Attached files

| file | filename |

|---|---|

| EX-31 - Grizzly Gold Corp. | form10k043011ex31.htm |

| EX-32 - Grizzly Gold Corp. | form10k043011ex32.htm |

| EX-14.1 - Grizzly Gold Corp. | form10k043011ex14-1.htm |

| EX-10.3 - Grizzly Gold Corp. | form10k043011ex10-3.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2011

Commission file number: 333-167386

BCS SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

95-0554260

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

3651 Lindell Road, Suite D

Las Vegas, Nevada, 89103

(Address of principal executive offices)

(702) 932-9959

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of October 31, 2010 was approximately $0.

The number of shares of the issuer’s common stock issued and outstanding as of August 9, 2011 was 47,900,000 shares.

Documents Incorporated By Reference: None

1

TABLE OF CONTENTS

| Page | |||

|

Glossary of Mining Terms

|

3 | ||

|

PART I

|

|||

|

Item 1

|

Business

|

6 | |

|

Item 1A

|

Risk Factors

|

9 | |

|

Item 1B

|

Unresolved Staff Comments | 14 | |

|

Item 2

|

Property

|

14 | |

|

Item 3

|

Legal Proceedings

|

19 | |

|

Item 4

|

(Removed and Reserved)

|

19 | |

|

PART II

|

|||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

20 | |

|

Item 6

|

Selected Financial Data

|

21 | |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

21 | |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk.

|

24 | |

|

Item 8

|

Financial Statements and Supplementary Data.

|

24 | |

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

24 | |

|

Item 9A

|

Controls and Procedures

|

25 | |

|

Item 9B

|

Other Information

|

26 | |

|

PART III

|

|||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

26 | |

|

Item 11

|

Executive Compensation

|

28 | |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

30 | |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

31 | |

|

Item 14

|

Principal Accountant Fees and Services

|

31 | |

|

PART IV

|

|||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

32 | |

|

SIGNATURES

|

|||

2

Glossary of Mining Terms

Adit(s), Historic working driven horizontally, or nearly so into a hillside to explore for and exploit ore.

Adularia. A potassium-rich alteration mineral – a form of orthoclase.

Ag. Elemental symbol for silver.

Air track holes. Drill hole constructed with a small portable drill rig using an air-driven hammer.

Au. Elemental symbol for gold.

Core holes. A hole in the ground that is left after the process where a hollow drill bit with diamond chip teeth is used to drill into the ground. The center of the hollow drill fills with the core of the rock that is being drilled into, and when the drill is extracted, a hole is left in the ground.

Felsic Tertiary Volcanic Rocks. Quartz-rich rocks derived from volcanoes and deposited between two and sixty-five million years ago.

Geochemical sampling. Sample of soil, rock, silt, water or vegetation analyzed to detect the presence of valuable metals or other metals which may accompany them. For example, arsenic may indicate the presence of gold.

Geologic mapping. Producing a plan and sectional map of the rock types, structure and alteration of a property.

Geophysical survey. Electrical, magnetic, gravity and other means used to detect features, which may be associated with mineral deposits

Leaching. Leaching is a cost effective process where ore is subjected to a chemical liquid that dissolves the mineral component from ore, and then the liquid is collected and the metals extracted from it.

Level(s), Main underground passage driven along a level course to afford access to stopes or workings and provide ventilation and a haulageway for removal of ore.

Magnetic lows. An occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver.

Plug. A vertical pipe-like body of magma representing a volcanic vent similar to a dome.

Quartz Monzonite. A medium to coarse crystalline rock composed primarily of the minerals quartz, plagioclase and orthoclase.

Quartz Stockworks. A multi-directional system of quartz veinlets.

3

RC holes. Short form for Reverse Circulation Drill holes. These are holes left after the process of Reverse Circulation Drilling.

Resource. An estimate of the total tons and grade of a mineral deposit defined by surface sampling, drilling and occasionally underground sampling of historic diggings when available.

Reverse circulation drilling. A less expensive form of drilling than coring that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not give as much information about the underlying rocks.

Scoping Study. A detailed study of the various possible methods to mine a deposit.

Sedimentation. The process of deposition of a solid material from a state of suspension or solution in a fluid (usually air or water).

Silicic dome. A convex landform created by extruding quartz-rich volcanic rocks.

Stope(s). An excavation from which ore has been removed from sub-vertical openings above or below levels.

Tertiary. That portion of geologic time that includes abundant volcanism in the western U.S.

Trenching. A cost effective way of examining the structure and nature of mineral ores beneath gravel cover. It involves digging long usually shallow trenches in carefully selected areas to expose unweathered rock and allow sampling.

Tuffaceous. Pertaining to sediments which contain up to 50% tuff.

Volcanic center. Origin of major volcanic activity.

Volcanoclastic. Coarse, unsorted sedimentary rock formed from erosion of volcanic debris.

4

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of BCS Solutions, Inc. (the “Company”, “BCS”, or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

5

PART I

Item 1. Description of Business.

We are currently engaged in natural resource exploration and anticipate acquiring, exploring, and if warranted and feasible, developing natural resource properties. Currently we are in the exploration stage and are undertaking one exploration program in Nevada.

History

BCS Solutions, Inc. is a development stage company. We were incorporated in the State of Florida on April 21, 2010 under the name BCS Solutions, Inc.

