Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - MCCLATCHY CO | Financial_Report.xls |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - MCCLATCHY CO | dex312.htm |

| EX-32.2 - SECTION 906 CFO CERTIFICATION - MCCLATCHY CO | dex322.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - MCCLATCHY CO | dex321.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - MCCLATCHY CO | dex311.htm |

| 10-Q - FORM 10-Q - MCCLATCHY CO | d10q.htm |

Exhibit 10.41

PURCHASE AND SALE AGREEMENT

BETWEEN

THE MCCLATCHY COMPANY, a Delaware corporation,

and RICHWOOD, INC., a Florida corporation

AND

BAYFRONT 2011 PROPERTY, LLC

MAY 26, 2011

EXHIBITS and SCHEDULES

| EXHIBITS |

||

| Exhibit “A” |

Description of Land | |

| Exhibit “A-1” |

Parcel 1 — Designated Subparcels for Purchase Price Allocation in Section 2.4 | |

| Exhibit “B” |

Intentionally Omitted | |

| Exhibit “C” |

List of Existing Commission Agreements and Management Agreement | |

| Exhibit “D” |

Rent Roll | |

| Exhibit “E” |

List of Operating Agreements | |

| Exhibit “F” |

Environmental Reports | |

| Exhibit “G” |

Miami Herald Lease and Guaranty | |

| Exhibit “H” |

Form of Amendment of License Agreement | |

| Exhibit “I” |

Form of Brown Mackie Termination Letter | |

| Exhibit “J” |

Form of Property Management Agreement | |

| SCHEDULES |

||

| Schedule 4.1(c) |

Violations | |

| Schedule 4.1(e) |

Leases | |

| Schedule 4.1(h) |

Compliance with Laws | |

| Schedule 4.1(n) |

Zoning | |

i

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (the “Agreement”), is made and entered into this day of May, 2011, by and between The McClatchy Company, a Delaware corporation (successor by merger with Knight-Ridder Newspapers, Inc., a Florida corporation and The Miami Herald Publishing Company, a Florida corporation) (“McClatchy”) and Richwood, Inc., a Florida corporation (together with McClatchy, hereinafter collectively the “Seller”), and Bayfront 2011 Property, LLC, a Delaware limited liability company (“Purchaser”).

W I T N E S E T H:

WHEREAS, Seller desires to sell certain improved real property located in Miami, Florida, together with certain related personal and intangible property, and Purchaser desires to purchase such real, personal and intangible property; and

WHEREAS, Seller intends to retain certain of the personal property located on the real property, including but not limited to its printing presses, business equipment and office furniture; and

WHEREAS, the Seller desires to remain in possession of a portion of the property for up to but not to exceed twenty four (24) months after the Closing Date pursuant to a lease to be entered into by Purchaser and Seller at the Closing of this Agreement; and

WHEREAS, the parties hereto desire to provide for said sale and purchase and lease on the terms and conditions set forth in this Agreement;

NOW, THEREFORE, for and in consideration of the premises, the mutual covenants and agreements hereinafter set forth, and for other good and valuable consideration, the receipt, adequacy, and sufficiency of which are hereby acknowledged by the parties hereto, the parties hereto hereby covenant and agree as follows:

ARTICLE 1.

DEFINITIONS

For purposes of this Agreement, each of the following capitalized terms shall have the meaning ascribed to such terms as set forth below:

“Affiliate” shall mean a Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the Person in question.

“Agreement” shall have the meaning ascribed thereto in the Preamble hereof.

“Amendment Fee” shall have the meaning ascribed thereto in Section 11.15 hereof.

“Amendment Fee Reimbursement” shall have the meaning ascribed thereto in Section 11.15 hereof.

1

“Amendments of License Agreements” shall mean that certain agreement to be executed by Seller and FUEL MIAMI LLC, a New York limited liability company, for each of the License Agreements in the form attached hereto as Exhibit “H”.

“Approval” shall have the meaning ascribed thereto in Section 6.2(d) hereof.

“Approval Date” shall have the meaning ascribed thereto in Section 6.2(d) hereof.

“Assignment and Assumption of Leases” shall mean the Assignment and Assumption of Leases and Security Deposits to be executed and delivered by Seller and Purchaser at the Closing.

“Bill of Sale” shall have the meaning ascribed thereto in Section 5.1(b) hereof.

“Board of Directors” shall have the meaning ascribed thereto in Section 6.2(d) hereof.

“Boulevard Shops” shall have the meaning ascribed thereto in Section 4.1 hereof.

“Brown Mackie” shall mean Brown Mackie College-Miami, Inc., a Florida corporation, d/b/a Brown Mackie College-Miami.

“Brown Mackie Lease” shall mean that certain Lease Agreement dated as of March 9, 2009 between Brown Mackie, as tenant, and the Seller, as landlord, as amended by that certain Letter Agreement Amendment dated as of November 16, 2010 between Brown Mackie and Seller.

“Brown Mackie Receipt Date” shall have the meaning ascribed thereto in Section 6.2(h) hereof.

“Brown Mackie Termination Evidence” shall have the meaning ascribed thereto in Section 6.2(h) hereof.

“Brown Mackie Termination Fee” shall mean the “Landlord Termination Fee” as that term is defined in Section 33.21(a) of the Brown Mackie Lease.

“Brown Mackie Termination Letter” shall mean that certain letter to be executed by Seller and addressed to Brown Mackie in the form attached hereto as Exhibit “I”.

“Business Day” shall mean any day other than a Saturday, Sunday or other day on which banking institutions in the State of Florida, County of Miami-Dade, are authorized by law or executive action to close.

“Claims” shall have the meaning ascribed thereto in Section 3.6 hereof.

“Closing” shall have the meaning ascribed thereto in Section 2.5 hereof.

“Closing Date” shall have the meaning ascribed thereto in Section 6.2(l)(i) hereof.

2

“Closing Deliveries Notice” shall have the meaning ascribed thereto in Section 6.2(f) hereof.

“Closing Escrow Deliveries” shall have the meaning ascribed thereto in Section 6.2(f) hereof.

“Coast Guard Lease” shall have the meaning ascribed thereto in Section 6.1(d) hereof.

“Commission Agreements” shall have the meaning ascribed thereto in Section 4.1(f) hereof, and such agreements are more particularly described on EXHIBIT “C” attached hereto and made a part hereof.

“CREC Leasing Agreement” shall mean that certain Leasing Agreement dated as of August 18, 2008 between MHMC and Continental Real Estate Companies Commercial Properties Corporation, a Florida corporation.

“Deed” shall have the meaning ascribed thereto in Section 5.1(a) hereof.

“Effective Date” shall mean the last date upon which Purchaser and Seller shall have executed this Agreement and delivered it to Escrow Agent pursuant to Section 6.2 hereof.

“Environmental Law” shall mean any law, ordinance, rule, regulation, order, judgment, injunction or decree relating to pollution or substances or materials which are considered to be hazardous or toxic, including, without limitation, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Hazardous Materials Transportation Act, the Clean Water Act, the Toxic Substances Control Act, the Emergency Planning and Community Right to Know Act, any state and local environmental law, all amendments and supplements to any of the foregoing and all regulations and publications promulgated or issued pursuant thereto.

“Environmental Reports” means those reports, studies and correspondence identified on Exhibit “F” attached hereto and made a part hereof.

“Escrow Agent” shall mean Fidelity National Title Insurance Company at its office at 15951 S.W. 41st Street, Suite 800, Weston, Florida 33331, Attention: Alan S. Weissman.

“Escrow Funds” shall have the meaning ascribed thereto in Section 11.10(a) hereof.

“Escrow Items” shall have the meaning ascribed thereto in Section 11.10 hereof.

“FIRPTA Affidavit” shall have the meaning ascribed thereto in Section 5.1(h) hereof.

“Forty-Year Recertification” shall mean that certain inspection and the work required thereunder or as a result thereof for the Boulevard Shops pursuant to Section 8-11(f) of the Code of Miami-Dade County, Florida.

3

“General Assignment” shall have the meaning ascribed thereto in Section 5.1(f) hereof.

“Good Faith Deposit” shall have the meaning ascribed thereto in Section 6.2(c) hereof.

“Guaranty” shall have the meaning ascribed thereto in Section 2.6 hereof.

“Hazardous Substances” shall mean any and all pollutants, contaminants, toxic or hazardous wastes or any other substances that might pose a hazard to health or safety, the removal of which may be required or the generation, manufacture, refining, production, processing, treatment, storage, handling, transportation, transfer, use, disposal, release, discharge, spillage, seepage or filtration of which is or shall be restricted, prohibited or penalized under any Environmental Law (including, without limitation, lead paint, asbestos, urea formaldehyde foam insulation, petroleum, polychlorinated biphenyls, mold, and fungus and Chinese Drywall).

