Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mastercard Inc | d8k.htm |

| EX-99.1 - PRESS RELEASE - Mastercard Inc | dex991.htm |

Exhibit 99.2

Exhibit 99.2

MasterCard Incorporated Second-Quarter 2011 Financial Results Conference Call

August 3, 2011

Business Update

• Operational Overview

• Economic Update

• U.S. Debit Regulation

• Business Highlights

2

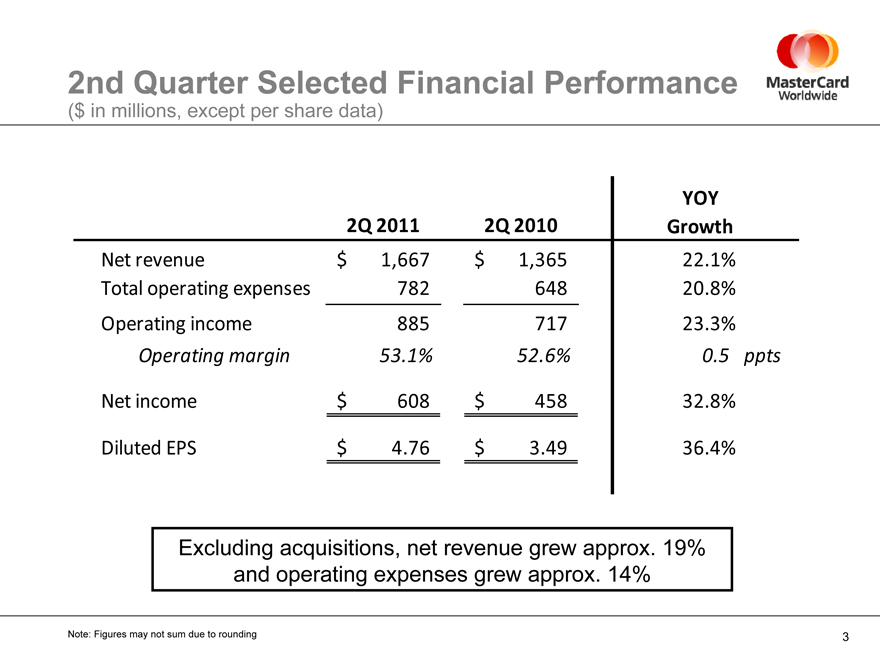

2nd Quarter Selected Financial Performance

($ in millions, except per share data)

2Q 2011 2Q 2010 YOY Growth

Net revenue $ 1,667 $ 1,365 22.1%

Total operating expenses 782 648 20.8%

Operating income 885 717 23.3%

Operating margin 53.1% 52.6% 0.5 ppts

Net income $ 608 $ 458 32.8%

Diluted EPS $ 4.76 $ 3.49 36.4%

Excluding acquisitions, net revenue grew approx. 19% and operating expenses grew approx. 14%

Note: Figures may not sum due to rounding

3

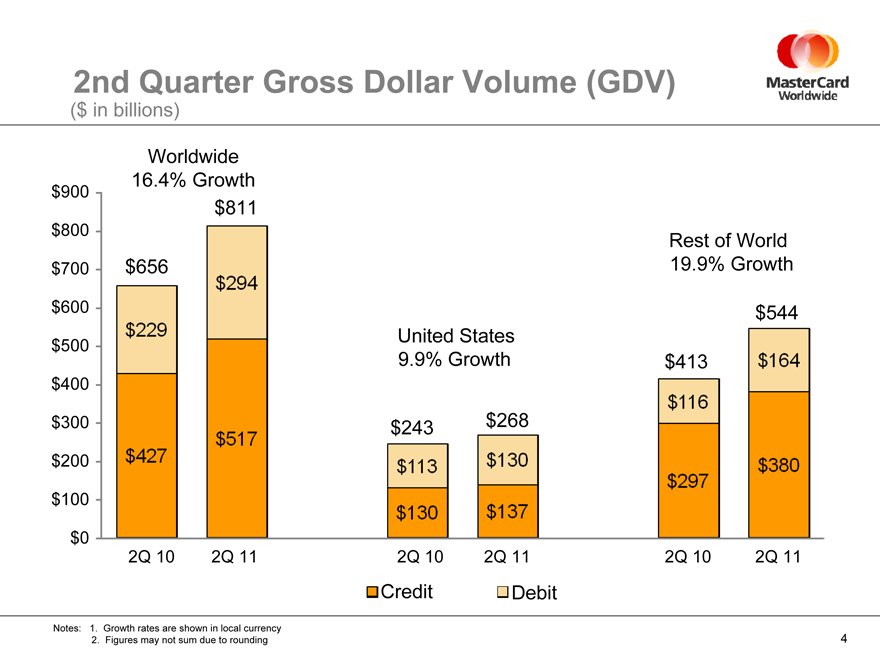

2nd Quarter Gross Dollar Volume (GDV)

