Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K FOR SECOND QUARTER 2011 PRESS RELEASE - Higher One Holdings, Inc. | q2-8k.htm |

| EX-99.1 - PRESS RELEASE - Higher One Holdings, Inc. | q2pressrelease.htm |

Higher One Holdings, Inc.

Q2’11 Earnings Results

August 2, 2011

Q2’11 Earnings Results

August 2, 2011

Exhibit 99.2

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

2

Forward-Looking Statements

This presentation includes forward-looking statements, as defined by the Securities and Exchange

Commission. Management’s projections and expectations are subject to a number of risks and

uncertainties that could cause actual performance to differ materially from that predicted or implied.

These statements speak only as of the date they are made, and the company does not intend to update or

otherwise revise the forward-looking information to reflect actual results of operations, changes in

financial condition, changes in estimates, expectations or assumptions, changes in general economic or

industry conditions or other circumstances arising and/or existing since the preparation of this

presentation or to reflect the occurrence of any unanticipated events. The forward-looking statements in

this presentation do not include the potential impact of any acquisitions or divestitures that may be

announced and/or completed after the date hereof. Information about the factors that could affect future

performance can be found in our recent SEC filings, available on our website at http://ir.higherone.com/.

Commission. Management’s projections and expectations are subject to a number of risks and

uncertainties that could cause actual performance to differ materially from that predicted or implied.

These statements speak only as of the date they are made, and the company does not intend to update or

otherwise revise the forward-looking information to reflect actual results of operations, changes in

financial condition, changes in estimates, expectations or assumptions, changes in general economic or

industry conditions or other circumstances arising and/or existing since the preparation of this

presentation or to reflect the occurrence of any unanticipated events. The forward-looking statements in

this presentation do not include the potential impact of any acquisitions or divestitures that may be

announced and/or completed after the date hereof. Information about the factors that could affect future

performance can be found in our recent SEC filings, available on our website at http://ir.higherone.com/.

This presentation includes certain metrics presented on a non-GAAP basis, including non-GAAP adjusted

EBITDA, non-GAAP adjusted EBITDA margin, non-GAAP adjusted net income, non-GAAP adjusted diluted

EPS, and non-GAAP Free Cash Flow. We believe that these non-GAAP measures, which exclude

amortization of intangibles, stock-based compensation, and certain non-recurring or non-cash impacts to

our results, all net of taxes, provide useful information regarding normalized trends relating to the

company’s financial condition and results of operations. Reconciliations of these non-GAAP measures to

their closest comparable GAAP measure are included in the appendix of this presentation.

EBITDA, non-GAAP adjusted EBITDA margin, non-GAAP adjusted net income, non-GAAP adjusted diluted

EPS, and non-GAAP Free Cash Flow. We believe that these non-GAAP measures, which exclude

amortization of intangibles, stock-based compensation, and certain non-recurring or non-cash impacts to

our results, all net of taxes, provide useful information regarding normalized trends relating to the

company’s financial condition and results of operations. Reconciliations of these non-GAAP measures to

their closest comparable GAAP measure are included in the appendix of this presentation.

