Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LCI INDUSTRIES | v231230_8k.htm |

EXHIBIT 99.1 Drew Industries Incorporated (NYSE: DW) A Leading National Supplier of a Wide Variety of Components for RVs and Manufactured Homes

Forward-Looking Statements This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, growth opportunities for existing products, plans and objectives of management, markets for the Company’s Common Stock and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Forward-looking statements, including, without limitation, those relating to our future business prospects, net sales, expenses, income (loss), cash flow, and financial condition, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of our senior management at the time such statements were made, and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by forward-looking statements. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. You should consider forward-looking statements, therefore, in light of various important factors, including those set forth in this presentation, and in our subsequent filings with the Securities and Exchange Commission. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, pricing pressures due to domestic and foreign competition, costs and availability of raw materials (particularly steel and steel-based components, vinyl, aluminum, glass and ABS resin) and other components, availability of credit for financing the retail and wholesale purchase of manufactured homes and recreational vehicles (“RVs”), availability and costs of labor, inventory levels of retail dealers and manufacturers, levels of repossessed manufactured homes and RVs, changes in zoning regulations for manufactured homes, sales declines in the RV or manufactured housing industries, the financial condition of our customers, the financial condition of retail dealers of RVs and manufactured homes, retention and concentration of significant customers, interest rates, oil and gasoline prices, and the outcome of litigation. In addition, international, national and regional economic conditions and consumer confidence affect the retail sale of RVs and manufactured homes.

SECTION IOverview

Drew’s Products – Components for RVs and Manufactured Homes $608 Million of Net Sales for the12 Months Ended June 30, 2011 RV Furniture and Mattresses: $58 million RV Chassis, Slide-outs and Other Chassis Parts: $279 million Bath Products: $19 million MH Chassis and Chassis Parts: $29 million Specialty Trailers: $5 million Other Products: $5 million Axles and Suspension Products: $42 million RV Windows and Doors: $116 million MH Windows and Doors: $55 million

Drew’s Segments – LTM 6/2011 Net Sales - $608 million MH = $96 million 16% RV = $512 million 84% 90+% for towable RVs Segment Operating Profit - $60 million MH MH = = $ 10$4 million 16%54% MH = $10 million 16% RV = $50 million RV = $3 million 84% 46% RV = $50 million 84%

Financial Performance Sales and EBITDASO(1) (in millions) Sales RV Segment sales MH Segment sales EBITDASO EBITDASO $100 $750 $729 $669 $669 $608 $573 75 $531 $511 500 $509 $448 $492 $398 0 $353 $325 $348 $477 $512 $368 $255 250 $171 $220 $313 $108 25 $221 $220 $183 $177 $147 $154 $134 $143 $85 $96 $96 0 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 LTM 6/11 (1) EBITDASO is operating profit plus depreciation, amortization, goodwill impairment and stock-based compensation (see page 39).

SECTION II Industries

RV Market TOWABLE RVS (90+% of Drew’s RV Segment revenues) Travel trailer Fifth-wheel travel trailer ? 90% of industry 2010 unit sales ? 62% of 2010 wholesale dollar sales, or $4.3 billion Travel trailer with Sport utility RV ? Retail cost $4,000 to $100,000 per expandable ends “Toy Hauler” unit. Average about $25,000 Folding camping trailer Truck camper MOTORHOMES (3% of Drew’s RV Segment revenues) ? 10% of industry 2010 unit sales ? 38% of 2010 wholesale dollar Type A Motorhome Type B Motorhome sales, or $2.7 billion ? Retail cost $41,000 to $400,000+ per unit. Average about $136,000 Type C Motorhome - 7 -

How RVs Are Used ? More economical family vacations › Typical RV family vacation is less expensive ? Shift in U.S. culture toward more RV-related activities › College and NFL football games › NASCAR events › More active, shorter, “greener”, & family oriented vacations

RVs - Industry Wholesale Shipments 90+% of Drew’s RV product sales are for Travel Trailers and 5th Wheel RVs Industry Drew’s Units Sales (Units in thousands, Sales in millions) 500 $500 509 492 77 Motorhomes 448 Other Towables Travel Trailers & 5th Wheel 391 400 384 $400 Drew RV Segment Sales 370 56 353 368 346 61 321 321 73 311 55 300 42 313 300 293 42 $300 72 257 62 60 43 36 260 61 64 242 250 49 237 26 45 26 55 28 25 17 71 16 62 18 200 220 24 $200 74 71 166 171 13 281 293 15 108 254 262 101 214 208 217 100 178 196 199 $100 185 155 177 157 78 138 59 0 $0 RV Share 53% 55% 59% 61% 63% 67% 69% 73% 75% 74% 78% 83% 82% 83% 83% Held by TT & 5th Wheel (1) Projection for 2011 is the latest published by the RVIA (June 2011). - 9 -

