Attached files

Exhibit 99.3

SUPPLEMENTAL PORTFOLIO INFORMATION

THE PMI GROUP, INC. |

DEFINITION

OF TERMS 2/28s

–

refers to loans with interest rates that are fixed for two years and reset to a new

interest rate at the end of year two for the remaining term of the loan.

ARMs

–

refers to loans with adjustable interest rates. We consider a loan an ARM if its

interest rate may be adjusted prior to the loan’s fifth anniversary.

A Quality Loans

–

we define A quality to include loans with credit scores of 620 and greater.

Alt-A Loans

–

we consider a loan Alt-A if it has a credit score of 620 or greater and the borrower

requests and is given the option of providing reduced documentation verifying

income, assets, deposit information and/or employment. Captive Reinsurance

–

refers to agreements in which a portion of risk insured by PMI is reinsured by a captive

reinsurance company affiliated with the mortgage originator or

investor. Defaults – our

primary mortgage insurance master policy defines “default” as the

borrower’s failure to pay when due an amount equal to the scheduled monthly

mortgage payment under the terms of the mortgage. Generally, the master policies require an

insured to notify PMI of a default no later than the last business day of the month

following the month in which the borrower becomes three monthly payments in

default. For reporting purposes and internal tracking purposes, we do not consider a loan to

be in default until the borrower has missed two consecutive payments. Depending upon

its scheduled payment date, a loan delinquent

for

two

consecutive

monthly

payments

could

be

reported

to

PMI

between

the

31

st

and

the

60

th

day

after

the

first

missed

payment.

Flow

–

generally refers to mortgage insurance offered on a loan-by-loan basis to

lenders. GSE Pool –

refers to a traditional pool product for mortgage loans sold by PMI’s customers to

the GSEs. This product was available from 1997 to 2001.

Interest Only Loans

–

refers to loans that do not reduce principal during the initial

deferral period (usually between two and ten

years) and therefore do not accumulate equity through loan amortization during the initial

deferral period. Insurance in Force (IIF)

–

refers to the current principal balance of all outstanding mortgage loans with insurance

coverage as of a given date.

Less-than-A Quality Loans

–

we define less-than-A credit quality loans to include loans with credit scores of

619 or below. The majority of our less-than-A-quality loans have credit

scores above 575. 2 |

DEFINITION

OF TERMS 3

Loan Modification –

a permanent change in one or more of the terms of a mortgagor’s loan, which allows

the loan to be reinstated. Modified Pool Insurance

–

modified pool insurance may be used in addition to primary mortgage insurance or may be

placed on loans that do not require primary insurance. Coverage of modified

pool products varies. Some products provide first loss protection by covering

a percentage of the losses on individual loans held within the pool of insured loans up to a stated

aggregate loss limit (“stop loss limit”) for the entire pool. Some

modified pool products offer mezzanine-level coverage by providing for claims

payments only after a predetermined cumulative claims level, or deductible, is reached.

New Insurance Written (NIW)

–

refers to the original principal balance of all loans that receive new primary mortgage

insurance coverage during a given period.

New Risk Written (NRW)

–

refers to the aggregate dollar amount of each insured mortgage loan’s current

principal balance multiplied

by

the

insurance

coverage

percentage

specified

in

the

policy

for

all

loans

that

receive

new

primary

mortgage

insurance

coverage during a given period.

Old Pool –

refers to a traditional pool product for mortgage loans sold by PMI’s customers to

capital market participants. Organic Cure –

generally refers to the borrower paying the mortgage payments in arrears and the loan

being reported by the servicers as current.

Payment Option ARMs

–

generally refers to loans that provide the borrower an option every month to make a

payment consisting of principal and interest, interest only, or an amount

established by the lender that may be less than the interest owed.

Primary

Insurance

–

refers

to

mortgage

insurance

placed

on

a

loan-by-loan

basis

through

our

“flow”

channel

and

mortgage

insurance

issued

for

mortgage-backed

securities

and

portfolio

investors

through

our

“structured

transactions”

channel.

Primary

insurance

does not include pool or modified pool information.

Primary Risk in Force

–

refers to the aggregate dollar amount of each insured mortgage loan’s current

principal balance multiplied by

the

insurance

coverage

percentage

specified

in

the

policy

for

insurance

policies

issued

through

our

“flow”

and

“structured

transactions”

channels only.

Risk in Force (RIF) –

refers to the aggregate dollar amount of each insured mortgage loan’s current

principal balance multiplied by the insurance coverage percentage specified in the

policy. Structured

–

generally refers to mortgage insurance offered by PMI that covers large portfolios of

mortgage loans and is provided to issuers of mortgage backed securities

(“MBS”) and portfolio investors. Traditional Pool

–

covers the entire loss on a defaulted mortgage loan that exceeds the claim payment under

any primary insurance coverage,

up

to

a

stated

aggregate

loss

limit,

or

stop

loss,

for

all

of

the

loans

in

a

pool.

PMI

is

not

currently

offering

traditional

pool insurance to its customers. |

CURES

FOCUS ON PARTICULAR PRIMARY PORTFOLIO SEGMENTS

PRIMARY PORTFOLIO CHARACTERISTICS BY VINTAGE

MODIFIED POOL CHARACTERISTICS BY VINTAGE

9

16

18

25

32

4

CAPTIVE REINSURANCE

35

PORTFOLIO CATEGORIES

5

CONTENTS OF PRESENTATION

PRIMARY PORTFOLIO CHARACTERISTICS

PRIMARY PORTFOLIO VINTAGE DEVELOPMENT

14 |

PORTFOLIO

CATEGORIES 5

PORTFOLIO CATEGORIES

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

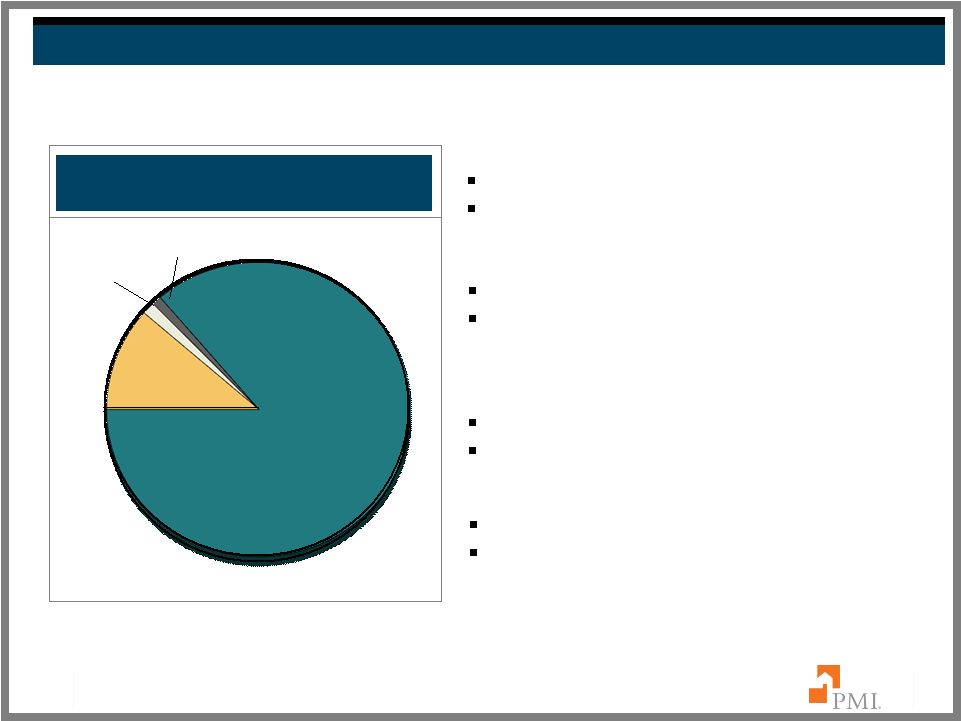

6

Primary Flow

86%

Primary

Structured

12%

Modified

Pool

1%

GENERAL PORTFOLIO CATEGORIES

Primary Flow Insurance

$21.0 billion of risk in force.

Primary mortgage insurance offered to lenders on a

loan-by-loan basis.

Primary Structured Insurance

$2.8 billion of risk in force.

Credit enhancement solutions offered across the credit

spectrum to agency and non-agency MBS issuers as

well as portfolio investors.

Modified Pool Risk in Force

$0.3 billion of remaining risk in force.

(1)

Insurance offered to agency and non-agency MBS issuers

and investors.

Other Pool

$0.3 billion of remaining risk in force.

(1)

Prior to 2002, PMI offered certain pool insurance

products, referred to principally as GSE or Old Pool, to

lenders, the GSEs and non-agency market.

Other

Pool

1%

* At June 30, 2011.

Note: Due to rounding, the sum of percentages may not total 100%.

(1)

Remaining risk in force for modified and other pool excludes non-performing risk

exposures, for which loss reserves have been established. $23.7 BILLION

PRIMARY RISK IN FORCE AND $0.6 BILLION POOL RISK IN FORCE*

|

7

$23.7 BILLION PRIMARY RISK IN FORCE*

Legacy: Performing

56%

New writings

23%

GENERAL PORTFOLIO CATEGORIES

Legacy

(1)

: Performing

$13.2 billion of risk in force.

Continues to perform through the housing downturn

and generates strong annual revenues.