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

3

Q2’11 Highlights

• Solid performance on both top and bottom

line

line

• Strong competitive position

• Executing against our strategic priorities

o Signing new clients

o Increasing adoption at existing clients

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

4

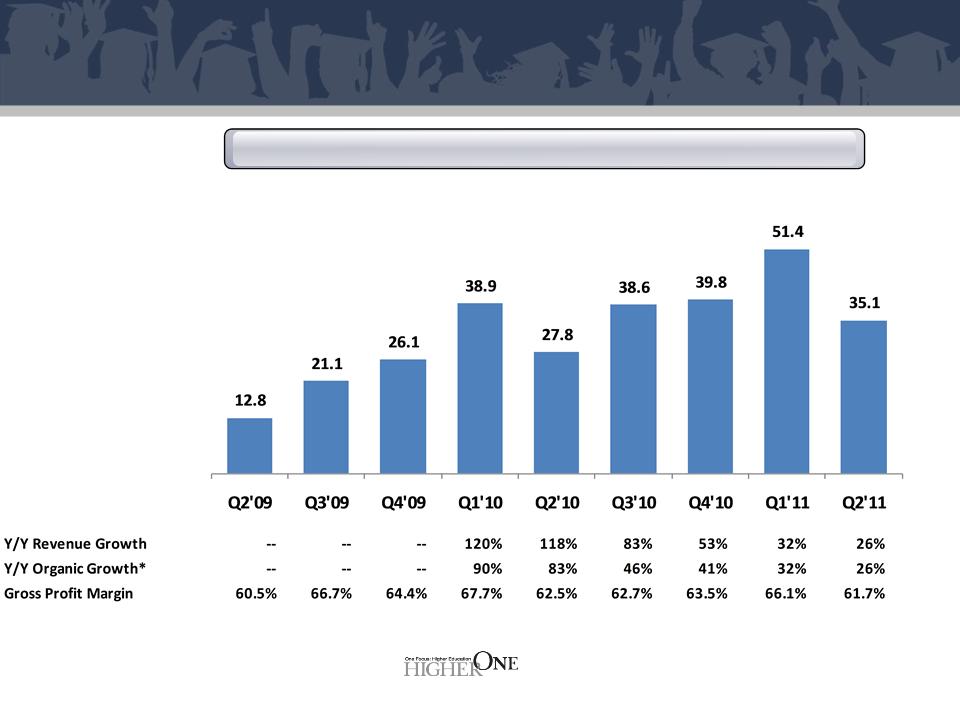

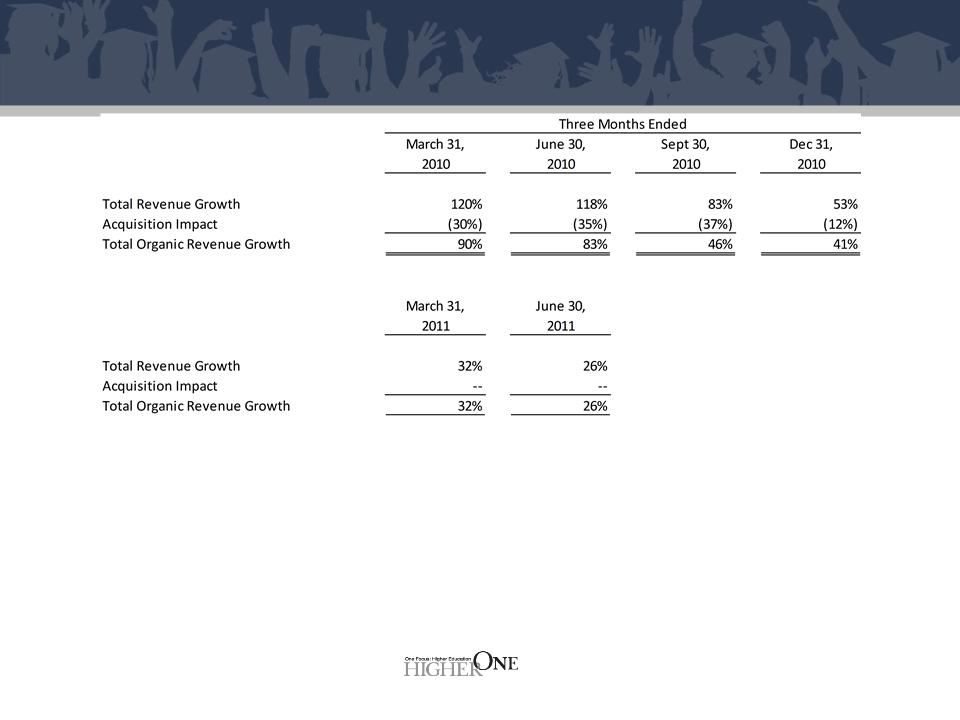

*Calculation of organic revenue growth is included in the appendix of this presentation

Revenue

(in $ millions)

Revenue in-line with expectations

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

5

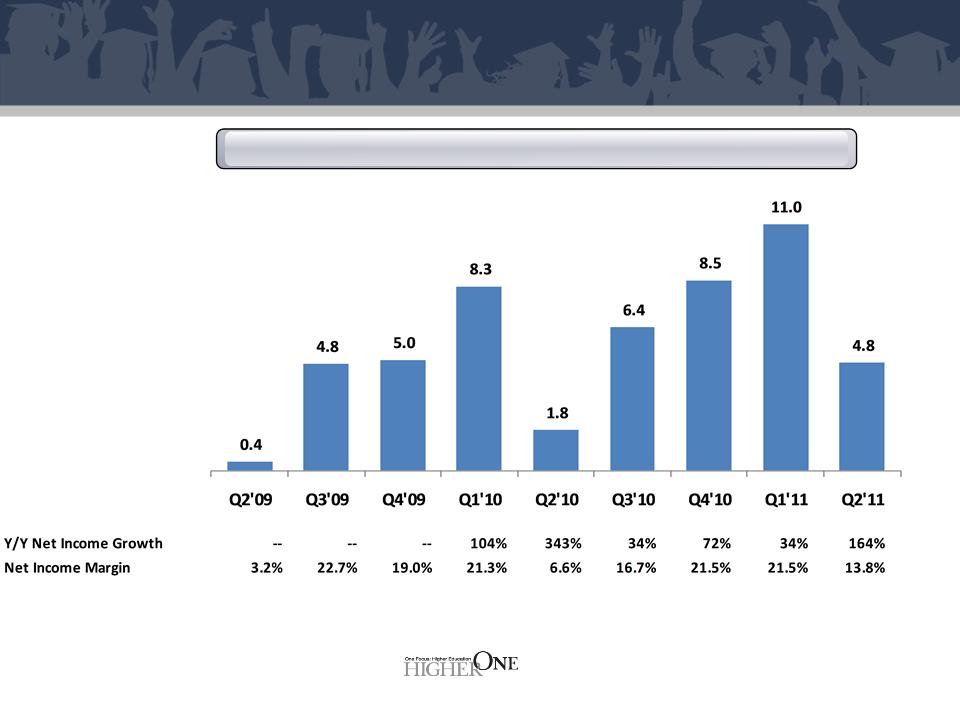

GAAP Net Income

Net Income

(in $ millions)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

6

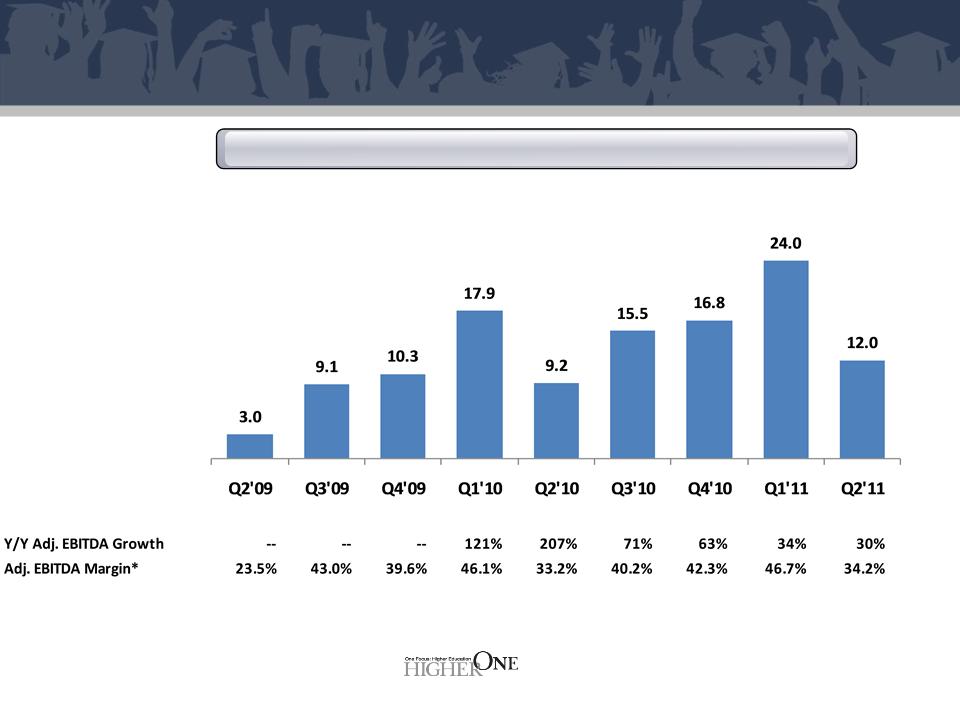

Margin expansion as we grow Adj. EBITDA

*Calculation of Adj. EBITDA and Adj. EBITDA Margin is included in the appendix of this presentation