Recent RV Industry Trends Travel Trailers and 5th Wheel RVs, Drew’s primary RV market Units 300,000 All data includes both US and Canada. 275,000 Wholesale Retail 250,000 226,387 225,000 199,200 200,000 186,010 185,100 175,000 164,254 150,000 138,300 20,200 125,000 11,600 103,877 00,572 100,000 75,000 50,000 25,000 0 2008 2009 2010 YTD June 2011 YTD June 2010 Dealer Inventory (1) (41,287) (25,954) 13,190 16,323 (est.) 11,028 Change (1) RV retail data only available through May 2011.

Manufactured Housing (MH) Market ? Cost per sq. ft. is $41 for MH vs. $84 for site-built homes ? Average retail price of $63,100 for a 1,530 sq. ft. MH ? 9 million manufactured homes across the U.S. ? Improved quality, appearance and safety ? Studies have shown that MHs built since 1995 sustain no more damage in hurricanes than site-built homes ? Industry production was down 87% from 1998 to 2010.

MH – Industry Production Industry Drew’s Units (Units in thousands, Dollars in millions) Sales 400 Multi-Sections Single-Section Drew’s MH Sales $250 373 $221 $225 350 349 $220 $196 $200 $191 300 144 123 $185 $177 $175 251 $154 250 $147 $150 $152 $142 75 200 193 $134 $125 168 49 $96 $96 $100 150 147 $85 37 131 131 27 52 117 $75 229 226 34 96 100 33 176 82 31 $50144 30 131 50 104 97 95 84 19 20 $2565 21 520 $0 MH Share 61% 65% 70% 75% 78% 80% 74% 64% 72% 68% 63% 63% 59% 55% Held by Multi-Sections - 12 - There are no industry forecasts for the manufactured housing industry.

MH: Favorable Factors INDUSTRY: ? Demand ―Demand for quality, affordable housing is likely to increase ―Baby boomers retiring in increasing numbers ―Dealer and manufacturer inventory levels are reasonable ? Availability of financing is still an issue DREW: ? Drew remains profitable in MH Segment: 9.9% operating profit margin for the 12 months ended June 30, 2011 ? Increased focus on aftermarket driving sales growth – up 10% for the 12 months ended June 30, 2011 ? Drew’s content per manufactured home increased 3% to $1,434 for the twelve months ended June 30, 2011

SECTION III Strategy

Business Strategy ? Maximize profitability and return on assets through Strategic acquisitions New product introductions Market share growth Operational efficiencies Diversification to related industries ? This strategy accomplished through Outstanding customer service Motivating management through strong profit incentives Low cost manufacturing:Optimizing production efficiencies and implementing stringent cost controls Facility consolidations and fixed cost reductions Working capital management R & D efforts Disciplined and patient acquisition philosophy - 15 -

Acquisition Criteria ? Drew is a disciplined and patient acquirer ? Gain market share or add products from other suppliers through asset acquisitions ? Seek products or technologies that we can expand through our nationwide customer base and factory network ? Become an even more extensive supplier to our customers ? Consider acquisitions in similar markets, such as components for mid-size buses and trailers used to haul boats, horses, livestock, equipment and other cargo