Legacy

(1)

: Non-performing

$5.1 billion of risk in force.

Key focus of PMI’s loss mitigation efforts.

PMI’s Homeownership Preservation Initiatives.

Home Affordable Modification Program (HAMP).

Other loan modification and workout programs.

New writings

(2)

$5.4 billion of risk in force.

High quality business originated under new guidelines and

higher premium rates.

* At June 30, 2011.

Note: Due to rounding, the sum of percentages may not total 100%.

Legacy:

Non-performing

21%

(1)

Legacy refers to risk in force from June 30, 2008 and prior.

(2)

New writings refers to risk in force originated from July 1, 2008 through June 30, 2011.

|

8

NEW WRITINGS*

New writings

$5.4 billion of risk in force from $30.6 billion of new insurance written in 2H 2008,

2009, 2010 and 1H 2011. High quality business originated under new guidelines and

higher premium rates.

* At June 30, 2011.

(1)

Condominium includes Townhouses and Cooperatives.

New writings characteristics as percentage of risk in force:

Loan Type

100% Fixed Rate

Documentation

100% Full Documentation

Property Type

85% Single Family

15% Condominium

(1)

Occupancy

96% Owner Occupied

3% Second Home

Average FICO of 746

94% FICO 680 and above

75% FICO 720 and above

Average Loan to Value of 90%

98% at 95% LTV and below

60% at 90% LTV and below

Average loan size of $216,337 |

9

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

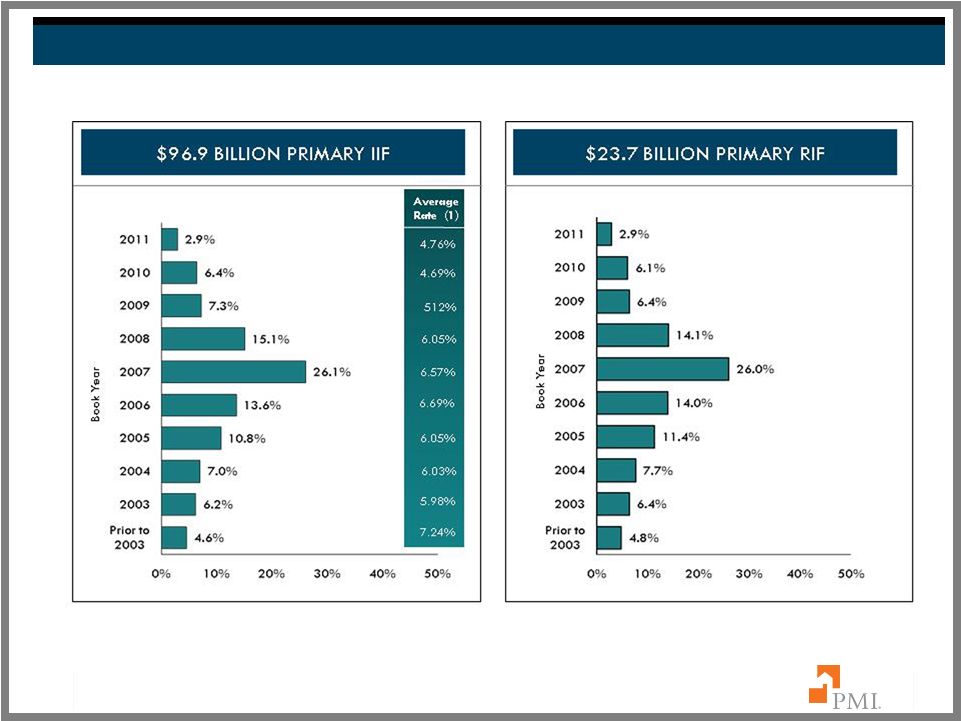

U.S.

PORTFOLIO AGE DISTRIBUTION 10

(1)

Average loan fixed annual mortgage interest rate.

Note: Due to rounding, the sum of percentages may not total 100%.

|

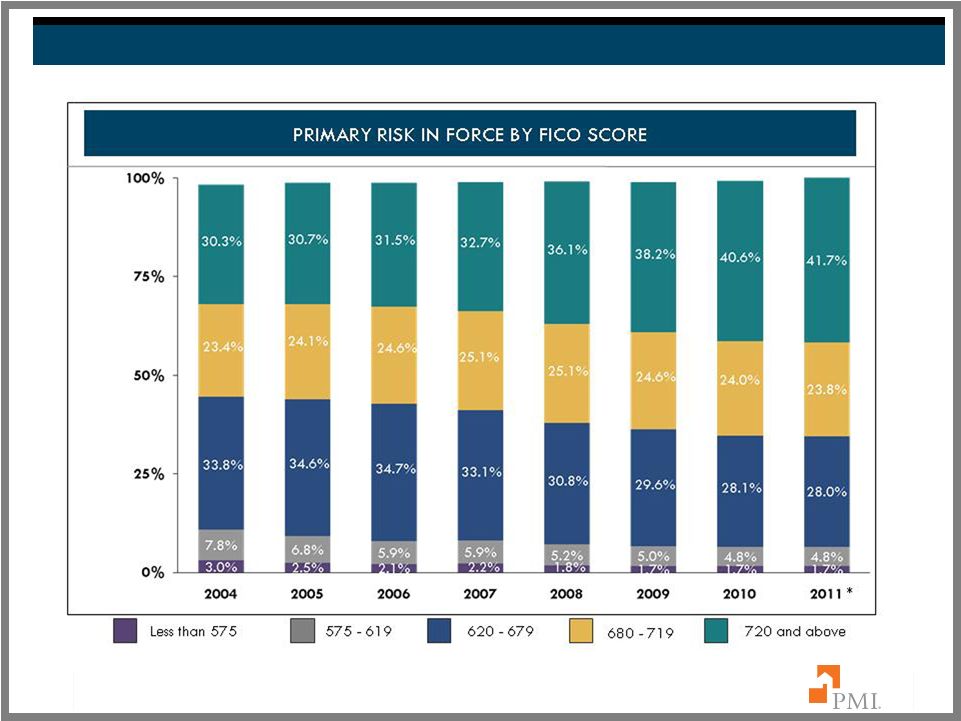

U.S.

PORTFOLIO CREDIT SCORE DISTRIBUTION 11

Note: Due to rounding, the sum of percentages may not total 100%.

* Through June 30, 2011. |

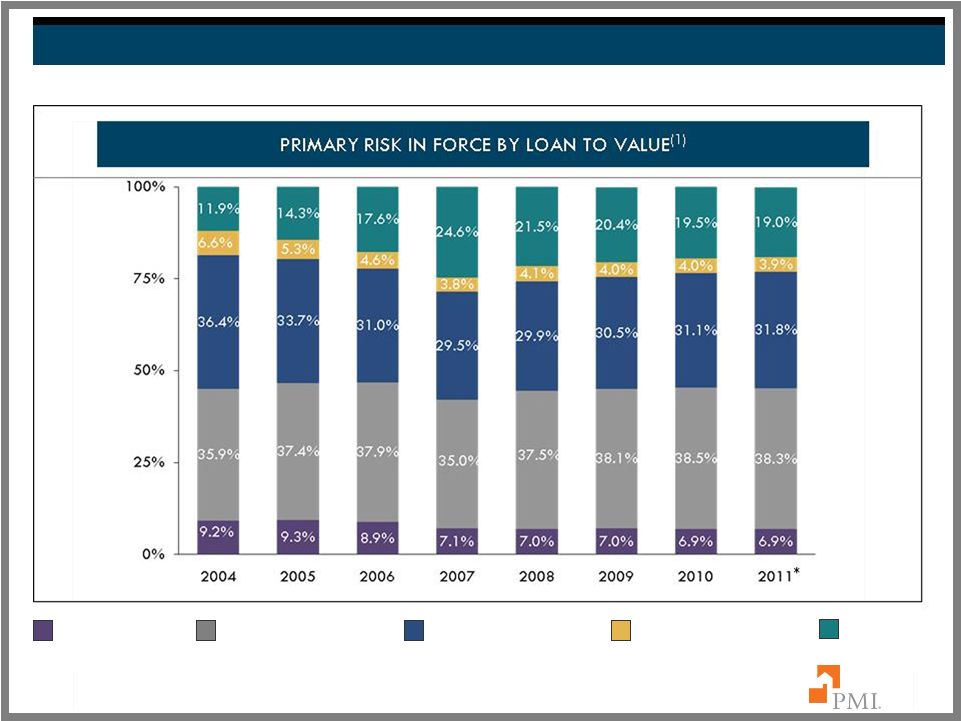

U.S.

PORTFOLIO LOAN TO VALUE DISTRIBUTION 12

Note: Due to rounding, the sum of percentages may not total 100%.

LTVs between 85.01%

and 90%

LTVs above

97%

LTVs between 95.01%

and 97%

LTVs between 90.01% and

95%

LTVs of 85% and

below

(1)

At origination.