Adj. EBITDA*

(in $ millions)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

7

GAAP Diluted EPS

GAAP Diluted EPS

(in $)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

8

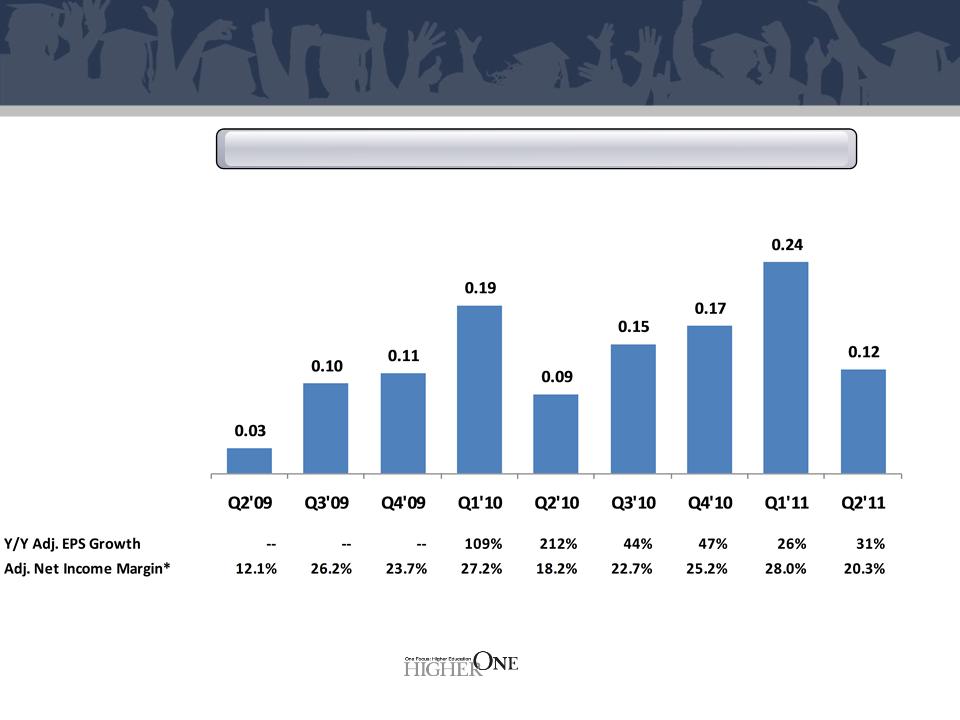

Adj. EPS above expectations

*Calculation of Adj. EPS and Adj. Net Income Margin is included in the appendix of this presentation