The Company was initially formed to offer small and medium-sized businesses services that reduced invoicing expenses, sped up receipt of monies, and allowed authorization and recovery of paper drafts. The Company intended to provide instant cash flow for small and medium-sized businesses and reduce expenses associated with invoicing with services that included pre-authorized checking, electronic payments, electronic check conversion, electronic check recovery, and telephone checks.

On April 21, 2010, the Company issued 204,000,000 of its $0.0001 par value common stock for $9,000 cash to the founder of the Company.

On October 20, 2010, the Company issued 20,400,000 shares of common stock to 24 investors in accordance with its Form S-1 for cash of $12,000.

On March 14, 2011 the Board of Directors and majority shareholder of the Company approved a 17 for one forward stock split of our issued and outstanding common stock. The forward stock split was distributed to all shareholders of record on March 25, 2011. No cash was paid or distributed as a result of the forward stock split and no fractional shares were issued. All fractional shares which would otherwise be required to be issued as a result of the stock split were rounded up to the nearest whole share. There was no change in the par value of our common stock. All references to share and per share amounts have been restated in the financial statements and in this Annual Report to reflect the split.

On April 5, 2011, the Company’s majority shareholder returned 180,000,000 shares of common stock to the Company for cancellation. The shares were returned for cancellation in order to reduce the number of shares issued and outstanding. Subsequent to the cancellation, the Company had 44,400,000 shares issued and outstanding, a number that the majority shareholder who was also a director of the Company, considered more in line with the Company’s business plans. Following the share cancellation, the majority shareholder owned 24,000,000 common shares, or at that time approximately 54%, of the remaining 44,400,000 issued and outstanding common shares of the Company at that time.

6

Also on April 5, 2011, the principal shareholder of the Company entered into a Stock Purchase Agreement which provided for the sale of his remaining 24,000,000 shares of common stock of the Company to Jeoffrey Avancena. In connection with the share acquisition, Mr. Avancena was appointed Secretary and Director of the Company and the Board of Directors of the Company elected Mr. Paul Strobel as President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Treasurer and a director of the Company. In connection with the change of control of the company in April 2011, the Company’s business was changed to mineral exploration.

On May 1, 2011, the Company executed a property option agreement (the “Agreement”) with Nevada Mine Properties II, Inc. (“NMP”) granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by NMP, a natural resource exploration company. The property known as the LB/Vixen Property is located in Humboldt County, Nevada and currently consists of 30 unpatented claims (the ‘Property”). Annual option payments and minimum annual exploration expenditures under the Agreement that must be paid or incurred by May 1, 2021 are an aggregate $895,000 and $3,200,000 respectively.

Also, on May 1, 2011 the Company closed a private placement of 3,500,000 common shares at $0.10 per share for a total offering price of $350,000 to five non-U.S. persons. The shares were offered pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended.

On July 8, 2011 our Board of Directors, and on July 5, 2011 our shareholders, approved the change of our name from BCS Solutions, Inc. to Grizzly Gold Corp. Also on July 5, 2011, the shareholders approved a proposal to change the Company's state of incorporation from Florida to Nevada by the merger of BCS Solutions, Inc. with and into its wholly-owned subsidiary, Grizzly Gold Corp., a Nevada corporation. The change of name and jurisdiction is expected to become effective at the end of July, 2011.

Business Operations

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, developing natural resource properties. Our primary focus in the natural resource sector is gold. We are an exploration stage company. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

7

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term. Therefore, we anticipate selling or partnering any ore bodies that we may discover to a major mining company. Many major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. By selling or partnering a deposit found by us to these major mining companies, it would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and it would also provide future capital for the Company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have optioned in Nevada contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the selling or partnering of our property, the purchase of small interests in producing property, the purchase of property where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date we have one property under option, and are in the early stages of exploring this property. There has been no indication as yet that any commercially viable mineral deposits exist on our property, and there is no assurance that a commercially viable mineral deposit exists on our property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Competition

The mineral exploration industry, in general, is intensively competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

8

Government Regulation

The federal government and various state and local governments have adopted laws and regulations regarding the protection of natural resources, human health and the environment. We will be required to conduct all exploration activities in accordance with all applicable laws and regulations. These may include requiring working permits for any exploration work that results in physical disturbances to the land and locating claims, posting claims and reporting work performed on the mineral claims. The laws and regulations may tell us how and where we can explore for natural resources, as well as environmental matters relating to exploration and development. Because these laws and regulations change frequently, the costs of compliance with existing and future environmental regulations cannot be predicted with certainty.

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The cost of complying with environmental concerns under any of these acts varies on a case-by-case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

Other than the normal bonding requirements, there are no costs to us at the present time in connection with compliance with environmental laws. However, since we do anticipate engaging in natural resource projects, these costs could occur at any time. Costs could extend into the millions of dollars for which we could be liable. In the event of liability, we would be entitled to contribution from other owners so that our percentage share of a particular project would be the percentage share of our liability on that project. However, other owners may not be willing or able to share in the cost of the liability. Even if liability is limited to our percentage share, any significant liability would wipe out our assets and resources.

Employees

We have commenced only limited operations. Therefore, we have no full time employees. Our sole officer and three directors provide planning and organizational services for us on a part-time basis.

Subsidiaries

We do not have any subsidiaries and we are not part of a group.