($ in billions)

$900

$800 $700 $600

$500 $400 $300

$200

$100

$0

Worldwide 16.4% Growth

$656

$229

$427

$811 $294 $517

United States 9.9% Growth

$243

$113

$130

$268

$130

$137

Rest of World 19.9% Growth

$413

$116

$297

$544

$164

$380

2Q 10 2Q 11 2Q 10 2Q 11 2Q 10 2Q 11

Credit Debit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

4

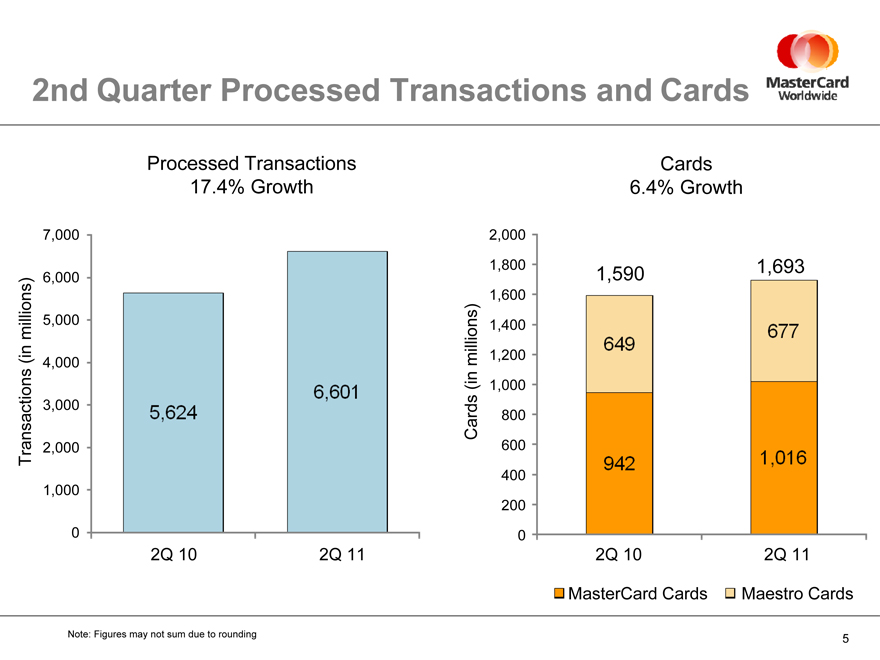

2nd Quarter Processed Transactions and Cards

Transactions (in millions)

7,000 6,000 5,000 4,000 3,000 2,000 1,000 0

Processed Transactions

17.4% Growth

5,624

6,601

2Q 10 2Q 11

Cards (in millions)