* Through June 30, 2011. |

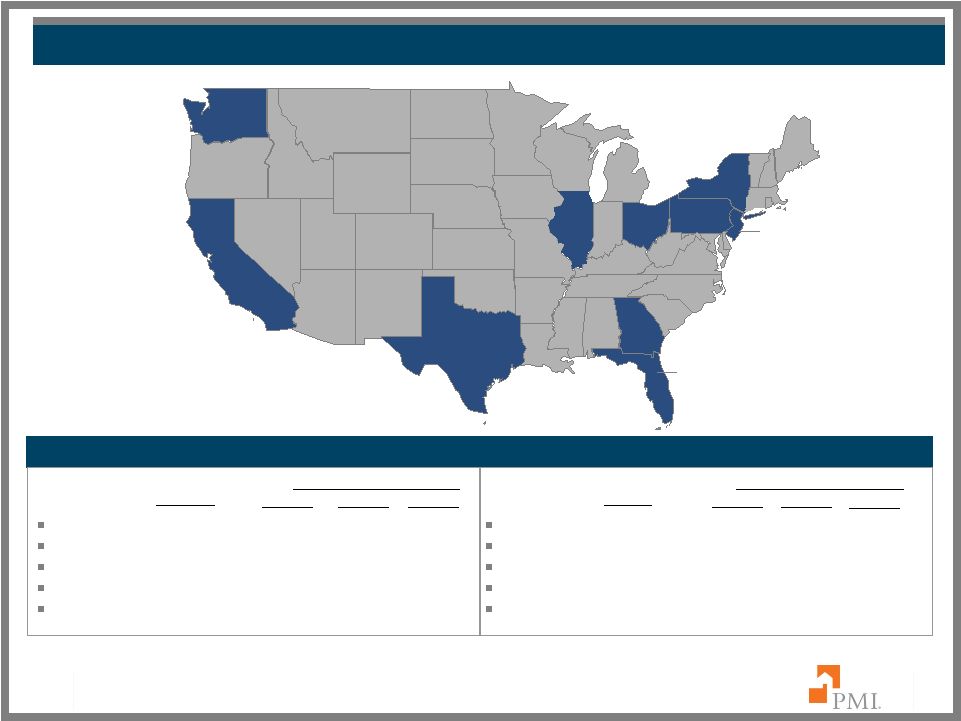

U.S.

PORTFOLIO GEOGRAPHIC DISTRIBUTION 13

(1)

Top ten states as determined by primary RIF on June 30, 2011.

(2)

Default rates as of June 30, 2011, December 31, 2010 and June 30, 2010

9.4%

8.2%

7.4%

5.2%

4.0%

3.5%

4.1%

3.4%

4.6%

3.3%

Florida

9.4%

39.99%

40.57%

40.75%

Texas

8.2%

10.11%

11.45%

11.88%

California

7.4%

26.59%

29.48%

33.82%

Illinois

5.2%

23.84%

24.63%

24.92%

Georgia

4.6%

19.18%

20.59%

22.19%

% of RIF

(1)

Jun 2011

Dec 2010

Jun 2010

New York

4.1%

20.18%

20.39%

19.55%

Ohio

4.0%

16.54%

17.20%

17.03%

Pennsylvania

3.5%

15.32%

15.80%

15.05%

New Jersey

3.4%

26.26%

25.35%

24.88%

Washington

3.3%

18.36%

17.76%

17.12%

% of RIF

(1)

Jun 2010

Dec 2010

Jun 2010

TOP TEN STATES –

PERCENT OF PRIMARY RISK IN FORCE AND DEFAULT RATES

Primary Default Rates

(2)

Primary Default Rates

(2) |

14

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

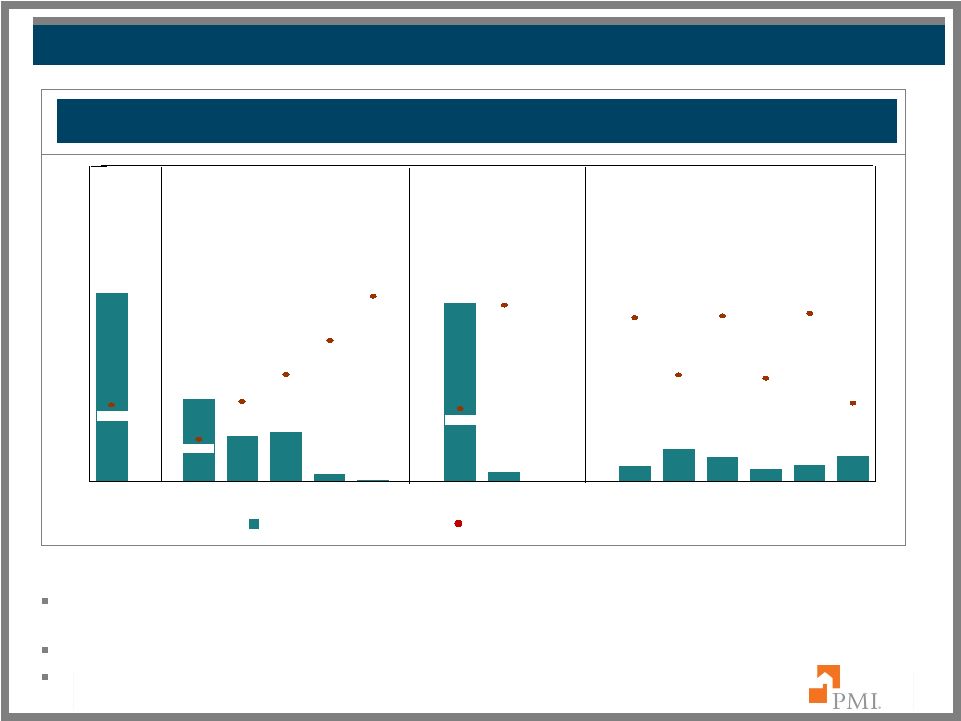

PRIMARY

PORTFOLIO VINTAGE DEVELOPMENT 15

NOTICE OF DEFAULT RECEIVED BY VINTAGE

Note: Vintage refers to the origination year.

1

2

3

4

5

6

New

notices

of

default

have

declined

from

their

peaks

for

2005,

2006,

2007

and

2008

vintages.

The 2008, 2009 and 2010 vintages are exhibiting fewer new notices of default than previous

vintages.

2007

2006

2008

2005

2009

2010 |

16

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

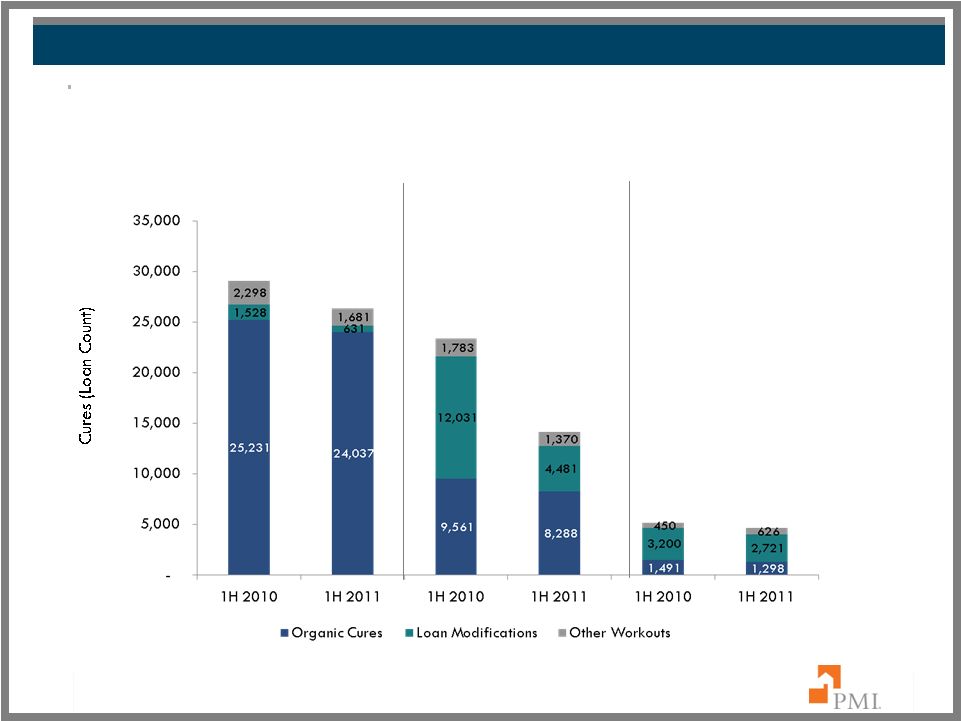

17

Note: Due to reporting lags from servicers, cures are understated.

Excludes rescissions and claim denials.

(1)

Other workouts includes forbearance plans and other retention workouts.

29,057

26,349

14,139

(1)

23,375

5,141

4,645

2-3 Payments

in Default

4-11 Payments

in Default

12 Payments

or more in Default

Organic cures, as a percentage of total cures, increased in the 2-3 and 4-11

payments in default categories in 1H 2011, while remaining essentially flat in the

12 payments or more default category.