Item 1A. Risk Factors

Factors that May Affect Future Results

1. We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

9

Based upon current plans we expect to incur operating losses in future periods. This will happen because there are expenses associated with the acquisition and exploration of natural resource property. We have sufficient cash on hand to fund our operating needs to April 30, 2012 but we will need to raise additional funds through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations in the future. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current exploration in Nevada, and as a result, could require us to diminish or suspend our operations and possibly cease our existence. Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and silver and copper. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

2. If we do not complete the required option payments and capital expenditure requirements mandated in our agreement with NMP we will lose our interest in our property and our business may fail.

If we do not make all of the property payments to NMP or incur the required expenditures in accordance with the property option agreement we will lose our option to acquire the property for which we have not made the payments and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Since our payment obligations are non-refundable, if we do not make any payments, we will lose any payments previously made and all our rights to the property.

3. Because of our reliance on NMP our operations would be severely impacted should our relationship with NMP be terminated for any reason.

Our property has been optioned from NMP. In addition, to date all of our exploration activity on the property has been undertaken by employees or contractors of NMP. As a result, NMP has significant knowledge about our property and it would be very difficult for us to replace NMP should our relationship with them be terminated for any reason. To date, there have not been any conflicts between the Company and NMP.

4. Because our Officer and Directors serve as Officers and Directors of other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire property to explore and to run our business.

10

All of our Directors and Officers work for other mining and mineral exploration companies. Due to time demands placed on our Directors and Officers, and due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that could adversely affect our ability to conduct our business. The Officers and Directors’ full-time employment with other entities limits the amount of time they can dedicate to us as a director or officer. Also, our Directors and Officers may have a conflict of interest in helping us identify and obtain the rights to mineral property because they may also be considering the same property. To mitigate these risks, we work with several geologists in order to ensure that we are not overly reliant on any one of our Directors to provide us with geological services. However, we cannot be certain that a conflict of interest will not arise in the future. To date, there have not been any conflicts of interest between any of our Directors or Officers and the Company.

5. Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have in Nevada contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

6. Because we have not commenced business operations, we face a high risk of business failure due to our inability to predict the success of our business.

We are in the initial stages of exploration of our mineral claims and thus have no way to evaluate the likelihood that we will be able to operate our business successfully. To date have been involved primarily in organizational activities, and the acquisition and exploration of the mineral claims. We have not earned any revenues as of the date of this report.

7. Because of the unique difficulties and uncertainties inherent in mineral exploration and the mining business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by early-stage mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral property that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

In addition, the search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

11

8. Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. Therefore, we expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

9. Because access to our mineral claims is restricted by inclement weather we may be delayed in our exploration.

Access to our mineral property is restricted through some of the year due to weather in the local area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our results of operations.

10. Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Mr. Strobel, our sole officer, owns a mineral exploration consulting business and works on a contract basis for several other mineral exploration companies. As a result of his duties and responsibilities with the other businesses Mr. Strobel provides his management services to a number of companies. Because we are in the early stages of our business, Mr. Strobel will not be spending all of his time working for the Company. Mr. Strobel will expend enough time to oversee the work programs that have been approved by the Company. Later, if the demands of our business require additional time from Mr. Strobel, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Strobel to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Strobel’s other interests increase. Competing demands on Mr. Strobel’s time may lead to a divergence between his interests and the interests of our shareholders.

11. As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration programs

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the federal, state and local laws of the United States and Nevada as we carry out our exploration programs. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration programs.

12

12. Our auditors’ opinion on our April 30, 2011 and 2010 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern.

We have incurred net losses of $26,252 from April 21, 2010 (inception) to April 30, 2011. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern. We will need to obtain additional funds in the future. Our plans to deal with this cash requirement include loans from existing shareholders, raising additional capital from the public or private sale of equity or entering into a strategic arrangement with a third party. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

13. Our principal shareholder who is also a director and our sole officer owns a controlling interest in our voting stock and investors will not have any voice in our management, which could result in decisions adverse to our general shareholders.

Our sole officer owns approximately 50% our outstanding common stock. As a result he has the ability to control substantially all matters submitted to our stockholders for approval including:

|

·

|

election of our board of directors;

|

|

·

|

removal of any of our directors;

|

|

·

|

amendment of our Articles of Incorporation or bylaws; and

|

|

·

|

adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

As a result of his ownership and position, our sole executive officer is able to influence all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. In addition, it is possible for our sole executive officer to modify his share purchase agreement such that he could force the repurchase of his shares and remain on the board. Also, sales of significant amounts of shares held by our sole executive officer, or the prospect of these sales, could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in the Company may decrease. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

RISKS RELATING TO OUR COMMON SHARES

14. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

13

Our Articles of Incorporation authorize the issuance of 300,000,000 common shares, of which 44,400,000 shares are issued and outstanding at April 30, 2010. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing shareholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common shares.

15. Our common shares are subject to the "Penny Stock" Rules of the SEC and we have no established market for our securities, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

·

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

·

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

·

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

|

·

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common shares and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

16. Because we do not intend to pay any cash dividends on our common shares, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

Item 2. Description of Property.

We do not own any real property. We currently maintain corporate office space at 3651 Lindell Road, Suite D, Las Vegas, Nevada, 89103 pursuant to a one-year lease for $202 per month. Management believes that our office space is suitable for our current needs.

