Attached files

| file | filename |

|---|---|

| 8-K - HERITAGE FINANCIAL GROUP INC 8-K 8-1-2011 - Heritage Financial Group Inc | form8k.htm |

| EX-99 - EXHIBIT 99 - Heritage Financial Group Inc | ex99.htm |

Exhibit 99.1

12th Annual KBW Community

Bank Investor Conference

Bank Investor Conference

August 3, 2011

O. Leonard Dorminey

Chief Executive Officer

Chief Executive Officer

T. Heath Fountain

Chief Financial Officer

Chief Financial Officer

1

CAUTIONARY STATEMENTS

This presentation contains forward-looking statements

about future financial performance, business plans and

strategies of Heritage Financial Group. Because forward

-looking statements involve risks and uncertainties,

actual results may differ materially from those

expressed or implied. Investors are cautioned not to

place undue reliance on these forward-looking

statements and are advised to carefully review the

discussion of forward-looking statements and risk factors

in documents that the Company files with the Securities

and Exchange Commission, including the Company’s

most recent Annual Report on Form 10-K and Quarterly

Report on Form 10-Q.

about future financial performance, business plans and

strategies of Heritage Financial Group. Because forward

-looking statements involve risks and uncertainties,

actual results may differ materially from those

expressed or implied. Investors are cautioned not to

place undue reliance on these forward-looking

statements and are advised to carefully review the

discussion of forward-looking statements and risk factors

in documents that the Company files with the Securities

and Exchange Commission, including the Company’s

most recent Annual Report on Form 10-K and Quarterly

Report on Form 10-Q.

2

EXECUTIVE MANAGEMENT TEAM

|

Name

|

Position

|

Years

in

Banking |

Years

with

HBOS

|

|

O. Leonard Dorminey

|

Chief Executive Officer

|

34

|

10

|

|

T. Heath Fountain

|

Chief Financial Officer

|

11

|

8

|

|

David A. Durland

|

Chief Banking Officer

|

29

|

1

|

|

Carol W. Slappey

|

President - Albany

Region & Chief Retail Administration Officer |

38

|

17

|

|

O. Mitchell Smith

|

Chief Credit Officer

|

34

|

6

|

3

MARKET FOOTPRINT

AL

GA

FL

ALBANY

OCALA

LAKE CITY

Banking

Mortgage

Investments

STATESBORO

4

HOW WE CREATE VALUE

lOperate on sound banking practices

lSupport the communities we serve

lImpart solid financial advice

lProvide a level of service that

exceeds expectations

exceeds expectations

5

HBOS STRATEGIC INITIATIVES

l Integrate acquisitions in a timely manner

l Pursue and execute FDIC-assisted

transactions that add franchise value

transactions that add franchise value

l Pursue and execute open bank and branch

transactions that add franchise value

transactions that add franchise value

l Continue to fill key roles in the organization

with experienced bankers

with experienced bankers

l Leverage our branch network for mortgage

and brokerage opportunities

and brokerage opportunities

6

HBOS OPERATING PHILOSOPHY

l Hire experienced bankers with a proven

track record

track record

l Allow market executives to run the banks in

their markets

their markets

l Maintain a tight rein on the credit approval

process and monitor portfolio performance

process and monitor portfolio performance

l Centralize credit and back office operations

to improve efficiency

to improve efficiency

l Allow our market executives to cultivate

local advisory boards

local advisory boards

7

A DISCIPLINED APPROACH TO GROWTH

l Company began looking at merger and acquisition

opportunities after the capital raise in 2005

opportunities after the capital raise in 2005

l In-house due diligence team with experience at other

acquisitive institutions

acquisitive institutions

l Rigorous due diligence process

l From 2006 - 2008, walked away from many M&A

opportunities, primarily due to pricing and credit quality

opportunities, primarily due to pricing and credit quality

l During that time period, the company opted to use

dividends and stock buybacks as a better method to

deploy capital

dividends and stock buybacks as a better method to

deploy capital

l In 2009, started M&A activity due to attractive pricing on

branch purchases and FDIC-assisted opportunities

branch purchases and FDIC-assisted opportunities

8

AN EXPANDING FRANCHISE

l Expanded into Ocala, Florida in 2006 with de novo branch

• $48 million in loans

• $57 million in deposits

l FDIC-assisted acquisition of The Tattnall Bank in December

2009

2009

• No loss-share - $15 million discount

• $37 million in loans and OREO

• $56 million in deposits

l Lake City, Florida branch purchase in December 2009

• $10 million in loans

• $41 million in deposits

l Five branches in Georgia in May 2010

• $52 million in loans

• $98 million in deposits (only $21 million in CD’s)