Adjusted Diluted EPS

(in $)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

9

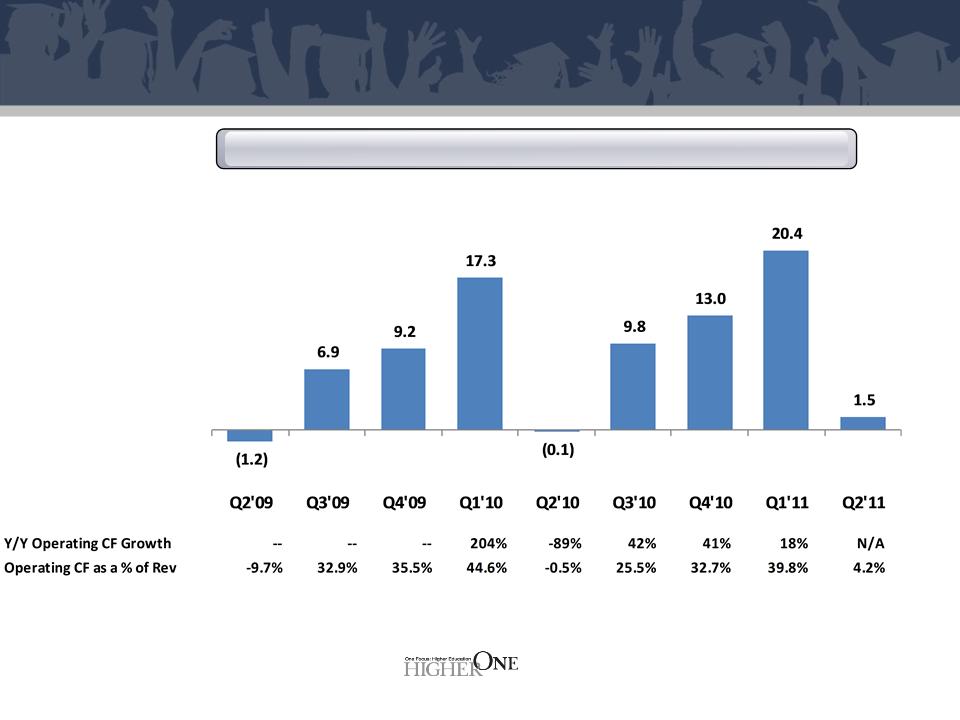

Operating Cash Flow

Operating Cash Flow

(in $ millions)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

10

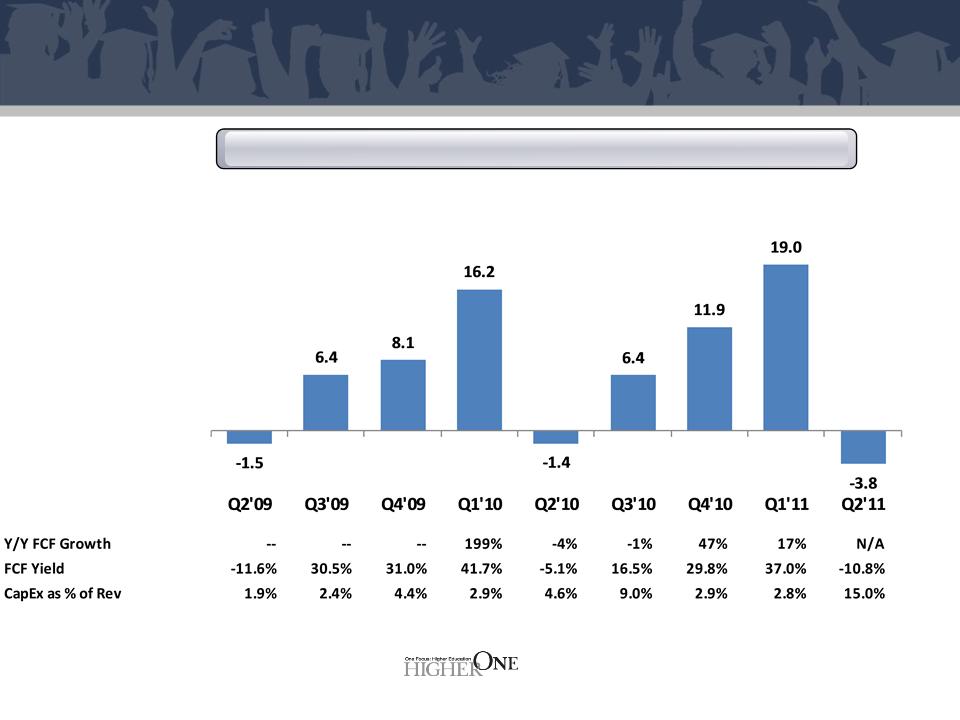

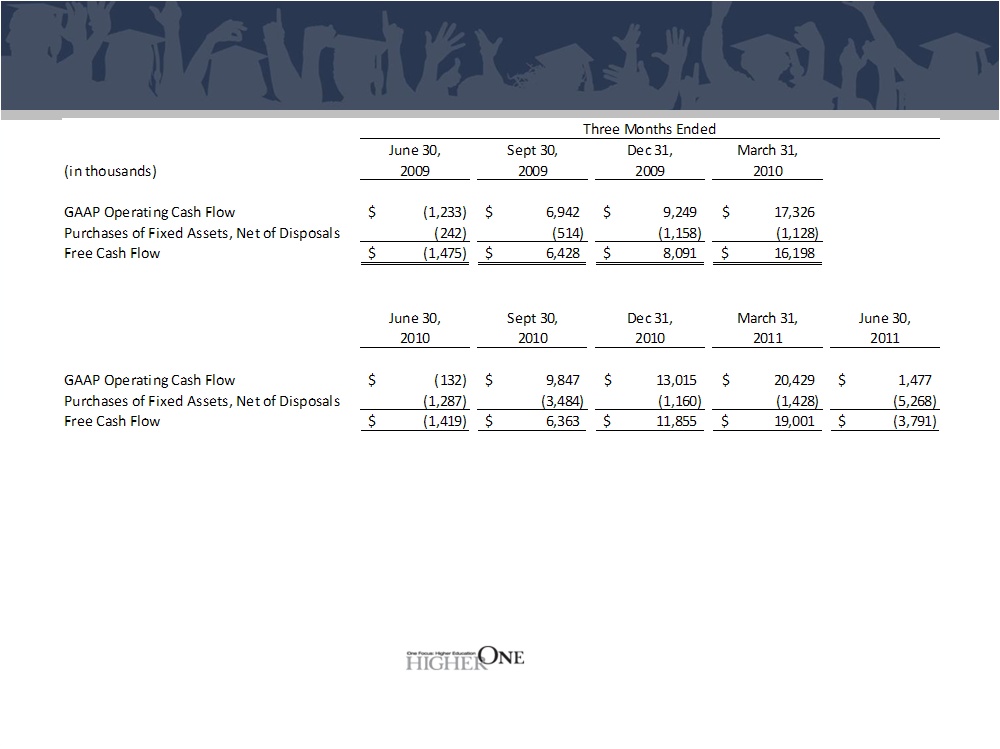

Increase in CapEx impacting Free Cash Flow

*Calculation of Free Cash Flow is included in the appendix of this presentation

Free Cash Flow

(in $ millions)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

11

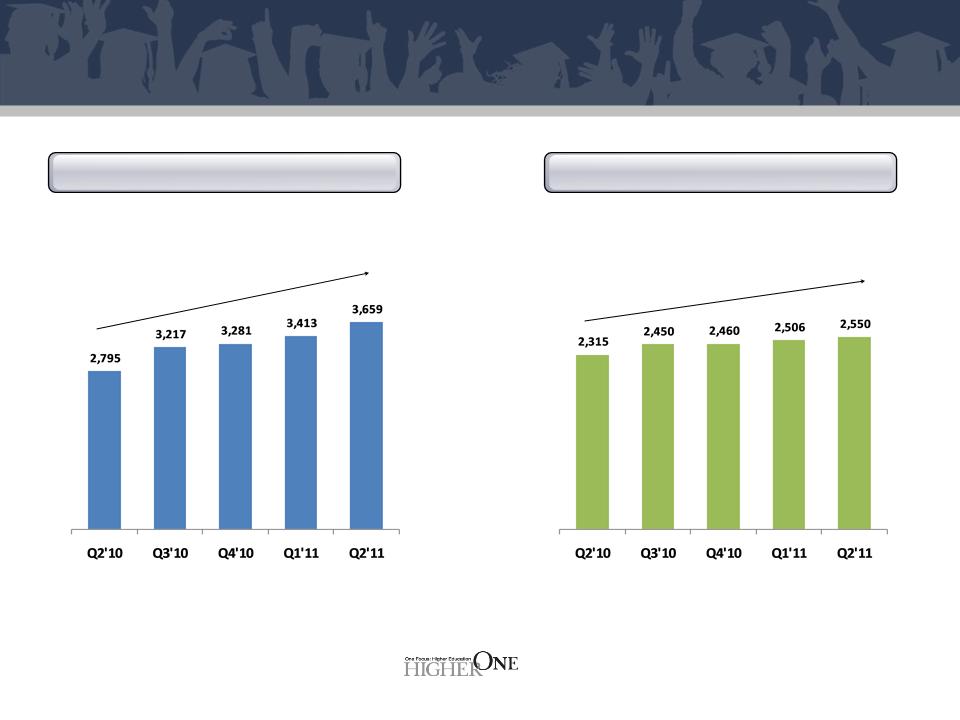

Solid sales, customer base continues to grow

*SSE stands for Signed School Enrollment, and is recorded each quarter as the total student enrollment at all schools that are contracted at

quarter-end for either our OneDisburse or at least one of our CASHNet Payment Suite products, as of the date the contract is signed (using the

most up-to-date IPEDS data at that point in time).

quarter-end for either our OneDisburse or at least one of our CASHNet Payment Suite products, as of the date the contract is signed (using the

most up-to-date IPEDS data at that point in time).