“Improvements” shall mean all buildings, structures and improvements now or on the Closing Date situated on the Land, including without limitation, all parking areas and facilities, improvements and fixtures located on the Land.

“Intangible Property” shall mean all intangible property, if any, owned by Seller and related to the Land and Improvements, including without limitation, Seller’s rights and interests, if any, in and to the following (to the extent assignable): (a) all assignable plans and specifications and other architectural and engineering drawings for the Land and Improvements; (b) all assignable warranties or guaranties given or made in respect of the Improvements or Personal Property; (c) all transferable consents, authorizations, variances or waivers, licenses, permits and approvals from any governmental or quasi-governmental agency, department, board, commission, bureau or other entity or instrumentality solely in respect of the Land or Improvements or the development of the Property; and (d) all of Seller’s right, title and interest in and to all assignable Operating Agreements that Purchaser agrees to assume. Notwithstanding the above, the term Intangible Property does not include the right to any trademarks or tradenames owned by Seller, including specifically, the names “The Miami Herald” and “The Nuevo Herald”, or any rights, title or interest to any business operations related to the Miami Herald, the Nuevo Herald, or Affiliates.

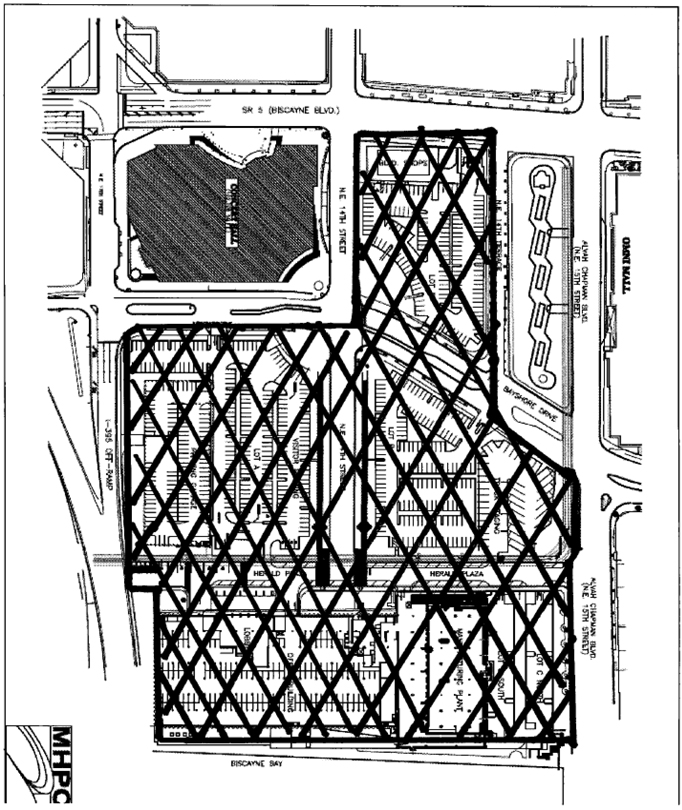

“Land” shall mean those certain tracts or parcels of real property located in the City of Miami, Miami-Dade County, Florida, which are more particularly described on EXHIBIT “A” attached hereto and made a part hereof, together with all rights, privileges and easements appurtenant to said real property, and all right, title and interest of Seller, if any, in and to any land lying in the bed of any street, road, alley or right-of-way, open or closed, adjacent to or abutting the Land.

“Lease” and “Leases” shall mean the occupancy leases, occupancy agreements and advertising licenses, including those in effect on the Effective Date which are more particularly identified on EXHIBIT “D” attached hereto and made a part hereof, and any new leases or agreements entered into after the Effective Date with Purchaser’s consent and approval which as of the Closing affect all or any portion of the Land or Improvements.

4

“License Agreements” shall mean that certain Outdoor Advertising Space License dated as of February 25, 2008 between the MHMC and FUEL MIAMI LLC, a New York limited liability company, as amended by that certain Letter Amendment dated as of May 19, 2011 and that certain Outdoor Advertising Space License last executed February 4, 2009 between MHMC and FUEL MIAMI LLC, as amended by that certain letter agreement dated September 24, 2010 and that certain Letter Amendment dated as of May 19, 2011.

“Management Agreement” shall have the meaning ascribed thereto in Section 4.1(f) hereof and is more particularly described on EXHIBIT “C” attached hereto and made a part hereof.

“McClatchy” shall have the meaning ascribed thereto in the Preamble of this Agreement.

“Miami Herald Lease” shall have the meaning ascribed thereto in Section 2.6 hereof.

“MHMC” shall mean Miami Herald Media Company, a Delaware corporation, and wholly-owned subsidiary of McClatchy.

“Monetary Objection” or “Monetary Objections” shall mean (a) any mortgage, deed to secure debt, deed of trust or similar security instrument encumbering all or any part of the Property, (b) any mechanic’s, materialman’s or similar lien (unless resulting from any act or omission of Purchaser or any of its agents, contractors, representatives or employees), (c) the lien of ad valorem real or personal property taxes, assessments and governmental charges affecting all or any portion of the Property which are delinquent, and (d) any judgment or tax warrant of record against Seller in the county or other applicable jurisdiction in which the Property is located.

“Operating Agreements” shall mean all those certain contracts and agreements more particularly described on EXHIBIT “E” attached hereto and made a part hereof relating to the repair, maintenance or operation of the Land, Improvements or Personal Property which will extend beyond the Closing Date, including, without limitation, all equipment leases.

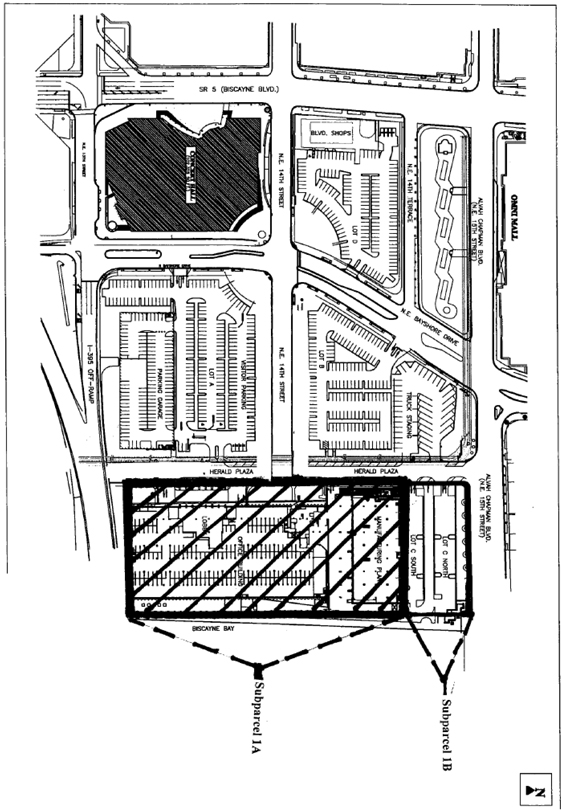

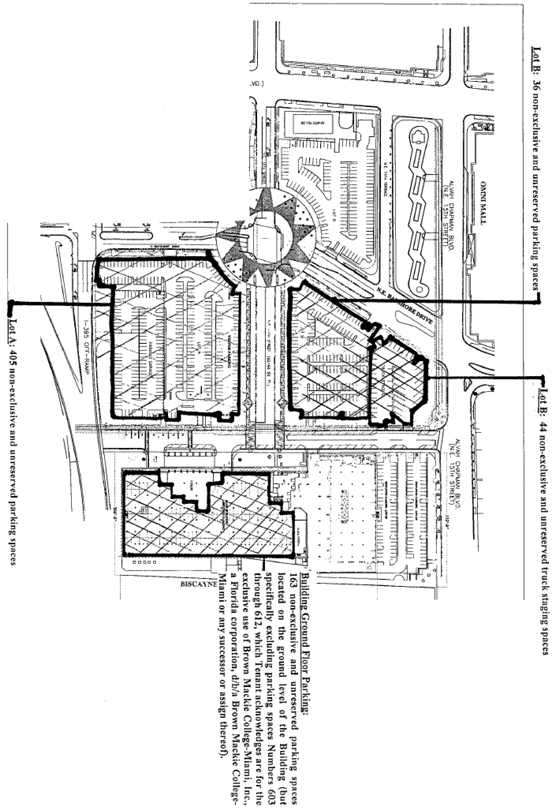

“Parcel” or “Parcels” shall mean those portions of the Land as identified individually as “Parcel 1”, “Parcel 2”, “Parcel 3A” and Parcel 3B” on EXHIBIT “A” attached hereto or two or more such portions as “Parcels” collectively. Solely for purposes of the Purchase Price allocation in Section 2.4 hereof, Parcel 1 may be further divided into Subpart 1A and Subpart 1B as shown on EXHIBIT “A-1” attached hereto and made a part hereof.