In the following discussion relating to our interests in real property, there are references to “patented” mining claims and “unpatented” mining claims. A patented mining claim is one for which the U.S. government has passed its title to the claimant, giving that person title to the land as well as the minerals and other resources above and below the surface. The patented claim is then treated like any other private land and is subject to local property taxes. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If one purchases an unpatented mining claim that is later declared invalid by the U.S. government, one could be evicted.

14

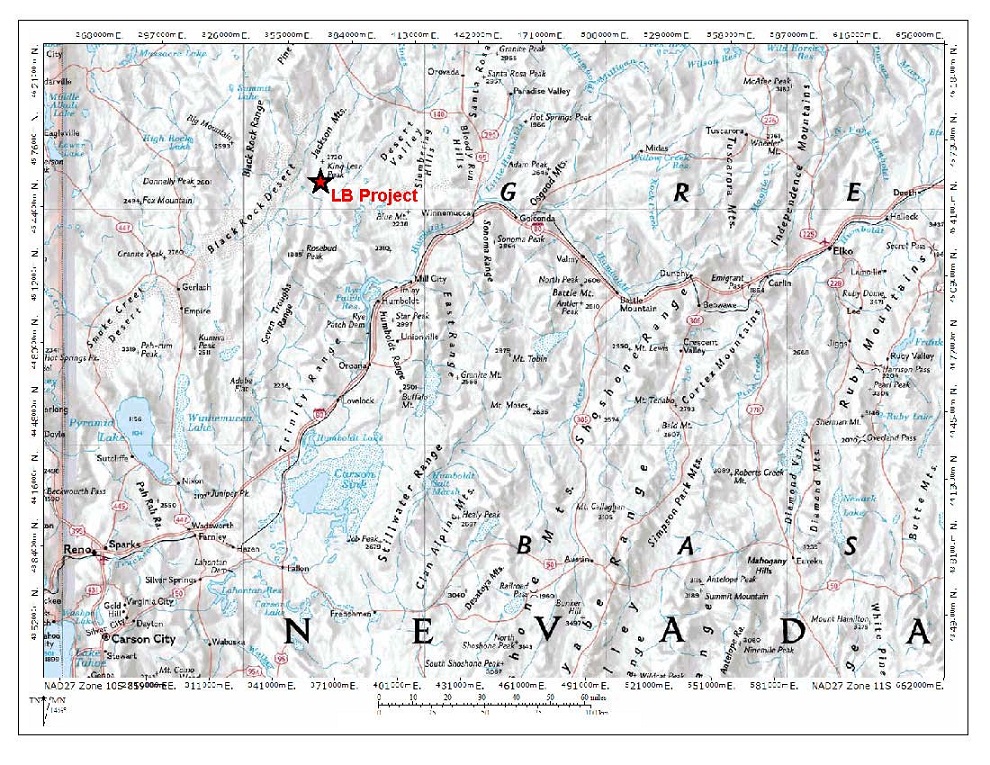

Map of our LB/Vixen Property located in Nevada.

15

LB/Vixen Property

Acquisition of Interest

On May 1, 2011, the Company executed a property option agreement (the “Agreement”) with NMP granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by NMP, a natural resource exploration company. The property known as the LB/Vixen Property is located in Humboldt County, Nevada and currently consists of 30 unpatented claims (the ‘Property”).

Annual option payments and minimum annual exploration expenditures are as noted below:

|

Property

|

Work

|

|||

|

Payments

|

Expenditures

|

|||

|

Upon Execution of the Agreement

|

$

|

20,000

|

$

|

-

|

|

By May 1, 2012

|

20,000

|

200,000

|

||

|

By May 1, 2013

|

60,000

|

200,000

|

||

|

By May 1, 2014

|

45,000

|

200,000

|

||

|

By May 1, 2015

|

60,000

|

250,000

|

||

|

By May 1, 2016

|

70,000

|

250,000

|

||

|

By May 1, 2017

|

80,000

|

300,000

|

||

|

By May 1, 2018

|

90,000

|

300,000

|

||

|

By May 1, 2019

|

100,000

|

350,000

|

||

|

By May 1, 2020

|

100,000

|

400,000

|

||

|

By May 1, 2021

|

250,000

|

750,000

|

||

|

$

|

895,000

|

$

|

3,200,000

|

|

Upon execution of the Agreement, we paid NMP $20,000 and reimbursed them $7,065 in claim fees and property holding costs. Since our payment obligations are non-refundable, if we do not make any payments under the Agreement we will lose any payments made and all our rights to the Property. If all said payments under the Agreement are made, then we will acquire all mining interests in the Property. If the Company fails to make any payment when due, the Agreement gives the Company a 60-day grace period to pay the amount of the deficiency. NMP retained a 3% royalty of the aggregate proceeds received by the Company from any smelter or other purchaser of any ores, concentrates, metals or other material of commercial value produced from the Property, minus the cost of transportation of the ores, concentrates or metals, including related insurance, and smelting and refining charges, including penalties.

The Company shall have the one time right exercisable for 90 days following completion of a bankable feasibility study to buy up to two thirds (66.7%) of NMP’s royalty (i.e. an amount equal to 2% of the royalty) for $3,000,000.