OneDisburse SSE*

CASHNet Suite SSE*

+31%

+10%

(in thousands)

(in thousands)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

12

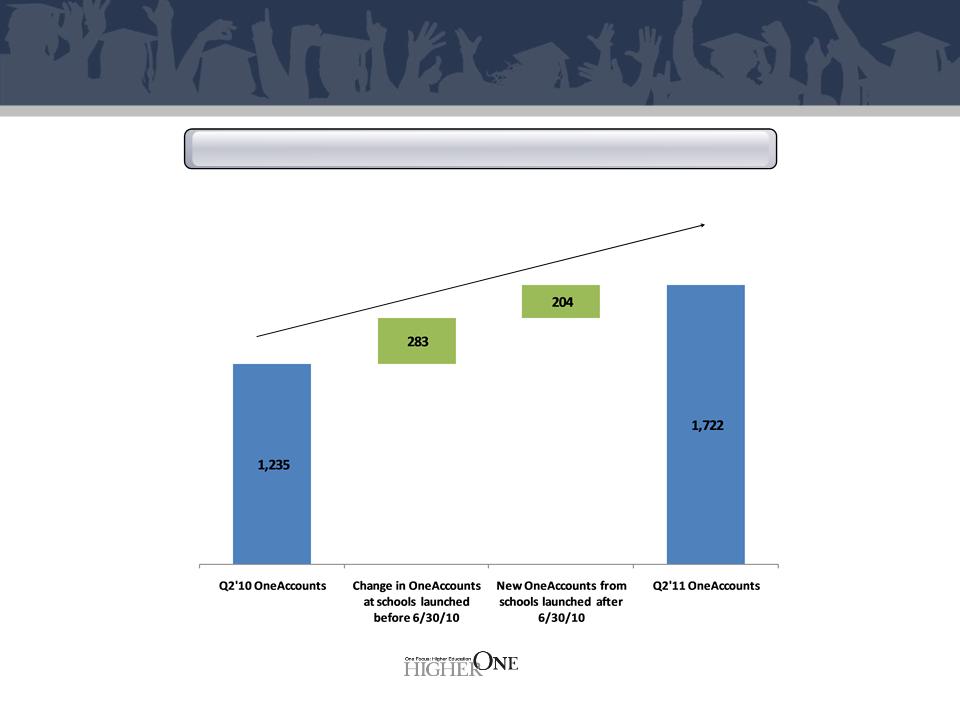

New sales, higher adoption drive account growth

OneAccount Growth

+39%

(in thousands)

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

13

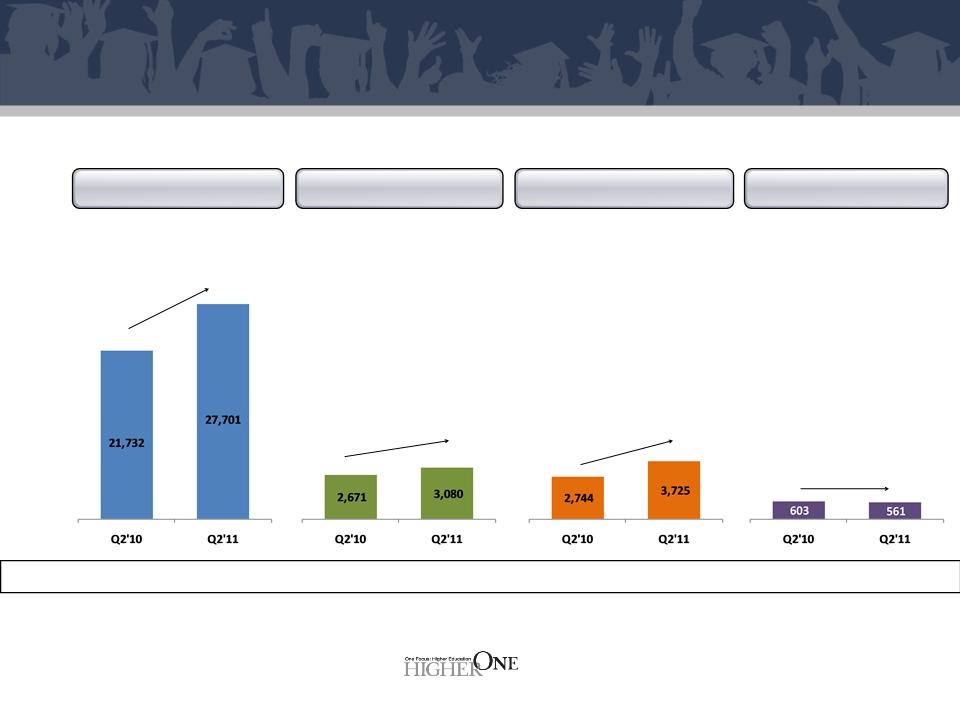

Continued growth in major revenue buckets

As a % of total

revenue

revenue

Account

(in $ thousands)

Payment Trxn

(in $ thousands)

Higher Ed. Institution

(in $ thousands)

Other

(in $ thousands)

