Attached files

| file | filename |

|---|---|

| 8-K - BERKSHIRE HILLS BANCORP INC | v230377_8k.htm |

KBW Community Bank Investor Conference

August 2 – 3, 2011

David H. Gonci

Investor Relations Officer

Phone: (413) 281-1973

Email: dgonci@berkshirebank.com

Kevin P. Riley

EVP, Chief Financial Officer

Phone: (413) 236-3195

Email: kriley@berkshirebank.com

P.O. Box 1308, Pittsfield, MA 01202 – Executive Offices – 66 West Street, Pittsfield, MA 01201

1

Patrick J. Sullivan

EVP, Commercial Banking &

Wealth Management

Phone: (413) 236-3736

Email: psullivan@berkshirebank.com

Robert M. Curley

Chairman, New York Region

Phone: (518) 729-1422

Email: rcurley@berkshirebank.com

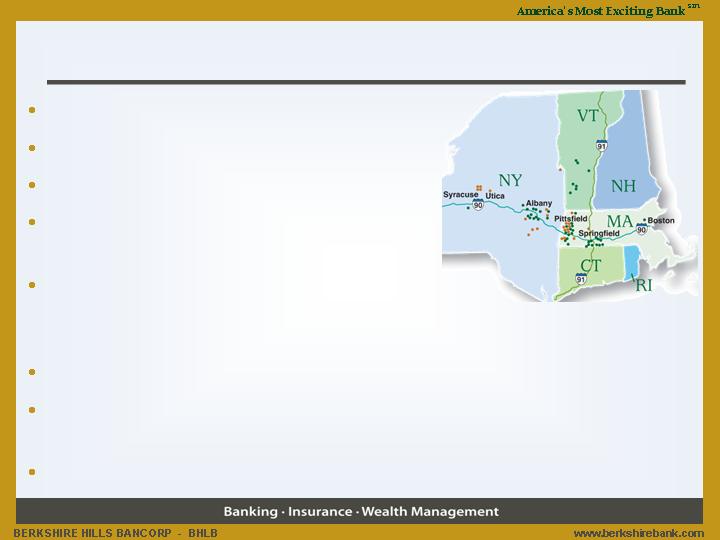

Berkshire Hills Bancorp

Strong revenue and earnings growth

Quality balance sheet

Regional bank with $4 billion in assets

60+ full service branches in three states -

Massachusetts, New York and Vermont

Retail & commercial banking, insurance,

& wealth management services

Experienced /energetic management team

Presence in high value, strong markets –

East and West

Market cap approaching $500 million

2

Tan dots represent recently

acquired Rome & Legacy

branches

3

Recruited Experienced Leadership Team

Michael P. Daly

President and CEO

Kevin Riley

EVP, CFO

Sean Gray

EVP, Retail

Background

Bank of America

Consumer Market

Executive

Background

Sovereign

EVP

Corporate Banking

Background

KeyBank

EVP

Group Head

Background

KeyBank

EVP

CFO

Lawrence A. Bossidy

Chairman

Background

Vice Chair, GE

CEO, Allied Signal/Honeywell

Patrick Sullivan

EVP, Commercial &

Wealth Management

Robert Curley

Chairman of the

New York Region

Background

Citizens Bank, NY

President & CEO

Citizens Bank, N.A. - Chairman

Linda Johnston

EVP, Human

Resources

Background

Berkshire Bank

Senior Officer

Richard Marotta

EVP, Risk

Management

Attractive Northeast Markets

4

Northeast stronger than most other regions

Improving conditions in traditional markets –

Western Mass. and Vermont

Tourism, recreation, hospitality

Albany – a national technology hotspot

Chip fabrication

Nanotechnology

Green technology

Eastern Mass.

Technology

Education

Trade and services

Note: State economic growth data is most recent 2010 data from U.S. Bureau of Economic Analysis. Green shaded states are