CURES |

18

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

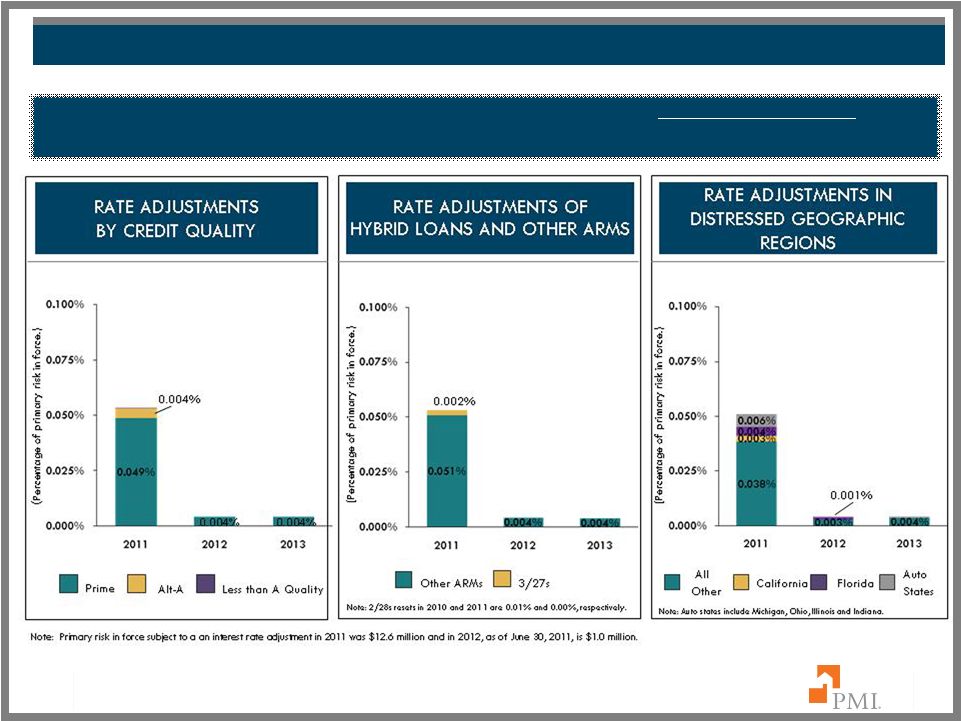

19

2011

2012

2013

TOTAL INTEREST RATE ADJUSTMENTS AS A PERCENTAGE OF PRIMARY RISK IN FORCE:

0.053%

0.004%

0.004%

U.S. PORTFOLIO INTEREST RATE ADJUSTMENTS |

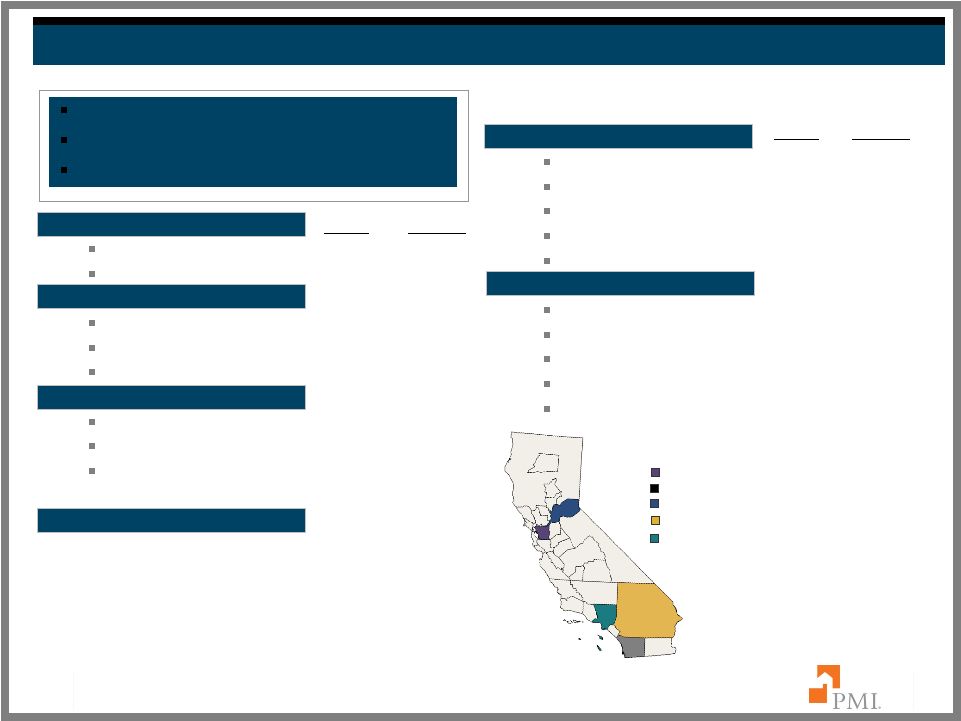

20

(1)

Condominium includes Townhouses and Cooperatives.

(2)

Excludes unreported FICO scores.

(3)

At origination.

% of

CA RIF

CA % of

Total RIF

CA % of

Total RIF

% of

CA RIF

CALIFORNIA AT JUNE 30, 2011

$1.7 BILLION OF TOTAL RISK IN FORCE

7.4% OF PMI’S PRIMARY RISK IN FORCE

$287,127 AVERAGE LOAN SIZE

MSA Distribution of Total Primary RIF

Oakland-Fremont-Hayward, CA–

0.4%

San Diego-Carlsbad-San Marcos –

0.6%

Sacramento--Arden-Arcade—Roseville –

0.7%

Riverside-San Bernardino-Ontario –

1.3%

Los Angeles-Long Beach-Glendale –

1.5%

Note: Due to rounding, the sum of percentages may not total 100%.

LOAN TYPE

Fixed Rate

83.2%

6.1%

ARM

16.8%

1.2%

PROPERTY TYPE

(1)

Single Family

81.0%

6.0%

Condominium

16.0%

1.2%

Multi-Family and other

3.0%

0.2%

OCCUPANCY

Primary Residence

94.4%

6.9%

Second Home

2.6%

0.2%

Non-owner occupied

3.0%

0.2%

ALT-A

24.2%

1.8%

FICO SCORES

(2)

720 and above

47.1%

3.5%

680-719

25.2%

1.9%

620-679

24.8%

1.8%

575-619

2.2%

0.2%

Less than 575

0.6%

0.0%

LOAN TO VALUE

(3)

Above 97.00%

11.4%

0.8%

95.01% to 97.00%

2.1%

0.2%

90.01% to 95.00%

20.4%

1.5%

85.01% to 90.00%

53.3%

3.9%

85.00% and below

12.8%

0.9% |

FLORIDA AT

JUNE 30, 2011 21

% of

FL RIF

FL % of

Total RIF

% of

FL RIF

FL % of

Total RIF

$2.2 BILLION OF TOTAL RISK IN FORCE

9.4% OF PMI’S PRIMARY RISK IN FORCE

$170,957 AVERAGE LOAN SIZE

Note: Due to rounding, the sum of percentages may not total 100%.

Tampa-St. Petersburg-Clearwater, FL–

1.4%

MSA Distribution of Total Primary RIF

Jacksonville, FL–

0.7%

Fort Lauderdale-Deerfield Beach, FL–

1.0%

Miami-Miami Beach-Kendall, FL–

1.5%

Orlando-Kissimmee, FL–

1.4%

(1)

Condominium includes Townhouses and Cooperatives.

(2)

Excludes unreported FICO scores.

(3)

At origination.

LOAN TYPE

Fixed Rate

85.8%

8.0%

ARM

14.2%

1.3%

PROPERTY TYPE

(1)

Single Family

73.2%

6.8%

Condominium

25.0%

2.3%

Multi-Family and other

1.8%

0.2%

OCCUPANCY

Primary Residence

81.6%

7.6%

Second Home

11.0%

1.0%

Non-owner occupied

7.4%

0.7%

ALT-A

30.6%

2.9%

FICO SCORES

(2)

720 and above

36.6%

3.4%

680-719

26.8%

2.5%

620-679

30.7%

2.9%

575-619

4.3%

0.4%

Less than 575

1.3%

0.1%

LOAN TO VALUE

(3)

Above 97.00%

20.0%

1.9%

95.01% to 97.00%

2.9%

0.3%

90.01% to 95.00%

29.5%

2.8%

85.01% to 90.00%

41.0%

3.8%

85.00% and below

6.6%

0.6% |

ARIZONA AT

JUNE 30, 2011 22

% of AZ % of

AZ RIF

Total RIF

% of

AZ RIF

AZ % of

Total RIF

$0.6 BILLION OF TOTAL RISK IN FORCE

2.3% OF PMI’S PRIMARY RISK IN FORCE

$181,716 AVERAGE LOAN SIZE

Lake Havasu City-Kingman, AZ-0.1%

Prescott, AZ –

0.1%

Yuma, AZ-0.1%

Tucson, AZ-0.4%

Phoenix-Mesa, AZ –

1.6%

MSA Distribution of Total Primary RIF

Note: Due to rounding, the sum of percentages may not total 100%.

(1)

Condominium includes Townhouses and Cooperatives.

(2)

Excludes unreported FICO scores.

(3)

At origination.

LOAN TYPE

Fixed Rate

91.5% 2.1%

ARM

8.5%

0.2%

PROPERTY TYPE

(1)

Single Family

85.7% 2.0%

Condominium

11.3%

0.3%

Multi-Family and other

3.0%

0.1%

OCCUPANCY

Primary Residence

87.6% 2.0%

Second Home

7.9%

0.2%

Non-owner occupied

4.4%

0.1%

ALT-A

17.6%

0.4%

FICO SCORES

(2)

720 and above

40.8%

1.0%

680-719

25.6%

0.6%

620-679

27.8%

0.6%

575-619

3.7%

0.1%

Less than 575

0.9%

0.0%

LOAN TO VALUE

(

3)

Above 97.00%

95.01% to 97.00%

2.7%

0.1%

90.01% to 95.00%

24.2%

0.6%

85.01% to 90.00%

41.0%

1.0%

85.00% and below

7.2%

0.2%

24.9%

0.6% |

NEVADA AT

JUNE 30, 2011 23

% of NV % of

NV RIF

Total RIF

% of

NV RIF

NV % of

Total RIF

$0.3 BILLION OF TOTAL RISK IN FORCE

1.4% OF PMI’S PRIMARY RISK IN FORCE

$223,124 AVERAGE LOAN SIZE

Note: Due to rounding, the sum of percentages may not total 100%.