16

Both the Company and NMP have the right to assign, sell, mortgage or pledge their rights in each respective Agreement or on each respective Property. In addition, any mineral interests staked, located, granted or acquired by either the Company or NMP which are located within a 1 mile radius of the Property will be included in the option granted to the Company. The Agreement will terminate if the Company fails to comply with any of its obligations in the Agreement and fails to cure such alleged breach. If the Company gives notice that it denies a default has occurred, the matter shall be determined finally through such means of dispute resolution as such matter has been subjected to by either party. The Agreement provides that all disputes shall be resolved by a sole arbitrator under the rules of the Arbitration Act of Nevada. The Company also has the right to terminate the Agreement by giving notice to NMP.

Description and Location of the LB/Vixen Property

The LB/Vixen property is located in Humboldt County, approximately 150 miles northeast of Reno and 55 miles west of Winnemucca, Nevada and currently consists of 30 unpatented claims.

Exploration History of the LB/Vixen Property

In 1985, the WX Syndicate staked claims that encompass the area of the current LB portion of the property. Initial activity included soil and rock chip sampling, geologic mapping, and shallow trenching. WX’s trenching revealed clay alteration and favorable limey shale units with some gold values with consistent anomalous gold throughout the length of four trenches. Trenching was followed by a two-phase drilling program. The two phase program utilized conventional rotary and air track drilling methods that generally provided inadequate sample collection compared to either reverse circulation or core drilling commonly used in exploration today. However, based on the thickness and grades encountered in drilling and that obtained from trenching and surface sampling, it is believed the holes represent adequate evidence of gold mineralization within the LB project boundaries, but cannot be relied on for true grade or thickness.

Seven shallow open-hole rotary holes were completed for 1,080 feet in 1987. The holes targeted gold anomalous zones within fractured and limonite stained Triassic shale and phyllite. Anomalous near-surface gold values were intercepted in four of seven holes. An additional 26 shallow air track holes were completed in a rough grid pattern filling in between the two areas of trenching. Air track holes are not generally reliable for reserve estimates because of unreliable sampling techniques. In this instance, air track holes were utilized for geochemical sampling of the near surface gold values and were meant as a targeting tool for deeper drill tests in the future rather than as a definition tool for ore reserves. Drill logs and assays are available from all sampling and drilling completed by WX Syndicate.

In 1988, U. S. Borax staked ground that is now covered by the Vixen claims. Borax reportedly completed soil and rock chip sampling, geological mapping, and drilled five reverse circulation drill holes for 1,190 feet. The holes reportedly targeted a northwesterly structural zone within similar stratigraphy to that of the LB portion of the claims. The original data is not available for review. However, a summary of drilling has been obtained.

17

In 1992, Independence Mining Company controlled the LB/Vixen ground as part of a larger exploration project in the Jackson Mountains comprising over 1,600 claims. Independence did not conduct work on the LB / Vixen property.

In February 2006, NMP staked 20 unpatented lode claims covering the former WX Syndicate drill area and extensions. NMP has not conducted physical work on the property. During the late 2000’s, Dave C. Mough Explorations located ten Vixen claims that covered the Borax drilling area. Subsequently, NMP signed a deal with Mough granting NMP a 75% interest in the Vixen claims.

Geology of the LB/Vixen Property

The LB/Vixen property is situated in northwestern Nevada within the Great Basin of the Basin and Range physiographic province. The Great Basin in Nevada is characterized by northerly trending mountain ranges with intervening broad, generally flat valleys. Such is the physiographic setting at the LB/Vixen property that occupies the low, southern foothills of the Jackson Mountains rising to the east above the Black Rock Desert. The oldest rocks in the Jackson Mountains are Permian or older volcanics.

The Happy Camp Group dominates the northern part of the range. Toward the southern Jacksons, a mixed, variable sequence of overlying Jurassic to Triassic arenite, carbonate, pelitic, and volcanic rocks occur. The rocks range from a metamorphosed sediment and volcanic package to a relatively fresh sediment package. The Triassic rock units in the vicinity of the LB/Vixen project include argillite, phyllite, chert, greywacke, limestone, limestone-pebble conglomerate and greenstone that span a broad time-stratigraphic range.

The Mesozoic sediment and volcanic units at LB/Vixen are overlain by ash-flow and ash-rich tuffs recognized as Tertiary. Diorite and basalt dikes and plugs make up part of this Tertiary tectonism. On the LB/Vixen property, alteration is present as bleaching, iron staining, argillization, jasperoidal silicification, quartz stockwork veining and local pervasive limonite staining. Native sulfur and mercury are found within fault gouge in several areas of the LB property. Gold mineralization occurs in shallow trenches in both unaltered and clay-limonite altered phyllites and limey phyllites indicating both a fracture and disseminated nature to the mineralization. Altered phyllites are commonly orange goethite stained and impregnated, with clay alteration. Gossan is notable is some areas with little or no silicification. Jasperoid is apparent along the fault contact between the Triassic sediments and Tertiary volcanic rocks. Gold mineralization in drill holes is described as being associated with silicification and limonite in shaley siltstone, phyllite, argillite and limestone.