2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0

Cards 6.4% Growth

1,590 649 942

1,693

677

1,016

2Q 10 2Q 11

MasterCard Cards Maestro Cards

Note: Figures may not sum due to rounding

5

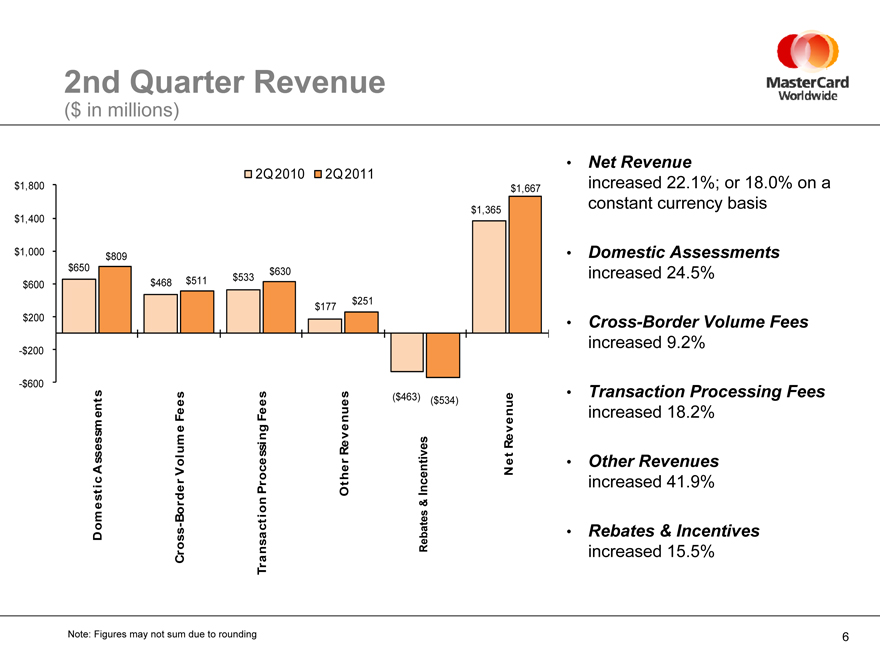

2nd Quarter Revenue ($ in millions)

$1,800 $1,400 $1,000 $600 $200 -$200 -$600

2Q 2010 2Q 2011

Domestic Assessments

Cross-Border Volume Fees

Transaction Processing Fees

Other Revenues

Rebates & Incentives

Net Revenues

$650 $809 $468 $511 $533 $630 $177 $251 ($463) ($534) $1,365 $1,667

• Net Revenue increased 22.1%; or 18.0% on a constant currency basis

Domestic Assessments increased 24.5%

Cross-Border Volume Fees increased 9.2%

Transaction Processing Fees increased 18.2%

Other Revenues increased 41.9%

Rebates & Incentives increased 15.5%

Note: Figures may not sum due to rounding

6

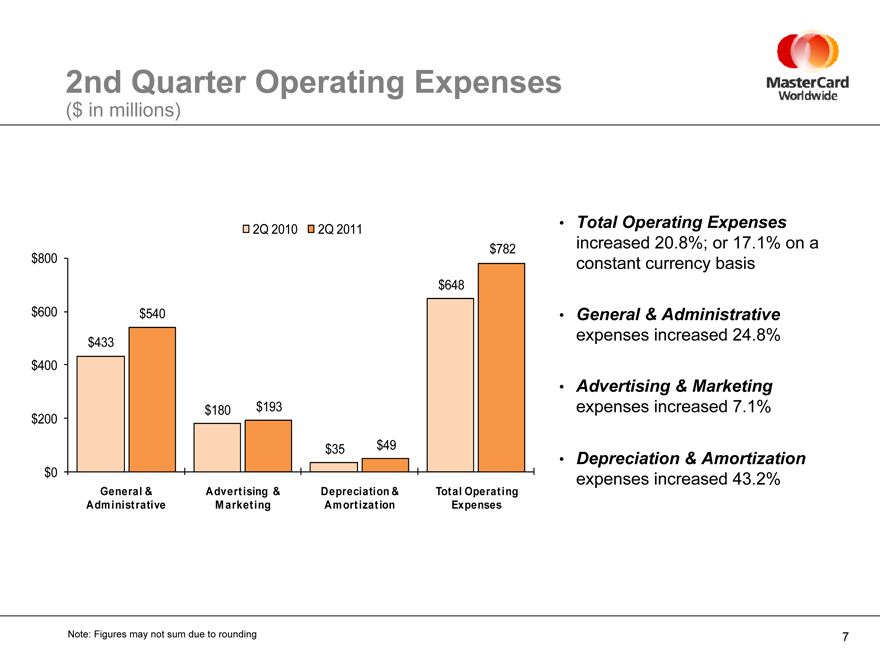

2nd Quarter Operating Expenses ($ in millions)

2Q 2010

2Q 2011

$800

$600

$400

$200

$0

$433

$540

$180

$193

$35

$49

$648

$782

General &

Administrative

Advertising &

Marketing

Depreciation &

Amortization

Total Operating

Expenses

Total Operating Expenses increased 20.8%; or 17.1% on a constant currency basis

General & Administrative expenses increased 24.8%

Advertising & Marketing expenses increased 7.1%

Depreciation & Amortization expenses increased 43.2%

Note: Figures may not sum due to rounding

7

2nd Quarter Cash Flow Statement and Balance Sheet Highlights

Cash flow from operations of $538 million

Cash, cash equivalents and other liquid investments of $3.6 billion

Share Repurchase Activity

2Q11: approx. 1.5 million shares (cost of $387 million)

3Q11 through July 28: 77,700 shares (cost of $24 million)

Remaining authorization: $935 million

8

Thoughts for the Future

Business update through July 28

Thoughts for 2011

Net Revenue

Total Operating Expenses

Tax Rate

Long-term financial objectives

9

MasterCard

Worldwide

The Heart of CommerceTM

10