9

AN EXPANDING FRANCHISE

l Expanded into Valdosta, Georgia in June 2010 with de novo

branch

branch

• $42 million in loans

• $16 million in deposits

l Mortgage origination expansion

• Historically in Albany and Statesboro as a broker

• Brought in an experienced back office team to originate as a

correspondent in January 2011

correspondent in January 2011

• Added 13 originators in 10 offices in Georgia and Florida

• Ability to recruit experienced mortgage lenders

• Produced $35 million in loans with fees of $908,000 year to date

• Produced $9 million in loans with fees of $297,000 in June 2011

• Breakeven at $10 million in monthly production

• Goal is to be at $20 million in monthly production by year end

10

CITIZENS ACQUISITION

l Acquired Citizens Bank of Effingham on February 18, 2011

l $140 million in loans

l $141 million in core deposits

l 80/20 loss-share agreement

l $25.1 million discount

l $2.2 million bargain purchase gain

l Four branches between Savannah and Statesboro, Georgia

l Provides entry into the Savannah MSA

l Market is home to the Savannah port

11

CITIZENS ACQUISITION

|

(dollars in millions)

|

At

Acquisition |

As of

June 30,

2011 |

|

Unpaid principal balance of loans

|

$139.9

|

$129.8

|

|

Fair value as recorded

|

$72.7

|

$65.2

|

|

HBOS value as a % of unpaid principal balance

|

52%

|

50%

|

|

OREO at acquired book value

|

$21.7

|

$20.6

|

|

Fair value as recorded

|

$7.5

|

$7.0

|

|

HBOS value as a % of acquired book value

|

35%

|

34%

|

12

OPPORTUNITIES IN OUR MARKETS

l Georgia and Florida markets have high number of problem

banks, many of which will be taken through the FDIC failure

process

banks, many of which will be taken through the FDIC failure

process

l Company has identified 27 banks with total assets of $5.6

billion as potential FDIC-assisted acquisition opportunities

billion as potential FDIC-assisted acquisition opportunities

l Significant opportunities to purchase branches from

struggling banks

struggling banks

l Problem banks in Georgia, Florida and Alabama have 783

branches, many of which could be branch acquisition targets

branches, many of which could be branch acquisition targets

l Open bank M&A will return

l Opportunities to hire talent from other institutions

• Commercial and retail bankers

• Mortgage bankers

• Investment advisors

13

LOAN PORTFOLIO

Real Estate

Farmland

3%

Real Estate

6%

Total Portfolio - $416.1 million

As of June 30, 2011

As of December 31, 2008

Commercial

Business

Business

12%

Consumer

16%

Real Estate

One- to Four-Family

25%

Real Estate

Commercial

17%

Commercial

17%

Real Estate

Multi-Family

4%

4%

Real Estate

Farmland

4%

Real Estate

Construction

and Land Loans

and Land Loans

14%

Real Estate

One- to

Four-Family

Junior Liens

and Revolving

8%

Total Portfolio - $302.5 million

Excludes loans acquired in FDIC-assisted acquisitions.

14

LOAN PORTFOLIO - CRE BREAKOUT

June 30, 2011

Owner-occupied - 52%

Non Owner-occupied - 48%

Office

Buildings

Buildings

34%

Other CRE

16%

Restaurants

21%

Industrial /

Warehouses

Warehouses

4%

Convenience

Stores

5%

Stores

5%

Retail Shopping

Centers

Centers

3%

Convenience

Stores

7%

Stores

7%

Retail

Shopping

Centers

Shopping

Centers

17%

Office

Buildings

Buildings

26%

Other CRE

10%

Industrial /

Warehouses

Warehouses

7%

Hotels /

Motels

9%

Restaurants

2%

Medical

8%

Total Portfolio - $67.5 million

Total Portfolio - $63.5 million

Medical

14%

Mini Storage

Facilities

Facilities

3%

Mini Storage

Facilities

Facilities

9%

Mobile Home

Parks

Parks

5%

Excludes loans acquired in FDIC-assisted acquisitions.