The LB/Vixen project is structurally complex. Gold mineralization and clay-limonite alteration are intimately related with fault zones. These structures are evidenced by jasperoidal silica, bleaching and limonite staining. WX Syndicate’s shallow drilling generally tested the footwall of the western most structure (LB Fault) with modest success. A major northwest structure crosses the Vixen and LB claims. An area lying between the above mentioned structures contains widespread fracturing with introduced quartz and calcite veining. This area is gold anomalous and remains untested by drilling. The intersection of the Vixen and LB structures, falling on the LB claims, also remains untested.

18

Structural preparation and structural control are clearly evident in outcrops and from descriptions of the shallow trenches on the LB/Vixen property. There are also indications of replacement mineralization in favorable hosts (limey phyllites and clay altered phyllites) in both unaltered and altered rock defined by the trench samples and trench notes. These styles of mineralization and alteration suggest potential for structural feeders providing pathways into favorable, structurally prepared rock and into favorable horizons for replacement. Limited trenching and drilling at the LB/Vixen property has helped to define favorable structure and lithology. Broad areas of alteration including jasperoid, stockwork quartz veining, silicification, gossan, and clay-alteration have been defined outward of the drill area.

It is somewhat unusual that the LB/Vixen property, underlain by nearly one square mile of altered, gold-anomalous, faulted, and fractured sediment package, is so poorly prospected and sparsely drilled. The property was virtually unprospected into the mid-1980’s. The presence of jasperoid ribs coupled with pervasive bleaching and limonite stained sediments caught the attention of WX Syndicate who located claims in 1985.

Current State of Exploration

The LB/Vixen claims presently do not have any mineral resources or reserves. The company has begun reviewing the results of the historic drilling and sampling. There is no mining plant or equipment located within the property boundaries. Currently, there is no power supply to the mineral claims. Our planned program includes compilation of all activities to the present with a follow-up reverse circulation drill program. However, this program is exploratory in nature and no minable reserves may ever be found.

Geological Exploration Program

The Company has received a technical report on the LB/Vixen property and is currently assessing what work is to be undertaken. NMP has submitted a budget to the Company’s Board of Directors but to date the Company has not approved the budget.

Item 3. Legal Proceedings.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

Item 4. (Removed and Reserved)

19

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

Market Information.

There has been no market for our securities. Our common stock is not traded on any exchange or on the over-the-counter market. The Company has received approval from FINRA for our common stock to be eligible for trading on the Over The Counter Bulletin Board. However, the Company has not yet received approval from DTC. As a result, a market has not yet developed. There is no assurance that a trading market will develop, or, if developed, that it will be sustained.

Holders.

On August 9, 2011, there were approximately twenty-five holders of record of the Company’s common stock.

Dividends.

The Company has not declared or paid any cash dividends on its common stock nor does it anticipate paying any in the foreseeable future. Furthermore, the Company expects to retain any future earnings to finance its operations and expansion. The payment of cash dividends in the future will be at the discretion of its Board of Directors and will depend upon its earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Warrants or Options.

The Company does not have any warrants outstanding and the Company has not yet adopted a stock option plan.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities.

On May 1, 2011 the Company closed a private placement of 3,500,000 shares of common stock at $0.10 per share for a total offering price of $350,000. The shares were offered pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended. The private placement was fully subscribed to by five non-U.S. persons.

Purchases of Equity Securities by the Company and Affiliated Purchasers.

None.

20

Item 6. Selected Financial Data

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 7. Management’s Discussion and Analysis or Plan of Operation.

Overview

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, exploiting natural resource property. Our primary focus in the natural resource sector is gold. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term indeed. We therefore anticipate optioning or selling any ore bodies that we may discover to a major mining company. Most major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. By optioning or selling a deposit found by us to these major mining companies, it would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and it would also provide future capital for the company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have in Nevada contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the purchase or option of early stage property. To date we have one property under option. We have not yet conducted exploration on the property but we have initiated an exploration program that will include mapping, sampling, surveying and drilling on each of our two property. There has been no indication as yet that any mineral deposits exist on the property, and there is no assurance that a commercially viable mineral deposit exists on our property. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

21

In the following discussion, there are references to “unpatented” mining claims. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If you purchase an unpatented mining claim that is later declared invalid by the U.S. government, you could be evicted.

Plan of Operation

During the twelve-month period ending April 30, 2012, our objective is to continue to explore the LB/Vixen property. The funds in our treasury are sufficient to meet all planned activities as outlined below. The Company expects that it will need approximately $270,000 to fund its operations during the next twelve months which will include property option payments, exploration of its property as well as the costs associated with maintaining an office. The Company completed a financing on May 1, 2011 for total proceeds of $350,000. The cash from this financing is sufficient to fund its planned operations for the next twelve months. However, in order to develop its property, the Company will need to obtain additional financing in the future. Management plans to seek additional capital through private placements and public offerings of its common stock. Although there are no assurances that management’s plans will be realized, management believes that the Company will be able to continue operations in the future.

We continue to run our operations with the use of contract operators, and as such do not anticipate a change to our company staffing levels. We remain focused on keeping the staff compliment, which currently consists of our sole executive officer, at a minimum to conserve capital. We believe outsourcing of necessary operations continues to be the most cost effective and efficient manner of conducting the business of the Company.

We do not anticipate any equipment purchases in the twelve months ending April 30, 2012.

The following is an overview of the project work to date, as well as anticipated work for the next twelve months. Specific dates when work will begin, and how long it will take to complete each step is subject to change due to the variables of weather, availability of work crews for a particular type of work, and the results of work that is planned, the outcome of which will determine what the next step on that project will be.