Las Vegas-Paradise, NV-1.1%

Reno-Sparks, NV-0.2%

Carson City, NV-0.01%

MSA Distribution of Total Primary RIF

(1)

Condominium includes Townhouses and Cooperatives.

(2)

Excludes unreported FICO scores.

(3)

At origination.

LOAN TYPE

Fixed Rate

84.5% 1.2%

ARM

15.5%

0.2%

PROPERTY TYPE

(1)

Single Family

80.0% 1.1%

Condominium

18.4%

0.3%

Multi-Family and other

1.6%

0.0%

OCCUPANCY

Primary Residence

84.2% 1.2%

Second Home

11.3%

0.2%

Non-owner occupied

4.5%

0.1%

ALT-A

25.5%

0.4%

FICO SCORES

(2)

720 and above

41.6%

0.6%

680-719

27.0%

0.4%

620-679

28.2%

0.4%

575-619

2.4%

0.0%

Less than 575

0.4%

0.0%

LOAN TO VALUE

(3)

Above 97.00%

17.0%

0.2%

95.01% to 97.00%

1.7%

0.0%

90.01% to 95.00%

26.7%

0.4%

85.01% to 90.00%

47.0%

0.7%

85.00% and below

7.6%

0.1% |

ALT-A

AT JUNE 30, 2011 24

% of

Alt-A RIF

Alt-A % of

Total RIF

Alt-A % of

Total RIF

$3.5 BILLION OF TOTAL RISK IN FORCE

14.7% OF PMI’S PRIMARY RISK IN FORCE

$201,437 AVERAGE LOAN SIZE

GUIDELINE CHANGES

% of

Alt-A RIF

Note: Due to rounding, the sum of percentages may not total 100%.

(1)

Condominium includes Townhouses and Cooperatives.

(2)

Excludes unreported FICO scores.

(3)

At origination.

State Distribution of Alt-A RIF

0.00% to 1.00%

1.00% to 2.00%

2.00% to 5.00%

5.00% to 10.00%

>10.00%

With the exception of previously issued

commitments, effective June 1, 2008, PMI no

longer insures Alt-A

LOAN TYPE

Fixed Rate

78.8% 11.6%

ARM

21.2%

3.1%

PROPERTY TYPE

(1)

Single Family

77.9% 11.4%

Condominium

14.8%

2.2%

Multi-Family and other

7.3%

1.1%

OCCUPANCY

Primary Residence

83.0% 12.2%

Second Home

6.2%

0.9%

Non-owner occupied

10.7%

1.6%

FICO SCORES

(2)

720 and above

37.5%

5.5%

680-719

35.4%

5.2%

620-679

27.1%

4.0%

LOAN TO VALUE

(3)

Above 97.00%

12.0%

1.8%

95.01% to 97.00%

0.2%

0.0%

90.01% to 95.00%

27.7%

4.1%

85.01% to 90.00%

50.5%

7.4%

85.00% and below

9.6%

1.4% |

25

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

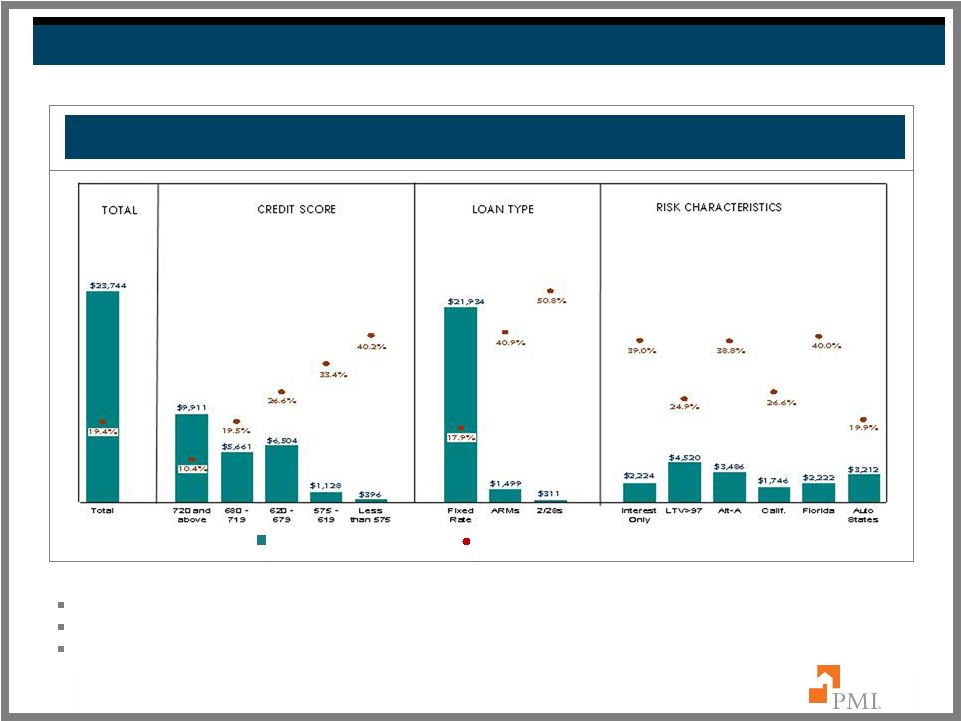

RISK

CHARACTERISTICS: TOTAL PRIMARY PORTFOLIO Risk in Force (dollars in millions).

Default Rate (as measured by policies).

TOTAL PRIMARY RISK IN FORCE AS OF JUNE 30, 2011

Total Primary Portfolio:

PMI’s total primary book is primarily driven by the flow channel.

Loans are primarily fixed rate and owner occupied with FICO scores greater than 620.

Certain geographies and select products have exhibited heightened levels of

defaults. 26 |

PORTFOLIO

CHARACTERISTICS – PRIMARY RIF AS OF JUNE 30, 2011

27

(1)

Excludes unreported FICO scores.

(2 )

At origination.

Note: Categories are not mutually exclusive except for Credit Score and Loan

Type. Vintage refers to the year that the insurance was issued. All $ in

Millions CREDIT SCORE

(1)

LOAN TYPE

Total

Less than 575

575 - 619

620 - 679

680 - 719

720 and above

Fixed Rate

ARM

2/28s

Total Portfolio

$23,744.0

$396.3

$1,128.2

$6,503.5

$5,660.8

$9,911.2

$21,933.6

$1,499.1

$311.3

Default Rate

19.4%

40.2%

33.4%

26.6%

19.5%

10.4%

17.9%

40.9%

50.8%

2011 Vintage

$700.1

$0.0

$0.0

$2.3

$122.7

$573.6

$699.4

$0.7

$0.0

Default Rate

0.0%

NA

NA

0.0%

0.0%

0.0%

0.0%

0.0%

NA

2010 Vintage

$1,445.6

$0.1

$0.0

$0.8

$240.6

$1,203.5

$1,444.6

$1.0

$0.0

Default Rate

0.2%

0.0%

NA

0.0%

0.5%

0.1%

0.2%

0.0%

NA

2009 Vintage

$1,518.4

$0.2

$0.2

$56.9

$272.9

$1,185.6

$1,514.8

$3.5

$0.0

Default Rate

1.9%

0.0%

0.0%

9.7%

3.3%

1.2%

1.8%

12.5%

NA

2008 Vintage

$3,356.0

$4.4

$40.1

$629.4

$888.4

$1,790.4

$3,314.9

$41.1

$0.0

Default Rate

13.2%

49.2%

34.9%

22.1%

14.6%

8.4%

13.1%

28.8%

NA

2007 Vintage

$6,181.5

$152.9

$423.0

$1,964.7

$1,565.0

$2,060.1

$5,795.0

$355.7

$30.8

Default Rate

27.8%

46.0%

38.2%

31.1%

27.0%

19.3%

27.1%

38.0%

52.6%

2006 Vintage

$3,333.9

$45.5

$153.9

$1,209.0

$861.6

$1,046.9

$2,753.7

$424.4

$155.8

Default Rate

28.6%

46.1%

37.1%

32.8%

28.9%

20.5%

25.2%

51.5%

54.3%

2005 Vintage

$2,712.4

$38.6

$126.0

$1,010.0

$691.6

$824.8

$2,220.7

$392.3

$99.3

Default Rate

23.8%

40.5%

32.9%

28.3%

24.0%

15.7%

20.1%

46.2%

52.3%

2004 Vintage and Prior

$4,496.1

$154.6

$385.0

$1,630.4

$1,018.0

$1,226.3

$4,190.3

$280.3

$25.4

Default Rate

17.2%

34.1%

28.2%

20.5%

14.6%

9.0%

16.3%

31.0%

36.0%

All $ in Millions, except for Average Loan Size

SPECIFIC PORTFOLIO CHARACTERISTICS

Interest Only

LTV > 97%

Alt-A

California

Florida

Auto States

Avg Loan Size

Avg LTV

(2)