“Party” or “Parties” shall mean each of Seller and Purchaser and collectively, the Seller and Purchaser.

“Permitted Exceptions” shall mean, collectively, (a) liens for taxes, assessments and governmental charges not yet due and payable or due and payable but not yet delinquent, (b) the Leases and the Miami Herald Lease, (c) any matters identified in the Title Commitment and Survey as of the Effective Date as set forth in Section 3.3 of this Agreement, and (d) such other easements, restrictions and encumbrances that are approved by Purchaser.

5

“Person” shall mean any individual, sole proprietorship, partnership, joint venture, trust, unincorporated organization, association, corporation, limited liability company, institution, entity, party or government (whether federal, state, county, city or otherwise, including, without limitation, any instrumentality, division, agency, body or department thereof).

“Personal Property” shall mean all currently installed floor and window coverings, including, without limitation, carpeting and draperies, and all appliances, machinery, apparatus and equipment that is (a) owned by Seller and (b) currently used exclusively in the operation, repair and/or maintenance of the Land and Improvements and situated thereon, and all non-confidential books, records and files relating to the design, construction, operation or maintenance of the Land and Improvements. The Personal Property does not include any personal property used by Seller in its trade or business (unless used exclusively in the operation, repair and/or maintenance of the Land and Improvements) nor any personal property owned by tenants, contractors or licensees.

“Pre-Closing Delivery Date” shall have the meaning ascribed thereto in Section 6.2(a) hereof.

“Property” shall have the meaning ascribed thereto in Section 2.1 hereof.

“Property Management Agreement” shall mean that certain property management agreement attached hereto in the form of EXHIBIT “J”.

“Purchase Price” shall be the amount specified in Section 2.4 hereof.

“Purchaser” shall have the meaning ascribed in the Preamble hereof.

“Purchaser Indemnifiable Damages” shall have the meaning ascribed thereto in Section 4.3 hereof.

“Purchaser’s Escrow Deliveries” shall have the meaning ascribed thereto in Section 6.2(f) hereof.

“Relocation Costs” shall have the meaning ascribed thereto in Section 2.7 hereof.

“Relocation Deposit” shall have the meaning ascribed thereto in Section 2.7 hereof.

“Rent Roll” shall mean EXHIBIT “D” attached to this Agreement and made a part hereof.

“Security Deposits” shall mean any security deposits, rent or damage deposits or similar amounts (other than rent paid for the month in which the Closing occurs) actually held by Seller with respect to any of the Leases.

“Seller” shall have the meaning ascribed thereto in the Preamble hereof.

“Seller Certificate” shall have the meaning ascribed thereto in Section 6.1(d) hereof.

6

“Seller Indemnifiable Damages” shall have the meaning ascribed thereto in Section 4.1 hereof.

“Seller’s Affidavit” shall have the meaning ascribed thereto in Section 5.1(g) hereof.

“Seller’s Escrow Deliveries” shall have the meaning ascribed thereto in Section 6.2(b) hereof.

“Seller’s Request” shall have the meaning ascribed thereto in Section 2.7 hereof.

“Siffin Litigation” shall have the meaning ascribed thereto in Section 4.1(d) hereof.

“Survey” shall have the meaning ascribed thereto in Section 3.3 hereof.

“Taxes” shall have the meaning ascribed thereto in Section 5.4(a) hereof.

“Temporary License Agreement” shall have the meaning ascribed thereto in Section 3.1(a) hereof.

“Tenant Estoppel Certificate” or “Tenant Estoppel Certificates” shall mean certificates to be obtained from the tenants under the Leases containing the information set forth in Section 6.1(d) and otherwise reasonably acceptable to Purchaser.

“Tenant Inducement Costs” shall mean any out-of-pocket payments required under a Lease to be paid by the landlord thereunder to or for the benefit of the tenant thereunder which is in the nature of a tenant inducement, including specifically, but without limitation, tenant improvement costs, lease buyout payments, and moving, design and refurbishment allowances and costs. The term “Tenant Inducement Costs” shall also include any free or reduced rental period.

“Tenant Notices of Sale” shall have the meaning ascribed thereto in Section 5.1(p) hereof.

“Title Company” shall mean Fidelity National Title Insurance Company or other national title insurance company acceptable to Purchaser.

“Title Commitment” shall have the meaning ascribed thereto in Section 3.3 hereof.

ARTICLE 2.

PURCHASE AND SALE

2.1 Agreement to Sell and Purchase. Subject to and in accordance with the terms and provisions of this Agreement, Seller agrees to sell and Purchaser agrees to purchase, the following property (collectively, the “Property”):

(a) the Land;

(b) the Improvements;

7

(c) all of Seller’s right, title and interest in and to the Leases, any guaranties of the Leases and the Security Deposits;

(d) the Personal Property; and

(e) the Intangible Property.

2.2 Permitted Exceptions. The Property shall be conveyed subject to the Permitted Exceptions.

2.3 Intentionally Deleted.

2.4 Purchase Price. Subject to adjustments and credits as otherwise specified in this Section 2.4 and elsewhere in this Agreement, the purchase price (the “Purchase Price”) to be paid by Purchaser to Seller for the Property shall be Two Hundred Thirty Million and no/100 Dollars ($230,000,000.00 U.S.). The Parties hereby agree that the Purchase Price shall be allocated to the portions of the Property as follows: a) all of Subparcel 1A: $92,789,149.00; b) all of Parcel 2, plus Subparcel 1B plus Parcel 3A: $119,022,891.00; c) all of Parcel 3B: $13,468,266.00 for land and $4,719,694.00 for building improvements. Subject to Section 6.2, the Purchase Price shall be paid by Purchaser to Seller at the Closing by wire transfer of immediately available federal funds to an account designated by Seller, subject to prorations, adjustments and credits as otherwise specified in this Agreement.

2.5 Closing. The consummation of the sale by Seller and purchase by Purchaser of the Property (the “Closing”) shall occur on the Closing Date. If on the Closing Date, insurance underwriting is suspended, Purchaser may postpone closing up to three (3) days after the insurance suspension is lifted.

2.6 Miami Herald Lease. Seller shall be permitted to retain possession of certain portions of the Land and Improvements for up to twenty-four (24) months after Closing pursuant to a lease to be entered into by MHMC and Purchaser (the “Miami Herald Lease”) at Closing in the form attached hereto as EXHIBIT “G” and made a part hereof, which such Lease shall be guaranteed by McClatchy pursuant to that certain Guaranty attached to the Miami Herald Lease (the “Guaranty”). The Miami Herald Lease shall, among other provisions, identify the areas of the Property to be occupied by Seller or its Affiliates as necessary to conduct its operations, including the warehouse and production space, certain parking areas and approximately 130,000 rentable square feet of office space as provided for in the attached Miami Herald Lease. Seller and Purchaser agree for a period of thirty (30) days after the Effective Date to reasonably cooperate to amend the Miami Herald Lease and/or the Property Management Agreement with respect to the Operating Expenses and Taxes (as each is defined in the Miami Herald Lease) with such non-material amendments as reasonably requested by the other Party. Additionally, the Seller and Purchaser agree following the Closing to discuss in good faith the terms on which Seller, MHMC and Purchaser would be prepared to work together on continuing to offer temporary banner advertising on the south façade of the building located at One Herald Plaza, Miami, Florida.

2.7 Relocation Deposit. At the Closing, the Purchaser shall deposit with Escrow Agent, the sum of Six Million Dollars ($6,000,000.00) (the “Relocation Deposit”) to be

8

held pursuant to Section 11.10 hereof. The purpose of the Relocation Deposit is to pay a portion of the costs to be incurred by Seller in connection with Seller’s relocation of its printing operations at the Premises to another location in Florida, which may include, without limitation, land acquisition, architectural and design work, site preparation, construction, tenant improvements, relocation costs, engineering work, and equipment purchase or rental costs required for such relocation (the “Relocation Costs”). At such time as Seller has commenced construction of a new building to house its printing operations or commenced the retrofitting of an existing facility to house its printing operations, Seller shall submit to Purchaser a requisition (the “Seller’s Request”) for payment of the Relocation Deposit, together with delivery of bona fide good faith evidence of the commencement of such new construction or retrofitting construction. So long as Seller delivers such evidence to Purchaser together with Seller’s Request, Purchaser shall have no right to deny such requisition and Seller shall be entitled to instruct Escrow Agent to disburse all of the proceeds from the Relocation Deposit (other than any interest which shall be paid to Purchaser and any amounts deducted from the Relocation Deposit as provided below) to Seller and both parties agree to enter into written directions to the Escrow Agent if so requested by the Escrow Agent. Prior to such disbursement, Purchaser shall be entitled to all interest earned on the Relocation Deposit and Seller shall have no rights thereto. Notwithstanding the above, the Parties agree that, so long as any portion of the Relocation Deposit is held by the Escrow Agent, any such amounts of the Relocation Deposit are subject to the terms and conditions of Section 38 of the Miami Herald Lease and that any amounts claimed under Section 38 of the Miami Herald Lease or deducted from the Relocation Deposit to satisfy the provisions of such Section 38 of the Miami Herald Lease shall not be required to be disbursed to Seller by Escrow Agent or replenished by Purchaser and shall be deemed to be a dollar-for-dollar reduction in the amount of the Relocation Deposit.