LB/Vixen Property

On May 1, 2011, the Company executed a property option agreement (the “Agreement”) with NMP granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by NMP, a natural resource exploration company. The property known as the LB/Vixen Property is located in Humboldt County, Nevada and currently consists of 30 unpatented claims (the ‘Property”). Upon execution of the Agreement, we paid NMP $20,000 and reimbursed them $7,065 in claim fees and property holding costs.

22

The Company has received a technical report on the LB/Vixen property and is currently assessing what work is to be undertaken. NMP has submitted a budget to the Company’s Board of Directors but to date the Company has not approved the budget.

Results of Operations

The Year Ended April 30, 2011 compared to the Period from April 21, 2010 (inception) to April 30, 2010.

We did not earn any revenues during the periods ended April 30, 2011 or 2010. We do not anticipate earning revenues until such time as we have entered into commercial production of our mineral property. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our property, or if such resources are discovered, that we will enter into commercial production of our mineral property.

For the year ended April 30, 2011 we had a net loss of $22,644 compared to $3,608 for the period ended April 30, 2010. The increase in the net loss was largely due to 2011 costs associated with preparing and filing the Company’s initial registration documents. The Company was only incorporated on April 21, 2010 resulting in minimal expenses being incurred for the period ended April 30, 2010. In addition, the Company undertook a business change in April 2011 resulting in a change to mineral exploration. The Company incurred $3,224 in mineral exploration expenses as it began its review of the LB/Vixen historical data.

Liquidity and capital resources

We had working capital of ($5,252) at April 30, 2011 consisting of cash of $624 and total current liabilities of $5,876.

We anticipate that we will incur the following to April 30, 2012:

|

-

|

$20,000 in connection with property option payments and claim fees under the Company’s LB/Vixen option agreement;

|

|

-

|

$207,000 in property exploration expenses and claim payments in order to meet the requirements of the Company’s property option agreement;

|

|

-

|

$43,000 for operating expenses, including working capital and general, legal, accounting and administrative expenses associated with reporting requirements under the Securities Exchange Act of 1934.

|

Cash used in operations was $20,368 for the year ended April 30, 2011 while it was $8 for the period ended April 30, 2010. The increase in cash used in operations was largely due to an increase in the net loss in 2011 to $22,644 from a net loss of $3,608 in 2010. Cash flows from financing activities for 2011 were the result of $12,000 received from a private placement while in 2010 they were the result of $9,000 received from private placements. There were no investing activities in either 2011 or 2010.

23

The Company expects that it will need approximately $270,000 to fund its operations during the next twelve months which will include property option payments, exploration of its property as well as the costs associated with maintaining an office. The Company completed a financing on May 1, 2011 for total proceeds of $350,000. The cash received from this financing is sufficient to fund its planned operations for the next twelve months. However, in order to develop its property in the future, the Company will need to obtain additional financing. Management plans to seek additional capital through private placements and public offerings of its common stock. Although there are no assurances that management’s plans will be realized, management currently believes that the Company will be able to continue operations in the future.

Going Concern Consideration

Management believes that the gross proceeds from the private placement will be sufficient to continue our planned activities to April 30, 2012, the end of our next fiscal year. We anticipate generating losses and therefore we may be unable to continue operations in the future as a going concern. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities that could result should we be unable to continue as a going concern.

We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Accordingly, our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

Off-balance sheet arrangements

We have no off-balance sheet arrangements.

Item 7A Quantitative and Qualitative Disclosure About Market Risk

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 8. Financial Statements.

The financial statements are set forth immediately preceding the signature page.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

24

Item 9A. Controls and Procedures.

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

As required by Rule 13a-15 under the Securities Exchange Act of 1934 (the “Exchange Act”), the Company’s management carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures as of April 30, 2011, being the date of the Company’s most recently completed fiscal year end. This evaluation was carried out under the supervision and with the participation of our Principal Executive Officer and Principal Financial Officer, Mr. Paul Strobel. Our Chief Executive Officer and Principal Financial Officer, after evaluating the effectiveness of the Company’s “disclosure controls and procedures” (as defined in the Securities Exchange Act of 1934 (Exchange Act) Rules 13a-15(e) or 15d-15(e)) as of the end of the period covered by this annual report, has concluded that our disclosure controls and procedures are effective at a reasonable assurance level based on his evaluation of these controls and procedures as required by paragraph (b) of Exchange Act Rules 13a-15 or 15d-15.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Rules 13a-15(f) under the Securities Exchange Act of 1934, internal control over financial reporting is a process designed by, or under the supervision of, the Company’s principal executive, principal operating and principal financial officers, or persons performing similar functions, and effected by the Company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

The Company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records, that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Company’s assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of the Company’s management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

25

The Company’s management, including the Company’s Chief Executive Officer and Principal Financial Officer assessed the effectiveness of the Company’s internal control over financial reporting as of April 30, 2011. In making this assessment, management used the framework in “Internal Control - Integrated Framework” promulgated by the Committee of Sponsoring Organizations of the Treadway Commission, commonly referred to as the “COSO” criteria. Based on the assessment performed, management believes that as of April 30, 2011 the Company’s internal control over financial reporting was effective based upon the COSO criteria.

