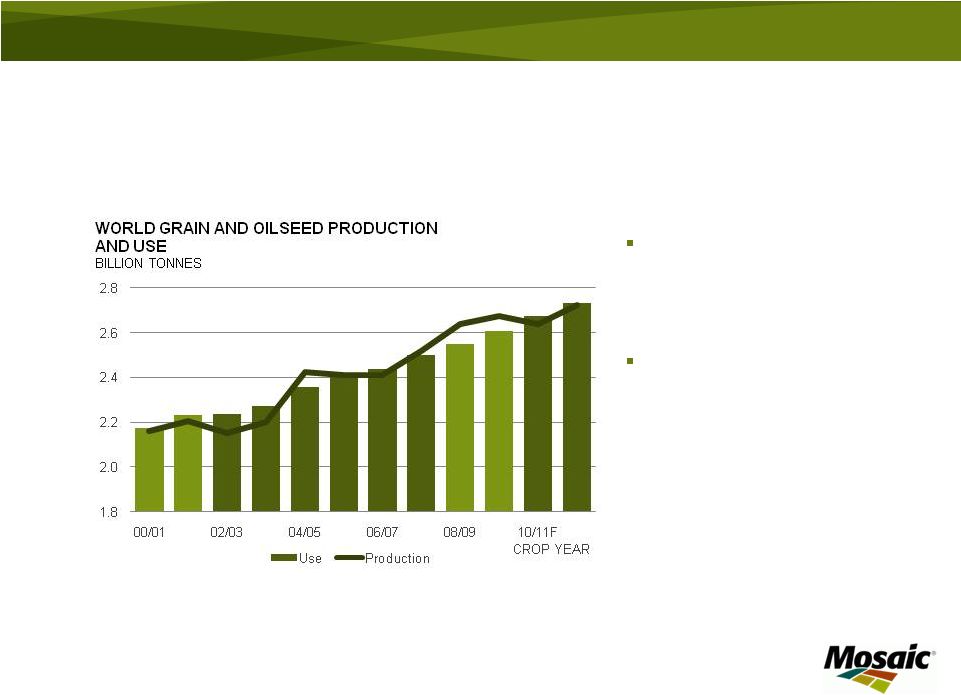

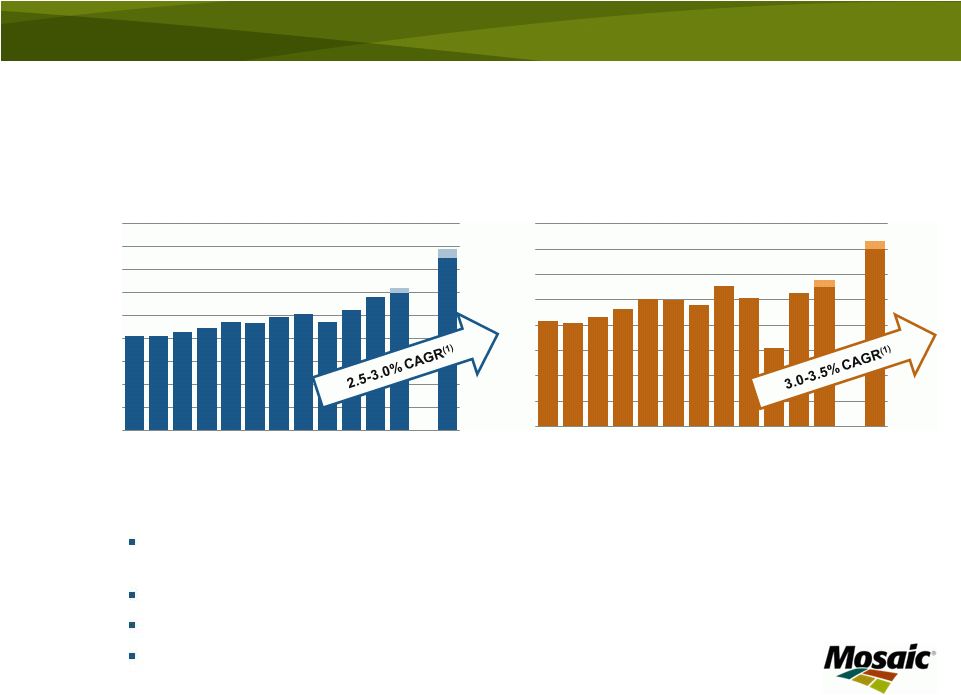

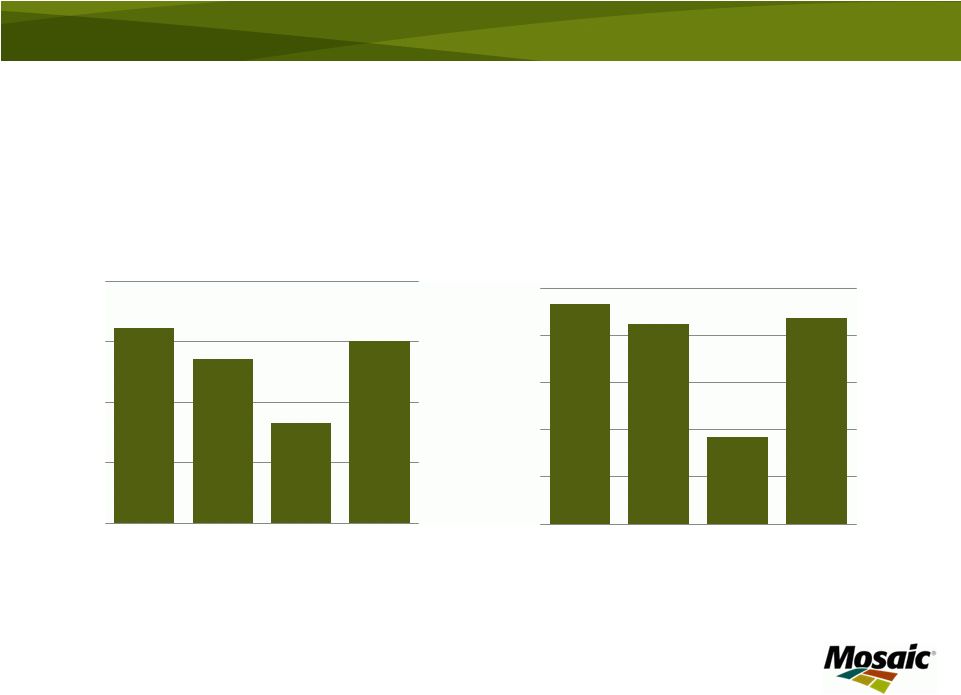

Accelerating Grain and Oilseed Use

6

Agricultural commodity

prices highly sensitive to

weather and political

developments

Steady upward trend in

demand

Source: USDA, lighter bars indicate recession years

|