ARTICLE 3.

Purchaser’s Inspection and Review Rights

3.1 Due Diligence Inspections.

(a) Prior to the Effective Date, Seller has permitted Purchaser and its authorized representatives to inspect the Property to perform due diligence, soil analysis and environmental investigations (including but not limited to such reasonable invasive testing and sampling as recommended by Purchaser’s consultants), to examine the records of Seller with respect to the Property, and make copies thereof, at such times during normal business hours as Purchaser or its representatives requested but with sufficient prior notice to Seller to enable Seller to have their representatives present during any such inspections, pursuant and subject to the terms of that certain Temporary License Agreement dated as of April 18, 2011, between Purchaser and Seller (the “Temporary License Agreement”), the terms and conditions of which are hereby incorporated by reference. All inspection fees, appraisal fees, engineering fees and all other costs and expenses of any kind incurred by Purchaser relating to the inspection of the Property shall be solely Purchaser’s expense.

(b) Without limiting the generality of the terms of the Temporary License Agreement, to the extent that Purchaser or any of its representatives, agents or contractors damages or disturbs the Property or any portion thereof, Purchaser shall return the same to substantially the same condition which existed immediately prior to such damage or disturbance.

9

Purchaser hereby agrees to and shall indemnify, defend and hold harmless Seller from and against any and all expense, loss or damage which Seller may incur (including, without limitation, reasonable attorney’s fees actually incurred) as a result of any act or omission of Purchaser or its representatives, agents or contractors, other than any expense, loss or damage to the extent arising from any act or omission of Seller during any such inspection and other than any expense, loss or damage resulting from the discovery or release of any Hazardous Substances at the Property (other than Hazardous Substances brought on to the Property by Purchaser or its representatives, agents or contractors). Purchaser provided Seller with proof of insurance during its prior inspections of the Property. This Section 3.1(b) shall survive the Closing of this Agreement.

3.2 Seller’s Deliveries to Purchaser; Purchaser’s Access to Seller’s Property Records.

(a) Seller has delivered to Purchaser or made available the following items to Purchaser and Purchaser’s Agents, to the extent such items are in Seller’s or Seller’s Affiliates’ current actual possession:

| (i) | 2010 Operating Budgets with respect to the Property. |

| (ii) | Copies of all Leases, guarantees, any amendments and letter agreements relating thereto. Copies of the financial statements or other financial information of any tenants under the Leases (and the Lease guarantors, if any), written information relative to the tenants’ payment histories, and tenant correspondence. |

| (iii) | Copies of the Commission Agreements. |

| (iv) | Evidence of payment of all sales and use taxes on the rents received from tenants under the Leases. |

| (v) | All material Operating Agreements currently in place at the Property. |

| (vi) | A copy of Seller’s (or its Affiliate’s) current policy of title insurance with respect to the Land and Improvements with copies of all matters listed as title exceptions in such policy. |

| (vii) | A copy of any surveys of the Property. |

| (viii) | Copies of all notes and other instruments evidencing or securing the existing indebtedness encumbering the Property. |

| (ix) | Copy of current insurance coverage and insurance bill. |

| (x) | Copy of last engineering report conducted for the Property. |

10

| (xi) | Copies of any existing environmental reports or other materials related to investigations, studies or correspondence with governmental agencies concerning the presence or absence of Hazardous Substances on, in or under the Property. |

| (xii) | Copies of any permits, licenses, or other similar documents in Seller’s possession relating to the use, occupancy or operation of the Property. |

| (xiii) | All available construction plans and specifications in Seller’s possession relating to the development, condition, repair and maintenance of the Property, the Improvements and the Personal Property. |

| (xiv) | Copies of all available records of any operating costs and expenses for the Property in Seller’s possession (including but not limited to existing insurance policies). |

| (xv) | Copies of such other information or reports related to the Property as Purchaser may reasonably request. |

3.3 Title and Survey. Purchaser has ordered at its expense through the Purchaser’s counsel or the Escrow Agent a preliminary title commitment with respect to the Property (the “Title Commitment”). Purchaser has also obtained, also at its expense, a survey of the Property (the “Survey”). Any matters identified in the Title Commitment and Survey as of the Effective Date shall be deemed to be Permitted Exceptions. Notwithstanding anything to the contrary contained elsewhere in this Agreement, Seller shall be obligated to cure or satisfy all Monetary Objections at or prior to Closing, and Purchaser may use the proceeds of the Purchase Price at Closing for such purpose.

3.4 Operating Agreements. All Operating Agreements identified on EXHIBIT “E” attached hereto shall be retained in the name of the Seller following Closing. Seller shall indemnify and hold Purchaser harmless from all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) that may be incurred by Purchaser in connection with any of the Operating Agreements. Upon the expiration or earlier termination of the Miami Herald Lease or provided Purchaser notifies Seller with no less than sixty (60) days’ notice of its intention to assume any particular Operating Agreement, Seller shall assign to Purchaser all Operating Agreements then in effect that are requested by Purchaser to be assigned to it and will terminate all other Operating Agreements at no cost to Purchaser. This Section 3.4 shall survive the Closing of this Agreement.

3.5 Intentionally Omitted.

3.6 Condition of the Property. Purchaser and Seller mutually acknowledge and agree that except as otherwise set forth in this Agreement, the Property is being sold in an “AS IS” condition, “WITH ALL FAULTS,” known or unknown, contingent or existing. Purchaser had the sole responsibility to fully inspect the Property, to investigate all matters relevant thereto, including, without limitation, the condition of the Property, and to reach its own, independent evaluation of any risks or rewards associated with the ownership, leasing, management and operation of the Property.

11

This Agreement, the Exhibits and the Schedules attached hereto contain all the terms of the agreement entered into between the parties, and Purchaser acknowledges that neither Seller nor any representatives of Seller has made any representations or held out any inducements to Purchaser, other than those expressly set forth in this Agreement. Without limiting the generality of the foregoing, Purchaser has not relied on any representations or warranties except for those expressly set forth in this Agreement and neither Seller nor its representatives made any representations or warranties, in either case express or implied, except as set forth in this Agreement, as to (i) the current or future real estate tax liability, assessment or valuation of the Property; (ii) the potential qualification of the Property for any and all benefits conferred by federal, state or municipal laws, whether for subsidies, special real estate tax treatment, insurance, mortgages, or any other benefits, whether similar or dissimilar to those enumerated; (iii) the compliance of the Property, in its current or any future state, with applicable zoning ordinances and the ability to obtain a change in the zoning or a variance in respect to the Property’s non-compliance, if any, with said zoning ordinances; (iv) the availability of any financing for the purchase, alteration, rehabilitation or operation of the Property from any source, including but not limited to, state, city, or federal government or any institutional lender; (v) the current or future use of the Property; (vi) the physical condition of the Property including, without limitation, any environmental conditions (including the presence of asbestos or other Hazardous Substances) which may exist; or (viii) the accuracy of any due diligence materials.

Without limiting the above, Purchaser on behalf of itself and its successors and assigns waives and releases Seller and Seller’s Affiliates and agents and their respective successors and assigns from any and all demands, Claims, legal or administrative proceedings, losses, liabilities, damages, penalties, fines, liens, judgments, costs or expenses whatsoever (including, without limitation, attorneys’ fees and costs), whether direct or indirect, known or unknown, foreseen or unforeseen, arising from or relating to the physical condition of the Property or any law or regulation applicable thereto; provided however Purchaser specifically does not waive or release Seller from any and all demands, Claims, legal or administrative proceedings, losses, liabilities, damages, penalties, fines, liens, judgments, costs or expenses whatsoever (including, without limitation, attorneys’ fees and costs) related to the presence or alleged presence of Hazardous Substances in, on, under or about the Property, including, without limitation, any Claims under or on account of (i) the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as the same may have been or may be amended from time to time, and similar state statutes, and any rules and regulations promulgated thereunder, (ii) any other federal, state or local law, ordinance, rules or regulation, now or hereafter in effect, that deals with or otherwise in any manner relates to, environmental, natural resources, or health and safety matters of any kind, or (iii) this Agreement or the common law unless the location and type of any such Hazardous Substances are specifically identified in the Environmental Reports. For purposes of clarification and by way of example, if Hazardous Substances are found after Closing in a location and of a type that is consistent with the identification of such Hazardous Substances in one or more of the Environmental Reports, Purchaser shall be deemed to have waived its right to take any action against Seller under this Agreement related to such Hazardous Substances. If, on the other hand, Hazardous Substances are found in a location or of a type not identified in any of the Environmental Reports, then Purchaser shall not be deemed to have waived its rights against

12

Seller under this Agreement related to the reporting, investigation, assessment, cleanup, remediation, monitoring, third party liability or any Claims of or related to any such Hazardous Substances.