Lack of Segregation Of Duties

Management is aware that there is a lack of segregation of duties at the Company due to the small number of employees dealing with general administrative and financial matters. However, at this time management has decided that considering the abilities of the employees now involved and the control procedures in place, the risks associated with such lack of segregation are low and the potential benefits of adding employees to clearly segregate duties do not justify the substantial expenses associated with such increases. Management will periodically reevaluate this situation.

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the SEC that permit the Company to provide only management’s report in this annual report.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There were no changes in our internal controls over financial reporting during our fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

None.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Directors and Officers.

All directors of our Company hold office until the next annual general meeting of the stockholders or until their successors are elected and qualified. The officers of our Company are appointed by our board of directors and hold office until their earlier death, retirement, resignation or removal. Our directors and executive officers, their ages, positions held and duration each person has held that position, are as follows:

26

|

Name

|

Position Held with the Company

|

Age

|

Date First Appointed

|

|

Paul Strobel

|

Chairman, President, Chief Executive Officer, Chief Operating Officer, Treasurer, and Director

|

63

|

April 5, 2011

|

|

Jeoffrey Avancena

|

Secretary and Director

|

33

|

April 5, 2011

|

Business Experience

The following is a brief account of the education and business experience of each director, executive officer and key employee during at least the past five years, indicating each person’s principal occupation during the period, and the name and principal business of the organization by which he was employed.

Paul Strobel is an accomplished geologist who has over 30 years of practical experience. Since 2008 he has been the Managing Partner of Western Resource Consultants which is a privately-held business providing consulting services to the mineral exploration industry. Prior to his current role he was a Vice President at Gold Reef International for one year, General Manager at Chambers Group, Inc. for one year and from 1997 to 2005 he was a contract geologist for Marston Environmental. Mr. Strobel holds a Bachelor of Science degree from the University of Arizona. Mr. Strobel is also a director of Ranger Gold Corp., a publicly traded mineral exploration company. Mr. Strobel was appointed to the Board of Directors as he is a geologist with decades of experience.

Jeoffrey Avancena was an assistant branch manager at TransCanada Credit (Wells Fargo Financial) from 2001 through 2005, and from 1996 through 2000 he was a personal banking representative at the Canadian Imperial Bank of Commerce. Since 2005 Mr. Avancena was not employed. Mr. Avanacena was appointed to the Board of Directors due to his experience in the banking industry and he is the Company’s controlling shareholder.

There are no family relationships among our directors or officers. None of our directors or officers has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our officers or directors, or any associate of any such officer or director, is a party adverse to our company or has a material interest adverse to it. There are no agreements with respect to the election of directors. Other than described in Section 10 below, we have not compensated our directors for service on our Board of Directors, any committee thereof, or reimbursed for expenses incurred for attendance at meetings of our Board of Directors and/or any committee of our Board of Directors.

Audit Committee Financial Expert.

The Board of Directors has not established an audit committee and does not have an audit committee financial expert. The Board is seeking additional Board members whom it hopes will qualify as such an expert.

27

Section 16(a) Beneficial Ownership Reporting Compliance.

Section 16(a) of the Securities Exchange Act of 1934 requires officers and directors of the Company and persons who own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in their ownership with the Securities and Exchange Commission, and forward copies of such filings to the Company. We believe, based solely on our review of the copies of such forms, that during the fiscal year ended April 30, 2011, all reporting persons complied with all applicable Section 16(a) filing requirements.

Code of Ethics.

In April 2010 we adopted a Code of Ethics and Business Conduct which is applicable to our future employees and which also includes a Code of Ethics for our sole officer and director. A code of ethics is a written standard designed to deter wrongdoing and to promote:

|

·

|

honest and ethical conduct,

|

|

·

|

full, fair, accurate, timely and understandable disclosure in regulatory filings and public statements,

|

|

·

|

compliance with applicable laws, rules and regulations,

|

|

·

|

the prompt reporting violation of the code, and

|

|

·

|

accountability for adherence to the code.

|

A copy of our Code of Business Conduct and Ethics has been filed with the Securities and Exchange Commission as an exhibit to Company’s Form S-1 filed with the Commission on June 8, 2010.

Changes to Procedures for Recommendations of Director Nominees.

During the fiscal year ended April 30, 2011, there were no material changes to the procedures by which security holders may recommend nominees to our board of directors.

Item 11. Executive Compensation.

Summary Compensation Table

The table below sets forth information concerning compensation paid, earned or accrued by our chief executive officers (each a “Named Executive Officer”) for the last two fiscal years. No executive officer earned compensation in excess of $100,000 during our 2011 or 2010 periods.

28

SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity

|

|

|

Nonqualified

|

|

|

All

|

|

|

|

|

||||||||

|

Name and

|

|

|

|

|

|

|

|

|

|

Stock

|

|

|

Option

|

|

|

Incentive Plan

|

|

|

Deferred

|

|

|

Other

|

|

|

|

|

||||||||

|

Principal

|

|

|

|

Salary

|

|

|

Bonus

|

|

|

Awards

|

|

|

Awards

|

|

|

Compensation

|

|

|

Compensation

|

|

|

Compensation

|

|

|

Total

|

|

||||||||

|

Position

|

|

Year

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

Earnings ($)

|

|

|

($)

|

|

|

($)

|

|

||||||||

|