fastest growing. NY – 5.1%, MA – 4.2%

Strategic Initiatives

5

Recruiting Top Teams

Asset Based Lending

Commercial Banking

Private Banking

De novo Branch Expansion

Albany De novo Branch Program

Innovative Branch Design

Brand Initiatives

AMEB U – America’s Most Exciting Bank University

www.jointheexcitement.com

Six Sigma Process Improvement

Insurance – Retail / Commercial Integration

Wealth Management

Mortgage Banking

Bank Acquisitions - Rome and Legacy

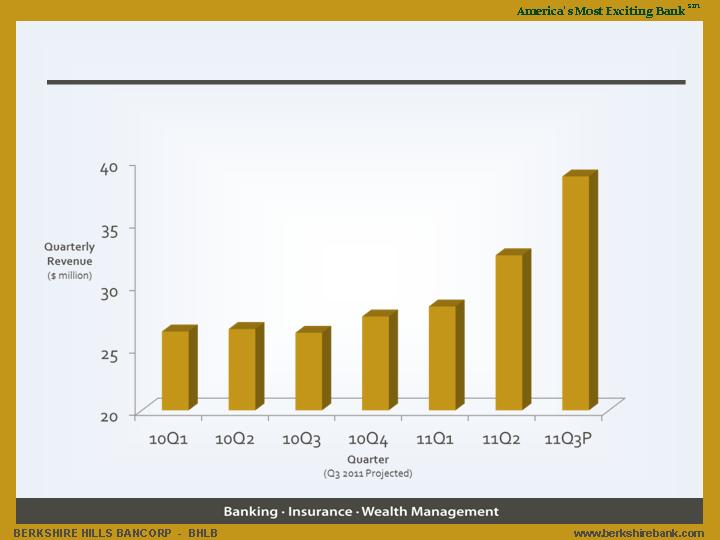

Revenue Growth

6

9% Organic Annual Growth

20%+ Total Annual Growth

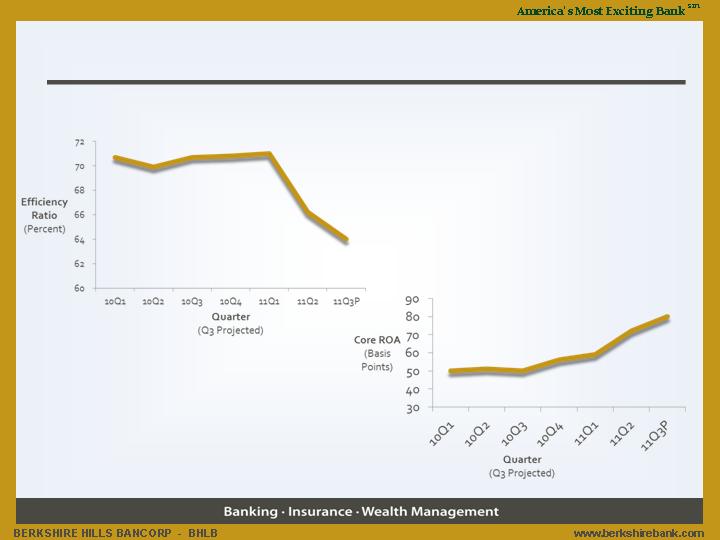

Performance Improvement

7

Increasing Core ROA

Target 1.00%+

Greater Efficiency

Target 60% Efficiency Ratio in Near Term

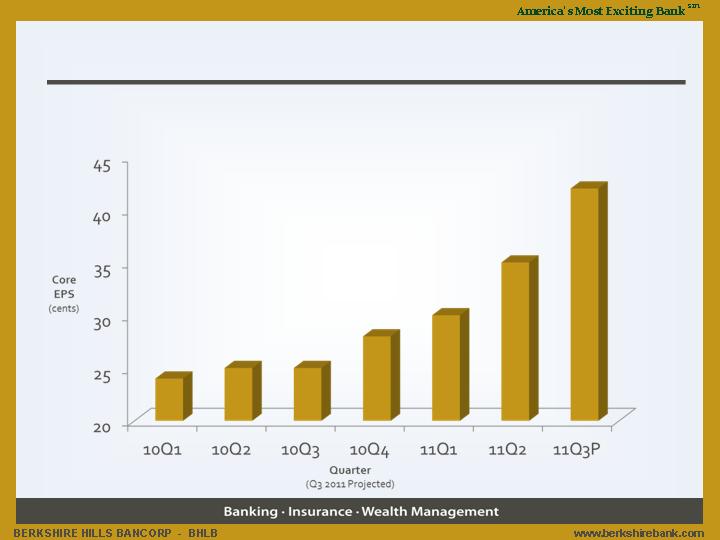

Core EPS Growth

8

25%+ Annualized Organic Growth

Positive Operating Leverage

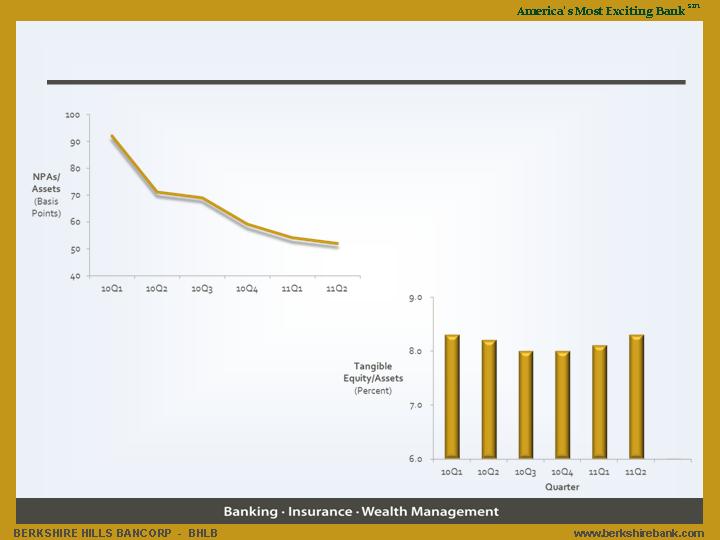

Balance Sheet Strength

9

Favorable and Improving

Asset Quality

Solid Capital Supporting

Strong Growth

Quarter

Building Through Bank Acquisitions

($ in millions)

Berkshire

Rome

Legacy

Pro

Forma

Combined

Increase

Total assets

$2,906

$320

$887

$4,113

42%

Total core revenue

$108

$16

$31

$155

44%

Total branches

42

5

15

62

48%

Total loans

$2,194

$263

$587

$3,044

39%

Total deposits

$2,257

$229

$502

$2,988

32%

Note: Balance sheet data is as of 6/30/11 (Rome data as of 4/1/11). Core revenue is for year 2010. Combined data is before any

merger related accounting adjustments. Legacy

data excludes four branches and $158 million deposits to be divested.

10

11

Acquisition Strategies

Target northeast markets

Earnings per share accretive

Double digit return on investment

Moderate tangible book value dilution

Improved financial metrics

Maintenance of strong capital

Prudent asset quality marks

Integration Strength

Dedicated Project Management Office reporting to CFO

Rome – 5 branch community bank; integration successfully

completed

Legacy – In-market merger. Neighboring headquarters, common

market knowledge, bank CEO has joined Berkshire executive team

Plans for Strong Core Earnings Growth in 2011 & 2012

Core EPS targeted to increase 40 – 50% in 2011 toward

upper end of $1.40 - $1.50 range

GAAP EPS to include one-time merger related charges

Organic core revenue growth target in high single digits