As used in this Agreement, “Claims” mean any claim, demand, lien, agreement, contract, covenant, action, suit, cause of action (whether based on statutory or common law theories), obligation, loss, cost, expense (including, without limitation, reasonable attorneys’ fees (whether or not litigation is commenced), penalty, damages, order or other liability, of any kind whatsoever, whether at law of in equity, fixed or contingent, known or unknown, and whether accruing now or in the future).

ARTICLE 4.

REPRESENTATIONS, WARRANTIES AND OTHER AGREEMENTS

4.1 Representations and Warranties of Seller. Subject to the limitations set forth in Section 3.6 above, and subject to the matters described in the schedules attached hereto, Seller represents and warrants to Purchaser as of the Effective Date as follows:

(a) Organization, Authorization and Consents. The McClatchy Company is a duly organized and validly existing corporation under the laws of the State of Delaware and Richwood, Inc. is a duly organized and validly existing corporation under the laws of the State of Florida. Seller has the right, power and authority to enter into this Agreement and to convey the Property in accordance with the terms and conditions of this Agreement, to engage in the transactions contemplated in this Agreement and to perform and observe the terms and provisions hereof.

(b) Action of Seller, Etc. Seller has taken all necessary action to authorize the execution, delivery and performance of this Agreement, and upon the execution and delivery of any document to be delivered by Seller on or prior to the Closing, this Agreement and such document shall constitute the valid and binding obligation and agreement of Seller, enforceable against Seller in accordance with its terms.

(c) No Violations of Agreements. Except as provided in Schedule 4.1(c) hereto, neither the execution, delivery or performance of this Agreement by Seller, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under, or result in the creation of any lien, charge or encumbrance upon the Property or any portion thereof pursuant to the terms of any indenture, deed to secure debt, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which Seller is bound.

(d) Litigation. No investigation, action or proceeding is pending or, to Seller’s knowledge, threatened, which (i) if determined adversely to Seller, would affect the use or value of the Property or Seller’s ability to transfer title to the Property to Purchaser free and clear of any encumbrances other than the Permitted Exceptions, or (ii) questions the validity of this Agreement or any action taken or to be taken pursuant hereto, or (iii) involves condemnation or eminent domain proceedings involving the Property or any portion thereof. Notwithstanding the foregoing, Seller has disclosed to Purchaser the current litigation filed by The McClatchy Company against Mark Siffin under Case No. 11-07383 CA 21, in the Circuit Court of the Eleventh Judicial Circuit in and for Miami-Dade County, Florida (the “Siffin Litigation”).

13

(e) Existing Leases. (i) Other than the Leases listed in the Rent Roll, Seller has not entered into any contract or agreement with respect to the occupancy or sale of the Property or any portion or portions thereof which will be binding on Purchaser after the Closing; (ii) the copies of the Leases heretofore delivered by Seller to Purchaser are true, correct and complete copies thereof; (iii) except as provided on Schedule 4.1(e) attached hereto, the Leases have not been amended except as evidenced by amendments similarly delivered and constitute the entire agreement between Seller and the tenants thereunder; (iv) to Seller’s knowledge, there are no existing defaults by Seller or any tenant under any of the Leases; (v) Seller has paid all sales and use taxes that are due and owing on rentals paid under all of the Leases; (vi) all Tenant Inducement Costs and all commissions that are or were due to any broker or salesperson in connection with the Leases have been paid in full and Purchaser shall not be liable for any Tenant Inducement Costs or commissions related to the Leases; (vii) Amendments of License Agreements in the form attached hereto as Exhibit “H” for each of the License Agreements have been executed and delivered by each party thereto and are fully enforceable against each party thereto; and (viii) the Brown Mackie Termination Letter is in the form required under the Brown Mackie Lease to terminate the Brown Mackie Lease and prior to Closing, Seller shall have taken all required actions and given all required notices in accordance with the terms of the Brown Mackie Lease as required for the Brown Mackie Lease to be terminated on or before September 30, 2012 and assuming that the Purchaser pays the Brown Mackie Termination Fee when such fee is required to be paid, the Brown Mackie Lease will terminate according to its terms.

(f) Leasing Commissions. (i) There are no lease brokerage agreements, leasing commission agreements or other agreements providing for payments of any amounts for leasing activities or procuring tenants with respect to the Property or any portion or portions thereof other than as disclosed in EXHIBIT “C” attached hereto and made a part hereof (the “Commission Agreements”), and (ii) there are no agreements currently in effect relating to the management and leasing of the Property other than as disclosed on said EXHIBIT “C” (the “Management Agreement”); and that all leasing commissions, brokerage fees and management fees accrued or due and payable under the Commission Agreements and the Management Agreement, as of the date hereof and at the Closing, if any, have been or shall be paid in full; and Seller shall terminate the Management Agreement as to the Property, if any, and pay all sums that may be due thereunder at Closing at no cost to Purchaser. Seller acknowledges and agrees that in no event either prior to or after Closing shall Purchaser be responsible for any sums due under any Management Agreement or Commission Agreement. Effective as of the Closing Date, the Seller will cause MHMC, and MHMC agrees, to terminate the CREC Leasing Agreement.

(g) Taxes and Assessments. Seller has filed or has retained a third party to file notices of protests against, or to commence action to review, real property tax assessments against the Property and has provided Purchaser with the contact information for the person handling all such challenges. Seller has not received any written notice of any proposed assessments by a public body, whether municipal, county or state, against any of the Property for public or private improvements which may become payable hereafter.

14

(h) Compliance with Laws. Except as provided on Schedule 4.1(h) attached hereto, to Seller’s knowledge, there are no violations of law, municipal or county ordinances, or other legal requirements with respect to the Property or any portion thereof which would adversely affect the use or value of the Property.

(i) Easements and Other Agreements. To Seller’s knowledge, Seller is not in default in complying with the terms and provisions of any of the covenants, conditions, restrictions or easements constituting a Permitted Exception which would adversely affect the use or value of the Property.

(j) Other Agreements. Except for the Leases, the Commission Agreements, the Management Agreement, the Operating Agreements and the Permitted Exceptions, there are no leases, management agreements, brokerage agreements, leasing agreements or other agreements or instruments in force or effect that grant to any person or any entity any right, title, interest or benefit in and to all or any part of the Property or any rights relating to the use, operation, management, maintenance or repair of all or any part of the Property which will survive the Closing or be binding upon Purchaser other than those which Purchaser has agreed in writing to assume as of the Closing Date. The copies of the Operating Agreements heretofore delivered by Seller to Purchaser are true, correct and complete copies thereof and the Operating Agreements have not been amended except as evidenced by amendments similarly delivered and constitute the entire agreement between Seller and the other parties thereunder, and to Seller’s knowledge, there are no outstanding defaults under the Operating Agreements which would adversely affect the use or value of the Property.

(k) Seller Not a Foreign Person. Neither entity comprising Seller is a disregarded entity as defined in Treasury Regulation section 1.1445-2(b)(2)(iii) nor a “foreign person” which would subject Purchaser to the withholding tax provisions of Section 1445 of the Internal Revenue Code of 1986, as amended.

(l) Employees. Seller has no employees to whom by virtue of such employment Purchaser will have any obligation after the Closing. Seller is not a party to any collective bargaining agreement or employment agreement with respect to any of the Property or Seller’s employees that will be binding on Purchaser after Closing. Seller is not a party to any written or oral retirement, pension, profit sharing, stock option, bonus, hospitalization, vacation or other employee benefit plan, practice, agreement or understanding affecting the Property that could be binding on Purchaser after Closing.

(m) Permits. To Seller’s knowledge, all licenses, permits, certificates of occupancy and approvals required for the lawful operation, use and occupancy of the Property, as it is currently being used, operated and occupied, have been issued and paid for and are in full force and effect.