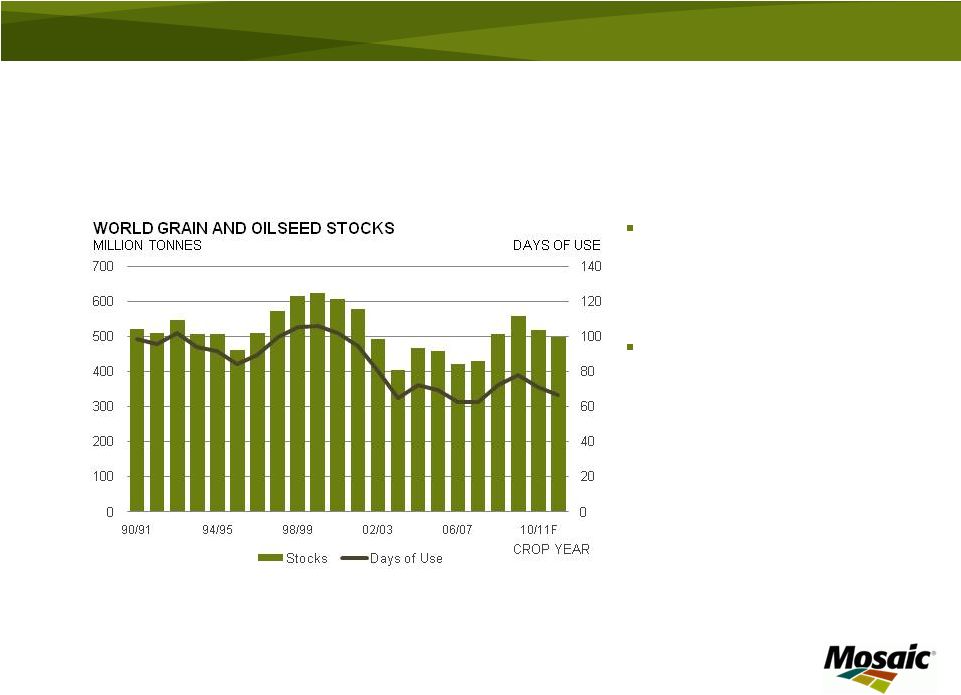

Stocks Remain at Low Levels

7

World requires record

yields and harvested area

to maintain stocks at

secure levels

Crop nutrient needed to

deliver required yields

Source: USDA |

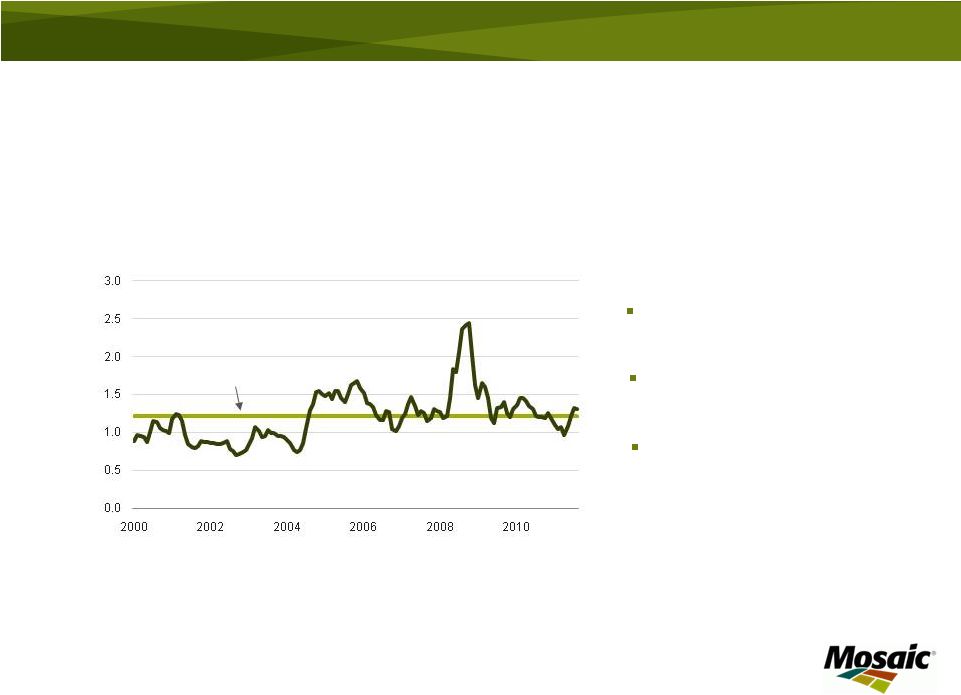

Crop Nutrients Very Affordable

8

Crop nutrients provide

farmers an excellent return

on investment:

Crop Nutrient Price Index: NPK weighting based on US nutrient use from

2005/06 thru 2007/08, indexed to average prices in 2000 = 100

Crop Price Index: Crop price weighting based on Corn/Wheat/Soybean US acreage

in 2007, indexed to average prices in 2000 = 100

Source: Mosaic

Fertilizer use less attractive

Fertilizer use more attractive

Average

Crop prices comfortable

relative to historical prices

Input costs well below

their highs

China, Brazil and India

farm economics at, or

near, record levels

CROP NUTRIENT AFFORDABILITY IN THE U.S CROP NUTRIENT

PRICE INDEX/CROP PRICE INDEX

CALENDAR YEAR |

Record Phosphate and Potash Demand

Positive P&K demand prospects underpinned by high agricultural commodity

prices and outstanding farm economics worldwide

Producers running hard to keep up, inventories expected to remain lean

Expect 2011 global processed phosphate shipments of 60 to 62 million tonnes

Expect 2011 global MOP shipments of 55 to 58 million tonnes

9

Source: Fertecon and Mosaic

(1) February 2011 Fertecon growth estimates through 2020

0

10

20

30

40

50

60

70

80

90

00

01

02

03

04

05

06

07

08

09

10E

11F

20F

CALENDAR YEAR

WORLD PROCESSED PHOSPHATE

SHIPMENTS

MILLION TONNES

0

10

20

30

40

50

60

70

80

00

01

02

03

04

05

06

07

08

09

10E

11F

20F

CALENDAR YEAR

WORLD MOP SHIPMENTS

MILLION TONNES |

New Capacity Required

Significant capacity expected to be required to meet growing demand

for crop nutrients

Key supply drivers suggest capacity constraints

Large capital requirements

Long lead time for new capacity

Operating rates high

Limited global rock reserves

10 |

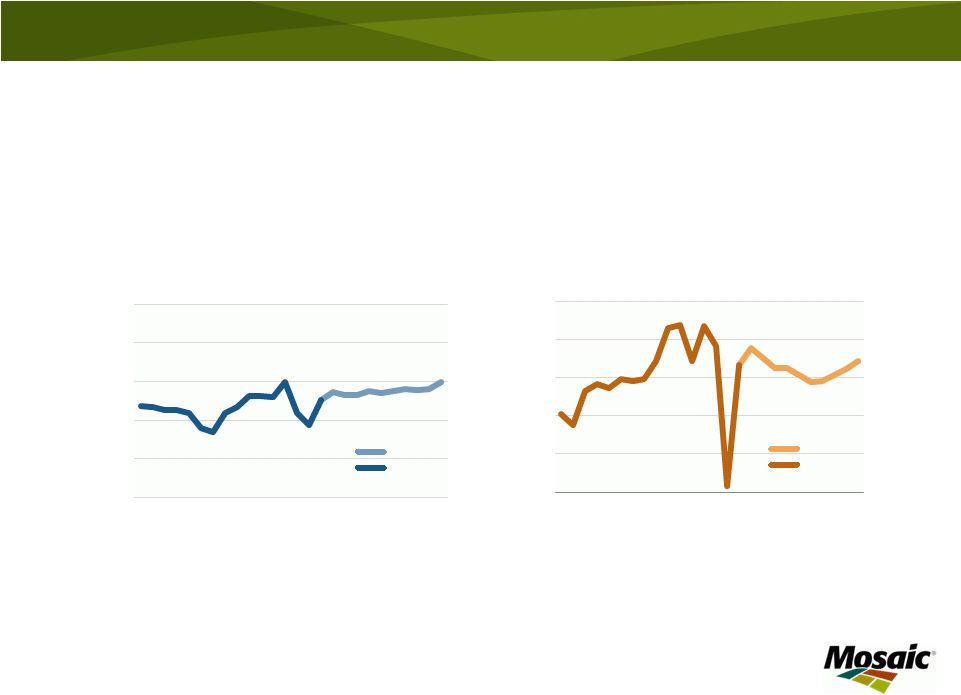

High Operating Rates Required to

Balance Supply and Demand

Operating rates expected to remain at high levels to meet projected

demand growth, with both brownfield and greenfield capacity added

11

Source: Fertecon demand assumptions, Mosaic estimates of

capacity additions of 11 million tonnes of phosphoric acid in

Middle East, North Africa, China and Latin America based on

announced expansion plans, including: Ma’aden on line in

2011, doubling in 2017.

Source: Fertecon demand assumptions, Mosaic estimates of

capacity additions of 23 million tonnes, with 17 million tonnes

from announced brownfield expansions and the remainder

from greenfield expansions. Does not include BHP’s Jansen

greenfield mine.

50%

60%

70%

80%

90%

100%

1995

2000

2005

2010

2015F

2020F

GLOBAL P2O5 OPERATING RATE

50%

60%

70%

80%

90%

100%

1995

2000

2005

2010

2015F

2020F

GLOBAL MOP OPERATING RATE

Projected

Projected

Actual

Actual |

DAP Prices Impacted by Raw Material

Input Costs

12

Slide

depicts

margin

after

raw

material

costs

for

non

integrated

producers

RAW

MATERIAL

COST

IN

ONE

TONNE

OF

DAP

$ PER TONNE

-600

-400

-200

0

200

400

600

800

1,000

1,200

1,400

May 06

May 07

May 08

May 09

May 10

May 11

DAP Export Price

Margin After Raw Material Cost

Source: Green Markets

Margin after raw material cost = price of 1 tonne of DAP, less cost for input prices of approximately

1.7 tonnes phosphate rock, .44 tonnes sulfur and .23 tonnes ammonia

|

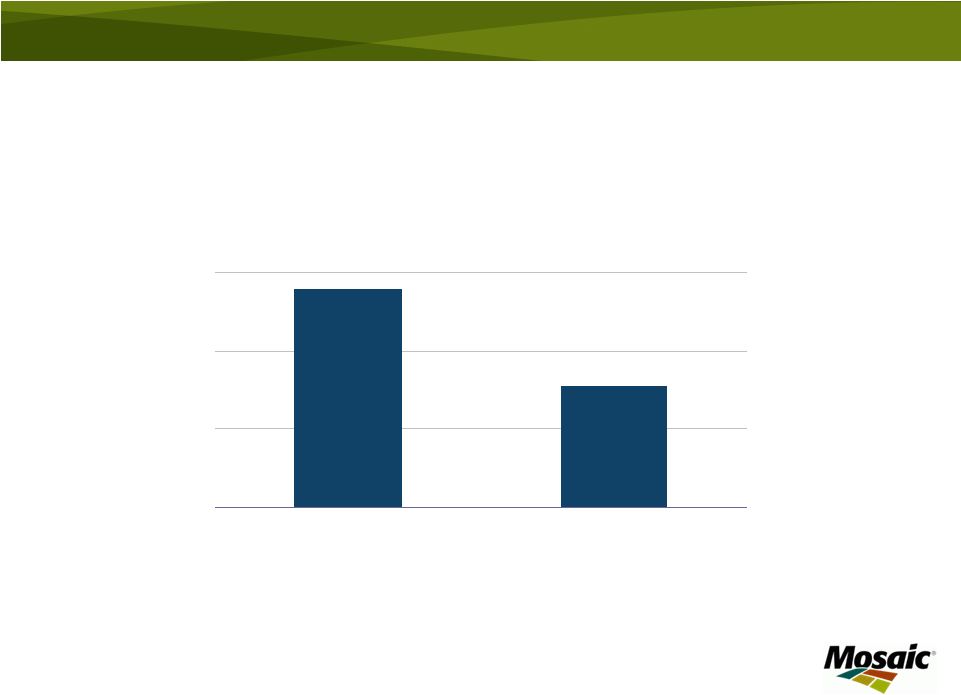

Significant Cost Advantage for Integrated

Producers

13

Source: Fertecon and Mosaic

Note: This analysis assumes 68% BPL rock and a 92% recovery rate.

Prices as reported by Fertecon. Central Florida producers integrated

in rock, partially in ammonia. •

Approximately one-third of industry production is by non-integrated

producers ESTIMATED RAW MATERIAL COSTS

$ PER TONNE DAP

0

200

400

600

Typical Producer in India

(Non Integrated)