78%

79%

10%

9%

10%

11%

2%

1%

+27%

+15%

+36%

-7%

14

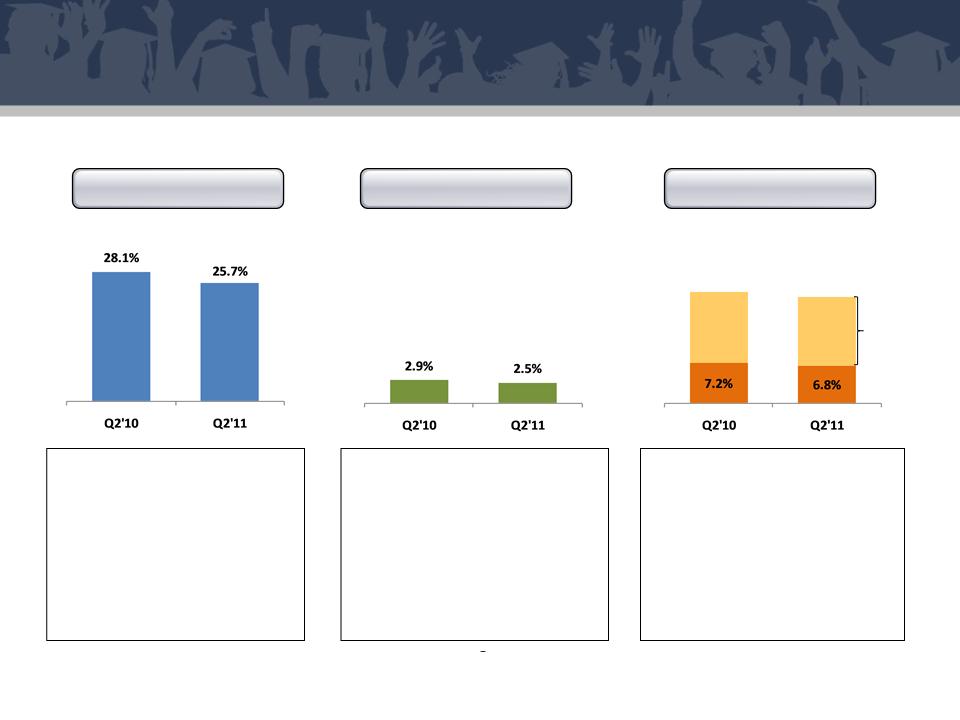

Carefully managing expenses as we scale revenue

• Continue to gain leverage from

scale

scale

• Continue to make the right

investments to grow the business…

recently announced OneDisburse

product innovations based on

feedback from the market.

investments to grow the business…

recently announced OneDisburse

product innovations based on

feedback from the market.

• Excluding stock-based and other

customer acquisition expense, S&M

expense as a percent of revenue was

6.8% in Q2’11 (compared to 7.2% in

Q2’10)

customer acquisition expense, S&M

expense as a percent of revenue was

6.8% in Q2’11 (compared to 7.2% in

Q2’10)

• Successful quarter for Evisions sales

partnership

partnership

G&A

(as a % of rev)

PD

(as a % of rev)

Adj. S&M*

(as a % of rev)

19.9%

19.1%

Stock-based and

other M&A

related expense

other M&A

related expense

*The Adjusted Sales and Marketing Expense graph shows both total Sales & Marketing as a percent of revenue as well as Sales & Marketing as a percent of revenue

excluding stock-based and other acquisition expense, which is related to the vesting of certain shares issued in connection with the acquisition of EduCard and CASHNET.

Stock-based and other acquisition expense is recognized in the quarter as a function of sales and average share price.

excluding stock-based and other acquisition expense, which is related to the vesting of certain shares issued in connection with the acquisition of EduCard and CASHNET.

Stock-based and other acquisition expense is recognized in the quarter as a function of sales and average share price.

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

15

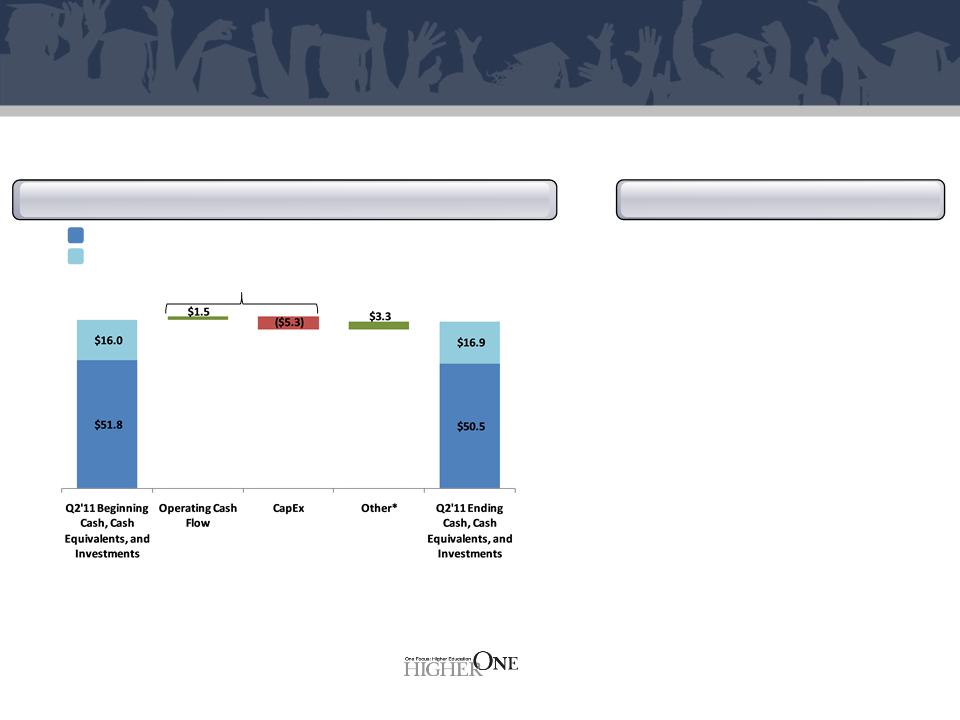

Continue to build on our strong liquidity position

• ($3.8M) in FCF

• Q2 is seasonally weakest quarter

• Increased CapEx on building project

• Fully liquid assets total $67.4M

• $1.5M from settlement with

former IDC stockholders

former IDC stockholders

• Additional $50M available under

new credit facility**

new credit facility**

• Building project to impact FCF

through Q2’12

through Q2’12

*Other primarily includes a gain related to litigation and proceeds and tax benefits from options exercises

**Subject to certain standard affirmative, negative and financial covenants, outlined in our SEC filings

Cash & Investment Balance/Flows

(in millions)