Organic core non-interest expense growth target in low

single digits

Goal to maintain pace to achieve $2.00 core EPS run rate

by end of 2012

12

Why Buy Berkshire Hills?

Strong growth from organic, de novo, product and acquisition strategies

Improving core profitability metrics

Core earnings advancing at 25%+ organic annualized rate

Strong asset quality with solid capital and core funding

Experienced executive team

Distinctive brand and culture as America’s Most Exciting Bank sm

Disciplined acquisition strategies – well received mergers

Attractive buying opportunity

100% BUY ratings from four equity analysts

Improving stock liquidity following recent mergers

Shares increased from 14 MM to 21 MM

Market cap approaching $500 MM at recent prices

13

14

FORWARD LOOKING STATEMENTS. This presentation contains certain forward-looking statements within

the meaning

of the Private Securities Litigation Reform Act of 1995, including statements about the mergers

of Berkshire with Rome Bancorp, Inc. (“Rome”) and Legacy Bancorp, Inc. (“Legacy”). These statements

include statements regarding anticipated

future results. Forward-looking statements can be identified by the

fact that they do not relate strictly to historical or current facts. They often include words like "believe,"

"expect," "anticipate," "estimate," and "intend" or future or conditional

verbs such as "will," "would," "should,"

"could" or "may." Certain factors that could cause actual results to differ materially from expected results

include difficulties in achieving cost savings from the mergers or in achieving such cost savings within

the

expected time frames, difficulties in integrating the companies, increased competitive pressures, changes in

the interest rate environment, changes in general economic conditions, adverse legislative and regulatory

changes, changes

in the securities markets and other risks and uncertainties disclosed from time to time in

documents that Berkshire files with the Securities and Exchange Commission.

NON-GAAP FINANCIAL MEASURES. This presentation references non-GAAP financial measures

incorporating tangible

equity and related measures, and core earnings excluding merger costs. These

measures are commonly used by investors in evaluating business combinations and financial condition.