15

LARGEST LOAN CUSTOMERS

Our five largest loan customers total $29.4 million or

5.9% of our total portfolio at June 30, 2011

5.9% of our total portfolio at June 30, 2011

1. $6.6 million to a specialty chemical company in

Southwest GA

Southwest GA

2. $6.3 million secured by two nursing homes in

Southwest GA

Southwest GA

3. $5.8 million to a finance company secured by

accounts receivable and real estate in Southwest GA

accounts receivable and real estate in Southwest GA

4. $5.5 million to a chain hotel in North Central FL

5. $5.1 million secured by mobile home retirement

communities in North Central FL

communities in North Central FL

Excludes loans acquired in FDIC-assisted acquisitions.

16

ASSET & CREDIT QUALITY

Peer group consists of publicly traded banks and thrifts located in the states of Georgia, Alabama and Florida with assets between $750 million and

$1.5 billion. Excludes announced merger targets. Source: SNL Financial, LC.

$1.5 billion. Excludes announced merger targets. Source: SNL Financial, LC.

Loan Loss Reserves /

Net Charge-Offs / Avg. Loans vs Peers (%)

HBOS

Peer Group Median

HBOS

Peer Group Median

7.4

HBOS

Peer Group Median

1.36

0.43

0.43

0.53

0.64

2.05

1.08

1.24

1.59

1.06

0.95

1.32

0.22

0.31

1.28

1.24

0.60

1.50

0.4

0.3

0.3

0.9

0.5

0.6

1.2

0.8

1.5

3.8

0.5

2.4

1.9

1.9

1.0

1.9

1.8

Mar

Jun

Sep

Dec

2009

Mar

Jun

2010

Sep

Dec

Mar

2011

Mar

Jun

Sep

Dec

2009

Mar

Jun

2010

Sep

Dec

Mar

2011

Excludes loans acquired in FDIC-assisted acquisitions.

17

TRENDS IN ASSET AND CREDIT QUALITY

Accruing Criticized Loans

Accruing Classified Loans

Nonaccrual Loans

Past Due Loans (30-89 days)

$10.5

$9.9

$6.5

$1.6

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

$8.5

$8.8

$7.5

$1.7

$9.5

$9.7

$12.2

$0.8

$4.8

$13.9

$9.9

$1.9

$7.3

$13.7

$9.1

$1.2

$5.8

$13.1

$8.6

$0.7

Excludes loans acquired in FDIC-assisted acquisitions.

($ in millions)

18

SECURITIES PORTFOLIO

Municipals

11%

11%

GSE

24%

24%

Corporate

and other

2%

2%

June 30, 2011

GSE MBS

63%

Total Portfolio - $186.9 million

19

DEPOSIT PORTFOLIO

Noninterest-

Bearing

Bearing

Demand

10%

10%

Interest-

Bearing

Demand

16%

16%

Savings and

Money-markets

37%

37%

As of June 30, 2011

As of December 31, 2008

Time

Deposits

Deposits

37%

Noninterest-

Bearing

Demand

6%

Bearing

Demand

6%

Interest-

Bearing

Demand

14%

Bearing

Demand

14%

Savings and Money

-markets

31%

-markets

31%

Total Deposits - $338.5 million

Total Deposits - $763.7 million

20

KEY FINANCIAL RATIO TRENDS

HBOS

Peer Group Median

Efficiency Ratio vs Peers (%)

Pre-Tax Pre-Provision/

Average Assets vs Peers (%)

Average Assets vs Peers (%)

1.3

1.4

1.5

1.4

1.2

1.3

1.4

1.4

1.2

2009

2010

2011

2.61

21

BALANCE SHEET TRENDS

Net Loans

2005

2006

2007

2008

2009

2010

2Q11

$500.7

$419.0

$328.1

$297.5

$300.3

$272.7

$250.5

Total Deposits

2005

2006

2007

2008

2009

2010

2Q11

$763.7

$534.2

$426.6

$338.5

$330.6

$299.2

$238.6

Total Assets

2005

2006

2007

2008

2009

2010

2Q11

$963.6

$755.4

$571.9

$502.1

$468.7

$413.3

$363.8

($ in millions)

22

CAPITAL RATIOS

23.4%

22.2%

12.4%

10.0%

6.0%

5.0%

13.4%

16.2%

7.4%

Tier 1 Leverage

Tier 1 Risk-based

Total Risk-based

Heritage Financial Group, Inc.