FCF/Other Movements

$67.8

FCF

Cash and cash equivalents

Investments in available for sale securities

$67.4

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

16

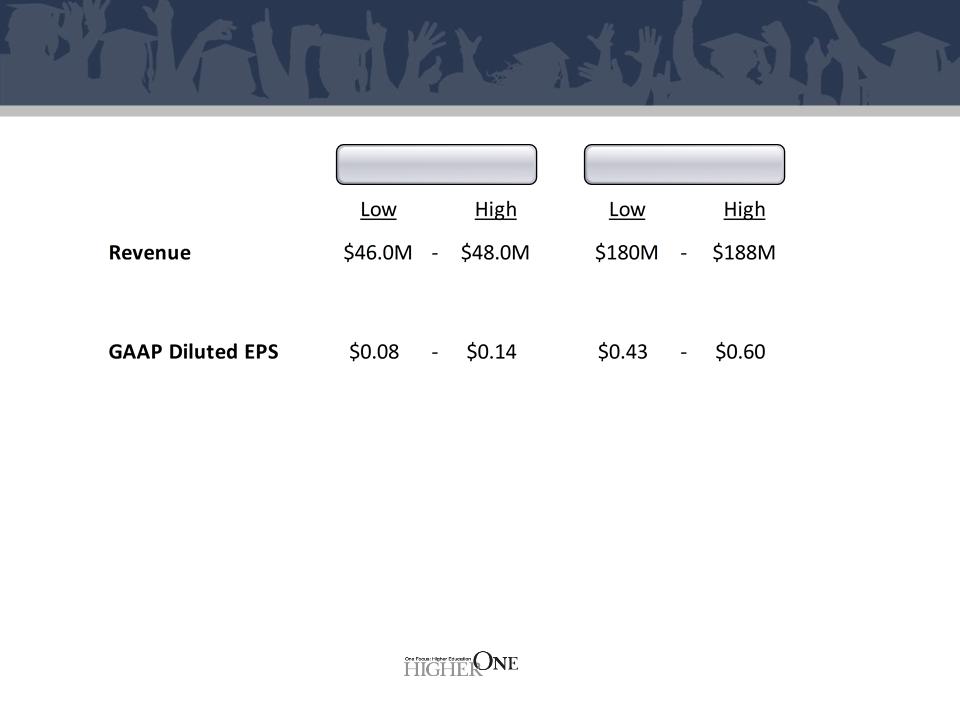

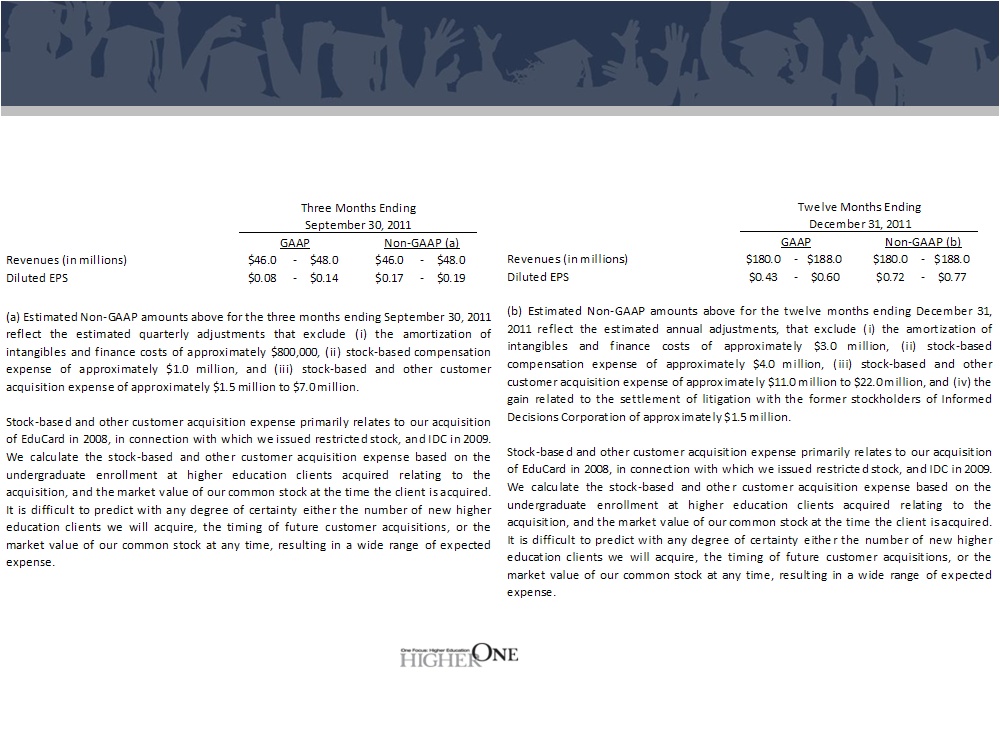

GAAP Guidance Update

FY’11

Q3’11

• Maintaining FY’11 revenue guidance

• Increase in FY’11 Adj. EPS guidance

• Anniversary Reg E impact part way through Q3

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

17

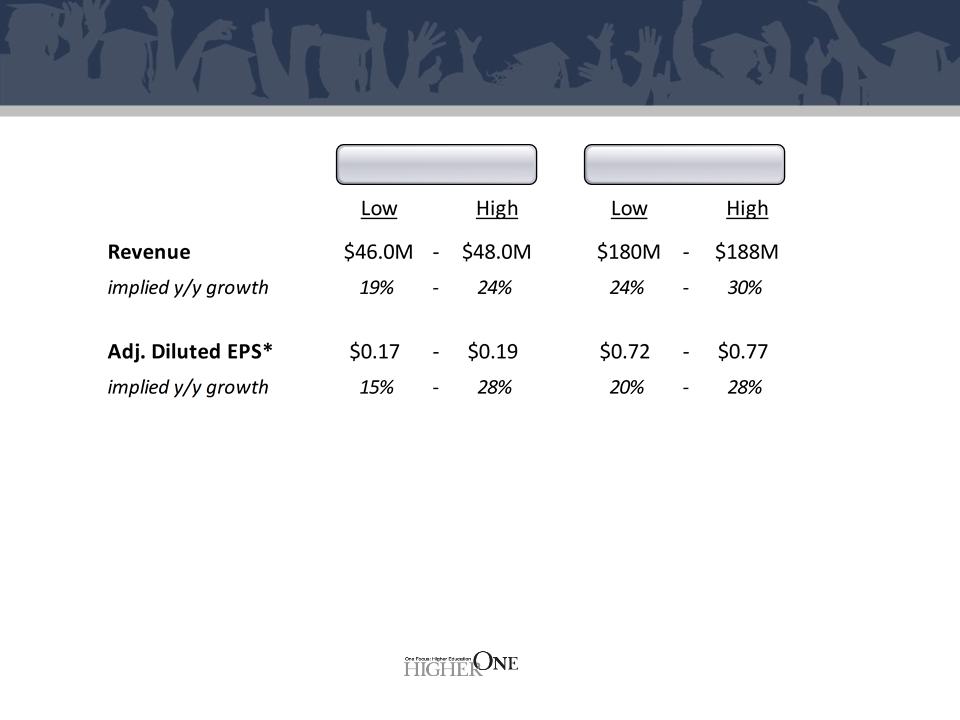

Non-GAAP Guidance Update

*Calculation of Adjusted Diluted EPS is included in the appendix of this presentation