(n) Zoning. Except as provided on Schedule 4.1(n) attached hereto, Seller has not filed and, to Seller’s knowledge, no one else has filed any pending applications for environmental permits or development orders, including but not limited to applications for zoning or land-use changes related to all or any portion of the Property.

15

(o) Insurance. Seller has not received any written notice from any of Seller’s insurance carriers stating that any of the policies or any of the coverage provided thereby will not or may not be renewed. For avoidance of doubt, Seller’s election not to renew any such policies shall not constitute a breach of this representation.

(p) Casualty. Neither the Property nor the conduct by Seller or any tenants under the Leases of their business at the Property, nor the possession, operation and/or use of the Property is currently adversely affected by any casualty, the cost to repair for which exceeds $100,000.00.

(q) Intentionally Omitted.

(r) Commitments to Governmental Authority. No commitments have been made by Seller, its affiliates, subsidiaries or any third party to any governmental authority, developer, utility company, school board, church or other religious body or any property owners’ association or to any other organization, group or individual relating to the Property which would impose an obligation upon Purchaser or its successors and assigns to make any contribution or dedications of money or land or to construct, install or maintain any improvements of a public or private nature on or off the Property. The provisions of this Section shall not apply to any regular or non-discriminatory local real estate taxes assessed against the Property.

(s) Rent Roll. The Rent Roll attached hereto as EXHIBIT “D” is true, correct and accurate in all respects.

(t) Personal Property. No items of Personal Property owned by Seller and to be transferred to Purchaser have been removed from the Improvements, except items for which similar replacements or substitutions of approximately equal like, kind and value are provided to the Improvements. All such items of Personal Property are owned outright by Seller, or shall be delivered to Purchaser at Closing free and clear of any lease, security interest, lien or encumbrance.

(u) No Rights to Purchase. Except for this Agreement, Seller has not entered into, and has no actual knowledge of any other agreement, commitment, option, right of first refusal or any other agreement, whether oral or written, with respect to the purchase, assignment or transfer of all or any portion of the Property (other than to lease any portion of the Property in accordance with the Leases) that is currently in effect.

All references in this Section to the “knowledge of Seller” or “to Seller’s knowledge” or any words of similar import shall refer only to the actual knowledge of Karole Morgan-Prager, Gus Perez, David Landsberg, Craig Woischwill and/or Pat Talamantes, who have been actively involved in the management of Seller’s business in respect of the Property. There shall be no personal liability on the part of the individuals named above arising out of any representations or warranties made herein or otherwise. All representations and warranties made in this Agreement by Seller shall survive the Closing for a period of one (1) year, and upon expiration thereof shall be of no further force or effect except to the extent that with respect to any particular alleged breach, Purchaser gives Seller written notice prior to the expiration of said one (1) year period of such alleged breach with reasonable detail as to the nature of such breach.

16

Subject to the immediately preceding paragraph, Seller hereby agrees to indemnify, protect, defend (through attorneys reasonably acceptable to Purchaser) and hold harmless Purchaser and its subsidiaries, Affiliates, officers, directors, agents, employees, successors and assigns from and against any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) (i) which may be asserted against or suffered by Purchaser or the Property as a result or on account of any breach of any representation, warranty or covenant on the part of Seller made herein or in any instrument or document delivered by Seller pursuant hereto or (ii) which may at any time following the Closing Date be asserted against or suffered by Purchaser arising out of or resulting from any matter pertaining to the operation of the Property prior to the Closing Date (whether asserted or accruing before or after Closing) (“Seller Indemnifiable Damages”). Notwithstanding the foregoing, the Seller shall not be responsible for Seller Indemnifiable Damages hereunder, and the Purchaser shall not be entitled to collect Seller Indemnifiable Damages hereunder from the Seller, until the Purchaser, in the aggregate, has incurred Seller Indemnifiable Damages for a claim or claims hereunder in an aggregate amount of at least Two Hundred Thousand and No/100 Dollars ($200,000.00), in which event the Purchaser shall be entitled to collect only Seller Indemnifiable Damages incurred hereunder in excess of such amount. Notwithstanding anything to the contrary contained in this Agreement, the maximum aggregate liability of Seller following the Closing, under this Agreement, any documents executed and delivered by Seller at the Closing (except the Miami Herald Lease, the Guaranty and the Property Management Agreement), and as a result of any Seller Certificate (as hereinafter defined), shall not exceed the aggregate amount of Five Million and No/100 Dollars ($5,000,000.00); provided that the cap on Seller Indemnifiable Damages identified in this sentence and the one (1) year survivability period referenced in the foregoing paragraph shall not apply to any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) arising from or related to a) the Siffin Litigation and the indemnification provided in Section 11.13 of this Agreement, b) any failure of Seller’s representation and warranty given in Section 4.1(e)(viii) of this Agreement, c) any failure or neglect by Seller to pay the $84,596.85 termination fee required pursuant to that certain Memorandum of Understanding Related to Agreement between Metropolitan Dade County and Knight-Ridder, Inc. to Design and Construct the Herald Plaza Metromover Station dated December 13, 1996, d) any fines, costs or other sums required to be paid or any repairs or alterations required to be made to the Property and improvements located thereon as a result of that certain inspection evidenced by that certain City of Miami General Fire Evacuation Drill Report dated December 7, 2010, e) the indemnifications of Seller pursuant to Section 6.1(d) of this Agreement, f) any failure of Seller’s representation and warranty given in Section 4.1(f) or Section 10.1 of this Agreement or (g) any fines, costs, fees, expenses or other sums required to be paid or any repairs, replacements or alterations, required or ordered to be made to the Property and the improvements located thereon as a result of the Forty-Year Recertification required for the three-story historical retail building located on Parcel 3 of the Land (the “Boulevard Shops”) and any fines, costs, fees, expenses or other sums resulting from Seller’s failure to timely file such Forty-Year Recertification prior to the deadline therefor and any professional fees and costs incurred in connection with the preparation, submission and completion of the Forty-Year Recertification. Without limiting the foregoing indemnification obligation of Seller and subject to applicable laws and regulations, Purchaser will consult with Seller in connection with the completion of the Forty-Year Recertification with respect to the Boulevard Shops with the goal of attempting to minimize indemnified costs

17

relating to the remediation of the Boulevard Shops in accordance with such Forty-Year Recertification. This Section 4.1 shall survive the Closing or any earlier termination of this Agreement.

4.2 Intentionally Omitted.

4.3 Representations and Warranties of Purchaser.

(a) Organization, Authorization and Consents. Purchaser is a duly organized and validly existing limited liability company under the laws of the State of Delaware. Purchaser has the right, power and authority to enter into this Agreement and to purchase the Property in accordance with the terms and conditions of this Agreement, to engage in the transactions contemplated in this Agreement and to perform and observe the terms and provisions hereof.

(b) Action of Purchaser, Etc. Purchaser has taken all necessary action to authorize the execution, delivery and performance of this Agreement, and upon the execution and delivery of any document to be delivered by Purchaser on or prior to the Closing, this Agreement and such document shall constitute the valid and binding obligation and agreement of Purchaser, enforceable against Purchaser in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws of general application affecting the rights and remedies of creditors.

(c) No Violations of Agreements. Neither the execution, delivery or performance of this Agreement by Purchaser, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under the terms of any indenture, deed to secure debt, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which Purchaser is bound.

(d) Litigation. Purchaser has received no written notice that any action or proceeding is pending or threatened, which questions the validity of this Agreement or any action taken or to be taken pursuant hereto.

All representations and warranties made in this Agreement by Purchaser shall survive the Closing for a period of one (1) year, and upon expiration thereof shall be of no further force or effect except to the extent that with respect to any particular alleged breach, Seller gives Purchaser written notice prior to the expiration of said one (1) year period of such alleged breach with reasonable detail as to the nature of such breach.

Subject to the immediately preceding paragraph, Purchaser hereby agrees to indemnify, protect, defend (through attorneys reasonably acceptable to Seller) hold harmless Seller and its subsidiaries, affiliates, officers, directors, agents, employees, successors and assigns from and against any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) which may at any time (i) be asserted against or suffered by Seller after the Closing Date as a result or on account of any breach of any warranty, representation or covenant on the part of Purchaser made herein or in any instrument or document delivered pursuant hereto (“Purchaser Indemnifiable Damages”). Notwithstanding the foregoing, the Purchaser shall not be responsible for Purchaser Indemnifiable Damages

18

hereunder, and the Seller shall not be entitled to collect Purchaser Indemnifiable Damages hereunder from the Purchaser, until the Seller, in the aggregate, has incurred Purchaser Indemnifiable Damages for a claim or claims hereunder in an aggregate amount of at least Two Hundred Thousand and No/100 Dollars ($200,000.00), in which event the Seller shall be entitled to collect only Purchaser Indemnifiable Damages incurred hereunder in excess of such amount. Notwithstanding anything to the contrary contained in this Agreement, the maximum aggregate liability of Purchaser following the Closing, under this Agreement, and any documents executed and delivered by Purchaser at the Closing (except the Miami Herald Lease, the Guaranty and the Property Management Agreement), shall not exceed the aggregate amount of Five Million and No/100 Dollars ($5,000,000.00); provided that the cap on Purchaser Indemnifiable Damages identified in this sentence and the one (1) year survivability period referenced in the foregoing paragraph shall not apply to any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) arising from or related to a) the proper payment of the Brown Mackie Termination Fee and the indemnification provided in Section 11.12 of this Agreement or b) any failure of Purchaser’s representation and warranty given in Section 10.1 of this Agreement. This Section 4.3 shall survive the Closing or any earlier termination of this Agreement.