To be well-capitalized

Excess

June 30, 2011

23

TOTAL RETURN ANALYSIS

Peer group consists of publicly traded banks and thrifts located in the states of Georgia, Alabama and Florida with assets between $750 million and

$1.5 billion. Excludes announced merger targets. Source: SNL Financial, LC.

$1.5 billion. Excludes announced merger targets. Source: SNL Financial, LC.

24

WHY INVEST IN

HERITAGE FINANCIAL GROUP, INC.

HERITAGE FINANCIAL GROUP, INC.

l Growth opportunities

• FDIC-assisted acquisitions

• Branch and open bank acquisitions

• Ability to attract and hire talented bankers

l Acquirer with a proven ability to do deals

l Disciplined approach to acquisitions and growth

l Strong asset quality in a difficult environment

l Experienced management team and market leaders

l Diversified loan portfolio

l Solid core deposit franchise

25

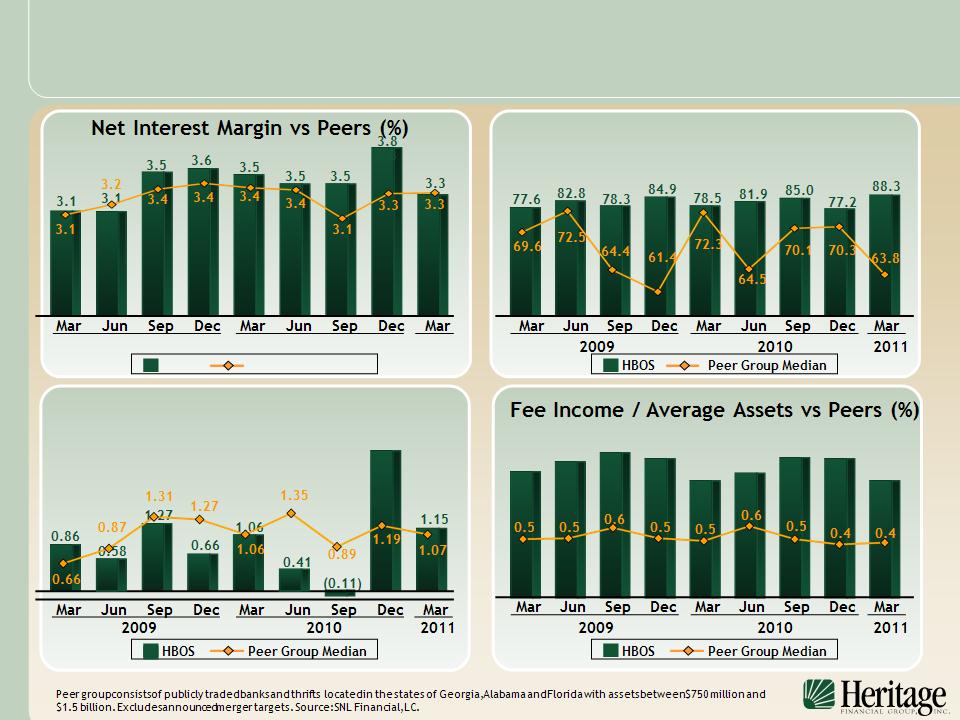

APPENDIX - PEER COMPARISON

Peer group consists of publicly traded banks & thrifts located in the states of Georgia, Alabama and Florida with assets between $750 million and

$1.5 billion. Excludes announced merger targets. Source: SNL Financial, LC.

$1.5 billion. Excludes announced merger targets. Source: SNL Financial, LC.

NASDAQ: HBOS