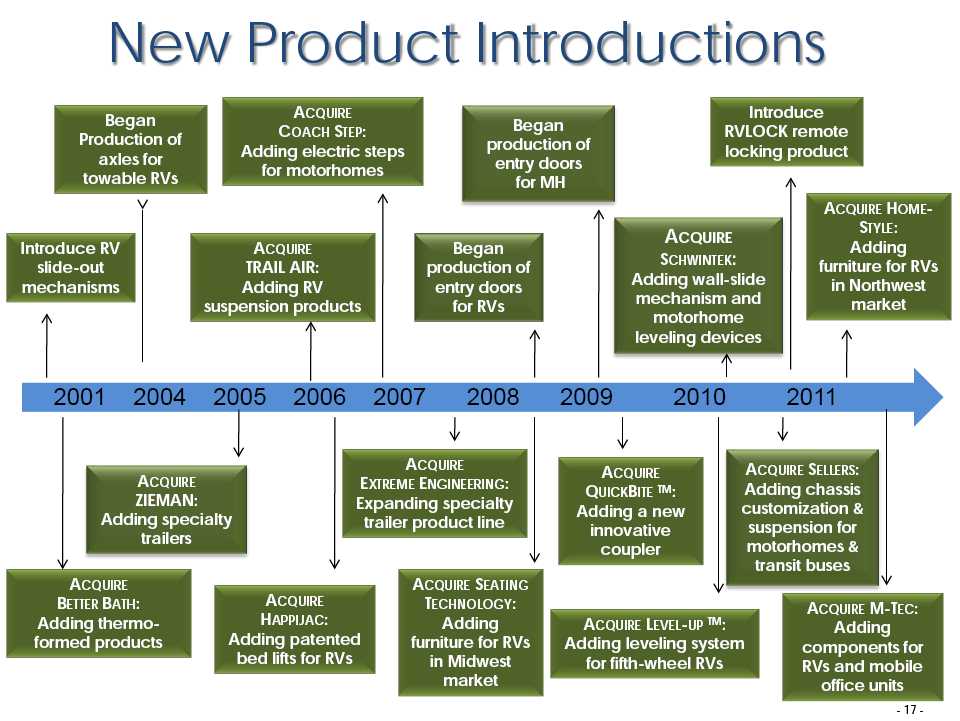

New Product Introductions Began ACQUIRE Introduce Began Production of COACH STEP: RVLOCK remote Adding electric steps production of locking product axles for entry doors towable RVs for motorhomes for MH ACQUIRE HOME-A STYLE: CQUIRE Introduce RV ACQUIRE Began Adding slide-out TRAIL AIR: production of SCHWINTEK: furniture for RVs mechanisms Adding RV entry doors Adding wall-slide in Northwest suspension products for RVs mechanism and market motorhome leveling devices 2001 2004 2005 2006 2007 2008 2009 2010 2011 ACQUIRE A ACQUIRE SELLERS: CQUIRE ACQUIRE EXTREME ENGINEERING: QUICKBITE TM: Adding chassis ZIEMAN: Expanding specialty customization & Adding a new Adding specialty trailer product line suspension for innovative trailers motorhomes & coupler transit buses ACQUIRE ACQUIRE SEATING BETTER BATH: ACQUIRE TECHNOLOGY: M T : ACQUIRE – EC Adding thermo- HAPPIJAC: Adding ACQUIRE LEVEL-UP TM: Adding formed products Adding patented furniture for RVs Adding leveling system components for bed lifts for RVs in Midwest for fifth-wheel RVs RVs and mobile market office units