Avg FICO

Total Portfolio

$2,224.2

$4,520.2

$3,485.8

$1,746.1

$2,222.2

$3,212.0

$162,370

93%

699

Default Rate

39.0%

24.9%

38.8%

26.6%

40.0%

19.9%

2011 Vintage

$0.0

$0.0

$0.0

$67.0

$9.0

$79.5

$224,423

91%

756

Default Rate

NA

NA

NA

0.0%

0.6%

0.0%

2010 Vintage

$0.0

$0.0

$0.0

$103.8

$16.4

$173.8

$217,846

90%

758

Default Rate

0.0%

NA

NA

0.2%

0.6%

0.2%

2009 Vintage

$2.4

$0.0

$1.9

$49.8

$30.6

$179.5

$208,175

90%

750

Default Rate

3.1%

0.0%

47.4%

1.2%

4.0%

1.9%

2008 Vintage

$182.5

$205.1

$164.3

$345.1

$177.5

$413.6

$199,826

91%

721

Default Rate

22.9%

21.9%

32.4%

15.3%

29.3%

14.1%

2007 Vintage

$1,096.1

$2,121.8

$1,410.8

$549.9

$686.2

$706.3

$182,628

94%

686

Default Rate

40.8%

29.0%

41.6%

39.0%

50.3%

26.5%

2006 Vintage

$557.7

$897.8

$994.1

$245.8

$495.7

$452.0

$167,310

93%

690

Default Rate

41.0%

25.4%

43.3%

50.9%

55.7%

25.6%

2005 Vintage

$322.0

$539.4

$541.3

$208.1

$399.6

$418.6

$150,934

92%

691

Default Rate

40.2%

22.3%

40.0%

44.9%

44.6%

22.1%

2004 Vintage and Prior

$63.6

$756.0

$373.5

$176.6

$407.3

$788.8

$106,455

93%

681

Default Rate

32.7%

17.9%

25.3%

15.7%

23.6%

20.8% |

$19,835

$5,073

$5,542

$9,138

$20,972

$855

$3,709

$2,749

$1,452

$1,929

$1,136

$1,761

$231

$0

$2,836

41.9%

25.5%

19.0%

10.1%

18.3%

33.5%

39.0%

25.4%

39.4%

24.6%

40.0%

17.4%

18.7%

44.1%

Total

720 and

above

680 -

719

620 -

679

575 -

619

Less

than 575

Fixed

Rate

ARMs

2/28s

Interest

Only

LTV>97

Alt-A

Calif.

Florida

Auto

States

CREDIT SCORE

LOAN TYPE

RISK CHARACTERISTICS

RISK CHARACTERISTICS: FLOW

28

TOTAL

Primary Flow Portfolio:

PMI’s primary flow book represents 88% of primary risk in force and is primarily

owner occupied, fixed rate loans with FICO scores greater than 620.

Approximately 94% of flow risk in force is within conforming loan limits.

Approximately 39% of flow risk in force is in captive reinsurance agreements.

FLOW RISK IN FORCE AS OF JUNE 30, 2011

Risk in Force (dollars in millions).

Default Rate (as measured by policies). |

PORTFOLIO

CHARACTERISTICS – FLOW RIF AS OF JUNE 30, 2011

29

(1)

Excludes unreported FICO scores.

(2 )

At origination.

Note: Categories are not mutually exclusive except for Credit Score and Loan

Type. Vintage refers to the year that the insurance was issued. All $ in

Millions, except for Average Loan Size CREDIT SCORE

(1)

LOAN TYPE

Total

Less than 575

575 - 619

620 - 679

680 - 719

720 and above

Fixed Rate

ARM

2/28s

CREDIT SCORE

(1)

CREDIT SCORE

(1)

CREDIT SCORE

(1)

CREDIT SCORE

(1)

CREDIT SCORE

(1)

Total Portfolio

$20,971.5

$230.5

$855.1

$5,542.3

$5,072.9

$9,137.6

$19,835.1

$1,136.4

n/a

Default Rate

18.3%

44.1%

33.5%

25.5%

19.0%

10.1%

17.4%

41.9%

n/a

2011 Vintage

$700.1

$0.0

$0.0

$2.3

$122.7

$573.6

$699.4

$0.7

n/a

Default Rate

0.0%

NA

NA

0.0%

0.0%

0.0%

0.0%

0.0%

n/a

2010 Vintage

$1,445.6

$0.1

$0.0

$0.8

$240.6

$1,203.5

$1,444.6

$1.0

n/a

Default Rate

0.2%

0.0%

NA

0.0%

0.5%

0.1%

0.2%

0.0%

n/a

2009 Vintage

$1,518.3

$0.2

$0.2

$56.9

$272.9

$1,185.6

$1,514.7

$3.5

n/a

Default Rate

1.9%

0.0%

0.0%

9.7%

3.3%

1.2%

1.8%

12.5%

n/a

2008 Vintage

$3,309.6

$3.6

$38.1

$616.2

$876.1

$1,772.2

$3,273.6

$36.0

n/a

Default Rate

13.2%

48.9%

34.3%

22.0%

14.7%

8.5%

13.0%

31.1%

n/a

2007 Vintage

$5,135.3

$105.7

$340.6

$1,693.3

$1,329.2

$1,650.6

$4,913.9

$221.4

n/a

Default Rate

28.7%

53.1%

39.8%

31.4%

28.1%

20.8%

28.1%

48.3%

n/a

2006 Vintage

$2,520.8

$19.2

$106.1

$869.3

$676.4

$832.8

$2,190.2

$330.6

n/a

Default Rate

27.1%

49.6%

35.4%

30.2%

28.3%

20.5%

24.7%

54.7%

n/a

2005 Vintage

$2,334.3

$16.9

$89.8

$834.2

$608.9

$763.1

$2,020.2

$314.1

n/a

Default Rate

22.2%

41.5%

30.3%

25.8%

23.0%

15.6%

19.8%

44.1%

n/a

2004 Vintage and Prior

$4,007.5

$84.7

$280.3

$1,469.4

$946.0

$1,156.3

$3,778.4

$229.1

n/a

Default Rate

16.7%

35.8%

28.1%

20.4%

14.7%

9.1%

16.1%

28.1%

n/a

SPECIFIC PORTFOLIO CHARACTERISTICS

Interest Only

LTV > 97%

Alt-A

California

Florida

Auto States

Avg Loan Size

Avg LTV

(2)