ARTICLE 5.

CLOSING DELIVERIES, CLOSING COSTS AND PRORATIONS

5.1 Seller’s Closing Deliveries. For and in consideration of, and as a condition precedent to Purchaser’s delivery to Seller of the Purchase Price, subject to Section 6.2, Seller shall obtain or execute and deliver to Purchaser at Closing the following documents, all of which shall be duly executed, acknowledged and notarized where required:

(a) Deed. A special warranty deed or, at Purchasers request, special warranty deeds, to the Land and Improvements (the “Deed”), subject only to the Permitted Exceptions, and executed, acknowledged and sealed by the appropriate Seller;

(b) Bill of Sale. A bill of sale for the Personal Property (the “Bill of Sale”), with warranty as to the title of the Personal Property, executed by Seller and MHMC;

(c) Assignment and Assumption of Leases and Security Deposits. Two (2) counterparts of the Assignment and Assumption of Leases, executed, acknowledged and sealed by Seller and MHMC;

(d) Updated Rent Roll. An update of the Rent Roll (with modifications as appropriate) and containing a listing of current arrearages, certified by Seller and MHMC to be accurate in all material respects as of the Closing Date;

(e) Intentionally Omitted.

(f) General Assignment. An assignment of the Intangible Property (the “General Assignment”), executed, acknowledged and sealed by Seller and MHMC;

(g) Seller’s Affidavit. An owner’s affidavit acceptable to the Title Company (“Seller’s Affidavit”), executed, acknowledged and sealed by Seller and MHMC;

19

(h) FIRPTA Affidavit A FIRPTA Affidavit executed, acknowledged and sealed by Seller;

(i) Miami Herald Lease. Two (2) counterparts of the Miami Herald Lease executed, acknowledged and sealed by MHMC and two (2) counterparts of the Guaranty executed, acknowledged and sealed by McClatchy;

(j) Evidence of Authority Such documentation as may reasonably be required by the Title Company insurer to establish that this Agreement, the transactions contemplated herein, and the execution and delivery of the documents required hereunder, are duly authorized, executed and delivered by Seller;

(k) Settlement Statement A settlement statement setting forth the amounts paid by or on behalf of and/or credited to each of Purchaser and Seller pursuant to this Agreement;

(l) Intentionally Omitted;

(m) Intentionally Omitted;

(n) Leases. Original executed counterparts of the Leases;

(o) Tenant Estoppel Certificates. All originally executed Tenant Estoppel Certificates;

(p) Notices of Sale to Tenants. Seller will join with Purchaser in executing a notice, in form and content reasonably satisfactory to Seller and Purchaser (the “Tenant Notices of Sale”), which Purchaser shall send to each tenant under the Leases informing such tenant of the sale of the Property and of the assignment to and assumption by Purchaser of Seller’s interest in the Leases and the Security Deposits and directing that all rent and other sums payable for periods after the Closing under such Lease shall be paid as set forth in said notices;

(q) Notice of Termination of CREC Lease Agreement. A copy of the termination notice to Continental Real Estate Companies Commercial Property Corporation, a Florida corporation, in a form and content reasonably satisfactory to Seller and Purchaser evidencing the termination of the CREC Lease Agreement effective as of the Closing Date;

(r) Intentionally Omitted;

(s) Keys and Records. Copies of any keys to any door or lock on the Property and the original tenant files and other books and records relating to the Property in Seller’s possession;

(t) Lease Termination. A copy of the Brown Mackie Termination Letter executed by the Seller and evidence that the executed Brown Mackie Termination Letter has been sent to and received by all required Brown Mackie notice parties via faxed and/or overnight delivery in accordance with Article 24 of the Brown Mackie Lease and Section 6.2 hereof;

20

(u) Amendments of License Agreements. Copies of the fully executed Amendments of the License Agreements for each of the License Agreements;

(v) Property Management Agreement. Two (2) counterparts of the Property Management Agreement, executed, acknowledged and sealed by Seller;

(w) Affidavit of Ownership. An affidavit of ownership regarding N.E. 14th Street in a form acceptable to the Title Company confirming that a certain portion of N.E. 14th Street (as more particularly described therein) is a private roadway, executed, acknowledged and sealed by Seller and MHMC; and

(x) Other Documents. Such other documents as shall be reasonably requested by Purchaser’s counsel or the Title Company to effectuate the purposes and intent of this Agreement.

5.2 Purchaser’s Closing Deliveries. Subject to Section 6.2, Purchaser shall obtain or execute and deliver to Seller at Closing the following documents, all of which shall be duly executed, acknowledged and notarized where required:

(a) Assignment and Assumption of Leases. Two (2) counterparts of the Assignment and Assumption of Leases, executed, acknowledged and sealed by Purchaser;

(b) Intentionally Omitted;

(c) General Assignment. Two (2) counterparts of the General Assignment, executed, acknowledged and sealed by Purchaser;

(d) Miami Herald Lease. Two (2) counterparts of the Miami Herald Lease, executed, acknowledged and sealed by Purchaser;

(e) Notice of Sale to Tenants. The Tenant Notices of Sale, executed by Purchaser, as contemplated in Section 5.1(p) hereof;

(f) Intentionally Omitted;

(g) Settlement Statement A settlement statement setting forth the amounts paid by or on behalf of and/or credited to each of Purchaser and Seller pursuant to this Agreement; and

(h) Property Management Agreement. Two (2) counterparts of the Property Management Agreement, executed, acknowledged and sealed by Purchaser.

The obligations contained in Section 5.1 and Section 5.2 shall survive the Closing of this Agreement.

5.3 Closing Costs. Seller shall pay the cost of the documentary stamps, surtax or transfer taxes imposed by the State of Florida or the county in which the Land is located upon the conveyance of the Property pursuant hereto, the cost to record any curative instruments or

21

documents, the cost to close any open permits or violations, the attorneys’ fees of Seller, and all other costs and expenses incurred by Seller in closing and consummating the purchase and sale of the Property pursuant hereto. Purchaser shall pay the cost of any owner’s title insurance premium and title examination fees, the cost of the Survey, the recording cost of the Deed, the attorneys’ fees of Purchaser, and all other costs and expenses incurred by Purchaser in the performance of Purchaser’s due diligence inspection of the Property and in closing and consummating the purchase and sale of the Property pursuant hereto.

5.4 Prorations and Credits. The items in this Section 5.4 shall be prorated between Seller and Purchaser or credited, as specified:

(a) Taxes. All general real estate and personal property ad valorem taxes imposed by any governmental authority on the Property (“Taxes”) for the period in which the Closing occurs shall be prorated between Seller and Purchaser as of the Closing. If the Closing occurs prior to the receipt by Seller of the tax bill for the calendar year or other applicable tax period in which the Closing occurs, Taxes shall be prorated for such calendar year or other applicable tax period based upon the amount equal to the prior year’s tax bill. Seller shall be responsible for and shall pay at Closing all Taxes assessed against the Property for all periods prior to the Closing Date.

(b) Reproration of Taxes. After receipt of final Taxes and other bills, Purchaser shall prepare and present to Seller a calculation of the reproration of such Taxes and other items, based upon the actual amount of such items charged to or received by the parties for the year or other applicable fiscal period. The parties shall make the appropriate adjusting payment between them within thirty (30) days after presentment to Seller of Purchaser’s calculation and appropriate back-up information. Purchaser shall provide Seller with appropriate backup materials related to the calculation, and Seller may inspect Purchaser’s books and records related to the Property to confirm the calculation.