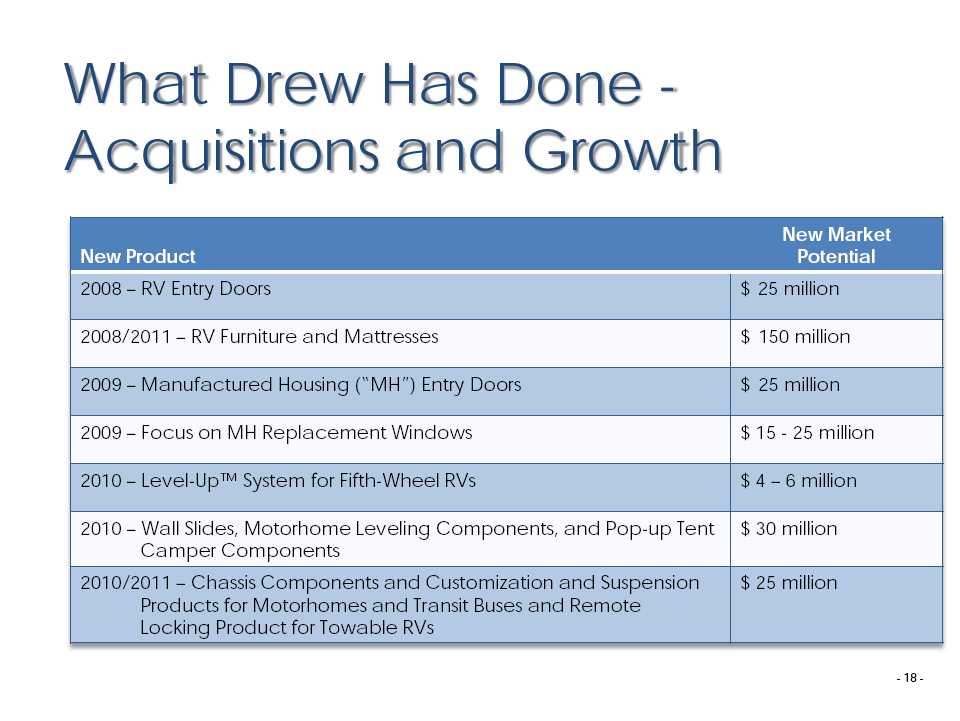

What Drew Has Done -Acquisitions and Growth New Market New Product Potential 2008 – RV Entry Doors $ 25 million 2008/2011 – RV Furniture and Mattresses $ 150 million 2009 – Manufactured Housing (“MH”) Entry Doors $ 25 million 2009 – Focus on MH Replacement Windows $ 15 - 25 million 2010 – Level-Up™ System for Fifth-Wheel RVs $ 4 – 6 million 2010 – Wall Slides, Motorhome Leveling Components, and Pop-up Tent $ 30 million Camper Components 2010/2011 – Chassis Components and Customization and Suspension $ 25 million Products for Motorhomes and Transit Buses and Remote Locking Product for Towable RVs

Content Per New Towable RV - 90+% of RV Segment sales are for Travel Trailers and Fifth-Wheel RVs - 100% market share in existing products would yield $4,500 to $5,000 per Towable RV - Growth in RV “features” drives content increases $2,229 $2,010 $1,847 $1,716 $1,542 $1,374 $1,281 $1,012 $862 $670 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 LTM RV Segment 6/11 operating profit margin 8.7% 10.0% 11.6% 9.7% 9.6% 8.3% 12.2% 6.7% 5.0% 9.3% 9.8% At industry production levels for the last 12 months ended June 2011, each $100 increase in content adds approximately $21 million in sales for Drew. - 19 - See Page 9 for Industry Information

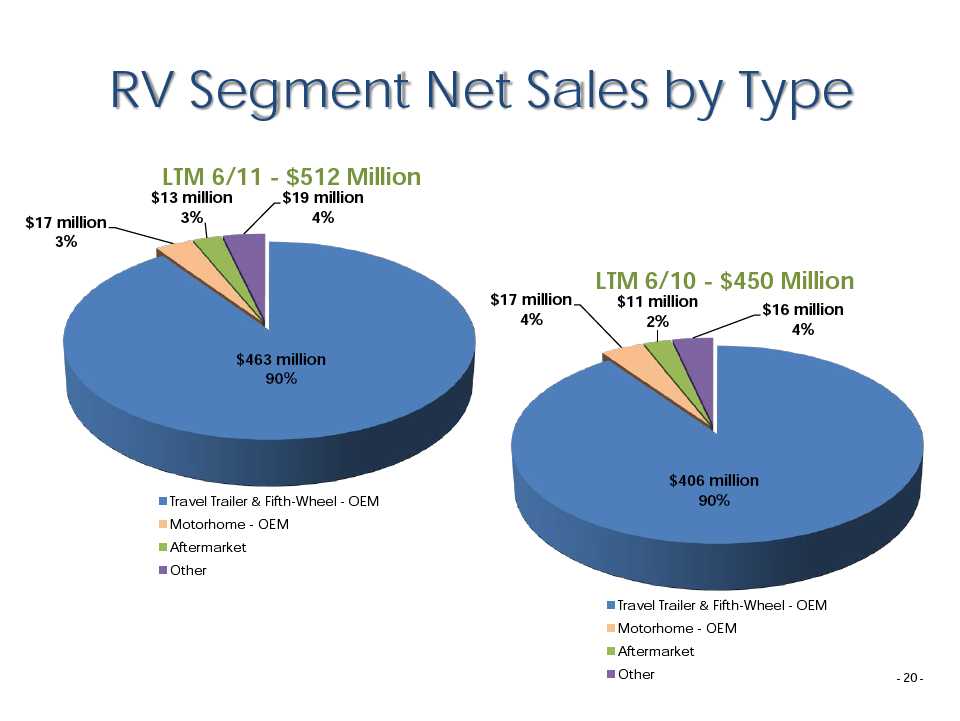

RV Segment Net Sales by Type LTM 6/11 - $512 Million $13 million $19 million $17 million 3% 4% 3% LTM 6/10 - $450 Million $17 million $11 million $16 million 4% 2% % $463 million 90% $406 million Travel Trailer & Fifth-Wheel - OEM 90% Motorhome – OEM Aftermarket Other Travel Trailer & Fifth-Wheel - OEM Motorhome – OEM Aftermarket Other - 20 -