Avg FICO

Total Portfolio

$1,760.7

$3,709.2

$2,749.4

$1,451.6

$1,928.5

$2,836.4

$163,281

93%

703

Default Rate

39.0%

25.4%

39.4%

24.6%

40.0%

18.7%

2011 Vintage

$0.0

$0.0

$0.0

$67.0

$9.0

$79.5

$224,423

91%

756

Default Rate

NA

NA

NA

0.0%

0.6%

0.0%

2010 Vintage

$0.0

$0.0

$0.0

$103.8

$16.4

$173.8

$217,846

90%

758

Default Rate

0.0%

NA

NA

0.2%

0.6%

0.2%

2009 Vintage

$2.4

$0.0

$1.9

$49.8

$30.6

$179.5

$208,177

90%

750

Default Rate

3.1%

0.0%

47.4%

1.2%

4.0%

1.9%

2008 Vintage

$181.7

$187.9

$163.0

$343.9

$175.9

$409.7

$199,907

91%

721

Default Rate

23.0%

22.2%

32.7%

15.3%

29.1%

13.9%

2007 Vintage

$949.6

$1,794.8

$1,221.8

$463.2

$562.5

$593.9

$183,482

94%

688

Default Rate

42.3%

29.9%

42.9%

40.8%

53.4%

26.5%

2006 Vintage

$347.7

$682.5

$633.9

$142.5

$401.1

$334.3

$166,581

93%

694

Default Rate

42.9%

25.3%

46.5%

51.2%

55.6%

23.6%

2005 Vintage

$223.2

$481.2

$419.4

$133.3

$370.9

$350.4

$149,565

93%

695

Default Rate

35.4%

21.1%

38.5%

42.7%

43.9%

20.6%

2004 Vintage and Prior

$55.9

$562.9

$309.4

$148.1

$362.1

$715.3

$106,338

93%

687

Default Rate

30.2%

18.7%

25.1%

14.8%

23.8%

20.1% |

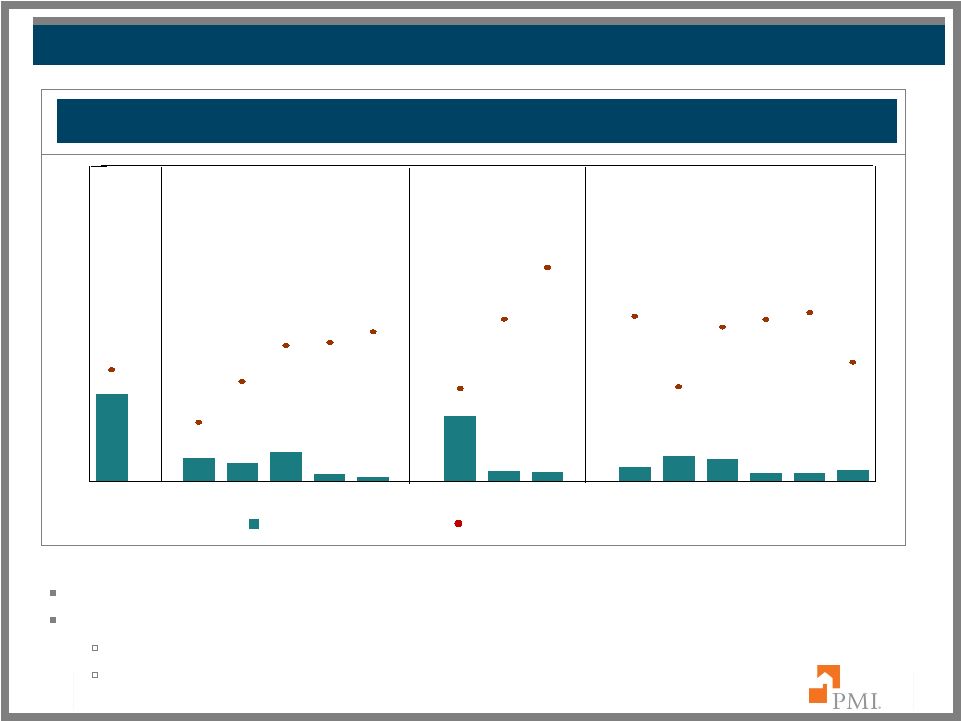

RISK

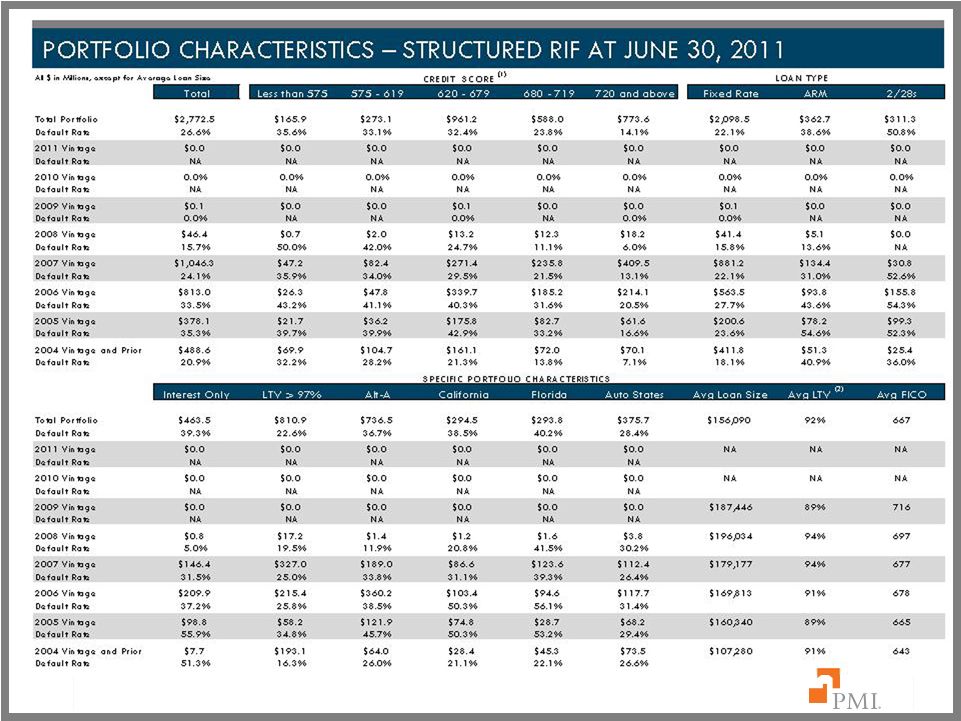

CHARACTERISTICS: STRUCTURED TRANSACTIONS 30

Primary Structured Portfolio:

PMI’s primary structured book represents approximately 12% of total primary risk in

force. Highest defaults are reported in the 2/28 hybrid ARMs product, in

which: All of the 2/28 hybrid ARM risk in force has passed the interest rate reset

date. Monthly reporting of notices of default began to decline in August 2007.

$376

$311

$166

$464

$363

$294

$295

$737

$811

$273

$2,773

$774

$961

$588

$2,099

35.6%

28.4%

22.1%

40.2%

38.5%

36.7%

22.6%

39.3%

50.8%

33.1%

26.6%

14.1%

23.8%

32.4%

38.6%

Total

720 and

above

680 -

719

620 -

679

575 -

619

Less

than 575

Fixed

Rate

ARMs

2/28s

Interest

Only

LTV>97

Alt-A

Calif.

Florida

Auto

States

CREDIT SCORE

LOAN TYPE

RISK CHARACTERISTICS

STRUCTURED TRANSACTIONS RISK IN FORCE AS OF JUNE 30, 2011

Risk in Force (dollars in millions).

Default Rate (as measured by policies). |

31

(1)

Excludes unreported FICO scores.

(2 )

At origination.

Note: Categories are not mutually exclusive except for Credit Score and Loan

Type. Vintage refers to the year that the insurance was issued. |

32

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

MODIFIED

POOL PORTFOLIO CHARACTERISTICS AT JUNE 30, 2011 33

All $ in Millions

Modified Pool:

Data shown in this exhibit is an aggregation of unique pools by book years.

Remaining risk in force

(3)

for modified pool was approximately $328 million at June 30, 2011.

Modified Pool with Deductibles remaining risk in force

(3)

was approximately $80 million.

Modified Pool without Deductibles remaining risk in force

(3)

was approximately $248 million.

All $ in Millions

2004 and Prior

2005

2006

2007

2008 / 2009

Insurance in Force

$2,721

$167

$98

$926

n/a

Stop Loss Amount

$121

$24

$12

$44

n/a

Losses Applicable to Deductible

$29

$11

$2

$12

n/a

Deductible Balance

$28

$0

$0

$8

n/a

PMI's Claims Paid to Date

(1)

$0

$2

$1

$2

n/a

Reserves for Losses

(2)

$12

$7

$3

$4

n/a

Remaining Risk In Force

(3)

$53

$3

$6

$19

n/a

2004 and Prior

2005

2006

2007

2008 / 2009

Insurance in Force

$1,225

$549

$3,123

n/a

n/a

Stop Loss Amount

$208

$25

$305

n/a

n/a

PMI's Claims Paid to Date

(1)

$40

$10

$99

n/a

n/a

Reserves for Losses

(2)

$23

$10

$39

n/a

n/a

Remaining Risk In Force

(3)

$76

$5

$167

n/a

n/a

(1)

PMI’s claims paid to date relates to the modified pool contracts in force as of June

30, 2011 and therefore excludes any payments made as part of restructurings.

(2)

Established loss reserves for non-performing (i.e. delinquent) modified pool loans,

which represents PMI’s estimate of losses for those loans at June 30, 2011.

(3)

Remaining risk in force excludes non-performing risk exposures, for which loss

reserves have been established. |

2/28S

MODIFIED POOL PORTFOLIO CHARACTERISTICS AT JUNE 30, 2011

34

(1)

Excludes unreported FICO scores.

(2)

Excludes Balloon, Buy Down, and Other.

(3)

At origination.

Note: PMI did not insure any modified pool contracts with deductibles in 2008 or

2009 and did not insure any modified pool contracts without deductibles in 2007, 2008 or 2009.

Categories are not mutually exclusive except for Credit Score and Loan Type. Vintage

refers to the year that the insurance was issued. All $ in Millions, except for

Average Loan Size Modified Pool Portfolio Insurance in Force

DEDUCTIBLE

Total

Less than 575

575 - 619

620 - 679

680 - 719

720 and above

Fixed Rate

ARM

2/28s

Total Portfolio

$3,913

$163

$330

$1,074

$795

$1,549

$3,487

$425

$0

2008 Vintage

$0

$0

$0

$0

$0

$0

$0

$0

$0

2007 Vintage

$926

$100

$220

$388

$156

$61

$586

$340

$0

2006 Vintage

$98

$32

$35

$28

$3

$0

$98

$0

$0

2005 Vintage

$167

$0

$0

$58

$43

$66

$105

$62

$0

2004 Vintage and Prior

$2,721

$31

$75

$601

$592

$1,422

$2,698

$23

$0

Interest Only

LTV > 97%

Alt-A

California

Florida

Auto States

Avg Loan Size

Avg LTV

(3)

Avg FICO

Total Portfolio

$93

$515

$1,257

$541

$258

$524

$129,131

74

703

2008 Vintage

$0

$0

$0

$0

$0

$0

$0

0

0

2007 Vintage

$0

$502

$0

$93

$74

$118

$171,774

95

639

2006 Vintage

$0

$12

$0

$5

$9

$13

$140,334

82

595

2005 Vintage

$0

$0

$135

$30

$20

$15

$179,717

77

706

2004 Vintage and Prior

$93

$1

$1,122

$414

$155

$378

$116,899

69

722

Avg LTV

(2)

NON DEDUCTIBLE

Total

Less than 575

575 - 619

620 - 679

680 - 719

720 and above

Fixed Rate

ARM

2/28s

Total Portfolio

$4,897

$269

$597

$1,879

$1,122

$882

$2,827

$2,068

$0

2006 Vintage

$3,123

$268

$582

$1,397

$604

$273

$1,126

$1,997

$0

2005 Vintage

$549

$0

$4

$134

$174

$226

$544

$5

$0

2004 Vintage and Prior

$1,225

$2

$12

$348

$344

$383

$1,156

$66

$0

Interest Only

LTV > 97%

Alt-A

California

Florida

Auto States

Avg Loan Size

Avg LTV

(3)