Typical Producer in Central Florida

(Integrated) |

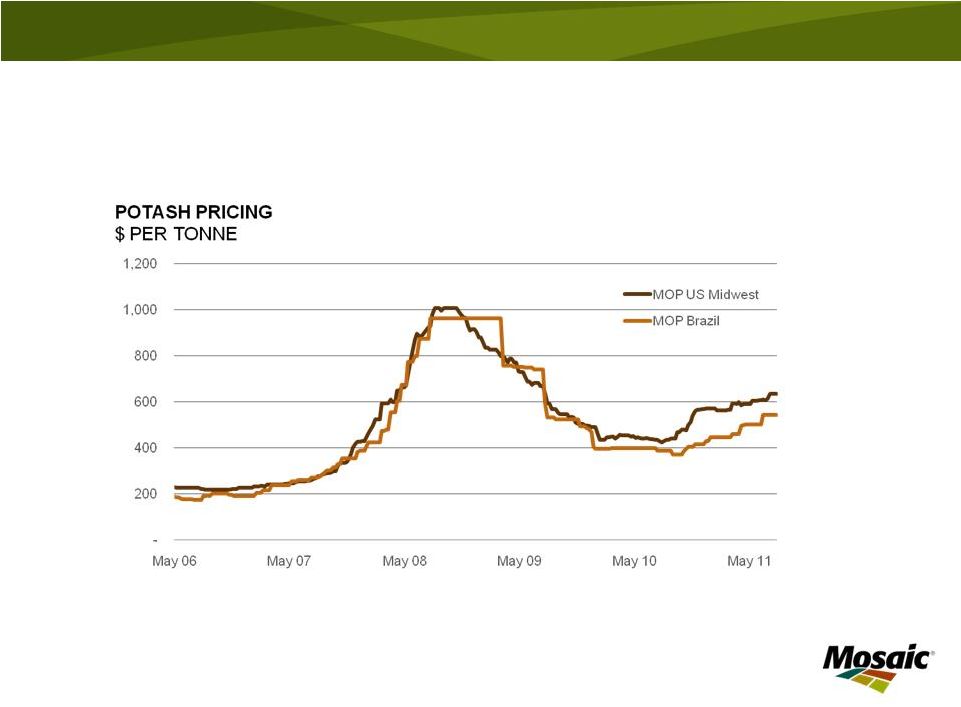

Potash Prices Strengthening

14

Source: Green Markets, ICIS |

Strategic and Business Overview

15

As a leader in crop nutrients, Mosaic is positioned to

capitalize on strong industry fundamentals and grow

shareholder value |

Strategic Overview

As a global leader in crop nutrients, Mosaic

is positioned to benefit from attractive long-

term agricultural fundamentals:

Potash –

grow cash flow by increasing

volume

Phosphates –

grow cash flow by

optimizing return on invested capital

Leverage global distribution assets to

enhance production efficiency

Balanced product portfolio

16 |

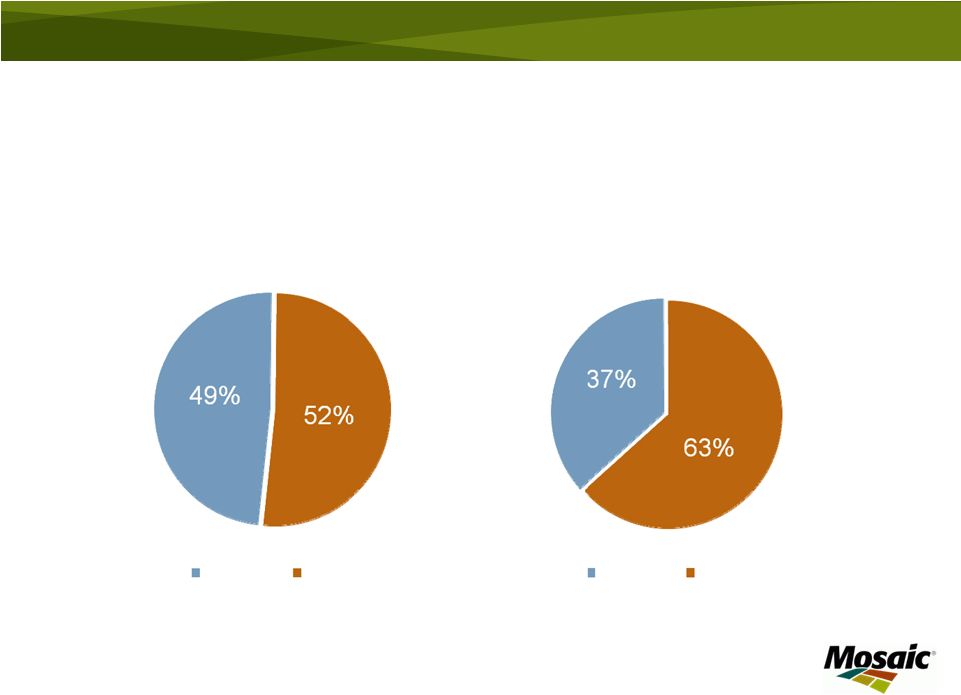

Changing Business Mix Expected to

Enhance Already Strong Returns

17

* Phosphates: FY11 processed phosphate operational capacity, assumed

to stay constant in the future.

Potash:

FY11

peaking

capacity,

assumed

to

add

4.9

million

tonnes

from

expansions

and

1.3

million

tonnes

from

reversion

of

the

Esterhazy

tolling

agreement

Current Business Mix

(FY 2011 capacity*)

Future Business Mix

(projected capacity*)

Phosphate

Phosphate

Potash

Potash |

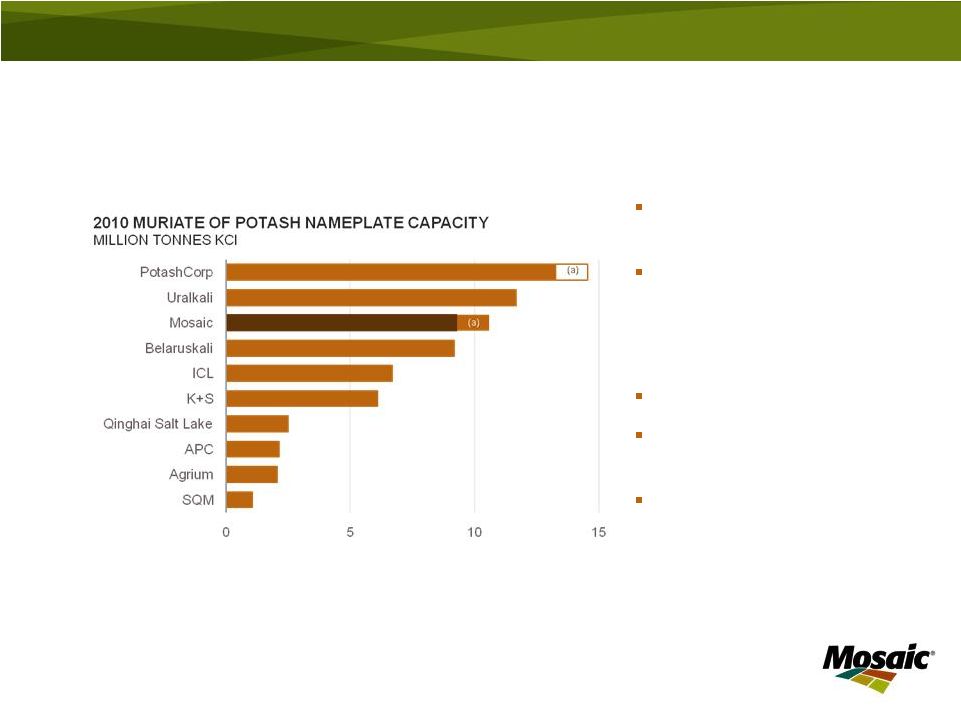

A

Leading Global Potash Producer 18

World MOP nameplate capacity

approximates 70 million tonnes

Mosaic FY11 MOP production

share

–

12% Global

–

38% North America

Global scale

Growing volume through

brownfield expansions

Top 10 producers represent over

90% of industry production

(a)