Content Per New Manufactured Home - 100% market share in existing products would yield $3,600 to $4,000 per home - Affordability of the homes constrains content growth $1,666 $1,450 $1,429 $1,434 $1,373 $1,330 $1,333 $1,281 $871 $796 $663 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 LTM 6/11 Sections per home 1.77 1.81 1.83 1.78 1.68 1.76 1.71 1.65 1.65 1.61 1.58 MH Segment operating profit margin 10.4% 10.7% 10.5% 10.4% 10.3% 8.7% 8.1% 7.2% 3.8% 10.0% 9.9% - 21 - See Page 12 for Industry Information

MH Segment Net Sales by Type LTM 6/11 - $96 Million $11 million 11% $18 million 19% LTM 6/10 - $95 Million 8 million $15 million 8% 16% $67 million 70% OEM Aftermarket Other OEM Aftermarket Other

Compensation Plans Aggregate 2010 Compensation of Key Executives By Component 33% Cash vs. Equity 53% 14% 31% 69% Performance-Based Stock Options Salary & Other Equity Cash

SECTION IV Operating Results

What Drew Has Done -Cost Reductions • Consolidated more than 35 production facilities into other existing facilities since 2006, improving operating efficiencies. • These facility consolidations, along with reductions in salaried staff, changes in insurance, IT improvements, along with other cost saving measures have saved us: ($ in millions) 2006 $ 1 • Our compensation program 2007 $ 6 incentivizes management based on bottom line results 2008 $ 5 and return on investment. 2009 $ 9 2010 $ 1 • The majority of these cost savings are permanent. Total $ 22 • Cautiously added back $2 - $3 million of annualized fixed costs as demand improved. - 25 -

Operating Results Three Months Ended June 30, FINANCIAL PERFORMANCE ($ in millions, except EPS) 2010 2011 Change Net Sales $ 173.5 $ 186.0 7% Operating Profit $ 15.8 $ 17.9 13% % of Sales 9.1% 9.6% Net Income $ 9.6 $ 11.0 14% Diluted EPS $ 0.43 $ 0.49 14%

Operating Results Six Months Ended June 30, FINANCIAL PERFORMANCE ($ in millions, except EPS) 2010 2011 Change Net Sales $ 319.7 $ 354.9 11% Operating Profit $ 28.1 $ 33.5 19% % of Sales 8.8% 9.4% Net Income $ 16.9 $ 20.4 20% Diluted EPS $ 0.76 $ 0.91 20%

Results By Segment Three Months Ended June 30, FINANCIAL PERFORMANCE ($ in millions) 2010 2011 Change Net Sales: RV Segment $ 144.3 $ 157.2 9% MH Segment $ 29.2 $ 28.8 -1% Operating Profit: RV Segment $ 14.0 $ 17.3 24% MH Segment $ 3.7 $ 3.0 -21% Operating Profit as a Percentage of Net Sales: RV Segment 9.7% 11.0% MH Segment 12.8% 10.2%