Avg FICO

Total Portfolio

$280

$1,162

$1,460

$750

$441

$620

$146,552

87

667

2006 Vintage

$95

$1,160

$133

$337

$323

$521

$147,637

94

647

2005 Vintage

$61

$0

$429

$143

$26

$24

$186,213

73

713

2004 Vintage and Prior

$123

$2

$898

$270

$92

$75

$131,526

76

703

SPECIFIC PORTFOLIO CHARACTERISTICS

CREDIT SCORES

(1)

LOAN TYPE

(2)

SPECIFIC PORTFOLIO CHARACTERISTICS

CREDIT SCORES

(1)

LOAN TYPE

(2) |

35

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

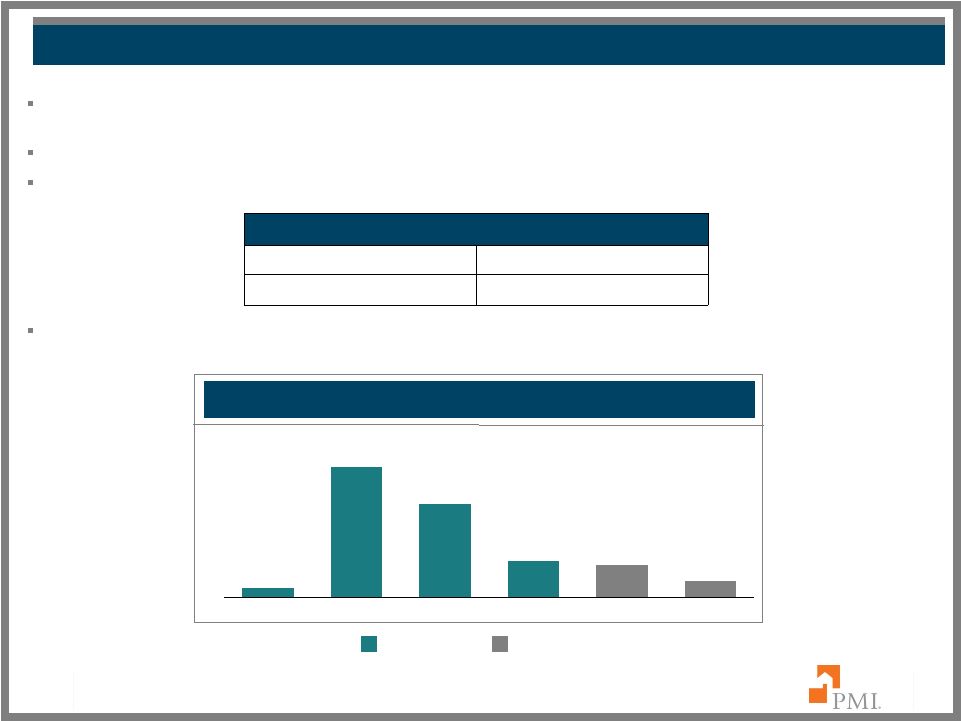

Captive

reinsurers are wholly-owned, bankruptcy remote subsidiaries of originators that provide mezzanine level reinsurance for loans for

which PMI has provided primary mortgage insurance coverage.

PMI is the named beneficiary on captive trust balances totaling approximately $635 million

as of June 30, 2011. At June 30, 2011, approximately 39% of flow risk in force was

covered by captive reinsurance agreements, including: Based on current expectations

of defaults, PMI forecasts the following approximate reductions to total incurred losses as a result of captive

reinsurance agreements in 2011 and 2012:

PMI’S CAPTIVE REINSURANCE AGREEMENTS

FLOW RISK IN FORCE COVERED BY CAPTIVES

~ 43% of prime

~ 45% of Alt-A

~ 51% of less-than-A quality

~ 50% of LTVs >97%*

36

*

Captive coverage for LTVs greater than 97% may overlap with other listed

categories. BENEFIT FROM CAPTIVE REINSURANCE AGREEMENTS

(Dollars in Millions)

Actual

Projected

$60

$122

$137

$350

$491

$34

2007

2008

2009

2010

2011

2012 |

PMI’S

CAPTIVE REINSURANCE AGREEMENTS 37

Note: Due to rounding, the totals may not equal the sum of each category.

Note:

For

the

combined

captive

trust

arrangements,

the

weighted

average

entry

point

is

4.04%

and

the

weighted

average

exit

point

is

11.73%.

Original RIF has been recalculated for the impact of rescissions.

The cumulative captive benefit on this page is for excess-of-loss (XOL) captive

reinsurance agreements only. PMI MORTGAGE INSURANCE CO.

CAPTIVE REINSURANCE AGREEMENTS ATTACHMENT ANALYSIS

(Dollars in millions)

Original

Progression to

Book Year

RIF

Attachment Point

2004 & Prior Total

$10,004

0 - 50%

$226

$148.1

$373

$155.9

$645

$183.1

5,892

50 - 75%

383

156.3

672

196.1

605

165.0

2,399

75 - 99%

262

76.0

432

98.3

336

70.0

8,608

Attached

1,210

409.0

974

290.7

1,251

308.4

$26,904

$2,082

$789.4

$94.9

$10.9

$2,450

$741.0

$65.6

$6.8

$2,838

$726.5

$59.6

$4.4

2005 Total

$11

0 - 50%

$3

$0.2

$7

$0.3

$8

$0.3

44

50 - 75%

22

1.5

19

1.0

21

0.8

0

75 - 99%

0

0.0

0

0.0

4

0.4

4,499

Attached

1,535

614.9

1,650

575.7

1,916

525.4

$4,554

$1,559

$616.6

$308.1

$205.2

$1,676

$577.0

$284.8

$179.8

$1,949

$526.9

$242.5

$125.6

2006 Total

$4

0 - 50%

$2

$0.1

$2

$0.1

$2

$0.1

27

50 - 75%

13

0.9

7

0.4

15

0.7

14

75 - 99%

6

0.6

14

1.1

12

0.9

3,271

Attached

1,449

646.7

1,567

619.9

1,892

558.6

$3,316

$1,469

$648.4

$258.8

$205.5

$1,589

$621.6

$273.1

$191.0

$1,921

$560.3

$246.1

$124.1

2007 Total

$21

0 - 50%

$12

$0.3

$12

$0.1

$22

$0.6

9

50 - 75%

4

0.3

7

0.4

0

0.0

5

75 - 99%

2

0.2

0

0.0

7

0.4

4,822

Attached

2,755

894.3

3,025

789.8

3,653

756.1

$4,856

$2,774

$895.1

$337.9

$230.7

$3,045

$790.3

$317.6

$140.5

$3,681

$757.1

$327.1

$41.8

2008 Total

$84

0 - 50%

$48

$1.4

$43

$0.8

$123

$2.3

52

50 - 75%

6

0.5

143

6.3

167

6.8

263

75 - 99%

182

11.8

139

8.2

79

3.8

1,318

Attached

884

112.5

938

95.6

1,038

89.0

$1,717

$1,119

$126.2

$42.9

$2.3

$1,263

$110.9

$32.9

$0.5

$1,408

$101.9

$30.0

$0.0

Cumulative Captive Benefit (MM)

$1,042.6

$654.6

$974.0

$518.5

$905.3

$295.9

Total Captive Trust Balances (MM)

$634.7

$724.3

$900.2

Ever to Date

Incurred Losses

Paid Loss

Paid Loss

RIF

Incurred Loss

Captive

Current

Current

RIF

Captive

RIF

Incurred Losses

Benefit

Cumulative

June 30, 2011

Incurred Loss

Cumulative

Cumulative

Cumulative

Cumulative

Cumulative

December 31, 2010

June 30, 2010

Benefit

Benefit

Incurred Loss

Paid Loss

Captive

Captive

Incurred Losses

Ever to Date

Benefit

Captive

Benefit

Captive

Benefit

Current

Ever to Date |

FORWARD-LOOKING STATEMENT

CAUTIONARY

STATEMENT:

Statements

in

this

portfolio

supplement

that

are

not

historical

facts,

or

that

relate

to

future

plans,

events

or

performance,

are

“forward-looking”

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

forward-looking

statements

include

our

estimates

with

respect

to

the

future

benefits

of

captive

reinsurance.

There

can

be

no

assurance

that

we

will

realize

the

expected

future

benefits

from

our

captive

reinsurance

arrangements.

Readers

are

cautioned

that

forward-looking

statements

by

their

nature

involve

risk

and

uncertainty

because

they

relate

to

events

and

depend

on

circumstances

that

will

occur

in

the

future.

Many

factors

could

cause

actual

results

and

developments

to

differ

materially

from

those

expressed

or

implied

by

forward-looking

statements.

Other

risks

and

uncertainties

are

discussed

in

the

Cautionary

Statement

to

our

press

release

and

supplement

dated

August

4,

2011

regarding

our

Second

Quarter

2011

Financial

Results

and

in

our

SEC

filings,

including

in

Item

1A

of

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2010

and

Item

1A

of

our

Quarterly

Report

on

Form

10-Q

for

the

quarters

ended

March

31

and

June

30,

2011.

We

undertake

no

obligation

to

update

forward-looking

statements.

38 |

|