FY’11

Q3’11

• Maintaining FY’11 revenue guidance

• Increase in FY’11 Adj. EPS guidance

• Anniversary Reg E impact part way through Q3

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

18

Q2’11 Summary

• Solid performance on both top and bottom

line

line

• Strong competitive position

• Executing against our strategic priorities

o Signing new clients

o Increasing adoption at existing clients

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

19

Q & A

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

20

Appendix

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

21

Calculation of Organic Revenue*

*Organic revenue calculation excludes the entire revenue impact from the current and prior year quarter for all acquisitions made within 15

months of a given quarter’s end

months of a given quarter’s end

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

22

Calculation of Free Cash Flow

23

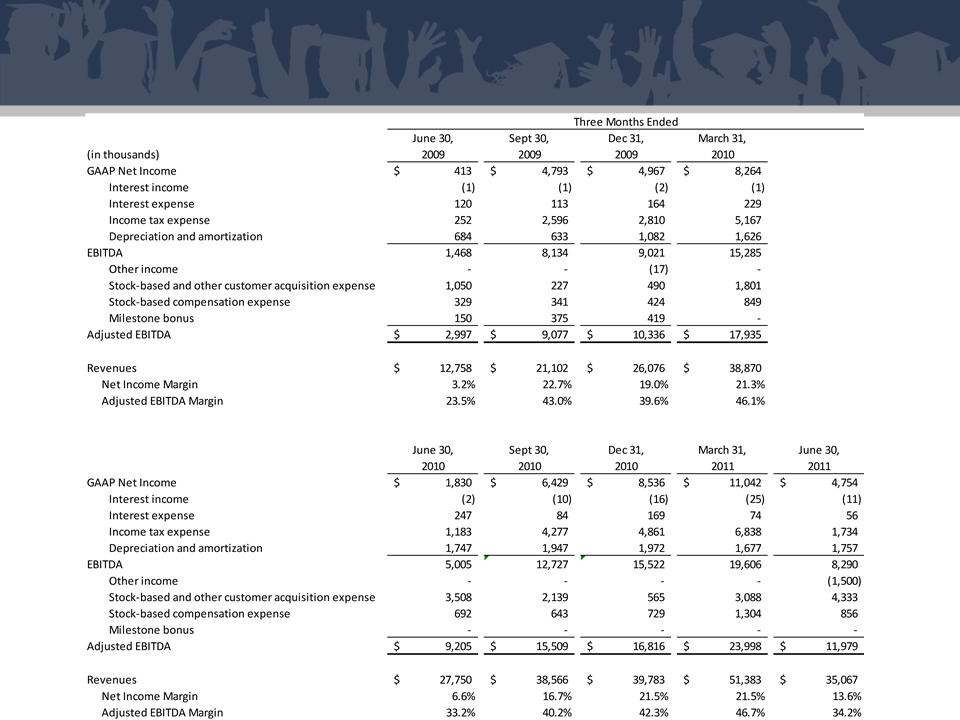

Calculation of Adjusted EBITDA

24

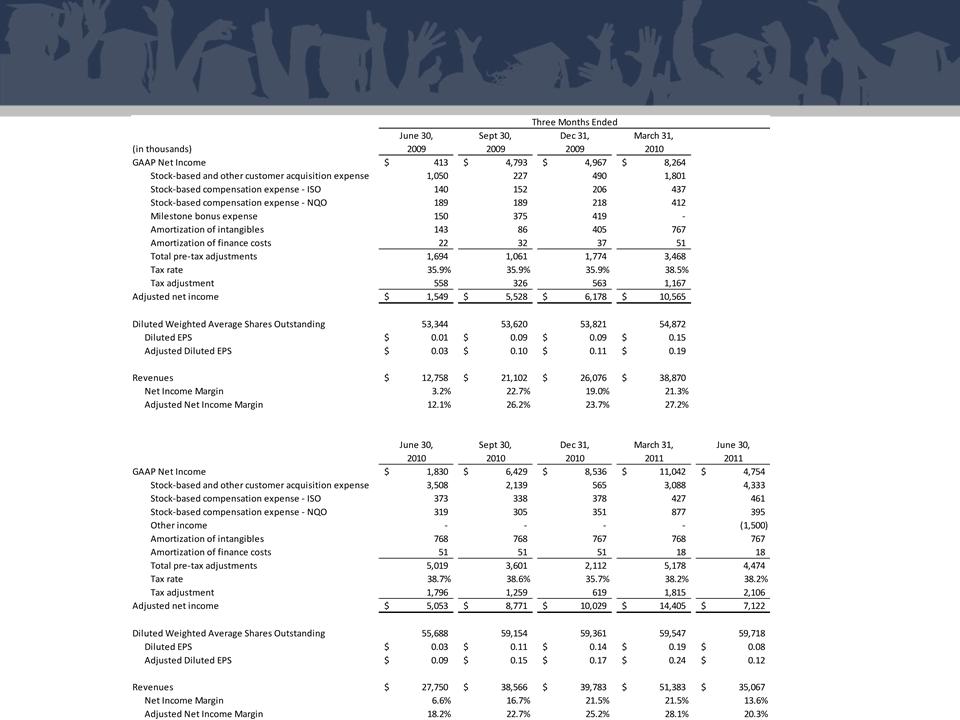

Calculation of Adjusted Diluted EPS

®

©2011 Higher One Holdings, Inc. Higher One and the Higher One logo are registered

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

trademarks of Higher One, Inc. All other marks are owned by their respective owners.

25

Reconciliation of GAAP to non-GAAP Guidance