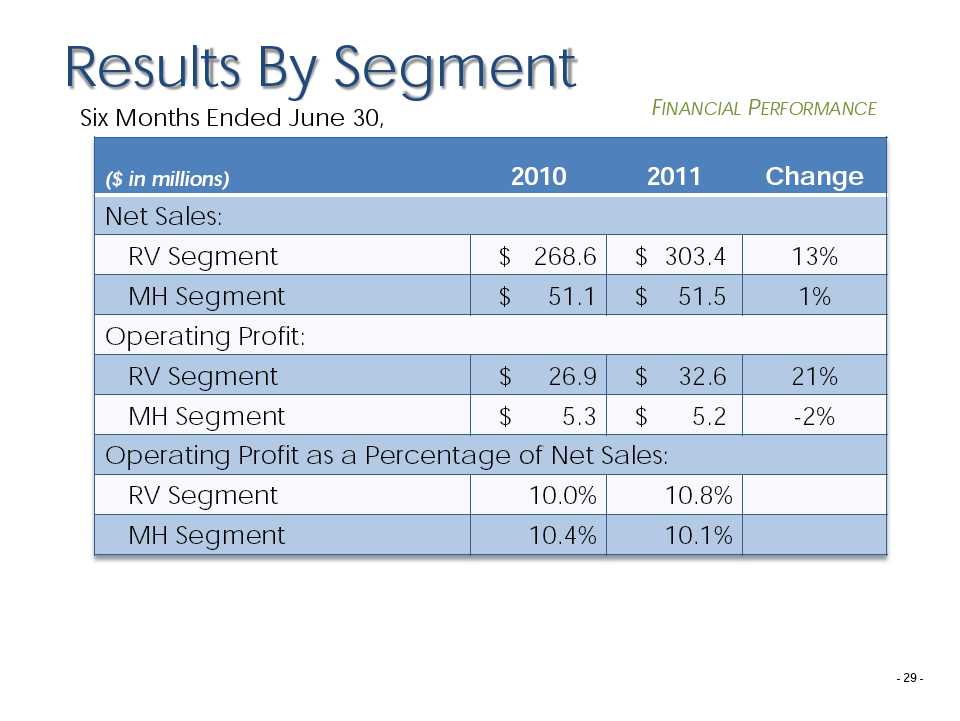

Results By Segment Six Months Ended June 30, FINANCIAL PERFORMANCE ($ in millions) 2010 2011 Change Net Sales: RV Segment $ 268.6 $ 303.4 13% MH Segment $ 51.1 $ 51.5 1% Operating Profit: RV Segment $ 26.9 $ 32.6 21% MH Segment $ 5.3 $ 5.2 -2% Operating Profit as a Percentage of Net Sales: RV Segment 10.0% 10.8% MH Segment 10.4% 10.1%

Net Sales Since 2007 FINANCIAL PERFORMANCE Q2 2007 – Q2 2011 ($ in millions) Q2 2007 $ 184.5 Industry-wide shipments: Travel Trailer and Fifth-Wheel RVs – 12% decline (14.2) Motorhomes – 51% decline (3.0) Manufactured Housing – 48% decline (19.2) Drew’s sales growth(1) 37.9 Q2 2011 $ 186.0 (1) Includes market share growth, new product introductions, acquisitions, as well as increased aftermarket sales and sales price increases.

What Drew Has Done -Strengthened Balance Sheet Cash and ($ in millions) Debt Investments Net Cash 12/31/08 $ 9 $ 9 $ -12/31/09 $ - $ 65 $ 65 12/31/10 $ - $ 44(1) $ 44(1) 6/30/11 $ - (3) $ 37(2) $ 37(2) (1) The Company completed four acquisitions in 2010 which utilized $22 million in cash. In addition, on December 28, 2010, the Company paid a special dividend of $1.50 per share of the Company’s Common Stock, or an aggregate of $33 million. (2) The Company completed one acquisition prior to June 30, 2011 which utilized $7 million in cash. In July 2011, the Company completed an additional acquisition which utilized $6 million in cash. (3) The Company had no borrowings during the six months ended June 30, 2011. Further, pursuant to a line of credit and a “shelf-loan” facility, $184.5 million is available to the Company.

Balance Sheet FINANCIAL PERFORMANCE ($ in millions) 6/30/08 6/30/09 6/30/10 6/30/11 Total Assets $ 352 $ 271 $ 351 $ 354 Total Debt $ 20 $ 1 $ - $ -Cash & Investments $ 43 $ 27 $ 58 $ 37 Stockholders’ Equity $ 267 $ 227 $ 263 $ 268(3) RATIOS Days Sales in A/R(1) 18 days 19 days 20 days 21 days Inventory Turns(2) 5.5 turns 3.5 turns 6.9 turns 6.2 turns (1) Days Sales in A/R is the most recent month’s net sales divided by accounts receivable, net, at the end of the period. (2) Inventory Turns is cost of goods sold for the last twelve months divided by average inventory for the last twelve months. (3) After cash dividend of $1.50 per share, or $33 million paid in December 2010. - 32 -

Cash Flow FINANCIAL PERFORMANCE Significant non-operating items since June 30, 2007 Acquisitions (10) $76 million Debt reduction $48 million Special dividend $33 million Stock repurchases $9 million Total $ 166 million

Financial Strength FINANCIAL PERFORMANCE 12/31/08 12/31/09 12/31/10 6/30/11 Return on Equity 6%(2) 2%(3) 11% 12% Return on Assets 4%(2) 2%(3) 9% 9% Total Debt to Equity 0.0 0.0 0.0 0.0 Total Debt to EBITDA(1) 0.2 0.0 0.0 0.0 (1) EBITDA is operating profit plus depreciation, amortization and goodwill impairment (see page 39). (2) Excludes a goodwill impairment charge of $5.5 million ($3.4 million after tax). (3) Excludes a goodwill impairment charge of $45.0 million ($29.4 million after tax).