Reflects

capacity

related

to

Esterhazy

tolling

agreement

between

Mosaic

and PotashCorp in which up to 1.3 million tonnes will revert to Mosaic at

the expiration of the agreement

Source: IFA, Fertecon, company reports and Mosaic

|

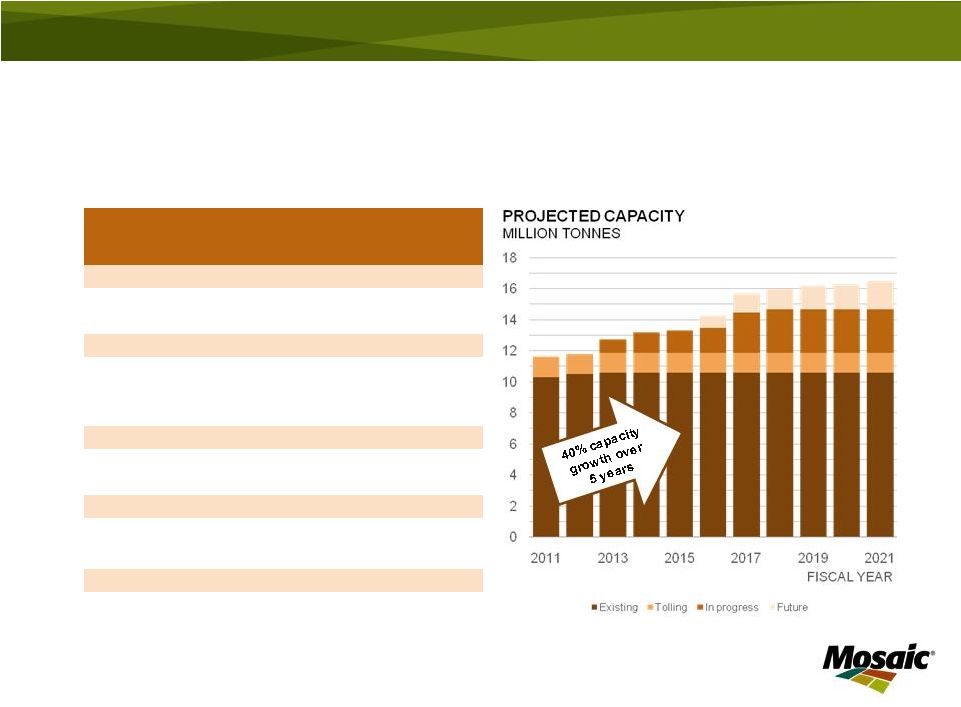

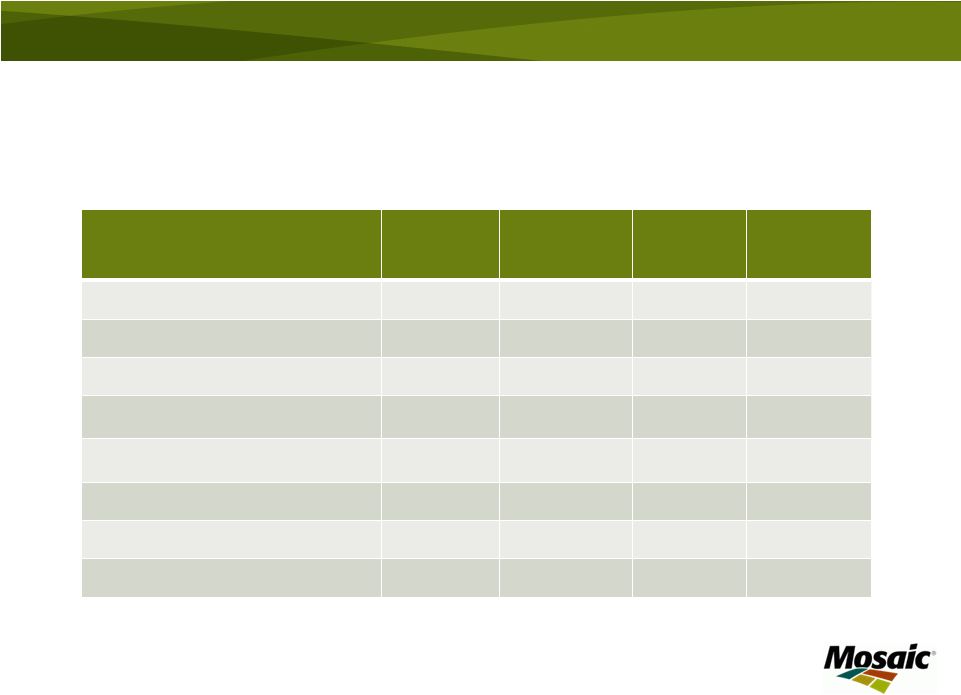

Potash –

Grow Cash Flow Through

Increased Volume

19

PROJECTED

INVESTMENT

($ IN BILLIONS)

PEAKING

CAPACITY

(MILLION TONNES)

ESTIMATED

CONSTRUCTION

COMPLETION

(FISCAL YEAR)

CONSTRUCTION COMPLETE

Colonsay

0.0

0.2

Esterhazy

0.0

0.1

CONSTRUCTION IN PROCESS

Belle Plaine

0.5

0.6

2012

Colonsay

0.7

0.5

2013

Esterhazy

2.0

1.7

2012-17

FUTURE

Belle Plaine

1.3

2016-19

Colonsay

0.5

2016

4.9

Tolling agreement

1.3

Capacity at May 31, 2011

10.3

16.5

Note:

The

projected

annual

capacity

includes

up

to

an

approximate

1.3

million

tonnes,

under

a

tolling

agreement

with

PotashCorp,

at

our

Esterhazy, Saskatchewan potash mine that reverts to us when the tolling agreement

expires. We have notified PotashCorp that our obligation to produce

additional product under the contract has expired. PotashCorp disputes our determination of the expiration date. |