Financial Performance and Goals

2008

2009

2010

2011 Q3

Guidance

Long Term

Financial Goals

Core revenue growth

21%

-8%

9%

49%

10%+

Net interest margin

3.44%

3.00%

3.27%

3.52%

3.50%+

Fee income/total revenue

28%

29%

28%

NA

35%+

Efficiency ratio

61%

73%

71%

64%

55%

Pretax, pre-prov. core ROA

1.40%

0.75%

0.98%

1.10%

1.70%+

Core ROA

0.87%

-0.57%

0.51%

0.80%

1.00%+

Core ROE

6.47%

-3.69%

3.69%

6.00%+

10.00%+

Core ROTE

16.16%

-5.73%

8.03%

NA

15.00%+

Core EPS

$2.06

$ (1.20)

$1.01

$0.42

$2.00+

Note: GAAP EPS was ($1.52) in 2009 due to TARP dividends and restructuring charges. GAAP EPS was $0.99 in 2010 due to

merger related expenses. Guidance and goals exclude

M&A deal expenses.

Exhibit A

15

16

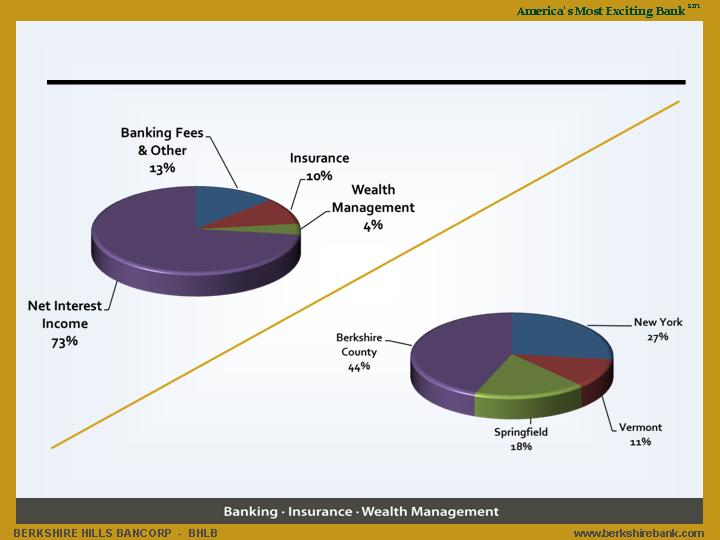

Diversified Revenues and Regional Presence

Record revenues of $114 million

Diversified Revenues

Expanding Regional Presence

Deposits

Note: Revenues are for 12 months ended 06/30/2011. Deposits based on

Berkshire Bank at 6/30/11 and Legacy Banks at 6/30/10 excluding deposits

to be divested

Exhibit B

Balanced Portfolios

17

Note: Balances are as of June 30, 2011 and include balances of Legacy Banks, which was acquired on July 21, 2011. Legacy

balances exclude any purchase accounting adjustments. Total

Legacy deposits excluded planned branch divestitures.

Deposits $3.0 Billion

Loans $3.0 Billion

Exhibit C

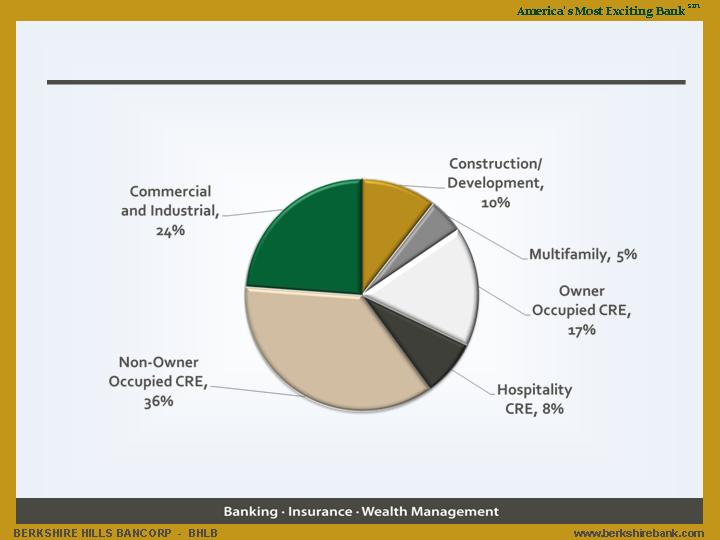

Diversified Commercial Loan Exposure

Total Commercial Loans = $1.6 Billion

Growing Commercial and Industrial

Exhibit D

18

Note: Data is as of 6/30/11 based on Call Reports of Berkshire Bank and Legacy Banks, which was acquired as of 07/21/2011.

Hospitality data estimated.

If you have any questions, please contact:

David Gonci

Investor Relations Officer

(413) 281-1973

dgonci@berkshirebank.com

Committed to the

RIGHT core values:

Respect

Integrity

Guts

Having Fun

Teamwork