The Future ? Increasing RV Content ? RV recovery from recession ? Demographic tailwind ? Exploring similar industries ? Affordable housing recovery

Stock Price History Drew has 22 million shares outstanding and a market capitalization of approximately $430 million as of August 2, 2011 50 $44 45 40 35 $28 30 25 $23 $27 $26 $21 $19 20 $18 15 $14 $12 10 $5 $3 $8 5 $6 0 2000 2001 2002 2003 2004 2005 2006 2007 10/5/07 2008 3/9/09 2009 2010 8/2/11 (December 31, unless noted)

Analyst Coverage Avondale Partners, LLC Bret Jordan – (617) 314-0487 CJS Securities Torin Eastburn – (914) 287-7600 Sidoti & Company, LLC Scott Stember – (212) 453-7017 Thompson Research Group Kathryn Thompson – (615) 891-6206

Thank you! For more information contact: Fredric M. Zinn Joseph S. Giordano III President and CEO CFO & Treasurer 914-428-9098 914-428-9098 fred@drewindustries.com joe@drewindustries.com OR VISIT OUR WEBSITE: www.drewindustries.com

Reconciliation of Operating Profit to EBITDA and EBITDASO FINANCIAL PERFORMANCE TM ($ in millions)` 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 6/30/11 Operating $ 20.3 $ 29.2 $ 34.3 $ 44.0 $ 57.7 $ 55.3 $ 66.0 $ 19.9 $ (35.6) $ 45.2 $ 50.8 Profit (Loss) Depreciation & $ 8.4 $ 7.3 $ 7.8 $ 9.3 $ 12.0 $ 15.7 $ 17.6 $ 17.1 $ 18.5 $ 17.1 $ 18.6 Amortization Goodwill $ - $ - $ - $ - $ - $ - $ - $ 5.5 $ 45.0 $ - $ -Impairment EBITDA $ 28.7 $ 36.5 $ 42.1 $ 53.3 $ 69.7 $ 71.0 $ 83.5 $ 42.5 $ 27.9 $ 62.5 $ 69.4 Stock-Based $ - $ 0.1 $ 0.4 $ 1.2 $ 1.5 $ 3.0 $ 2.5 $ 3.8 $ 3.6 $ 4.1 $ 5.6 Compensation EBITDASO $ 28.7 $ 36.6 $ 42.5 $ 54.5 $ 71.2 $ 74.0 $ 86.0 $ 46.3 $ 31.5 $ 66.6 $ 75.0 Capital Expenditures $ 8.2 $ 10.5 $ 5.1 $ 27.1 $ 26.1 $ 22.3 $ 8.8 $ 4.2 $ 3.1 $ 10.1 $ 16.2

Reconciliation of Segment Results to Consolidated F P INANCIAL ERFORMANCE ($ in millions) 12 Months Ended 2007 2008 2009 2010 6/30/11 Net Sales: RV Segment $ 491.8 $ 368.1 $ 312.5 $ 477.2 $ 512.0 MH Segment 176.8 142.4 85.3 95.6 95.9 Total Net Sales $ 668.6 $ 510.5 $ 397.8 $ 572.8 $ 607.9 Operating Profit: RV Segment $ 60.1 $ 24.6 $ 15.7 $ 44.4 $ 50.1 MH Segment 14.2 10.3 3.2 9.6 9.5 Total Segment Operating 74.3 34.9 18.9 54.0 59.6 Profit Corporate (7.8) (7.4) (6.5) (8.0) (8.1) Goodwill Impairment - (5.5) (45.0) - -Other Non-Segment Items (0.5) (2.1) (2.9) (0.6) (0.7) Total Operating Profit $ 66.0 $ 19.9 $ (35.6) $ 45.4 $ 50.8