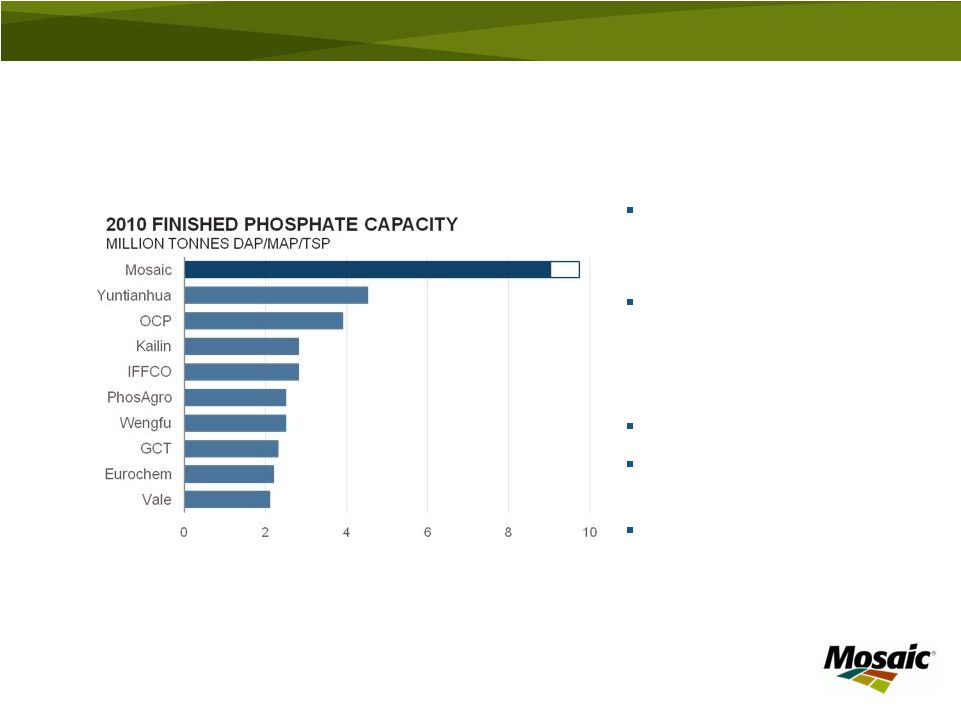

World’s Largest Integrated Phosphate Producer

World capacity

approximates 80 million

tonnes (DAP/MAP/TSP)

Mosaic FY11 phosphate

production share

–

13% Global

–

57% North America

Vertically integrated

Large scale of mines and

plants

Geographic advantages

(a)

Feed phosphate production capacity

This chart does not include Ma’aden estimated capacity that, when completed,

will Source: IFA, Fertecon, company reports and Mosaic

20

(a)

World capacity

approximates 80 million

tonnes (DAP/MAP/TSP)

Mosaic FY11 phosphate

production share

–

13% Global

–

57% North America

Vertically integrated

Large scale of mines and

plants

Geographic advantages

approximate three million tonnes per year |

Phosphates –

Grow Cash

Flow by Optimizing ROIC

21

Grow innovative, high value products

Leverage scale and location

Low cost producer

Cost advantaged sulfur, competitive ammonia

Procurement leverage

Extend phosphate reserves

(incl. investment in Miski Mayo)

Operational excellence

Maintenance practices

Energy use and co-generation capacity

Improve coordination of sales and operations

planning |

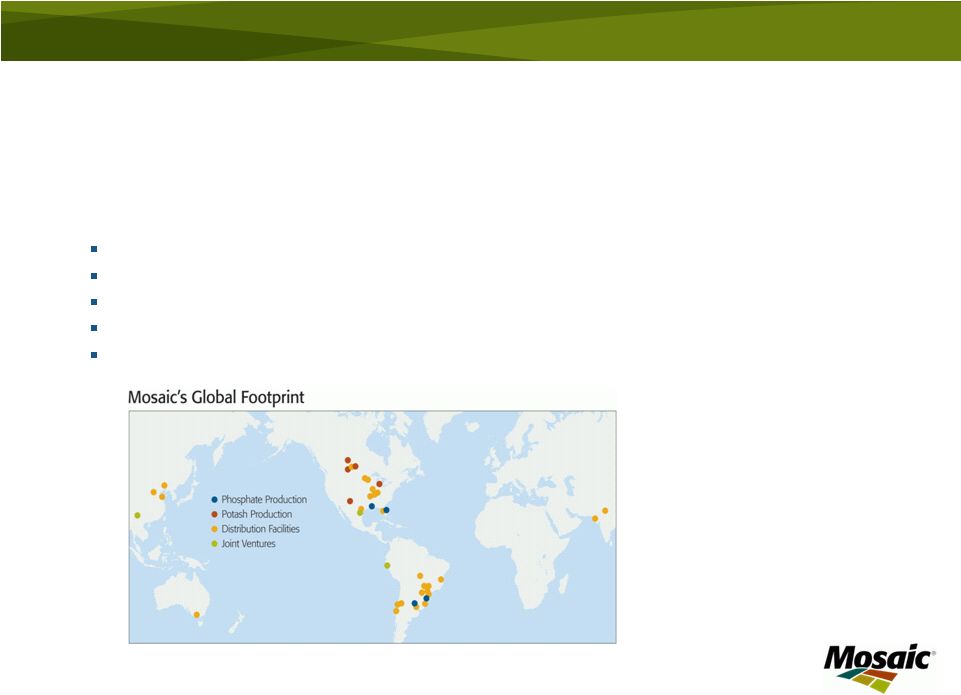

A

Global Presence 22

Global distribution capabilities with local presence provides additional

flexibility to maximize cash flow generation:

Ship product to approximately 40 countries

Balance seasonal demand to improve operating efficiency

Increase ability to effectively position product and improve logistics

efficiencies Gather on the ground intelligence to improve decision

making Work with Canpotex and PhosChem export associations

|

Financial Performance

Substantially improved profitability, a strong balance

sheet and significant financial flexibility allow investments

to capitalize on opportunities across the cycle and

generate shareholder value |

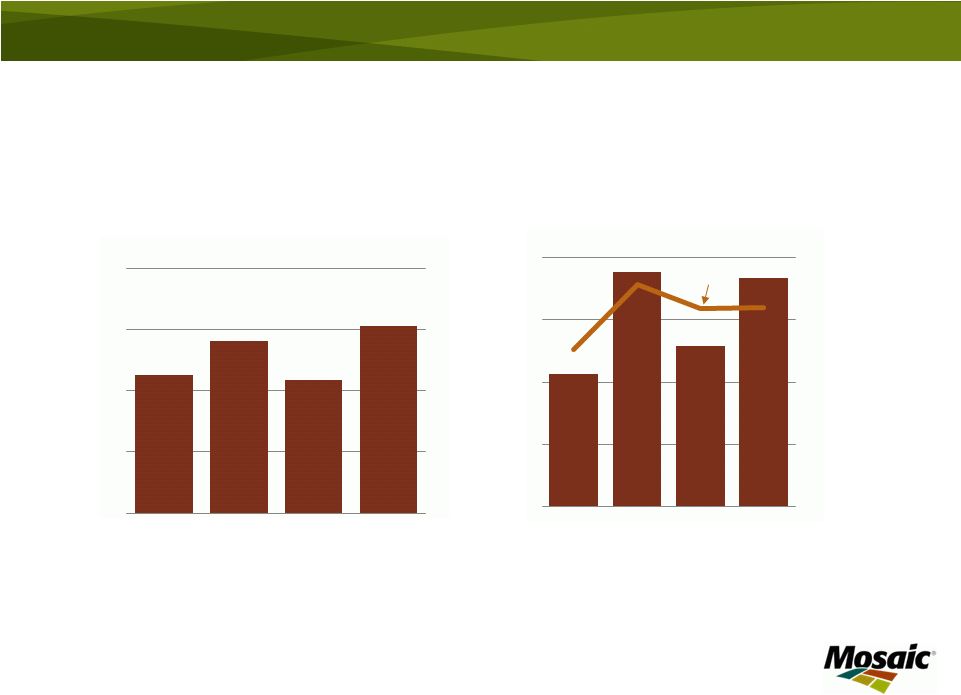

Potash Sales and Gross Margin

24

Fiscal year end: May 31

0

1

2

3

4

FY08

FY09

FY10

FY11

SEGMENT SALES

$ IN BILLIONS

0%

15%

30%

45%

60%

0

400

800

1,200

1,600

FY08

FY09

FY10

FY11

SEGMENT GROSS MARGIN

$ IN MILLIONS

GROSS

MARGIN % |

Phosphate Sales and

Gross Margin 25

Fiscal year end: May 31

0

2

4

6

8

FY08

FY09

FY10

FY11

FY08

FY09

FY10

FY11

0

600

1,200

1,800

2,400

GROSS

MARGIN %

40%

30%

20%

10%

0%

SEGMENT SALES

$ IN BILLIONS

SEGMENT GROSS MARGIN

$ IN BILLIONS |

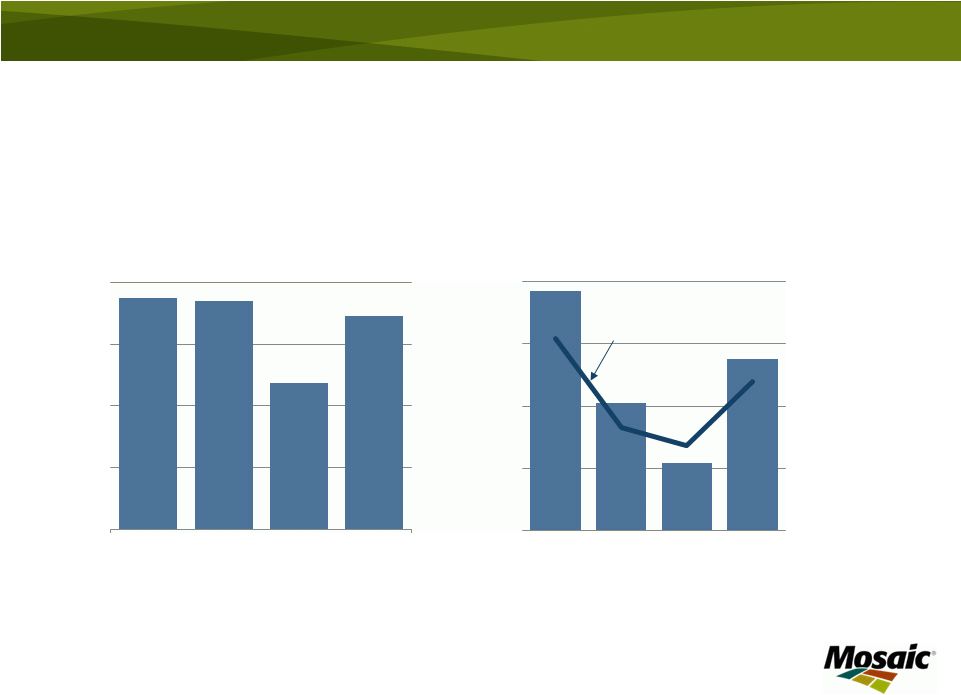

EBITDA and Earnings Per Share

26

Fiscal year end: May 31

* Excludes gain on sale from Saskferco and Fosfertil S.A. See Appendix

1 for reconciliation of Adusted EBITDA and Appendix 4 for reconciliation of

EPS Excluding gain on sale from Saskferco and Fosfertil S.A.

0

1

2

3

4

FY08

FY09

FY10

FY11

ADJUSTED EBITDA

*

$ IN BILLIONS

0

1

2

3

4

5

FY08

FY09

FY10

FY11

ADJUSTED EARNINGS PER SHARE*

$ |

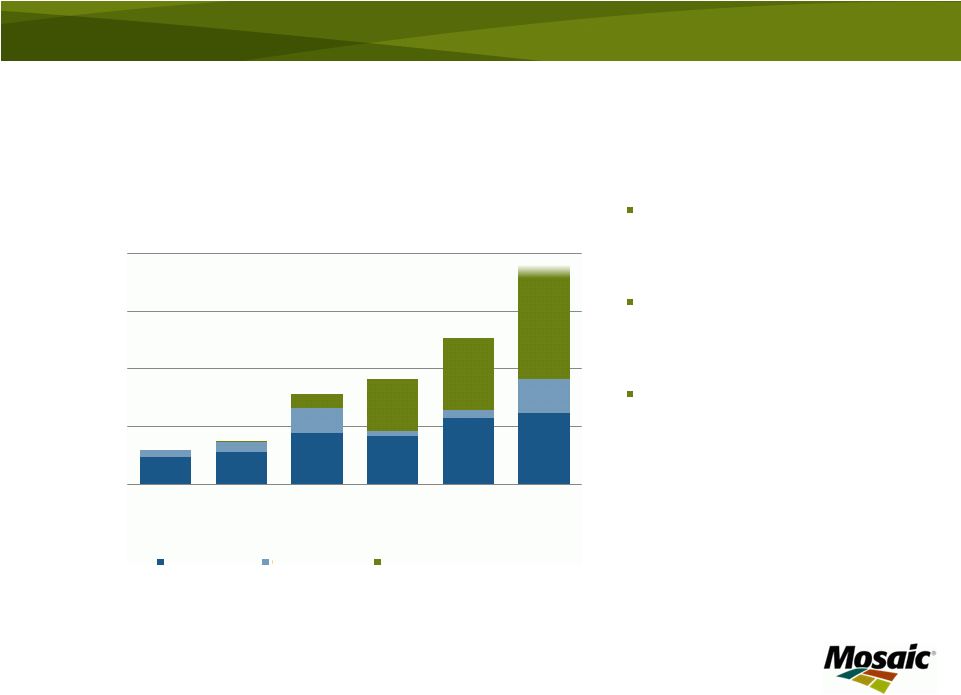

Investing for Growth and Returns

27

Fiscal FY12 Capex

guidance $1.6 to $1.9

billion

Potash expansion project

expenditures continuing

at high level

Increase in opportunity

investments to improve

returns on invested

capital

Fiscal year end: May 31

2007

2008

2009

2010

2011

2012F

CAPITAL EXPENDITURES

$ IN BILLIONS

Sustaining

Opportunity

Potash Expansion

FISCAL YEAR

0.0

0.5

1.0

1.5

2.0 |

Financial Strength & Flexibility

High Cash and Low Debt

Financial Targets

•

$3.9 billion in cash and cash equivalents

•

$2.4 billion in cash from operations in

fiscal 2011

•

$0.8 billion in long-term debt

•

Maintain $1.5 billion in liquidity

•

Maintain “BBB”

rating, Moody’s criteria

(a)

:

–

Debt

to

EBITDA

of

2.25

to

3

times

–

Coverage ratio of 5 to 10 times

–

Viewed over the cycle

Investment Priorities

Return Capital to Shareholders

•

Maintain financial targets

•

Invest in organic opportunities

•

Invest in strategic opportunities

•

Return capital to shareholders

•

Regular dividend appropriate for cyclical

industry

•

Share repurchases over special

dividends

•

Near term constraints

28

Disciplined capital allocation drives substantial value in cyclical, capital

intense businesses, like crop nutrients.