(c) Rents, Income and Other Expenses. Rents and any other amounts payable by tenants shall be prorated as of the Closing Date and be adjusted against the Purchase Price on the basis of a schedule which shall be prepared by Seller and delivered to Purchaser for Purchaser’s review and approval prior to Closing. Purchaser shall receive at Closing a credit for Purchaser’s pro rata share of the rents, additional rent, common area maintenance charges, tenant reimbursements and escalations, and all other payments payable for the month of Closing and for all other rents and other amounts that apply to periods from and after the Closing, but which are received by Seller prior to Closing. Purchaser agrees to pay to Seller, upon receipt, any rents or other payments by tenants under their respective Leases that apply to periods prior to Closing but are received by Purchaser after Closing; provided, however, that any delinquent rents or other payments by tenants shall be applied first to any current amounts owing by such tenants, then to delinquent rents in the order in which such rents are most recently past due, with the balance, if any, paid over to Seller to the extent of delinquencies existing at the time of Closing to which Seller is entitled; it being understood and agreed that Purchaser shall not be legally responsible to Seller for the collection of any rents or other charges payable with respect to the Leases or any portion thereof, which are delinquent or past due as of the Closing Date; but Purchaser agrees that Purchaser shall send monthly notices prepared by Seller for a period of three (3) consecutive months in an effort to collect any rents and charges not collected as of the Closing Date. Any

22

reimbursements payable by any tenant under the terms of any tenant lease affecting the Property as of the Closing Date, which reimbursements pertain to such tenant’s pro rata share of increased operating expenses or common area maintenance costs incurred with respect to the Property at any time prior to the Closing, shall be prorated upon Purchaser’s actual receipt of any such reimbursements, on the basis of the number of days of Seller and Purchaser’s respective ownership of the Property during the period in respect of which such reimbursements are payable; and Purchaser agrees to pay to Seller Seller’s pro rata portion of such reimbursements within thirty (30) days after Purchaser’s receipt thereof. Conversely, if any tenant under any such Lease shall become entitled at any time after Closing to a refund of tenant reimbursements actually paid by such tenant prior to Closing, then, Seller shall, within thirty (30) days following Purchaser’s demand therefor, pay to Purchaser any amount equal to Seller’s pro rata share of such reimbursement refund obligations, said proration to be calculated on the same basis as hereinabove set forth. Seller hereby waives its right to file any administrative or legal action against any tenant under the Leases for sums due Seller for periods attributable to Seller’s ownership of the Property, except that Seller shall be entitled to continue to pursue any legal proceedings commenced prior to Closing; but shall not be permitted to commence or pursue any legal proceedings against any tenant seeking eviction of such tenant or the termination of the applicable Lease unless consented to by Purchaser in writing. Seller shall be responsible for collecting and remitting all sales and use taxes that are due or become due on rent payments under the Leases received by Seller prior to Closing. Purchaser shall be responsible for collecting and remitting all sales and use taxes that become due on rent payments under the Leases received by Purchaser after Closing.

(d) Intentionally Omitted.

(e) Security Deposits. Purchaser shall receive a credit at Closing for all Security Deposits (and any interest thereon required to be reimbursed to any tenant) pursuant to Leases or pursuant to applicable law. Seller agrees to and does hereby indemnify, defend and hold Purchaser harmless from and against any liability or expense incurred by Purchaser by reason of any Security Deposit (and interest thereon, if required by law) actually collected by Seller and not credited to Purchaser at the Closing. Purchaser agrees to and does hereby indemnify and hold Seller harmless from and against any liability or expense incurred by Seller by reason of any Security Deposit (and interest thereon, if required by law) which is credited to Purchaser at the Closing and which Purchaser does not properly refund to the tenant pursuant to the terms of the applicable Lease.

(f) Operating Expenses. Personal property taxes, installment payments of special assessment liens, vault charges, sewer charges, utility charges, and normally prorated operating expenses actually paid or payable as of the Closing Date shall be prorated as of the Closing Date and adjusted against the Purchase Price, provided that within one (1) year after the Closing, Purchaser and Seller will make a further adjustment for such taxes, charges and expenses which may have accrued or been incurred prior to the Closing Date, but not collected or paid at that date. In addition, on or before the end of the fiscal year(s) used in calculating the pass-through to tenants of operating expenses and/or common area maintenance costs under the Leases (where such fiscal year(s) include(s) the Closing Date), Seller and Purchaser shall, upon the request of either, re-prorate on a fair and equitable basis in order to adjust for the effect of any credits or payments due to or from tenants for periods prior to the Closing Date. All

23

prorations shall be made based on the number of calendar days in such year or month, as the case may be. In no event shall Purchaser be responsible for any management fees, commissions or other amounts due Seller’s property manager for periods prior to the Closing, or for any premiums or other amounts due in relation to any policies of insurance maintained by Seller or Seller’s property manager, or for any amounts due any Affiliate of Seller, all of which shall remain Seller’s responsibility.

(g) Special Assessments. Certified, confirmed and ratified special assessment liens as of the Closing Date (and not as of the Effective Date) shall be paid by Seller or Purchaser shall receive a credit therefor. Pending liens as of the Closing Date shall be assumed by Purchaser; provided, however, that where the improvement, for which the special assessment was levied, has been substantially completed as of the Effective Date, such pending liens shall be considered as certified, confirmed or ratified and Seller shall, at Closing, be charged an amount equal to the estimated amount of the assessment for the improvement. If any special assessment liens are due in installments Seller shall be required to pay any installment due as of the Closing Date and Purchaser shall be responsible for all such installments due after the Closing Date.

(h) Leased Personal Property. All amounts payable or prepaid under leases of any of the leased items of Personal Property, if any, which Purchaser elects to include in the Property shall be prorated as of the Closing Date.

The provisions of this Section 5.4 shall survive the Closing of this Agreement.

ARTICLE 6.

CONDITIONS TO CLOSING

6.1 Conditions Precedent to Purchaser’s Obligations. The obligations of Purchaser hereunder to consummate the transaction contemplated hereunder shall in all respects be conditioned upon the satisfaction of each of the following conditions prior to or simultaneously with the Closing, any of which may be waived by Purchaser in its sole discretion by written notice to Seller at or prior to the Closing Date:

(a) Subject to Section 6.2 hereof, Seller shall have delivered to Purchaser all of the items required to be delivered to Purchaser pursuant to the terms of this Agreement, including, but not limited to Section 5.1 hereof.

(b) Seller shall have performed, in all material respects, all covenants, agreements and undertakings of Seller contained in this Agreement.

(c) All representations and warranties of Seller as set forth in this Agreement shall be true and correct as of the Closing Date.

(d) Prior to the Closing, Tenant Estoppel Certificates from Brown Mackie and all other tenants under the Leases. Each Tenant Estoppel Certificate shall (i) be dated within thirty (30) days prior to the Closing Date, (ii) confirm the material terms of the applicable Lease, as contained in the copies of the Leases obtained by or delivered to Purchaser, and (iii) confirm the absence of any defaults under the applicable Lease as of the date thereof. Notwithstanding the foregoing, in lieu of Seller obtaining Tenant Estoppel Certificates for the License

24

Agreements or that certain U.S. Government Lease for Real Property dated October 1, 2009, between The McClatchy Company and the United States of America, specifically the United States Coast Guard (the “Coast Guard Lease”), Seller shall be permitted to provide Purchaser with estoppel certificates for the License Agreements and the Coast Guard Lease in a form similar to a Tenant Estoppel Certificate (each a “Seller Certificate”). If after Closing, Seller delivers to Purchaser a fully executed Tenant Estoppel Certificate from any party for which Seller provided a Seller Certificate that is fully consistent with the factual information provided in the Seller Certificate, then the Seller Certificate shall be deemed to be superseded by the Tenant Estoppel Certificate and Seller shall have no further obligations or liabilities arising from the Seller Certificate except as expressly provided in this paragraph. To the extent that there are any differences between the new Tenant Estoppel Certificate and the prior Seller Certificate, Seller shall indemnify, protect, defend (through attorneys reasonably acceptable to Purchaser) and hold harmless Purchaser and its subsidiaries, Affiliates, officers, directors, agents, employees, successors and assigns from and against any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) which may be asserted against or suffered by Purchaser or the Property as a result or on account of such differences between the new Tenant Estoppel Certificate and the respective Seller Certificate. This Section 6.1(d) shall survive the Closing of this Agreement.

(e) The delivery by the Title Company of a “marked up” Title Commitment, subject only to the Permitted Exceptions, with gap coverage, deleting all requirements and deleting the standard exceptions.

(f) Except as cured by Seller or otherwise approved or waived in writing by Purchaser, no event shall have occurred which may have a material adverse effect on the Property.

(g) Seller shall have delivered to Brown Mackie the Brown Mackie Termination Letter and shall have delivered to Purchaser evidence of receipt thereof by the Brown Mackie notice parties as described in Section 5.1(t) above and Section 6.2 below.

(h) The Amendments of License Agreements for each of the License Agreements shall have been fully executed and delivered by each party thereto.