(a) Moody’s Global Chemical Industry Rating Methodology, 2009

|

Positioned to Create Value

As the leading producer of phosphate and potash crop nutrients, Mosaic is well

positioned to create value:

High quality assets

Industry leading facilities

Global marketing and distribution

Differentiated products

Excellence in execution

Potash expansions

Operational excellence

Efficient capital allocation

Strong balance sheet and cash position

Investing to drive shareholder value

29

Mosaic: positioned to create long-term

shareholder value |

Thank you |

Appendix |

Appendix 1: EBITDA Reconciliation

32

$ IN MILLIONS

(1)

Gain on sale of our interest in Saskferco

(2)

Gain on the sale of our interest in Fosfertil S.A.

FY2008

FY2009

FY2010

FY2011

Net earnings

$2,082.8

$2,350.2

$827.1

$2,514.6

Interest expense, net

90.5

43.3

49.6

5.1

Income tax expense

714.9

649.3

347.3

752.8

Depreciation, depletion & amortization

358.1

360.5

445.0

447.4

Amortization of out-of-market contracts

-19.4

-17.2

-12.6

-14.7

EBITDA

3,226.9

3,385.7

1,656.4

3,705.2

Gain on sale

673.4

(1)

685.6

(2)

Adjusted EBITDA

$3,226.9

$2,712.3

$1,656.4

$3,019.6 |

Appendix 2: Return on Invested Capital

33

FY 2010

FY 2011

Short term debt

$83.1

$23.6

Current maturity of long-term debt

15.2

48.0

Long-term debt, less current maturities

1,245.6

761.3

Total equity

8,748.4

11,661.9

Total capitalization

10,092.3

12,494.8

Average capitalization

$11,293.6

Net income

$2,514.6

Return on invested capital

22.3%

$ IN MILLIONS |

Appendix 3: Orderly Distribution of

Cargill Shares

34

Formation Offerings

Post –

Formation Offerings

Initial formation offering of approximately 115 million

shares on May 25, 2011

42 million shares from Charitable Trusts remain to be

sold within 15 months after closing

Possible disposition:

•

S&P inclusion offering

•

Second Formation Offering within 6-9 months

•

Mosaic could buy shares from the Trusts

Beginning 2 years from closing, 1/3 shares remaining

after formation offerings held by Charitable Trusts and

other Cargill shareholders become eligible to be

distributed annually

Closing

6-15 months

2 –

2.5 years

3 –

3.5 years

4 –

4.5 years

Initial

Formation

Offering

Additional Formation Offerings

and/or share repurchases

Released share

offering

Released

share offering

Released share

offering

115 million

shares

42 million shares

129 million shares |

Appendix 4: EPS Reconciliation

35

(1)

Gain on sale of our interest in Saskferco

(2)

Gain on sale of our interest in Fosfertil S.A.

FY2008

FY2009

FY2010

FY2011

EPS

$4.67

$5.27

$1.85

$5.62

Gain on sales

1.03

(1)

1.25

(2)

Adjusted EPS

$4.67

$4.24

$1.85

$4.37 |

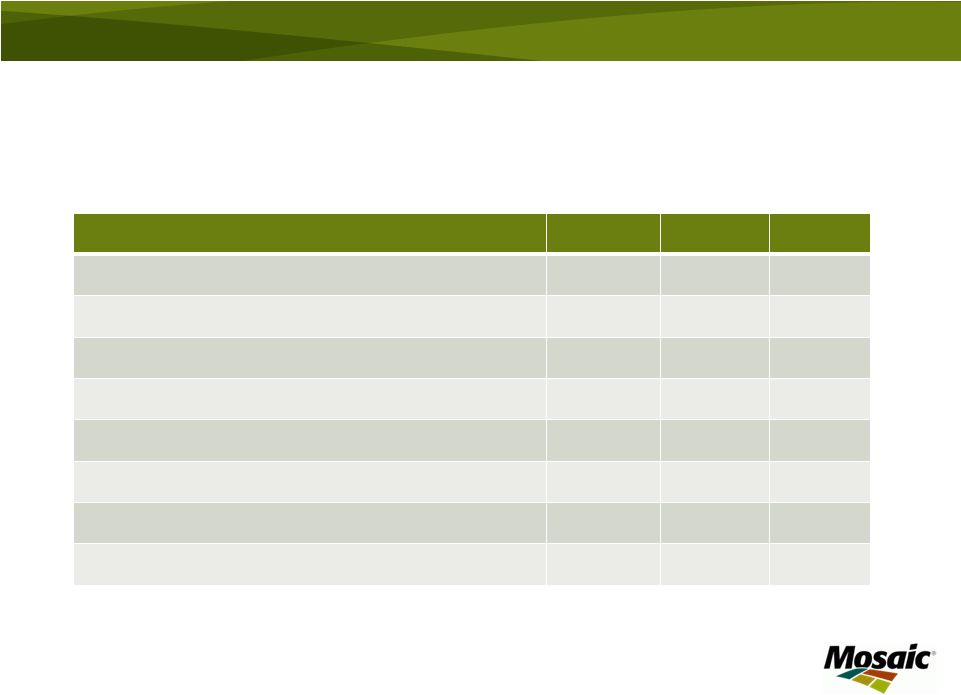

Appendix 5: Earnings Sensitivity to Key

Drivers

(a)

(a)

These factors do not change in isolation; actual results could vary from the above

estimates 36

2011 Actual

Change

Estimated Change in

Pre-Tax Earnings

($ in millions)

Estimated

Change in

Annual EPS

MOP Price ($/tonne)

$359

$50

$368

$0.59

Potash Volume (000 tonnes)

7.5

500

$157

$0.25

DAP Price ($/tonne)

$491

$50

$412

$0.66

Phosphates Volume (000 tonnes)

12.0

500

$92

$0.15

Sulfur ($/lt)

$162

$25

$173

$0.28

Ammonia ($/tonne)

$407

$25

$77

$0.12 |